UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrantþ

Filed by a Party other than the Registranto

Check the appropriate box:

| þ | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12 |

RENTECH, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| |

| | | | |

| | | | |

| |

| | (2) | | Aggregate number of securities to which transaction applies: |

| |

| | | | |

| | | | |

| |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| | | | |

| | | | |

| |

| | (4) | | Proposed maximum aggregate value of transaction: |

| |

| | | | |

| | | | |

| |

| | (5) | | Total fee paid: |

| |

| | | | |

| | | | |

| o | | Fee paid previously with preliminary materials. |

| |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| |

| | | | |

| | | | |

| |

| | (2) | | Form, Schedule or Registration Statement No.: |

| |

| | | | |

| | | | |

| |

| | (3) | | Filing Party: |

| |

| | | | |

| | | | |

| |

| | (4) | | Date Filed: |

| |

| | | | |

| | | | |

Rentech, Inc.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD APRIL 18, 2008

You are cordially invited to attend the annual meeting of shareholders of Rentech, Inc. to be held at the Natchez Eola Hotel, 110 North Pearl Street, Natchez, Mississippi, on Friday, April 18, 2008 at (CDT) for the following purposes:

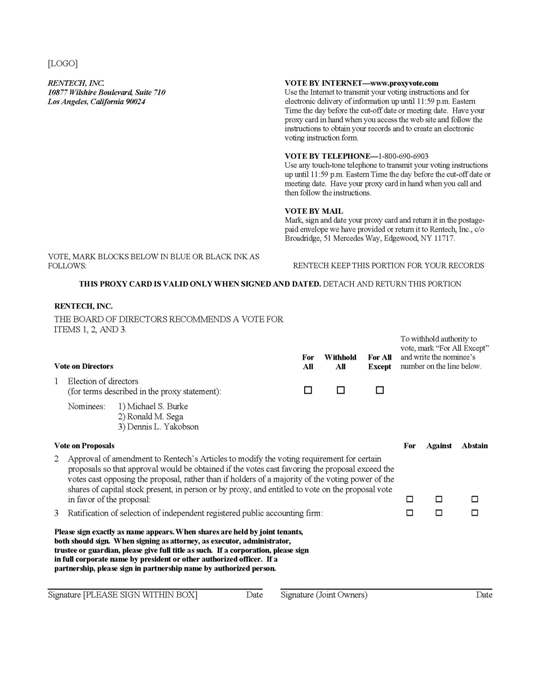

1. To elect three directors for terms of three years each;

2. To vote upon a proposal to amend Rentech’s Amended and Restated Articles of Incorporation (the “Articles”) to modify the voting requirement for certain proposals so that approval would be obtained if the votes cast favoring the proposal exceed the votes cast opposing the proposal (a “majority of the votes cast voting requirement”), rather than if holders of a majority of the voting power of the shares of capital stock present, in person or by proxy, and entitled to vote on the proposal vote in favor of the proposal (a “majority of the quorum voting requirement”);

3. To ratify the selection of Ehrhardt Keefe Steiner & Hottman P.C. as Rentech’s independent registered public accounting firm; and

4. To transact such other business as may properly come before the meeting or any adjournments or postponements of the meeting.

Only holders of record of the common stock of Rentech at the close of business on February , 2008 will be entitled to notice of and to vote at the meeting and any adjournments or postponements of the meeting.

By Order of the Board of Directors,

Colin M. Morris

Secretary

Los Angeles, California

Date: March , 2008

YOUR VOTE IS IMPORTANT

This proxy statement is furnished in connection with the solicitation of proxies by Rentech, Inc. on behalf of the Board of Directors, for the 2008 annual meeting of shareholders. The proxy statement and the related proxy form are first being distributed to shareholders on or about March , 2008. You can vote your shares using one of the following methods:

| | |

| | • | Vote through the Internet at the website shown on the proxy card. |

| |

| | • | Vote by telephone using the toll-free number shown on the proxy card. |

| |

| | • | Complete and return a written proxy card. |

| |

| | • | Attend Rentech’s 2008 annual meeting of shareholders and vote. |

Votes submitted through the Internet or by telephone must be received by 12:00 p.m. Eastern Time, on April 17, 2008. Internet and telephone voting are available 24 hours per day. If you vote via Internet or telephone, you do not need to return a proxy card.

You are invited to attend the meeting; however, to ensure your representation at the meeting, you are urged to vote via the Internet or telephone, or mark, sign, date, and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope enclosed for that purpose. Any shareholder of record attending the meeting may vote in person even if he or she has voted via the Internet or telephone, or returned a proxy card.

TABLE OF CONTENTS

| | | | | |

| | | Page |

| |

| | | 1 | |

| | | 1 | |

| | | 2 | |

| | | 2 | |

| | | 3 | |

| | | 4 | |

| | | 4 | |

| | | 5 | |

| | | 7 | |

| | | 8 | |

| | | 8 | |

| | | 8 | |

| | | 14 | |

| | | 14 | |

| | | 14 | |

| | | 22 | |

| | | 22 | |

| | | 23 | |

| | | 24 | |

| | | 24 | |

| | | 25 | |

| | | 26 | |

| | | 26 | |

| | | 26 | |

| | | | |

| | | 27 | |

| | | 27 | |

| | | 28 | |

| | | 29 | |

| | | 29 | |

| | | 30 | |

| | | 30 | |

i

RENTECH, INC.

10877 Wilshire Blvd., Suite 710

Los Angeles, California 90024

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD APRIL 18, 2008

This proxy statement is furnished to shareholders in connection with the solicitation by the Board of Directors of Rentech, Inc. of proxies for use at the annual meeting of shareholders to be held at the Natchez Eola Hotel, 110 North Pearl Street, Natchez, Mississippi, on Friday, April 18, 2008 at (CDT), and at any adjournments or postponements of the meeting.

Rentech anticipates that this proxy statement and the accompanying form of proxy will be first sent or given to shareholders on or about March , 2008.

VOTING SECURITIES AND VOTING RIGHTS

Only shareholders of record at the close of business on February , 2008 are entitled to notice of and to vote at the annual meeting or any adjournments or postponements of the meeting. On February , 2008, shares of common stock were outstanding held by shareholders of record. Each share of common stock outstanding on that date entitles the holder to one vote on each matter submitted to a vote at the meeting. Cumulative voting is not allowed. Shares may only be voted by or on behalf of the shareholder of record. If a holder’s shares are held of record by another person, such as a stock brokerage firm or bank, that person must vote the shares as the shareholder of record.

Shareholders may vote in person or by proxy at the annual meeting. All properly executed proxies received prior to the commencement of voting at the meeting, and which have not been revoked, will be voted in accordance with the directions given. If no specific instructions are given for a matter to be voted upon, the proxy holders will vote the shares covered by proxies received by them (i) FOR the election of the three nominees to the Board of Directors; (ii) FOR the proposal to amend Rentech’s Articles to replace the majority of the quorum voting requirement with a majority of the votes cast voting requirement; and (iii) FOR the ratification of the selection of Ehrhardt Keefe Steiner & Hottman P.C. as Rentech’s independent registered public accounting firm.

A quorum for the transaction of business at the meeting requires the presence at the annual meeting, in person or by proxy, of the holders of not less than a majority of the voting power of the shares of Rentech capital stock then outstanding and entitled to vote at the meeting. If a quorum is present, the three nominees for election as directors who receive the greatest number of votes in favor of their election at the meeting will be elected. Cumulative voting is not allowed for the election of directors. The proposal to amend Rentech’s Articles to replace the majority of the quorum voting requirement with the majority of the votes cast voting requirement will be approved if it receives the affirmative vote of the holders of a majority of shares of common stock entitled to vote on the matter. The proposal to ratify the selection of Ehrhardt Keefe Steiner & Hottman P.C. as Rentech’s independent registered public accounting firm will be approved if it receives the affirmative vote of the holders of a majority of shares of common stock present, in person or by proxy, at the meeting and entitled to vote on the matter.

If brokers have not received any instruction from their customers on how to vote the customer’s shares on a particular proposal, the brokers are allowed to vote on routine matters but not on non-routine proposals. The absence of votes by brokers on non-routine matters are “broker non-votes.” Abstentions and broker non-votes will be counted as present for purposes of establishing a quorum, but will have no effect on the election of directors. Abstentions and broker non-votes will have the effect of a vote against the proposals to amend Rentech’s Articles to replace the majority of the quorum voting requirement with a majority of the votes cast voting requirement and to ratify the appointment of Ehrhardt Keefe Steiner & Hottman P.C. as Rentech’s independent registered public accountants.

1

Any shareholder giving a proxy pursuant to the present solicitation has the power to revoke it at any time before it is exercised. It may be revoked by giving a subsequent proxy or by mailing to our principal executive offices at 10877 Wilshire Boulevard, Suite 710, Los Angeles, California 90024, Attn: Secretary, an instrument of revocation. If you vote electronically via the Internet or telephone, a proxy may be revoked by the submission of a later electronic proxy. A proxy may also be revoked by attending the meeting and giving our Secretary a vote in person (subject to the restriction that a shareholder holding shares in street name must bring to the meeting a legal proxy from the broker, bank or other nominee holding that shareholder’s shares which confirms that shareholder’s beneficial ownership of the shares and gives the shareholder the right to vote the shares).

Rentech will bear the cost of solicitation of proxies, including expenses in connection with preparing and mailing this proxy statement. We will furnish copies of solicitation materials to brokerage houses, fiduciaries, and custodians to forward to beneficial owners of our common stock held in their names. In addition, we will reimburse brokerage firms and other persons representing beneficial owners of stock for their expenses in forwarding solicitation materials to such beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, facsimile, and personal solicitation by our directors, officers, and other employees. No additional compensation will be paid to our directors, officers, or other employees for these services.

The purposes of the meeting and the matters to be acted upon are set forth in the foregoing attached Notice of Annual Meeting. As of the date of this proxy statement, management knows of no other business that will be presented for consideration at the meeting. However, if any such other business shall properly come before the meeting, votes will be cast pursuant to said proxies in respect of any such other business in accordance with the best judgment of the persons acting under said proxies.

ELECTION OF DIRECTORS

(Proxy Item 1)

There are currently eight positions on Rentech’s Board of Directors. The Board of Directors currently is divided into three classes, one of which includes two directors, and two of which currently include three directors. The directors in each class are elected for three years and until the election and qualification of their successors.

Michael S. Burke, Ronald M. Sega, and Dennis L. Yakobson have been nominated for election as directors for a term of three years each and until their successors have qualified and are elected. The three nominees are presently members of the Board of Directors. All other members of the Board of Directors will continue in office until the expiration of their respective terms at the 2009 or 2010 annual meetings of shareholders.

If your vote is properly submitted, it will be voted for the election of the nominees, unless contrary instructions are specified. Each nominee has consented to serve if elected. Although the Board of Directors has no reason to believe that either of the nominees will be unable to serve as a director, should that occur, the persons appointed as proxies in the accompanying proxy card will vote, unless the number of nominees or directors is reduced by the Board of Directors, for such other nominee or nominees as the Nominating Committee of the Board may propose and the Board approves.

Information Regarding Nominees for Election to the Board of Directors:

Michael S. Burke, Director, Age 44 — Mr. Burke was appointed as a member of our Board of Directors in March 2007. Mr. Burke is currently the Executive Vice President, Chief Corporate Officer, and Chief Financial Officer of AECOM Technology Corporation (NYSE: ACM), a global provider of professional technical and management support services to government and commercial clients. Mr. Burke joined AECOM as Senior Vice President, Corporate Strategy in October 2005. From 1990 to 2005, Mr. Burke was with the accounting firm, KPMG LLP. He served in various senior leadership positions, most recently as a Western Area Managing Partner from 2002 to 2005, and was a member of KPMG’s Board of Directors from 2000 through 2005. While on the KPMG Board of Directors, Mr. Burke served as the Chairman of the Board Process and Governance Committee, and as a member of the Audit and Finance Committee. Mr. Burke also serves on various charitable and community boards.

2

Ronald M. Sega, Director, Age 55 — Dr. Sega was appointed as a member of our Board of Directors in December 2007 upon the recommendation of the Nominating Committee of the Board of Directors. Currently, Dr. Sega serves as Vice President for Applied Research at the Colorado State University Research Foundation. He also serves as the Woodward Professor of Systems Engineering at Colorado State University’s College of Engineering. In addition, he serves as Special Assistant to the University’s Vice President for Research. From August 2005 to August 2007, Dr. Sega served as Under Secretary for the U.S. Air Force. In that capacity, he oversaw the recruiting, training, and equipping of approximately 700,000 people, with a budget of approximately $110 billion. Designated the Department of Defense Executive Agent for Space, Dr. Sega developed, coordinated, and integrated plans and programs for space systems of all Department of Defense space major defense acquisition programs. From August 2001 until July 2005, Dr. Sega was Director of Defense Research and Engineering for the Office of the Secretary of Defense. Dr. Sega worked for NASA from 1990 until 1996 and made two shuttle flights during his career as an astronaut. Dr. Sega received a Bachelor of Science degree in Mathematics and Physics from the United States Air Force Academy in 1974, a Master of Science degree in Physics from The Ohio State University in 1975, and a doctorate in Electrical Engineering from the University of Colorado at Boulder in 1982.

Dennis L. Yakobson, Director and Chairman of the Board, Age 71 — Mr. Yakobson has served as a director of Rentech and Chairman of the Board since 1983, and is one of the founders. In December 2005, he resigned from his position as Chief Executive Officer and currently serves as the Chairman. He was employed as Vice President of Administration and Finance of Nova Petroleum Corporation in Denver, Colorado from 1981 to 1983. From 1979 to 1983, he served as a Director and Secretary of Nova Petroleum Corporation in Denver, Colorado. He resigned from those positions in November 1983 to become a Director and assume the presidency of Rentech. From 1976 to 1981 he served as a Director, Secretary, and Treasurer of Power Resources Corporation, a mineral exploration company in Denver, Colorado, and was employed by it as VicePresident-Land. From 1975 to 1976 he was employed by Wyoming Mineral Corporation in Denver, Colorado as a contract administrator. From 1971 through 1975 he was employed by Martin Marietta Corporation in Denver, Colorado as marketing engineer in space systems. From 1969 to 1971 he was employed by Martin Marietta in a similar position. From 1960 to 1969 he was employed by Grumman Aerospace Corporation, his final position with it being contract administrator with responsibility for the negotiation of prime contracts with governmental agencies. He is a Director of GTL Energy Pty Ltd., a private company based in Adelaide, Australia. He received a Bachelor of Science degree in Civil Engineering from Cornell University in 1959 and a Master of Business Administration degree from Adelphi University in 1963.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR ELECTION

OF THE NOMINEES.

Information Regarding Continuing Directors with Terms Expiring in 2009:

D. Hunt Ramsbottom, Director, Chief Executive Officer, and President, Age 50 — Mr. Ramsbottom was appointed President and director of Rentech in September 2005, and Chief Executive Officer in December 2005. Mr. Ramsbottom had been serving as a consultant to Rentech since August 2005 under the terms of a Management Consulting Agreement Rentech entered into with Management Resource Center, Inc. Mr. Ramsbottom has over 25 years of experience building and managing growth companies. Prior to accepting his position at Rentech, Mr. Ramsbottom held various key management positions including: Principal and Managing Director of Circle Funding Group LLC from 2004 to 2005; Chief Executive Officer and Chairman of M2 Automotive, Inc. from 1997 to 2004; and Chief Executive Officer of Thompson PBE (NASDAQ: THOM) from 1989 to 1997. Thompson PBE was acquired by FinishMaster, Inc. in 1997. On April 17, 2005, M2 Automotive, Inc. completed an assignment for the benefit of its creditors pursuant to a state law insolvency proceeding. Mr. Ramsbottom holds a Bachelor of Science degree from Plymouth State College.

Erich W. Tiepel, Director, Age 64 — Dr. Tiepel has served as a director of Rentech since 1983. Dr. Tiepel has 23 years of experience in all phases of process design and development, plant management, and operations for chemical processing plants. Since 2005, Dr. Tiepel has been a principal of the environmental engineering company Golder Associates. From 1982 to 2005, Dr. Tiepel was a principal owner, president, and director of Resource Technologies Group, Inc. (RTG), a privately owned company he founded. RTG is a high technology consulting organization specializing in process engineering, water treatment, hazardous waste remediation, and regulatory

3

affairs. From 1977 to 1981 he was project manager for Wyoming Mineral Corporation, a subsidiary of Westinghouse Electric Corp. in Lakewood, Colorado, where his responsibilities included management of the design, contraction, and operation of ground water treatment systems for ground water cleanup programs. From 1971 to 1976, he was a principal project engineer for process research for Westinghouse Research Labs. From 1967 to 1971, he was a trainee of the National Science Foundation at the University of Florida in Gainesville, Florida. He obtained a Bachelor of Science degree in Chemical Engineering from the University of Cincinnati in 1967, and a Ph.D. in Chemical Engineering from the University of Florida in 1971.

Halbert S. Washburn, Director, Age 47 — Mr. Washburn was appointed as a director of Rentech in December 2005. Mr. Washburn has over 20 years of experience in the energy industry. Mr. Washburn has been the Co-Chief Executive Officer and a director of BreitBurn GP, LLC, the general partner of BreitBurn Energy Partners L.P. (NASDAQ: BBEP), since March 2006. He is also the co-founder and has been the Co-Chief Executive Officer of BreitBurn Energy Company LP and its predecessors since 1988. Mr. Washburn is responsible for BreitBurn’s oil and gas operations and co-manages BreitBurn’s acquisition and capital formation activities. Mr. Washburn currently serves on the Executive Committee of the Board of Directors of the California Independent Petroleum Association. He also served as Chairman of the Stanford University Petroleum Investments Committee and as Secretary and Chairman of the Wildcat Committee. Mr. Washburn holds a Bachelor of Science degree in Petroleum Engineering from Stanford University.

Information Regarding Continuing Directors with Terms Expiring in 2010:

Michael F. Ray, Director, Age 54 — Mr. Ray was appointed as a member of our Board of Directors in May 2005. Mr. Ray founded and has served as President of ThioSolv, LLC since 2001. ThioSolv, LLC is in the business of developing and licensing technology. Mr. Ray is also a partner of GBTX Leasing, LLC, a rail car leasing company. From 1995 to 2001, Mr. Ray served as Vice President of Business Development for Coastal Catalyst and Chemicals Division. Mr. Ray worked for Coastal Chem, Inc. as President from 1990 to 1995, and Vice President of Corporate Development and Administration from 1986 to 1990. From 1985 to 1986, Mr. Ray served as Vice President of Carbon Dioxide Marketing. Mr. Ray worked for Liquid Carbonic Corporation as Regional Operations Manager from 1981 to 1985, and Plant Manager from 1980 to 1981. Mr. Ray received a Bachelor of Science degree in Industrial Technology from Western Washington University, and a Master of Business Administration degree from Houston Baptist University. Mr. Ray previously served as a member of the Board of Directors of Coastal Chem, Inc., Cheyenne LEADS, and The Wyoming Heritage Society. Mr. Ray also served on the Nitrogen Fertilizer Industry Ad Hoc Committee, The University of Wyoming EPSCOR Steering Committee, and the Wyoming Governor’s committee for evaluating state employee compensation.

Edward M. Stern, Director, Age 49 — Mr. Stern was appointed as a member of our Board of Directors in December 2006. Since 2004, Mr. Stern has served as the President and Chief Executive Officer of Neptune Regional Transmission System, LLC, a company which developed, constructed, and now operates a 600 MW undersea electric transmission system that interconnects Sayreville, New Jersey with Long Island, New York. Mr. Stern is also leading the development of several other large transmission and renewable energy projects. From 1991 through 2004, Mr. Stern was employed by Enel North America, Inc. (a subsidiary of Enel SpA, an Italian electric utility company) and its predecessor, CHI Energy, Inc., an energy company which owned or operated nearly one hundred power plants in seven countries, specializing in renewable energy technologies such as hydroelectric projects and wind farms. While at Enel North America, Inc. and CHI Energy, Inc., Mr. Stern served as General Counsel and, commencing in 1999, as President, Director, and Chief Executive Officer. Mr. Stern currently serves on the Board of Directors of Energy Photovoltaics, Inc., a Princeton, NJ based manufacturer of solar energy products and systems, and Capital Access Network, Inc., a small business lender. Mr. Stern also serves on the Advisory Board of Starwood Energy Group Global, LLC, a private equity firm specializing in energy and infrastructure investments. Mr. Stern received B.A., J.D., and M.B.A. degrees from Boston University and is a member of the Massachusetts Bar and the Federal Energy Bar.

Executive Officers

Information concerning the business experience of Mr. Ramsbottom, who serves as President and Chief Executive Officer, is provided under “Information Regarding Directors with Terms Expiring in 2009.”

4

Douglas M. Miller, Chief Operating Officer and Executive Vice President, Age 48 — Mr. Miller has served as Chief Operating Officer and Executive Vice President of Rentech since January 2006. Mr. Miller was employed by Unocal Corporation since 1991 through its acquisition by Chevron Corporation in October 2005, and for more than five years prior to the acquisition, served as Vice President, Corporate Development.

I. Merrick Kerr, Chief Financial Officer and Executive Vice President, Age 41 — Mr. Kerr was appointed our Chief Financial Officer, Executive Vice President, and Treasurer in May 2006. Mr. Kerr was employed by Scottish Power PLC from 1992 through October 2005, where he progressed through the company in both financial and commercial roles, culminating in his appointment as Chief Financial Officer of PPM Energy, a non-utility subsidiary of Scottish Power based in Portland, Oregon, in 2001. Mr. Kerr has a bachelor’s degree in accountancy and economics from the University of Edinburgh and is a member of the Institute of Chartered Accountants of Scotland.

Richard T. Penning, Executive Vice President, Commercial Affairs, Age 52 — Mr. Penning was appointed Executive Vice President, Commercial Affairs of Rentech in January 2007. Mr. Penning had served as a consultant to Rentech beginning in August 2006. Mr. Penning has over 30 years of business experience in the oil and chemical industries. Mr. Penning worked for 28 years with UOP, LLC until its acquisition by Honeywell, having held various management positions, including: Vice President and General Manager of Ventures and Business Development from 2004 to 2005, and Vice President, Six Sigma and Supply Chain from 2002 to 2004. Previously, he held leadership roles in the catalyst and marketing areas of UOP, LLC. Mr. Penning obtained a Bachelor of Science degree in Chemical Engineering from Case Western Reserve University and a Master of Business Administration degree from The University of Chicago Graduate School of Business.

Colin M. Morris, Vice President, General Counsel, and Secretary, Age 35 — Mr. Morris has served as the Vice President, General Counsel, and Secretary of Rentech since June 2006. Mr. Morris practiced Corporate and Securities Law at the Los Angeles office of Latham & Watkins LLP from June 2004 to May 2006. From September 2000 to May 2004, Mr. Morris practiced Corporate and Securities Law in the Silicon Valley office of Wilson, Sonsini, Goodrich & Rosati PC. Prior to that, Mr. Morris practiced Corporate and Securities Law in the Silicon Valley office of Pillsbury Winthrop Shaw Pittman LLP. Mr. Morris received an A.B. degree in Government from Georgetown University and a J.D. from the University of California, Berkeley, Boalt Hall School of Law.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding beneficial ownership of Rentech’s common stock as of January 31, 2008 by (i) all persons of record who own or are known to Rentech to beneficially own more than 5% of the issued and outstanding shares of Rentech’s common stock, and (ii) each director and named officer, and by all executive officers and directors as a group:

| | | | | | | | | |

| | | Amount and Nature of

| | Percent of

|

Directors and Executive Officers(1)(2) | | Beneficial Ownership(3) | | Class |

| |

| Michael S. Burke | | | 50,000 | | | | * | |

| I. Merrick Kerr | | | 102,512 | | | | * | |

| Douglas M. Miller | | | 184,878 | | | | * | |

| Colin M. Morris | | | 57,067 | | | | * | |

| Richard T. Penning | | | 91,667 | | | | * | |

| D. Hunt Ramsbottom(4)(5) | | | 2,320,942 | | | | 1.4 | % |

| Michael F. Ray(6) | | | 298,985 | | | | * | |

| Ronald M. Sega | | | 20,000 | | | | * | |

| Edward M. Stern | | | 60,000 | | | | * | |

| Erich W. Tiepel | | | 692,725 | | | | * | |

| Halbert S. Washburn | | | 77,000 | | | | * | |

| Dennis L. Yakobson(7) | | | 1,352,910 | | | | * | |

| All Directors and Executive Officers as a Group (12 persons) | | | 5,308,686 | | | | 3.1 | % |

5

| | | | | | | | | |

| | | Amount and Nature of

| | | Percent of

| |

Beneficial Owners of More than 5% | | Beneficial Ownership | | | Class | |

| |

| BlackRock, Inc.(8) | | | 24,601,172 | | | | 14.9 | % |

| Wellington Management Company, LLP(9) | | | 16,680,078 | | | | 10.1 | % |

| Asset Managers International, Limited(10) | | | 9,626,785 | | | | 5.8 | % |

| | |

| * | | Less than 1%. |

| |

| (1) | | Except as otherwise noted, and subject to applicable community property laws, each shareholder has sole voting and investment power with respect to the shares beneficially owned. The business address of each director and executive officer isc/o Rentech, Inc., 10877 Wilshire Blvd., Suite 710, Los Angeles, CA 90024. |

| |

| (2) | | If a person has the right to acquire shares of common stock subject to options and other convertible securities within 60 days of January 31, 2008, then such shares are deemed outstanding for purposes of computing the percentage ownership of that person, but are not deemed outstanding for purposes of computing the percentage ownership of any other person. The following shares of common stock subject to stock options, warrants, restricted stock units, and convertible promissory notes may be acquired within 60 days of January 31, 2008, and are included in the table above: |

| | |

| | • | Michael S. Burke — 35,000 under options and 3,750 under restricted stock units; |

| |

| | • | I. Merrick Kerr — 25,000 under options; |

| |

| | • | Douglas M. Miller — 43,333 under options; |

| |

| | • | Colin M. Morris — 25,000 under options; |

| |

| | • | D. Hunt Ramsbottom — 2,082,500 under warrants, and 83,333 under options; |

| |

| | • | Michael F. Ray — 62,248 under warrants, 70,000 under options and 3,750 under restricted stock units; |

| |

| | • | Ronald M. Sega — 20,000 under options; |

| |

| | • | Edward M. Stern — 35,000 under options and 3,750 under restricted stock units; |

| |

| | • | Erich W. Tiepel — 130,000 under options and 3,750 under restricted stock units; |

| |

| | • | Halbert S. Washburn — 50,000 under options and 3,750 under restricted stock units; and |

| |

| | • | Dennis L. Yakobson — 540,000 under options, 155,156 under convertible promissory notes and 3,750 under restricted stock units. |

| | |

| (3) | | Information with respect to beneficial ownership is based upon information furnished by each shareholder or contained in filings with the Securities and Exchange Commission. |

| |

| (4) | | Includes a warrant held by East Cliff Advisors, LLC for 2,082,500 shares which have vested, and excludes a warrant held by East Cliff Advisors, LLC for 787,500 shares which will vest when Rentech’s stock price reaches $5.25 or higher for twelve consecutive trading days. Mr. Ramsbottom is the managing member and has sole investment and voting power in East Cliff Advisors, LLC. |

| |

| (5) | | Includes 6,000 shares held for the benefit of Mr. Ramsbottom’s children as to which Mr. Ramsbottom disclaims beneficial ownership. |

| |

| (6) | | Includes 7,500 shares held by Mr. Ray’s spouse’s IRA, as to which Mr. Ray disclaims beneficial ownership. |

| |

| (7) | | Includes 20,000 shares held in custodial accounts, as to which Mr. Yakobson disclaims beneficial ownership. |

| |

| (8) | | Based solely on information in a Schedule 13G/A filed by BlackRock, Inc. (“BlackRock”) with the SEC on February 8, 2008. BlackRock reports (on behalf of its investment advisory subsidiaries) that, of the shares it beneficially owns, it has the shared power to vote or to direct the vote of and the shared power to dispose of or to direct the disposition of, all 24,601,172 shares. According to the Schedule 13G/A, BlackRock is the parent holding company for the following subsidiary investment advisors which hold the shares: BlackRock Advisors LLC, BlackRock Investment Management LLC, BlackRock (Channel Islands) Ltd, BlackRock |

6

| | |

| | Investment Management UK Ltd. BlackRock’s principal business office address is 40 East 52nd Street, New York, New York 10022. |

| |

| (9) | | Based solely on information in a Schedule 13G/A filed by Wellington Management Company, LLP (“Wellington”) with the SEC on February 11, 2008. Wellington reports that, of the shares it beneficially owns, it has the shared power to vote or to direct the vote of 9,124,778 of such shares, and the shared power to dispose of or to direct the disposition of, all 16,680,078 shares. According to the Schedule 13G/A, Wellington is an investment adviser and may be deemed to beneficially own 16,680,078 shares. Wellington reports that the shares beneficially owned by it are owned of record by clients of Wellington, and that those clients have the right to receive, or the power to direct the receipt of dividends from, or the proceeds from the sale of, such shares. According to the Schedule 13G/A, no client is known to have such right or power with respect to more than five percent of the shares beneficially owned by Wellington. Wellington’s principal business office address is 75 State Street, Boston, Massachusetts 02109. |

| |

| (10) | | Based solely on information in a Schedule 13D filed with the SEC on December 12, 2007 as a joint statement by Asset Managers International Limited (“AMIL”), which operated as a wholly owned subsidiary of Pentagon Special Purpose Fund, Ltd. until November 2006, when Pentagon Special Purpose Fund distributed the shares of AMIL to its shareholders in exchange for their shares of Pentagon Special Purpose Fund, Pentagon Capital Management, PLC (“Pentagon”), Lewis Chester (“Chester”), and Jafar Omid (“Omid”). AMIL is a pooled investment vehicle, and Pentagon is the investment adviser to AMIL with full control over the decisions as to what securities to buy or sell, and how to vote securities owned by AMIL. Chester is the Chief Executive Officer of Pentagon, and Omid is the Chief Financial Officer of Pentagon. Chester and Omid are directors of, and control, Pentagon. The Schedule 13D reports that the filing group has the shared power to vote or to direct the vote of, and the shared power to dispose of or to direct the disposition of, all 9,626,785 shares beneficially owned by it. Of those 9,626,785 shares, 986,985 are issuable upon the exercise of warrants. The address of the principal business and principal office of AMIL isc/o Olympia Capital (Ireland) Ltd., Harcourt Center, 6th Floor, Block 3, Harcourt Road, Dublin 2, Ireland. The address of the principal business and principal office of Pentagon, Chester, and Omid is 1 Knightsbridge, London, England SW1X 7LX. |

Equity Compensation Plan Information

The following table provides information as of September 30, 2007 with respect to our compensation plans, including individual compensation arrangements under which our equity securities are authorized for issuance.

| | | | | | | | | | | | | |

| | | Number of Securities

| | | | Number of

|

| | | to be Issued

| | Weighted-Average

| | Securities Remaining

|

| | | upon Exercise of

| | Exercise Price of

| | Available for Future

|

| | | Outstanding Options,

| | Outstanding Options,

| | Issuance Under Equity

|

Plan Category | | Warrants and Rights | | Warrants and Rights | | Compensation Plans |

| |

| Equity compensation plans approved by security holders | | | 4,542,000 | | | $ | 2.34 | | | | 3,683,000 | |

| Equity compensation plans not approved by security holders | | | 3,731,000 | | | $ | 1.51 | | | | — | |

| | | | | | | | | | | | | |

| Total | | | 8,273,000 | | | $ | 1.97 | | | | 3,683,000 | |

| | | | | | | | | | | | | |

The equity securities issued as compensation under shareholder approved compensation plans consist of stock options and restricted stock units. The equity securities issued as compensation without shareholder approval consist of stock options, stock purchase warrants and restricted stock units. The stock options and stock purchase warrants have exercise prices equal to the fair market value of our common stock, as reported by the American Stock Exchange or the Nasdaq Bulletin Board, as of the date the securities were granted. The options and warrants may be exercised for a term ranging from five to ten years after the date they were granted. For a narrative description of the material terms of the equity compensation plans and other compensation arrangements summarized in the above table, please see the section entitled “Accounting for Stock Based Compensation” in note 15 to our consolidated financial statements included in the Annual Report onForm 10-K for the fiscal year ended September 30, 2007.

7

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires Rentech’s executive officers and directors, and persons who own more than ten percent of a registered class of Rentech’s equity securities (collectively, “Insiders”), to file initial reports of ownership and reports of changes in ownership with the Securities and Exchange Commission (the “SEC”). Insiders are required by SEC regulations to furnish Rentech with copies of all Section 16(a) forms they file. To Rentech’s knowledge, based solely on its review of the copies of such reports furnished to Rentech, or written representations from certain Insiders that they were not required to file a Form 5 to report previously unreported ownership or changes in ownership, we believe that during our fiscal year ended September 30, 2007, the Insiders complied with all such filing requirements.

Meetings and Committees of the Board of Directors

The Board of Directors held eleven meetings during the fiscal year ended September 30, 2007. Actions were also taken during the year by written consent. Each of our directors attended at least 75% of the meetings of the Board of Directors held during the period for which he has been a director or of the meetings of committees of the Board of Directors on which he served during the period that he served. Each director attended the annual meeting of shareholders held in 2007 and is reimbursed for his expenses incurred in attending meetings. We encourage all incumbent directors and director nominees to attend our annual meetings of stockholders.

The Board of Directors has three standing committees, an Audit Committee, a Compensation Committee, and a Nominating Committee. The Board of Directors has determined that the members of our Board of Directors, other than Mr. Ramsbottom and Mr. Yakobson, are “independent” within the meaning of the listing standards of the American Stock Exchange, including each member of our Audit Committee, Compensation Committee, and Nominating Committee. The Board of Directors has also determined that each member of the Audit Committee is “independent” within the meaning of the rules of the Securities and Exchange Commission.

The charters of our Audit Committee, Compensation Committee, and Nominating Committee are available on the Corporate Governance section of our website athttp://www.rentechinc.com. The Board of Directors regularly reviews developments in corporate governance and modifies these policies and charters as warranted. Modifications are reflected on our website at the address previously given. Information contained on our website is not incorporated into and does not constitute a part of this proxy statement. Our website address referenced above is intended to be an inactive textural reference only and not an active hyperlink to the website.

The Audit Committee of the Board of Directors has been delegated responsibility for reviewing with the independent auditors the plans and results of the audit engagement; reviewing the adequacy, scope, and results of the internal accounting controls and procedures; reviewing the degree of independence of the auditors; reviewing the auditors’ fees; and recommending the engagement of the auditors to the full Board of Directors. The Audit Committee currently consists of Mr. Burke, Mr. Washburn, and Dr. Tiepel. The Board of Directors has determined that Mr. Burke, the Chairman of the Audit Committee, qualifies as an “audit committee financial expert” as defined by the rules of the Securities and Exchange Commission. The committee met four times during fiscal 2007.

The Compensation Committee is currently comprised of Mr. Ray, Mr. Washburn, and Dr. Tiepel. None of them is or has been an employee of Rentech. The Compensation Committee reviews and approves executive officer compensation and stock option grants, administers Rentech’s stock option plans, and establishes compensation philosophy for executive officers. The committee met nine times during the last fiscal year.

The Nominating Committee currently consists of Edward M. Stern and Michael F. Ray. The primary duty of the Committee is to make recommendations to the Board of Directors regarding recruitment of new directors and re-election of incumbent directors. The committee met two times during fiscal year 2007.

Compensation Discussion and Analysis

Compensation Program Objectives and Executive Summary

Rentech’s goal is to commercialize its proprietary technology for the production of ultra clean synthetic fuels and chemicals. We plan to achieve this by first demonstrating our technology in a small scale Product

8

Demonstration Unit, or PDU, and then in a single full scale commercial reactor. We believe the successful commercialization of our technology should result in a significant number of opportunities to have our technology deployed in ultra clean synthetic fuel and chemical plants both domestically and internationally. We expect to have our technology deployed in projects where Rentech owns equity, as well as where Rentech is simply a technology licensor. We expect that successful commercialization of our technology will enable Rentech to significantly increase its market capitalization and result in a very substantial increase in business complexity.

The key operational goals to achieve our overall goal presently include completing the PDU, completing the development and design of the site in Adams County, Mississippi for our first commercial scale reactor, producing fuels and chemicals that meet customer requirements, entering into contracts for the sale of those products, maximizing the value from our nitrogen fertilizer plant in East Dubuque, Illinois through improved product mix and plant reliability, securing the financing necessary for our first full commercial scale reactor, and then building our first commercial scale reactor.

We have focused on building an experienced management team that is capable of managing Rentech through a period of growth in order to meet our goals. We believe it is important for us to maintain continuity in our senior management team during this period. We have made it a policy to hire executives who are not only highly qualified for their position at our current size, but who also have the skills we believe to be necessary to perform their roles at the same high standard in a company that is significantly greater in size and complexity. We believe that the team that we have assembled is capable of delivering on our goals.

In fiscal year 2007, we compared the pay levels of our executive positions to those in a selected group of peer companies set forth in more detail below. Our base salaries were at or near the median of our peers. Our target total cash compensation was above the peer group median by about 20%. Our long-term incentives were not tied as closely to the performance of Rentech and shareholder returns as some in the peer group. As a result, other than the hire-on grant to Mr. Penning in January 2007 and stock option grants made to our other named executive officers in July of 2006 which were intended to cover the15-month period through the end of fiscal year 2007, we made no long-term incentive grants to our executive officers during fiscal 2007 while we worked on developing a new long-term incentive plan designed to more closely align management’s compensation with Rentech’s performance over the long term.

We believe that in our marketplace for talent, our base salaries are competitive, because they are in line with the median of that paid by our peer companies. Our annual cash bonuses are structured to provide short-term incentives that place a focus on specific, defined business objectives for Rentech over the year. Rentech’s results as compared to the business objectives for 2007 were mixed, but given the challenges that faced Rentech in 2007, the performance was in line with, and in some cases better than, that of many peer companies. The Compensation Committee of our Board of Directors has been working on a new long-term incentive plan that we expect will go into effect during fiscal year 2008. The new plan is expected to place a strong emphasis on retention and on both relative and absolute stock price performance. It is anticipated that the performance elements will pay nothing for 25th percentile performance, but offer an opportunity for pay at the 75th percentile for 75th percentile and above performance, with a sliding scale for performance in between those benchmarks.

Our focus is on providing a market-level salary for our executives with the opportunity to exceed market levels if short- and long-term performance exceeds expectations. The total compensation package for fiscal year 2008 is expected to pay our executives at the median level of the market for average performance, with compensation approaching the 75th percentile of the market for exceptional performance.

Independent Compensation Consultant

In July 2007, the Compensation Committee retained an independent compensation consultant, Watson Wyatt Worldwide (“Watson Wyatt”), to assist it in evaluating our current executive compensation programs and in developing programs to meet our needs going forward. The Compensation Committee was ultimately responsible for selecting the consultant, determining the scope of any work done, and negotiating and approving fees for such work. Management provided input on each of these items as requested by the Committee.

9

Peer Group Generation and Benchmarking Results

When originally assembling the current management team, the Compensation Committee gathered information independently, with the assistance of a compensation consultant, on executives in comparable positions in energy companies of between $100 million and $500 million in market capitalization. This information was used as a benchmark in making the original salary, incentive, and equity awards to the existing executive team, as documented in the existing employment contracts. Mr. Morris does not have an employment contract, but a similar process was followed in his hiring and offer process.

In 2007, Watson Wyatt worked with the Compensation Committee and Rentech management to develop an updated group of peer companies to which Rentech’s current executive compensation programs could be compared. The list was created by targeting companies (a) in the alternative energyand/or fertilizer industry, and (b) with a market capitalization of about $500 million, slightly larger than our market capitalization at the time. We believe this is a group that represents the type of companies for which we may compete for executive talent, and with whom we therefore want to be competitive in terms of compensation. The original peer group was constructed by Watson Wyatt. Rentech management reviewed the list and made a few suggested modifications, which were reviewed by Watson Wyatt. The final group of companies was submitted for review and approval to the Compensation Committee, and consisted of the following:

| | |

| | • | AVENTINE RENEWABLE ENERGY |

| |

| | • | HEADWATERS INC |

| |

| | • | VERASUN ENERGY CORP |

| |

| | • | US BIOENERGY CORP |

| |

| | • | MGP INGREDIENTS INC |

| |

| | • | PACIFIC ETHANOL INC |

| |

| | • | ENERGY CONVERSION DEV |

| |

| | • | FUEL TECH INC |

| |

| | • | BALLARD POWER SYSTEMS INC |

| |

| | • | EVERGREEN ENERGY INC |

| |

| | • | FUELCELL ENERGY INC |

| |

| | • | METHANEX CORP |

| |

| | • | TERRA INDUSTRIES INC |

Methanex and Terra Industries were judged to be too large for proper comparison of compensation, and were removed from the analysis for the purposes of making judgments on compensation. However, these are considered good industry peers and are included in the peer group for comparisons of company stock price performance.

In mid-2007, data were gathered from these peer companies, as well as from published survey data from major compensation survey providers (including Watson Wyatt), on various elements of executive compensation, including base salaries, total cash compensation, long-term incentives, and total direct compensation.

Rentech’s base salaries were found to be at or near the median of the market data gathered, exceeding the 50th percentile of the data by 3% on average for our named executive officers (“NEOs”). Our target total cash compensation was higher than the median of the market data, on average about 23% above the 50th percentile of market data gathered for our NEOs. We made stock option grants to our NEOs in July 2006 with a three-year vesting schedule which was designed to cover the15-month period until the end of fiscal year 2007. We made few other equity grants in fiscal year 2007. A comparison of our long-term incentives (“LTIs”) and total direct compensation (base, bonus, and LTI), including annualized grant values from 2006 and part of sign-on equity, was generally between the 60th and 75th percentiles of the market. We concluded from this that our base salaries and short-term incentives are well positioned to attract and retain the type of management team that we believe is necessary to

10

successfully implement our commercialization strategy. However, we determined that our long-term incentive plan could be improved by more closely aligning Rentech’s performance and the return to shareholders with management’s compensation. To that end we have been developing a new LTI plan.

Core Components of Executive Compensation

Base Salary

Base salaries for the executive officers at Rentech were generally set during the hiring process for the executives in late 2005 and early 2006. The Board considered data on executives in comparable positions at other publicly traded companies within the energy industry when making offers to the current team of executives and, with the exception of Mr. Morris, the terms of these negotiations are documented in written employment contracts. Each of these employment contracts provides for an automatic increase in base salary equal to the change in the Consumer Price Index for all Urban Consumers on a year-over-year, August-to-August basis. Salary increases for fiscal year 2007 based on the Consumer Price Index for Messrs. Ramsbottom, Kerr, Miller, and Morris were 3.8%.

For Messrs. Kerr and Morris, performance evaluations were completed a short time after their date of hire, and they were slotted into the general increase guidelines as applied to all Rentech employees, which allowed for merit increases of between 0% and 5%. Mr. Kerr received an increase of 3.5% based on this performance evaluation. Mr. Morris received an increase of 5.0% based on this performance evaluation. The Board may provide additional merit increases to the base salary of Rentech’s executives at its discretion. No such adjustments were made in the prior year.

Annual Bonus

Rentech maintains an annual incentive plan for its executive officers. Successful completion of Rentech’s short-term objectives are critical in achieving the planned level of growth, but are not yet necessarily reflected in traditional incentive plan targets such as revenue or financial growth metrics. The annual incentive plan is designed to reward our executives for successfully taking the immediate needed steps toward Rentech’s long-term success. The target bonus for the CEO in his employment agreement is set at 100% of his base salary. The targets for the other NEOs in their employment agreements or arrangements are set at 50% of their respective base salaries.

Prior to the beginning of each fiscal year, the CEO and other senior officers develop a series of broad business-related objectives for the upcoming fiscal year. This plan is then reviewed by the Board, which provides substantial input and revisions, and sets the goals for the year. The ultimate decision on objectives is made by the Board. These goals are then widely distributed among eligible participants.

At the end of the year, the CEO develops a “scorecard” of recommendations for each of his direct reports based on their performance on the goals set by the Board, with each goal ranked on a scale from zero (did not meet) to two (exceptional performance). This scorecard is reviewed by the Compensation Committee and the Board, and modified as appropriate in their discretion. Final bonus payments for the CEO and the other executives are determined based on Renetch’s performance on goals over which they exert some level of control, as determined by the CEO, the Compensation Committee, and the Board, and ranges from 0% of target to 200% of target depending on performance. The ultimate decision on executive bonuses is made by the Compensation Committee and the Board.

In fiscal 2007, we had the following goals and results:

1. Close financing on the East Dubuque conversion project — The financing for the proposed East Dubuque conversion project was not closed during the goal period; however, there was a significant change in the relative economics of proceeding with this project as compared to continuing to operate the existing nitrogen fertilizer plant as is during the period; the Board determined to postpone the project for this reason and the reasons previously discussed in our public filings with the Securities and Exchange Commission.

2. PDU completion — The PDU was not completed during the goal period; however there were many challenges during the period, including weather delays in the Denver area, shortages of skilled labor, problems with critical equipment purchased from third-party vendors, and some design changes due to poor original

11

design that we believe we have now addressed. We are on track for producing first fuel at the PDU by Spring 2008.

3. Natchez Project progress — We executed strongly in this area during the goal period, including taking control over a larger and better suited site, and entering into a long-term contract for the sale of the carbon dioxide to be produced at the site of our proposed Strategic Fuels and Chemicals Complex in Adams County, Mississippi, near the city of Natchez (the “Natchez Project”).

4. Coal Supply and Equity Option Agreements for East Dubuque conversion project — We successfully negotiated these critical agreements.

5. Rentech brand / positioning — We made progress on this goal by highlighting that our technology can convert more than just coal into synthetic fuels and chemicals.

6. Breaking ground at East Dubuque — We did not break ground at East Dubuque during the goal period for the reasons described in Item 1 above.

7. Corporate financing goals — We achieved our goals in this area with a successful Secondary Offering of approximately $54.9 million during the goal period.

8. Development of long-term strategic focus — We completed a detailed business strategy incorporating a10-year business plan during the goal period.

9. Management team development — The management team was completed during the period with the hiring of an Executive Vice President for Commercial Affairs and a Senior Vice President for Government Affairs and Communications.

10. Development of at least 5 new patents — We exceeded this goal by filing 10 patent applications during the goal period.

11. Development of commercial agreements — We continued to work on developing agreements to commercialize our technology but did not enter into a major agreement during the period.

Determination of the level of achievement of these goals is largely at the discretion of the CEO and ultimately the Compensation Committee and the Board for the CEO’s direct reports, and completely at the discretion of the Compensation Committee and the Board for the CEO. While not all of the goals were achieved during the period, many of the goals were. Management faced significant challenges in 2007 which inhibited some of Rentech’s plans and presented opportunities for changes in Rentech’s plans, such as the shift in focus from the East Dubuque conversion project to the Natchez Project. As a result of Rentech’s performance in fiscal year 2007 on these goals, Mr. Ramsbottom received 120% of his target bonus, Mr. Kerr received 110% of his target bonus, Mr. Miller received 65% of his target bonus, Mr. Morris received 120% of his target bonus, and Mr. Penning received 100% of his target bonus on a prorated basis.

The specific goals for Rentech in fiscal year 2008 are along similar lines to those disclosed for 2007. The Board feels that the goals set are challenging, and appropriately calibrated to require a high level of performance in fiscal year 2008 from Rentech’s executive group. While some of the goals consist of proprietary information that may hurt the performance of Rentech in the marketplace were they to be disclosed, the following is an overview of some of the goals: (1) development of our plans for our first commercial scale reactor, currently planned at the Natchez site; (2) completion and successful operation of the PDU by Spring of 2008; (3) partnership and off-take agreements to support our Natchez Project; (4) building out of our brand and greater awareness in the market of the positive environmental impacts of our technology; (5) continued strong safety record at our facilities; (6) certification of our product for the market; (7) development of certain commercial opportunities; and (8) certain financial performance levels at our nitrogen fertilizer plant.

Long-Term Incentives

Historically, Rentech has granted both restricted stock units and option awards to its executives. Restricted stock units were made at or around the date of hire for each of the executives at Rentech. An award of stock options was made on July 16, 2006, which was intended to cover 15 months of performance for Rentech executives.

12

Mr. Penning received a grant of restricted stock units on January 22, 2007. No other equity awards were made to Rentech’s NEOs in fiscal year 2007.

From the latter part of 2007 to date, the Compensation Committee has been working with Watson Wyatt to design a new long-term incentive plan for awards to be made in 2008. The Compensation Committee intends to strike a good balance between retention, equity ownership, and performance with its new design. The plan is expected to have several elements, including time-based restricted stock units and performance shares. The goals set for the performance share plan are expected to provide for maximum payout only if Rentech has relative performance at or above the 75th percentile of other companies in the industry, and a significant absolute share price increase. The performance-based elements of the plan are not expected to provide for any payout for performance at or below the 25th percentile of the peer group, or an absolute share price increase below a threshold.

The Board feels that the rewards provided to the executives for such performance should adequately compensate them for the efforts required to achieve these goals, and better align their incentives with shareholder returns.

Management Stock Purchase Plan (MSPP)

The Compensation Committee and the Board also anticipate implementing a program under which NEOs would be required to use a portion of any annual incentive bonus received to purchase shares of Rentech stock. Rentech would then match the deferral on a dollar-for-dollar basis in shares of restricted stock, with cliff vesting at the end of three years, but only if the stock is not sold in the intervening time. Executives would be able to choose to defer additional funds into the plan, but no additional matching would be available. The Board believes that this would promote ownership of Rentech stock among the executive group, increasing their personal investments in Rentech, and rewarding the participants as the shareholders are rewarded.

Benefits and Perquisites

As part of the compensation package, Rentech provides its executives with a car allowance, a financial advisor, and other benefits, such as health insurance and a 401(k) matching program at levels comparable to those provided to employees at other levels in the organization. Mr. Penning also receives a housing allowance as part of a relocation package related to his move from Illinois to Los Angeles, California to join Rentech. The Compensation Committee does not feel that perquisites should play an important role in the compensation of our executives, but also feels that the benefits described above are reasonable and in line with those provided to management level employees.

Employment Contracts

Rentech has entered into employment agreements with Messrs. Ramsbottom, Kerr, Miller, and Penning. The industry in which we operate is very volatile and acquisitive, and we feel that these contracts provide our executive team with an adequate level of security in their roles in such an environment. Generally speaking, the employment agreements provide our executives with one year’s base salary (two years’ for Mr. Ramsbottom) and one year’s target bonus in severance in the event that their employment is terminated without cause. See “Summary Compensation Table” and discussions below for more details on these agreements. The contracts also provide for accelerated vesting of any sign-on equity granted, as well as 18 months of company-paid medical coverage in certain situations. Though Mr. Morris does not have a contract, and therefore no contractual severance provisions, his sign-on equity grant would vest in similar circumstances.

Further, in the event of a change in control of Rentech, all outstanding option awards would immediately become vested and exercisable. The employment contracts also providegross-up protection against potential liabilities under IRC Sections 280G and 4999, though none of the executives currently exceed their statutory safe harbor limits under these provisions.

13

Compensation Committee Report

The Compensation Committee of the Board of Directors has reviewed and discussed with management the foregoing Compensation Discussion and Analysis and, based on such review and discussion, the Compensation Committee determined that the Compensation Discussion and Analysis should be included in this proxy statement.

COMPENSATION COMMITTEE

Michael F. Ray, Chairman

Erich W. Tiepel

Halbert S. Washburn

Compensation Committee Interlocks and Insider Participation

During fiscal year 2007, the following individuals served as members of the Compensation Committee: Michael F. Ray, Erich W. Tiepel, and Halbert S. Washburn. None of these individuals has ever served as an officer or employee of Rentech or any of its subsidiaries. No executive officer of Rentech has served as a director or member of the compensation committee of another entity at which an executive officer of such entity is also a director of Rentech.

Executive Compensation

The following table sets forth information concerning total NEO compensation for fiscal 2007, as prescribed by the new SEC guidelines, on a GAAP basis. These amounts combine both compensation earned and paid in fiscal 2007 with compensation awarded or earned relative to prior years, but expensed this year.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | Non-

| | Change in

| | | | |

| | | | | | | | | | | | | Equity

| | Pension

| | | | |

| | | | | | | | | | | | | Incentive

| | Value and

| | | | |

| | | | | | | | | | | | | Plan

| | Deferred

| | All Other

| | |

| | | | | | | | | Stock

| | Option

| | Compen-

| | Compen-

| | Compen-

| | |

| | | | | Salary

| | Bonus

| | Awards

| | Awards

| | sation

| | sation

| | sation

| | Total

|

Name and Principal Position | | Year | | ($) | | ($)(1) | | ($)(2) | | ($) | | ($) | | ($) | | ($)(3) | | ($) |

| |

| D. Hunt Ramsbottom — Chief Executive Officer | | | 2007 | | | $ | 384,100 | | | $ | 470,150 | | | $ | 742,500 | | | | — | | | | — | | | | — | | | $ | 28,022 | | | $ | 1,624,772 | |

| I. Merrick Kerr — Chief Financial Officer | | | 2007 | | | $ | 278,280 | | | $ | 162,900 | | | $ | 487,500 | | | | — | | | | — | | | | — | | | $ | 38,398 | | | $ | 967,078 | |

| Douglas M. Miller — Chief Operating Officer | | | 2007 | | | $ | 311,400 | | | $ | 103,200 | | | $ | 618,750 | | | | — | | | | — | | | | — | | | $ | 33,803 | | | $ | 1,067,153 | |

| Colin M. Morris — General Counsel | | | 2007 | | | $ | 204,925 | | | $ | 127,500 | | | $ | 216,000 | | | | — | | | | — | | | | — | | | $ | 26,661 | | | $ | 575,086 | |

| Richard T. Penning Executive Vice President — Commercial Affairs | | | 2007 | | | $ | 188,727 | | | $ | 116,350 | (4) | | $ | 364,260 | | | | — | | | | — | | | | — | | | $ | 111,044 | | | $ | 780,381 | |

| | |

| (1) | | The fiscal 2007 bonus was awarded in December 2007 and is payable 80% in cash, with the remaining 20% being withheld to potentially purchase shares of Rentech stock. The Compensation Committee and the Board anticipate implementing a program under which NEOs would be required to use a portion of any annual incentive bonus received to purchase shares of Rentech stock. For a further discussion, refer to the “Management Stock Purchase Plan” above. |

| |

| (2) | | Amounts reflect the amounts recognized for financial statement reporting purposes in fiscal year 2007, calculated in accordance with Statement of Financial Accounting Standards No. 123(R) Share-Based Payment (“SFAS No. 123(R)”). See Note 15 — Accounting for Stock Based Compensation in Rentech’s Annual Report onForm 10-K for the fiscal year ended September 30, 2007 for an explanation of the valuation model assumptions used. |

14

| | |

| (3) | | All Other Compensation includes 401(k) matching contributions of $10,398, $14,553, and $1,661 for Messrs. Kerr, Miller, and Morris, and legal fee reimbursement of $5,798 for Mr. Penning related to his employment agreement. All Other Compensation also includes perquisites valued at the aggregate incremental cost to Rentech, consisting of car allowance, relocation expenses, and financial and tax planning services paid by Rentech. |

| |

| (4) | | Amount includes a commencement bonus of $15,000. The commencement bonus was not subject to the apportionment described in Note 1. |

Perquisites

| | | | | | | | | | | | | | | | | |

| | | Auto

| | | Relocation

| | | Financial &

| | | | |

Name | | Allowance | | | Expenses | | | Tax Planning | | | Total | |

| |

| D. Hunt Ramsbottom | | $ | 12,000 | | | | — | | | $ | 16,022 | | | $ | 28,022 | |

| I. Merrick Kerr | | $ | 12,000 | | | | — | | | $ | 16,000 | | | $ | 28,000 | |

| Douglas M. Miller | | $ | 12,000 | | | | — | | | $ | 7,250 | | | $ | 19,250 | |

| Colin M. Morris | | $ | 9,000 | | | | — | | | $ | 16,000 | | | $ | 25,000 | |

| Richard T. Penning | | $ | 8,545 | | | $ | 96,701 | | | | — | | | $ | 105,246 | |

Grants of Plan-Based Awards

The following table sets forth information with respect to the NEOs concerning the grant of plan-based awards during the last fiscal year. All the plan-based awards were granted at the fair market value on the date of grant.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | All Other

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | All Other

| | | Option

| | | | | | | |

| | | | | | | | | Estimated Future

| | | Estimated Future

| | | Stock

| | | Awards:

| | | Exercise or

| | | | |

| | | | | | | | | Payouts Under

| | | Payouts Under

| | | Awards:

| | | Number of

| | | Base Price of

| | | Grant

| |

| | | | | | Equity or

| | | Non-Equity Incentive Plan Awards | | | Equity Incentive Plan Awards | | | Number of

| | | Securities

| | | Option

| | | Date

| |

| | | Grant

| | | Non-Equity

| | | Threshold

| | | Target

| | | Maximum

| | | Threshold

| | | Target

| | | Maximum

| | | Shares of

| | | Underlying

| | | Awards

| | | Fair Value

| |

Name | | Date | | | Award | | | ($) | | | ($) | | | ($) | | | (#) | | | (#) | | | (#) | | | Stock or Units (#) | | | Options (#) | | | ($/Sh) | | | ($)(1) | |

| |

| D. Hunt Ramsbottom | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| I. Merrick Kerr | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Douglas M. Miller | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Colin M. Morris | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Richard T. Penning(2) | | | 1/22/2007 | | | | Equity | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 275,000 | | | | — | | | | — | | | $ | 1,028,500 | |

| | |

| (1) | | See Note 15 — “Accounting for Stock Based Compensation” in Rentech’s Annual Report onForm 10-K for the fiscal year ended September 30, 2007 for an explanation of the valuation model assumptions used to value stock awards under SFAS No. 123(R). |

| |

| (2) | | The restricted stock units granted to Mr. Penning vest over a three-year period such that one-third will vest on each one-year, two-year, and three-year anniversary of the vesting commencement date of January 15, 2007. |

Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table

For a narrative description of fiscal year 2007 salaries, bonuses and equity-based awards, please see the sections entitled “Compensation Discussion and Analysis” and “Employment Contracts”.

15

Outstanding Equity Awards at Fiscal Year End

The following table sets forth information with respect to the NEOs concerning the outstanding equity awards, as of September 30, 2007.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Option Awards | | | Stock Awards | |

| | | | | | | | | Equity

| | | | | | | | | | | | | | | Equity

| | | Equity Incentive

| | | | |

| | | | | | | | | Incentive

| | | | | | | | | | | | | | | Incentive

| | | Plan Awards:

| | | | |

| | | | | | | | | Plan Awards:

| | | | | | | | | | | | Market

| | | Plan Awards:

| | | Market or

| | | | |

| | | Number of

| | | Number of

| | | Number of

| | | | | | | | | Number

| | | Value

| | | Number of

| | | Payout

| | | | |

| | | Securities

| | | Securities

| | | Securities

| | | | | | | | | of Shares or

| | | of Shares or

| | | Unearned

| | | Value of

| | | | |

| | | Underlying

| | | Underlying

| | | Underlying

| | | | | | | | | Units of

| | | Units of

| | | Shares, Units

| | | Unearned

| | | | |

| | | Unexercised

| | | Unexercised

| | | Unexercised

| | | Option

| | | Option

| | | Stock

| | | Stock

| | | or

| | | Shares, Units or

| | | | |

| | | Options

| | | Options

| | | Unearned

| | | Exercise

| | | Expiration

| | | that have not

| | | that have not

| | | Other Rights

| | | Other Rights

| | | | |

| | | (#)

| | | (#)

| | | Options

| | | Price

| | | Date

| | | Vested

| | | Vested

| | | that have not

| | | that have not

| | | | |

Name | | Exercisable | | | Unexercisable | | | (#) | | | ($) | | | ($) | | | (#) | | | ($)(1) | | | Vested (#) | | | Vested ($) | | | Notes | |

| |

| D. Hunt Ramsbottom | | | 83,333 | | | | 166,667 | | | | — | | | $ | 4.15 | | | | 7/13/2016 | | | | — | | | | — | | | | — | | | | — | | | | (2 | ) |

| | | | — | | | | — | | | | 787,500 | | | $ | 1.82 | | | | 8/4/2010 | | | | — | | | | — | | | | — | | | | — | | | | (3 | ) |

| | | | — | | | | — | | | | — | | | | — | | | | — | | | | 300,000 | | | $ | 648,000 | | | | — | | | | — | | | | (4 | ) |

| I. Merrick Kerr | | | 25,000 | | | | 50,000 | | | | — | | | $ | 4.15 | | | | 7/13/2016 | | | | — | | | | — | | | | — | | | | — | | | | (2 | ) |

| | | | — | | | | — | | | | — | | | | — | | | | — | | | | 216,667 | | | $ | 468,000 | | | | — | | | | — | | | | (5 | ) |

| Douglas M. Miller | | | 43,333 | | | | 86,667 | | | | — | | | $ | 4.15 | | | | 7/13/2016 | | | | — | | | | — | | | | — | | | | — | | | | (2 | ) |

| | | | — | | | | — | | | | — | | | | — | | | | — | | | | 250,000 | | | $ | 540,000 | | | | — | | | | — | | | | (6 | ) |

| Colin M. Morris | | | 25,000 | | | | 50,000 | | | | — | | | $ | 4.15 | | | | 7/13/2016 | | | | — | | | | — | | | | — | | | | — | | | | (2 | ) |

| | | | — | | | | — | | | | — | | | | — | | | | — | | | | 100,000 | | | $ | 216,000 | | | | — | | | | — | | | | (7 | ) |

| Richard T. Penning | | | — | | | | — | | | | — | | | | — | | | | — | | | | 275,000 | | | $ | 594,000 | | | | — | | | | — | | | | (8 | ) |

| | |

| (1) | | Calculated based on the $2.16 closing price of Rentech’s common stock on September 28, 2007. |

| |

| (2) | | Represents an option award granted on July 14, 2006, which vests in three equal annual installments starting on the first anniversary of the grant date. The award will be fully vested on July 14, 2009. |

| |

| (3) | | Represents a warrant held by East Cliff Advisors, LLC, an entity affiliated with Mr. Ramsbottom. The warrant will vest when Rentech’s stock price reaches $5.25 or higher for twelve consecutive trading days. |

| |

| (4) | | Represents a restricted stock unit award which will vest in two equal annual installments on December 15, 2007 and December 15, 2008. |

| |

| (5) | | Represents a restricted stock unit award which will vest in two equal annual installments on May 15, 2008 and May 15, 2009. |

| |

| (6) | | Represents a restricted stock unit award which will vest in two equal annual installments on January 20, 2008 and January 20, 2009. |

| |

| (7) | | Represents a restricted stock unit award which will vest in two equal annual installments on June 5, 2008 and June 5, 2009. |

| |

| (8) | | Represents a restricted stock unit award which will vest in three equal annual installments on January 15, 2008, January 15, 2009 and January 15, 2010. |

16

Option Exercises and Stock Vested

The following table sets forth information with respect to the NEOs concerning the option exercises and stock vested during the fiscal year ended September 30, 2007.

| | | | | | | | | | | | | | | | | |

| | | Option Awards | | | Stock Awards | |

| | | Number of

| | | Value

| | | Number of

| | | Value

| |

| | | Shares Acquired

| | | Realized

| | | Shares Acquired

| | | Realized

| |

| | | on Exercise

| | | on Exercise

| | | on Vesting

| | | on Vesting

| |

Name | | (#) | | | ($) | | | (#) | | | ($)(1) | |

| |

| D. Hunt Ramsbottom | | | — | | | | — | | | | 150,000 | | | $ | 571,500 | |

| I. Merrick Kerr | | | — | | | | — | | | | 108,333 | | | $ | 246,999 | |

| Douglas M. Miller | | | — | | | | — | | | | 125,000 | | | $ | 476,250 | |

| Colin M. Morris | | | — | | | | — | | | | 50,000 | | | $ | 141,500 | |

| Richard T. Penning | | | — | | | | — | | | | — | | | | — | |

| | |

| (1) | | Value Realized on Vesting represents the amount equal to the closing market price of the shares on the date of vesting multiplied by the number of shares that vested pursuant to restricted stock units. |

Potential Payments upon Termination or Change in Control