Use these links to rapidly review the document

TABLE OF CONTENTS

Filed Pursuant to Rule 424(b)(5)

Registration Statement No. 333-132594

SUBJECT TO COMPLETION, DATED APRIL 3, 2006

This prospectus supplement relates to an effective registration statement under the Securities Act of 1933, but is not complete and may be changed. This prospectus supplement is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS SUPPLEMENT TO PROSPECTUS DATED MARCH 30, 2006

12,500,000 Shares

Common Stock

We are selling 12,500,000 shares of common stock.

Our common stock is traded on the American Stock Exchange under the symbol "RTK." The closing price of our common stock on the American Stock Exchange on March 30, 2006 was $4.18 per share.

The underwriters have an option to purchase a maximum of 1,875,000 additional shares solely to cover over-allotments of shares. If the number of shares of common stock that we are offering increases or decreases, as described below, the underwriters' over-allotment option also will be proportionately increased or decreased.

Concurrently with this offering, we are offering $50 million in aggregate principal amount of our convertible senior notes due 2013, or convertible notes, in a public offering. In this offering and the concurrent offering of convertible notes, taken together, we are proposing to issue and sell securities having an aggregate gross offering price of approximately $102 million. We may, however, modify the number of shares of common stock and the principal amount of convertible notes that we are offering. The consummation of this offering is conditioned upon the concurrent consummation of the offering of the convertible notes andvice versa. The consummation of our acquisition of Royster-Clark Nitrogen, Inc. is not a condition to the consummation of this offering or the offering of the convertible notes.

Investing in our common stock involves risks. See "Risk Factors" on page S-13.

| | Price to

Public

| | Underwriting

Discounts and

Commissions

| | Proceeds to

Rentech

|

|---|

| Per Share | | $ | | $ | | $ |

| Total | | $ | | $ | | $ |

Delivery of the shares will be made on or about April , 2006.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these shares or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Credit Suisse

Canaccord Adams

The date of this prospectus supplement is April , 2006.

TABLE OF CONTENTS

Prospectus Supplement

| | Page

|

|---|

| ABOUT THIS PROSPECTUS SUPPLEMENT | | S-ii |

| CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | | S-ii |

| MARKET AND INDUSTRY DATA | | S-ii |

| PROSPECTUS SUPPLEMENT SUMMARY | | S-1 |

| RISK FACTORS | | S-13 |

| USE OF PROCEEDS | | S-28 |

| PRICE RANGE OF COMMON STOCK AND DIVIDEND POLICY | | S-30 |

| CAPITALIZATION | | S-31 |

| DILUTION | | S-33 |

| UNAUDITED CONDENSED PRO FORMA COMBINED FINANCIAL STATEMENTS | | S-34 |

| BUSINESS | | S-42 |

| MANAGEMENT | | S-61 |

| DESCRIPTION OF CERTAIN INDEBTEDNESS | | S-65 |

| CERTAIN UNITED STATES FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS | | S-68 |

| DESCRIPTION OF COMMON STOCK | | S-71 |

| DESCRIPTION OF PREFERRED STOCK | | S-73 |

| CERTAIN PROVISIONS OF COLORADO LAW AND OUR CHARTER AND BYLAWS | | S-75 |

| UNDERWRITING | | S-78 |

| NOTICE TO CANADIAN RESIDENTS | | S-81 |

| INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE | | S-83 |

| WHERE YOU CAN FIND MORE INFORMATION ABOUT RENTECH | | S-84 |

| LEGAL MATTERS | | S-84 |

Prospectus

| | Page

|

|---|

| ABOUT THIS PROSPECTUS | | 1 |

| RENTECH, INC. | | 2 |

| RISK FACTORS | | 2 |

| CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | | 3 |

| RATIO OF EARNINGS TO FIXED CHARGES | | 3 |

| USE OF PROCEEDS | | 3 |

| PLAN OF DISTRIBUTION | | 4 |

| DESCRIPTION OF DEBT SECURITIES | | 6 |

| DESCRIPTION OF WARRANTS | | 15 |

| DESCRIPTION OF COMMON STOCK | | 16 |

| DESCRIPTION OF PREFERRED STOCK | | 17 |

| DESCRIPTION OF DEPOSITARY SHARES | | 19 |

| CERTAIN PROVISIONS OF COLORADO LAW AND OUR CHARTER AND BYLAWS | | 20 |

| LEGAL MATTERS | | 23 |

| INTERESTS OF NAMED EXPERTS AND COUNSEL | | 23 |

| EXPERTS | | 23 |

| WHERE YOU CAN FIND MORE INFORMATION ABOUT RENTECH | | 23 |

| INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE | | 24 |

You should rely only on the information contained in this document or to which we have referred you. We have not authorized anyone to provide you with information that is different. This document may only be used where it is legal to sell these securities. The information in this document may only be accurate on the date of this document.

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

This document consists of two parts. The first part is this prospectus supplement, which describes the specific terms of this offering. The second part is the accompanying prospectus, which describes more general information, some of which may not apply to this offering. You should read both this prospectus supplement and the accompanying prospectus, together with the additional information described below under the headings "Incorporation of Certain Documents by Reference" and "Where You Can Find More Information About Rentech."

If the description of the offering varies between this prospectus supplement and the accompanying prospectus, you should rely on the information in this prospectus supplement.

Any statement made in this prospectus supplement or in a document incorporated or deemed to be incorporated by reference in this prospectus supplement will be deemed to be modified or superseded for purposes of this prospectus supplement to the extent that a statement contained in this prospectus supplement or in any other subsequently filed document that is also incorporated or deemed to be incorporated by reference in this prospectus supplement modifies or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement. See "Incorporation of Certain Documents By Reference."

CAUTIONARY STATEMENT

REGARDING FORWARD-LOOKING STATEMENTS

Statements made in this prospectus supplement and the accompanying prospectus and the information incorporated by reference herein and therein that are not historical factual statements are "forward-looking statements" within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, Section 27A of the Securities Act of 1933, as amended, and pursuant to the Private Securities Litigation Reform Act of 1995. The forward-looking statements may relate to financial results and plans for future business activities, and are thus prospective. The forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from future results expressed or implied by the forward-looking statements. They can be identified by the use of terminology such as "may," "will," "expect," "believe," "intend," "plan," "estimate," "anticipate," "should" and other comparable terms or the negative of them. You are cautioned that, while forward- looking statements reflect our good faith belief and best judgment based upon current information, they are not guarantees of future performance and are subject to known and unknown risks and uncertainties. Factors that could affect our results include, but are not limited to, those described under the heading "Risk Factors" in this prospectus supplement. Any and all forward-looking statements are made pursuant to the Private Securities Litigation Reform Act of 1995, and thus are current only as of the date made.

MARKET AND INDUSTRY DATA

The market, industry or similar data presented or incorporated by reference herein are based upon estimates by our management, using various third party sources where available. While our management believes that such estimates are reasonable and reliable, in certain cases such estimates cannot be verified by information available from independent sources. While we are not aware of any misstatements regarding any market, industry or similar data presented herein, such data involves risks and uncertainties and is subject to change based on various factors, including those discussed under the heading "Risk Factors" in this prospectus supplement.

S-ii

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information contained elsewhere in this prospectus supplement. Because this is only a summary, it does not contain all of the information that you should consider before investing in the securities offered hereby. You should carefully read the entire prospectus supplement, the accompanying prospectus and the documents incorporated by reference, including "Risk Factors" beginning on page S-13 of this prospectus supplement, before deciding to invest in our securities. Unless otherwise indicated, financial information included in this prospectus supplement is presented on an historical basis and assumes that the underwriters do not exercise their over-allotment options related to this offering or the concurrent offering of convertible notes. As used in this prospectus supplement, unless we indicate otherwise or the context otherwise requires (such as with respect to the securities offered hereby), the terms "our," "we," "us," "Rentech," "the Company" and similar terms refer to Rentech, Inc. and our subsidiaries.

Our Company

We were incorporated in 1981 to develop technologies that transform under-utilized energy resources into valuable and clean alternative fuels, chemicals and power. We have developed an advanced derivative of the well-established Fischer-Tropsch, or FT, process for manufacturing diesel fuel and other fuel products. The FT process was originally developed in Germany in the 1920s. Our proprietary application of the FT process, which we refer to as the Rentech Process, efficiently converts synthetic gas, referred to as syngas, derived from coal, petroleum coke or natural gas into liquid hydrocarbon products, including ultra high-quality diesel fuel and other fuel products.

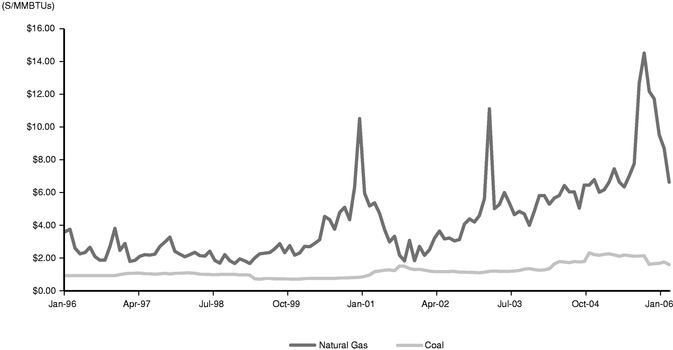

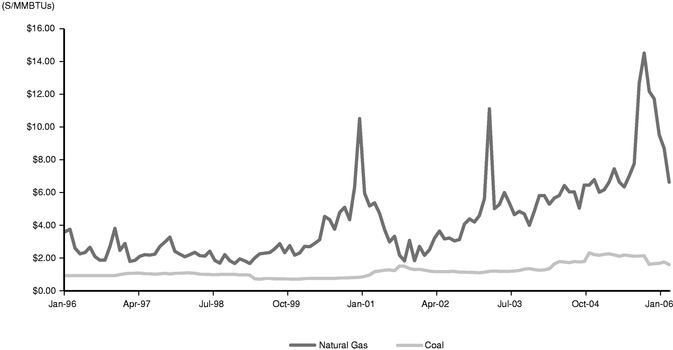

Both the Rentech Process and the fuels it produces carry unique and differentiating characteristics which we believe will facilitate economic deployment of the Rentech Process in large scale commercial projects. First, since our process is able to utilize solids such as coal as a principal feedstock, we are able to take advantage of the relative stability of coal prices compared to other hydrocarbon-based feedstocks such as natural gas. Second, because the fuels derived from our proprietary process have a long shelf life and can be manufactured using domestic resources, they effectively address national security priorities framed by foreign control of oil reserves and limited domestic refining capacity. And third, because fuel produced by the Rentech Process is a clean-burning fuel which exceeds all current and promulgated environmental rules applicable to diesel engines and requires no new distribution infrastructure, we believe there are no restrictions on immediate and widespread adoption of FT fuels.

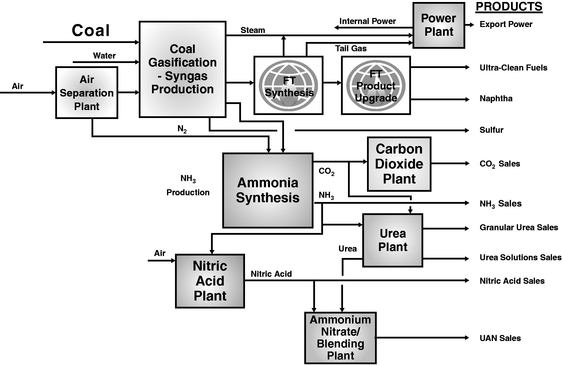

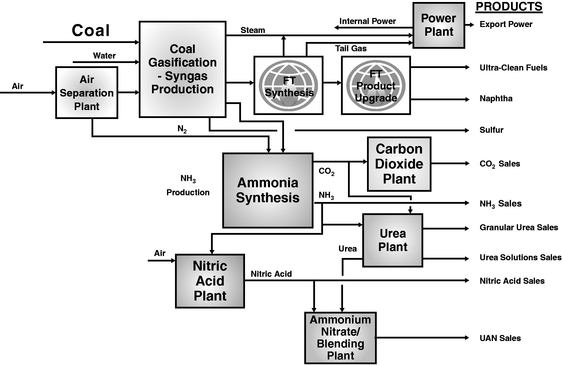

Our business historically has focused on the research and development of the Rentech Process and its licensing to third parties. During 2004, we decided to directly deploy our technology in select domestic projects in order to demonstrate commercial operation of the Rentech Process. We are planning initially to implement this strategy by purchasing Royster-Clark Nitrogen, Inc., which owns an operating natural gas-fed nitrogen fertilizer facility in East Dubuque, Illinois. The acquisition will allow us to commercially deploy the Rentech Process on an accelerated basis by using the existing infrastructure and systems of the facility. We intend to continue to operate the facility for the production of nitrogen fertilizer products while we execute a phased conversion to a commercial scale FT fuel production facility. In Phase 1 of the conversion, we intend to add a commercially available clean coal gasification module that converts coal into syngas for use in fertilizer production and to add a power plant generating energy from the excess steam produced in the coal gasification process. The converted facility is expected to be capable of producing enough power to meet all of its needs and to provide excess power for sale to the local grid. During Phase 1A of the conversion, we plan to add the Rentech Process to produce liquid hydrocarbon products, such as diesel and jet fuels, from the excess syngas produced from the coal gasification process. By converting the East Dubuque facility in this manner, we believe we can significantly enhance its profitability. We refer to the integration of the Rentech Process with the production of nitrogen fertilizer products and power as "polygeneration." We presently anticipate that Phases 1 and 1A of the conversion will cost approximately $750 million

S-1

(including approximately $250 million of interest during construction, potential debt reserve requirements and other expenses) and approximately $60 million, respectively.

We intend to follow the conversion of the East Dubuque facility with other projects focusing on FT production and polygeneration opportunities involving small to medium sized facilities with a production capacity of up to 50,000 barrels of fuel per day. As part of this strategy, we are currently in the development stages for a project in Mississippi that would involve the construction of an FT facility on undeveloped land situated along the Mississippi River at the Port of Natchez. The site is located within the federally designated Hurricane Katrina Gulf opportunity "GO Zone." In addition to the East Dubuque and Natchez projects, we are pursuing opportunities with major coal mining companies to site and build FT facilities located at coal mines.

Business Strategy

Our strategic objective is to establish the Rentech Process as the standard technological platform for coal-to-liquids production. Key elements of our strategy include:

Accelerate deployment of the Rentech Process by using existing infrastructure. By using the infrastructure already in place at the East Dubuque facility, we believe we can produce an FT facility that utilizes the Rentech Process in less time than would be required if we constructed an entirely new facility to manufacture a similar type and quantity of products. We believe the enhanced speed to market will provide an opportunity for us to set the standards for manufactured fuels to be used by end users. We also believe the project will enable us to establish our technology as an accepted and financeable platform for future facilities. Acquiring and converting the East Dubuque facility also will allow us to generate immediate revenues and cash flows by continuing operations while its reconfiguration is underway.

Strategically build projects in the United States utilizing the Rentech Process. We intend to develop greenfield projects, which involve no existing infrastructure or process plant, where the design is both replicable and scalable. In addition to the East Dubuque and Natchez projects, we plan to focus on greenfield projects located at coal mines. We believe we will be able to leverage the engineering, design and construction associated with each facility, thereby reducing the required capital and technical resources for each subsequent project. We will target projects where the scale-up opportunities are such that, over time, we can achieve production capacity of up to 50,000 barrels per day of FT fuels. While our technology would enable us to pursue larger projects, we believe that small to medium sized projects require less capital and development time.

Extend the reach of Rentech technology through licensing. We plan to continue to market the licensing of our technology for coal and other carbon bearing feedstock to enhance the deployment and acceptance of our technology. We believe that our successful commercialization of the Rentech Process will enhance our licensing opportunities, resulting in additional revenue streams.

Continue investment in our research and development program. We intend to continue to invest in advancing our technology. Our product development unit, currently being developed on a site we own in Commerce City, Colorado, will serve as a platform to allow us to remain a leader in alternative fuels technology. We are preparing to build and operate on the site what we believe will be the United States' first fully integrated Fischer-Tropsch, coal-to-liquids, product development unit research facility.

S-2

Our Proprietary Rentech Process

Our proprietary Rentech Process is a significant enhancement of the Fischer-Tropsch technology originally developed in Germany in the 1920s. Prior to the application of the Rentech Process, hydrocarbon feedstocks are reformed by various commercially available processes into syngas. The syngas is then converted through the Rentech Process into differentiated liquid hydrocarbon products in a reactor vessel containing Rentech's patented and proprietary catalyst, and then upgraded with commercially available refining processes. We believe the ability of the Rentech Process to efficiently utilize a broad range of hydrocarbon feedstocks, including coal and other lower priced feedstocks, distinguishes it from competing technologies.

We also believe the successful integration of the Rentech Process into the East Dubuque facility will enable us to more cost efficiently produce nitrogen fertilizer products at the facility, while also producing transportation fuels and power. In addition, we believe that the operating cost savings we expect to achieve following the conversion of the facility to use coal as feedstock rather than more expensive natural gas, as well as the enhanced revenue opportunities from the production of diesel fuels and power, will permit us to earn an attractive return on the capital costs of the conversion.

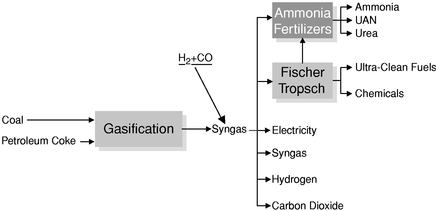

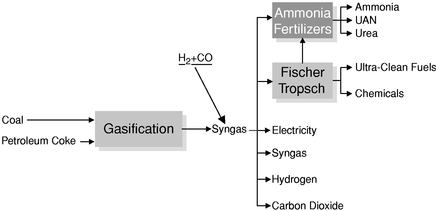

The diagram below provides an overview of production of nitrogen fertilizer products, transportation fuels and power with the Rentech Process.

The Rentech Process can be used with fossil fuels like coal, petroleum coke and natural gas. In addition to coal-to-liquids markets, other potential markets for the Rentech Process include unused natural gas supplies associated with producing crude oil fields that are presently being flared, re-injected into the reservoir or merely left in the ground due to the lack of economic or practical means to transport these resources to market. Our technology could also enable refineries to more fully utilize heavier crude oil in addition to petroleum coke to produce an improved slate of higher-value products. Potential benefits to the refiner include lower refinery feedstock costs, higher revenue and a reduction in waste disposal costs leading to increased margins.

Use of the Rentech Process in a Fischer-Tropsch facility was successfully demonstrated in 1992 and 1993 at the Synhytech facility located at Pueblo, Colorado. The Synhytech facility was designed to produce up to 235 barrels of liquid hydrocarbons per day. Our licensee, Fuel Resources Development Company, or Fuelco, had full control of the supply of syngas and the construction and operation of the facility. We designed the Fischer-Tropsch reactors and provided our catalyst for use in the FT reactors. The facility was constructed at a municipal landfill, with the intent of using, at minimal cost, the methane in the landfill gas that was generated from the decomposition of the landfill material. Although the Rentech Process performed as expected to produce liquid hydrocarbons, Fuelco determined that the volume and the energy content of the landfill gas it captured were inadequate to operate the facility on an economic basis, and thus ceased operation of the facility.

S-3

Competitive Strengths

Advanced Fischer-Tropsch Technology. We believe the ability of the Rentech Process to efficiently utilize a broad range of hydrocarbon feedstocks, including coal and other lower priced feedstocks, distinguishes it from other FT technologies. Other key aspects of our technology are our patented and proprietary catalyst, reactor design and the overall configuration of the process. We believe our iron catalyst is a superior FT technology as it requires lower capital costs for the conversion of solids and reduces operating costs compared to cobalt-based catalysts.

Abundant Low Cost Coal Reserves. We believe that we have a competitive advantage because the Rentech Process uses abundantly available coal as feedstock. In the United States, there are vast deposits of coal (approximately 500 billion tons of proven reserves), which represent approximately 97% of the domestic fossil energy reserves on an energy equivalent basis according to the United States Department of Energy. The United States produces more than one-fifth of the world's coal and is the second largest coal producer in the world, exceeded only by China. In 2004, total coal production in the United States as estimated by the United States Department of Energy was 1.1 billion tons. Due to the extensive supply, coal prices have been historically stable compared to prices for oil and natural gas in the United States, which reached record levels in 2005.

Significant Growth Potential for Clean Fuels. The Clean Air Act Amendments of 1990, or the CAAA, established several programs in order to improve air quality by, among other things, imposing restrictions on the emissions of hazardous pollutants into the atmosphere. As a means to address common sources of air pollution such as automobiles, trucks and electric power plants, the CAAA encourages the development and sale of alternative fuels as the United States attempts to meet national air quality standards. In addition, beginning in 2006, the United States Environmental Protection Agency will start to phase-in a program to reduce the permissible sulfur content in highway diesel fuel from 500 parts per million to 15 parts per million. Furthermore, California has promulgated state-specific standards to reduce the sulfur content of diesel fuel. FT diesel fuel produced using the Rentech Process is a low-sulfur, clean-burning fuel, and should therefore be attractive to users.

Proven Coal Gasification Technology. Gasification offers the cleanest, most efficient method available to produce syngas from feedstocks such as coal, petroleum coke, high sulfur fuel oil or materials that would otherwise be disposed as waste. Gasification has been in commercial use for more than fifty years as a process technology for the refining, chemical and power industries. Over the ten year period between 1990 and 1999 world gasification capacity grew by 50%, with forty-three new facilities coming on line. Coal and petroleum-based materials provide the vast majority of feedstocks for world gasification capacity, making up 80% of the capacity added between 1990 and 1999.

Strong Government Support. In 2000, Congress designated liquid fuels from domestic coal and natural gas as an "alternative fuel" under the Energy Policy Act of 1992. The Energy Policy Act of 1992 set the stage for incentives under the Highway Reauthorization and Excise Tax Simplification Act of 2005, which provides a $0.50 per gallon fuel excise tax credit for FT fuels from coal. The Energy Policy Act of 2005, or the EPACT 2005, also provides for a 20% tax credit for qualifying gasification projects and authorizes grants for gasification and gasification coproduction. In addition, EPACT 2005 authorizes comprehensive loan guarantees up to 80% of the project cost for deployment and commercialization of innovative technologies. We anticipate that our proposed projects may qualify for us to receive grants, loan guarantees and other incentives under EPACT 2005.

Experienced Management. We have assembled a team of professionals with over 100 years of experience in the industry. Our Chief Executive Officer, D. Hunt Ramsbottom, has 25 years of experience operating growth stage companies. Our Chief Operating Officer, Douglas M. Miller, has over 20 years of experience in the energy industry, most recently as a senior executive with Unocal Corporation.

S-4

Acquisition of Royster-Clark Nitrogen, Inc.

Royster-Clark Nitrogen, Inc., or RCN, owns and operates a nitrogen manufacturing facility located in East Dubuque, Illinois. The facility has the capacity to produce approximately 830 tons of ammonia per day. On November 5, 2005, we entered into a definitive stock purchase agreement with Royster-Clark, Inc., or Royster-Clark, for the purchase of all the issued and outstanding shares of capital stock of RCN. Under the terms of the agreement, subject to obtaining sufficient financing and the approval of our shareholders and other customary conditions, we will pay $50 million for the stock of RCN, plus an amount equal to RCN's closing net working capital as defined in the agreement.

The East Dubuque facility is designed to produce anhydrous ammonia, nitric acid, ammonium nitrate solution, liquid and granular urea, nitrogen solutions (urea ammonium nitrate solution, or UAN) and carbon dioxide using natural gas as a feedstock. Sales of anhydrous ammonia and UAN make up over 80% of the facility's total revenues. Following our acquisition of RCN, we expect to sell all of the facility's products other than carbon dioxide pursuant to a long-term distribution agreement with Royster-Clark, which will then primarily sell them to wholesale and retail agricultural customers. Carbon dioxide will continue to be sold to third parties on a contract basis. In 2005, final products shipped from the facility totaled approximately 365,000 tons of ammonia and upgraded nitrogen products and approximately 86,000 tons of carbon dioxide. After we have converted the facility to use coal as feedstock, it is expected to be able to produce approximately 526,000 and 110,000 tons of ammonia and upgraded nitrogen products and carbon dioxide per year, respectively.

Prior to our conversion of the East Dubuque facility to use coal as a feedstock, the principal feedstock will continue to be natural gas. We will purchase natural gas for use in the facility in the spot market, through the use of forward purchase contracts, or a combination of both. Forward purchase contracts will be used to lock in pricing for a portion of the facility's natural gas requirements. These forward purchase contracts will generally be either fixed-price or index-priced, short term in nature and for a fixed supply quantity. The East Dubuque facility is able to purchase natural gas at competitive prices due to its connection to the Northern Illinois Gas Company, or NICOR, distribution system and its proximity to the Northern Natural Gas pipeline. Natural gas purchases used in production were approximately 8.7 billion cubic feet in 2005. After completion of Phase 1, the East Dubuque facility is expected to purchase approximately 1,560 tons of coal per day on a fixed contract basis.

Sources and Uses of Funds

We intend to use the net proceeds from this offering, together with net proceeds from our concurrent offering of convertible notes, to consummate the acquisition of RCN, to fund its working capital, to pay related fees and expenses and for general corporate purposes. The estimated sources and uses of funds are shown in the table below.

| |

|

|---|

Sources

| | Uses

|

|---|

(thousands)

|

|---|

| Revolving facility(1)(2) | | $ | — | | Purchase of RCN capital stock(2) | | $ | 50,000 |

| Convertible notes(3) | | | 50,000 | | RCN net working capital acquired(2) | | | 20,500 |

| Common stock offered hereby(3) | | | 52,250 | | General corporate purposes(2)(3) | | | 24,080 |

| | | | | | Estimated fees and expenses | | | 7,670 |

| | |

| | | |

|

| Total Sources | | $ | 102,250 | | Total Uses | | $ | 102,250 |

| | |

| | | |

|

- (1)

- In connection with our acquisition of RCN, we expect RCN to enter into a revolving working capital facility providing for up to $30 million in borrowing availability. See "Description of Certain Indebtedness—Revolving Facility."

S-5

- (2)

- Pursuant to our stock purchase agreement with Royster-Clark, the purchase price for RCN is equal to $50 million plus the amount of RCN's closing net working capital, as defined in the agreement. Our estimate of RCN's net working capital reflected in the table is subject to change at the time of the closing of the acquisition. To the extent that RCN's net working capital at the closing of the acquisition is lower than the amount shown in the table, the amount available for general corporate purposes would increase by a like amount. To the extent that RCN's net working capital at closing is higher than the amount shown in the table, the amount available for general corporate purposes would decrease by a like amount. Depending on the actual level of working capital and expected working capital needs post-closing, we may elect to partially draw on the revolving facility. In the event of such a drawing, the amounts reflected in the table for the revolving facility and general corporate purposes and/or RCN net working capital acquired would correspondingly increase.

- (3)

- Concurrently with this offering, we are offering $50 million in aggregate principal amount of our convertible senior notes due 2013 in a public offering. See "Description of Certain Indebtedness—Concurrent Offering of Convertible Notes." In this offering and the concurrent offering of convertible notes, taken together, we are proposing to issue and sell securities having an aggregate gross offering price of approximately $102 million. We may, however, modify the number of shares of common stock or the principal amount of convertible notes that we are offering. Any increase or decrease in the aggregate net proceeds raised from this offering and the concurrent offering of convertible notes will change the net proceeds available for general corporate purposes.

S-6

The Offering

We provide the following summary solely for your convenience. This summary is not a complete description of this offering. You should read the full text and more specific details contained elsewhere in this prospectus supplement, the accompanying prospectus, and any other offering material. For a more detailed description of our common stock, see the section entitled "Description of Common Stock" in the accompanying prospectus and the documents incorporated by reference herein.

| Common Stock Offered by Rentech | | 12,500,000 shares |

Common Stock to be Outstanding

after the Offering |

|

132,095,584 shares |

Use of Proceeds |

|

We intend to use the net proceeds from this offering, together with the net proceeds of the concurrent offering of our convertible notes, to finance the purchase of RCN, to fund working capital at RCN, and for general corporate purposes, which may include some of the initial development costs for the conversion of the East Dubuque facility to use coal as a feedstock. |

Risk Factors |

|

See "Risk Factors" and other information included in this prospectus supplement for a discussion of factors you should carefully consider before deciding to invest in our securities. |

American Stock Exchange Symbol |

|

"RTK" |

Overallotment Option |

|

1,875,000 shares of common stock to be offered by us if the underwriters exercise their over-allotment option in full. |

Concurrent Offering of Convertible Notes |

|

Concurrently with this offering, we are offering $50 million in aggregate principal amount of our convertible senior notes due 2013 in a public offering. See "Description of Certain Indebtedness—Concurrent Offering of Convertible Notes." In this offering and the concurrent offering of convertible notes, taken together, we are proposing to issue and sell securities having an aggregate gross offering price of approximately $102 million. We may, however, modify the number of shares of common stock or the principal amount of convertible notes that we are offering. The consummation of this offering is conditioned upon the concurrent consummation of the offering of the convertible notes andvice versa. The consummation of our acquisition of RCN is not a condition to the consummation of this offering or the offering of the convertible notes. |

The number of shares of common stock to be outstanding after this offering is based on our shares outstanding as of March 30, 2006 and assumes that the underwriters' over-allotment options are not

S-7

exercised. The number of shares to be outstanding after this offering excludes (in each case, at March 30, 2006):

- •

- 16,494,582 shares of common stock reserved for issuance upon the exercise of outstanding stock options, warrants and upon the vesting of unvested restricted stock units;

- •

- 1,480,000 shares of common stock reserved for stock options and restricted stock units which have been granted subject to shareholder approval of our 2006 Incentive Award Plan;

- •

- 2,287,666 shares of common stock reserved for issuance upon the conversion of outstanding convertible promissory notes; and

- •

- shares of common stock reserved for issuance upon conversion of the convertible notes we are offering in the concurrent offering.

Risk Factors

See "Risk Factors" immediately following this summary for a discussion of certain risks relating to an investment in our securities.

Additional Information

Rentech is a Colorado corporation. Our executive offices are located at 1331 17th Street, Suite 720, Denver, Colorado 80202. Our telephone number is (303) 298-8008. We maintain a website at www.rentechinc.com. Information contained on our website does not constitute a part of this prospectus supplement and is not incorporated by reference herein.

S-8

Summary Historical and Pro Forma Condensed Financial Data

The following tables set forth certain summary historical and pro forma condensed financial and other data of Rentech and RCN as of the dates and for the periods indicated. The historical data for Rentech as of and for the fiscal years ended September 30, 2003, 2004 and 2005 have been derived from the audited consolidated financial statements of Rentech which, in the case of the audited consolidated financial statements for the fiscal year ended September 30, 2003 and as of and for the fiscal years ended September 30, 2004 and 2005, are incorporated by reference in this prospectus supplement. The historical data for Rentech as of and for the three months ended December 31, 2004 and as of and for the three and twelve months ended December 31, 2005 have been derived from the unaudited consolidated financial statements of Rentech which, in the case unaudited consolidated financial statements for the three months ended December 31, 2004 and as of and for the three months ended December 31, 2005, are incorporated by reference in this prospectus supplement. The historical data for Rentech for the twelve months ended December 31, 2005 was derived by subtracting the three months ended December 31, 2004 from the twelve months ended September 30, 2005 and then adding the three months ended December 31, 2005 to the result. In the opinion of our management, our unaudited consolidated financial statements contain all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the information set forth therein. Our results of operations for the three months ended December 31, 2005 are not necessarily indicative of the results to be expected for the full year.

The historical data for RCN for its fiscal years ended December 31, 2003 (Predecessor) and December 31, 2004 (Predecessor), for its 202-day period from January 1, 2005 through July 21, 2005 (Predecessor), and for its 163-day period from July 22, 2005 through December 31, 2005 (Successor), and as of December 31, 2004 (Predecessor) and December 31, 2005 (Successor), have been derived from the audited financial statements of RCN, which are incorporated by reference in this prospectus supplement. As a result of certain transactions consummated on July 22, 2005, the financial statements including and after July 22, 2005 are not comparable to those prior to that date. See Note 1 to the audited financial statements of RCN, incorporated herein by reference.

The pro forma condensed combined data for the twelve months ended September 30, 2005 and as of and for the three and twelve months ended December 31, 2005 have been derived from our audited consolidated financial statements for the fiscal year ended September 30, 2005 and our unaudited consolidated financial statements as of and for the three and twelve months ended December 31, 2005 and give effect to the offering of the common stock offered hereby and the concurrent offering of our convertible notes, and the application of the net proceeds therefrom to consummate the acquisition of RCN, in each case as if such transactions occurred as of October 1, 2004, in the case of the statement of operations data, and as of December 31, 2005, in the case of the other data. The pro forma combined data do not purport to represent what our actual results of operation or financial position would have been had the transactions occurred on such dates.

The following tables should be read in conjunction with the audited, unaudited and pro forma combined financial statements, including the related notes, "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our Annual Report on Form 10-K for the year ended September 30, 2005 and in our Quarterly Report on Form 10-Q for the quarter ended December 31, 2005 and "Management's Discussion and Analysis of Financial Condition and Results of Operations of RCN" in our definitive proxy statement filed with the SEC on March 15, 2006, in each case incorporated by reference in this prospectus supplement.

S-9

Rentech, Inc.

| |

| |

| |

| | Three Months Ended

December 31,

| |

| |

|---|

| | Year Ended September 30,

| | Twelve Months

Ended

December 31,

2005

| |

|---|

| | 2003

| | 2004

| | 2005

| | 2004

| | 2005

| |

|---|

| |

| |

| |

| | (unaudited)

| | (unaudited)

| |

|---|

| | (thousands, except per share amounts)

| |

|---|

| Statement of Operations Data: | | | | | | | | | | | | | | | | | | | |

| Net sales | | $ | 4,496 | | $ | 5,706 | | $ | 7,186 | | $ | 1,770 | | $ | 1,922 | | $ | 7,338 | |

| Cost of sales | | | 2,940 | | | 4,036 | | | 5,213 | | | 1,415 | | | 1,313 | | | 5,111 | |

| | |

| |

| |

| |

| |

| |

| |

| | Gross profit | | | 1,556 | | | 1,670 | | | 1,973 | | | 355 | | | 609 | | | 2,227 | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | |

| | General and administrative expenses(a)(b) | | | 5,825 | | | 5,269 | | | 11,601 | | | 1,294 | | | 4,803 | | | 15,110 | |

| | Depreciation and amortization | | | 740 | | | 447 | | | 436 | | | 105 | | | 134 | | | 464 | |

| | Research and development | | | 747 | | | 749 | | | 496 | | | 168 | | | 1,280 | | | 1,608 | |

| | |

| |

| |

| |

| |

| |

| |

| Total operating expenses | | | 7,312 | | | 6,465 | | | 12,533 | | | 1,567 | | | 6,217 | | | 17,182 | |

| | |

| |

| |

| |

| |

| |

| |

| | Operating loss | | | (5,756 | ) | | (4,795 | ) | | (10,560 | ) | | (1,212 | ) | | (5,608 | ) | | (14,955 | ) |

| Non-operating items | | | 3,056 | | | 1,698 | | | 3,748 | | | 850 | | | 21 | | | 2,919 | |

| | |

| |

| |

| |

| |

| |

| |

| | Net loss from continuing operations before taxes | | | (8,812 | ) | | (6,493 | ) | | (14,308 | ) | | (2,062 | ) | | (5,629 | ) | | (17,874 | ) |

| Income tax expense | | | — | | | — | | | (61 | ) | | — | | | — | | | (61 | ) |

| | |

| |

| |

| |

| |

| |

| |

| | Net loss from continuing operations | | | (8,812 | ) | | (6,493 | ) | | (14,369 | ) | | (2,062 | ) | | (5,629 | ) | | (17,935 | ) |

| Deemed dividend related to beneficial conversion feature and warrants | | | — | | | — | | | (9,000 | ) | | — | | | — | | | (9,000 | ) |

| | Cash dividends paid to preferred stockholders | | | — | | | — | | | (341 | ) | | — | | | (74 | ) | | (416 | ) |

| | |

| |

| |

| |

| |

| |

| |

| Net loss from continuing operations applicable to common stockholders | | $ | (8,812 | ) | $ | (6,493 | ) | $ | (23,711 | ) | $ | (2,062 | ) | $ | (5,703 | ) | $ | (27,351 | ) |

| | |

| |

| |

| |

| |

| |

| |

| Basic and diluted loss from continuing operations per common share, including dividends | | $ | (0.12 | ) | $ | (0.08 | ) | $ | (0.26 | ) | $ | (0.02 | ) | $ | (0.05 | ) | $ | (0.24 | ) |

| | |

| |

| |

| |

| |

| |

| |

| Basic and diluted weighted-average number of common shares outstanding | | | 73,907 | | | 85,933 | | | 92,919 | | | 90,027 | | | 113,474 | | | 113,474 | |

Other Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash | | $ | 316 | | $ | 255 | | $ | 24,721 | | $ | 1,313 | | $ | 29,480 | | $ | 29,480 | |

| Working capital | | | (1,572 | ) | | (1,081 | ) | | 32,031 | | | (2,690 | ) | | 27,470 | | | 27,470 | |

| Total assets | | | 11,187 | | | 9,379 | | | 43,492 | | | 11,829 | | | 41,385 | | | 41,385 | |

| Total debt | | | 5,436 | | | 4,263 | | | 5,548 | | | 6,351 | | | 3,732 | (c) | | 3,732 | (c) |

| Total stockholders' equity | | | 3,027 | | | 3,038 | | | 34,271 | | | 2,937 | | | 35,021 | | | 35,021 | |

- (a)

- During fiscal 2005, we incurred a number of expenses that were non-recurring in nature. In the second quarter of fiscal 2005, our general and administrative expense included $2.9 million of one-time write-offs of expenses directly related to our abandonment of the initial proposed acquisition of RCN. In addition, we accrued $1.6 million of salary expense related to the retirement packages issued to our former chief executive officer and chief operating officer in the fourth quarter of fiscal 2005.

- (b)

- In the first quarter of fiscal 2006, we adopted a revision to Statement of Financial Accounting Standard No. 123 (revised 2004), "Share-Based Payment," or SFAS 123(R). SFAS 123(R) requires the recognition of compensation expense in the amount equal to the fair value of share-based payments granted to employees. We recorded $2.5 million of compensation expense related to this revision during the period.

- (c)

- Net of unamortized debt issuance costs of $394,000.

S-10

Royster-Clark Nitrogen, Inc.

| | Predecessor

| |

| |

|---|

| | Year Ended December 31,

| |

| | Successor

| |

|---|

| | 202-Day Period

Ended

July 21, 2005

| | 163-Day Period

Ended

December 31, 2005

| |

|---|

| | 2003

| | 2004

| |

|---|

| | (thousands)

| |

|---|

| Statement of Operations Data: | | | | | | | | | | | | | |

| Net sales | | $ | 76,651 | | $ | 102,630 | | $ | 58,302 | | $ | 54,305 | |

| Cost of sales | | | 78,933 | | | 95,310 | | | 53,618 | | | 58,294 | |

| | |

| |

| |

| |

| |

| | Gross profit (loss) | | | (2,282 | ) | | 7,320 | | | 4,684 | | | (3,989 | ) |

| Selling, general and administrative expenses | | | 1,788 | | | 1,775 | | | 908 | | | 573 | |

| | |

| |

| |

| |

| |

| | Operating income (loss) | | | (4,070 | ) | | 5,545 | | | 3,776 | | | (4,562 | ) |

| Non-operating items | | | 5,402 | | | 5,120 | | | 2,974 | | | 3,094 | |

| | |

| |

| |

| |

| |

| | Net income (loss) before taxes | | | (9,472 | ) | | 425 | | | 802 | | | (7,656 | ) |

| Income tax expense | | | 13,549 | | | — | | | — | | | — | |

| | |

| |

| |

| |

| |

| | Net income (loss) | | $ | (23,021 | ) | $ | 425 | | $ | 802 | | $ | (7,656 | ) |

| | |

| |

| |

| |

| |

Other Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash | | | | | $ | 27 | | | | | $ | 16 | |

| Working capital | | | | | | 2,913 | | | | | | 18,614 | |

| Total assets | | | | | | 35,205 | | | | | | 79,150 | |

| Total debt | | | | | | 58,765 | | | | | | 67,126 | |

| Total stockholders' equity | | | | | | (26,743 | ) | | | | | 9,657 | |

S-11

Pro Forma Combined(a)

(unaudited)

| | 12 Months Ended

September 30, 2005

| | 3 Months Ended

December 31, 2005

| | 12 Months Ended

December 31, 2005

| |

|---|

| | (unaudited)

(thousands, except per share amounts)

| |

|---|

| Statement of Operations Data: | | | | | | | | | | |

| Net sales | | $ | 105,209 | | $ | 43,994 | | $ | 127,097 | |

| Cost of sales | | | 88,734 | | | 43,566 | | | 115,583 | |

| | |

| |

| |

| |

| | Gross profit | | | 16,475 | | | 428 | | | 11,514 | |

| Operating expenses: | | | | | | | | | | |

| | General and administrative expenses | | | 13,596 | | | 5,003 | | | 16,591 | |

| | Depreciation and amortization | | | 436 | | | 134 | | | 464 | |

| | Research and development | | | 496 | | | 1,280 | | | 1,608 | |

| | |

| |

| |

| |

| Total operating expenses | | | 14,528 | | | 6,417 | | | 18,663 | |

| | |

| |

| |

| |

| | Operating income (loss) | | | 1,947 | | | (5,989 | ) | | (7,149 | ) |

| Non-operating items | | | 6,159 | | | 624 | | | 5,329 | |

| | |

| |

| |

| |

| | Net loss from continuing operations before taxes | | | (4,212 | ) | | (6,613 | ) | | (12,478 | ) |

| Income tax expense | | | (61 | ) | | — | | | (61 | ) |

| | |

| |

| |

| |

| | Net loss from continuing operations | | | (4,273 | ) | | (6,613 | ) | | (12,539 | ) |

| Deemed dividend related to beneficial conversion feature and warrants | | | (9,000 | ) | | — | | | (9,000 | ) |

| | Cash dividends paid to preferred stockholders | | | (341 | ) | | (74 | ) | | (416 | ) |

| | |

| |

| |

| |

| Net loss from continuing operations applicable to common stockholders | | $ | (13,614 | ) | $ | (6,687 | ) | $ | (21,955 | ) |

| | |

| |

| |

| |

| Basic and diluted loss from continuing operations per common share, including dividends | | $ | (0.13 | ) | $ | (0.05 | ) | $ | (0.17 | ) |

| | |

| |

| |

| |

| Basic and diluted weighted-average number of common shares outstanding | | | 105,419 | | | 125,974 | | | 125,974 | |

| | |

| |

| |

| |

Other Data: |

|

|

|

|

|

|

|

|

|

|

| Cash | | | | | | | | $ | 49,076 | |

| Working capital | | | | | | | | | 65,664 | |

| Total assets | | | | | | | | | 142,030 | |

| Total debt | | | | | | | | | 53,732 | (b) |

| Total stockholders' equity | | | | | | | | | 83,299 | |

- (a)

- See "Unaudited Condensed Pro Forma Combined Financial Statements" for a full presentation of the underlying pro forma financial statements and related assumptions, adjustments and basis of presentation.

- (b)

- Net of unamortized debt issuance costs of $394,000.

S-12

RISK FACTORS

You should carefully consider the risk factors set forth below as well as the other information contained in this prospectus supplement before purchasing the securities offered pursuant to this prospectus supplement. The risks described below are not the only risks facing us. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business operations. Any of the following risks could materially and adversely affect our business, financial condition, results of operations or prospects.

Risks Related to Our Liquidity, Financial Condition, and Results of Operations

Our liquidity and capital resources are limited and we must raise substantial additional capital to execute our business plan and to fund our operations.

Our liquidity and capital resources are limited. At December 31, 2005, after giving effect to the consummation of this offering and the concurrent offering of the convertible notes, as well as our intended application of the net proceeds therefrom as described in "Use of Proceeds," we would have had approximately $65.7 million of working capital (current assets in excess of current liabilities). We must raise substantial additional capital to execute our business plan of commercializing and licensing the Rentech Process, including acquiring and converting the East Dubuque facility to use coal as a feedstock, and to continue to fund our operations. We cannot assure you that we will have access to sufficient liquidity or capital resources to complete the conversion of the East Dubuque facility and to fund our operations, and the failure to do so would have material adverse effect on our business.

We have never operated at a profit. If we do not achieve significant amounts of additional revenues and become profitable, we may be unable to continue our operations.

We have a history of operating losses and have never operated at a profit. From our inception on December 18, 1981 through December 31, 2005, we have incurred cumulative net losses of $67.6 million. During our fiscal year ended September 30, 2005 and the three months ended December 31, 2005, we had a net loss of $14.4 million and $5.6 million, respectively. If we do not achieve significant amounts of additional revenues and operate at a profit in the future, we may be unable to continue our operations at their current level. Ultimately, our ability to remain in business will depend upon earning a profit from commercialization of the Rentech Process. We have not been able to achieve sustained commercial use of the technology as of this time. Failure to do so would have a material adverse effect on our financial position, results of operations and prospects.

We do not expect our historical operating results to be indicative of our future performance.

Historically, our business focused on the development and licensing of our technology, the business of our Petroleum Mud Logging, Inc. subsidiary, which provides well logging services to the oil and gas industry, and other operations which have been discontinued. In the future, we expect to acquire and convert the East Dubuque facility and to develop other facilities. We expect to finance a substantial part of the cost of these projects with indebtedness and the sale of equity securities, including from the net proceeds from this offering and our concurrent offering of the convertible notes. Accordingly, our operating expenses, interest expense, and depreciation and amortization are all expected to increase materially if we succeed in making such acquisitions, developing such projects and effecting such financings. As a result, we do not expect that historical operating results will be indicative of future performance.

S-13

The net proceeds of this offering and the concurrent offering of convertible notes will be used to acquire RCN and provide general corporate proceeds, and we cannot assure you that we will able to raise the substantial amount of additional financing necessary to convert the East Dubuque facility to use coal as a feedstock and the Rentech Process.

Our current estimate of the cost for Phases 1 and 1A of the conversion of the East Dubuque facility to FT technology using the Rentech Process is approximately $810 million. The net proceeds of this offering and the concurrent offering of the convertible notes will be used to finance the acquisition of RCN and provide general corporate proceeds. Substantial additional financing will be required to execute our planned conversion of the East Dubuque facility. If we are not able to obtain the amount of financing necessary to complete both phases, we would not be able to complete the conversion of the East Dubuque facility as expected, which would have a material adverse effect on our business, financial condition and results of operations.

After giving effect to the consummation of the concurrent offering of the convertible notes and the revolving facility, we will have a substantial amount of indebtedness. We also plan to incur a substantial amount of additional indebtedness to finance the conversion of the East Dubuque facility. Our substantial indebtedness could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industry and prevent us from meeting our obligations.

As of December 31, 2005, after giving effect to the consummation of our concurrent offering of the convertible notes, we would have had $54.1 million principal amount of total indebtedness. In addition, we expect to have up to $30 million of availability under the revolving facility, subject to a borrowing base limitation. Costs to effect both Phases 1 and 1A of the conversion of the East Dubuque facility are estimated to be approximately $810 million which will require substantial further borrowing. If we undertake additional projects, significant additional indebtedness would be required.

Our substantial debt could have important consequences, including:

- •

- increasing our vulnerability to general economic and industry conditions;

- •

- requiring a substantial portion of our cash flow from operations to be dedicated to the payment of principal and interest on our indebtedness, therefore reducing our ability to use our cash flow to fund our operations, capital expenditures and future business opportunities;

- •

- limiting our ability to obtain additional financing for working capital, capital expenditures, debt service requirements, acquisitions and general corporate or other purposes; and

- •

- limiting our ability to adjust to changing market conditions and placing us at a competitive disadvantage compared to our competitors who have greater capital resources.

If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay capital expenditures, sell assets, seek additional capital or restructure or refinance our indebtedness. These alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations. Failure to pay our indebtedness on time would constitute an event of default under the agreements governing our indebtedness, which would give rise to our lenders' ability to accelerate the obligations and seek other remedies against us.

The revolving facility will include restrictive covenants that will limit our ability to operate our business.

Concurrently with the acquisition of RCN, we expect that RCN will enter into the revolving facility. The revolving facility will be secured by a pledge of all of the capital stock of RCN and a lien on substantially all of RCN's assets, and will impose various restrictions and covenants on us, which could limit our ability to respond to changing business conditions that may affect our financial condition. In addition, our failure to comply with the restrictions and covenants would result in an

S-14

event of default giving rise to the revolving facility lender's right to accelerate our obligations under the revolving facility.

We most likely will have to record higher compensation expense as a result of the implementation of SFAS 123(R).

In December 2004, the Financial Accounting Standards Board issued Statement of Financial Accounting Standard No. 123 (revised 2004), "Share-Based Payment," or SFAS 123(R), which established standards for transactions in which an entity exchanges its equity instruments for goods or services. This statement requires a public entity to measure the cost of employee services received in exchange for an award of equity instruments based on the grant-date fair value of the award. We adopted SFAS No. 123(R) on October 1, 2005, using the modified prospective method for the adoption of its provisions, which results in the recognition of compensation expense for all share-based awards granted after the effective date and the recognition of compensation expense for all previously granted share-based awards that remain unvested at the effective date. This change in accounting is not expected to materially impact our financial position. However, because we previously accounted for share-based payments to employees using the intrinsic value method, our results of operations have not included the recognition of compensation expense for the issuance of stock option awards. As a result of adopting SFAS 123(R), we recognized $2.5 million of compensation expense for the three months ended December 31, 2005. We believe that compensation expense recorded in future periods due to the implementation of SFAS No. 123(R) may be significantly higher than the amounts that would have been recorded in prior years.

We have agreed to acquire RCN subject to financing and to pay a break-up fee should we be unable to finance the acquisition.

We have agreed to acquire RCN, subject to financing, shareholder approval, and other conditions. The purchase price is $50 million plus an amount equal to RCN's net working capital at closing. We intend to raise the funds required to complete the acquisition with the net proceeds from this offering and our concurrent offering of the convertible notes. Neither this offering nor the concurrent offering of convertible notes is conditioned on the closing of the acquisition, and we cannot assure you that the acquisition will be consummated. If we fail to consummate the acquisition because we fail to obtain the full amount of financing necessary, or because we fail to obtain the necessary approval of our shareholders, then our agreement requires that we pay Royster-Clark a break-up fee of $2.5 million. In addition, costs related to the transaction, such as legal and accounting, must be paid even if the transaction is not completed.

We are pursing other alternative fuels projects, including one at Natchez, Mississippi, that will involve substantial expense and risk.

We are pursing opportunities to develop alternative fuels projects, including a proposal to gain site control and develop an FT facility in Natchez, Mississippi. We are also considering other alternative fuels projects. We do not have the financing for any of these acquisitions, conversions, developments or operations. Moreover, the pursuit of such opportunities requires that we incur material expenses, including for financial, legal and other advisors, whether or not our efforts are successful. Our pursuit of any of these alternative fuel projects involves significant risks, and our failure to successfully develop these projects, or failure to operate them successfully after we have developed them, could have a material adverse effect on our financial position and results of operations.

RCN's operations have not been profitable and require substantial working capital financing.

RCN sustained net losses and negative cash flows from operations in 2003 and 2005. These net losses and negative cash flows were the result of, among other things, difficult market conditions in its industry and rapidly rising costs of the natural gas feedstock and energy required to produce nitrogen fertilizers. Moreover, RCN's business is extremely seasonal, with the result that working capital

S-15

requirements in its off season are substantial. Following our acquisition of RCN, if we are not able to operate the East Dubuque facility at a profit, or if we are not able to access a sufficient amount of financing for working capital, our business, financial condition and results of operations would be materially adversely effected.

The conversion of the East Dubuque facility and the development of other alternative fuels projects will require several years and substantial additional financing, and may not be successful.

The engineering, design, procurement of materials, and construction necessary to convert the East Dubuque facility to use coal gasification as a feedstock and to include the Rentech Process is estimated to take several years and to cost approximately $810 million. We cannot assure you that we will be able to obtain this financing at all, or in the time required, and our failure to do so would prevent us from implementing our business plan as expected. Further, acquisition and development of other alternative fuels projects could involve comparable or greater commitments of capital, time and other resources. We have never undertaken any such projects, and the duration, cost, and eventual success of our efforts are all uncertain.

If we do not receive funds from additional financing or other sources of working capital for our business activities and future transactions, we will not be able to execute our business plan.

We need additional financing to maintain our operations, and substantially increased financing, revenues and cash flow to accomplish our goal of acquiring, converting and building process plants. We will continue to expend substantial funds to research and develop our technologies, to market licenses of the Rentech Process, and to acquire, convert and develop process plants. We intend to finance the conversion and development, and in some cases the acquisition, of plants primarily through non-recourse debt financing at the project level. Additionally, we might obtain additional funds through joint ventures or other collaborative arrangements, and through debt and equity financing in the capital markets.

Financing for our projects may not be available when needed or on terms acceptable or favorable to us. In addition, we expect that definitive agreements with equity and debt participants in our capital projects will include conditions to funding, many of which could be outside our control. If we cannot obtain sufficient funds, we may be required to reduce, delay or eliminate expenditures for our business activities (including efforts to acquire, convert and develop process plants) and we may not be able to execute our business plan.

Our ability to use our net operating losses could be limited.

As of December 31, 2005, we had approximately $48 million of tax net operating loss carryforwards. Realization of any benefit from our tax net operating losses is dependent on our ability to generate future taxable income and the absence of certain "ownership changes" of our common stock. An "ownership change," as defined in the applicable federal income tax rules, would place significant limitations, on an annual basis, on the use of such net operating losses to offset any future taxable income we may generate. Such limitations, in conjunction with the net operating loss expiration provisions, could effectively eliminate our ability to use a substantial portion of our net operating losses to offset any future taxable income.

It is possible that we have incurred one or more ownership changes in the past, in which case our ability to use our net operating losses would be limited. In addition, the issuance of shares of our common stock, including the shares we are selling in this offering, could cause an "ownership change" which would also limit our ability to use our net operating losses. Other issuances of shares of our common stock which could cause an "ownership change" include the issuance of shares of common stock upon future conversion or exercise of outstanding options and warrants. In this regard, we contemplate that we would need to issue a substantial amount of additional shares of our common stock (or securities convertible into or exercisable or exchangeable for common stock) in connection

S-16

with our proposed plans to finance the commercialization of the Rentech Process and the implementation of our business plan.

Risks Related to the Rentech Process

Our receipt of revenues from licensees is dependant on their ability to successfully develop, construct and operate FT facilities using the Rentech Process.

We have marketed licenses for use of the Rentech Process, but have no active licensees at this time other than a master license agreement we entered into with DKRW Advanced Fuels LLC, or DKRW-AF, and a site license agreement with Medicine Bow Fuel & Power, LLC, or MBF&P. Under these or other license agreements, a licensee would be responsible for, among other things, obtaining governmental approvals and permits and sufficient financing for the large capital expenditures required. The ability of any licensee to accomplish these requirements, and the efforts, resources and timing schedules to be applied by a licensee, will be controlled by the licensee. Whether licensees are willing to expend the resources necessary to construct FT facilities using the Rentech Process will depend on a variety of factors outside our control, including the prevailing price outlook for crude oil, natural gas, coal, petroleum coke and refined products. In addition, our license agreements generally may be terminated by the licensee with cause. Furthermore, our potential licensees may not be restricted from pursuing alternative Fischer-Tropsch technologies on their own or in collaboration with others, including our competitors, for projects other than the ones we might license in the future.

If our licensees do not proceed with commercial facilities using the Rentech Process or do not successfully operate their facilities, we will not significantly benefit from the licensing of our technology. To date, no licensee of the Rentech Process has proceeded to construct and operate a facility for which royalties on production would be due. If we do not receive payments under our license agreements, our anticipated revenues will be diminished. This would harm our results of operations, financial condition and prospects.

We and our licensees may be unable to successfully implement use of the Rentech Process at commercial scale Fischer-Tropsch facilities, including the East Dubuque facility.

A variety of results necessary for successful operation of the Rentech Process could fail to occur at a commercial facility, including the East Dubuque facility. Results that could cause commercial scale Fischer-Tropsch plants to be unsuccessful include:

- •

- reaction activity different than that demonstrated in laboratory and pilot plant operations, which could increase the amount of catalyst or number of reactors required to convert syngas into liquid hydrocarbons;

- •

- shorter than anticipated catalyst life, which would require more frequent catalyst regeneration, catalyst purchases, or both;

- •

- insufficient catalyst separation from the crude wax product stream, which would impair the operation of the product upgrading unit;

- •

- product upgrading catalyst sensitivities to impurities in the crude FT products, which would impair the efficiency and economics of the product upgrade unit and require design revisions; and

- •

- higher than anticipated capital and operating costs to design, construct or reconfigure and operate a Fischer-Tropsch facility.

If any of the foregoing were to occur, our capital and operating costs would increase. In addition, our plants or those of our licensees could experience mechanical difficulties, either related or unrelated to elements of the Rentech Process. Our failure to construct and operate a commercial scale, Fischer-

S-17

Tropsch plant based on the Rentech Process could, and any such failure at the East Dubuque facility would, materially and adversely affect our business, results of operation, financial condition and prospects.

Facilities that would use the Rentech Process process carbon bearing materials. This creates risks of fire and explosions, which could cause severe damage and injuries, create liabilities for us, and materially and adversely affect our business.

Facilities that use Fischer-Tropsch technology process carbon-bearing materials, including coal and petroleum coke, into syngas. These materials are highly flammable and explosive. Severe personal injuries and material property damage may result. If such accidents did occur, we and our licensees could have substantial liabilities and costs. We are not currently insured for these risks. Furthermore, accidents of this type would likely adversely affect the operation of existing as well as proposed plants by increasing costs for enhanced safety features.

We could have potential indemnification liabilities to licensees relating to the operation of Fischer-Tropsch facilities based on the Rentech Process and due to intellectual property disputes.

We anticipate that license agreements will require us to indemnify the licensee against specified losses relating to, among other things:

- •

- use of patent rights and technical information relating to the Rentech Process; and

- •

- acts or omissions by us in connection with our preparation of preliminary and final design packages for the licensee's plant and approval of the licensee's construction plans.

Our indemnification obligations could result in substantial expenses and liabilities to us if intellectual property rights claims were to be made against us or our licensees, or if Fischer-Tropsch facilities based on the Rentech Process were to fail to operate as we expect.

Industry rejection of Fischer-Tropsch technology or the Rentech Process would adversely affect our ability to receive future license fees.

As is typical in the case of new and/or rapidly evolving technologies, demand for and industry acceptance of the Rentech Process is highly uncertain. Historically, most applications of FT processes have not economically produced FT fuels in comparison with the price of conventional fuel sources. Failure by the industry to accept the Rentech Process, whether due to unsuccessful use, uneconomic results, the novelty of our technology, the lower price of conventionally sourced fuels, or for other reasons, or if acceptance develops more slowly than expected, would materially and adversely affect our business, operating results, financial condition and prospects.

If a high profile industry participant were to adopt the Rentech Process and fail to achieve success, or if any commercial FT plant based on the Rentech Process were to fail to achieve success, other industry participants' perceptions of the Rentech Process could be adversely affected. That could adversely affect our ability to obtain future license fees and generate other revenue. In addition, some oil companies may be motivated to seek to prevent industry acceptance of FT technology in general, or the Rentech Process in particular, based on their belief that widespread adoption of FT technology might negatively impact their competitive position.

S-18

If our competitors introduce new technology, new legislation or regulations are adopted, or new industry standards emerge, our technologies and products could become obsolete and unmarketable.

The markets for our services and products are characterized by rapidly changing competition, new legislation and regulations, and evolving industry standards. If we do not anticipate these changes and successfully develop and introduce improvements on a timely basis, we could lose some or all of our customers, which would have a material adverse effect on our business, financial condition, results of operations and prospects.

Our success depends in part on the successful and timely completion of our product development unit and its subsequent operation.

Our success in designing, constructing, developing and operating our product development unit, or PDU, on a timely basis is essential to our successful deployment of the Rentech Process as well as fulfilling our contractual obligations to DKRW-AF. Under our agreement with DKRW-AF, we are required to satisfy certain testing procedures for the licensed technology at the PDU. We must also obtain governmental approvals and permits as well as procure equipment and materials on a timely basis and a delay or failure in securing such governmental approvals, equipment and/or materials may cause significant harm to us. A variety of results necessary for successful operation of the Rentech Process could fail to be demonstrated by the PDU. In addition, our PDU could experience mechanical difficulties related or unrelated to the Rentech Process. If we are not able to successfully develop and operate a PDU utilizing the Rentech Process, we may not be able to obtain any further licensing agreements with third parties and this may cause a delay in our development of projects utilizing the Rentech Process, which would have a material adverse effect on our business, financial condition, results of operations and prospects.

Our success depends on the performance of our management team, project development team and technology group. The loss of key individuals within these groups would disrupt our business operations.

Our success in implementing our business plan is substantially dependent upon the contributions of our management team, project development team and technology group. We do not have key man life insurance for any of our officers or key employees. Economic success of the Rentech Process depends upon several factors, including design of the syngas reactors for the plants and startup to achieve optimal plant operations, which are highly reliant on the knowledge, skills, and relationships unique to our key personnel. Moreover, to successfully compete, we will be required to engage in continuous research and development regarding processes, products, markets and costs. Unexpected loss of the services of key employees could have a material adverse effect on our business, operating results and financial condition.

Our success depends in part on our ability to protect our intellectual property rights, which involves complexities and uncertainties.

We rely on a combination of patents, copyrights, trademarks, trade secrets and contractual restrictions to protect our proprietary rights. Our business and prospects depend largely upon our ability to maintain control of rights to exploit our intellectual property. Our published and issued patents both foreign and domestic provide us certain exclusive rights (subject to licenses we have granted to others) to exploit the Rentech Process. Our existing patents might be infringed upon, invalidated or circumvented by others. The availability of patents in foreign markets, and the nature of any protection against competition that may be afforded by those patents, is often difficult to predict and varies significantly from country to country. We or our licensees may choose not to seek, or may be unable to obtain, patent protection in a country that could potentially be an important market for our technology. The confidentiality agreements that are designed to protect our trade secrets could be breached, and we might not have adequate remedies for the breach. Additionally, our trade secrets and proprietary know-how might otherwise become known or be independently discovered by others.

S-19

We may not be aware of patents or rights of others that may have applicability in our technology until after we have made a substantial investment in the development and commercialization of our technologies. Third parties may claim that we have infringed upon past, present or future technologies. Legal actions could be brought against us, our co-venturers or our licensees claiming damages and seeking an injunction that would prevent us, our co-venturers or our licensees from testing, marketing or commercializing the affected technologies. If an infringement action were successful, in addition to potential liability for damages, we, our co-venturers or our licensees could be subjected to an injunction or required to obtain a license from a third party in order to continue to test, market or commercialize our affected technologies. Any required license might not be made available or, if available, might not be available on acceptable terms, and we could be prevented entirely from testing, marketing or commercializing the affected technologies. We may have to expend substantial resources in litigation, in enforcing our patents or defending against the infringement claims of others, or both. If we are unable to successfully maintain our technology, including the Rentech Process, against claims by others, our competitive position would be harmed and our revenues could be substantially reduced, and our business, operating results and financial condition could be materially and adversely affected.

The Rentech Process may not compete successfully against Fischer-Tropsch technology developed by our competitors, many of whom have significantly more resources.