UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| | |

| þ Filed by the registrant | | ¨ Filed by a party other than the registrant |

| | |

| Check the appropriate box: |

| ¨ | | Preliminary Proxy Statement |

| ¨ | | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(E)(2)) |

| þ | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

RENTECH, INC.

(Name of Registrant as Specified in Its Chapter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | |

| Payment of filing fee (check the appropriate box): |

| þ | | No fee required. |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) Title of each class of securities to which transaction applies: |

| | | (2) Aggregate number of securities to which transaction applies: |

| | | (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) Proposed maximum aggregate value of transaction. |

| | | (5) Total fee paid: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) Amount Previously Paid: |

| | | (2) Form, Schedule or Registration Statement No.: |

| | | (3) Filing Party: |

| | | (4) Date Filed: |

RENTECH, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held June 4, 2013

You are cordially invited to attend the annual meeting of shareholders of Rentech, Inc.

| | | | |

Time and Date: | | 8:30 a.m. PDT on June 4, 2013. Check-in will begin at 7:30 a.m. PDT and you should allow ample time for the check-in procedures. |

| |

Place: | | Sheraton Gateway Los Angeles Hotel, 6101 W. Century Boulevard, Los Angeles, California 90045 |

| |

Items of Business: | | 1. To elect three directors for terms of three years each; |

| |

| | 2. To approve the Second Amended and Restated 2009 Incentive Award Plan; |

| |

| | 3. To ratify the selection of PricewaterhouseCoopers LLP as Rentech’s independent registered public accounting firm; and |

| |

| | 4. To transact such other business as may properly come before the meeting or any adjournments or postponements of the meeting. |

| |

Adjournments and Postponements: | | Any action on the items of business described above may be considered at the annual meeting at the time and on the date specified above or at any time and date to which the annual meeting may be properly adjourned or postponed. |

| |

Record Date: | | You are entitled to vote only if you were a Rentech shareholder as of the close of business on April 11, 2013. |

| |

Meeting Admission: | | You are entitled to attend the annual meeting only if you were a Rentech shareholder as of the close of business on the Record Date or hold a valid proxy for the annual meeting, or are a guest of the Company. You should be prepared to present photo identification for admittance. If you are a registered shareholder, an admission ticket is attached to your proxy card. Please detach and bring the admission ticket with you to the meeting. Shareholders who do not present admission tickets at the meeting will be admitted only upon verification of ownership. If your shares are held in the name of your broker, bank, or other nominee, you must bring to the meeting an account statement or letter from the nominee indicating that you beneficially owned the shares on the Record Date for voting. Persons acting as proxies must bring a valid proxy from a record holder who owns shares as of the close of business on the Record Date. If you do not provide photo identification and comply with the other procedures outlined above, you will not be admitted to the annual meeting. |

Voting: | | Your vote is very important. Whether or not you plan to attend the annual meeting, we hope you will vote as soon as possible. You may vote your shares via a toll-free telephone number or over the Internet. If you received a paper copy of a proxy or voting instruction card by mail, you may submit your proxy or voting instruction card for the annual meeting by completing, signing, dating and returning your proxy or voting instruction card in the pre-addressed envelope provided. Votes submitted through the Internet or by telephone must be received by 11:59 p.m. Eastern Time on June 3, 2013. Internet and telephone voting are available 24 hours per day. If you vote via Internet or telephone, you do not need to return a proxy card. You are invited to attend the meeting; however, to ensure your representation at the meeting, you are urged to vote via the Internet or telephone, or mark, sign, date, and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope enclosed for that purpose. Any shareholder of record attending the meeting may vote in person even if he or she has voted via the Internet or telephone, or returned a proxy card. |

Los Angeles, California

Date: April 30, 2013

By Order of the Board of Directors,

Colin M. Morris

Secretary

YOUR VOTE IS IMPORTANT

This proxy statement is furnished in connection with the solicitation of proxies by Rentech, Inc. on behalf of the Board of Directors, for the 2013 annual meeting of shareholders. The proxy statement and the related proxy form are first being distributed to shareholders on or about April 30, 2013. You can vote your shares using one of the following methods:

| • | | Vote through the Internet at the website shown on the proxy card. |

| • | | Vote by telephone using the toll-free number shown on the proxy card. |

| • | | Complete and return a written proxy card. |

| • | | Attend Rentech’s 2013 annual meeting of shareholders and vote. |

Votes submitted through the Internet or by telephone must be received by 11:59 p.m. Eastern Time on June 3, 2013. Internet and telephone voting are available 24 hours per day. If you vote via Internet or telephone, you do not need to return a proxy card.

You are invited to attend the meeting; however, to ensure your representation at the meeting, you are urged to vote via the Internet or telephone, or mark, sign, date, and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope enclosed for that purpose. Any shareholder of record attending the meeting may vote in person even if he or she has voted via the Internet or telephone, or returned a proxy card.

TABLE OF CONTENTS

RENTECH, INC.

10877 Wilshire Blvd., Suite 600

Los Angeles, California 90024

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

To Be Held June 4, 2013

This proxy statement is furnished to shareholders in connection with the solicitation by the Board of Directors (the “Board”) of Rentech, Inc. (“Rentech,” the “Company,” “we,” “us” or “our”) of proxies for use at the annual meeting of shareholders to be held at the Sheraton Gateway Los Angeles Hotel, 6101 W. Century Boulevard, Los Angeles, California,

on June 4, 2013 at 8:30 a.m. PDT, and at any adjournments or postponements of the meeting.

We anticipate that this proxy statement and the accompanying form of proxy will be first sent or given to our shareholders on or about April 30, 2013.

VOTING SECURITIES AND VOTING RIGHTS

Only shareholders of record at the close of business on April 11, 2013 are entitled to notice of and to vote at the annual meeting or any adjournments or postponements of the meeting. On April 11, 2013, 225,829,236 shares of common stock were outstanding held by 446 shareholders of record. Each share of common stock outstanding on that date entitles the holder to one vote on each matter submitted to a vote at the meeting. Cumulative voting is not allowed. Shares may only be voted by or on behalf of the shareholder of record. If a holder’s shares are held of record by another person, such as a stock brokerage firm or bank, that person must vote the shares as the shareholder of record.

Shareholders may vote in person or by proxy at the annual meeting. All properly executed proxies received prior to the commencement of voting at the meeting, and which have not been revoked, will be voted in accordance with the directions given. If no specific instructions are given for a matter to be voted upon, the proxy holders will vote the shares covered by proxies received by them (i) FOR the election of the three nominees to the Board; (ii) FOR the approval of the Second Amended and Restated 2009 Incentive Award Plan (referred to as the “Plan Amendment”); and (iii) FOR the ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm.

A quorum for the transaction of business at the meeting requires the presence at the annual meeting, in person or by proxy, of the holders of not less than a majority of the issued and outstanding shares of common stock. If a quorum is

present, the three nominees for election as directors who receive the greatest number of votes in favor of their election at the meeting will be elected. Cumulative voting is not allowed for the election of directors. The proposal to approve the Plan Amendment will be approved if the holders of a majority of the voting power of the outstanding shares of common stock that are present in person or by proxy at the annual meeting and entitled to vote on the proposal approve the plan, and the proposal to ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm will be approved if the votes cast favoring the proposal exceed the votes cast opposing the proposal.

If brokers have not received any instruction from their customers on how to vote the customer’s shares on a particular proposal, the brokers are allowed to vote on routine matters but not on non-routine proposals. The absence of votes by brokers on non-routine matters are “broker non-votes.” Abstentions and broker non-votes will be counted as present for purposes of establishing a quorum, but will have no effect on the election of directors, the proposal to approve the Plan Amendment or the proposal to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accountants. As the proposal to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accountants is a routine proposal, broker non-votes are not expected to result from this proposal.

Any shareholder giving a proxy pursuant to the present solicitation has the power to revoke it at any time before it is

RENTECH, INC. ï 2013 Proxy Statement 1

exercised. It may be revoked by giving a subsequent proxy or by mailing to our principal executive offices at 10877 Wilshire Boulevard, Suite 600, Los Angeles, California 90024, Attn: Secretary, an instrument of revocation. If you vote electronically via the Internet or telephone, a proxy may be revoked by the submission of a later electronic proxy. A proxy may also be revoked by attending the meeting and giving our Secretary a vote in person (subject to the restriction that a shareholder holding shares in street name must bring to the meeting a legal proxy from the broker, bank, or other nominee holding that shareholder’s shares which confirms that shareholder’s beneficial ownership of the shares and gives the shareholder the right to vote the shares).

We will bear the cost of solicitation of proxies, including expenses in connection with preparing and mailing this proxy statement. We will furnish copies of solicitation materials to brokerage houses, fiduciaries, and custodians to forward to beneficial owners of our common stock that are held in their names. In addition, we will reimburse brokerage firms and

other persons representing beneficial owners of stock for their expenses in forwarding solicitation materials to such beneficial owners. We have retained MacKenzie Partners, Inc. to assist us with the solicitation of proxies and will pay them an aggregate fee of $10,000 plus expenses. Original solicitation of proxies by mail may be supplemented by telephone, facsimile, and personal solicitation by our directors, officers, and other employees. No additional compensation will be paid to our directors, officers, or other employees for these services.

The purposes of the meeting and the matters to be acted upon are set forth in the foregoing attached Notice of Annual Meeting. As of the date of this proxy statement, management knows of no other business that will be presented for consideration at the meeting. However, if any such other business shall properly come before the meeting, votes will be cast pursuant to said proxies in respect of any such other business in accordance with the best judgment of the persons acting under said proxies.

2 RENTECH, INC. ï 2013 Proxy Statement

ELECTION OF DIRECTORS

(Proxy Item 1)

There are currently nine positions on the Board. The Board currently is divided into three classes, one of which currently consists of four directors, one of which currently consists of two directors and one of which currently consists of three directors. The directors in each class are elected for three years and until the election and qualification of their successors.

Michael F. Ray, Edward M. Stern and John A. Williams have been nominated for election as directors for a term of three years each and until their successors have qualified and are elected. The three nominees are presently members of the Board. All other members of the Board will continue in office until the expiration of their respective terms at the 2014 or 2015 annual meetings of shareholders.

If your vote is properly submitted, it will be voted for the election of the nominees, unless contrary instructions are specified. Each nominee has consented to serve if elected. Although the Board has no reason to believe that any of the nominees will be unable to serve as a director, should that occur, the persons appointed as proxies in the accompanying proxy card will vote, unless the number of nominees or directors is reduced by the Board, for such other nominee or nominees as the Nominating and Corporate Governance Committee of the Board may propose and the Board approves.

Information Regarding Nominees for Election to the Board:

Michael F. Ray,

Director, Age 60—

Mr. Ray was appointed as a director of Rentech in May 2005 and as a director of Rentech Nitrogen GP, LLC in July 2011 and served as the Chairman of Rentech’s Compensation Committee from 2005 until 2010. Mr. Ray founded and, since 2001, has served as President of ThioSolv, LLC, a company that develops and licenses technology to the refining and chemical sector. Also, since May 2005, Mr. Ray has served as General Partner of GBTX Leasing, LLC, a company that owns and leases rail cars for the movement of liquid chemicals and salts. Since 2008, Mr. Ray has served as a member of the board of directors and the Technology Committee for OCM Cyanco Holdings, LLC, a producer of sodium cyanide in the Western United States, and a subsidiary of Oaktree Capital Management, which holds a controlling interest in the company. From 1995 to 2001, Mr. Ray served as Vice President of Business Development for the Catalyst and Chemicals Division of The Coastal Corporation, a company that principally gathered, processed, stored and distributed natural gas. Mr. Ray served as President (from 1990 to 1995), Vice President of Corporate Development and Administration (from 1986 to 1990) and Vice President of Carbon Dioxide Marketing (from 1985 to 1986) of Coastal Chem, Inc., a manufacturer of dry ice and solid carbon dioxide. Mr. Ray served as Regional Operations Manager (from 1981 to 1985) and Plant Manager (from 1980 to 1981) of Liquid Carbonic Corporation, a seller of carbon dioxide products. Mr. Ray previously served as a member of the board of directors of Coastal Chem, Inc., Cheyenne LEADS and Wyoming Heritage Society. Mr. Ray also served on the Nitrogen Fertilizer Industry Ad Hoc Committee, the University of Wyoming EPSCOR Steering Committee and

Wyoming Governor’s committee for evaluating state employee compensation. The Board has determined that Mr. Ray brings to the Board experience with start-up and technology companies, familiarity with the business of developing and licensing technology and with the nitrogen fertilizer industry and directorial and governance experience as a director of Coastal Chem, Inc., and therefore he should serve on the Board.

Edward M. Stern,

Director, Age 54—

Mr. Stern was appointed as a director of Rentech in December 2006 and has more than 25 years of experience leading the successful development, financing and operation of major energy and infrastructure projects. Mr. Stern is the President and Chief Executive Officer of PowerBridge, LLC and under his guidance, Neptune Regional Transmission System, LLC, a PowerBridge company, has developed, constructed and, since 2007, has operated the Neptune Project, a 660 MW, 65 mile long, high-voltage, direct current, or HVDC, undersea and underground electric transmission system that interconnects the PJM market at Sayreville, New Jersey with Long Island, New York. Through PowerBridge, Mr. Stern is also leading the development of other major undersea and underground HVDC transmission projects, including the 8 mile long 660 megawatt Hudson Project, which is under construction and will interconnect the PJM market with Manhattan. Mr. Stern is also leading the development of several other large transmission and renewable energy projects domestically and abroad. From 1991 through 2003, Mr. Stern was employed by Enel North America, Inc. (a subsidiary of Enel SpA, an Italian electric utility company) and its predecessor, CHI Energy, Inc., an energy

RENTECH, INC. ï 2013 Proxy Statement 3

company that owned or operated nearly one hundred power plants in seven countries, specializing in renewable energy technologies including hydroelectric projects and wind farms. While at Enel North America, Inc. and CHI Energy, Inc., Mr. Stern served as General Counsel and, commencing in 1999, as President, Director and Chief Executive Officer. Mr. Stern currently serves on the board of directors of Deepwater Wind Holdings, LLC, an offshore wind energy developer and Capital Access Network, Inc., a small business lender. Mr. Stern also serves on the Advisory Board of Starwood Energy Group Global, LLC, a private equity firm specializing in energy and infrastructure investments. The Board has determined that Mr. Stern brings to the Board significant management and legal experience at energy companies, including substantial project development experience, and his directorial and governance experience as a director at numerous companies in the industry in which we operate, and therefore he should serve on the Board.

John A. Williams,

Director, Age 70—

Mr. Williams was appointed as a director of Rentech in November 2009. Mr. Williams has over 40 years of business experience, principally in the real estate and banking

industries. Since January 2004, Mr. Williams has served as the Chief Executive Officer, President and Managing Member of Corporate Holdings, LLC, a diversified holdings company, and since November 2004, he has served as Chief Executive Officer and Managing Member of Williams Realty Advisors, LLC, a real estate fund advisor to over $3 billion in assets. Mr. Williams is currently Chairman and Chief Executive Officer of Preferred Apartment Communities, Inc., a new real estate investment trust. In 1970, Mr. Williams founded Post Properties, Inc., a developer, owner and manager of upscale multifamily apartment communities in selected markets in the United States. Mr. Williams served as Chief Executive Officer of Post Properties from 1970 until 2002, and he served on its board from inception until 2004. Mr. Williams served as Chairman for Post Properties from inception until February 2003 and Chairman Emeritus from February 2003 until August 2004. Mr. Williams currently serves on the board of directors of the Atlanta Falcons of which he is also a minority owner. Mr. Williams previously served on a variety of boards of directors, including those of NationsBank Corporation, Barnett Banks, Inc. and Crawford & Company. The Board has determined that Mr. Williams brings to the Board over 40 years of business experience and directorial and governance experience on boards of directors, and therefore he should serve on the Board.

Recommendation

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” ELECTION OF THE NOMINEES

Information Regarding Continuing Directors with Terms Expiring in 2014:

Michael S. Burke,

Director, Age 50—

Mr. Burke was appointed as a director of Rentech in March 2007 and was appointed as a director of Rentech Nitrogen GP, LLC in July 2011. Mr. Burke was appointed President of AECOM Technology Corporation, or AECOM, on October 1, 2011. AECOM is a global provider of professional technical and management support services to government and commercial clients. From December 2006 through September 2011, Mr. Burke served as Executive Vice President, Chief Financial Officer of AECOM. Mr. Burke joined AECOM as Senior Vice President, Corporate Strategy in October 2005. From 1990 to 2005, Mr. Burke was with the accounting firm, KPMG LLP, where he served in various senior leadership positions, most recently as a Western Area Managing Partner from 2002 to 2005. Mr. Burke also was a member of the board of directors of KPMG from 2000 through 2005. While on the board of directors of KPMG, Mr. Burke served as the Chairman of the Board Process and Governance Committee and a member of the Audit and Finance Committee. Mr. Burke also serves on the boards of directors of various charitable and community organizations. Mr. Burke received a B.S. degree in accounting from the University of Scranton and a J.D. degree from Southwestern

University. The Board has determined that Mr. Burke brings to the Board extensive accounting, financial and business experience, including experience with a public company, and therefore he should serve on the Board.

General (ret) Wesley K. Clark,

Director, Age 68—

General Clark was appointed as a director of Rentech in December 2010. General Clark is a businessman, educator, writer and commentator. In 2003, General Clark founded the strategic consulting firm of Wesley K. Clark & Associates, where he currently serves as Chairman and Chief Executive Officer. From June 2000 through March 2003, General Clark was a managing director at Stephens, Inc., an investment banking firm based in Arkansas. Prior to that, from June 1966 through June 2000, General Clark served in the United States Army where he held numerous staff and command positions and rose to the rank of 4-star general. He served as NATO Supreme Allied Commander and Commander in Chief of the U.S.-European Command from July 1997 through May 2000. General Clark serves on the board of directors of AMG Advanced Metallurgical Group N.V., a global producer of specialty metals and metallurgical vacuum furnace systems;

4 RENTECH, INC. ï 2013 Proxy Statement

BNK Petroleum Inc., an energy company focused on the

acquisition, exploration and production of large oil and gas reserves; Bankers Petroleum Ltd., a Canadian based oil and gas exploration and production company; Juhl Wind Inc., a wind energy provider; Amaya Gaming, a Canadian company in the electronic gaming industry; Torvec Inc., a U.S. automotive technology company; and is a partner in United Global Resources, LLC, a U.S. broker dealer focused on project development. General Clark previously served on the board of directors of Prysmian S.r.L., a provider of high-technology cables and systems for energy and telecommunication, from 2007 until 2012; Rodman & Renshaw, an investment banking firm, from 2009 until 2012; Argyle Security, Inc., a provider of security solutions, from

2008 until 2009; NutraCea, a processor of rice-bran based

products, from 2009 until 2011; and EWT, N.V., a producer of wind farms, from 2008 until 2010. General Clark graduated first in his class from the United States Military Academy at West Point in 1966. He received degrees in philosophy, politics and economics from Oxford University (B.A. and M.A.) where he was a Rhodes Scholar from 1966 to 1968. The Board has determined that General Clark brings to the Board extensive leadership experience, including having held high-ranking positions in the United States Army, and directorial and governance experience and familiarity with our industry as a result of having served on boards of directors of numerous companies in the renewable and alternative energy industry, and therefore he should serve on the Board.

Ronald M. Sega,

Director, Age 60—

Dr. Sega was appointed as a director of Rentech in December 2007. Currently, Dr. Sega serves as Vice President and Enterprise Executive for Energy and the Environment at both Colorado State University, or CSU, and Ohio State University, or OSU. He is the Woodward Professor of Systems Engineering, Director of Graduate Studies in Systems Engineering and serves as chair of the Sustainability, Energy, and Environment Advisory Committee at CSU. Dr. Sega also serves on the President’s and the Provost’s Council on Sustainability at OSU. Since 2008, Dr. Sega has served as a member of the board of directors of Woodward Governor Company, a company that designs, manufactures and services energy control systems and components for aircraft and industrial engines and turbines. Dr. Sega also serves on the Advisory Board of Ball Aerospace and Technology Corporation. From August 2005 to August 2007, Dr. Sega served as Under Secretary for the United States Air Force. In that capacity, he oversaw the recruiting, training and equipping of approximately 700,000 people and a budget of approximately $110 billion. Designated as the Department of Defense Executive Agent for Space, Dr. Sega developed, coordinated and integrated plans and programs for space systems of all Department of Defense space major defense acquisition programs. From August 2001 until July 2005, Dr. Sega was Director of Defense Research and Engineering, Office of the Secretary of Defense. Dr. Sega worked for the National Aeronautics and Space Administration, or NASA, from 1990 until 1996 and made two shuttle flights during his career as an astronaut at NASA. Dr. Sega received a B.S. in mathematics and physics from the United States Air Force Academy in 1974, a M.S. in physics from OSU in 1975, and a doctorate in electrical engineering from the University of Colorado at Boulder in 1982. The Board has determined that Dr. Sega brings to the Board a strong background in science and research, aerospace, energy and operations with significant experience in leadership positions, including those involving responsibility for large budgets, and therefore he should serve on the Board.

Dennis L. Yakobson,

Director and Chairman Emeritus of the Board, Age 76—

Mr. Yakobson has served as a director of Rentech since 1983 and is one of its founders. He served as the Chairman of the Board until June 2011, at which time he became Chairman Emeritus of the Board, and he served as Chief Executive Officer until December 2005. He was employed as Vice President of Administration and Finance of Nova Petroleum Corporation, Denver, Colorado, from 1981 to 1983. From 1979 to 1983, he served as a Director and Secretary of Nova Petroleum Corporation. He resigned from those positions in November 1983 to become a Director and assume the presidency of Rentech. From 1976 to 1981, he served as a Director, Secretary and Treasurer of Power Resources Corporation in Denver, a mineral exploration company, and was employed by it as the Vice President-Land. From 1975 to 1976, he was employed by Wyoming Mineral Corporation in Denver as a contract administrator. From 1971 through 1975, he was employed by Martin Marietta Corporation, Denver, as marketing engineer in space systems. From 1969 to 1971, he was employed by Martin Marietta in a similar position. From 1960 to 1969, he was employed by Grumman Aerospace Corporation, his final position with it being contract administrator with responsibility for negotiation of prime contracts with governmental agencies. He is a director of GTL Energy Pty Ltd., a private company based in Adelaide, Australia. The Board has determined that Mr. Yakobson brings to the Board knowledge of our business and, as the founder, his historical understanding of our operations combined with his experience in leadership positions, including directorial and governance experience on boards of directors, at multiple engineering and energy companies, and therefore he should serve on the Board.

RENTECH, INC. ï 2013 Proxy Statement 5

Information Regarding Continuing Directors with Terms Expiring in 2015:

D. Hunt Ramsbottom,

Chief Executive Officer, President and Director, Age 55—

Mr. Ramsbottom was appointed President and as a director of Rentech in September 2005, and he was appointed Chief Executive Officer of Rentech in December 2005. Mr. Ramsbottom had been serving as a consultant to Rentech since August 2005 under the terms of a Management Consulting Agreement Rentech entered into with Management Resource Center, Inc. Mr. Ramsbottom has over 25 years of experience building and managing growth companies. Prior to accepting his position at Rentech, Mr. Ramsbottom held various key management positions including: from 2004 to 2005, as Principal and Managing Director of Circle Funding Group, LLC, a buyout firm; from 1997 to 2004, as Chief Executive Officer and Chairman of M2 Automotive, Inc., an automotive repair venture; and from 1989 to 1997, as Chief Executive Officer of Thompson PBE, a supplier of paints and related supplies, which was acquired by FinishMaster, Inc. in 1997. On April 17, 2005, M2 Automotive, Inc. completed an assignment for the benefit of its creditors pursuant to a state law insolvency proceeding. Mr. Ramsbottom holds a B.S. degree from Plymouth State College. The Board has determined that Mr. Ramsbottom brings to the Board knowledge of our business and his historical understanding of our operations gained through his service as our President and Chief Executive Officer and experience with companies as chief executive officer, principal and managing director, and therefore he should serve on the Board. In July 2011, Mr. Ramsbottom was appointed Chief Executive Officer and as a member of the board of directors of Rentech Nitrogen GP, LLC, the general partner of Rentech Nitrogen Partners, L.P. (NYSE: RNF). Rentech Nitrogen GP, LLC is one of our indirect wholly-owned subsidiaries and Rentech Nitrogen Partners, L.P. is one of our indirect majority-owned subsidiaries.

Halbert S. Washburn,

Director and Chairman of the Board, Age 53—

Mr. Washburn was appointed as a director of Rentech in December 2005, and has served as Chairman of the Board since June 2011. In July 2011, Mr. Washburn was appointed as a director of Rentech Nitrogen GP, LLC. Mr. Washburn has over 25 years of experience in the energy industry. Since April 2010, Mr. Washburn has been the Chief Executive Officer of BreitBurn GP, LLC, the general partner of BreitBurn Energy Partners LP. From August 2006 until April 2010, he was the co-Chief Executive Officer and served on the board of directors of BreitBurn GP, LLC. In December 2011, he was reappointed as a member of the board of directors of BreitBurn GP, LLC . He has served as the co-President and a director of BreitBurn Energy Corporation since 1988. He also has served as a co-Chief Executive Officer and a director for Pacific Coast Energy Holdings, LLC (formerly BreitBurn Energy Holdings, LLC) and as co-Chief Executive Officer and a director of PCEC (GP), LLC (formerly BEH (GP), LLC). Mr. Washburn previously served as Chairman on the Executive Committee of the board of directors of the California Independent Petroleum Association. He also served as Chairman of the Stanford University Petroleum Investments Committee and as Secretary and Chairman of the Wildcat Committee. The Board has determined that Mr. Washburn brings to the Board knowledge of our business, extensive experience in our industry, including his service as an executive officer and director of several BreitBurn entities, and familiarity with start-up and public energy companies, and therefore he should serve on the Board.

Executive Officers

Information concerning the business experience of Mr. Ramsbottom, who serves as our President and Chief Executive Officer, is provided above.

Dan J. Cohrs,

Executive Vice President, Chief Financial Officer and Treasurer, Age 60—

Mr. Cohrs was appointed Executive Vice President and Chief Financial Officer of Rentech in October 2008. Mr. Cohrs was also Treasurer of Rentech from October 2008 until November 2009 and was re-appointed Treasurer in October 2010. Mr. Cohrs has more than 25 years of experience in corporate finance, strategy and planning, and mergers and acquisitions. From April 2008 through September 2008, Mr. Cohrs served as Chief Development

and Financial Officer of Agency 3.0, LLC, a private digital advertising and consulting agency in Los Angeles, California and he was a Partner and a Board Member of Agency 3.0, LLC until September 2009. From August 2007 through September 2008, he served as Chief Development & Financial Officer of Skycrest Ventures, LLC, a private investment and consulting firm in Los Angeles that was related to Agency 3.0, LLC. From June 2006 to May 2007, Mr. Cohrs served as a consultant for finance and corporate development, as well as Interim Chief Financial Officer for several months during that period of time, for Amp’d Mobile, a

6 RENTECH, INC. ï 2013 Proxy Statement

private mobile media entertainment company in Los Angeles. From 2003 to 2007, Mr. Cohrs worked as an independent consultant and advised companies regarding financings, investor presentations and business plans. From November 2005 to March 2006, Mr. Cohrs served as a Visiting Senior Lecturer at Cornell University’s Johnson School of Management in the area of corporate governance. From May 1998 to June 2003, Mr. Cohrs served as Executive Vice President and Chief Financial Officer of Global Crossing Ltd. Prior to being employed at Global Crossing Ltd., Mr. Cohrs held senior positions in finance and strategy at Marriot Corporation, Northwest Airlines, Inc. and GTE Corporation, a predecessor of Verizon Communications, Inc. Mr. Cohrs earned M.S. and Ph.D. degrees in finance, economics and public policy from Cornell University’s Johnson Graduate School of Management and a B.S. degree in Engineering from Michigan State University. Mr. Cohrs was appointed Chief Financial Officer of Rentech Nitrogen GP, LLC, the general partner of Rentech Nitrogen Partners, L.P., in July 2011.

On June 1, 2007, Amp’d Mobile, Inc. filed a petition for bankruptcy under chapter 11 of title 11 of the United States Code, 11 U.S.C. § 101, et seq., or the Bankruptcy Code, with the United States Bankruptcy Court for the District of Delaware. On January 28, 2002, Global Crossing Ltd., and certain of its direct and indirect subsidiaries, filed a petition for

bankruptcy under chapter 11 of title 11 of the Bankruptcy Code with the United States Bankruptcy Court for the Southern District of New York. On April 11, 2005, the Securities and Exchange Commission, or the SEC, Global Crossing Ltd., Mr. Cohrs (at the relevant time, the Chief Financial Officer of Global Crossing Ltd.) and other members of Global Crossing Ltd.’s senior management reached a settlement related to an SEC investigation regarding alleged violations of the reporting provisions of Section 13(a) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the regulations thereunder. The parties to the agreement (other than the SEC) agreed not to cause any violations of such reporting provisions in the future, and in connection with a parallel civil action, Mr. Cohrs agreed to pay a $100,000 civil penalty. In the SEC order, none of the allegations related to fraud, no party admitted liability and no other violations of securities laws were alleged. Also in connection with Global Crossing, Ltd., on July 16, 2004, Mr. Cohrs and the Secretary of the United States Department of Labor entered into a settlement agreement, the relevant restrictions of which expired on July 16, 2009, pursuant to which Mr. Cohrs agreed, among other things, that he would give notice to the Secretary, and if the Secretary objected, then he would not serve in a fiduciary capacity with respect to any plan covered by the Employee Retirement Income Security Act.

John H. Diesch,

Senior Vice President Operations, Age 56—

John H. Diesch was appointed Senior Vice President of Operations of Rentech in January 2008 and is responsible for plant operations at our facilities. From April 2006 to January 2008, Mr. Diesch served as President of Rentech Nitrogen, LLC (formerly Rentech Energy Midwest Corporation) and Vice President of Operations for Rentech. From April 1999 to April 2006, Mr. Diesch served as Managing Director of Royster-Clark Nitrogen, Inc., and previously served as Vice President and General Manager of nitrogen production and distribution for IMC AgriBusiness Inc., an agricultural fertilizer manufacturer. In 1991, he joined Vigoro Industries Inc., a manufacturer and distributor of potash, nitrogen fertilizers and related products, as North Bend, Ohio Plant Manager after serving as Plant Manager, Production Manager and Process Engineer with Arcadian Corporation, a nitrogen manufacturer, Columbia Nitrogen Corp., a manufacturer of fertilizer products, and Monsanto Company, a multinational agricultural biotechnology corporation. Mr. Diesch is a member of the board of directors of The Fertilizer Institute, a former member of the board of directors of the Gasification Technologies Council and previously served as director of the Dubuque Area Chamber of Commerce, and was recently management Chairman of the Board for the Dubuque Area Labor Management Council. Mr. Diesch was appointed President and a member of the board of directors of Rentech Nitrogen GP, LLC, the general partner of Rentech Nitrogen Partners, L.P., in July 2011.

Harold A. Wright,

Senior Vice President and Chief Technology Officer, Age 48—

Mr. Wright was appointed Senior Vice President and Chief Technology Officer of Rentech in March 2007. Mr. Wright served as Vice President of Technology for Eltron Research & Development, a developer of technologies for the energy, chemical and water services industries, from June 2005 until February 2007. From 1991 to 2005, Mr. Wright worked at ConocoPhillips, during which time Mr. Wright served in various capacities including Director of Gas-To-Liquids, or GTL, Research and Development from February 2004 to June 2005 and director of Synthesis Gas Development from July 2000 to February 2004. In these positions, Mr. Wright was responsible for synthesis gas technology development, GTL commercial reactor design, directing GTL catalyst development and product upgrading technology development. Mr. Wright oversaw all aspects of the company’s scale-up of GTL technology, which resulted in a 400 barrel per day demonstration plant in Ponca City, Oklahoma. With 30 United States patents issued to his credit, Mr. Wright is also a registered patent agent and is authorized to practice patent law before the United States Patent and Trademark Office. Mr. Wright received a B.S. in chemical engineering, cum laude, from the University of Missouri in

1986 and a Ph.D. in chemical engineering from Purdue University in 1991.

RENTECH, INC. ï 2013 Proxy Statement 7

Colin M. Morris,

Senior Vice President and General Counsel, Age 40—

Mr. Morris has served as the Senior Vice President and General Counsel of Rentech since October 2011. From June 2006 to October 2011, Mr. Morris served as Vice President and General Counsel. Mr. Morris practiced corporate and securities law at the Los Angeles office of Latham & Watkins LLP from June 2004 to May 2006. From September 2000 to May 2004, Mr. Morris practiced corporate and securities law

in the Silicon Valley office of Wilson, Sonsini, Goodrich and Rosati. Prior to that Mr. Morris practiced corporate and securities law in the Silicon Valley office of Pillsbury Winthrop Shaw Pittman LLP. Mr. Morris received an A.B. degree in government from Georgetown University and a J.D. from the University of California, Berkeley, Boalt Hall School of Law. Mr. Morris was appointed Senior Vice President, General Counsel and Secretary of Rentech Nitrogen GP, LLC, the general partner of Rentech Nitrogen Partners, L.P., in October 2011, and from July 2011 to October 2011, Mr. Morris served as Vice President, General Counsel and Secretary.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding beneficial ownership of our common stock as of March 31, 2013 by (i) all owners of record or those who are known to us to beneficially own more than 5% of the issued and outstanding shares of our common stock, (ii) each director and named executive officer identified in the tables under “—Executive Compensation,” and (iii) by all executive officers and directors as a group:

| | | | | | | | |

Directors and Named Executive Officers (1)(2)(3) Listed in alphabetical order | | Amount and Nature of Beneficial Ownership (4) | | | Percent of Class (5) | |

Michael S. Burke | | | 324,439 | | | | * | |

General Wesley K. Clark | | | 133,301 | | | | * | |

Dan J. Cohrs | | | 983,274 | | | | * | |

John H. Diesch | | | 567,182 | | | | * | |

Colin M. Morris | | | 672,774 | | | | * | |

D. Hunt Ramsbottom(6) | | | 2,353,562 | | | | * | |

Michael F. Ray (7) | | | 458,505 | | | | * | |

Ronald M. Sega | | | 316,462 | | | | * | |

Edward M. Stern | | | 355,143 | | | | * | |

Halbert S. Washburn | | | 345,642 | | | | * | |

John A. Williams | | | 49,991 | | | | * | |

Harold A. Wright | | | 628,519 | | | | * | |

Dennis L. Yakobson(8) | | | 491,155 | | | | * | |

All Directors and Executive Officers as a Group (13 persons) | | | 7,679,949 | | | | 3.4% | |

| | | | | | | | |

Beneficial Owners of More than 5% | | Amount and Nature of

Beneficial Ownership | | | Percent of Class | |

The Vanguard Group(9) | | | 15,345,919 | | | | 6.8% | |

BlackRock, Inc.(10) | | | 11,279,956 | | | | 5.0% | |

| (1) | Except as otherwise noted and subject to applicable community property laws, each shareholder has sole or shared voting and investment power with respect to the shares beneficially owned. The business address of each director and executive officer is c/o Rentech, Inc., 10877 Wilshire Blvd., Suite 600, Los Angeles, CA 90024. |

| (2) | If a person has the right to acquire shares of common stock subject to options, time-vesting restricted stock units, or RSUs, or other convertible or exercisable securities within 60 days of March 31, 2013, then such shares (including certain RSUs that are fully vested but will not be yet paid out until the earlier of the recipient’s termination and three years from the applicable award date, subject to any required payment delays arising under applicable tax laws) are deemed outstanding for purposes of computing the percentage ownership of that person, but are not deemed outstanding for purposes of computing the percentage ownership of any other person. The following shares of common stock that may be acquired within 60 days of March 31, 2013 and are included in the table above: |

| | • | | Michael S. Burke — 60,742 under options; |

| | • | | General Wesley K. Clark — 21,501 under options; |

| | • | | Dan J. Cohrs — 295,125 under options; |

| | • | | John H. Diesch — 161,053 under options; |

| | • | | Colin M. Morris — 198,681 under options; |

| | • | | D. Hunt Ramsbottom — 770,484 under options; |

| | • | | Michael F. Ray — 60,742 under options; |

| | • | | Ronald M. Sega — 60,742 under options; |

8 RENTECH, INC. ï 2013 Proxy Statement

| | • | | Edward M. Stern — 82,243 under options; |

| | • | | Halbert S. Washburn — 60,742 under options; |

| | • | | John A. Williams — 49,991 under options; |

| | • | | Harold A. Wright — 118,050 under options; |

| | • | | Dennis L. Yakobson — 168,251 under options; and |

| | • | | all directors and named executive officers as a group — 2,108,347 under options. |

| (3) | The Security Ownership table above does not include the following: |

(A) Performance-vesting restricted stock units, or PSUs, held by our named executive officers, or our NEOs, that vest upon each of the first three anniversaries of the grant date based on the level of total shareholder return over the average fair market value for the thirty-day trading period through the grant date (the numbers below represent the greatest number of PSUs that maybe issued to the NEOs):

| | • | | Dan J. Cohrs — 290,512 PSUs; |

| | • | | John H. Diesch — 290,512 PSUs; |

| | • | | Colin M. Morris — 203,359 PSUs; |

| | • | | D. Hunt Ramsbottom — 677,864 PSUs; |

| | • | | Harold Wright — 188,834 PSUs; and |

(B) unvested RSUs and/or options that will vest assuming the continued employment of the officer or director beyond each applicable vesting date:

| | • | | Michael S. Burke — 14,700 RSUs; |

| | • | | General Wesley K. Clark — 14,700 RSUs; |

| | • | | Dan J. Cohrs — 423,027 RSUs and 147,562 options; |

| | • | | John H. Diesch — 248,407 RSUs and 59,025 options; |

| | • | | Colin M. Morris — 268,877 RSUs and 59,025 options; |

| | • | | D. Hunt Ramsbottom — 731,926 RSUs and 250,856 options; and |

| | • | | Michael F. Ray — 14,700 RSUs; |

| | • | | Ronald M. Sega — 14,700 RSUs; |

| | • | | Edward M. Stern — 14,700 RSUs; |

| | • | | Halbert S. Washburn — 14,700 RSUs; |

| | • | | John A. Williams — 14,700 RSUs; |

| | • | | Harold Wright — 128,060 RSUs and 59,025 options; and |

| | • | | Dennis L. Yakobson — 14,700 RSUs. |

| (4) | Information with respect to beneficial ownership is based upon information furnished by each shareholder or contained in filings with the SEC. |

| (5) | Based on 225,823,861 shares of common stock outstanding as of March 31, 2013. |

| (6) | Includes 68,000 shares held for the benefit of Mr. Ramsbottom’s children as to which Mr. Ramsbottom disclaims beneficial ownership and 10,000 shares held by the L.E. Ramsbottom Living Trust owned by Mr. Ramsbottom’s spouse as to which Mr. Ramsbottom disclaims beneficial ownership. |

| (7) | Includes 7,500 shares held by Mr. Ray’s spouse’s individual retirement arrangement as to which Mr. Ray disclaims beneficial ownership. |

| (8) | Includes 40,000 shares held in custodial accounts as to which Mr. Yakobson disclaims beneficial ownership. |

| (9) | Based on information in a Schedule 13G filed by The Vanguard Group, or Vanguard, with the SEC on February 11, 2013 for its holdings as of December 31, 2012, Vanguard reported that it has sole power to vote all 303,257 shares, and that it has the sole power to dispose of 15,056,562 of its shares and the shared power to dispose 289,357 of its shares. Vanguard’s principal business office address is 100 Vanguard Blvd., Malvem, PA 19355. |

| (10) | Based on information in Amendment No. 8 to a Schedule 13G filed by BlackRock, Inc., or BlackRock, with the SEC on July 11, 2012 for its holdings as of June 29, 2012. BlackRock reported that it has sole power to vote and to dispose of all 11,279,956 shares. BlackRock’s principal business office address is 40 East 52nd Street, New York, NY 10022. |

Equity Compensation Plan Information

The following table provides information as of December 31, 2012 with respect to our compensation plans, including individual compensation arrangements, under which our equity securities are authorized for issuance.

| | | | | | | | | | | | |

| Plan category | | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | | | Weighted-average exercise price of outstanding options, warrants and rights (b) | | | Number of securities remaining available for future issuance under equity compensation plans

(excluding securities

reflected in column (a)) (c) | |

Equity compensation plans approved by security holders | | | 15,440,000 | | | $ | 0.45 | | | | 3,580,000 | |

Equity compensation plans not approved by security holders | | | 33,000 | | | | — | | | | — | |

Total | | | 15,473,000 | | | $ | 0.45 | | | | 3,580,000 | |

The equity securities issued as compensation under shareholder approved compensation plans consist of stock options, RSUs and performance shares. The equity securities issued as compensation without shareholder approval consist of RSUs. The stock options have exercise prices equal to the fair market value of our common stock, as reported by the NYSE MKT, as of the date the securities were granted. The options may be exercised for a term ranging from five to ten years after the date they were granted.

RENTECH, INC. ï 2013 Proxy Statement 9

Ownership of Common Units of RNP

On December 14, 2012 each of Messrs. Ramsbottom, Cohrs, Diesch and Morris were granted phantom units of Rentech Nitrogen Partners, L.P., a publicly traded Delaware limited partnership and one of our indirectly majority owned subsidiaries, or RNP, common units in the amounts of 5,600, 2,400, 2,400 and 1,680, respectively. Such phantom units will vest in three equal parts on each of the next three

anniversaries of December 14, 2012. Further, on March 29, 2012, each of Messrs. Burke, Ray and Washburn were granted 1,250 phantom units of RNP common units that vested on November 9, 2012. In addition, on June 5, 2012, each of Messrs. Burke, Ray and Washburn were granted 1,130 RNP common units.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our executive officers and directors, and persons who own more than ten percent of a registered class of our equity securities, or Insiders, to file initial reports of ownership and reports of changes in ownership with the SEC. Insiders are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. To our knowledge, based solely on its review of the copies of such reports furnished to us or written representations from certain Insiders that they were not

required to file a Form 5 to report previously unreported ownership or changes in ownership, we believe that, during the year ended December 31, 2012, all Insiders complied with all applicable filing requirements, except for a Form 4 filed on December 14, 2012 by Ronald M. Sega reporting the acquisition of 20,000 shares of our common stock on December 6, 2012 pursuant to the exercise of stock options and the disposition of 12,180 shares of our common stock on December 6, 2012.

Meetings and Committees of the Board

The Board held six meetings during the year ended December 31, 2012. Actions were also taken during the year by written consent. Each of our directors attended at least 75% of the aggregate of (i) meetings of the Board held during the period for which he has been a director and (ii) meetings of committees of the Board on which he served during the period that he served. All of our nine incumbent directors attended the annual meeting of shareholders held in 2012. Our directors are reimbursed for expenses incurred in attending meetings. We encourage all incumbent directors and director nominees to attend our annual meetings of shareholders. We have adopted a Corporate Governance Policy which provides that each member of the Board shall attend the annual meeting of shareholders in person, absent good cause.

The Board has three standing committees, an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. The Board has determined that all the members of our Board, other than Mr. Ramsbottom and Mr. Williams, are “independent” within

the meaning of the listing standards of the NYSE Amex, including each member of our Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. The Board has also determined that each member of the Audit Committee is “independent” within the meaning of the rules of the SEC.

The charters of our Audit Committee, Compensation Committee, and Nominating and Corporate Governance

Committee are available on the Corporate Governance section of our website at http://www.rentechinc.com. The Board regularly reviews developments in corporate governance and modifies these policies and charters as warranted. Modifications are reflected on our website at the address previously given. Information contained on our website is not incorporated into and does not constitute a part of this proxy statement. Our website address referenced above is intended to be an inactive textural reference only and not an active hyperlink to the website.

The Audit Committee of the Board has been delegated responsibility for reviewing with the independent auditors the plans and results of the audit engagement; reviewing the adequacy, scope and results of the internal accounting controls and procedures; reviewing the degree of independence of the auditors; reviewing the auditors’ fees; and recommending the engagement of the auditors to the full Board. During 2012, the Audit Committee consisted of Mr. Burke, Mr. Ray and Mr. Washburn until June 15, 2012, and since such date through the date of this proxy statement, the Audit Committee has consisted of Mr. Burke, Mr. Ray and General Clark. The Board has determined that Mr. Burke, the Chairman of the Audit Committee, qualifies as an “audit committee financial expert” as defined by the rules of the SEC. The Audit Committee met four times during the fiscal year ended December 31, 2012. Actions were also taken during the year by written consent.

10 RENTECH, INC. ï 2013 Proxy Statement

The Compensation Committee is currently comprised of Mr. Burke, Mr. Stern, and Mr. Washburn. None of them is or has been an employee of us. The Compensation Committee reviews and approves executive officer compensation and equity grants, administers our equity plans, and establishes compensation philosophy for executive officers. Please see our Compensation Discussion and Analysis section beginning on page 11 of this proxy statement for a detailed description of the roles of our Compensation Committee, compensation consultants and Chief Executive Officer in determining compensation for our named executive officers, or NEOs. The

Compensation Committee met four times during the fiscal year ended December 31, 2012. Actions were also taken during the year by written consent.

The Nominating and Corporate Governance Committee currently consists of Mr. Sega and Mr. Stern. The primary duty of the Nominating and Corporate Governance Committee is to make recommendations to the Board regarding recruitment of new directors and re-election of incumbent directors. The Nominating and Corporate Governance Committee met two times during the fiscal year ended December 31, 2012. Actions were also taken during the year by written consent.

Board Leadership and Role in Risk Oversight

Our Board does not have a policy on whether the offices of Chairman of the Board and Chief Executive Officer should be separate and, if they are to be separate, whether the Chairman of the Board should be selected from among the independent directors. Our Board believes that it should have the flexibility to make these determinations at any given time in the way that it believes best to provide appropriate leadership for us at that time. Our Board has reviewed our current Board’s leadership structure in light of the composition of the Board, our size, the nature of our business, our peer group and other relevant factors. Considering these factors, we have determined to have a separate Chief Executive Officer and Chairman of the Board. We have determined that this structure is currently the most appropriate board leadership structure for us. After carefully considering the benefits and risks of separating the roles of the Chairman of the Board and Chief Executive Officer, the Board has determined that having an independent director serve as the Chairman of the Board is the most appropriate leadership structure for us and is in the best interest of our stockholders at this time. Separating the roles of the Chairman of the Board and Chief Executive Officer enables the independent directors to participate meaningfully in the leadership of the Board. The Board believes this structure provides an appropriate degree of oversight over our Chief Executive Officer and senior management. At the same time, the current Chairman of the Board is a director who has experience with other public companies, including publicly traded limited partnerships, and therefore has a strong understanding of organizations such as ours. For this reason, our Chairman of the Board is able to understand the unique challenges faced by management and

serve as a liaison between the Board of Directors and management.

We face a variety of risks. An effective risk management system will identify the material risks we face in a timely manner, communicate necessary information to senior executives and the Board related to those material risks, implement appropriate and responsive strategies to manage those risks, and integrate the process of risk management into regular decision-making. The Board has designated the Audit Committee to take the lead in overseeing risk management as the Audit Committee regularly reviews our internal audit reports, independent compliance audit reports, regulatory examination reports and financial information of us. In addition to the Audit Committee, the Board encourages management to promote a corporate culture that incorporates risk management into our strategies and day-to-day operations. The Compensation Committee is responsible for the assessment of risks related to the Company’s compensation programs. In March 2013, our Compensation Committee approved, and we adopted, a clawback policy pursuant to which, in the event of an accounting restatement due to material non-compliance with any financial reporting requirements under the securities law, we will be entitled (but not required) to recoup from executive officers all cash bonuses and all contingent equity that would not have been paid if performance had been measured in accordance with the restated financials. This policy only applies to incentives paid (i) within three years of the date that the accounting restatement is required (ii) on or after January 1, 2013.

Compensation Discussion and Analysis

Executive Summary

This Compensation Discussion and Analysis provides an overview and analysis of our executive compensation program during the fiscal year ended December 31, 2012, or 2012, for our named executive officers, or NEOs. Our executive compensation program is designed to align executive pay with individual performance on both short- and long-term bases; to link executive pay to specific, measurable financial, technological and development achievements intended to create value for shareholders; and to utilize compensation as a tool to attract and retain the high-caliber executives that are critical to our long-term success.

RENTECH, INC. ï 2013 Proxy Statement 11

Pay for Performance

Pay for performance is a key component of our compensation philosophy. Consistent with this focus, our compensation program includes (i) annual performance-based incentives and (ii) long-term equity compensation that is both performance-linked by nature in that its value relates to stock price appreciation and performance-linked by designation in that 70% of our 2012 long-term equity incentive awards granted to our NEOs condition vesting on the attainment of designated performance goals. For 2012, approximately 56% of our NEOs’ aggregate compensation came from variable performance-based pay consisting of performance-based cash bonuses and restricted stock units.

We endeavor to structure our executive compensation program in a manner that reflects good corporate governance practices and aligns our NEOs’ pay with our performance. Highlights of our 2012 executive compensation program included the following:

| • | | During 2012, our executive officers were eligible to earn bonuses based on the Company’s and the individual executive officers’ achievement of a wide range of challenging, pre-established performance goals (discussed in detail below). |

| • | | In addition to the pre-established performance goals, in recognition of our extraordinary total shareholder return and stock value appreciation in 2012 (including the increase in our stock price from $1.31 per share as of December 31, 2011 to $2.63 per share as of December 31, 2012, as well as the payment of a 19 cents per share extraordinary dividend during 2012), our Compensation Committee determined to increase the final incentive payments for each NEO. We believe that this increase was merited by our outstanding performance and supports our philosophy of aligning our executive officers’ pay with our performance and shareholder interests and encourages our executive offices to work towards increasing our stock price. |

| • | | We believe that our equity compensation program supports long-term performance by aligning interests between our executives and our stockholders. During 2012, all of the equity incentive awards received by our NEOs vested over time in order to provide meaningful retention devices linked to stockholder value, while 70% of these awards were also subject to performance-vest |

| | | conditions, including the achievement of a high level of total shareholder return, which provides strong alignment between the interests of our executives and our stockholders. |

| • | | We maintain compensation arrangements that provide only for “double trigger” cash severance provisions in connection with a change in control, meaning that an executive must be involuntarily terminated in connection with a change in control of the Company to receive cash severance. We believe that this format provides reasonable executive protections, but also encourages executives to stay with us and focus on our post-transaction success rather than just closing the transaction. |

| • | | In March 2013, we adopted a clawback policy pursuant to which, in the event of an accounting restatement due to material non-compliance with any financial reporting requirements under the securities law, we will be entitled to recoup from executive officers all cash bonuses and all contingent equity that would not have been paid if performance had been measured in accordance with the restated financials. |

| • | | In April 2013, we adopted stock ownership guidelines for our executives officers and non-employee directors, pursuant to which they must accumulate and hold equity of the Company valued at three times (3x) (or six times (6x) in the case of our Chief Executive Officer) their annual base salary (with respect to our executive officers) or their annual cash retainer (with respect to our non-employee directors) within the earlier of (i) five years after the adoption of these guidelines or (ii) five years after becoming an executive officer of the Company (with respect to our executive officers) or five years after joining the Company’s Board of Directors (with respect to our non-employee directors). If, after the five year period set forth above, an individual fails to satisfy the above ownership requirements, then he or she will be required to retain 100% of any of our shares acquired through stock option exercise or vesting of any performance stock units, restricted stock units and restricted stock awards (net of shares sold or withheld to satisfy taxes and, in the case of stock options, the exercise price) until such time that he or she meets the ownership requirements. |

12 RENTECH, INC. ï 2013 Proxy Statement

Elements of Compensation

The following table sets forth the key elements of our NEOs’ compensation, along with the primary objectives associated with each element of compensation:

| | |

| Compensation Element | | Primary Objective |

Base salary | | To recognize performance of job responsibilities, provide stable income and attract and retain experienced individuals with superior talent. |

Annual incentive compensation | | To promote short-term performance objectives and reward individual contributions to the achievement of those objectives. |

Long-term equity incentive awards | | To emphasize long-term performance objectives, align the interests of our NEOs with the interests of our shareholders, encourage the maximization of shareholder value and retain key executives. |

Severance and change in control benefits | | To encourage the continued attention and dedication of our NEOs and provide reasonable individual security to enable our NEOs to focus on our best interests, particularly when considering strategic alternatives. |

Retirement savings (401(k) plan) | | To provide an opportunity for tax-efficient savings and matching contributions by us. |

Other elements of compensation and perquisites | | To attract and retain talented executives in a cost-efficient manner by providing benefits with high perceived values at relatively low cost. |

To serve the foregoing objectives, our overall compensation program is generally designed to be flexible rather than purely formulaic. In alignment with the objectives set forth above, the Company’s Compensation Committee (the “Compensation Committee”) and the Company’s Board of Directors (the “Board”) have generally determined the overall compensation of our NEOs and its allocation among the elements described above, relying on the analyses and advice provided by the Compensation Committee’s compensation consultant. The

Compensation Committee has generally made these determinations in executive sessions without our management team present, but has also sought input from our Chief Executive Officer with regard to individual NEO performance.

Our compensation decisions for our NEOs with respect to 2012 are discussed in detail below. This discussion is intended to be read in conjunction with the executive compensation tables and related disclosures that follow this Compensation Discussion and Analysis.

Compensation Program Objectives

The following discussion and analysis describes our compensation objectives and policies for each of NEOs for 2012, who consisted of:

| • | | D. Hunt Ramsbottom, Chief Executive Officer; |

| • | | Dan J. Cohrs, Chief Financial Officer; |

| • | | John H. Diesch, Senior Vice President — Operations; |

| • | | Harold A. Wright, Senior Vice President and Chief Technology Officer; and |

| • | | Colin M. Morris, Senior Vice President, General Counsel and Secretary. |

To succeed in achieving our key operational goals, we need to recruit and retain a highly talented and seasoned team of executive, technical, sales, marketing, operations, financial and other business professionals. As such, our compensation packages are designed to incentivize the achievement of

these goals, and to recruit, reward and retain our employees, including our NEOs.

We have focused on building an experienced management team that is capable of managing our day-to-day operations during a period of growth while working to achieve our long-term operational goals. We believe it is important both to retain our key executives, including our NEOs, and to recruit the additional talent we need to expand the Company. Accordingly, our policy is to hire executives who are not only highly qualified for their positions at our current size, but who also have the skills we believe are necessary to perform their roles at the same high standard if we are successful in our commercial development, and we achieve significantly greater size and complexity.

Each of the key elements of our executive compensation program is discussed in more detail below under “—Core Components of Executive Compensation.”

RENTECH, INC. ï 2013 Proxy Statement 13

Compensation Consultant

During 2010 and 2011 and continuing through February 2012, the Compensation Committee engaged Radford, an Aon Hewitt Company, as an independent compensation consultant to assist in the analysis of the executive compensation program for certain of our officers. In early 2012, the Compensation Committee evaluated the scope of consulting services historically provided to us and determined that it was appropriate to reevaluate our executive compensation programs. Based on this assessment, in March 2012, the Compensation Committee engaged a new independent compensation consultant, Frederic W. Cook &

Co., Inc. (“Cook”), to analyze our existing executive compensation programs, assist with the design of future compensation programs that more closely align our executive officers’ interests with those of our stockholders, and ensure that the levels and types of compensation provided to our executives (including our NEOs) and directors continue to reflect market practices. Following the engagement of Cook by the Compensation Committee to provide this advice, Radford ceased providing such services, with the exception of certain equity valuation services.

Services Provided With Respect to 2012 Compensation

Radford and Cook each provided services with respect to the compensation provided to our NEOs in respect of 2012. Services provided by Radford in late 2011 and early 2012 included the following:

| • | | Advising on the levels of our officers, including our NEOs’, base salaries, as well as any appropriate changes to such salaries; |

| • | | Advising on the reasonableness and effectiveness of the annual incentive programs in which our executive officers, including our NEOs, participate; and |

| • | | Analyzing the effectiveness of our use of long-term equity compensation, including award levels and types of equity awards used to compensate our employees and officers, including our NEOs, as well as any appropriate changes or additions to equity compensation. |

The services provided by Cook following its engagement by the Compensation Committee in February 2012 included the following:

| • | | Analyzing our peer group companies and advising on appropriate changes to such companies; |

| • | | Reviewing compensation data and analysis provided by Radford with regard to historical levels and types of compensation provided to our officers, including our NEOs, and directors; |

| • | | Analyzing the reasonableness and effectiveness of our compensation components, levels and programs for our directors and officers, including our NEOs, as well as any appropriate compensation changes, including changes to our long-term equity compensation program, to bring the compensation levels of our directors and officers in line with the median compensation levels of our peer group companies; and |

| • | | Analyzing and advising on the reasonableness and competitiveness of the annual incentive compensation awards earned by our executive officers, including our NEOs. |

Comparison to Market Practices

The Compensation Committee provides levels and elements of executive compensation, including base salaries, target annual incentives as a percentage of salary, total cash compensation, long-term incentives and total direct compensation, based on information gathered from the public filings of our peer group companies as well as industry-specific published survey data (discussed in more detail below).

From 2010 through the first half of 2012, our peer group was comprised of companies selected in 2010 based on discussions among the members of the Compensation Committee, certain of our executive officers and Radford (the “2010 Peer Group”). In June 2012, the Compensation Committee, certain of our executive officers and Cook reviewed and discussed the composition of the 2010 Peer

Group. Based on these discussions, certain changes were made to our peer group in order to (i) remove approximately twelve companies, including companies that had been acquired, had become insolvent or that were no longer appropriate to our peer group based on size, industry and/or market value, and (ii) add approximately ten companies that are more similar to us in terms of industry, revenue and market value. We refer to our current peer group (after giving effect to the changes discussed above) as the “2012 Peer Group.”

Our 2010 Peer Group consisted of alternative energy companies and certain technology companies with a related focus, in each case, with (i) annual revenues ranging from $50 million to $550 million (with a median of $316 million), (ii) market values ranging from $70 million to $550 million, and

14 RENTECH, INC. ï 2013 Proxy Statement

(iii) similar employee numbers. Following are the companies that comprised our 2010 Peer Group:

| | |

Advanced Energy Industries | | Fuel Tech |

Broadwind Energy | | Fuelcell Energy |

Cohu, Inc. | | LSB Industries |

Converge, Inc. | | Maxwell Technologies |

Echelon Corp. | | MGP Ingredients |

EMCORE Corp. | | Rudolph Technologies |

Energy Conversion Devices | | Satcon Technology |

EnerNoc Inc. | | Ultra Clean Holdings |

Evergreen Solar | | Vicor Corp. |

FormFactor Inc. | | Zoltek |

Our 2012 Peer Group consists of alternative energy, energy, energy technology, chemical and fertilizer companies, in each case, with (i) annual revenues ranging from $63 million to $650 million and (ii) market values ranging from $150 million to $1.5 billion. Following are the companies that comprise our 2012 Peer Group:

| | |

ADA-ES, Inc. | | Fuel Tech |

Advanced Energy Industries | | Fuelcell Energy |

American Vanguard Corp. | | Hawkins Inc. |

Amyris Inc. | | LSB Industries |

Arabian American Development Co. | | Maxwell Technologies |

Balchem Corp. | | Quaker Chemical |

Clean Energy Fuels Corp. | | REX American Resources |

EnerNoc Inc. | | Vicor Corp. |

Flotek Industries | | Zoltek |

In mid-2011, the Compensation Committee reviewed the public filings of our 2010 Peer Group to gather data points with regard to various elements of executive compensation, including base salaries, target incentive as a percentage of salary, total cash compensation, long-term incentives and total direct compensation. The Compensation Committee also reviewed aggregated published survey data from Radford’s 2011 Global Technology Survey (using a data set comprised of public high-tech companies with revenue between $50 million and $500 million) in order to further validate its comparative data. In October 2011, our Compensation Committee reviewed data and analysis provided by Radford with regard to the levels and types of compensation, including base salaries, target incentive as a percentage of salary, total cash compensation, long-term incentives and total direct compensation, provided to our NEOs and directors. The information provided by Radford included data gathered from the public filings of our 2010 Peer Group

and was utilized by the Compensation Committee in its review and adjustment of our NEOs’ base salaries for 2012 and its review and establishment of our NEOs’ cash incentive opportunities for 2012.

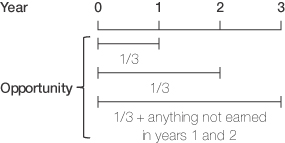

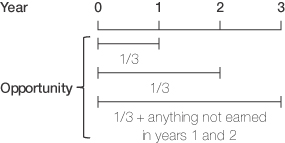

In June 2012, the Compensation Committee conducted a similar review of compensation data provided by Cook with regard to the levels and types of compensation provided to our NEOs and directors. The information provided by Cook included data gathered from the public filings of our 2012 Peer Group (instead of our 2010 Peer Group). The Compensation Committee considered this data when determining the final incentive awards earned by our NEOs for 2012 under our annual incentive compensation programs and the levels and types of equity awards granted to our NEOs during 2012.