Exhibit 99.1

Hunt Ramsbottom

Credit Suisse Basic Materials Conference September 17, 2014

President & CEO EO

Forward-Looking Statements

This presentation contains forward-looking statements about matters such as: estimates regarding nitrogen fertilizer and wood fibre market opportunities; forecasts for our results of operations; the timing for completion and the capacity for our Canadian pellet projects; the estimated annual revenues and EBITDA for our wood chipping business and wood pellets projects; our targeted EBITDA within the five years and our ability to capitalize on opportunities in the wood fibre market; the completion of our exit from energy technologies in 2014; our plans to take our wood fibre processing business public as a master limited partnership; and our plans for restructuring our Pasadena facility. These statements are based on management’s current expectations and actual results may differ materially as a result of various risks and uncertainties. Factors that could cause actualresults to differfrom those reflected in the forward-looking statements are set forth in Rentech’s and Rentech Nitrogen’s press releases and periodic reports filed with the Securities and Exchange Commission, which are available via Rentech’s and Rentech Nitrogen’s websites at www.rentechinc.com and www.rentechnitrogen.com. The forward-looking statements in this presentation are made as of the date of this presentation and Rentech and Rentech Nitrogen does not undertake to revise or update these forward-looking statements, except to the extent that it is required to do so under applicable law.

References to an initial public offering of our wood fibre business in this presentation are being made solely to advise Rentech’s investors regarding the company’s current business plan. This presentation does not constitute an offer to sell or a solicitation of an offer to buy any securities. Any such offer or solicitation will be made only by means of a prospectus.

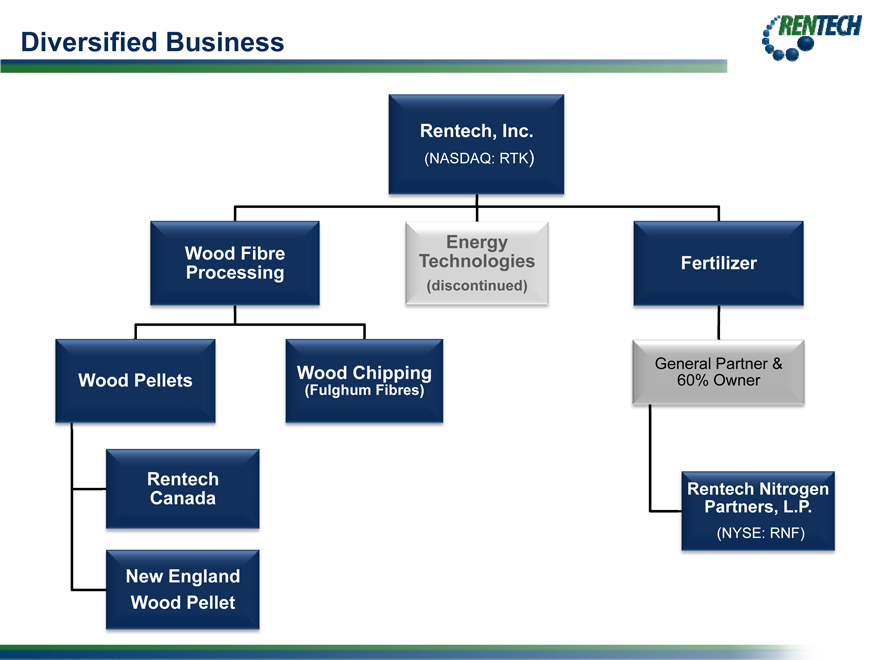

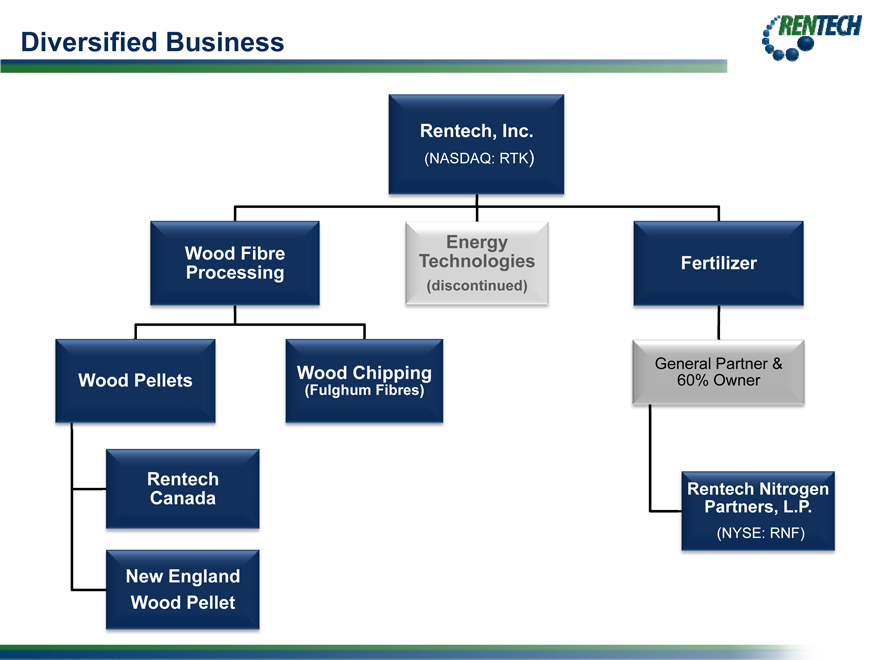

Diversified Business

Rentech, Inc.

(NASDAQ: RTK)

Energy

Wood Fibre Technologies Fertilizer

Processing

(discontinued)

Wood Chipping General Partner &

Wood Pellets 60% Owner

(Fulghum Fibres)

Rentech

Canada Rentech Nitrogen

Partners, L.P.

(NYSE: RNF)

New England

Wood Pellet

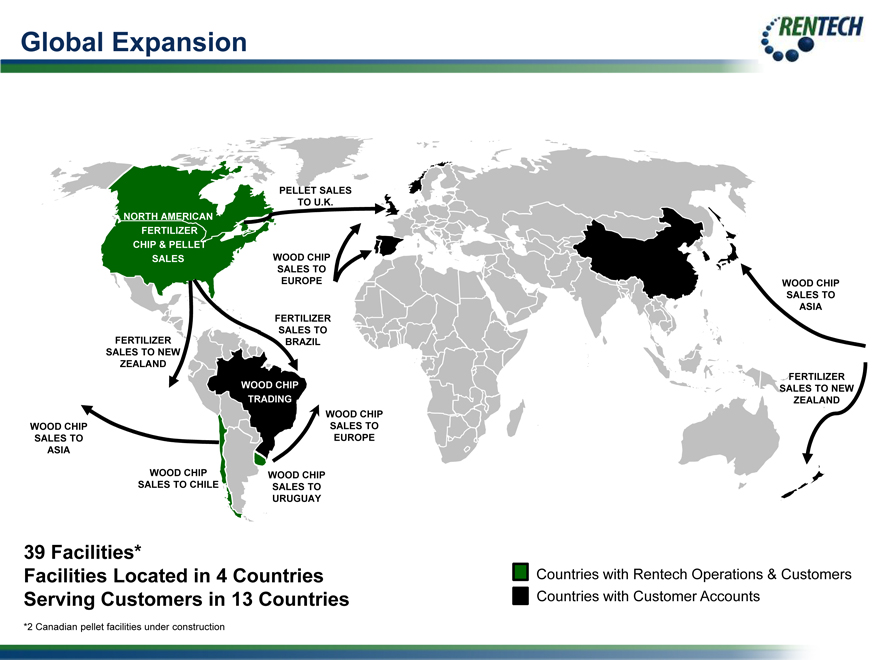

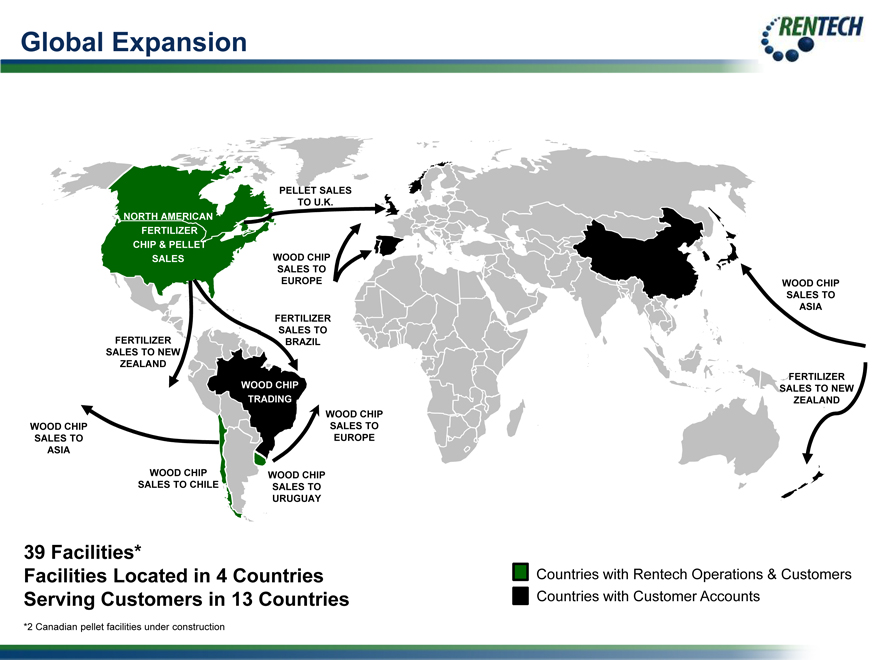

Global Expansion

NORTH AMERICAN FERTILIZER

CHIP & PELLET SALES

FERTILIZER SALES TO NEW

ZEALAND

WOOD CHIP SALES TO

ASIA

WOOD CHIP SALES TO CHILE

PELLET SALES TO U.K.

WOOD CHIP SALES TO

EUROPE WOOD CHIP SALES TO

ASIA FERTILIZER

SALES TO BRAZIL

WOOD CHIP FERTILIZER SALES TO NEW

TRADING ZEALAND WOOD CHIP

SALES TO EUROPE

WOOD CHIP SALES TO URUGUAY

39 Facilities*

Facilities Located in 4 Countries Countries with Rentech Operations & Customers

Serving Customers in 13 Countries Countries with Customer Accounts

*2 Canadian pellet facilities under construction

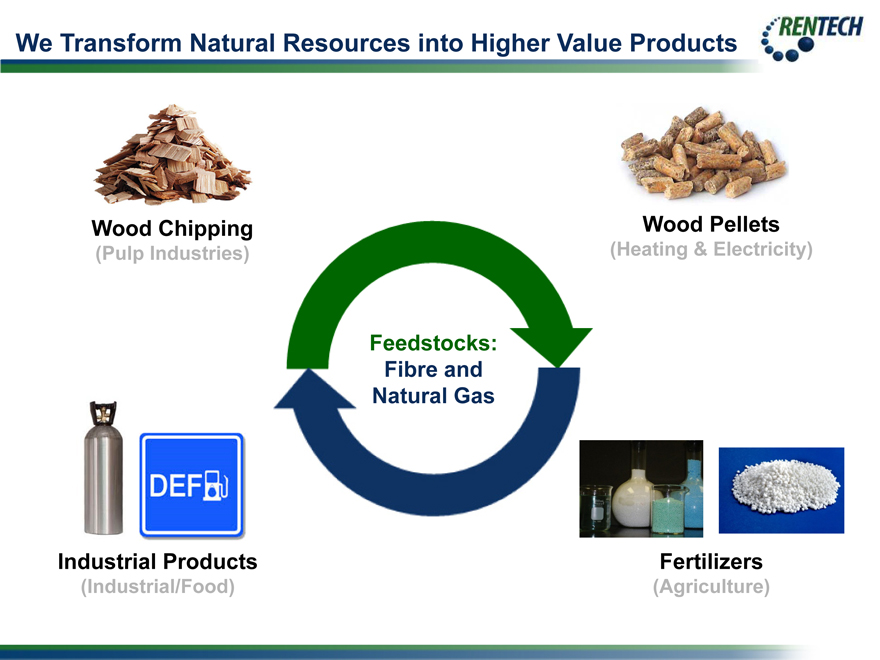

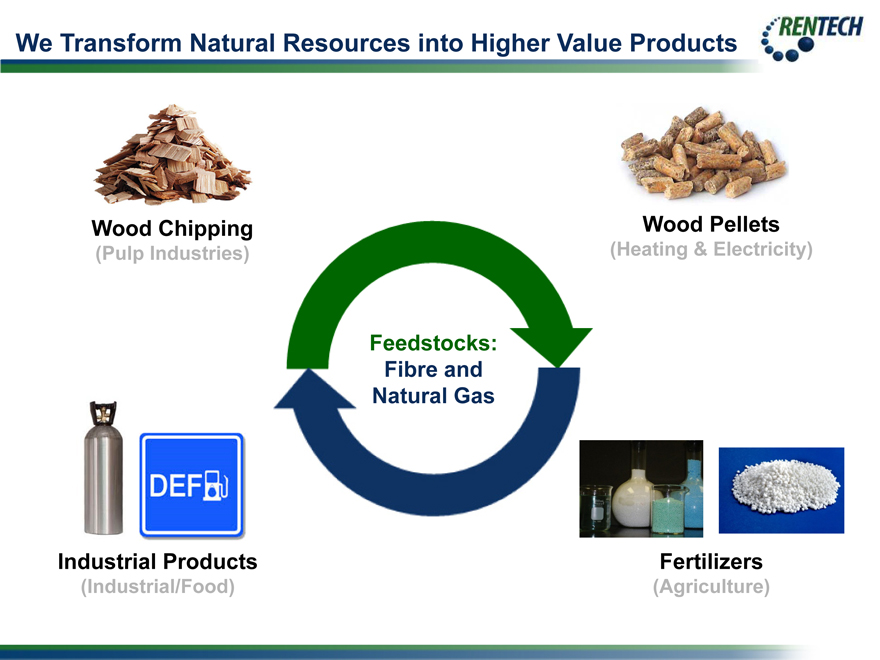

We Transform Natural Resources into Higher Value Products

Wood Chipping Wood Pellets

(Pulp Industries) (Heating & Electricity)

Feedstocks: Fibre and Natural Gas

Industrial Products Fertilizers

(Industrial/Food) (Agriculture)

We Serve Diversified Markets

Pulp Industries Heating & Electricity

(Wood Chipping) (Wood Pellets)

Rentech’s products

support many Alfalfa Canola Corn

industries

Cotton Potato Soybean Wheat

Industrial/Food Agriculture

(Industrial Products) (Fertilizers)

Rentech is a Leader

Wood Fibre

Largest pellet producer in Eastern Canada by early 2015

Largest pellet producer for the U.S. heating market

Largest independent producer of wood chips in the U.S.

Fertilizer

One of the key regional nitrogen suppliers to the U.S. Mid Corn Belt

Largest producer of synthetic ammonium sulfate in North America

Wood Fibre Business

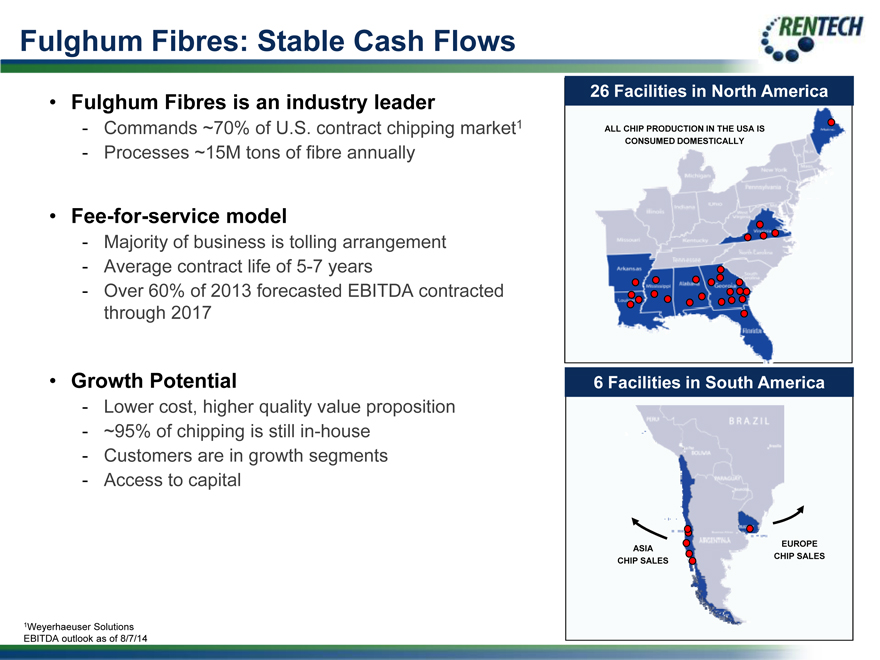

Fulghum Fibres: Stable Cash Flows

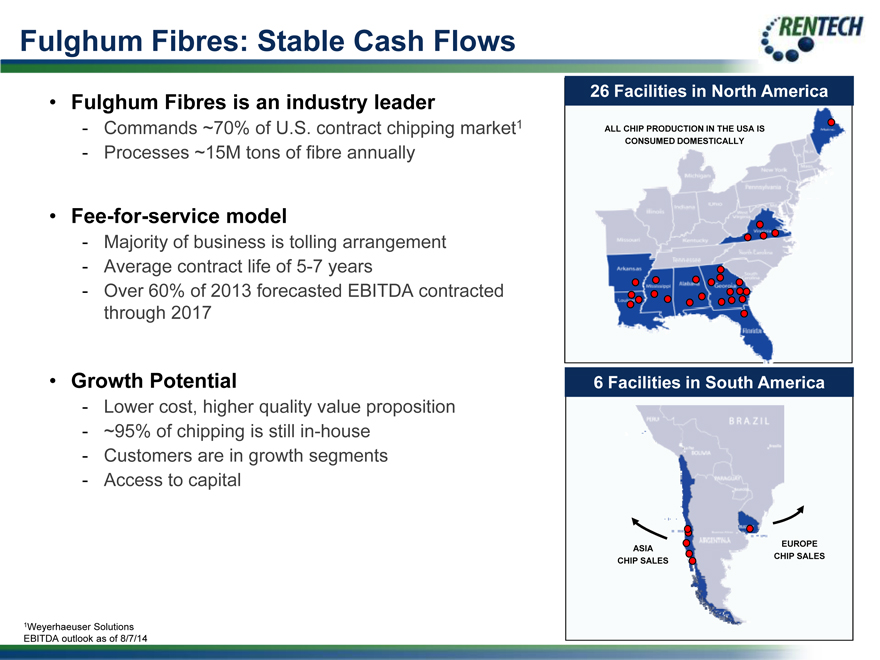

• Fulghum Fibres is an industry leader

- Commands ~70% of U.S. contract chipping market1

- Processes ~15M tons of fibre annually

• Fee-for-service model

- Majority of business is tolling arrangement

- Average contract life of 5-7 years

- Over 60% of 2013 forecasted EBITDA contracted through 2017

• Growth Potential

- Lower cost, higher quality value proposition

- ~95% of chipping is still in-house

- Customers are in growth segments

- Access to capital

1Weyerhaeuser Solutions EBITDA outlook as of 8/7/14

26 Facilities in North America

ALL CHIP PRODUCTION IN THE USA IS CONSUMED DOMESTICALLY

6 Facilities in South America

EUROPE ASIA CHIP SALES

CHIP SALES

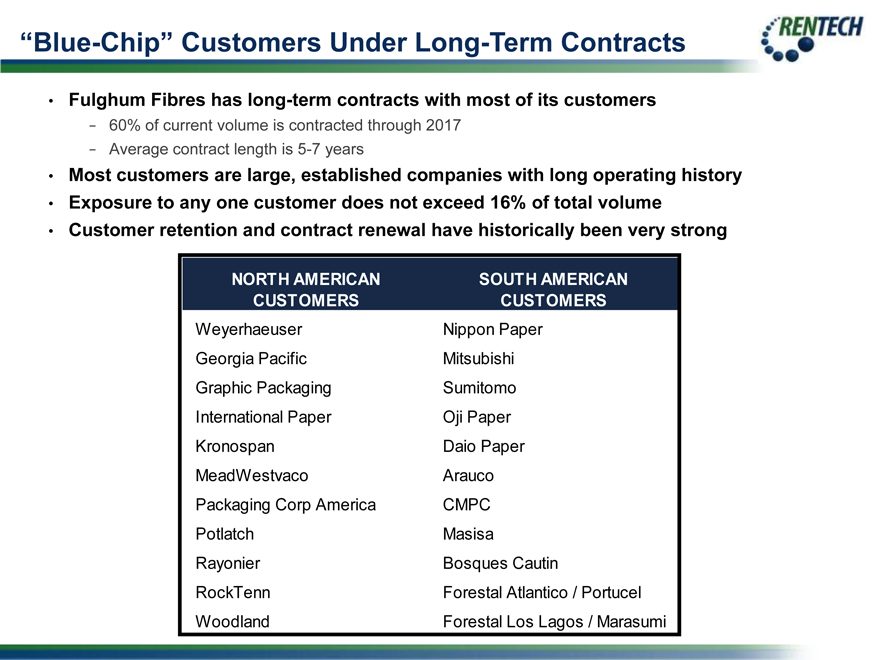

“Blue-Chip” Customers Under Long-Term Contracts

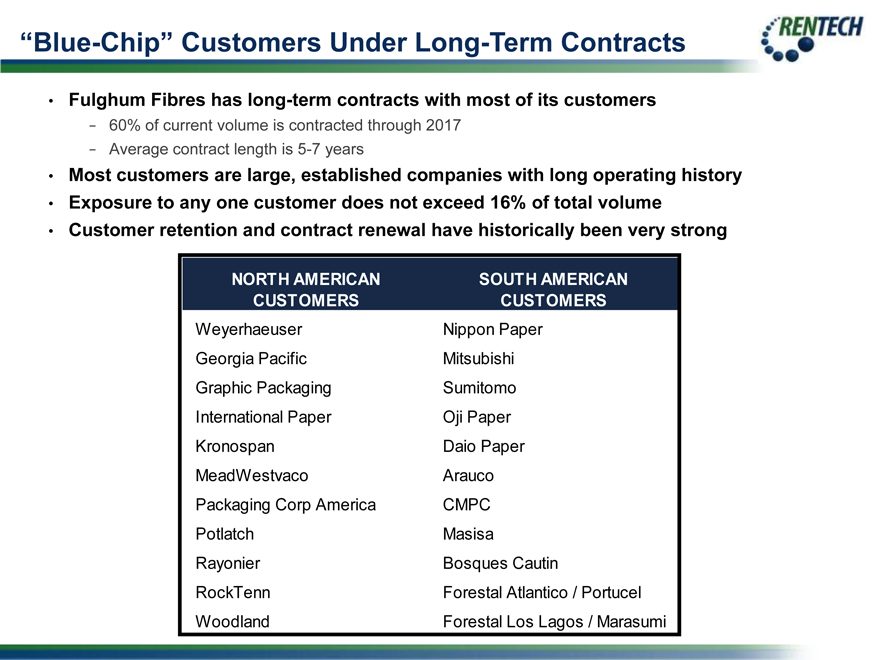

• Fulghum Fibres has long-term contracts with most of its customers

- 60% of current volume is contracted through 2017

- Average contract length is 5-7 years

• Most customers are large, established companies with long operating history

• Exposure to any one customer does not exceed 16% of total volume

• Customer retention and contract renewal have historically been very strong

NORTH AMERICAN SOUTH AMERICAN

CUSTOMERS CUSTOMERS

Weyerhaeuser Nippon Paper

Georgia Pacific Mitsubishi

Graphic Packaging Sumitomo

International Paper Oji Paper

Kronospan Daio Paper

MeadWestvaco Arauco

Packaging Corp America CMPC

Potlatch Masisa

Rayonier Bosques Cautin

RockTenn Forestal Atlantico / Portucel

Woodland Forestal Los Lagos / Marasumi

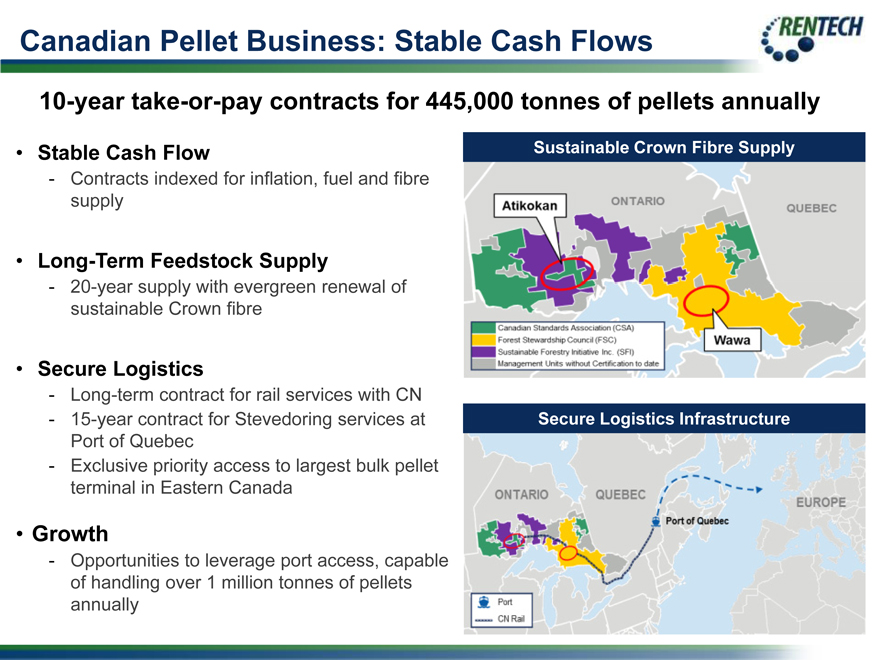

Canadian Pellet Business: Stable Cash Flows

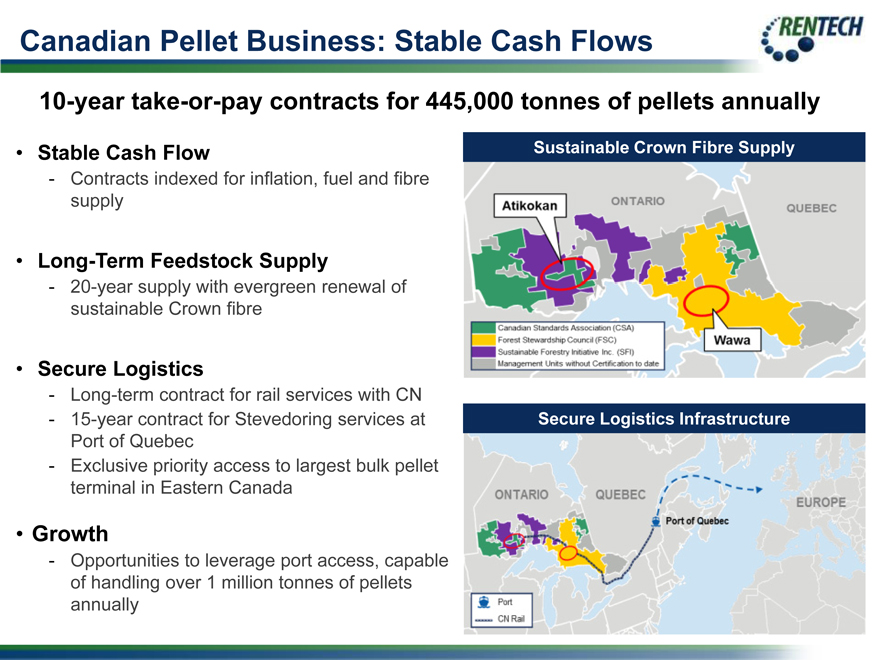

10-year take-or-pay contracts for 445,000 tonnes of pellets annually

• Stable Cash Flow Sustainable Crown Fibre Supply

- Contracts indexed for inflation, fuel and fibre supply

• Long-Term Feedstock Supply

- 20-year supply with evergreen renewal of sustainable Crown fibre

• Secure Logistics

- Long-term contract for rail services with CN

- 15-year contract for Stevedoring services at Secure Logistics Infrastructure Port of Quebec

- Exclusive priority access to largest bulk pellet terminal in Eastern Canada

• Growth

- Opportunities to leverage port access, capable of handling over 1 million tonnes of pellets annually

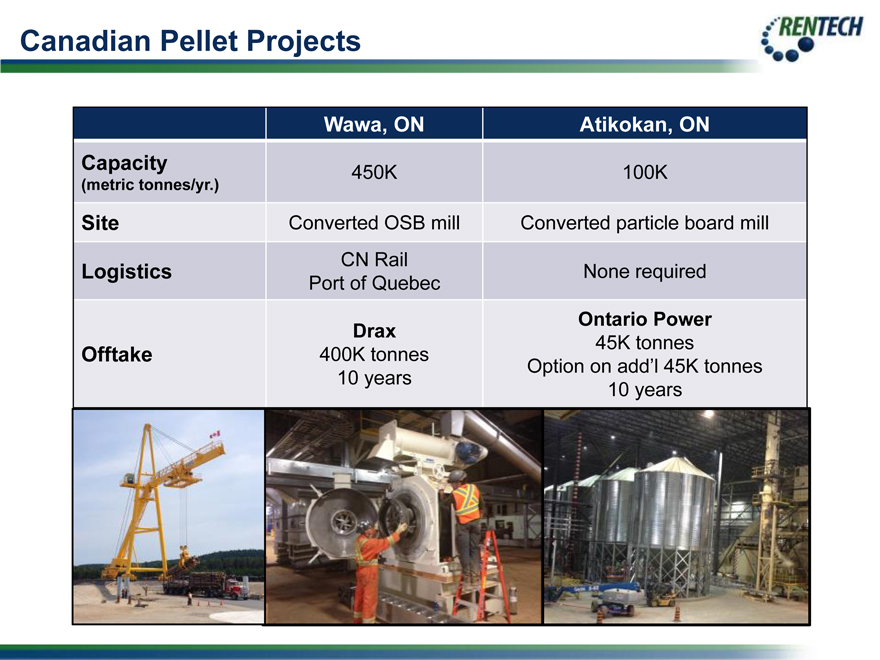

Canadian Pellet Projects

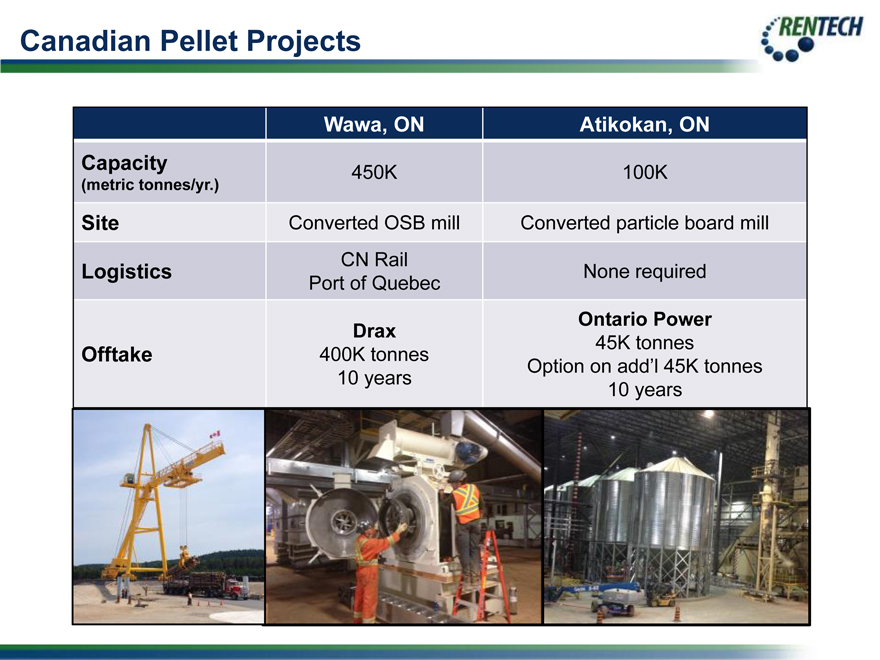

Wawa, ON Atikokan, ON

Capacity 450K 100K

(metric tonnes/yr.)

Site Converted OSB mill Converted particle board mill

CN Rail

Logistics None required

Port of Quebec

Ontario Power

Drax 45K tonnes

Offtake 400K tonnes Option on add’l 45K tonnes

10 years 10 years

Update on Canadian Wood Pellet Facilities

Atikokan Facility

95% mechanically complete

Completed production test run using dry sawdust as feedstock to demonstrate certain key equipment

Expected production shifted from September to October 2014 awaiting final equipment deliveries

Customer’s requirements are being met

Wawa Facility

Completed mechanical installation of the chippers, pellet mills and final product storage

Log cranes have been erected on site

Production continues to be expected in fourth quarter of 2014

First shipment of pellets expected in early 2015, depending on Drax’s ship scheduling requirements

Canadian Wood Pellet Guidance

Construction costs to be modestly higher than budget

Expect to update 2015 EBITDA after the facilities are operating

Stabilized 2016 EBITDA for the facilities remains unchanged

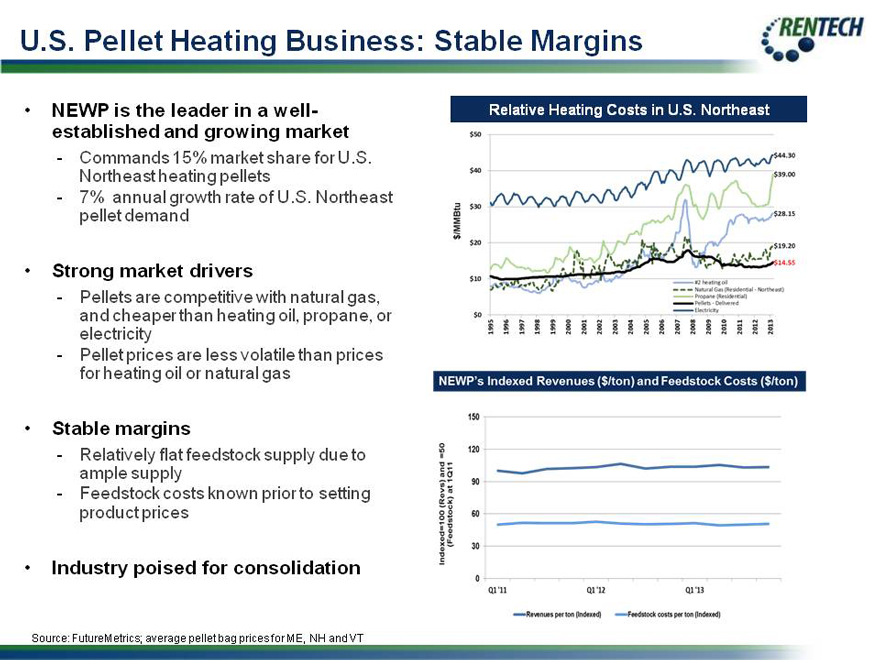

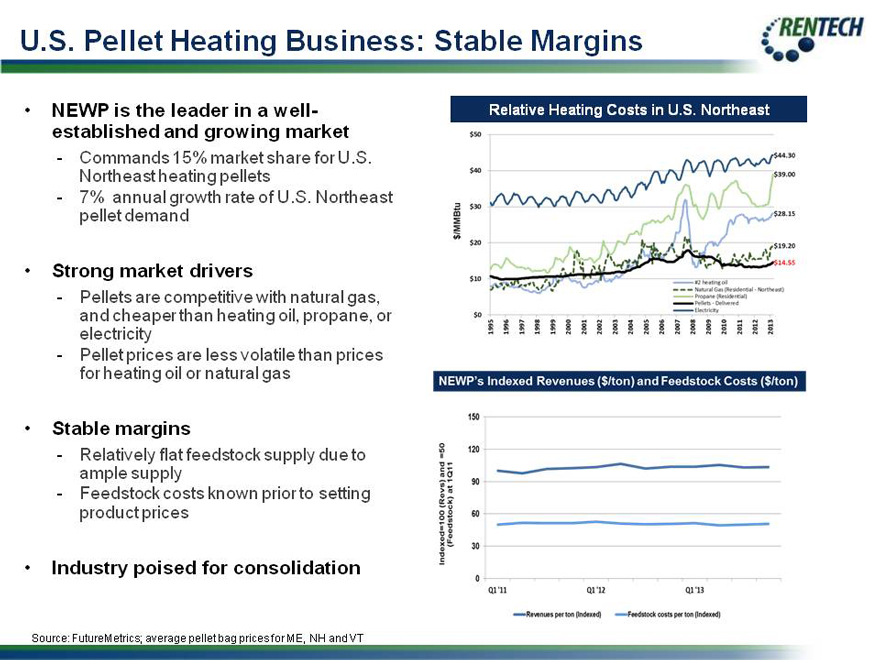

U.S. Pellet Heating Business: Stable Margins

• NEWP is the leader in a well- Relative Heating Costs in U.S. Northeast

established and growing market

- Commands 15% market share for U.S. Northeast heating pellets

- 7% annual growth rate of U.S. Northeast pellet demand

• Strong market drivers

- Pellets are competitive with natural gas, and cheaper than heating oil, propane, or electricity

- Pellet prices are less volatile than prices for heating oil or natural gas

• Stable margins

- Relatively flat feedstock supply due to ample supply

- Feedstock costs known prior to setting product prices

• Industry poised for consolidation

Source: FutureMetrics; average pellet bag prices for ME, NH and VT

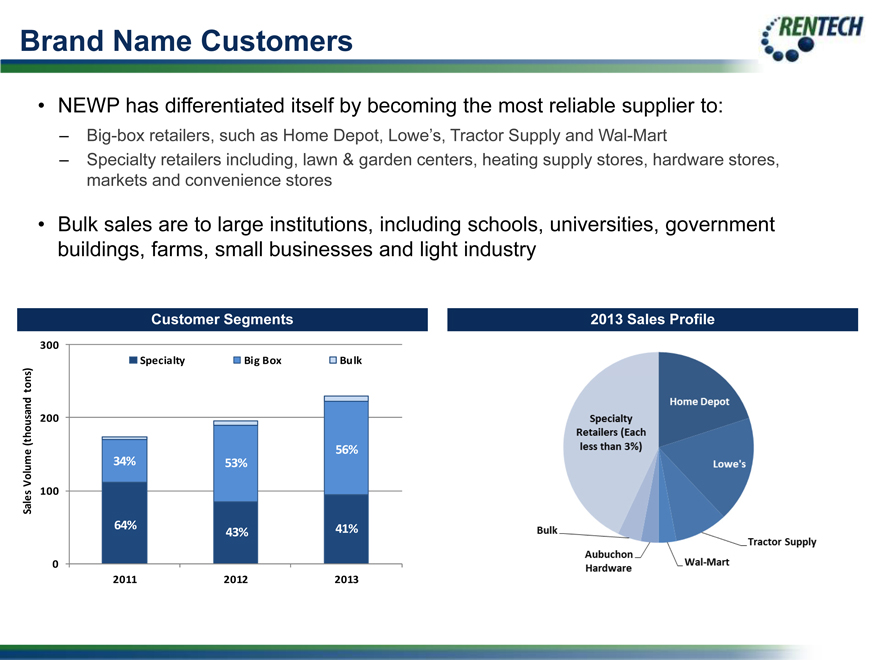

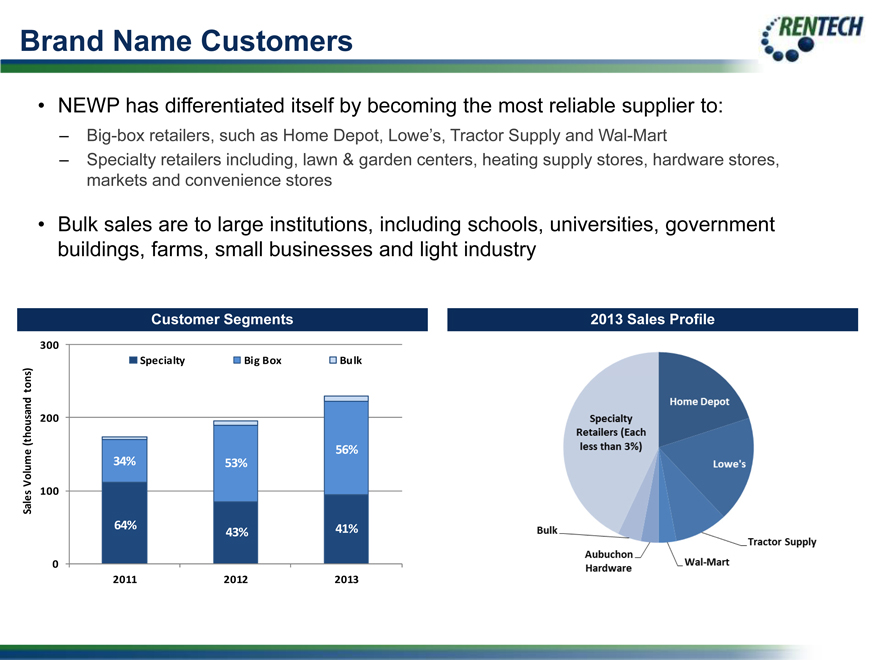

Brand Name Customers

NEWP has differentiated itself by becoming the most reliable supplier to:

– Big-box retailers, such as Home Depot, Lowe’s, Tractor Supply and Wal-Mart

– Specialty retailers including, lawn & garden centers, heating supply stores, hardware stores, markets and convenience stores

Bulk sales are to large institutions, including schools, universities, government buildings, farms, small businesses and light industry

Customer Segments 2013 Sales Profile

300

Specialty Big Box Bulk ton s) (thousand 200

56% ume 34% 53%

Vol Sales 100

64% 41% 43%

0

2011 2012 2013

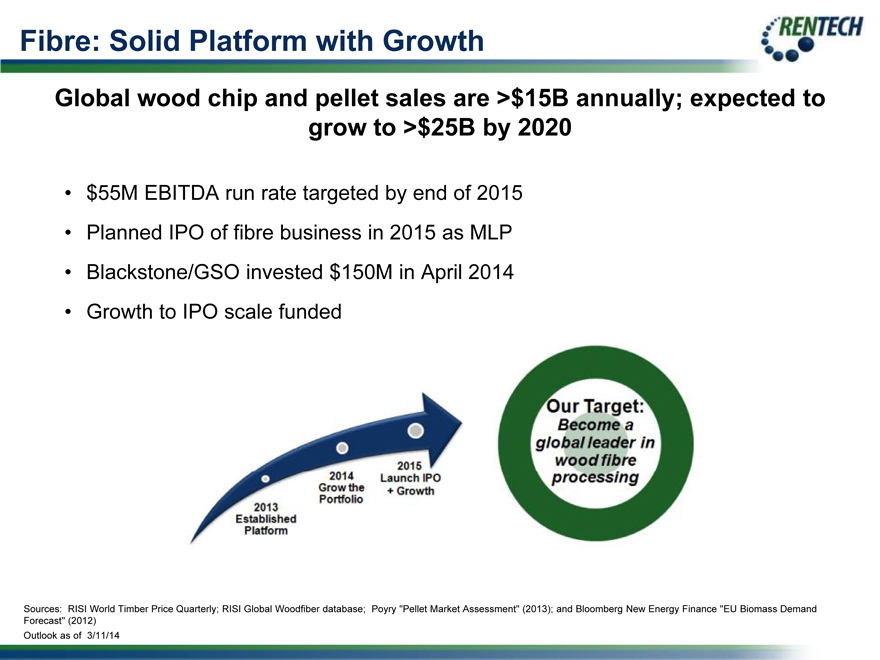

Fibre: Solid Platform with Growth

Global wood chip and pellet sales are >$15B annually; expected to grow to >$25B by 2020

$55M EBITDA run rate targeted by end of 2015

Planned IPO of fibre business in 2015 as MLP

Blackstone/GSO invested $150M in April 2014

Growth to IPO scale funded

Sources: RISI World Timber Price Quarterly; RISI Global Woodfiber database; Poyry “Pellet Market Assessment” (2013); and Bloomberg New Energy Finance “EU Biomass Demand Forecast” (2012) Outlook as of 3/11/14

Rentech Nitrogen

Rentech Nitrogen Partners, L.P. (NYSE: RNF)

East Dubuque, IL Facility

Pasadena, TX Facility

Publicly traded partnership with variable cash distributions Two nitrogen fertilizer production facilities with location advantages

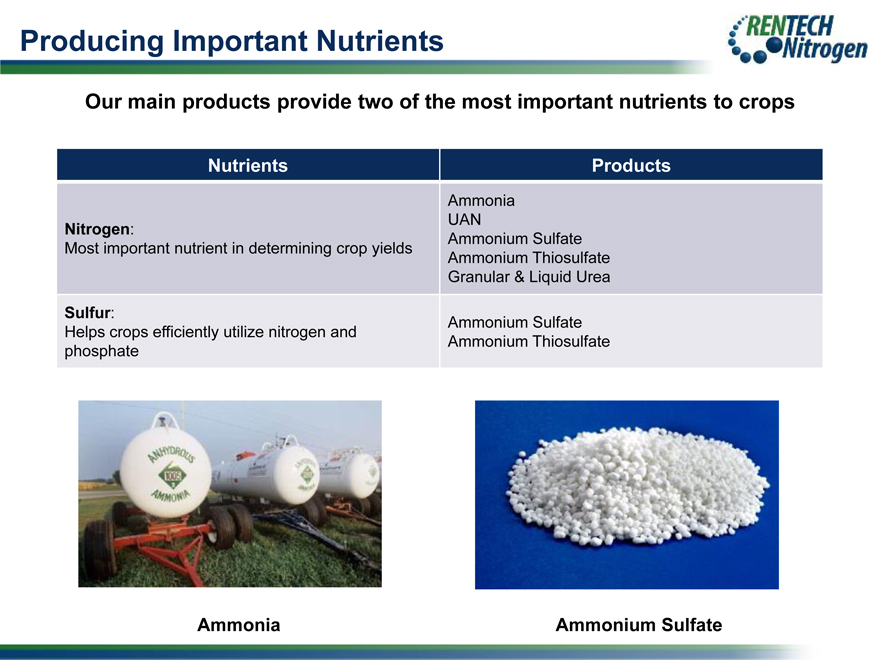

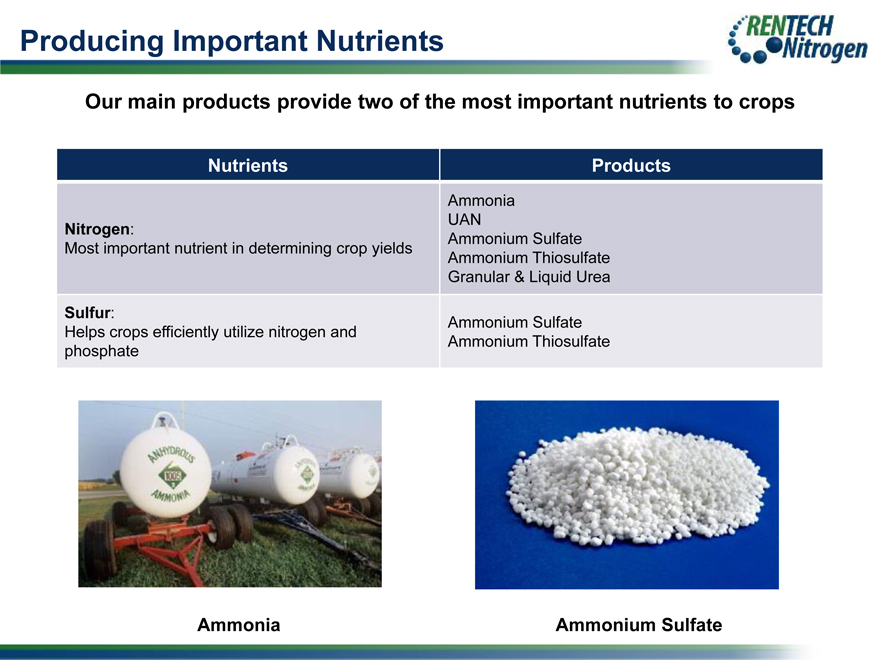

Producing Important Nutrients

Our main products provide two of the most important nutrients to crops

Nutrients Products

Ammonia

Nitrogen: UAN

Most important nutrient in determining crop yields Ammonium Sulfate

Ammonium Thiosulfate

Granular & Liquid Urea

Sulfur:

Helps crops efficiently utilize nitrogen and Ammonium Sulfate

phosphate Ammonium Thiosulfate

Ammonia Ammonium Sulfate

Multiple Fertilizers for Multiple Crops

Corn Alfalfa Cotton Canola Potato Soybean Wheat

Ammonia, UAN, Ammonium Sulfate, Urea & Ammonium Thiosulfate

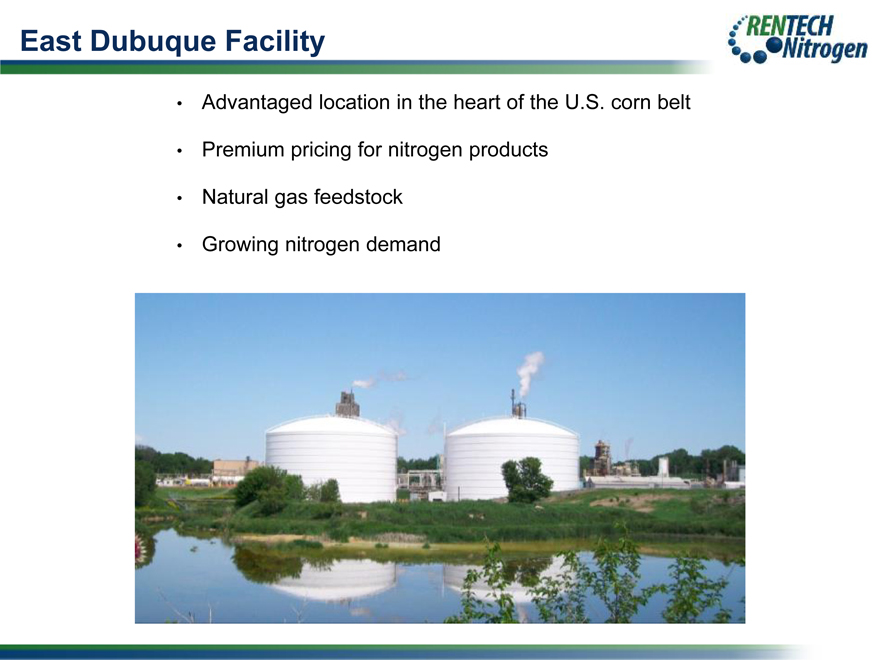

East Dubuque Facility

East Dubuque Facility

Advantaged location in the heart of the U.S. corn belt

Premium pricing for nitrogen products

Natural gas feedstock

Growing nitrogen demand

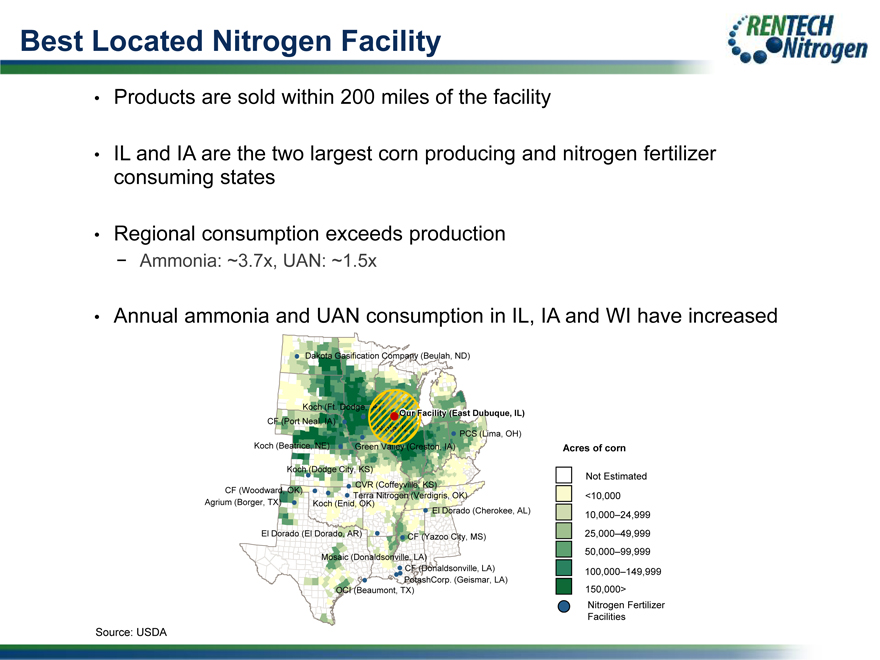

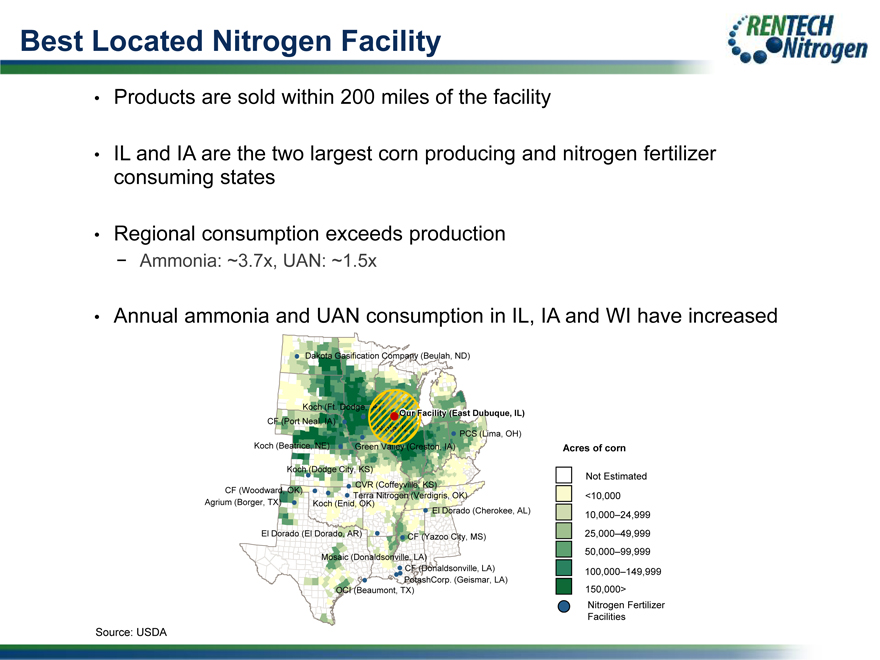

Best Located Nitrogen Facility

Products are sold within 200 miles of the facility

IL and IA are the two largest corn producing and nitrogen fertilizer consuming states

Regional consumption exceeds production

- Ammonia: ~3.7x, UAN: ~1.5x

Annual ammonia and UAN consumption in IL, IA and WI have increased

Source: USDA

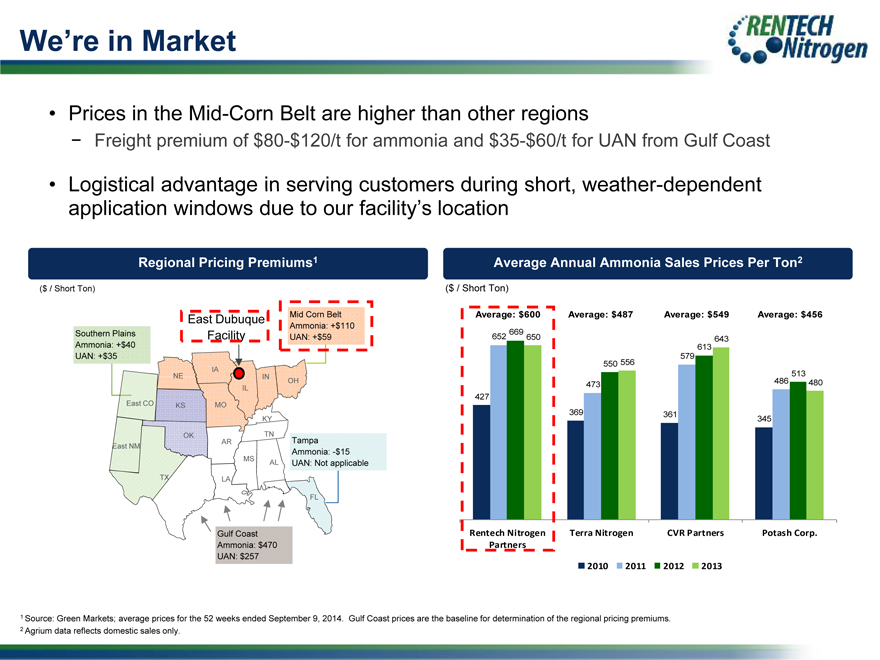

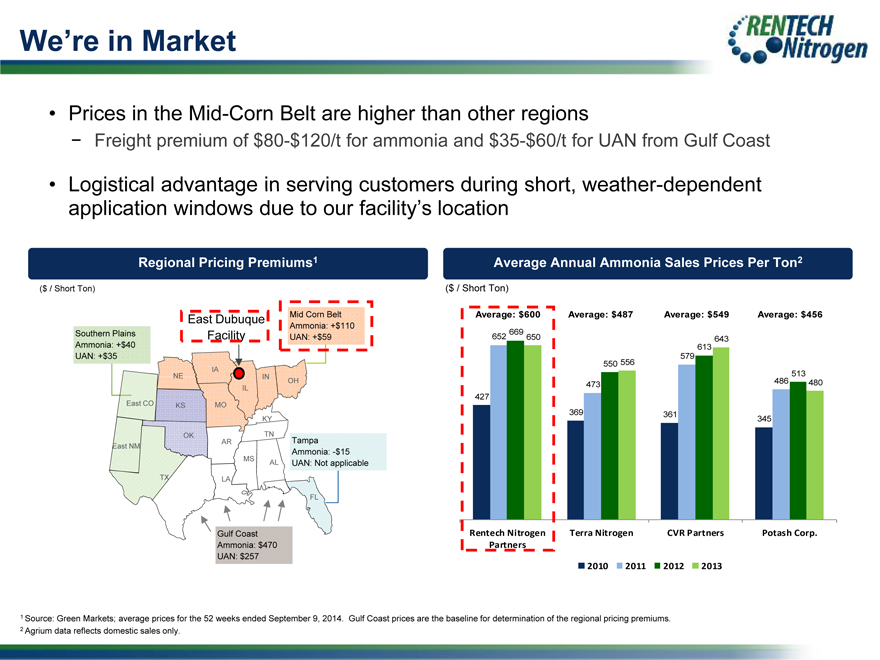

We’re in Market

Prices in the Mid-Corn Belt are higher than other regions

- Freight premium of $80-$120/t for ammonia and $35-$60/t for UAN from Gulf Coast

Logistical advantage in serving customers during short, weather-dependent application windows due to our facility’s location

Regional Pricing Premiums1

Average Annual Ammonia Sales Prices Per Ton2

($ / Short Ton)

($ / Short Ton)

1 Source: Green Markets; average prices for the 52 weeks ended September 9, 2014. Gulf Coast prices are the baseline for determination of the regional pricing premiums.

2 Agrium data reflects domestic sales only.

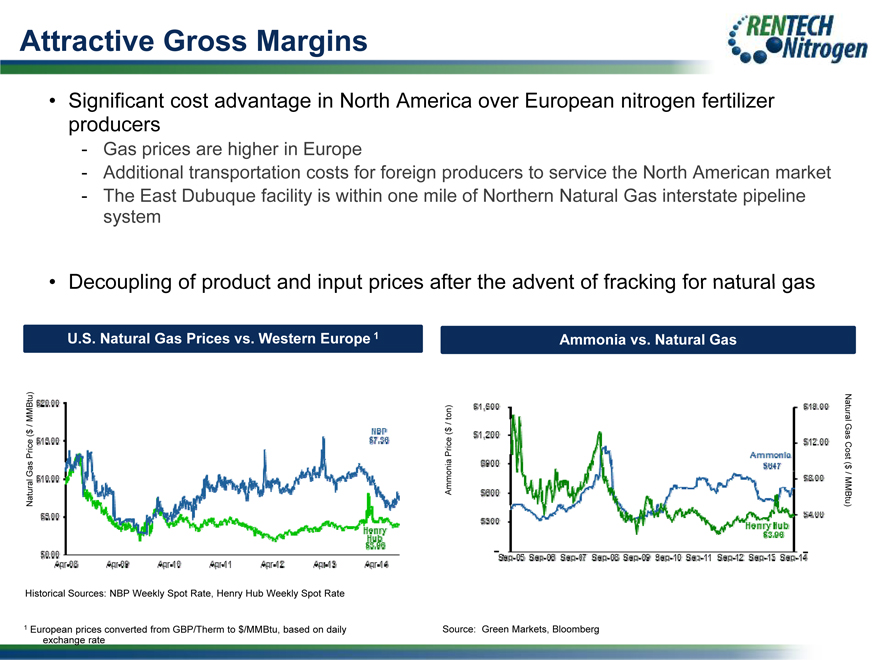

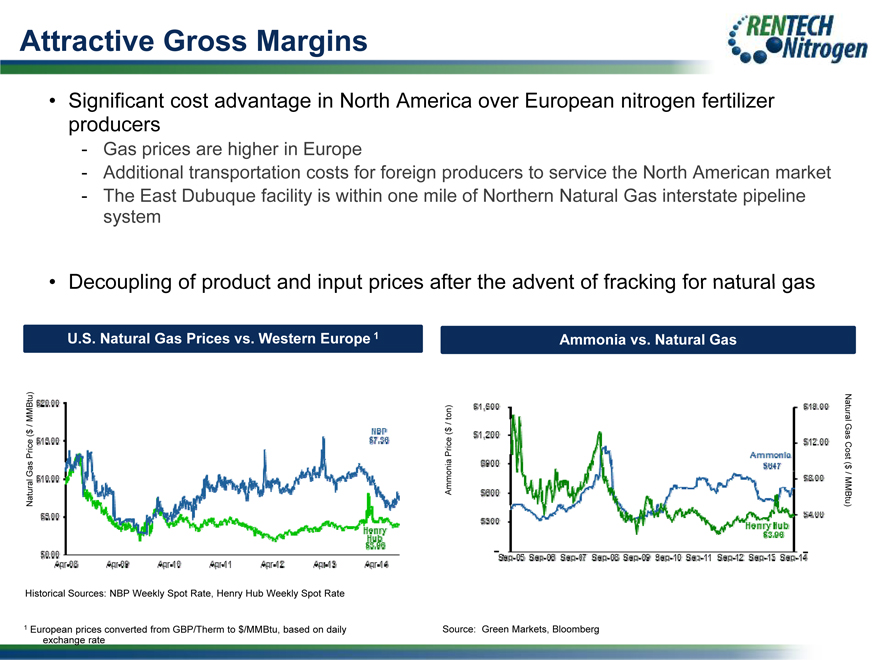

Attractive Gross Margins

Significant cost advantage in North America over European nitrogen fertilizer producers

- Gas prices are higher in Europe

- Additional transportation costs for foreign producers to service the North American market

- The East Dubuque facility is within one mile of Northern Natural Gas interstate pipeline system

Decoupling of product and input prices after the advent of fracking for natural gas

U.S. Natural Gas Prices vs. Western Europe 1

Ammonia vs. Natural Gas

Natural Gas Price ($ / MMBtu)

Natural Gas Cost ($ / MMBtu)

Historical Sources: NBP Weekly Spot Rate, Henry Hub Weekly Spot Rate

1 European prices converted from GBP/Therm to $/MMBtu, based on daily Source: Green Markets, Bloomberg exchange rate

Historical Sources: NBP Weekly Spot Rate, Henry Hub Weekly Spot Rate

1 European prices converted from GBP/Therm to $/MMBtu, based on daily Source: Green Markets, Bloomberg exchange rate

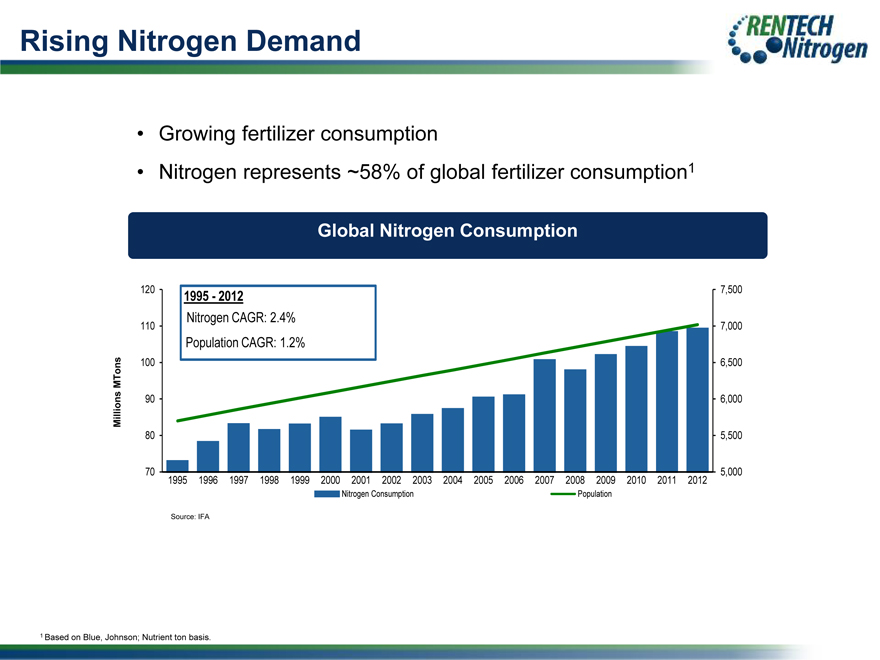

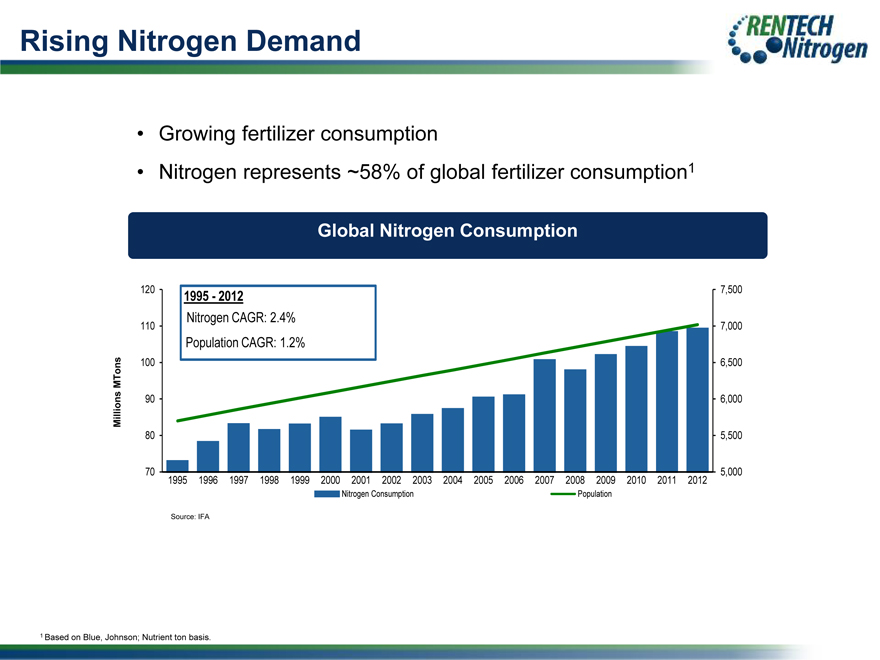

Rising Nitrogen Demand

Growing fertilizer consumption

Nitrogen represents ~58% of global fertilizer consumption1

Global Nitrogen Consumption

120 1995—2012 7,500

Nitrogen CAGR: 2.4%

110 7,000

Population CAGR: 1.2%

ons 100 6,500

MT

Millions 90 6,000

80 5,500

70 5000 , 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Nitrogen Consumption Population

Source: IFA

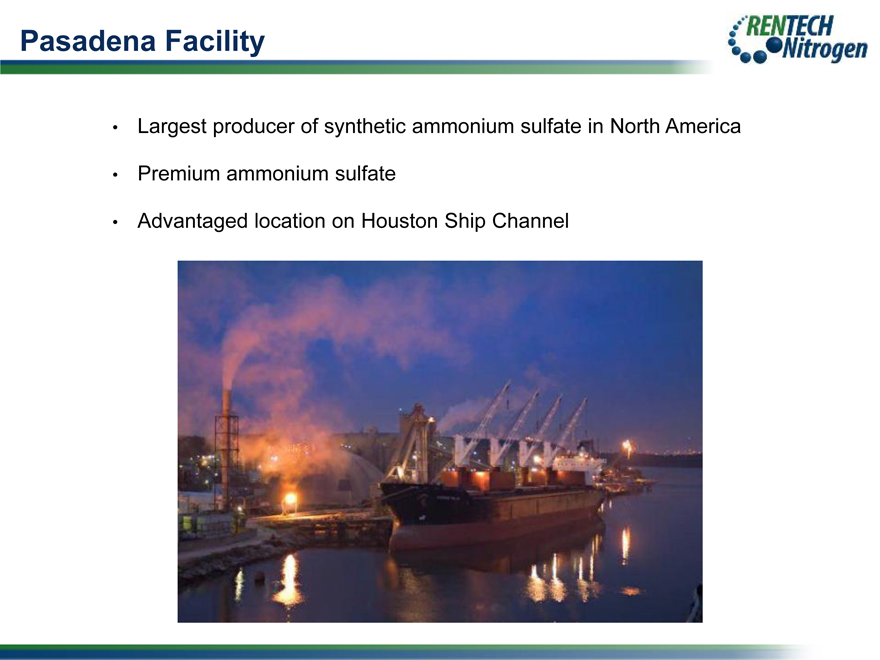

Pasadena Facility

Pasadena Facility

Largest producer of synthetic ammonium sulfate in North America

Premium ammonium sulfate

Advantaged location on Houston Ship Channel

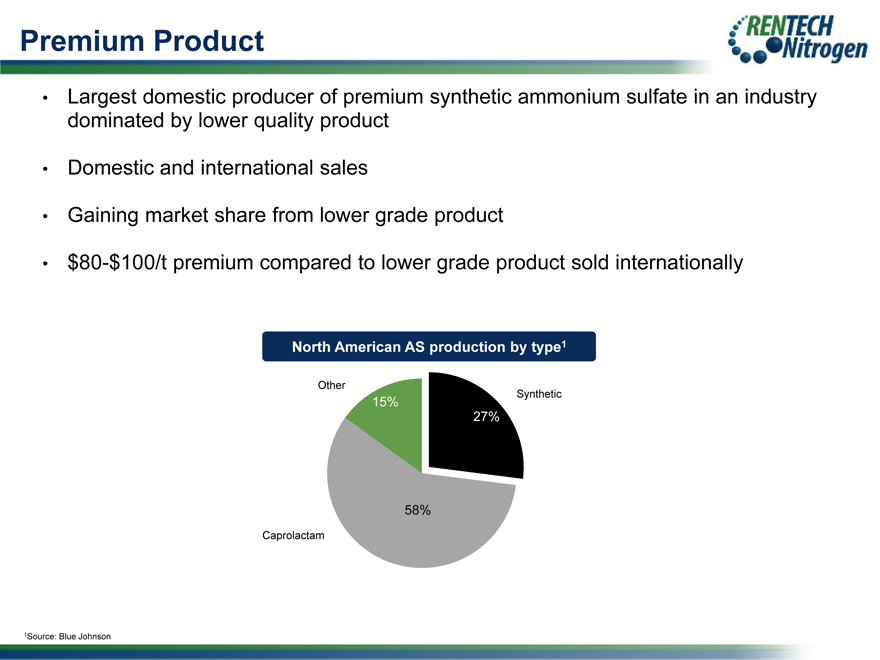

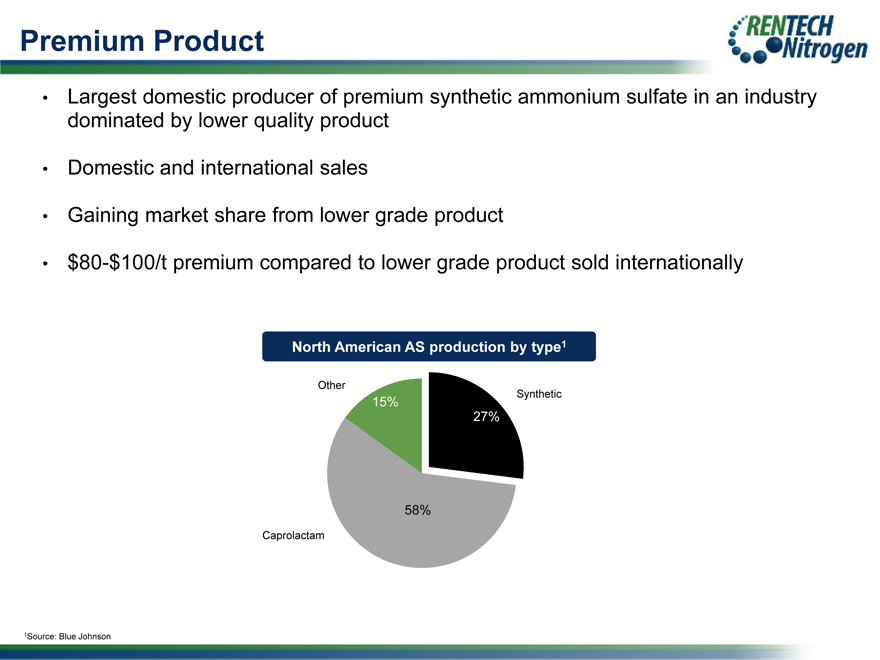

Premium Product

Largest domestic producer roduc of premium remium synthetic ammonium sulfate in an industry dominated by lower quality product

Domestic and international sales

Gaining market share from lower grade product

$80-$100/t premium compared to lower grade product sold internationally

North American AS production by type1

Other

Synthetic

15%

27%

58%

Caprolactam

1Source: Blue Johnson

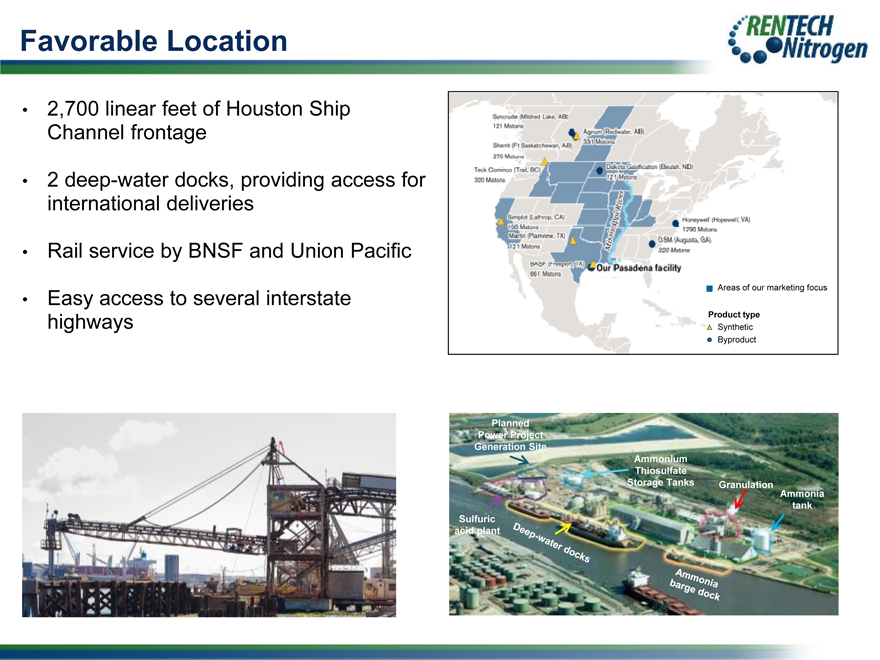

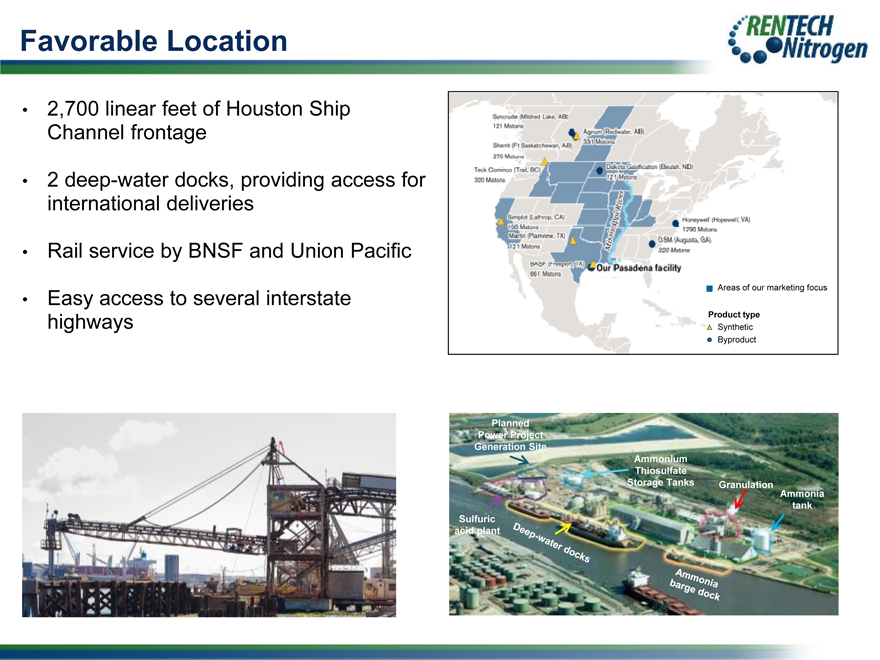

Favorable Location

2,700 linear feet of Houston Ship Channel frontage

2 deep-water docks, providing access for international deliveries

Rail service by BNSF and Union Pacific

Easy access to several interstate Areas of our marketing focus

highways Product type

Synthetic Byproduct

Planned Power Project Generation Site

Ammonium Thiosulfate

Storage Tanks Granulation

Ammonia tank Sulfuric acid plant

Pasadena Facility Challenges

Actual and expected margins have compressed

Expect to implement restructured operating plan in the fourth quarter of this year

Engaged an advisory firm to help evaluate terminalling proposals and other opportunities to create value at the site

As of 8/7/14

Rentech Nitrogen: Value Creation

East Dubuque Facility

Urea expansion of 5%

Nitric acid expansion of 8%

Third DEF storage tank

Hydrogen recovery upgrade

Pasadena Facility

Restructured operating plan

Co-gen project

Terminal opportunities

As of 7/24/14 & 8/7/14

Market Update

Market Update

USDA projecting a corn crop of 14.4 billion bushels

USDA projection for ending corn stocks of 2.0 billion bushels up 0.2 billion bushels

Lower corn prices could result in greater feed usage and ethanol production

- Ethanol exports are strong: up 60% year-over-year in Q2

Tight global ammonia supplies

Ammonium sulfate prices seeing strength

Natural gas prices softening

Our 2014 forecasted deliveries are nearly fully locked-in at avg. prices of $545 and $278 per ton for ammonia and UAN1

1As of 8/7/14

Summary

We are Well Positioned

Diversified businesses, geographies and customers in growing stalwart industries

Market leaders

Expertise in each business segment

Execution: operational excellence and value creation

MLP-qualifying businesses