UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM 10-K

___________________

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 30, 2006

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____________________ to ____________________________

Commission file number 0-18914

DORMAN PRODUCTS, INC.

(Exact name of registrant as specified in its charter)

Pennsylvania | | 23-2078856 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. - Employer Identification No.) |

3400 East Walnut Street, Colmar, Pennsylvania 18915

(Address of principal executive offices) (Zip Code)

(215) 997-1800

(Registrants telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: NONE

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.01 Par Value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer" and "large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | | Accelerated filer x | | Non-accelerated filer o |

Indicate by check mark whether the registrant is a shell company (as defined in the Rule 12b-2 of the Exchange Act.)

Yes o No x

As of March 1, 2007 the registrant had 17,677,090 shares of common stock, $.01 par value, outstanding. The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2006 was $120,786,901.46.

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of the registrant's definitive proxy statement, in connection with its Annual Meeting of Shareholders, to be filed with the Securities and Exchange Commission within 120 days after December 30, 2006, are incorporated by reference into Part III of this Annual Report on Form 10-K

INDEX TO ANNUAL REPORT ON FORM 10-K

DECEMBER 30, 2006

| | Part I | |

| | | Page |

| Item 1. | | 3 |

| | | 3 |

| | | 3 |

| | | 4 |

| | | 4 |

| | | 5 |

| | | 6 |

| | | 6 |

| | | 6 |

| | | 6 |

| | | 7 |

| | | 7 |

| Item 1A. | | 7 |

| Item 1B. | | 8 |

| Item 2. | | 8 |

| Item 3. | | 9 |

| Item 4. | | 9 |

| tem 4.1 | | 9 |

| | | |

| | Part II | |

| | | |

| Item 5. | | 10 |

| Item 6. | | 12 |

| Item 7. | | 12 |

| Item 7A. | | 19 |

| Item 8. | | 19 |

| Item 9. | | 36 |

| Item 9A. | | 36 |

| | | |

| | Part III | |

| | | |

| Item 10. | | 38 |

| Item 11. | | 38 |

| Item 12. | | 38 |

| Item 13. | | 39 |

| Item 14. | | 39 |

| | | |

| | Part IV | |

| Item 15. | | 39 |

| 41 |

| 42 |

PART I

Dorman Products, Inc. (formerly R&B, Inc.) was incorporated in Pennsylvania in October 1978. As used herein, unless the context otherwise requires, "Dorman", the "Company", “we”, “us”, or “our” refers to Dorman Products, Inc. and its subsidiaries.

We are a leading supplier of original equipment dealer "exclusive" automotive replacement parts, and fasteners and service line products primarily for the automotive aftermarket, a market segment which we helped to establish. We design, package and market over 77,000 different automotive replacement parts (including brake parts), fasteners and service line products manufactured to our specifications. Approximately 34% of our parts and 60% of our net sales consist of original equipment dealer "exclusive" parts and fasteners. Original equipment dealer "exclusive" parts are those which were traditionally available to consumers only from original equipment manufacturers or salvage yards and include, among other parts, intake manifolds, exhaust manifolds, oil cooler lines, window regulators, radiator fan assemblies, power steering pulleys and harmonic balancers. Fasteners include such items as oil drain plugs and wheel lug nuts. Approximately 90% of our products are sold under our brand names and the remainder is sold for resale under customers' private labels, other brands or in bulk. Our products are sold primarily in the United States through automotive aftermarket retailers (such as AutoZone, Advance and O'Reilly), national, regional and local warehouse distributors (such as Carquest and NAPA) and specialty markets and salvage yards. Through our Scan-Tech and Hermoff subsidiaries, we are increasing our international distribution of automotive replacement parts, with sales into Canada, Europe, the Middle East and the Far East.

The automotive replacement parts market is made up of two components: parts for passenger cars and light trucks, which accounted for sales of approximately $204.4 billion in 2006, and parts for heavy duty trucks, which accounted for sales of approximately $74.9 billion in 2006. We currently market products primarily for pas-senger cars and light trucks.

Two distinct groups of end-users buy replacement automotive parts: (i) individual consumers, who purchase parts to perform "do-it-yourself" repairs on their own vehicles; and (ii) professional installers, which include automotive repair shops and the service departments of automobile dealers. The individual consumer market is typically supplied through retailers and through the retail arms of warehouse distributors. Automotive repair shops generally purchase parts through local independent parts wholesalers and through national warehouse distributors. Automobile dealer service departments generally obtain parts through the distribution systems of automobile manufacturers and specialized national and regional warehouse distributors.

The increasing complexity of automobiles and the number of different makes and models of automobiles have resulted in a significant increase in the number of products required to service the domestic and foreign automotive fleet. Accordingly, the number of parts required to be carried by retailers and wholesale distributors has increased substantially. These pressures to include more products in inventory and the significant consolidation among distributors of automotive replacement parts have in turn resulted in larger distributors.

Retailers and others who purchase aftermarket automotive repair and replacement parts for resale are constrained to a finite amount of space in which to display and stock products. Thus, the reputation for quality, customer service, and line profitability which a supplier enjoys is a significant factor in a purchaser's decision as to which product lines to carry in the limited space available. Further, because of the efficiencies achieved through the ability to order all or part of a complete line of products from one supplier (with possible volume discounts), as opposed to satisfying the same requirements through a variety of different sources, retailers and other purchasers of automotive parts seek to purchase products from fewer but stronger suppliers.

We sell over 77,000 different automotive replacement parts, fasteners and service line products to meet a variety of needs including original equipment dealer "exclusive" parts. Our DORMAN® NEW SINCE 1918™ marketing campaign launched in 2005 repositioned our brands under a single corporate umbrella - DORMAN® . All of our products are now sold under one of the seven DORMAN® sub-brands as follows:

DORMAN® OE Solutions ™ | - Original equipment dealer "exclusive" parts, such as intake manifolds, exhaust manifolds, oil cooler lines, window regulators, harmonic balances and radiator fan assemblies. |

| | |

| DORMAN® HELP! ® | - An extensive array of replacement parts, including window handles, and switches, door hardware, interior trim parts, headlamp aiming screws and retainer rings, radiator parts, bat-tery hold-down bolts and repair kits, valve train parts and power steering filler caps |

| | |

| DORMAN® Auto Grade | - A comprehensive line of application specific and general automotive hardware that is a necessary element to a complete repair. Product categories include body hardware, general automotive fasteners, oil drain plugs, and wheel hardware. |

| | |

| DORMAN® Conduct-Tite!® | - Extensive selection of electrical connectors, wire, tools, testers, and accessories. |

| | |

DORMAN® First Stop™ | - Value priced technician quality brake and clutch program containing more than 8,500 SKU's. |

| | |

| DORMAN® Pik-A-Nut® | - A specialized and highly efficient line of home hardware and home organization products specifically designed for retail merchandisers. |

| | |

| DORMAN® Scan-Tech® | - Based in Stockholm, Sweden, DORMAN7 Scan-Tech7 sells a complete line of Volvo7 and Saab7 replacement parts throughout the world, reducing the dependency on the OE Dealer. |

The remainder of our revenues are generated by the sale of parts that we package for ourselves, or others, for sale in bulk or under the private labels of parts manufacturers and national warehouse distributors (such as Carquest and NAPA). During the years ended December 2006, 2005, and 2004, no single product or related group of products accounted for more than 10% of gross sales.

We warrant our products against certain defects in material and workmanship when used as designed on the vehicle on which it was originally installed. We offer a one year, two year, or limited lifetime warranty depending on the product type. All warranties limit the customer’s remedy to the repair or replacement of the part that is defective.

Product development is central to our business. The development of a broad range of products, many of which are not conveniently or economically available elsewhere, has in part, enabled us to grow to our present size and is important to our future growth. In developing our products, our strategy has been to design and package parts so as to make them better and easier to install and/or use than the original parts they replace and to sell automotive parts for the broadest possible range of uses. Through careful evaluation, exacting design and precise tooling, we are frequently able to offer products which fit a broader range of makes and models than the original equipment parts they replace, such as an innovative neoprene replacement oil drain plug which fits not only a variety of Chevrolet models, but also Fords, Chryslers and a range of foreign makes. This assists retailers and other purchasers in maximizing the productivity of the limited space available for each class of part sold. Further, where possible, the Company improves its parts so they are better than the parts they replace. Thus, many of the our products are simpler to install or use, such as a replacement "split boot" for a constant velocity joint that can be installed without disassembling the joint itself and a replacement spare tire hold-down bolt that is longer and easier to thread than the original equipment bolt it replaced. In addition, we often package different items in complete kits to ease installation.

Ideas for expansion of our product lines arise through a variety of sources. We maintain an in-house product management staff that routinely generates ideas for new parts and expansion of existing lines. Further, we maintain an "800" telephone number and an Internet site for "New Product Suggestions" and receive, either directly or through our sales force, many ideas from our customers as to which types of presently unavailable parts the ultimate consumers are seeking.

Each new product idea is reviewed by our product management staff, as well as by members of the production, sales, finance, marketing, and administrative staffs. In determining whether to produce an individual part or a line of related parts, we consider the number of vehicles of a particular model to which the part may be applied, the potential for modifications which will allow the product to be used over a broad range of makes and models, the average age of the vehicles in which the part would be used and the failure rate of the part in question. This review process narrows the many new product suggestions down to those most likely to enhance our exist-ing product lines or to support new product lines.

We market our products to three groups of purchasers who in turn supply individual consumers and professional installers:

(i) Approximately 46% of our revenues are generated from sales to automotive aftermarket retailers (such as AutoZone, Advance and O'Reilly), local independent parts wholesalers and national general merchandise chain retailers. We sell some of our products to virtually all major chains of automotive aftermarket retailers;

(ii) Approximately 30% of our revenues are generated from sales to warehouse distributors (such as Carquest and NAPA), which may be local, regional or national in scope, and which may also engage in retail sales; and

(iii) The balance of our revenues (approximately 24%) are generated from international sales and sales to special markets, which include, among others, mass merchants (such as Wal-Mart), salvage yards and the parts distribution systems of parts manufacturers.

We use a number of different methods to sell our products. Our more than 30 person direct sales force solicits purchases of our products directly from customers, as well as managing the activities of 18 independent manufacturers’ representative agencies. We use independent manufacturers’ represen-tative agencies to help service existing retail and warehouse distribution customers, providing frequent on-site contact. The sales focus is designed to increase sales by adding new product lines and expanding product selection within existing customers and secure new customers. For certain of our major customers, and our private label purchasers, we rely primarily upon the direct efforts of our sales force, who, together with the marketing department and our executive officers, coordinate the more complex pricing and ordering requirements of these accounts.

Our sales efforts are not directed merely at selling individual products, but rather more broadly towards selling groups of related products that can be displayed on attractive Dorman-designed display systems, thereby maximizing each customer's ability to present our product line within the confines of the available area.

We prepare a number of catalogs, application guides and training materials designed to describe our products and other applications as well as to train our customers' salesmen in the promotion and sale of our products. Every two to three years we prepare a new master catalog which lists all of our products. The catalog is updated periodically through supplements.

We currently service more than 2,500 active accounts. During 2006, three customers (AutoZone, Advance and O’Reilly) each accounted for more than 10% of net sales and in the aggregate accounted for 40% of net sales. During 2005 and 2004, two customers (AutoZone and Advance) each accounted for more than 10% of net sales and in the aggregate accounted for 31% and 34% of net sales, respectively.

Substantially all of our products are manufactured to our specifications by third parties. Because numerous contract manufacturers are available to manufacture our products, we are not dependent upon the services of any one contract manufacturer or any small group of them. No one vendor supplies more than 10% of our products. In 2006, as a percentage of our total dollar volume of purchases, approximately 33% of our products were purchased from various suppliers throughout the United States and the balance of our products were purchased directly from a variety of foreign countries.

Once a new product has been developed, our engineering department produces detailed engineering drawings and prototypes which are used to solicit bids for manufacture from a variety of vendors in the United States and abroad. After a vendor is selected, tooling for a production run is produced by the vendor at our expense. A pilot run of the product is produced and subjected to rigorous testing by our engineering department and, on occasion, by outside testing laboratories and facilities in order to evaluate the precision of manufacture and the resiliency and structural integrity of the materials used. If acceptable, the product then moves into full production.

Packaging, Inventory and Shipping

Finished products are received at one or more of our facilities, depending on the type of part. It is our practice to inspect samples of shipments based upon vendor performance. If cleared, these shipments of finished parts are logged into our computerized production tracking systems and staged for packaging.

We employ a variety of custom-designed packaging machines which include blister sealing, skin film sealing, clamshell sealing, bagging and boxing lines. Packaged product contains our label (or a private label), a part number, a universal packaging bar code suitable for electronic scanning, a description of the part and, if appropriate, installation instructions. Products are also sold in bulk to automotive parts manufacturers and packagers. Computerized tracking systems, mechanical counting devices and experienced workers combine to assure that the proper variety and numbers of parts meet the correct packaging materials at the appropriate places and times to produce the required quantities of finished products.

Completed inventory is stocked in the warehouse portions of our facilities and is stored and organized to facilitate the most efficient methods of retrieving product to fill customer orders. We strive to maintain a level of inventory to adequately meet current customer order demand with additional inventory to satisfy new customer orders and special programs. We maintain a "safety stock" of inventory to compensate for fluctuations in demand and delivery.

We ship our products from all of our locations by contract carrier, common carrier or parcel service. Products are generally shipped to the customer's main warehouse for redistribution within their network. In certain circumstances, at the request of the customer, we ship directly to the customer's stores either via smaller direct ship orders or consolidated store orders that are cross docked.

The replacement automotive parts industry is highly competitive. Various competitive factors affecting the automotive aftermarket are price, product quality, breadth of product line, range of applications and customer serv-ice. Substantially all of our products are subject to competition with similar products manufactured by other manufacturers of aftermarket automotive repair and replacement parts. Some of these competitors are divisions and subsidiaries of companies much larger than us, and possess a longer history of operations and greater financial and other resources than we do. Further, some of our private label customers also compete with us.

While we take steps to register our trademarks when possible, we do not believe that trademark registration is generally important to our business. Similarly, while we actively seek patent protection for the products and improvements which we develop, we do not believe that patent protection is generally important to our business.

At December 30, 2006, we had 961 employees worldwide, of whom 942 were employed full-time and 19 were employed part-time. Of these employees, 657 were engaged in production, inventory, or quality control, 94 were involved in engineering, product development and brand management, 71 were employed in sales and order entry, and the remaining 139, including our 7 executive officers, were devoted to administration, finance, legal, and strategic plan-ning.

No domestic employees are covered by any collective bargaining agreement. Approximately 30 employees at the our Swedish subsidiary are governed by a national union. We consider our relations with our employees to be generally good.

Our internet address is www.dormanproducts.com. The information on this website is not and should not be considered part of this Form 10-K and is not incorporated by reference in this Form 10-K. This website is, and is only intended to be, for reference purposes only. We make available free of charge on our web site our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. In addition, we will provide, at no cost, paper or electronic copies of our reports and other filings made with the SEC. Requests should be directed to: Dorman Products, Inc. - Office of General Counsel, 3400 East Walnut Street, Colmar, Pennsylvania 18915.

In addition to the other information set forth in this report, you should carefully consider the following factors, which could materially affect our business, financial condition or future results. The risks described below are not the only risks we face. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially affect our business, financial conditions or results of operations.

Competition for Shelf Space. Since the amount of space available to a retailer and other purchasers of our products is limited, our products compete with other automotive aftermarket products, some of which are entirely dissimilar and otherwise non-competitive (such as car waxes and engine oil), for shelf and floor space. No assurance can be given that additional space will be available in our customers' stores to support expansion of the number of products that we offer.

Concentration of Sales to Certain Customers. A significant percentage of our sales has been, and will continue to be, concentrated among a relatively small number of customers. During 2006, three customers (AutoZone, Advance, and O’Reilly) each accounted for more than 10% of net sales and in the aggregate accounted for 40% of net sales. During 2005 and 2004, two customers (AutoZone and Advance) each accounted for more than 10% of net sales and in the aggregate accounted for 31% and 34% of net sales, respectively. We anticipate that this concentration of sales among customers will continue in the future. The loss of a significant customer or a substantial decrease in sales to such a customer could have a material adverse effect on our sales and operating results. See "Management's Discussion and Analysis of Results of Operations and Financial Condition" and "Business-Sales and Marketing" sections of this Form 10-K.

Concentrations of Credit Risk. Financial instruments that potentially subject us to concentrations of credit risk consist primarily of cash and cash equivalents and accounts receivable. All cash equivalents are managed within established guidelines which limit the amount which may be invested with one issuer. A significant percentage of our accounts receivable have been, and will continue to be concentrated among a relatively small number of automotive retailers and warehouse distributors in the United States. Our five largest customers accounted for 73% and 77% of total accounts receivable as of December 30, 2006 and December 31, 2005, respectively. Management continually monitors the credit terms and credit limits to these and other customers.

Customer Terms. The automotive aftermarket has been consolidating over the past several years. As a result, many of our customers have grown larger and therefore have more leverage in negotiations. Customers press for extended payment terms and returns of slow moving product when negotiating with us. While we do our best to avoid such concessions, in some cases payment terms to customers have been extended and returns of product have exceeded historical levels. The product returns primarily affect our profit levels while terms extensions generally reduce operating cash flow and require additional capital to finance the business. We expect both of these trends to continue for the foreseeable future.

Foreign Currency Fluctuations. In 2006, 67% of our products were purchased from suppliers located in a variety of foreign countries. The products generally are purchased through purchase orders with the purchase price specified in U.S. dollars. Accordingly, we do not have exposure to fluctuations in the relationship between the dollar and various foreign currencies between the time of execution of the purchase order and payment for the product. However, weakness in the dollar has resulted in some materials price increases and pressure from several foreign suppliers to increase prices. To the extent that the dollar decreases in value to foreign currencies in the future or the present weakness in the dollar continues for a sustained period of time, the price of the product in dollars for new purchase orders may increase further.

The largest portion of our overseas purchases come from China. The value of the Chinese Yuan has increased relative to the U.S. Dollar over 6% since July 2005 when it was allowed to fluctuate against a basket of currencies. Most experts believe that the value of the Yuan will increase further relative to the U.S. Dollar over the next few years. Such a move would most likely result in an increase in the cost of products that are purchased from China.

Dependence on Senior Management. The success of our business will continue to be dependent upon Richard N. Berman, Chairman of the Board, President and Chief Executive Officer and Steven L. Berman, Executive Vice President, Secretary-Treasurer and Director. The loss of the services of one or both of these individuals could have a material adverse effect on our business.

Dividend Policy. We do not intend to pay cash dividends for the foreseeable future. Rather, we intend to retain our earnings, if any, for the operation and expansion of our business.

Control by Officers, Directors and Family Members. As of March 1, 2007, Richard N. Berman and Steven L. Berman, who are officers and directors of Dorman Products, Inc., their father, Jordan S. Berman, and their brothers, Marc H. Berman and Fred B. Berman beneficially own approximately 42 % of the outstanding Common Stock and are able to elect the Board of Directors, determine the outcome of most corporate actions requiring share-holder approval (including certain fundamental transactions) and control over our policies.

Increase in OE Patent Filings. Recently, we have seen an increase in patent requests for new designs made by original equipment manufacturers. If original equipment manufacturers are able to obtain patents on new designs at a rate higher than historical levels, we could be restricted or prohibited from selling aftermarket products covered by such items, which could have an adverse impact on our business.

There are no unresolved comments from the Commission staff regarding our periodic or current reports under the Securities Act.

Facilities

We currently have 13 warehouse and office facilities located throughout the United States, Canada, Sweden, China and Korea. Two of these facilities are owned and the remainder are leased. Our headquarters and principal warehouse facilities are as follows:

| Location | | Description |

| | | |

| Colmar, PA | | Corporate Headquarters and Warehouse and office - 334,000 sq. ft. (leased) (1) |

| Warsaw, KY | | Warehouse and office - 362,000 sq. ft. (owned) |

| Portland, TN | | Warehouse and office - 269,000 sq. ft. (leased) |

| Louisiana, MO | | Warehouse and office - 90,000 sq. ft. (owned) |

| Baltimore, MD | | Warehouse and office - 83,000 sq. ft. (leased) |

| Hagersville, ON | | Manufacturing, warehouse, and office 37,000 sq. ft. (leased) (2) |

In the opinion of management, the existing facilities are in good condition.

_________________

(1) We lease the Colmar facility from a partnership of which Richard N. Berman, President and Chief Executive Officer of the Company, and Steven L. Berman, Executive Vice President of the Company, their father, Jordan S. Berman, and their brothers, Marc H. Berman and Fred B. Berman, are partners. Under the lease we paid rent of $3.89 per square foot ($1.3 million per year) in 2006. The rents payable will be adjusted on January 1 of each year to reflect annual changes in the Consumer Price Index for All Urban Consumers - U.S. City Average, All Items. In 2002, the lease term was extended and will expire on December 31, 2007. In the opinion of management, the terms of this lease are no less favorable than those which could have been obtained from an unaffiliated party.

(2) In June 2005, we acquired The Automotive Edge/Hermoff (Hermoff) for approximately $1.7 million. As part of the acquisition of Hermoff, we leased the existing facility from an Ontario corporation of which Arthur Bluhm, President of Hermoff, and Robert Bluhm, Vice President of Hermoff, are shareholders. Under the lease we paid rent of $112,000 Canadian in 2006. The term of the lease is for a period of 2 years beginning June 1, 2005 and ending May 31, 2007. In the opinion of management, the terms of this lease are no less favorable than those which could have been obtained from an unaffiliated party.

We are a party to or otherwise involved in legal proceedings that arise in the ordinary course of business, such as various claims and legal actions involving contracts, competitive practices, trademark rights, product liability claims and other matters arising out of the conduct of our business. In the opinion of management, none of the actions, individually or in the aggregate, would likely have a material financial impact on the Company.

There were no matters submitted to a vote of our security holders during the fourth quarter of fiscal year 2006.

The following table sets forth certain information with respect to our executive officers:

| Name | Age | Position with the Company |

| | | |

| Mathias J. Barton | 47 | Senior Vice President, Chief Financial Officer |

| | | |

| Joseph M. Beretta | 52 | Senior Vice President, Product |

| | | |

| Richard N. Berman | 50 | President, Chief Executive Officer, Chairman of the Board of Directors, and Director |

| | | |

| Steven L. Berman | 47 | Executive Vice President, Secretary-Treasurer, and Director |

| | | |

| Fred V. Frigo | 50 | Senior Vice President, Operations |

| | | |

| Donald J. Barry | 44 | Senior Vice President of Sales and Trade Marketing |

| | | |

| Thomas J. Knoblauch | 51 | Vice President, General Counsel and Assistant Secretary |

Mathias J. Barton joined the Company in November 1999 as Senior Vice President, Chief Financial Officer. Prior to joining the Company, Mr. Barton was Senior Vice President and Chief Financial Officer of Central Sprinkler Corporation, a manufacturer and distributor of automatic fire sprinklers, valves and component parts. From May 1989 to September 1998, Mr. Barton was employed by Rapidforms, Inc., most recently as Executive Vice President and Chief Financial Officer. He is a graduate of Temple University.

Joseph M. Beretta joined the Company in January 2004 as Senior Vice President, Product. Prior to joining the Company, Mr. Beretta was employed by Cardone Industries, Inc., most recently as its Chief Operating Officer. Cardone is a remanufacturer and supplier of automotive replacement parts. He is a graduate of Oral Roberts University.

Richard N. Berman has been President, Chief Executive Officer and a Director of the Company since its incep-tion in October 1978. He is a graduate of the University of Pennsylvania.

Steven L. Berman has been Executive Vice-President, Secretary-Treasurer and a Director of the Company since its inception. He attended Temple University.

Fred V. Frigo joined the Company in March 1997 as Director, Operations and was named Senior Vice President, Operations in September 2003. Prior to joining the Company, Mr. Frigo was the Plant Manager for Cooper Industries (Federal Mogul), where he was responsible for their Wagner Brake Plant in Boston and following that the Wagner Lighting Operations in Boyertown Pennsylvania. He is a graduate of Elmhurst College.

Donald J. Barry joined the Company in July 2005 as Senior Vice President of Sales and Trade Marketing. Prior to joining the Company he was European Business Director for 3M Company where he was responsible for Consumer and Office business operations. He is a graduate of University of Wisconsin-Whitewater.

Thomas J Knoblauch joined the Company in April 2005 as Vice President and General Counsel. In May 2005, Mr. Knoblauch was appointed Assistant Secretary. Prior to joining the Company he was Corporate Counsel at SunGard Data Systems, Inc. and General Counsel at Rosenbluth International, Inc. He is a graduate of Widener University, St. Joseph's University , and the Widener University School of Law. Mr. Knoblauch is a member of both the Pennsylvania and New York Bar.

PART II

Item 5. Market for Registrant's Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities.

Our shares of common stock are traded publicly in the over-the-counter market on the NASDAQ system. At March 1, 2007 there were 154 holders of record of common stock, representing more than 1,400 beneficial owners. The last price for our common stock on March 1, 2007, as reported by NASDAQ, was $11.28 per share. Since our initial public offering, we have paid no cash dividends. We do not presently contemplate paying any such dividends in the foreseeable future. The range of high and low sales prices for our common stock for each quarterly period of 2006 and 2005 are as follows:

| | | 2006 | | 2005 (1) | |

| | | High | | Low | | High | | Low | |

| First Quarter | | $ | 11.36 | | $ | 9.15 | | $ | 13.75 | | $ | 12.03 | |

| Second Quarter | | | 11.78 | | | 9.90 | | | 14.46 | | | 10.00 | |

| Third Quarter | | | 12.81 | | | 9.99 | | | 14.50 | | | 9.04 | |

| Fourth Quarter | | | 10.83 | | | 9.95 | | | 12.62 | | | 9.35 | |

| (1) | Amounts have been restated to reflect a two-for-one split of our common stock on March 28, 2005. |

For the information regarding our compensation plans, see Item 12, Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

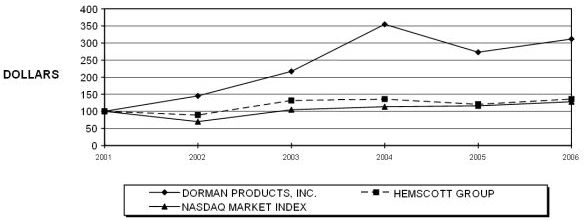

Stock Performance Graph. Below is a line graph comparing, for period from December 29, 2001 to December 31, 2006, the cumulative total shareholder return on our Common Stock with the cumulative total shareholder return on the Automotive Parts & Accessories Peer Group of the Hemscott Group Index and the NASDAQ Market Index. The Automotive Parts & Accessories Peer Group is comprised of 35 public companies and the information was furnished by Hemscott Inc. The graph assumes $100 invested on December 29, 2001 in our Common Stock and each of the indices, and that the dividends were reinvested when and as paid. In calculating the cumulative total shareholder returns, the companies included are weighted according to the stock market capitalization of such companies.

COMPARE 5-YEAR CUMULATIVE TOTAL RETURN

AMONG DORMAN PRODUCTS, INC.,

NASDAQ MARKEY INDEX AND HEMSCOTT GROUP INDEX

ASSUMES $100 INVESTED ON DEC. 29, 2001

ASSUMES DIVIDEND REINVESTED

FISCAL YEAR ENDING DEC. 31, 2006

Stock Repurchases

During the last three months of fiscal year ended December 30, 2006, we purchased shares of our Common Stock as follows:

| Period | Total Number of Shares Purchased (1) | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Number (or Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs |

| October 1, 2006 through October 31, 2006 | - | | - | - |

| November 1, 2006 through November 30, 2006 | 5,477 | $ 10.01 | - | - |

| December 1, 2006 through December 30, 2006 | 6,158 | $ 10.05 | - | - |

| Total | 11,635 | $ 10.03 | - | - |

(1) We currently do not have a publicly announced repurchase program in place. All of the shares indicated in the above table were purchased from our 401(k) Plan. Shares are generally purchased from our 401(k) Plan when participants elect to sell units as permitted by the Plan or to leave the Plan upon retirement, termination or other reason. This table does not include shares tendered to satisfy the exercise price in connection with cashless exercises of employee stock options or shares tendered to satisfy tax withholding obligations in connection with equity awards.

| | | Selected Consolidated Financial Data | |

| | | Year Ended December | |

| (in thousands, except per share data) | | 2006 (a) | | 2005 | | 2004 | | 2003 | | 2002 (b) | |

| Statement of Operations Data: | | | | | | | | | | | |

| Net sales | | $ | 295,825 | | $ | 278,117 | | $ | 249,526 | | $ | 222,083 | | $ | 215,524 | |

| Income from operations | | | 26,770 | | | 29,776 | | | 29,638 | | | 24,052 | | | 23,133 | |

| Net income | | | 13,799 | | | 17,077 | | | 17,081 | | | 13,304 | | | 12,357 | |

| Earnings per share | | | | | | | | | | | | | | | | |

| Basic (c) | | $ | 0.78 | | $ | 0.95 | | $ | 0.97 | | $ | 0.77 | | $ | 0.73 | |

| Diluted (c) | | $ | 0.76 | | $ | 0.93 | | $ | 0.93 | | $ | 0.73 | | $ | 0.69 | |

| Balance Sheet Data: | | | | | | | | | | | | | | | | |

| Total assets | | | 217,758 | | | 212,156 | | | 195,404 | | | 176,606 | | | 170,128 | |

| Working capital | | | 126,804 | | | 115,812 | | | 101,585 | | | 98,452 | | | 91,340 | |

| Long-term debt | | | 20,596 | | | 27,243 | | | 25,714 | | | 35,213 | | | 44,218 | |

| Shareholders' equity | | | 153,843 | | | 138,542 | | | 125,227 | | | 105,985 | | | 89,572 | |

(a) Results for 2006 include a $3.2 million non-cash write-down for goodwill impairment ($2.9 million or $0.16 per share) and the write-off of deferred tax benefits ($0.3 million or $0.02 per share).

(b) Results for 2002 include a gain on sale of specialty fastener business of $2,143 ($1,329 after tax or $0.07 per share).

(c) Per share amounts have been retroactively adjusted to reflect a two-for-one stock split of our common stock effective March 28, 2005.

Cautionary Statement Regarding Forward Looking Statements

Certain statements in this document constitute “forward-looking statements” within the meaning of the Federal Private Securities Litigation Reform Act of 1995. While forward-looking statements sometimes are presented with numerical specificity, they are based on various assumptions made by management regarding future circumstances over many of which the Company has little or no control. Forward-looking statements may be identified by words including “anticipate,” “believe,” “estimate,” “expect,” and similar expressions. The Company cautions readers that forward-looking statements, including, without limitation, those relating to future business prospects, revenues, working capital, liquidity, and income, are subject to certain risks and uncertainties that would cause actual results to differ materially from those indicated in the forward-looking statements. Factors that could cause actual results to differ from forward-looking statements include but are not limited to competition in the automotive aftermarket industry, concentration of the Company’s sales and accounts receivable among a small number of customers, the impact of consolidation in the automotive aftermarket industry, foreign currency fluctuations, dependence on senior management and other risks and factors identified from time to time in the reports the Company files with the Securities and Exchange Commission. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. For additional information concerning factors that could cause actual results to differ materially from the information contained in this report, reference is made to the information in Part I, “Item 1A, Risk Factors.”

Overview

We are a leading supplier of Original Equipment (OE) Dealer “Exclusive” automotive replacement parts, automotive hardware, brake products, and household hardware to the automotive aftermarket and mass merchandise markets. Dorman automotive parts and hardware are marketed under the OE Solutions™, HELP!®, AutoGrade™, First Stop™, Conduct-Tite®, Pik-A-Nut®, and Scan-Tech™ brand names. We design, package and market over 77,000 different automotive replacement parts (including brake parts), fasteners and service line products manufactured to our specifications. Our products are sold under one of the seven Dorman brand names listed above. Our products are sold primarily in the United States through automotive aftermarket retailers (such as AutoZone, Advance and O’Reilly), national, regional and local warehouse distributors (such as Carquest and NAPA) and specialty markets including parts manufacturers for resale under their own private labels and salvage yards. Through our Scan-Tech and Hermoff subsidiaries, we are increasing our international distribution of automotive replacement parts, with sales into Canada, Europe, the Middle East and the Far East.

The automotive aftermarket in which we compete has been growing in size; however, the market continues to consolidate. As a result, our customers regularly seek more favorable pricing, product returns and extended payment terms when negotiating with us. While we do our best to avoid such concessions, in some cases pricing concessions have been made, customer payment terms have been extended and returns of product have exceeded historical levels. The product returns and more favorable pricing primarily affect our profit levels while terms extensions generally reduce operating cash flow and require additional capital to finance the business. We expect both of these trends to continue for the foreseeable future. Gross profit margins have declined over the past two years as a result of this pricing pressure. Another contributing factor in our gross profit margin decline is a shift in mix to higher-priced, but lower gross margin products. Both of these trends are expected to continue for the foreseeable future. We have increased our focus on efficiency improvements and product cost reduction initiatives to offset the impact of price pressures.

In addition, we are relying on new product development as a way to offset some of these customer demands and as our primary vehicle for growth. As such, new product development is a critical success factor for us. We have invested heavily in resources necessary for us to increase our new product development efforts and to strengthen our relationships with our customers. These investments are primarily in the form of increased product development resources and awareness programs, customer service improvements and increased customer credits and allowances. This has enabled us to provide an expanding array of new product offerings and grow our revenues.

We may experience significant fluctuations from quarter to quarter in our results of operations due to the timing of orders placed by our customers. Generally, the second and third quarters have the highest level of customer orders, but the introduction of new products and product lines to customers may cause significant fluctuations from quarter to quarter.

We operate on a fifty-two, fifty-three week period ending on the last Saturday of the calendar year. The fiscal years ended December 30, 2006, December 31, 2005 and December 25, 2004 were fifty-two, fifty-three, and fifty-two weeks, respectively.

Stock Split

All prior period common stock and applicable share and per share amounts have been adjusted to reflect a two-for-one split in the form of a stock dividend of our common stock effective March 28, 2005.

Write Off of Goodwill and Deferred Tax Asset Related to Swedish Subsidiary

During the second quarter of fiscal 2006, we assessed the value of the goodwill recorded at our Swedish subsidiary (Scan-Tech) as a result of a review of the Scan-Tech business in response to bad debt charge offs of two large customers and the resulting loss of those customers in the first half of the year. After completing the required analyses, we concluded that the goodwill at the subsidiary was impaired. Accordingly, an impairment charge of approximately $2.9 million, which represented the entire goodwill balance at the subsidiary, was recorded in the consolidated statements of operations. In addition, we recorded a $0.3 million charge to our provision for income taxes to write off deferred tax assets of the subsidiary which were deemed unrealizable.

Acquisition

In June 2005, we acquired The Automotive Edge/Hermoff (“Hermoff”) for approximately $1.7 million. The consolidated results include Hermoff since June 1, 2005. We have not presented pro forma results of operations for the years ended December 31, 2005 and December 25, 2004, assuming the acquisition had occurred at the beginning of the respective periods, as these results would not have been materially different than actual results for the periods.

Stock-Based Compensation

Effective January 1, 2006, we adopted SFAS No. 123(R) and related interpretations and began expensing the grant-date fair value of employee stock options. Prior to January 1, 2006, we applied Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees,” and related interpretations in accounting for our stock option plans. Accordingly, no compensation expense was recognized in net income for employee stock options for those options granted which had an exercise price equal to the market value of the underlying common stock on the date of grant.

We adopted SFAS No. 123(R) using the modified prospective transition method and therefore have not restated prior periods. Under this transition method, compensation cost associated with employee stock options recognized in 2006 includes amortization related to the remaining unvested portion of stock option awards granted prior to January 1, 2006, and amortization related to new awards granted after January 1, 2006. Prior to the adoption of SFAS No. 123(R), we presented tax benefits resulting from stock-based compensation as operating cash flows in the consolidated statements of cash flows. SFAS No. 123(R) requires that cash flows resulting from tax deductions in excess of compensation cost recognized in the financial statements be classified as financing cash flows.

Compensation cost is recognized on a straight-line basis over the vesting period during which employees perform related services. The compensation cost charged against income for the year ended December 30, 2006 was $0.5 million before taxes. The compensation cost recognized is classified as selling, general and administrative expense in the consolidated statement of operations.

Results of Operations

The following table sets forth, for the periods indicated, the percentage of net sales represented by certain items in our Consolidated Statements of Operations:

| | | Percentage of Net Sales | |

| | | Year Ended | |

| | | December 30, 2006 | | December 31, 2005 | | December 25, 2004 | |

| Net Sales | | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| Cost of goods sold | | | 65.0 | | | 64.5 | | | 62.9 | |

| Gross profit | | | 35.0 | | | 35.5 | | | 37.1 | |

| Selling, general and administrative expenses | | | 25.0 | | | 24.8 | | | 25.2 | |

| Goodwill impairment | | | 1.0 | | | - | | | - | |

| Income from operations | | | 9.0 | | | 10.7 | | | 11.9 | |

| Interest expense, net | | | 0.7 | | | 0.9 | | | 1.2 | |

| Income before taxes | | | 8.3 | | | 9.8 | | | 10.7 | |

| Provision for taxes | | | 3.6 | | | 3.7 | | | 3.9 | |

| Net Income | | | 4.7 | % | | 6.1 | % | | 6.8 | % |

Fiscal Year Ended December 30, 2006 Compared to Fiscal Year Ended December 31, 2005

Net sales increased 6% to $295.8 million in 2006 from $278.1 million in 2005. Revenues in 2006 increased primarily as a result of increases in revenue from new products. Results for 2005 include an extra week’s sales due to the 53-week year. The loss of an extra week’s sales in 2006 was somewhat offset by a full year’s sales from the Hermoff acquisition made in June 2005.

Cost of goods sold, as a percentage of sales, increased to 65.0% in 2006 from 64.5% in the prior year. The increase is the result of gross margin reductions in several product lines due to higher customer allowances and selling price reductions due to competitive pressures. We offset a portion of these increased selling price reductions through material cost savings from suppliers.

Selling, general and administrative expenses in 2006 increased 7% to $73.8 million from $69.1 million in 2005. The increase is the result of the addition of a new distribution center in 2006, inflationary cost increases and higher variable costs as a result of our 6% sales increase. Selling, general and administrative expenses in 2006 also include a $0.9 million increase in bad debt expense primarily as a result of the write off of two large Scan-Tech accounts receivable, $0.5 million in additional financing costs associated with accounts receivable sales programs whereby we sell our accounts receivable on a non-recourse basis to financial institutions and $0.5 million in stock option expense under SFAS-123(R). These increased costs were partially offset by a $1.3 million reduction in incentive compensation expense in the current year.

As noted above, the Company recorded a $2.9 million charge in the second quarter of 2006 to write off goodwill of its Swedish subsidiary.

Interest expense, net, decreased to $2.3 million in 2006 from $2.6 million in 2005 due to lower overall borrowing levels as cash generated by operations was used to reduce debt levels.

Our effective tax rate increased to 43.7% in 2006 from 37.1% in 2005. The increase is primarily the result of the $2.9 million second quarter goodwill impairment charge which is not tax deductible and therefore had no income tax benefit associated with it. In addition, our 2006 provision for income includes a $0.3 million charge to write off deferred tax assets.

Fiscal Year Ended December 31, 2005 Compared to Fiscal Year Ended December 25, 2004

Net sales increased 11% to $278.1 million in 2005 from $249.5 million in 2004. Revenues in 2005 were up primarily as a result of continued growth in new product sales. An additional week’s sales in 2005 and the June 2005 acquisition of Hermoff accounted for approximately 1% of the sales growth.

Cost of goods sold, as a percentage of net sales, increased from 62.9% in 2004 to 64.5% in 2005. The primary reasons for the increase in cost of goods sold as a percentage of sales were a continued mix shift toward lower margin automotive hard parts and a $1.8 million increase in the provision for excess and slow moving inventory reserves in 2005.

Selling, general and administrative expenses in 2005 increased 10% to $69.1 million from $62.9 million. The expense increase was the result of inflationary cost increases, an increase in variable operating expenses due to sales volume growth and the Company’s decision to invest more resources in new product development which resulted in higher spending for product management, purchasing, engineering and quality control in 2005. During 2005, the Company also increased the use of its accounts receivable sale facilities. Financing costs associated with the sale of accounts receivable are recorded as operating expenses and amounted to $1.2 million and $0.3 million in 2005 and 2004, respectively.

Interest expense, net decreased to $2.6 million in 2005 from $2.9 million in 2004 due to lower overall borrowing rates in 2005. The primary reason for the lower borrowing rates was a reduction in the outstanding principal of the Company’s 6.81% Senior Notes, which was replaced with revolving credit borrowings at a lower interest rate.

The Company’s effective tax rate increased to 37.1% in 2005 from 36.2% in 2004 due to the loss of certain state tax benefits in 2005 as a result of changes in state tax legislation and lower earnings from the Company’s Swedish subsidiary where tax rates are lower than the statutory rate in the United States.

Liquidity and Capital Resources

Historically, we have financed our growth through a combination of cash flow from operations, accounts receivable sales programs provided by certain customers and through the issuance of senior indebtedness through our bank credit facility and senior note agreements. At December 30, 2006, working capital was $126.8 million, total long-term debt (including the current portion and revolving credit borrowings) was $29.2 million and shareholders’ equity was $153.8 million. Cash and cash equivalents as of December 30, 2006 totaled $5.1 million.

Over the past several years we have extended payment terms to certain customers as a result of customer requests and market demands. These extended terms have resulted in increased accounts receivable levels and significant uses of cash flow. We participate in accounts receivable sales programs with several customers which allow us to sell our accounts receivable on a non-recourse basis to financial institutions to offset the negative cash flow impact of these payment terms extensions. As of December 30, 2006 and December 31, 2005, respectively, we had sold $18.5 million and $23.2 million in accounts receivable under these programs and had removed them from our balance sheets. We expect continued pressure to extend our payment terms for the foreseeable future. Further extensions of customer payment terms will result in additional uses of cash flow or increased costs associated with the sale of accounts receivable.

In July 2006, we amended our revolving credit facility. The amendment increased the size of the total credit facility from $20 million to $30 million and extended the expiration date from June 2007 to June 2008. Borrowings under the facility are on an unsecured basis with interest at rates ranging from LIBOR plus 65 basis points to LIBOR plus 150 basis points based upon the achievement of certain benchmarks related to the ratio of funded debt to EBITDA. The interest rate at December 30, 2006 was LIBOR plus 85 basis points (6.17%). Borrowings under the facility were $11.5 million as of December 30, 2006. We have approximately $16.5 million available under the facility at December 30, 2006. The loan agreement also contains covenants, the most restrictive of which pertain to net worth and the ratio of debt to EBITDA. We were in compliance with all financial covenants contained in the Notes and Revolving Credit Facility at December 30, 2006.

At December 30, 2006, long-term debt includes $17.2 million in Senior Notes that were originally issued in August 1998, in a private placement on an unsecured basis (“Notes”). The Notes bear a 6.81% fixed interest rate, payable quarterly. Annual principal payments of $8.6 million are due in August 2007 and August 2008. The Notes require, among other things, that we maintain certain financial covenants relating to debt to capital ratios and minimum net worth.

In September 2006, we borrowed $625,000 under a commercial loan granted in connection with the opening of a new distribution facility. The principal balance is paid monthly in equal installments through September 2013. The outstanding balance bears interest at an annual rate of 4% payable monthly. The loan is secured by a letter of credit issued under our revolving credit facility.

Our business activities do not include the use of unconsolidated special purpose entities, and there are no significant business transactions that have not been reflected in the accompanying financial statements.

We have future obligations for debt repayments, future minimum rental and similar commitments under noncancellable operating leases as well as contingent obligations related to outstanding letters of credit. These obligations (in millions) as of December 30, 2006 are summarized in the tables below:

| | | | | Payments Due by Period | |

| | | | | Less than | | | | | | | |

| Contractual Obligations | | Total | | 1 year | | 1-3 years | | 4-5 years | | After 5 years | |

| Long-term borrowings | | $ | 29,247 | | $ | 8,651 | | $ | 20,330 | | $ | 188 | | $ | 78 | |

| Estimated interested payments (1) | | | 2,463 | | | 1,681 | | | 768 | | | 14 | | | 1 | |

| Operating leases | | | 9,546 | | | 3,088 | | | 3,342 | | | 1,225 | | | 1,891 | |

| | | $ | 41,256 | | $ | 13,420 | | $ | 24,440 | | $ | 1,427 | | $ | 1,970 | |

(1) These amounts represent future interest payments related to our existing debt obligations based on fixed and variable interest rates specified in the underlying loan agreements. Payments related to variable debt are based on interest rates and outstanding balances as of December 30, 2006. The amounts do not assume the refinancing or replacement of such debt.

| | | | | Amount of Commitment Expiration Per Period | |

| | | Total Amount | | | | | | | | | |

| | | Amounts | | Less than | | | | | | | |

| Other Commercial Commitments | | Committed | | 1 year | | 1-3 years | | 4-5 years | | Over 5 years | |

| Letters of credit | | $ | 1,998 | | $ | 1,998 | | $ | - | | $ | - | | $ | - | |

| | | $ | 1,998 | | $ | 1,998 | | $ | - | | $ | - | | $ | - | |

We reported a net source of cash flow from our operating activities of $16.7 million in fiscal 2006. Net income, depreciation and a $8.7 million decrease in inventory were the primary sources of operating cash flow in 2006. Inventory levels declined despite higher sales volumes as a result of our efforts to reduce vendor lead times and more accurately forecast customer demand for our products. The primary use of cash flow was accounts receivable which increased $13.1 million. The increase is the result of a lengthening of payment terms to certain customers, higher sales levels and a $4.7 million reduction in accounts receivable sold under accounts receivable sales programs with several customers.

Investing activities used $7.3 million of cash in fiscal 2006 as a result of additions to property, plant and equipment. Our largest 2006 capital project was the automation and expansion of our central distribution center in Warsaw, Kentucky, which was completed in the third quarter of 2006 at a cost of approximately $7.0 million, most of which was incurred in prior years. Capital spending in 2006 also included tooling associated with new products, purchases of equipment to outfit our new distribution center in Portland, Tennessee, upgrades to information systems, purchases of equipment designed to improve operational efficiencies and scheduled equipment replacements.

Financing activities used $7.2 million in fiscal 2006. The primary use of cash flow was a scheduled $8.6 million repayment of our Senior Notes in August 2006. This repayment was partially funded with $1.4 million in borrowings under our revolving credit facility with the rest coming from operating cash flow.

Based on our current operating plan, we believe that our available sources of capital under our Revolving Credit Agreement, accounts receivable sales programs and cash generated from operations will be sufficient to meet our ongoing cash needs for the next twelve months.

Foreign Currency Fluctuations

In 2006, approximately 67% of our products were purchased from a variety of foreign countries. The products generally are purchased through purchase orders with the purchase price specified in U.S. dollars. Accordingly, we do not have exposure to fluctuations in the relationship between the dollar and various foreign currencies between the time of execution of the purchase order and payment for the product. However, weakness in the dollar has resulted in some materials price increases and pressure from several foreign suppliers to increase prices further. To the extent that the dollar decreases in value to foreign currencies in the future or the present weakness in the dollar continues for a sustained period of time, the price of the product in dollars for new purchase orders may increase further.

The largest portion of our overseas purchases come from China. The value of the Chinese Yuan has increased relative to the U.S. Dollar over 6% since July 2005 when it was allowed to fluctuate against a basket of currencies. Most experts believe that the value of the Yuan will increase further relative to the U.S. Dollar over the next few years. Such a move would most likely result in an increase in the cost of products that are purchased from China.

Impact of Inflation

We have experienced increases in the cost of materials and transportation costs as a result of raw materials shortages and commodity price increases. These increases did not have a material impact on us. We believes that further cost increases could potentially be mitigated by passing along price increases to customers or through the use of alternative suppliers or resourcing purchases to other countries, however there can be no assurance that we will be successful in such efforts.

Related-Party Transactions

We have a noncancelable operating lease for our primary operating facility from a partnership in which Richard N. Berman, our Chief Executive Officer, and Steven L. Berman, our Executive Vice President, are partners. Total rental payments in 2006 to the partnership under the lease arrangement were $1.3 million.

Critical Accounting Policies

Our discussion and analysis of our financial condition and results of operations are based upon the consolidated financial statements, which have been prepared in accordance with U.S. generally accepted accounting principles. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets and liabilities, the disclosure of contingent liabilities and the reported amounts of revenues and expenses. We regularly evaluate our estimates and judgments, including those related to revenue recognition, bad debts, customer credits, inventories, goodwill and income taxes. Estimates and judgments are based upon historical experience and on various other assumptions believed to be accurate and reasonable under the circumstances. Actual results may differ materially from these estimates under different assumptions or conditions. We believe the following critical accounting policies affect our more significant estimates and judgments used in the preparation of our consolidated financial statements:

Allowance for Doubtful Accounts. The preparation of our financial statements requires us to make estimates of the collectability of our accounts receivable. We specifically analyze accounts receivable and historical bad debts, customer creditworthiness, current economic trends and changes in customer payment patterns when evaluating the adequacy of the allowance for doubtful accounts. A significant percentage of our accounts receivable have been, and will continue to be, concentrated among a relatively small number of automotive retailers and warehouse distributors in the United States. Our five largest customers accounted for 73% and 77% of net accounts receivable as of December 30, 2006 and December 31, 2005, respectively. A bankruptcy or financial loss associated with a major customer could have a material adverse effect on our sales and operating results.

Revenue Recognition and Allowance for Customer Credits. Revenue is recognized from product sales when goods are shipped, title and risk of loss have been transferred to the customer and collection is reasonably assured. We record estimates for cash discounts, product returns and warranties, discounts and promotional rebates in the period of the sale ("Customer Credits"). The provision for Customer Credits is recorded as a reduction from gross sales and reserves for Customer Credits are shown as a reduction of accounts receivable. Amounts billed to customers for shipping and handling are included in net sales. Costs associated with shipping and handling are included in cost of goods sold. Actual Customer Credits have not differed materially from estimated amounts for each period presented.

Excess and Obsolete Inventory Reserves. We must make estimates of potential future excess and obsolete inventory costs. We provide reserves for discontinued and excess inventory based upon historical demand, forecasted usage, estimated customer requirements and product line updates. We maintain contact with our customer base in order to understand buying patterns, customer preferences and the life cycle of our products. Changes in customer requirements are factored into the reserves as needed.

Goodwill. We follow the provisions of SFAS No. 142, "Goodwill and Other Intangible Assets". We employ a discounted cash flow analysis and a market comparable approach in conducting our impairment tests. Cash flows were discounted at 12% and an earnings multiple of 5.6 to 5.85 times EBITDA was used when conducting these tests in 2006. As a result of the impairment test, we wrote-off all of the goodwill of our Swedish subsidiary (Scan-Tech). See Note 1 of the Notes to Consolidated Financial Statements in this report.

Income Taxes. We follow the liability method of accounting for deferred income taxes. Under this method, income tax expense is recognized for the amount of taxes payable or refundable for the current year and for the change in the deferred tax liabilities and assets for the future tax consequences of events that have been recognized in an entity's financial statements or tax returns. We must make assumptions, judgments and estimates to determine our current provision for income taxes and also our deferred tax assets and liabilities and any valuation allowance to be recorded against a deferred tax asset. Our judgments, assumptions and estimates relative to the current provision for income taxes takes into account current tax laws, our interpretation of current tax laws and possible outcomes of current and future audits conducted by tax authorities. Changes in tax laws or our interpretation of tax laws and the resolution of current and future tax audits could significantly impact the amounts provided for income taxes in our consolidated financial statements. Our assumptions, judgments and estimates relative to the value of a deferred tax asset takes into account predictions of the amount and category of future taxable income. Actual operating results and the underlying amount and category of income in future years could render our current assumptions, judgments and estimates of recoverable net deferred taxes inaccurate. Any of the assumptions, judgments and estimates mentioned above could cause our actual income tax obligations to differ from our estimates.

Recent Accounting Pronouncements

In September 2006, the SEC Office of the Chief Accountant and divisions of Corporation Finance and Investment Management released SAB No. 108, “Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements,” that provides interpretive guidance on how the effects of the carryover or reversal of prior year misstatements should be considered in quantifying a current year misstatement. The SEC staff believes that registrants should quantify errors using both a balance sheet and an income statement approach and evaluate whether either approach results in quantifying a misstatement that, when all relevant quantitative and qualitative factors are considered, is material. This pronouncement is effective for fiscal year 2006. This pronouncement had no effect on our Consolidated Financial Statements.

In September 2006, the Financial Accounting Standards Board (FASB) issued SFAS No. 157, “Fair Value Measurements.” SFAS No. 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. This statement applies under other accounting pronouncements that require or permit fair value measurements. Accordingly, SFAS No. 157 does not require any new fair value measurements. The provisions of SFAS No. 157 are to be applied prospectively and are effective for financial statements issued for fiscal years beginning after November 15, 2007. We are currently evaluating what effect, if any, adoption of SFAS No. 157 will have on the Company’s consolidated results of operations and financial position.

In June 2006, the FASB issued FIN 48, “Accounting for Uncertainty in Income Taxes - an interpretation of FASB Statement No. 109, Accounting for Income Taxes”, which clarifies the accounting for uncertainty in income taxes. FIN 48 prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. The Interpretation requires that the Company recognize in the financial statements, the impact of a tax position, if that position is more likely than not of being sustained on audit, based on the technical merits of the position. FIN 48 also provides guidance on derecognition, classification, interest and penalties, accounting in interim periods and disclosure. The provisions of FIN 48 are effective beginning January 1, 2007 with the cumulative effect of the change in accounting principle recorded as an adjustment to opening retained earnings. We have performed a preliminary assessment of the impact of adopting FIN 48, and do not believe that adoption of this pronouncement will have a material impact on the Company’s consolidated financial condition or results of operation.

Our market risk is the potential loss arising from adverse changes in interest rates. With the exception of our revolving credit facility, long-term debt obligations are at fixed interest rates and denominated in U.S. dollars. We manage our interest rate risk by monitoring trends in interest rates as a basis for determining whether to enter into fixed rate or variable rate agreements. Under the terms of our revolving credit facility and customer-sponsored programs to sell accounts receivable, a change in either the lender's base rate or LIBOR would affect the rate at which we could borrow funds under the revolving credit facility. We believe that the effect of any such change would be minimal.

Our financial statement schedules that are filed with this Report on Form 10-K are listed in Item 15(a)(2), Part IV, of this Report.

Report of Independent Registered Public Accounting Firm

The Board of Directors

Dorman Products, Inc.:

We have audited the accompanying consolidated balance sheets of Dorman Products, Inc. (formerly R&B, Inc.) and subsidiaries (the “Company”) as of December 30, 2006 and December 31, 2005, and the related consolidated statements of operations, shareholders’ equity and cash flows for each of the years in the three-year period ended December 30, 2006. In connection with our audits of the consolidated financial statements, we also have audited the financial statement schedule. These consolidated financial statements and financial statement schedule are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements and financial statement schedule based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Dorman Products, Inc. and subsidiaries as of December 30, 2006 and December 31, 2005, and the results of their operations and their cash flows for each of the years in the three-year period ended December 30, 2006, in conformity with U.S. generally accepted accounting principles. Also, in our opinion, the related financial statement schedule, when considered in relation to the basic consolidated financial statements taken as a whole, presents fairly, in all material respects, the information set forth therein.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the effectiveness of Dorman Products, Inc.’s internal control over financial reporting as of December 30, 2006, based on criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO), and our report dated March 7, 2007 expressed an unqualified opinion on management’s assessment of, and the effective operation of, internal control over financial reporting.

As discussed in Note 11 to the consolidated financial statements, effective January 1, 2006, the Company adopted the provisions of Statement of Financial Accounting Standards (SFAS) No. 123(R) Share-Based Payment, applying the modified prospective method.

KPMG LLP

Philadelphia, Pennsylvania

March 7, 2007

DORMAN PRODUCTS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

| | | For the Year Ended | |

| (in thousands, except per share data) | | December 30, 2006 | | December 31, 2005 | | December 25, 2004 | |

| | | | | | | | |

| Net Sales | | $ | 295,825 | | $ | 278,117 | | $ | 249,526 | |

| Cost of goods sold | | | 192,348 | | | 179,253 | | | 157,004 | |

| Gross profit | | | 103,477 | | | 98,864 | | | 92,522 | |

| Selling, general and administrative expenses | | | 73,810 | | | 69,088 | | | 62,884 | |

| Goodwill impairment | | | 2,897 | | | - | | | - | |

| Income from operations | | | 26,770 | | | 29,776 | | | 29,638 | |

| Interest expense, net | | | 2,267 | | | 2,615 | | | 2,853 | |

| Income before income taxes | | | 24,503 | | | 27,161 | | | 26,785 | |

| Income taxes | | | 10,704 | | | 10,084 | | | 9,704 | |

| Net Income | | $ | 13,799 | | $ | 17,077 | | $ | 17,081 | |

| Earnings Per Share: | | | | | | | | | | |

| Basic | | $ | 0.78 | | $ | 0.95 | | $ | 0.97 | |

| Diluted | | $ | 0.76 | | $ | 0.93 | | $ | 0.93 | |

| Weighted Average Shares Outstanding: | | | | | | | | | | |

| Basic | | | 17,722 | | | 17,914 | | | 17,690 | |

| Diluted | | | 18,139 | | | 18,437 | | | 18,368 | |

See accompanying notes to consolidated financial statements.

DORMAN PRODUCTS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| (in thousands, except share data) | | December 30, 2006 | | December 31, 2005 | |

| Assets | | | | | |

| Current Assets: | | | | | |

| Cash and cash equivalents | | $ | 5,080 | | $ | 2,944 | |

| Accounts receivable, less allowance for doubtful accounts and customer credits of $27,601 and $22,728 | | | 77,187 | | | 64,778 | |

| Inventories | | | 67,768 | | | 75,535 | |

| Deferred income taxes | | | 10,330 | | | 9,560 | |

| Prepaids and other current assets | | | 1,443 | | | 1,545 | |

| Total current assets | | | 161,808 | | | 154,362 | |

| Property, Plant and Equipment, net | | | 27,963 | | | 27,473 | |

| Goodwill | | | 26,958 | | | 29,617 | |

| Other Assets | | | 1,029 | | | 704 | |

| Total | | $ | 217,758 | | $ | 212,156 | |

| | | | | | | | |

| Liabilities and Shareholders' Equity | | | | | | | |

| Current Liabilities: | | | | | | | |

| Current portion of long-term debt | | $ | 8,651 | | $ | 8,571 | |

| Accounts payable | | | 12,822 | | | 14,739 | |

| Accrued compensation | | | 6,949 | | | 6,727 | |

| Other accrued liabilities | | | 6,582 | | | 8,513 | |

| Total current liabilities | | | 35,004 | | | 38,550 | |

| Other Long-Term Liabilities | | | - | | | 626 | |

| Long-Term Debt | | | 20,596 | | | 27,243 | |

| Deferred Income Taxes | | | 8,315 | | | 7,195 | |

| Commitments and Contingencies (Note 10) | | | | | | | |

| Shareholders' Equity: | | | | | | | |

| Common stock, par value $.01; authorized 25,000,000 shares; issued and outstanding 17,705,499 and 17,749,583 shares | | | 177 | | | 177 | |

| Additional paid-in capital | | | 32,956 | | | 33,138 | |

| Cumulative translation adjustments | | | 2,954 | | | 1,270 | |

| Retained earnings | | | 117,756 | | | 103,957 | |

| Total shareholders' equity | | | 153,843 | | | 138,542 | |

| Total | | $ | 217,758 | | $ | 212,156 | |

See accompanying notes to consolidated financial statements.

DORMAN PRODUCTS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY