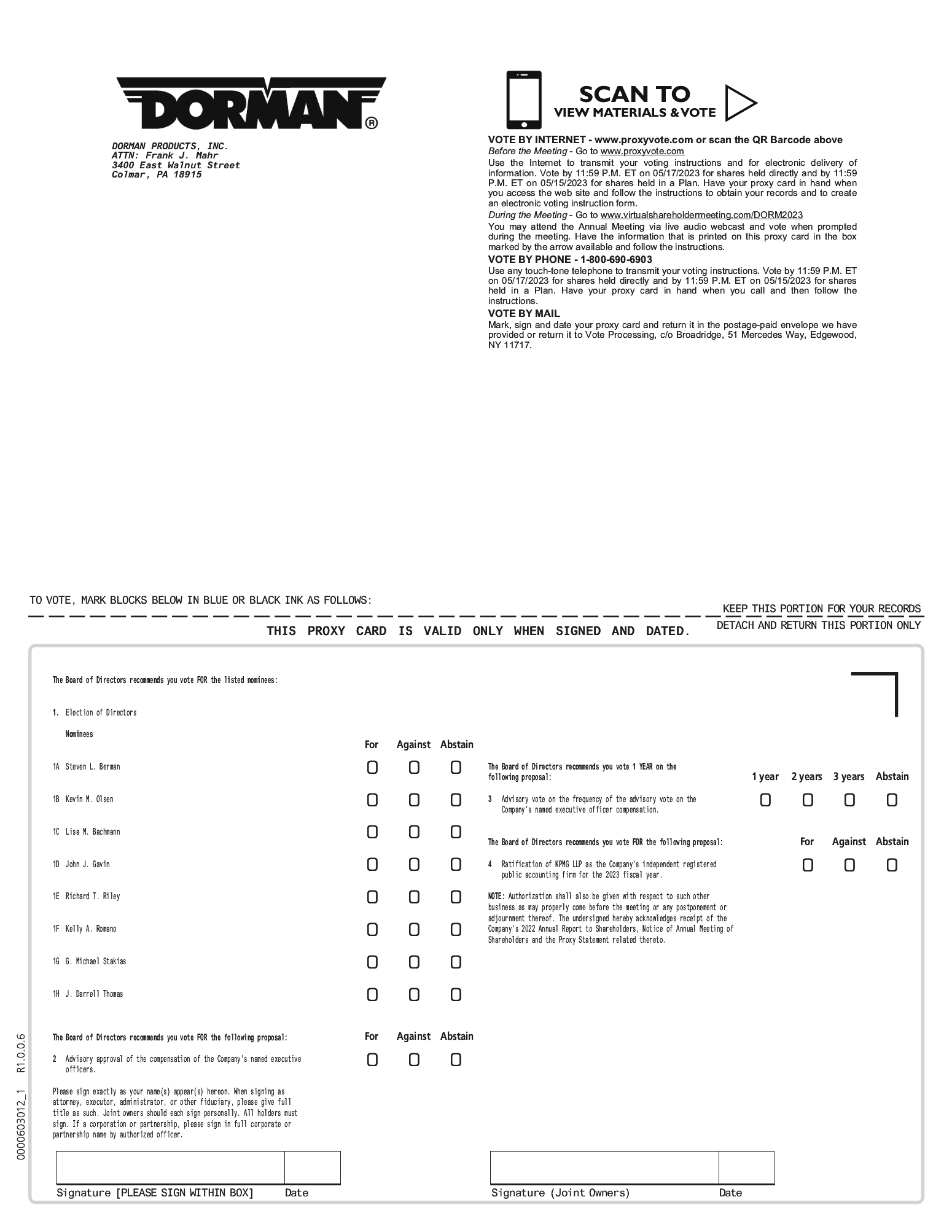

Proposal II: Advisory Approval of the Compensation of our Named Executive Officers

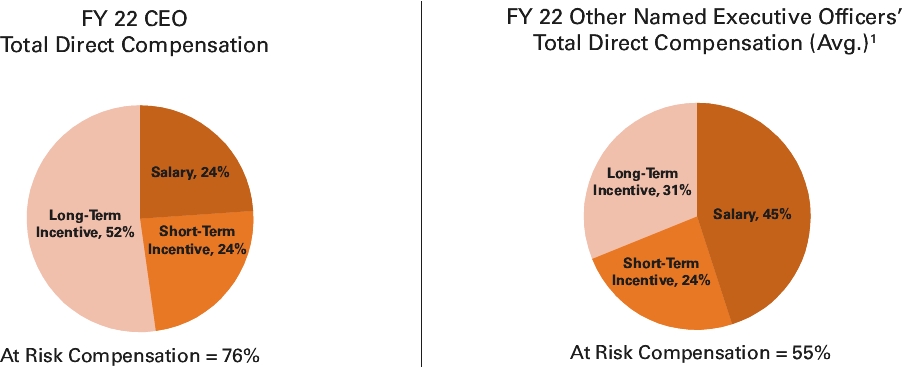

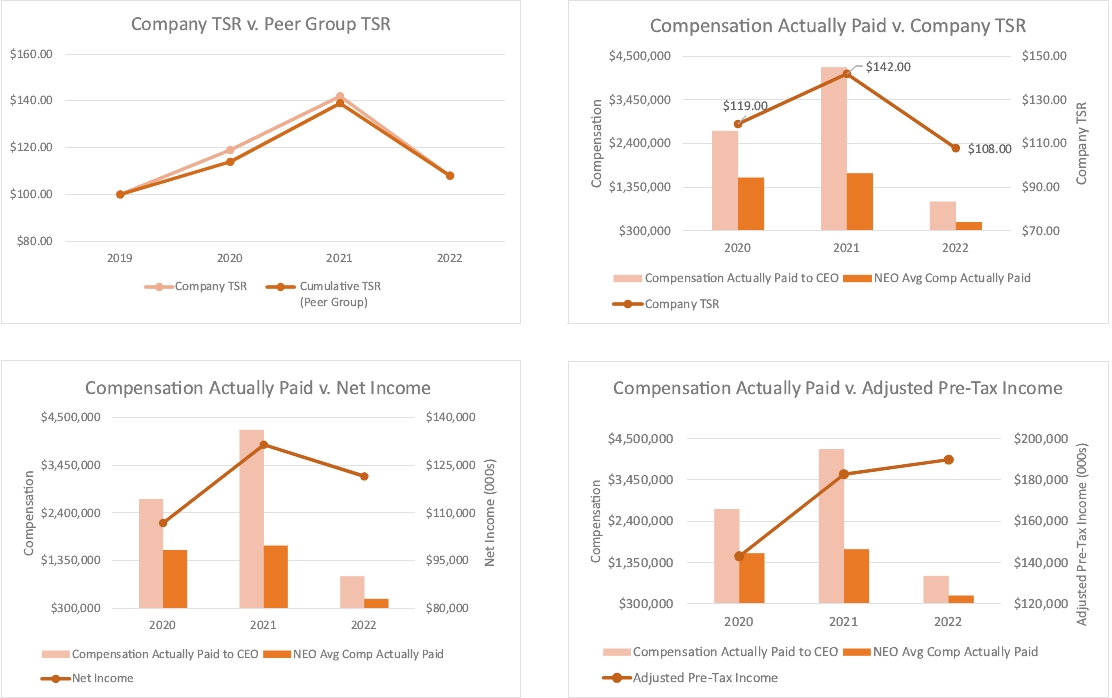

Our executive compensation program is designed to promote the successful implementation of our annual strategic plan as approved by the Board as well as long-term growth and profitability of the Company, which is intended to enhance shareholder value. Below is information to support the Board’s recommendation that shareholders approve on an advisory basis the compensation of the Company’s named executive officers for 2022.

Executive Compensation Highlights

Our executive compensation program is designed to help ensure that pay is aligned with our business objectives and the interests of our shareholders. Below are some of the key highlights of our executive compensation program.

| | ☑ | | | A majority of fiscal 2022 target compensation for named executive officers was variable and performance-based | | | ☑ | | | Robust stock ownership guidelines for executive officers | |

| | ☑ | | | Grants of performance-based restricted stock units that vest based on total shareholder return as compared to companies comprising the S&P Mid-Cap 400 Growth Index | | | ☑ | | | Clawback policy for executive officers covering both cash and equity incentive compensation | |

| | ☑ | | | Mix of diversified short- and long-term performance metrics to incentivize and reward the achievement of strategic objectives | | | ☑ | | | No tax gross-up provided under our Executive Severance Plan | |

| | ☑ | | | Caps on annual and certain long-term incentive programs | | | ☑ | | | No excessive perquisites for any of our executive officers | |

| | ☑ | | | Anti-hedging and anti-pledging policies applicable to executive officers and directors | | | | | | | |

2022 Financial and Operational Highlights

| | ■ | | | Net sales increased 29% to $1,733.7 million in fiscal 2022 from $1,345.2 million in fiscal 2021 | | | ■ | | | Opened a new distribution center in Whiteland, Indiana and invested in technology to automate certain of our other distribution facilities | |

| | ■ | | | Generated cash flows from operations of $42.2 million in fiscal 2022 | | | ■ | | | Acquired SuperATV, accelerating the Company’s specialty vehicle growth strategy | |

| | ■ | | | Diluted earnings per share of $3.85 for the twelve months ended December 31, 2022, a 7.0% decrease over the prior year | | | ■ | | | Successfully integrated the Dayton Parts business, expanding upon the Company’s commitment to the heavy-duty sector | |

For additional information, see “Executive Compensation: Compensation Discussion and Analysis.”

Proposal III: Advisory Approval of the Frequency of the Advisory Vote on Named Executive Officer Compensation

We are required to hold an advisory vote regarding the frequency of “say-on-pay” votes every six years. Our shareholders were most recently provided with the opportunity to vote on the frequency of “say-on-pay” votes in 2017. At that time, shareholders voted in favor of holding “say-on-pay” votes every year, and the Board adopted this standard.

The Board believes that an annual shareholder vote on the compensation paid to the Company’s named executive officers provides the Board with current information on shareholder sentiment about our executive compensation program and enables the Board to respond timely, when deemed appropriate, to shareholder concerns about that program. Accordingly, the Board recommends a vote of “one year” as the frequency with which shareholders are provided an advisory vote on the compensation of our named executive officers.

Proposal IV: Ratification of KMPG as our Independent Registered Public Accounting Firm for Fiscal 2023

KPMG was our independent registered public accounting firm for the fiscal year ended December 31, 2022. The Board recommends that shareholders ratify, on an advisory basis, the appointment of KPMG as our independent registered public accounting firm for the fiscal year ending December 31, 2023.