Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| (Mark one) | ||

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2008 | ||

OR | ||

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to | ||

Commission file number 0-52423

AECOM TECHNOLOGY CORPORATION

(Exact name of Registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) | 61-1088522 (I.R.S. Employer Identification No.) | |

555 South Flower Street, Suite 3700 Los Angeles, California 90071 (Address of principal executive offices, including zip code) | ||

(213) 593-8000 (Registrant's telephone number, including area code) | ||

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Exchange on Which Registered | |

|---|---|---|

| Common Stock, par value $0.01 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ý Yes o No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes ý No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filerý | Accelerated filero | Non-accelerated filero (Do not check if a smaller reporting company) | Smaller reporting companyo |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes ý No

The aggregate market value of registrant's common stock held by non-affiliates on March 31, 2008 (the last business day of the registrant's most recently completed second fiscal quarter), based upon the closing price of a share of the registrant's common stock on such date as reported on the New York Stock Exchange was approximately $1.97 billion.

Number of shares of the registrant's common stock outstanding as of November 17, 2008: 103,101,460

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates information by reference from the registrant's definitive proxy statement for the 2009 Annual Meeting of Stockholders, to be filed within 120 days of the registrant's fiscal 2008 year end.

| | | Page | ||

|---|---|---|---|---|

ITEM 1. | 1 | |||

ITEM 1A. | 12 | |||

ITEM 1B. | 18 | |||

ITEM 2. | 19 | |||

ITEM 3. | 19 | |||

ITEM 4. | 19 | |||

ITEM 5. | 20 | |||

ITEM 6. | 23 | |||

ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 24 | ||

ITEM 7A. | 44 | |||

ITEM 8. | 46 | |||

ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 94 | ||

ITEM 9A. | 94 | |||

ITEM 9B. | 95 | |||

ITEM 10. | 96 | |||

ITEM 11. | 96 | |||

ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 96 | ||

ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 96 | ||

ITEM 14. | 96 | |||

ITEM 15. | 96 |

i

In this report, we use the terms "AECOM," "the Company," "we," "us" and "our" to refer to AECOM Technology Corporation and its consolidated subsidiaries. Unless otherwise noted, references to years are for fiscal years. Our fiscal year consists of 52 or 53 weeks, ending on the Friday closest to September 30. For clarity of presentation, we present all periods as if the year ended on September 30. We refer to the fiscal year ended September 30, 2007 as "fiscal 2007" and the fiscal year ended September 30, 2008, as "fiscal 2008."

Overview

We are a leading global provider of professional technical and management support services for commercial and government clients around the world. We provide planning, consulting, architectural and engineering design, and program and construction management services for a broad range of projects, including highways, airports, bridges, mass transit systems, government and commercial buildings, water and wastewater facilities and power transmission and distribution. We also provide facilities management, training, logistics and other support services, primarily for agencies of the U.S. government.

Through our network of approximately 43,000 employees, we provide our services in a broad range of end markets, including the transportation, facilities, environmental, and energy markets. According to Engineering News-Record's (ENR) 2008 Design Survey, we are the largest general architectural and engineering design firm in the world, ranked by 2007 design revenue. In addition, we are ranked by ENR as the leading firm in a number of design end markets, including transportation and general building.

We were formed in 1980 as Ashland Technology Company, a Delaware corporation and a wholly owned subsidiary of Ashland, Inc., an oil and gas refining and distribution company. Since becoming independent of Ashland Inc., we have grown by a combination of organic growth and strategic mergers and acquisitions from approximately 3,300 employees and $387 million in revenue in fiscal 1991, the first full fiscal year of operations, to approximately 43,000 employees at September 30, 2008 and $5.2 billion in revenue for fiscal 2008. We completed the initial public offering of our common stock in May 2007 and such shares are traded on the New York Stock Exchange.

We offer our services through two business segments: Professional Technical Services and Management Support Services.

Professional Technical Services (PTS). Our PTS segment delivers planning, consulting, architectural and engineering design, and program and construction management services to commercial and government clients worldwide in major end markets such as transportation, facilities, environmental, and energy and power markets. For example, we are providing master planning services for the 2012 London Summer Olympic Games, program management services through a joint venture for the Second Avenue subway line in New York City, development management services to create the new Saadiyat Island Cultural District in Abu Dhabi and engineering and environmental management services to support global energy infrastructure development for a number of large petroleum companies. Our PTS segment contributed $4.3 billion, or 83% of our fiscal 2008 revenue.

Management Support Services (MSS). Our MSS segment provides program and facilities management and maintenance, training, logistics, consulting, technical assistance and systems integration services, primarily for agencies of the U.S. government. For example, we manage more than 8,000 personnel in Kuwait that provide logistics, security, communications and information technology services for the U.S. Army Central Command-Kuwait. We also provide operations and maintenance services for the U.S. Army's Fort Polk Joint Readiness Training Center in Louisiana. Our MSS segment contributed $867 million, or 17% of our fiscal 2008 revenue.

1

Our Business Strategy

Our business strategy focuses on leveraging our competitive strengths and leadership positions in our core markets while opportunistically entering new markets and geographies. Key elements of our strategy include:

Expand our long-standing client relationships and provide our clients with a broad range of services

We have long-standing relationships with a number of large corporations, public and private institutions and governmental agencies worldwide. We will continue to focus on client satisfaction along with opportunities to sell a greater range of services to clients and deliver full-service solutions for their needs. For example, as our environmental business has grown, we have provided environmental services for transportation and other infrastructure projects where such services have in the past been subcontracted to third parties.

By integrating and providing a broad range of services, we believe we deliver maximum value to our clients at competitive costs. Also, by coordinating and consolidating our knowledge base, we believe we have the ability to export our leading edge technical skills to any region in the world in which our clients may need them.

Capitalize on opportunities in our core markets

We intend to leverage our leading positions in the transportation, facilities, environmental and energy and power markets to continue to expand our services and revenue. We believe that the need for infrastructure upgrades, environmental management and government outsourcing of support services, among other things, will result in continued growth opportunities in our core markets. With our track record and our global resources, we believe we are well positioned to compete for projects in these markets.

Continue to pursue our acquisition strategy

We intend to continue to attract other successful companies whose growth can be enhanced by joining us. This approach has served us well as we have strengthened and diversified our leadership positions geographically, technically and across end markets. We believe that the trend towards consolidation in our industry will continue to produce candidates that align with our acquisition strategy. For example, we increased our global presence, particularly in the Americas, United Kingdom and Australia, with the addition of Earth Tech, Inc. (Earth Tech) in July 2008. For additional information regarding our acquisition of Earth Tech, see Note 3 to our consolidated financial statements.

Strengthen and support human capital

Our experienced employees and management are our most valuable resources. Attracting and retaining key personnel has been and will remain critical to our success. We will continue to focus on providing our personnel with training and other personal and professional growth opportunities, performance-based incentives, opportunities for stock ownership and other competitive benefits in order to strengthen and support our human capital base. We believe that our employee programs align the interests of our personnel with those of our clients and stockholders.

2

Our Business Segments

The following table sets forth the revenue attributable to our business segments for the periods indicated(1):

| | Year Ended September 30, (in thousands) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | 2008 | 2007 | 2006 | |||||||

Professional Technical Services (PTS) | $ | 4,327,671 | $ | 3,418,683 | $ | 2,774,304 | ||||

Management Support Services (MSS) | 866,811 | 818,587 | 647,188 | |||||||

Total | $ | 5,194,482 | $ | 4,237,270 | $ | 3,421,492 | ||||

- (1)

- For additional financial information by segment, see Note 21 to the notes to our consolidated financial statements.

Our Professional Technical Services Segment (PTS)

Our PTS segment is comprised of a broad array of services, generally provided on a fee-for-service basis. These services include planning, architecture and engineering, design, consulting, program management and construction management for industrial, commercial, institutional and government clients worldwide. For each of these services, our technical expertise includes civil, structural, process, mechanical, geotechnical systems and electrical engineering, architecture, landscape and interior design, urban and regional planning, project economics, and environmental, health and safety work.

With our technical and management expertise, we are able to provide our clients with a broad spectrum of services. For example, within our environmental management service offerings, we provide regulatory compliance planning and management, environmental modeling, environmental impact assessment and environmental permitting for major capital/infrastructure projects.

Our services may be sequenced over multiple phases. For example, in the area of program management and construction management services, these services may begin with a small consulting or planning contract, and may later develop into an overall management role for the project or a series of projects, which we refer to as a program. Program and construction management contracts typically employ a staff of 10 to more than 100 and, in many cases, operate as an outsourcing arrangement with our staff located at the project site. For example, since 1990, we have been managing the renovation work at the Pentagon for the U.S. Department of Defense. Another example of our program and construction management services would be our services related to the development of educational facilities for K-12 school districts and/or community colleges throughout the United States, including the cities of Dallas, Los Angeles and Houston.

We provide the services in our PTS segment both directly and through joint ventures or similar partner arrangements to the following key end markets:

Transportation. We serve several key transportation sectors, including:

- •

- Transit and Rail. Projects include light rail, heavy rail (including high speed, commuter and freight) and multimodal transit projects. For example, we have provided engineering design services for the new World Trade Center Terminal for PATH and the Second Avenue Subway (8.5-mile rail route and 16 stations) in New York City, and the Ma On Shan Rail (7-mile elevated railway) in Hong Kong.

- •

- Marine, Ports and Harbors. Projects include wharf facilities and container port facilities for private and public port operators. For example, we have provided marine design and engineering services for container facilities in Hong Kong, the Ports of Los Angeles, Long Beach, New York and New

3

- •

- Highways, Bridges and Tunnels. Projects include interstate, primary and secondary urban and rural highway systems and bridge projects. For example, we have provided engineering services for the SH-130 Toll Road (49-mile "greenfield" highway project) in Austin, Texas, the Sydney Orbital Bypass (39 kilometer highway) in Sydney, Australia and the Sutong cable-stayed bridge (1088 meter span) crossing the Yangtze River in China.

- •

- Aviation. Projects include landside terminal and airside facilities and runways as well as taxiways. For example, we have provided program management services to a number of major U.S. airports, including O'Hare International in Chicago; Los Angeles International; John F. Kennedy and La Guardia in New York City; Reagan National and Dulles International in Washington, D.C.; and Miami International. We also have provided services to airports in Hong Kong, London, Cyprus and Qatar.

- •

- Government. Projects include our emergency response services for the Department of Homeland Security, including the Federal Emergency Management Agency and engineering and program management services for agencies of the Department of Defense. We also provide architectural and engineering services for several national laboratories, including the laboratories at Hanford, Washington and Los Alamos, New Mexico.

- •

- Industrial. Projects include industrial facilities for a variety of niche end markets including manufacturing, distribution, aviation, aerospace, communications, media, pharmaceuticals, renewable energy, chemical, and food and beverage facilities.

- •

- Urban Master Planning/Design. Projects include design services, landscape architecture, general policy consulting and environmental planning projects for a variety of government, institutional and private sector clients. For example, we have provided planning and consulting services for the Olympic Games sites in Atlanta, Sydney, Beijing, Salt Lake City and London. We are providing strategic planning and master planning services for new cities and major mixed use developments in China, Southeast Asia, the Middle East, the United Kingdom and the United States.

- •

- Commercial and Leisure Facilities. Projects include corporate headquarters, high-rise office towers, historic buildings, leisure and entertainment facilities and corporate campuses. For example, we provided electronic security programming and installation services for the renovation of Soldier Field in Chicago, construction management for the renovation of Dodger Stadium in Los Angeles, and building services, engineering, architectural lighting, advanced modeling, infrastructure and utilities engineering and advanced security for the headquarters of the British Broadcasting Company in London.

- •

- Institutional. Projects include engineering services for college and university campuses, including the new Kennedy-King College in Chicago, Illinois. We also have undertaken assignments for Oxford University in the United Kingdom, Pomona College and Loyola Marymount University in California, and various private hospitals throughout the U.S.

- •

- Water and Wastewater. Projects include treatment facilities as well as supply, distribution and collection systems, stormwater management, desalinization, and other water re-use technologies for metropolitan governments. We have provided services to the Metropolitan Water Reclamation District of Greater Chicago's Calumet and Stickney wastewater treatment plants, two of the largest such plants in the world. Currently we are working with New York City on the Bowery Bay facility

Jersey, the new $7 billion Doha Port project in Qatar and waterfront transshipment facilities for oil and liquid natural gas.

Facilities.

Environmental

4

- •

- Environmental Management. Projects include remediation, waste handling, testing and monitoring of environmental conditions and environmental construction management for private sector clients. For example, we have provided environmental remediation, restoration of damaged wetlands, and services associated with reduction of greenhouse gas emissions for large multinational corporations.

- •

- Water Resources. Projects include regional-scale floodplain mapping and analysis for public agencies, along with the analysis and development of protected groundwater resources for companies in the bottled water industry.

- •

- Demand Side Management. Projects include energy efficient systems for public K-12 schools and universities, health care facilities, and courthouses and other public buildings, as well as energy conservation systems for utilities.

- •

- Transmission and Distribution. Projects include power stations and electric transmissions and distribution and co-generation systems, including enhanced electrical power generation in Stung Treng, Cambodia. These projects utilize a wide range of services that include consulting, forecasting and surveying to detailed engineering design and construction management.

- •

- Alternative/Renewable Energy. Projects include production facilities such as ethanol plants, wind farms and micro hydropower and geothermal subsections of regional power grids. We typically provide engineering, procurement and construction management and related services.

- •

- Hydropower/Dams. Projects include hydroelectric power stations, dams, spillways, and flood control systems including the Song Ba Ha Hydropower Project in Vietnam, the Pine Brook Dam in Boulder County, Colorado and the Peribonka Hydroelectric Power Plant in Quebec, Canada.

- •

- Environmental Management. Projects include remediation, testing and monitoring of environmental conditions and environmental construction management for private sector clients in the energy and power industry. For example, we have provided permitting services for pipeline projects for major energy companies.

reconstruction, and have had a major role in Hong Kong's Harbor Area Treatment Scheme for Victoria Harbor.

Energy/Power

Our Management Support Services Segment (MSS)

Through our MSS segment, we offer program and facilities management and maintenance, training, logistics, consulting, technical assistance and systems integration services, primarily for agencies of the U.S. government.

We provide a wide array of services in our MSS segment, both directly and through joint ventures or similar partner arrangements, including:

Installation, Operations and Maintenance. Projects include Department of Defense and Department of Energy installations where we provide comprehensive services for the operation and maintenance of complex government installations, including military bases, test ranges and equipment. We have undertaken assignments in this category in the Middle East and the United States. We also provide services for the operations and maintenance of the Department of Energy's Nevada Test Site.

Logistics and Field Services. Projects include logistics support services for a number of Department of Defense agencies and defense prime contractors focused on developing and managing integrated supply and distribution networks. We oversee warehousing, packaging, delivery and traffic management for the distribution of government equipment and materials.

5

Training. Projects include training applications in live, virtual and simulation training environments. We have conducted training at the U.S. Army's Center for Security Training in Maryland for law enforcement and military personnel. We have also supported the training of international police officers and peacekeepers for deployment in various locations around the world in the areas of maintaining electronics and communications equipment.

Systems Support. Projects cover a diverse set of operational and support systems for the maintenance, operation and modernization of Department of Defense and Department of Energy installations. Our services in this area range from information technology and communications to life cycle optimization and engineering, including environmental management services. Through our joint venture operations at the Nevada Test Site and the Combat Support Services operation in Kuwait, our teams are responsible for facility and infrastructure support for critical missions of the U.S. government in its nonproliferation efforts, emergency response readiness, and force support and sustainment. Enterprise network operations and information systems support, including remote location engineering and operation in classified environments, are also specialized services we provide.

Technical Personnel Placement. Projects include the placement of personnel in key functional areas of military and other government agencies, as these entities continue to outsource critical services to commercial entities. We provide systems, processes and personnel in support of the Department of Justice's management of forfeited assets recovered by law enforcement agencies. We also support the Department of State in its enforcement programs by recruiting, training and supporting police officers for international and homeland security missions.

Field Services. Projects include maintaining, modifying and overhauling ground vehicles, armored carriers and associated support equipment both within and outside of the United States under contracts with the Department of Defense. We also maintain and repair telecommunications systems for military and civilian entities.

Our Clients

Our clients consist primarily of national, state, regional and local governments, public and private institutions and major corporations. The following table sets forth our total revenue attributable to these categories of clients for each of the periods indicated:

| | Year Ended September 30, (dollars in thousands) | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2008 | % | 2007 | % | 2006 | % | ||||||||||||||

U.S. Federal Government | ||||||||||||||||||||

PTS | $ | 329,333 | 6 | % | $ | 279,530 | 7 | % | $ | 319,675 | 9 | % | ||||||||

MSS | 866,811 | 17 | % | 818,587 | 19 | % | 641,764 | 19 | % | |||||||||||

U.S. State and Local Governments | 1,051,234 | 20 | % | 949,870 | 22 | % | 848,530 | 25 | % | |||||||||||

Non-U.S. Governments | 1,085,686 | 21 | % | 556,893 | 13 | % | 355,835 | 10 | % | |||||||||||

Subtotal Governments | 3,333,064 | 64 | % | 2,604,880 | 61 | % | 2,165,804 | 63 | % | |||||||||||

Private Entities (worldwide) | 1,861,418 | 36 | % | 1,632,390 | 39 | % | 1,255,688 | 37 | % | |||||||||||

Total | $ | 5,194,482 | 100 | % | $ | 4,237,270 | 100 | % | $ | 3,421,492 | 100 | % | ||||||||

Other than the U.S. government, no single client accounted for 10% or more of our revenue in any of the past five fiscal years. Approximately 23%, 26% and 28% of the Company's revenue was derived through direct contracts with agencies of the U.S. federal government in the years ended September 30, 2008, 2007 and 2006, respectively. One of these contracts accounted for approximately 10%, 13% and 10% of the Company's revenue in the years ended September 30, 2008, 2007 and 2006 respectively. The work

6

attributed to the U.S. federal government includes our work for the Department of Defense, Department of Energy and the Department of Homeland Security.

Contracts

The price provisions of the contracts we undertake can be grouped into two broad categories: cost-reimbursable contracts and fixed-price contracts. The majority of our contracts fall under the category of cost-reimbursable contracts, which we believe are generally less subject to loss than fixed-price contracts. As detailed below, our fixed-price contracts relate primarily to design and construction management contracts where we do not self-perform or take the risk of construction.

Cost-Reimbursable Contracts

Cost-reimbursable contracts consist of two similar contract types, cost-plus and time and material.

Cost-Plus. Cost-plus is the predominant contracting method used by U.S. federal, state and local governments. These contracts provide for reimbursement of actual costs and overhead incurred by us, plus a predetermined fee. Under some cost-plus contracts, our fee may be based on quality, schedule and other performance factors.

Time and Material. Time and material is common for smaller scale engineering and consulting services. Under these types of contracts, we negotiate hourly billing rates and charge our clients based upon actual hours expended on a project. Unlike cost-plus contracts, however, there is no predetermined fee. In addition, any direct project expenditures are passed through to the client and are reimbursed. These contracts may have a fixed-price element in the form of not-to-exceed or guaranteed maximum price provisions.

For fiscal 2008 and 2007, cost-reimbursable contracts represented approximately 63% and 62%, respectively, of our total revenue, consisting of cost-plus contracts and time and material contracts as follows:

| | Year Ended September 30, | |||||||

|---|---|---|---|---|---|---|---|---|

| | 2008 | 2007 | ||||||

Cost-plus contracts | 30 | % | 35 | % | ||||

Time and materials contracts | 33 | 27 | ||||||

Total | 63 | % | 62 | % | ||||

Fixed-Price Contracts

Fixed-price contracts are the predominant contracting method outside of the United States. There are typically two types of fixed-price contracts. The first and more common type, lump-sum, involves performing all of the work under the contract for a specified lump-sum fee. Lump-sum contracts are typically subject to price adjustments if the scope of the project changes or unforeseen conditions arise. The second type, fixed-unit price, involves performing an estimated number of units of work at an agreed price per unit, with the total payment under the contract determined by the actual number of units delivered.

Many of our fixed-price contracts are negotiated and arise in the design of projects with a specified scope. Fixed-price contracts often arise in the areas of construction management and design-build services. Construction management services can be in the form of general administrative oversight (in which we do not assume responsibility for construction means and methods and which is on a cost-reimbursable basis), or on a fixed price, "at risk" basis. Under our design-build projects, we are typically responsible for the

7

design of a facility with the fixed contract price negotiated after we have had the opportunity to secure specific bids from various subcontractors and to add a contingency and fee.

We typically attempt to mitigate the risks of fixed-price design-build contracts by contracting to complete the projects based on our design as opposed to a third party's design, by not self-performing any construction, by not guaranteeing new or untested processes or technologies and by working only with experienced subcontractors with sufficient bonding capacity. When public agencies seek a design-build approach for major infrastructure projects, we generally act as a fixed-price design subcontractor to the general construction contractor and do not assume overall project or construction risk.

Some of our fixed-price contracts require us to provide performance bonds or parent company guarantees to assure our clients that their project will be completed in accordance with the terms of the contracts. In such cases, we typically require our primary subcontractors to provide similar bonds and guarantees or be adequately insured, and we pass the terms and conditions set forth in our agreement on to our subcontractors.

For fiscal 2008 and 2007, fixed-price contracts represented approximately 37% of our total revenue. Less than 10% of our revenue was generated from contracts where we have exposure to construction cost overruns. There may be risks associated with completing these projects' profitably if we are not able to perform our professional services for the amount of the fixed fee. However, we attempt to mitigate these risks as described above.

Joint Ventures

Some of our larger contracts may operate under joint ventures or other arrangements under which we team with other reputable companies, typically companies with which we have worked for many years. This is often done where the scale of the project dictates such an arrangement or when we want to strengthen either our market position or our technical skills.

Backlog

Our contracted backlog includes revenue we expect to record in the future from signed contracts, and in the case of a public client, where the project has been funded. Our awarded backlog includes revenue we expect to record in the future where we have been awarded the work, but the contractual agreement has not yet been completed. For non-government contracts, our backlog includes future revenue at contract rates, excluding contract renewals or extensions that are at the discretion of the client. For contracts with a not-to-exceed maximum amount, we include revenue from such contracts in backlog to the extent of the remaining estimated amount. We calculate backlog without regard to possible project reductions or expansions or potential cancellations until such changes or cancellations occur.

Backlog is expressed in terms of gross revenue and therefore may include significant estimated amounts of third party, or pass-through costs to subcontractors and other parties. Moreover, our backlog for the period beyond 12 months may be subject to variations from year to year as existing contracts are completed, delayed or renewed or new contracts are awarded, delayed or cancelled. As a result, we believe that year-to-year comparisons of the portion of backlog expected to be performed more than one year in the future are difficult to interpret and not necessarily indicative of future revenue or profitability. Because backlog is not a defined accounting term, our computation of backlog may not necessarily be comparable to that of our peers. No assurance can be given that we will ultimately realize our full backlog.

8

The following summarizes contracted and awarded backlog excluding backlog related to businesses which we intend to divest, as discussed in Notes 4 and 10 to the Consolidated Financial Statements (in billions):

| | September 30, | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| | 2008 | 2007 | |||||||

Contracted backlog: | |||||||||

PTS segment | $ | 4.2 | $ | 2.6 | |||||

MSS segment | 0.6 | 0.4 | |||||||

Total contracted backlog | $ | 4.8 | $ | 3.0 | |||||

Awarded backlog: | |||||||||

PTS segment | $ | 3.5 | $ | 2.2 | |||||

MSS segment | 0.3 | 0.8 | |||||||

Total awarded backlog | $ | 3.8 | $ | 3.0 | |||||

Total backlog: | |||||||||

PTS segment | $ | 7.7 | $ | 4.8 | |||||

MSS segment | 0.9 | 1.2 | |||||||

Total backlog | $ | 8.6 | $ | 6.0 | |||||

Competition

The professional technical and management support services markets we serve are highly fragmented and we compete with a large number of regional, national and international companies. Certain of these competitors have greater financial and other resources than we do. Others are smaller and more specialized, and concentrate their resources in particular areas of expertise. The extent of our competition varies according to the particular markets and geographic area. The degree and type of competition we face is also influenced by the type and scope of a particular project. Our clients make competitive determinations based upon experience, reputation and ability to provide the relevant services in a timely, safe and cost-efficient manner.

Seasonality

The fourth quarter of our fiscal year (July 1 to September 30) is typically our strongest quarter. The U.S. federal government tends to authorize more work during the period preceding the end of its fiscal year, September 30. In addition, many U.S. state governments with fiscal years ending on June 30 tend to accelerate spending during the fiscal first quarter when new funding budgets become available. Within the United States, as well as other parts of the world, we generally benefit from milder weather conditions in our fiscal fourth quarter, which allows for more productivity from our field inspection and other on-site civil services. Our construction and project management services also typically expand during the high construction season of the summer months. The first quarter of our fiscal year (October 1 to December 31) is typically our weakest quarter. The harsher weather conditions impact our ability to complete work in parts of North America and the holiday season schedule affects our productivity during this period.

Insurance and Risk Management

We maintain insurance covering professional liability and claims involving bodily injury and property damage. We consider our present limits of coverage, deductibles, and reserves to be adequate. Wherever possible, we endeavor to eliminate or reduce the risk of loss on a project through the use of quality assurance/control, risk management, workplace safety and similar methods. A majority of our operating subsidiaries are quality certified under ISO 9001:2000 or an equivalent standard, and we plan to continue

9

to obtain certification where applicable. ISO 9001:2000 refers to international quality standards developed by the International Organization for Standardization, or ISO.

Risk management is an integral part of our project management approach for fixed-price contracts and our project execution process. We have a risk management group that reviews and oversees the risk profile of our operations. This group also participates in evaluating risk through internal risk analyses in which our corporate management reviews higher-risk projects, contracts or other business decisions that require corporate approval.

Regulation

We are regulated in a number of fields in which we operate. In the United States, we deal with numerous U.S. government agencies and entities, including branches of the U.S. military, the Department of Defense, the Department of Energy, intelligence agencies and the Nuclear Regulatory Commission. When working with these and other U.S. government agencies and entities, we must comply with laws and regulations relating to the formation, administration and performance of contracts. These laws and regulations, among other things:

- •

- require certification and disclosure of all cost or pricing data in connection with various contract negotiations;

- •

- impose procurement regulations that define allowable and unallowable costs and otherwise govern our right to reimbursement under various cost-based U.S. government contracts; and

- •

- restrict the use and dissemination of information classified for national security purposes and the exportation of certain products and technical data.

Internationally, we are subject to various government laws and regulations (including the U.S. Foreign Corrupt Practices Act, Proceeds of Crime Act and other similar non-U.S. laws and regulations), local government regulations and procurement policies and practices and varying currency, political and economic risks.

To help ensure compliance with these laws and regulations, all of our employees are required to complete tailored ethics and other compliance training relevant to their position and our operations.

Personnel

Our principal asset is our employees. A large percentage of our employees have technical and professional backgrounds and undergraduate and/or advanced degrees. We believe that we attract and retain talented employees by offering them the opportunity to work on highly visible and technically challenging projects in a stable work environment. The tables below identify our personnel by segment and geographic region.

Personnel by Segment

| | As of September 30, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | 2008 | 2007 | 2006 | |||||||

Professional Technical Services | 33,700 | 22,700 | 18,700 | |||||||

Management Support Services | 9,000 | 9,000 | 8,300 | |||||||

Corporate | 300 | 300 | 300 | |||||||

Total | 43,000 | 32,000 | 27,300 | |||||||

10

Personnel by Geographic Region

| | As of September 30, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | 2008 | 2007 | 2006 | |||||||

Americas | 20,000 | 12,500 | 10,400 | |||||||

Europe | 4,100 | 3,400 | 3,100 | |||||||

Middle East | 11,100 | 10,000 | 8,800 | |||||||

Asia/Pacific | 7,800 | 6,100 | 5,000 | |||||||

Total | 43,000 | 32,000 | 27,300 | |||||||

Personnel by Segment and Geographic Region

| | As of September 30, 2008 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | PTS | MSS | Total | |||||||

Americas | 18,800 | 900 | 19,700 | |||||||

Europe | 4,100 | — | 4,100 | |||||||

Middle East | 3,000 | 8,100 | 11,100 | |||||||

Asia/Pacific | 7,800 | — | 7,800 | |||||||

Total | 33,700 | 9,000 | 42,700 | |||||||

We have a number of personnel with "Top Secret" or "Q" security clearances. Some of our contracts with the U.S. government relate to projects that have elements that are classified for national security reasons. Although most of our contracts are not themselves classified, persons with high security clearances are often required to perform portions of the contracts.

A portion of our employees are employed on a project-by-project basis to meet our contractual obligations, generally in connection with government projects in our MSS segment. We believe our employee relations are good.

Geographic Information

For geographic information, please refer to Note 21 to the notes to our consolidated financial statements found elsewhere in this Form 10-K.

Available Information

The reports we file with the Securities and Exchange Commission, including annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and proxy materials, are available free of charge on our website atwww.aecom.com. You may read and copy any materials filed with the SEC at the SEC's Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information about the public reference room. The SEC also maintains a web site (www.sec.gov) containing reports, proxy, and other information that we file with the SEC. Our Corporate Governance Guidelines and our Code of Ethics are available on our website atwww.aecom.com under the "Investors" section. Copies of the information identified above may be obtained without charge from us by writing to AECOM Technology Corporation, 555 South Flower Street, Suite 3700, Los Angeles, California 90071, Attention: Corporate Secretary.

11

The Company operates in a changing environment that involves numerous known and unknown risks and uncertainties that could materially adversely affect our operations. The risks described below highlight some of the factors that have affected, and in the future could affect our operations. Additional risks we do not yet know of or that we currently think are immaterial may also affect our business operations. If any of the events or circumstances described in the following risks actually occur, our business, financial condition or results of operations could be materially adversely affected.

We depend on long-term government contracts, some of which are only funded on an annual basis. If appropriations for funding are not made in subsequent years of a multiple-year contract, we may not be able to realize all of our anticipated revenue and profits from that project.

A substantial majority of our revenue is derived from contracts with agencies and departments of national, state and local governments. During fiscal 2008, 2007 and 2006, approximately 64%, 61% and 63%, respectively, of our revenue was derived from contracts with government entities.

Most government contracts are subject to the government's budgetary approval process. Legislatures typically appropriate funds for a given program on a year-by-year basis, even though contract performance may take more than one year. As a result, at the beginning of a program, the related contract is only partially funded, and additional funding is normally committed only as appropriations are made in each subsequent fiscal year. These appropriations, and the timing of payment of appropriated amounts, may be influenced by, among other things, the state of the economy, competing priorities for appropriation, changes in administration or control of legislatures and the timing and amount of tax receipts and the overall level of government expenditures. If appropriations are not made in subsequent years on our government contracts, then we will not realize all of our potential revenue and profit from that contract.

For instance, a significant portion of historical funding for state and local transportation projects has come from the U.S. federal government through its "SAFETEA-LU" infrastructure funding program and predecessor programs. This $286 billion program covers federal fiscal years 2004-2009. Approximately 79% of the SAFETEA-LU funding is for highway programs, 18.5% is for transit programs and 2.5% is for other programs such as motor carrier safety, national highway traffic safety and research. A key uncertainty in the outlook for federal transportation funding in the United States is the future viability of the Highway Trust Fund, which has experienced shortfalls due to a decrease in the federal gas tax receipts that fund it. In September 2008, the President signed HR 6532, a bill to amend the Internal Revenue Code to restore the Highway Trust Fund balance, transferring funds from the general Treasury to the Highway Trust Fund to provide for the funding of authorized federal transportation priorities through the end of fiscal year 2009. This raises concerns about the future funding structure for federal highway programs, particularly after SAFETEA-LU expires on September 30, 2009.

Governmental agencies may modify, curtail or terminate our contracts at any time prior to their completion and, if we do not replace them, we may suffer a decline in revenue.

Most government contracts may be modified, curtailed or terminated by the government either at its convenience or upon the default of the contractor. If the government terminates a contract at its convenience, then we typically are able to recover only costs incurred or committed, settlement expenses and profit on work completed prior to termination, which could prevent us from recognizing all of our potential revenue and profits from that contract. If the government terminates the contract due to our default, we could be liable for excess costs incurred by the government in obtaining services from another source.

12

A delay in the completion of the budget process of government agencies could delay procurement of our services and have an adverse effect on our future revenue.

In years when the U.S. government does not complete its budget process before the end of its fiscal year on September 30, government operations are typically funded pursuant to a "continuing resolution" that authorizes agencies of the U.S. government to continue to operate, but does not authorize new spending initiatives. When the U.S. government operates under a continuing resolution, government agencies may delay the procurement of services, which could reduce our future revenue. Delays in the budgetary processes of states or other jurisdictions may similarly have adverse effects on our future revenue.

Demand for our services is cyclical and may be vulnerable to sudden economic downturns and reductions in government and private industry spending. If the economy weakens, our revenue and profitability could be adversely affected.

Demand for our services is cyclical and may be vulnerable to sudden economic downturns and reductions in government and private industry spending, which may result in clients delaying, curtailing or canceling proposed and existing projects. Due to the recent economic downturn in the U.S. and international markets and severe tightening of the global credit markets, some of our clients may face considerable budget shortfalls that may limit their overall demand for our services. In addition, our clients may find it more difficult to raise capital in the future to fund their projects due to uncertainty in the municipal and general credit markets. Also, the global demand for commodities has increased raw material costs, which will cause our clients' projects to increase in overall cost and may result in the more rapid depletion of the funds that are available to our clients to spend on projects.

Because of an overall weakening economy, our clients may demand more favorable pricing terms while their ability to pay our invoices or to pay them in a timely manner may be adversely affected. Our government clients may face budget deficits that prohibit them from funding proposed and existing projects. If the economy continues to weaken and/or government spending is reduced, our revenue and profitability could be adversely affected.

Our contracts with governmental agencies are subject to audit, which could result in adjustments to reimbursable contract costs or, if we are charged with wrongdoing, possible temporary or permanent suspension from participating in government programs.

Our books and records are subject to audit by the various governmental agencies we serve and their representatives. These audits can result in adjustments to the amount of contract costs we believe are reimbursable by the agencies and the amount of our overhead costs allocated to the agencies. In addition, if one of our subsidiaries is charged with wrongdoing as a result of an audit, that subsidiary, and possibly our company as a whole, could be temporarily suspended or could be prohibited from bidding on and receiving future government contracts for a period of time. Furthermore, as a government contractor, we are subject to an increased risk of investigations, criminal prosecution, civil fraud, whistleblower lawsuits and other legal actions and liabilities to which purely private sector companies are not, the results of which could harm our business.

Our business and operating results could be adversely affected by losses under fixed-price contracts.

Fixed-price contracts require us to either perform all work under the contract for a specified lump-sum or to perform an estimated number of units of work at an agreed price per unit, with the total payment determined by the actual number of units performed. In fiscal 2008, approximately 37% of our revenue was recognized under fixed-price contracts. Fixed-price contracts are the predominant method of contracting outside of the United States and our exposure to fixed-price contracts will likely increase as we increase the non-U.S. portions of our business. Fixed-price contracts expose us to a number of risks not

13

inherent in cost-plus and time and material contracts, including underestimation of costs, ambiguities in specifications, unforeseen costs or difficulties, problems with new technologies, delays beyond our control, failures of subcontractors to perform and economic or other changes that may occur during the contract period. Losses under fixed- price contracts could be substantial and harm our results of operations.

We conduct a portion of our operations through joint venture entities, over which we may have limited control.

Approximately 21% of our fiscal 2008 revenue was derived from our operations through joint ventures or similar partnership arrangements, where control may be shared with unaffiliated third parties. As with most joint venture arrangements, differences in views among the joint venture participants may result in delayed decisions or disputes. We also cannot control the actions of our joint venture partners, and we typically have joint and several liability with our joint venture partners under the applicable contracts for joint venture projects. These factors could potentially harm the business and operations of a joint venture and, in turn, our business and operations.

Operating through joint ventures in which we are minority holders results in us having limited control over many decisions made with respect to projects and internal controls relating to projects. Approximately 7% of our fiscal 2008 revenue was derived from our unconsolidated joint ventures where we generally do not have control of the joint venture. These joint ventures may not be subject to the same requirements regarding internal controls and internal control over financial reporting that we follow. As a result, internal control problems may arise with respect to these joint ventures, which could have a material adverse effect on our financial condition and results of operations.

Misconduct by our employees or consultants or our failure to comply with laws or regulations applicable to our business could cause us to lose customers or lose our ability to contract with government agencies.

As a government contractor, misconduct, fraud or other improper activities caused by our employees' or consultants' failure to comply with laws or regulations could have a significant negative impact on our business and reputation. Such misconduct could include the failure to comply with federal procurement regulations, regulations regarding the protection of classified information, legislation regarding the pricing of labor and other costs in government contracts, regulations on lobbying or similar activities, and other applicable laws or regulations. Our failure to comply with applicable laws or regulations, misconduct by any of our employees or consultants or our failure to make timely and accurate certifications to government agencies regarding misconduct or potential misconduct could subject us to fines and penalties, loss of security clearance, cancellation of contracts and suspension or debarment from contracting with government agencies, any of which may adversely affect our business.

Our defined benefit plans have significant deficits that could grow in the future and cause us to incur additional costs.

We have defined benefit pension plans for employees in the United States, United Kingdom and Australia. At September 30, 2008, our defined benefit pension plans had an aggregate deficit (the excess of projected benefit obligations over the fair value of plan assets) of approximately $116.3 million. In the future, our pension deficits may increase or decrease depending on changes in the levels of interest rates, pension plan performance and other factors. If we are forced or elect to make up all or a portion of the deficit for unfunded benefit plans, our profits could be materially and adversely affected.

14

Our operations worldwide expose us to legal, political and economic risks in different countries as well as currency exchange rate fluctuations that could harm our business and financial results.

During fiscal 2008, revenue attributable to our services provided outside of the United States was approximately 54% of our total revenue. There are risks inherent in doing business internationally, including:

- •

- imposition of governmental controls and changes in laws, regulations or policies;

- •

- political and economic instability;

- •

- civil unrest, acts of terrorism, force majeure, war, or other armed conflict;

- •

- changes in U.S. and other national government trade policies affecting the markets for our services;

- •

- changes in regulatory practices, tariffs and taxes;

- •

- potential non-compliance with a wide variety of laws and regulations, including the U.S. Foreign Corrupt Practice Act, export control and anti-boycott laws and similar non-U.S. laws and regulations;

- •

- changes in labor conditions;

- •

- logistical and communication challenges; and

- •

- currency exchange rate fluctuations, devaluations and other conversion restrictions.

Any of these factors could have a material adverse effect on our business, results of operations or financial condition.

We work in international locations where there are high security risks, which could result in harm to our employees and contractors or material costs to us.

Some of our services are performed in high-risk locations, such as Iraq and Afghanistan, where the country or location is suffering from political, social or economic problems, or war or civil unrest. In those locations where we have employees or operations, we may incur material costs to maintain the safety of our personnel. Despite these precautions, the safety of our personnel in these locations may continue to be at risk. Acts of terrorism and threats of armed conflicts in or around various areas in which we operate could limit or disrupt markets and our operations, including disruptions resulting from the evacuation of personnel, cancellation of contracts, or the loss of key employees and contractors or assets.

Failure to successfully execute our acquisition strategy may inhibit our growth.

We have grown in part as a result of our acquisitions over the last several years, and we expect continued growth in the form of additional acquisitions and expansion into new markets. We cannot assure you that suitable acquisitions or investment opportunities will continue to be identified or that any of these transactions can be consummated on favorable terms or at all. Any future acquisitions will involve various inherent risks, such as:

- •

- our ability to accurately assess the value, strengths, weaknesses, liabilities and potential profitability of acquisition candidates;

- •

- the potential loss of key personnel of an acquired business;

- •

- increased burdens on our staff and on our administrative, internal control and operating systems, which may hinder our legal and regulatory compliance activities;

- •

- post-acquisition integration challenges; and

15

- •

- post-acquisition deterioration in an acquired business that could result in goodwill impairment charges.

Furthermore, during the acquisition process and thereafter, our management may need to assume significant transaction-related responsibilities, which may cause them to divert their attention from our existing operations. For example, our management and other personnel have been, and will continue to be, required to devote considerable amounts of time away from other business activities to focus on the integration of Earth Tech, which we acquired in July 2008, and its employees into our business operations. If our management is unable to successfully integrate acquired companies or implement our growth strategy, our operating results could be harmed. Moreover, we cannot assure you that we will continue to successfully expand or that growth or expansion will result in profitability.

Our ability to grow and to compete in our industry will be harmed if we do not retain the continued services of our key technical and management personnel and identify, hire and retain additional qualified personnel.

There is strong competition for qualified technical and management personnel in the sectors in which we compete. We may not be able to continue to attract and retain qualified technical and management personnel, such as engineers, architects and project managers, who are necessary for the development of our business or to replace qualified personnel. Our planned growth may place increased demands on our resources and will likely require the addition of technical and management personnel and the development of additional expertise by existing personnel. Also, some of our personnel hold security clearances required to obtain government projects; if we were to lose some or all of these personnel, they would be difficult to replace. Loss of the services of, or failure to recruit, key technical and management personnel could limit our ability to complete existing projects successfully and to compete for new projects.

Our revenue and growth prospects may be harmed if we or our employees are unable to obtain the security clearances or other qualifications we and they need to perform services for our customers.

A number of government programs require contractors to have security clearances. Depending on the level of required clearance, security clearances can be difficult and time-consuming to obtain. If we or our employees are unable to obtain or retain necessary security clearances, we may not be able to win new business, and our existing customers could terminate their contracts with us or decide not to renew them. To the extent we cannot obtain or maintain the required security clearances for our employees working on a particular contract, we may not derive the revenue or profit anticipated from such contract.

Our industry is highly competitive and we may be unable to compete effectively, which could result in reduced revenue, profitability and market share.

We are engaged in a highly competitive business. The extent of competition varies with the types of services provided and the locations of the projects. Generally, we compete on the bases of technical and management capability, personnel qualifications and availability, geographic presence, experience and price. Increased competition may result in our inability to win bids for future projects and loss of revenue, profitability and market share.

Our services expose us to significant risks of liability and our insurance policies may not provide adequate coverage.

Our services involve significant risks of professional and other liabilities that may substantially exceed the fees that we derive from our services. In addition, we sometimes contractually assume liability under indemnification agreements. We cannot predict the magnitude of potential liabilities from the operation of our business.

Our professional liability policies cover only claims made during the term of the policy. Additionally, our insurance policies may not protect us against potential liability due to various exclusions in the policies

16

and self-insured retention amounts. Partially or completely uninsured claims, if successful and of significant magnitude, could have a material adverse affect on our business.

Our backlog of uncompleted projects under contract is subject to unexpected adjustments and cancellations and thus, may not accurately reflect future revenue and profits.

At September 30, 2008, our contracted backlog was approximately $4.8 billion and our awarded backlog was approximately $3.8 billion for a total backlog of $8.6 billion. Our contracted backlog includes revenue we expect to record in the future from signed contracts, and in the case of a public client, where the project has been funded. Our awarded backlog includes revenue we expect to record in the future where we have been awarded the work, but the contractual agreement has not yet been completed. We cannot guarantee that future revenue will be realized from either category of backlog or, if realized, will result in profits. Many projects may remain in our backlog for an extended period of time because of the size or long-term nature of the contract. In addition, from time to time projects are delayed, scaled back or cancelled. These types of backlog reductions adversely affect the revenue and profits that we ultimately receive from contracts reflected in our backlog.

We have submitted claims to clients for work we performed beyond the scope of some of our contracts. If these clients do not approve these claims, our results of operations could be adversely impacted.

We typically have pending claims submitted under some of our contracts for payment of work performed beyond the initial contractual requirements for which we have already recorded revenue. In general, we cannot guarantee that such claims will be approved in whole, in part, or at all. If these claims are not approved, our revenue may be reduced in future periods.

In conducting our business, we depend on other contractors and subcontractors. If these parties fail to satisfy their obligations to us or other parties, or if we are unable to maintain these relationships, our revenue, profitability and growth prospects could be adversely affected.

We depend on contractors and subcontractors in conducting our business. There is a risk that we may have disputes with our subcontractors arising from, among other things, the quality and timeliness of work performed by the subcontractor, customer concerns about the subcontractor, or our failure to extend existing task orders or issue new task orders under a subcontract. In addition, if any of our subcontractors fail to deliver on a timely basis the agreed-upon supplies and/or perform the agreed-upon services, our ability to fulfill our obligations as a prime contractor may be jeopardized.

We also rely on relationships with other contractors when we act as their subcontractor or joint venture partner. Our future revenue and growth prospects could be adversely affected if other contractors eliminate or reduce their subcontracts or joint venture relationships with us, or if a government agency terminates or reduces these other contractors' programs, does not award them new contracts or refuses to pay under a contract.

Our quarterly operating results may fluctuate significantly.

Our quarterly revenue, expenses and operating results may fluctuate significantly because of a number of factors, including:

- •

- the spending cycle of our public sector clients;

- •

- employee hiring and utilization rates;

- •

- the number and significance of client engagements commenced and completed during a quarter;

- •

- the ability of clients to terminate engagements without penalties;

- •

- the ability of our project managers to accurately estimate the percentage of the project completed;

17

- •

- delays incurred as a result of weather conditions;

- •

- delays incurred in connection with an engagement;

- •

- the size and scope of engagements;

- •

- the timing and magnitude of expenses incurred for, or savings realized from, corporate initiatives;

- •

- the impairment of goodwill or other intangible assets; and

- •

- general economic and political conditions.

Variations in any of these factors could cause significant fluctuations in our operating results from quarter to quarter.

Systems and information technology interruption could adversely impact our ability to operate.

We rely heavily on computer, information and communications technology and related systems in order to properly operate. From time to time, we experience occasional system interruptions and delays. If we are unable to continually add software and hardware, effectively upgrade our systems and network infrastructure and take other steps to improve the efficiency of and protect our systems, systems operation could be interrupted or delayed. In addition, our computer and communications systems and operations could be damaged or interrupted by natural disasters, telecommunications failures, acts of war or terrorism, computer viruses, physical or electronic security breaches and similar events or disruptions. Any of these or other events could cause system interruption, delays and loss of critical data, or delay or prevent operations, and adversely affect our operating results.

Our charter documents contain provisions that may delay, defer or prevent a change of control.

Provisions of our certificate of incorporation and bylaws could make it more difficult for a third party to acquire control of us, even if the change in control would be beneficial to stockholders. These provisions include the following:

- •

- division of our Board of Directors into three classes, with each class serving a staggered three-year term;

- •

- removal of directors for cause only;

- •

- ability of our Board of Directors to authorize the issuance of preferred stock in series without stockholder approval;

- •

- two-thirds stockholder vote requirement to approve specified business combinations, which include a sale of substantially all of our assets;

- •

- vesting of exclusive authority in our Board of Directors to determine the size of the board (subject to limited exceptions) and to fill vacancies;

- •

- advance notice requirements for stockholder proposals and nominations for election to our Board of Directors; and

- •

- prohibitions on our stockholders from acting by written consent and limitations on calling special meetings.

We do not expect to pay any cash dividends for the foreseeable future.

We do not anticipate paying any cash dividends to our stockholders for the foreseeable future. Our credit facilities also restrict our ability to pay dividends. Accordingly, you may have to sell some or all of your common stock in order to generate cash flow from your investment. You may not receive a gain on your investment when you sell our common stock and may lose some or all of the amount of your

18

investment. Any determination to pay dividends in the future will be made at the discretion of our board of directors and will depend on our results of operations, financial conditions, contractual restrictions, restrictions imposed by applicable law and other factors our board of directors deems relevant.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

Our corporate offices are located in approximately 121,000 square feet of space at 555 and 515 South Flower Street, Los Angeles, California. Our other offices consist of an aggregate of approximately 6.4 million square feet worldwide. We also maintain smaller administrative or project offices. Virtually all of our offices are leased. See Note 14 of the notes to our consolidated financial statements for information regarding our lease obligations. We believe our current properties are adequate for our business operations and are not currently underutilized. We may add additional facilities from time to time in the future as the need arises.

As a government contractor, we are subject to various laws and regulations that are more restrictive than those applicable to non-government contractors. Intense government scrutiny of contractors' compliance with those laws and regulations through audits and investigations is inherent in government contracting, and, from time to time, we receive inquiries, subpoenas, and similar demands related to our ongoing business with government entities. Violations can result in civil or criminal liability as well as suspension or debarment from eligibility for awards of new government contracts or option renewals.

We are involved in various investigations, claims and lawsuits in the normal conduct of our business. Although the outcome of our legal proceedings cannot be predicted with certainty and no assurances can be provided, in the opinion of our management, based upon current information and discussions with counsel, none of the investigations, claims and lawsuits in which we are involved is expected to have a material adverse effect on our consolidated financial position, results of operations, cash flows or our ability to conduct business. From time to time we establish reserves for litigation when we consider it probable that a loss will occur and the loss is estimable.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None.

19

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF SECURITIES

Our common stock is listed on the New York Stock Exchange (NYSE). According to the records of our transfer agent, there were 1,422 stockholders of record as of November 17, 2008. The following table sets forth the low and high closing sales prices of a share of our common stock during each of the fiscal quarters presented, based upon quotations on the NYSE consolidated reporting system:

| | Low Sales Price ($) | High Sales Price ($) | ||||||

|---|---|---|---|---|---|---|---|---|

Fiscal 2008: | ||||||||

First quarter | 26.47 | 37.25 | ||||||

Second quarter | 23.01 | 29.95 | ||||||

Third quarter | 25.31 | 34.13 | ||||||

Fourth quarter | 19.79 | 33.18 | ||||||

| | Low Sales Price ($) | High Sales Price ($) | ||||||

|---|---|---|---|---|---|---|---|---|

Fiscal 2007: | ||||||||

Third quarter(1) | 21.00 | 26.00 | ||||||

Fourth quarter | 24.40 | 35.94 | ||||||

- (1)

- The low and high sales price reported for this quarter only reflects the range of prices for the period beginning May 10, 2007 through June 30, 2007 as our first day of trading of our common stock on the NYSE was May 10, 2007.

Our policy is to use cash flow from operations to fund future growth and pay down debt. Accordingly, we have not paid a cash dividend since our inception and we currently have no plans to pay cash dividends in the foreseeable future. Additionally, our term credit agreement and revolving credit facility restrict our ability to pay cash dividends.

20

The following table presents certain information about our equity compensation plans as of September 30, 2008:

| | Column A | Column B | Column C | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants, and rights | Weighted-average exercise price of outstanding options, warrants, and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in Column A) | ||||||||

Equity compensation plans not approved by stockholders: | N/A | N/A | N/A | ||||||||

Equity compensation plans approved by stockholders: | |||||||||||

AECOM Technology Corporation 2006 Stock Incentive Plan | 1,059,082 | $ | 21.04 | 14,010,062 | |||||||

AECOM Technology Corporation Stock Incentive Plan | 425,600 | $ | 5.47 | 0 | |||||||

AECOM Technology Corporation 2000 Stock Incentive Plan | 3,581,713 | $ | 9.88 | 0 | |||||||

AECOM Technology Corporation Stock Incentive Plan for Non-Employee Directors | 172,350 | $ | 9.87 | 0 | |||||||

AECOM Technology Corporation Equity Incentive Plan | N/A | N/A | 4,189,556 | ||||||||

AECOM Technology Corporation 2006 Stock Incentive Plan for Non-Employee Directors | 70,000 | $ | 12.54 | 0 | |||||||

AECOM Technology Corporation Global Stock Program(1) | N/A | N/A | 27,493,678 | ||||||||

Total | 5,308,745 | $ | 11.78 | 45,693,296 | |||||||

- (1)

- The AECOM Technology Corporation Global Stock Program consists of our plans in Australia, Canada, Hong Kong, New Zealand, Singapore, United Arab Emirates/Qatar, and United Kingdom; and for the United States, the Retirement & Savings Plan, Deferred Compensation Plan and Equity Investment Plan.

During the three-month period ended September 30, 2008, we have issued the following securities that were not registered under the Securities Act:

On September 30, 2008, 0.727 shares of our Class C preferred stock to U.S. Trust for the benefit of our employee stockholders under our Deferred Compensation Plan.

We issued the securities identified in the paragraph above to our directors, officers, employees and consultants under written compensatory benefit plans in reliance upon Rule 701 under the Securities Act and/or Section 4(2) of the Securities Act as transactions by an issuer not involving any public offering.

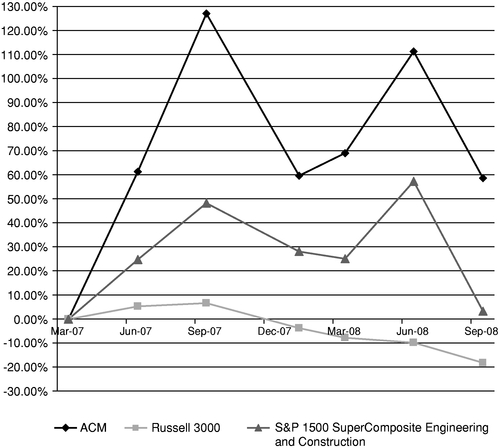

Performance Measurement Comparison(1)

The following chart compares the percentage change of AECOM stock with that of the Russell 3000 and the S&P 1500 SuperComposite Engineering and Construction indices from March 31, 2007 to September 30, 2008. We believe the Russell 3000 Index is an appropriate independent broad market index, since it measures the performance of companies in numerous sectors with small and large market capitalizations. In addition, we believe the S&P 1500 SuperComposite Engineering and Construction Index is an appropriate published industry index since it measures the performance of engineering and construction companies.

21

Comparison of Percentage Change

March 1, 2007—September 30, 2008

End-of-Month Prices

| | Mar. 31, 2007 | June 30, 2007 | Sept. 30, 2007 | Dec. 31, 2007 | Mar. 31, 2008 | June 30, 2008 | Sept. 30, 2008 | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

AECOM(2) | 15.40 | 24.81 | 34.93 | 28.57 | 26.01 | 32.53 | 24.44 | |||||||||||||||

Russell 3000 | 829.05 | 873.19 | 882.79 | 849.22 | 764.63 | 748.10 | 678.50 | |||||||||||||||

S&P 1500 Super Composite Engineering and Construction | 141.40 | 176.08 | 209.65 | 215.20 | 176.98 | 222.13 | 145.96 | |||||||||||||||

- (1)

- This section is not "soliciting material," is not deemed "filed" with the SEC and is not incorporated by reference in any of our filings under the Securities Act or Exchange Act whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

- (2)

- AECOM stock was registered under Section 12(g) of the Exchange Act but not freely traded from March 29, 2007, through May 9, 2007. Its valuation during that time was performed by an independent, third-party appraiser. The end-of-month price as of March 31, 2007 reflects the 2-for-1 stock split effected in the form of a 100% stock dividend effective May 4, 2007. Our common stock began trading on the NYSE on May 10, 2007.

22

ITEM 6. SELECTED FINANCIAL DATA

SELECTED CONSOLIDATED FINANCIAL DATA

You should read the following selected consolidated financial data along with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and the accompanying notes, which are included in this Form 10-K. We derived the selected consolidated financial data from our audited consolidated financial statements.

| | Year Ended September 30, | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2008 | 2007 | 2006 | 2005 | 2004 | ||||||||||||

| | (in millions, except share data) | ||||||||||||||||

Consolidated Statement of Income Data: | |||||||||||||||||

Revenue | $ | 5,194 | $ | 4,237 | $ | 3,421 | $ | 2,395 | $ | 2,012 | |||||||

Cost of revenue(1) | 4,907 | 4,039 | 3,278 | 2,278 | 1,907 | ||||||||||||

Gross profit | 287 | 198 | 143 | 117 | 105 | ||||||||||||

Equity in earnings of joint ventures | 22 | 12 | 6 | 2 | 3 | ||||||||||||

General and administrative expenses(1) | 70 | 54 | 46 | 21 | 21 | ||||||||||||

Income from operations | 239 | 156 | 103 | 98 | 87 | ||||||||||||

Minority interest share of earnings | 14 | 16 | 14 | 8 | 3 | ||||||||||||

Gain on the sale of equity investment | — | 11 | — | — | — | ||||||||||||

Other expense | (3 | ) | — | — | — | — | |||||||||||

Interest income (expense)—net | 1 | (3 | ) | (10 | ) | (7 | ) | (8 | ) | ||||||||

Income before income tax expense | 223 | 148 | 79 | 83 | 76 | ||||||||||||