Exhibit 99.2

Accelerating Our Value Creation Strategy SAVANNAH RIVER SITE United States Operating the largest radioactive waste vitrification, or gasification, plant in the world and reducing the largest environmental risk in South Carolina.

Disclosures Forward-Looking Statements All statements in this communication other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws, including any projections of earnings, revenue, cost savings, profitability, cash flows, tax rates, interest expense, or other financial items, any statements of the plans, strategies and objectives for future operations, profitability, strategic value creation, risk profile and investment strategies, any statements regarding future economic conditions or performance and any statements with respect to the proposed sale of the Management Services segment, the expected financial and operational results of AECOM, and expectations regarding AECOM’s business or organization after the proposed transaction. Although we believe that the expectations reflected in our forward-looking statements are reasonable, actual results could differ materially from those projected or assumed in any of our forward-looking statements. Important factors that could cause our actual results, performance and achievements, or industry results to differ materially from estimates or projections contained in our forward-looking statements include, but are not limited to, the following: our business is cyclical and vulnerable to economic downturns and client spending reductions; long-term government contracts and subject to uncertainties related to government contract appropriations; government shutdowns; governmental agencies may modify, curtail or terminate our contracts; government contracts are subject to audits and adjustments of contractual terms; losses under fixed-price contracts; limited control over operations run through our joint venture entities; liability for misconduct by our employees or consultants; failure to comply with laws or regulations applicable to our business; maintaining adequate surety and financial capacity; high leverage and potential inability to service our debt and guarantees; exposure to Brexit; exposure to political and economic risks in different countries; currency exchange rate fluctuations; retaining and recruiting key technical and management personnel; legal claims; inadequate insurance coverage; environmental law compliance and adequate nuclear indemnification; unexpected adjustments and cancellations related to our backlog; partners and third parties who may fail to satisfy their legal obligations; AECOM Capital real estate development projects; managing pension cost; cybersecurity issues, IT outages and data privacy; uncertainties as to the timing of the consummation of the proposed transaction or whether it will be completed; risks associated with the impact or terms of the potential transaction; risks associated with the benefits and costs of the proposed transaction, including the risk that the expected benefits of the proposed transaction or any contingent purchase price will not be realized within the expected time frame, in full or at all, and the risk that conditions to the potential transaction will not be satisfied and/or that the potential transaction will not be completed within the expected time frame, on the expected terms or at all; the risk that any consents or regulatory or other approvals required in connection with the proposed transaction will not be received or obtained within the expected time frame, on the expected terms or at all; the risk that the financing intended to fund the proposed transaction may not be obtained; the risk that costs of restructuring transactions and other costs incurred in connection with the proposed transaction will exceed our estimates or otherwise adversely affect our business or operations; and the impact of the proposed transaction on our businesses and the risk that consummating the proposed transaction may be more difficult, time-consuming or costly than expected, including the impact on our resources, systems, procedures and controls, diversion of management’s attention and the impact on relationships with customers, governmental authorities, suppliers, employees and other business counterparties; as well as other additional risks and factors that could cause actual results to differ materially from our forward-looking statements set forth in our reports filed with the Securities and Exchange Commission. There can be no assurance that the proposed transaction will in fact be completed in the manner described or at all. Any forward-looking statements are made as of the date hereof. We do not intend, and undertake no obligation, to update any forward-looking statement. Non-GAAP Measures This document contains financial information calculated other than in accordance with U.S. generally accepted accounting principles (“GAAP”). The Company believes that non-GAAP financial measures such as adjusted EPS, adjusted EBITDA, adjusted operating income and free cash flow provide a meaningful perspective on its business results as the Company utilizes this information to evaluate and manage the business. We use adjusted EBITDA, adjusted EPS, adjusted net/operating income, adjusted tax rate and adjusted interest expense to exclude the impact of non-operating items, such as amortization expense, taxes, acquisition and integration expenses, and non-core operating losses to aid investors in better understanding our core performance results. We use free cash flow to represent the cash generated after capital expenditures to maintain our business. We present constant currency information, such as organic revenue, to help assess how our underlying businesses performed excluding the effect of foreign currency rate fluctuations to aid investors in better understanding our international operational performance. Our non-GAAP disclosure has limitations as an analytical tool, should not be viewed as a substitute for financial information determined in accordance with GAAP, and should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP, nor is it necessarily comparable to non-GAAP performance measures that may be presented by other companies. When we provide our long term projections for organic revenue growth, adjusted EBITDA, adjusted operating margin and free cash flow on a forward-looking basis, the closest corresponding GAAP measure and a reconciliation of the differences between the non-GAAP expectation and the corresponding GAAP measure generally is not available without unreasonable effort due to the length, high variability, complexity and low visibility associated with the non-GAAP expectation projected against the multi-year forecast which could significantly impact the GAAP measure. Page 1

Michael S. Burke Chairman Chief Executive Officer GORDIE HOWE INTERNATIONAL BRIDGE United States / Canada Connecting Windsor, Canada and Detroit, Michigan via a 2.5 kilometer bridge that when completed will be the longest cable-stayed bridge on the continent.

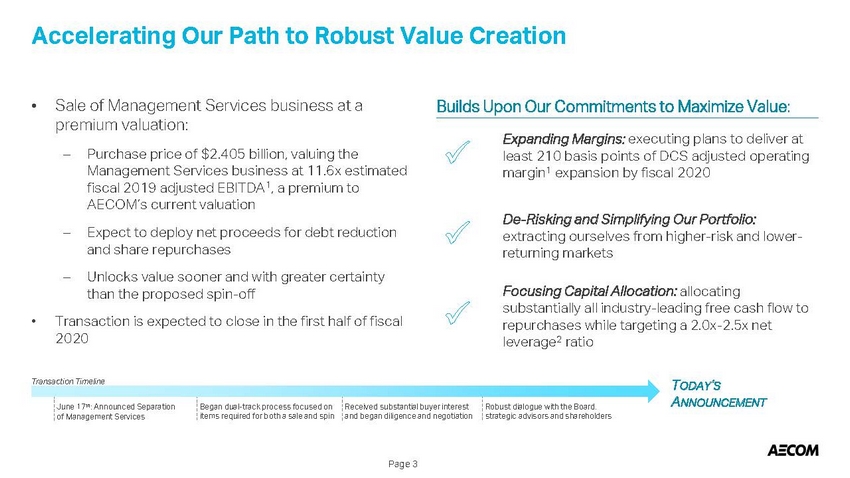

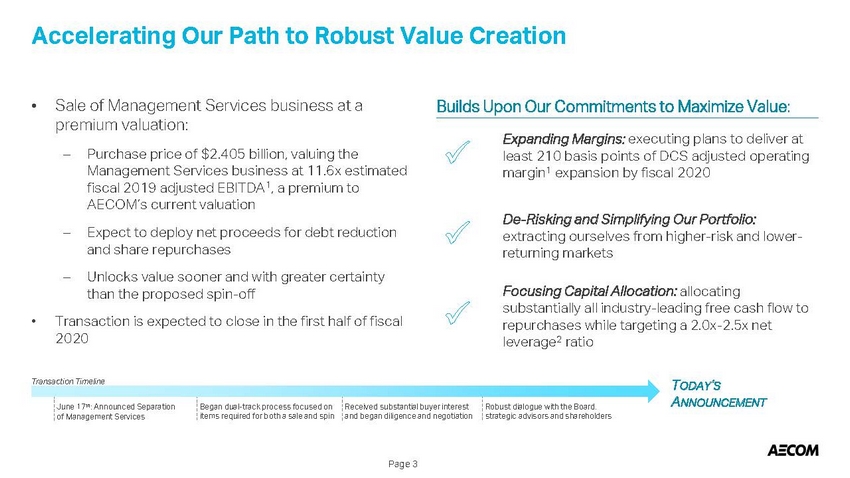

Accelerating Our Path to Robust Value Creation • Sale of Management Services business at a premium valuation: Builds Upon Our Commitments to Maximize Value: Expanding Margins: executing plans to deliver at least 210 basis points of DCS adjusted operating margin1 expansion by fiscal 2020 – Purchase price of $2.405 billion, valuing the Management Services business at 11.6x estimated fiscal 2019 adjusted EBITDA1, a premium to AECOM’s current valuation Expect to deploy net proceeds for debt reduction and share repurchases Unlocks value sooner and with greater certainty than the proposed spin-off De-Risking and Simplifying Our Portfolio: extracting ourselves from higher-risk and lower-returning markets – – Focusing Capital Allocation: allocating substantially all industry-leading free cash flow to repurchases while targeting a 2.0x-2.5x net leverage2 ratio • Transaction is expected to close in the first half of fiscal 2020 Transaction Timeline TODAY’S ANNOUNCEMENT June 17th: Announced Separation of Management Services Began dual-track process focused on items required for both a sale and spin Received substantial buyer interest and began diligence and negotiation Robust dialogue with the Board, strategic advisors and shareholders Page 3

Transforming Our Balance Sheet and Leverage Profile Total Proceeds Expected from the Announced Transaction and Expected Q4’19 Free Cash Flow3 • The sale of the Management Services segment is expected to generate net proceeds of $2.35 billion • Following the anticipated close, proceeds will be deployed towards debt reduction and share repurchases while maintaining a net leverage2 target of 2.0x - 2.5x Total Proceeds and Expected Q4’19 Free Cash Flow as a Percentage of AECOM’s Market Capitalization as of Market Close on 10/11/19 • Share repurchases remain the highest priority use of available cash to capitalize on the implied discounted valuation in our professional services business Company’s Long-Term Net Leverage Target, Creating Capital Allocation Flexibility 2 Page 4

Today’s Announcement Furthers Our Commitment to Value Creation • • Successfully extracting ourselves from riskier and lower-returning geographies and markets Continued execution on our plan to exit more than 30 countries and will continue our review of how best to optimize our geographic footprint Goal of exiting nearly all hard-bid at-risk construction exposure, no longer pursuing international at-risk construction projects, and achieving our end-state goal of nearly zero self perform construction • • Delivered 100 bps of adjusted operating margin1 improvement in the DCS segment through the first three quarters of fiscal 2019 Expect to achieve an at least 8% adjusted operating margin1 in fiscal 2020 in the DCS segment, which is an at least 210 basis points improvement from fiscal 2018, and which translates to approximately 11.5% margins on a net service revenue basis • • Current areas of focus include increased penetration of best-cost global shared services and design centers Page 5 EVALUATING FURTHER MARGIN IMPROVEMENT OPPORTUNITIES DRIVING SUBSTANTIAL MARGIN IMPROVEMENT HONING OUR FOCUS AND DE-RISKING OUR BUSINESS PORTFOLIO

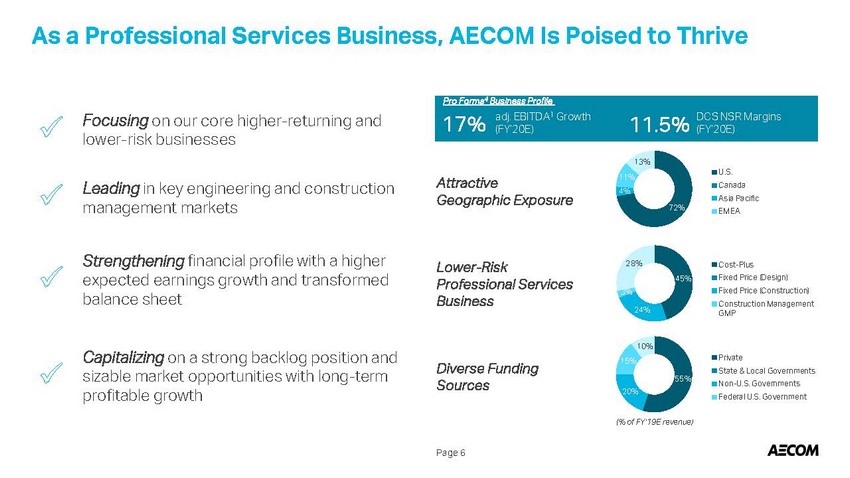

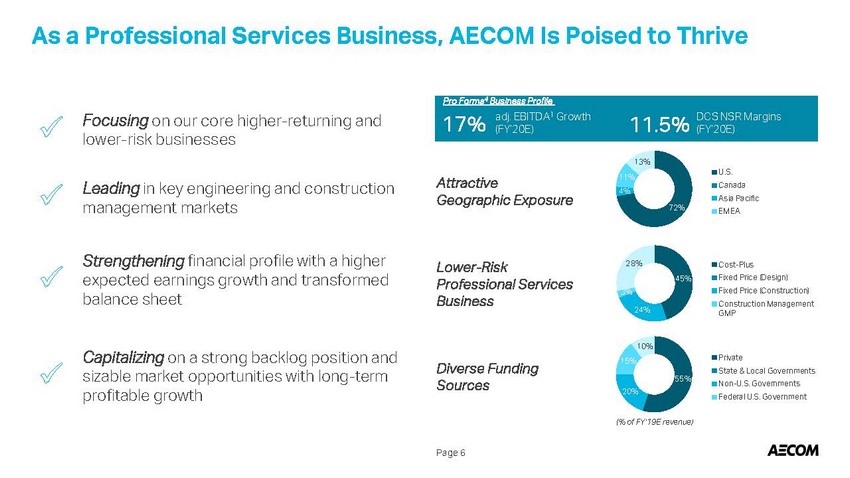

As a Professional Services Business, AECOM Is Poised to Thrive Focusing on our core higher-returning and lower-risk businesses 11.5% (FY’20E) (FY’20E) 13% 11% 4% U.S. Canada Asia Pacific EMEA Attractive Geographic Exposure Leading in key engineering and construction management markets 72% Strengthening financial profile with a higher expected earnings growth and transformed balance sheet 28% Lower-Risk Professional Services Business Cost-Plus Fixed Price (Design) Fixed Price (Construction) Construction Management GMP 45% 24% 10% Capitalizing on a strong backlog position and sizable market opportunities with long-term profitable growth Private State & Local Governments Non-U.S. Governments Federal U.S. Government 15% Diverse Funding Sources 55% 20% (% of FY’19E revenue) Page 6 Pro Forma4 Business Profile 1 17% adj. EBITDA GrowthDCS NSR Margins

W. Troy Rudd Chief Financial Officer PHOENIX SKY HARBOR INTERATIONAL AIRPORT TERMINAL 3 MODERNIZATION United States Serving as design-builder for the new renovation of the Terminal 3 facility, north concourse and the addition of a new south concourse.

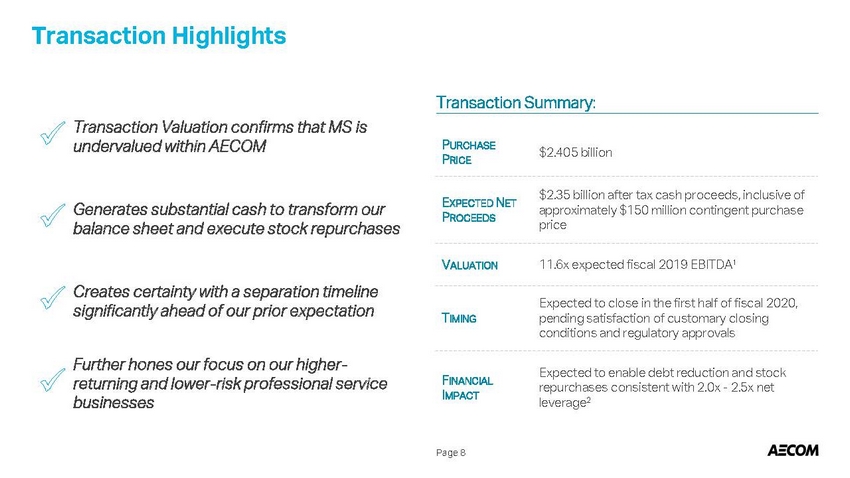

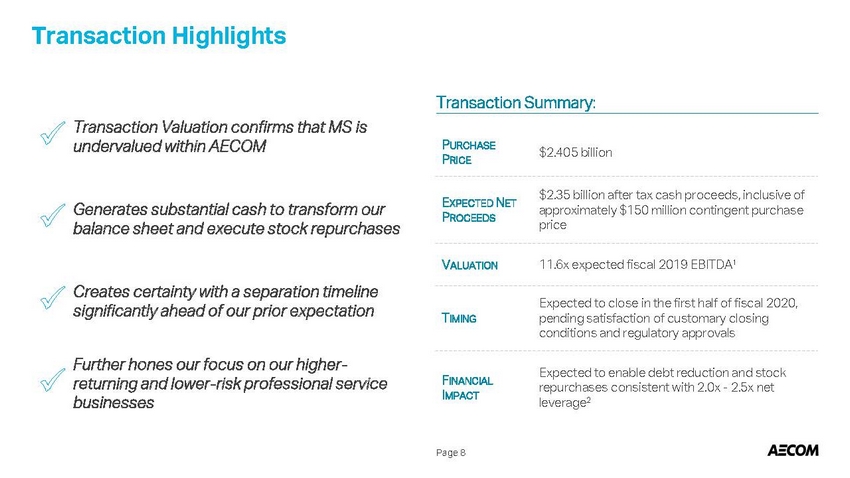

Transaction Highlights Transaction Summary: Transaction Valuation confirms that MS is undervalued within AECOM PURCHASE PRICE $2.405 billion $2.35 billion after tax cash proceeds, inclusive of approximately $150 million contingent purchase price EXPECTED NET PROCEEDS Generates substantial cash to transform our balance sheet and execute stock repurchases 11.6x expected fiscal 2019 EBITDA1 VALUATION Creates certainty with a separation timeline significantly ahead of our prior expectation Expected to close in the first half of fiscal 2020, pending satisfaction of customary closing conditions and regulatory approvals TIMING Further hones our focus on our higher-returning and lower-risk professional service businesses Expected to enable debt reduction and stock repurchases consistent with 2.0x - 2.5x net leverage2 FINANCIAL IMPACT Page 8

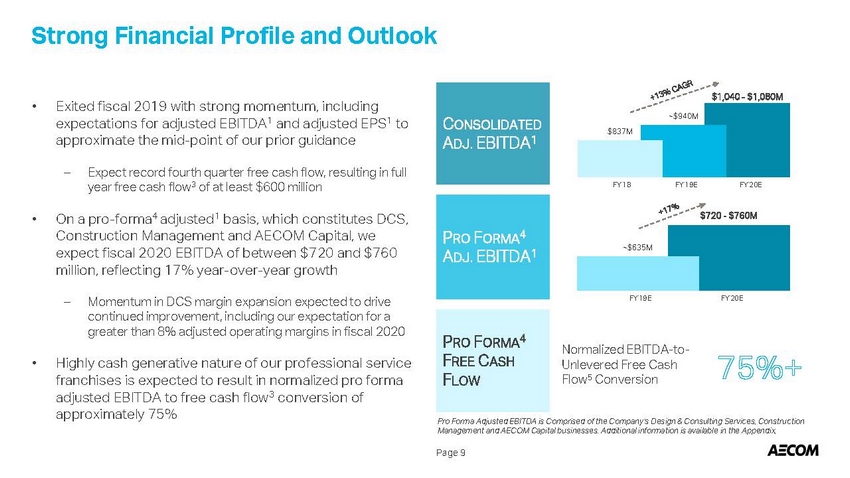

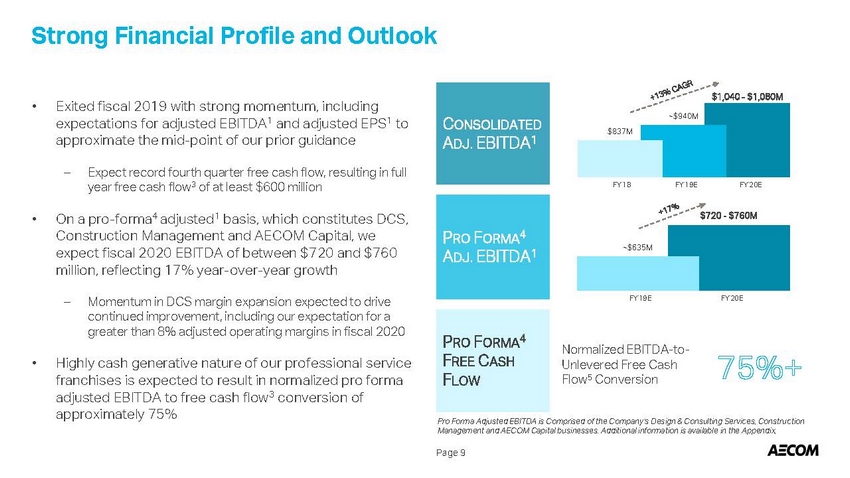

Strong Financial Profile and Outlook $1,040 - $1,080M • Exited fiscal 2019 with strong momentum, including expectations for adjusted EBITDA1 and adjusted EPS1 to approximate the mid-point of our prior guidance – Expect record fourth quarter free cash flow, resulting in full year free cash flow3 of at least $600 million FY’18 FY’19E FY’20E On a pro-forma4 adjusted1 basis, which constitutes DCS, Construction Management and AECOM Capital, we expect fiscal 2020 EBITDA of between $720 and $760 million, reflecting 17% year-over-year growth $720 - $760M • FY’19E FY’20E – Momentum in DCS margin expansion expected to drive continued improvement, including our expectation for a greater than 8% adjusted operating margins in fiscal 2020 Normalized EBITDA-to-Unlevered Free Cash Flow5 Conversion • Highly cash generative nature of our professional service franchises is expected to result in normalized pro forma adjusted EBITDA to free cash flow3 conversion of approximately 75% Pro Forma Adjusted EBITDA is Comprised of the Company’s Design & Consulting Services, Construction Management and AECOM Capital businesses. Additional information is available in the Appendix, Page 9 PRO FORMA4 FREE CASH FLOW ~$635M PRO FORMA4 ADJ. EBITDA1 ~$940M $837M CONSOLIDATED ADJ. EBITDA1

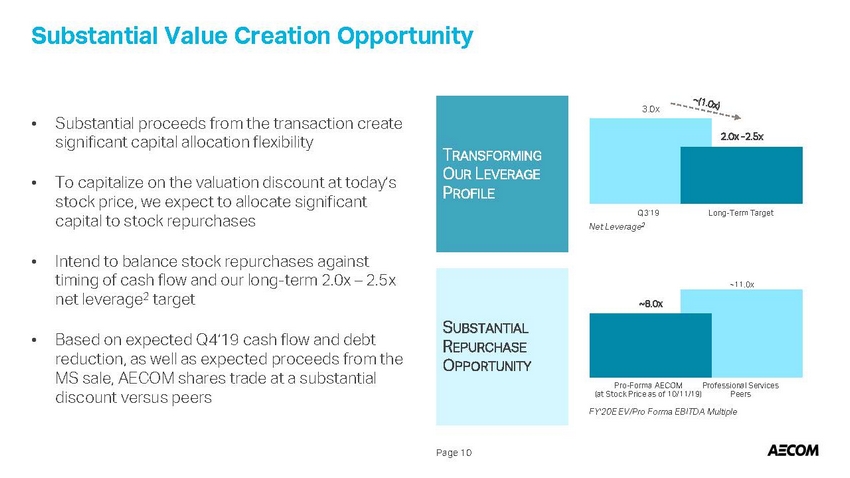

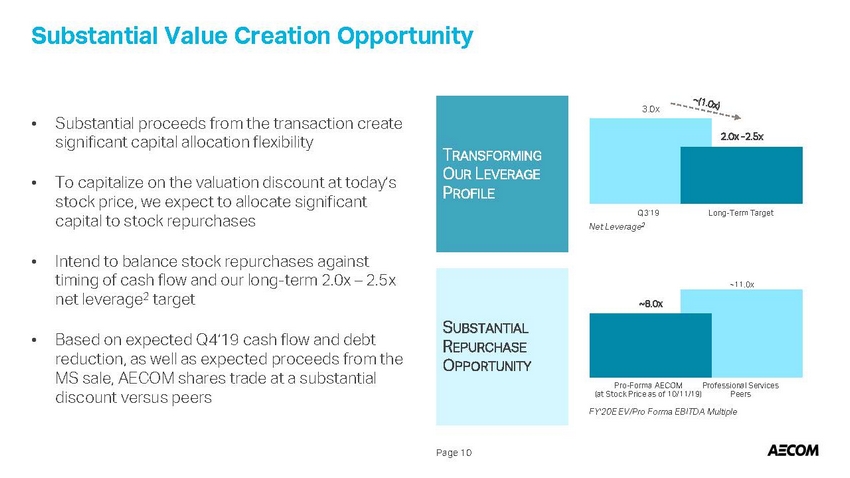

Substantial Value Creation Opportunity 3.0x • Substantial proceeds from the transaction create significant capital allocation flexibility • To capitalize on the valuation discount at today’s stock price, we expect to allocate significant capital to stock repurchases Q3’19 Net Leverage2 Long-Term Target • Intend to balance stock repurchases against timing of cash flow and our long-term 2.0x – 2.5x net leverage2 target ~11.0x • Based on expected Q4’19 cash flow and debt reduction, as well as expected proceeds from the MS sale, AECOM shares trade at a substantial discount versus peers Pro-Forma AECOM (at Stock Price as of 10/11/19) Professional Services Peers FY’20E EV/Pro Forma EBITDA Multiple Page 10 ~8.0x SUBSTANTIAL REPURCHASE OPPORTUNITY 2.0x -2.5x TRANSFORMING OUR LEVERAGE PROFILE

Appendix DELTA JET ENGINE TEST CELL FACILITY United States The new state-of-the-art test cell is the world’s largest and the first cell built by a U.S. airline in more than 20 years.

Footnotes 1 Excluding acquisition and integration related items, transaction-related expenses, financing charges in interest expense, foreign exchange gains, the amortization of intangible assets, financial impacts associated with expected and actual dispositions of non-core businesses and assets, restructuring costs and the revaluation of deferred taxes and the one-time tax repatriation charge associated with U.S. tax reform. 2 Net debt-to-EBITDA, or net leverage, is comprised of EBITDA as defined in the Company’s credit agreement, which excludes stock-based compensation, and net debt as defined as total debt on the Company’s financial statements, net of cash and cash equivalents. 3 Free cash flow is defined as cash flow from operations less capital expenditures net of proceeds from disposals. 4 Comprised of the Company’s Design & Consulting Services, Construction Management and AECOM Capital businesses, and excludes expected stranded costs associated with planned separations and divestitures that are expected to be eliminated. 5 Unlevered free cash flow is derived by adding back after-tax adjusted interest expense at a 25% tax rate and is after the deduction of distributions to non-controlling interests. Page 12

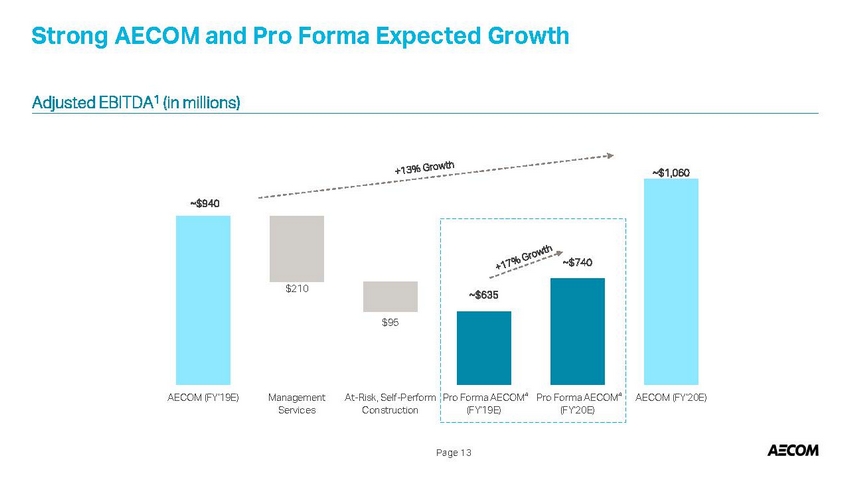

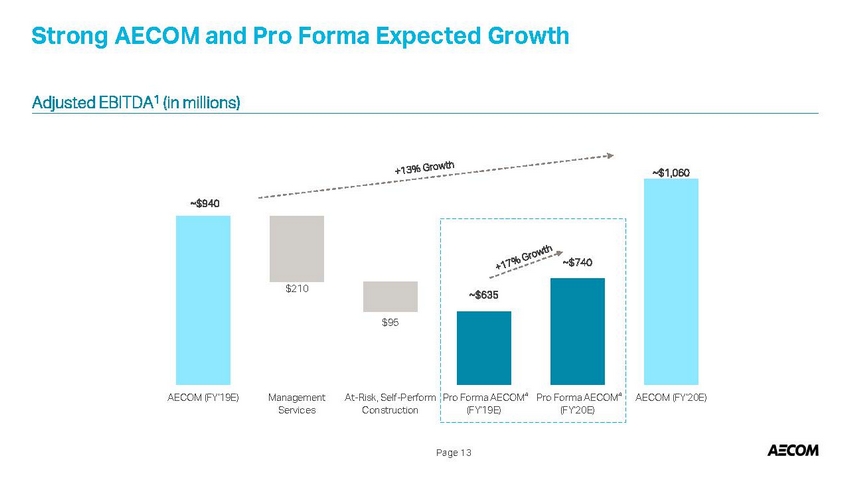

Strong AECOM and Pro Forma Expected Growth Adjusted EBITDA1 (in millions) ~$1,060 ~$940 $210 $95 AECOM (FY'19E) Management Services At-Risk, Self-Perform Construction AECOM (FY'20E) Page 13 ~$740 ~$635 Pro Forma AECOM4 Pro Forma AECOM4 (FY'19E)(FY'20E)

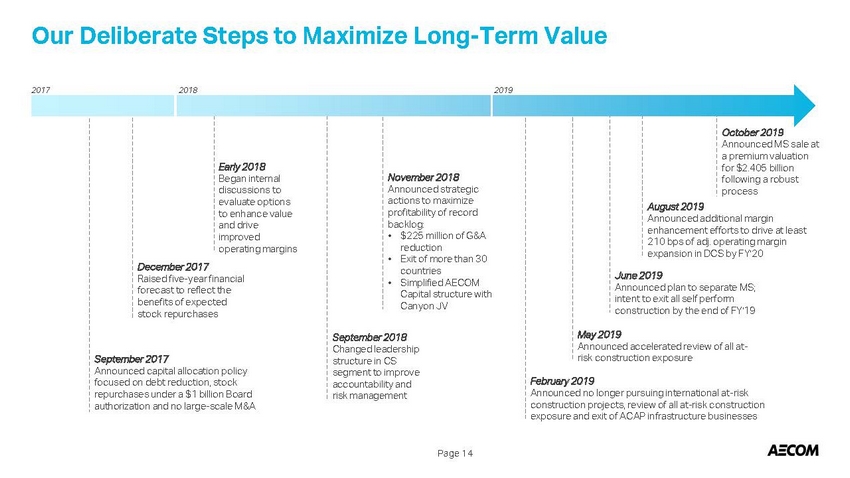

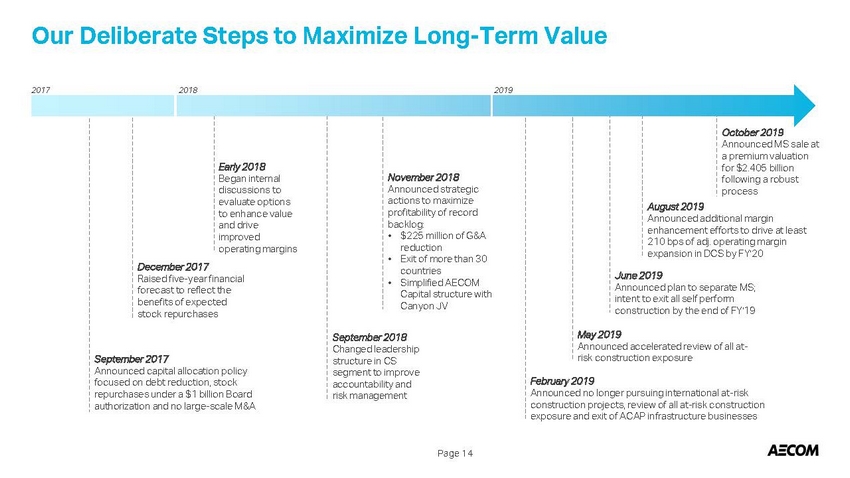

Our Deliberate Steps to Maximize Long-Term Value 2017 2018 2019 October 2019 Announced MS sale at a premium valuation for $2.405 billion following a robust process Early 2018 Began internal discussions to evaluate options to enhance value and drive improved operating margins November 2018 Announced strategic actions to maximize profitability of record backlog: August 2019 Announced additional margin enhancement efforts to drive at least 210 bps of adj. operating margin expansion in DCS by FY’20 • $225 million of G&A reduction Exit of more than 30 countries Simplified AECOM Capital structure with Canyon JV • December 2017 Raised five-year financial forecast to reflect the benefits of expected stock repurchases June 2019 Announced plan to separate MS; intent to exit all self perform construction by the end of FY’19 • May 2019 Announced accelerated review of all at-risk construction exposure September 2018 Changed leadership structure in CS segment to improve accountability and risk management September 2017 Announced capital allocation policy focused on debt reduction, stock repurchases under a $1 billion Board authorization and no large-scale M&A February 2019 Announced no longer pursuing international at-risk construction projects, review of all at-risk construction exposure and exit of ACAP infrastructure businesses Page 14