Whitehall’s business is managed under the direction of its Board of Directors. The Board of Directors is presently composed of four directors, divided into three classes, one of whom is a Class I director, one of whom is a Class II director and two of whom are Class III directors. At the annual meeting, two Class III directors will be elected to serve until the annual meeting in the year 2008, or until his successor is duly elected and qualified. The nominees for election as Class III directors are identified below. In the event either nominee, each of whom has expressed an intention to serve if elected, fails to stand for election, the persons named in the proxy presently intend to vote for a substitute nominee designated by the Board of Directors.

The following persons, if elected at the annual meeting, will serve as Class III directors until the annual meeting in the year 2008, or until his successor is elected and qualified.

Norman J. Patinkin is a first cousin, once removed, of Matthew M. Patinkin, an executive officer of Whitehall.

After due consideration, the Governance and Nominating Committee approved Messrs. Berkowitz and Patinkin for such appointments. In connection with the 2005 annual meeting of stockholders, the Governance and Nominating Committee recommended Mr. Berkowitz’s and Mr. Patinkin’s inclusion on Whitehall’s proxy card and recommended that the Board of Directors nominate Messrs. Berkowitz and Patinkin as Class III directors standing for election.

Other Directors

The following persons are currently directors of Whitehall whose terms will continue after the annual meeting.

CLASS II DIRECTOR — TERM SCHEDULED TO EXPIRE IN 2007

Sanford Shkolnik, age 66, was appointed to the Board of Directors of Whitehall on April 15, 2003. In 1972, he co-founded Equity Properties and Development Co., which operated a substantial retail real estate portfolio, and served as its Chairman and Chief Executive Officer from 1972 to 1996. Since 1997, Mr. Shkolnik has independently pursued opportunities in real estate and other business ventures. Mr. Shkolnik is the Chairman of the Long Range Planning Committee and a member of the Audit Committee, the Governance and Nominating Committee and the Compensation Committee.

CLASS I DIRECTOR — TERM SCHEDULED TO EXPIRE IN 2006

Daniel H. Levy, age 61, is the Chief Executive Officer of Donnkenny, LLC, a designer, manufacturer and marketer of women’s apparel, and has served as a director of Whitehall since January 7, 1997 (and had served as a director from March 1996 until May 1996). Mr. Levy was also Chief Executive Officer and Chairman of the Board of Donnkenny, Inc. until April 6, 2005. On February 8, 2005, Donnkenny, Inc. filed for voluntary Chapter 11 bankruptcy protection. Mr. Levy served as Chairman and Chief Executive Officer of Best Products Co. Inc., a large discount retailer of jewelry and brand name hardline merchandise, from April 1996 until January 1997. Prior to such time, Mr. Levy was a Principal for LBK Consulting from 1994 until 1996. Mr. Levy served as Chairman and Chief Executive Officer of Conran’s during 1993. Prior to such time, Mr. Levy was Vice Chairman and Chief Operating Officer for Montgomery Ward & Co. from 1991 until 1993. Mr. Levy is the Chairman of the Board, Chairman of the Compensation Committee and a member of the Audit Committee, the Governance and Nominating Committee and the Long Range Planning Committee.

Meetings and Committees

Directors are expected to attend board meetings and meetings of the committees on which they serve. The Board of Directors of Whitehall held twelve meetings during fiscal year 2004. Each director attended all of the meetings of the Board of Directors and its committees on which he served during fiscal year 2004. In addition, it is the Board of Directors’ policy that the directors should attend Whitehall’s annual meeting of stockholders absent exceptional circumstances. Last year, all directors attended the annual meeting.

Audit Committee. The Audit Committee presently consists of Richard K. Berkowitz (Chairman), Daniel H. Levy and Sanford Shkolnik. The Audit Committee held eleven meetings in fiscal year 2004.

The Board of Directors has determined that all of the members of the Audit Committee meet the requirements for independence and expertise, including financial literacy, under applicable New York Stock Exchange listing standards and federal securities laws. The Board of Directors has also determined that Mr. Berkowitz is an “Audit Committee financial expert” under federal securities laws.

The Audit Committee operates under a written charter adopted by the Board of Directors, a current copy of which is available on Whitehall’s website at www.whitehalljewellers.com and is included as Appendix A to this proxy. Whitehall will provide a copy of the charter without charge to any stockholder upon written or verbal request of such person.

The functions of the Audit Committee include assisting the Board in monitoring the integrity of Whitehall’s financial statements, the independent registered public accounting firm’s qualifications and independence, the performance of Whitehall’s internal audit function and independent registered public accounting firm and the compliance by Whitehall with legal and regulatory requirements. The Audit Committee has the sole authority to appoint or replace the independent registered public accounting firm of Whitehall, who report directly to the Audit Committee. The Audit Committee pre-approves all auditing services and permitted non-audit services (including the fees and terms associated with such services) to be provided by the independent registered public accounting firm. The Audit Committee has the authority to retain independent legal, accounting and other advisors and Whitehall is required to provide adequate funding and the compensation of any such advisors.

5

The Audit Committee is also responsible for preparing a report for inclusion in Whitehall’s proxy statement stating among other things, whether Whitehall’s audited financial statements should be included in Whitehall’s Annual Report on Form 10-K.

Compensation Committee. The Compensation Committee presently consists of Daniel H. Levy (Chairman), Richard K. Berkowitz and Sanford Shkolnik. The Compensation Committee held two meetings in fiscal year 2004. The Compensation Committee reviews and recommends the compensation arrangements for all executive officers and directors and administers and takes such other action as may be required in connection with certain compensation and incentive plans of Whitehall (including the granting of stock options and other stock based awards).

The Board of Directors has determined that all of the members of the Compensation Committee meet the requirements for independence under applicable New York Stock Exchange listing standards. Whitehall’s By-Laws require that the Compensation Committee consist of non-employee directors. The Compensation Committee operates under a written charter adopted by the Board of Directors, a current copy of which is available on Whitehall’s website at www.whitehalljewellers.com and is available in print without charge to any stockholder upon written or verbal request of such person.

Governance and Nominating Committee. The Governance and Nominating Committee presently consists of Richard K. Berkowitz (Chairman), Daniel H. Levy and Sanford Shkolnik. As of April 14, 2004, Mr. Shkolnik replaced Norman J. Patinkin as a member of the committee. The Governance and Nominating Committee held five meetings in fiscal year 2004. The Governance and Nominating Committee identifies, evaluates, and recommends individuals qualified to be directors of Whitehall to the Board of Directors for either appointment to the Board of Directors or to stand for election at a meeting of the stockholders, develops and recommends to the Board of Directors corporate governance guidelines for Whitehall and reviews and makes recommendations with respect to a variety of other governance matters.

The Board of Directors has determined that all of the members of the Governance and Nominating Committee meet the requirements for independence under applicable New York Stock Exchange listing standards. The Governance and Nominating Committee operates under a written charter adopted by the Board of Directors, a current copy of which is available on Whitehall’s website at www.whitehalljewellers.com and is available in print without charge to any stockholder upon written or verbal request of such person.

Stockholder recommendations for director nominations may be submitted to the Secretary of Whitehall by written request at 155 North Wacker Drive, Suite 500, Chicago, Illinois 60606, and they will be forwarded to the Governance and Nominating Committee for its consideration. Each such written request must be received by no later than March 10, 2006, which is 90 calendar days prior to the anniversary of the mailing date of this proxy statement. The Governance and Nominating Committee will consider all stockholder recommendations for candidates for the Board of Directors. In addition to considering candidates recommended by stockholders, the committee considers potential candidates recommended by current directors, company officers and others. The committee screens all potential candidates in the same manner regardless of the source of the recommendation. The committee’s initial review is typically based on any written materials provided with respect to the potential candidate. The committee determines whether the candidate has the specific qualities and skills desirable for directors of Whitehall and whether requesting additional information or an interview is appropriate. The consideration of any candidate for director will be based on the committee’s assessment of the individual’s background, skills and abilities, and if such characteristics qualify the individual to fulfill the needs of the Board of Directors at that time. In fiscal year 2004, the committee retained a third-party firm to advise Whitehall on, among other things, the structure of the Board of Directors. The Governance and Nominating Committee also has retained outside consultants to help identify potential candidates.

Long Range Planning Committee. The Long Range Planning Committee presently consists of Sanford Shkolnik (Chairman), Daniel H. Levy and Norman J. Patinkin. The Long Range Planning Committee held one meeting in fiscal year 2004. The purpose of the Long Range Planning Committee is to review the long-range operating plan of Whitehall and advise management and the Board of Directors with respect to strategic issues.

Executive Sessions. Non-employee directors meet in executive session at each regularly scheduled meeting of the Board of Directors. Chairmanship of the sessions rotates among the chairperson of the Audit, Nominating and Governance and Compensation Committees.

6

Director Independence

In accordance with the rules of the New York Stock Exchange (and with respect to the Audit Committee, the rules of the Securities and Exchange Commission) and after considering all existing relationships, the Board of Directors has determined that all of its members are independent, and that all members of the Audit, Compensation and Governance and Nominating Committees are independent. In connection with these determinations, the Board of Directors has adopted standards concerning director independence, which conform to the independence requirements in the New York Stock Exchange listing rules and other applicable laws, rules and regulations. A current copy of Whitehall’s Corporate Governance Guidelines is available on Whitehall’s website at www.whitehalljewellers.com and is available in print without charge to any stockholder upon written or verbal request of such person.

Compensation of Directors

Directors who are officers or employees of Whitehall will receive no compensation for serving as directors. Currently, the Board of Directors is comprised entirely of non-employee directors. All directors are reimbursed for out-of-pocket expenses incurred in connection with attendance at meetings of the Board of Directors, meetings of committees of the Board of Directors, and the performance of other Board of Directors related matters.

In fiscal year 2005, non-employee directors will receive compensation of $6,250 per fiscal quarter. In addition, non-employee directors are entitled to receive $1,250 for each meeting of the Board of Directors attended and committee members are entitled to receive $400 for each committee meeting attended. The chairman of the Audit Committee is entitled to receive an annual cash retainer of $25,000, to be paid in four equal installments at the beginning of each fiscal quarter. The chairman of each other committee is entitled to receive an annual cash retainer of $5,000, to be paid in four equal installments at the beginning of each fiscal quarter. Each non-employee director of Whitehall has the option to receive shares of restricted common stock at the beginning of each fiscal quarter in lieu of receiving the quarterly directors’ fees of $6,250 described above. The fair market value of the common stock on the date of issuance, and the restriction period (that is, the period in which the common stock subject to the award may not be sold, transferred, assigned, pledged, hypothecated or otherwise encumbered or disposed of) relating to each such award will lapse at the end of the fiscal quarter in which the shares of restricted common stock were issued. Shares of restricted stock are subject to forfeiture if the non-employee director ceases to serve as a director of Whitehall during the restriction period.

Each of the 1996 Long-Term Incentive Plan and the 1997 Long-Term Incentive Plan provides that non-employee directors may be granted stock-based awards at the discretion of the Compensation Committee, with the approval of the Board of Directors, to advance the interests of Whitehall by attracting and retaining well-qualified directors. Accordingly, Whitehall may grant such awards from time to time for such purpose. The non-employee directors have received such additional awards with respect to each of the past six fiscal years of Whitehall and it is the current expectation of the Compensation Committee that such annual grants will continue in the form of a grant of 1,667 shares of restricted stock.

As permitted under Whitehall’s 1997 Long-Term Incentive Plan, each non-employee director is granted a restricted stock award each year as of the Audit Certification Date (as defined below). Such award entitles each non-employee director to receive an amount of restricted common stock equal to $10,000 divided by the fair market value of such common stock on the applicable Audit Certification Date, rounded down to the nearest whole share. The restriction period relating to each such award is one year from the date of grant. Shares of restricted stock are subject to forfeiture if the non-employee director ceases to serve as a director of Whitehall during the restriction period. The “Audit Certification Date” is the date each year on which Whitehall’s independent public accountants deliver an opinion to Whitehall as to its yearly audit of the financial statements of Whitehall.

Whitehall offers health insurance coverage to the members of its Board of Directors. The health insurance policy options and related policy cost available to the directors are the same as those available to Whitehall’s senior level employees.

7

Communications with the Board of Directors

Whitehall does not have formal procedures for stockholder communication with the Board of Directors. However, any matter intended for the Board of Directors, including the chair of the Nominating and Governance Committee, the non-management directors as a group or the presiding director of the executive sessions, should be directed to the Secretary of Whitehall at 155 North Wacker Drive, Suite 500, Chicago, Illinois 60606, with a request to forward the same to the intended recipient. All stockholder communications delivered to the Secretary of Whitehall for forwarding to the Board of Directors or specified Board members will be forwarded in accordance with the stockholder’s instructions. Information regarding how to submit comments or complaints relating to Whitehall’s accounting, internal accounting controls or auditing matters can be found in Whitehall’s Code of Conduct, which can be found on Whitehall’s website at www.whitehalljewellers.com and is available in print without charge to any stockholder upon written or verbal request of such person.

EXECUTIVE OFFICERS

The following sets forth certain information with respect to the executive officers of Whitehall.

Lucinda M. Baier, age 40, joined Whitehall in November 2004. Ms. Baier initially served as Whitehall’s President and Chief Operating Officer and then served as Interim Chief Executive Officer following the death of Hugh M. Patinkin, the former Chairman and Chief Executive Officer of Whitehall, on March 30, 2005. On April 13, 2005, Ms. Baier was appointed as Chief Executive Officer, President and Chief Operating Officer of Whitehall. Until April 2004, Ms. Baier was actively employed at Sears, Roebuck and Co., a multiline retail company, where she spent over three years in senior management positions, most recently as the Senior Vice President and General Manager for its Credit and Financial Products business. Prior to her employment with Sears, Roebuck and Co., Ms. Baier served in senior merchandising and financial positions at major retail, chemical and defense corporations, including US Office Products, ICI PLC and General Dynamics.

John R. Desjardins, age 54, joined Whitehall in 1979 and has served as Executive Vice President, Chief Financial Officer and Secretary. He also served as Treasurer of Whitehall from 2003 to present and from 1989 through October 1998 and as a member of the Board of Directors of Whitehall from 1989 to January 2004. Previously, he worked as a certified public accountant with Deloitte & Touche L.L.P.

Debbie Nicodemus-Volker, age 51, joined Whitehall in June 2004 as its Executive Vice President of Merchandise. Ms. Nicodemus-Volker joined Whitehall after a fourteen year tenure with Duty Free Shoppers. Most recently Ms. Nicodemus-Volker was a Vice President of Merchandising and Planning for Donna Karan International, based in New York. Donna Karan International and Duty Free Shoppers are divisions of Louis Vuitton Moet Hennessey. At Duty Free Shoppers, Ms. Nicodemus-Volker was Vice President for Merchandise Planning and Procurement for European Brands, including responsibility for fine jewelry and watches. For the six years before that, Ms. Nicodemus-Volker was Vice President for Merchandising — Fine Jewelry at Duty Free Shoppers.

Matthew M. Patinkin, age 47, joined Whitehall in 1979 and has served as its Executive Vice President, Operations since July 2000. He also served as Executive Vice President, Store Operations, from 1989 through July 2000 and as a member of the Board of Directors of Whitehall from 1989 to January 2004.

8

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Executive Compensation

Summary Compensation. The following summary compensation table sets forth certain information concerning compensation for services rendered in all capacities awarded to, earned by or paid to Whitehall’s Chief Executive Officer and the other named executive officers during the years ended January 31, 2005, 2004 and 2003.

Summary Compensation Table

| | | | Annual Compensation

| | Long-Term Compensation

Awards

| |

|---|

Name and Principal Position

| | | | Year

ended

Jan. 31

| | Salary

| | Bonus

| | Other

Annual

Compensation

| | Restricted

Stock

Awards(1)

| | Shares

Underlying

Options(2)

| | All

Other

Compensation(6)

|

|---|

| Lucinda M. Baier | | | | | 2005 | | | $ | 63,750 | | | $ | 100,000 | | | $ | 2,469 | | | $ | 414,000 | | | | — | | | $ | — | |

| Chief Executive Officer, | | | | | 2004 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | | — | | | $ | — | |

| President and Chief | | | | | 2003 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | | — | | | $ | — | |

| Operating Officer (3) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| John R. Desjardins | | | | | 2005 | | | $ | 305,000 | | | $ | — | | | $ | — | | | $ | — | | | | — | | | $ | 12,796 | |

| Executive Vice President, | | | | | 2004 | | | $ | 305,000 | | | $ | 45,700 | | | $ | — | | | $ | — | | | | — | | | $ | 24,932 | |

| Chief Financial Officer | | | | | 2003 | | | $ | 305,000 | | | $ | — | | | $ | — | | | $ | — | | | | 15,000 | | | $ | 38,477 | |

| and Secretary | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| Matthew M. Patinkin | | | | | 2005 | | | $ | 280,000 | | | $ | — | | | $ | — | | | $ | — | | | | — | | | $ | 9,457 | |

| Executive Vice President, | | | | | 2004 | | | $ | 280,000 | | | $ | 40,500 | | | $ | — | | | $ | — | | | | — | | | $ | 5,577 | |

| Operations | | | | | 2003 | | | $ | 270,000 | | | $ | — | | | $ | — | | | $ | — | | | | 20,000 | | | $ | 6,015 | |

| |

| Debbie Nicodemus-Volker | | | | | 2005 | | | $ | 190,385 | | | $ | 25,000 | | | $ | 91,731 | | | $ | 162,400 | | | | — | | | $ | 125 | |

| Executive Vice President | | | | | 2004 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | | — | | | $ | — | |

| of Merchandise (4) | | | | | 2003 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | | — | | | $ | — | |

| |

| Hugh M. Patinkin | | | | | 2005 | | | $ | 525,000 | | | $ | — | | | $ | — | | | $ | — | | | | — | | | $ | 20,654 | |

| Former Chairman, Chief | | | | | 2004 | | | $ | 525,000 | | | $ | 75,000 | | | $ | — | | | $ | — | | | | — | | | $ | 21,188 | |

| Executive Officer and | | | | | 2003 | | | $ | 500,000 | | | $ | — | | | $ | — | | | $ | 101,200 | | | | 150,000 | | | $ | 25,702 | |

| President | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| Manny A. Brown | | | | | 2005 | | | $ | 235,000 | | | $ | — | | | $ | — | | | $ | — | | | | — | | | $ | 671,685 | |

| Former Executive Vice | | | | | 2004 | | | $ | 260,000 | | | $ | 37,425 | | | $ | — | | | $ | — | | | | — | | | $ | 8,572 | |

| President, Operations (5) | | | | | 2003 | | | $ | 250,000 | | | $ | — | | | $ | — | | | $ | — | | | | 12,500 | | | $ | 12,784 | |

| (1) | | On January 28, 2003, Whitehall’s former Chief Executive Officer received an award of 10,000 shares of restricted stock as an incentive award with respect to services to be rendered during the fiscal year ending January 31, 2004. The restrictions on shares of restricted stock lapse in three equal annual installments on the first, second and third anniversaries of the dates of each of the grants, except for the award to Mr. H. Patinkin, which vested in full upon death and the award to Mr. M. Brown (see footnote 5 below). Dividends or other distributions, if paid on shares of common stock generally, will be paid with respect to shares of restricted stock. As of January 31, 2005, the number and value of the aggregate restricted stock holdings of Whitehall’s former Chief Executive Officer and the other named executive officers were: Mr. H. Patinkin, 3,333 shares ($24,064); Ms. Baier, 50,000 shares ($361,000), Mr. Desjardins, 713 shares ($5,148); Mr. M. Brown, 0 shares ($0); Mr. M. Patinkin, 632 shares ($4,563); and Ms. Nicodemus-Volker, 20,000 shares ($144,400). |

| (2) | | The shares underlying options shown for the fiscal year ended January 31, 2003 include separate option grants for services to be rendered during fiscal years 2003 and 2004. On February 7, 2002, as an incentive award with respect to services to be rendered during the fiscal year ended January 31, 2003, each of Whitehall’s former Chief Executive Officer and the following named executive officers were granted options to purchase shares of Whitehall’s common stock in the following amounts: Mr. H. Patinkin, 100,000; Mr. Desjardins, 10,000; Mr. M. Patinkin, 10,000; and Mr. M. Brown, 5,000. On January 28, 2003, as an incentive award with respect to services to be rendered during the fiscal year ending January 31, 2004, each of Whitehall’s former Chief |

9

| | Executive Officer and the other named executive officers were granted options to purchase shares of Whitehall’s common stock in the following amounts: Mr. H. Patinkin, 50,000; Mr. Desjardins, 5,000; Mr. M. Patinkin, 10,000; and Mr. M. Brown, 7,500. Prior to the date of Mr. Patinkin’s death, 16,666 of his options remained unvested. Pursuant to his stock option agreement, 5,555 of the unvested options became exercisable effective March 30, 2005 and will remain exercisable until March 30, 2006. |

| (3) | | Ms. Baier commenced her employment with Whitehall on November 30, 2004 as President and Chief Operating Officer. Ms. Baier’s annual base salary in such position was $425,000 during fiscal year 2004. Ms. Baier also received $2,469 for amounts reimbursed during fiscal year 2004 for the payment of taxes related to relocation expenses. |

| (4) | | Ms. Nicodemus-Volker commenced employment with Whitehall on June 1, 2004. Ms. Nicodemus-Volker’s annual base salary is $300,000. Ms. Nicodemus-Volker also received $91,731 for amounts reimbursed during fiscal year 2004 for the payment or reimbursement of residential relocation expenses and taxes related thereto. |

| (5) | | Mr. M. Brown tendered his resignation effective December 17, 2004. Pursuant to his separation and release agreement, Mr. M. Brown’s employment with Whitehall was deemed to have been terminated for good reason and therefore his awards of restricted stock vested in full and his options to purchase shares of Whitehall’s common stock vested in full and remain exercisable until December 17, 2006. Also pursuant to the separation and release agreement, Whitehall made a payment of $666,000 to Mr. M. Brown. |

| (6) | | Payments in these amounts for fiscal year 2004 consists of (i) executive medical benefits, (ii) payments or reimbursements for life insurance premiums and (iii) payments in connection with separation agreements (see footnote 5 above). The foregoing amounts were as follows: |

Name

| | | | Executive

Medical

Benefits

| | Life

Insurance

Premium

| | Separation

Agreement

Payment

| | Total

|

|---|

| Lucinda M. Baier | | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| John R. Desjardins | | | | $ | 10,593 | | | $ | 2,203 | | | $ | — | | | $ | 12,796 | |

| Debbie Nicodemus-Volker | | | | $ | 125 | | | $ | — | | | $ | — | | | $ | 125 | |

| Matthew M. Patinkin | | | | $ | 8,805 | | | $ | 652 | | | $ | — | | | $ | 9,457 | |

| Hugh M. Patinkin | | | | $ | 14,009 | | | $ | 6,645 | | | $ | — | | | $ | 20,654 | |

| Manny A. Brown | | | | $ | 4,375 | | | $ | 1,310 | | | $ | 666,000 | | | $ | 671,685 | |

General Information Regarding Options. The following tables show information regarding stock options exercised by and held by the executive officers named in the Summary Compensation Table. Stock options were not granted to any of the named executive officers in fiscal year 2004.

10

Option Exercises in Fiscal Year 2004 and Fiscal Year End Option Values

| | | |

| |

| | Number of Securities

underlying unexercised

Options as of

January 31, 2005

| | Value of unexercised in the

Money Options as of

January 31, 2005

| |

|---|

Name

| | | | Shares

Acquired

on Exercise

| | Value

Realized

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Lucinda M. Baier | | | | | — | | | $ | — | | | | — | | | | — | | | $ | — | | | $ | — | |

| John R. Desjardins | | | | | — | | | $ | — | | | | 392,826 | | | | 4,999 | | | $ | — | | | $ | — | |

| Debbie Nicodemus-Volker | | | | | — | | | $ | — | | | | — | | | | — | | | $ | — | | | $ | — | |

| Matthew M. Patinkin | | | | | — | | | $ | — | | | | 377,869 | | | | 6,666 | | | $ | — | | | $ | — | |

| Hugh M. Patinkin (1) | | | | | — | | | $ | — | | | | 1,329,315 | | | | 49,999 | | | $ | — | | | $ | — | |

| Manny A. Brown (2) | | | | | — | | | $ | — | | | | 124,632 | | | | — | | | $ | — | | | $ | — | |

| (1) | | Mr. H. Patinkin passed away after January 31, 2005, the date as of which this table speaks. Prior to Mr. H. Patinkin’s death on March 30, 2005, only 16,666 of his options remained unvested. Pursuant to his stock option agreement, 5,555 of the unvested options became exercisable by his estate effective March 30, 2005 and will remain exercisable until March 30, 2006. |

| (2) | | Mr. M. Brown tendered his resignation effective December 17, 2004. Pursuant to his separation and release agreement, Mr. M. Brown’s employment with Whitehall was deemed to have been terminated for good reason and therefore his options to purchase shares of Whitehall’s common stock vested in full and remain exercisable until December 17, 2006. |

Severance and Employment Agreements

Severance Agreements with Named Executive Officers. As described below, Whitehall has entered into severance agreements with each of John R. Desjardins, Executive Vice President and Secretary, dated May 7, 1996 and Matthew M. Patinkin, Executive Vice President, Operations, dated May 7, 1996.

The agreements provide for certain payments after a “change of control.” A “change of control” is defined under the agreements to include (i) an acquisition by a third party (excluding certain affiliates of Whitehall) of beneficial ownership of at least 25% of the outstanding shares of common stock, (ii) a change in a majority of the incumbent Board of Directors and (iii) merger, consolidation or sale of substantially all of Whitehall’s assets if Whitehall’s stockholders do not continue to own at least 60% of the equity of the surviving or resulting entity. Pursuant to these agreements, the employees will receive certain payments and benefits if they terminate employment voluntarily six months after a “change of control,” or if, during a three-year period following a change in control (i) they terminate for “good reason,” as defined in the agreements (such as certain changes in duties, titles, compensation, benefits or work locations) or (ii) if they are terminated by Whitehall, other than for “cause,” as so defined. The severance agreements also provide for certain payments absent a change of control if they terminate employment for “good reason” or if they are terminated by Whitehall, other than for “cause.” Their payment will equal 2.5 times (1.5 times if a change of control has not occurred) their highest salary plus bonus over the five years preceding the change of control, together with continuation of health and other insurance benefits for 30 months (18 months if a change of control has not occurred). The severance agreements also provide for payment of bonus for any partial year worked at termination of employment equal to the higher of (x) the employee’s average bonus for the immediately preceding two years and (y) 50% of the maximum bonus the employee could have earned in the year employment terminates, pro rated for the portion of the year completed. To the extent any payments to either of these two senior executives under these agreements would constitute an “excess parachute payment” under section 280G(b)(1) of the Internal Revenue Code (the “Code”), the payments will be “grossed up” for any excise tax payable under such section, so that the amount retained after paying all federal income taxes due would be the same as such person would have retained if such section had not been applicable.

Employment Agreements with Named Executive Officers. As described below, Whitehall has entered into employment agreements with each of Lucinda M. Baier, Chief Executive Officer, President and Chief Operating Officer, dated November 30, 2004 and Debbie Nicodemus-Volker, Executive Vice President of Merchandise, dated June 1, 2004.

11

Under the terms of Ms. Baier’s employment agreement, Ms. Baier will receive an initial annual base salary of $425,000. Pursuant to her employment agreement, Ms. Baier received a one-time “sign-on” bonus payment of $100,000, subject to required withholdings, on January 7, 2005. This “sign-on” bonus will be credited against any bonus earned by Ms. Baier for the fiscal year ending January 31, 2006. In addition, beginning for the fiscal year ending January 31, 2006 and in the sole discretion of the Compensation Committee of Whitehall’s Board of Directors, Ms. Baier will have an opportunity to participate in Whitehall’s Management Cash Bonus Plan. Furthermore, Ms. Baier shall, in the sole discretion of the Compensation Committee, be eligible during her employment with Whitehall to be granted stock options, restricted stock and/or other equity-based compensation awards. Ms. Baier was named Chief Executive Officer of Whitehall on April 13, 2005 and her annual base salary was increased to $500,000.

Under the terms of Ms. Nicodemus-Volker’s employment agreement, Ms. Nicodemus-Volker will receive an initial annual base salary of $300,000. In addition, beginning for the fiscal year ending January 31, 2005 and in the sole discretion of the Compensation Committee of Whitehall’s Board of Directors, Ms. Nicodemus-Volker will have an opportunity to participate in Whitehall’s Management Cash Bonus Plan, with the same percentage bonus opportunity as Whitehall’s other Executive Vice Presidents. Furthermore, Ms. Nicodemus-Volker shall, in the sole discretion of the Compensation Committee, be eligible during her employment with Whitehall to be granted stock options, restricted stock and/or other equity-based compensation awards.

Each of Ms. Baier’s and Ms. Nicodemus-Volker’s employment agreements is for an initial term of one year, subject to earlier termination, and will be automatically extended for one additional year unless either party to the applicable employment agreement gives written notice of termination at least 60 days prior to the expiration of the term.

The employment agreements also provide that if the executive’s employment is terminated without Cause (as defined in each executive’s employment agreement), such executive will receive a severance payment equal to her base salary for a period of twelve months following termination, any accrued but unpaid salary and annual bonus through and including the effective date of the termination of her employment (determined on a pro rata basis for the number of days of the fiscal year for which she was employed by Whitehall), such annual bonus to be paid following the Compensation Committee’s determination of her annual bonus, if any, for the fiscal year in which the termination of employment occurred, and other employee benefits to which she was entitled on the date of the termination of her employment in accordance with the terms of the applicable plans. In addition, Ms. Baier will receive these payments if she terminates her employment with Good Reason (as defined in the employment agreement), provided that in order to receive the severance payment equal to her base salary for a period of twelve months following termination she must execute a mutual release and non-disparagement agreement, in form and substance reasonably satisfactory to Whitehall and Ms. Baier.

The employment agreements also provide Ms. Baier and Ms. Nicodemus-Volker with certain benefits, including participation in Whitehall’s employee benefit plans generally available to executives of the company (currently including health insurance, life insurance, participation in Whitehall’s 401(k) plan, automobile benefits and reimbursement for business expenses) and relocation assistance. The employment agreements also contain confidentiality, noncompete and nonsolicitation covenants from Ms. Baier and Ms. Nicodemus-Volker.

Executive Officer Compensation Report by the Compensation Committee

All compensation decisions for the Chief Executive Officer and each of the other executive officers named in the Summary Compensation Table (other than Manny Brown, whose employment with Whitehall was terminated on December 17, 2004, and Hugh Patinkin, who passed away on March 30, 2005) are currently made by the Compensation Committee of the Board of Directors. The Compensation Committee consists of Daniel H. Levy (Chairman), Richard K. Berkowitz and Sanford Shkolnik. Each member of the Compensation Committee is a non-employee director who has not previously been an officer or employee of Whitehall.

Executive compensation consists of both annual and long-term compensation. Annual compensation consists of a base salary and bonus. Long-term compensation is generally provided through awards under the 1996 Long-Term Incentive Plan and the 1997 Long-Term Incentive Plan.

12

The Compensation Committee’s approach to annual base salary is to offer competitive salaries in comparison with market practices. The base salary of each officer is set at a level considered to be appropriate in the judgment of the Compensation Committee based on an assessment of the particular responsibilities and performance of the officer taking into account the performance of Whitehall, other comparable companies, the retail jewelry industry, the economy in general and such other factors as the Compensation Committee may deem relevant. The comparable companies considered by the Compensation Committee may include companies included in the peer group index discussed below and/or other companies in the sole discretion of the Compensation Committee. No specific measures of Whitehall’s performance or other factors are considered determinative in the base salary decisions of the Compensation Committee. Instead, substantial judgment is used and all of the facts and circumstances are taken into consideration by the Compensation Committee in its executive compensation decisions.

In addition to base salary, the former Chief Executive Officer and each of the other executive officers named in the Summary Compensation Table above other than Ms. Baier were eligible to participate in Whitehall’s Management Bonus Program during fiscal year 2004. Under this bonus program, each executive officer was entitled to receive a cash bonus (not to exceed 125% of base salary in the case of the Chief Executive Officer and up to 100% of base salary in the case of the other executive officers named in the Summary Compensation Table above) and a restricted stock bonus (not to exceed 25% of the cash bonus paid) based on the net income of Whitehall before extraordinary items. Based on Whitehall’s performance during fiscal year 2004, no bonuses were paid pursuant to the Management Bonus Program to the former Chief Executive Officer or the other executive officers named in the Summary Compensation Table above.

The executive officers are eligible to participate in the 1996 Long-Term Incentive Plan and the 1997 Long-Term Incentive Plan. Each of the 1996 Long-Term Incentive Plan and the 1997 Long-Term Incentive Plan is administered by the Compensation Committee. Subject to the terms of the plans, the Compensation Committee (and the Chief Executive Officer with respect to non-executive officer employees) is authorized to select eligible directors, officers and other key employees for participation in the plans and to determine the number of shares of common stock subject to the awards granted thereunder, the exercise price, if any, the time and conditions of exercise, and all other terms and conditions of the awards. The purposes of the plans are to align the interests of Whitehall’s stockholders and the recipients of grants under the plans by increasing the proprietary interest of the recipients in Whitehall’s growth and success and to advance the interests of Whitehall by attracting and retaining officers and other key employees. The terms and the size of the option grants to each executive officer will vary from individual to individual in the discretion of the Compensation Committee. No specific factors are considered determinative in the grants of options to executive officers by the Compensation Committee. Instead, all of the facts and circumstances are taken into consideration by the Compensation Committee in its executive compensation decisions. Grants of options are based on the judgment of the members of the Compensation Committee considering the total mix of information.

Section 162(m) of the Code. Section 162(m) of the Code generally limits to $1 million the amount that a publicly held corporation is allowed each year to deduct for the compensation paid to each of the corporation’s chief executive officer and the corporation’s four most highly compensated officers other than the chief executive officer, subject to certain exceptions. One such exception is “qualified performance-based compensation.” Compensation attributable to stock options granted to executives is intended to constitute “qualified performance-based compensation.” Whitehall does not believe that the $1 million deduction limitation should have any effect on it in the near future. If the $1 million deduction limitation is expected to have any effect on Whitehall in the future, Whitehall will consider ways to maximize the deductibility of executive compensation, while retaining the discretion it deems necessary to compensate executive officers in a manner commensurate with performance and the competitive environment for executive talent.

THE COMPENSATION COMMITTEE OF

THE BOARD OF DIRECTORS

Daniel H. Levy(Chairman)

Richard K. Berkowitz

Sanford Shkolnik

13

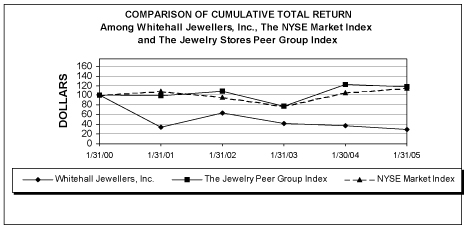

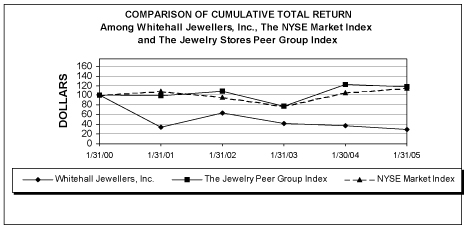

Performance Graph

The rules of the Securities and Exchange Commission require each public company to include a performance graph comparing the cumulative total stockholder return on the company’s common stock for the five preceding fiscal years, or such shorter period as the registrant’s class of securities has been registered with the Securities and Exchange Commission, with the cumulative total returns of a broad equity market index and a peer group or similar index. The common stock traded on The NASDAQ Stock Market under the symbol “WHJI” from May 2, 1996 through January 26, 2000. On January 27, 2000, the common stock began trading on the New York Stock Exchange under the symbol “JWL.” The performance graph included in this proxy statement shows the period from January 31, 2000 through the last trading day of the fiscal year, which was January 31, 2005.

The following chart graphs the performance of the cumulative total return to stockholders (stock price appreciation plus dividends) between January 31, 2000 and January 31, 2005 in comparison to the New York Stock Exchange Market Index and the “Jewelry Stores Peer Group Index” or “JSPGI.” The retail jewelry store companies comprising the JSPGI are companies traded on The Nasdaq Stock Market, the New York Stock Exchange, The American Stock Exchange or over-the-counter who have listed their companies’ SIC code as 5944 — Jewelry Store. These companies include Whitehall, Blue Nile, Inc., DGSE Companies, Inc., Finlay Enterprises, Inc., Lion-Gri International, Reeds Jewelers, Inc., SGD Holdings, Ltd., Signet Group PLC, Tiffany & Co. and Zale Corporation.

Assumes $100 invested on January 31, 2000 in Whitehall’s common stock, The Jewelry Stores Peer Group Index, and The NYSE Market Index. Cumulative total return assumes reinvestment of dividends.

| | | | 1/31/00

| | 1/31/01

| | 1/31/02

| | 1/31/03

| | 1/31/04

| | 1/31/05

|

|---|

| Whitehall Jewellers, Inc. | | | | | 100.00 | | | | 34.26 | | | | 64.00 | | | | 41.31 | | | | 37.91 | | | | 29.62 | |

| The Jewelry Stores Peer Group Index | | | | | 100.00 | | | | 99.77 | | | | 107.79 | | | | 77.25 | | | | 122.92 | | | | 117.53 | |

| NYSE Market Index | | | | | 100.00 | | | | 108.42 | | | | 96.00 | | | | 77.75 | | | | 105.62 | | | | 114.49 | |

14

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of Whitehall’s common stock as of June 1, 2005, by (i) each person who is known by Whitehall to own beneficially more than 5% of the outstanding shares of common stock, (ii) each director of Whitehall, (iii) each of the executive officers named in the Summary Compensation Table and (iv) all directors and executive officers of Whitehall as a group.

Name of Beneficial Owner(1)

| | | | Amount of

Beneficial

Ownership

| | Percent

of Class(2)

|

|---|

5% Stockholders | | | | | | | | | | |

Estate of Hugh M. Patinkin (3)

c/o Jenner & Block LLP

Attn: John Buttita, Esq.

One IBM Plaza

Chicago, IL 60611-7603 | | | | | 2,216,885 | | | | 14.5 | % |

| |

Newcastle Partners, L.P. (4)

300 Crescent Court, Suite 1110

Dallas, TX 75201 | | | | | 2,018,400 | | | | 14.5 | % |

| |

FMR Corp. (5)

82 Devonshire Street

Boston, MA 02109 | | | | | 1,548,900 | | | | 11.1 | % |

| |

Reed Conner & Birdwell LLC (6)

11111 Santa Monica Boulevard, Suite 1700

Los Angeles, CA 90025 | | | | | 1,441,025 | | | | 10.3 | % |

| |

Myron M. Kaplan (7)

P.O. Box 385

Leonia, NJ 07605 | | | | | 1,386,600 | | | | 9.9 | % |

| |

Wasatch Advisors, Inc. (8)

150 Social Hall Avenue

Salt Lake City, UT 84111 | | | | | 1,331,952 | | | | 9.5 | % |

| |

Dimensional Fund Advisors Inc. (9)

1299 Ocean Avenue, 11th Floor

Santa Monica, CA 90401 | | | | | 1,022,750 | | | | 7.3 | % |

| |

Directors and Executive Officers | | | | | | | | | | |

| Hugh M. Patinkin (10) | | | | | — | | | | — | |

| Matthew M. Patinkin (11) | | | | | 890,936 | | | | 6.2 | % |

| John R. Desjardins (12) | | | | | 670,664 | | | | 4.7 | % |

| Manny A. Brown (13) | | | | | 127,920 | | | | * | |

| Norman J. Patinkin (14) | | | | | 90,645 | | | | * | |

| Daniel H. Levy (15) | | | | | 64,385 | | | | * | |

| Richard K. Berkowitz (16) | | | | | 61,247 | | | | * | |

| Lucinda M. Baier (17) | | | | | 50,000 | | | | * | |

| Sanford Shkolnik (18) | | | | | 29,697 | | | | * | |

| Debbie Nicodemus-Volker (19) | | | | | 20,000 | | | | * | |

| All executive officers and directors as a group | | | | | 2,005,494 | | | | 13.4 | % |

| (1) | | Except as set forth in the footnotes to this table, the persons named in the table above have sole voting and investment power with respect to all shares shown as beneficially owned by them. |

15

| (2) | | Applicable percentage of ownership is based on 13,960,067 shares of common stock outstanding on June 1, 2005. Where indicated in the footnotes, this table also includes common stock issuable pursuant to stock options exercisable within 60 days of the filing of this proxy statement. |

| (3) | | Includes 1,368,203 shares of common stock issuable pursuant to presently exercisable stock options. Includes 388,439 shares owned by MJSB Investment Partners, L.P., a Delaware limited partnership, U/A/D 10/28/97, of which the Hugh M. Patinkin Trust, dated December 12, 1986, as amended, is the 1% general partner and various trusts created for Sheila C. Patinkin and the children of Hugh M. Patinkin are the 99% limited partners, and for which Sheila C. Patinkin and Harold S. Patinkin, as Trustees of the Hugh M. Patinkin Trust, jointly exercise the rights of the general partner as the sole managing agent of the partnership. Includes 9,916 shares held by Sheila C. Patinkin and Harold S. Patinkin, as Trustees of various other trusts for the children of Hugh M. Patinkin and Sheila C. Patinkin, with respect to which shares Sheila C. Patinkin and Harold S. Patinkin share voting and investment power. |

| (4) | | Share information based solely on information contained on a Schedule 13D, dated April 18, 2005, filed with the Securities and Exchange Commission. This Schedule 13D indicates that Newcastle Partners, L.P. beneficially owns 2,018,400 shares of common stock and has sole voting and investment power with respect to the reported shares. Newcastle Capital Management, L.P., as the general partner of Newcastle Partners, L.P., may also be deemed to beneficially own the 2,018,400 shares of common stock beneficially owned by Newcastle Partners, L.P. Newcastle Capital Group, L.L.C., as the general partner of Newcastle Capital Management, L.P., which in turn is the general partner of Newcastle Partners, L.P., may also be deemed to beneficially own the 2,018,400 shares of common stock beneficially owned by Newcastle Partners, L.P. Mark E. Schwarz, as the managing member of Newcastle Capital Group, L.L.C., the general partner of Newcastle Capital Management, L.P., which in turn is the general partner of Newcastle Partners, L.P., may also be deemed to beneficially own the 2,018,400 shares of common stock beneficially owned by Newcastle Partners, L.P. Newcastle Capital Management, L.P., Newcastle Capital Group, L.L.C. and Mr. Schwarz disclaim beneficial ownership of the shares of common stock held by Newcastle Partners, L.P., except to the extent of their pecuniary interest therein. By virtue of his position with Newcastle Partners, L.P., Newcastle Capital Management, L.P. and Newcastle Capital Group, L.L.C., Mark E. Schwarz has the sole power to vote and dispose of the shares of common stock owned by Newcastle Partners, L.P. |

| (5) | | Share information based solely on information contained on a Schedule 13G/A, dated February 14, 2005, filed with the Securities and Exchange Commission. This Schedule 13G/A indicates that Fidelity Management & Research Company, a wholly-owned subsidiary of FMR Corp. and an investment adviser registered under section 203 of the Investment Advisers Act of 1940, has sole investment power with respect to 1,131,900 of the reported shares. The Schedule 13G/A further indicates that Edward C. Johnson 3d, Chairman of FMR Corp., and FMR Corp., through their control of Fidelity Management & Research Company, have sole power to dispose of the 1,131,900 shares. This Schedule 13G/A also indicates that Fidelity Management Trust Company, a wholly-owned subsidiary of FMR Corp. and a bank as defined in Section 3(a)(6) of the Securities Exchange Act of 1934, is the beneficial owner of 417,000 of the reported shares as a result of its serving as investment manager of the institutional account(s). This Schedule 13G/A further indicates that Edward C. Johnson 3d and FMR Corp., through their control of Fidelity Management Trust Company, each has sole dispositive power over 417,000 shares and sole power to vote or to direct the voting of 417,000 shares of Common Stock owned by the institutional account(s) as reported above. In addition, the Schedule 13G/A indicates that Fidelity Management & Research Company carries out the voting of the shares under written guidelines established by the Board of Directors of Trustees of the Fidelity Funds, that members of the Edward C. Johnson 3d family own approximately 49% of the voting power of FMR Corp., and that the Johnson family group and all Class B shareholders of FMR Corp. have entered into a shareholders’ voting agreement under which all Class B shares will be voted in accordance with the majority vote of Class B shares. Furthermore, the Schedule 13G states that through their ownership of voting common stock and the execution of the shareholders’ voting agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940, to form a controlling group with respect to FMR Corp. |

| (6) | | Share information based solely on information contained on a Schedule 13G/A, dated April 18, 2005, filed with the Securities and Exchange Commission. This Schedule 13G/A indicates that Reed Conner & Birdwell LLC, an investment adviser registered under section 203 of the Investment Advisers Act of 1940, has sole voting and investment power with respect to the reported shares. |

16

| (7) | | Share information based solely on information contained on a Form 4, dated April 15, 2005, filed with the Securities and Exchange Commission. This Form 4 indicates that Myron M. Kaplan has sole voting and investment power with respect to the reported shares. |

| (8) | | Share information based solely on information contained on a Schedule 13G/A, dated February 14, 2005, filed with the Securities and Exchange Commission. This Schedule 13G/A indicates that Wasatch Advisors, Inc., an investment adviser registered under section 203 of the Investment Advisers Act of 1940, has sole voting and investment power with respect to the reported shares. |

| (9) | | Share information based solely on information contained on a Schedule 13G, dated February 9, 2005, filed with the Securities and Exchange Commission. This Schedule 13G indicates that Dimensional Fund Advisors Inc., an investment adviser registered under section 203 of the Investment Advisers Act of 1940, has sole voting and investment power with respect to the reported shares. |

| (10) | | Mr. Hugh M. Patinkin passed away prior to June 1, 2005, the date as of which the table speaks. Mr. Patinkin served as Chairman and Chief Executive Officer of Whitehall until the time of his death. See footnote 3 above. |

| (11) | | Includes 381,202 shares of common stock issuable pursuant to presently exercisable stock options or stock options which will become exercisable within 60 days of this proxy statement. Includes 185,208 shares solely owned by Robin J. Patinkin, as Trustee of the Robin Patinkin UA2-2-92 Trust. Robin J. Patinkin, Matthew Patinkin’s wife, has sole investment power with respect to such shares. Includes 32,406 shares held by Matthew M. Patinkin and Robin J. Patinkin, as Trustees of various trusts for the benefit of their children. Includes 13,281 shares held by Robin J. Patinkin, as Trustee of various trusts for the benefit of the children of Matthew M. Patinkin and Robin J. Patinkin, with respect to which shares Matthew M. Patinkin disclaims beneficial ownership because Robin J. Patinkin has sole voting and investment power with respect to such shares. The mailing address of Matthew M. Patinkin is c/o Whitehall Jewellers, Inc., 155 North Wacker Drive, Suite 500, Chicago, Illinois 60606. |

| (12) | | Includes 396,159 shares of common stock issuable pursuant to presently exercisable stock options or stock options which will become exercisable within 60 days of this proxy statement. Includes 35,748 shares beneficially owned by John R. Desjardins, which shares are held by Cheryl Desjardins and Stephen Kendig, as Trustees of the John R. Desjardins 1995 Family Trust U/A/D 12/28/95. Cheryl Desjardins and Stephen Kendig have shared investment power with respect to such shares. Shares beneficially owned by Mr. Desjardins include shares allocated to his account in the ESOP (12,440 shares), as to which he shares voting power with the ESOP. The ESOP has sole investment power with respect to such shares. The mailing address of John R. Desjardins is c/o Whitehall Jewellers, Inc., 155 North Wacker Drive, Suite 500, Chicago, Illinois 60606. |

| (13) | | Includes 124,632 shares of common stock issuable pursuant to presently exercisable stock options or stock options which will become exercisable within 60 days of this proxy statement. Mr. M. Brown tendered his resignation effective December 17, 2004. Pursuant to his separation and release agreement, Mr. M. Brown’s employment with Whitehall was deemed to have been terminated for good reason and therefore his options to purchase shares of Whitehall’s common stock vested in full and remain exercisable until December 17, 2006. Includes 750 shares owned by Marcy Brown, Mr. M. Brown’s wife, in her self directed IRA account, with respect to which shares Manny A. Brown disclaims beneficial ownership. The mailing address of Manny A. Brown is 184 Oak Knoll Terrace, Highland Park, IL 60035. |

| (14) | | Includes 47,366 shares of common stock issuable pursuant to presently exercisable stock options or stock options which will become exercisable within 60 days of this proxy statement. Includes 1,111 shares of restricted common stock granted on February 19, 2004, which restrictions lapse in equal installments on February 19, 2006 and February 19, 2007. Includes 1,667 shares of restricted common stock granted on March 3, 2005, which restrictions lapse in equal installments on March 3, 2006, March 3, 2007 and March 3, 2008. Includes 1,402 shares of restricted common stock granted on April 13, 2005, which restrictions lapse on April 13, 2006. The mailing address of Norman J. Patinkin is c/o United Marketing Group, L.L.C., 5724 North Pulaski, Chicago, Illinois 60647. |

| (15) | | Includes 49,444 shares of common stock issuable pursuant to presently exercisable stock options or stock options which will become exercisable within 60 days of this proxy statement. Includes 1,111 shares of restricted common stock granted on February 19, 2004, which restrictions lapse in equal installments on February 19, 2006 and February 19, 2007. Includes 1,667 shares of restricted common stock granted on March 3, 2005, which restrictions lapse in equal installments on March 3, 2006, March 3, 2007 and March 3, 2008. Includes 1,402 |

17

| | shares of restricted common stock granted on April 13, 2005, which restrictions lapse on April 13, 2006. The mailing address for Daniel H. Levy is c/o Donnkenny, Inc., 1411 Broadway, New York, New York 10019. |

| (16) | | Includes 46,306 shares of common stock issuable pursuant to presently exercisable stock options or stock options which will become exercisable within 60 days of this proxy statement. Includes 1,111 shares of restricted common stock granted on February 19, 2004, which restrictions lapse in equal installments on February 19, 2006 and February 19, 2007. Includes 1,667 shares of restricted common stock granted on March 3, 2005, which restrictions lapse in equal installments on March 3, 2006, March 3, 2007 and March 3, 2008. Includes 1,402 shares of restricted common stock granted on April 13, 2005, which restrictions lapse on April 13, 2006. The mailing address for Richard K. Berkowitz is 3201 NE 183rd Street, Unit 1905, Aventure, Florida 33160. |

| (17) | | Includes 50,000 shares of restricted common stock which may not be sold or transferred until after November 30, 2005. The mailing address of Lucinda M. Baier is c/o Whitehall Jewellers, Inc., 155 North Wacker Drive, Suite 500, Chicago, Illinois 60606. |

| (18) | | Includes 6,141 shares of common stock issuable pursuant to presently exercisable stock options. Includes 1,111 shares of restricted common stock granted on February 19, 2004, which restrictions lapse in equal installments on February 19, 2006 and February 19, 2007. Includes 1,667 shares of restricted common stock granted on March 3, 2005, which restrictions lapse in equal installments on March 3, 2006, March 3, 2007 and March 3, 2008. Includes 1,402 shares of restricted common stock granted on April 13, 2005, which restrictions lapse on April 13, 2006. The mailing address of Sanford Shkolnik is c/o Encore Investments, LLC, 101 West Grand Avenue, Chicago, Illinois 60610. |

| (19) | | The mailing address of Debbie Nicodemus-Volker is c/o Whitehall Jewellers, Inc., 155 North Wacker Drive, Suite 500, Chicago, Illinois 60606. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities and Exchange Act of 1934, as amended, and the rules and regulations thereunder require our directors and executive officers and persons who are deemed to own more than ten percent of our common stock, to file certain reports with the Securities and Exchange Commission with respect to their beneficial ownership of our common stock.

Based upon a review of filings with the Securities and Exchange Commission and written representations from certain reporting persons that other filings were required to be made, we believe that all our directors and executive officers complied during fiscal year 2004 with the reporting requirements of Section 16(a).

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

At the end of fiscal year 2004, Messrs. Hugh Patinkin, John Desjardins and Matthew Patinkin owned a 52% equity interest in Double P Corporation, PDP Limited Liability Company and CBN Limited Liability Company, which own and operate primarily mall-based snack food stores. A substantial portion of the remaining equity interest is owned by the adult children and other family members of Norman Patinkin, a member of the Board of Directors. One of Norman Patinkin’s adult children is a director and chief executive officer of Double P Corporation. During fiscal year 2004, Messrs. Hugh Patinkin, John Desjardins and Matthew Patinkin spent a limited amount of time providing services to Double P Corporation, PDP Limited Liability Company and CBN Limited Liability Company, and such services were provided in accordance with Whitehall’s Code of Conduct. Messrs. Hugh Patinkin, John Desjardins and Matthew Patinkin received no remuneration for these services other than reimbursement of expenses incurred. In the past, Whitehall and Double P Corporation agreed to divide and separately lease contiguous mall space. Whitehall and Double P Corporation concurrently negotiated separately with each landlord (“Simultaneous Negotiations”) to reach agreements for their separate locations. Since Whitehall’s initial public offering, its policy had required that the terms of any such leases must be approved by a majority of Whitehall’s outside directors. Whitehall had conducted such negotiations in less than ten situations since Whitehall’s initial public offering in 1996. Whitehall’s current policy is that it will no longer enter into such Simultaneous Negotiations.

18

Whitehall offers health insurance coverage to the members of its Board of Directors. The health insurance policy options and related policy cost available to the Directors are the same as those available to Whitehall’s senior level employees.

Whitehall operated a program under which executive officers and directors, and parties introduced to Whitehall by its executive officers and directors, were permitted to purchase most Whitehall merchandise at approximately ten percent above Whitehall’s cost. No such purchases were made under this program during fiscal year 2004 as compared to approximately $174,000 of such purchases in fiscal year 2003. This program was discontinued during the third quarter of fiscal year 2004. Executive officers and directors, and parties introduced to Whitehall by its executive officers and directors, are now permitted to purchase Company merchandise at the same level of discount that is offered to Whitehall’s support office employees, field supervisors and store managers, which is less favorable in comparison to the discount that was offered under the discontinued program.

REPORT BY THE AUDIT COMMITTEE

The Audit Committee assists the Board of Directors in monitoring the integrity of Whitehall’s financial statements, the independent registered public accounting firm’s qualifications and independence, the performance of Whitehall’s internal audit function and independent registered public accounting firm and the compliance by Whitehall with legal and regulatory requirements. Management is responsible for Whitehall’s internal controls and the financial reporting process. The independent registered public accounting firm is responsible for performing an independent audit of the Whitehall financial statements in accordance with generally accepted auditing standards and issuing a report on those financial statements. The Audit Committee monitors and oversees these processes.

In this context, the Audit Committee has reviewed and discussed the audited financial statements for fiscal year 2004 with management. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61, “Communication with Audit Committees,” as amended by Statements on Auditing Standards Nos. 89 and 90, which includes, among other items, matters related to the conduct of the audit of Whitehall’s annual financial statements.

The Audit Committee also has received the written disclosures and the letter from the independent registered public accounting firm required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” and has discussed with the independent registered public accounting firm the issue of its independence from Whitehall and management. In addition, the Audit Committee has considered whether the provision of non-audit services by the independent registered public accounting firm in 2004 is compatible with maintaining the accounting firm’s independence and has concluded that it is.

Based on its review of the audited financial statements and the various discussions noted above, and discussions with the independent registered public accounting firm, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in Whitehall’s Annual Report on Form 10-K for the fiscal year ended January 31, 2005.

THE AUDIT COMMITTEE OF

THE BOARD OF DIRECTORS

Richard K. Berkowitz(Chairman)

Daniel H. Levy

Sanford Shkolnik

19

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Representatives of PwC, Whitehall’s independent registered public accounting firm for the last fiscal year, are expected to be present at the annual meeting and will have an opportunity to make a statement and to respond to appropriate questions raised by stockholders at the annual meeting or submitted in writing prior thereto.

Audit and Non-Audit Fees

The following table sets forth the fees billed for each of fiscal years 2004 and 2003 for professional services rendered by PwC.

| | | | 2004

| | 2003

|

|---|

| Audit Fees (1) | | | | $ | 1,102,224 | | | $ | 2,429,679 | |

| Audit-Related Fees (2) | | | | $ | 28,844 | | | $ | 35,000 | |

| Tax Fees (3) | | | | $ | 83,076 | | | $ | 153,527 | |

| All Other Fees (4) | | | | $ | 5,000 | | | $ | 48,800 | |

| TOTAL | | | | $ | 1,219,144 | | | $ | 2,667,006 | |

| (1) | | Audit fees related to professional services rendered for the audit of Whitehall’s annual financial statements and quarterly review of financial statements included in Whitehall’s quarterly reports on Form 10-Q. The fiscal year 2004 audit fee decreased primarily as a result of the settlement of the consolidated Capital Factors actions and the non-prosecution agreement with the United States Attorney’s Office for the Eastern District of New York. |

| (2) | | Audit-related fees include professional services related to the audit of Whitehall’s financial statements, consultation on accounting standards or transactions and audits of employee benefit plans. |

| (3) | | Tax fees relate to professional services rendered for tax compliance, tax advice and tax planning. |

| (4) | | All other fees for fiscal year 2003 included professional services rendered in connection with the production of information in response to a subpoena from the Supreme Court of the State of New York regarding the Capital Factors civil litigation. |

Approval of Independent Registered Public Accounting Firm Services and Fees

Under Whitehall’s policy approved by the Audit Committee, the Audit Committee must pre-approve all services provided by Whitehall’s independent registered public accounting firm and fees charged. The Audit Committee will consider annually the provision of audit services and, if appropriate, pre-approve certain defined audit fees, audit related fees, tax fees and other fees with specific dollar value limits for each category of service. During the year, the Audit Committee will periodically monitor the levels of PwC fees against the pre-approved limits. The Audit Committee will also consider on a case by case basis and, if appropriate, approve specific engagements that are not otherwise pre-approved. Any proposed engagement that does not fit within the definition of a pre-approved service may be presented to the Audit Committee for approval. All fiscal year 2004 audit and non-audit services provided by the independent registered public accounting firm were pre-approved.

20

PROPOSAL 2 — RATIFICATION OF SELECTION OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected PricewaterhouseCoopers LLP (“PwC”) as Whitehall’s independent registered public accounting firm to conduct the audit of Whitehall’s financial statements for the fiscal year ending January 31, 2006. PwC, a registered accounting firm, also served as Whitehall’s independent registered public accounting firm for the fiscal years ended January 31, 2005, 2004 and 2003. The Board of Directors is submitting the selection of independent registered public accounting firm for stockholder ratification at the annual meeting. Although ratification by stockholders is not required by Whitehall’s organizational documents or under applicable law, the Audit Committee has determined that a policy of requesting ratification by stockholders of its selection of independent registered public accounting firm is a matter of good corporate practice. If stockholders do not ratify the selection, the Audit Committee will reconsider whether or not to retain PwC, but may still retain them. Even if the selection is ratified, the Audit Committee, in its discretion, may change the appointment at any time during the year if it determines that such a change would be in the best interest of Whitehall and its stockholders.

21

THE BOARD OF DIRECTORS OF WHITEHALL RECOMMENDS

VOTES “FOR” THE RATIFICATION OF

THE SELECTION OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

FOR THE FISCAL YEAR ENDING JANUARY 31, 2006

STOCKHOLDER PROPOSALS FOR 2006 ANNUAL MEETING

The Securities and Exchange Commission and Whitehall’s by-laws establish advance notice procedures for stockholder proposals to be brought before any annual meeting of stockholders, including proposed nominations of persons for election to the Board of Directors. Under the rules of the Securities and Exchange Commission, proposals to be considered for inclusion in the proxy statement for the 2006 annual meeting must be received no later than February 8, 2006. Any proposal submitted must be in compliance with Rule 14a-8 of Regulation 14A of the Securities and Exchange Act of 1934, as amended. Whitehall’s by-laws set forth additional requirements and procedures regarding the submission by stockholders of matters for consideration at the annual meeting, including a requirement that such proposals be given to the secretary in writing not later than 90 calendar days in advance of the anniversary date of the release of Whitehall’s proxy statement to stockholders in connection with the preceding year’s annual meeting. Accordingly, a stockholder proposal intended to be considered at the 2006 annual meeting must be received by the secretary prior to March 10, 2006. All proposals and nominations should be directed to Whitehall Jewellers, Inc., 155 North Wacker Drive, Suite 500, Chicago, Illinois 60606, Attention: Secretary.

ANNUAL REPORT ON FORM 10-K

WHITEHALL WILL FURNISH WITHOUT CHARGE A COPY OF ITS ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED JANUARY 31, 2005, INCLUDING THE FINANCIAL STATEMENTS AND THE SCHEDULES THERETO, UPON THE WRITTEN REQUEST OF ANY STOCKHOLDER AS OF THE RECORD DATE, AND WILL PROVIDE COPIES OF THE EXHIBITS TO THE REPORT UPON PAYMENT OF A REASONABLE FEE THAT WILL NOT EXCEED WHITEHALL’S REASONABLE EXPENSES INCURRED IN CONNECTION THEREWITH. REQUESTS FOR SUCH MATERIALS SHOULD BE DIRECTED TO WHITEHALL JEWELLERS, INC., 155 NORTH WACKER DRIVE, SUITE 500, CHICAGO, ILLINOIS 60606, TELEPHONE (312) 782-6800, ATTENTION: JOHN R. DESJARDINS.

OTHER BUSINESS

It is not anticipated that any matter will be considered by the stockholders other than those set forth above, but if other matters are properly brought before the annual meeting, the persons named in the proxy will vote in accordance with their best judgment.

By order of the Board of Directors,

Daniel H. Levy

Chairman of the Board

ALL STOCKHOLDERS ARE URGED TO SIGN, DATE

AND MAIL THEIR PROXIES PROMPTLY.

22

APPENDIX A

AUDIT COMMITTEE

CHARTER

| A. | | The purpose of the Audit Committee (the “Audit Committee”) of the Board of Directors (the “Board”) of Whitehall Jewellers, Inc., a Delaware corporation (the “Corporation”), is: |

| 1. | | to assist the Board in its oversight of (a) the integrity of the Corporation’s financial statements, (b) the Corporation’s compliance with legal and regulatory requirements, (c) the qualifications and independence of the Corporation’s external auditor (the “Independent Auditor”), and (d) the performance of the Corporation’s internal auditing department (“Internal Audit”) and the Independent Auditor; and |

| 2. | | to prepare the report of the Audit Committee that is required, pursuant to rules promulgated by the Securities and Exchange Commission (the “SEC”), to be included in the Corporation’s annual proxy statement. |

| B. | | The Board recognizes that while the Audit Committee has been given certain duties and responsibilities pursuant to this Charter, the Audit Committee is not responsible for guaranteeing the accuracy of the Corporation’s financial statements or the quality of the Corporation’s accounting practices. The fundamental responsibility for the Corporation’s financial statements and disclosures rests with management and the Independent Auditor. The Board also recognizes that meeting the responsibilities of an Audit Committee in a dynamic business environment requires a degree of flexibility. Accordingly, the procedures outlined in this Charter are meant to serve as guidelines rather than inflexible rules, and the Audit Committee is encouraged to adopt such different or additional procedures as it deems necessary from time to time. |

| II. | | Structure and Operations |

| A. | | Composition of the Committee |

The Audit Committee shall consist of three or more members of the Board, each of whom, in the Board’s determination, has no material relationship with the Corporation (either directly or as a partner, shareholder, or officer of an organization that has a relationship with the Corporation) and otherwise satisfies the applicable requirements for audit committee service under the (i) Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder (the “Exchange Act”) and (ii) listing standards of the New York Stock Exchange, Inc. (the “NYSE”). One member of the Audit Committee shall be a “financial expert,” as such term is defined by the SEC. No director who serves on the audit committee of more than two public companies other than the Corporation shall be eligible to serve as a member of the Audit Committee. Determinations as to whether a particular director satisfies the requirements for membership on the Audit Committee shall be made by the Board.

The members of the Audit Committee shall be appointed by the majority of the vote of the Board on the recommendation of the Nominating/Corporate Governance Committee. A Member of the Audit Committee shall serve at the pleasure of the Board for such term as the Board may determine, or until his or her earlier resignation, death or removal. Unless a Chair is designated by the Board, the members of the Audit Committee may elect a Chair by majority vote.

The Committee shall meet with such frequency and at such intervals as it shall determine is necessary to carry out its duties and responsibilities set forth in this Charter. Meetings of the Committee may be in person or by means of a conference call or similar communications equipment, provided that all of the participants at the meeting can hear each other.

The majority vote of the members of Committee at any meeting in which a quorum is present shall constitute an official action of the Committee. The Committee also may take an official Committee action by means of a written

A-1

consent signed by all of the members of the Committee. A quorum for purposes of any meeting of the Committee shall be a majority of the members of the Committee.

| III. | | Duties and Responsibilities |

The duties and responsibilities of the Audit Committee are to:

Documents/Reports Review

| 1. | | Review the adequacy of this Charter at least annually and at such other intervals as the Audit Committee or the Board determines. |

| 2. | | Review and discuss the annual audited financial statements and quarterly financial statements with management and the Independent Auditor, including the disclosures under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The Audit Committee shall make a recommendation to the Board as to whether the annual audited financial statements should be included in the Corporation’s Annual Report on Form 10-K. |

| 3. | | Discuss earnings press releases, as well as financial information and earnings guidance provided to analysts and ratings agencies, it being understood that such discussions may, in the discretion of the Audit Committee, be done generally (i.e., by discussing the types of information to be disclosed and the type of presentation to be made) and that the audit committee need not discuss in advance each earnings release or each instance in which the Corporation gives earnings guidance. |

| 4. | | Review reports to management prepared by the Independent Auditor or Internal Audit and any responses to the same by management. |

Independent Auditor

| 5. | | Be responsible for the appointment, retention, termination, compensation and oversight of the Independent Auditor. The Audit Committee shall also be responsible for the resolution of disagreements between management and the Independent Auditor regarding financial reporting. The Independent Auditor shall report directly to the Audit Committee. |

| 6. | | Preapprove all auditing and non-audit services to be provided to the Corporation by the Independent Auditor, subject to any exceptions provided in the Act. |