Table of Contents

The information in this preliminary prospectus supplement is not complete and may be changed. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. This preliminary prospectus supplement and the accompanying prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-156305

SUBJECT TO COMPLETION, DATED SEPTEMBER 1, 2010

PRELIMINARY PROSPECTUS SUPPLEMENT

(To Prospectus Dated August 27, 2010)

The Korea Development Bank

US$ % Notes due 20

Our US$ aggregate principal amount of notes due 20 (the “Notes”) will bear interest at a rate of % per annum. Interest on the Notes is payable semi-annually in arrears on March and September of each year, beginning on March , 2011. The Notes will mature on , 20 . The “Change of Support Offer” described in “Description of the Securities—Description of Debt Securities—Change of Support Offer” of the accompanying prospectus does not apply to the Notes. Accordingly, we will not have an obligation to make an offer to repurchase the Notes following a Change of Support Triggering Event (as defined in the accompanying prospectus), and a failure to make such an offer will not constitute an event of default with respect to the Notes.

The Notes will be issued in minimum denominations of US$100,000 principal amount and integral multiples of US$1,000 in excess thereof. The Notes will be represented by one or more global notes registered in the name of a nominee of The Depository Trust Company, as depositary.

The payment of interest and the repayment of principal on the Notes will not be guaranteed by the Government (as defined herein). However, as of the date of the initial sale of the Government’s equity interest in us, our mid-to-long term foreign currency debt then outstanding (including the Notes offered hereby) are expected to be guaranteed by the Government, subject to the authorization of the Government guarantee amount by the National Assembly of the Republic of Korea. See “The Korea Development Bank—Overview” and “—Business—Government Support and Supervision” in the accompanying prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Note | Total | |||||

Public offering price | % | US$ | ||||

Underwriting discount | % | US$ | ||||

Proceeds to us (before deduction of expenses) | % | US$ | ||||

In addition to the initial public offering price, you will have to pay for accrued interest, if any, from and including September , 2010.

We have applied to the Singapore Exchange Securities Trading Limited (the “SGX-ST”) for the listing of the Notes. There can be no assurance that such listing will be obtained for the Notes. The SGX-ST assumes no responsibility for the correctness of any statements made, opinions expressed or reports contained in this prospectus supplement and the accompanying prospectus. Admission of the Notes to the Official List of the SGX-ST is not to be taken as an indication of the merits of the issuer or the Notes. Currently, there is no public market for the Notes.

We expect to make delivery of the Notes to investors through the book-entry facilities of The Depository Trust Company on or about September , 2010.

Joint Bookrunners

BARCLAYS CAPITAL | CITI | CRÉDIT AGRICOLE CIB | DEUTSCHE BANK | J.P. MORGAN | KDB ASIA LTD |

Prospectus Supplement Dated September , 2010

Table of Contents

You should rely only on the information contained in or incorporated by reference in this prospectus supplement and the accompanying prospectus. We have not authorized anyone to provide you with different information. We are not making an offer to sell these securities in any state or jurisdiction where the offer or sale is not permitted.

Prospectus Supplement

| Page | |||

| S-5 | |||

| S-7 | |||

| S-8 | |||

| S-14 | |||

| S-18 | |||

| S-21 | |||

| S-22 | |||

| S-26 | |||

| S-26 | |||

| S-26 |

Prospectus

| Page | ||

| 1 | ||

| 2 | ||

| 3 | ||

| 3 | ||

| 6 | ||

| 7 | ||

| 9 | ||

| 15 | ||

| 22 | ||

| 24 | ||

| 25 | ||

| 25 | ||

| 25 | ||

| 26 | ||

| 30 | ||

| 87 | ||

| 87 | ||

| 89 | ||

| 92 | ||

| 99 | ||

| 105 | ||

| 110 | ||

| 113 | ||

| 120 | ||

| 122 | ||

| 124 | ||

| 128 | ||

| 128 | ||

| 136 |

S-2

Table of Contents

| Page | ||

| 137 | ||

| 138 | ||

Description of Guarantees to be Issued by The Republic of Korea | 138 | |

Limitations on Issuance of Bearer Debt Securities and Bearer Warrants | 140 | |

| 141 | ||

| 141 | ||

| 142 | ||

| 149 | ||

| 150 | ||

| 150 | ||

| 150 | ||

| 150 | ||

| 151 | ||

| 152 |

S-3

Table of Contents

Certain Defined Terms

All references to “we” or “us” mean The Korea Development Bank. All references to “Korea” or the “Republic” contained in this prospectus supplement mean The Republic of Korea. All references to the “Government” mean the government of Korea. Terms used but not defined in this prospectus supplement shall have the same meanings given to them in the accompanying prospectus.

In this prospectus supplement and the accompanying prospectus, where information has been provided in units of thousands, millions or billions, such amounts have been rounded up or down. Accordingly, actual numbers may differ from those contained herein due to rounding. Any discrepancy between the stated total amount and the actual sum of the itemized amounts listed in a table, is due to rounding.

Our principal financial statements are our non-consolidated financial statements. Unless specified otherwise, our financial and other information is presented on a non-consolidated basis and does not include such information with respect to our subsidiaries.

Additional Information

The information in this prospectus supplement is in addition to the information contained in our prospectus dated August 27, 2010. The accompanying prospectus contains information regarding ourselves and Korea, as well as a description of some terms of the Notes. You can find further information regarding us, Korea, and the Notes in registration statement no. 333-156305, as amended, relating to our debt securities, with or without warrants, and guarantees, which is on file with the U.S. Securities and Exchange Commission.

We are Responsible for the Accuracy of the Information in this Document

We are responsible for the accuracy of the information in this document and confirm that to the best of our knowledge we have included all facts that should be included not to mislead potential investors. The SGX-ST assumes no responsibility for the correctness of any statements made or opinions expressed or reports contained in this prospectus supplement and the accompanying prospectus. Admission of the Notes to the Official List of the SGX-ST is not to be taken as an indication of the merits of the issuer or the Notes.

Not an Offer if Prohibited by Law

The distribution of this prospectus supplement and the accompanying prospectus, and the offer of the Notes, may be legally restricted in some countries. If you wish to distribute this prospectus supplement or the accompanying prospectus, you should observe any restrictions. This prospectus supplement and the accompanying prospectus should not be considered an offer and should not be used to make an offer, in any state or country which prohibits the offering.

The Notes may not be offered or sold in Korea, directly or indirectly, or to any resident of Korea, except as permitted by Korean law. For more information, see “Underwriting—Foreign Selling Restrictions.”

Information Presented Accurate as of Date of Document

This prospectus supplement and the accompanying prospectus are the only documents on which you should rely for information about the offering. We have authorized no one to provide you with different information. You should not assume that the information in this prospectus supplement or the accompanying prospectus is accurate as of any date other than the date on the front of each document.

S-4

Table of Contents

This summary highlights selected information from this prospectus supplement and the accompanying prospectus and may not contain all of the information that is important to you. To understand the terms of our Notes, you should carefully read this prospectus supplement and the accompanying prospectus.

The Notes

We are offering US$ aggregate principal amount of % notes due , 20 .

The Notes will bear interest at a rate of % per annum, payable semi-annually in arrears on March and September , beginning on March , 2011. Interest on the Notes will accrue from September , 2010 and will be computed based on a 360-day year consisting of twelve 30-day months. See “Description of the Notes—Payment of Principal and Interest.”

The Notes will be issued in minimum denominations of US$100,000 principal amount and integral multiples of US$1,000 in excess thereof. The Notes will be represented by one or more global securities registered in the name of a nominee of The Depository Trust Company (“DTC”), as depositary.

The payment of interest and the repayment of principal on the Notes will not be guaranteed by the Government. However, as of the date of the initial sale of the Government’s equity interest in us, our mid-to-long term foreign currency debt then outstanding (including the Notes offered hereby) are expected to be guaranteed by the Government, subject to the authorization of the Government guarantee amount by the National Assembly of the Republic. See “The Korea Development Bank—Overview” and “—Business—Government Support and Supervision” in the accompanying prospectus.

We do not have any right to redeem the Notes prior to maturity.

The “Change of Support Offer” described in “Description of the Securities—Description of Debt Securities—Change of Support Offer” of the accompanying prospectus does not apply to the Notes. Accordingly, we will not have an obligation to make an offer to repurchase the Notes following a Change of Support Triggering Event (as defined in the accompanying prospectus), and a failure to make such an offer will not constitute an event of default with respect to the Notes.

Listing

We have applied to list the Notes on the SGX-ST. Settlement of the Notes is not conditioned on obtaining the listing. We cannot give assurance that the application to the SGX-ST for the Notes will be approved. The Notes will be traded on the SGX-ST in a minimum board lot size of US$200,000 for so long as the Notes are listed on the SGX-ST and the rules of the SGX-ST so require.

Form and Settlement

We will issue the Notes in the form of one or more fully registered global notes, registered in the name of a nominee of DTC, as depositary. Except as described in the accompanying prospectus under “Description of the Securities—Description of Debt Securities—Global Securities,” the global notes will not be exchangeable for Notes in definitive registered form, and will not be issued in definitive registered form. Financial institutions, acting as direct and indirect participants in DTC, will represent your beneficial interests in the global notes. These financial institutions will record the ownership and transfer of your beneficial interest through book-entry accounts. You may hold your beneficial interests in the Notes through Euroclear Bank S.A./N.V. (“Euroclear”)

S-5

Table of Contents

or Clearstream Banking,société anonyme(“Clearstream”) if you are a participant in such systems, or indirectly through organizations that are participants in such systems. Any secondary market trading of book-entry interests in the Notes will take place through DTC participants, including Euroclear and Clearstream. See “Clearance and Settlement—Transfers Within and Between DTC, Euroclear and Clearstream.”

Further Issues

We may from time to time, without the consent of the holders of the Notes, create and issue additional debt securities with the same terms and conditions as the Notes in all respects so that such further issue shall be consolidated and form a single series with the Notes. We will not issue any such additional debt securities unless such additional securities have no more than ade minimis amount of original issue discount or such issuance would constitute a “qualified reopening” for U.S. federal income tax purposes.

Delivery of the Notes

We expect to make delivery of the Notes, against payment in same-day funds on or about September , 2010, which will be the fifth business day following the date of this prospectus supplement, referred to as “T+5.” You should note that initial trading of the Notes may be affected by the T+5 settlement. See “Underwriting—Delivery of the Notes.”

Underwriting

KDB Asia Limited, one of the underwriters, is our affiliate and has agreed to offer and sell the Notes only outside the United States to non-U.S. persons. See “Underwriting—Relationship with the Underwriters.”

S-6

Table of Contents

The net proceeds from the issue of the Notes, after deducting the underwriting discount but not estimated expenses, will be US$ . We will use the net proceeds from the sale of the Notes for our general operations, including extending foreign currency loans and repayment of our maturing debt and other obligations.

S-7

Table of Contents

This section provides information that supplements the information about our bank and the Republic included under the headings corresponding to the headings below in the accompanying prospectus dated August 27, 2010. Defined terms used in this section have the meanings given to them in the accompanying prospectus. If the information in this section differs from the information in the accompanying prospectus, you should rely on the information in this section.

THE KOREA DEVELOPMENT BANK

Overview

As of June 30, 2010, we had (Won)77,723.8 billion of loans outstanding (including equipment capital loans, working capital loans, call loans, domestic usance, bills of exchange bought, debentures accepted by private subscription, bonds purchased, inter-bank loans, local letters of credit negotiation, loan-type suspense accounts pursuant to applicable guidelines and other loans, without adjusting for provision for loan losses and present value discounts), total assets of (Won)122,450.9 billion and total shareholders’ equity of (Won)15,587.7 billion, as compared to (Won)76,211.4 billion of loans outstanding (including equipment capital loans, working capital loans, call loans, domestic usance, bills of exchange bought, debentures accepted by private subscription, bonds purchased, inter-bank loans, local letters of credit negotiation, loan-type suspense accounts pursuant to applicable guidelines and other loans, without adjusting for provision for loan losses and present value discounts), (Won)122,333.4 billion of total assets and (Won)15,110.7 billion of total shareholders’ equity as of December 31, 2009. For the six months ended June 30, 2010, we recorded interest income of (Won)2,281.4 billion, interest expense of (Won)1,446.0 billion and net income of (Won)220.6 billion, as compared to (Won)2,804.1 billion of interest income, (Won)2,495.9 billion of interest expense and (Won)246.4 billion of net income for the six months ended June 30, 2009. These changes in our results of operations for the six months ended June 30, 2010 as compared to the corresponding period of 2009 reflected the spin-off of a significant portion of our assets and liabilities in connection with the establishment of KDBFG and KoFC in October 2009. See “The Korea Development Bank—Overview” in the accompanying prospectus.

KoFC’s authorized capital is (Won)15,000 billion. As such, KoFC is permitted to hold only that percentage of KDBFG shares of which the aggregate value does not exceed (Won)15,000 billion. Due to an increase in valuation of the KDBFG shares in July 2010, KoFC currently owns 90.3% of KDBFG’s share capital, a decrease from 94.3% as of December 31, 2009, and the Government currently directly owns 9.7% of KDBFG’s share capital, an increase from 5.7% as of December 31, 2009.

S-8

Table of Contents

Capitalization

As of June 30, 2010, our authorized capital was (Won)15,000 billion and capitalization was as follows:

| June 30, 2010(1) | |||

| (billions of won) | |||

| (unaudited) | |||

Long-term debt(2)(3): | |||

Won and foreign currency borrowings | 4,680.3 | ||

Industrial finance bonds | 33,147.2 | ||

Foreign currency borrowings | 2,278.3 | ||

Total long-term debt | 40,105.8 | ||

Capital: | |||

Paid-in capital | 9,251.9 | ||

Capital surplus | 47.5 | ||

Capital adjustments | (0.3 | ) | |

Retained earnings | 5,300.2 | ||

Accumulated other comprehensive income(4) | 988.4 | ||

Total capital | 15,587.7 | ||

Total capitalization | 55,693.5 | ||

| (1) | Except as disclosed in this prospectus supplement, there has been no material change in our capitalization since June 30, 2010. |

| (2) | We have translated borrowings in foreign currencies into Won at the rate of (Won)1,210.3 to US$1.00, which was the market average exchange rate, as announced by the Seoul Money Brokerage Services Ltd., on June 30, 2010. |

| (3) | As of June 30, 2010, we had contingent liabilities totaling (Won)14,278.3 billion under outstanding guarantees issued on behalf of our clients. |

S-9

Table of Contents

Selected Financial Statement Data

The following tables present unaudited financial information as of June 30, 2010 and December 31, 2009 and for the six months ended June 30, 2010 and 2009:

THE KOREA DEVELOPMENT BANK

Interim non-consolidated statements of financial position

as of June 30, 2010 and December 31, 2009

(Korean Won in millions) | June 30, 2010 (Unaudited) | December 31, 2009 (Audited) | ||||||

Assets | ||||||||

Cash and due from banks | (Won) | 5,485,281 | (Won) | 2,965,356 | ||||

Securities | 26,252,932 | 31,664,203 | ||||||

Loan, net of provision for possible loan losses of (Won)1,856,284 million as of June 30, 2010 ((Won)1,413,400 million as of December 31, 2009) and deferred loan fees of (Won)20,316 million as of June 30, 2010 ((Won)12,499 million as of December 31, 2009) | 75,847,163 | 74,785,455 | ||||||

Property and equipment, net | 532,629 | 542,190 | ||||||

Derivative financial instruments | 7,439,791 | 7,675,978 | ||||||

Other assets | 6,893,099 | 4,700,264 | ||||||

Total assets | (Won) | 122,450,895 | (Won) | 122,333,446 | ||||

LIABILITIES AND EQUITY | ||||||||

Deposits | (Won) | 15,948,823 | (Won) | 13,935,926 | ||||

Borrowings | 26,255,800 | 28,636,206 | ||||||

Industrial finance bonds, gross of premium of bonds of (Won)3,057 million as of June 30, 2010 ((Won)3,699 million as of December 31, 2009) and net of discount on bonds of (Won)95,136 million as of June 30, 2010 ((Won)111,163 million as of December 31, 2009) | 50,503,141 | 52,051,582 | ||||||

Provision for possible guarantee losses | 218,998 | 243,561 | ||||||

Accrued severance benefits | 71,269 | 62,965 | ||||||

Derivative financial instruments | 6,603,265 | 6,644,753 | ||||||

Other liabilities | 7,261,920 | 5,647,746 | ||||||

Total liabilities | (Won) | 106,863,216 | (Won) | 107,222,739 | ||||

Equity: | ||||||||

Paid-in capital | 9,251,861 | 9,241,861 | ||||||

Capital surplus | 47,510 | 52,168 | ||||||

Retained earnings | 5,300,196 | 5,070,927 | ||||||

Accumulated other comprehensive income | 988,413 | 746,980 | ||||||

Capital adjustments | (301 | ) | (1,229 | ) | ||||

Total equity | 15,587,679 | 15,110,707 | ||||||

Total liabilities and equity | (Won) | 122,450,895 | (Won) | 122,333,446 | ||||

S-10

Table of Contents

THE KOREA DEVELOPMENT BANK

Interim non-consolidated statements of income (Unaudited)

For the six months ended June 30, 2010 and 2009

| For the six months ended June 30, | ||||||

(Korean Won in millions) | 2010 | 2009 | ||||

Operating revenue: | ||||||

Interest income: | ||||||

Interest on loans | (Won) | 1,713,980 | (Won) | 1,937,088 | ||

Interest on due from banks | 32,051 | 89,349 | ||||

Interest on securities | 528,112 | 761,092 | ||||

Other interest income | 7,220 | 16,580 | ||||

| 2,281,363 | 2,804,109 | |||||

Gain on valuation and disposal of securities: | ||||||

Gain on disposal of trading securities | 20,427 | 16,234 | ||||

Gain on valuation of trading securities | 1,134 | 1,857 | ||||

Gain on disposal of available-for-sale securities | 364,799 | 589,301 | ||||

Gain on disposal of equity method investments | 7,707 | 1,155 | ||||

Reversal of impairment loss on available-for-sale securities | 4,550 | — | ||||

| 398,617 | 608,547 | |||||

Gain on disposal of loans | 41,208 | 12,135 | ||||

Gain on foreign currency transactions | 785,348 | 1,537,079 | ||||

Fees and commission income | 241,692 | 203,081 | ||||

Dividend income | 36,020 | 284,073 | ||||

Other operating income: | ||||||

Fees and commission from trust accounts | 10,346 | 7,350 | ||||

Gain from derivatives transactions | 3,060,361 | 8,876,430 | ||||

Gain from derivatives valuation | 3,018,907 | 3,167,393 | ||||

Gain on valuation of hedged items | 303,514 | 477,421 | ||||

Others | 29,328 | 1,023 | ||||

| 7,526,724 | 14,565,985 | |||||

Total operating revenue | 10,206,704 | 17,978,641 | ||||

Operating expenses: | ||||||

Interest expense: | ||||||

Interest on deposits | 210,410 | 287,266 | ||||

Interest on borrowings | 279,283 | 497,378 | ||||

Interest on debentures | 947,279 | 1,696,304 | ||||

Others | 8,982 | 14,924 | ||||

| 1,445,954 | 2,495,872 | |||||

S-11

Table of Contents

THE KOREA DEVELOPMENT BANK

Interim non-consolidated statements of income (Unaudited)

For the six months ended June 30, 2010 and 2009

| For the six months ended June 30, | |||||||

(Korean Won in millions) | 2010 | 2009 | |||||

Loss on valuation and disposal of securities: | |||||||

Loss on disposal of trading securities | 12,841 | 21,926 | |||||

Loss on valuation of trading securities | 2,361 | 1,351 | |||||

Loss on disposal of available-for-sale securities | 16,552 | 34,252 | |||||

Loss on disposal of equity method investments | 1,918 | 992 | |||||

Impairment loss on available-for-sale securities | 132,781 | 25,661 | |||||

Impairment loss on equity method investments | 1,101 | — | |||||

| 167,554 | 84,182 | ||||||

Provision of allowance for possible loan losses | 836,922 | 483,508 | |||||

Loss on disposal of loans | 2,534 | 1,320 | |||||

Loss on foreign currency transactions | 664,368 | 1,729,693 | |||||

Fees and commission expenses | 11,938 | 17,643 | |||||

General and administrative expenses | 209,499 | 212,028 | |||||

Other operating expenses: | |||||||

Provision of allowance for possible losses on acceptances and guarantees | — | 56,096 | |||||

Provision of allowances for unused loan commitments | 39,218 | 25,428 | |||||

Loss from derivatives transactions | 3,037,343 | 8,929,459 | |||||

Loss from derivatives valuation | 2,964,416 | 3,404,998 | |||||

Loss on valuation of hedged items | 485,938 | 241,895 | |||||

Contributions to credit management fund | 45,656 | 44,609 | |||||

Others | 27,646 | 48,740 | |||||

| 8,325,478 | 15,195,417 | ||||||

Total operating expenses | 9,938,986 | 17,775,471 | |||||

Operating income (loss) | 267,718 | 203,170 | |||||

Non-operating income (expense): | |||||||

Gain (loss) on disposal of property and equipment, net | 15 | (41 | ) | ||||

Rental income | 465 | 491 | |||||

Gain (loss) on valuation of equity method investments, net | 75,988 | (26,697 | ) | ||||

Others, net | 1,536 | 192,900 | |||||

| 78,004 | 166,653 | ||||||

Income (loss) before income taxes | 345,722 | 369,823 | |||||

Income tax expenses | 125,087 | 123,470 | |||||

Net income (loss) | (Won) | 220,635 | (Won) | 246,353 | |||

S-12

Table of Contents

Six Months Ended June 30, 2010

For the six months ended June 30, 2010, we had net income of (Won)220.6 billion compared to net income of (Won)246.4 billion for the six months ended June 30, 2009. Our results of operations for the six months ended June 30, 2010 as compared to the corresponding period of 2009 were affected by the spin-off of a significant portion of our assets and liabilities in connection with the establishment of KDBFG and KoFC in October 2009. See “The Korea Development Bank—Overview” in the accompanying prospectus.

Other principal factors for the decrease in net income for the six months ended June 30, 2010 compared to the six months ended June 30, 2009 included:

| • | an increase in provision for loan losses to (Won)836.9 billion in the six months ended June 30, 2010 from (Won)483.5 billion in the corresponding period of 2009, primarily due to increased non-performing loans; and |

| • | a decrease in dividend income to (Won)36.0 billion in the six months ended June 30, 2010 from (Won)284.1 billion in the corresponding period of 2009, primarily due to a decrease in dividend income from KDB 3rd Securitization Specialty. |

The above factors were partially offset by an increase in net interest income to (Won)835.4 billion in the six months ended June 30, 2010 from (Won)308.2 billion in the corresponding period of 2009, primarily due to a decrease in interest expenses resulting from the transfer of interest-bearing liabilities, including Won-denominated industrial finance bonds, to KoFC in connection with the spin-off in October 2009.

Loans to Financially Troubled Companies

We have credit exposure (including loans, guarantees and equity investments) to a number of financially troubled Korean companies including Kumho Tires Co., Inc., Daewoo Motor Sales, Ssangyong Motor Company, SLS Shipbuilding Co., Ltd. and TY the First ABS Ltd. As of June 30, 2010, our credit extended to these companies totaled (Won)1,880.0 billion, accounting for 1.5% of our total assets as of such date.

As of June 30, 2010, our exposure (including loans classified as substandard or below and equity investment classified as estimated loss or below) to Kumho Tires increased to (Won)658.7 billion from (Won)583.0 billion as of December 31, 2009, primarily due to extension of new emergency loans to Kumho Tires in the first half of 2010. We downgraded the classification of our exposure to Daewoo Motor Sales from normal to substandard in April 2010. As of June 30, 2010, our exposure to Daewoo Motor Sales was (Won)361.2 billion. As of June 30, 2010, our exposure to Ssangyong Motor Company slightly increased to (Won)338.5 billion from (Won)318.2 billion as of December 31, 2009, primarily due to extension of additional loans to Ssangyong Motor Company in the first half of 2010. As of June 30, 2010, our exposure to SLS Shipbuilding decreased to (Won)284.7 billion from (Won)341.3 billion as of December 31, 2009, primarily due to the write-off of certain of our exposure to SLS Shipbuilding. As of June 30, 2010, our exposure to TY the First ABS Ltd. increased to (Won)236.8 billion from (Won)21.3 billion as of December 31, 2009, primarily due to guarantee payments by us to the creditors of TY the First ABS in the first half of 2010.

As of June 30, 2010, we established provisions of (Won)197.6 billion for our exposure to Kumho Tires, (Won)129.7 billion for SLS Shipbuilding, (Won)72.2 billion for Daewoo Motor Sales, (Won)67.7 billion for Ssangyong Motor Company and (Won)47.4 billion for TY the First ABS Ltd.

For the six months ended June 30, 2010, we did not sell any non-performing loans to the Korea Asset Management Corporation, or KAMCO.

Based on our unaudited internal management accounts, as of June 30, 2010, our exposure to Kumho Tires, Kumho Industrial, Kumho Petrochemical and Asiana Airlines was (Won)658.7 billion, (Won)186.9 billion, (Won)1,059.7 billion and (Won)872.9 billion, respectively. Based on our unaudited internal management accounts, as of June 30, 2010, we established provisions of (Won)197.6 billion, (Won)49.5 billion, (Won)68.2 billion and (Won)52.7 billion for our exposure to Kumho Tires, Kumho Industrial, Kumho Petrochemical and Asiana Airlines, respectively.

S-13

Table of Contents

The following is a description of some of the terms of the Notes we are offering. Since it is only a summary, we urge you to read the fiscal agency agreement described below and the forms of global note before deciding whether to invest in the Notes. We have filed a copy of these documents with the United States Securities and Exchange Commission as exhibits to the registration statement no. 333-156305.

The general terms of our Notes are described in the accompanying prospectus. The description in this prospectus supplement further adds to that description or, to the extent inconsistent with that description, replaces it.

Governed by Fiscal Agency Agreement

We will issue the Notes under the fiscal agency agreement, dated as of February 15, 1991, as amended and supplemented from time to time, between us and The Bank of New York (now The Bank of New York Mellon), as fiscal agent. The fiscal agent will maintain a register for the Notes.

Payment of Principal and Interest

The Notes are initially limited to US$ aggregate principal amount and will mature on , 20 (the “Maturity Date”). The Notes will bear interest at the rate of % per annum, payable semi-annually in arrears on March and September of each year (each, an “Interest Payment Date”), beginning on March , 2011. Interest on the Notes will accrue from September , 2010. If any Interest Payment Date or the Maturity Date shall be a day on which banking institutions in The City of New York or Seoul are authorized or obligated by law to close, then such payment will not be made on such date but will be made on the next succeeding day which is not a day on which banking institutions in The City of New York or Seoul are authorized or obligated by law to close, with the same force and effect as if made on the date for such payment, and no interest shall be payable in respect of any such delay. We will pay interest to the person who is registered as the owner of a Note at the close of business on the fifteenth day (whether or not a business day) preceding such Interest Payment Date. Interest on the Notes will be computed on the basis of a 360-day year consisting of twelve 30-day months. We will make principal and interest payments on the Notes in immediately available funds in U.S. dollars.

The payment of interest and the repayment of principal on the Notes will not be guaranteed by the Government. However, as of the date of the initial sale of the Government’s equity interest in us, our mid-to-long term foreign currency debt then outstanding (including the Notes offered hereby) are expected to be guaranteed by the Government, subject to the authorization of the Government guarantee amount by the National Assembly of the Republic. See “The Korea Development Bank—Overview” and “—Business—Government Support and Supervision” in the accompanying prospectus.

Denomination

The Notes will be issued in minimum denominations of US$100,000 principal amount and integral multiples of US$1,000 in excess thereof.

Redemption

We may not redeem the Notes prior to maturity. At maturity, we will redeem the Notes at par.

No Obligation to Repurchase Following Change of Support

The “Change of Support Offer” described in “Description of the Securities—Description of Debt Securities—Change of Support Offer” of the accompanying prospectus does not apply to the Notes. All

S-14

Table of Contents

paragraphs under the heading “Change of Support Offer” on pages 132 and 133 of the accompanying prospectus shall be deleted. Accordingly, we will not have an obligation to make an offer to repurchase the Notes following a Change of Support Triggering Event (as defined in the accompanying prospectus), and a failure to make such an offer will not constitute an event of default with respect to the Notes.

Events of Default

With respect to the Notes, the paragraphs under “Description of the Securities—Description of Debt Securities—Events of Default” on pages 133 through 135 of the accompanying prospectus shall be replaced with the following:

Each of the following constitutes an event of default with respect to the Notes:

| 1. | Non-Payment: we do not pay principal or interest or premium, if any, on the Notes when due and such failure to pay continues for 30 days. |

| 2. | Breach of Other Obligations: we fail to observe or perform any of the covenants in the Notes (other than non-payment) for 60 days after written notice of the default is delivered to us at the corporate trust office of the fiscal agent in New York City by holders representing at least 10% of the aggregate principal amount of the Notes. |

| 3. | Cross Default and Cross Acceleration: |

| • | we default on any External Indebtedness, and, as a result, become obligated to pay an amount equal to or greater than US$10,000,000 in aggregate principal amount prior to its due date; or |

| • | we fail to pay when due, including any grace period, any of our External Indebtedness in aggregate principal amount equal to or greater than US$10,000,000 or we fail to pay when requested and required by the terms thereof any guarantee for External Indebtedness of another person equal to or greater than US$10,000,000 in aggregate principal amount. |

| 4. | Moratorium/Default: |

| • | the Republic declares a general moratorium on the payment of its External Indebtedness, including obligations under guarantees; |

| • | the Republic becomes liable to repay prior to maturity any amount of External Indebtedness, including obligations under guarantees, as a result of a default under such External Indebtedness or obligations; or |

| • | the international monetary reserves of the Republic become subject to a security interest or segregation or other preferential arrangement for the benefit of any creditors. |

| 5. | Bankruptcy: |

| • | we are declared bankrupt or insolvent by any court or administrative agency with jurisdiction over us; |

| • | we pass a resolution to apply for bankruptcy or to request the appointment of a receiver or trustee or similar official in insolvency; |

| • | a substantial part of our assets are liquidated; or |

| • | we cease to conduct the banking business. |

| 6. | Cessation of Government Control or Failure of Support: the Republic ceases to (directly or indirectly) control us or fails to provide financial support for us as required under Article 44 of the KDB Act stipulated as of the issue date of the Notes, provided, however, that neither such event will constitute an event of default if, at such time, the Notes shall have the benefit of a Government Guarantee (as defined below). |

S-15

Table of Contents

| 7. | IMF Membership/World Bank Membership: the Republic ceases to be a member of the IMF or the International Bank for Reconstruction and Development (World Bank). |

For purposes of the foregoing, “External Indebtedness” means any obligation for the payment or repayment of money borrowed that is denominated in a currency other than the currency of the Republic.

As used in paragraph 6 above, “Government Guarantee” means a direct and irrevocable obligation by the Republic to guarantee or repay in full, or otherwise protect against any losses on any amount due under, or to purchase, the Notes, including principal of, premium, if any, and interest on the Notes, provided that:

| a) | the Republic shall have expressly assumed the payment obligations in respect of the Notes under such Government Guarantee by way of agreement, deed, statute or any other instrument or law or regulation having a similar effect; |

| b) | the Government Guarantee shall be subject to the obligation to make all payments of principal of, premium, if any, and interest on the Notes without withholding or deducting any present or future taxes imposed by the Republic or any of its political subdivisions; any obligation to pay additional amounts as described in “—Additional Amounts” above shall apply to the Government Guarantee and the Republic, as guarantor; and |

| c) | we shall have obtained an opinion of independent legal advisers that the Government Guarantee is binding upon and enforceable against the Republic, and that the Notes shall remain our valid, binding and enforceable obligations. |

We will notify holders of the Notes of the occurrence of the cessation of government control or failure of support described under paragraph 6 above as soon as practicable thereafter setting out details of the event, cessation or failure described above and the establishment of the Government Guarantee, and shall make available for inspection by the holders copies of the documentation or statute, law or regulation, as the case may be, evidencing the Government Guarantee and the opinion described in paragraph (c) of the definition of “Government Guarantee” above, during normal business hours at the office of the fiscal agent.

As used in paragraph 6 above, “control” means the acquisition or control of a majority of our voting share capital or the right to appoint and/or remove all or the majority of the members of our board of directors or other governing body, whether obtained directly or indirectly, and whether obtained by ownership of share capital, the possession of voting rights, contract or otherwise.

If an event of default occurs, any holder may declare the principal amount of Notes that it holds to be immediately due and payable by written notice to us and the fiscal agent.

You should note that:

| • | despite the procedure described above, no Notes may be declared due and payable if we cure the applicable event of default before we receive the written notice from holder of the Notes; |

| • | we are not required to provide periodic evidence of the absence of defaults; and |

| • | the fiscal agency agreement does not require us to notify holders of the Notes of an event of default or grant any holder of the Notes a right to examine the security register. |

Form and Registration

We will issue the Notes in the form of one or more fully registered global notes, registered in the name of a nominee of and deposited with the custodian for DTC. Except as described in the accompanying prospectus under “Description of the Securities—Description of Debt Securities—Global Securities,” the global notes will not be exchangeable for Notes in definitive registered form, and will not be issued in definitive registered form.

S-16

Table of Contents

Financial institutions, acting as direct and indirect participants in DTC, will represent your beneficial interests in the global notes. These financial institutions will record the ownership and transfer of your beneficial interest through book-entry accounts. You may hold your beneficial interests in the Notes through Euroclear or Clearstream if you are a participant in such systems, or indirectly through organizations that are participants in such systems. Any secondary market trading of book-entry interests in the Notes will take place through DTC participants, including Euroclear and Clearstream. See “Clearance and Settlement—Transfers Within and Between DTC, Euroclear and Clearstream.”

The fiscal agent will not charge you any fees for the Notes, other than reasonable fees for the replacement of lost, stolen, mutilated or destroyed Notes. However, you may incur fees for the maintenance and operation of the book-entry accounts with the clearing systems in which your beneficial interests are held.

For so long as the Notes are listed on the SGX-ST and the rules of the SGX-ST so require, we will appoint and maintain a paying and transfer agent in Singapore, where the certificates representing the Notes may be presented or surrendered for payment or redemption (if required), in the event that we issue the Notes in definitive form in the limited circumstances set forth in the accompanying prospectus. In addition, an announcement of such issue will be made through the SGX-ST. Such announcement will include all material information with respect to the delivery of the definitive Notes, including details of the paying and transfer agent in Singapore.

Notices

All notices regarding the Notes will be published in London in the Financial Times and in New York in The Wall Street Journal (U.S. Edition). If we cannot, for any reason, publish notice in any of those newspapers, we will choose an appropriate alternate English language newspaper of general circulation, and notice in that newspaper will be considered valid notice. Notice will be considered made on the first date of its publication.

S-17

Table of Contents

We have obtained the information in this section from sources we believe to be reliable, including DTC, Euroclear and Clearstream. We accept responsibility only for accurately extracting information from such sources. DTC, Euroclear and Clearstream are under no obligation to perform or continue to perform the procedures described below, and they may modify or discontinue them at any time. Neither we nor the registrar will be responsible for DTC’s, Euroclear’s or Clearstream’s performance of their obligations under their rules and procedures. Nor will we or the registrar be responsible for the performance by direct or indirect participants of their obligations under their rules and procedures.

Introduction

The Depository Trust Company

DTC is:

| • | a limited-purpose trust company organized under the New York Banking Law; |

| • | a “banking organization” under the New York Banking Law; |

| • | a member of the Federal Reserve System; |

| • | a “clearing corporation” under the New York Uniform Commercial Code; and |

| • | a “clearing agency” registered under Section 17A of the Securities Exchange Act of 1934. |

DTC was created to hold securities for its participants and facilitate the clearance and settlement of securities transactions between its participants. It does this through electronic book-entry changes in the accounts of its direct participants, eliminating the need for physical movement of securities certificates.

Euroclear and Clearstream

Like DTC, Euroclear and Clearstream hold securities for their participants and facilitate the clearance and settlement of securities transactions between their participants through electronic book-entry changes in their accounts. Euroclear and Clearstream provide various services to their participants, including the safekeeping, administration, clearance and settlement and lending and borrowing of internationally traded securities. Participants in Euroclear and Clearstream are financial institutions such as underwriters, securities brokers and dealers, banks and trust companies. Some of the underwriters participating in this offering are participants in Euroclear or Clearstream. Other banks, brokers, dealers and trust companies have indirect access to Euroclear or Clearstream by clearing through or maintaining a custodial relationship with a Euroclear or Clearstream participant.

Ownership of the Notes through DTC, Euroclear and Clearstream

We will issue the Notes in the form of one or more fully registered global notes, registered in the name of a nominee of DTC. Financial institutions, acting as direct and indirect participants in DTC, will represent your beneficial interests in the Notes. These financial institutions will record the ownership and transfer of your beneficial interests through book-entry accounts. You may also hold your beneficial interests in the Notes through Euroclear or Clearstream, if you are a participant in such systems, or indirectly through organizations that are participants in such systems. Euroclear and Clearstream will hold their participants’ beneficial interests in the global notes in their customers’ securities accounts with their depositaries. These depositaries of Euroclear and Clearstream in turn will hold such interests in their customers’ securities accounts with DTC.

We and the fiscal agent generally will treat the registered holder of the Notes, initially Cede & Co., as the absolute owner of the Notes for all purposes. Once we and the fiscal agent make payments to the registered

S-18

Table of Contents

holder, we and the fiscal agent will no longer be liable on the Notes for the amounts so paid. Accordingly, if you own a beneficial interest in the global notes, you must rely on the procedures of the institutions through which you hold your interests in the Notes, including DTC, Euroclear, Clearstream and their respective participants, to exercise any of the rights granted to holders of the Notes. Under existing industry practice, if you desire to take any action that Cede & Co., as the holder of the global notes, is entitled to take, then Cede & Co. would authorize the DTC participant through which you own your beneficial interest to take such action. The participant would then either authorize you to take the action or act for you on your instructions.

DTC may grant proxies or authorize its participants, or persons holding beneficial interests in the Notes through such participants, to exercise any rights of a holder or take any actions that a holder is entitled to take under the fiscal agency agreement or the Notes. Euroclear’s or Clearstream’s ability to take actions as holder under the Notes or the fiscal agency agreement will be limited by the ability of their respective depositaries to carry out such actions for them through DTC. Euroclear and Clearstream will take such actions only in accordance with their respective rules and procedures.

Transfers Within and Between DTC, Euroclear and Clearstream

Trading Between DTC Purchasers and Sellers

DTC participants will transfer interests in the Notes among themselves in the ordinary way according to DTC rules. Participants will pay for such transfers by wire transfer. The laws of some states require certain purchasers of securities to take physical delivery of the securities in definitive form. These laws may impair your ability to transfer beneficial interests in the global notes to such purchasers. DTC can act only on behalf of its direct participants, who in turn act on behalf of indirect participants and certain banks. Thus, your ability to pledge a beneficial interest in the global notes to persons that do not participate in the DTC system, and to take other actions, may be limited because you will not possess a physical certificate that represents your interest.

Trading Between Euroclear and/or Clearstream Participants

Participants in Euroclear and Clearstream will transfer interests in the Notes among themselves according to the rules and operating procedures of Euroclear and Clearstream.

Trading Between a DTC Seller and a Euroclear or Clearstream Purchaser

When the Notes are to be transferred from the account of a DTC participant to the account of a Euroclear or Clearstream participant, the purchaser must first send instructions to Euroclear or Clearstream through a participant at least one business day prior to the settlement date. Euroclear or Clearstream will then instruct its depositary to receive the Notes and make payment for them. On the settlement date, the depositary will make payment to the DTC participant’s account, and the Notes will be credited to the depositary’s account. After settlement has been completed, DTC will credit the Notes to Euroclear or Clearstream, Euroclear or Clearstream will credit the Notes, in accordance with its usual procedures, to the participant’s account, and the participant will then credit the purchaser’s account. These securities credits will appear the next day (European time) after the settlement date. The cash debit from the account of Euroclear or Clearstream will be back-valued to the value date, which will be the preceding day if settlement occurs in New York. If settlement is not completed on the intended value date (i.e., the trade fails), the cash debit will instead be valued at the actual settlement date.

Participants in Euroclear and Clearstream will need to make funds available to Euroclear or Clearstream to pay for the Notes by wire transfer on the value date. The most direct way of doing this is to pre-position funds (i.e., have funds in place at Euroclear or Clearstream before the value date), either from cash on hand or existing lines of credit. Under this approach, however, participants may take on credit exposure to Euroclear and Clearstream until the Notes are credited to their accounts one day later.

As an alternative, if Euroclear or Clearstream has extended a line of credit to a participant, the participant may decide not to pre-position funds, but to allow Euroclear or Clearstream to draw on the line of credit to

S-19

Table of Contents

finance settlement for the Notes. Under this procedure, Euroclear or Clearstream would charge the participant overdraft charges for one day, assuming that the overdraft would be cleared when the Notes were credited to the participant’s account. However, interest on the Notes would accrue from the value date. Therefore, in many cases the interest income on the Notes which the participant earns during that one-day period will substantially reduce or offset the amount of the participant’s overdraft charges. Of course, this result will depend on the cost of funds (i.e., the interest rate that Euroclear or Clearstream charges) to each participant.

Since the settlement will occur during New York business hours, a DTC participant selling an interest in the Notes can use its usual procedures for transferring global securities to the depositories of Euroclear or Clearstream for the benefit of Euroclear or Clearstream participants. The DTC seller will receive the sale proceeds on the settlement date. Thus, to the DTC seller, a cross-market sale will settle no differently than a trade between two DTC participants.

Finally, day traders who use Euroclear or Clearstream and who purchase Notes from DTC participants for credit to Euroclear participants or Clearstream participants should note that these trades will automatically fail unless one of three steps is taken:

| • | borrowing through Euroclear or Clearstream for one day, until the purchase side of the day trade is reflected in the day trader’s Euroclear or Clearstream account, in accordance with the clearing system’s customary procedures; |

| • | borrowing the Notes in the United States from DTC participants no later than one day prior to settlement, which would allow sufficient time for the Notes to be reflected in the Euroclear or Clearstream account in order to settle the sale side of the trade; or |

| • | staggering the value dates for the buy and sell sides of the trade so that the value date for the purchase from the DTC participant is at least one day prior to the value date for the sale to the Euroclear or Clearstream participant. |

Trading Between a Euroclear or Clearstream Seller and a DTC Purchaser

Due to time-zone differences in their favor, Euroclear and Clearstream participants can use their usual procedures to transfer Notes through their depositaries to a DTC participant. The seller must first send instructions to Euroclear or Clearstream through a participant at least one business day prior to the settlement date. Euroclear or Clearstream will then instruct its depositary to credit the Notes to the DTC participant’s account and receive payment. The payment will be credited in the account of the Euroclear or Clearstream participant on the following day, but the receipt of the cash proceeds will be back-valued to the value date, which will be the preceding day if settlement occurs in New York. If settlement is not completed on the intended value date (i.e., the trade fails), the receipt of the cash proceeds will instead be valued at the actual settlement date.

If the Euroclear or Clearstream participant selling the Notes has a line of credit with Euroclear or Clearstream and elects to be in debit for the Notes until it receives the sale proceeds in its account, then the back-valuation may substantially reduce or offset any overdraft charges that the participant incurs over that period.

Settlement in other currencies between DTC and Euroclear and Clearstream is possible using free-of-payment transfers to move the Notes, but funds movement will take place separately.

S-20

Table of Contents

Korean Taxation

For a discussion of certain Korean tax considerations that may be relevant to you if you invest in the Notes, see “Taxation—Korean Taxation” in the accompanying prospectus. The following are supplemental Korean tax considerations.

Tax on Capital Gains

You will not be subject to any Korean income or withholding taxes in connection with the sale, exchange or other disposition of the Notes, as long as such Notes are denominated in a currency other than Won, provided that the disposition does not involve a transfer of such Notes within Korea or the disposition does not involve a transfer of such Notes to a resident of Korea or a Korean corporation (or the Korean permanent establishment of a non-resident or a non-Korean corporation). If you sell or otherwise dispose of such Notes to a Korean resident or a Korean corporation (or the Korean permanent establishment of a non-resident or a non-Korean corporation) and such disposition or sale is made within Korea, any gain realized on the transaction will be taxable at ordinary Korean withholding tax rates (the lesser of 22% of net gain or 11% of gross sale proceeds with respect to transactions), unless an exemption is available under an applicable income tax treaty. For example, if you are a resident of the United States for the purposes of the income tax treaty currently in force between Korea and the United States, you are generally entitled to an exemption from Korean taxation in respect of any gain realized on a disposition of the Notes, regardless of whether the disposition is to a Korean resident. For more information regarding tax treaties, please refer to the heading “Taxation—Korean Taxation—Tax Treaties” in the accompanying prospectus.

United States Tax Considerations

Stated interest on the Notes will be treated as qualified stated interest for U.S. federal income tax purposes. Under certain circumstances as described under “Taxation—Korean Taxation” in this prospectus supplement and the accompanying prospectus, a U.S. holder may be subject to Korean withholding tax upon the sale or other disposition of Notes. A U.S. holder eligible for benefits of the Korea-U.S. tax treaty, which exempts capital gains from tax in Korea, would not be eligible to credit against its U.S. federal income tax liability any such Korean tax withheld. U.S. holders should consult their own tax advisers with respect to their eligibility for benefits under the Korea-U.S. tax treaty and, in the case of U.S. holders that are not eligible for treaty benefits, their ability to credit any Korean tax withheld upon sale of the Notes against their U.S. federal income tax liability. For a discussion of additional U.S. federal income tax considerations that may be relevant to you if you invest in the Notes and are a U.S. holder, see “Taxation—United States Tax Considerations” in the accompanying prospectus.

S-21

Table of Contents

Relationship with the Underwriters

We and the underwriters named below (the “Underwriters”) have entered into a Terms Agreement dated , 2010 (the “Terms Agreement”) with respect to the Notes relating to the Underwriting Agreement— Standard Terms (together with the Terms Agreement, the “Underwriting Agreement”) filed as an exhibit to the registration statement. Barclays Bank PLC, Citigroup Global Markets Inc., Credit Agricole Securities (USA) Inc., Deutsche Bank AG, Singapore Branch, J.P. Morgan Securities LLC and KDB Asia Limited are acting as representatives of the Underwriters. Subject to the terms and conditions set forth in the Underwriting Agreement, we have agreed to sell to each of the Underwriters, severally and not jointly, and each of the Underwriters has severally and not jointly agreed to purchase, the following principal amount of the Notes set out opposite its name below:

Name of Underwriters | Principal Amount of the Notes | ||

Barclays Bank PLC | US$ | ||

Citigroup Global Markets Inc. | |||

Credit Agricole Securities (USA) Inc. | |||

Deutsche Bank AG, Singapore Branch | |||

J.P. Morgan Securities LLC | |||

KDB Asia Limited | |||

Daiwa Capital Markets Europe Limited | |||

Total | US$ | ||

KDB Asia Limited, one of the Underwriters, is our affiliate and has agreed to offer and sell the Notes only outside the United States to non-U.S. persons.

Under the terms and conditions of the Underwriting Agreement, if the Underwriters take any of the Notes, then the Underwriters are obligated to take and pay for all of the Notes.

The Underwriters initially propose to offer the Notes directly to the public at the offering price described on the cover page of this prospectus supplement and may offer a portion to certain dealers at a price that represents a concession not in excess of % of the principal amount with respect to the Notes. Any Underwriter may allow, and any such dealer may reallow, a concession to certain other dealers. After the initial offering of the Notes, the Underwriters may from time to time vary the offering price and other selling terms.

The Notes are a new class of securities with no established trading market. We have applied for the listing of the Notes on the SGX-ST. There can be no assurance that such listing will be obtained. The Underwriters have advised us that they intend to make a market in the Notes. However, they are not obligated to do so and they may discontinue any market making activities with respect to the Notes at any time without notice. Accordingly, we cannot assure you as to the liquidity of any trading market for the Notes.

We have agreed to indemnify the Underwriters against certain liabilities, including liabilities under the Securities Act of 1933, as amended, or to contribute to payments which the Underwriters may be required to make in respect of any such liabilities.

The amount of net proceeds is US$ after deducting the underwriting discounts but not estimated expenses. Expenses associated with this offering are estimated to be approximately US$ . The Underwriters have agreed to pay certain of our expenses incurred in connection with the offering of the Notes.

S-22

Table of Contents

The Underwriters and certain of their affiliates may have performed certain commercial banking, investment banking and advisory services for us and/or our affiliates from time to time for which they have received customary fees and expenses and may, from time to time, engage in transactions with and perform services for us and/or our affiliates in the ordinary course of their business.

The Underwriters or certain of their affiliates may purchase Notes and be allocated Notes for asset management and/or proprietary purposes but not with a view to distribution. The Underwriters or their respective affiliates may purchase Notes for its or their own account and enter into transactions, including credit derivatives, such as asset swaps, repackaging and credit default swaps relating to Notes and/or other securities of us or our subsidiaries or affiliates at the same time as the offer and sale of Notes or in secondary market transactions. Such transactions would be carried out as bilateral trades with selected counterparties and separately from any existing sale or resale of Notes to which this prospectus supplement relates (notwithstanding that such selected counterparties may also be purchasers of Notes).

Delivery of the Notes

We expect to make delivery of the Notes, against payment in same-day funds on or about September , 2010, which we expect will be the fifth business day following the date of this prospectus supplement. Under Rule 15c6-1 promulgated under the Securities Exchange Act of 1934, as amended, U.S. purchasers are generally required to settle trades in the secondary market in three business days, unless they and the other parties to any such trade expressly agree otherwise. Accordingly, if you wish to trade in the Notes on the date of this prospectus supplement or the next succeeding business day, because the Notes will initially settle in T+5, you may be required to specify an alternate settlement cycle at the time of your trade to prevent a failed settlement. Purchasers in other countries should consult with their own advisors.

Foreign Selling Restrictions

Each Underwriter has agreed, severally and not jointly, to the following selling restrictions in connection with the offering with respect to the following jurisdictions:

Korea

Each Underwriter has severally represented and agreed that (i) it has not offered, sold or delivered and will not offer, sell or deliver, directly or indirectly, any Notes in Korea, or to, or for the account or benefit of, any resident of Korea, except as otherwise permitted by applicable Korean laws and regulations, and (ii) any securities dealer to whom the Underwriters may sell the Notes will agree that it will not offer any Notes, directly or indirectly, in Korea, or to any resident of Korea, except as permitted by applicable Korean laws and regulations, or to any other dealer who does not so represent and agree.

United Kingdom

Each Underwriter has severally represented and agreed that (i) it has only communicated or caused to be communicated and will only communicate or cause to be communicated any invitation or inducement to engage in investment activity (within the meaning of Section 21 of the Financial Services and Markets Act of 2000 (the “FSMA”)) received by it in connection with the issue or sale of any of the Notes in circumstances in which section 21(1) of the FSMA does not apply to us, and (ii) it has complied, and will comply with, all applicable provisions of the FSMA with respect to anything done by it in relation to the Notes, from or otherwise involving the United Kingdom.

S-23

Table of Contents

Japan

Each Underwriter has severally represented and agreed that the Notes have not been and will not be registered under the Financial Instruments and Exchange Law of Japan (Law No. 25 of 1948, as amended); it has not offered or sold, and it will not offer or sell, directly or indirectly, any of the Notes in Japan or to, or for the account or benefit of, any resident of Japan or to, or for the account or benefit of, any resident for reoffering or resale, directly or indirectly, in Japan or to, or for the account or benefit of, any resident of Japan except (i) pursuant to an exemption from the registration requirements of, or otherwise in compliance with, the Financial Instruments and Exchange Law of Japan, and (ii) in compliance with the other relevant laws of Japan.

Hong Kong

Each Underwriter has severally represented and agreed that:

| • | it has not offered or sold and will not offer or sell in Hong Kong, by means of any document, any Notes other than (i) to “professional investors” as defined in the Securities and Futures Ordinance (Cap. 571) of Hong Kong and any rules made under that Ordinance or (ii) in circumstances which do not result in the document being a “prospectus” as defined in the Companies Ordinance (Cap. 32) of Hong Kong or which do not constitute an offer to the public within the meaning of that Ordinance; and |

| • | it has not issued, or had in its possession for the purposes of issue, and will not issue or have in its possession for the purposes of issue, any advertisement, invitation or document relating to the Notes, whether in Hong Kong or elsewhere, which is directed at, or the contents of which are or are likely to be accessed or read by, the public in Hong Kong (except if permitted to do so under the securities laws of Hong Kong) other than with respect to Notes which are or are intended to be disposed of to persons outside Hong Kong or only to “professional investors” within the meaning of the Securities and Futures Ordinance (Cap. 571) of the laws of Hong Kong and any rules made thereunder. |

Singapore

Each Underwriter has severally represented and agreed that neither the preliminary prospectus nor the prospectus have been registered as a prospectus with the Monetary Authority of Singapore under the Securities and Futures Act (Chapter 289 of Singapore)(the “SFA”). Accordingly, each Underwriter has severally represented, warranted and agreed that it has not offered or sold any Notes or caused the Notes to be made the subject of an invitation for subscription or purchase and will not offer or sell any Notes or cause the Notes to be made the subject of an invitation for subscription or purchase, and has not circulated or distributed, nor will it circulate or distribute, the preliminary prospectus or the prospectus or any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of the Notes, whether directly or indirectly, to any person in Singapore other than under exemptions provided in the SFA for offers made (i) to an institutional investor (as defined in Section 4A of the SFA) pursuant to Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA), or any person pursuant to an offer referred to in Section 275(1A) of the SFA, and in accordance with the conditions, specified in Section 275 of the SFA or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Where the Notes are acquired by persons who are relevant persons specified in Section 276 of the SFA namely:

(a) a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or

(b) a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor,

the shares, debentures and units of shares and debentures of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within 6 months after that

S-24

Table of Contents

corporation or that trust has acquired the Notes pursuant to an offer made under Section 275 of the SFA except:

(1) to an institutional investor (under Section 274 of the SFA) or to a relevant person defined in Section 275(2) of the SFA, or any person pursuant to an offer that is made on terms that such shares, debentures and units of shares and debentures of that corporation or such rights or interest in that trust are acquired at a consideration of not less than S$200,000 (or its equivalent in a foreign currency) for each transaction, whether such amount is to be paid for in cash or by exchange of securities or other assets, and further for corporations, in accordance with the conditions, specified in Section 275(1A) of the SFA;

(2) where no consideration is or will be given for the transfer; or

(3) where the transfer is by operation of law.

Price Stabilization and Short Position

In connection with this offering, Citigroup Global Markets Inc. (the “Stabilizing Manager”) or any person acting for it, on behalf of the Underwriters, may purchase and sell the Notes in the open market. These transactions may include over-allotment, covering transactions, penalty bids and stabilizing transactions. Over-allotment involves sales of the Notes in excess of the principal amount of Notes to be purchased by the Underwriters in this offering, which creates a short position for the Underwriters. Covering transactions involve purchases of the Notes in the open market after the distribution has been completed in order to cover short positions. Penalty bid occurs when a particular Underwriter repays to the Underwriters a portion of the underwriting discount received by it because the Underwriters or the Stabilizing Manager has repurchased Notes sold by or for the account of such Underwriter in stabilizing or short covering transactions. Stabilizing transactions consist of certain bids or purchases of Notes in the open market for the purpose of preventing or retarding a decline in the market price of the Notes while the offering is in progress. Any of these activities may have the effect of preventing or retarding a decline in the market price of the Notes. They may also cause the price of the Notes to be higher than the price that otherwise would exist in the open market in the absence of these transactions. The Stabilizing Manager may conduct these transactions in the over-the-counter market or otherwise. If the Stabilizing Manager commences any of these transactions, it may discontinue them at any time, and must discontinue them after a limited period.

S-25

Table of Contents

The validity of the Notes is being passed upon for us by Cleary Gottlieb Steen & Hamilton LLP, New York, New York, and by Lee & Ko, Seoul, Korea. Certain legal matters will also be passed upon for the Underwriters by Davis Polk & Wardwell LLP, New York, New York. In giving their opinions, Cleary Gottlieb Steen & Hamilton LLP and Davis Polk & Wardwell LLP may rely as to matters of Korean law upon the opinions of Lee & Ko, and Lee & Ko may rely as to matters of New York law upon the opinions of Cleary Gottlieb Steen & Hamilton LLP.

OFFICIAL STATEMENTS AND DOCUMENTS

Our President and Chairman of the Board of Directors, in his official capacity, has supplied the information set forth in this prospectus supplement under “Recent Developments—The Korea Development Bank.” Such information is stated on his authority. The documents identified in the portion of this prospectus supplement captioned “Recent Developments—The Republic of Korea” as the sources of financial or statistical data are derived from official public documents of the Republic and of its agencies and instrumentalities.

We were established in 1954 as a government-owned financial institution pursuant to The Korea Development Bank Act, as amended. The address of our registered office is 16-3, Youido-dong, Yongdeungpo-gu, Seoul 150-973, The Republic of Korea.

Our Board of Directors can be reached at the address of our registered office: c/o 16-3, Youido-dong, Yongdeungpo-gu, Seoul 150-973, The Republic of Korea.

The issue of the Notes has been authorized by a resolution of our Board of Directors passed on December 23, 2009 and a decision of our President dated August 18, 2010. On August 19, 2010, we filed our reports on the proposed issuance of the Notes with the Ministry of Strategy and Finance of Korea.

The registration statement with respect to us and the Notes has been filed with the U.S. Securities and Exchange Commission in Washington, D.C. under the Securities Act of 1933, as amended. Additional information concerning us and the Notes is contained in the registration statement and post-effective amendments to such registration statement, including their various exhibits, which may be inspected at the public reference facilities maintained by the Securities and Exchange Commission at Room 1580, 100 F Street N.E., Washington, D.C. 20549, United States.

The Notes have been accepted for clearance through DTC, Euroclear and Clearstream:

| ISIN | CUSIP | Common Code | ||||

Notes | US500630BS61 | 500630BS6 | 053812317 |

S-26

Table of Contents

PROSPECTUS

$4,000,000,000

The Korea Development Bank

Debt Securities

Warrants to Purchase Debt Securities

Guarantees

The Republic of Korea

Guarantees

We will provide the specific terms of these securities in supplements to this prospectus. You should read this prospectus and any prospectus supplement carefully before you invest.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus is dated August 27, 2010

Table of Contents

| Page | ||

| 1 | ||

| 2 | ||

| 3 | ||

| 3 | ||

| 6 | ||

| 7 | ||

| 9 | ||

| 15 | ||

| 22 | ||

| 24 | ||

| 25 | ||

| 25 | ||

| 25 | ||

| 26 | ||

| 30 | ||

| 87 | ||

| 87 | ||

| 89 | ||

| 92 | ||

| 99 | ||

| 105 | ||

| 110 | ||

| 113 | ||

| 120 | ||

| 122 | ||

| 124 | ||

| 128 | ||

| 128 | ||

| 136 | ||

| 137 | ||

| 138 | ||

Description of Guarantees to be Issued by The Republic of Korea | 138 | |

Limitations on Issuance of Bearer Debt Securities and Bearer Warrants | 140 | |

| 141 | ||

| 141 | ||

| 142 | ||

| 149 | ||

| 150 | ||

| 150 | ||

| 150 | ||

| 150 | ||

| 151 | ||

| 152 |

i

Table of Contents

CERTAIN DEFINED TERMS AND CONVENTIONS

All references to the “Bank”, “we”, “our” or “us” mean The Korea Development Bank. All references to “Korea” or the “Republic” contained in this prospectus mean The Republic of Korea. All references to the “Government” mean the government of Korea.

Unless otherwise indicated, all references to “won”, “Won” or “(Won)” contained in this prospectus are to the currency of Korea, references to “U.S. dollars”, “Dollars”, “$”, “USD” or “US$” are to the currency of the United States of America, references to “Euro”, “EUR” or “€” are to the currency of the European Union, references to “Japanese yen”, “JPY” or “¥” are to the currency of Japan, references to “Singapore dollar” or “SGD” are to the currency of Singapore, references to “Swiss franc” or “CHF” are to the currency of Switzerland, references to “pound sterling”, “GBP” or “£” are to the currency of the United Kingdom, references to “Chinese yuan” or “CNY” are to the currency of the People’s Republic of China, references to “Hong Kong dollar” or “HKD” are to the currency of Hong Kong, S.A.R., references to “Malaysian ringgit” or “MYR” are to the currency of Malaysia, and references to “Brazilian real” or “BRL” are to the currency of the Federative Republic of Brazil.

All discrepancies in any table between totals and the sums of the amounts listed are due to rounding.

Our principal financial statements are our non-consolidated financial statements. Unless specified otherwise, our financial and other information is presented on a non-consolidated basis and does not include such information with respect to our subsidiaries.

1

Table of Contents

Unless otherwise specified in the applicable prospectus supplement, we will use the net proceeds from the sale of the securities for our general operations.

2

Table of Contents

We were established in 1954 as a government-owned financial institution pursuant to The Korea Development Bank Act, as amended (the “KDB Act”). Since our establishment, we have been the leading bank in the Republic with respect to the provision of long-term financing for projects designed to assist the nation’s economic growth and development. The Government indirectly owns all of our paid-in capital. Our registered office is located at 16-3 Youido-dong, Youngdeungpo-gu, Seoul, The Republic of Korea.

In June 2008, the Financial Services Commission announced the Government’s preliminary plan for our privatization and, in May 2009, the KDB Act was amended to facilitate our privatization. The preliminary plan reflected the Government’s intention to nurture a more competitive corporate and investment banking sector and trigger reorganization and further advancement of the Korean financial industry.

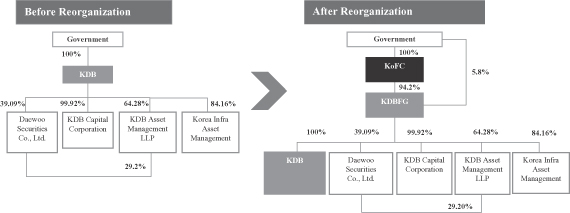

As a first step in implementing our privatization, the Government established KDB Financial Group, or KDBFG, a financial holding company, and Korea Finance Corporation, or KoFC, a public policy financing vehicle, in October 2009, by spinning off a portion of our assets, liabilities and shareholders’ equity. In the spin-off, our interests in Daewoo Securities Co., Ltd., KDB Asset Management Co., Ltd. and KDB Capital Corp. were transferred to KDBFG, and our equity holdings in certain government-controlled companies, including Korea Electric Power Corporation, or KEPCO, and certain companies under restructuring programs, including Hyundai Engineering & Construction Co., Ltd., were transferred to KoFC. For more information on the assets, liabilities and shareholders’ equity transferred in the spin-off, see “—Selected Financial Statement Data—Spin-off of KDB.” The Government transferred its ownership interest in us to KDBFG in exchange for all of KDBFG’s share capital on November 24, 2009 and contributed 94.27% of KDBFG’s shares to KoFC as a capital contribution on December 30, 2009. In March 2010, the Government made a further capital contribution of (Won)10.0 billion in cash to KDBFG. As a result, as of the date of this prospectus, KoFC, which is wholly owned by the Government, owns 94.2% of KDBFG’s share capital and the Government directly owns the remaining 5.8% of KDBFG’s share capital. KDBFG owns 100.0% of our share capital.