December 31, 2017, our exposure to STX Offshore & Shipbuilding wasW1,079.8 billion, a decrease fromW1,422.8 billion as of December 31, 2016, primarily due to a decrease in guarantees. As of December 31, 2017, our exposure to Dongbu Steel decreased toW1,212.1 billion fromW1,325.2 billion as of December 31, 2016, primarily due to the repayment of certain existing loans. As of December 31, 2017, our exposure to Hanjin Heavy Industries and Construction decreased toW1,145.4 billion fromW1,242.2 billion as of December 31, 2016, primarily due to the repayment of certain existing loans. As of December 31, 2017, our exposure to Hyundai Merchant Marine increased toW1,095.5 billion fromW1,080.4 billion as of December 31, 2016, primarily due to the extension of new loans. As of December 31, 2017, our exposure to Daehan Shipbuilding decreased toW756.9 billion fromW769.2 billion as of December 31, 2016, primarily due to a decrease in guarantees. As of December 31, 2017, our exposure to Hanjin Shipping decreased toW363.1 billion fromW439.5 billion as of December 31, 2016, primarily due to the repayment of certain existing loans through the sale of collateral. As of December 31, 2017, our exposure to STX Heavy Industries increased slightly toW269.2 billion fromW268.7 billion as of December 31, 2016, primarily due to a slight increase in valuation of shares of common stock of STX Heavy Industries.

As of December 31, 2017, we established provisions ofW741.3 billion for our exposure to DSME,W701.8 billion for STX Offshore & Shipbuilding,W239.7 billion for Dongbu Steel,W104.2 billion for Hanjin Heavy Industries and Construction,W175.1 billion for Hyundai Merchant Marine,W50.2 billion for Daehan Shipbuilding,W115.7 billion for Hanjin Shipping andW96.4 billion for STX Heavy Industries.

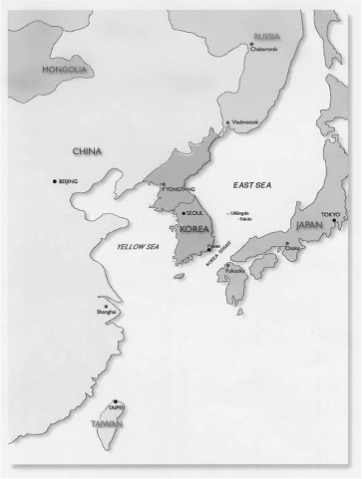

Companies in the STX Group, a large Korean conglomerate primarily engaged in shipbuilding and trading, have faced financial difficulties for the past several years due to prolonged slowdowns in the Korean construction, shipbuilding and shipping industries. STX Pan Ocean had been in court receivership since June 2013 and was sold to Harim Group in June 2015. STX Construction has been in court receivership since April 2013. STX Offshore & Shipbuilding, which had filed for court receivership in May 2016 and executed debt-to-equity swaps with their creditors (including us) in December 2016 under a rehabilitation plan through which we increased our equity interest to 43.9% and became its largest shareholder, exited court receivership in July 2017. In August 2016, STX Heavy Industries filed for court receivership, and in January 2017, the Seoul Central District Court approved its rehabilitation plan, which includes debt-to-equity swaps. In December 2017, the creditors of STX Engine, including us, and UAMCO Ltd., a private bad asset clearing house in Korea, signed a stock purchase agreement in which the creditors agreed to sell off an 87% stake in STX Engine forW185.2 billion. In April 2018, the creditors of STX Corporation, including us, and AFC Korea, a Chinese private equity fund, signed a stock purchase agreement in which the creditors agreed to sell an 86.3% stake in STX Corporation forW68.5 billion. Companies in the Dongbu Group, a large Korean conglomerate providing industrial, chemical, shipping, insurance and financial products and services, have also been facing financial difficulties for the past several years due to the prolonged slowdown in the Korean construction industry and in the Korean economy in general. Certain troubled companies in the Dongbu Group are in voluntary out-of-court debt restructuring programs with their creditors, and Dongbu Steel entered into a voluntary workout agreement with its creditors in October 2015. We are the main creditor bank of STX Group and Dongbu Group.

In May 2016, Hanjin Shipping, Korea’s largest container operator, submitted itself to joint management with us, as its largest creditor, and other creditors in an effort to revive itself from financial difficulties. In August 2016, we and the other creditors rejected Hanjin Shipping’s last funding plan, and Hanjin Shipping entered into court receivership in September 2016 and was declared bankrupt in February 2017. In July 2016, Hyundai Merchant Marine executed a debt-to-equity swap with us and other creditors, as part of its continued restructuring led by us as its largest creditor, and affiliates of the Hyundai group reduced their shareholdings in Hyundai Merchant Marine, which resulted in us becoming the largest shareholder of Hyundai Merchant Marine. As of December 31, 2017, our equity interest in Hyundai Merchant Marine was 13.1%.

During 2015, DSME, one of the largest shipbuilding and offshore construction companies in Korea, suffered from financial difficulties primarily due to significant losses incurred in connection with the construction of offshore plants resulting from a prolonged slowdown in the global shipbuilding industry. In October 2015, we

13