Filed Pursuant to Rule 424(b)(2)

Registration No. 333-280021

|

PROSPECTUS SUPPLEMENT (To Prospectus Dated June 17, 2024) |

|

The Korea Development Bank

US$900,000,000 4.625% Notes due 2028

US$1,200,000,000 4.875% Notes due 2030

US$900,000,000 Floating Rate Notes due 2030

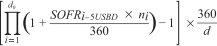

Our US$900,000,000 aggregate principal amount of notes due 2028 (the “2028 Notes”) will bear interest at a rate of 4.625% per annum, our US$1,200,000,000 aggregate principal amount of notes due 2030 (the “2030 Notes”) will bear interest at a rate of 4.875% per annum and our US$900,000,000 aggregate principal amount of floating rate notes due 2030 (the “Floating Rate Notes,” and together with the 2028 Notes and the 2030 Notes, the “Notes”) will bear interest at a rate equal to Compounded Daily SOFR (as defined herein) plus 0.760% per annum.

Interest on the 2028 Notes and the 2030 Notes is payable semi-annually in arrear on February 3 and August 3 of each year, beginning on August 3, 2025. Interest on the Floating Rate Notes is payable quarterly in arrear on February 3, May 3, August 3 and November 3 of each year, subject in each case to adjustment in accordance with the Modified Following Business Day Convention, as explained herein (each, a “Floating Rate Notes Interest Payment Date”). The first interest payment on the Floating Rate Notes will be made on the Floating Rate Notes Interest Payment Date falling on or nearest to May 3, 2025 in respect of the period from (and including) February 3, 2025 to (but excluding) the Floating Rates Notes Interest Payment Date falling on or nearest to May 3, 2025. The 2028 Notes will mature on February 3, 2028, the 2030 Notes will mature on February 3, 2030 and the Floating Rate Notes will mature on the Floating Rate Notes Interest Payment Date falling on or nearest to February 3, 2030.

The Notes will be issued in minimum denominations of US$200,000 principal amount and integral multiples of US$1,000 in excess thereof. The Notes will be represented by one or more global securities registered in the name of a nominee of The Depository Trust Company (“DTC”), as depositary.

The payment of interest and the repayment of principal on the Notes will not be guaranteed by the Government (as defined herein).

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2028 Notes | | | 2030 Notes | | | Floating Rate Notes | |

| | | Per Note | | | Total | | | Per Note | | | Total | | | Per Note | | | Total | |

Public offering price | | | 99.765% | | | US$ | 897,885,000 | | | | 99.829% | | | US$ | 1,197,948,000 | | | | 100.000% | | | US$ | 900,000,000 | |

Underwriting discounts | | | 0.200% | | | US$ | 1,800,000 | | | | 0.200% | | | US$ | 2,400,000 | | | | 0.200% | | | US$ | 1,800,000 | |

Proceeds to us, before expenses | | | 99.565% | | | US$ | 896,085,000 | | | | 99.629% | | | US$ | 1,195,548,000 | | | | 99.800% | | | US$ | 898,200,000 | |

In addition to the initial public offering price, you will have to pay for accrued interest, if any, from and including February 3, 2025.

Applications have been made to the Singapore Exchange Securities Trading Limited (the “SGX-ST”) for the listing and quotation of the Notes on the SGX-ST. The SGX-ST assumes no responsibility for the correctness of any of the statements made, opinions expressed or reports contained in this prospectus supplement and the accompanying prospectus. Approval in-principle from, admission to the Official List of, and listing and quotation of the Notes on, the SGX-ST are not to be taken as an indication of the merits of us or the Notes. Currently, there is no public market for the Notes. In addition, applications will be made to list the Notes on the Luxembourg Stock Exchange and to have the Notes admitted to trading on the Euro MTF Market of the Luxembourg Stock Exchange. Applications will also be made for listing of the Notes to the International Securities Market of the London Stock Exchange. No assurance can be given that such applications will be approved or that such listings will be maintained.

We expect to make delivery of the Notes to investors through the book-entry facilities of DTC on or about February 3, 2025.

Joint Bookrunners and Lead Managers

| | | | | | | | | | |

BofA Securities | |

| | Citigroup | |

| | | | Crédit Agricole CIB | | | | |

| | | | | | MUFG | |

| | | | | | | | | Standard Chartered Bank | |

Prospectus Supplement Dated January 23, 2025