UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08657

Pioneer Equity Income Fund

(Exact name of registrant as specified in charter)

60 State Street, Boston, MA 02109

(Address of principal executive offices) (ZIP code)

Christopher J. Kelley, Amundi Asset Management, Inc.,

60 State Street, Boston, MA 02109

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 742-7825

Date of fiscal year end: October 31, 2023

Date of reporting period: November 1, 2022 through April 30, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Pioneer Equity Income Fund

Semiannual Report | April 30, 2023

| | | | | |

| A: PEQIX | C: PCEQX | K: PEQKX | R: PQIRX | Y: PYEQX |

visit us: www.amundi.com/us

Pioneer Equity Income Fund | Semiannual Report | 4/30/231

President’s Letter

Dear Shareholders,

On February 13, 2023, Amundi US celebrated the 95th anniversary of Pioneer Fund, the second-oldest mutual fund in the United States. We recognized the anniversary with ringing of the closing bell at the New York Stock Exchange, which seemed fitting for this special milestone.

Pioneer Fund was launched on February 13, 1928 by Phil Carret, one of the earliest proponents of value investing and a leading innovator in the asset management industry. Mr. Carret began investing in the 1920s and founded Pioneer Investments (now Amundi US) in 1928, and was one of the first investors to realize he could uncover value through rigorous, innovative, fundamental research techniques.

Consistent with Mr. Carret’s investment approach and employing many of the same techniques utilized in the 1920s, Amundi US's portfolio managers have adapted Mr. Carret’s philosophy to a new age of “active” investing.

The last few years have seen investors face some unprecedented challenges, from a global pandemic that shuttered much of the world’s economy for months, to geopolitical strife, to rising inflation that has reached levels not seen in decades. Now, more than ever, Amundi US believes active management – that is, making active investment decisions across all of our portfolios – can help mitigate risk during periods of market volatility.

At Amundi US, active management begins with our own fundamental, bottom-up research process. Our team of dedicated research analysts and portfolio managers analyzes each security under consideration, communicating frequently with the management teams of the companies and other entities issuing the securities, and working together to identify those securities that we believe best meet our investment criteria for our family of funds. Our risk management approach begins with each security under consideration, as we strive to develop a deep understanding of the potential opportunity, while considering any potential risk factors.

Today, as shareholders, we have many options. It is our view that active management can serve shareholders well, not only when markets are thriving, but also during periods of market stress. As you consider your long-term investment goals, we encourage you to work with your financial professional to develop an investment plan that paves the way for you to pursue both your short-term and long-term goals.

2Pioneer Equity Income Fund | Semiannual Report | 4/30/23

We greatly appreciate the trust you have placed in us and look forward to continuing to serve you in the future.

Lisa M. Jones

Head of the Americas, President and CEO of US

Amundi Asset Management US, Inc.

June 2023

Any information in this shareowner report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is no guarantee of future results.

Pioneer Equity Income Fund | Semiannual Report | 4/30/233

Portfolio Management Discussion | 4/30/23

In the following interview, Sammi Truong and John A. Carey* discuss the market environment for equities and the factors that affected the performance of Pioneer Equity Income Fund during the six-month period ended April 30, 2023. Mr. Carey, Managing Director, Director of Equity Income, US, and a portfolio manager at Amundi Asset Management US, Inc. (Amundi US), is responsible for the day-to-day management of the Fund’s portfolio, along with Ms. Truong, a vice president and a portfolio manager at Amundi US.

| Q | How did the Fund perform over the six-month period ended April 30, 2023? |

| A | Pioneer Equity Income Fund’s Class A shares returned 4.09% at net asset value during the six-month period ended April 30, 2023, while the Fund’s benchmark, the Russell 1000 Value Index, returned 4.54%. During the same period, the average return of the 1,233 mutual funds in Morningstar’s Large Value Funds category was 3.89%. |

| Q | How would you describe the market environment for US equities during the six-month period ended April 30, 2023? |

| A | Following a difficult prior 12-month period, the US stock market experienced a bounce during the past six months, generating a total return of 8.63%, as measured by the Standard and Poor’s 500 Index (the S&P 500). However, the advances in the equity market did not occur without investors having to climb a “wall of worry.” The corporate earnings of companies within the S& P 500 contracted, in general, and fears of a recession mounted as the Federal Reserve (Fed) continued with its fastest pace of interest-rate increases since the 1980s in an effort to combat inflation, which has remained well above the Fed’s target rate. Financial stress also emerged during the period, as depositors seeking better interest rates moved their deposits to higher-yielding accounts, exposing the risks of mismatches in assets and liabilities within the banking system. Silicon Valley Bank, Signature Bank, and then First Republic Bank failed during the period, despite efforts by regulators to shore up confidence. |

*Note to shareholders: John A. Carey will retire from portfolio management effective in May 2024. He remains a member of the Fund's current portfolio management team. In addition, effective May 24, 2023, John Arege, a vice president and portfolio manager at Amundi US, became a portfolio manager of the Fund.

4Pioneer Equity Income Fund | Semiannual Report | 4/30/23

On anticipation that the Fed could be close to reaching the end of its monetary tightening cycle, growth stocks, as measured by the Russell 1000 Growth Index, rallied and gained 11.51% for the period, aided by the resurgence in mega-cap technology stocks. The Fund’s benchmark, the Russell 1000 Value Index (the Russell Index), which has more exposure to cyclical sectors of the economy, trailed growth stocks and the overall market due to investors’ uneasiness about an economic slowdown, and returned 4.54% during the six-month period.

| Q | Could you please discuss the main factors affecting the Fund’s benchmark-relative performance during the six-month period ended April 30, 2023, and any investments or strategies significantly helping or hurting benchmark-relative returns? |

| A | Sector allocation results contributed positively to the Fund’s benchmark-relative return for the six-month period, driven by the portfolio’s underweight exposures to the poor-performing financials and energy sectors. Partially offsetting the positive allocation results was the portfolio’s underweight versus the Russell Index to the strong-performing communication services sector. The main detractor from the Fund’s relative performance within the communication services sector was not holding shares of Meta Platforms, which, as a non-dividend* payer, does not fit our investment criteria. |

| | With regard to stock selection, the Fund’s positions in Lincoln National, Raymond James Financial, and Charles Schwab, all in the financials sector, were negative performance attributors versus the benchmark for the six-month period. The financials sector faced deposit outflows, increased funding costs, and the need to shore up capital, particularly in the wake of the bank failures mentioned previously. We have eliminated the portfolio’s holdings of Lincoln National and Schwab, as we saw diminished prospect for growth, and retained the position in Raymond James. Another detractor from the Fund’s benchmark-relative returns was Alexandria Real Estate, a life-science real estate company that saw its share price decrease during the period due to increased interest rates, and because a pullback in funding for |

| * | Dividends are not guaranteed. |

Pioneer Equity Income Fund | Semiannual Report | 4/30/235

| | biotech companies has led investors to forecast reduced demand for Alexandria’s lab spaces. |

| | On the positive side, the Fund’s positions in Novo Nordisk, Reliance Steel & Aluminum, Materion, Sun Life Financial, and Borg Warner aided benchmark-relative performance for the six-month period. Novo Nordisk, in the health care sector, has been displaying better-than-expected growth in its diabetic and weight-loss drugs. In the materials sector, Reliance Steel & Aluminum and Materion saw strong demand for their products during the period. Sun Life Financial, in financials, which offers insurance and wealth-and-asset-management products, proved to be more resilient, due to the company’s strong balance sheet. Finally, BorgWarner, in the consumer discretionary sector, has demonstrated progress in its pivot towards providing automotive components for electric vehicles. |

| Q | Could you highlight some of the more notable changes you made to the Fund’s portfolio during the six-month period ended April 30, 2023? |

| A | During the six-month period, we added 22 positions to the portfolio and eliminated 19, with some of the more notable buys and sells discussed below. |

| | Within the financials sector, we added Truist Financial and Regions Financial, which we believe have attractive geographic footprints, and CME, in order to gain exposure to the exchange market, which we think could benefit from heightened market volatility. We sold the Fund’s shares of Chubb, and, as previously mentioned, stepped aside from positions in Lincoln National and Charles Schwab, as well as a position in M&T Bank. Those moves resulted in the Fund’s having a larger benchmark-relative underweight to financials stocks. |

| | We also exited ConocoPhillips in favor of a position in Shell, an integrated energy company, as we saw better value and development opportunities for the latter. In addition, we initiated positions in Coterra Energy and EQT, both of which have been trading at discounts after a warmer-than-expected winter, but we also see long-term prospects for potential growth in natural gas demand, driven by Europe, as the region looks for alternative |

6Pioneer Equity Income Fund | Semiannual Report | 4/30/23

| | sources to Russian gas. The trades, in aggregate, reduced the portfolio’s underweight to energy versus the Russell Index. |

| | During the period, we increased the Fund’s weighting in the health care sector with the additions of Bruker, Thermo Fisher Scientific, and Merck, partially offset by the elimination of positions in Abbott Laboratories and Organon. We view the medical tools space as attractive over the longer term, and see potential growth prospects for Bruker and Thermo Fisher Scientific with their analytical instrument offerings. With regard to Merck, we see potential opportunities for the company to deliver on its pipeline. We eliminated the Fund’s shares of Abbott Laboratories during the period as the benefits the company derived from COVID-19 testing waned. We eliminated the portfolio’s Organon position, as we became more concerned with the company’s debt burden in the higher interest-rate environment. |

| | In the communication services sector, we traded out of AT&T and Verizon, on increased competition for consumer wireless subscriptions, and added Comcast, as we like the company’s quality assets of theme parks and its broadband business. We also believe the market has overly discounted the competition Comcast faces from fixed-wireless solutions. |

| Q | Did the Fund have any derivatives exposure during the six-month period ended April 30, 2023? |

| A | No, the Fund held no derivatives during the period. |

| Q | What is your outlook for equities heading into the second half of the Fund’s fiscal year? |

| A | Most economic indicators have continued to point to slower growth over the next several quarters. The Fed’s interest-rate increases over the past year are just starting to affect the real economy, and while inflation has probably peaked —and could decline from here, in our view — profit-margin contraction could continue to hurt corporate earnings. |

| | We believe the recent dislocations in the regional banking sector may cause further stress to financial conditions over the coming months as banks tighten their lending standards to preserve |

Pioneer Equity Income Fund | Semiannual Report | 4/30/237

| | liquidity. As a result, the Fed could reduce the scale of further interest-rate increases. However, we think the market’s hopes of rate cuts later in the year may prove to be premature, as persistent labor-market strength could lead the Fed to keep interest rates at an elevated level for an extended period in order to prevent inflation from rebounding. If the Fed does reduce interest rates, we feel it would be the result of greater-than-expected economic weakness, which would likely be detrimental to corporate earnings. The stock market tends to react negatively in such an environment. |

| | A mild recession, in our view, is more likely than a “soft landing” for the economy. In either scenario, earnings estimates could very well decline as companies take a more cautious approach to 2023, given economic uncertainty. In mid-2023, if the market adequately discounts a potential recession, we anticipate becoming more constructive. While expectations are for volatility in 2023 to remain high, the market may look forward to an earnings recovery in 2024 and end the year higher than where it began. |

| | The Fund currently has benchmark-relative overweight allocations to the cyclical sectors – or sectors more exposed to the ebbs and flows of the economic cycle – that we anticipate could do well during an economic recovery, including industrials, materials, and consumer discretionary. The portfolio has a large absolute sector weighting to financials, but is underweight to the sector, and to the banking industry, relative to the Russell Index. To balance the Fund’s cyclical positioning, given the uncertain trajectory of the economic recovery, we also have maintained exposures to the more defensive areas of the market, such as the consumer staples, real estate, and health care sectors. |

8Pioneer Equity Income Fund | Semiannual Report | 4/30/23

Please refer to the Schedule of Investments on pages 19-24 for a full listing of Fund securities.

All investments are subject to risk, including the possible loss of principal. In the past several years, financial markets have experienced increased volatility and heightened uncertainty. The market prices of securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues, armed conflict including Russia's military invasion of Ukraine, sanctions against Russia, other nations or individuals or companies and possible countermeasures, market disruptions caused by tariffs, trade disputes or other government actions, or adverse investor sentiment. These conditions may continue, recur, worsen or spread.

Investing in foreign and/or emerging markets securities involves risks relating to interest rates, currency exchange rates, economic, and political conditions.

The Fund invests in REIT securities, the value of which can fall for a variety of reasons, such as declines in rental income, fluctuating interest rates, poor property management, environmental liabilities, uninsured damage, increased competition, or changes in real estate tax laws.

For more information on this or any Pioneer fund, please visit amundi.com/usinvestors or call 1-800-622-9876. This material must be preceded or accompanied by the Fund's current prospectus or summary prospectus. Before investing, consider the product's investment objectives, risks, charges, and expenses. Read it carefully.

Any information in this shareholder report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is not a guarantee of future results.

Pioneer Equity Income Fund | Semiannual Report | 4/30/239

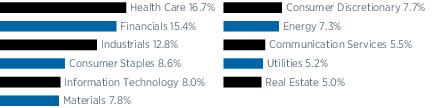

Portfolio Summary | 4/30/23

Portfolio Diversification

(As a percentage of total investments)*

10 Largest Holdings

| (As a percentage of total investments)* |

| 1. | Sun Life Financial, Inc. | 2.62% |

| 2. | Exxon Mobil Corp. | 2.21 |

| 3. | Reliance Steel & Aluminum Co. | 2.02 |

| 4. | Chevron Corp. | 1.94 |

| 5. | Materion Corp. | 1.85 |

| 6. | Mondelez International, Inc., Class A | 1.80 |

| 7. | Becton Dickinson & Co. | 1.72 |

| 8. | JPMorgan Chase & Co. | 1.69 |

| 9. | Stryker Corp. | 1.66 |

| 10. | Raytheon Technologies Corp. | 1.62 |

| | |

| * | Excludes short-term investments and all derivative contracts except for options purchased. The Fund is actively managed, and current holdings may be different. The holdings listed should not be considered recommendations to buy or sell any securities. |

10Pioneer Equity Income Fund | Semiannual Report | 4/30/23

Prices and Distributions | 4/30/23

Net Asset Value per Share

| Class | 4/30/23 | 10/31/22 |

| A | $33.51 | $35.99 |

| C | $32.79 | $35.30 |

| K | $33.56 | $36.03 |

| R | $34.42 | $36.85 |

| Y | $34.10 | $36.56 |

| | | |

Distributions per Share: 11/1/22 - 4/30/23

| Class | Net

Investment

Income | Short-Term

Capital Gains | Long-Term

Capital Gains |

| A | $0.4397 | $— | $3.5451 |

| C | $0.3194 | $— | $3.5451 |

| K | $0.4955 | $— | $3.5451 |

| R | $0.3648 | $— | $3.5451 |

| Y | $0.4753 | $— | $3.5451 |

Index Definition

The Russell 1000 Value Index is an unmanaged measure of the performance of large-cap U.S. value stocks. Indices are unmanaged and their returns assume reinvestment of dividends and do not reflect any fees or expenses. It is not possible to invest directly in an index.

The index defined here pertains to the “Value of $10,000 Investment” and “Value of $5 Million Investment” charts on pages 12 - 16.

Pioneer Equity Income Fund | Semiannual Report | 4/30/2311

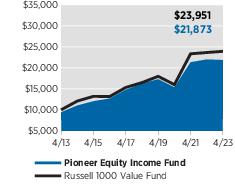

| Performance Update | 4/30/23 | Class A Shares |

Investment Returns

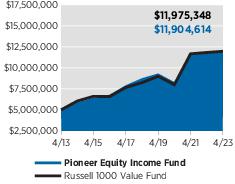

The mountain chart on the right shows the change in value of a $10,000 investment made in Class A shares of Pioneer Equity Income Fund at public offering price during the periods shown, compared to that of the Russell 1000 Value Index.

Average Annual Total Returns

(As of April 30, 2023) |

| Period | Net

Asset

Value

(NAV) | Public

Offering

Price

(POP) | Russell

1000

Value

Index |

| 10 Years | 8.78% | 8.14% | 9.13% |

| 5 Years | 6.06 | 4.81 | 7.75 |

| 1 Year | -0.65 | -6.37 | 1.21 |

Expense Ratio

(Per prospectus dated March 1, 2023) |

| Gross |

| 0.99% |

Value of $10,000 Investment

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

NAV results represent the percent change in net asset value per share. POP returns reflect deduction of maximum 5.75% sales charge. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for a more current expense ratio.

12Pioneer Equity Income Fund | Semiannual Report | 4/30/23

| Performance Update | 4/30/23 | Class C Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $10,000 investment made in Class C shares of Pioneer Equity Income Fund during the periods shown, compared to that of the Russell 1000 Value Index.

Average Annual Total Returns

(As of April 30, 2023) |

| Period | If

Held | If

Redeemed | Russell

1000

Value

Index |

| 10 Years | 7.99% | 7.99% | 9.13% |

| 5 Years | 5.28 | 5.28 | 7.75 |

| 1 Year | -1.40 | -2.28 | 1.21 |

Expense Ratio

(Per prospectus dated March 1, 2023) |

| Gross |

| 1.73% |

Value of $10,000 Investment

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

Class C shares held for less than one year are also subject to a 1% contingent deferred sales charge (CDSC). “If Held” results represent the percent change in net asset value per share. “If Redeemed” returns reflect deduction of the CDSC for the one-year period, assuming a complete redemption of shares at the last price calculated on the last business day of the period, and no CDSC for the five- and 10-year periods. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for a more current expense ratio.

Pioneer Equity Income Fund | Semiannual Report | 4/30/2313

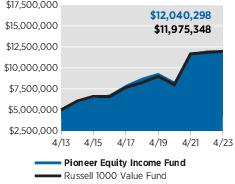

| Performance Update | 4/30/23 | Class K Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $5 million investment made in Class K shares of Pioneer Equity Income Fund during the periods shown, compared to that of the Russell 1000 Value Index.

Average Annual Total Returns

(As of April 30, 2023) |

| Period | Net

Asset

Value

(NAV) | Russell

1000

Value

Index |

| 10 Years | 9.19% | 9.13% |

| 5 Years | 6.44 | 7.75 |

| 1 Year | -0.31 | 1.21 |

Expense Ratio

(Per prospectus dated March 1, 2023) |

| Gross |

| 0.66% |

Value of $5 Million Investment

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

Class K shares are not subject to sales charges and are available for limited groups of eligible investors, including institutional investors. All results are historical and assume the

reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for a more current expense ratio.

14Pioneer Equity Income Fund | Semiannual Report | 4/30/23

| Performance Update | 4/30/23 | Class R Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $10,000 investment made in Class R shares of Pioneer Equity Income Fund during the periods shown, compared to that of the Russell 1000 Value Index.

Average Annual Total Returns

(As of April 30, 2023) |

| Period | Net

Asset

Value

(NAV) | Russell

1000

Value

Index |

| 10 Years | 8.38% | 9.13% |

| 5 Years | 5.66 | 7.75 |

| 1 Year | -1.10 | 1.21 |

Expense Ratio

(Per prospectus dated March 1, 2023) |

| Gross |

| 1.40% |

Value of $10,000 Investment

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

Class R shares are not subject to sales charges and are available for limited groups of eligible investors, including institutional investors. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for a more current expense ratio.

Pioneer Equity Income Fund | Semiannual Report | 4/30/2315

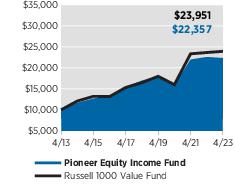

| Performance Update | 4/30/23 | Class Y Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $5 million investment made in Class Y shares of Pioneer Equity Income Fund during the periods shown, compared to that of the Russell 1000 Value Index.

Average Annual Total Returns

(As of April 30, 2023) |

| Period | Net

Asset

Value

(NAV) | Russell

1000

Value

Index |

| 10 Years | 9.06% | 9.13% |

| 5 Years | 6.31 | 7.75 |

| 1 Year | -0.46 | 1.21 |

Expense Ratio

(Per prospectus dated March 1, 2023) |

| Gross |

| 0.78% |

Value of $5 Million Investment

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

Class Y shares are not subject to sales charges and are available for limited groups of eligible investors, including institutional investors. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for a more current expense ratio.

16Pioneer Equity Income Fund | Semiannual Report | 4/30/23

Comparing Ongoing Fund Expenses

As a shareowner in the Fund, you incur two types of costs:

| (1) | ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses; and |

| (2) | transaction costs, including sales charges (loads) on purchase payments. |

This example is intended to help you understand your ongoing expenses (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 at the beginning of the Fund’s latest six-month period and held throughout the six months.

Using the Tables

Actual Expenses

The first table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period as follows:

| (1) | Divide your account value by $1,000

Example: an $8,600 account value ÷ $1,000 = 8.6 |

| (2) | Multiply the result in (1) above by the corresponding share class’s number in the third row under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. |

Expenses Paid on a $1,000 Investment in Pioneer Equity Income Fund

Based on actual returns from November 1, 2022 through April 30, 2023.

| Share Class | A | C | K | R | Y |

Beginning Account

Value on 11/1/22 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

Ending Account Value

(after expenses) on 4/30/23 | $1,040.90 | $1,037.10 | $1,042.90 | $1,039.10 | $1,041.90 |

Expenses Paid

During Period* | $5.16 | $8.94 | $3.44 | $7.08 | $4.30 |

| | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.02%, 1.77%, 0.68%, 1.40%, and 0.85% for Class A, Class C, Class K, Class R, and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

Pioneer Equity Income Fund | Semiannual Report | 4/30/2317

Comparing Ongoing Fund Expenses (continued)

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads) that are charged at the time of the transaction. Therefore, the table below is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Expenses Paid on a $1,000 Investment in Pioneer Equity Income Fund

Based on a hypothetical 5% return per year before expenses, reflecting the period from November 1, 2022 through April 30, 2023.

| Share Class | A | C | K | R | Y |

Beginning Account

Value on 11/1/22 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

Ending Account Value

(after expenses) on 4/30/23 | $1,019.74 | $1,016.02 | $1,021.42 | $1,017.85 | $1,020.58 |

Expenses Paid

During Period* | $5.11 | $8.85 | $3.41 | $7.00 | $4.26 |

| | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.02%, 1.77%, 0.68%, 1.40%, and 0.85% for Class A, Class C, Class K, Class R, and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

18Pioneer Equity Income Fund | Semiannual Report | 4/30/23

Schedule of Investments | 4/30/23

(unaudited)

| Shares | | | | | | Value |

| | UNAFFILIATED ISSUERS — 99.9% | |

| | Common Stocks — 99.9% of Net Assets | |

| | Aerospace & Defense — 2.8% | |

| 100,144 | L3Harris Technologies, Inc. | $ 19,543,102 |

| 265,414 | Raytheon Technologies Corp. | 26,514,858 |

| | Total Aerospace & Defense | $46,057,960 |

|

|

| | Air Freight & Logistics — 1.5% | |

| 109,443 | CH Robinson Worldwide, Inc. | $ 11,039,516 |

| 71,436 | United Parcel Service, Inc., Class B | 12,844,907 |

| | Total Air Freight & Logistics | $23,884,423 |

|

|

| | Automobile Components — 1.9% | |

| 66,101 | Autoliv, Inc. | $ 5,672,127 |

| 518,467 | BorgWarner, Inc. | 24,953,817 |

| | Total Automobile Components | $30,625,944 |

|

|

| | Automobiles — 0.8% | |

| 501,230 | Honda Motor Co., Ltd. (A.D.R.) | $ 13,322,693 |

| | Total Automobiles | $13,322,693 |

|

|

| | Banks — 5.3% | |

| 786,333 | Bank of America Corp. | $ 23,023,830 |

| 200,322 | JPMorgan Chase & Co. | 27,692,513 |

| 132,251 | PNC Financial Services Group, Inc. | 17,225,693 |

| 518,518 | Regions Financial Corp. | 9,468,139 |

| 268,533 | Truist Financial Corp. | 8,748,805 |

| | Total Banks | $86,158,980 |

|

|

| | Capital Markets — 7.0% | |

| 406,426 | Bank of New York Mellon Corp. | $ 17,309,683 |

| 77,474 | CME Group, Inc. | 14,392,345 |

| 177,444 | Morgan Stanley | 15,964,637 |

| 221,649 | Northern Trust Corp. | 17,324,086 |

| 221,124 | Raymond James Financial, Inc. | 20,018,356 |

| 155,383 | State Street Corp. | 11,227,975 |

| 168,214 | T Rowe Price Group, Inc. | 18,895,479 |

| | Total Capital Markets | $115,132,561 |

|

|

| | Chemicals — 2.7% | |

| 58,679 | Air Products and Chemicals, Inc. | $ 17,272,750 |

| 157,112 | Celanese Corp. | 16,691,579 |

| 177,592 | Corteva, Inc. | 10,854,423 |

| | Total Chemicals | $44,818,752 |

|

|

The accompanying notes are an integral part of these financial statements.

Pioneer Equity Income Fund | Semiannual Report | 4/30/2319

Schedule of Investments | 4/30/23

(unaudited) (continued)

| Shares | | | | | | Value |

| | Commercial Services & Supplies — 0.5% | |

| 67,746 | MSA Safety, Inc. | $ 8,790,044 |

| | Total Commercial Services & Supplies | $8,790,044 |

|

|

| | Communications Equipment — 0.5% | |

| 161,947 | Cisco Systems, Inc. | $ 7,651,996 |

| | Total Communications Equipment | $7,651,996 |

|

|

| | Consumer Staples Distribution & Retail — 1.7% | |

| 113,432 | Target Corp. | $ 17,893,898 |

| 63,069 | Walmart, Inc. | 9,521,527 |

| | Total Consumer Staples Distribution & Retail | $27,415,425 |

|

|

| | Diversified Telecommunication Services — 0.7% | |

| 231,788 | BCE, Inc. | $ 11,142,049 |

| | Total Diversified Telecommunication Services | $11,142,049 |

|

|

| | Electric Utilities — 3.7% | |

| 144,661 | American Electric Power Co., Inc. | $ 13,369,569 |

| 307,654 | Eversource Energy | 23,877,027 |

| 296,887 | NextEra Energy, Inc. | 22,750,451 |

| | Total Electric Utilities | $59,997,047 |

|

|

| | Electrical Equipment — 0.5% | |

| 50,899 | Eaton Corp. Plc | $ 8,506,241 |

| | Total Electrical Equipment | $8,506,241 |

|

|

| | Electronic Equipment, Instruments & Components —

0.8% | |

| 78,535 | CDW Corp. | $ 13,318,751 |

| | Total Electronic Equipment, Instruments & Components | $13,318,751 |

|

|

| | Food Products — 6.2% | |

| 293,367 | Campbell Soup Co. | $ 15,929,828 |

| 111,410 | John B Sanfilippo & Son, Inc. | 11,581,070 |

| 281,758 | McCormick & Co., Inc., Non-Voting Shares | 24,752,440 |

| 383,924 | Mondelez International, Inc., Class A | 29,454,649 |

| 154,539 | Nestle S.A. (A.D.R.) | 19,821,172 |

| | Total Food Products | $101,539,159 |

|

|

| | Ground Transportation — 1.1% | |

| 52,209 | Canadian National Railway Co. | $ 6,226,967 |

| 30,578 | Union Pacific Corp. | 5,984,115 |

| 131,155 | Werner Enterprises, Inc. | 5,924,271 |

| | Total Ground Transportation | $18,135,353 |

|

|

The accompanying notes are an integral part of these financial statements.

20Pioneer Equity Income Fund | Semiannual Report | 4/30/23

| Shares | | | | | | Value |

| | Health Care Equipment & Supplies — 3.4% | |

| 106,658 | Becton Dickinson & Co. | $ ���28,190,776 |

| 90,579 | Stryker Corp. | 27,141,997 |

| | Total Health Care Equipment & Supplies | $55,332,773 |

|

|

| | Health Care Providers & Services — 3.6% | |

| 72,328 | AmerisourceBergen Corp. | $ 12,067,927 |

| 192,340 | Cardinal Health, Inc. | 15,791,114 |

| 234,932 | CVS Health Corp. | 17,222,865 |

| 27,267 | Humana, Inc. | 14,464,871 |

| | Total Health Care Providers & Services | $59,546,777 |

|

|

| | Health Care REITs — 0.4% | |

| 368,630 | Healthcare Realty Trust, Inc. | $ 7,291,501 |

| | Total Health Care REITs | $7,291,501 |

|

|

| | Hotels, Restaurants & Leisure — 0.6% | |

| 65,661 | Darden Restaurants, Inc. | $ 9,975,876 |

| | Total Hotels, Restaurants & Leisure | $9,975,876 |

|

|

| | Household Products — 1.9% | |

| 52,393 | Clorox Co. | $ 8,677,329 |

| 273,309 | Colgate-Palmolive Co. | 21,810,058 |

| | Total Household Products | $30,487,387 |

|

|

| | Industrial REITs — 1.3% | |

| 169,581 | Prologis, Inc. | $ 21,240,020 |

| | Total Industrial REITs | $21,240,020 |

|

|

| | Insurance — 3.0% | |

| 113,920 | MetLife, Inc. | $ 6,986,714 |

| 875,020 | Sun Life Financial, Inc. | 42,945,981 |

| | Total Insurance | $49,932,695 |

|

|

| | IT Services — 1.0% | |

| 129,627 | International Business Machines Corp. | $ 16,386,149 |

| | Total IT Services | $16,386,149 |

|

|

| | Life Sciences Tools & Services — 2.4% | |

| 255,866 | Bruker Corp. | $ 20,246,677 |

| 34,489 | Thermo Fisher Scientific, Inc. | 19,137,946 |

| | Total Life Sciences Tools & Services | $39,384,623 |

|

|

| | Machinery — 5.6% | |

| 31,009 | Caterpillar, Inc. | $ 6,784,769 |

| 28,220 | Deere & Co. | 10,667,724 |

| 1,020,614 | Gorman-Rupp Co. | 25,056,074 |

| 90,086 | Oshkosh Corp. | 6,893,381 |

The accompanying notes are an integral part of these financial statements.

Pioneer Equity Income Fund | Semiannual Report | 4/30/2321

Schedule of Investments | 4/30/23

(unaudited) (continued)

| Shares | | | | | | Value |

| | Machinery — (continued) | |

| 343,507 | PACCAR, Inc. | $ 25,656,538 |

| 211,986 | Timken Co. | 16,291,124 |

| | Total Machinery | $91,349,610 |

|

|

| | Media — 4.8% | |

| 372,914 | Comcast Corp., Class A | $ 15,427,452 |

| 461,721 | Fox Corp., Class A | 15,356,841 |

| 688,893 | Interpublic Group of Cos., Inc. | 24,614,147 |

| 255,337 | Omnicom Group, Inc. | 23,125,872 |

| | Total Media | $78,524,312 |

|

|

| | Metals & Mining — 5.1% | |

| 200,797 | Freeport-McMoRan, Inc. | $ 7,612,214 |

| 279,104 | Materion Corp. | 30,229,754 |

| 133,372 | Reliance Steel & Aluminum Co. | 33,049,582 |

| 256,662 | Teck Resources, Ltd., Class B | 11,960,449 |

| | Total Metals & Mining | $82,851,999 |

|

|

| | Multi-Utilities — 0.8% | |

| 221,849 | CMS Energy Corp. | $ 13,812,319 |

| | Total Multi-Utilities | $13,812,319 |

|

|

| | Office REITs — 1.2% | |

| 163,070 | Alexandria Real Estate Equities, Inc. | $ 20,250,033 |

| | Total Office REITs | $20,250,033 |

|

|

| | Oil, Gas & Consumable Fuels — 7.3% | |

| 188,736 | Chevron Corp. | $ 31,817,115 |

| 333,384 | Coterra Energy, Inc. | 8,534,631 |

| 259,624 | EQT Corp. | 9,045,300 |

| 305,742 | Exxon Mobil Corp. | 36,181,508 |

| 157,250 | Phillips 66 | 15,567,750 |

| 288,197 | Shell Plc (A.D.R.) | 17,862,450 |

| | Total Oil, Gas & Consumable Fuels | $119,008,754 |

|

|

| | Pharmaceuticals — 7.3% | |

| 277,595 | AstraZeneca Plc (A.D.R.) | $ 20,325,506 |

| 59,960 | Eli Lilly & Co. | 23,735,766 |

| 161,840 | Johnson & Johnson | 26,493,208 |

| 166,950 | Merck & Co., Inc. | 19,277,716 |

| 126,822 | Novo Nordisk AS (A.D.R.) | 21,190,688 |

| 209,768 | Pfizer, Inc. | 8,157,877 |

| | Total Pharmaceuticals | $119,180,761 |

|

|

The accompanying notes are an integral part of these financial statements.

22Pioneer Equity Income Fund | Semiannual Report | 4/30/23

| Shares | | | | | | Value |

| | Residential REITs — 1.1% | |

| 161,948 | Camden Property Trust | $ 17,822,377 |

| | Total Residential REITs | $17,822,377 |

|

|

| | Semiconductors & Semiconductor Equipment — 4.5% | |

| 131,383 | Analog Devices, Inc. | $ 23,633,174 |

| 48,143 | KLA Corp. | 18,609,195 |

| 112,720 | Microchip Technology, Inc. | 8,227,433 |

| 89,652 | MKS Instruments, Inc. | 7,519,113 |

| 95,336 | Texas Instruments, Inc. | 15,940,179 |

| | Total Semiconductors & Semiconductor Equipment | $73,929,094 |

|

|

| | Software — 1.2% | |

| 63,303 | Microsoft Corp. | $ 19,450,480 |

| | Total Software | $19,450,480 |

|

|

| | Specialized REITs — 0.9% | |

| 57,265 | Crown Castle, Inc. | $ 7,048,749 |

| 86,267 | Digital Realty Trust, Inc. | 8,553,373 |

| | Total Specialized REITs | $15,602,122 |

|

|

| | Specialty Retail — 2.2% | |

| 63,336 | Home Depot, Inc. | $ 19,035,001 |

| 217,108 | TJX Cos., Inc. | 17,112,453 |

| | Total Specialty Retail | $36,147,454 |

|

|

| | Textiles, Apparel & Luxury Goods — 1.1% | |

| 141,510 | Carter's, Inc. | $ 9,873,152 |

| 77,020 | Ralph Lauren Corp. | 8,841,126 |

| | Total Textiles, Apparel & Luxury Goods | $18,714,278 |

|

|

| | Trading Companies & Distributors — 0.8% | |

| 96,182 | Ferguson Plc | $ 13,544,349 |

| | Total Trading Companies & Distributors | $13,544,349 |

|

|

| | Water Utilities — 0.7% | |

| 278,835 | Essential Utilities, Inc. | $ 11,906,255 |

| | Total Water Utilities | $11,906,255 |

|

|

| | Total Common Stocks

(Cost $1,237,306,348) | $1,638,169,376 |

|

|

| | TOTAL INVESTMENTS IN UNAFFILIATED ISSUERS — 99.9%

(Cost $1,237,306,348) | $1,638,169,376 |

| | OTHER ASSETS AND LIABILITIES — 0.1% | $ 1,542,298 |

| | net assets — 100.0% | $1,639,711,674 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

Pioneer Equity Income Fund | Semiannual Report | 4/30/2323

Schedule of Investments | 4/30/23

(unaudited) (continued)

| (A.D.R.) | American Depositary Receipts. |

Purchases and sales of securities (excluding short-term investments) for the six months ended April 30, 2023, aggregated $338,177,593 and $522,242,871, respectively.

At April 30, 2023, the net unrealized appreciation on investments based on cost for federal tax purposes of $1,238,176,198 was as follows:

| Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost | $430,609,667 |

| Aggregate gross unrealized depreciation for all investments in which there is an excess of tax cost over value | (30,616,489) |

| Net unrealized appreciation | $399,993,178 |

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in the three broad levels below.

| Level 1 | – | unadjusted quoted prices in active markets for identical securities. |

| Level 2 | – | other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.). See Notes to Financial Statements — Note 1A. |

| Level 3 | – | significant unobservable inputs (including the Adviser's own assumptions in determining fair value of investments). See Notes to Financial Statements — Note 1A. |

The following is a summary of the inputs used as of April 30, 2023, in valuing the Fund's investments:

| | Level 1 | Level 2 | Level 3 | Total |

| Common Stocks | $1,638,169,376 | $— | $— | $1,638,169,376 |

| Total Investments in Securities | $ 1,638,169,376 | $ — | $ — | $ 1,638,169,376 |

During the period ended April 30, 2023, there were no transfers in or out of Level 3.

The accompanying notes are an integral part of these financial statements.

24Pioneer Equity Income Fund | Semiannual Report | 4/30/23

Statement of Assets and Liabilities | 4/30/23 (unaudited)

| ASSETS: | |

| Investments in unaffiliated issuers, at value (cost $1,237,306,348) | $1,638,169,376 |

| Receivables — | |

| Fund shares sold | 1,509,685 |

| Dividends | 3,057,285 |

| Interest | 27,039 |

| Other assets | 67,113 |

| Total assets | $ 1,642,830,498 |

| LIABILITIES: | |

| Overdraft due to custodian | $ 1,012,538 |

| Payables — | |

| Fund shares repurchased | 1,320,166 |

| Distributions | 2,983 |

| Trustees' fees | 11,920 |

| Transfer agent fees | 461,624 |

| Management fees | 133,319 |

| Administrative expenses | 42,966 |

| Distribution fees | 33,392 |

| Accrued expenses | 99,916 |

| Total liabilities | $ 3,118,824 |

| NET ASSETS: | |

| Paid-in capital | $1,109,968,195 |

| Distributable earnings | 529,743,479 |

| Net assets | $1,639,711,674 |

| NET ASSET VALUE PER SHARE: | |

| No par value (unlimited number of shares authorized) | |

| Class A (based on $716,946,119/21,396,385 shares) | $ 33.51 |

| Class C (based on $47,200,264/1,439,354 shares) | $ 32.79 |

| Class K (based on $222,472,040/6,629,578 shares) | $ 33.56 |

| Class R (based on $39,957,598/1,160,958 shares) | $ 34.42 |

| Class Y (based on $613,135,653/17,982,229 shares) | $ 34.10 |

| MAXIMUM OFFERING PRICE PER SHARE: | |

| Class A (based on $33.51 net asset value per share/100%-5.75% maximum sales charge) | $ 35.55 |

The accompanying notes are an integral part of these financial statements.

Pioneer Equity Income Fund | Semiannual Report | 4/30/23 25

Statement of Operations (unaudited)

FOR THE SIX MONTHS ENDED 4/30/23

| INVESTMENT INCOME: | | |

| Dividends from unaffiliated issuers (net of foreign taxes withheld $312,407) | $ 21,539,060 | |

| Interest from unaffiliated issuers | 6,980 | |

| Total Investment Income | | $ 21,546,040 |

| EXPENSES: | | |

| Management fees | $ 5,118,190 | |

| Administrative expenses | 283,873 | |

| Transfer agent fees | | |

| Class A | 274,403 | |

| Class C | 18,819 | |

| Class K | 354 | |

| Class R | 43,760 | |

| Class Y | 537,615 | |

| Distribution fees | | |

| Class A | 913,957 | |

| Class C | 250,304 | |

| Class R | 102,874 | |

| Shareowner communications expense | 79,421 | |

| Custodian fees | 10,518 | |

| Registration fees | 45,250 | |

| Professional fees | 56,434 | |

| Printing expense | 24,917 | |

| Officers' and Trustees' fees | 58,170 | |

| Insurance expense | 9,675 | |

| Miscellaneous | 181,919 | |

| Total expenses | | $ 8,010,453 |

| Net investment income | | $ 13,535,587 |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | |

| Net realized gain (loss) on: | | |

| Investments in unaffiliated issuers | $130,238,679 | |

| Other assets and liabilities denominated in foreign currencies | 3,086 | $130,241,765 |

| Change in net unrealized appreciation (depreciation) on: | | |

| Investments in unaffiliated issuers | $ (70,779,932) | |

| Other assets and liabilities denominated in foreign currencies | 37,474 | $ (70,742,458) |

| Net realized and unrealized gain (loss) on investments | | $ 59,499,307 |

| Net increase in net assets resulting from operations | | $ 73,034,894 |

The accompanying notes are an integral part of these financial statements.

26Pioneer Equity Income Fund | Semiannual Report | 4/30/23

Statements of Changes in Net Assets

| | Six Months

Ended

4/30/23

(unaudited) | Year

Ended

10/31/22 |

| FROM OPERATIONS: | | |

| Net investment income (loss) | $ 13,535,587 | $ 33,367,486 |

| Net realized gain (loss) on investments | 130,241,765 | 165,368,417 |

| Change in net unrealized appreciation (depreciation) on investments | (70,742,458) | (349,850,575) |

| Net increase (decrease) in net assets resulting from operations | $ 73,034,894 | $ (151,114,672) |

| DISTRIBUTIONS TO SHAREOWNERS: | | |

| Class A ($3.99 and $3.85 per share, respectively) | $ (80,834,408) | $ (78,936,753) |

| Class C ($3.87 and $3.58 per share, respectively) | (5,553,814) | (5,771,572) |

| Class K ($4.05 and $3.99 per share, respectively) | (26,408,063) | (27,593,300) |

| Class R ($3.91 and $3.69 per share, respectively) | (4,403,589) | (4,539,376) |

| Class Y ($4.03 and $3.92 per share, respectively) | (75,856,236) | (99,581,307) |

| Total distributions to shareowners | $ (193,056,110) | $ (216,422,308) |

| FROM FUND SHARE TRANSACTIONS: | | |

| Net proceeds from sales of shares | $ 88,239,406 | $ 277,146,279 |

| Reinvestment of distributions | 186,145,392 | 209,794,473 |

| Cost of shares repurchased | (295,105,165) | (768,286,292) |

| Net decrease in net assets resulting from Fund share transactions | $ (20,720,367) | $ (281,345,540) |

| Net decrease in net assets | $ (140,741,583) | $ (648,882,520) |

| NET ASSETS: | | |

| Beginning of period | $1,780,453,257 | $2,429,335,777 |

| End of period | $1,639,711,674 | $ 1,780,453,257 |

The accompanying notes are an integral part of these financial statements.

Pioneer Equity Income Fund | Semiannual Report | 4/30/2327

Statements of Changes in Net Assets (continued)

| | Six Months

Ended

4/30/23

Shares

(unaudited) | Six Months

Ended

4/30/23

Amount

(unaudited) | Year

Ended

10/31/22

Shares | Year

Ended

10/31/22

Amount |

| Class A | | | | |

| Shares sold | 857,635 | $ 29,280,833 | 1,625,345 | $ 63,032,773 |

| Reinvestment of distributions | 2,244,636 | 76,729,092 | 1,958,991 | 75,082,572 |

| Less shares repurchased | (2,046,445) | (70,078,954) | (3,826,468) | (147,980,660) |

Net increase

(decrease) | 1,055,826 | $ 35,930,971 | (242,132) | $ (9,865,315) |

| Class C | | | | |

| Shares sold | 82,030 | $ 2,710,465 | 184,468 | $ 6,974,688 |

| Reinvestment of distributions | 156,389 | 5,238,345 | 144,937 | 5,458,663 |

| Less shares repurchased | (246,227) | (8,198,682) | (552,139) | (20,980,036) |

| Net decrease | (7,808) | $ (249,872) | (222,734) | $ (8,546,685) |

| Class K | | | | |

| Shares sold | 486,770 | $ 16,625,563 | 1,601,110 | $ 62,498,755 |

| Reinvestment of distributions | 763,550 | 26,129,182 | 709,741 | 27,229,561 |

| Less shares repurchased | (1,177,920) | (39,876,346) | (2,779,686) | (107,667,109) |

Net increase

(decrease) | 72,400 | $ 2,878,399 | (468,835) | $ (17,938,793) |

| Class R | | | | |

| Shares sold | 45,172 | $ 1,571,940 | 144,900 | $ 5,729,158 |

| Reinvestment of distributions | 125,400 | 4,403,135 | 115,539 | 4,537,977 |

| Less shares repurchased | (150,289) | (5,291,685) | (356,596) | (14,045,087) |

Net increase

(decrease) | 20,283 | $ 683,390 | (96,157) | $ (3,777,952) |

| Class Y | | | | |

| Shares sold | 1,102,863 | $ 38,050,605 | 3,536,861 | $ 138,910,905 |

| Reinvestment of distributions | 2,116,793 | 73,645,638 | 2,502,650 | 97,485,700 |

| Less shares repurchased | (4,907,251) | (171,659,498) | (12,314,328) | (477,613,400) |

| Net decrease | (1,687,595) | $ (59,963,255) | (6,274,817) | $(241,216,795) |

The accompanying notes are an integral part of these financial statements.

28Pioneer Equity Income Fund | Semiannual Report | 4/30/23

| | Six Months

Ended

4/30/23

(unaudited) | Year

Ended

10/31/22 | Year

Ended

10/31/21 | Year

Ended

10/31/20 | Year

Ended

10/31/19 | Year

Ended

10/31/18 |

| Class A | | | | | | |

| Net asset value, beginning of period | $ 35.99 | $ 42.74 | $ 31.38 | $ 35.59 | $ 34.39 | $ 35.68 |

| Increase (decrease) from investment operations: | | | | | | |

| Net investment income (loss) (a) | $ 0.25 | $ 0.56 | $ 0.55 | $ 0.58 | $ 0.72 | $ 0.72 |

| Net realized and unrealized gain (loss) on investments | 1.26 | (3.46) | 11.32 | (3.35) | 2.85 | (0.04) |

| Net increase (decrease) from investment operations | $ 1.51 | $ (2.90) | $ 11.87 | $ (2.77) | $ 3.57 | $ 0.68 |

| Distributions to shareowners: | | | | | | |

| Net investment income | $ (0.44) | $ (0.59) | $ (0.51) | $ (0.61) | $ (0.79) | $ (0.57) |

| Net realized gain | (3.55) | (3.26) | — | (0.83) | (1.58) | (1.40) |

| Total distributions | $ (3.99) | $ (3.85) | $ (0.51) | $ (1.44) | $ (2.37) | $ (1.97) |

| Net increase (decrease) in net asset value | $ (2.48) | $ (6.75) | $ 11.36 | $ (4.21) | $ 1.20 | $ (1.29) |

| Net asset value, end of period | $ 33.51 | $ 35.99 | $ 42.74 | $ 31.38 | $ 35.59 | $ 34.39 |

| Total return (b) | 4.09%(c) | (7.22)% | 37.99% | (8.00)% | 11.15% | 1.84% |

| Ratio of net expenses to average net assets | 1.02%(d) | 0.99% | 1.02% | 1.06% | 1.00% | 1.00% |

| Ratio of net investment income (loss) to average net assets | 1.50%(d) | 1.47% | 1.41% | 1.78% | 2.14% | 2.00% |

| Portfolio turnover rate | 20%(c) | 30% | 25% | 8% | 23% | 27% |

| Net assets, end of period (in thousands) | $716,946 | $731,964 | $879,753 | $703,864 | $884,809 | $835,012 |

| (a) | The per-share data presented above is based on the average shares outstanding for the period presented. |

| (b) | Assumes initial investment at net asset value at the beginning of each period, reinvestment of all distributions, the complete redemption of the investment at net asset value at the end of each period and no sales charges. Total return would be reduced if sales charges were taken into account. |

| (c) | Not annualized. |

| (d) | Annualized. |

The accompanying notes are an integral part of these financial statements.

Pioneer Equity Income Fund | Semiannual Report | 4/30/2329

Financial Highlights (continued)

| | Six Months

Ended

4/30/23

(unaudited) | Year

Ended

10/31/22 | Year

Ended

10/31/21 | Year

Ended

10/31/20 | Year

Ended

10/31/19 | Year

Ended

10/31/18 |

| Class C | | | | | | |

| Net asset value, beginning of period | $ 35.30 | $ 42.01 | $ 30.85 | $ 35.00 | $ 33.80 | $ 35.06 |

| Increase (decrease) from investment operations: | | | | | | |

| Net investment income (loss) (a) | $ 0.13 | $ 0.27 | $ 0.27 | $ 0.35 | $ 0.46 | $ 0.48 |

| Net realized and unrealized gain (loss) on investments | 1.23 | (3.40) | 11.12 | (3.29) | 2.79 | (0.05) |

| Net increase (decrease) from investment operations | $ 1.36 | $ (3.13) | $ 11.39 | $ (2.94) | $ 3.25 | $ 0.43 |

| Distributions to shareowners: | | | | | | |

| Net investment income | $ (0.32) | $ (0.32) | $ (0.23) | $ (0.38) | $ (0.47) | $ (0.29) |

| Net realized gain | (3.55) | (3.26) | — | (0.83) | (1.58) | (1.40) |

| Total distributions | $ (3.87) | $ (3.58) | $ (0.23) | $ (1.21) | $ (2.05) | $ (1.69) |

| Net increase (decrease) in net asset value | $ (2.51) | $ (6.71) | $ 11.16 | $ (4.15) | $ 1.20 | $ (1.26) |

| Net asset value, end of period | $ 32.79 | $ 35.30 | $ 42.01 | $ 30.85 | $ 35.00 | $ 33.80 |

| Total return (b) | 3.71%(c) | (7.92)% | 37.00% | (8.64)% | 10.27% | 1.14% |

| Ratio of net expenses to average net assets | 1.77%(d) | 1.73% | 1.75% | 1.75% | 1.78% | 1.72% |

| Ratio of net investment income (loss) to average net assets | 0.75%(d) | 0.73% | 0.69% | 1.11% | 1.38% | 1.35% |

| Portfolio turnover rate | 20%(c) | 30% | 25% | 8% | 23% | 27% |

| Net assets, end of period (in thousands) | $47,200 | $51,086 | $70,156 | $68,832 | $103,483 | $111,558 |

| Ratios with no waiver of fees and assumption of expenses by the Adviser and no reduction for fees paid indirectly: | | | | | | |

| (a) | The per-share data presented above is based on the average shares outstanding for the period presented. |

| (b) | Assumes initial investment at net asset value at the beginning of each period, reinvestment of all distributions, the complete redemption of the investment at net asset value at the end of each period and no sales charges. Total return would be reduced if sales charges were taken into account. |

| (c) | Not annualized. |

| (d) | Annualized. |

The accompanying notes are an integral part of these financial statements.

30Pioneer Equity Income Fund | Semiannual Report | 4/30/23

| | Six Months

Ended

4/30/23

(unaudited) | Year

Ended

10/31/22 | Year

Ended

10/31/21 | Year

Ended

10/31/20 | Year

Ended

10/31/19 | Year

Ended

10/31/18 |

| Class K | | | | | | |

| Net asset value, beginning of period | $ 36.03 | $ 42.81 | $ 31.44 | $ 35.65 | $ 34.47 | $ 35.75 |

| Increase (decrease) from investment operations: | | | | | | |

| Net investment income (loss) (a) | $ 0.31 | $ 0.69 | $ 0.70 | $ 0.71 | $ 0.83 | $ 0.85 |

| Net realized and unrealized gain (loss) on investments | 1.27 | (3.48) | 11.33 | (3.36) | 2.85 | (0.04) |

| Net increase (decrease) from investment operations | $ 1.58 | $ (2.79) | $ 12.03 | $ (2.65) | $ 3.68 | $ 0.81 |

| Distributions to shareowners: | | | | | | |

| Net investment income | $ (0.50) | $ (0.73) | $ (0.66) | $ (0.73) | $ (0.92) | $ (0.69) |

| Net realized gain | (3.55) | (3.26) | — | (0.83) | (1.58) | (1.40) |

| Total distributions | $ (4.05) | $ (3.99) | $ (0.66) | $ (1.56) | $ (2.50) | $ (2.09) |

| Net increase (decrease) in net asset value | $ (2.47) | $ (6.78) | $ 11.37 | $ (4.21) | $ 1.18 | $ (1.28) |

| Net asset value, end of period | $ 33.56 | $ 36.03 | $ 42.81 | $ 31.44 | $ 35.65 | $ 34.47 |

| Total return (b) | 4.29%(c) | (6.94)% | 38.49% | (7.62)% | (11.53)% | 2.21% |

| Ratio of net expenses to average net assets | 0.68%(d) | 0.66% | 0.66% | 0.66% | 0.66% | 0.66% |

| Ratio of net investment income (loss) to average net assets | 1.84%(d) | 1.80% | 1.77% | 2.18% | 2.46% | 2.38% |

| Portfolio turnover rate | 20%(c) | 30% | 25% | 8% | 23% | 27% |

| Net assets, end of period (in thousands) | $222,472 | $236,277 | $300,778 | $242,250 | $276,921 | $212,103 |

| (a) | The per-share data presented above is based on the average shares outstanding for the period presented. |

| (b) | Assumes initial investment at net asset value at the beginning of each period, reinvestment of all distributions and the complete redemption of the investment at net asset value at the end of each period. |

| (c) | Not annualized. |

| (d) | Annualized. |

The accompanying notes are an integral part of these financial statements.

Pioneer Equity Income Fund | Semiannual Report | 4/30/2331

Financial Highlights (continued)

| | Six Months

Ended

4/30/23

(unaudited) | Year

Ended

10/31/22 | Year

Ended

10/31/21 | Year

Ended

10/31/20 | Year

Ended

10/31/19 | Year

Ended

10/31/18 |

| Class R | | | | | | |

| Net asset value, beginning of period | $ 36.85 | $ 43.67 | $ 32.04 | $ 36.28 | $ 34.98 | $ 36.24 |

| Increase (decrease) from investment operations: | | | | | | |

| Net investment income (loss) (a) | $ 0.20 | $ 0.41 | $ 0.43 | $ 0.48 | $ 0.61 | $ 0.56 |

| Net realized and unrealized gain (loss) on investments | 1.28 | (3.54) | 11.56 | (3.42) | 2.90 | (0.02) |

| Net increase (decrease) from investment operations | $ 1.48 | $ (3.13) | $ 11.99 | $ (2.94) | $ 3.51 | $ 0.54 |

| Distributions to shareowners: | | | | | | |

| Net investment income | $ (0.36) | $ (0.43) | $ (0.36) | $ (0.47) | $ (0.63) | $ (0.40) |

| Net realized gain | (3.55) | (3.26) | — | (0.83) | (1.58) | (1.40) |

| Total distributions | $ (3.91) | $ (3.69) | $ (0.36) | $ (1.30) | $ (2.21) | $ (1.80) |

| Net increase (decrease) in net asset value | $ (2.43) | $ (6.82) | $ 11.63 | $ (4.24) | $ 1.30 | $ (1.26) |

| Net asset value, end of period | $ 34.42 | $ 36.85 | $ 43.67 | $ 32.04 | $ 36.28 | $ 34.98 |

| Total return (b) | 3.91%(c) | (7.61)% | 37.54% | (8.33)% | 10.71% | 1.42% |

| Ratio of net expenses to average net assets | 1.40%(d) | 1.40% | 1.37% | 1.41% | 1.39% | 1.44% |

| Ratio of net investment income (loss) to average net assets | 1.13%(d) | 1.06% | 1.07% | 1.44% | 1.77% | 1.55% |

| Portfolio turnover rate | 20%(c) | 30% | 25% | 8% | 23% | 27% |

| Net assets, end of period (in thousands) | $39,958 | $42,033 | $54,015 | $48,198 | $69,435 | $74,323 |

| (a) | The per-share data presented above is based on the average shares outstanding for the period presented. |

| (b) | Assumes initial investment at net asset value at the beginning of each period, reinvestment of all distributions and the complete redemption of the investment at net asset value at the end of each period. |

| (c) | Not annualized. |

| (d) | Annualized. |

The accompanying notes are an integral part of these financial statements.

32Pioneer Equity Income Fund | Semiannual Report | 4/30/23

| | Six Months

Ended

4/30/23

(unaudited) | Year

Ended

10/31/22 | Year

Ended

10/31/21 | Year

Ended

10/31/20 | Year

Ended

10/31/19 | Year

Ended

10/31/18 |

| Class Y | | | | | | |

| Net asset value, beginning of period | $ 36.56 | $ 43.35 | $ 31.82 | $ 36.05 | $ 34.82 | $ 36.10 |

| Increase (decrease) from investment operations: | | | | | | |

| Net investment income (loss) (a) | $ 0.29 | $ 0.65 | $ 0.66 | $ 0.69 | $ 0.81 | $ 0.86 |

| Net realized and unrealized gain (loss) on investments | 1.28 | (3.52) | 11.48 | (3.42) | 2.88 | (0.08) |

| Net increase (decrease) from investment operations | $ 1.57 | $ (2.87) | $ 12.14 | $ (2.73) | $ 3.69 | $ 0.78 |

| Distributions to shareowners: | | | | | | |

| Net investment income | $ (0.48) | $ (0.66) | $ (0.61) | $ (0.67) | $ (0.88) | $ (0.66) |

| Net realized gain | (3.55) | (3.26) | — | (0.83) | (1.58) | (1.40) |

| Total distributions | $ (4.03) | $ (3.92) | $ (0.61) | $ (1.50) | $ (2.46) | $ (2.06) |

| Net increase (decrease) in net asset value | $ (2.46) | $ (6.79) | $ 11.53 | $ (4.23) | $ 1.23 | $ (1.28) |

| Net asset value, end of period | $ 34.10 | $ 36.56 | $ 43.35 | $ 31.82 | $ 36.05 | $ 34.82 |

| Total return (b) | 4.19%(c) | (7.04)% | 38.36% | (7.76)% | 11.41% | 2.09% |

| Ratio of net expenses to average net assets | 0.85%(d) | 0.78% | 0.78% | 0.77% | 0.78% | 0.76% |

| Ratio of net investment income (loss) to average net assets | 1.69%(d) | 1.67% | 1.65% | 2.08% | 2.37% | 2.37% |

| Portfolio turnover rate | 20%(c) | 30% | 25% | 8% | 23% | 27% |

| Net assets, end of period (in thousands) | $613,136 | $719,094 | $1,124,634 | $934,973 | $1,302,212 | $1,255,700 |

| (a) | The per-share data presented above is based on the average shares outstanding for the period presented. |

| (b) | Assumes initial investment at net asset value at the beginning of each period, reinvestment of all distributions and the complete redemption of the investment at net asset value at the end of each period. |

| (c) | Not annualized. |

| (d) | Annualized. |

The accompanying notes are an integral part of these financial statements.

Pioneer Equity Income Fund | Semiannual Report | 4/30/2333

Notes to Financial Statements | 4/30/23

(unaudited)

1. Organization and Significant Accounting Policies

Pioneer Equity Income Fund (the “Fund”) is a Delaware statutory trust. The Fund is registered under the Investment Company Act of 1940, as amended (the "1940 Act") as a diversified, open-end management investment company. The investment objective of the Fund is current income and long-term growth of capital from a portfolio consisting primarily of income producing equity securities of U.S. corporations.

The Fund offers five classes of shares designated as Class A, Class C, Class K, Class R and Class Y shares. Each class of shares represents an interest in the same portfolio of investments of the Fund and has identical rights (based on relative net asset values) to assets and liquidation proceeds. Share classes can bear different rates of class-specific fees and expenses such as transfer agent and distribution fees. Differences in class-specific fees and expenses will result in differences in net investment income and, therefore, the payment of different dividends from net investment income earned by each class. The Amended and Restated Declaration of Trust of the Fund gives the Board of Trustees the flexibility to specify either per-share voting or dollar-weighted voting when submitting matters for shareholder approval. Under per-share voting, each share of a class of the Fund is entitled to one vote. Under dollar-weighted voting, a shareholder’s voting power is determined not by the number of shares owned, but by the dollar value of the shares on the record date. Each share class has exclusive voting rights with respect to matters affecting only that class, including with respect to the distribution plan for that class. There is no distribution plan for Class K or Class Y shares.

Amundi Asset Management US, Inc., an indirect, wholly owned subsidiary of Amundi and Amundi’s wholly owned subsidiary, Amundi USA, Inc., serves as the Fund’s investment adviser (the “Adviser”). Amundi Distributor US, Inc., an affiliate of the Adviser, serves as the Fund’s

distributor (the “Distributor”).

In March 2020, FASB issued an Accounting Standard Update, ASU 2020-04, Reference Rate Reform (Topic 848) — Facilitation of the Effects of Reference Rate Reform on Financial Reporting (“ASU 2020-04”), which provides optional, temporary relief with respect to the financial reporting of contracts subject to certain types of modifications due to the planned discontinuation of the London Interbank Offered Rate (“LIBOR”) and other LIBOR-based reference rates at the end of 2021. The temporary relief provided by ASU 2020-04 is effective for certain reference rate-related

34Pioneer Equity Income Fund | Semiannual Report | 4/30/23

contract modifications that occur during the period from March 12, 2020 through December 31, 2023. Management is evaluating the impact of ASU 2020-04 on the Fund's investments, derivatives, debt and other contracts, if applicable, that will undergo reference rate-related modifications as a result of the reference rate reform.

The Fund is required to comply with Rule 18f-4 under the 1940 Act, which governs the use of derivatives by registered investment companies. Rule 18f-4 permits funds to enter into derivatives transactions (as defined in Rule 18f-4) and certain other transactions notwithstanding the restrictions on the issuance of “senior securities” under Section 18 of the 1940 Act. Rule 18f-4 requires a fund to establish and maintain a comprehensive derivatives risk management program, appoint a derivatives risk manager and comply with a relative or absolute limit on fund leverage risk calculated based on value-at-risk ("VaR"), unless the fund uses derivatives in only a limited manner (a "limited derivatives user"). The Fund is currently a limited derivatives user for purposes of Rule 18f-4.

The Fund is an investment company and follows investment company accounting and reporting guidance under U.S. Generally Accepted Accounting Principles (“U.S. GAAP”). U.S. GAAP requires the management of the Fund to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income, expenses and gain or loss on investments during the reporting period. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements:

| A. | Security Valuation |

| | The net asset value of the Fund is computed once daily, on each day the New York Stock Exchange (“NYSE”) is open, as of the close of regular trading on the NYSE. |

| | Equity securities that have traded on an exchange are valued by using the last sale price on the principal exchange where they are traded. Equity securities that have not traded on the date of valuation, or securities for which sale prices are not available, generally are valued using the mean between the last bid and asked prices or, if both last bid and asked prices are not available, at the last quoted bid price. Last sale and bid and asked prices are provided by independent third party pricing services. In the case of equity securities not traded on an exchange, prices are typically determined by independent third party pricing services using a variety of techniques and methods. |

Pioneer Equity Income Fund | Semiannual Report | 4/30/2335

| | The value of foreign securities is translated into U.S. dollars based on foreign currency exchange rate quotations supplied by a third party pricing source. Trading in non-U.S. equity securities is substantially completed each day at various times prior to the close of the NYSE. The values of such securities used in computing the net asset value of the Fund's shares are determined as of such times. The Adviser may use a fair value model developed by an independent pricing service to value non-U.S. equity securities. |

| | Forward foreign currency exchange contracts are valued daily using the foreign exchange rate or, for longer term forward contract positions, the spot currency rate and the forward points on a daily basis, in each case provided by a third party pricing service. Contracts whose forward settlement date falls between two quoted days are valued by interpolation. |

| | Shares of open-end registered investment companies (including money market mutual funds) are valued at such funds’ net asset value. |

| | Securities for which independent pricing services or broker-dealers are unable to supply prices or for which market prices and/or quotations are not readily available or are considered to be unreliable are valued by a fair valuation team comprised of certain personnel of the Adviser. The Adviser is designated as the valuation designee for the Fund pursuant to Rule 2a-5 under the 1940 Act. The Adviser’s fair valuation team is responsible for monitoring developments that may impact fair valued securities. |

| | Inputs used when applying fair value methods to value a security may include credit ratings, the financial condition of the company, current market conditions and comparable securities. The Adviser may use fair value methods if it is determined that a significant event has occurred after the close of the exchange or market on which the security trades and prior to the determination of the Fund's net asset value. Examples of a significant event might include political or economic news, corporate restructurings, natural disasters, terrorist activity or trading halts. Thus, the valuation of the Fund's securities may differ significantly from exchange prices, and such differences could be material. |

| B. | Investment Income and Transactions |

| | Dividend income is recorded on the ex-dividend date, except that certain dividends from foreign securities where the ex-dividend date may have passed are recorded as soon as the Fund becomes aware of the ex-dividend data in the exercise of reasonable diligence. |

36Pioneer Equity Income Fund | Semiannual Report | 4/30/23

| | Interest income, including interest on income-bearing cash accounts, is recorded on the accrual basis. Dividend and interest income are reported net of unrecoverable foreign taxes withheld at the applicable country rates and net of income accrued on defaulted securities. |

| | Interest and dividend income payable by delivery of additional shares is reclassified as PIK (payment-in-kind) income upon receipt and is included in interest and dividend income, respectively. |

| | Security transactions are recorded as of trade date. Gains and losses on sales of investments are calculated on the identified cost method for both financial reporting and federal income tax purposes. |

| C. | Foreign Currency Translation |

| | The books and records of the Fund are maintained in U.S. dollars. Amounts denominated in foreign currencies are translated into U.S. dollars using current exchange rates. |

| | Net realized gains and losses on foreign currency transactions, if any, represent, among other things, the net realized gains and losses on foreign currency exchange contracts, disposition of foreign currencies and the difference between the amount of income accrued and the U.S. dollars actually received. Further, the effects of changes in foreign currency exchange rates on investments are not segregated on the Statement of Operations from the effects of changes in the market prices of those securities, but are included with the net realized and unrealized gain or loss on investments. |

| D. | Federal Income Taxes |

| | It is the Fund's policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its net taxable income and net realized capital gains, if any, to its shareowners. Therefore, no provision for federal income taxes is required. As of April 30, 2023, the Fund did not accrue any interest or penalties with respect to uncertain tax positions, which, if applicable, would be recorded as an income tax expense on the Statement of Operations. Tax returns filed within the prior three years remain subject to examination by federal and state tax authorities. |