UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06200

Schwab Investments – Schwab 1000 Index Fund

(Exact name of registrant as specified in charter)

211 Main Street, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Omar Aguilar

Schwab Investments – Schwab 1000 Index Fund

211 Main Street, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 636-7000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2023

Item 1: Report(s) to Shareholders.

Annual Report | October 31, 2023

Schwab Equity Index Funds®

Schwab S&P 500 Index Fund

Schwab 1000 Index® Fund

Schwab Small-Cap Index Fund®

Schwab Total Stock Market Index Fund®

Schwab U.S. Large-Cap Growth

Index Fund

Schwab U.S. Large-Cap Value

Index Fund

Schwab U.S. Mid-Cap Index Fund

Schwab International Index Fund®

This page is intentionally left blank.

Eight cost-efficient ways to tap into the power of the stock market for long-term growth potential.

Fund investment adviser: Charles Schwab Investment Management, Inc., dba Schwab Asset Management®

Distributor: Charles Schwab & Co., Inc. (Schwab)

The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc. (MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Schwab. The Industry classifications used in the Portfolio Holdings are sub-categories of Sector classifications.

Schwab Equity Index Funds | Annual Report1

Schwab Equity Index Funds

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/schwabfunds_prospectus.

Total Return for the 12 Months Ended October 31, 2023 |

Schwab S&P 500 Index Fund (Ticker Symbol: SWPPX) | |

| |

Fund Category: Morningstar Large Blend1 | |

| |

| |

Schwab 1000 Index Fund (Ticker Symbol: SNXFX) | |

| |

| |

Fund Category: Morningstar Large Blend1 | |

| |

| |

Schwab Small-Cap Index Fund (Ticker Symbol: SWSSX) | |

| |

Fund Category: Morningstar Small Blend1 | |

| |

| |

Schwab Total Stock Market Index Fund (Ticker Symbol: SWTSX) | |

Dow Jones U.S. Total Stock Market IndexSM | |

Fund Category: Morningstar Large Blend1 | |

| |

Total Return for the 12 Months Ended October 31, 2023 |

| |

Schwab U.S. Large-Cap Growth Index Fund (Ticker Symbol: SWLGX) | |

Russell 1000® Growth Index | |

Fund Category: Morningstar Large Growth1 | |

| |

| |

Schwab U.S. Large-Cap Value Index Fund (Ticker Symbol: SWLVX) | |

Russell 1000® Value Index | |

Fund Category: Morningstar Large Value1 | |

| |

| |

Schwab U.S. Mid-Cap Index Fund (Ticker Symbol: SWMCX) | |

| |

Fund Category: Morningstar Mid-Cap Blend1 | |

| |

| |

Schwab International Index Fund2 (Ticker Symbol: SWISX) | |

| |

Fund Category: Morningstar Foreign Large Blend1 | |

| |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption of fund shares.

1

Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds and ETFs within the category as of the report date.

2

The fund’s performance relative to the index may be affected by fair-value pricing and timing differences in foreign exchange calculations. See financial note 2 for more information.

3

The net version of the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes.

2

Schwab Equity Index Funds | Annual Report

Schwab Equity Index Funds

The Investment Environment

For the 12-month reporting period ended October 31, 2023, U.S. equity markets were mixed, and international equity markets posted positive returns. U.S. stocks were volatile for the first half of the reporting period as inflation remained elevated, the U.S. Federal Reserve (Fed) continued to raise interest rates, and the failure of three U.S. regional banks in early March raised concerns about the stability of the banking sector. Despite these headwinds, as inflation began to ease, U.S. stocks staged a relatively steady upswing through August driven primarily by performance of the “Magnificent Seven” (Alphabet, Inc., Amazon.com, Inc., Apple, Inc., Meta Platforms, Inc., Microsoft Corp., NVIDIA Corp., and Tesla, Inc.). U.S. stocks, particularly dividend paying stocks, began to falter over the final two months of the reporting period as soaring U.S. Treasury yields offered investors attractive alternatives to stocks. Outside the U.S., the ongoing war between Russia and Ukraine and the Israel-Hamas war that broke out following Hamas’ attack on Israel in early October weighed on the global economy. The U.S. dollar, as measured against a basket of international currencies, generally weakened until mid-July, when it hit a reporting-period low, then began to rise but ended the reporting period weaker than where it began. For the reporting period, the S&P 500® Index, a bellwether for the overall U.S. stock market, returned 10.14%. U.S. large-cap stocks outperformed U.S. small-cap stocks, with the Russell 1000® Index and the Russell 2000® Index returning 9.48% and -8.56%, respectively. Among U.S. large-cap stocks, growth stocks outperformed value stocks, with the Russell 1000® Growth Index and the Russell 1000® Value Index returning 18.95% and 0.13%, respectively. Outside the U.S., the MSCI EAFE® Index (Net)*, a broad measure of developed international equity performance, returned 14.40% for the reporting period.

Economies around the world grew out of sync as they wrestled with record levels of government debt, rising geopolitical tensions, and weak productivity gains that stifled economic growth. The U.S. economy continued to show unexpected resiliency. Surprisingly robust job growth and strong consumer spending helped propel U.S. gross domestic product (GDP) to a 5.2% annualized growth rate for the third quarter of 2023, up from roughly 2% over the prior three quarters. Inflation remained above the Fed’s historical 2% target over the reporting period but declined between November 2022 and June 2023 as rents and wage growth eased, profit margins declined, and monetary policy remained restrictive before ticking up slightly in July 2023 through September 2023. The unemployment rate remained low throughout the period despite inflationary pressures but did rise slightly in August and October. An

Asset Class Performance Comparison % returns during the 12 months ended October 31, 2023

Index figures assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. Past performance is not a guarantee of future results.

For index definitions, please see the Glossary.

Data source: Index provider websites and Schwab Asset Management.

Nothing in this report represents a recommendation of a security by the investment adviser.

Management views may have changed since the report date.

*

The net version of the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes.

Schwab Equity Index Funds | Annual Report3

Schwab Equity Index Funds

The Investment Environment (continued)

increase in the labor force participation rate (the proportion of working-age Americans who have a job or are looking for one) in August and strike activity in October were large contributors to the increase in unemployment in the last three months of the reporting period.

Oil prices were volatile, ranging from a high of $92 per barrel at the beginning of the reporting period to a low of $66 and ending the period at just over $80 per barrel. Eurozone GDP growth contracted slightly in the fourth quarter of 2022 driven by manufacturing pressures and headwinds related to oil and commodity prices, was flat for the first quarter of 2023, expanded slightly for the second quarter of 2023 bolstered by a moderation in inflationary pressures, and contracted slightly for the third quarter of 2023 as financing conditions remained tight. The United Kingdom posted small gains in GDP growth throughout the reporting period, with household consumption expenditures and manufacturing output among key growth drivers. In Japan, following flat GDP growth in the fourth quarter of 2022, GDP rose for the first two quarters of 2023, primarily on rising exports and falling imports. Among emerging markets, China’s GDP grew throughout the reporting period as the government’s various policies seeking to help the economy have offset the impact of a prolonged property crisis and weak trade. India’s GDP grew in the fourth quarter of 2022 and the first two quarters of 2023, driven primarily by robust performance of the services sector along with strong consumer demand and increased government spending.

In its efforts to lower inflation, the Fed raised interest rates six times during the reporting period, increasing the federal funds rate from a range of 3.00% to 3.25% to a range of 5.25% to 5.50%. At its meetings in June, September, and October, the Fed maintained the then current rates, citing robust economic activity, strong—though moderating—job gains, and low unemployment while acknowledging tighter financial and credit conditions for households and businesses. The Fed also maintained its program to reduce the assets held on its balance sheet, though its balance sheet temporarily spiked in March 2023 when the Fed supported banks after the failure of three U.S. regional banks. Despite the spike, balance sheet assets declined over the reporting period. Central banks outside the United States also battled with persistently high, albeit waning, inflation. After raising rates eight times during the reporting period, the European Central Bank held its rate steady at its October meeting as inflation and pricing pressures finally showed signs of easing. Similarly, the Bank of England maintained its key official bank rate at its September meeting, after seven rate hikes during the reporting period, leaving borrowing costs at a 15-year high. In contrast, the Bank of Japan continued to uphold its short-term interest rate target of -0.1%, unchanged since 2016, despite inflationary pressures but relaxed its yield control policy.

4

Schwab Equity Index Funds | Annual Report

Schwab Equity Index Funds

| Christopher Bliss, CFA, Managing Director and Head of Passive Equity Strategies for Schwab Asset Management, is responsible for overseeing the investment process and portfolio management of investment strategies for passive equity Schwab Funds and Schwab ETFs, and Schwab Personalized Indexing™ separately managed accounts. Before joining Schwab in 2016, Mr. Bliss spent 12 years at BlackRock (formerly Barclays Global Investors) managing and leading institutional index teams, most recently as a managing director and the head of the Americas institutional index team. In this role, Mr. Bliss was responsible for overseeing a team of portfolio managers managing domestic, developed international and emerging markets index strategies. Prior to BlackRock, he worked as an equity analyst and portfolio manager for Harris Bretall and before that, as a research analyst for JP Morgan. |

| Jeremy Brown, CFA, Senior Portfolio Manager for Schwab Asset Management, is responsible for the day-to-day co-management of the funds, except for the Schwab International Index Fund. Prior to joining Schwab in 2017, Mr. Brown spent six years with ALPS Advisors, Inc. in Denver, most recently as a senior analyst on the ETF portfolio management and research team where he performed portfolio management, trading, and analytics/research functions for ALPS ETFs and passive funds. Additionally, Mr. Brown led a number of investment research, commentary, industry trend analysis, and sales and marketing support initiatives. |

| Ferian Juwono, CFA, Senior Portfolio Manager for Schwab Asset Management, is responsible for the oversight and day-to-day co-management of the funds, except for the Schwab International Index Fund. Prior to joining Schwab in 2010, Mr. Juwono worked at BlackRock (formerly Barclays Global Investors) where he spent more than three years as a portfolio manager, managing equity index funds for institutional clients, and two years as a senior business analyst. Prior to that, Mr. Juwono worked for more than four years as a senior financial analyst with Union Bank of California. |

| David Rios, Portfolio Manager for Schwab Asset Management, is responsible for the day-to-day co-management of the Schwab International Index Fund. Prior to this role, Mr. Rios was an associate portfolio manager on the equity index strategies team for four years. His first role with Schwab Asset Management was as a trade operations specialist. Prior to joining Schwab in 2008, Mr. Rios was a senior fund accountant at Investors Bank & Trust (subsequently acquired by State Street Corporation). |

| Agnes Zau, CFA, Portfolio Manager for Schwab Asset Management, is responsible for the day-to-day co-management of the funds, except for the Schwab International Index Fund. Prior to joining Schwab in 2018, Ms. Zau was at BlackRock for three years, most recently as a multi-asset portfolio investment consultant where she advised institutional clients on asset allocation and strategy, constructed risk decomposition and portfolio optimization, and conducted scenario analyses for the core multi-asset target risk strategies. She spent the preceding three years as a derivatives specialist at Mellon Capital. |

Schwab Equity Index Funds | Annual Report5

Schwab S&P 500 Index Fund as of October 31, 2023

The Schwab S&P 500 Index Fund’s (the fund) goal is to track the total return of the S&P 500® Index (the index). The index includes the stocks of 500 leading U.S. publicly traded companies from a broad range of industries. The fund generally will seek to replicate the performance of the index by giving the same weight to a given stock as the index does. For more information concerning the fund’s investment objective, strategies, and risks, please see the fund’s prospectus.

Market Highlights. For the 12-month reporting period ended October 31, 2023, U.S. equity markets were mixed, and international equity markets posted positive returns. U.S. stocks were volatile for the first half of the reporting period as inflation remained elevated, the U.S. Federal Reserve (Fed) continued to raise interest rates, and the failure of three U.S. regional banks in early March raised concerns about the stability of the banking sector. Despite these headwinds, as inflation began to ease, U.S. stocks staged a relatively steady upswing through August driven primarily by performance of the “Magnificent Seven” (Alphabet, Inc., Amazon.com, Inc., Apple, Inc., Meta Platforms, Inc., Microsoft Corp., NVIDIA Corp., and Tesla, Inc.). U.S. stocks, particularly dividend paying stocks, began to falter over the final two months of the reporting period as soaring U.S. Treasury yields offered investors attractive alternatives to stocks. Outside the U.S., the ongoing war between Russia and Ukraine and the Israel-Hamas war that broke out following Hamas’ attack on Israel in early October weighed on the global economy. U.S. large-cap stocks outperformed U.S. small-cap stocks and among U.S. large-cap stocks, growth stocks outperformed value stocks.Within the index, stocks in the communication services and information technology sectors were the top performers, while stocks in the utilities and real estate sectors underperformed.

Performance. The fund generally tracked the index for the reporting period. The fund returned 10.11% for the 12-month reporting period ended October 31, 2023, compared with the index, which returned 10.14%. Differences between the return of the fund and the return of the index may be attributable to, among other things, the operational and transactional costs incurred by the fund and not the index.

Contributors and Detractors. The health care sector detracted the most from the total return of the fund. Health care stocks represented an average weight of approximately 14% of the fund’s investments and returned approximately -5% for the reporting period. One example from this sector is Pfizer, Inc., a pharmaceutical company, which represented an average weight of less than 1% of the fund’s investments and returned approximately -32% for the reporting period.

The financials sector also detracted from the total return of the fund, representing an average weight of approximately 11% of the fund’s investments and returning approximately -2% for the reporting period.

The information technology sector contributed the most to the total return of the fund. Information technology stocks represented an average weight of approximately 29% of the fund’s investments and returned approximately 29% for the reporting period. One example from this sector is Microsoft Corp., which develops, manufactures, licenses, sells, and supports software products. The fund’s holdings of Microsoft Corp. represented an average weight of approximately 6% of the fund’s investments and returned approximately 47% for the reporting period.

The communication services sector also contributed to the total return of the fund, representing an average weight of approximately 8% of the fund’s investments and returning approximately 36% for the reporting period.

Management views and portfolio holdings may have changed since the report date.

6

Schwab Equity Index Funds | Annual Report

Schwab S&P 500 Index Fund

Performance and Fund Facts as of October 31, 2023

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/schwabfunds_prospectus.

Performance of Hypothetical $10,000 Investment (October 31, 2013 – October 31, 2023)1

Average Annual Total Returns1

| | | |

Fund: Schwab S&P 500 Index Fund (5/19/97) | | | |

| | | |

Fund Category: Morningstar Large Blend2 | | | |

Fund Expense Ratio3: 0.02% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Index ownership – “Standard & Poor’s®,” “S&P®,” and “S&P 500®” are registered trademarks of Standard & Poor’s Financial Services LLC (S&P), and “Dow Jones®” is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones) and have been licensed for use by S&P Dow Jones Indices LLC and its affiliates and sublicensed for certain purposes by Charles Schwab Investment Management, Inc. The “S&P 500® Index” is a product of S&P Dow Jones Indices LLC or its affiliates, and has been licensed for use by Charles Schwab Investment Management, Inc. The Schwab S&P 500 Index Fund is not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P, or their respective affiliates, and neither S&P Dow Jones Indices LLC, Dow Jones, S&P, nor their respective affiliates make any representation regarding the advisability of investing in the fund.

1

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

2

Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds and ETFs within the category as of the report date.

3

As stated in the prospectus.

Schwab Equity Index Funds | Annual Report7

Schwab S&P 500 Index Fund

Performance and Fund Facts as of October 31, 2023 (continued)

| |

Weighted Average Market Cap (millions) | |

Price/Earnings Ratio (P/E) | |

| |

| |

Sector Weightings % of Investments3

Top Equity Holdings % of Net Assets6

Portfolio holdings may have changed since the report date.

Source of Sector Classification: S&P and MSCI.

2

Portfolio turnover rate excludes in-kind transactions.

3

The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, excluding derivatives, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets.

5

Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended.

6

This list is not a recommendation of any security by the investment adviser.

8

Schwab Equity Index Funds | Annual Report

Schwab 1000 Index Fund as of October 31, 2023

The Schwab 1000 Index Fund’s (the fund) goal is to match the total return of the Schwab 1000 Index® (the index). The index is a float-adjusted market capitalization weighted index that includes the 1,000 largest stocks of publicly traded companies in the United States, with size being determined by market capitalization (total market value of all shares outstanding). The fund generally will seek to replicate the performance of the index by giving the same weight to a given stock as the index does. For more information concerning the fund’s investment objective, strategies, and risks, please see the fund’s prospectus.

Market Highlights. For the 12-month reporting period ended October 31, 2023, U.S. equity markets were mixed, and international equity markets posted positive returns. U.S. stocks were volatile for the first half of the reporting period as inflation remained elevated, the U.S. Federal Reserve (Fed) continued to raise interest rates, and the failure of three U.S. regional banks in early March raised concerns about the stability of the banking sector. Despite these headwinds, as inflation began to ease, U.S. stocks staged a relatively steady upswing through August driven primarily by performance of the “Magnificent Seven” (Alphabet, Inc., Amazon.com, Inc., Apple, Inc., Meta Platforms, Inc., Microsoft Corp., NVIDIA Corp., and Tesla, Inc.). U.S. stocks, particularly dividend paying stocks, began to falter over the final two months of the reporting period as soaring U.S. Treasury yields offered investors attractive alternatives to stocks. Outside the U.S., the ongoing war between Russia and Ukraine and the Israel-Hamas war that broke out following Hamas’ attack on Israel in early October weighed on the global economy. U.S. large-cap stocks outperformed U.S. small-cap stocks and among U.S. large-cap stocks, growth stocks outperformed value stocks. Within the index, stocks in the communication services and information technology sectors were the top performers, while stocks in the utilities and real estate sectors underperformed.

Performance. The fund generally tracked the index for the reporting period. The fund returned 9.35% for the 12-month reporting period ended October 31, 2023, compared with the index, which returned 9.39%. Differences between the return of the fund and the return of the index may be attributable to, among other things, the operational and transactional costs incurred by the fund and not the index.

Contributors and Detractors. The health care sector detracted the most from the total return of the fund. Health care stocks represented an average weight of approximately 14% of the fund’s investments and returned approximately -5% for the reporting period. One example from this sector is Pfizer, Inc., a pharmaceutical company, which represented an average weight of less than 1% of the fund’s investments and returned approximately -32% for the reporting period.

The financials sector also detracted from the total return of the fund, representing an average weight of approximately 11% of the fund’s investments and returning approximately -2% for the reporting period.

The information technology sector contributed the most to the total return of the fund. Information technology stocks represented an average weight of approximately 28% of the fund’s investments and returned approximately 28% for the reporting period. One example from this sector is Microsoft Corp., which develops, manufactures, licenses, sells, and supports software products. The fund’s holdings of Microsoft Corp. represented an average weight of approximately 6% of the fund’s investments and returned approximately 47% for the reporting period.

The communication services sector also contributed to the total return of the fund, representing an average weight of approximately 8% of the fund’s investments and returning approximately 33% for the reporting period.

Management views and portfolio holdings may have changed since the report date.

Schwab Equity Index Funds | Annual Report9

Performance and Fund Facts as of October 31, 2023

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/schwabfunds_prospectus.

Performance of Hypothetical $10,000 Investment (October 31, 2013 – October 31, 2023)1

Average Annual Total Returns1

| | | |

Fund: Schwab 1000 Index Fund (4/2/91) | | | |

| | | |

| | | |

Fund Category: Morningstar Large Blend2 | | | |

Fund Expense Ratio3: 0.05% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

1

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

2

Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds and ETFs within the category as of the report date.

3

As stated in the prospectus.

10

Schwab Equity Index Funds | Annual Report

Performance and Fund Facts as of October 31, 2023 (continued)

| |

Weighted Average Market Cap (millions) | |

Price/Earnings Ratio (P/E) | |

| |

| |

Sector Weightings % of Investments4

Top Equity Holdings % of Net Assets6

Portfolio holdings may have changed since the report date.

Source of Sector Classification: S&P and MSCI.

2

As a result of the Schwab 1000 Index®’s once per year reconstitution and the effects of certain corporate actions, the fund may hold more or less than 1,000 securities.

3

Portfolio turnover rate excludes in-kind transactions.

4

The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, excluding derivatives, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets.

5

Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended.

6

This list is not a recommendation of any security by the investment adviser.

Schwab Equity Index Funds | Annual Report11

Schwab Small-Cap Index Fund as of October 31, 2023

The Schwab Small-Cap Index Fund’s (the fund) goal is to track the performance of a benchmark index that measures the total return of small-capitalization U.S. stocks. To pursue its goal, the fund generally invests in stocks that are included in the Russell 2000® Index (the index). The fund generally will seek to replicate the performance of the index by giving the same weight to a given stock as the index does. For more information concerning the fund’s investment objective, strategies, and risks, please see the fund’s prospectus.

Market Highlights. For the 12-month reporting period ended October 31, 2023, U.S. equity markets were mixed, and international equity markets posted positive returns. U.S. stocks were volatile for the first half of the reporting period as inflation remained elevated, the U.S. Federal Reserve (Fed) continued to raise interest rates, and the failure of three U.S. regional banks in early March raised concerns about the stability of the banking sector. Despite these headwinds, as inflation began to ease, U.S. stocks staged a relatively steady upswing through August driven primarily by performance of the “Magnificent Seven” (Alphabet, Inc., Amazon.com, Inc., Apple, Inc., Meta Platforms, Inc., Microsoft Corp., NVIDIA Corp., and Tesla, Inc.). U.S. stocks, particularly dividend paying stocks, began to falter over the final two months of the reporting period as soaring U.S. Treasury yields offered investors attractive alternatives to stocks. Outside the U.S., the ongoing war between Russia and Ukraine and the Israel-Hamas war that broke out following Hamas’ attack on Israel in early October weighed on the global economy. U.S. large-cap stocks outperformed U.S. small-cap stocks and among U.S. large-cap stocks, growth stocks outperformed value stocks. Within the index, stocks in the energy and industrials sectors were the top performers, while stocks in the health care and financials sectors underperformed.

Performance. The fund generally tracked the index for the reporting period. The fund returned -8.47% for the 12-month reporting period ended October 31, 2023, compared with the index, which returned -8.56%.

Contributors and Detractors. The energy sector contributed the most to the total return of the fund. Energy stocks represented an average weight of approximately 7% of the fund’s investments and returned approximately 7% for the reporting period. One example from this sector is Weatherford International PLC which provides oilfield equipment and services. The fund’s holdings of Weatherford International PLC represented an average weight of less than 1% of the fund’s investments and returned approximately 123% for the reporting period.

The industrials sector also contributed to the total return of the fund, representing an average weight of approximately 16% of the fund’s investments and returning approximately 2% for the reporting period.

The health care sector detracted the most from the total return of the fund. Health care stocks represented an average weight of approximately 16% of the fund’s investments and returned approximately -22% for the reporting period. One example from this sector is Intellia Therapeutics, Inc., a biotechnology company. The fund’s holdings of Intellia Therapeutics, Inc. represented an average weight of less than 1% of the fund’s investment and returned approximately -53% for the reporting period.

The financials sector also detracted from the total return of the fund, representing an average weight of approximately 16% of the fund’s investments and returning approximately -18% for the reporting period.

Management views and portfolio holdings may have changed since the report date.

12

Schwab Equity Index Funds | Annual Report

Schwab Small-Cap Index Fund

Performance and Fund Facts as of October 31, 2023

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/schwabfunds_prospectus.

Performance of Hypothetical $10,000 Investment (October 31, 2013 – October 31, 2023)1

Average Annual Total Returns1

| | | |

Fund: Schwab Small-Cap Index Fund (5/19/97) | | | |

| | | |

Fund Category: Morningstar Small Blend2 | | | |

Fund Expense Ratio3: 0.04% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Index ownership – “Russell 2000®” is a registered mark of the Frank Russell Company (Russell) and has been licensed for use by the Schwab Small-Cap Index Fund. The Schwab Small-Cap Index Fund is not sponsored, endorsed, sold or promoted by Russell and Russell makes no representation regarding the advisability of investing in the fund.

1

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

2

Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds and ETFs within the category as of the report date.

3

As stated in the prospectus.

Schwab Equity Index Funds | Annual Report13

Schwab Small-Cap Index Fund

Performance and Fund Facts as of October 31, 2023 (continued)

| |

Weighted Average Market Cap (millions) | |

Price/Earnings Ratio (P/E) | |

| |

| |

Sector Weightings % of Investments3

Top Equity Holdings % of Net Assets5

Portfolio holdings may have changed since the report date.

Source of Sector Classification: S&P and MSCI.

Small-company stocks are subject to greater volatility than many other asset classes.

2

Portfolio turnover rate excludes in-kind transactions.

3

The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, excluding derivatives, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets.

4

Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended.

5

This list is not a recommendation of any security by the investment adviser.

14

Schwab Equity Index Funds | Annual Report

Schwab Total Stock Market Index Fund as of October 31, 2023

The Schwab Total Stock Market Index Fund’s (the fund) goal is to track the total return of the entire U.S. stock market, as measured by the Dow Jones U.S. Total Stock Market IndexSM (the index). The index is designed to measure all publicly traded stocks of companies headquartered in the United States for which pricing information is readily available. The fund uses a sampling investment approach that involves investing in a representative sample of securities included in the index that, when taken together, are expected to perform similarly to the index as a whole. Due to the use of representative sampling, the fund may not hold all of the securities in the index. For more information concerning the fund’s investment objective, strategies, and risks, please see the fund’s prospectus.

Market Highlights. For the 12-month reporting period ended October 31, 2023, U.S. equity markets were mixed, and international equity markets posted positive returns. U.S. stocks were volatile for the first half of the reporting period as inflation remained elevated, the U.S. Federal Reserve (Fed) continued to raise interest rates, and the failure of three U.S. regional banks in early March raised concerns about the stability of the banking sector. Despite these headwinds, as inflation began to ease, U.S. stocks staged a relatively steady upswing through August driven primarily by performance of the “Magnificent Seven” (Alphabet, Inc., Amazon.com, Inc., Apple, Inc., Meta Platforms, Inc., Microsoft Corp., NVIDIA Corp., and Tesla, Inc.). U.S. stocks, particularly dividend paying stocks, began to falter over the final two months of the reporting period as soaring U.S. Treasury yields offered investors attractive alternatives to stocks. Outside the U.S., the ongoing war between Russia and Ukraine and the Israel-Hamas war that broke out following Hamas’ attack on Israel in early October weighed on the global economy. U.S. large-cap stocks outperformed U.S. small-cap stocks and among U.S. large-cap stocks, growth stocks outperformed value stocks. Within the index, stocks in the communication services and information technology sectors were the top performers, while stocks in the utilities and real estate sectors underperformed.

Performance. The fund tracked the index for the reporting period. The fund returned 8.38% for the 12-month reporting period ended October 31, 2023, compared with the index, which returned 8.39%. Differences between the return of the fund and the return of the index may be attributable to, among other things, the operational and transactional costs incurred by the fund and not the index.

Contributors and Detractors. The health care sector detracted the most from the total return of the fund. The health care sector represented an average weight of approximately 14% of the fund’s investments and returned approximately -6% for the reporting period. One example from this sector is Pfizer, Inc., a pharmaceutical company, which represented an average weight of less than 1% of the fund’s investments and returned approximately -32% for the reporting period.

The financials sector also detracted from the total return of the fund, representing an average weight of approximately 11% of the fund’s investments and returning approximately -3% for the reporting period.

The information technology sector contributed the most to the total return of the fund. The information technology sector represented an average weight of approximately 27% of the fund’s investments and returned approximately 27% for the reporting period. One example from this sector is Microsoft Corp., which develops manufactures, licenses, sells, and supports software products. The fund’s holdings of Microsoft Corp. represented an average weight of approximately 5% of the fund’s investments and returned approximately 47% for the reporting period.

The communication services sector also contributed to the total return of the fund, representing an average weight of approximately 8% of the fund’s investments and returning approximately 32% for the reporting period.

Management views and portfolio holdings may have changed since the report date.

Schwab Equity Index Funds | Annual Report15

Schwab Total Stock Market Index Fund

Performance and Fund Facts as of October 31, 2023

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/schwabfunds_prospectus.

Performance of Hypothetical $10,000 Investment (October 31, 2013 – October 31, 2023)1

Average Annual Total Returns1

| | | |

Fund: Schwab Total Stock Market Index Fund (6/1/99) | | | |

Dow Jones U.S. Total Stock Market IndexSM | | | |

Fund Category: Morningstar Large Blend2 | | | |

Fund Expense Ratio3: 0.03% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Index ownership – “Standard & Poor’s®” and “S&P®” are registered trademarks of Standard & Poor’s Financial Services LLC (S&P), and “Dow Jones®” is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones) and have been licensed for use by S&P Dow Jones Indices LLC and its affiliates and sublicensed for certain purposes by Charles Schwab Investment Management, Inc. The “Dow Jones U.S. Total Stock Market IndexSM” is a product of S&P Dow Jones Indices LLC or its affiliates, and has been licensed for use by Charles Schwab Investment Management, Inc. The Schwab Total Stock Market Index Fund is not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P, or their respective affiliates, and neither S&P Dow Jones Indices LLC, Dow Jones, S&P, nor their respective affiliates make any representation regarding the advisability of investing in the fund.

1

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

2

Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds and ETFs within the category as of the report date.

3

As stated in the prospectus.

16

Schwab Equity Index Funds | Annual Report

Schwab Total Stock Market Index Fund

Performance and Fund Facts as of October 31, 2023 (continued)

| |

Weighted Average Market Cap (millions) | |

Price/Earnings Ratio (P/E) | |

| |

| |

Sector Weightings % of Investments2

Top Equity Holdings % of Net Assets4

Portfolio holdings may have changed since the report date.

Source of Sector Classification: S&P and MSCI.

2

The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, excluding derivatives, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets.

3

Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended.

4

This list is not a recommendation of any security by the investment adviser.

Schwab Equity Index Funds | Annual Report17

Schwab U.S. Large-Cap Growth Index Fund as of October 31, 2023

The Schwab U.S. Large-Cap Growth Index Fund’s (the fund) goal is to track the performance of a benchmark index that measures the total return of large-capitalization U.S. growth stocks. To pursue its goal, the fund generally invests in stocks that are included in the Russell 1000® Growth Index (the index). The fund generally will seek to replicate the performance of the index by giving the same weight to a given stock as the index does. For more information concerning the fund’s investment objective, strategies, and risks, please see the fund’s prospectus.

Market Highlights. For the 12-month reporting period ended October 31, 2023, U.S. equity markets were mixed, and international equity markets posted positive returns. U.S. stocks were volatile for the first half of the reporting period as inflation remained elevated, the U.S. Federal Reserve (Fed) continued to raise interest rates, and the failure of three U.S. regional banks in early March raised concerns about the stability of the banking sector. Despite these headwinds, as inflation began to ease, U.S. stocks staged a relatively steady upswing through August driven primarily by performance of the “Magnificent Seven” (Alphabet, Inc., Amazon.com, Inc., Apple, Inc., Meta Platforms, Inc., Microsoft Corp., NVIDIA Corp., and Tesla, Inc.). U.S. stocks, particularly dividend paying stocks, began to falter over the final two months of the reporting period as soaring U.S. Treasury yields offered investors attractive alternatives to stocks. Outside the U.S., the ongoing war between Russia and Ukraine and the Israel-Hamas war that broke out following Hamas’ attack on Israel in early October weighed on the global economy. U.S. large-cap stocks outperformed U.S. small-cap stocks and among U.S. large-cap stocks, growth stocks outperformed value stocks. Within the index, stocks in the communication services and information technology sectors were the top performers, while stocks in the utilities and real estate sectors underperformed.

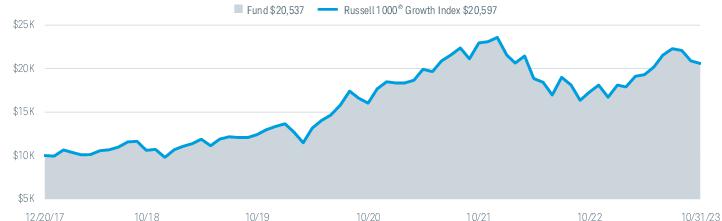

Performance. The fund generally tracked the index for the reporting period. The fund returned 18.89% during the 12-month reporting period ended October 31, 2023, compared with the index, which returned 18.95%. Differences between the return of the fund and the return of the index may be attributable to, among other things, the operational and transactional costs incurred by the fund and not the index.

Contributors and Detractors. The energy sector detracted the most from the total return of the fund. Energy stocks represented an average weight of approximately 1% of the fund’s investments and returned approximately -5% for the reporting period. One example from this sector is Occidental Petroleum Corp., which explores for, develops, produces, and markets crude oil and natural gas. The fund’s holdings of Occidental Petroleum Corp. represented an average weight of less than 1% of the fund’s investments and returned approximately -22% for the reporting period.

The utilities sector also detracted from the total return of the fund, representing an average weight of less than 1% of the fund’s investments and returning approximately -13% for the reporting period.

The information technology sector contributed the most to the total return of the fund. Information technology stocks represented an average weight of approximately 46% of the fund’s investments and returned approximately 32% for the reporting period. One example from this sector is Microsoft Corp, which develops, manufactures, licenses, sells, and supports software products. The fund’s holdings of Microsoft Corp. represented an average weight of approximately 11% of the fund’s investments and returned approximately 47% for the reporting period.

The communication services sector also contributed to the total return of the fund, representing an average weight of approximately 9% of the fund’s investments and returning approximately 35% for the reporting period.

Management views and portfolio holdings may have changed since the report date.

18

Schwab Equity Index Funds | Annual Report

Schwab U.S. Large-Cap Growth Index Fund

Performance and Fund Facts as of October 31, 2023

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/schwabfunds_prospectus.

Performance of Hypothetical $10,000 Investment (December 20, 2017 – October 31, 2023)1

| | | |

Fund: Schwab U.S. Large-Cap Growth Index Fund (12/20/17) | | | |

Russell 1000® Growth Index | | | |

Fund Category: Morningstar Large Growth2 | | | |

Fund Expense Ratio3: 0.035% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Index ownership – The Russell 1000® Growth Index is a registered mark of the Frank Russell Company (Russell) and has been licensed for use by the Schwab U.S. Large-Cap Growth Index Fund. The Schwab U.S. Large-Cap Growth Index Fund is not sponsored, endorsed, sold or promoted by Russell and Russell makes no representation regarding the advisability of investing in the fund.

1

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

2

Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds and ETFs within the category as of the report date.

3

As stated in the prospectus.

Schwab Equity Index Funds | Annual Report19

Schwab U.S. Large-Cap Growth Index Fund

Performance and Fund Facts as of October 31, 2023 (continued)

| |

Weighted Average Market Cap (millions) | |

Price/Earnings Ratio (P/E) | |

| |

| |

Sector Weightings % of Investments3

Top Equity Holdings % of Net Assets6

Portfolio holdings may have changed since the report date.

Source of Sector Classification: S&P and MSCI.

2

Portfolio turnover rate excludes in-kind transactions.

3

The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, excluding derivatives, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets.

5

Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended.

6

This list is not a recommendation of any security by the investment adviser.

20

Schwab Equity Index Funds | Annual Report

Schwab U.S. Large-Cap Value Index Fund as of October 31, 2023

The Schwab U.S. Large-Cap Value Index Fund’s (the fund) goal is to track the performance of a benchmark index that measures the total return of large-capitalization U.S. value stocks. To pursue its goal, the fund generally invests in stocks that are included in the Russell 1000® Value Index (the index). The fund generally will seek to replicate the performance of the index by giving the same weight to a given stock as the index does. For more information concerning the fund’s investment objective, strategies, and risks, please see the fund’s prospectus.

Market Highlights. For the 12-month reporting period ended October 31, 2023, U.S. equity markets were mixed, and international equity markets posted positive returns. U.S. stocks were volatile for the first half of the reporting period as inflation remained elevated, the U.S. Federal Reserve (Fed) continued to raise interest rates, and the failure of three U.S. regional banks in early March raised concerns about the stability of the banking sector. Despite these headwinds, as inflation began to ease, U.S. stocks staged a relatively steady upswing through August driven primarily by performance of the “Magnificent Seven” (Alphabet, Inc., Amazon.com, Inc., Apple, Inc., Meta Platforms, Inc., Microsoft Corp., NVIDIA Corp., and Tesla, Inc.). U.S. stocks, particularly dividend paying stocks, began to falter over the final two months of the reporting period as soaring U.S. Treasury yields offered investors attractive alternatives to stocks. Outside the U.S., the ongoing war between Russia and Ukraine and the Israel-Hamas war that broke out following Hamas’ attack on Israel in early October weighed on the global economy. U.S. large-cap stocks outperformed U.S. small-cap stocks and among U.S. large-cap stocks, growth stocks outperformed value stocks. Within the index, stocks in the communication services and information technology sectors were the top performers, while stocks in the health care and utilities sectors underperformed.

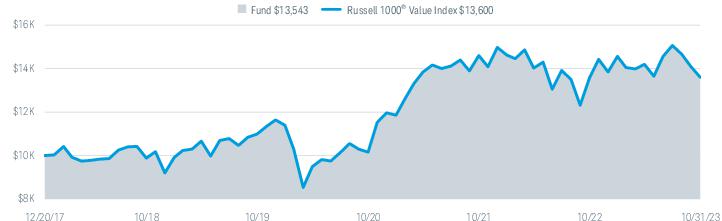

Performance. The fund generally tracked the index for the reporting period. The fund returned 0.11% during the 12-month reporting period ended October 31, 2023, compared with the index, which returned 0.13%. Differences between the return of the fund and the return of the index may be attributable to, among other things, the operational and transactional costs incurred by the fund and not the index.

Contributors and Detractors. The health care sector detracted the most from the total return of the fund. Health care stocks represented an average weight of approximately 16% of the fund’s investments and returned approximately -10% for the reporting period. One example from this sector is Pfizer, Inc., a pharmaceutical company, which represented an average weight of approximately 1% of the fund’s investments and returned approximately -32% for the reporting period.

The financials sector also detracted from the total return of the fund, representing an average weight of approximately 20% of the fund’s investments and returning approximately -3% for the reporting period.

The communication services sector contributed the most to the total return of the fund. Communication services stocks represented an average weight of approximately 7% of the fund’s investments and returned approximately 30% for the reporting period. One example from this sector is Meta Platforms, Inc., a social technology company. The fund’s Class A holdings of Meta Platforms, Inc. represented an average weight of approximately 1% of the fund’s investments and returned approximately 210% for the reporting period. The fund’s investment in Meta Platforms, Inc. was sold prior to the end of the reporting period.

The industrials sector also contributed to the total return of the fund, representing an average weight of approximately 12% of the fund’s investments and returning approximately 7% for the reporting period.

Management views and portfolio holdings may have changed since the report date.

Schwab Equity Index Funds | Annual Report21

Schwab U.S. Large-Cap Value Index Fund

Performance and Fund Facts as of October 31, 2023

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/schwabfunds_prospectus.

Performance of Hypothetical $10,000 Investment (December 20, 2017 – October 31, 2023)1

| | | |

Fund: Schwab U.S. Large-Cap Value Index Fund (12/20/17) | | | |

Russell 1000® Value Index | | | |

Fund Category: Morningstar Large Value2 | | | |

Fund Expense Ratio3: 0.035% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Index ownership – The Russell 1000® Value Index is a registered mark of the Frank Russell Company (Russell) and has been licensed for use by the Schwab U.S. Large-Cap Value Index Fund. The Schwab U.S. Large-Cap Value Index Fund is not sponsored, endorsed, sold or promoted by Russell and Russell makes no representation regarding the advisability of investing in the fund.

1

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

2

Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds and ETFs within the category as of the report date.

3

As stated in the prospectus.

22

Schwab Equity Index Funds | Annual Report

Schwab U.S. Large-Cap Value Index Fund

Performance and Fund Facts as of October 31, 2023 (continued)

| |

Weighted Average Market Cap (millions) | |

Price/Earnings Ratio (P/E) | |

| |

| |

Sector Weightings % of Investments3

Top Equity Holdings % of Net Assets5

Portfolio holdings may have changed since the report date.

Source of Sector Classification: S&P and MSCI.

2

Portfolio turnover rate excludes in-kind transactions.

3

The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, excluding derivatives, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets.

4

Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended.

5

This list is not a recommendation of any security by the investment adviser.

Schwab Equity Index Funds | Annual Report23

Schwab U.S. Mid-Cap Index Fund as of October 31, 2023

The Schwab U.S. Mid-Cap Index Fund’s (the fund) goal is to track the performance of a benchmark index that measures the total return of mid-capitalization U.S. stocks. To pursue its goal, the fund generally invests in securities that are included in the Russell Midcap® Index (the index). The fund generally will seek to replicate the performance of the index by giving the same weight to a given security as the index does. For more information concerning the fund’s investment objective, strategies, and risks, please see the fund’s prospectus.

Market Highlights. For the 12-month reporting period ended October 31, 2023, U.S. equity markets were mixed, and international equity markets posted positive returns. U.S. stocks were volatile for the first half of the reporting period as inflation remained elevated, the U.S. Federal Reserve (Fed) continued to raise interest rates, and the failure of three U.S. regional banks in early March raised concerns about the stability of the banking sector. Despite these headwinds, as inflation began to ease, U.S. stocks staged a relatively steady upswing through August driven primarily by performance of the “Magnificent Seven” (Alphabet, Inc., Amazon.com, Inc., Apple, Inc., Meta Platforms, Inc., Microsoft Corp., NVIDIA Corp., and Tesla, Inc.). U.S. stocks, particularly dividend paying stocks, began to falter over the final two months of the reporting period as soaring U.S. Treasury yields offered investors attractive alternatives to stocks. Outside the U.S., the ongoing war between Russia and Ukraine and the Israel-Hamas war that broke out following Hamas’ attack on Israel in early October weighed on the global economy. U.S. large-cap stocks outperformed U.S. small-cap stocks and among U.S. large-cap stocks, growth stocks outperformed value stocks. Within the index, stocks in the industrials and information technology sectors were the top performers, while stocks in the health care and financials sectors underperformed.

Performance. The fund generally tracked the index for the reporting period. The fund returned -1.03% during the 12-month reporting period ended October 31, 2023, compared with the index, which returned -1.01%. Differences between the return of the fund and the return of the index may be attributable to, among other things, the operational and transactional costs incurred by the fund and not the index.

Contributors and Detractors. The health care sector detracted the most from the total return of the fund. Health care stocks represented an average weight of approximately 11% of the fund’s investments and returned approximately -10% for the reporting period. One example from this sector is Illumina, Inc., which develops, manufactures and markets integrated systems for the large-scale analysis of genetic variation and biological function. The fund’s holdings of Illumina, Inc. represented an average weight of less than 1% of the fund’s investments and returned approximately -46% for the reporting period.

The financials sector also detracted from the total return of the fund, representing an average weight of approximately 13% of the fund’s investments and returning approximately -6% for the reporting period.

The industrials sector contributed the most to the total return of the fund. Industrials stocks represented an average weight of approximately 17% of the fund’s investments and returned approximately 11% for the reporting period. One example from this sector is TransDigm Group, Inc., which designs, produces, and supplies highly engineered aerospace systems, subsystems, and component parts, for nearly all aircraft currently in service. The fund’s holdings of TransDigm Group, Inc. represented an average weight of less than 1% of the fund’s investments and returned approximately 44% for the reporting period.

The information technology sector also contributed to the total return of the fund, representing an average weight of approximately 16% of the fund’s investments and returning approximately 3% for the reporting period.

Management views and portfolio holdings may have changed since the report date.

24

Schwab Equity Index Funds | Annual Report

Schwab U.S. Mid-Cap Index Fund

Performance and Fund Facts as of October 31, 2023

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/schwabfunds_prospectus.

Performance of Hypothetical $10,000 Investment (December 20, 2017 – October 31, 2023)1

| | | |

Fund: Schwab U.S. Mid-Cap Index Fund (12/20/17) | | | |

| | | |

Fund Category: Morningstar Mid-Cap Blend2 | | | |

Fund Expense Ratio3: 0.04% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Index ownership – The Russell Midcap® Index is a registered mark of the Frank Russell Company (Russell) and has been licensed for use by the Schwab U.S. Mid-Cap Index Fund. The Schwab U.S. Mid-Cap Index Fund is not sponsored, endorsed, sold or promoted by Russell and Russell makes no representation regarding the advisability of investing in the fund.

1

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

2

Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds and ETFs within the category as of the report date.

3

As stated in the prospectus.

Schwab Equity Index Funds | Annual Report25

Schwab U.S. Mid-Cap Index Fund

Performance and Fund Facts as of October 31, 2023 (continued)

| |

Weighted Average Market Cap (millions) | |

Price/Earnings Ratio (P/E) | |

| |

| |

Sector Weightings % of Investments3

Top Equity Holdings % of Net Assets5

Portfolio holdings may have changed since the report date.

Source of Sector Classification: S&P and MSCI.

2

Portfolio turnover rate excludes in-kind transactions.

3

The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, excluding derivatives, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets.

4

Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended.

5

This list is not a recommendation of any security by the investment adviser.

26

Schwab Equity Index Funds | Annual Report

Schwab International Index Fund as of October 31, 2023

The Schwab International Index Fund’s (the fund) goal is to track the performance of a benchmark index that measures the total return of large, publicly traded non-U.S. companies from countries with developed equity markets outside of the United States. To purse its goal, the fund generally invests in stocks that are included in the MSCI EAFE® Index (the index). The index includes stocks from developed markets in Europe, Australasia and the Far East. The fund generally will seek to replicate the performance of the index by giving the same weight to a given stock as the index does. For more information concerning the fund’s investment objective, strategies, and risks, please see the fund’s prospectus.

Market Highlights. For the 12-month reporting period ended October 31, 2023, U.S. equity markets were mixed, and international equity markets posted positive returns. U.S. stocks were volatile for the first half of the reporting period as inflation remained elevated, the U.S. Federal Reserve (Fed) continued to raise interest rates, and the failure of three U.S. regional banks in early March raised concerns about the stability of the banking sector. Despite these headwinds, as inflation began to ease, U.S. stocks staged a relatively steady upswing through August driven primarily by performance of the “Magnificent Seven” (Alphabet, Inc., Amazon.com, Inc., Apple, Inc., Meta Platforms, Inc., Microsoft Corp., NVIDIA Corp., and Tesla, Inc.). U.S. stocks, particularly dividend paying stocks, began to falter over the final two months of the reporting period as soaring U.S. Treasury yields offered investors attractive alternatives to stocks. Outside the U.S., the ongoing war between Russia and Ukraine and the Israel-Hamas war that broke out following Hamas’ attack on Israel in early October weighed on the global economy. U.S. large-cap stocks outperformed U.S. small-cap stocks and among U.S. large-cap stocks, growth stocks outperformed value stocks. The U.S. dollar, as measured against a basket of international currencies, generally weakened until mid-July, when it hit a reporting-period low, then began to rise but ended the reporting period weaker than where it began.

Performance. The fund generally tracked the index for the reporting period. The fund returned 15.30% for the 12-month reporting period ended October 31, 2023, compared with the index, which returned 14.40%1. Fair valuation of the fund’s holdings contributed to the fund’s relative performance.2

Contributors and Detractors. Stocks from Japan contributed the most to the total return of the fund. Japanese stocks represented an average weight of approximately 22% of the fund’s investments and returned approximately 17% in U.S. dollar terms for the reporting period. One example from this market is Mitsubishi UFJ Financial Group, Inc., which provides a variety of financial and investment services. The fund’s holdings of Mitsubishi UFJ Financial Group, Inc. represented an average weight of less than 1% of the fund’s investments and returned approximately 83% in U.S. dollar terms for the reporting period.

Stocks from France also contributed to the total return of the fund, representing an average weight of approximately 12% of the fund’s investments and returning approximately 19% in U.S. dollar terms for the reporting period.

Stocks from Israel detracted the most from the total return of the fund. Israeli stocks represented an average weight of less than 1% of the fund’s investments and returned approximately -17% in U.S. dollar terms for the reporting period. One example from this market is Bank Leumi Le-Israel BM, a full-service commercial bank, which represented an average weight of less than 1% of the fund’s investments and returned approximately -30% in U.S. dollar terms for the reporting period.

Stocks from Finland also detracted from the total return of the fund, representing an average weight of approximately 1% of the fund’s investments and returning approximately -6% in U.S. dollar terms for the reporting period.

Management views and portfolio holdings may have changed since the report date.

1

The net version of the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes.

2

Typically, the securities in the index are valued using foreign exchange rates obtained at the close of the London foreign currency exchange (11:00 AM EST). Securities in the fund, however, are valued using foreign exchange rates obtained at the close of the New York foreign currency exchange (4:00 PM EST). This difference in closing times can result in different foreign currency exchange rates between the two exchanges, and thus different foreign currency exchange rates used in the valuation of the index’s and fund’s securities.

Schwab Equity Index Funds | Annual Report27

Schwab International Index Fund

Performance and Fund Facts as of October 31, 2023

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/schwabfunds_prospectus.

Performance of Hypothetical $10,000 Investment (October 31, 2013 – October 31, 2023)1,2

Average Annual Total Returns1,2

| | | |

Fund: Schwab International Index Fund (5/19/97) | | | |

| | | |

Fund Category: Morningstar Foreign Large Blend4 | | | |

Fund Expense Ratio5: 0.06% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Index ownership – “MSCI EAFE®” is a registered mark of MSCI and has been licensed for use by the Schwab International Index Fund. The Schwab International Index Fund is not sponsored, endorsed, sold or promoted by MSCI and MSCI bears no liability with respect to the fund. The Statement of Additional Information contains a more detailed description of the limited relationship MSCI has with the fund.

1

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

2

The fund’s performance relative to the index may be affected by fair-value pricing. See financial note 2 for more information.

3

The net version of the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes.

4

Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds and ETFs within the category as of the report date.

5

As stated in the prospectus.

28

Schwab Equity Index Funds | Annual Report

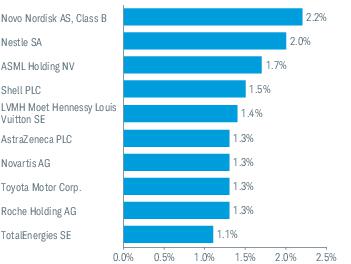

Schwab International Index Fund

Performance and Fund Facts as of October 31, 2023 (continued)

| |

Weighted Average Market Cap (millions) | |

Price/Earnings Ratio (P/E) | |

| |

| |

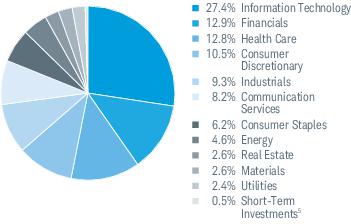

Sector Weightings % of Investments1

Top Equity Holdings % of Net Assets3

Top Country Weightings % of Investments4

Portfolio holdings may have changed since the report date.

Source of Sector Classification: S&P and MSCI.

International investments are subject to additional risks such as currency fluctuation, geopolitical risk and the potential for illiquid markets.

2

Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended.

3

This list is not a recommendation of any security by the investment adviser.

4

The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, excluding derivatives, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets.

Schwab Equity Index Funds | Annual Report29

Schwab Equity Index Funds

Fund Expenses (Unaudited)

Examples for a $1,000 Investment

As a fund shareholder, you may incur two types of costs: (1) transaction costs; and (2) ongoing costs, including management fees.

The expense examples below are intended to help you understand your ongoing cost (in dollars) of investing in a fund and to compare this cost with the ongoing cost of investing in other mutual funds. These examples are based on an investment of $1,000 invested for six months beginning May 1, 2023 and held through October 31, 2023.

Actual Return lines in the table below provide information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number given for your fund under the heading entitled “Expenses Paid During Period.”

Hypothetical Return lines in the table below provide information about hypothetical account values and hypothetical expenses based on a fund’s actual expense ratio and an assumed return of 5% per year before expenses. Because the return used is not an actual return, it may not be used to estimate the actual ending account value or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in a fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the hypothetical return lines of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | BEGINNING

ACCOUNT VALUE

AT 5/1/23 | ENDING

ACCOUNT VALUE

(NET OF EXPENSES)

AT 10/31/23 | EXPENSES PAID

DURING PERIOD

|

Schwab S&P 500 Index Fund | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Schwab Small-Cap Index Fund | | | | |

| | | | |

| | | | |

Schwab Total Stock Market Index Fund | | | | |

| | | | |

| | | | |

Schwab U.S. Large-Cap Growth Index Fund | | | | |

| | | | |

| | | | |

Schwab U.S. Large-Cap Value Index Fund | | | | |

| | | | |

| | | | |

Schwab U.S. Mid-Cap Index Fund | | | | |

| | | | |

| | | | |

Schwab International Index Fund | | | | |

| | | | |

| | | | |

| Based on the most recent six-month expense ratio. |

| Expenses for each fund are equal to its annualized expense ratio, multiplied by the average account value over the period, multiplied by the 184 days in the period, and divided by the 365 days in the fiscal year. |

30

Schwab Equity Index Funds | Annual Report

Schwab S&P 500 Index Fund

Financial Statements

| | | | | | |

|

Net asset value at beginning of period | | | | | | |

Income (loss) from investment operations: | | | | | | |

Net investment income (loss)1 | | | | | | |

Net realized and unrealized gains (losses) | | | | | | |

Total from investment operations | | | | | | |

| | | | | | |

Distributions from net investment income | | | | | | |

Distributions from net realized gains | | | | | | |

| | | | | | |

Net asset value at end of period | | | | | | |

| | | | | | |

|

Ratios to average net assets: | | | | | | |

| | | | | | |

Net investment income (loss) | | | | | | |

| | | | | | |

Net assets, end of period (x 1,000,000) | | | | | | |

| Calculated based on the average shares outstanding during the period. |

| Ratio includes less than 0.005% of non-routine proxy expenses. |

| Effective December 20, 2018, the annual operating expense ratio was reduced to 0.02%. The ratio presented for period ended October 31, 2019 is a blended ratio. |

| Portfolio turnover rate excludes in-kind transactions. |

Schwab Equity Index Funds | Annual Report31

Schwab S&P 500 Index Fund

Portfolio Holdings as of October 31, 2023

This section shows all the securities in the fund’s portfolio and their values as of the report date.