SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2003

Commission File Number 0-18927

Tandy Brands Accessories, Inc.

(Exact Name of Registrant as Specified in its Charter)

| | | |

A Delaware Corporation | | 75-2349915 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

690 E. Lamar Blvd., Suite 200

Arlington, Texas 76011

(Address of Principal Executive Offices)

(817) 548-0090

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

| | | | | |

| | Title of Class | | |

| |

| | |

| | | Common Stock, Par Value $1.00 Per Share | | |

Indicate by check mark whether the registrant (l) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Act). Yes o No þ

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of December 31, 2002 (computed by reference to the price at which the common equity was last sold on such date) was approximately $38,664,012.

There were 6,090,599 shares of common stock, $1.00 par value per share, outstanding on September 8, 2003.

DOCUMENTS INCORPORATED BY REFERENCE:

(a) Annual Report to Stockholders for Fiscal Year Ended June 30, 2003 (incorporated herein by reference in Parts I and II).

(b) Definitive Proxy Statement for the Annual Meeting of Stockholders to be held October 15, 2003 (incorporated herein by reference in Part III).

TABLE OF CONTENTS

TANDY BRANDS ACCESSORIES, INC. AND SUBSIDIARIES

FORM 10-K

PART I

What do we do?

We are a leading designer, manufacturer and marketer of branded men’s, women’s and children’s accessories, including belts and small leather goods such as wallets. Our product line also includes handbags, socks, scarves, gloves, hats, hair accessories, suspenders, cold weather accessories and sporting goods accessories. We market our merchandise under a broad portfolio of nationally recognized licensed and proprietary brand names, including DOCKERS®, LEVI’S®, LEVI STRAUSS SIGNATURETM, JONES NEW YORK®, PERRY ELLIS PORTFOLIO®, PERRY ELLIS AMERICA®, ROLFS®, HAGGAR®, WOOLRICH®, JORDACHE®, BUGLE BOY®, CANTERBURY®, PRINCE GARDNER®, PRINCESS GARDNER®, COLETTA®, STAGG®, AMITY®, ACCESSORY DESIGN GROUP® and TIGER®, as well as private brands for major retail customers. We sell our products to a variety of retail outlets, including mass merchants, national chain stores, major department stores, men’s and women’s specialty stores, catalog retailers, grocery stores, drug stores, golf pro shops, sporting goods stores and the retail exchange operations of the United States military.

What are our product lines?

| | | |

| |

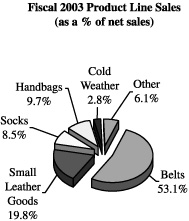

| | Our primary products consist of belts, which accounted for approximately 53.1% of our net sales in fiscal 2003, and small leather goods, such as wallets, which accounted for approximately 19.8% of our net sales in fiscal 2003. Our other products include women’s handbags, socks, scarves, gloves, hats, hair accessories and men’s neckwear, suspenders and other fashion accessories. Collectively, these other products accounted for the remaining 27.1% of our net sales in fiscal 2003.

To facilitate our internal operations as well as our customer relationships, our products are generally organized along men’s and women’s product lines. As a result, we have two reportable segments: men’s accessories and women’s accessories. Men’s and boys’ accessories accounted for approximately 48.5% of net sales during fiscal 2003, and women’s and girls’ accessories accounted for approximately 51.5% of net sales during the same period. Financial information regarding our operations and assets by segment appears on page 31 of our 2003 Annual Report to Stockholders, and is incorporated herein by reference. |

We, along with our predecessors, have been manufacturing and marketing belts for over 70 years, and belts remain our largest single product category, representing approximately 53.1% of net sales in fiscal 2003, 55.2% of net sales in fiscal 2002 and 49.7% of net sales in fiscal 2001. We compete in all four categories of the belt market: casual, work, dress and fashion. In fiscal 2003, we manufactured approximately 32.6% of the men’s belts we distributed and imported the balance, including all women’s belts, from China, Guatemala and various other countries.

1

| | | |

| | A trend toward retailers targeting lifestyle niches through packaging and branding has created an increasing demand for belts, other than those in the traditional dress category. Additionally, trends in women’s fashion dress categories, such as jeans, have attributed to sales increases in certain categories of women’s belts. Our belt sales were $119.3 million in fiscal 2003, which represents an increase of 5.0% compared to fiscal 2002. In fiscal 2003, sales of men’s and boys’ belts represented $80.9 million, or 67.8% of total belt sales, and women’s and girls’ belts represented $38.4 million, or 32.2% of total belt sales. |

| | | |

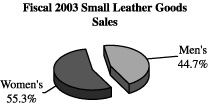

| | Our small leather goods consist primarily of men’s and women’s wallets sold under licensed, private and proprietary brands. Our small leather goods are primarily sourced from manufacturers in foreign countries, such as China, due to the labor-intensive nature of manufacturing small leather goods and the relative low cost of labor in those countries. Sales of small leather goods accounted for approximately $44.4 million, or 19.8% of our net sales in fiscal 2003. Sales of small leather goods accounted for approximately 21.0% of our net sales in fiscal 2002 and 25.8% of our net sales in fiscal 2001. |

In fiscal 2003, sales of men’s and boys’ small leather goods represented $19.9 million, or 44.7% of total small leather goods sales, and women’s and girls’ small leather goods represented $24.6 million, or 55.3% of our total small leather goods sales.

In addition to belts and small leather goods, we distribute accessories such as women’s handbags, socks, scarves, gloves, hats, hair accessories, men’s suspenders and sporting goods accessories. These products are marketed under certain of our proprietary brands, licensed brands and private brands. These other accessories complement our core belt and small leather goods products. We purchase all of our other accessory items, which are manufactured according to our design specifications, from foreign and domestic sources. In fiscal 2003, our sales of other accessories totaled $60.8 million, or 27.1% of our net sales. Sales of other accessories accounted for 23.8% of our net sales in fiscal 2002 and 24.5% of our net sales in fiscal 2001.

What brands do we sell?

| | | |

| | Our brand sales consist of licensed brands, which accounted for approximately 9.9% of our net sales in fiscal 2003, private brands, which accounted for approximately 43.4% of our net sales in fiscal 2003, and proprietary brands which accounted for approximately 46.7% of our net sales for the same period. |

| |

| Exclusive License Agreements |

We have been awarded exclusive license agreements for several well recognized brands, including Dockers®, Levi’s®, Jones New York®, Perry Ellis Portfolio®, Perry Ellis America®, Bugle Boy®, Haggar®, Woolrich® and Jordache®.

2

On May 13, 2003, we signed an exclusive license agreement with Levi Strauss & Co. to produce cold weather accessories, headwear and scarves under the Dockers® brand name. We expect to begin shipping Dockers® cold weather accessories in June of 2004.

On August 31, 2003, we signed an exclusive license agreement with Levi Strauss & Co. to produce men’s, young men’s and boy’s belts, personal leather goods and casual multi-purpose bags under the Levi Strauss SignatureTM brand name. We expect to begin shipping products in the fall of 2004.

Generally, our license agreements cover specific products and require us to pay annual royalties, ranging from 2% to 8% of net sales, based on minimum sales quotas or sales. The terms of the agreements are typically four to ten years, with options to extend the terms, provided certain sales or royalty minimums are achieved. For fiscal 2003, sales of our licensed products accounted for approximately $22.3 million, or 9.9% of our net sales, with sales from no individual license agreement accounting for more than 5% of total net sales.

In fiscal 2003, private brand products accounted for approximately $97.5 million, or 43.4% of our net sales. In a private brand program we are responsible for designing, manufacturing and delivering unique products for select customers according to the customer’s individual requirements. These programs offer our customers exclusivity and pricing control over their products, both of which are important factors in the retail marketplace. We believe our flexible sourcing capabilities, advanced electronic inventory management and replenishment systems and design, product development and merchandising expertise provide retailers with a superior alternative to direct sourcing of their private brand products. Our principal private brand programs include those for leading retailers such as

| | |

| | • | Wal-Mart, |

| |

| | • | Target, |

| |

| | • | JCPenney, |

| |

| | • | Sears, and |

| |

| | • | Payless ShoeSource. |

Our principal private brand programs also include nationally recognized private brand names such as

| | |

| | • | Farah®, |

| |

| | • | Faded Glory®, |

| |

| | • | Meeting Street®, |

| |

| | • | No Boundaries®, |

| |

| | • | Xhilaration®, |

| |

| | • | Mossimo®, and |

| |

| | • | Cherokee®. |

In addition to our licensed and private brands, we produce and market products under our own registered trademarks and trade names. We own leading and well recognized trademarks such as Rolfs®, Amity®, Canterbury®, Tiger®, Stagg®, Accessory Design Group®, Prince Gardner®, Princess Gardner® and Coletta®. We intend to build on the success of our proprietary brand portfolio by pursuing additional ownership opportunities and expanding the assortment of products we offer and the retail channels we serve with our proprietary brands. Net sales under our proprietary brands were approximately $104.7 million, or 46.7% of our net sales in fiscal 2003.

3

| |

| Distribution of our Key Brands |

The following table summarizes our key brands, each brand’s targeted distribution channels, and each brand’s primary products.

| | | | | |

| Brand | | Distribution Channel | | Products |

| |

| |

|

| Dockers® | | National chain stores | | Belts |

| | | Department stores | | Handbags |

| | | Specialty stores | | Small leather goods

Cold weather accessories |

| |

| Levi’s® | | National chain stores | | Belts |

| | | Department stores | | Small leather goods |

| | | Specialty stores | | |

| |

Levi Strauss SignatureTM | | Mass merchants | | Belts |

| | | National chain stores | | Small leather goods

Casual multi-purpose bags |

| |

| Jones New York® | | Department stores | | Belts |

| | | Specialty stores | | Small leather goods |

| |

| Perry Ellis Portfolio®/ | | Department stores | | Belts |

| Perry Ellis America® | | Specialty stores | | |

| |

| Rolfs® | | Department stores | | Small leather goods |

| | | Specialty stores | | Handbags |

| |

| Haggar® | | National chain stores | | Belts |

| | | Department stores | | Small leather goods |

| | | Catalogs | | |

| |

| Woolrich® | | Department stores | | Belts |

| | | Specialty stores | | Small leather goods |

| |

| Jordache® | | National chain stores | | Belts |

| |

| Bugle Boy® | | National chain stores | | Belts |

| | | Department stores | | Small leather goods |

| |

| Canterbury® | | Specialty stores | | Belts |

| | | Golf pro shops | | Small leather goods |

| |

| Prince Gardner® | | National chain stores | | Small leather goods |

| | | Specialty stores | | |

| |

| Princess Gardner® | | National chain stores | | Small leather goods |

| | | Specialty stores | | |

| |

| Amity® | | Mass merchants | | Small leather goods |

| | | National chain stores | | |

| |

| Coletta® | | Mass merchants | | Handbags |

| | | National chain stores | | |

| |

| Accessory Design Group® | | Mass merchants | | Belts |

| | | National chain stores | | Women’s accessories |

| |

| Tiger® | | Mass merchants | | Belts |

| | | National chain stores | | |

| |

| Stagg® | | Mass merchants | | Belts |

| | | National chain stores | | Small leather goods |

What are our channels of distribution?

We sell our products to a variety of retail outlets, including

| | |

| | • | mass merchants, |

| |

| | • | national chain stores, |

4

| | |

| | • | major department stores, |

| |

| | • | men’s and women’s specialty stores, |

| |

| | • | catalog retailers, |

| |

| | • | grocery stores, |

| |

| | • | drug stores, |

| |

| | • | golf pro shops, |

| |

| | • | sporting goods stores, and |

| |

| | • | the retail exchange operations of the United States military. |

Who are our customers?

We maintain strong relationships with major retailers in the United States and Canada, including

| | |

| | • | Wal-Mart (U.S. and Canada), |

| |

| | • | Target, |

| |

| | • | Meijer’s, |

| |

| | • | Shopko, |

| |

| | • | AAFES, |

| |

| | • | Sears (U.S. and Canada), |

| |

| | • | JCPenney, |

| |

| | • | Kohl’s, |

| |

| | • | The Bay (Canada), |

| |

| | • | Payless ShoeSource, |

| |

| | • | May Department Stores, |

| |

| | • | Dillard’s, |

| |

| | • | Mervyn’s, and |

| |

| | • | Federated Department Stores. |

For fiscal 2003, Wal-Mart accounted for 35.6% of our net sales and Target accounted for 15.4% of our net sales. In fiscal 2003, our top ten customers accounted for approximately 72.1% of net sales, with no single customer, other than Wal-Mart and Target, accounting for more than 10% of our total net sales. A decision by Wal-Mart, Target or any other significant customer, whether motivated by competitive conditions, financial difficulties or otherwise, to decrease the amount of merchandise purchased from us or to change their manner of doing business with us could have a material adverse effect on our financial position and results of operations.

How do we maintain strong customer relations?

We believe our success is due in large part to our strong customer relationships, strong sales and marketing organization and superior customer service. Factors which help facilitate these characteristics include our “quick response” distribution, vendor inventory management services, electronic data interchange capabilities and expertise in the communication of fashion and lifestyle concepts through product lines and innovative point-of-sale presentations. We develop and manage our accounts through the coordinated efforts of senior management, regional managers, account executives and an organization of salespeople and independent sales representatives. Members of our senior management or senior account executives manage

5

our relationships with certain of our national accounts such as Wal-Mart, Shopko, Kohl’s, Dillard’s, JCPenney, Sears, Meijer’s and Target.

We maintain in-store customer service relationships with various specialty stores, national chain stores and major department stores. We have a team of more than 139 sales associates in the United States and approximately 19 sales associates in Canada. These sales associates are organized on a regional basis and supervised by regional sales managers. Sales associates are responsible for overseeing accounts within a defined geographic territory, developing and maintaining business relationships with their respective customers, preparing and conducting line presentations and assisting customers in the implementation of programs at the individual store level. In addition, sales associates may, depending on the needs of an individual customer, assist in the maintenance and presentation of merchandise on the selling floor. Our regional sales organization is supported by account executives. Sales personnel, other than senior managers, generally are compensated based on a combination of salary and commission.

Did we have firm backlog orders for fiscal 2003 and the prior fiscal year?

We had firm backlog orders totaling $9,593,000 at June 30, 2003 and $12,865,000 at June 30, 2002. Our backlog orders are fairly consistent throughout the year with a seasonal increase during the second quarter. Generally, whether we can fill our backlog orders is dependent on product availability. Historically, the amount of unfilled backlog orders has been immaterial. We currently use electronic data interchange, commonly referred to as EDI, for electronic communications of invoices, shipping notices, purchase orders and other transactions. Because we fulfill orders on a rapid basis utilizing our EDI system, it is impossible to predict future backlog levels. As a result, the backlog at June 30, 2003 may not be indicative of future results.

How do we merchandise and develop our products?

Senior managers are responsible for generating profitable performance results by developing, planning, selling and implementing merchandise programs for their accounts. Individual senior managers develop and maintain business relationships with customers’ buyers and merchandise managers. Senior managers also develop and propose comprehensive programs relating to product mix, pricing and fixturing, and they assist customers’ buyers and merchandise managers in the implementation of these programs. We coordinate the implementation of marketing programs through the efforts of senior and regional managers. Senior managers are compensated based on a combination of salary and bonus tied to various measures of profitability and sales performance.

Our product development and merchandising professionals work closely with our customers, suppliers and licensors to interpret market trends, develop new products and create and implement comprehensive merchandising programs, which consist of packaging and point-of-sale fixturing and presentation materials. We believe our ability to design all of our products internally represents a significant competitive advantage because retail customers have become increasingly reliant on the design and merchandising expertise of their suppliers.

What is our competitive position?

Competition in the fashion accessories industry is intense. The accessories market is highly fragmented, and management believes we are one of the largest competitors in the accessories industry. Based on our internal analysis, we believe the sectors of the accessories market we serve have grown at an average annual rate of 3-5% in recent years. In our opinion, this growth has resulted from

| | |

| | • | the trend toward more casual attire, which has increased demand for accessories outside the traditional dress category, |

| |

| | • | increased consumer awareness of branded accessories as a fashion and lifestyle statement, and |

| |

| | • | a desire for newness and change in accessories styles. |

6

As a result of recent consolidation in the retail industry, retailers have increasingly chosen to consolidate their supply bases to a core group of companies that have the resources and expertise to meet the retailers’ increasing demands. Over the past several years, our net sales growth has exceeded that of the accessories industry, and we believe we are well positioned to continue to capitalize on these market trends.

Our ability to remain competitive depends largely on our ability to maintain our customer relationships, create new designs and products and offer high quality merchandise at competitive prices. The following table summarizes our primary competitors.

| | | |

| Product Segment | | Primary Competitors |

| |

|

| Men’s and Boys’ Belts | | Swank, Randa/ Humphreys, Leegin, Max Leather and Salant |

| Men’s Wallets | | Buxton, Randa/ Humphreys, Mundi and Fossil |

| Women’s and Girls’ Belts | | Cipriani, Liz Claiborne, Circa and Fossil |

| Women’s Handbags | | Nine West, Liz Claiborne, Kenneth Cole and Fossil |

| Women’s Personal Leather Goods | | Buxton, Mundi, Fossil, Liz Claiborne and Nine West |

We compete on the basis of customer service, brand recognition, product quality and price. We believe our ability to compete successfully is based on our strong customer relationships, superior customer service, strong national brand portfolio, national distribution capabilities, proprietary inventory management systems, flexible sourcing and product design and innovation.

How do we seek to grow our business?

We seek increased sales and earnings through a variety of means, including increased sales through our current operating units, as well as growth through the acquisition of assets and similar businesses. Since our incorporation in Delaware on November 1, 1990, we have acquired numerous businesses. Over the last three years, we made the following acquisitions.

| | | | | | | | | | | |

| | Name of Business | | | | |

| Date Acquired | | or Assets Acquired | | Product Lines | | Brands Acquired |

| |

| |

| |

|

| January 18, 2001 | | | Stagg Industries, Inc. | | | Men’s and children’s belts, wallets and neckwear | | | Stagg® | |

| April 17, 2001 | | | Certain assets of Torel, Inc. | | | Men’s belts and sporting goods accessories | | | Torel | |

| April 12, 2002 | | | Certain assets of AA&E Leathercraft, Inc. | | | Sporting goods accessories | | | AA&E | |

Where and how do we manufacture our products?

Our manufacturing facilities are located in Yoakum, Texas and Scarborough, Ontario, and have the combined capacity to manufacture approximately 5.3 million belts per year. During fiscal 2003, our manufacturing facilities operated at approximately 82% of capacity. We continually seek to increase the automation of our manufacturing operations. We believe we are one of the lowest-cost domestic belt producers because of our automated equipment, large production volumes and economies of scale in raw materials and finished goods sourcing.

In fiscal 2003, we obtained certain finished products representing approximately 88% of our net sales from outside manufacturers, both domestic and foreign. We have strong relationships with a number of high quality, low-cost foreign manufacturers which provide particularly labor-intensive products, such as small leather goods, manufactured to our specifications.

Our transactions with foreign manufacturers and suppliers are subject to the risks of doing business abroad. Imports into the United States, including both finished goods and raw materials, are affected by,

7

among other things, the cost of and delays in transportation, and the imposition of import duties and restrictions. The United States, China and other countries where our products are manufactured may, from time to time, impose new quotas, tariffs or other restrictions, or adjust presently prevailing quotas, duty or tariff levels, which could affect our operations and our ability to import products at current or increased levels. We cannot predict the magnitude, likelihood or frequency of any such events.

To what extent is our business seasonal?

Our quarterly sales and net income results are fairly consistent throughout the year, with a seasonal increase during the second quarter.

What are the sources and availability of our raw materials?

Our raw materials requirements are limited to materials used in the manufacture of men’s belts, which is the only product line we manufacture ourselves. These raw materials consist primarily of leather hides and hardware, such as buckles, and are readily available from a variety of foreign and domestic sources. As a result, we have not experienced any significant disruption of product flow based on our raw materials needs. Nonetheless, because we purchase a substantial amount of leather items from third-party suppliers, an unanticipated material increase in the market price of leather could increase the cost of these products to us and therefore have a negative effect on our financial condition and results of operations.

Are we subject to governmental regulations?

Many of our products are manufactured in countries other than the United States. Accordingly, those countries and the United States may from time to time modify existing quotas, duties, tariffs, or import restrictions, or otherwise regulate or restrict imports in a manner which could be material and adverse to us. In addition, economic and political disruptions in Asia and other parts of the world from which we import goods could have an adverse effect on our ability to maintain an uninterrupted flow of products to our major customers.

Due to the fact that we sell our products to retail exchange operations of the United States military, and are therefore a supplier to the federal government, we must comply with all federal statutes applicable to federal government suppliers. Historically, we have not needed to make any material modifications or accommodations to our operations as a result of government regulations.

How many employees do we have?

We had approximately 1,216 employees as of June 30, 2003. We believe employee relations are generally good.

What role does intellectual property play in our business?

We believe our trademarks, our licenses to use certain trademarks and our other proprietary rights in and to intellectual property are important to our success and our competitive position, and we seek to protect our intellectual property rights against infringement. Specifically, we seek to protect our interests not only in our brands, but also in our designs. We devote considerable resources to the establishment and protection of our intellectual property on a nationwide basis and in selected foreign markets. Our trademarks remain valid and enforceable as long as the marks are used in connection with our products and services and the required registration renewals are filed.

What are our working capital practices?

We do not enter into long-term agreements with any of our customers. Instead, we enter into a number of purchase order commitments with our customers for each of our lines every season. Due to the production time required by our foreign suppliers to produce and ship goods to our distribution centers, we attempt, based on internal estimates, to carry on hand inventory levels necessary for the timely shipment of initial shipment

8

and replenishment orders of men’s and women’s accessories to our customers. A decision by the customer buyer of a group of stores or any significant customer, whether motivated by competitive conditions, financial difficulties or otherwise, to change the amount of merchandise purchased from us significantly, or to change the customer buyer’s manner of doing business with us, may have a material effect on our financial condition and results of operations. However, this exposure is mitigated in that we sell our products to a variety of retail partners throughout the United States and Canada.

Where can investors access additional information regarding Tandy Brands?

Our website address iswww.tandybrands.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, Forms 3, 4 and 5 filed by our officers, directors and stockholders holding 10% or more of our common stock and all amendments to those reports are available free of charge through our website, as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission You may also read and copy any reports, proxy statements or other information that we file with the SEC at the SEC’s public reference room at 450 Fifth Street N.W., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation and location of the public reference room. Our SEC filings are also available to the public free of charge at the SEC’s website atwww.sec.gov.

We own and lease numerous facilities throughout the United States and abroad. We currently lease our corporate offices which are located in Arlington, Texas, for which we have a renewal option. We believe our properties are adequate and suitable for the particular uses involved. The following table summarizes our properties.

| | | | | | | |

| | | | Form of |

| Facility Location | | Use | | Ownership |

| |

| |

|

| Yoakum, Texas (4 facilities) | | Leather product manufacturing, product distribution and administrative offices | | | Own | |

| West Bend, Wisconsin | | Distribution of small leather goods and handbags | | | Own | |

| Scarborough, Ontario | | Manufacture and distribution of leather goods | | | Lease | |

| Dallas, Texas | | Distribution of women’s accessories | | | Lease | |

| Arlington, Texas | | Corporate offices | | | Lease | |

| New York, New York | | Office space | | | Lease | |

| San Francisco, California | | Office space | | | Lease | |

| St. Louis, Missouri | | Office space | | | Lease | |

| Birmingham, Alabama | | Office space | | | Lease | |

| Minneapolis, Minnesota | | Office space | | | Lease | |

| Hong Kong | | Office space | | | Lease | |

The total space we own, lease and occupy as of June 30, 2003, is as follows.

| | | | | | | | | | | | | |

| | |

| | Approximate Square Feet |

| |

|

| | Owned | | Leased | | Total |

| |

| |

| |

|

| Warehouse and Office | | | 509,000 | | | | 245,000 | | | | 754,000 | |

| Factory | | | 60,000 | | | | 27,000 | | | | 87,000 | |

| | | |

| | | |

| | | |

| |

| Total | | | 569,000 | | | | 272,000 | | | | 841,000 | |

| | | |

| | | |

| | | |

| |

9

| |

| Item 3. | Legal Proceedings. |

We are not involved in any material pending legal proceedings, other than ordinary routine litigation incidental to our business. No material legal proceedings were terminated during the fourth quarter of fiscal 2003.

| |

| Item 4. | Submission of Matters to a Vote of Security Holders. |

There were no matters submitted to a vote of security holders during the fourth quarter of fiscal 2003.

PART II

| |

| Item 5. | Market for the Registrant’s Common Equity and Related Stockholder Matters. |

What is the principal market for our common stock?

The principal market for our common stock is the NASDAQ National Market System. Our common stock is listed on the NASDAQ National Market System under the symbol “TBAC.�� Information regarding the high and low sales prices for our common stock for each full quarterly period within the two most recent fiscal years as reported on NASDAQ appears on page 40 of our 2003 Annual Report to Stockholders, and is incorporated herein by reference.

How many common stockholders do we have?

As of September 8, 2003, we had approximately 893 common stockholders of record.

Did we declare any cash dividends in fiscal 2003 or the prior fiscal year?

We did not declare any dividends in fiscal 2003 or the prior fiscal year. However, on August 12, 2003 our board of directors declared the company’s first quarterly dividend. The dividend of $.025 per share will be payable to stockholders of record as of September 30, 2003. The payment of the dividend will occur on October 21, 2003. The payment of dividends in the future will be at the sole discretion of our board of directors and will depend on our profitability, financial condition, capital needs, future prospects, contractual restrictions and other factors deemed relevant by our board of directors.

How many shares of common stock are authorized for issuance under our equity compensation plans?

The following table provides information regarding the number of shares of our common stock that may be issued on exercise of outstanding stock options and warrants under our existing equity compensation plans as of June 30, 2003. These plans include

| | |

| | • | the 1993 Employee Stock Option Plan, |

| |

| | • | the 1997 Employee Stock Option Plan, |

| |

| | • | the Nonqualified Formula Stock Option Plan for Non-Employee Directors, |

| |

| | • | the Nonqualified Stock Option Plan for Non-Employee Directors, |

| |

| | • | the 2002 Omnibus Plan, |

| |

| | • | the 1995 Stock Deferral Plan for Non-Employee Directors, |

10

| | |

| | • | the Stock Purchase Program, and |

| |

| | • | the Benefit Restoration Plan. |

| | | | | | | | | | | | | |

| | | | (B) | | (C) |

| | (A) | | Weighted-Average | | Number of Securities Remaining |

| | Number of Securities to be | | Exercise Price of | | Available for Future Issuance |

| | Issued upon Exercise of | | Outstanding Options, | | Under Equity Compensation Plans |

| | Outstanding Options, | | Warrants and | | (Excluding Securities Reflected |

| Plan Category | | Warrants and Rights | | Rights | | in Column (A)) |

| |

| |

| |

|

| Equity Compensation Plans Approved by Stockholders | | | 988,750 | (1) | | $ | 11.28 | | | | 871,469 | (2) |

| Equity Compensation Plans Not Approved by Stockholders | | | 19,250 | (3) | | $ | 6.09 | | | | 0 | (4) |

| | | |

| | | | | | | |

| |

| Total | | | 1,008,000 | | | $ | 11.18 | | | | 871,469 | (2) |

| | | |

| | | | | | | |

| |

| |

| (1) | Includes options to purchase 129,650 shares of common stock under the 1993 Employee Stock Option Plan, 748,877 shares of common stock under the 1997 Employee Stock Option Plan, 93,337 shares of common stock under the Nonqualified Formula Stock Option Plan for Non-Employee Directors, 2,461 shares of common stock under the Nonqualified Stock Option Plan for Non-Employee Directors and 14,425 shares of common stock under the 2002 Omnibus Plan. |

| |

| (2) | Includes 514,840 shares of common stock issuable under the 2002 Omnibus Plan, 28,694 shares of common stock issuable under the 1995 Stock Deferral Plan for Non-Employee Directors and 327,935 shares of common stock issuable under the Stock Purchase Program. Upon adoption of the 2002 Omnibus Plan by our stockholders at our 2002 annual stockholders’ meeting, the number of shares authorized and reserved for issuance under our previously existing stock option plans were transferred to the 2002 Omnibus Plan and are presently authorized and reserved for issuance under that plan. All shares of common stock authorized and reserved for issuance on the exercise of outstanding stock options under our previous stock option plans and the 2002 Omnibus Plan will, on the cancellation or expiration of any such stock options, automatically be authorized and reserved for issuance under the 2002 Omnibus Plan. |

| |

| (3) | Options to purchase an aggregate of 19,250 shares of common stock at an exercise price of $6.09 per share were issued to five non-employee directors on October 16, 2001. These options are fully vested and expire on October 16, 2011. |

| |

| (4) | Does not include shares of common stock issuable pursuant to our Benefit Restoration Plan. Under our Benefit Restoration Plan, certain members of management and highly compensated employees may elect to defer a portion of their compensation for contribution to the plan to restore retirement benefits decreased due to limitations imposed by Sections 401(a)(17) and 402(g)(1) of the Internal Revenue Code of 1986, as amended. All or a portion of the deferred compensation together with a matching contribution made by the company on behalf of any participant in the plan may be invested in common stock of the company. The number of shares issuable under the plan is not subject to limitation. As a result, an indeterminable amount of common stock is issuable to certain employees under this plan. |

| |

| Item 6. | Selected Financial Data. |

The information required by this item appears on page 40 of our 2003 Annual Report to Stockholders, and is incorporated herein by reference.

| |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

The information required by this item appears on pages 35 through 39 of our 2003 Annual Report to Stockholders, and is incorporated herein by reference.

11

| |

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk. |

We are subject to interest rate risk on our long-term debt. We manage our exposure to changes in interest rates. We hedged our exposure to changes in interest rates on a portion of our variable debt by entering into an interest rate swap agreement to lock in a fixed interest rate for a portion of these borrowings. On July 1, 2001, we entered into a three-year interest rate swap agreement with Wells Fargo HSBC Trade Bank, N.A., which expires on June 27, 2004, converting $30,000,000 of outstanding indebtedness from a variable to a fixed interest rate. The average receive rate is based on a 90-day LIBOR rate. At June 30, 2003, the receive and pay rates related to the interest rate swap were 1.29% and 5.60%, respectively. Interest differentials paid or received under the swap agreement are reflected as an adjustment to interest expense when paid. Prior to June 26, 2003, the interest rate swap agreement represented a valid cash flow hedge investment under Statement No. 133. As such, during fiscal 2003, changes in the fair value of the interest rate swap were recognized in other comprehensive income. The fair value of the swap agreement at June 30, 2003, 2002, and 2001 was approximately ($1,665,000), ($1,700,000), and ($15,000), respectively, and is included in accrued liabilities at June 30, 2003 and other non-current liabilities at June 30, 2002 and 2001. At June 30, 2003, 2002, and 2001, the balance in other comprehensive income, related to the swap agreement, was approximately ($1,019,000), ($1,041,000), and ($9,000), respectively. We do not expect the potential impact of market conditions on the fair value of our indebtedness to be material.

On June 26, 2003, we amended our committed secured revolving credit facility. The amendment to our credit facility extended the expiration of the agreement from June 27, 2004 to November 30, 2006. In conjunction with the amendment to our credit facility, we discontinued hedge accounting on the swap described above. We intend to hold the swap until maturity on June 27, 2004. The change in the fair value of the swap agreement and balance in other comprehensive income will be charged to interest expense over the term of the swap.

We are also exposed to market risk with respect to changes in the global price level of certain commodities used in the production of our products. We routinely purchase leather hides during the year for use in the manufacture of men’s belts. We also purchase a substantial amount of leather items from third-party suppliers. An unanticipated material increase in the market price of leather could increase the cost of these products to us and therefore have a negative effect on our financial condition and results of operations.

| |

| Item 8. | Financial Statements and Supplementary Data. |

The information required by this item appears on pages 14 through 40 of our 2003 Annual Report to Stockholders, and is incorporated herein by reference. Following is a cross reference for location of the required information.

| | | | | |

| | Page Number in the |

| | Tandy Brands Accessories, Inc. |

| | 2003 Annual |

| Financial Statements and Supplementary Data | | Report to Stockholders |

| |

|

| Consolidated Statements of Income for the Years Ended June 30, 2003, 2002 and 2001 | | | 14 | |

| Consolidated Balance Sheets at June 30, 2003 and 2002 | | | 15 | |

| Consolidated Statements of Cash Flows for the Years | | | | |

| Ended June 30, 2003, 2002 and 2001 | | | 16 | |

| Consolidated Statements of Stockholders’ Equity for the Years Ended June 30, 2003, 2002 and 2001 | | | 17 | |

| Notes to Consolidated Financial Statements | | | 18-32 | |

| Selected Unaudited Quarterly Financial Data | | | 32 | |

| Report of Independent Auditors | | | 33 | |

| Selected Financial Data | | | 40 | |

12

| |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. |

None.

PART III

The information required by Items 10 through 13 is included in our definitive Proxy Statement relating to our 2003 Annual Meeting of Stockholders, and is incorporated herein by reference. Following is a cross reference for location of the required information.

| | | | | | | | | |

| | | | | | Page Number in the |

| | | | | | Tandy Brands |

| | | | Caption in the | | Accessories, Inc. |

| | | | Tandy Brands Accessories, Inc. | | 2003 Proxy |

| | Item | | 2003 Proxy Statement | | Statement |

| |

| |

| |

|

Item 10. | | Directors and Executive Officers of the Registrant | | “Proposal: Election of Directors” | | | 5-7 | |

| |

| | | | | “Other Information You Need to Make a Decision — Who are our executive officers?” | | | 9-10 | |

| |

| | | | | “Section 16(a) Beneficial Ownership Reporting Compliance” | | | 9 | |

| |

| | | | | “Other Information You Need to Make a Decision — What are the board of directors’ committees? What functions do they serve?” | | | 14-15 | |

| |

Item 11. | | Executive Compensation | | “Other Information You Need to Make a Decision — How do we compensate our executive officers?” | | | 10-12 | |

| |

| | | | | “Other Information You Need to Make a Decision — How do we compensate our non-employee directors?” | | | 13-14 | |

| |

| | | | | “Other Information You Need to Make a Decision — How did our common stock perform compared to certain indexes?” | | | 13 | |

| |

| | | | | “Other Information You Need to Make a Decision — What are the board of directors’ committees? What functions do they serve? — Compensation Committee Interlocks and Insider Participation” | | | 14-15 | |

| |

| | | | | “Report of Human Resources and Compensation Committee” | | | 17-18 | |

| |

Item 12. | | Security Ownership of Certain Beneficial Owners and Management | | “Security Ownership of Certain Beneficial Owners” | | | 7-9 | |

| |

Item 13. | | Certain Relationships and Related Transactions | | “Other Information You Need to Make a Decision — Did we have transactions with our officers, directors or 5% stockholders?” | | | 12 | |

13

PART IV

| |

| Item 14. | Controls and Procedures. |

Evaluation of Disclosure Controls and Procedures

In accordance with Rules 13a-15 and 15d-15 under the Securities Exchange Act of 1934, we have evaluated, under the supervision and with the participation of management, including our Chief Executive Officer and our Chief Financial Officer, the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act) as of the end of the period covered by this annual report. Based on that evaluation, our Chief Executive Officer and our Chief Financial Officer concluded that, as of the end of the period covered by this annual report, our disclosure controls and procedures were effective in timely alerting them to material information relating to our business (including our consolidated subsidiaries) required to be included in our Exchange Act filings.

Changes in Internal Controls

There have been no significant changes in our internal controls or in other factors, which could significantly affect internal controls subsequent to the date we carried out our most recent evaluation.

| |

| Item 15. | Exhibits, Financial Statement Schedule, and Reports on Form 8-K. |

(a) The following documents are filed as a part of this report:

| |

| | (1) The financial statements listed in response to Item 8 of this report have been incorporated herein by reference to pages 14 through 32 of our 2003 Annual Report to Stockholders. |

| |

| | (2) Financial Statement Schedule: Report of Independent Auditors on Financial Statement Schedule for the three years in the period ended June 30, 2003; Schedule II — Valuation and Qualifying Accounts. The financial statement schedule should be read in conjunction with the consolidated financial statements in our 2003 Annual Report to Stockholders. Financial statement schedules not included in this report have been omitted because they are not applicable or the required information is shown in the consolidated financial statements or notes thereto. |

| |

| | (3) Exhibits: A list of the exhibits filed as part of this report is set forth in the Index to Exhibits, which immediately precedes such exhibits and is incorporated herein by reference. |

(b) Reports on Form 8-K.

During the last quarter of fiscal 2003, we filed one current report on Form 8-K on April 17, 2003, to report the issuance of the press release announcing our financial results for the third quarter of fiscal 2003.

14

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

| | TANDY BRANDS ACCESSORIES, INC. |

| | (Registrant) |

| |

| | /s/ J.S.B. JENKINS |

| |

|

| | J.S.B. Jenkins |

| | President and Chief Executive Officer |

Date: September 23, 2003

Pursuant to the requirements of the Securities and Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | | | | | | |

| | | | |

| Name | | Position | | Date |

| |

| |

|

| |

/s/ DR. JAMES F. GAERTNER

Dr. James F. Gaertner | | Director and Chairman of the Board | | September 23, 2003 |

| |

/s/ J.S.B. JENKINS

J.S.B. Jenkins | | Director, President and Chief Executive Officer (principal executive officer) | | September 23, 2003 |

| |

/s/ C.A. RUNDELL, JR.

C.A. Rundell, Jr. | | Director | | September 23, 2003 |

| |

/s/ ROGER R. HEMMINGHAUS

Roger R. Hemminghaus | | Director | | September 23, 2003 |

| |

/s/ GENE STALLINGS

Gene Stallings | | Director | | September 23, 2003 |

| |

/s/ COLOMBE M. NICHOLAS

Colombe M. Nicholas | | Director | | September 23, 2003 |

| |

/s/ MARK J. FLAHERTY

Mark J. Flaherty | | Chief Financial Officer (principal financial and accounting officer) | | September 23, 2003 |

15

REPORT OF INDEPENDENT AUDITORS ON FINANCIAL STATEMENT SCHEDULE

To the Board of Directors of

Tandy Brands Accessories, Inc.

We have audited the consolidated financial statements of Tandy Brands Accessories, Inc. and subsidiaries as of June 30, 2003 and 2002, and for each of the three years in the period ended June 30, 2003, and have issued our report thereon dated July 30, 2003, incorporated by reference in this Annual Report on Form 10-K. Our audits also included the financial statement schedule listed in Item 15(a) of this Annual Report on Form 10-K. The schedule is the responsibility of the Company’s management. Our responsibility is to express an opinion based on our audits.

In our opinion, the financial statement schedule referred to above, when considered in relation to the basic financial statements taken as a whole, presents fairly in all material respects the information set forth therein.

Fort Worth, Texas

July 30, 2003

16

TANDY BRANDS ACCESSORIES, INC. AND SUBSIDIARIES

SCHEDULE II — VALUATION AND QUALIFYING ACCOUNTS

For the Year Ended June 30,

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | Additions | | | | |

| | Balance at | |

| | | | Balance at |

| | Beginning | | Charged to Costs | | Charged to Other | | | | End of |

| Description | | of Period | | and Expenses | | Accounts | | Deductions(1) | | Period |

| |

| |

| |

| |

| |

|

2003 | | | | | | | | | | | | | | | | | | | | |

| Allowance for Doubtful Accounts And Returns | | $ | 1,707,000 | | | $ | 1,523,000 | | | $ | -0- | | | $ | 1,485,000 | | | $ | 1,745,000 | |

2002 | | | | | | | | | | | | | | | | | | | | |

| Allowance for Doubtful Accounts And Returns | | $ | 1,671,000 | | | $ | 1,152,000 | | | $ | -0- | | | $ | 1,116,000 | | | $ | 1,707,000 | |

2001 | | | | | | | | | | | | | | | | | | | | |

| Allowance for Doubtful Accounts And Returns | | $ | 1,101,000 | | | $ | 1,720,000 | | | $ | -0- | | | $ | 1,150,000 | | | $ | 1,671,000 | |

| |

| (1) | Represents uncollectible accounts written off, net of recoveries and application of allowances to sales returns. |

17

TANDY BRANDS ACCESSORIES, INC. AND SUBSIDIARIES

EXHIBIT INDEX

| | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | | Incorporated by Reference |

| | | | (If Applicable) |

| | | |

|

| | Exhibit Number and Description | | Form | | Date | | File No. | | Exhibit |

| |

| |

| |

| |

| |

|

| | (3 | ) | | Articles of Incorporation and By-laws | | | | | | | | | | | | | | | | |

| | 3 | .1 | | Certificate of Incorporation of Tandy Brands Accessories, Inc. | | | S-1 | | | | 11/02/90 | | | | 33-37588 | | | | 3 | .1 |

| | 3 | .2 | | Bylaws of Tandy Brands Accessories, Inc. | | | S-1 | | | | 11/02/90 | | | | 33-37588 | | | | 3 | .2 |

| | 3 | .3 | | Amendment No. 1 to Bylaws of Tandy Brands Accessories, Inc. | | | 10-Q | | | | 5/10/02 | | | | 0-18927 | | | | 3 | .3 |

| | (4 | ) | | Instruments Defining the Rights of Security Holders, Including Indentures | | | | | | | | | | | | | | | | |

| | 4 | .1 | | Certificate of Designations, Powers, Preferences, and Rights of Series A Junior Participating Cumulative Preferred Stock of Tandy Brands Accessories, Inc. | | | S-1 | | | | 12/31/90 | | | | 33-37588 | | | | 4 | .1 |

| | 4 | .2 | | Form of Common Stock Certificate of Tandy Brands Accessories, Inc. | | | S-1 | | | | 12/31/90 | | | | 33-37588 | | | | 4 | .2 |

| | 4 | .3 | | Form of Preferred Share Purchase Rights Certificate of Tandy Brands Accessories, Inc. | | | S-1 | | | | 12/31/90 | | | | 33-37588 | | | | 4 | .3 |

| | 4 | .4 | | Form of Rights Certificate of Tandy Brands Accessories, Inc. | | | 8-K | | | | 11/02/99 | | | | 0-18927 | | | | 4 | |

| | 4 | .5 | | Amended and Restated Rights Agreement, dated October 19, 1999, between Tandy Brands Accessories, Inc. and Bank Boston, N.A. | | | 8-K | | | | 11/02/99 | | | | 0-18927 | | | | 4 | |

| | 4 | .6 | | Amendment to Rights Agreement, dated October 19, 1999, between Tandy Brands Accessories, Inc. and Fleet National Bank (f.k.a. Bank Boston, N.A.) | | | 10-Q | | | | 05/10/02 | | | | 0-18927 | | | | 4 | .7 |

| | (10 | ) | | Material Contracts | | | | | | | | | | | | | | | | |

| | 10 | .1 | | Tandy Brands Accessories, Inc. 1991 Stock Option Plan* | | | S-1 | | | | 11/02/90 | | | | 33-37588 | | | | 10 | .8 |

| | 10 | .2 | | Form of Stock Option Agreement — 1991 Stock Option Plan* | | | S-1 | | | | 11/02/90 | | | | 33-37588 | | | | 10 | .9 |

| | 10 | .3 | | Tandy Brands Accessories, Inc. Benefit Restoration Plan and related Trust Agreement and Amendments Nos. 1 and 2 thereto* | | | 10-K | | | | 09/25/97 | | | | 0-18927 | | | | 10 | .14 |

| | 10 | .4 | | Form of Indemnification Agreement between Tandy Brands Accessories, Inc. and each of its Directors | | | S-1 | | | | 12/31/90 | | | | 33-37588 | | | | 10 | .16 |

| | 10 | .5 | | Form of Indemnification Agreement between Tandy Brands Accessories, Inc. and each of its Officers | | | S-1 | | | | 12/31/90 | | | | 33-37588 | | | | 10 | .17 |

| | 10 | .6 | | Office Lease Agreement, dated March 6, 1991, between John Hancock Mutual Life Insurance Co. and Tandy Brands Accessories, Inc. relating to the corporate offices | | | 10-K | | | | 09/20/91 | | | | 0-18927 | | | | 10 | .16 |

| | 10 | .7 | | Tandy Brands Accessories, Inc. Non-Qualified Formula Stock Option Plan for Non-Employee Directors* | | | S-8 | | | | 02/10/94 | | | | 33-75114 | | | | 28 | .1 |

| | 10 | .8 | | Tandy Brands Accessories, Inc. 1993 Employee Stock Option Plan and form of Stock Option Agreement thereunder* | | | S-8 | | | | 02/10/94 | | | | 33-75114 | | | | 28 | .2 |

18

| | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | | Incorporated by Reference |

| | | | (If Applicable) |

| | | |

|

| | Exhibit Number and Description | | Form | | Date | | File No. | | Exhibit |

| |

| |

| |

| |

| |

|

| | 10 | .9 | | Tandy Brands Accessories, Inc. Non-Qualified Stock Option Plan for Non-Employee Directors* | | | S-8 | | | | 02/10/94 | | | | 33-75114 | | | | 28 | .3 |

| | 10 | .10 | | Tandy Brands Accessories, Inc. 1995 Stock Deferral Plan for Non-Employee Directors* | | | S-8 | | | | 06/03/96 | | | | 33-08579 | | | | 99 | .1 |

| | 10 | .11 | | Tandy Brands Accessories, Inc. 1997 Employee Stock Option Plan* | | | S-8 | | | | 12/12/97 | | | | 333-42211 | | | | 10 | .23 |

| | 10 | .12 | | Tandy Brands Accessories, Inc. Employees Investment Plan, as Amended and Restated effective July 1, 2000* | | | 10-K | | | | 09/26/00 | | | | 0-18927 | | | | 10 | .39 |

| | 10 | .13 | | Credit Agreement, dated as of June 27, 2001, among Tandy Brands Accessories, Inc. as the Borrower, Wells Fargo HSBC Trade Bank, N.A. as Administrative Agent and as Lender, certain Financial Institutions as Lenders and Wells Fargo Bank, N.A. as Arranger | | | 10-K | | | | 09/25/01 | | | | 0-18927 | | | | 10 | .34 |

| | 10 | .14 | | ISDA Master Agreement, dated as of June 27, 2001, between Tandy Brands Accessories, Inc. and Wells Fargo Bank, N.A. | | | 10-K | | | | 09/25/01 | | | | 0-18927 | | | | 10 | .35 |

| | 10 | .15 | | Tandy Brands Accessories, Inc. Stock Purchase Program (as amended and restated effective October 18, 1991)* | | | S-8 | | | | 03/27/92 | | | | 33-46814 | | | | 28 | .1 |

| | 10 | .16 | | Limited Consent and Waiver, dated November 5, 2001, between Tandy Brands Accessories, Inc. and Wells Fargo HSBC Trade Bank, N.A. as Administrative Agent under the Agreement | | | 10-Q | | | | 11/13/01 | | | | 0-18927 | | | | 10 | .37 |

| | 10 | .17 | | Amendment No. 2 to the Tandy Brands Accessories, Inc. 1997 Employee Stock Option Plan* | | | 10-Q | | | | 5/10/02 | | | | 0-18927 | | | | 10 | .38 |

| | 10 | .18 | | Amendment No. 4 to the Tandy Brands Accessories, Inc. Nonqualified Formula Stock Option Plan For Non- Employee Directors* | | | 10-Q | | | | 5/10/02 | | | | 0-18927 | | | | 10 | .39 |

| | 10 | .19 | | Nonqualified Stock Option Agreement for Non-Employee Directors, dated October 16, 2001, by and between Tandy Brands Accessories, Inc. and Dr. James F. Gaertner* | | | S-8 | | | | 5/15/02 | | | | 33-88276 | | | | 10 | .2 |

| | 10 | .20 | | Nonqualified Stock Option Agreement for Non-Employee Directors, dated October 16, 2001, by and between Tandy Brands Accessories, Inc. and Marvin J. Girouard* | | | S-8 | | | | 5/15/02 | | | | 33-88276 | | | | 10 | .3 |

| | 10 | .21 | | Nonqualified Stock Option Agreement for Non-Employee Directors, dated October 16, 2001, by and between Tandy Brands Accessories, Inc. and Gene Stallings* | | | S-8 | | | | 5/15/02 | | | | 33-88276 | | | | 10 | .4 |

| | 10 | .22 | | Nonqualified Stock Option Agreement for Non-Employee Directors, dated October 16, 2001, by and between Tandy Brands Accessories, Inc. and Roger R. Hemminghaus* | | | S-8 | | | | 5/15/02 | | | | 33-88276 | | | | 10 | .5 |

| | 10 | .23 | | Nonqualified Stock Option Agreement for Non-Employee Directors, dated October 16, 2001, by and between Tandy Brands Accessories, Inc. and Colombe M. Nicholas* | | | S-8 | | | | 5/15/02 | | | | 33-88276 | | | | 10 | .6 |

19

| | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | | Incorporated by Reference |

| | | | (If Applicable) |

| | | |

|

| | Exhibit Number and Description | | Form | | Date | | File No. | | Exhibit |

| |

| |

| |

| |

| |

|

| | 10 | .24 | | First Amendment to Credit Agreement, dated June 28, 2002, between Tandy Brands Accessories, Inc. and Wells Fargo HSBC Trade Bank, N.A. | | | 10-K | | | | 9/27/02 | | | | 0-18927 | | | | 10 | .23 |

| | 10 | .25 | | Tandy Brands Accessories, Inc. 2002 Omnibus Plan* | | | 10-Q | | | | 11/12/02 | | | | 0-18927 | | | | 10 | .24 |

| | 10 | .26 | | Tandy Brands Accessories, Inc. Supplemental Executive Retirement Plan* | | | 10-Q | | | | 2/12/03 | | | | 0-18927 | | | | 10 | .25 |

| | 10 | .27 | | Amendment No. 1 to the Tandy Brands Accessories, Inc. Stock Purchase Program* | | | 10-Q | | | | 5/12/03 | | | | 0-18927 | | | | 10 | .27 |

| | 10 | .28 | | Mid-Market Trust Agreement, dated August 19, 2001, between Tandy Brands Accessories, Inc. and State Street Bank and Trust Company, relating to the Tandy Brands Accessories, Inc. Employees Investment Plan* ** | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | 10 | .29 | | Second Amendment to Credit Agreement, dated June 26, 2003, between Tandy Brands Accessories, Inc. and Wells Fargo HSBC Trade Bank, N.A.** | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | 10 | .30 | | Amendment No. 1 to Tandy Brands Accessories, Inc. Supplemental Executive Retirement Plan, effective January 1, 2003* ** | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | 10 | .31 | | Amendments Nos. 1-3 to the Tandy Brands Accessories, Inc. Employees Investment Plan, as Amended and Restated effective July 1, 2000* ** | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | 10 | .32 | | Amendment No. 3 to the Tandy Brands Accessories, Inc. Benefit Restoration Plan, effective as of July 1, 2003* ** | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | 10 | .33 | | Form of Severance Agreement between Tandy Brands Accessories, Inc. and each of J.S.B. Jenkins, Stanley T. Ninemire and Mark J. Flaherty** | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | 10 | .34 | | Succession Agreement, dated July 1, 2001, between Tandy Brands Accessories, Inc. and Chase Texas, N.A. (the Former Trustee) and Comerica Bank — Texas (the Trustee), relating to the Tandy Brands Accessories, Inc. Benefit Restoration Plan* ** | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | 10 | .35 | | Succession Agreement, dated June 20, 2002, between Tandy Brands Accessories, Inc. and Comerica Bank — Texas (the Trustee), relating to the Tandy Brands Accessories, Inc. Employees Investment Plan* ** | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | (13 | ) | | Annual Report to Security Holders, Form 10-Q or Quarterly Report to Security Holders | | | | | | | | | | | | | | | | |

| | 13 | .1 | | Annual Report to Stockholders of Tandy Brands Accessories, Inc.** | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | (21 | ) | | Subsidiaries of the Registrant | | | | | | | | | | | | | | | | |

| | 21 | .1 | | List of subsidiaries** | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | (23 | ) | | Consents of Experts and Counsel | | | | | | | | | | | | | | | | |

| | 23 | .1 | | Consent of Ernst & Young LLP** | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

20

| | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | | Incorporated by Reference |

| | | | (If Applicable) |

| | | |

|

| | Exhibit Number and Description | | Form | | Date | | File No. | | Exhibit |

| |

| |

| |

| |

| |

|

| | (31 | ) | | Rule 13a-14(a)/15d-14(a) Certifications | | | | | | | | | | | | | | | | |

| | 31 | .1 | | Certification Pursuant to Rule 13a-14(a)/15d-14(a) (Chief Executive Officer)** | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | 31 | .2 | | Certification Pursuant to Rule 13a-14(a)/15d-14(a) (Chief Financial Officer)** | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | (32 | ) | | Section 1350 Certifications | | | | | | | | | | | | | | | | |

| | 32 | .1 | | Section 1350 Certification (Chief Executive Officer)** | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | 32 | .2 | | Section 1350 Certification (Chief Financial Officer)** | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | |

| | * | Management contract or compensatory plan |

21