Exhibit 99.1

B. Riley Conference May 20, 2014 NYSE MKT: API

Forward Looking Statement This presentation contains forward-looking statements. All forward-looking statements involve risks and uncertainties, including, without limitation, the risks detailed in the Company’s filings and reports with the Securities and Exchange Commission. Such statements are only predictions, and actual events or results may differ materially from those projected. 2

What is Optoelectronics? The manufacturing and application of electronic devices that create, detect and control visible and invisible light. 3 Laser Marking Systems LED Lights Solar Panels Digital Cameras Telecommunications Barcode Scanners

API Leading Edge Competencies API excels in design and manufacturing Ultrafast and ultrasensitive semiconductor components Converting photons to electrons Converting electrons to photons Terahertz instrumentation Leading provider of industrial systems Quality control and inspection Process control Value added engineering solutions for optical subsystem sensors Flexible designs and customization 4

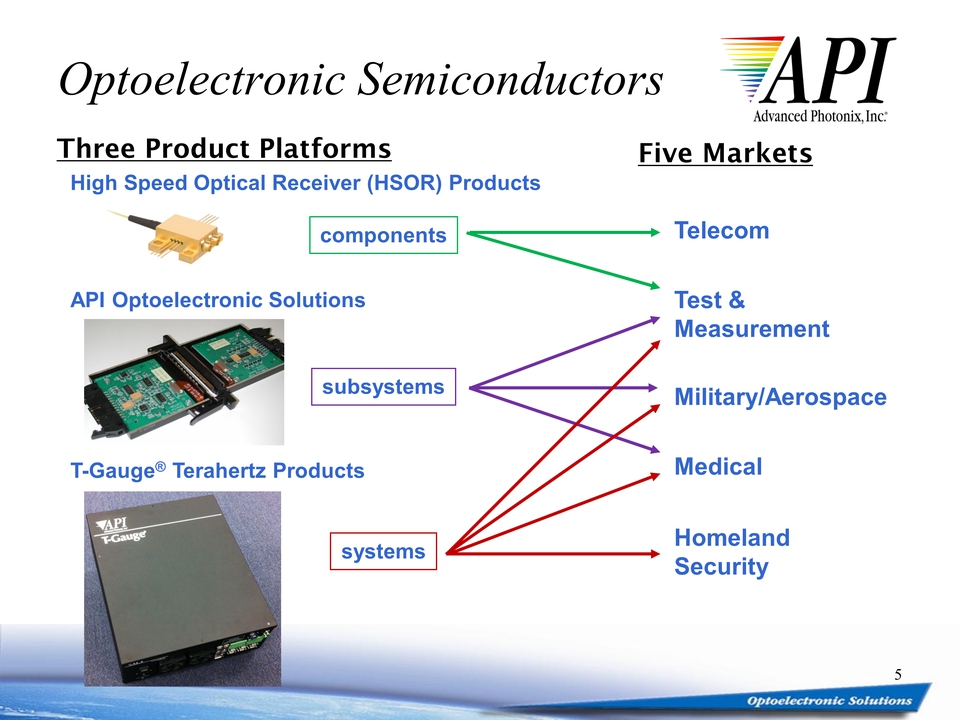

Optoelectronic Semiconductors Three Product Platforms Five Markets Homeland Security Telecom Military/Aerospace Medical Test & Measurement High Speed Optical Receiver (HSOR) Products API Optoelectronic Solutions T-Gauge® Terahertz Products components subsystems systems 5

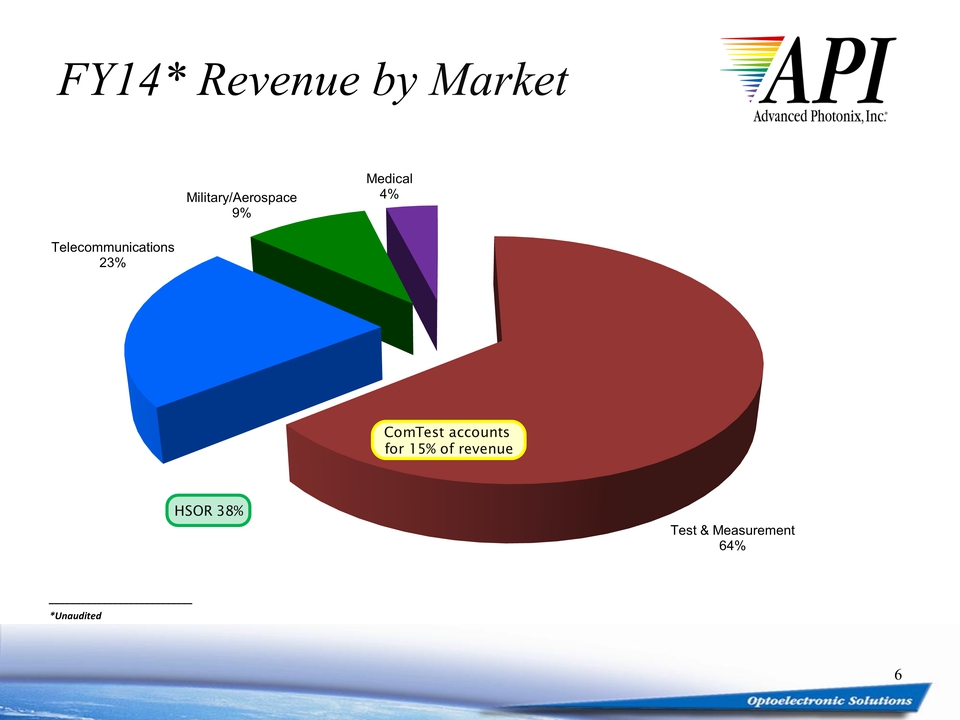

FY14* Revenue by Market 6 Test & Measurement 64% Telecommunications 23% Military/Aerospace 9% Medical 4%*Unaudited ComTest accounts for 15% of revenue HSOR 38%

Our Tier 1 Clients 7 oclaro Finisar Alacatel Lucent Lockheed Martin Raytheon Boeing JDSU ZTE Tektronix DICKEY-john Corporation HACH FLUKE LeCroy Alcon Honeywell Huawai Anritsu Nonin optos BD Diebold Innovation Delivered

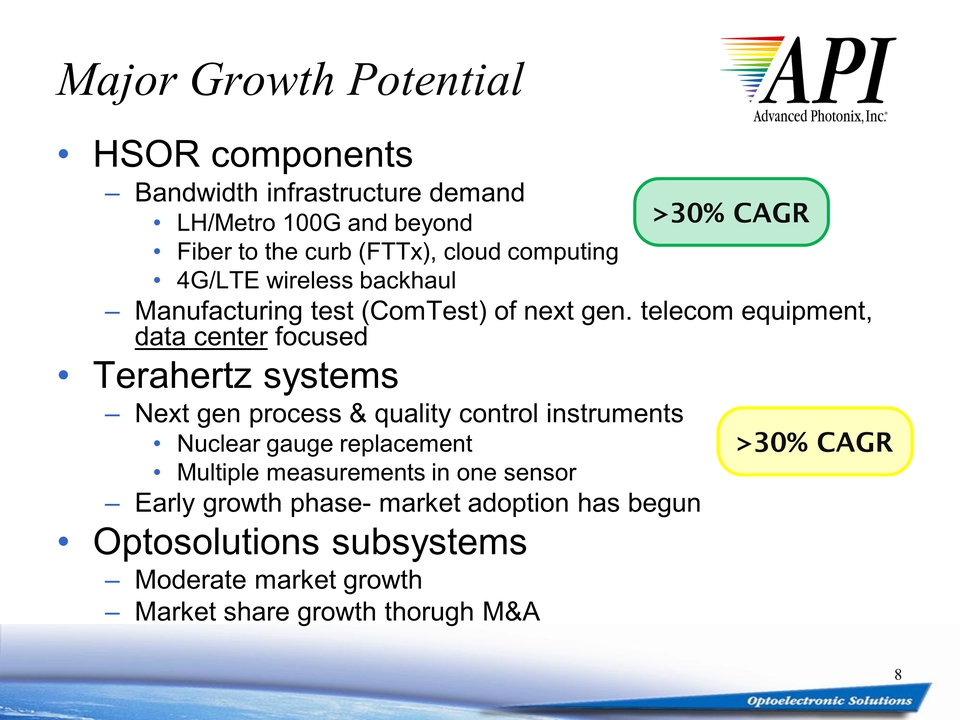

Major Growth Potential HSOR components Bandwidth infrastructure demand LH/Metro 100G and beyond Fiber to the curb (FTTx), cloud computing 4G/LTE wireless backhaul Manufacturing test (ComTest) of next gen. telecom equipment, data center focused Terahertz systems Next gen process & quality control instruments Nuclear gauge replacement Multiple measurements in one sensor Early growth phase- market adoption has begun Optosolutions subsystems Moderate market growth Market share growth thorugh M&A 8 >30% CAGR >30% CAGR

HSOR (Components) Telecom & ComTest Customers Supply world’s major OEMs Technology leader Best in class independent supplier Broad product portfolio 100G Line-side 9 CoreStream Agility Alcatel Lucent Huawei ZTE ciena CoreSteam Agility Finisar Anritsu JDSU oclaro Tektronix LeCroy Agilent Technologies

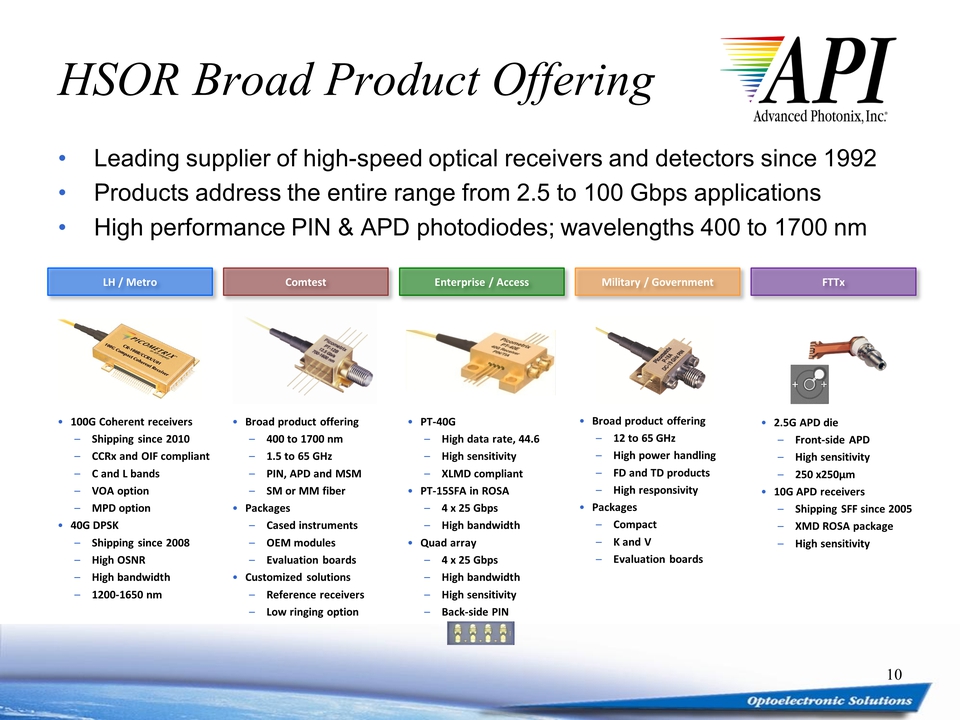

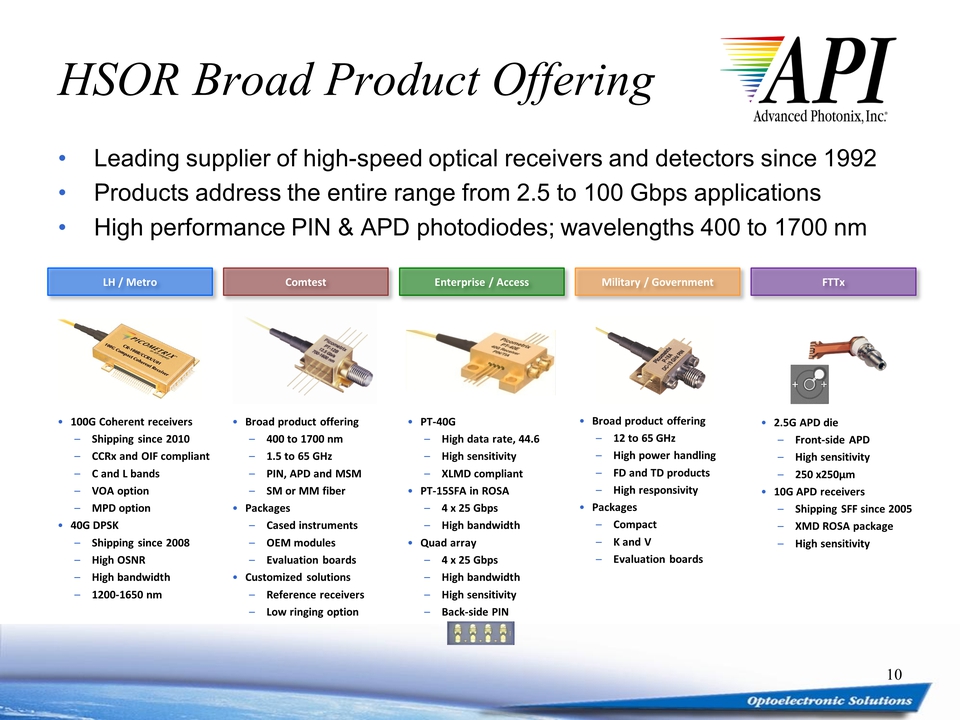

HSOR Broad Product Offering Leading supplier of high-speed optical receivers and detectors since 1992 Products address the entire range from 2.5 to 100 Gbps applications High performance PIN & APD photodiodes; wavelengths 400 to 1700 nm 100G Coherent receivers Shipping since 2010 CCRx and OIF compliant C and L bands VOA option MPD option 40G DPSK Shipping since 2008 High OSNR High bandwidth 1200-1650 nm LH / Metro FTTx Comtest Enterprise / Access Military / Government 2.5G APD die Front-side APD High sensitivity 250 x250µm 10G APD receivers Shipping SFF since 2005 XMD ROSA package High sensitivity Broad product offering 400 to 1700 nm 1.5 to 65 GHz PIN, APD and MSM SM or MM fiber Packages Cased instruments OEM modules Evaluation boards Customized solutions Reference receivers Low ringing option PT-40G High data rate, 44.6 High sensitivity XLMD compliant PT-15SFA in ROSA 4 x 25 Gbps High bandwidth Quad array 4 x 25 Gbps High bandwidth High sensitivity Back-side PIN Broad product offering 12 to 65 GHz High power handling FD and TD products High responsivity Packages Compact K and V Evaluation boards 10

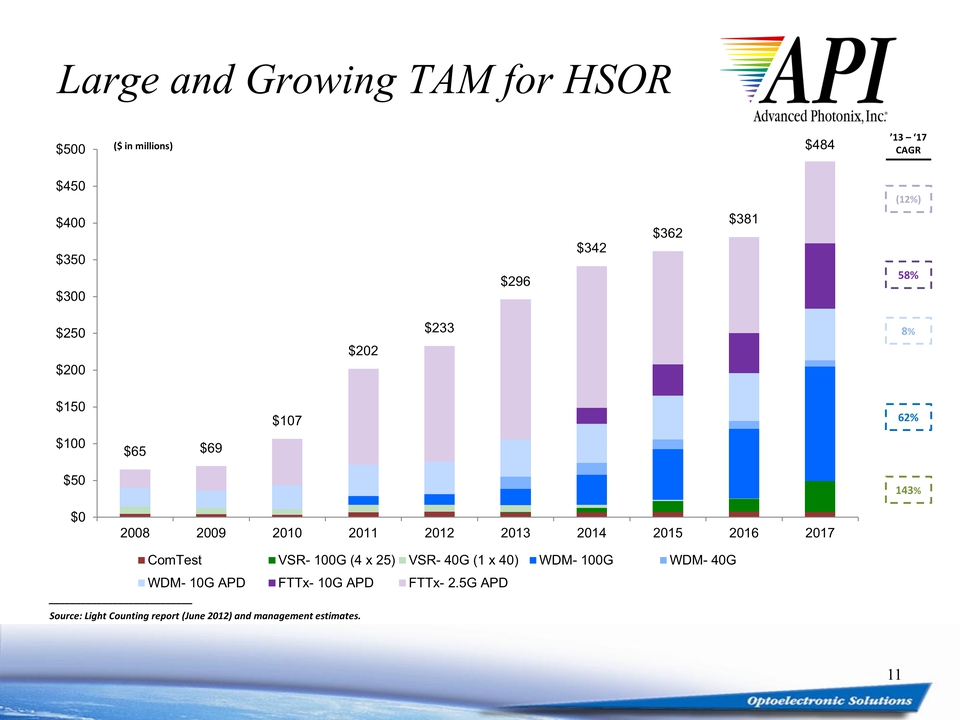

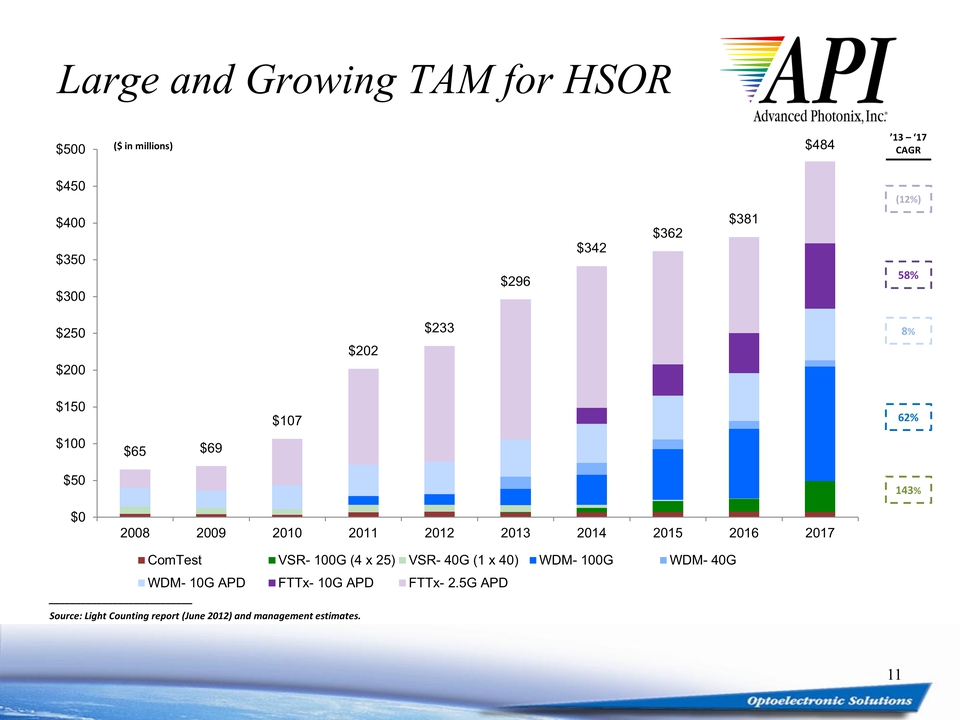

’13 – ‘17 CAGR 58% 143% 8% ($ in millions) Source: Light Counting report (June 2012) and management estimates. Large and Growing TAM for HSOR 11 $65 $69 $107 $202 $233 $296 $342 $362 $381 $484 $0$50$100$150$200$250$300$350$400$450$5002008200920102011201220132014201520162017ComTestVSR- 100G (4 x 25)VSR- 40G (1 x 40)WDM- 100GWDM- 40GWDM- 10G APDFTTx- 10G APDFTTx- 2.5G APD62% (12%)

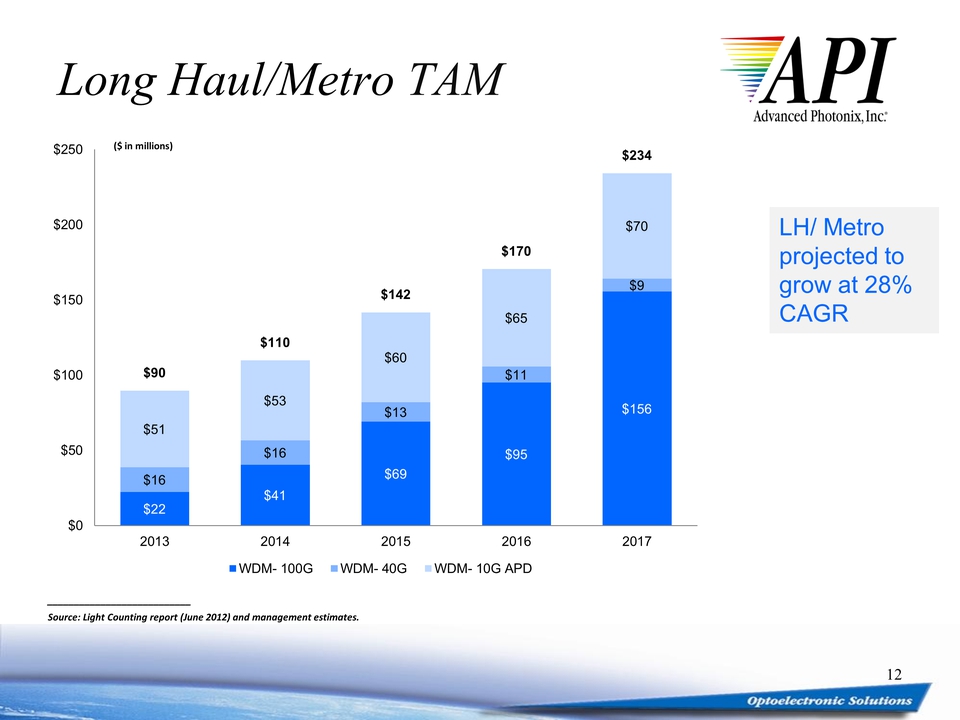

Long Haul/Metro TAM LH/ Metro projected to grow at 28% CAGR Source: Light Counting report (June 2012) and management estimates. 12 ($ in millions) $22 $41 $69 $95 $156 $16 $16 $13 $11 $9 $51 $53 $60 $65 $70 $90 $110 $142 $170 $234 $0$50$100$150$200$25020132014201520162017WDM- 100GWDM- 40GWDM- 10G APD

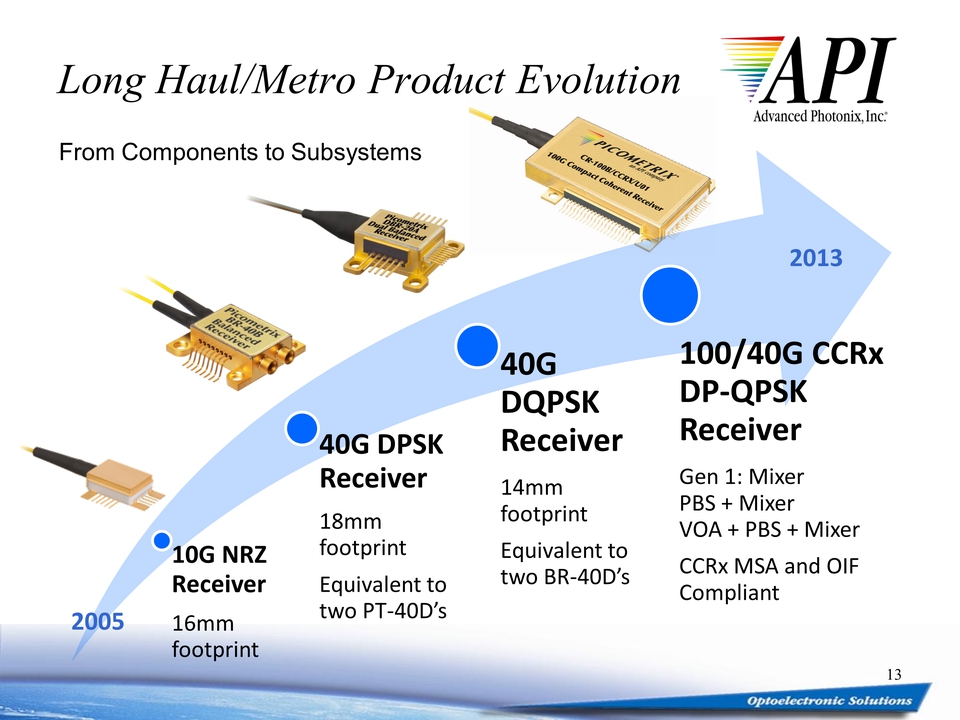

10G NRZ Receiver 16mm footprint 40G DPSK Receiver 18mm footprint Equivalent to two PT-40D’s 40G DQPSK Receiver 14mm footprint Equivalent to two BR-40D’s 100/40G CCRx DP-QPSK Receiver Gen 1: Mixer PBS + Mixer VOA + PBS + Mixer CCRx MSA and OIF Compliant Long Haul/Metro Product Evolution From Components to Subsystems 2005 2013 13

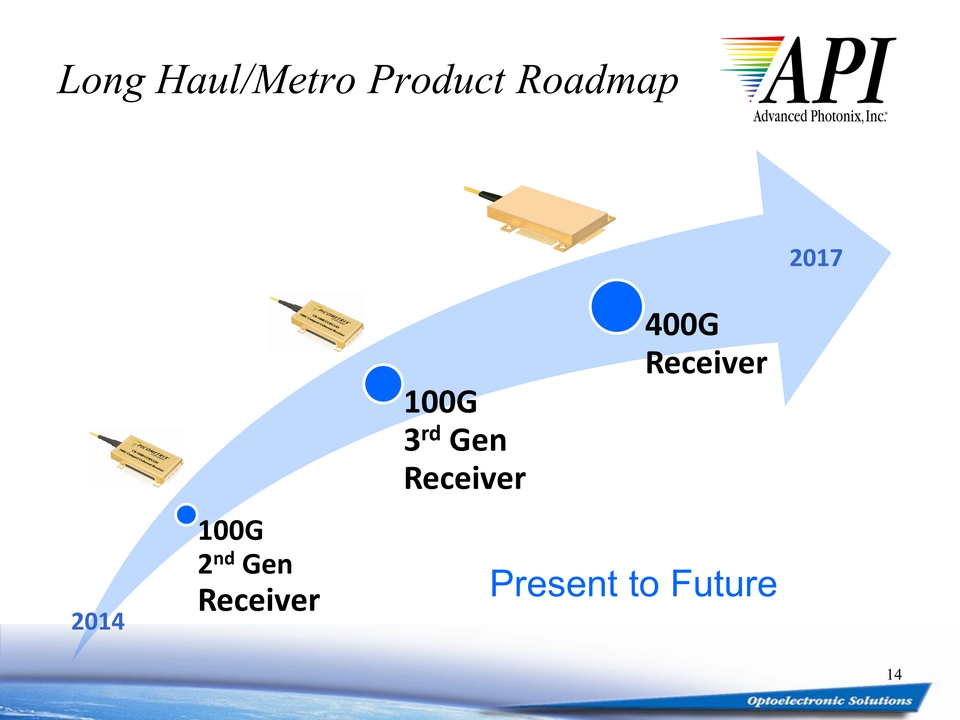

100G 2nd Gen Receiver 100G 3rd Gen Receiver 400G Receiver Long Haul/Metro Product Roadmap 2014 2017 14 Present to Future

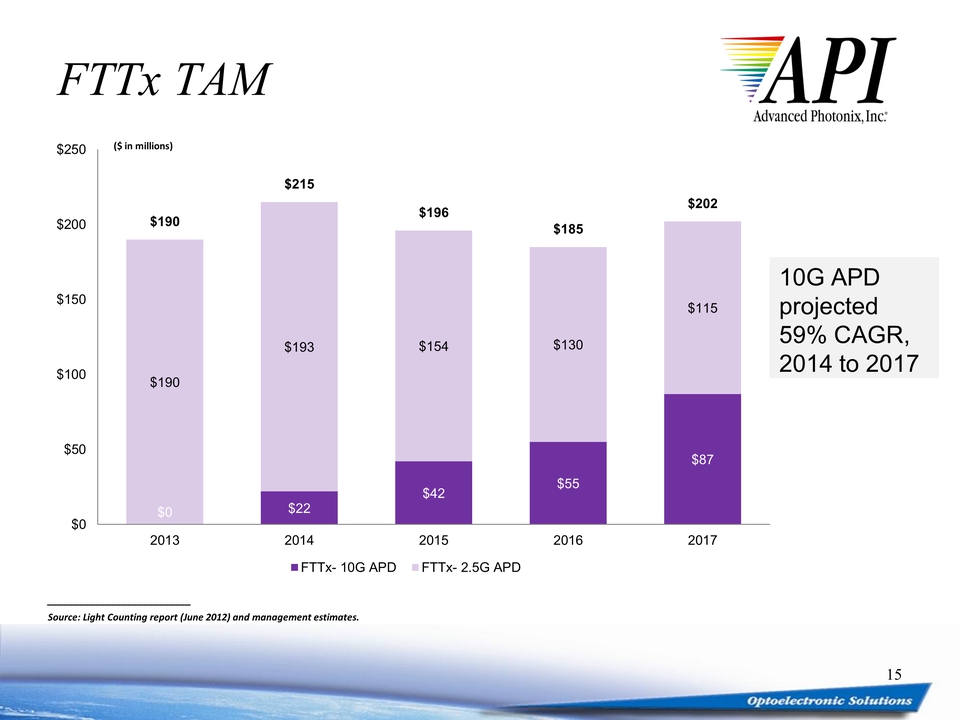

FTTx TAM 10G APD projected 59% CAGR, 2014 to 2017 Source: Light Counting report (June 2012) and management estimates. 15 ($ in millions) $0 $22 $42 $55 $87 $190 $193 $154 $130 $115 $190 $215 $196 $185 $202 $0$50$100$150$200$25020132014201520162017FTTx- 10G APDFTTx- 2.5G APD

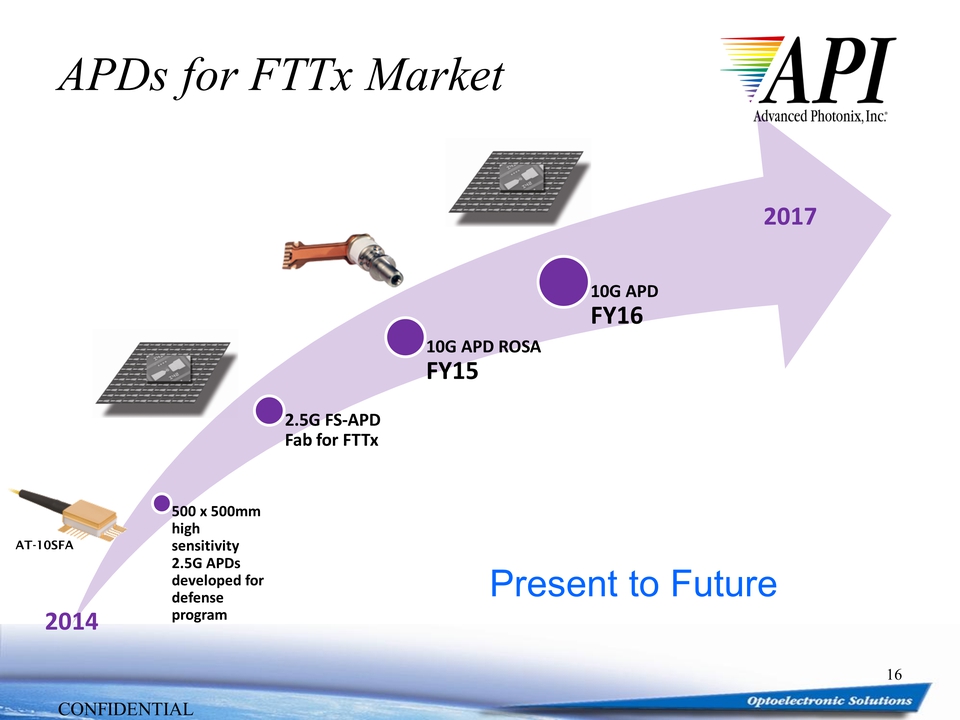

APDs for FTTx Market 500 x 500mm high sensitivity 2.5G APDs developed for defense program 2.5G FS-APD Fab for FTTx 10G APD ROSA FY15 10G APD FY16 2014 2017 AT-10SFA CONFIDENTIAL Present to Future 16

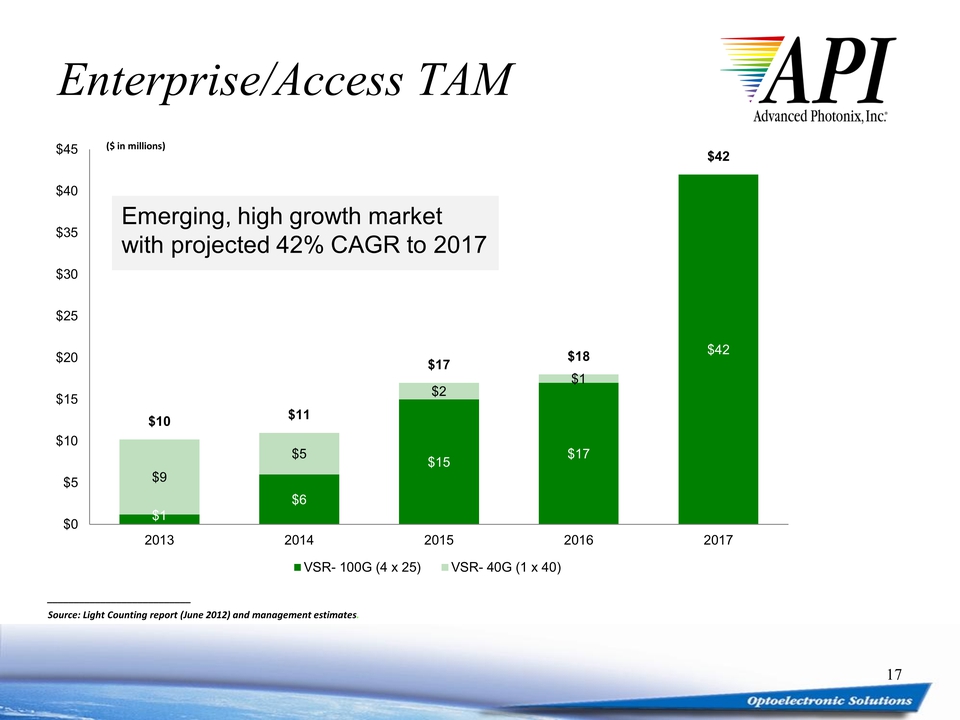

Enterprise/Access TAM Emerging, high growth market with projected 42% CAGR to 2017 ($ in millions) Source: Light Counting report (June 2012) and management estimates. 17 $1 $6 $15 $17 $42 $9 $5 $2 $1 $10 $11 $17 $18 $42 $0$5$10$15$20$25$30$35$40$4520132014201520162017VSR- 100G (4 x 25)VSR- 40G (1 x 40)

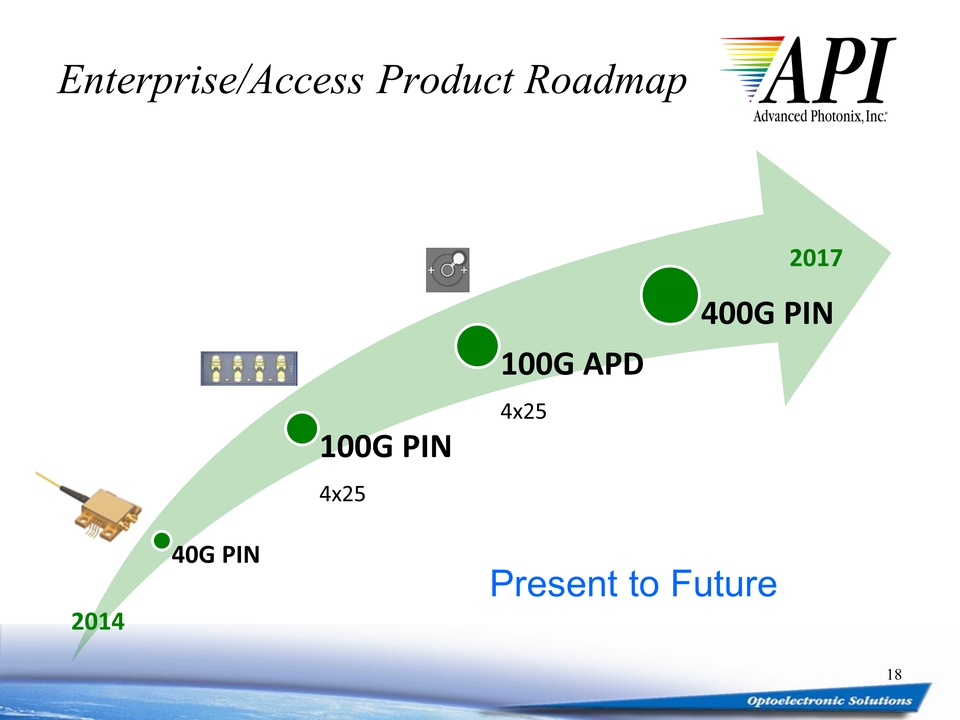

40G PIN 100G PIN 4x25 100G APD 4x25 400G PIN Enterprise/Access Product Roadmap Present to Future 2014 2017 18

Optoelectronic Solutions Military/Space Market High reliability applications Navigation, Guidance Medical Market Imaging Diagnostics Test & Measurement Water turbidity Safety, Process Control Currency Validation 19

20 Military Applications (subsystems) Missile guidance Laser range finders Heads-up displays Satellite positioning Navigation

Test & Measurement Market Control Seed Planting Safety monitoring Test & Measurement 21 Raytek 3i Pyrometer Water Quality Monitoring

22 Medical Applications (subsystems) Immunoassay testing Retina Eye Diagnostics Pulse Oximeter Flow Cytometry

Expanding T&M Markets Currency validation Counterfeit detection 23 Diebold Innovation Delivered Glory Glory Global Solutions CA Cummins Allison

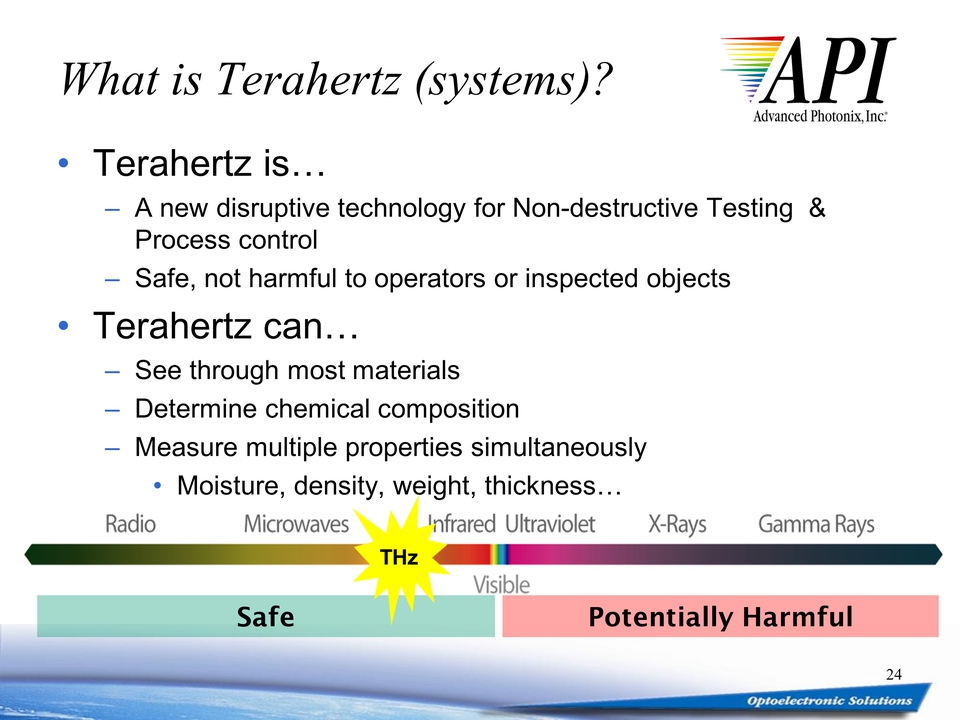

Potentially Harmful Safe 24 What is Terahertz (systems)? Terahertz is… A new disruptive technology for Non-destructive Testing & Process control Safe, not harmful to operators or inspected objects Terahertz can… See through most materials Determine chemical composition Measure multiple properties simultaneously Moisture, density, weight, thickness… THz Radio Microwaves Infrared Ultraviolet X-Rays Gamma Rays

T-Gauge® Sensor 5th Generation targeted at Industrial Process Control $30 Million invested in R&D over 11 years with >35 patents and patents pending Continuous manufacturing applications Paper, plastics, shingles, flat roofs, walkways Replacing nuclear gauges (NG) Total NG market size $100 million annually Customers Fortune 500 25

Industrial Markets 26 Quality and Process Control [TAM growing to $100M] Industrial Process Control [TAM growing to $80M] Extruded web or roofing [TAM $50M] Nuclear gauge replacement Multiple measurements for process control Extruded Pipe Market Replacing ultrasonic gauging Automotive [TAM $10M] Fuel Tank thickness measurements Paper [TAM $10M] Coatings Package product inspection [TAM $10M] Pharmaceuticals, consumer goods

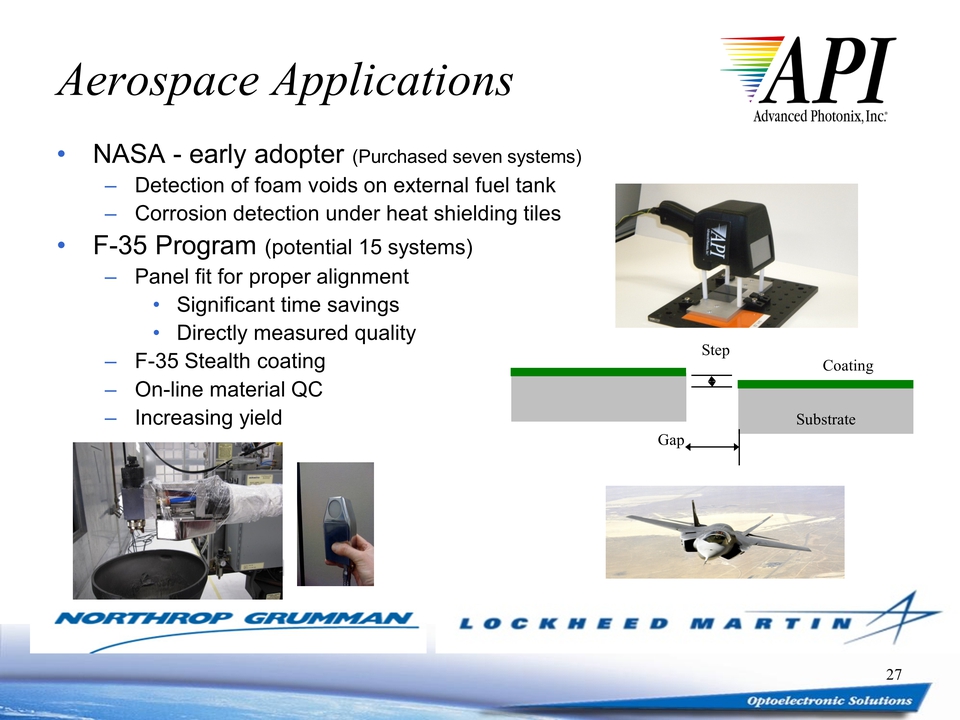

Aerospace Applications NASA early adopter (Purchased seven systems) Detection of foam voids on external fuel tank Corrosion detection under heat shielding tiles F-35 Program (potential 15 systems) Panel fit for proper alignment Significant time savings Directly measured quality F-35 Stealth coating On-line material QC Increasing yield 27 Step Gap Coating Substrate Northrop Grumman Lockheed Martin

Company Growth Strategy 5 Year CAGR 25% ($814M TAM) Components HSOR (TAM growing to $484M) Expanding customer base Offshore manufacturing Homerun potential with Fiber-to-the-home (FTTx) 2.5G and 10G Die Subsystems Custom Optosolutions (TAM $150M) New product development Market share growth Strategic acquisitions & partnerships Systems Terahertz (TAM growing to $180M) Process and quality control market expansion Establishing worldwide distribution VARs 28

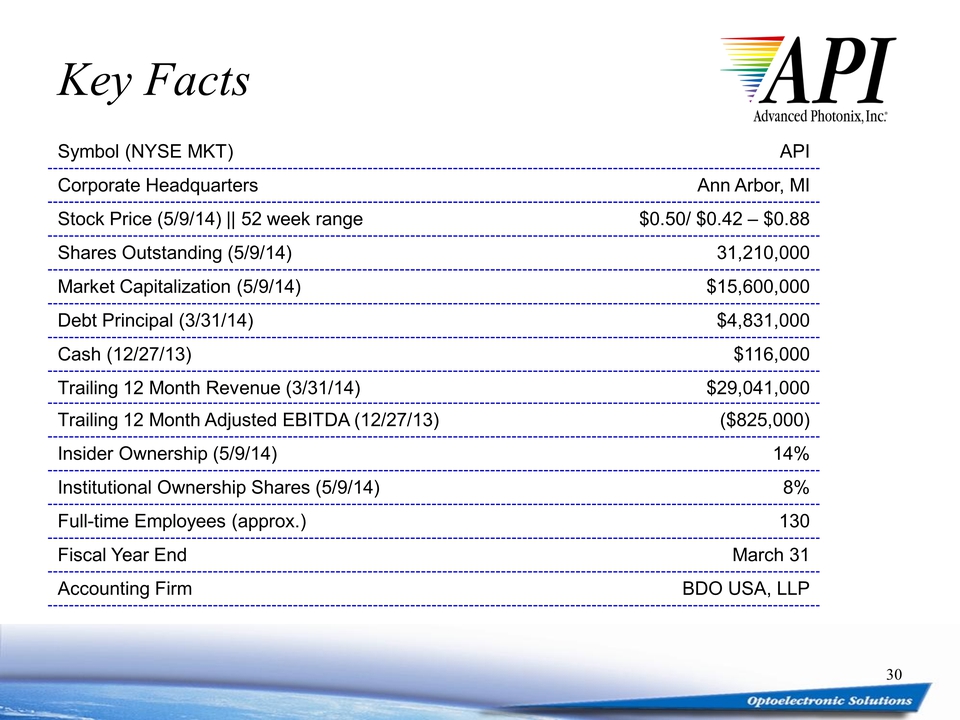

Key Facts Symbol (NYSE MKT) API Corporate Headquarters Ann Arbor, MI Stock Price (5/9/14) || 52 week range $0.50/ $0.42 $0.88 Shares Outstanding (5/9/14) 31,210,000 Market Capitalization (5/9/14) $15,600,000 Debt Principal (3/31/14) $4,831,000 Cash (12/27/13) $116,000 Trailing 12 Month Revenue (3/31/14) $29,041,000 Trailing 12 Month Adjusted EBITDA (12/27/13) ($825,000) Insider Ownership (5/9/14) 14% Institutional Ownership Shares (5/9/14) 8% Full-time Employees (approx.) 130 Fiscal Year End March 31 Accounting Firm BDO USA, LLP 30

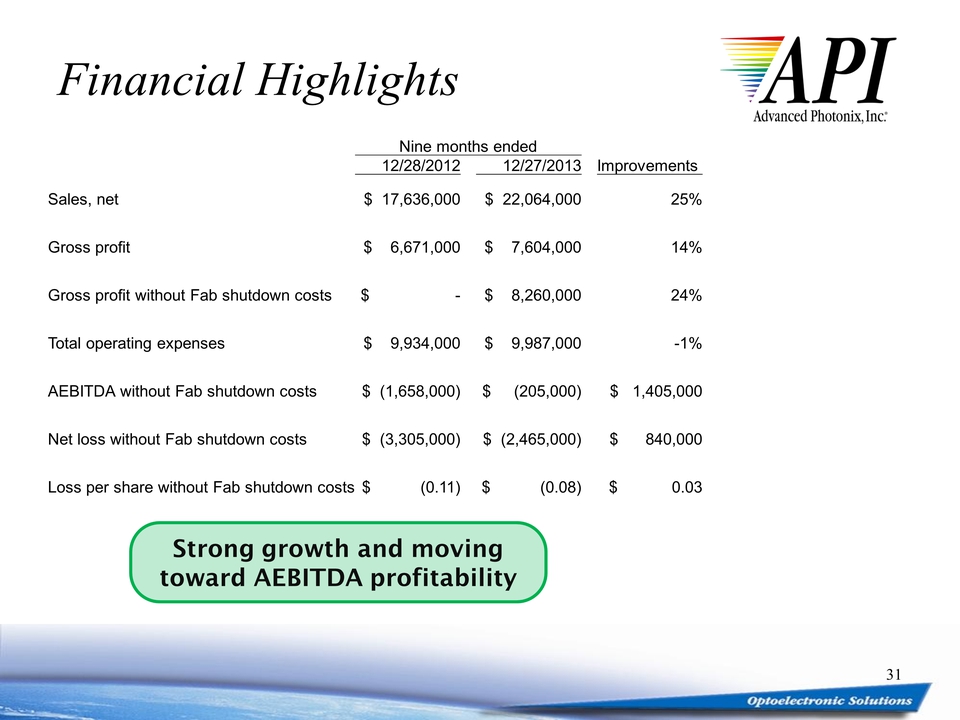

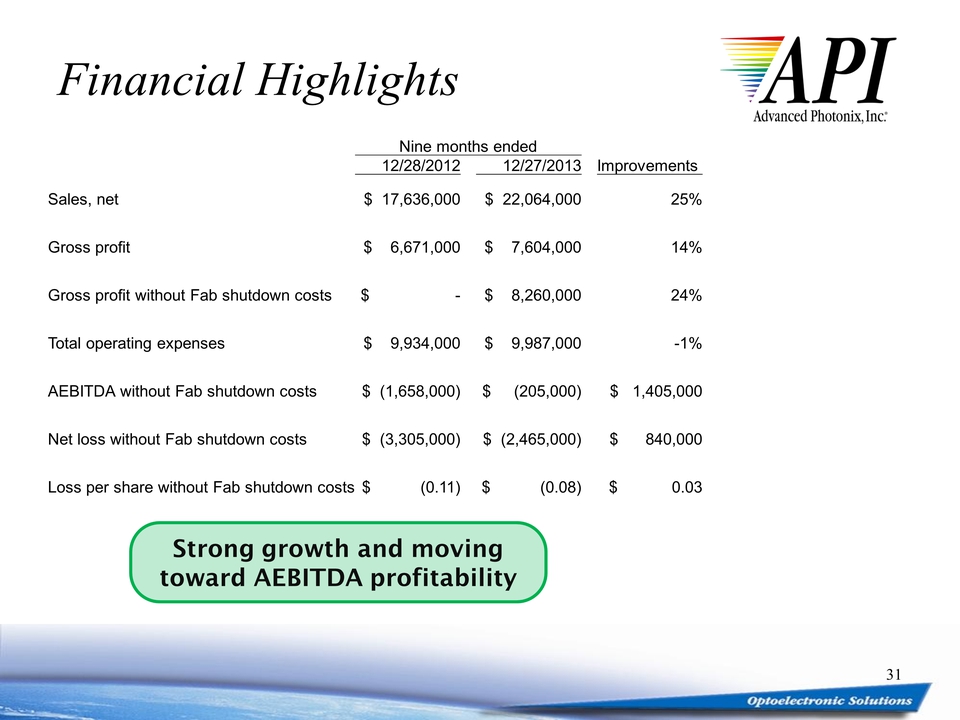

Financial Highlights 31 Nine months ended 12/28/2012 12/27/2013 Improvements Sales, net $ 17,636,000 $ 22,064,000 25% Gross profit $ 6,671,000 $ 7,604,000 14% Gross profit without Fab shutdown costs $ - $ 8,260,000 24% Total operating expenses $ 9,934,000 $ 9,987,000 -1% AEBITDA without Fab shutdown costs $ (1,658,000) $ (205,000) $ 1,405,000 Net loss without Fab shutdown costs $ (3,305,000) $ (2,465,000) $ 840,000 Loss per share without Fab shutdown costs $ (0.11) $ (0.08) $ 0.03 Strong growth and moving toward AEBITDA profitability

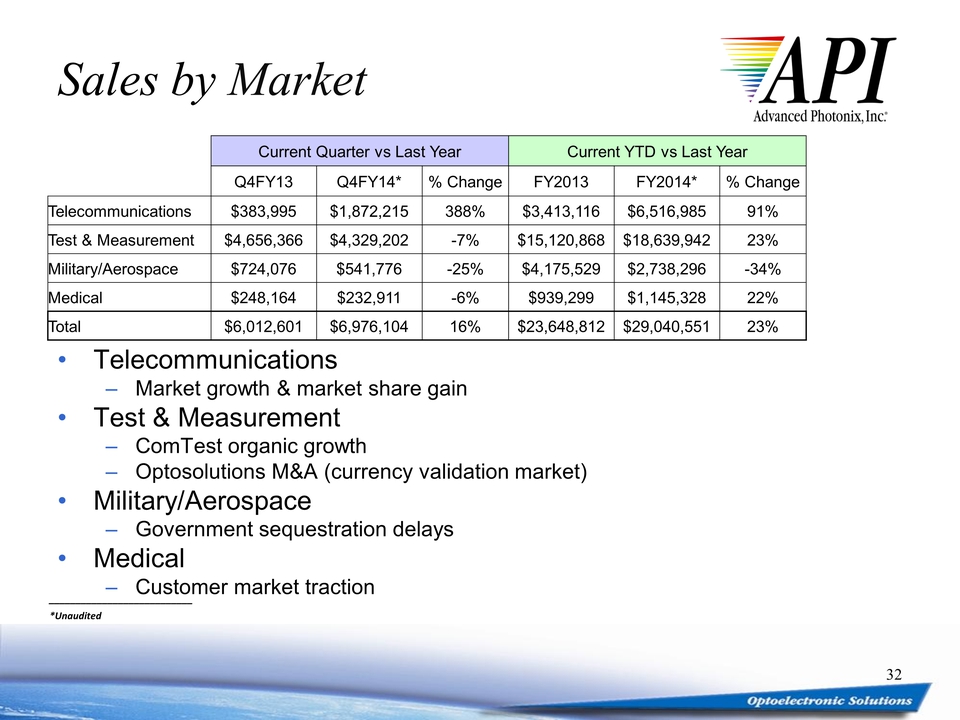

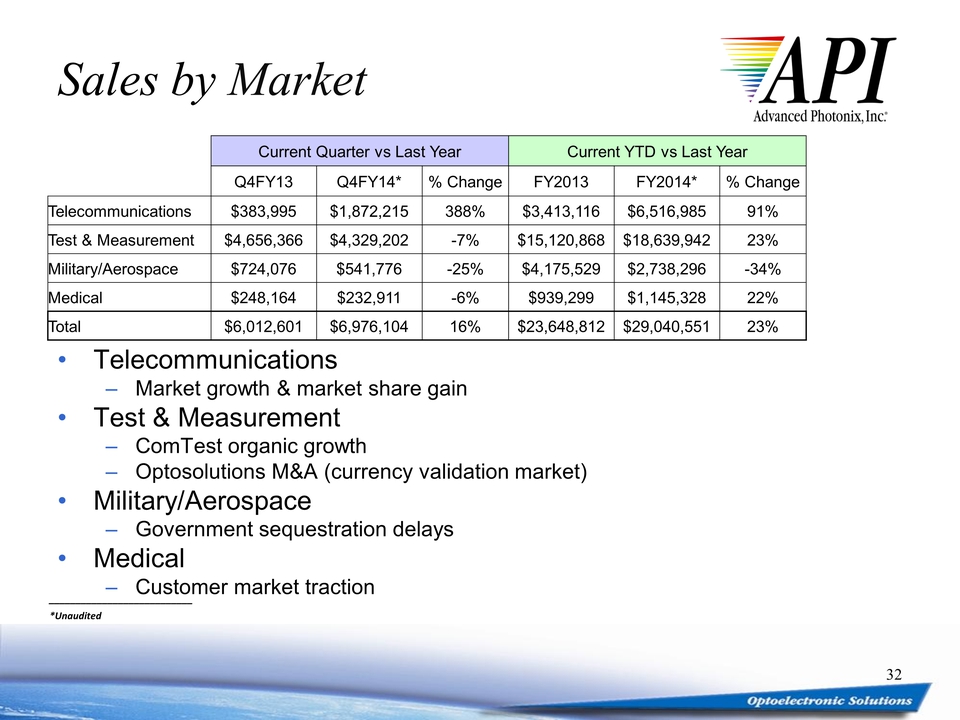

Sales by Market 32 Current Quarter vs Last Year Current YTD vs Last Year Q4FY13 Q4FY14* % Change FY2013 FY2014* % Change Telecommunications $383,995 $1,872,215 388% $3,413,116 $6,516,985 91% Test & Measurement $4,656,366 $4,329,202 -7% $15,120,868 $18,639,942 23% Military/Aerospace $724,076 $541,776 -25% $4,175,529 $2,738,296 -34% Medical $248,164 $232,911 -6% $939,299 $1,145,328 22% Total $6,012,601 $6,976,104 16% $23,648,812 $29,040,551 23% Telecommunications Market growth & market share gain Test & Measurement ComTest organic growth Optosolutions M&A (currency validation market) Military/Aerospace Government sequestration delays Medical Customer market traction *Unaudited

Financial Actions Focusing on growth markets Telecom & ComTest Test & Measurement (Terahertz) Managing to superior margins 5% to 10% higher gross margin than peers Continued cost reduction (ML&B) Investor Relations awareness programs Presenting at various investor conferences Corporate media video clips 33

Compelling Reasons to Become a Shareholder Company trades at low multiples with high revenue growth rates and growth prospects Participating in high growth sectors of Telecom and ComTest markets (100G and beyond) Terahertz just entering adoption phase for industrial systems leading to long term growth opportunities Homerun potential in leveraging core technologies for enterprise & FTTx telecom and Terahertz industrial markets Significant earnings leverage in a growth scenario due to high value-added content and superior margins 34

Thank You Richard Kurtz, President & CEO rkurtz@advancedphotonix.com NYSE MKT: API www.advancedphotonix.com