As filed with the Securities and Exchange Commission on July 23, 2010

Securities Act File No. 333-_______

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Pre-Effective Amendment No. __

Post-Effective Amendment No. __

(Check appropriate box or boxes)

Quaker Investment Trust

(Exact Name of Registrant as Specified in Charter)

309 Technology Drive Malvern, PA 19355 (Address of Principal Executive Offices) Registrant’s Telephone Number: 610-455-2200 Jeffry H. King, Sr. Quaker Investment Trust 309 Technology Drive Malvern, PA 19355 (Name and Address of Agent for Service) |

Copy to: Jonathan M. Kopcsik, Esq. Stradley Ronon Stevens & Young, LLP 2600 One Commerce Square Philadelphia, PA 19103 |

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective.

Title of Securities Being Registered: Class A Shares of common stock, beneficial interest, par value $0.01, of Quaker Akros Absolute Strategies Fund.

It is proposed that this filing will become effective on August 22, 2010, pursuant to Rule 488.

No filing fee is due because an indefinite number of shares of the Quaker Akros Absolute Strategies Fund have been deemed to be registered in reliance on Section 24(f) under the Investment Company Act of 1940, as amended.

Akros Absolute Return Fund

a series of Trust for Professional Managers

615 East Michigan Street

Milwaukee, Wisconsin 53202

1-877-257-6748

Special Meeting of Shareholders to be held [_________], 2010

Dear Shareholder:

Your Board of Trustees has called a Special Meeting of Shareholders (the “Special Meeting”) of the Akros Absolute Return Fund (the “Akros Fund”), a series of Trust for Professional Managers (the “Trust”) which is scheduled for 10:00 a.m., Central time, on [_________], 2010 at the offices of the Akros Fund’s administrator, U.S. Bancorp Fund Services, LLC, 615 East Michigan Street, Milwaukee, Wisconsin 53202.

The Trust’s Board of Trustees recommends that the Akros Fund be combined with the Quaker Akros Absolute Strategies Fund (the “Quaker Fund”), a series of the Quaker Investment Trust, in a tax-free reorganization (the “Reorganization”). No sales charges or redemption fees will be imposed in connection with the Reorganization.

You are being asked to vote to approve an Agreement and Plan of Reorganization. If approved by shareholders, you will become a shareholder of the Quaker Fund on the date that the Reorganization occurs. Among other things, the accompanying document describes the proposed transaction and compares the strategies and expenses of Quaker Fund for your evaluation.

The Quaker Fund is a newly created fund with investment objectives, strategies and policies that are substantially similar to the Akros Fund. The portfolio manager that currently manages the Akros Fund will continue to manage the portfolio as portfolio manager to the Quaker Fund using the same investment approach.

After careful consideration, the Trust’s Board of Trustees unanimously approved the Reorganization and recommends that each Akros Fund shareholder vote “FOR” the Reorganization.

A Proxy Statement/Prospectus that describes the Reorganization is enclosed. Your vote is very important to us regardless of the number of shares of the Akros Fund that you own. Whether or not you plan to attend the Special Meeting in person, please read the Proxy Statement/Prospectus and cast your vote promptly. It is important that your vote be received by no later than the time of the Special Meeting on [_________], 2010. You may cast your vote by completing, signing, and returning the enclosed proxy card by mail in the envelope provided. If you have any questions before you vote, please contact the Akros Fund by calling toll-free 1-877-257-6748. We will get you the answers that you need promptly.

In addition to voting by mail you may also vote by either telephone or via the Internet as follows:

| | |

| (1) Read the Proxy Statement/Prospectus and have your proxy card at hand. | | (1) Read the Proxy Statement/Prospectus and have your proxy card at hand. |

| | | |

| (2) Call the 1-800 number that appears on your proxy card. | | (2) Go to the website address printed on your proxy card. |

| | | |

| (3) Enter the control number set forth on the proxy card and follow the simple instructions. | | (3) Enter the control number set forth on the proxy card and follow the simple instructions. |

| | | |

We encourage you to vote by telephone or via the Internet by using the control number that appears on your enclosed proxy card. Use of telephone or Internet voting will reduce the time and costs associated with this proxy solicitation.

NOTE: You may receive more than one proxy package if you hold shares in more than one account. You must return separate proxy cards for separate holdings. We have provided pre-addressed return envelopes for each, which require no postage if mailed in the United States.

We appreciate your participation and prompt response in this matter and thank you for your continued support.

Sincerely,

Joseph C. Neuberger

President

Trust for Professional Managers

Akros Absolute Return Fund

a series of Trust for Professional Managers

615 East Michigan Street

Milwaukee, Wisconsin 53202

1-877-257-6748

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

OF THE AKROS ABSOLUTE RETURN FUND

To Be Held on [_________], 2010

To the Shareholders:

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders of the Akros Absolute Return Fund, a series of the Trust for Professional Managers, will be held at the offices of U.S. Bancorp Fund Services, LLC, 615 East Michigan Street, Milwaukee, Wisconsin 53202 on [_________], 2010, at 10:00 a.m., Central time.

At the Special Meeting you will be asked to consider and approve the following proposals:

(1) To approve or disapprove the Agreement and Plan of Reorganization, providing for: (i) the acquisition of all of the assets and the assumption of all of the liabilities of the Akros Absolute Return Fund, in exchange for shares of beneficial interest of the Quaker Akros Absolute Strategies Fund (the “Reorganization”); and (ii) the subsequent liquidation of the Akros Absolute Return Fund; and

(2) To transact such other business as may properly come before the Special Meeting or any adjournments or postponements thereof.

You may vote at the Special Meeting if you are the record owner of shares of the Akros Absolute Return Fund as of the close of business on July 31, 2010 (the “Record Date”). If you attend the Special Meeting, you may vote your shares in person. If you do not attend the Special Meeting, you may vote by proxy by completing, signing, and returning the enclosed proxy card by mail in the envelope provided or follow the instructions on the proxy card in order to vote by telephone or Internet as soon as possible.

Your vote is very important to us. If you have any questions, please contact [Proxy Solicitor] for additional information by calling toll-free [____________].

By order of the Board of Trustees of

Trust for Professional Managers

Rachel A. Spearo

Secretary

August [_], 2010

PROXY STATEMENT/PROSPECTUS

August [_], 2010

Akros Absolute Return Fund

a series of Trust for Professional Managers

615 East Michigan Street

Milwaukee, Wisconsin 53202

1-877-257-6748

PROSPECTUS FOR:

Quaker Akros Absolute Strategies fund

309 Technology Drive

Malvern, PA 19355

1-888-220-8888

INTRODUCTION

This combined Proxy Statement and Prospectus (“Proxy Statement/Prospectus”) is being furnished in connection with the solicitation of proxies by the Board of Trustees of Trust for Professional Managers, a Delaware statutory trust (“TPM”), of which the Akros Absolute Return Fund (the “Acquired Fund”) is a separate investment series, for a Special Meeting of Shareholders (the “Special Meeting”). The Special Meeting will be held at the offices of U.S. Bancorp Fund Services, LLC, 615 East Michigan Street, Milwaukee, Wisconsin 53202, on [_________], 2010, at 10:00 a.m., Central time. As more fully described in this Proxy Statement/Prospectus, the purpose of the Special Meeting is to vote on a proposed reorganization (the “Reorganization”) of the Akros Absolute Return Fund into the Quaker Akros Absolute Strategies Fund (the “Quaker Fund” or “Surviving Fund”), which is a series of the Quaker Investment Trust, a Delaware statutory trust (the “Quaker Trust”).

Because shareholders of the Acquired Fund are being asked to approve the Agreement and Plan of Reorganization (the “Plan”) that will result in transactions in which those shareholders will ultimately hold shares of the Quaker Fund, this Proxy Statement/Prospectus also serves as a Prospectus for the Quaker Fund.

This Proxy Statement/Prospectus, which should be read and retained for future reference, sets forth concisely the information that a shareholder should know before voting on the Agreement and Plan of Reorganization. A Statement of Additional Information (“SAI”) relating to this Proxy Statement/Prospectus, dated August [__], 2010, containing additional information about the Reorganization and the parties thereto, has been filed with the U.S. Securities and Exchange Commission (“SEC”) and is incorporated herein by reference. You may receive a copy of the SAI without charge by contacting the Akros Absolute Return Fund at 615 East Michigan Street, Milwaukee, WI 53202, or calling toll free 1-877-257-6748.

For more information regarding the Akros Absolute Return Fund, see the prospectus and SAI dated December 29, 2009, which have been filed with the SEC and which are incorporated herein by

reference. The annual report of the Akros Absolute Return Fund for the fiscal year ended August 31, 2009, which highlights certain important information such as investment results and financial information and which have been filed with the SEC, are incorporated herein by reference. You may receive copies of the prospectuses, SAI and shareholder reports mentioned above without charge by contacting the Akros Absolute Return Fund, c/o U.S. Bancorp Fund Services, LLC, P.O. Box 701, Milwaukee, WI 53201-0701, or calling toll free 1-877-257-6748.

The Quaker Fund is a newly created fund and is not yet operational. You may receive copies of the prospectus and SAI, both dated August [9], 2010 without charge by contacting the Quaker Fund, c/o U.S. Bancorp Fund Services, LLC, PO Box 701, Milwaukee, WI 53201-0701 or calling toll free 1-800-220-8888.

You can copy and review information about the Akros Absolute Return Fund and the Quaker Fund (including the SAI) at the SEC’s Public Reference Room in Washington, D.C. You may obtain information on the operation of the Public Reference Room by calling the SEC at 202-551-8090 or 1-800-SEC-0330. Reports and other information about the Funds are available on the EDGAR Database on the SEC’s Internet site at http://www.sec.gov. You may obtain copies of this information, after paying a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Section, 100 F Street N.E., Washington, D.C. 20549-0102.

THE U.S. SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES, OR DETERMINED THAT THIS PROXY STATEMENT/PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

TABLE OF CONTENTS

| SYNOPSIS | |

The Reorganization | |

Comparison of the Funds’ Investment Objectives and Strategies | |

Comparison of the Fund’s Principal Risks | |

Comparison of the Funds’ Portfolio Management | |

Comparison of Acquired Fund and Pro Forma Surviving Fund Fees and Expenses | |

Comparison of the Funds’ Sales Load and Distribution Arrangements | |

Comparison of the Funds’ Purchase and Redemption Procedures; Exchange Procedures; Dividends, Distributions, and Pricing | |

| INFORMATION ABOUT THE REORGANIZATION | |

| Material Features of the Plan | |

| Reasons for the Reorganization | |

| Federal Income Tax Consequences | |

| Shareholder Rights, Description of the Securities to be Issued | |

| ADDITIONAL INFORMATION ABOUT THE SURVIVING FUND AND THE ACQUIRED FUND | |

| Comparison of Fundamental Investment Policies | |

| Performance Information | |

| ADDITIONAL INFORMATION | |

| Investment Adviser | |

| Principal Underwriter | |

| Fund Administration and Transfer Agency Services | |

| Custodians | |

| Independent Registered Public Accounting Firm | |

| FINANCIAL HIGHLIGHTS | |

| GENERAL INFORMATION | |

| Solicitation of Votes | |

| Quorum | |

| Vote Required | |

| Effect of Abstentions and Broker “Non-Votes” | |

| Adjournments | |

| Record Date and Outstanding Shares | |

| PRINCIPAL SHAREHOLDERS | |

| CONTROL PERSONS | |

| APPENDIX A | |

| Form of Agreement and Plan of Reorganization | A-1 |

SYNOPSIS

The Reorganization

The Reorganization involves the transfer of all of the assets and liabilities of the Acquired Fund to the Surviving Fund in exchange for Class A Shares of the Surviving Fund. The transfer of assets by the Acquired Fund will occur at their then-current market value, as determined in accordance with the Acquired Fund’s valuation procedures. Class A Shares of the Surviving Fund will be distributed to shareholders of the Acquired Fund in exchange for their shares of the Acquired Fund. After completion of the Reorganization, each shareholder of the Acquired Fund will own Class A Shares of the Surviving Fund equal in value to the current net asset value per share (“NAV”) of such shareholder’s shares of the Acquired Fund. Additionally, after the completion of the Reorganization, the Acquired Fund will be liquidated and its registration under the Investment Company Act of 1940, as amended (the “1940 Act”), will be terminated.

The Reorganization is intended to be a tax-free transaction for federal income tax purposes. This means that shareholders of the Acquired Fund will become shareholders of the Surviving Fund without realizing any gain or loss for federal income tax purposes. This also means that the Reorganization will be a tax-free transaction for the Surviving Fund.

The implementation of the Reorganization is subject to a number of conditions set forth in the Plan. Among the more significant conditions is the receipt by the Funds of an opinion of counsel to the effect that the Reorganization will be treated as a tax-free transaction to the Funds and their shareholders for federal income tax purposes, as described further below. The Acquired Fund does not expect to sell securities held in the portfolio in connection with effectuating the Reorganization. For more information about the Reorganization, see “Information About the Reorganization” below.

Quaker Funds, Inc., the investment manager of the Surviving Fund (the “Manager”), and Akros Capital, LLC, the investment adviser for the Acquired Fund and the sub-adviser to the Surviving Fund (“Akros Capital”), have undertaken to bear and pay all expenses related to the proxy solicitation.

For the reasons set forth below under “Information about the Reorganization – Reasons for the Reorganization,” the Board of Trustees, including all of the Trustees who are not “interested persons” of the Trust, as that term is defined in the 1940 Act (the “Independent Trustees”), has concluded that the Reorganization would be in the best interests of the Acquired Fund, and therefore has submitted the Plan for approval to you, the shareholders of the Acquired Fund. The Board recommends that you vote FOR the Reorganization.

Comparison of the Funds’ Investment Objectives and Strategies

Investment Objectives. The Acquired Fund investment objective is to seek to provide long-term capital appreciation and income, while seeking to protect principal during unfavorable market conditions. The Surviving Fund’s investment objective is identical to the Acquired Fund.

Investment Strategies. The principal investment strategies of the Acquired Fund and the Surviving Fund are substantially similar. The primary difference between the investment strategies of the two Funds is that unlike the Acquired Fund, the Surviving Fund’s principal investment strategies do not include investing in initial public offerings, private placements (also known as restricted securities), warrants, or aggressively lending portfolio securities. In pursuing their investment objectives, the Funds both employ the following investment strategies:

Absolute return strategies seek positive returns regardless of market conditions. To achieve their investment objective, the Funds’ portfolio manager, will invest in securities, including common and

preferred stock of companies of any size. The Funds may also invest up to 100% of their net assets in debt instruments, including convertible debt, options and futures, as well as privately negotiated options. The Funds may also invest up to 30% of their net assets in foreign securities, including American Depositary Receipts (“ADRs”) and European Depositary Receipts (“EDRs”). The Funds invest significantly (up to 20% of their net assets in satisfaction of margin requirements) in futures contracts on stock indexes, a wide variety of swap agreements, options on futures contracts and other financial instruments such as options on securities and stock index options. The maximum position of the Funds in stocks, either directly through stocks or indirectly through options, futures and swaps, will be limited to 125% of their net assets including borrowing. The Funds use these investments to produce “leveraged” investment results, which generate returns that are more pronounced, both positively and negatively, than what would be generated on invested capital without leverage, thus changing small market movements into larger changes in the value of the investments. The portfolio manager shall engage in a high level of trading in seeking to achieve the Funds’ investment objectives.

The Funds may invest in debt securities (up to 30% of their net assets) that fall below investment grade debt (securities rated below BBB by Standard & Poor’s Rating Service (“S&P”) or below Baa by Moody’s Investors Service, Inc. (“Moody’s”))— commonly referred to as “junk bonds.” However, the Funds will not invest in debt securities rated below D by S&P or Moody’s. The maturities and durations of the fixed-income securities will vary widely depending on market conditions, the quality of the securities in which the Funds are invested, and where the Funds’ portfolio manager believes the markets are in the investment cycle.

Additionally, the Funds may invest in asset-backed securities, such as automobile receivables, credit-card receivables, equipment leases, health-care receivables, home-equity loans, litigation-finance notes and student loans, as well as mortgage-backed securities and Federal Home Loan Bank securities, and other fixed-income securities of higher credit quality, derivative securities of traditional fixed-income instruments, reverse repurchase agreements and warrants.

To achieve their objectives, the portfolio manager may use derivative transactions and arbitrage investment strategies, and may change over time as new instruments and techniques are introduced or as a result of regulatory or market developments. For hedging purposes, the portfolio manager may simultaneously take long and short positions on similar securities for which there exists an attractive spread to their relative valuations.

The Funds will invest substantially in derivatives that may involve a sizeable amount of economic leveraging that will cause returns to be volatile.

Comparison of the Funds’ Principal Risks

The Acquired Fund and Surviving Fund are both subject to the following principal risks:

| · | Management Risk. The ability of the Fund to meet its investment objective is directly related to the Fund’s investment strategies for the Fund. Your investment in the Fund varies with the effectiveness of Akros Capital’s research, analysis and asset allocation among portfolio securities. If Akros Capital’s investment strategies do not produce the expected results, your investment could be diminished or even lost. |

| · | Market Risk. Different types of stocks tend to shift into and out of favor with market investors, depending on market and economic conditions. For instance, from time to time the stock market may not favor growth-oriented stocks or the stocks of large capitalization companies. Rather, the market could favor value stocks or the stocks of smaller companies, or the market may not favor equity securities at all during a certain time. Accordingly, as this Fund may change its investment focus between growth and value or between large and small-cap stocks, , performance may at times be better or worse than the performance of stock funds that focus on other types of stocks, or that have a broader investment style. |

| · | Common Stock Risk. Risks include the financial risk of selecting individual companies that do not perform as anticipated, the risk that the stock markets in which the Fund invests may experience periods of turbulence or |

| | instability, and the general risk that domestic and global economies may go through periods of decline and cyclical change. |

| · | Small- and Mid-Cap Company Risk. Investing in small and medium-size companies, even indirectly, may involve greater volatility than investing in larger and more established companies. Small companies may have limited product lines, markets or financial resources and their management may be dependent on a limited number of key individuals. Securities of those companies may have limited market liquidity, and their prices may be more volatile. |

| · | Large-Cap Company Risk. Larger, more established companies may be unable to respond quickly to new competitive challenges, such as changes in consumer tastes or innovative smaller competitors. Also, large-cap companies are sometimes unable to attain the high growth rates of successful, smaller companies, especially during extended periods of economic expansion. |

| · | Foreign Securities Risk. To the extent that the Fund invests in securities of foreign companies, including ADRs and EDRs, the Fund is subject to foreign securities risk. Foreign companies may not be subject to the regulatory requirements of U.S. companies; foreign companies generally are not subject to uniform accounting, auditing and financial reporting standards; dividends and interest on foreign securities may be subject to foreign withholding taxes; and foreign securities are often denominated in a currency other than the U.S. dollar, which will subject the Fund to the risks associated with fluctuations in currency values. |

| · | Credit Risk. Debt obligations are generally subject to the risk that the issuer will default on interest or principal payments. Adverse changes in the creditworthiness of an issuer can have an adverse effect on the value of the issuer’s securities. Investments in below investment grade debt are considered to be more speculative and susceptible to credit risk than higher quality fixed income securities. |

| · | Interest Rate Risk. Fixed-income securities are subject to the risk that the securities could lose value because of interest rate changes. For example, bonds tend to decrease in value as interest rates rise. Debt obligations with longer maturities sometimes offer higher yields, but are subject to greater price shifts as a result of interest rate changes than debt obligations with shorter maturities. |

| · | Mortgage-Backed and Asset-Backed Securities Risk. Falling interest rates could cause faster than expected prepayments of the obligations underlying mortgage- and asset-backed securities, which the Fund would have to invest at lower interest rates. Conversely, rising interest rates could cause prepayments of the obligations to decrease, extending the life of mortgage- and asset-backed securities with lower payment rates. |

| · | Short Selling Risk. Positions in shorted securities are speculative and more risky than long positions (purchases). When a Fund engages in short selling, it sells a security it does not own in anticipation of being able to buy that security later at a lower price. If the price of the security increases, the Fund loses money. Further, during the time when the Fund has shorted the security, the Fund must borrow that security in order to make delivery on the previous sale, which raises the cost to the Fund. Such investments involve the risk of an unlimited increase in the market price of the security sold short, which could result in a theoretically unlimited loss. Short sale strategies are often categorized as a form of leveraging or speculative investment. The use of leverage may multiply small price movements in securities into large changes in value. As a result of using leverage, the Fund’s price may be more volatile than if no leverage were used. Positions in shorted securities are speculative and more risky than long positions. You should be aware that any strategy that includes selling securities short could suffer significant losses. |

| · | Leverage Risk. The use of leverage (i.e., borrowing) may multiply small price movements in securities into large changes in value. As a result of using leverage, the Fund’s price may be more volatile than if no leverage were used. |

| · | Derivative Instruments Risk. Derivatives involve substantial risk, because a relatively small change in the security or index underlying a derivative can produce a disproportionately large profit or loss. If the Fund has a derivative investment that begins to deteriorate, there may be no way to sell it and avoid further losses, because no buyer may be available. In addition, the securities underlying some derivatives may be illiquid. The Fund may be forced to hold a position until exercise or expiration, which could result in losses. |

| · | Swap Agreement Risk. The Fund may enter into equity, interest rate, index and currency rate swap agreements. A swap contract may not be assigned without the consent of the counter-party, and may result in losses in the event of a default or bankruptcy of the counter-party. Such investments may become illiquid. |

| · | Portfolio Turnover Risk. Because the Fund has a very high portfolio turnover, it will incur significant additional costs due to brokerage commission expenses (and dealer spreads built into the cost of securities) than |

| | those incurred by a fund with a lower portfolio turnover rate. These additional expenses will substantially reduce the Fund’s total return, and the Fund therefore must significantly outperform the market in order to generate a return comparable to market returns. The higher portfolio turnover rate may result in the realization for federal income tax purposes of additional net capital gains, which also may result in substantial ordinary income to shareholders and negatively affect the Fund’s after-tax performance. |

| · | Non-Diversification Risk. The Fund is not a “diversified” fund, which means the Fund may allocate its investments to a relatively small number of issuers or to a single industry, making it more susceptible to adverse developments of a single issuer or industry. As a result, investing in the Fund is potentially more risky than investing in a diversified fund that is otherwise similar to the Fund. |

| · | Shares of Other Investment Companies. The Fund may invest in shares of other investment companies, including ETFs, as a means to pursue its investment objective. Federal law generally prohibits a Fund from acquiring shares of an investment company if, immediately after such acquisition, the Fund and its affiliated persons would hold more than 3% of such investment company’s total outstanding shares. This prohibition may prevent the Fund from allocating its investments in an optimal manner. As a result of this policy, your cost of investing in the Fund will generally be higher than the cost of investing directly in the underlying fund shares. You will indirectly bear fees and expenses charged by the underlying funds in addition to the Fund’s direct fees and expenses. Furthermore, the use of this strategy could affect the timing, amount and character of distributions to you and therefore may increase the amount of taxes payable by you. |

| · | Aggressive Investment Risk. The Fund may employ investment strategies that involve greater risks than the strategies used by typical mutual funds, including short sales (which involve the risk of an unlimited increase in the market of the security sold short, which could result in a theoretically unlimited loss), leverage and derivative transactions. The absolute return strategies employed by the Fund generally will emphasize hedged positions rather than non-hedged positions in securities and derivatives in an effort to protect against losses due to general movements in market prices. However, no assurance can be given that such hedging will be successful or that consistent absolute returns will be achieved. |

In addition, the Acquired Fund is subject to the following principal risks:

| · | Concentration Risk. The Fund may concentrate its investments within one industry or sector among a broad range of industries or sectors. Events may occur that impact that industry or sector more significantly than the securities market as a whole. For example, some industries or sectors may lose favor with the investing public and fall rapidly in value due to news events that quickly affect the market’s perception of the industry or sector. As a result, the value of these investments may be subject to greater market fluctuations than investments in a broader range of securities. Furthermore, each industry or sector possesses particular risks that may not affect other industries or sectors. |

| · | U.S. Government Obligations. The Fund may invest in various types of U.S. Government obligations. U.S. Government obligations include securities issued or guaranteed as to principal and interest by the U.S. Government, its agencies or instrumentalities, such as the U.S. Treasury. Payment of principal and interest on U.S. Government obligations may be backed by the full faith and credit of the United States or may be backed solely by the issuing or guaranteeing agency or instrumentality itself. In the latter case, the investor must look principally to the agency or instrumentality issuing or guaranteeing the obligation for ultimate repayment, which agency or instrumentality may be privately owned. There can be no assurance that the U.S. Government would provide financial support to its agencies or instrumentalities (including government-sponsored enterprises) where it is not obligated to do so. |

| · | Prepayment Risk. Many types of debt instruments are subject to prepayment risk. Prepayment occurs when the issuer of an instrument can repay principal prior to the security’s maturity. Instruments subject to prepayment can offer less potential for gains during a declining interest rate environment and similar or greater potential for loss in a rising interest rate environment. In addition, the potential impact of prepayment features on the price of a debt instrument can be difficult to predict and result in greater volatility. |

| · | Warrant Risk. The Fund may invest in warrants, which are derivative instruments that permit, but do not obligate, the holder to purchase other securities. Warrants do not carry with them any right to dividends or voting rights. A warrant ceases to have value if it is not exercised prior to its expiration date. |

| · | Privately Negotiated Options Risk. The Fund intends to invest in privately negotiated options. Each privately negotiated option will be based on an asset or a basket of securities selected by the Fund. The counter-party to each privately negotiated option will typically be a financial institution (or an affiliate of a financial institution) |

| | that is experienced in the field of alternative investments. Upon expiration or termination of a privately negotiated option, the Fund will be entitled to a cash payment from the counterparty if the value of the asset or basket at that time is favorable to the Fund in comparison to the exercise price for the privately negotiated option. As with more traditional options, privately negotiated options will allow for the use of economic leverage. Although the Fund will not be exposed to risk of loss in excess of its payment for a privately negotiated option, the Fund may incur losses that are magnified by the use of leverage and the payment of fees to the counter-party. The Fund will also be exposed to the risk that the counter-party is unable to pay the settlement price upon the termination or expiration of a privately negotiated option. Under the supervision of the Board of Trustees, the Fund will determine whether investments in privately negotiated options are illiquid. The Fund is restricted to investing no more than 15% of its total assets in securities that are illiquid. |

| · | Reverse Repurchase Agreement Risk. The Fund may invest in reverse repurchase agreements, which involve a sale of a security to a bank or securities dealer and the Fund’s simultaneous agreement to repurchase the security for a fixed price, reflecting a market rate of interest, on a specific date. These transactions involve a risk that the other party to a reverse repurchase agreement will be unable or unwilling to complete the transaction as scheduled, which may result in a loss to the Fund. Reverse repurchase agreements are a form of leverage, which also may increase the volatility of the Fund. |

| · | Initial Public Offerings Risk. The Fund may purchase securities of companies in initial public offerings. Special risks associated with these securities may include a limited number of shares available for trading, unseasoned trading, lack of investor knowledge of the company and limited operating history. These factors may contribute to substantial price volatility for the shares of these companies. The limited number of shares available for trading in some initial public offerings may make it more difficult for the Fund to buy or sell significant amounts of shares without unfavorable impact on prevailing market prices. Some companies in initial public offerings are involved in relatively new industries or lines of business, which may not be widely understood by investors. Some of these companies may be undercapitalized or regarded as developmental stage companies without revenues or operating income, or the near-term prospects of achieving them. |

| · | Private Placements and Restricted Securities Risk. The Fund may invest in restricted securities (securities with limited transferability under the securities laws) acquired from the issuer in “private placement” transactions. Private placement securities are not registered under the Securities Act. They offer attractive investment opportunities not otherwise available on the open market. However, private placements and other restricted securities cannot be resold without registration under the Securities Act or pursuant to an exemption, such as Rule 144A. Rule 144A securities are securities that have been privately placed but are eligible for purchase and sale by certain qualified institutional buyers, such as the Fund, under Rule 144A under the Securities Act. Under the supervision of the Board of Trustees, the Fund will determine whether securities purchased under Rule 144A are illiquid. The Fund is restricted to investing no more than 15% of its total assets in securities that are illiquid. If it is determined that other qualified institutional buyers are unwilling to purchase these securities, the percentage of the Fund’s assets invested in illiquid securities would increase. |

| · | Securities Lending. The Fund may lend securities from its portfolio to brokers, dealers and financial institutions (but not individuals) in order to increase the return on its portfolio. The principal risk of portfolio lending is potential default or insolvency of the borrower. In either of these cases, the Fund could experience delays in recovering securities or collateral or could lose all or part of the value of the loaned securities. |

| · | Arbitrage Trading Risk. The principal risk associated with the Fund’s arbitrage investment strategies are that the underlying relationships between securities in which the Fund takes investment positions may change in an adverse manner, in which case the Fund may realize losses. |

| · | Distressed Securities Risk. Some of the risks involved with distressed securities include legal difficulties and negotiations with creditors and other claimants that are common when dealing with distressed companies. Because of the relative illiquidity of distressed debt and equity, short sales are difficult. Some relative value trades are possible, selling short one class of a distressed company’s capital structure and purchasing another. Among the many risks associated with distressed investing are the time lag between when an investment is made and when the value of the investment is realized and the legal and other monitoring costs that are involved in protecting the value of the Fund’s claims. |

Comparison of the Funds’ Portfolio Management

Akros Capital has served as the Acquired Fund’s investment adviser since its inception. Brady T. Lipp of Akros Capital has been responsible for the day-to-day management of the Acquired Fund’s portfolio since its inception. Mr. Lipp founded Akros Capital in 2003 and serves as its Managing Principal and Chief Executive Officer. Prior to founding Akros Capital, Mr. Lipp was a Managing Director at Credit Suisse Asset Management from 1999 to 2003 and a member of the global post-venture capital investment team, which focused on publicly traded stocks that had professional private-equity backing. He also served as a Managing Director at Warburg Pincus Asset Management from 1994 to 1999 and was an institutional relationship manager at Strong Capital Management from 1987 to 1994. Mr. Lipp has managed accounts using a similar style to the Fund since January 2004.

Following the Reorganization, the Manager will serve as the Surviving Fund’s investment manager and Akros Capital will serve as its sub-adviser. Mr. Lipp will serve as the Surviving Fund’s portfolio manager. The Manager is responsible for recommending to the Surviving Fund’s Board of Trustees whether to hire, terminate or replace sub-advisers to the Surviving Fund, and will oversee the Surviving Fund’s sub-adviser, Akros Capital. Akros Capital will have discretionary responsibility for investment of the assets and the portfolio management of the Surviving Fund. The Manager has entered into a sub-advisory agreement with Akros Capital and will compensate Akros Capital out of the investment advisory fees it will receive from the Surviving Fund.

Comparison of Acquired Fund and Pro Forma Surviving Fund Fees and Expenses

The following table sets forth: (i) the fees and expenses of the Acquired Fund as of August 31, 2009; and (ii) the estimated fees and expenses of the Class A Shares of the Surviving Fund on a pro forma basis after giving effect to the Reorganization, based on pro-forma combined assets as of May 31, 2010. (The fees and expenses for the Surviving Fund are not shown because it had not commenced operations as of the date of this Proxy Statement/Prospectus.)

Shareholder Fees1 (fees paid directly from your investment) | | Acquired Fund | | Pro Forma –Quaker Fund (Class A Shares) after Reorganization |

| Maximum Sales Charge (Load) Imposed on Purchases | | None | | 5.50%1 |

Redemption Fee | | 1.00% | | none |

Annual Fund Operating Expenses (expenses deducted from Fund assets) | | | | |

Investment Advisory Fees | | 1.00% | | 1.25% |

Distribution (12b-1) Fees | | 0.25% | | 0.25% |

| Shareholder servicing fee | | 0.10% | | none |

| | | | | |

| Dividends on Short Positions and Interest Expense | | 0.04% | | 0.04% |

| Other Expenses | | 6.13% | | 0.43% |

Total Other Expenses | | 6.17% | | 0.47% |

Acquired Fund Fees and Expenses2 | | 0.07% | | 0.07% |

Total Annual Fund Operating Expenses | | 7.59% | | 2.04% |

Fee Reduction and/or Expense Reimbursement3 | | (5.49%) | | none |

Net Annual Fund Operating Expense | | 2.10% | | 2.04% |

| 1 | The front-end sales charge will be waived for all Acquired Fund shareholders receiving Surviving Fund shares in connection with the Reorganization and any future purchases of Class A Shares of the Surviving Fund made by shareholders of the Acquired Fund, including reinvested dividends. |

| 2 | The “Total Annual Fund Operating Expenses” will not correlate to the ratio of expenses to average net assets in the Acquired Fund’s Financial Highlights, which reflect operating expenses and do not include “Acquired Fund Fees and Expenses.” Acquired Fund Fees and Expenses for the Surviving Fund are based on estimated amounts for the current fiscal year. |

| 3 | Pursuant to an operating expense limitation agreement between the Acquired Fund and Akros Capital, Akros Capital has agreed to waive its fees and/or absorb expenses of the Acquired Fund to ensure that Total Annual Fund Operating Expenses (excluding dividends on short positions, interest expense and Acquired Fund Fees and Expenses) do not exceed 1.99% of the Acquired Fund’s average annual net assets until August 31, 2010 and for an indefinite period thereafter (the “Fee Waiver Agreement”). This Fee Waiver Agreement can be terminated at any time by, or with the consent of, the Acquired Fund’s Board of Trustees. Akros Capital is permitted to seek reimbursement from the Fund, subject to limitations, for fees it waived and Acquired Fund expenses it paid for the prior three fiscal years, so long as the reimbursement does not cause the Acquired Fund’s operating expenses to exceed the expense cap. Additionally, the Manager and Akros Capital have contractually agreed to continue the existing Fee Waiver Agreement for an additional one-year period from September 1, 2010 to August 31, 2011. |

Expense Example. The following Expense Examples are intended to help you compare the cost of investing in the Acquired Fund with the cost of investing in the Quaker Fund. Each Example assumes that you invest $10,000 in each Fund for the time period indicated and then redeem all of your shares at the end of those periods. Each Example also assumes that your investment has a 5% return each year. These are examples only, and do not represent future expenses, which may be greater or less than those shown below.

| | 1 Year | 3 Years | 5 Years | 10 Years |

| | | | | |

| Acquired Fund | $213 | $658 | $1,129 | $2,431 |

| | | | | |

Pro Forma – Quaker Fund after Reorganization1 | $746 | $1,154 | $1,588 | $2,789 |

| 1 | The pro forma expense example shown above does not reflect the waiver of the Class A Shares front-end sales load for Acquired Fund shareholders who will receive Surviving Fund shares in connection with the Reorganization. If the pro forma expense example reflected the waiver of the Class A Shares front-end sales load for Acquired Fund shareholders, the 1 year, 3 years, 5 years, and 10 years expenses would be as follows: $207; $640; $1,098; and $2,369, respectively. |

The projected post-Reorganization pro forma Annual Fund Operating Expenses and Expense Examples presented above are based on numerous material assumptions, including that certain fixed costs involved in operating the Acquired Fund will be eliminated. Although these projections represent good faith estimates, there can be no assurance that any particular level of expenses or expense savings will be achieved because expenses depend on a variety of factors, including the future level of the Surviving Fund’s assets, many of which are beyond the control of the Surviving Fund, the Manager, and Akros Capital.

Comparison of the Funds’ Sales Load and Distribution Arrangements

The Acquired Fund currently offers one class of shares, which does not charge a front-end sales load at the time of purchase or a contingent-deferred sales load at the time of redemption. The Acquired Fund charges a Rule 12b-1 fee of 0.25% of the Fund’s average daily net assets and a shareholder servicing fee of 0.10% of the Fund’s average daily net assets.

The Surviving Fund offers three classes of shares: Class A, Class C, and Institutional Class. The Surviving Fund’s Class A Shares charge a front-end sales load of 5.50% at the time of purchase. This load will be waived for the Acquired Fund shareholders who receive Class A Shares of the Surviving Fund in connection with the Reorganization. The front-end sales load applicable to Class A Shares of the Surviving Fund will not be charged for the shares received in the Reorganization or for future purchases of shares of the Surviving Fund made by shareholders of the Acquired Fund.

The Surviving Fund’s Class C Shares do not charge front-end or contingent deferred sales loads. The Surviving Fund’s Class A and Class C Shares have each adopted plans pursuant to Rule 12b-1 under the 1940 Act. Pursuant to the plans, the Class A and Class C Shares of the Surviving Fund may pay certain third parties fees at an annual rate of up to 0.25% and 1.00%, respectively, of their average daily net assets for the provision of distribution and/or shareholder support services. The Surviving Fund’s Class A and Class C shares do not assess a shareholder servicing fee. The Surviving Fund’s Institutional Class Shares do not charge front-end or contingent deferred sales loads or shareholder servicing fee, and have not adopted a plan pursuant to Rule 12b-1.

Comparison of the Funds’ Purchase and Redemption Procedures; Exchange Procedures; Dividends, Distributions and Pricing

Procedures for purchasing and selling shares of the Surviving Fund are similar to those of the Acquired Fund. The Surviving Fund also permits shareholders to exchange shares of the Surviving Fund with other funds of the Quaker Trust. Both Funds permit the purchase of shares through the mail, by wire transfer, or through financial intermediaries. However, the Acquired Fund requires a minimum initial investment of $2,500. The Surviving Fund requires a minimum initial investment of $2,000 ($1,000 for qualified retirement accounts) and $100 for subsequent share purchases.

Generally, Quaker Fund shares may be exchanged for the same share class of any other Fund of the Quaker Trust without incurring any additional sales charges. In addition, shareholders of Class A Shares of a Quaker Fund may exchange into Class A Shares of First American Prime Obligations Fund and Class C Shares of a Quaker Fund may exchange into Class C-A of First American Prime Obligations Fund, without incurring any additional sales charges (Class A Shares and Class C-A Shares of First American Prime Obligations Fund will be referred to herein as the “Money Market Account shares”). Money Market Account shares are available only as an exchange option for Quaker Fund shareholders. Money Market Account shares acquired through an exchange may be exchanged back into Quaker Fund shares without the imposition of an additional sales load. An exchange involves the simultaneous redemption of shares of one fund of the Quaker Trust and purchase of shares of another fund of the Quaker Trust at each fund’s respective closing NAV next determined after a request for exchange has been received, and is a taxable transaction.

Additionally, both Funds intend to pay out as dividends substantially all of its net income and capital gains annually.

The Funds determine their NAVs as of the close of regular trading hours on the New York Stock Exchange (“NYSE”) (normally 4:00 p.m., Eastern time). For each share class of each Fund, the net asset value is determined by dividing the total net assets (i.e., assets minus liabilities) attributable to that share class by the number of outstanding shares for that class of shares. Both Funds have adopted procedures for valuing portfolio assets when market quotations are not readily available. These procedures provide that securities and assets for which market quotations are not readily available may be valued based upon valuation methods that include, among other things: (i) multiple of earnings; (ii) yield to maturity with respect to debt issues; (iii) discounts from market prices of similar freely traded securities; or (iv) a combination of these methods. The table below describes how each Fund prices its shares and values its portfolio securities.

Acquired Fund | Surviving Fund |

Share Price. Your share price will be the next NAV per share calculated after the Transfer Agent or your Authorized Intermediary receives your purchase request in good order. “Good order” means that your purchase request includes: • the name of the Fund; • the dollar amount of shares to be purchased; • your account application or investment stub; and • a check payable to “Akros Absolute Return Fund.” | Share Price. When you buy shares, you pay the “offering price” for the shares. The “offering price” includes any applicable sales charge, and is determined by dividing the NAV by an amount equal to 1 minus the sales charge applicable to the purchase. The number of Fund shares you will be issued will equal the amount invested divided by the applicable offering price for those shares. |

| | |

Fair Valuation. When market quotations are not readily available, a security or other asset is valued at its fair value as determined under fair value pricing procedures approved by the Board of Trustees. These fair value pricing procedures will also be used to price a security when corporate events, events in the securities market and/or world events cause the Advisor to believe that a security’s last sale price may not reflect its actual market value. | Fair Valuation. The Fund expects to price most of its securities based on the current market values. Securities and assets for which market quotations are not readily available will be valued at fair value. The Fund has adopted fair valuation procedures to value securities at fair market. Securities may also be priced using fair value pricing methods when their closing prices do not reflect their market values at the time the Fund calculates its NAV because an event had occurred since the closing prices were established on the domestic or foreign exchange or market but before the Fund’s NAV calculation. |

INFORMATION ABOUT THE REORGANIZATION

Material Features of the Plan

The Plan sets forth the terms and conditions of the Reorganization. Certain provisions of the Plan are summarized below; however, this summary is qualified in its entirety by reference to the Plan, a form of which is attached as Appendix A to this Proxy Statement/Prospectus.

At the consummation of the Reorganization, which is expected to occur at the close of business on or about August [_], 2010 (the “Effective Time”), all of the assets and liabilities of the Acquired Fund’s shares will be transferred to the Surviving Fund in exchange for Class A Shares of the Surviving Fund, such that at and after the Effective Time, the assets and liabilities of the Acquired Fund will become the assets and liabilities of the Surviving Fund. The transfer of assets by the Acquired Fund will occur at their then-current market value, as determined in accordance with the Acquired Fund’s valuation procedures. Class A Shares of the Surviving Fund will be distributed to shareholders of the Acquired Fund in exchange for the Acquired Fund. After completion of the Reorganization, each shareholder of the Acquired Fund will own Class A Shares of the Surviving Fund equal in value to the current NAV of such shareholder’s shares of the Acquired Fund. The front-end sales load applicable to Class A Shares of the Surviving Fund will not be charged for the shares received in the reorganization or for future purchases of shares of the Surviving Fund made by shareholders of the Acquired Fund. Following the completion of the Reorganization, the Acquired Fund will be liquidated and terminated under the 1940 Act.

The Plan provides that the Acquired Fund’s Board of Trustees will declare a dividend or dividends, as necessary, with respect to the Acquired Fund prior to the Effective Time. This dividend, together with all previous dividends, will have the effect of distributing to the shareholders of the Acquired Fund all undistributed ordinary income earned and net capital gains recognized up to and including the time at which the Acquired Fund’s NAV is determined for purposes of the Reorganization (the “Valuation Date”). The shareholders of the Acquired Fund will recognize ordinary income and capital gain with respect to this distribution and such income and gain may be subject to federal, state and/or local taxes.

The stock transfer books of TPM with respect to the Acquired Fund will be permanently closed as of the close of business on the Valuation Date, which is the day immediately preceding the Effective Time. Redemption requests received thereafter by TPM with respect to the Acquired Fund will be deemed to be redemption requests for shares of the Surviving Fund issued pursuant to the Plan. If any shares of the Acquired Fund are represented by a share certificate, the certificate must be surrendered to TPM’s transfer agent for cancellation before the Surviving Fund shares issuable to the shareholder pursuant to the Plan will be issued. Any special options relating to a shareholder’s account in the Acquired Fund will transfer over to the Surviving Fund without the need for the shareholder to take any action.

The Reorganization is subject to a number of conditions, as set forth in the Plan. TPM, by consent of its Board or an officer authorized by the Board, may waive any condition to the obligations of the Acquired Fund or the Surviving Fund under the Plan. The Plan may be terminated, and the Reorganization abandoned, at any time prior to the Closing: (i) by mutual consent by TPM and the Quaker Trust; (ii) by the Quaker Trust if certain conditions have not been fulfilled, or waived by it; and (iii) by TPM if certain conditions have not been fulfilled, or waived by it. The Plan provides further that the Plan may be amended only by mutual consent of TPM and the Quaker Trust in writing.

The Manager and Akros Capital have undertaken to bear and pay all expenses associated with the Reorganization, including, without limitation, the costs of legal and audit services in connection with the Reorganization, and of printing and mailing this Proxy Statement/Prospectus.

Reasons for the Reorganization

The Acquired Fund’s Board considered the Reorganization at a meeting held on June 30, 2010, and approved the Plan. In considering the Plan, the Board received information from representatives of the Quaker Trust and Akros Capital, LLC detailing the Reorganization, including: (i) the specific terms of the Plan, including information regarding comparative expenses; (ii) the proposed plans for ongoing management, distribution and operation of the Surviving Fund; (iii) the management, financial position and business of the Manager and its affiliates; and (iv) the impact of the Reorganization on the Acquired Fund and its shareholders. In approving the Reorganization, the Board of the Acquired Fund determined that (i) participation in the Reorganization is in the best interest of the Acquired Fund’s shareholders; and (ii) the interests of the Acquired Fund’s shareholders will not be diluted as a result of the Reorganization.

In making this determination, the Board of the Acquired Fund considered the following factors:

| · | The investment objectives of the Acquired Fund and Surviving Fund are identical; |

| · | The strategies and risks of the Acquired Fund and the Surviving Fund are substantially similar; |

| · | The Acquired Fund’s investment adviser and portfolio manager will serve as the sub-adviser and portfolio manager for the Surviving Fund; |

| · | The total expense ratio of the Surviving Fund is expected to be less than the total expense ratio of the Acquired Fund; |

| · | The future prospects of the Acquired Fund if the Reorganization were not effected; |

| · | Shareholders of the Acquired Fund will have the opportunity to diversify into a broad range of investments through the exchange privilege with the other funds of Quaker Trust; |

| · | Shareholders of the Acquired Fund will likely benefit from economies of scale as a result of the Manager’s efforts to increase the size of the Surviving Fund; |

| · | The Reorganization is intended to be tax-free for federal income tax purposes for shareholders of the Acquired Fund; and |

| · | The Acquired Fund’s shareholders will not bear any costs of the Reorganization. |

Federal Income Tax Consequences

Each Fund intends to qualify as of the Effective Time as a “regulated investment company” under the Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, each of the Funds has been, and expects to continue to be, relieved of all or substantially all federal income taxes.

The following is a general summary of the material federal income tax consequences of the Reorganization and is based upon the current provisions of the Internal Revenue Code of 1986, as

amended (the “Code”), the existing U.S. Treasury Regulations thereunder, current administrative rulings of the Internal Revenue Service and published judicial decisions, all of which are subject to change. Based on certain assumptions made and representations to be made on behalf of the Acquired Fund and the Surviving Fund, it is expected that Stradley Ronon Stevens & Young, LLP will provide a legal opinion for federal income tax purposes to the effect that:

| · | the Reorganization will qualify as a “reorganization” within the meaning of Section 368(a) of the Code; |

| · | No gain or loss will be recognized by the Acquired Fund upon the transfer of all of its assets to, and assumption of its liabilities by, the Surviving Fund in exchange solely for the Surviving Fund shares or on the distribution of the Surviving Fund shares to the Acquired Fund’s shareholders; |

| · | No gain or loss will be recognized by the Surviving Fund upon the receipt by it of all of the assets of the Acquired Fund in exchange solely for shares of the Surviving Fund and the assumption by the Surviving Fund of the liabilities of the Acquired Fund; |

| · | No gain or loss will be recognized by the shareholders of the Acquired Fund upon the exchange of their Acquired Fund shares solely for shares of the Surviving Fund; |

| · | The basis of the Surviving Fund shares received by the shareholders of the Acquired Fund will be the same as the basis of the Acquired Fund shares surrendered in exchange therefor; |

| · | The holding period of the Surviving Fund shares received by the shareholders of the Acquired Fund will include the holding period of the Acquired Fund shares surrendered in exchange therefor; and |

| · | The Surviving Fund will succeed to and take into account any capital loss carryovers and certain other tax attributes of the Acquired Fund. |

Neither TPM nor Quaker Trust has sought a tax ruling from the Internal Revenue Service (“IRS”). Opinions of counsel are not binding upon the IRS or the courts. If the Reorganization is consummated but the IRS or the courts determine that the Reorganization does not qualify as a tax-free reorganization under the Code, and thus is taxable, the Acquired Fund would recognize gain or loss on the transfer of its assets to the Surviving Fund and each shareholder of the Acquired Fund would recognize a taxable gain or loss equal to the difference between its tax basis in its Acquired Fund shares and the fair market value of the shares of the Surviving Fund it receives.

Dividend. Prior to the closing of a Reorganization, the Acquired Fund will distribute to its shareholders any undistributed income and gains to the extent required to avoid entity level tax or as otherwise deemed desirable.

General Limitation on Capital Losses. Capital losses of a fund can generally be carried forward to each of the eight (8) taxable years succeeding the loss year to offset future capital gains, subject to an annual limitation if there is a more than 50% “change in ownership” of a fund. If, as is anticipated, at the time of the closing of the Reorganization the Surviving Fund has either no assets or nominal assets incident to its organization, there will be no change of ownership of the Acquired Fund on a combined basis post-Reorganization. Thus, no annual limitation will apply to use of the Acquired Fund’s capital loss carryovers, if any, as a result of the Reorganization. However, the capital losses of the Surviving Fund, as the successor in interest to the Acquired Fund, may subsequently become subject to an annual limitation as a result of sales of Surviving Fund shares or other reorganization transactions in which the Surviving Fund might engage post-Reorganization.

In addition, if the Surviving Fund changes its fiscal year end following the consummation of a Reorganization, the short taxable year resulting from such a change in fiscal year is counted as one full year for purposes of the eight year carryforward period for capital losses. This might cause the capital loss carryovers, if any, of the Surviving Fund to expire earlier than they otherwise would.

Tracking Your Basis and Holding Period; State and Local Taxes. After the Reorganization, shareholders will continue to be responsible for tracking the adjusted tax basis and holding period for shares for federal income tax purposes. You should consult your tax advisor regarding the effect, if any, of the Reorganization in light of your individual circumstances. You should also consult your tax advisor about the state and local tax consequences, if any, of the Reorganization because this discussion only relates to the federal income tax consequences.

Shareholder Rights, Description of the Securities to be Issued

The Acquired Fund is organized as a series of TPM, which is a trust organized under the laws of the State of Delaware. The Surviving Fund is organized as a separate series of the Quaker Trust, which is a Massachusetts business trust. Each Fund is authorized to issue an unlimited number of shares of beneficial interest. The shares of the Acquired Fund have a par value of $0.001 per share while the shares of the Surviving Fund have a par value of $0.01 per share. The operations of the Acquired Fund and the Surviving Fund are governed by their trust documents; by-laws; and Delaware and Massachusetts state law, respectively. Each Fund must also adhere to the 1940 Act, the rules and regulations promulgated by the SEC thereunder, and any applicable state securities laws.

Each of the Funds is governed by a board of trustees. The composition of the boards of trustees differs between the two funds, both in terms of membership and the number of independent trustees. Both Funds indemnify their respective trustees and officers against liabilities and expenses incurred in connection with their proceedings relating to their positions with the Funds, except if the trustee or officer would otherwise be subject to liability by reason of willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of such person’s office.

Under TPM’s trust agreement, the Acquired Fund’s shareholders have the power to vote only for: (a) the election of Trustees; (b) the removal of Trustees; (c) the approval of any investment advisory or management contract; (d) the termination of the Trust; (e) the amendment of the declaration of trust as required by law or the Acquired Fund’s registration statement, or submitted by the Board of Trustees; and (f) such additional matters relating to TPM as may be required by law, the declaration of trust or any registration of TPM with the SEC or any state, or as the Trustees may consider desirable.

Under Quaker Trust’s declaration of trust, the Surviving Fund’s shareholders have to the power to vote: (i) for the election Trustees; (ii) for the removal of Trustees; (iii) with respect to any contract as to which shareholder approval is required by the 1940 Act; (iv) with respect to certain amendments of the declaration of trust; (v) to the same extent as the shareholders of a Massachusetts business corporation as to whether or not a court action, proceeding or claim should be brought or maintained derivatively or as a class action on behalf of the Quaker Trust or its shareholders; (iv) with respect to such additional matters relating to the Quaker Trust as may be required by law, its declaration of trust, its by-laws, or any regulation of the Quaker Trust by the SEC or any state, or as the Trustees may consider desirable.

Neither Fund is required to hold an annual shareholder meeting. A special meeting of the Acquired Fund may be called by its Board or upon the written request of shareholders owning at least 10% of the shares entitled to vote; a special meeting of the Surviving Fund may be called by its Board of Trustees or upon the written request of shareholders of a series or class holding in the aggregate not less than 10% of the outstanding shares of such series or class. If a shareholder meeting is held, the Funds

have substantially similar notice, quorum, and voting requirements. Both Funds typically require a majority vote of the shares present to decide any questions related to a particular matter, except a plurality shall elect a trustee.

ADDITIONAL INFORMATION ABOUT THE

SURVIVING FUND AND THE ACQUIRED FUND

Comparison of Fundamental Investment Policies

The fundamental investment restrictions of the Acquired Fund and the Surviving Fund are substantially similar. Unlike the Acquired Fund, however, the Surviving Fund has not adopted a fundamental investment restriction with respect to diversification. To assist in comparing the similarities and differences in the Funds’ fundamental investment restrictions, the following table describes in detail the fundamental investment restrictions for each Fund:

| Fundamental Investment Restrictions |

| | Acquired Fund | Quaker Fund |

| Borrowing | The Fund may not issue senior securities, borrow money or pledge its assets, except that (i) the Fund may borrow from banks in amounts not exceeding one-third of its total assets (including the amount borrowed); and (ii) this restriction shall not prohibit the Fund from engaging in options transactions or short sales in accordance with its objective and strategies. | The Fund will not borrow money, except: (a) from a bank, provided that immediately after such borrowing there is an asset coverage of 300% for all borrowings of the Fund; or (b) from a bank or other persons for temporary purposes only, provided that such temporary borrowings are in an amount not exceeding 5% of the Fund’s total assets at the time when the borrowing is made. This limitation does not preclude the Fund from entering into reverse repurchase transactions, provided that the Fund has asset coverage of 300% for all borrowings and repurchase commitments of the Fund pursuant to reverse repurchase transactions. |

| Senior Securities | The Fund may not issue senior securities, borrow money or pledge its assets, except that (i) the Fund may borrow from banks in amounts not exceeding one-third of its total assets (including the amount borrowed); and (ii) this restriction shall not prohibit the Fund from engaging in options transactions or short sales in accordance with its objective and strategies. | The Fund will not issue senior securities. This limitation is not applicable to activities that may be deemed to involve the issuance or sale of a senior security by the Fund, provided that the Fund’s engagement in such activities is consistent with or permitted by the 1940 Act, the rules and regulations promulgated thereunder or interpretations of the SEC or its staff. |

| Underwriting | The Fund may not act as underwriter (except to the extent the Fund may be deemed to be an underwriter in connection with the sale of securities in its investment portfolio). | The Fund will not act as underwriter of securities issued by other persons. This limitation is not applicable to the extent that, in connection with the disposition of portfolio securities (including restricted securities), the Fund may be deemed an underwriter under certain federal securities laws. |

| Real Estate | The Fund may not purchase or sell real estate unless acquired as a result of ownership of securities (although the Fund may purchase and sell securities which are secured by real estate and securities of companies that invest or deal in real estate). | The Fund will not purchase or sell real estate. This limitation is not applicable to investments in marketable securities that are secured by or represent interests in real estate. This limitation does not preclude the Fund from investing in mortgage-related securities or investing in companies engaged in the real estate business or that have a significant portion of their assets in real estate (including real estate investment trusts). |

| Commodities | The Fund may not purchase or sell physical commodities, unless acquired as a result of ownership of securities or other instruments and provided that this restriction does not prevent the Fund from engaging in transactions involving currencies and futures contracts and options thereon or investing in securities or other instruments that are secured by physical commodities. | The Fund will not purchase or sell commodities unless acquired as a result of ownership of securities or other investments. This limitation does not preclude the Fund from purchasing or selling options or futures contracts, from investing in securities or other instruments backed by commodities or from investing in companies, which are engaged in a commodities business or have a significant portion of their assets in commodities. |

| Loans | The Fund may not make loans of money (except for the lending of its portfolio securities, purchases of debt securities consistent with the investment policies of the Fund and except for repurchase agreements). | The Fund will not make loans to other persons, except: (a) by loaning portfolio securities; (b) by engaging in repurchase agreements; or (c) by purchasing nonpublicly offered debt securities. For purposes of this limitation, the term “loans” shall not include the purchase of a portion of an issue of publicly distributed bonds, debentures or other securities. |

| Concentration | The Fund may not invest more than 25% of its net assets, calculated at the time of purchase and taken at market value, in securities of issuers in any one industry (other than U.S. Government securities) | The Fund will not invest more than 25% of its total assets in a particular industry. The Fund will not invest 25% or more of its total assets in any investment company that concentrates in a particular industry. This limitation is not applicable to investments in obligations issued or guaranteed by the U.S. government, its agencies and instrumentalities or repurchase agreements with respect thereto. |

| Diversification | With respect to 50% of its total assets, the Fund may not invest more than 5% of its total assets in securities of a single issuer or hold more than 10% of the voting securities of such issuer. (Does not apply to investment in the securities of the U.S. Government, its agencies or instrumentalities or securities of other investment companies.). | None |

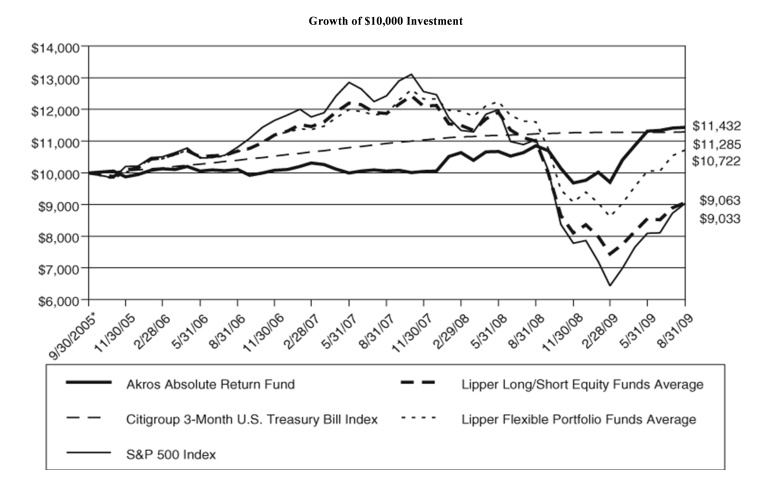

Performance Information

The Surviving Fund will not commence investment operations until the closing of the Reorganization, and therefore does not have any performance information to disclose. It is expected that as a result of the Reorganization, the Surviving Fund will succeed to the performance and financial history of the Acquired Fund. Management’s discussion of fund performance for the Acquired Fund’s last fiscal year, which is included in the Acquired Fund’s Annual Report to Shareholders dated August 31, 2009, is attached as Appendix B.

* * *

More information about the Acquired Fund and the Surviving Fund is included in: (i) the Acquired Fund’s Prospectus dated December 29, 2009 (as it may be amended), which is incorporated by reference herein and considered a part of this Proxy Statement/Prospectus; (ii) the Statement of Additional Information dated December 29, 2009 (as it may be amended) relating to the Acquired Fund’s Prospectus (iii) the Surviving Fund’s Prospectus dated August [9], 2010, which accompanies this Proxy Statement/Prospectus and is incorporated by reference and considered a part of this Proxy Statement/Prospectus; (iv) the Statement of Additional Information dated August [9], 2010 relating to the Surviving Fund’s Prospectus; and (v) the Statement of Additional Information dated August [_], 2010 relating to this Proxy Statement/Prospectus, which is incorporated by reference herein.

You may request free copies of the Acquired Fund’s Prospectus or Statement of Additional (including any supplements) by calling 1-877-257-6748 or by writing via U.S. mail to the Akros Absolute Return Fund, c/o U.S. Bancorp Fund Services, LLC (“U.S. Bancorp Fund Services”), P.O. Box 701, Milwaukee, WI 53201-0701. You may request free copies of the Surviving Fund’s Statement of Additional Information or the Statement of Additional Information relating to this Proxy Statement/Prospectus, by calling (800) 220-8888, or by writing to Quaker Trust, c/o U.S. Bancorp Fund Services, P.O. Box 701, Milwaukee, WI 53201-0701.

This Proxy Statement/Prospectus, which constitutes part of a Registration Statement filed by the Quaker Trust with the SEC under the Securities Act of 1933, as amended, omits certain information contained in such Registration Statement. Reference is hereby made to the Registration Statement and to the exhibits and amendments thereto for further information with respect to the Surviving Fund and the shares offered. Statements contained herein concerning the provisions of documents are necessarily summaries of such documents, and each such statement is qualified in its entirety by reference to the copy of the applicable document filed with the SEC.

Each Fund also files proxy materials, reports, and other information with the SEC in accordance with the informational requirements of the Securities Exchange Act of 1934, as amended, and the 1940 Act. These materials can be inspected and copied at the public reference facilities maintained by the SEC in Washington, DC located at Room 1580, 100 F Street, N.E., Washington, D.C. 20549. Copies of such material can be obtained at prescribed rates from the Public Reference Branch, Office of Consumer Affairs and Information Services, SEC, Washington, D.C. 20549, or obtained electronically from the EDGAR database on the SEC’s website (www.sec.gov).

ADDITIONAL INFORMATION

Investment Adviser. Akros Capital, LLC, located at 230 Park Avenue, Suite 453, New York, NY, is the investment adviser for the Acquired Fund. For its services to the Acquired Fund, Akros Capital, LLC is entitled to a fee of 1.00% of the Fund’s average daily net assets,

The Surviving Fund’s investment manager is Quaker Funds, Inc., located at 309 Technology Drive, Malvern, PA 19355. Quaker Funds, Inc. manages the Surviving Fund and, for its services, Quaker Funds, Inc. is entitled to a fee of 1.25% of the Fund’s average daily net assets.

Principal Underwriter. Quasar Distributors, LLC (“Quasar”), located at 615 E. Michigan St., Milwaukee, WI 53202, serves as the distributor for both Funds. As the distributor, it has agreed to use reasonable efforts to distribute the shares of both Funds. Quasar is not obligated to sell any certain number of shares of the Funds, and does not receive any fee or other compensation from the Funds under their respective distribution agreements other than the Rule 12b-1 fees received in connection with the

sale of shares of the Acquired Fund and sales of shares of the Class A and Class C Shares of the Surviving Fund. Quasar is a wholly owned subsidiary of U.S. Bancorp and is affiliated with U.S. Bancorp Fund Services, which is the transfer agent for both Funds.

Fund Administration and Transfer Agency Services. U.S. Bancorp Fund Services serves as the Acquired Fund’s transfer, dividend paying, and shareholder servicing agent, and performs fund accounting and administration services for the Acquired Fund. For all services provided under the fund accounting and administration services agreement, the Acquired Fund pays U.S. Bancorp Fund Services a fee computed daily and paid monthly of a percentage of the Acquired Fund’s net assets.

Brown Brothers Harriman & Co. (“BBH”), 40 Water Street, Boston, MA 02109, serves as the Surviving Fund’s fund accountant and administrator. For its services, the Quaker Trust pays BBH an annual fee, paid monthly based on the aggregate average net assets, as determined by valuations made as of the close of business at the end of the month. The Surviving Fund is charged its pro rata share of such expenses. U.S. Bancorp Fund Services serves as the Surviving Fund’s transfer, dividend paying, and shareholder servicing agent.

Custodians. U.S. Bank, N.A. 1555 North River Center Drive, Suite 302, Milwaukee, WI 53212 is custodian of the Acquired Fund’s investments. For the custodial services, it receives a fee, paid monthly, based on the average net assets of the Acquired Fund, as determined by valuations made as of the close of business day of the month.

BBH serves as the custodian for the Surviving Fund’s assets. For its services, BBH is paid a fee based on the NAV of the Fund and is reimbursed by the Trust for its disbursements, certain expenses and charges based on an out-of-pocket schedule agreed upon by BBH and the Quaker Trust from time to time.

Independent Registered Public Accounting Firm. Deloitte & Touche LLP located at 555 East Wells Street, Milwaukee, WI 53202, serves as the independent registered public accounting firm to the Acquired Fund.