(Amendment No. __)

PROXY MATERIALS

Quaker Global Tactical Allocation Fund

Quaker Mid-Cap Value Fund

Quaker Small-Cap Value Fund

Quaker Strategic Growth Fund

series of

QUAKER INVESTMENT TRUST

Dear Shareholder:

The enclosed proxy materials relate to two separate special meetings of shareholders ("Shareholders") of the Quaker Global Tactical Allocation Fund, Quaker Mid-Cap Value Fund, Quaker Small-Cap Value Fund, and Quaker Strategic Growth Fund (each, a "Fund" and together, the "Funds"), series of Quaker Investment Trust (the "Trust"), to be held at the offices of Stradley Ronon Stevens & Young LLP, 30 Valley Stream Parkway, Berwyn, PA 19355 on May 23, 2018. The first meeting will be held at 10:00 am Eastern time (the "First Meeting") and the second meeting will be held at 10:30 am Eastern time (the "Second Meeting" and collectively with the First Meeting, the "Meetings"). The Meetings relate to the Proposals described below. As a Shareholder, you have the opportunity to voice your opinion on the matters that affect your Fund. This package contains information about the Proposals and the materials to use when voting by mail, telephone, or through the Internet.

First Meeting Proposal:

Proposal 1. To Elect a Board of Trustees for the Trust.

Second Meeting Proposals:

Proposal 1. To Approve a New Investment Management Agreement between Community Capital Management, Inc. and the Trust, on behalf of each Fund.

Proposal 2. To Approve an Agreement and Plan of Reorganization that Provides for the Reorganization of the Trust from its Current Form of Organization as a Massachusetts Business Trust into a Newly Formed Delaware Statutory Trust.

The Proposals are described in greater detail in the enclosed Proxy Statement.

The Board unanimously recommends that you vote FOR each Proposal.

Voting is quick and easy. Everything you need is enclosed. Your vote is important no matter how many shares you own. Voting your shares early will avoid costly follow-up mail and telephone solicitation. After reviewing the enclosed materials, please complete, sign and date your proxy card(s) before mailing it (them) in the postage-paid envelope, or help save time and postage costs by calling the toll free number and following the instructions. You may also vote via the Internet by logging on to the website indicated on your proxy card and following the instructions. If we do not hear from you, our proxy solicitor, Okapi Partners (the "Proxy Solicitor"), may contact you. This will ensure that your vote is counted even if you cannot attend the Meetings in person. If you have any questions about the Proposals or the voting instructions, please call the Proxy Solicitor at (877) 285-5990. Representatives are available to assist you Monday through Friday, 8:00 a.m. to 11:00 p.m. Eastern Time.

Very truly yours,

____________________

Alyssa Greenspan

President

Quaker Investment Trust

March [__], 2018

IMPORTANT INFORMATION TO HELP YOU UNDERSTAND AND VOTE ON THE PROPOSALS.

Below is a brief overview of the matters being submitted to a shareholder vote. Your vote is important, no matter how large or small your holdings may be. Please read the full text of the proxy statement (the "Proxy Statement"), which contains additional information about the proposals (each a "Proposal" and together, the "Proposals"), and keep it for future reference.

QUESTIONS AND ANSWERS.

Q. Why are you sending me this information?

A. You are receiving these proxy materials because you have the right to vote on important Proposals concerning your investment.

Q. What are the Proposals being considered at the Meetings?

A. At two separate special meetings to be held on May 23, 2018, shareholders ("Shareholders") of the Quaker Global Tactical Allocation Fund, Quaker Mid-Cap Value Fund, Quaker Small-Cap Value Fund, and Quaker Strategic Growth Fund (each, a "Fund" and together, the "Funds"), series of Quaker Investment Trust (the "Trust"), are being asked to:

First Meeting:

| · | Elect five proposed trustees (each a "Nominee" and together, the "Nominees") to the Board of Trustees (the "Board") of the Trust. |

Second Meeting:

| · | Approve a new investment management agreement between Community Capital Management, Inc. (the "Adviser") and the Trust, on behalf of each Fund (the "New Investment Advisory Agreement"); and |

| · | Approve an agreement and plan of reorganization that provides for the reorganization of the Trust from its current form of organization as a Massachusetts business trust into a newly formed Delaware statutory trust. |

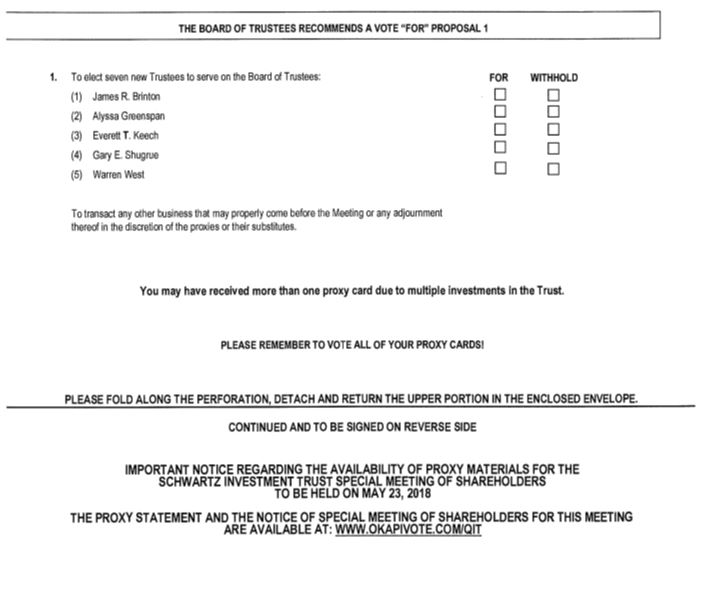

PROPOSAL 1 FOR THE FIRST MEETING: ELECT TRUSTEE NOMINEES TO THE BOARD

Q. What are shareholders being asked to do?

A. Shareholders of the Trust are being asked to elect five trustees to the Board. More information about these Board changes is provided in the Proxy Statement under Proposal 1.

Q. Who are the candidates? Has the Board nominated them?

A. Four of the Nominees (James Brinton, Gary Shugrue, Everett Keech and Warren West) are currently Independent Trustees (defined below) of the Trust and two of these Nominees were previously elected to the Board by shareholders of the Funds. The fifth Nominee, Alyssa Greenspan, is an interested person of the Trust due to her affiliation with the Adviser. The Trust's current interested trustees, Jeffrey H. King Sr. and Laurie Keyes are not standing for reelection. Each Nominee was reviewed and recommended for nomination by the Nominating Committee of the Board, which is comprised of the Independent Trustees (defined below) of the Trust, and approved for nomination by the Board. The Board has reviewed the qualifications and backgrounds of all five Nominees and concluded that each Nominee's ability to perform his or her duties effectively is evidenced by his or her educational background or professional training, business or consulting experience, and experience serving as a board member of investment funds (including the Trust), public companies or non-profit entities or other organizations. At a Board meeting held on February 6, 2018, the Board nominated the Nominees and recommended that their election to the Board be put to a vote of the shareholders of the Funds.

Q. How many of the Nominees will be Independent Trustees if elected?

A. Four of the five Nominees will be independent if elected and will not be considered to be "interested persons" (as such term is defined in the Investment Company Act of 1940, as amended (the "1940 Act")) ("Independent Trustees"). Independent Trustees have no affiliation with the Funds or the Adviser, other than as disclosed and apart from any personal investments they choose to make in a

Fund as private individuals. Independent Trustees play a critical role in overseeing Fund operations and representing the interests of shareholders.

Q. How does the Board recommend that I vote in connection with the Proposal 1?

A. The Board unanimously recommends that you vote "FOR" the approval of Proposal 1 described in the Proxy Statement.

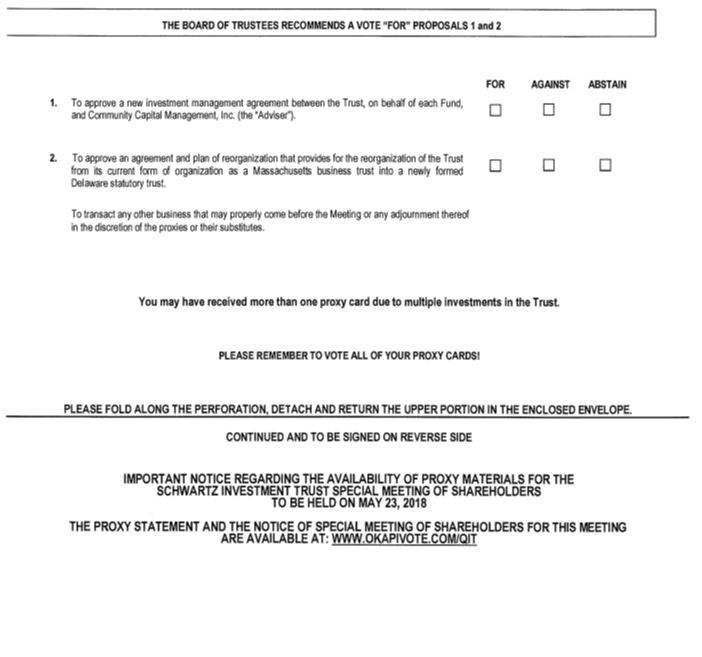

PROPOSAL 1 FOR THE SECOND MEETING: APPROVE NEW INVESTMENT MANAGEMENT AGREEMENT

Q. Why am I being asked to vote on a New Investment Management Agreement for my Fund?

A. As discussed in more detail in the Proxy Statement, on November 16, 2017, the Board decided to retain Community Capital Management, Inc. (the "Adviser") as the investment adviser to the Funds. The Adviser began managing the Funds effective January 1, 2018, pursuant to an interim investment advisory agreement following the termination of the Funds' former adviser by the Board due to the Adviser's plans to exit the investment advisory business in 2018. Shareholders of each Fund are therefore being asked to approve a new investment management agreement (the "New Investment Advisory Agreement"). The New Investment Advisory Agreement will become effective as to a Fund only if approved by the shareholders of the applicable Fund.

Q. Will there be any changes in the services provided or fees paid by my Fund under the New Investment Advisory Agreement?

A. Under the New Investment Advisory Agreement, the Adviser will provide investment management services to each Fund on substantially identical terms and for the fees that are lower than those in effect pursuant to the Funds' prior investment advisory agreement (the "Prior Investment Advisory Agreement"). The Trust's investment advisory structure will not change under the New Investment Advisory Agreement. Furthermore, Los Angeles Capital Management and Equity Research, Inc. ("Los Angeles Capital"), the former sub-adviser to the Quaker Strategic Growth Fund, Kennedy Capital Management, Inc. ("Kennedy"), the former sub-adviser to the Quaker Mid-Cap Value Fund, and Aronson Johnson Ortiz, LP ("AJO LP" and together with Los Angeles Capital and Kennedy, the "Sub-Advisers"), the former sub-adviser to Quaker Small-Cap Value Fund, no longer serve as Sub-Advisers to their respective Funds.

Q. Will there be any changes to the Funds' investment policies, strategies or risks in connection with the approval of the New Investment Advisory Agreement with the Adviser?

A. In addition to the Funds' existing investment policies and strategies, the Adviser will implement an impact investing categorization and risk assessment process for the Funds.

Q. What will happen if Shareholders do not approve the New Investment Advisory Agreement?

A. If the New Investment Advisory Agreement is not approved by Shareholders the Board will take such action as it deems necessary and in the best interests of the Funds and their respective Shareholders, which may include further solicitation of Shareholders or liquidation of the Funds.

Q. Will there be any change in the fees payable by the Funds to the Adviser under the New Investment Advisory Agreement?

A. No, if the New Investment Advisory Agreement is approved by the Funds' shareholders, the Funds' advisory fees will be lower under the New Investment Advisory Agreement than they were under the Funds' prior investment management agreement with the Funds' former investment adviser.

Q. How does the Board recommend that I vote in connection with this Proposal?

A. The Board unanimously recommends that you vote "FOR" the approval of Proposal described in the Proxy Statement.

PROPOSAL 2 FOR THE SECOND MEETING: APPROVE AN AGREEMENT AND PLAN OF REORGANIZATION (THE "PLAN")

Q. What is the purpose of the Plan?

A. The purpose of the Plan is to reorganize the Trust from a Massachusetts business trust into a newly organized Delaware statutory trust. The Board believes that a fund operating as a Delaware statutory trust is able to simplify its operations and has more flexibility to adjust its operations to changes in competitive or regulatory conditions.

Q. How will such a reorganization affect my Fund?

A. It is not anticipated that the reorganization of the Trust, if approved by shareholders, would affect your investment in a Fund or how the Fund is managed on a day-to-day basis. The reorganization of the Trust will not change its Board members, officers, investment policies or strategies or any of its service providers, including investment manager(s), or their fees. The reorganization will not alter the Board members' existing duties to act with due care and in the shareholders' interests.

OTHER MATTERS

Q. Is the passage of one proposal contingent on the passage of the other proposal?

A. No. The three proposals are independent of one another. If shareholders approve a proposal, such action will become effective regardless of how shareholders vote on the other proposals.

Q. Will my Fund pay for this proxy solicitation or for the costs of the Transaction?

A. The Adviser will pay one-third of the proxy costs, reflecting the costs associated with the approval of the New Investment Management Agreement, and the Trust will pay two-thirds of the proxy costs, reflecting the costs associated with the approval of the Trustee Nominees and the re-domestication of the Trust.

Q. How can I vote my shares?

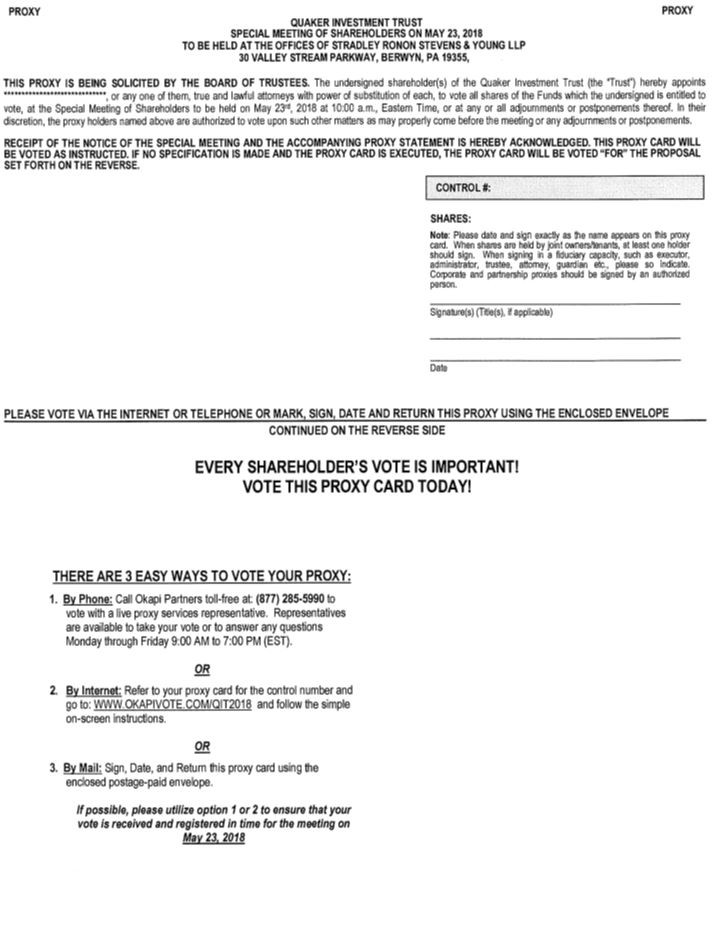

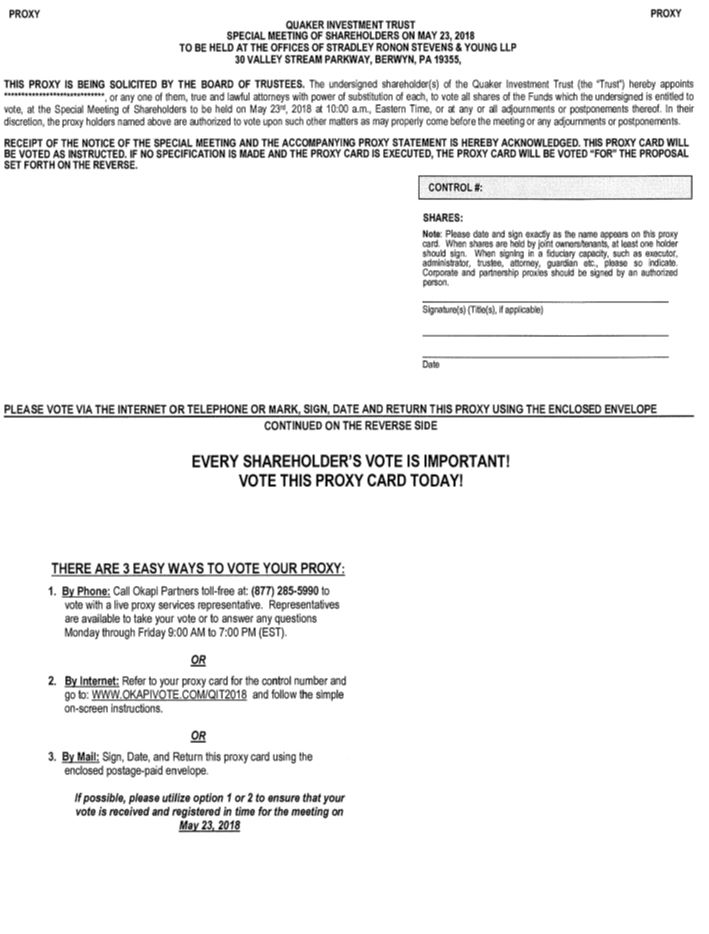

A. For your convenience, there are several ways you can vote:

By Mail: Vote, sign and return the enclosed proxy card(s) in the enclosed self-addressed, postage-paid envelope;

By Telephone: Call the number printed on the enclosed proxy card(s);

By Internet: Access the website address printed on the enclosed proxy card(s); or

In Person: Attend the Meetings as described in the Proxy Statement. If you wish to attend the Meetings, please notify us by calling (800) 220-8888. Shareholders whose shares are held in "street name" through their broker will need to obtain a legal proxy from their broker and present it at the Meetings in order to vote in person.

Q. How may I revoke my proxy?

A. Any proxy may be revoked at any time prior to its use by written notification received by the Trust's Secretary, by the execution and delivery of a later-dated proxy, or by attending the Meetings and voting in person. Shareholders whose shares are held in "street name" through their broker will need to obtain a legal proxy from their broker and present it at the Meeting in order to vote in person. Any letter of revocation or later-dated proxy must be received by the appropriate Fund prior to the Meetings and must indicate your name and account number to be effective. Proxies voted by telephone or Internet may be revoked at any time before they are voted at the Meetings in the same manner that proxies voted by mail may be revoked.

Q. Where can I obtain additional information about this Proxy Statement?

A. If you need any assistance, or have any questions regarding the Proposals or how to vote your shares, please call our proxy solicitor, Okapi Partners (the "Proxy Solicitor"), at (877) 285-5990. Representatives are available to assist you Monday through Friday, 8:00 a.m. to 11:00 p.m. Eastern Time.

THE BOARD OF TRUSTEES OF THE TRUST UNANIMOUSLY RECOMMENDS THAT

YOU VOTE FOR THE PROPOSALS DESCRIBED IN THE PROXY STATEMENT.

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To be held on May 23, 2018

Quaker Global Tactical Allocation Fund

Quaker Mid-Cap Value Fund

Quaker Small-Cap Value Fund

Quaker Strategic Growth Fund

Important notice regarding the availability of proxy materials for the shareholder meeting to be held on May 23, 2018:

In addition to the written notice of special meeting of shareholders, proxy statement and form of proxy that you are receiving, these documents also available on the Internet at www.okapivote.com/Quaker. The form of proxy on the Internet site cannot be used to cast your vote.

To the shareholders ("Shareholders") of the Quaker Global Tactical Allocation Fund, Quaker Mid-Cap Value Fund, Quaker Small-Cap Value Fund, and Quaker Strategic Growth Fund (each, a "Fund" and together, the "Funds"), series of Quaker Investment Trust (the "Trust"):

NOTICE IS HEREBY GIVEN that two separate special meetings of Shareholders will be held at the offices of Stradley Ronon Stevens & Young LLP, 30 Valley Stream Parkway, Berwyn, PA 19355 on May 23, 2018. The first meeting will be held at 10:00 am Eastern time (the "First Meeting") and the second meeting will be held at 10:30 am Eastern time (the "Second Meeting" and collectively with the First Meeting, the "Meetings"). The Meetings relate to the Proposals described below. The proxy materials for the shareholder meeting are first being sent to Shareholders on or about March [__], 2018.

At the Meetings, Shareholders will be asked to consider the following Proposals, as described in the accompanying Proxy Statement:

First Meeting:

| 1. | To elect a Board of Trustees of the Trust. |

Second Meeting:

| 1. | To approve a new investment management agreement between the Trust, on behalf of each Fund, and Community Capital Management, Inc. (the "Adviser"). |

| 2. | To approve an agreement and plan of reorganization that provides for the reorganization of the Trust from its current form of organization as a Massachusetts business trust into a newly formed Delaware statutory trust. |

THE BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR EACH OF THE PROPOSALS.

The Proposals are discussed in greater detail in the enclosed proxy statement (the "Proxy Statement"). You are entitled to vote at the Meetings if you owned shares of a Fund at the close of business on March 5, 2018 ("Record Date"). If you attend the Meetings, you may vote your shares in person. Shareholders whose shares are held in "street name" through their broker will need to obtain a legal proxy from their broker and present it at the Meetings in order to vote in person. However, we urge you, whether or not you expect to attend the Meeting in person, to complete, date, sign and return the enclosed proxy card(s) in the enclosed postage-paid envelope or vote by telephone or through the Internet.

YOUR VOTE IS IMPORTANT – PLEASE SIGN, DATE AND RETURN YOUR PROXY PROMPTLY.

By order of the Board of Trustees,

Alyssa Greenspan

President

Quaker Investment Trust

March [__], 2018

To secure the largest possible representation and to save the expense of further mailings, please mark your proxy card(s), sign, and return it (them) in the enclosed envelope, which requires no postage if mailed from the United States. If you prefer, you may instead vote by telephone or the Internet. You may revoke your proxy at any time before or at the Meetings or vote in person if you attend the Meetings, as provided in the attached Proxy Statement.

PROXY STATEMENT

TABLE OF CONTENTS

| | PAGE |

| FIRST MEETING -- PROPOSAL 1: TO ELECT A BOARD OF TRUSTEES OF THE TRUST | 2 |

| Information about the Nominees | 2 |

| Selection of Nominees | 3 |

| Board Structure and Compensation | 4 |

| Executive Officers of the Trust | 4 |

| Standing Committees of the Board | 5 |

| Information Regarding the Trust's Independent Auditor | 5 |

| Required Vote to Elect Trustees | 6 |

| SECOND MEETING -- PROPOSAL 1: APPROVAL OF NEW A INVESTMENT MANAGEMENT AGREEMENT ON BEHALF OF EACH FUND | 7 |

| The New Investment Advisory Agreement | 8 |

| Board Considerations in Approving the New Investment Advisory Agreement | 11 |

| Required Vote to Approve Advisory Agreements | 13 |

| SECOND MEETING -- PROPOSAL 2: APPROVAL OF PLAN OF REORGANIZATION | |

| MORE INFORMATION ABOUT THE FUNDS | 13 |

| PRINCIPAL HOLDERS OF SHARES | 15 |

| MORE INFORMATION ABOUT VOTING AND THE MEETING | 16 |

| APPENDIX A – NOMINATING AND CORPORATE GOVERNANCE COMMITTEE CHARTER | A-1 |

| APPENDIX B – AUDITOR INFORMATION | B-1 |

| APPENDIX C – FORM OF NEW INVESTMENT MANAGEMENT AGREEMENT | C-1 |

APPENDIX D – AGREEMENT AND PLAN OF REORGANIZATION | D-1 |

| APPENDIX E – COMPARISON OF MASSACHUSETSS AND DELAWARE GOVERNING INSTRUMENTS AND STATE LAW | E-1 |

PROXY STATEMENT

For

Quaker Global Tactical Allocation Fund

Quaker Mid-Cap Value Fund

Quaker Small-Cap Value Fund

Quaker Strategic Growth Fund

series of

QUAKER INVESTMENT TRUST

Dated March [__], 2018

Important notice regarding the availability of proxy materials for the shareholder meeting to be held on May 23, 2018:

In addition to the written notice of special meeting of shareholders, proxy statement and form of proxy that you are receiving, these documents also available on the Internet at www.okapivote.com/Quaker. The form of proxy on the Internet site cannot be used to cast your vote.

This proxy statement (the "Proxy Statement") solicits proxies to be voted at a two special meetings of shareholders ("Shareholders") of the Quaker Global Tactical Allocation Fund, Quaker Mid-Cap Value Fund, Quaker Small-Cap Value Fund, and Quaker Strategic Growth Fund (each, a "Fund" and together, the "Funds"), series of Quaker Investment Trust (the "Trust"). The first meeting will be held at 10:00 am Eastern time (the "First Meeting") and the second meeting will be held at 10:30 am Eastern time (the "Second Meeting" and collectively with the First Meeting, the "Meetings"). The Meetings will be held at the offices of Stradley Ronon Stevens & Young LLP, 30 Valley Stream Parkway, Berwyn, PA 19355 on May 23, 2018. The Meetings were called by the Board of Trustees of the Trust (the "Board") to vote on the following proposals (the "Proposals"), which are described more fully below:

First Meeting | Who votes on the Proposal? |

| To elect a Board of Trustees of the Trust | Shareholders of all Funds voting collectively. |

Second Meeting | |

| To approve a new investment management agreement for each Fund | Shareholders of each Fund, voting separately from shareholders of each other Fund. |

| To approve an agreement and plan of reorganization that provides for the reorganization of the Trust from its current form of organization as a Massachusetts business trust into a newly formed Delaware statutory trust. | Shareholders of all Funds voting collectively. |

Only officers of the Trust and Community Capital Management, Inc., the Funds' current investment adviser (the "Adviser"), and Fund Shareholders of record as of March 5, 2018 (the "Record Date"), will be admitted to the Meeting. The Board, on behalf of each Fund, is soliciting these proxies. This Proxy Statement is first being sent to Shareholders on or about March [__], 2018.

The principal office of the Trust is located at 2500 Weston Road, Suite 101, Weston, FL 33331. You can reach the office of the Trust by telephone by calling toll free at (800) 220-8888. The Trust is a Massachusetts business trust registered as an open-end management investment company under the Investment Company Act of 1940, as amended (the "1940 Act").

This Proxy Statement gives you information about the Proposals, and other matters that you should know before voting.

The Trust will furnish, without charge, a copy of its annual report and most recent semi-annual report succeeding the annual report, if any, to a Shareholder upon request. Such requests should be directed to the Trust by calling toll free at (800) 220-8888. Copies are also available on http://www.quakerfunds.com/. Copies of the annual and semi-annual reports of the Trust are also available on the EDGAR Database on the U.S. Securities and Exchange Commission's ("SEC") Internet site at www.sec.gov.

Two or more Shareholders of a Fund who share an address might receive only one annual report or Proxy Statement, unless the Trust has received instructions to the contrary. The Trust will promptly send a separate copy of the Proxy Statement to any Shareholder upon request. To request a separate copy of an annual report or the Proxy Statement, Shareholders should contact the Trust at (800) 220-8888.

FIRST MEETING – PROPOSAL 1: TO ELECT A BOARD OF TRUSTEES OF THE TRUST

Information about the Nominees

Shareholders of the Trust are being asked to elect five Trustees (together, the "Nominees") to the Board: James R. Brinton, Alyssa Greenspan, Everett T. Keech, Gary E. Shugrue, and Warren West. Messrs. Brinton, Keech, Shugrue and West are Nominees who will not be "interested persons" as defined under the 1940 Act (together, the "Independent Nominees"). The Independent Nominees are all currently independent members of the Board.

The Trust is governed by the Board, which has oversight responsibility for the management of the Trust's business affairs. The Trustees of the Board (each, a "Trustee" and collectively, the "Trustees") are responsible for supervising the management of the Trust and serving the needs and best interests of Fund shareholders. The Trustees establish procedures and oversee and review the performance of the investment adviser, distributor, and other service providers of the Trust.

As stated above, the four Independent Nominees currently serve as Independent Trustees (defined below) of the Trust. Shareholders have previously elected Warren West and James R. Brinton as Trustees. At a meeting held on February 6, 2018, the Nominees were recommended for consideration by the Trust's Nominating Committee, which is comprised of the current Trustees of the Trust who are not "interested persons" as that term is defined in the 1940 Act (together, the "Independent Trustees"). Each Nominee was then reviewed and recommended for nomination by the Nominating Committee and approved for nomination by the Board. If Proposal 1 is not approved, then the current Trustees would continue to serve as Trustees and determine what action, if any, to take.

If elected, each Nominee will hold office for an indefinite term until his successor is elected and qualified, or until his earlier death, resignation, or removal. Each Nominee currently is available and has consented to serve if elected. If any of the Nominees should become unavailable before the First Meeting, the designated proxy holders will have the authority to vote in their discretion for another person or persons who may be nominated as Trustees.

The Trust's other two current Trustees are Jeffry King and Laurie Keyes. Mr. King and Ms. Keyes both are interested Trustees due to their ownership interests in the Funds' former investment adviser, Quaker Funds. Inc. ("QFI"). Due to QFI's plans to exit the investment advisory business in 2018, neither Mr. King nor Ms. Keyes will stand for reelection by Fund shareholders.

Listed below, beside the name, address and age of each Nominee, are the Nominees' principal occupations during the past five years (their titles may have varied during that period), the number of Funds that the Nominees would oversee and other board memberships that the Nominees hold (if applicable).

| Name, Address and Age | Proposed Position with the Trust | Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of Portfolios in Fund Complex Overseen/To be Overseen by Nominee1 | Other Directorships Held by Nominee |

| Independent Nominees |

James R. Brinton 2500 Weston Road, Suite 101 Weston, FL 33331 Age 62 | Trustee Lead Independent Trustee | 2002-Present; 2007 – Present | Vice President, Powers Craft Parker & Beard, Inc. (commercial insurance brokerage firm)2 (2016-present); President, Robert J. McAllister Agency, Inc. (a commercial insurance brokerage firm) (1979 – 2016). | 5 | None |

Gary E. Shugrue 2500 Weston Road, Suite 101 Weston, FL 33331 Age 62 | Trustee | 2008 – Present | President and Chief Investment Officer, Ascendant Capital Partners (2001 – | 5 | Director, BHR Institutional Funds; Director, ACP |

| | | | Present). | | Funds Trust. |

Warren West 2500 Weston Road, Suite 101 Weston, FL 33331

Age 60 | Trustee | 2003 – Present | President, Greentree Brokerage Services, Inc. (1998 – 2017). | 5 | None |

Everett T. Keech 2500 Weston Road, Suite 101 Weston, FL 33331

Age 76 | Trustee | 2005 – Present | Chairman-Executive Committee, Technology Development Corp., (1997 – Present); Affiliated Faculty, University of Pennsylvania (1998 – Present); Chairman- Executive Committee, Advanced Training Systems International (2002 – Present). | 5 | Director, Technology Development Corp. |

| Interested Nominee |

Alyssa Greenspan

2500 Weston Road, Suite 101

Weston, FL 33331

Age 45 | Trustee | N/A | President, Community Capital Management, Inc. since January 2015; Chief Operating Officer, Community Capital Management, Inc. since June 2009; Senior Vice President and Portfolio Manager, Community Capital Management, Inc. since May 2003. | 5 | None |

| 1 | The Trust's fifth series, the Quaker Event Arbitrage Fund, is overseen by the Trustees but the Trust is separately soliciting shareholders of that Fund to approve a reorganization of the Fund into another unaffiliated mutual fund that will occur prior to the Meetings. |

| 2 | Powers Craft Parker & Beard, Inc. assists the Adviser in obtaining its professional liability insurance. The business relationship is not in excess of $250,000 per year and is not material to Powers Craft Parker & Beard, Inc., its parent company, or Mr. Brinton. The Board does not believe that this relationship affects Mr. Brinton's status as an Independent Trustee. |

Information about the Background, Experience and Related information regarding the Nominees

Nominees

As indicated above, Mr. Brinton is vice president of a commercial insurance brokerage firm; Mr. Shugrue is president and chief investment officer of a hedge fund advisory firm; Mr. West managed a securities brokerage firm; and Mr. Keech has more than 30 years of experience teaching at the Wharton School of the University of Pennsylvania and has executive experience in the private equity industry. Ms. Greenspan is president of the Adviser.

Selection of Nominees

The Nominating Committee generally identifies candidates for Board membership through personal and business contacts of Trustees and, in its sole discretion, may solicit names of potential candidates from the Adviser. The Nominating Committee's process for evaluating a candidate generally includes a review of the candidate's background and experience, and other due diligence. In evaluating a candidate, the Nominating Committee will also consider whether the candidate, if elected, would qualify as an independent trustee.

The Nominating Committee has not established any specific minimum requirements that candidates must meet in order to be recommended by the Nominating Committee for nomination for election to the Board. Rather, the Nominating Committee seeks candidates to serve on the Board who, in its judgment, will serve the best interests of the Trust's long term shareholders and whose background will complement the experience, skills and diversity of the other Trustees and add to the overall effectiveness of the Board. The Nominating Committee does not currently consider shareholder recommendations for nomination of trustees to the Board.

The adopted and approved Nominating Committee charter is attached as Appendix A to this Proxy Statement.

Board Structure and Compensation

The Board is responsible for establishing the Trust's policies and for overseeing the management of the Trust. The Board held 5 meetings during the 12-month period ended June 30, 2017. Each of the currently serving Trustees attended at least 75% of those Board meetings and also attended at least 66% of those committee meetings on which the Trustee serves as a member. The Trust does not have a formal policy regarding Trustee attendance at shareholders' meetings but they encourage Trustees to do so. The Trust does not hold annual meetings at which Trustees are elected.

None of the Nominees owns, beneficially or of record, securities issued by any investment adviser or principal underwriter, of the Funds, or a person directly or indirectly controlling, controlled by, or under common control with any of the foregoing as of the date of this proxy statement.

Information relating to each Trustee's ownership (including the ownership of his or her immediate family) in each Fund as of December 31, 2017 is set forth in the chart below.

| Name | Fund Name | Dollar Range of Shares of Beneficial Interest of the Funds Beneficially Owned | | Aggregate Dollar Range of Equity Securities in All Registered Investment Companies Overseen by Trustee in the Fund Complex |

| James R. Brinton | Quaker Global Tactical Allocation Fund Quaker Strategic Growth Fund Quaker Mid-Cap Value Fund Quaker Small-Cap Value Fund | None None None Over $100,000 | | Over $100,000 |

| Everett T. Keech | Quaker Global Tactical Allocation Fund Quaker Strategic Growth Fund Quaker Mid-Cap Value Fund Quaker Small-Cap Value Fund | None $1-$10,000 None None | | $1 - $10,000 |

| Gary E. Shugrue | Quaker Global Tactical Allocation Fund Quaker Strategic Growth Fund Quaker Mid-Cap Value Fund Quaker Small-Cap Value Fund | None None None None | | None |

| Warren West | Quaker Global Tactical Allocation Fund Quaker Strategic Growth Fund Quaker Mid-Cap Value Fund Quaker Small-Cap Value Fund | None $10,001 - $50,000 None None | | $10,001 - $50,000 |

| Alyssa Greenspan | Quaker Global Tactical Allocation Fund Quaker Strategic Growth Fund Quaker Mid-Cap Value Fund Quaker Small-Cap Value Fund | None None None None | | None |

Each Independent Trustee receives compensation from the Funds. Each Independent Trustee currently receives a total annual retainer of $25,000 for serving as a Trustee of the Trust. The compensation tables below set forth the total compensation paid to the Trustees

for the fiscal year ended June 30, 2017. The Trust has no pension or retirement benefits for any of the Trustees. Interested Trustees are not compensated by the Trust.

Name and Position(s) Held | Aggregate Compensation from the Trust | Pension or Retirement Benefits Accrued as Part of Trust Expenses | Total Estimated Annual Benefits upon Retirement | Compensation from the Fund(s) and Fund Complex Paid to Trustee |

James R. Brinton Lead Independent Trustee | $25,000 | N/A | N/A | $25,000 |

Warren West Independent Trustee | $25,000 | N/A | N/A | $25,000 |

Everett T. Keech Independent Trustee | $25,000 | N/A | N/A | $25,000 |

Gary E. Shugrue Independent Trustee | $25,000 | N/A | N/A | $25,000 |

Timothy E. Richards, the Chief Compliance Officer of the Trust, is the only other officer of the Trust who receives compensation from the Trust. For the fiscal year ended June 30, 2017, Mr. Richards received $181,127 in compensation from the Trust.

Executive Officers of the Trust

Officers of the Trust are appointed by the Trust's Board and serve at the pleasure of the Board. Information regarding the proposed executive officers of the Trust, including the officers' names, birthdates, addresses, positions and length of service with the Trust, and principal occupations during the past five years is provided below.

| Name, Address and Age | Position(s) Held with the Trust | Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of Portfolios in Fund Complex Overseen Officer | Other Directorships Held by Officer |

| Officers |

Alyssa Greenspan 2500 Weston Road, Suite 101

Weston, FL 33331

Age 45 | President | 2018 | President, Community Capital Management, Inc. since January 2015; Chief Operating Officer, Community Capital Management, Inc. since June 2009; Senior Vice President and Portfolio Manager, Community Capital Management, Inc. since May 2003. | 5 | None |

Timothy E. Richards 2500 Weston Road, Suite 101

Weston, FL 33331 Age 51 | Chief Compliance Officer | 2004 – Present | Chief Compliance Officer to Quaker Funds, Inc. (2003-Present); Chief Compliance Officer for the Quaker Investment Trust (2004-Present). | 5 | N/A |

Todd Cohen

2500 Weston Road, Suite 101 Weston, FL 33331

Age 52 | Treasurer | 2018 | Chief Executive Officer and Chief Investment Officer, Community Capital Management, Inc. since January 2015; President and Chief Investment Officer, Community Capital Management, Inc., since January 2007. | 5 | N/A |

David K. Downes

2500 Weston Road, Suite 101

Weston, FL 33331

Age 78 | Secretary | 2018 | Chair of the Board, Community Capital Management, Inc. since February 2015; Chief Executive Officer, Community Capital Management, Inc. from January 2004 to February 2015. | 5 | N/A |

Standing Committees of the Board

Audit Committee: The members of the Audit Committee are: Messrs. Everett T. Keech (Chairperson of the Audit Committee), James R. Brinton, Gary E. Shugrue and Warren West. The Audit Committee operates pursuant to a charter adopted by the Board. The purposes of the Audit Committee are to: (i) oversee the Funds' accounting and financial reporting principles and policies and related controls and procedures maintained by or on behalf of the Funds; (ii) oversee the Funds' financial statements and the independent audit thereof; (iii) select, evaluate and, where deemed appropriate, replace the Funds' independent registered public accountants ("independent auditors"); (iv) evaluate the independence of the Funds' independent auditors; and (v) to report to the full Board on its activities and recommendations. The function of the Audit Committee is oversight; it is management's responsibility to maintain appropriate systems for accounting and internal control, and the independent auditors' responsibility to plan and carry out a proper audit. The independent auditors are ultimately accountable to the Board and the Audit Committee, as representatives of the Funds' shareholders. Each of the members of the Audit Committee have a working knowledge of basic finance and accounting matters and are not interested persons of the Trust, as defined in the 1940 Act. The Audit Committee met two (2) times during the past fiscal year.

Nominating Committee: The members of the Nominating Committee are: Messrs. James R. Brinton (Chairperson of the Nominating Committee), Everett T. Keech, Gary E. Shugrue and Warren West, each of whom is an Independent Trustee, and, as such, satisfies the independence requirements under Rule 10A-3 of the 1934 Act, as amended. The Nominating Committee operates pursuant to a charter adopted by the Board. The purpose of the Nominating Committee is to recommend nominees for: (i) consideration as an independent trustee by the incumbent Independent Trustees of the Trust; and (ii) consideration as an interested trustee by the full Board. The Nominating Committee for the Trust did not meet during the past fiscal year.

Information Regarding the Trust's Independent Auditor

Selection of Auditors. The Audit Committee and the Board have selected the firm of Tait, Weller & Baker LLP ("Tait Weller") to serve as auditors of the Trust. Representatives of Tait Weller are not expected to be present at the Meeting.

Audit Fees. Please see Appendix B for information regarding the aggregate fees billed for each of the last two fiscal years for professional services rendered by Tait Weller for the audit of the Trust's annual financial statements or for services that are normally provided by Tait Weller in connection with statutory and regulatory filings or engagements for those fiscal years.

Audit-Related Fees. The Trust was not billed during its last two fiscal years for assurance and related services rendered by Tait Weller that are reasonably related to the performance of the audit, which were not reported under "Audit Fees" above. For the Trust's last two fiscal years, Tait Weller did not provide services relating to the performance of the audit of the financial statements of the Funds' investment adviser and other service providers under common control with the Funds' investment adviser and that relate directly to the operations or financial reporting of the Trust.

Tax Fees. Appendix B also includes the aggregate fees billed in each of the last two fiscal years for professional services rendered by Tait Weller for tax compliance, tax advice, and tax planning. The percentage of these fees relating to services approved by the Trust's Audit Committee pursuant to the de minimis exception from the pre-approval requirement in Rule 2-01(c)(7)(i)(c) of Regulation S-X was 0%. The aggregate fees billed by Tait Weller for tax-related services provided to the Funds' investment adviser and other service providers under common control with the Funds' investment adviser and that relate directly to the operations or financial reporting of the Trust were $12,500 for each of the Trust's last two fiscal years.

Aggregate Non-Audit Fees. Please see Appendix B for information regarding the aggregate non-audit fees billed by Tait Weller for services rendered to the Trust, its investment adviser, and any entity controlling, controlled by, or under common control with its investment adviser that provides ongoing services to the Trust during the Trust's last two fiscal years.

All Other Fees. There were no additional fees paid by any Trust during its last two fiscal years for products and services provided by Tait Weller, other than the services reported above.

Pre-Approval Policies and Procedures. Audit committees must pre-approve all audit services provided by an independent auditor, either specifically or in accordance with established pre-approval policies and procedures that pre-approves specific types of services to be performed by the independent auditor. Due to the size of the Trust and the Trust's Audit Committee, the Board has not adopted Pre-Approval Policies and Procedures.

Required Vote to Elect Trustees

In accordance with the Trust's governing documents, fifty-percent (50%) of the shares entitled to vote at the First Meeting present in person or represented by proxy at the First Meeting will constitute a quorum. You may withhold your vote for any or all Nominees. A

direction to withhold authority to vote for any Nominee will result in such nominee receiving fewer votes for his or her election. Provided that quorum requirements have been satisfied, the Nominees will be elected to the Board by the affirmative vote of a plurality of the votes cast collectively by the Funds' Shareholders. This means that the Nominees receiving the largest number of votes will be elected to fill the available positions and that abstentions and broker non-votes (if any) will have no effect on the approval of this Proposal. Because five Nominees have been nominated to fill five available positions and each are unopposed, assuming the presence of a quorum, the Nominees are expected to be elected.

FOR THE REASONS DISCUSSED ABOVE, THE BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR THE APPROVAL OF EACH OF THE NOMINEES.

SECOND MEETING – PROPOSAL 1: APPROVAL OF NEW INVESTMENT MANAGEMENT AGREEMENT ON BEHALF OF EACH FUND

Shareholders of each Fund are being asked to approve a new investment management agreement (the "New Investment Advisory Agreement") between the Trust, on behalf of each Fund, and Community Capital Management, Inc. (the "Adviser") . Each Fund is an open-end management investment company under the 1940 Act.

The Funds' prior investment advisory agreement (the "Prior Investment Advisory Agreement") with Quaker Funds, Inc. ("QFI") was terminated by the Board effective December 31, 2017 due to QFI's plans to exit the investment advisory business in 2018. As a result of the termination of the Prior Investment Advisory Agreement, the Adviser currently serves as the investment adviser to each Fund under an interim investment advisory agreement pursuant to Rule 15a-4(b)(1) under the 1940 Act (the "Interim Advisory Agreement"). The Interim Advisory Agreement was approved by the Board, including a majority of its Independent Trustees, at an in-person meeting held on November 16, 2017 and became effective on January 1, 2018. The terms and conditions of the Interim Advisory Agreement are substantially identical to the terms of the Prior Investment Advisory Agreement. However, the Interim Advisory Agreement is temporary and will expire after 150 days. Accordingly, the New Investment Advisory Agreement must be approved by Shareholders in order to allow the Adviser to continue to serve as the Funds' investment adviser following the expiration of the Interim Advisory Agreement. For a general description of the proposed New Investment Advisory Agreement and a comparison of the New Investment Advisory Agreement and the Prior Investment Advisory Agreement, see "The New Investment Advisory Agreement" section below. The form of the New Investment Advisory Agreement is provided in Appendix C.

Shareholders of each Fund are therefore being asked to approve a New Investment Advisory Agreement. If approved by a Fund's Shareholders, the New Investment Advisory Agreement would become effective as of the date of execution.

Post-Transition Structure and Operations

QFI and the Trust requested and received an exemptive order from the SEC on in 2006 which exempts QFI and the Trust from certain of the shareholder approval requirements of Section 15(a) of the 1940 Act and allows the Board, subject to certain conditions, to appoint new, unaffiliated sub-advisors and approve new investment sub-advisory agreements on behalf of the Trust without shareholder approval (the "Manager of Managers Relief"). Although the Board terminated the sub-advisers for the Quaker Strategic Growth Fund, Quaker Mid Cap Value Fund, and Quaker Small Cap Value Fund effective December 31, 2017 along with QFI, and although the Adviser does not currently plan to use sub-advisers to manage any of the Funds, the Board and the Adviser intend to seek approval from the SEC to transition the Manager of Managers Relief from QFI to the Adviser.

The Board and the Adviser currently do not anticipate any other changes to the Funds' service providers. Although two of the Trustees of the Trust, Jeffry H. King Sr. and Laurie Keyes, decided not to stand for reelection to the Board, Timothy Richards, the Trust's current Chief Compliance Officer ("CCO") and former general counsel of QFI, will continue to serve as the Funds' CCO. The Board was comfortable that the Adviser possesses the resources, experience and personnel to manage the Funds' assets notwithstanding that Mr. King and Ms. Keyes will no longer be involved with the Funds' operations, particularly in light of the fact that Mr. Richards would continue to serve as the Funds' CCO.

The New Investment Advisory Agreement

The New Investment Advisory Agreement is identical to the Prior Investment Advisory Agreement. Appendix C contains the form of New Investment Advisory Agreement. The following description of the New Investment Advisory Agreement is qualified in its entirety by reference to the full text of the agreement as set forth in Appendix C. The key features of the New Investment Advisory Agreement and Prior Investment Advisory Agreement are described below.

Investment Management Services

Under both the Prior and New Investment Advisory Agreement, the Funds' investment adviser has overall supervisory responsibility for: (i) the general management and investment of each Fund's securities portfolio; (ii) the evaluation, selection and recommendation to the Board of Trustees of the hiring, termination and replacement of sub-advisers to manage the assets of a Fund; (iii) overseeing and monitoring the ongoing performance of the sub-advisers of the Funds, including their compliance with the investment objectives, policies and restrictions of those Funds; and (iv) the implementation of procedures and policies to ensure that the Sub-advisers comply with the Fund's investment objectives, policies and restrictions.

Fees

The fees to be paid by the Funds for investment advisory services under the New Investment Advisory Agreement are less than, the fees paid under the Prior Investment Advisory Agreement. Under the Prior Investment Advisory Agreement, each Fund paid QFI management fees for managing the Fund's investments that are calculated as a percentage of the Fund's assets under management. QFI had contractually agreed to waive the lesser of 0.30 of its management fee and/or assume expenses to the extent necessary to reduce the Total Annual Fund Operating Expenses of the Quaker Global Tactical Allocation Fund (excluding 12b-1 fees) when they exceed 1.50% of the Fund's average daily net assets (the "Annualized Expense Ratio"). The Adviser has agreed to continue this waiver agreement during the Interim Advisory Agreement and if the New Investment Advisory Agreement is approved by Shareholders.

The contractual advisory fee rates payable under the Prior and New Investment Advisory Agreements are as follows:

Name of Fund

| Prior Advisory Agreement

Total Advisory Fee

as a Percentage of

Average Net Assets | New Advisory Agreement

Total Advisory Fee

as a Percentage of

Average Net Assets

|

| Quaker Global Tactical Allocation Fund | 1.25% | 0.75% |

| Quaker Mid-Cap Value Fund | 1.05% | 0.90% |

| Quaker Small-Cap Value Fund | 1.00% | 0.90% |

| Quaker Strategic Growth Fund | 1.30% | 0.75% |

Limitation of Liability

Under both the New and Prior Investment Advisory Agreements, the Funds' investment adviser shall not be liable for any error of judgment, mistake of law or for any other loss suffered by the Trust or any Fund in connection with the performance of the Agreement, except a loss to the Trust or to any Fund resulting from such adviser's breach of fiduciary duties with respect to the receipt of compensation for services or a loss resulting from the adviser's willful malfeasance, bad faith or gross negligence on its part in the performance of its duties or from reckless disregard by it of its obligations or duties under the Agreement.

Duration

If approved by Shareholders of the Funds, the New Investment Advisory Agreement shall remain in force for an initial term of two years from the date of its execution. Thereafter, the New Investment Advisory Agreement will continue in effect from year to year only if such continuance is specifically approved at least annually by both (i) the vote of a majority of a Fund's Board or the vote of a "majority of the outstanding voting securities" of the Fund, and (ii) the vote of a majority of the Independent Trustees, cast in person at a meeting called for the purpose of voting on such approval. The Prior Investment Advisory Agreement contained similar provisions regarding its terms and continuance.

A vote of a "majority of the outstanding voting securities" is defined in the 1940 Act as the lesser of the vote of (i) 67% or more of the voting securities of a Fund that are present at a meeting if holders of shares representing more than 50% of the outstanding voting securities of the Fund are present or represented by proxy or (ii) more than 50% of the outstanding voting securities of a Fund (a "1940 Act Majority").

Termination

The New Investment Advisory Agreement may be terminated at any time without the payment of any penalty, by (i) the Board, or by vote of holders of a 1940 Act Majority of a Fund's shares upon sixty (60) days written notice to the Adviser, or (ii) by the Adviser upon sixty (60) days written notice to a Fund. The Prior Investment Advisory Agreement contained identical termination provisions. As with the Prior Investment Advisory Agreement, the New Investment Advisory Agreement will also immediately terminate in the event of an "assignment" (as defined in the 1940 Act).

Board Considerations in Approving the New Investment Advisory Agreement

At a special in-person Board meeting held on November 16, 2017, the Board, including the Independent Trustees, discussed and approved the New Investment Advisory Agreement between the Adviser and the Trust, on behalf of each Fund, and determined to recommend that Shareholders approve the New Investment Advisory Agreement. In considering information relating to the approval of the New Investment Advisory Agreement, the Board, and the Independent Trustees, received assistance and advice from counsel and Independent Trustees' counsel, and was provided with a written description of their responsibilities in approving the New Investment Advisory Agreement. The Independent Trustees had requested and been provided with detailed materials prepared by the Adviser in advance of the meeting. At the meeting, the Trustees discussed QFI's intention to exit the investment advisory business in 2018; the Funds' need for continuity in investment advisory services; and the capabilities, resources, and personnel available through the Adviser. The Board also considered the Adviser's general plans and intentions regarding the operations and management of the Funds and the Trust. At the meeting, representatives of the Adviser responded to questions from the Board.

In connection with the Board's review of the New Investment Advisory Agreement, the Adviser advised the Trustees on a variety of matters, including the that no material changes were contemplated in the nature, quality, or extent of services currently provided to the Funds and their Shareholders, including investment management, distribution, or other Shareholder services, other than no longer relying on sub-advisers to manage certain of the Funds' portfolios.

In addition to the information provided by the Adviser as described above, the Board also considered, among other factors, the following:

| · | The significant financial resources of the Adviser that the Adviser indicated would benefit the Funds by providing a more robust operational infrastructure and a dedicated team designed to grow Fund assets. |

| · | The terms and conditions of the New Investment Advisory Agreement, including that each Fund's contractual fee rate under the New Investment Advisory Agreement will be lower than under the Prior Investment Advisory Agreement. |

| · | The Funds' existing investment policies and strategies will remain the same and additionally, the Adviser will implement an impact investing categorization and risk assessment process for the Funds. |

| · | At its in-person meeting on November 16, 2017, the Board reviewed the New Investment Advisory Agreement as required by the 1940 Act and determined that the Adviser had the capabilities, resources, experience and personnel necessary to provide at least the level of investment management services provided to the Funds pursuant to the Prior Investment Advisory Agreement. The Board carefully considered that the advisory fees to be paid by the Funds would be lower than under the Prior Investment Advisory Agreement, and acknowledged the Adviser's willingness to continue to waive fees and/or reimburse expenses in order to cap the costs paid by shareholders of the Quaker Global Tactical Allocation Fund. |

| · | The Adviser has agreed to pay all costs of associated with this Proposal 2. As a result, the Funds will not bear any costs in obtaining shareholder approval of the New Investment Advisory Agreement. |

Certain of these considerations are discussed in more detail below.

In making the decision to approve the New Investment Advisory Agreement, the Independent Trustees gave attention to all information furnished. The following discussion identifies the primary factors taken into account by the Board in approving the New Investment Advisory Agreement.

The nature, extent, and quality of services to be provided to the Funds by the Adviser. The Board considered materials provided describing the services to be provided by the Adviser to each Fund and its Shareholders as well as information provided at the November Board meeting. In reviewing the nature, extent, and quality of services to be provided to each Fund, the Board considered that the New Investment Advisory Agreement will be substantially identical to the Prior Investment Advisory Agreement. The Board carefully considered the Adviser's proposed reduction in advisory fees. The Board noted the continuity between the prior and new agreements with respect to the Adviser's anticipated responsibilities as the Funds' investment adviser, including: overall supervisory responsibility for the general management and investment of each Fund's securities portfolio; the Adviser's strategic plans to market the Funds; and the Adviser's expected adoption of the existing compliance structure for the Funds to monitor compliance with the Funds' respective investment objectives, strategies and restrictions on a day-to-day basis and undertaking to report to the Board on a quarterly basis and as otherwise deemed necessary or appropriate.

Based on their consideration and review of the foregoing information, the Board determined that the Funds were likely to benefit from the nature, extent, and quality of services to be provided by the Adviser, as well as the Adviser's ability to render such services based on its experience, operations, and resources.

Comparison of services to be provided and fees to be charged by the Adviser, and the cost of the services provided and profits realized by the Adviser from the relationship with the Funds. At this meeting, the Board carefully considered the Adviser's proposed contractual advisory fee rates, noting that they are less than the contractual fees under the Prior Investment Advisory Agreement. The

Board also acknowledged the Adviser's willingness to continue to waive fees and/or reimburse expenses in order to cap the costs paid by Fund Shareholders of the Quaker Global Tactical Allocation Fund.

Profitability and Economies of Scale. The Board considered possible costs, profitability and any "fall out" or ancillary benefits that may accrue to the Adviser as a result of its proposed relationship with the Funds. Based on the discussions with representatives of the Adviser and the relative size of the Funds, the Trustees concluded that there did not appear to be any significant benefits in this regard.

Conclusion. Based on the totality of the information considered, the Trustees concluded that the Funds were likely to benefit from the nature, extent and quality of Adviser's services and that the Adviser has the ability to provide these services based on its significant experience, operations and resources. After evaluation of the performance, fee and expense information, ancillary benefits and other considerations as described above, and in light of the nature, extent and quality of services to be provided by the Adviser, the Trustees, including a majority of the Independent Trustees, approved the New Investment Advisory Agreement, concluding that the advisory fee rates are reasonable in relation to the services provided to each Fund and that the New Investment Advisory Agreement is in the best interests of the Shareholders and the Funds.

Required Vote to Approve Advisory Agreement

This Proposal must be approved by the vote of a 1940 Act Majority of a Fund's shares, voting separately from shareholders of each other Fund. A "1940 Act Majority" of the outstanding voting securities of a Fund means the lesser of (i) 67% or more of the voting securities of the Fund that are present in person or by proxy at a meeting if holders of shares representing more than 50% of the outstanding voting securities of the Fund are present in person or by proxy or (ii) more than 50% of the outstanding voting securities of the Fund. Accordingly, abstentions and broker non-votes (if any) will have the same effect as a vote against Proposal 2.

The New Investment Advisory Agreement was approved separately by the Independent Trustees, and by the Board as a whole, after consideration of all factors that it determined to be relevant to its deliberations, including those discussed above. The Board also determined to submit the New Investment Advisory Agreement for consideration by the Shareholders and to recommend that Shareholders of the Funds vote FOR approval of the Funds' New Investment Advisory Agreement. If the Shareholders of a Fund do not approve the Funds' New Investment Advisory Agreement, the Board will consider other possible courses of action for the Fund.

To assure the presence of a quorum at the Second Meeting, please promptly execute and return the enclosed proxy. A self-addressed, postage-paid envelope is enclosed for your convenience. Alternatively, you may vote by telephone or through the Internet at the number or website address printed on the enclosed proxy card(s).

SECOND MEETING – PROPOSAL 2: APPROVAL OF AN AGREEMENT AND PLAN OF REORGANIZATION (THE "PLAN")

Shareholders of the Trust are being asked to approve an Agreement and Plan of Reorganization (the "Plan"), substantially in the form attached to this Proxy Statement as Appendix D, that would change the state and form of organization of the Trust, which is currently organized as a Massachusetts business trust. This proposed change calls for the reorganization of the Trust into a newly formed Delaware statutory trust (the "DE Trust"). Such proposed reorganization will be referred to throughout this proxy statement as the "DE Reorganization." To implement the DE Reorganization, the Board has approved the Plan, which contemplates the continuation of the current business of the Trust, and each of the Funds, in the form of the new DE Trust with five series corresponding to the Funds (the "DE Funds").

If the Plan is approved by shareholders of the Trust and the DE Reorganization is implemented, the DE Funds would have the same investment goal(s), policies and restrictions as their corresponding Funds. The DE Trust's Board, including any persons elected under Proposal 1 in this proxy statement, and the officers of the DE Trust would be the same as those of the Trust, and would operate the DE Trust in essentially the same manner as they previously operated the Trust. Thus, on the effective date of the DE Reorganization, you would hold an interest in the applicable DE Fund(s) that is equivalent to your interest in the corresponding Funds.

Board Recommendation to Approve the Plan and the DE Reorganization

The Board of the Trust has determined that investment companies formed as Delaware statutory trusts have certain advantages over investment companies organized as Massachusetts business trusts. Under Delaware statutory trust law, investment companies are able to simplify their operations by reducing administrative burdens. For example, the Delaware procedures allow a Delaware statutory trust to file a one-page Certificate of Trust with the State of Delaware, which rarely needs to be amended. In contrast, Massachusetts business trusts are required to file an Officer's Certificate with The Commonwealth of Massachusetts with resolutions adopted by the Board each time that the Board determines to amend the Declaration of Trust (for example, to designate and create additional classes of shares of the Funds or to change or eliminate classes of shares of the Funds). Such filings and any related filing fees are not required in Delaware.

Another advantage of Delaware statutory trusts compared to Massachusetts business trusts is greater certainty regarding limiting the liability of shareholders for obligations of the statutory trust or its trustees. The Delaware Statutory Trust Act (the "DSTA") entitles shareholders to the same limitation of personal liability extended to stockholders of Delaware for-profit corporations (generally limited to the full subscription price of the stock). Moreover, Massachusetts business trust law does not explicitly provide for the separation of assets and liabilities among separate series of a Massachusetts business trust. The DSTA, by contrast, provides a mechanism so that the liabilities of a particular series are only enforceable against the assets of that series and not against the assets of the trust generally or any of its other series, and none of the liabilities of the trust generally or any of the other series are enforceable against the assets of that series.

Funds organized as Delaware statutory trusts also have significant flexibility in structuring shareholder voting rights and shareholder meetings. The DSTA allows a fund to provide in its governing documents that certain fund transactions such as mergers, certain reorganizations and liquidations, may go forward with only trustee approval; all are subject, however, to any special voting requirements of the 1940 Act. [The governing documents for the Trust provide that any merger, consolidation or share exchange must be authorized by vote of a majority of the outstanding shares of the Trust, as a whole, or any affected series, as may be applicable. Under the governing documents for the DE Trust, the Board of Trustees of the DE Trust, by vote of a majority of the trustees, may cause the DE Trust to merge or consolidate with or into one or more statutory trusts or other business entities.] Such a merger or consolidation would not require the vote of the shareholders unless a shareholder vote is required by the 1940 Act.

Finally, Delaware has a well-established body of legal precedent in the area of corporate law that may be relevant in deciding issues pertaining to a Delaware statutory trust. This could benefit the DE Trust and its shareholders by, for example, making litigation involving the interpretation of provisions in the DE Trust's governing documents less likely or, if litigation should be initiated, less burdensome or expensive. Appendix E to this proxy statement includes a more complete description of the advantages of the Delaware statutory trust form of organization and the differences from Massachusetts business trusts.

Procedures and consequences of the DE Reorganization

Upon completion of the DE Reorganization, the DE Trust and the DE Funds will continue the business of the Trust and the Funds with the same investment goals and policies as those existing on the date of the DE Reorganization, and will hold the same portfolio of securities previously held by the corresponding Fund. The DE Trust and the DE Funds will be operated under substantially identical overall management, investment advisory, distribution and administrative arrangements as those of the corresponding Funds. As the

successor to the Funds' operations, the DE Trust will adopt the Trust's registration statement under the federal securities laws with amendments to show the new Delaware statutory trust structure.

The DE Trust and the DE Funds were created solely for the purpose of becoming the successors to, and carrying on the business of, the Trust and the corresponding Funds. To accomplish the DE Reorganization, the Plan provides that the Trust, on behalf of the Funds will transfer all of the Fund portfolio securities and any other assets, subject to all related liabilities, to the corresponding DE Fund. In exchange for these assets and liabilities, the DE Trust, on behalf of the applicable DE Funds will issue their own shares to the corresponding Fund, which will then distribute those shares pro rata to you as a shareholder of the Fund. Through this procedure, you will receive exactly the same number and dollar amount of shares of the applicable DE Fund as you held in the corresponding Fund on the date of the DE Reorganization. The net asset value of each share of a DE Fund will be the same as that of the corresponding Fund on the date of the DE Reorganization. You will retain the right to any declared but undistributed dividends or other distributions payable on the shares of your Fund that you may have had as of the effective date of the DE Reorganization. As soon as practicable after the date of the DE Reorganization, the Trust and its Funds will be dissolved and will cease their existence.

The Board may terminate the Plan and abandon the DE Reorganization at any time prior to the effective date of the DE Reorganization if it determines that proceeding with the DE Reorganization is inadvisable and not in the best interests of Fund shareholders. If the DE Reorganization is not approved by shareholders, or if the Board abandons the DE Reorganization, the Trust will continue to operate as a Massachusetts business trust. If the DE Reorganization is approved by shareholders, it is expected to be completed within a reasonable time following such approval.

Effect of the DE Reorganization on the New Investment Advisory Agreement

As a result of the DE Reorganization, each DE Fund will be subject to an initial investment management agreement between the DE Trust, on behalf of such DE Fund and the Adviser. The initial investment management agreement for the DE Funds will be identical to the New Investment Advisory Agreement, if approved by shareholders.

Effect of the DE Reorganization on the shareholder servicing agreements and distribution plans

The DE Trust will enter into agreements with U.S. Bancorp Fund Services, LLC for transfer agency, dividend disbursing, shareholder servicing and accounting services. This new agreement will be substantially identical to the agreement currently in place for the Trust. Foreside Fund Services, LLC ("Foreside") will serve as the distributor for the shares of the DE Trust and the DE Funds under a distribution agreement that will be substantially identical to the distribution agreement currently in effect for the Trust.

As of the effective date of the Reorganization, the DE Trust will have distribution plans under Rule 12b-1 of the 1940 Act relating to the distribution of the classes of shares that are substantially identical to the distribution plans currently in place for the corresponding classes of shares of the corresponding Funds.

Effect of shareholder approval of the Plan

By voting "FOR" the Plan, you will be agreeing to become a shareholder of a mutual fund organized as a Delaware statutory trust, with Board members, investment advisory agreement(s), distribution plans and other service arrangements that are substantially the same as those in place for the Trust.

Under the 1940 Act, the shareholders of an investment company must elect trustees, approve the initial investment management agreement for a fund, and approve the use of the Manager of Managers Structure. Theoretically, if the Plan is approved for the Trust and the Trust is reorganized as the DE Trust, the shareholders of the DE Trust would need to vote on these items in order to comply with the 1940 Act.

In order to comply with these requirements and consistent with SEC guidance, Shareholder approval of the Plan will also constitute, for purposes of the 1940 Act, Shareholder approval of: (1) the election of the Board members of the Trust who are in office at the effective date of the DE Reorganization, as described in Proposal 1, as trustees of the DE Trust; (2) the initial investment management agreement(s) for the DE Funds that are identical to the New Investment Advisory Agreement that will be in place at the time of the Reorganization; and (3) use of the Manager of Managers Structure.

If the Plan is approved, then this initial shareholder approval will be arranged by the Trust (1) purchasing one share of each DE Fund; (2) as sole shareholder, voting "FOR" the election of Board members, the initial investment advisory agreement(s) and the use of the Manager of Managers Structure; and (3) then redeeming its shares, all prior to the completion of the DE Reorganization. These actions will enable the DE Trust to satisfy the requirements of the 1940 Act without involving the time and expense of another shareholder meeting.

Capitalization and structure of the DE Trust

The DE Trust will be formed as a Delaware statutory trust as soon as practicable, pursuant to Delaware law. The DE Trust will be authorized to issue an unlimited number of shares of beneficial interest, without par value, of the DE Funds and the same classes as the corresponding Fund.

As of the effective date of the DE Reorganization, shares of the respective series and classes of the Trust and the DE Trust will: (1) have similar distribution and redemption rights; (2) be fully paid and non-assessable; (3) have similar conversion rights; and (4) have no preemptive or subscription rights. Shares of the respective classes of DE Funds and the corresponding Fund will have similar voting and liquidation rights and have one vote per share and a proportionate fractional vote for each fractional share. Neither the Trust nor the DE Trust provides for cumulative voting in the election of its Board members. The DE Trust also will have the same fiscal year as the Trust.

Tax consequences

The DE Reorganization is designed to be tax-free for federal income tax purposes so that you will not experience a taxable gain or loss when the DE Reorganization is completed. Generally, the basis and holding period of your shares in a DE Fund will be the same as the basis and holding period of your shares in the corresponding Fund. Consummation of the DE Reorganization is subject to receipt of a legal opinion from the law firm of Stradley Ronon Stevens & Young, LLP, counsel to the DE Trust and the Trust, that, under the Code, the exchange of assets of the Funds for the shares of the corresponding DE Funds, the transfer of such shares to the shareholders of Funds and the dissolution of the Trust pursuant to the Plan will not give rise to the recognition of a gain or loss for federal income tax purposes to the Funds, the DE Funds or either of their shareholders.

Required Vote

This Proposal must be approved by the affirmative vote of a majority of outstanding shares of the Trust, voting collectively. If this Proposal is not approved by a majority of the outstanding shares of the Trust, the DE Reorganization will not occur, and the Board of the Trust will consider what action, if any, to take in the future.

MORE INFORMATION ABOUT THE FUNDS

Management of the Funds

Community Capital Management, Inc. (the "Adviser") is located at 2500 Weston Road, Suite 101, Weston, FL 33331. The Adviser is registered as an investment advisor with the SEC under the Investment Advisers Act of 1940, as amended.

The current executives of the Adviser and their positions with the Trust are listed below. The address of each person listed, as it relates to the person's position with the Adviser or the Trust, is 2500 Weston Road, Suite 101, Weston, FL 33331.

| Name | Positions Held With the Adviser | Positions Held With the Trust

|

| Todd Cohen | Chief Executive Officer and Chief Information Officer | Treasurer |

| David Downes | Chair of the Board | Secretary |

| Alyssa Greenspan | President and Chief Operating Officer | President |

| | | |

Distributor

Foreside Fund Services, LLC (the "Distributor"), located at 3 Canal Plaza, Suite 100, Portland, Maine 04101, serves as the principal underwriter of the Trust's shares pursuant to a Distribution Agreement with each Fund (each, a "Distribution Agreement"). Shares of the Funds are offered on a continuous basis by the Distributor and may be purchased directly by contacting the Distributor or the Trust.

The Distribution agreement on behalf of each Fund is renewable annually and the Board annually reviews fees paid to the Distributor. The Distributor is a registered broker-dealer under the Securities Exchange Act of 1934, as amended, and each state's securities laws and is a member of the Financial Industry Regulatory Authority.

Fund Administrator

General Information. The Administrator and Fund Accountant for the Funds is U.S. Bancorp Fund Services, LLC ("Administrator"), which has its principal office at 615 East Michigan Street, Milwaukee, Wisconsin 53202 and is primarily in the business of providing administrative, fund accounting and stock transfer services to retail and institutional funds. The Administrator performs these services pursuant to two separate agreements with each respective Fund, a Fund Administration Servicing Agreement and a Fund Accounting Servicing Agreement. For the fiscal periods ended June 30, 2015, June 30, 2016 and June 30, 2017, the Funds paid the Administrator the following amounts for its fund administration services:

| Fund Name | Fiscal Year Ended June 30, 2017 | Fiscal Year Ended June 30, 2016 | Fiscal Year Ended June 30, 2015 |

Quaker Global Tactical Allocation Fund | $9,093 | $7,157 | $4,638 |

Quaker Mid-Cap Value Fund | $9,193 | $5,924 | $5,659 |

Quaker Small-Cap Value Fund | $39,725 | $27,437 | $21,472 |

| Quaker Strategic Growth Fund | $98,529 | $91,408 | $96,082 |

Administration Agreement. Pursuant to the Fund Administration Servicing Agreement ("Administration Agreement") with each Fund, the Administrator provides all administrative services necessary for the Fund, other than those provided by the Adviser, subject to the supervision of the Board. Employees of the Administrator generally will not be officers of the Fund for which they provide services.

The Administration Agreement is terminable by the Board or the Administrator on ninety (90) days' written notice and may be assigned provided the non-assigning party provides prior written consent. The Administration Agreement shall remain in effect for

three years from the date of its initial approval, unless amended, and its renewal is subject to approval of the Board for periods thereafter. The Administration Agreement provides that in the absence of the Administrator's refusal or willful failure to comply with the Agreement or bad faith, negligence or willful misconduct on the part of the Administrator, the Administrator shall not be liable for any action or failure to act in accordance with its duties thereunder.

Under the Administration Agreements, the Administrator provides all administrative services, including, without limitation: (i) providing services of persons competent to perform such administrative and clerical functions as are necessary to provide effective administration of the Funds; (ii) overseeing the performance of administrative and professional services to the Funds by others, including the Funds' Custodian; (iii) preparing, but not paying for, the periodic updating of the Funds' Registration Statement, Prospectuses and Statements of Additional Information in conjunction with Fund counsel, including the printing of such documents for the purpose of filings with the Securities and Exchange Commission and state securities administrators, preparing the Funds' tax returns, and preparing reports to the Funds' shareholders and the Securities and Exchange Commission; (iv) calculation of yield and total return for the Funds; (v) monitoring and evaluating daily income and expense accruals, and sales and redemptions of shares of the Funds (vi) preparing in conjunction with Fund counsel, but not paying for, all filings under the securities or "Blue Sky" laws of such states or countries as are designated by the Distributor, which may be required to register or qualify, or continue the registration or qualification, of the Funds and/or their shares under such laws; (vii) preparing notices and agendas for meetings of the Board and minutes of such meetings in all matters required by the 1940 Act to be acted upon by the Board; and (viii) monitoring periodic compliance with respect to all requirements and restrictions of the 1940 Act, the Internal Revenue Code and the Funds' Prospectuses.

For the administrative services rendered to the Funds by the Administrator, each Fund pays the Administrator an asset-based fee plus certain out-of-pocket expenses.