UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 29, 2020

UnitedBankshares, Inc.

(Exact name of registrant as specified in its charter)

| West Virginia | No. 002-86947 | 55-0641179 | ||

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

300 United Center

500 Virginia Street, East

Charleston, West Virginia 25301

(Address of Principal Executive Offices)

(304) 424-8800

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or address, if changed since last report)

Check the appropriate box below if the Form8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☒ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule14a-12 under the Exchange Act (17 CFR240.14a-12)

☐ Pre-commencement communications pursuant to Rule14d-2(b) under the Exchange Act (17 CFR240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule13e-4(c) under the Exchange Act (17 CFR240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common Stock, par value $2.50 per share | UBSI | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On January 29, 2020 United Bankshares, Inc. (“United”) announced its financial results for the fourth quarter and year of 2019. A copy of the press release is attached as Exhibit 99.1 to this report and a copy of the slide presentation of the financial information for the fourth quarter and fiscal year 2019 is attached as Exhibit 99.2. The press release and slide presentation are being furnished under Item 2.02 of this Form8-K.

Item 9.01. Financial Statements and Exhibits

(c) The following exhibits are being furnished herewith:

| 99.1 | Press Release, dated January 29, 2020, issued by United Bankshares, Inc. | |

| 99.2 | Slide presentation of financial information for the fourth quarter of 2019 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| UNITED BANKSHARES, INC. | ||||||

| Date: January 29, 2020 | By: /s/ W. Mark Tatterson | |||||

| W. Mark Tatterson, Executive Vice | ||||||

| President and Chief Financial Officer | ||||||

EXHIBIT 99.1

News Release

For Immediate Release | Contact: W. Mark Tatterson | |

January 29, 2020 | Chief Financial Officer | |

| (800)445-1347 ext. 8716 |

United Bankshares, Inc. Announces Record Earnings

for the Year of 2019

WASHINGTON, D.C. and CHARLESTON,WV-- United Bankshares, Inc. (NASDAQ: UBSI), today reported earnings for the fourth quarter and year of 2019. Earnings for the fourth quarter of 2019 were $63.3 million or $0.62 per diluted share as compared to earnings of $64.0 million or $0.62 per diluted share for the fourth quarter of 2018. Earnings for the year of 2019 were a record $260.1 million or $2.55 per diluted share as compared to earnings of $256.3 million or $2.45 per diluted share for the year of 2018.

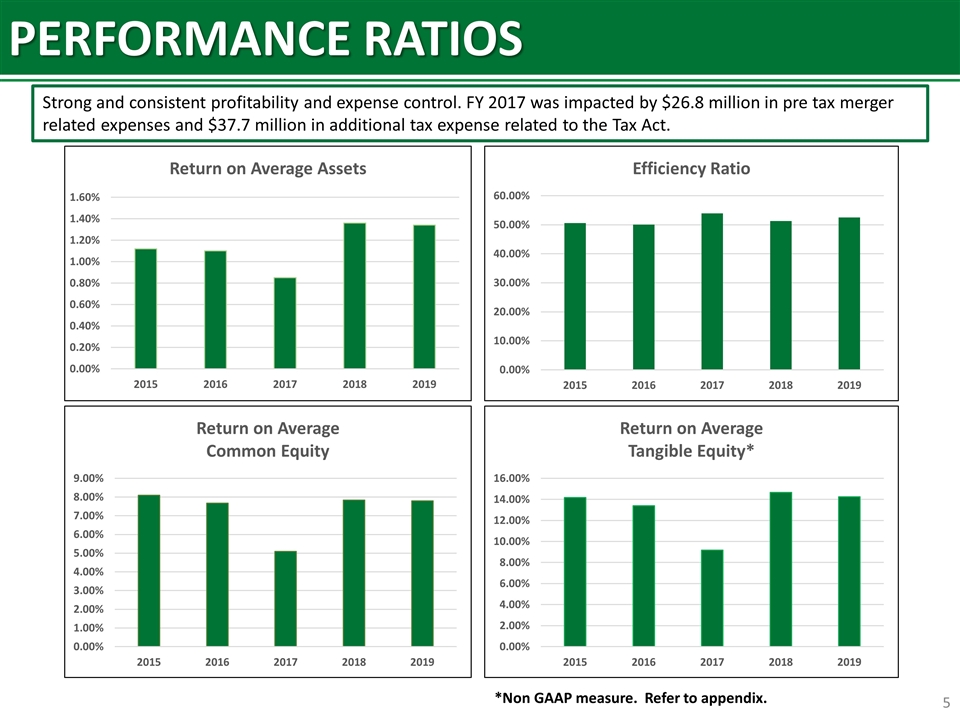

Fourth quarter of 2019 results produced an annualized return on average assets of 1.29%, an annualized return on average equity of 7.42% and an annualized return on average tangible equity of 13.38%. For the year of 2019, United’s return on average assets was 1.34% while the return on average equity was 7.80% and the return on average tangible equity was 14.26%. United’s annualized returns on average assets, average equity and average tangible equity were 1.33%, 7.77% and 14.52%, respectively, for the fourth quarter of 2018 while the returns on average assets, average equity and average tangible equity were 1.36%, 7.84% and 14.65%, respectively, for the year of 2018.

“2019 was another great year for United Bankshares,” stated Richard M. Adams, United’s Chairman of the Board and Chief Executive Officer. “We earned record net income of $260 million and record diluted earnings per share of $2.55, announced the intent to acquire Carolina Financial Corporation, our 32nd acquisition of the current administration, and increased dividends to our shareholders for the 46th consecutive year, a record only one other major banking company in the USA has been able to achieve.”

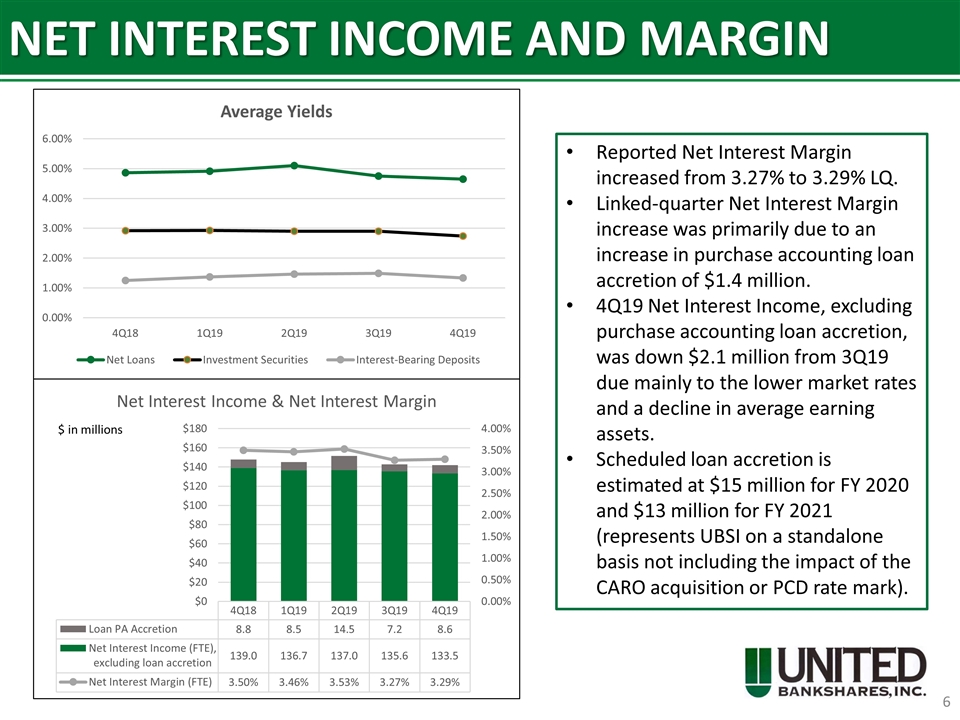

Net interest income for the fourth quarter of 2019 was $141.3 million, which was a decrease of $5.4 million or 4% from the fourth quarter of 2018.Tax-equivalent net interest income, which adjusts for thetax-favored status of income from certain loans and investments, for the fourth quarter of 2019 was $142.1 million, a decrease of $5.6 million or 4% from the fourth quarter of 2018 due mainly to a decrease of 18 basis points in the average yield on earning assets and an increase of 7 basis points in the average cost of funds as compared to the fourth quarter of 2018. Partially offsetting these decreases totax-equivalent net interest income for the fourth quarter of 2019 was an increase in average earning assets as compared to the fourth quarter of 2018. Average earning assets for the fourth quarter of 2019 increased $373.0 million or 2% from the fourth quarter of 2018 due mainly to an increase of $410.8 million or 3% in average net loans. In addition, average investment securities for the fourth quarter of 2019 increased $199.1 million or 8% from the fourth quarter of 2018. Partially offsetting these increases was a decrease in average short-term investments of $236.9 million or 28%. The net interest margin of 3.29% for the fourth quarter of 2019 was a decrease of 21 basis points from the net interest margin of 3.50% for the fourth quarter of 2018.

United Bankshares, Inc. Announces...

January 29, 2020

Page Two

Net interest income for the year of 2019 was $577.9 million, which was a decrease of $10.7 million or 2% from the year of 2018.Tax-equivalent net interest income for the year of 2019 was $581.7 million, which was a decrease of $11.3 million or 2% from the year of 2018 due mainly to an increase in the average cost of funds. The average cost of funds for the year of 2019 increased 45 basis points from the year of 2018 due to higher market interest rates and a change in the mix of interest bearing liabilities. Partially offsetting the decreases totax-equivalent net interest income for the year of 2019 were increases in average earning assets and the average yield on those average earning assets. For the year of 2019, average earning assets increased $608.0 million or 4% from the year of 2018 due mainly to increases of $403.4 million or 3% in average net loans and $313.9 million or 14% in average investment securities. Average short-term investments decreased $109.2 million or 13%. The average yield on earning assets for the year of 2019 increased 11 basis points from the year of 2018 due primarily to higher market rates. Loan accretion on acquired loans was $38.8 million and $43.2 million for the year of 2019 and 2018, respectively, decreasing $4.4 million or 10%. The net interest margin of 3.39% for the year of 2019 was a decrease of 19 basis points from the net interest margin of 3.58% for the year of 2018.

On a linked-quarter basis, net interest income for the fourth quarter of 2019 was relatively flat from the third quarter of 2019, decreasing $635 thousand or less than 1%. United’stax-equivalent net interest income for the fourth quarter of 2019 was also relatively flat from the third quarter of 2019, decreasing $698 thousand or less than 1% due mainly to a decrease of 10 basis points in the average yield on earning assets. In addition, average earning assets declined $191.1 million or 1%. Specifically, average short-term investments decreased $234.6 million or 28% while average investment securities increased $34.6 million or 1%. Average net loans were relatively flat for the quarter, increasing $8.9 million or less than 1%. Virtually offsetting the decreases was a decline of 14 basis points in the average cost of funds. In addition, loan accretion on acquired loans increased $1.4 million. Loan accretion on acquired loans was $8.6 million and $7.2 million for the fourth quarter and third quarter of 2019, respectively. The net interest margin of 3.29% for the fourth quarter of 2019 increased 2 basis points from the net interest margin of 3.27% for the third quarter of 2019.

For the quarters ended December 31, 2019 and 2018, the provision for loan losses was $5.9 million and $5.8 million, respectively, while the provision for the year of 2019 was $21.3 million as compared to $22.0 million for the year of 2018. Net charge-offs were $5.9 million and $21.0 million for the fourth quarter and year of 2019, respectively, as compared to $6.1 million and $21.9 million for the same time periods in 2018. Annualized net charge-offs as a percentage of average loans were 0.17% and 0.16% for the fourth quarter and year of 2019, respectively. On a linked-quarter basis, the provision for loan losses for the fourth quarter of 2019 increased $834 thousand while net charge-offs increased $1.6 million from the third quarter of 2019.

Noninterest income for the fourth quarter of 2019 was $37.2 million, which was an increase of $7.4 million or 25% from the fourth quarter of 2018. The increase was due mainly to an increase of $6.0 million in income from mortgage banking activities due to increased production and sales of mortgage loans in the secondary market by United’s mortgage banking subsidiary, George Mason Mortgage, LLC (George Mason). In addition, United recognized a net gain of $109 thousand on investment securities’ activity in the fourth quarter of 2019 as compared to a net loss of $1.9 million in the fourth quarter of 2018. Also, income from bank-owned life insurance policies increased $1.6 million from the fourth quarter of 2018 due to the recognition of death benefits of $1.7 million in the fourth quarter of 2019. Partially offsetting these increases was a net gain of $2.8 million on the sale of bank premises United recorded in the fourth quarter of 2018.

United Bankshares, Inc. Announces...

January 29, 2020

Page Three

Noninterest income for the year of 2019 was $150.5 million, which was an increase of $21.8 million or 17% from the year of 2018. The increase was due mainly to an increase of $18.8 million in income from mortgage banking activities primarily due to increased loan originations and a higher realized gain on sale margin by George Mason. In addition, fees from trust services increased $943 thousand due to an increase in managed assets, fees from brokerage services increased $789 thousand due to increased volume and income from bank-owned life insurance increased $2.3 million due to the recognition of $2.3 million in death benefits for the year of 2019. Also, United recognized a net gain of $175 thousand on investment securities’ activity in the year of 2019 as compared to a net loss of $2.6 million for the year of 2018. Partially offsetting these increases was the previously mentioned net gain of $2.8 million on the sale of bank premises in the year of 2018.

On a linked-quarter basis, noninterest income for the fourth quarter of 2019 decreased $5.0 million or 12% from the third quarter of 2019. This decrease was due mainly to a decrease of $6.5 million in income from mortgage banking activities due to decreased production and sales of mortgage loans in the secondary market as a result of a typical seasonal slowdown. Partially offsetting this decrease was an increase of $1.6 million in income from bank-owned life insurance policies due to the previously mentioned recognition of death benefits of $1.7 million in the fourth quarter of 2019.

Noninterest expense for the fourth quarter of 2019 was $96.9 million, an increase of $5.9 million or 6% from the fourth quarter of 2018 due mainly to an increase of $5.2 million in employee compensation expense. The increase was due primarily to an increase in employee commissions expense related to the increase in production and sales of mortgage loans at George Mason. In addition, other expense increased $2.6 million due to an increase of $1.2 million in donations and merger expenses of $589 thousand related to the announced acquisition of Carolina Financial Corporation. Partially offsetting these increases was a decline of $2.2 million in Federal Deposit Insurance Corporation (FDIC) assessment fees.

Noninterest expense for the year of 2019 was $382.7 million, an increase of $14.5 million or 4% from the year of 2018. In particular, employee compensation expense increased $9.5 million due mainly to increased salaries and commissions expense primarily related to the increase in production and sales of mortgage loans at George Mason. In addition, United recognized prepayment penalties on FHLB advances of $5.1 million in the second quarter of 2019 and other expense increased $5.6 million due mainly to an increase of $2.8 million on the amortization of income tax credits and an increase of $1.1 million in donations. The amortization of tax credits lowered the effective tax rate. Partially offsetting these increases were decreases of $3.4 million in FDIC insurance expense resulting from a small bank assessment credit and lower assessment fees, $1.6 million in net occupancy expense due mainly to a decline in building rental expense and $1.6 million in data processing fees due to lower fees under a new contract.

On a linked-quarter basis, noninterest expense for the fourth quarter of 2019 was relatively flat from the third quarter of 2019, increasing $766 thousand or less than 1%. An increase of $2.2 million in other expense due to an increase of $1.2 million in donations and the merger expenses of $589 thousand was virtually offset by a decline of $1.9 million in employee compensation due mainly to a decrease in commissions and incentives expense for George Mason.

United Bankshares, Inc. Announces...

January 29, 2020

Page Four

For the fourth quarter and year of 2019, income tax expense was $12.5 million and $64.3 million, respectively, as compared to $15.8 million and $70.8 million, respectively, in the fourth quarter and year of 2018. The decreases in 2019 were mainly due to a decline in the effective tax rate as a result of the increased benefit from income tax credits. On a linked-quarter basis, income tax expense for the fourth quarter of 2019 decreased $4.5 million from the third quarter of 2019 due to lower earnings and a lower effective tax rate. United’s effective tax rate was 16.5% for the fourth quarter of 2019, 20.5% for the third quarter of 2019 and 19.8% for the fourth quarter of 2018. For the year of 2019 and 2018, United’s effective tax rate was 19.8% and 21.7%, respectively.

United’s asset quality continues to be sound. At December 31, 2019, nonperforming loans were $131.1 million, or 0.96% of loans, net of unearned income, a decline from nonperforming loans of $142.8 million, or 1.06% of loans, net of unearned income, at December 31, 2018. As of December 31, 2019, the allowance for loan losses was $77.1 million or 0.56% of loans, net of unearned income, which was comparable to $76.7 million or 0.57% of loans, net of unearned income, at December 31, 2018. Total nonperforming assets of $146.6 million, including OREO of $15.5 million at December 31, 2019, represented 0.75% of total assets as compared to nonperforming assets of $159.7 million or 0.83% at December 31, 2018.

United continues to be well-capitalized based upon regulatory guidelines. United’s estimated risk-based capital ratio is 14.7% at December 31, 2019 while its estimated Common Equity Tier 1 capital, Tier 1 capital and leverage ratios are 12.5%, 12.5% and 10.5%, respectively. The regulatory requirements for a well-capitalized financial institution are a risk-based capital ratio of 10.0%, a Common Equity Tier 1 capital ratio of 6.5%, a Tier 1 capital ratio of 8.0% and a leverage ratio of 5.0%.

During the fourth quarter of 2019, United announced that it entered into a definitive merger agreement with Carolina Financial Corporation. Under the merger agreement, United will acquire 100% of the outstanding shares of Carolina Financial Corporation in exchange for common shares of United. The combined organization will be approximately $25 billion in assets with more than 200 locations in some of the most desirable banking markets in the nation. United recently filed a FormS-4 with the Securities and Exchange Commission regarding the proposed merger. United expects the merger to close during the second quarter of 2020.

As of December 31, 2019, United had consolidated assets of approximately $19.7 billion. United is the parent company of United Bank, the largest community bank headquartered in the D.C. Metro region. United Bank which comprises 138 full-service banking offices and 15 George Mason Mortgage, LLC locations, is located throughout Virginia, West Virginia, Maryland, North Carolina, South Carolina, Ohio, Pennsylvania and Washington, D.C. United’s stock is traded on the NASDAQ Global Select Market under the quotation symbol “UBSI”.

United Bankshares, Inc. Announces...

January 29, 2020

Page Five

Cautionary Statements

The Company is required under generally accepted accounting principles to evaluate subsequent events through the filing of its December 31, 2019 consolidated financial statements on Form10-K. As a result, the Company will continue to evaluate the impact of any subsequent events on critical accounting assumptions and estimates made as of December 31, 2019 and will adjust amounts preliminarily reported, if necessary.

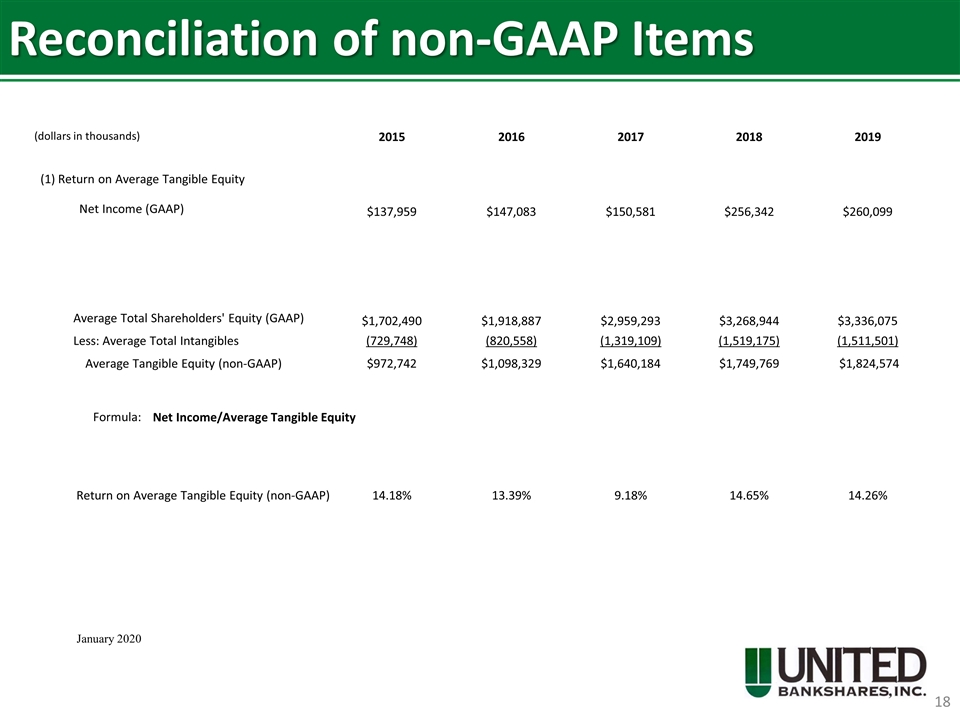

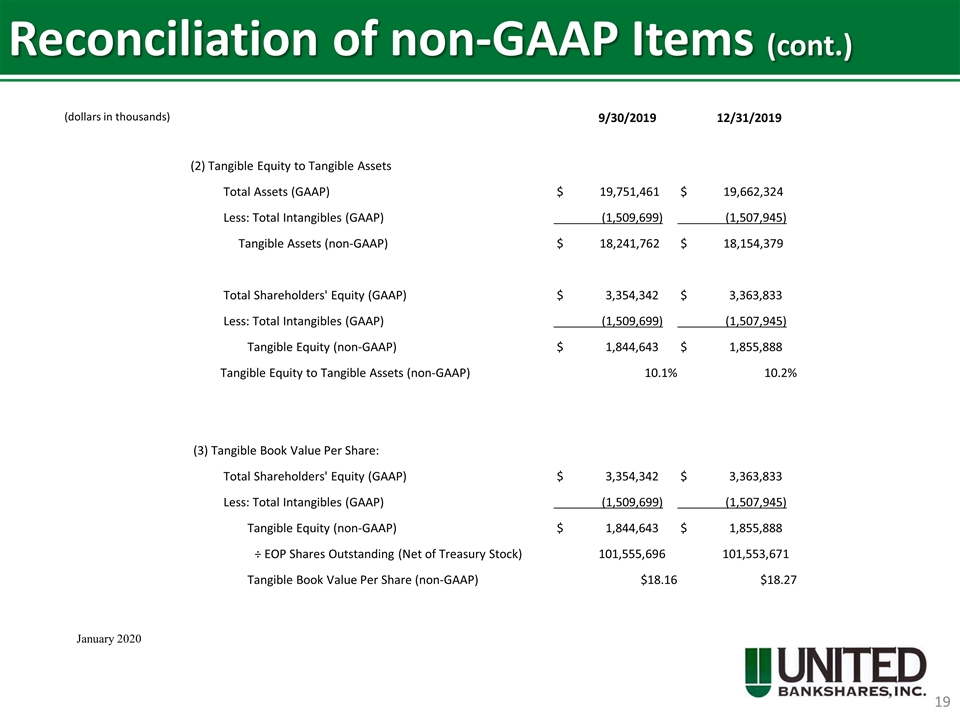

Use ofnon-GAAP Financial Measures

This press release contains certain financial measures that are not recognized under U.S. generally accepted accounting principles (“GAAP”). Generally, United has presented these“non-GAAP” financial measures because it believes that these measures provide meaningful additional information to assist in the evaluation of United’s results of operations or financial position. Presentation of thesenon-GAAP financial measures is consistent with how United’s management evaluates its performance internally and thesenon-GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the banking industry.

Specifically, this press release contains certain references to financial measures identified astax-equivalent (FTE) net interest income, tangible equity and tangible book value per share. Management believes thesenon-GAAP financial measures to be helpful in understanding United’s results of operations or financial position.

Net interest income is presented in this press release on atax-equivalent basis. Thetax-equivalent basis adjusts for thetax-favored status of income from certain loans and investments. Although this is anon-GAAP measure, United’s management believes this measure is more widely used within the financial services industry and provides better comparability of net interest income arising from taxable andtax-exempt sources. United uses this measure to monitor net interest income performance and to manage its balance sheet composition. Thetax-equivalent adjustment combines amounts of interest income on federally nontaxable loans and investment securities using the statutory federal income tax rate of 21%.

Tangible common equity is calculated as GAAP total shareholders’ equity minus total intangible assets. Tangible common equity can thus be considered the most conservative valuation of the company. Tangible common equity is also presented on a per common share basis and considering net income, a return on average tangible equity. Management provides these amounts to facilitate the understanding of as well as to assess the quality and composition of United’s capital structure. By removing the effect of intangible assets that result from merger and acquisition activity, the “permanent” items of common equity are presented. These measures, along with others, are used by management to analyze capital adequacy and performance.

Wherenon-GAAP financial measures are used, the comparable GAAP financial measure, as well as reconciliation to that comparable GAAP financial measure can be found in the attached financial information tables to this press release. Investors should recognize that United’s presentation of thesenon-GAAP financial measures might not be comparable to similarly titled measures at other companies. Thesenon-GAAP financial measures should not be considered a substitute for GAAP basis measures and United strongly encourages a review of its condensed consolidated financial statements in their entirety.

Forward-Looking Statements

This press release contains certain forward-looking statements, including certain plans, expectations, goals and projections, which are subject to numerous assumptions, risks and uncertainties. Actual results could differ materially from those contained in or implied by such statements for a variety of factors including: changes in economic conditions; movements in interest rates; competitive pressures on product pricing and services; success and timing of business strategies; the nature and extent of governmental actions and reforms; and rapidly changing technology and evolving banking industry standards.

UNITED BANKSHARES, INC. AND SUBSIDIARIES

FINANCIAL SUMMARY

(In Thousands Except for Per Share Data)

| Three Months Ended | Year Ended | ||||||||||||||||||||||||

December 31 2019 | December 31 2018 | December 31 2019 | December 31 2018 | ||||||||||||||||||||||

EARNINGS SUMMARY: | |||||||||||||||||||||||||

Interest income | $ 183,869 | $ 187,500 | $ 762,562 | $ 717,715 | |||||||||||||||||||||

Interest expense | 42,586 | 40,795 | 184,640 | 129,070 | |||||||||||||||||||||

Net interest income | 141,283 | 146,705 | 577,922 | 588,645 | |||||||||||||||||||||

Provision for loan losses | 5,867 | 5,823 | 21,313 | 22,013 | |||||||||||||||||||||

Noninterest income | 37,242 | 29,827 | 150,484 | 128,712 | |||||||||||||||||||||

Noninterest expenses | 96,900 | 91,002 | 382,654 | 368,179 | |||||||||||||||||||||

Income before income taxes | 75,758 | 79,707 | 324,439 | 327,165 | |||||||||||||||||||||

Income taxes | 12,473 | 15,757 | 64,340 | 70,823 | |||||||||||||||||||||

Net income | $ 63,285 | $ 63,950 | $ 260,099 | $ 256,342 | |||||||||||||||||||||

PER COMMON SHARE: | |||||||||||||||||||||||||

Net income: | |||||||||||||||||||||||||

Basic | $ 0.62 | $ 0.62 | $ 2.55 | $ 2.46 | |||||||||||||||||||||

Diluted | 0.62 | 0.62 | 2.55 | 2.45 | |||||||||||||||||||||

Cash dividends | $ 0.35 | $ 0.34 | 1.37 | 1.36 | |||||||||||||||||||||

Book value | 33.12 | 31.78 | |||||||||||||||||||||||

Closing market price | $ 38.66 | $ 31.11 | |||||||||||||||||||||||

Common shares outstanding: | |||||||||||||||||||||||||

Actual at period end, net of treasury shares | 101,553,671 | 102,323,488 | |||||||||||||||||||||||

Weighted average- basic | 101,250,489 | 102,929,563 | 101,585,599 | 104,015,976 | |||||||||||||||||||||

Weighted average- diluted | 101,537,640 | 103,164,267 | 101,852,577 | 104,298,825 | |||||||||||||||||||||

FINANCIAL RATIOS: | |||||||||||||||||||||||||

Return on average assets | 1.29% | 1.33% | 1.34% | 1.36% | |||||||||||||||||||||

Return on average shareholders’ equity | 7.42% | 7.77% | 7.80% | 7.84% | |||||||||||||||||||||

Return on average tangible equity(non-GAAP)(1) | 13.38% | 14.52% | 14.26% | 14.65% | |||||||||||||||||||||

Average equity to average assets | 17.39% | 17.10% | 17.13% | 17.34% | |||||||||||||||||||||

Net interest margin | 3.29% | 3.50% | 3.39% | 3.58% | |||||||||||||||||||||

| | December 31 2019 | | December 31 2018 | | December 31 2017 | | September 30 2019 | ||||||||||||||||||

PERIOD END BALANCES: | |||||||||||||||||||||||||

Assets | $ 19,662,324 | $ 19,250,498 | $ 19,058,959 | $ 19,751,461 | |||||||||||||||||||||

Earning assets | 17,344,638 | 16,971,602 | 16,741,819 | 17,389,984 | |||||||||||||||||||||

Loans, net of unearned income | 13,712,129 | 13,422,222 | 13,011,421 | 13,633,427 | |||||||||||||||||||||

Loans held for sale | 387,514 | 249,846 | 265,955 | 412,194 | |||||||||||||||||||||

Investment securities | 2,669,797 | 2,543,727 | 2,071,645 | 2,673,312 | |||||||||||||||||||||

Total deposits | 13,852,421 | 13,994,749 | 13,830,591 | 14,095,411 | |||||||||||||||||||||

Shareholders’ equity | 3,363,833 | 3,251,624 | 3,240,530 | 3,354,342 | |||||||||||||||||||||

Note: (1) See information under the “Selected Financial Ratios” table for a reconciliation ofnon-GAAP measure.

UNITED BANKSHARES, INC. AND SUBSIDIARIES

Washington, D.C. and Charleston, WV

Stock Symbol: UBSI

(In Thousands Except for Per Share Data)

Consolidated Statements of Income

| Three Months Ended | ||||||||||||||||||||

|

| |||||||||||||||||||

| December 2019 | December 2018 | September 2019 | June 2019 | March 2019 | ||||||||||||||||

Interest & Loan Fees Income (GAAP) | $ | 183,869 | $ | 187,500 | $ | 190,351 | $ | 199,245 | $ | 189,097 | ||||||||||

Tax equivalent adjustment | 851 | 1,060 | 914 | 977 | 993 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

Interest & Fees Income (FTE)(non-GAAP) | 184,720 | 188,560 | 191,265 | 200,222 | 190,090 | |||||||||||||||

Interest Expense | 42,586 | 40,795 | 48,433 | 48,692 | 44,929 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

Net Interest Income (FTE)(non-GAAP) | 142,134 | 147,765 | 142,832 | 151,530 | 145,161 | |||||||||||||||

Provision for Loan Losses | 5,867 | 5,823 | 5,033 | 5,417 | 4,996 | |||||||||||||||

Non-Interest Income: | ||||||||||||||||||||

Fees from trust services | 3,597 | 3,385 | 3,574 | 3,438 | 3,264 | |||||||||||||||

Fees from brokerage services | 2,468 | 2,383 | 2,378 | 2,766 | 2,524 | |||||||||||||||

Fees from deposit services | 8,549 | 8,650 | 8,702 | 8,464 | 8,053 | |||||||||||||||

Bankcard fees and merchant discounts | 1,154 | 784 | 1,262 | 1,102 | 1,156 | |||||||||||||||

Other charges, commissions, and fees | 576 | 588 | 568 | 576 | 521 | |||||||||||||||

Income from bank owned life insurance | 2,906 | 1,269 | 1,280 | 1,326 | 1,827 | |||||||||||||||

Income from mortgage banking activities | 17,547 | 11,570 | 24,019 | 21,704 | 13,681 | |||||||||||||||

Net gain on the sale of bank premises | 0 | 2,763 | 0 | 0 | 0 | |||||||||||||||

Net gains (losses) on investment securities | 109 | (1,926) | 116 | 109 | (159) | |||||||||||||||

Other income | 336 | 361 | 325 | 310 | 356 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

TotalNon-Interest Income | 37,242 | 29,827 | 42,224 | 39,795 | 31,223 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

Non-Interest Expense: | ||||||||||||||||||||

Employee compensation | 44,399 | 39,200 | 46,313 | 44,301 | 38,949 | |||||||||||||||

Employee benefits | 9,121 | 8,658 | 8,615 | 8,578 | 9,431 | |||||||||||||||

Net occupancy | 8,734 | 8,686 | 8,698 | 8,667 | 8,751 | |||||||||||||||

Data processing | 5,727 | 6,065 | 5,776 | 5,567 | 5,162 | |||||||||||||||

Amortization of intangibles | 1,754 | 2,010 | 1,754 | 1,754 | 1,754 | |||||||||||||||

OREO expense | 1,450 | 1,021 | 1,837 | 633 | 1,416 | |||||||||||||||

Equipment expense | 3,522 | 3,518 | 3,698 | 3,675 | 3,315 | |||||||||||||||

FDIC expense | 1,005 | 3,244 | 465 | 3,300 | 3,300 | |||||||||||||||

Prepayment penalties on FHLB borrowings | 0 | 0 | 0 | 5,105 | 0 | |||||||||||||||

Other expense | 21,188 | 18,600 | 18,978 | 18,615 | 17,347 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

TotalNon-Interest Expense | 96,900 | 91,002 | 96,134 | 100,195 | 89,425 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

Income Before Income Taxes (FTE)(non-GAAP) | 76,609 | 80,767 | 83,889 | 85,713 | 81,963 | |||||||||||||||

Tax equivalent adjustment | 851 | 1,060 | 914 | 977 | 993 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

Income Before Income Taxes (GAAP) | 75,758 | 79,707 | 82,975 | 84,736 | 80,970 | |||||||||||||||

Taxes | 12,473 | 15,757 | 17,010 | 17,529 | 17,328 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

Net Income | $ | 63,285 | $ | 63,950 | $ | 65,965 | $ | 67,207 | $ | 63,642 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

MEMO: Effective Tax Rate | 16.46% | 19.77% | 20.50% | 20.69% | 21.40% | |||||||||||||||

UNITED BANKSHARES, INC. AND SUBSIDIARIES

Washington, D.C. and Charleston, WV

Stock Symbol: UBSI

(In Thousands Except for Per Share Data)

Consolidated Statements of Income

| Year Ended | ||||||||||||||||

| December | December | December | December | |||||||||||||

| 2019 | 2018 | 2017 | 2016 | |||||||||||||

Interest & Loan Fees Income (GAAP) | $ 762,562 | $ 717,715 | $ 623,806 | $ 470,341 | ||||||||||||

Tax equivalent adjustment | 3,735 | 4,328 | 8,429 | 6,121 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Interest & Fees Income (FTE)(non-GAAP) | 766,297 | 722,043 | 632,235 | 476,462 | ||||||||||||

Interest Expense | 184,640 | 129,070 | 74,809 | 45,010 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Net Interest Income (FTE)(non-GAAP) | 581,657 | 592,973 | 557,426 | 431,452 | ||||||||||||

Provision for Loan Losses | 21,313 | 22,013 | 28,406 | 24,509 | ||||||||||||

Non-Interest Income: | ||||||||||||||||

Fees from trust services | 13,873 | 12,930 | 11,801 | 12,025 | ||||||||||||

Fees from brokerage services | 10,136 | 9,347 | 7,730 | 7,012 | ||||||||||||

Fees from deposit services | 33,768 | 33,973 | 33,622 | 32,858 | ||||||||||||

Bankcard fees and merchant discounts | 4,674 | 5,168 | 4,795 | 5,215 | ||||||||||||

Other charges, commissions, and fees | 2,241 | 2,228 | 2,057 | 2,059 | ||||||||||||

Income from bank owned life insurance | 7,339 | 5,045 | 5,110 | 5,794 | ||||||||||||

Income from mortgage banking activities | 76,951 | 58,109 | 58,907 | 3,450 | ||||||||||||

Net gain on the sale of bank premises | 0 | 2,763 | 0 | 0 | ||||||||||||

Net gains (losses) on investment securities | 175 | (2,618 | ) | 5,584 | 280 | |||||||||||

Other income | 1,327 | 1,767 | 2,039 | 1,339 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

TotalNon-Interest Income | 150,484 | 128,712 | 131,645 | 70,032 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Non-Interest Expense: | ||||||||||||||||

Employee compensation | 173,962 | 164,468 | 166,393 | 95,655 | ||||||||||||

Employee benefits | 35,745 | 36,172 | 34,997 | 26,591 | ||||||||||||

Net occupancy | 34,850 | 36,462 | 39,067 | 27,529 | ||||||||||||

Data processing | 22,232 | 23,800 | 21,019 | 15,280 | ||||||||||||

Amortization of intangibles | 7,016 | 8,039 | 7,772 | 3,944 | ||||||||||||

OREO expense | 5,336 | 3,444 | 6,003 | 5,844 | ||||||||||||

Equipment expense | 14,210 | 13,846 | 10,528 | 8,622 | ||||||||||||

FDIC expense | 8,070 | 11,464 | 7,051 | 8,548 | ||||||||||||

Prepayment penalties on FHLB borrowings | 5,105 | 0 | 0 | 0 | ||||||||||||

Other expense | 76,128 | 70,484 | 74,579 | 56,183 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

TotalNon-Interest Expense | 382,654 | 368,179 | 367,409 | 248,196 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Income Before Income Taxes (FTE)(non-GAAP) | 328,174 | 331,493 | 293,256 | 228,779 | ||||||||||||

Tax equivalent adjustment | 3,735 | 4,328 | 8,429 | 6,121 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Income Before Income Taxes (GAAP) | 324,439 | 327,165 | 284,827 | 222,658 | ||||||||||||

Taxes | 64,340 | 70,823 | 134,246 | 75,575 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Net Income | $ 260,099 | $ 256,342 | $ 150,581 | $ 147,083 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

MEMO: Effective Tax Rate | 19.83% | 21.65% | 47.13% | 33.94% | ||||||||||||

UNITED BANKSHARES, INC. AND SUBSIDIARIES

Washington, D.C. and Charleston, WV

Stock Symbol: UBSI

(In Thousands Except for Per Share Data)

Consolidated Balance Sheets

| December 31 | December 31 | |||||||||||||||||||

| 2019 | 2018 | December 31 | December 31 | December 31 | ||||||||||||||||

| Q-T-D Average | Q-T-D Average | 2019 | 2018 | 2017 | ||||||||||||||||

Cash & Cash Equivalents | $ 777,007 | $ 1,025,695 | $ 837,493 | $ 1,020,396 | $ 1,666,167 | |||||||||||||||

Securities Available for Sale | 2,463,101 | 2,287,480 | 2,437,296 | 2,337,039 | 1,888,756 | |||||||||||||||

Securities Held to Maturity | 1,463 | 20,017 | 1,446 | 19,999 | 20,428 | |||||||||||||||

Equity Securities | 8,984 | 9,880 | 8,894 | 9,734 | 0 | |||||||||||||||

Other Investment Securities | 210,855 | 167,953 | 222,161 | 176,955 | 162,461 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total Securities | 2,684,403 | 2,485,330 | 2,669,797 | 2,543,727 | 2,071,645 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total Cash and Securities | 3,461,410 | 3,511,025 | 3,507,290 | 3,564,123 | 3,737,812 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Loans Held for Sale | 368,966 | 226,028 | 387,514 | 249,846 | 265,955 | |||||||||||||||

Commercial Loans | 9,347,641 | 9,433,610 | 9,399,170 | 9,447,420 | 9,822,027 | |||||||||||||||

Mortgage Loans | 3,052,045 | 2,906,314 | 3,107,721 | 2,979,787 | 2,443,780 | |||||||||||||||

Consumer Loans | 1,195,999 | 994,233 | 1,206,657 | 1,002,325 | 761,530 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Gross Loans | 13,595,685 | 13,334,157 | 13,713,548 | 13,429,532 | 13,027,337 | |||||||||||||||

Unearned Income | (2,823) | (9,290) | (1,419) | (7,310) | (15,916) | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Loans, Net of Unearned Income | 13,592,862 | 13,324,867 | 13,712,129 | 13,422,222 | 13,011,421 | |||||||||||||||

Allowance for Loan Losses | (77,073) | (76,933) | (77,057) | (76,703) | (76,627) | |||||||||||||||

Goodwill | 1,478,014 | 1,478,014 | 1,478,014 | 1,478,014 | 1,478,380 | |||||||||||||||

Other Intangibles | 30,837 | 37,989 | 29,931 | 36,947 | 44,986 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total Intangibles | 1,508,851 | 1,516,003 | 1,507,945 | 1,514,961 | 1,523,366 | |||||||||||||||

Operating LeaseRight-of-Use Asset | 59,031 | --- | 57,783 | --- | --- | |||||||||||||||

Other Real Estate Owned | 18,472 | 18,428 | 15,515 | 16,865 | 24,348 | |||||||||||||||

Other Assets | 532,561 | 560,230 | 551,205 | 559,184 | 572,684 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total Assets | $ 19,465,080 | $ 19,079,648 | $ 19,662,324 | $ 19,250,498 | $ 19,058,959 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

MEMO: Interest-earning Assets | $ 17,165,071 | $ 16,792,108 | $ 17,344,638 | $ 16,971,602 | $ 16,741,819 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Interest-bearing Deposits | $ 9,281,403 | $ 9,615,474 | $ 9,231,059 | $ 9,577,934 | $ 9,535,904 | |||||||||||||||

Noninterest-bearing Deposits | 4,647,907 | 4,418,443 | 4,621,362 | 4,416,815 | 4,294,687 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total Deposits | 13,929,310 | 14,033,917 | 13,852,421 | 13,994,749 | 13,830,591 | |||||||||||||||

Short-term Borrowings | 132,621 | 193,971 | 374,654 | 351,327 | 477,587 | |||||||||||||||

Long-term Borrowings | 1,836,423 | 1,481,732 | 1,838,029 | 1,499,103 | 1,363,977 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total Borrowings | 1,969,044 | 1,675,703 | 2,212,683 | 1,850,430 | 1,841,564 | |||||||||||||||

Operating Lease Liability | 62,662 | --- | 61,342 | --- | --- | |||||||||||||||

Other Liabilities | 118,702 | 106,671 | 172,045 | 153,695 | 146,274 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total Liabilities | 16,079,718 | 15,816,291 | 16,298,491 | 15,998,874 | 15,818,429 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Preferred Equity | --- | --- | --- | --- | --- | |||||||||||||||

Common Equity | 3,385,362 | 3,263,357 | 3,363,833 | 3,251,624 | 3,240,530 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total Shareholders’ Equity | 3,385,362 | 3,263,357 | 3,363,833 | 3,251,624 | 3,240,530 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total Liabilities & Equity | $ 19,465,080 | $ 19,079,648 | $ 19,662,324 | $ 19,250,498 | $ 19,058,959 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

MEMO: Interest-bearing Liabilities | $ 11,250,447 | $ 11,291,177 | $ 11,443,742 | $ 11,428,364 | $ 11,377,468 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

UNITED BANKSHARES, INC. AND SUBSIDIARIES

Washington, D.C. and Charleston, WV

Stock Symbol: UBSI

(In Thousands Except for Per Share Data)

| Three Months Ended | ||||||||||||||||||||

| December | December | September | June | March | ||||||||||||||||

| Quarterly Share Data: | 2019 | 2018 | 2019 | 2019 | 2019 | |||||||||||||||

Earnings Per Share: | ||||||||||||||||||||

Basic | $ 0.62 | $ 0.62 | $ 0.65 | $ 0.66 | $ 0.62 | |||||||||||||||

Diluted | $ 0.62 | $ 0.62 | $ 0.65 | $ 0.66 | $ 0.62 | |||||||||||||||

Common Dividend Declared Per Share | $ 0.35 | $ 0.34 | $ 0.34 | $ 0.34 | $ 0.34 | |||||||||||||||

High Common Stock Price | $ 40.70 | $ 36.84 | $ 39.98 | $ 39.88 | $ 39.14 | |||||||||||||||

Low Common Stock Price | $ 36.09 | $ 29.13 | $ 34.77 | $ 35.42 | $ 30.67 | |||||||||||||||

Average Shares Outstanding (Net of Treasury Stock): | ||||||||||||||||||||

Basic | 101,250,489 | 102,929,563 | 101,432,243 | 101,773,643 | 101,894,786 | |||||||||||||||

Diluted | 101,537,640 | 103,164,267 | 101,711,740 | 102,047,845 | 102,162,704 | |||||||||||||||

Common Dividends | $ 35,543 | $ 34,975 | $ 34,518 | $ 34,688 | $ 34,759 | |||||||||||||||

Dividend Payout Ratio | 56.16% | 54.69% | 52.33% | 51.61% | 54.62% | |||||||||||||||

| Year Ended | ||||||||||||||||||||

| December | December | December | December | |||||||||||||||||

| YTD Share Data: | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||

Earnings Per Share: | ||||||||||||||||||||

Basic | $ 2.55 | $ 2.46 | $ 1.54 | $ 2.00 | ||||||||||||||||

Diluted | $ 2.55 | $ 2.45 | $ 1.54 | $ 1.99 | ||||||||||||||||

Common Dividend Declared Per Share | $ 1.37 | $ 1.36 | $ 1.33 | $ 1.32 | ||||||||||||||||

Average Shares Outstanding (Net of Treasury Stock): | ||||||||||||||||||||

Basic | 101,585,599 | 104,015,976 | 97,502,633 | 73,531,992 | ||||||||||||||||

Diluted | 101,852,577 | 104,298,825 | 97,890,078 | 73,893,127 | ||||||||||||||||

Common Dividends | $ 139,508 | $ 141,610 | $ 131,755 | $ 98,696 | ||||||||||||||||

Dividend Payout Ratio | 53.64% | 55.24% | 87.50% | 67.10% | ||||||||||||||||

EOP Employees (full-time equivalent) | 2,204 | 2,230 | 2,381 | 1,701 | ||||||||||||||||

| Three Months Ended | ||||||||||||||||||||

| December | December | September | June | March | ||||||||||||||||

| EOP Share Data: | 2019 | 2018 | 2019 | 2019 | 2019 | |||||||||||||||

Book Value Per Share | $ 33.12 | $ 31.78 | $ 33.03 | $ 32.70 | $ 32.19 | |||||||||||||||

Tangible Book Value Per Share(1) | $ 18.27 | $ 16.97 | $ 18.16 | $ 17.87 | $ 17.37 | |||||||||||||||

52-week High Common Stock Price | $ 40.70 | $ 39.95 | $ 39.98 | $ 39.95 | $ 39.95 | |||||||||||||||

Date | 11/05/19 | 08/21/18 | 09/13/19 | 08/21/18 | 08/21/18 | |||||||||||||||

52-week Low Common Stock Price | $ 30.67 | $ 29.13 | $ 30.67 | $ 29.13 | $ 29.13 | |||||||||||||||

Date | 01/02/19 | 12/27/18 | 01/02/19 | 12/27/18 | 12/27/18 | |||||||||||||||

EOP Shares Outstanding (Net of Treasury Stock): | 101,553,671 | 102,323,488 | 101,555,696 | 101,963,030 | 102,118,029 | |||||||||||||||

Note: | ||||||||||||||||||||

(1) Tangible Book Value Per Share: | ||||||||||||||||||||

Total Shareholders’ Equity (GAAP) | $ 3,363,833 | $ 3,251,624 | $ 3,354,342 | $ 3,333,858 | $ 3,286,891 | |||||||||||||||

Less: Total Intangibles | (1,507,945) | (1,514,961) | (1,509,699) | (1,511,453) | (1,513,207) | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Tangible Equity(non-GAAP) | $ 1,855,888 | $ 1,736,663 | $ 1,844,643 | $ 1,822,405 | $ 1,773,684 | |||||||||||||||

÷ EOP Shares Outstanding (Net of Treasury Stock) | 101,553,671 | 102,323,488 | 101,555,696 | 101,963,030 | 102,118,029 | |||||||||||||||

Tangible Book Value Per Share(non-GAAP) | $ 18.27 | $ 16.97 | $ 18.16 | $ 17.87 | $ 17.37 | |||||||||||||||

UNITED BANKSHARES, INC. AND SUBSIDIARIES

Washington, D.C. and Charleston, WV

Stock Symbol: UBSI

(In Thousands Except for Per Share Data)

| Three Months Ended | ||||||||||||||||||||

| December 2019 | December 2018 | September 2019 | June 2019 | March 2019 | ||||||||||||||||

Selected Yields and Net Interest Margin: | ||||||||||||||||||||

Net Loans | 4.65% | 4.86% | 4.75% | 5.10% | 4.91% | |||||||||||||||

Investment Securities | 2.74% | 2.92% | 2.90% | 2.90% | 2.93% | |||||||||||||||

Money Market Investments/FFS | 2.57% | 2.57% | 2.98% | 2.81% | 3.20% | |||||||||||||||

Average Earning Assets Yield | 4.28% | 4.46% | 4.38% | 4.67% | 4.54% | |||||||||||||||

Interest-bearing Deposits | 1.33% | 1.25% | 1.49% | 1.46% | 1.37% | |||||||||||||||

Short-term Borrowings | 1.52% | 1.52% | 1.78% | 1.79% | 1.61% | |||||||||||||||

Long-term Borrowings | 2.35% | 2.58% | 2.44% | 2.70% | 2.77% | |||||||||||||||

Average Liability Costs | 1.50% | 1.43% | 1.64% | 1.66% | 1.58% | |||||||||||||||

Net Interest Spread | 2.78% | 3.03% | 2.74% | 3.01% | 2.96% | |||||||||||||||

Net Interest Margin | 3.29% | 3.50% | 3.27% | 3.53% | 3.46% | |||||||||||||||

Selected Financial Ratios: | ||||||||||||||||||||

Return on Average Common Equity | 7.42% | 7.77% | 7.79% | 8.12% | 7.88% | |||||||||||||||

Return on Average Assets | 1.29% | 1.33% | 1.33% | 1.38% | 1.34% | |||||||||||||||

Return on Average Tangible Equity (non-GAAP)(1) | 13.38% | 14.52% | 14.16% | 14.90% | 14.64% | |||||||||||||||

Efficiency Ratio | 54.28% | 51.55% | 52.21% | 52.64% | 50.99% | |||||||||||||||

Note: | ||||||||||||||||||||

(1) Return on Average Tangible Equity: | ||||||||||||||||||||

(a) Net Income (GAAP) | $ 63,285 | $ 63,950 | $ 65,965 | $ 67,207 | $ 63,642 | |||||||||||||||

(b) Number of days | 92 | 92 | 92 | 91 | 90 | |||||||||||||||

Average Total Shareholders’ Equity (GAAP) | $3,385,362 | $3,263,357 | $3,359,437 | $3,220,987 | $3,276,822 | |||||||||||||||

Less: Average Total Intangibles | (1,508,851) | (1,516,003) | (1,510,653) | (1,512,400) | (1,514,168) | |||||||||||||||

(c) Average Tangible Equity(non-GAAP) | $1,876,511 | $1,747,354 | $1,848,784 | $1,808,587 | $1,762,654 | |||||||||||||||

Return on Tangible Equity(non-GAAP) [(a) / (b)] x 365 / (c) | 13.38% | 14.52% | 14.16% | 14.90% | 14.64% | |||||||||||||||

| Year Ended | ||||||||||||||||||||

| December 2019 | December 2018 | December 2017 | December 2016 | |||||||||||||||||

Selected Yields and Net Interest Margin: | ||||||||||||||||||||

Net Loans | 4.85% | 4.77% | 4.56% | 4.38% | ||||||||||||||||

Investment Securities | 2.86% | 2.73% | 2.63% | 2.89% | ||||||||||||||||

Money Market Investments/FFS | 2.91% | 2.29% | 1.23% | 0.51% | ||||||||||||||||

Average Earning Assets Yield | 4.47% | 4.36% | 4.07% | 4.00% | ||||||||||||||||

Interest-bearing Deposits | 1.41% | 0.97% | 0.54% | 0.42% | ||||||||||||||||

Short-term Borrowings | 1.67% | 1.00% | 0.51% | 0.39% | ||||||||||||||||

Long-term Borrowings | 2.56% | 2.34% | 1.80% | 1.28% | ||||||||||||||||

Average Liability Costs | 1.60% | 1.15% | 0.69% | 0.53% | ||||||||||||||||

Net Interest Spread | 2.87% | 3.21% | 3.38% | 3.47% | ||||||||||||||||

Net Interest Margin | 3.39% | 3.58% | 3.58% | 3.62% | ||||||||||||||||

Note:

(1) Includes allowance for loan losses and reserve for lending-related commitments

UNITED BANKSHARES, INC. AND SUBSIDIARIES

Washington, D.C. and Charleston, WV

Stock Symbol: UBSI

(In Thousands Except for Per Share Data)

| Year Ended | ||||||||||||||||

| December | December | December | December | |||||||||||||

| 2019 | 2018 | 2017 | 2016 | |||||||||||||

|

| |||||||||||||||

Selected Financial Ratios: | ||||||||||||||||

Return on Average Common Equity | 7.80% | 7.84% | 5.09% | 7.67% | ||||||||||||

Return on Average Assets | 1.34% | 1.36% | 0.85% | 1.10% | ||||||||||||

Return on Average Tangible Equity(non-GAAP)(1) | 14.26% | 14.65% | 9.18% | 13.39% | ||||||||||||

Loan / Deposit Ratio | 98.99% | 95.91% | 94.08% | 95.78% | ||||||||||||

Allowance for Loan Losses/ Loans, Net of Unearned Income | 0.56% | 0.57% | 0.59% | 0.70% | ||||||||||||

Allowance for Credit Losses(2)/ Loans, Net of Unearned Income | 0.57% | 0.58% | 0.59% | 0.71% | ||||||||||||

Nonaccrual Loans / Loans, Net of Unearned Income | 0.46% | 0.51% | 0.84% | 0.81% | ||||||||||||

90-Day Past Due Loans/ Loans, Net of Unearned Income | 0.07% | 0.11% | 0.08% | 0.08% | ||||||||||||

Non-performing Loans/ Loans, Net of Unearned Income | 0.96% | 1.06% | 1.30% | 1.10% | ||||||||||||

Non-performing Assets/ Total Assets | 0.75% | 0.83% | 1.01% | 1.00% | ||||||||||||

Primary Capital Ratio | 17.44% | 17.23% | 17.34% | 15.84% | ||||||||||||

Shareholders’ Equity Ratio | 17.11% | 16.89% | 17.00% | 15.41% | ||||||||||||

Price / Book Ratio | 1.17 | x | 0.98 | x | 1.13 | x | 1.68 | x | ||||||||

Price / Earnings Ratio | 15.14 | x | 12.71 | x | 22.59 | x | 23.24 | x | ||||||||

Efficiency Ratio | 52.53% | 51.32% | 53.98% | 50.10% | ||||||||||||

| Notes: | ||||||||||||||||

(1) Return on Average Tangible Equity: | ||||||||||||||||

(a) Net Income (GAAP) | $ 260,099 | $ 256,342 | $ 150,581 | $ | 147,083 | |||||||||||

Average Total Shareholders’ Equity (GAAP) | $3,336,075 | $3,268,944 | $2,959,293 | $ | 1,918,887 | |||||||||||

Less: Average Total Intangibles | (1,511,501) | (1,519,174) | (1,319,109) | (820,558) | ||||||||||||

(b) Average Tangible Equity(non-GAAP) | $1,824,574 | $1,749,770 | $1,640,184 | $ | 1,098,329 | |||||||||||

Return on Tangible Equity(non-GAAP) [(a) / (b)] | 14.26% | 14.65% | 9.18% | 13.39% | ||||||||||||

(2) Includes allowance for loan losses and reserve for lending-related commitments |

| |||||||||||||||

| Three Months Ended | ||||||||||||||||||||

| December | December | September | June | March | ||||||||||||||||

| 2019 | 2018 | 2019 | 2019 | 2019 | ||||||||||||||||

Mortgage Banking Data – George Mason: | ||||||||||||||||||||

Applications | $ | 896,000 | $ | 714,000 | $ | 1,290,000 | $ | 1,278,000 | $ | 866,000 | ||||||||||

Loans originated | 777,312 | 530,088 | 907,896 | 801,926 | 454,588 | |||||||||||||||

Loans sold | $ | 800,400 | $ | 514,294 | $ | 865,873 | $ | 680,986 | $ | 457,192 | ||||||||||

Purchase money % of loans closed | 66% | 86% | 63% | 81% | 86% | |||||||||||||||

Realized gain on sales and fees as a % of loans sold | 2.84% | 2.82% | 2.74% | 2.89% | 3.07% | |||||||||||||||

Net interest income | $ | 547 | $ | 287 | $ | 203 | $ | 111 | $ | 55 | ||||||||||

Other income | 19,946 | 13,726 | 24,331 | 23,501 | 16,106 | |||||||||||||||

Other expense | 18,419 | 15,066 | 20,256 | 18,771 | 14,842 | |||||||||||||||

Income taxes (benefit) | 192 | (121) | 877 | 1,004 | 282 | |||||||||||||||

Net income (loss) | $ | 1,882 | $ | (932) | $ | 3,401 | $ | 3,837 | $ | 1,037 | ||||||||||

UNITED BANKSHARES, INC. AND SUBSIDIARIES

Washington, D.C. and Charleston, WV

Stock Symbol: UBSI

(In Thousands Except for Per Share Data)

| Year Ended | ||||||||||||||||

| December | December | |||||||||||||||

| Mortgage Banking Data – George Mason: | 2019 | 2018 | ||||||||||||||

Applications | $ | 4,330,000 | $ | 3,912,000 | ||||||||||||

Loans originated | 2,941,722 | 2,619,454 | ||||||||||||||

Loans sold | $ | 2,804,451 | $ | 2,608,242 | ||||||||||||

Purchase money % of loans closed | 72% | 83% | ||||||||||||||

Realized gain on sales and fees as a % of loans sold | 2.86% | 2.72% | ||||||||||||||

Net interest income | $ | 916 | $ | 1,315 | ||||||||||||

Other income | 83,884 | 68,555 | ||||||||||||||

Other expense | 72,288 | 72,632 | ||||||||||||||

Income taxes (benefit) | �� | 2,355 | (505) | |||||||||||||

Net income (loss) | $ | 10,157 | $ | (2,257) | ||||||||||||

Period End Mortgage Banking Data – George Mason: | December | December | September | June | March | |||||

| 2019 | 2018 | 2019 | 2019 | 2019 | ||||||

Locked pipeline | $ 143,465 | $ 122,677 | $ 262,313 | $ 305,843 | $ 223,657 |

| December | December | September | June | March | ||||||||||||||||

| Asset Quality Data: | 2019 | 2018 | 2019 | 2019 | 2019 | |||||||||||||||

EOPNon-Accrual Loans | $ | 63,209 | $ | 68,544 | $ | 69,884 | $ | 71,123 | $ | 63,402 | ||||||||||

EOP90-Day Past Due Loans | 9,494 | 14,851 | 9,840 | 12,729 | 15,572 | |||||||||||||||

EOP Restructured Loans(1) (2) | 58,369 | 59,425 | 60,559 | 58,750 | 56,778 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total EOPNon-performing Loans | $ | 131,072 | $ | 142,820 | $ | 140,283 | $ | 142,602 | $ | 135,752 | ||||||||||

EOP Other Real Estate & Assets Owned | 15,515 | 16,865 | 18,367 | 14,469 | 17,465 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total EOPNon-performing Assets | $ | 146,587 | $ | 159,685 | $ | 158,650 | $ | 157,071 | $ | 153,217 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Notes:

| (1) | Restructured loans with an aggregate balance of $48,387, $50,757, $48,586, $47,459 and $48,899 at December 31, 2019, September 30, 2019, June 30, 2019, March 31, 2019 and December 31, 2018, respectively, were on nonaccrual status, but are not included in “EOPNon-Accrual Loans” above. |

| (2) | Restructured loans with an aggregate balance of $265 and $690 at March 31, 2019 and December 31, 2018, respectively, were 90 days or more past due, but are not included in “EOP90-Day Past Due Loans.” |

UNITED BANKSHARES, INC. AND SUBSIDIARIES

Washington, D.C. and Charleston, WV

Stock Symbol: UBSI

(In Thousands Except for Per Share Data)

| Three Months Ended | Year Ended | |||||||||||||||||||

| December | December | December | December | December | ||||||||||||||||

| Allowance for Loan Losses: | 2019 | 2018 | 2019 | 2018 | 2017 | |||||||||||||||

Beginning Balance | $ | 77,098 | $ | 76,941 | $ | 76,703 | $ | 76,627 | $ | 72,771 | ||||||||||

Provision for Loan Losses | 5,867 | 5,823 | 21,313 | 22,013 | 28,406 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

| 82,965 | 82,764 | 98,016 | 98,640 | 101,177 | ||||||||||||||||

Gross Charge-offs | (9,704) | (7,992) | (29,110) | (28,606) | (32,863) | |||||||||||||||

Recoveries | 3,796 | 1,931 | 8,151 | 6,669 | 8,313 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Net Charge-offs | (5,908) | (6,061) | (20,959) | (21,937) | (24,550) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Ending Balance | $ | 77,057 | $ | 76,703 | $ | 77,057 | $ | 76,703 | $ | 76,627 | ||||||||||

Reserve for lending-related commitments | 1,733 | 1,389 | 1,733 | 1,389 | 679 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Allowance for Credit Losses(1) | $ | 78,790 | $ | 78,092 | $ | 78,790 | $ | 78,092 | $ | 77,306 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Note:

| (1) | Includes allowance for loan losses and reserve for lending-related commitments. |

United Bankshares, Inc. Fourth Quarter & Fiscal Year 2019 Earnings Review January 29, 2020 Exhibit 99.2

Forward-Looking Statements Forward Looking Statements This presentation and statements made by United Bankshares, Inc. (“United”) and its management contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are intended to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about (i) the merger (the “Merger”) between Carolina Financial Corporation (“Carolina Financial”) and United; (ii) United’s and Carolina Financial’s plans, objectives, expectations and intentions and other statements contained in this press release that are not historical facts; and (iii) other statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “targets,” “projects,” or words of similar meaning generally intended to identify forward-looking statements. These forward-looking statements are based upon the current beliefs and expectations of the respective managements of United and Carolina Financial and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control of United and Carolina Financial. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from the anticipated results discussed in these forward-looking statements because of possible uncertainties. The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (1) the businesses of United and Carolina Financial may not be combined successfully, or such combination may take longer, be more difficult, time-consuming or costly to accomplish than expected; (2) the expected growth opportunities or cost savings from the Merger may not be fully realized or may take longer to realize than expected; (3) deposit attrition, operating costs, customer losses and business disruption following the Merger, including adverse effects on relationships with employees, may be greater than expected; (4) the regulatory approvals required for the Merger may not be obtained on the proposed terms or on the anticipated schedule; (5) the stockholders of Carolina Financial may fail to approve the Merger; (6) legislative or regulatory changes, including changes in accounting standards, may adversely affect the businesses in which United and Carolina Financial are engaged; (7) the interest rate environment may further compress margins and adversely affect net interest income; (8) results may be adversely affected by continued diversification of assets and adverse changes to credit quality; (9) competition from other financial services companies in United's and Carolina Financial's markets could adversely affect operations; and (10) the economic slowdown could continue to adversely affect credit quality and loan originations. Additional factors, that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in Carolina Financial’s and United’s reports (such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed with the Securities and Exchange Commission and available on the SEC's Internet site (http://www.sec.gov). United and Carolina Financial caution that the foregoing list of factors is not exclusive. All subsequent written and oral forward-looking statements concerning the proposed transaction or other matters attributable to United or Carolina Financial or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. United and Carolina Financial do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statements are made. Additional Information About the Merger and Where to Find It This presentation shall not constitute an offer to sell, the solicitation of an offer to sell, or the solicitation of an offer to buy any securities or the solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. Stockholders of United and Carolina Financial and other investors are urged to read the joint proxy statement/prospectus that will be included in the registration statement on Form S-4 that United files with the Securities and Exchange Commission in connection with the proposed Merger because it will contain important information about United, Carolina Financial, the Merger, the persons soliciting proxies in the Merger and their interests in the Merger and related matters. Investors will be able to obtain all documents filed with the SEC by United free of charge at the SEC's Internet site (http://www.sec.gov). In addition, documents filed with the SEC by United will be available free of charge from the Corporate Secretary of United Bankshares, Inc., 514 Market Street, Parkersburg, West Virginia 26101 telephone (304) 424-8800. The joint proxy statement/prospectus and the other documents may also be obtained for free by accessing United’s website at www.ubsi-inc.com under the tab “Investor Relations” and then under the heading “SEC Filings” or by accessing Carolina Financial’s website at www.haveanicebank.com under the tab “Investor Relations” and then under the heading “SEC Filings”. You are urged to read the joint proxy statement/prospectus carefully before making a decision concerning the Merger. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Participants in the Transactions United, Carolina Financial and their respective directors, executive officers and certain other members of management and employees may be deemed “participants” in the solicitation of proxies from United’s and Carolina Financial’s stockholders in favor of the Merger. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the United and Carolina Financial stockholders in connection with the proposed Merger will be set forth in the joint proxy statement/prospectus when it is filed with the SEC. You can find information about the executive officers and directors of United in its Annual Report on Form 10-K for the year ended December 31, 2018 and in its definitive proxy statement filed with the SEC on March 29, 2019. You can find information about Carolina Financial’s executive officers and directors in its Annual Report on Form 10-K for the year ended December 31, 2018 and in its definitive proxy statement filed with the SEC on March 22, 2019. You can obtain free copies of these documents from United, or Carolina Financial using the contact information above.

2019 HIGHLIGHTS Achieved record Net Income of $260.1 million and record Diluted Earnings Per Share of $2.55 for FY 2019 Increased dividends to shareholders for the 46th consecutive year, with a current dividend yield of 3.9% (based upon recent prices) Announced the signing of a definitive merger agreement to acquire Carolina Financial Corporation Generated Return on Average Assets of 1.34%, Return on Average Equity of 7.80%, and Return on Average Tangible Equity* of 14.26% Outperformed peer ROAA and ROATE Strong expense control with an efficiency ratio of 52.5% Asset quality and capital position remain sound, with Non Performing Assets decreasing 8.2% in FY 2019 Repurchased 1,009,150 shares of common stock during 2019 *Non GAAP measure. Refer to appendix.

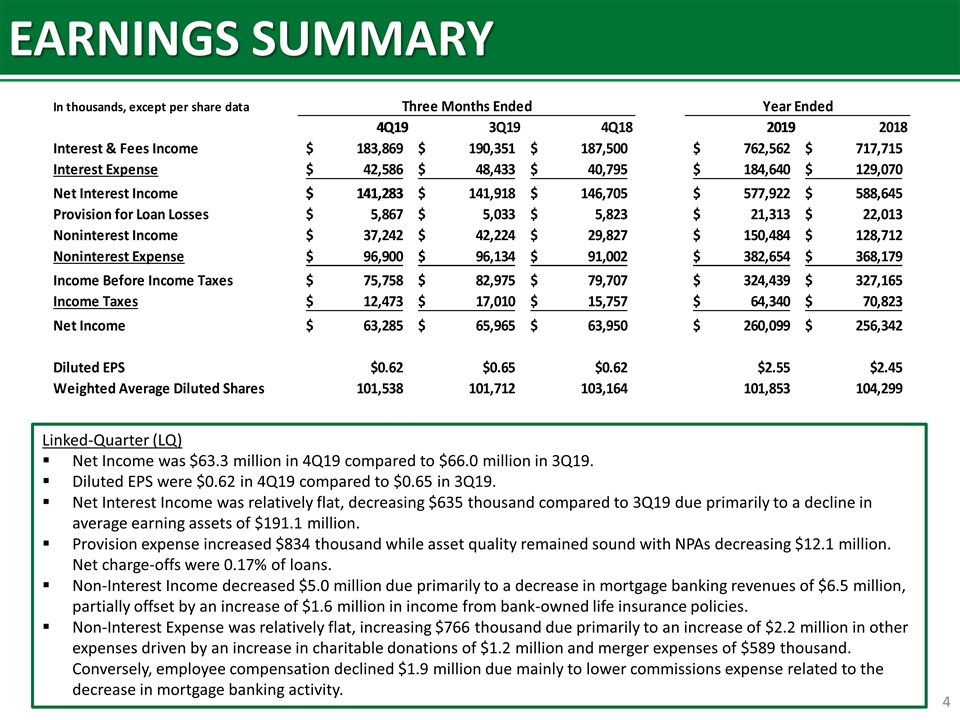

EARNINGS SUMMARY Linked-Quarter (LQ) Net Income was $63.3 million in 4Q19 compared to $66.0 million in 3Q19. Diluted EPS were $0.62 in 4Q19 compared to $0.65 in 3Q19. Net Interest Income was relatively flat, decreasing $635 thousand compared to 3Q19 due primarily to a decline in average earning assets of $191.1 million. Provision expense increased $834 thousand while asset quality remained sound with NPAs decreasing $12.1 million. Net charge-offs were 0.17% of loans. Non-Interest Income decreased $5.0 million due primarily to a decrease in mortgage banking revenues of $6.5 million, partially offset by an increase of $1.6 million in income from bank-owned life insurance policies. Non-Interest Expense was relatively flat, increasing $766 thousand due primarily to an increase of $2.2 million in other expenses driven by an increase in charitable donations of $1.2 million and merger expenses of $589 thousand. Conversely, employee compensation declined $1.9 million due mainly to lower commissions expense related to the decrease in mortgage banking activity.

PERFORMANCE RATIOS Strong and consistent profitability and expense control. FY 2017 was impacted by $26.8 million in pre tax merger related expenses and $37.7 million in additional tax expense related to the Tax Act. *Non GAAP measure. Refer to appendix.

NET INTEREST INCOME AND MARGIN Reported Net Interest Margin increased from 3.27% to 3.29% LQ. Linked-quarter Net Interest Margin increase was primarily due to an increase in purchase accounting loan accretion of $1.4 million. 4Q19 Net Interest Income, excluding purchase accounting loan accretion, was down $2.1 million from 3Q19 due mainly to the lower market rates and a decline in average earning assets. Scheduled loan accretion is estimated at $15 million for FY 2020 and $13 million for FY 2021 (represents UBSI on a standalone basis not including the impact of the CARO acquisition or PCD rate mark). $ in millions

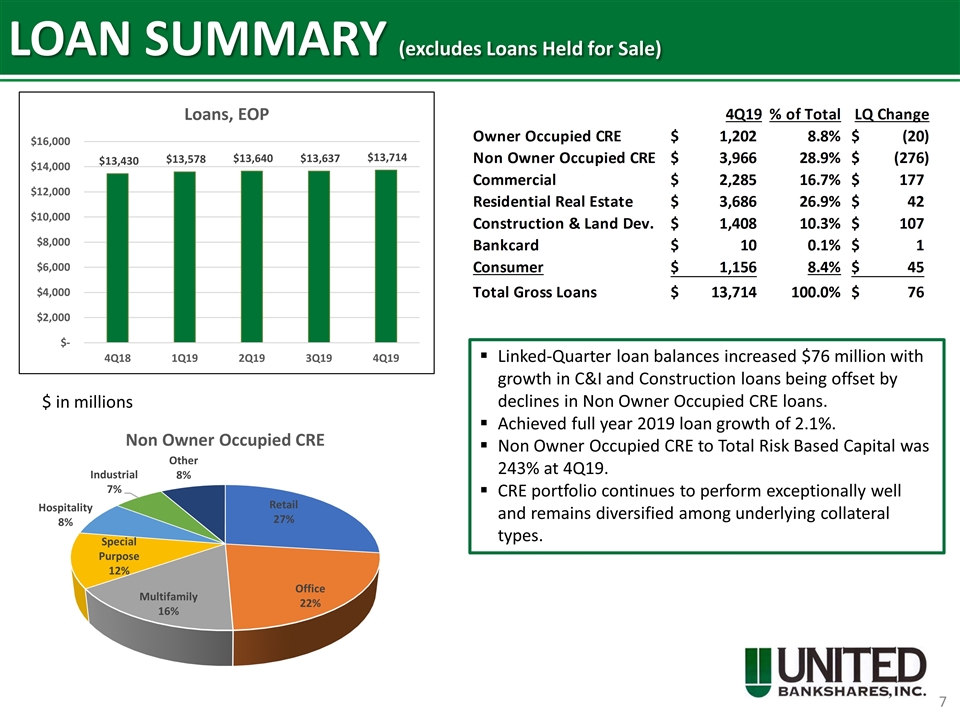

LOAN SUMMARY (excludes Loans Held for Sale) Linked-Quarter loan balances increased $76 million with growth in C&I and Construction loans being offset by declines in Non Owner Occupied CRE loans. Achieved full year 2019 loan growth of 2.1%. Non Owner Occupied CRE to Total Risk Based Capital was 243% at 4Q19. CRE portfolio continues to perform exceptionally well and remains diversified among underlying collateral types. $ in millions

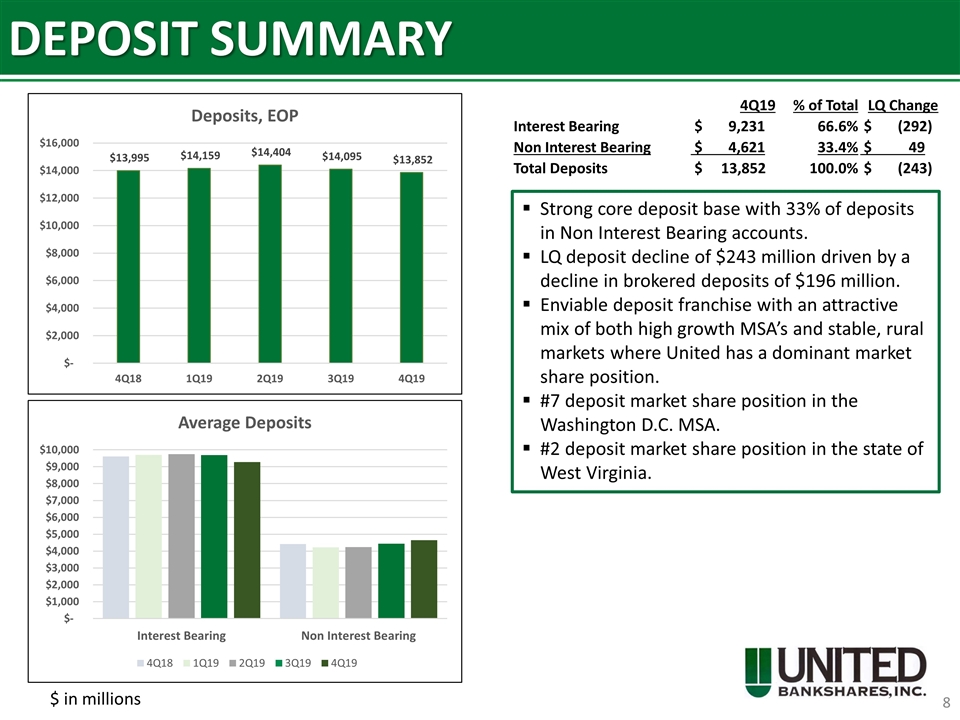

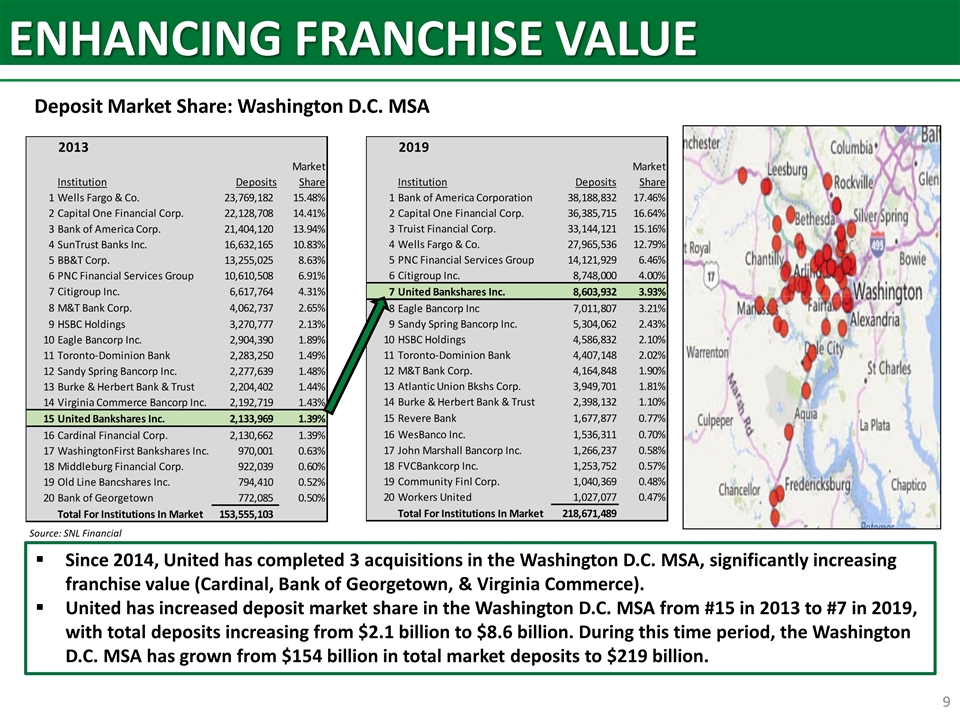

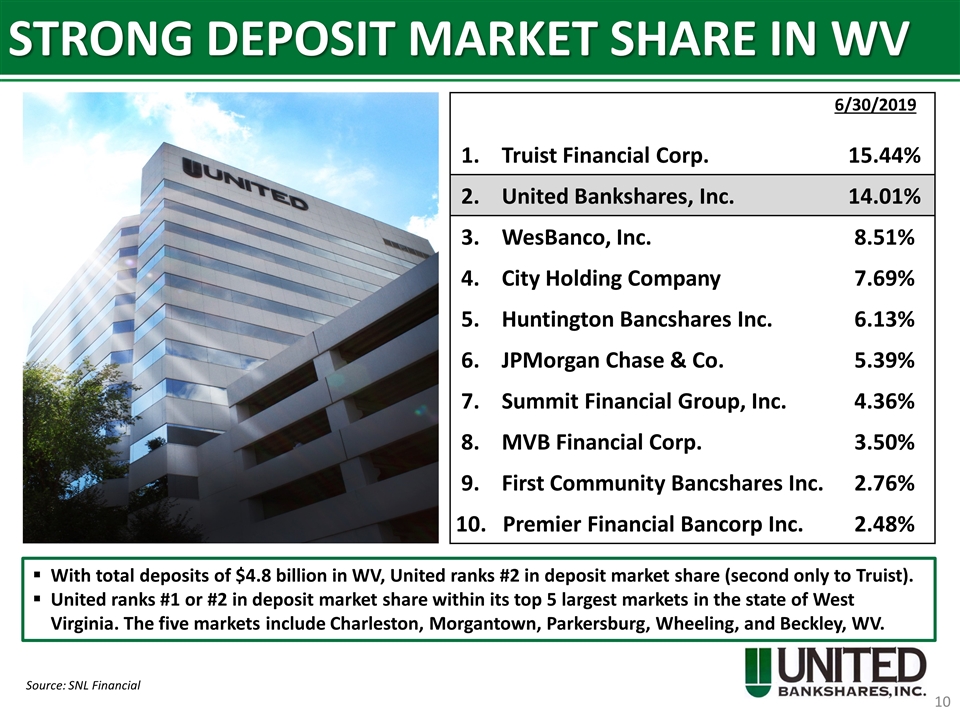

DEPOSIT SUMMARY Strong core deposit base with 33% of deposits in Non Interest Bearing accounts. LQ deposit decline of $243 million driven by a decline in brokered deposits of $196 million. Enviable deposit franchise with an attractive mix of both high growth MSA’s and stable, rural markets where United has a dominant market share position. #7 deposit market share position in the Washington D.C. MSA. #2 deposit market share position in the state of West Virginia. $ in millions 4Q19 % of Total LQ Change Interest Bearing $ 9,231 66.6% $ (292) Non Interest Bearing $ 4,621 33.4% $ 49 Total Deposits $ 13,852 100.0% $ (243)

ENHANCING FRANCHISE VALUE Deposit Market Share: Washington D.C. MSA Since 2014, United has completed 3 acquisitions in the Washington D.C. MSA, significantly increasing franchise value (Cardinal, Bank of Georgetown, & Virginia Commerce). United has increased deposit market share in the Washington D.C. MSA from #15 in 2013 to #7 in 2019, with total deposits increasing from $2.1 billion to $8.6 billion. During this time period, the Washington D.C. MSA has grown from $154 billion in total market deposits to $219 billion. Source: SNL Financial

STRONG DEPOSIT MARKET SHARE IN WV Source: SNL Financial 6/30/2019 1. Truist Financial Corp. 15.44% 2. United Bankshares, Inc. 14.01% 3. WesBanco, Inc. 8.51% 4. City Holding Company 7.69% 5. Huntington Bancshares Inc. 6.13% 6. JPMorgan Chase & Co. 5.39% 7. Summit Financial Group, Inc. 4.36% 8. MVB Financial Corp. 3.50% 9. First Community Bancshares Inc. 2.76% 10. Premier Financial Bancorp Inc. 2.48% With total deposits of $4.8 billion in WV, United ranks #2 in deposit market share (second only to Truist). United ranks #1 or #2 in deposit market share within its top 5 largest markets in the state of West Virginia. The five markets include Charleston, Morgantown, Parkersburg, Wheeling, and Beckley, WV.

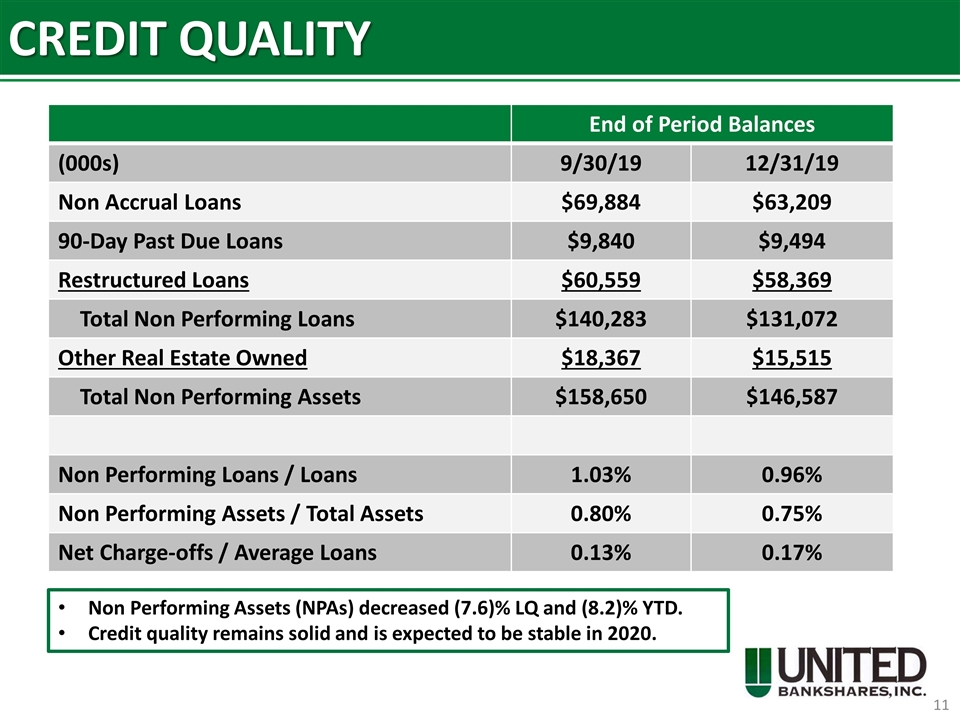

CREDIT QUALITY End of Period Balances (000s) 9/30/19 12/31/19 Non Accrual Loans $69,884 $63,209 90-Day Past Due Loans $9,840 $9,494 Restructured Loans $60,559 $58,369 Total Non Performing Loans $140,283 $131,072 Other Real Estate Owned $18,367 $15,515 Total Non Performing Assets $158,650 $146,587 Non Performing Loans / Loans 1.03% 0.96% Non Performing Assets / Total Assets 0.80% 0.75% Net Charge-offs / Average Loans 0.13% 0.17% Non Performing Assets (NPAs) decreased (7.6)% LQ and (8.2)% YTD. Credit quality remains solid and is expected to be stable in 2020.

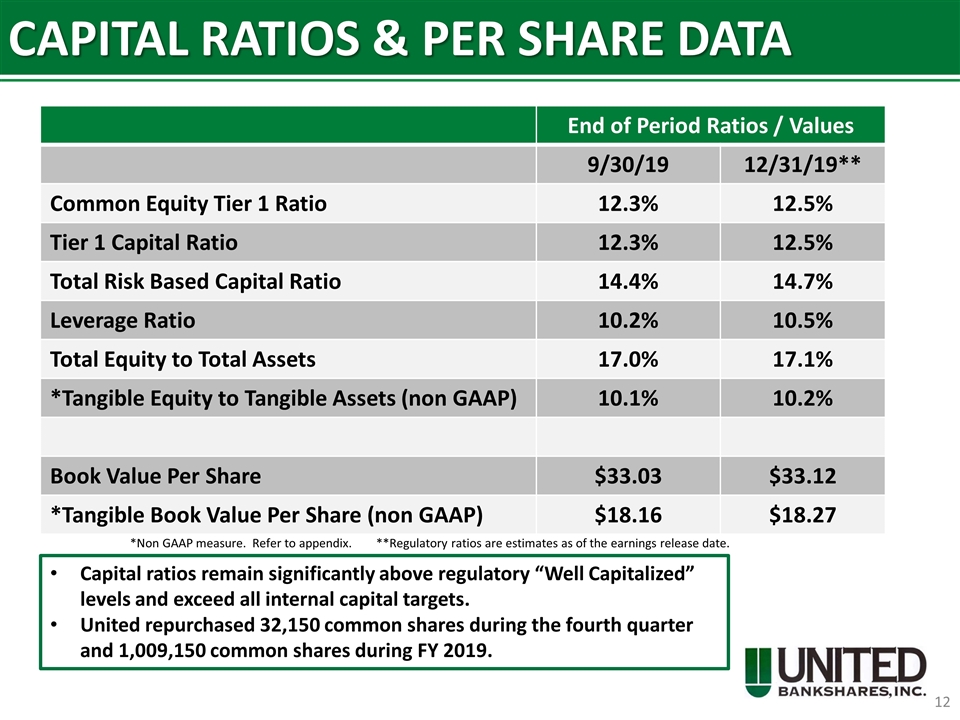

CAPITAL RATIOS & PER SHARE DATA End of Period Ratios / Values 9/30/19 12/31/19** Common Equity Tier 1 Ratio 12.3% 12.5% Tier 1 Capital Ratio 12.3% 12.5% Total Risk Based Capital Ratio 14.4% 14.7% Leverage Ratio 10.2% 10.5% Total Equity to Total Assets 17.0% 17.1% *Tangible Equity to Tangible Assets (non GAAP) 10.1% 10.2% Book Value Per Share $33.03 $33.12 *Tangible Book Value Per Share (non GAAP) $18.16 $18.27 Capital ratios remain significantly above regulatory “Well Capitalized” levels and exceed all internal capital targets. United repurchased 32,150 common shares during the fourth quarter and 1,009,150 common shares during FY 2019. *Non GAAP measure. Refer to appendix. **Regulatory ratios are estimates as of the earnings release date.

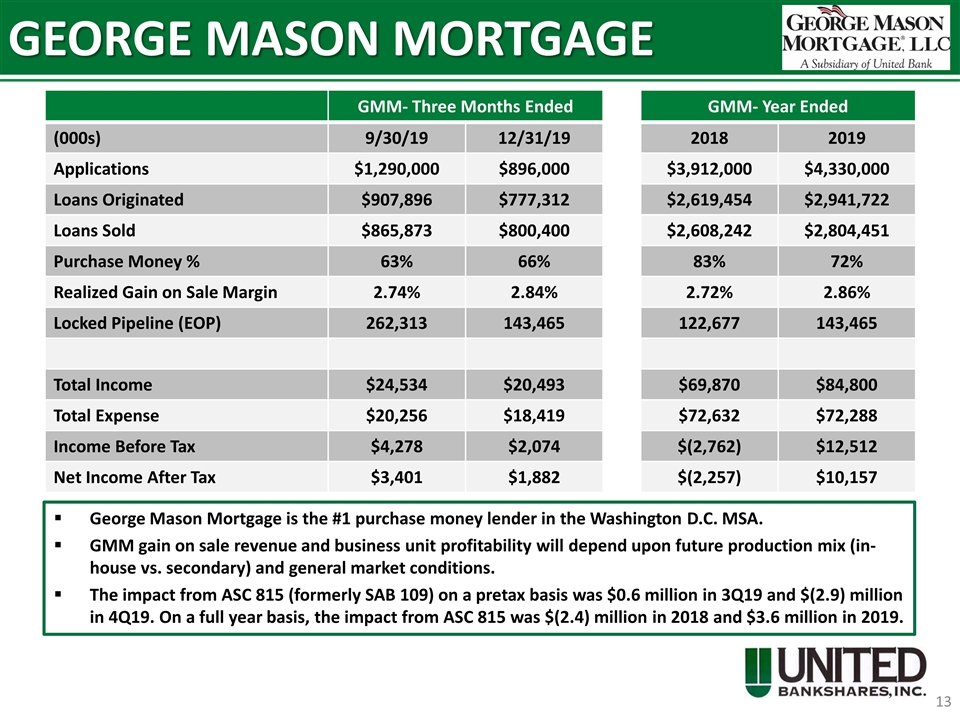

GEORGE MASON MORTGAGE George Mason Mortgage is the #1 purchase money lender in the Washington D.C. MSA. GMM gain on sale revenue and business unit profitability will depend upon future production mix (in-house vs. secondary) and general market conditions. The impact from ASC 815 (formerly SAB 109) on a pretax basis was $0.6 million in 3Q19 and $(2.9) million in 4Q19. On a full year basis, the impact from ASC 815 was $(2.4) million in 2018 and $3.6 million in 2019. GMM- Three Months Ended GMM- Year Ended (000s) 9/30/19 12/31/19 2018 2019 Applications $1,290,000 $896,000 $3,912,000 $4,330,000 Loans Originated $907,896 $777,312 $2,619,454 $2,941,722 Loans Sold $865,873 $800,400 $2,608,242 $2,804,451 Purchase Money % 63% 66% 83% 72% Realized Gain on Sale Margin 2.74% 2.84% 2.72% 2.86% Locked Pipeline (EOP) 262,313 143,465 122,677 143,465 Total Income $24,534 $20,493 $69,870 $84,800 Total Expense $20,256 $18,419 $72,632 $72,288 Income Before Tax $4,278 $2,074 $(2,762) $12,512 Net Income After Tax $3,401 $1,882 $(2,257) $10,157

2020 OUTLOOK Loans & Deposits: Annual loan and deposit growth rates expected in the low to mid single digits for 2020 (compared to 4Q19 end of period balances). Net Interest Margin / Net Interest Income: Relatively stable core NIM (excluding purchase accounting loan accretion / compared to 4Q19 net interest margin). Asset Quality: Stable asset quality metrics. CECL Impact: Estimated 20-30% increase in allowance for credit losses Non Interest Income: 2020 NII growth, excluding George Mason Mortgage Company, gain on sale of premises, and gain / loss on investments, is estimated in the low single digits (compared to FY 2019). Non Interest Expense: 2020 NIE growth, excluding George Mason Mortgage Company and $5.1 million in FHLB prepayment penalties, is estimated in the low single digits (compared to FY 2019). FDIC expense is estimated to be approximately $2.4 million per quarter in 2020. Tax Rate: 2020 Tax Rate estimated at approximately 20.5%. The outlook below considers UBSI on a standalone basis and does not consider the pending acquisition of CARO. The outlook below reflects a continuation of the current economic climate and interest rate environment with no changes to the federal funds target rate. Our outlook may change if the expectations for these items vary from current expectations.

UBSI INVESTMENT THESIS Excellent franchise with long-term growth prospects Current income opportunity with a dividend yield of 3.9% (based upon recent prices) High-performance bank with a low-risk profile Experienced management team with a proven track record of execution High level of insider ownership 46 consecutive years of dividend increases evidences United’s strong profitability, solid asset quality, and sound capital management over a very long period of time Attractive valuation with a current Price-to-Earnings Ratio of 14.5x (based upon median 2020 street consensus estimate of $2.47 per Bloomberg)

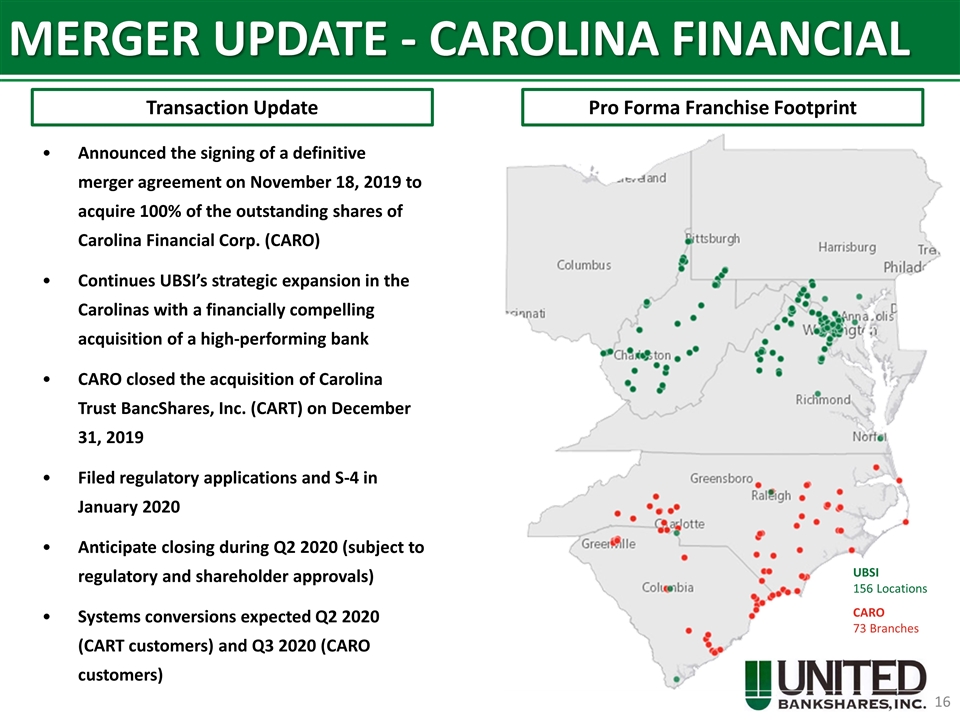

MERGER UPDATE - CAROLINA FINANCIAL Announced the signing of a definitive merger agreement on November 18, 2019 to acquire 100% of the outstanding shares of Carolina Financial Corp. (CARO) Continues UBSI’s strategic expansion in the Carolinas with a financially compelling acquisition of a high-performing bank CARO closed the acquisition of Carolina Trust BancShares, Inc. (CART) on December 31, 2019 Filed regulatory applications and S-4 in January 2020 Anticipate closing during Q2 2020 (subject to regulatory and shareholder approvals) Systems conversions expected Q2 2020 (CART customers) and Q3 2020 (CARO customers) Pro Forma Franchise Footprint Transaction Update UBSI 156 Locations CARO 73 Branches

THE CHALLENGE TO BE THE BEST NEVER ENDS www.ubsi-inc.com

Reconciliation of non-GAAP Items January 2020 (dollars in thousands) 2015 2016 2017 2018 2019 (1) Return on Average Tangible Equity Net Income (GAAP) $137,959 $147,083 $150,581 $256,342 $260,099 Average Total Shareholders' Equity (GAAP) $1,702,490 $1,918,887 $2,959,293 $3,268,944 $3,336,075 Less: Average Total Intangibles (729,748) (820,558) (1,319,109) (1,519,175) (1,511,501) Average Tangible Equity (non-GAAP) $972,742 $1,098,329 $1,640,184 $1,749,769 $1,824,574 Formula: Net Income/Average Tangible Equity Return on Average Tangible Equity (non-GAAP) 14.18% 13.39% 9.18% 14.65% 14.26%

Reconciliation of non-GAAP Items (cont.) January 2020 (dollars in thousands) 9/30/2019 12/31/2019 (2) Tangible Equity to Tangible Assets Total Assets (GAAP) $ 19,751,461 $ 19,662,324 Less: Total Intangibles (GAAP) (1,509,699) (1,507,945) Tangible Assets (non-GAAP) $ 18,241,762 $ 18,154,379 Total Shareholders' Equity (GAAP) $ 3,354,342 $ 3,363,833 Less: Total Intangibles (GAAP) (1,509,699) (1,507,945) Tangible Equity (non-GAAP) $ 1,844,643 $ 1,855,888 Tangible Equity to Tangible Assets (non-GAAP) 10.1% 10.2% (3) Tangible Book Value Per Share: Total Shareholders' Equity (GAAP) $ 3,354,342 $ 3,363,833 Less: Total Intangibles (GAAP) (1,509,699) (1,507,945) Tangible Equity (non-GAAP) $ 1,844,643 $ 1,855,888 ÷ EOP Shares Outstanding (Net of Treasury Stock) 101,555,696 101,553,671 Tangible Book Value Per Share (non-GAAP) $18.16 $18.27