UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

(Mark One)

| x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |

For the fiscal year ended December 31, 2019

or

| o | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |

For the transition period from to

Commission file number 001-10897

| Carolina Financial Corporation |

(Exact name of registrant as specified in its charter)

| Delaware | | 57-1039673 |

| (State of Incorporation) | | (I.R.S. Employer Identification No.) |

| 288 Meeting Street, Charleston, South Carolina | | 29401 |

| (Address of principal executive offices) | | (Zip Code) |

| (843) 723-7700 |

| (Issuer’s Telephone Number) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of Each Class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | CARO | | The Nasdaq Capital Market® |

Securities registered under Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yesx Noo

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yeso Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yesx Noo

Indicate by check mark whether the registrant has submitted electronically, if any, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yesx Noo

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer x | Accelerated filer o |

| | |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act

o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yeso Nox

The aggregate market value of the voting and nonvoting common equity held by non-affiliates of the registrant (computed by reference to the price at which the stock was most recently sold) was $738,763,981 as of the last business day of the registrant’s most recently completed second fiscal quarter.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| Class | | Outstanding at April 20, 2020 |

| Common Stock, $.01 par value per share | | 24,847,938 shares |

DOCUMENTS INCORPORATED BY REFERENCE

Some of the information required by Part I and Part III is incorporated by reference from the prospectus and joint proxy statement filed by United Bankshares, Inc. and the registrant on February 13, 2020 pursuant to Rule 424(b) under the Securities Act of 1933 and Rule 14a-6 under the Securities Exchange Act of 1934.

EXPLANATORY NOTE

Unless this Amendment No. 1 to the Annual Report on Form 10-K/A (this “Amendment”) indicates otherwise, or the context otherwise requires, the terms “we,” “our,” “us,” and “the Company,” as used herein refer to Carolina Financial Corporation and its subsidiaries, including CresCom Bank.

This Amendment amends our Annual Report on Form 10-K for the fiscal year ended December 31, 2019 as filed with the Securities and Exchange Commission (“SEC”) on March 2, 2020 (the “Original Filing”). This Amendment is being filed solely to include the information required by Part III (Items 10 through 14) of Form 10-K. The information required by Part III was previously omitted from the Original Filing in reliance on General Instruction G, which provides that registrants may incorporate by reference certain information from a definitive proxy statement that is filed with the SEC no later than 120 days after the end of the fiscal yearcovered by the Form 10-K, otherwise the Items comprising Part III information must be filed as an amendment to the Form 10-K not later than the end of the 120-day period. We are filing this Amendment to include the Part III information in our Form 10-K.

In accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), Part III, Items 10 through 14 of the Original Filing are hereby amended and restated in their entirety, and Part IV, Item 15 of the Original Filing is hereby amended and restated in its entirety, with the only changes to Part IV, Item 15 being the addition of new certifications by our principal executive officer and principal financial officer filed herewith. This Amendment does not amend or otherwise update any other information in the Original Filing. Accordingly, this Amendment should be read in conjunction with the Original Filing and with our filings with the SEC subsequent to the Original Filing.

Except as described above, no other changes have been made to the Original Filing. The Original Filing continues to speak as of the date of the Original Filing, and we have not updated the disclosures contained therein to reflect any events which occurred at a date subsequent to the filing of the Original Filing.

TABLE OF CONTENTS

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

Biographical Information for Each Director

Set forth below is information about each of the Company’s directors and executive officers, including their age, the period they have served as a director or executive officer, their business experience for at least the past five years, the names of other companies where they currently serve as a director or served as a director during the past five years, and additional information about the specific experience, qualifications, attributes, or skills that led to the board’s conclusion that such person should serve as a director for the Company.

W. Scott Brandon, 56, has served as a member of the Company’s Board of Directors since 2001. Mr. Brandon is owner and Chief Executive Officer of The Brandon Agency. He is also owner of Intellistrand, a company that buys, sells and monetizes intuitive domain names on the internet as well as Fuel Travel, a firm that specializes in digital marketing and software for hotels. He holds a Bachelor of Science degree in Economics from Davidson College and a Juris Doctor degree from the University Of South Carolina School Of Law. Mr. Brandon is a 2012 recipient of The American Advertising Federation’s Silver Medal Award for his outstanding contributions to advertising and creative excellence and in the same year was awarded the Myrtle Beach Chamber of Commerce Citizen of the Year award. Mr. Brandon currently serves on the Board of Directors for Waterside Brands (a private company and owner of the Fish Hippie apparel brand), Guntersville Breathables Inc. (a private company and owner of the Frogg Toggs outerwear brand), Springs Creative Products Group, LLC (an independently owned and operated textile and creative service business), the Charleston Metro Chamber of Commerce and the Myrtle Beach Area Recovery Council and is a member of the Board of Trustees for Brookgreen Gardens. He is a past member of the Horry-Georgetown Technical College Board of Visitors, past board member of The E. Craig Wall School of Business Administration Board of Visitors, past board member of the American Heart Association (Coastal Chapter), past board member of the Better Business Bureau, past board member of the Salvation Army Horry County as well as the Myrtle Beach Haven. He is a current member of World Presidents Organization, YPO Gold and Chief Executives Organization. Mr. Brandon has substantial leadership and financial experience as founder of several successful businesses and is extensively involved in the local community, both of which enhance his ability to serve on the Company’s Board of Directors.

Robert G. Clawson, Jr., 77,has served as a member of the Company’s Board of Directors since 1996. Mr. Clawson is a founding member of the law firm of Clawson and Staubes, LLC, and is a member of the South Carolina State Bar, the American Bar Association, the Metropolitan Exchange Club, and The Hibernian Society. Mr. Clawson is admitted to practice law before the South Carolina Supreme Court, the U.S. District Court for the District of South Carolina, the U.S. Court of Appeals for the Fourth Circuit, the U.S. Court of Federal Claims, the U.S. Tax Court, and the U.S. Court of International Trade. Mr. Clawson previously served as President of the South Carolina Municipal Attorneys Association and the College of Charleston Cougar Club. He is a graduate of the University of North Carolina and the University Of South Carolina School Of Law. Mr. Clawson’s qualification as a member of the Board of Directors is primarily attributed to his experience in founding a successful law practice and his extensive legal experience.

Lindsey A. Crisp, 48, served as a member of the First South Bancorp, Inc. (“First South”) board from 2015 to 2017. He also served as the Chairman of the Audit Committee, the Asset/Liquidity Management Committee and the Director’s Loan Committee of the First South board from 2015 to 2017. He joined the Company’s board following its acquisition of First South in November 2017. Since 2005, Mr. Crisp has serviced as President, Chief Executive Officer and as a Director of Carver Machine Works, Inc., a private company located in Washington, North Carolina. He was previously employed with Dixon Hughes, LLP, Certified Public Accountants from 2001 to 2005 as a Manager and a Senior Manager. Mr. Crisp is a graduate of East Carolina University, with a Bachelor of Science degree in Accounting, and is a Certified Public Accountant. He is also a Chartered Global Management Accountant. He is a member of the American Institute of Certified Public Accountants and the North Carolina Association of Certified Public Accountants. Mr. Crisp serves on the Beaufort County Directors’ Council for Vidant Health and was Chairman from 2014 through 2017. He has previously served as an Advisory Board Member of Wells Fargo Bank in Washington, North Carolina, and a Board Member of the Beaufort County Committee of 100. He is a former Commissioner of the Greenville Housing Authority in Greenville, North Carolina; a former Treasurer of the North Carolina Aerospace Alliance; a former Board Member of the East Carolina University Engineering Advisory Board, and was previously a Certified Valuation Analyst. Mr. Crisp’s finance and accounting expertise and business skills qualifies him to serve on the Company’s Board of Directors.

Jeffery L. Deal, M.D. 65, has served as a member of the Company’s Board of Directors since 1996. Dr. Deal is an anthropologist and physician and served as Director of Health Studies for Water Missions International, a non-profit non-governmental organization that provides water and sanitation for developing areas. Dr. Deal is a founding partner of Charleston ENT, and previously served as President of the Medical Staff of Bon Secours-St. Francis Hospital, Medical Director of a startup medical facility in South Sudan, and several other related positions. Dr. Deal is the inventor of the Tru-D room decontamination system, a Fellow in the American College of Surgeons, a Fellow in the American Academy of Otolaryngology - Head and Neck Surgery, and a Fellow in the Royal Society of Tropical Medicine. Dr. Deal is a graduate of the Medical University of South Carolina and completed his residency at the National Naval Medical Center in Bethesda, Maryland. He brings to the Board of Directors insights relative to the challenges and opportunities facing small businesses and healthcare professionals within our market areas.

Gary M. Griffin, 65, a native of Greer, South Carolina, served as a director of Greer Bancshares Incorporated and Greer State Bank (collectively, “Greer”) from 1992 until March 2017 when they were acquired by the Company. He was appointed to the Company’s Board of Directors immediately following the Greer acquisitions. During his tenure as a Greer director, Mr. Griffin served two terms as Chairman of the Board of Directors. He is a graduate of Furman University and has served as Vice-President and part owner of Mutual Home Stores, a group of retail home furnishings stores in the upstate region of South Carolina, where he has over 40 years of work experience in all aspects of the business. Mr. Griffin is a past president of the Greer Lions Club. He has served as a board member and treasurer of Greer Community Ministries, which provides a Meals on Wheels program in the region. He also served as a board member of The Greer Relief and Resources Agency. Mr. Griffin’s qualification to serve on the Company’s Board of Directors is primarily attributed to his previous experience serving as a director of Greer, as well as his successful business experience in the upstate region of South Carolina.

Frederick N. Holscher, 72, served as a member of First South board of directors from 1985 to 2017. He joined the Company’s board following its acquisition of First South in November 2017. At the time of the acquisition, Mr. Holscher was serving as Chairman of the First South board. Mr. Holscher is a graduate of the University of North Carolina at Chapel Hill, with a degree in Political Science. He is also a graduate of the UNC School of Law and is currently an attorney and president of the law firm of Rodman, Holscher, Peck & Edwards, P.A. located in Washington, North Carolina and has been with the firm since 1973. He is an active member of the Beaufort County Bar Association, the Second Judicial District Bar Association and the North Carolina Bar Association. He has served on the boards of many local and statewide civic and service organizations including the Salvation Army, Washington Board of Realtors, Washington/Beaufort County Chamber of Commerce and the Eastern Region of Friends of the Institute of Government. Mr. Holscher’s experience serving as a member of the First South board, as well as his professional expertise, are the primary attributes qualifying him to serve on the Company’s Board of Directors.

Daniel H. Isaac, Jr., 68, has served as a member of the Company’s Board of Directors since 2016 and has served as a member of the Board of Directors of the Company’s wholly-owned subsidiary, CresCom Bank, since 2001. Mr. Isaac is founder and owner of A&I Fire and Water Restoration. He holds a Bachelor of Science degree from The Citadel in Charleston, South Carolina. Mr. Isaac has been involved in numerous local and state organizations. He previously served as Chairman of the Myrtle Beach Chamber of Commerce and the South Carolina Department of Transportation. Mr. Isaac’s qualification to serve on the Company’s Board of Directors is attributable primarily to his experience of founding a successful business and his involvement in many leadership positions.

Beverly Ladley, 53, has served as a member of the Company’s Board of Directors since March 2018. She currently the Head of Consumer and Small Business Financing, Loyalty and Healthcare for Fiserv. Prior to joining Fiserv, she was a Senior Advisor to McKinsey and Company, a global management consulting firm. Before joining McKinsey and Company, Mrs. Ladley was the Executive Vice President and Head of Retail Products and Consumer Lending position at SunTrust Banks Inc. from 2012 to 2016. Her position included responsibility for the Deposits, Retail Lending, Consumer Credit Card, and National Lending Businesses, as well as Retail and Small Business Segment Strategy. During the two decades before joining SunTrust, Mrs. Ladley held various positions of increasing responsibility with Bank of America. These positions included Executive, Deposit Growth (2000 - 2005), Senior Vice President and Executive, Small Business Strategy and Deposits, Executive, Customer Segment (2009 - 2010), Executive, U.S. Credit Card and Small Business Products (2010-2011), Executive, Global Sourcing (2011 - 2012). Ms. Ladley earned a Bachelor of Arts degree in Economics and Public Policy from Duke University in 1988 and a Masters in Business Administration from the University of Virginia’s Darden Graduate School of Business Administration in 1992. Ms. Ladley’s qualification as a member of the Board of Directors is primarily attributed to her extensive financial services, banking and consulting experience.

Robert M. Moïse, 71, has served as a member of the Company’s Board of Directors since 1996. Mr. Moïse recently retired as a partner with WebsterRogers LLP in Charleston, South Carolina and serves as a consultant to that firm. He holds Bachelor of Science in Accounting and Master of Accountancy degrees from the University of South Carolina and has been admitted to practice before the United States Tax Court. He serves as the Immediate Past President of the Coastal Council Boy Scouts of America, is a member of the Coastal Boys Council Board and currently serves as the Sea Scout Commodore for the Council. He is a volunteer at Camp Happy Days, a summer camp for children with cancer. He is a member of the American Institute of Certified Public Accountants, having served on their national Tax Practice Responsibilities Committee and is a member of the South Carolina Association of Certified Public Accountants. Mr. Moïse also served as Chairman of the Charleston County Business License Appeals Board. In his professional practice, Mr. Moïse has, after leaving the Internal Revenue Service, worked with national and local accounting firms and has concentrated his practice in the tax area with an emphasis on tax controversy matters and complicated mergers, acquisitions and liquidations for many clients around the state. Mr. Moïse brings to the board his 40 years of financial expertise and business skills. His finance and accounting expertise also qualify him to serve as Chairman of the Company’s Audit Committee and is considered as an “audit committee financial expert.”

David L. Morrow, 69, has served as an Executive Vice President of the Company since 2004 and has served as a member of the Company’s Board of Directors since 2001. Mr. Morrow is a graduate of Clemson University with a Bachelor of Science degree and has more than 46 years of experience in banking and financial institution management in South Carolina. Prior to founding Crescent Bank, a predecessor to CresCom Bank, he served as President of Carolina First Savings Bank and also as Executive Vice President and member of the Board of Directors of Carolina First Bank. Mr. Morrow is the immediate past Chairman of the South Carolina Bankers Association, a member of the Board of Advisors of the Hollings Cancer Center at MUSC, a member of the Clemson University Foundation Board and a member of the Charleston Metro Chamber of Commerce Board. Most recently, Mr. Morrow served on the Clemson University Board of Visitors, the Federal Reserve Community Depository Institutions Advisory Council, as well as the ABA Community Bankers Council. He is also a past Board member of the Storm Eye Institute at MUSC, a past member of the Board of Directors of Leadership South Carolina and a past member of the Board of Directors for the South Carolina Museum Foundation. His years of experience in financial institution management, including previous service as a director of a state-wide financial institution and Chief Executive Officer of both predecessor banks of CresCom Bank, provide a valuable perspective as a director.

Thompson E. “Thom” Penney, 69,has served as a member of the Company’s Board of Directors since 2013. Mr. Penney is the Chairman of the Board and President/CEO (a position he has held since 1989) of LS3P, a multi-disciplinary firm offering architecture, planning, and interior architecture services to clients throughout the United States. With more than 320 personnel throughout eight offices in the Carolinas and Georgia, he is responsible for overall firm management, organizational vision, and successful integration of professional services, marketing, and operations of the firm. Mr. Penney has more than 45 years of experience in the architectural field and under his leadership, LS3P has grown to become a firm consistently recognized by Engineering News and Record as one of the Top 200 Design Firms and Top 20 Architectural Firms in the United States. A graduate of Clemson University with a bachelor’s degree (1972) and master’s degree (1974) in architecture, Mr. Penney has received the Alumni Distinguished Service Award from Clemson University, was a 2019 inductee in the College of Architecture, Arts and Humanities Hall of Fame, received the AIA South Carolina Medal of Distinction, its highest honor, received the Joseph P. Riley Leadership Award from the Charleston Metro Chamber and was honored with the Award for Ethics and Civic Responsibility from The Free Enterprise Foundation. Mr. Penney generously volunteers his time to his profession and community, having served as National President of The American Institute of Architects (2003); Chairman of the Charleston Metro Chamber of Commerce (2008), and Co-Chair of the National AIA-AGC Joint Committee. He is also on the Boards of the Charleston Regional Development Alliance, the AIA Large Firm Roundtable, and is Vice Chair of the Trident CEO Council. His qualification as a member of the Board of Directors is attributed to his business expertise within our market areas.

Jerold L. Rexroad, 59, joined the Company in May 2008 as Executive Vice President, and he has served as the Company’s President and Chief Executive Officer and a director since 2012. Mr. Rexroad also serves as Executive Chairman of the Board of CresCom Bank and Executive Chairman of the Board of Crescent Mortgage Company, a subsidiary of CresCom Bank. Mr. Rexroad is a graduate of Bob Jones University, cum laude. He began his career in 1982 with Peat, Marwick, Mitchell and Co., a predecessor to the international accounting firm KPMG LLP, and is a Certified Public Accountant. He became a KPMG partner in 1994 with responsibilities for all financial institutions in South Carolina. In 1995, Mr. Rexroad joined Coastal Financial Corporation as Executive Vice President and Chief Financial Officer. Under his oversight, the bank grew organically from $375 million in total assets to over $1.8 billion in total assets. Coastal Financial Corporation was sold to BB&T Bank in 2007. Mr. Rexroad is a member of the American Institute of Certified Public Accountants. His leadership experience, including over 30 years of experience in public accounting and financial institution management, as well as his service as the chief financial officer and chief executive officer of a public bank holding company, enhance his ability to serve on the Company’s Board of Directors. These roles have required industry expertise combined with operational and global management expertise.

Johnathan L. Rhyne, Jr., 64, served as a member of the Carolina Trust BancShares, Inc. (“Carolina Trust”) board of directors from 2016-2019 and joined the Company’s board following the acquisition of Carolina Trust in December 2019. At the time of the acquisition, Mr. Rhyne was serving as Chairman of the Carolina Trust board. Mr. Rhyne is an attorney in Lincolnton, North Carolina and from 2009 to 2011, he was a member of the North Carolina General Assembly where he served as chairman of the House Banking Committee. He previously served four terms in the General Assembly, from 1985 through 1992, which included service as the minority leader. Mr. Rhyne also serves as chair of the board of directors of a public foundation and on the board of directors of one local non-profit organization. Mr. Rhyne also previously served from 2015 to 2017 on the North Carolina State Banking Commission. Mr. Rhyne’s background as an attorney and a legislator give him the leadership and consensus building skills to serve on the Company’s Board. He also has previous experience as a director for another bank in Lincoln County, which gives him a deep knowledge of the markets in which we operate.

Claudius E. “Bud” Watts IV, 58, has served as a member of the Company’s Board of Directors since 2015. Mr. Watts is a private investor and a Senior Advisor to The Carlyle Group. Mr. Watts also serves as the Lead Independent Director on the Board of Directors of CommScope (NASDAQ: COMM), where he has served as Director since 2011. Mr. Watts joined The Carlyle Group in 2000 and was a Partner and Managing Director until his retirement in late 2017. Mr. Watts established Carlyle’s Technology Buyout Group in 2004 and led it until 2014. He also led The Carlyle Group’s investments in and served on the Boards of SS&C Technologies (NASDAQ: SSNC), Open Link Financial, Open Solutions, Freescale Semiconductor (previously NYSE: FSL), and Jazz Semiconductor, as well as aerospace companies Firth Rixon, Sippican, and CPU Technology. Prior to joining The Carlyle Group, Mr. Watts was a Managing Director in the Mergers & Acquisitions group of First Union Securities, Inc. He joined First Union when it acquired Bowles Hollowell Conner & Co., where Mr. Watts was a principal. Prior to joining Bowles Hollowell, Mr. Watts was a fighter pilot in the U.S. Air Force. During his service, he was qualified as an instructor pilot in both the F-16 and A-10 aircraft and served in a number of leadership and operations management positions in the United States and abroad. In addition to his current business activities, Mr. Watts serves as the Chairman of the Board of The Citadel Trust and on the board of The Citadel Foundation, which together manage the primary endowment funds supporting The Citadel. He also serves on the boards of The Roper St. Francis Foundation and The Belle W. Baruch Foundation. Mr. Watts earned a Bachelor of Science in electrical engineering cum laude from The Citadel in Charleston, South Carolina, and a Masters of Business Administration from the Harvard Graduate School of Business Administration. His qualifications as a member of the Board of Directors are attributed to his business expertise with public companies.

Biographical Information for Executive Officers

Other than Messrs. Morrow and Rexroad, for which disclosure is provided above, the following provides information regarding our other executive officers:

William A. Gehman III, 59, has served as the Company’s Executive Vice President and Chief Financial Officer since 2012. Prior to being promoted to Chief Financial Officer, Mr. Gehman was the Company’s Controller from 2008 to 2012. Mr. Gehman is also the Chief Financial Officer of the Bank, Crescent Mortgage Company and Carolina Services Corporation. Mr. Gehman, a Certified Public Accountant with over 16 years of experience in financial institutions, spent over nine years with Peat, Marwick, Mitchell & Co, predecessor to KPMG LLP. He joined Coastal Financial Corporation in 2002 as Senior Vice President and Corporate Controller, where his responsibilities included public and regulatory reporting. Mr. Gehman is a member of the American Institute of Certified Public Accountants and the South Carolina Association of Certified Public Accountants. Mr. Gehman is a graduate of Liberty Baptist College.

M. J. Huggins, III, 57, has served as the Company’s Executive Vice President since 2010 and Secretary since 2012. Mr. Huggins is also President and Secretary of CresCom Bank and a founding board member. He was also the former President, Chief Credit Officer and Secretary of Crescent Bank, predecessor to CresCom Bank. Prior to joining the Company and assisting in the founding of Crescent Bank, Mr. Huggins served as Area Executive and Senior Vice President of Carolina First Bank, responsible for commercial and retail operations from Georgetown to Myrtle Beach, South Carolina. Prior to his tenure with Carolina First Bank, Mr. Huggins worked for C&S Bank. Mr. Huggins is an executive board member of the Wall College Board of Visitors at Coastal Carolina University. He is a graduate of Coastal Carolina University (Wall College Alumnus of the Year in 2003) and The Graduate School of Banking at Louisiana State University.

Fowler Williams, 45, has served as President, as well as a Director of Crescent Mortgage Company since 2011. In 2016, Mr. Williams was promoted to CEO and President of Crescent Mortgage Company. In his 20 years at Crescent Mortgage Company, Mr. Williams has previously worked as National Sales Manager and Executive Vice President over Sales and Operations. Mr. Williams holds the highest designation in the mortgage industry as a Certified Mortgage Banker. Mr. Williams serves on the Board of Directors for the national Mortgage Bankers Association where he also is Governor on the Residential Board (RESBOG), past Chairman of the Community Bank and Credit Union Network, and Mortgage Action Alliance, the grassroots policy, advocacy, and lobbying network for the real estate finance industry. Mr. Williams also has been named to the Customer Advisory Board of Freddie Mac and Mortgage Cadence. He has twice been named to the 40 most influential mortgage professionals under 40 by National Mortgage Professional magazine. In 2017 he was awarded the Schumacher-Bolduc Award for political advocacy in real estate finance.

Family Relationships

No director has a family relationship with any other director or executive officer of the Company.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act of 1934 requires directors, executive officers, and 10% stockholders to file reports of holdings and transactions in the Company’s stock with the SEC. Based on a review of Section 16(a) reports, amendments thereto, and written representations from the Company’s directors and executive officers, the Company believes that all of its directors, executive officers, and 10% stockholders have made all filings required under Section 16(a) in a timely manner, with the following exceptions:

| · | Mr. Deal filed a late Form 4 to report two transactions in which shares directly owned were disposed; and |

| · | Mr. Morrow filed two late Forms 4 to report five transactions in which shares directly owned were disposed. |

Code of Ethics

We expect all of our employees to conduct themselves honestly and ethically. We have adopted a Code of Ethics that reflects our policy of responsible and ethical business practices, and applies to all directors, officers, and employees of the Company and its subsidiaries. Stockholders and other interested persons may view our Codes of Ethics on the Investor Relations section under the Governance Documents section of the Corporate Information tab of our website,https://www.haveanicebank.com.

Board Leadership Structure and Role in Risk Oversight

The Board of Directors is focused on the Company’s corporate governance practices and values independent board oversight as an essential component of strong corporate performance to enhance stockholder value. The Board of Directors’ commitment to independent oversight is demonstrated by the fact that the majority of the Company’s directors are independent.

The Company believes that it is preferable for an independent director to serve as Chairman of the Board of Directors. Claudius E. “Bud” Watts IV, a director of the Company since 2015 and a long-time resident of the Company’s primary market area, has served as Chairman of the Board of Directors since 2016. The Company believes it is the Chief Executive Officer’s responsibility to run the Company and the Chairman’s responsibility to run the Board of Directors. As directors continue to have more oversight responsibility than ever before, the Company believes it is beneficial to have an independent Chairman whose sole job is leading the Board of Directors. The Company believes this structure provides strong leadership for the Board of Directors, while also positioning the Chief Executive Officer as the leader of the Company in the eyes of the Company’s customers, employees, and other stakeholders.

Risk oversight is the responsibility of the Board of Directors, collectively and individually. The Board of Directors fulfills this responsibility through a combination of oversight with respect to direct board reports from management and the delegation of specific risk monitoring to its committees, which in turn provide reports to the full Board of Directors at each regular meeting. Notwithstanding the foregoing, the Board of Directors believes that its role is one of oversight, recognizing that management is responsible for executing the Company’s risk management policies.

At each regular meeting, the Board of Directors’ standing agenda requires reports from the Chief Financial Officer and other executive officers, who collectively are responsible for all risk areas. Their agenda items are designed to elicit information with respect to each of these areas. The Board of Directors does not concentrate the delegation of its responsibility for risk oversight in a single committee. Instead, each of the Board of Directors’ committees concentrates on specific risks for which its members have an expertise, and each committee is required to regularly report to the Board of Directors on its findings. The Company believes this division of responsibility is the most effective approach for addressing the risks it faces and that the Board of Directors leadership structure supports this approach.

The Company recognizes that different board leadership structures may be appropriate for companies in different situations. The Company will continue to reexamine its corporate governance policies and leadership structures on an ongoing basis to ensure that they continue to meet the Company’s needs.

Meetings and Committees of the Board of Directors

During 2019, the Board of Directors held ten regular and special meetings. Each of the current directors attended at least 75% of the aggregate of such board meetings and meetings of each committee on which they served for the periods during which they served. The Board of Directors has not implemented a formal policy regarding director attendance at the Company’s Annual Meeting of Stockholders, although each director is expected to attend all Annual Meetings of Stockholders absent unusual or extenuating circumstances. All but one of the Company’s directors attended the 2019 Annual Meeting of Stockholders.

The Board of Directors has standing Audit, Compensation/Benefits and Corporate Governance and Nominating committees, each of which is described in more detail below.

Audit Committee

The Audit Committee is responsible for the review of the Company’s annual audit report prepared by its independent registered public accounting firm. The Audit Committee is composed of five members: Messrs. Moïse, Crisp, Deal, Griffin, and Isaac, each of whom is a non-management director. The Audit Committee met five times during 2019.

The Audit Committee’s review includes a detailed discussion with the independent registered public accounting firm and recommendation to the full Board of Directors concerning any action to be taken regarding the audit. The Audit Committee also has the authority to conduct or authorize investigations into any matters within its scope of responsibility. The Audit Committee is empowered to:

| • | appoint, compensate, retain, and oversee the work of any registered public accounting firm employed by the Company for the purpose of preparing or issuing an audit report or performing other audit, review, or attest services for the Company, with any such registered public accounting firm reporting directly to the Audit Committee; |

| • | resolve any disagreements between management and the independent registered public accounting firm regarding financial reporting; |

| • | pre-approve all external audit services; |

| • | retain independent counsel, accountants, or others to advise the committee or assist in the conduct of an investigation; and |

| • | meet with the Company’s officers, employees, independent registered public accounting firm, or outside counsel as deemed necessary. |

Under its charter, all members of the Audit Committee must be independent members. Each of the current Audit Committee members is independent under NASDAQ rules. The Audit Committee Charter provides that at least one member of the committee shall be a “financial expert.” The financial expert on the Audit Committee is Robert M. Moïse.

The Audit Committee functions are set forth in its charter, which was adopted on April 24, 2013 and revised December 16, 2015. A copy of the Audit Committee Charter may be found under the Investor Relations section under the Governance Documents tab of the Company’s website,https://www.haveanicebank.com.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee is responsible for identifying potential directors and presenting them for nomination to the Board of Directors. The Corporate Governance/ Nominating Committee is composed of five members: Messrs. Deal, Crisp, Moïse, Penney and Mme. Ladley. The Corporate Governance/ Nominating Committee met two times during 2019.

Potential director candidates may come to the attention of the Corporate Governance/ Nominating Committee through current members of the Board of Directors, stockholders, or other persons. In evaluating such recommendations, the Corporate Governance and Nominating Committee uses the qualifications and standards discussed below and seeks to achieve a balance of knowledge, experience, and capability on the Board of Directors. The Company does not pay a third party to assist in identifying and evaluating potential director candidates.

The Corporate Governance and Nominating Committee recommends to the Board of Directors criteria for the selection of new directors, evaluates the qualifications and independence of potential candidates for directors, including any nominees submitted by stockholders, in accordance with the provisions of the Company’s certificate of incorporation and bylaws, and recommends to the Board of Directors a slate of nominees for election by the stockholders at the Annual Meeting of stockholders. The Corporate Governance and Nominating Committee is also responsible for recommending to the Board of Directors any nominees to be considered to fill a vacancy or a newly created directorship resulting from any increase in the authorized number of directors. When considering a person to be recommended for nomination as a director, the Corporate Governance and Nominating Committee considers, among other factors, the skills and background needed by the Company and possessed by the person, diversity of the Board of Directors, and the ability of the person to devote the necessary time to service as a director. Each director must represent the interests of our stockholders.

Any stockholder may nominate persons for election to the Board of Directors by complying with the procedures set forth in our bylaws, which require that timely written notice be provided to the Secretary of the Company in advance of the meeting of stockholders at which directors are to be elected. To be timely, such notice must be delivered or received not less than 90 days prior to the date of the Meeting; provided, that if less than 100 days’ notice or prior disclosure of the date of the Meeting is given or made to stockholders, such notice must be received not later than the close of business on the 10th day following the day on which such notice was given or made to stockholders. Each notice must set forth: (i) all information relating to such person that is required to be disclosed in solicitations of proxies for the election of directors, or is otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act of 1934 (including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected); and (ii) as to the stockholder giving notice of (x) the name and address, as they appear on the Company’s books, of such stockholder and (y) the class and number of shares of the Company’s capital stock that are beneficially owned by such stockholder. The officer of the Company or other person presiding at the meeting may determine that a nomination was not made in accordance with the foregoing procedure and disregard the defective nomination.

The Corporate Governance and Nominating Committee annually reviews the adequacy of, and the Company’s compliance with, the corporate governance principals of the Company and recommends any proposed changes to the Board of Directors for approval. The Corporate Governance and Nominating Committee also administers the annual self-evaluation process for the Board of Directors and each of its committees.

The Corporate Governance and Nominating Committee functions are set forth in its charter, which was adopted on April 24, 2013 and revised on June 18, 2014. A copy of the Corporate Governance and Nominating Charter may be found under the Investor Relations section under the Governance Documents tab of the Company’s website,https://www.haveanicebank.com.

Compensation/Benefits Committee

The Compensation/Benefits Committee is responsible for evaluating the performance of the Company’s principal officers and employees and determining the compensation and benefits to be paid to such persons. The Compensation/Benefits Committee is composed of four members: Messrs. Penney, Clawson, Holscher, and Isaac. The Compensation/Benefits Committee met seven times during the 2019 fiscal year.

The Compensation/Benefits Committee is authorized to (i) review and approve annually the corporate goals and objectives relevant to the compensation of the chief executive officers of the Company and the Bank, (ii) conduct an annual evaluation of the performance of the Chief Executive Officer of the Company, and (iii) annually review and establish the base salary and incentive bonus levels and payments to the Chief Executive Officer and all other executive officers of the Company and the Bank. The Compensation/Benefits Committee has oversight of the Corporation’s incentive plans, including equity-based incentive plans, and for reviewing and granting equity awards to all eligible employees. The Compensation/Benefits Committee may delegate to one or more officers of the Company who are also directors the authority to designate officers and employees of the Company or its subsidiaries to receive equity awards and to determine the number of such awards to be granted to them; provided, that such delegation shall include the total number of equity awards that may be granted under such authority and that no officer may be delegated the power to designate himself or herself the recipient of such awards. In addition, the Compensation/Benefits Committee may engage compensation consultants or other advisors as it deems appropriate to assist it in performing its duties and responsibilities.

In determining the compensation for executive officers, the Compensation/Benefits Committee’s objectives are to encourage the achievement of the Company’s long-range objectives by providing compensation that directly relates to the performance of the individual and the achievement of internal strategic objectives. The Compensation/Benefits Committee believes that its executive officers’ level of compensation is reasonable based upon the Company’s corporate goals and objectives, the business plan of the Bank, normal and customary levels of compensation within the banking industry taking into consideration geographic and competitive factors, the Bank’s asset quality, capital level, operations and profitability and the duties performed and responsibilities held by the officer.

The Compensation/Benefits Committee functions are set forth in its charter, which was adopted on June 18, 2014 and revised on February 17, 2016. A copy of the Compensation/Benefits Committee Charter may be found under the Investor Relations section under the Governance Documents section of the Corporate Information tab of the Company’s website,https://www.haveanicebank.com.

Item 11. Executive Compensation.

The disclosure under the heading “The Merger — Interests of Certain Carolina Financial Directors and Executive Officers in the Merger” in the prospectus and joint proxy statement filed by United Bankshares, Inc. and the Company on February 13, 2020, is incorporated by herein by reference.

Director Compensation

We do not pay our “inside” employee-directors any additional compensation for their services as directors. During 2019, non-employee directors of the Company received a retainer fee of $8,000 paid in cash and 677 shares of the Company’s common stock. Those directors not employed by a subsidiary of the Company also received $750 for each audit committee meeting attended, $500 for each Compensation/Benefits committee meeting and Corporate Governance and Nominating Committee meeting, and $300 for each Board Loan Committee meeting attended. The annual fee, paid monthly to the Chairman of the Board of Directors, runs from Annual Stockholder Meeting to Annual Stockholder Meeting. Accordingly, in 2019, the Chairman of the Company’s Board of Directors received an annual fee of $75,000 in cash and $24,998 paid in stock. Additionally, the Chairman of the Company’s Audit Committee received a fee of $9,000 per year, the Chairman of the Compensation/Benefits Committee received a fee of $6,000 per year and the Chairman of the Corporate Governance and Nominating Committee received a fee of $5,000, while the Board Loan Committee Chairman received $2,500 per year.

As directors of CresCom Bank, Messrs. Brandon, Clawson, Crisp, Deal, Griffin, Holscher, Isaac, Moïse, Penney and Mrs. Ladley received $1,250 per meeting. As a director of Crescent Mortgage Company, Mr. Clawson received $1,250 per meeting.

The following table presents all compensation paid by the Company to current and former directors during the year ended December 31, 2019.

Director Compensation Table for Fiscal Year 2019

| Director Name | | Fees Earned or

Paid in Cash1 | | | Stock

Awards4 | | | Total | |

| W. Scott Brandon | | $ | 35,625 | | | $ | 24,988 | | | $ | 60,613 | |

| Robert G. Clawson, Jr. | | $ | 39,750 | | | $ | 24,988 | | | $ | 64,738 | |

| Lindsey A. Crisp | | $ | 35,000 | | | $ | 24,988 | | | $ | 59,988 | |

| Jeffery L. Deal, M.D. | | $ | 38,500 | | | $ | 24,988 | | | $ | 63,488 | |

| Gary M. Griffin | | $ | 36,750 | | | $ | 24,988 | | | $ | 61,738 | |

| Frederick N. Holscher | | $ | 35,000 | | | $ | 24,988 | | | $ | 59,988 | |

| Daniel H. Isaac, Jr. | | $ | 43,300 | | | $ | 24,988 | | | $ | 68,288 | |

| Beverly Ladley | | $ | 33,000 | | | $ | 24,988 | | | $ | 57,988 | |

| Michael P. Leddy2 | | $ | 14,000 | | | $ | — | | | $ | 14,000 | |

| Robert M. Moïse, CPA | | $ | 42,250 | | | $ | 24,988 | | | $ | 67,238 | |

| Thompson E. Penney | | $ | 48,550 | | | $ | 24,988 | | | $ | 73,538 | |

| Johnathan L. Rhyne, Jr.3 | | $ | — | | | $ | — | | | $ | — | |

| Claudius E. Watts IV | | $ | 75,000 | | | $ | 24,988 | | | $ | 99,988 | |

| | | | | | | | | | | | | |

| 1 | Includes fees, if any, for serving on boards of the Company’s subsidiaries. |

| 2 | Includes fees paid to Mr. Leddy prior to his retirement from the Board effective April 24, 2019. |

| 3 | Mr. Rhyne joined the Company's board of directors effective December 31, 2019 following our acquisition of Carolina Trust. As such, no director fees were earned by, or paid to, Mr. Rhyne in 2019. |

| 4 | Stock awards reflect 677 shares granted on April 25, 2019 with a fair value of $36.91. |

Executive Compensation

Compensation Discussion and Analysis

This compensation discussion and analysis (“CD&A”) explains our executive compensation philosophy, describes our compensation programs and reviews compensation decisions for the following named executive officers (“NEOs”):

| NEOs | | Title |

| Jerold L. Rexroad | | Chief Executive Officer and President, Carolina Financial Corporation |

| William A. Gehman III | | Executive Vice President and Chief Financial Officer, Carolina Financial Corporation |

| M.J. Huggins, III | | Executive Vice President and Secretary, and President CresCom Bank |

| David L. Morrow | | Executive Vice President and Chief Executive Officer, CresCom Bank |

| Fowler Williams | | Chief Executive Officer and President, Crescent Mortgage Company |

This CD&A is composed of the following sections:

| Page 13 | Executive Summary |

| Page 15 | Executive Compensation Principles and Strategy |

| Page 15 | Compensation Determination Process |

| Page 17 | Components of Our Compensation Program |

| Page 26 | Additional Compensation Policies and Practices |

Executive Summary.The Company’s primary business is to serve as the holding company for CresCom Bank, a South Carolina state-chartered commercial bank with 73 branches located in North Carolina and South Carolina. CresCom Bank operates five wholly-owned subsidiaries, Crescent Mortgage Company, Carolina Services Corporation of Charleston, CresCom Leasing LLC, DTFS, Inc, and Western Carolina Holdings, LLC. Beginning in fiscal year 2019, we no longer qualified as an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012.

Achievements.We have experienced significant growth and change in recent years, including our listing on NASDAQ in 2014, a functional initial public offering of common stock in 2015 raising $32.2 million net proceeds, the acquisition of Congaree Bancshares Inc. in 2016 ($104.2 million in assets), a secondary offering of common stock in 2017 raising $47.7 million net proceeds, the acquisition of Greer Bancshares Inc. in 2017 ($384.5 million in assets), the acquisition of First South Bancorp, Inc. in 2017 ($1.1 billion in assets), and the acquisition of Carolina Trust BancShares, Inc. in 2019 ($635.0 million in assets). These transactions, in addition to strong organic growth, significantly expanded our geographic footprint in North Carolina and South Carolina. During 2018, we completed a secondary offering of shares of common stock, raising approximately $63.0 million in net proceeds to the Company.

In addition, 2019 reflected record earnings, driven primarily by organic growth, successful integration of strategic acquisitions, and our presence in several of the fastest growing markets in the Southeast. The 2019 results reflect our achievement of earnings and asset quality metrics. Our compensation philosophy is grounded in rewarding our executives achievement of financial goals as well as their individual goals, which are similarly aligned to our basic corporate objective which is “to maximize the value of our stockholders’ investment over both the short and long term.” Accordingly, the financial results for the year serve as a background to the discussion of our compensation practices that follows.

2019 Financial Highlights

| · | Net Income– our net income determined in accordance with generally accepted accounting principles (“GAAP”) for the year ended December 31, 2019 was $62.7 million, a 26.3% increase compared to $49.7 million for the year ended December 31, 2018. |

| · | Pre-Tax Operating Earnings– our pre-tax operating earnings for the year ended December 31, 2019 were $86.5 million, an increase of 8.2% compared to $79.9 million for the year ended December 31, 2018. |

| · | Banking Segment Pre-Tax Operating Earnings– our banking segment pre-tax operating earnings for the year ended December 31, 2019 were $84.4 million, a 5.6% increase compared to $80.0 million for the year ended December 31, 2018. |

Pre-tax operating earnings and banking segment pre-tax operating earnings are non-GAAP financial measures used by management that exclude gains or losses from securities, gains or losses on extinguishment of debt, gains or losses on bulk servicing, fair value adjustments on interest rate swaps, other than temporary impairment, MSR impairment, and merger-related expenses. Please see Appendix “Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations-Non-GAAP Financial Measures” in the Original Filing for reconciliations to the most directly comparable GAAP measures.

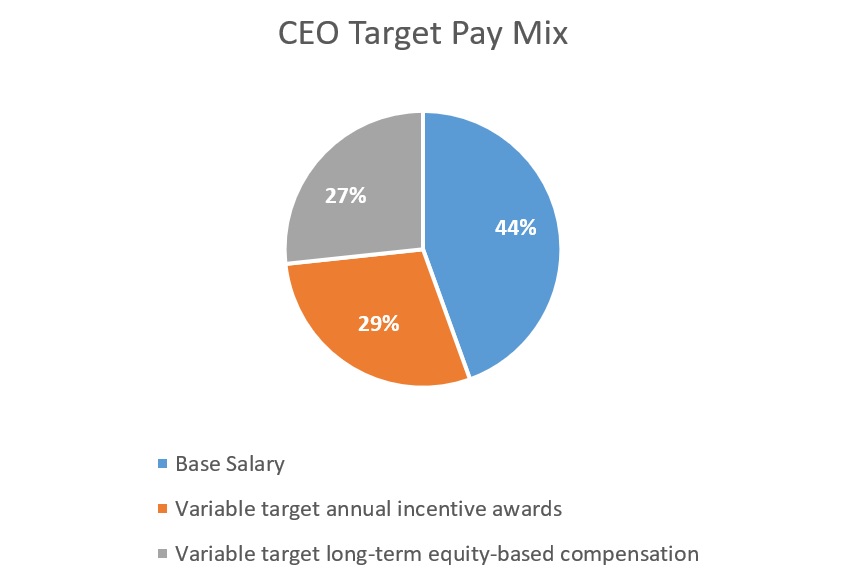

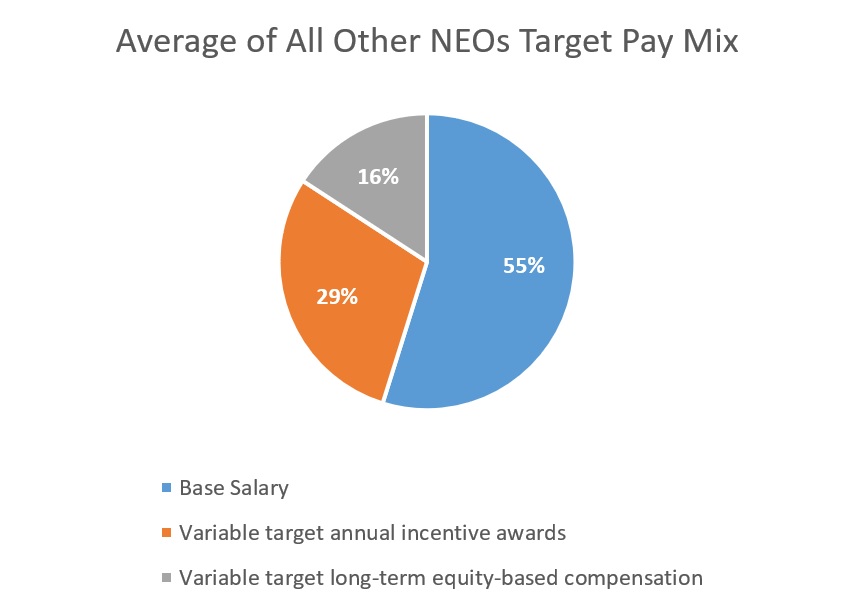

Components of Compensation and Target Pay Mix.A meaningful portion of our executive pay program is variable and “at-risk.” We consider compensation to be “at risk” if it is subject to performance-based payment or vesting conditions or its value depends on share price appreciation.

The charts below for our Chief Executive Officer (“CEO”) and our other NEOs illustrate the target compensation established for 2019, consisting of base salary, annual incentive awards, and long-term equity-based compensation granted in 2019.

Compensation Governance Practices.We have strong compensation governance practices that reinforce our principles, support sound risk management and are stockholder-aligned:

| | | | |

| | What We Do | What We Don’t Do | |

| | Align pay and performance | No guaranteed bonuses – incentive compensation may be reduced to zero if financial and/or personal metrics are not met | |

| | Engage an independent third-party compensation consultant for advice in making compensation decisions | No highly leveraged incentive plans that encourage excessive risk taking | |

| | Review compensation data from peers whose industry, revenues, and footprint share similarities with Carolina Financial | No uncapped incentive award payouts for our NEOs | |

| | Effective as of January 23, 2019, adopted a Clawback Policy intended to recover certain incentive-based compensation if there is an accounting misstatement and the Board of Directors determines such restatement involved fraud or intentional misconduct | No excessive perquisites for our directors and executive officers | |

| | | | |

Executive Compensation Principles and Strategy.Our Board believes a well-designed compensation program should align executive interests with the drivers of growth and stockholder returns, support achievement of our primary business goals, and attract, motivate and retain executives whose talents, expertise, leadership and contributions are expected to maximize the value of our stockholders’ investment over both the short and long term. Consequently, our Board believes a meaningful portion of NEO compensation should be performance-based and variable pay.

Our philosophy does not specifically indicate a desired positioning level relative to the market or total compensation. Salaries have historically been targeted near the median, with additional considerations given for each executive’s scope of responsibility, performance in the role, special projects completed during the year, and any potential retention or internal equity concerns.

Compensation Determination Process

Role of the Compensation/Benefits Committee.Our Compensation/Benefits Committee is generally responsible for reviewing, modifying, approving and otherwise overseeing the compensation policies and practices applicable to all of our NEOs and the administration of equity plans available to all eligible employees. As part of this responsibility, the Compensation/Benefits Committee establishes, reviews and modifies the compensation structure for our NEOs.

As part of its deliberations, in any given year, the Compensation/Benefits Committee may review and consider materials such as studies and reports prepared by a compensation consultant; financial reports and projections; operational data; tax and accounting information that sets forth the total compensation that may become payable to executives in various hypothetical scenarios; executive and director stock ownership information; our common stock performance data; analyses of historical executive compensation levels and current Company-wide compensation levels; and the recommendations of the chief executive officer and the Compensation/Benefits Committee’s independent compensation consultant.

Role of Management.Our Compensation/Benefits Committee solicits and considers the performance evaluations and compensation recommendations with respect to our NEOs submitted by our CEO. The Compensation/Benefits Committee conducts a formal performance evaluation of our CEO annually, with informal commentary discussed as needed throughout the year. In addition, our CEO prepares and presents the annual evaluations and recommendations for the NEOs to our Compensation/Benefits Committee outside of the presence of any other NEO. However, our Compensation/Benefits Committee retains the final authority to make all compensation decisions. Our Compensation/Benefits Committee meets in executive session after our CEO has presented the evaluations and reports back to management on the results of their deliberations. No executive officer participated directly in the final determinations of the Compensation/Benefits Committee regarding the amount of any component of his own compensation package for 2019.

Our finance and human resources departments work with our CEO to make recommendations regarding compensation of our NEOs and other senior executives, to recommend changes to existing compensation programs, to recommend financial and other performance targets to be achieved under those programs, to prepare analyses of financial data, to prepare peer data comparisons and other briefing materials, and ultimately to implement the decisions of the Compensation/Benefits Committee. Our CEO also meets separately with the Compensation/Benefits Committee’s independent compensation consultant to convey information on proposals that management may make to the Compensation/Benefits Committee, as well as to allow the consultant to collect information about our Company to develop its own proposals.

Compensation Consultant.Our Compensation/Benefits Committee decided to continue its engagement of McLagan, a part of the Rewards Solutions practice of Aon plc, as its independent compensation consultant for compensation decisions for 2019. In 2016, our Compensation/Benefits Committee engaged McLagan as its independent compensation consultant for a three-year period covering the fall of 2016 to the fall of 2019. This arrangement includes the market analyses and advice that were considered for compensation decisions for 2019. Our Compensation/Benefits Committee selected McLagan for its expertise in the banking industry, the recommendations of other clients of McLagan, and the availability of the consultant to attend meetings.

McLagan conducts in-depth reviews of the design and competitive positioning of our compensation programs for our CEO and other executive officers in preparation for the Compensation/Benefits Committee making compensation decisions. In the fall of 2018, for use by our Compensation/Benefits Committee for making 2019 compensation decisions, McLagan provided analyses of compensation levels and opportunities, incentive plan design, long-term incentive practices and perquisites of our chief executive officer and other executive officers using our 2019 peer group data.

Our Compensation/Benefits Committee regularly reviews the services provided by McLagan and believes that it is independent from the Company in providing executive compensation consulting services. Our Compensation/Benefits Committee has also assessed the independence of McLagan consistent with SEC rules and NASDAQ listing standards and has concluded that the engagement of McLagan does not raise any conflicts of interest. Our Compensation/Benefits Committee continues to monitor the independence of McLagan on a periodic basis.

Compensation Peer Group and Peer Selection Process.The Compensation/Benefits Committee and McLagan developed a compensation peer group for 2019 that fairly represents the market for executive talent in which we compete and includes institutions that share our business and market characteristics. The Compensation/Benefits Committee reviews the composition of the peer group annually and may change it due to mergers, changes to banks within the group, or changes within the Company.

The 2019 compensation peer group includes publicly-traded financial institutions that were selected based on the following criteria:

| · | total assets between $2.0 billion to $8.0 billion; |

| · | headquarters in one of the following states: Alabama, Florida, Georgia, Kentucky, Mississippi, North Carolina, South Carolina, Tennessee, Virginia, or West Virginia; |

| · | return on average tangible assets and return on average tangible equity greater than 0%: |

| · | no current TARP participants; |

| · | no recent mutual conversions; and |

| · | business model compatibility; |

The peer group was constructed, in part, such that our total assets are generally in the range of the median of the peer group companies. The Compensation/Benefits Committee reviewed a group of 18 peers with median assets of $4.0 billion as of June 30, 2018. Our anticipated 2018 year-end total assets of $4.0 billion was used as the targeted asset size for the peer group utilized by the Compensation/Benefits Committee for 2019 NEO compensation decisions.

2019 Peer Group.The peer group established for setting 2019 compensation consisted of the following companies:

| Access National Corp. (ANCX) | | First Community Bancshares Inc. (FCBC) |

| Atlantic Capital Bancshares Inc. (ACBI) | | Franklin Financial Network Inc. (FSB) |

| Capital City Bank Group Inc. (CCBG) | | HomeTrust Bancshares Inc. (HTBI) |

| Carter Bank & Trust (CARE) | | National Commerce Corp. (NCOM) |

| City Holding Co. (CHCO) | | Republic Bancorp Inc. (RBCA.A) |

| Community Trust Bancorp Inc. (CTBI) | | Seacoast Banking Corp. of FL (SBCF) |

| FB Financial Corp. (FBK) | | ServisFirst Bancshares Inc. (SFBS) |

| Fidelity Southern Corp. (LION) | | Stock Yards Bancorp Inc. (SYBT) |

| First Bancorp (FBNC) | | Summit Financial Group Inc. (SMMF) |

| | | Total Assets as of 6/30/2018

($000) | |

| 25thPercentile | | | 3,016,481 | |

| 50thPercentile | | | 4,127,375 | |

| 75thPercentile | | | 4,940,900 | |

| Carolina Financial (anticipated 2018) | | | 4,000,000 | |

| Percentile Rank | | | 41 | % |

| | | | | |

Each year, with assistance from McLagan, the Compensation/Benefits Committee reviews the compensation practices of our peers to assess the competitiveness of the compensation arrangements of our NEOs. Although such benchmarking is an active tool used to measure compensation structures among peers, it is only one of the tools used by the Compensation/Benefits Committee to determine total compensation. Benchmarking is used primarily to ascertain competitive total compensation levels (including base salary, cash incentives, equity awards, etc.) with comparable institutions.

Components of our Compensation Program

2019 Components in General.The Compensation/Benefits Committee selected the components of compensation set forth in the chart below to achieve our stated executive officer compensation program objectives. The Compensation/Benefits Committee reviews all components of the compensation of executive officers in order to verify that the executive officer’s total compensation is consistent with our compensation philosophy and objectives. Four primary components make up our executive pay program: base salary, annual cash incentives, annual equity incentives and long-term equity incentives. The purpose and strategic role of each of these elements paid and awarded in 2019 are summarized below.

| Element | Description | Strategic Role |

| Base Salary | Fixed cash compensation, reviewed and adjusted annually, as appropriate Based on each NEO’s individual skills, experience, performance, external market and internal equity | Attracts and rewards executives via market competitive pay and industry norms and reflects individual performance |

| Banking Segment Annual Cash Bonus Plan – Variable Pay | To be eligible for an annual cash bonus award under this plan, the Banking Segment must achieve a specified threshold of Pre-tax Operating Earnings In addition, the plan rewards NEOs for annual corporate performance based on a scorecard of financial and operational metrics Performance levels (threshold, target, maximum) are established for each metric An NEO’s award is subject to negative discretion by the Compensation/Benefits Committee based on failure to achieve individual performance targets | Motivate executives by linking variable cash compensation to key annual performance goals tied to the Company’s business strategy |

| Element | Description | Strategic Role |

| Banking Segment Annual Supermax Bonus-Variable Pay | Participants in the Banking Segment Annual Bonus Plan are eligible to receive a Supermax bonus if the Banking Segment achieves Operating Earnings Per Share (“EPS”) at or above a specified annual level that is above the maximum Supermax bonus for the CEO is equal to 20% of base salary, with any amounts earned paid out in the form of cash (15%) and equity (5%) Supermax bonus for all other NEOs is equal to 5% of base salary, with any amounts earned paid out in the form of equity | Motivate executives to achieve above-maximum level performance by linking incentive compensation to overachievement of a key annual performance metric that is tied to the Company’s business strategy |

| Crescent Mortgage Co. Annual Cash Bonus Plan – Variable Pay | To be eligible for the annual cash award under this plan, Crescent Mortgage Company must achieve positive Net Income After Taxes In addition, the plan rewards NEOs for annual corporate performance based on a scorecard of financial, operational and strategic metrics Performance levels (threshold, target low, target high, maximum) are established for each metric NEO’s award is subject to negative discretion by the Compensation/Benefits Committee based on failure to achieve individual performance targets | Motivate executives by linking variable cash compensation to key annual performance goals tied to the Company’s business strategy |

| Long-Term Equity Incentives – Variable Pay | Variable equity-based compensation Performance Restricted Stock Units (RSUs): Restricted share units are earned only upon the attainment of a specified Pre-Tax Operating EPS measured over a two-year performance period Performance levels (Threshold - 50% of Target, Target and Maximum - 150% of Target), to be paid on a pro-rata achievement basis between performance levels There is no award if the attainment of Pre-Tax Operating EPS is less than Threshold. Time-Based Restricted Stock Awards (RSAs): RSAs are time-based, generally vesting ratably over a three-year period | Equity-based compensation is used to foster a long-term link between executive officers’ interests and the interests of the Company and its stockholders, as well as to attract, motivate and retain executive officers for the long-term |

Base Salary

Purpose:Base salaries provide stable compensation to executive officers, allow us to attract and retain competent executive talent and maintain a stable leadership team. Base salaries vary among executive officers, and are individually determined according to each executive officer’s areas of responsibility, role and experience, based on a variety of considerations, including:

| · | Professional Background:Factors such as education, skills, expertise, professional experience and achievements are considered. |

| · | Competitiveness:The base salary of executive officers is evaluated for competitiveness by considering external information with respect to our peer group that is selected based on such factors as our size, nature of activities and competitors for similar talent, as well as the relevant geographic location. |

| · | Internal Fairness:The variation in the relative base salary among executive officers is designed to reflect the differences in position, education, scope of responsibilities, location, previous experience in similar roles and contribution to the attainment of our goals. |

Adjustments to base salary:The Compensation/Benefits Committee reviews the base salaries of the NEOs on an annual basis as well as whenever an NEO is promoted or there is a material change to his or her duties and responsibilities.

Decisions regarding salary adjustments reflect a variety of factors including the NEO’s role and responsibilities, individual performance, tenure, current base salary, the base salaries paid to similarly-situated executives in comparable positions in the market, internal equity, and retention risk.

In considering base salary adjustments for 2019, the Compensation/Benefits Committee reviewed the individual performance of the NEOs, peer proxy and survey data gathered by McLagan, and the increases recommended by the CEO for each of the NEOs other than himself. Effective January 1, 2019, the Compensation/Benefits Committee provided the base salary increases shown in the table below.

| | | | | | | | | | |

| Name | | 2018 Salary | | | 2019 Salary | | | % Change | |

| Rexroad | | $ | 540,000 | | | $ | 560,000 | | | | 3.7 | % |

| Gehman | | $ | 270,000 | | | $ | 280,000 | | | | 3.7 | % |

| Huggins | | $ | 293,000 | | | $ | 310,000 | | | | 5.8 | % |

| Morrow | | $ | 435,000 | | | $ | 448,000 | | | | 3.0 | % |

| Williams | | $ | 329,000 | | | $ | 339,000 | | | | 3.0 | % |

These increases reflect the outstanding contributions of the NEOs to our performance in 2018 as well as the increased scope and responsibility of their respective roles due to our continued anticipated growth in 2019.

Annual Incentive Plans.Messrs. Rexroad, Gehman, Huggins and Morrow are eligible to participate in the Banking Segment Annual Cash Bonus Plan and the Banking Segment Supermax Bonus, while Mr. Williams is eligible to participate in the Crescent Mortgage Company Annual Cash Bonus Plan. These annual bonus plans are performance-based plans designed to reward eligible employees for the achievement of our specific Company financial goals and successful individual performance. The primary objective of these plans is to provide our NEOs with a direct link between their compensation and their attainment of pre-established annual performance goals. We believe that the performance required for rewards under the plans is challenging, but with effort, attainable, and will contribute to the Company attaining its long-term strategic goals.

Annual Incentive Opportunities.We set target incentive opportunities based on a percentage of base salary that reflects a market-level target compensation opportunity for each NEO. The threshold and maximum percentages for the Banking Segment Annual Cash Bonus Plan and the Crescent Mortgage Annual Cash Bonus Plan as well as the Supermax bonus percentages reflect both the Compensation/Benefits Committee’s review of market practices and the Compensation/Benefits Committee’s judgment of the level of award opportunity appropriate for the performance goals established. The differences in opportunity levels also reflect each NEO’s relative influence on achieving performance goals based on his position.

Banking Segment Annual Cash Bonus Plan Opportunity

| | | Percentage of Base Salary | |

| Name | | Threshold | | | Target | | | Maximum | |

| Rexroad | | | 30 | % | | | 60 | % | | | 90 | % |

| Gehman | | | 25 | % | | | 50 | % | | | 75 | % |

| Huggins | | | 25 | % | | | 50 | % | | | 75 | % |

| Morrow | | | 25 | % | | | 50 | % | | | 75 | % |

| | | | | | | | | | | | | |

Banking Segment Supermax Bonus Opportunity.Participants in the Banking Segment Annual Cash Bonus Plan are also eligible to receive a Supermax bonus if a certain level of Banking Segment Pre-Tax Operating Earnings is achieved that is greater than the defined maximum level of performance. Any earned Supermax award is paid entirely in common stock for all the NEOs except Mr. Rexroad, who would receive any payout in the following form: 5% in common stock and 15% in cash.

| Name | | Percentage of

Base Salary | |

| Rexroad | | | 20 | % |

| Gehman | | | 5 | % |

| Huggins | | | 5 | % |

| Morrow | | | 5 | % |

| | | | | |

Crescent Mortgage Company Annual Cash Bonus Plan

| | | Percentage of Base Salary | |

| Name | | Threshold | | | Target Low | | | Target High | | | Maximum | |

| Williams | | | 30 | % | | | 50 | % | | | 75 | % | | | 100 | % |

| | | | | | | | | | | | | | | | | |

Company Performance Goals and Results.Each of our annual cash incentive plans requires that a certain threshold level of performance must be achieved for executives to receive an award under the plan:

| · | Banking Segment Annual Cash Bonus Plan:We must have Banking Segment Pre-Tax Operating Earnings of at least $40.0 million for 2019. |

| · | Crescent Mortgage Company Annual Cash Bonus Plan:We must have positive Crescent Mortgage Company Net Operating Income for 2019, unless otherwise approved by the Board of Directors. In addition, 75% of the bonus is paid in the first quarter of 2020. In order for the remaining 25% to be paid, Crescent Mortgage Company must have income for the first six months of 2020 of at least $1.0 million. |

For 2019, the Compensation/Benefits Committee utilized six performance goals in the Banking Segment Annual Cash Bonus Plan and five performance goals in the Crescent Mortgage Company Annual Cash Bonus Plan. The goals for each performance measure are set based on our performance expectations in the annual operating plan that our Board of Directors approved in early 2019. The Compensation/Benefits Committee established the various threshold and maximum levels for each performance measure after analyzing the performance required at each award level. The Compensation/Benefits Committee also established a Banking Segment Supermax Bonus that will pay out only if Banking Segment Pre-Tax Operating EPS are at or above a specified level above the defined maximum level under the Banking Segment Annual Cash Bonus Plan. These particular metrics were selected by the Compensation/Benefits Committee to link our annual incentive plan for our leadership team to our internal strategic objectives that we believe drive stockholder value over both the short and long term.

For each respective annual cash incentive plan, the charts below show the 2019 performance goals and their respective weightings as well as the actual results achieved during 2019.

Banking Segment Annual Cash Bonus Plan & Supermax Bonus

| | | 2019 Performance Goals | | | 2019 Actual | |

| Performance Measure | | Weighting1,3 | | | Threshold | | | Target | | | Maximum | | | Supermax | | | Results | |

| Consolidated Carolina Financial Operating Earnings Per Share2 | | | 10% - 20% | | | $ | 2.70 | | | $ | 2.87 | | | $ | 2.95 | | | | n/a | | | $ | 3.02 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Banking Segment Operating Earnings Per Share2,3 | | | 40% - 50% | | | $ | 2.72 | | | $ | 2.83 | | | $ | 2.92 | | | $ | 2.98 | | | $ | 2.94 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

1For the Operating EPS, the weightings for Mr. Rexroad and Mr. Gehman are 20% consolidated Carolina Financial and 40% banking segment due to their increased responsibility and focus at the holding company level. The weightings for Mr. Huggins and Mr. Morrow are 10% consolidated Carolina Financial and 50% banking segment.

2Operating EPS excludes gains or losses from securities, gains or losses on extinguishment of debt, bulk servicing sales gains or losses, fair value adjustments on interest rate swaps, other than temporary impairment, MSR impairment, and merger-related expenses. Please see “Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations -- Non-GAAP Financial Measures” in the Original Filing for reconciliations to the most comparable GAAP measures.

3The Banking Segment also has other performance measures that include growth in loan and checking balances, increase in the number of checking accounts and asset quality performance goals that comprise an aggregate of up to 40% of the overall weightings. These individual performance targets are not presented herein as we believe these performance goals to be competitively sensitive information. In 2019, the Banking Segment did not meet threshold for certain of these performance goals and, accordingly, the annual incentive earned was adjusted.

Crescent Mortgage Company Annual Cash Bonus Plan

| | | | | | | | | | | | | | | | | | | |

| | | 2019 Performance Goals | | | 2019 Actual | |

| Performance Measure | | Weighting | | | Threshold | | | Target Low | | | Target High | | | Maximum | | | Results | |

| Consolidated Carolina Financial Operating Earnings Per Share1 | | | 10 | % | | $ | 2.70 | | | $ | 2.87 | | | | 2.95 | | | | 2.98 | 2 | | $ | 3.02 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Crescent Mortgage Company Pre-tax Operating Earnings1,3 | | | 55 | % | | | $4 Million | | | | $5.5 Million | | | | $7.5 Million | | | | $9 Million | | | | $5.1 Million | |

| | | | | | | | | | | | | | | | | | | | | | | | | |