Exhibit 99.1

Neonode Reports Third Quarter Ended September 30, 2019 Financial Results

STOCKHOLM, SWEDEN – November 6, 2019 – Neonode Inc. (NASDAQ: NEON), the optical interactive sensing technology company, today reported financial results for the three and nine months ended September 30, 2019.

“There is significant interest for Neonode’s sensor and license technology in the automotive and other key markets but in our business, we have to accept long lead times in acquiring new customer contracts. Having said that, we are not satisfied with the development over the last 12-18 months. Our newly recruited CEO, Dr. Urban Forssell, brings a deep understanding of the automotive markets and has successfully managed embedded technology operations throughout his career. He will add a lot of energy to the company and continue to focus the business on all selected markets and use cases while driving ongoing cost efficiencies throughout the company. The company’s ability to convert the strong customer interest into revenue generating contracts is the absolute key moving forward”, said Ulf Rosberg, Board Chairman of Neonode.

FINANCIAL SUMMARY FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2019

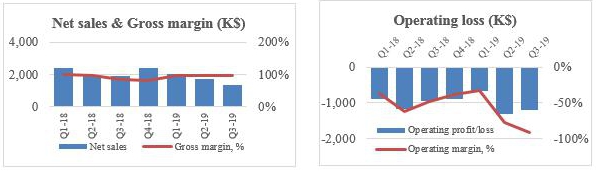

| ● | Net sales totaled $1.3 million and $5.0 million for the three and nine months ended September 30, 2019 compared to $1.9 million and $6.2 million, respectively, for the same periods last year. |

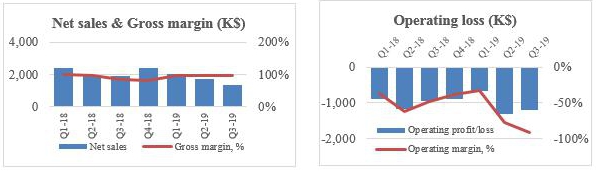

| ● | Operating expenses totaled $2.4 million and $8.0 million for the three and nine months ended September 30, 2019 compared to $2.5 million and $8.7 million, respectively, for the same periods last year. |

| ● | Net loss totaled $1.1 million and $2.9 million for the three and nine months ended September 30, 2019 compared to a net loss of $0.8 million and $2.5 million, respectively, for the same periods last year. |

| ● | Loss per share totaled $0.12 and $0.33 for the three and nine months ended September 30, 2019 compared to a loss per share of $0.14 and $0.42, respectively, for the same periods last year. |

| ● | Net cash used in operating activities totaled $2.9 million for the nine months ended September 30, 2019 compared to $2.3 million for the same period last year. |

HIGHLIGHTS SUBSEQUENT TO SEPTEMBER 30, 2019

| ● | In October 2019, Hakan Persson resigned as Chief Executive Officer and the Board of Directors appointed Urban Forssell as new Chief Executive Officer, effective latest January 1, 2020. Mr. Forssell has most recently served as Vice President and General Manager at Öhlins Racing AB. His positions at Öhlins Racing have included responsibility for sales and marketing of MC and Automotive suspension systems, research and development, and quality assurance. |

THE CEO’S COMMENTS

“We have focused on sales, cost efficiency, marketing and technology development during the past few months and now expect to capitalize on our efforts while keeping our cost reduction focus. Over the course of the year, we participated in numerous relevant trade and industry shows where our latest version of our license and sensor module technologies have been well received. Our sales partner networks in North America and Japan have a growing number of opportunities which are in the evaluation and product development phase. We have signed with a sales partner in China, Serial Microelectronics, and they are in the final stages of product orientation and is beginning initial sales efforts. In addition, our distributor, Digi-Key has shipped a significant number of evaluation kits globally, primarily to industrial accounts in the U.S. and Asia. The leads generated through this channel are continuously being qualified by our local representatives and sales partners”, said Maria Ek, Neonode interim CEO and CFO.

“We are engaged with automotive OEMs and their Tier 1 suppliers in projects such as tailgate sensors and infotainment systems, military ruggidized control panels and medical device control panels to name a few. We are encourgaged by the increasing pipeline of customer discussions and activities that is being driven by the combination of our internal and external sales groups”, continued Ms. Ek.

“In summary we have increased our sales and distribution network as well as our understanding of the market for Neonode’s technology. The task going forward will be to deliver revenue by focusing on the best opportunities”, concluded Ms. Ek.

FINANCIAL OVERVIEW FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2019

All of our sales for the three and nine months ended September 30, 2019 and 2018 were to customers located in the U.S., Europe and Asia.

Our net revenues for the three and nine months ended September 30, 2019 are $1.3 million and $5.0 million, respectively, and include revenues earned from technology license fees, NRE and module sales. Revenues for the three and nine months ended September 30, 2019 decreased by $0.6 million, or 32%, and $1.1 million, or 19%, year over year, respectively.

Our total license fees for the third quarter 2019 decreased by $0.4 million, or 24%, primarily due to the adoption of a new technology platforms by an e-reader and a printer customer in the fourth quarter of 2018, resulting in a 96% decrease in total e-reader license fees and a 31% decrease in total printer license fees for the comparable quarters. The decrease in license fees from these two customers is partially offset by a 61% increase in license fees from our automotive customers.

In addition, non-recurring engineering revenue for the third quarter 2019 decreased $0.3 million, or 99% compared to 2018 due to NRE fees related to an automotive entry system project recorded in the third quarter of 2018. Revenues from sensor module sales increased $0.1 million, or 144%, compared to the third quarter in 2018. The overall decrease in revenues for the comparable nine month periods is primarily due to the same customer activities.

Operating expenses for the three months ended September 30, 2019 are in line with the same period in 2018 but is lower by 8% for the nine months ended September 30, 2019 due to lower administrative payroll and professional fees compared to the same period in 2018. Net loss for the three and nine months ended September 30, 2019 increased by $0.3 million, or 34% and $0.5 million, or 19% compared to the same periods in 2018.

Cash used by operations during the nine months ended September 30, 2019 increased by $0.6 million, or 26% year over year. Cash and accounts receivables totaling $5.0 million on September 30, 2019 is sufficient to execute according to our plan. Our third quarter Form 10-Q is available for download from the Investor Section of our website at www.neonode.com.

Financial Overview

| | | Three months ended

September 30, | | | Nine months ended

September 30, | |

| Amounts in USD thousand unless otherwise stated | | 2019 | | | 2018 | | | 2019 | | | 2018 | |

| Net sales | | $ | 1,310 | | | $ | 1,923 | | | $ | 5,032 | | | $ | 6,174 | |

| Net sales decline % | | | (31.9 | )% | | | | | | | (18.5 | )% | | | | |

| Gross margin % | | | 95.1 | % | | | 82.4 | % | | | 95.3 | % | | | 92.3 | % |

| Operating loss | | $ | (1,189 | ) | | $ | (934 | ) | | $ | (3,171 | ) | | $ | (2,974 | ) |

| Operating margin % | | | (90.8 | )% | | | (48.6 | )% | | | (63.0 | )% | | | (48.2 | )% |

| Net cash used in operating activities | | | | | | | | | | $ | (2,873 | ) | | $ | (2,275 | ) |

Revenue Distribution by Business Model

| | | 2019 | | | 2018 | | | 2019 | | | 2018 | |

| Revenue Distribution By Business Model | | Q3 | | | Q3 | | | Nine months | | | Nine months | |

| License fees | | $ | 1,213 | | | $ | 1,597 | | | $ | 4,622 | | | $ | 5,681 | |

| Sensor modules | | | 95 | | | | 39 | | | | 368 | | | | 176 | |

| Non-recurring engineering | | | 2 | | | | 287 | | | | 42 | | | | 317 | |

License Fee Revenue Distribution per Market

| | | 2019 | | | 2018 | | | 2019 | | | 2018 | |

| License Fee Revenue Distribution Per Market | | Q3 | | | Q3 | | | Nine months | | | Nine months | |

| Printers | | $ | 805 | | | $ | 1,159 | | | $ | 3,162 | | | $ | 3,830 | |

| E-Readers and Tablets | | | 8 | | | | 190 | | | | 124 | | | | 700 | |

| Automotive | | | 400 | | | | 248 | | | | 1,336 | | | | 1,151 | |

FOR MORE INFORMATION, PLEASE CONTACT:

Investor Relations

David Brunton

Email: david.brunton@neonode.com

Interim CEO and Chief Financial Officer

Maria Ek

E-mail: maria.ek@neonode.com

ABOUT NEONODE

Neonode Inc. (NASDAQ:NEON) develops, manufactures and sells advanced sensor modules based on our company’s proprietary ZFORCE AIR technology. Neonode ZFORCE AIR Sensor Modules enable touch interaction, mid-air interaction and object sensing and are ideal for integration in a wide range of applications within the automotive, consumer electronics, medical, robotics and other markets. Our company also develops and licenses user interfaces and optical interactive touch solutions based on its patented ZFORCE CORE technology.

NEONODE, the NEONODE logo, ZFORCE and ZFORCE AIR are trademarks of Neonode Inc. registered in the United States and other countries. ZFORCE CORE is a trademark of Neonode Inc.

For further information please visitwww.neonode.com

Follow us at:

Linkedin.com/company/neonode

News.cision.com/neonode

Subscribe to our news here

SAFE HARBOR STATEMENT

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These include, but are not limited to, statements relating to expectations, future performance or future events, business plan and strategy, potential revenue from license fees and module sales, development and introduction of new sensor modules, proceed from patent licensing, revenue from patent monetization, customer shipments and orders, and product cost, performance, and functionality matters. These statements are based on current assumptions, expectations and information available to Neonode management and involve a number of known and unknown risks, uncertainties and other factors that may cause Neonode’s actual results, levels of activity, performance or achievements to be materially different from any expressed or implied by these forward-looking statements.

These risks, uncertainties, and factors are discussed under “Risk Factors” and elsewhere in Neonode’s public filings with the U.S. Securities and Exchange Commission from time to time, including Neonode’s annual report on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K. You are advised to carefully consider these various risks, uncertainties and other factors. Although Neonode management believes that the forward-looking statements contained in this press release are reasonable, it can give no assurance that its expectations will be fulfilled. Forward-looking are made as today’s date, and Neonode undertakes no duty to update or revise them.

NEONODE INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share amounts)

| | | September 30, | | | December 31, | |

| | | 2019 | | | 2018 | |

| ASSETS | | (Unaudited) | | | (Audited) | |

| Current assets: | | | | | | |

| Cash | | $ | 3,025 | | | $ | 6,555 | |

| Accounts receivable and unbilled revenue, net | | | 1,934 | | | | 1,830 | |

| Projects in process | | | 7 | | | | - | |

| Inventory | | | 1,104 | | | | 1,219 | |

| Prepaid expenses and other current assets | | | 862 | | | | 890 | |

| Total current assets | | | 6,932 | | | | 10,494 | |

| | | | | | | | | |

| Investment in joint venture | | | 3 | | | | 3 | |

| Property and equipment, net | | | 1,704 | | | | 2,484 | |

| Operating lease right-of-use assets | | | 581 | | | | - | |

| Other assets | | | 290 | | | | 261 | |

| Total assets | | $ | 9,510 | | | $ | 13,242 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable | | $ | 498 | | | $ | 501 | |

| Accrued payroll and employee benefits | | | 828 | | | | 902 | |

| Accrued expenses | | | 178 | | | | 265 | |

| Deferred revenues | | | 54 | | | | 75 | |

| Current portion of finance lease obligations | | | 552 | | | | 570 | |

| Current portion of operating lease obligations | | | 413 | | | | - | |

| Total current liabilities | | | 2,523 | | | | 2,313 | |

| | | | | | | | | |

| Finance lease obligations, net of current portion | | | 599 | | | | 1,133 | |

| Operating lease obligations, net of current portion | | | 105 | | | | - | |

| Total liabilities | | | 3,227 | | | | 3,446 | |

| | | | | | | | | |

| Commitments and contingencies | | | | | | | | |

| | | | | | | | | |

| Stockholders’ equity: | | | | | | | | |

| Series B Preferred stock, 54,425 shares authorized with par value $0.001 per share; 0 and 82 shares issued and outstanding at September 30, 2019 and December 31, 2018, respectively. (In the event of dissolution, each share of Series B Preferred stock has a liquidation preference equal to par value of $0.001 per share over the shares of common stock) | | | - | | | | - | |

| Common stock, 15,000,000 shares authorized with par value $0.001 per share; 8,811,154 and 8,800,313 shares issued and outstanding at September 30, 2019 and December 31, 2018, respectively. | | | 9 | | | | 9 | |

| Additional paid-in capital | | | 197,507 | | | | 197,507 | |

| Accumulated other comprehensive loss | | | (756 | ) | | | (456 | ) |

| Accumulated deficit | | | (188,145 | ) | | | (185,222 | ) |

| Total Neonode Inc. stockholders’ equity | | | 8,615 | | | | 11,838 | |

| Noncontrolling interests | | | (2,332 | ) | | | (2,042 | ) |

| Total stockholders’ equity | | | 6,283 | | | | 9,796 | |

| Total liabilities and stockholders’ equity | | $ | 9,510 | | | $ | 13,242 | |

NEONODE INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts)

(Unaudited)

| | | Three months ended

September 30, | | | Nine months ended

September 30, | |

| | | 2019 | | | 2018 | | | 2019 | | | 2018 | |

| Revenues: | | | | | | | | | | | | |

| License fees | | $ | 1,213 | | | $ | 1,597 | | | $ | 4,622 | | | $ | 5,681 | |

| Sensor module | | | 95 | | | | 39 | | | | 368 | | | | 176 | |

| Non-recurring engineering | | | 2 | | | | 287 | | | | 42 | | | | 317 | |

| Total revenues | | | 1,310 | | | | 1,923 | | | | 5,032 | | | | 6,174 | |

| Cost of revenues: | | | | | | | | | | | | | | | | |

| Sensor module | | | 65 | | | | 57 | | | | 121 | | | | 191 | |

| Non-recurring engineering | | | (1 | ) | | | 282 | | | | 115 | | | | 283 | |

| Total cost of revenues | | | 64 | | | | 339 | | | | 236 | | | | 474 | |

| | | | | | | | | | | | | | | | | |

| Total gross margin | | | 1,246 | | | | 1,584 | | | | 4,796 | | | | 5,700 | |

| | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | |

| Research and development | | | 1,167 | | | | 1,113 | | | | 3,878 | | | | 3,993 | |

| Sales and marketing | | | 491 | | | | 446 | | | | 1,431 | | | | 1,472 | |

| General and administrative | | | 777 | | | | 959 | | | | 2,658 | | | | 3,209 | |

| | | | | | | | | | | | | | | | | |

| Total operating expenses | | | 2,435 | | | | 2,518 | | | | 7,967 | | | | 8,674 | |

| Operating loss | | | (1,189 | ) | | | (934 | ) | | | (3,171 | ) | | | (2,974 | ) |

| | | | | | | | | | | | | | | | | |

| Other expense: | | | | | | | | | | | | | | | | |

| Interest expense | | | 8 | | | | 12 | | | | 27 | | | | 39 | |

| Total other expense | | | 8 | | | | 12 | | | | 27 | | | | 39 | |

| | | | | | | | | | | | | | | | | |

| Loss before provision for income taxes | | | (1,197 | ) | | | (946 | ) | | | (3,198 | ) | | | (3,013 | ) |

| | | | | | | | | | | | | | | | | |

| Provision for income taxes | | | 2 | | | | 5 | | | | 15 | | | | 13 | |

| Net loss including noncontrolling interests | | | (1,199 | ) | | | (951 | ) | | | (3,213 | ) | | | (3,026 | ) |

| Less: Net loss attributable to noncontrolling interests | | | 113 | | | | 142 | | | | 290 | | | | 560 | |

| Net loss attributable to Neonode Inc. | | $ | (1,086 | ) | | $ | (809 | ) | | $ | (2,923 | ) | | $ | (2,466 | ) |

| | | | | | | | | | | | | | | | | |

| Loss per common share: | | | | | | | | | | | | | | | | |

| Basic and diluted loss per share | | $ | (0.12 | ) | | $ | (0.14 | ) | | $ | (0.33 | ) | | $ | (0.42 | ) |

| Basic and diluted – weighted average number of common shares outstanding | | | 8,811 | | | | 5,859 | | | | 8,804 | | | | 5,859 | |

NEONODE INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(In thousands)

(Unaudited)

| | | Three months ended

September 30, | | | Nine months ended

September 30, | |

| | | 2019 | | | 2018 | | | 2019 | | | 2018 | |

| | | | | | | | | | | | | |

| Net loss | | $ | (1,199 | ) | | $ | (951 | ) | | $ | (3,213 | ) | | $ | (3,026 | ) |

| Other comprehensive income (loss): | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustments | | | (145 | ) | | | 13 | | | | (300 | ) | | | (417 | ) |

| Comprehensive loss | | | (1,344 | ) | | | (938 | ) | | | (3,513 | ) | | | (3,443 | ) |

| Less: Comprehensive loss attributable to noncontrolling interests | | | 113 | | | | 142 | | | | 290 | | | | 560 | |

| Comprehensive loss attributable to Neonode Inc. | | $ | (1,231 | ) | | $ | (796 | ) | | $ | (3,223 | ) | | $ | (2,883 | ) |

NEONODE INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(In thousands, except for Series B Preferred Stock Shares Issued)

(Unaudited)

For the Quarter to Date periods ended September 30, 2018 through September 30, 2019

| | | Series B Preferred Stock Shares Issued | | | Series B Preferred Stock Amount | | | Common Stock Shares Issued | | | Common Stock Amount | | | Additional Paid-in Capital | | | Accumulated Other Comprehensive Income

(Loss) | | | Accumulated Deficit | | | Total

Neonode Inc. Stockholders’ Equity | | | Noncontrolling Interests | | | Total

Stockholders’ Equity | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balances, January 1, 2018 | | | 83 | | | $ | - | | | | 5,859 | | | $ | 6 | | | $ | 192,861 | | | $ | (99 | ) | | $ | (183,745 | ) | | $ | 9,023 | | | $ | (1,160 | ) | | $ | 7,863 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjustment related to adoption of ASC 606 revenue recognition | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 1,583 | | | | 1,583 | | | | - | | | | 1,583 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock option and warrant compensation expense to employees and directors | | | - | | | | - | | | | - | | | | - | | | | 12 | | | | - | | | | - | | | | 12 | | | | - | | | | 12 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustment | | | - | | | | - | | | | - | | | | - | | | | - | | | | (94 | ) | | | - | | | | (94 | ) | | | - | | | | (94 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (693 | ) | | | (693 | ) | | | (207 | ) | | | (900 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balances, March 31, 2018 | | | 83 | | | $ | - | | | | 5,859 | | | $ | 6 | | | $ | 192,873 | | | $ | (193 | ) | | $ | (182,855 | ) | | $ | 9,831 | | | $ | (1,367 | ) | | $ | 8,464 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock option compensation expense to employees and directors | | | - | | | | - | | | | - | | | | - | | | | 18 | | | | - | | | | - | | | | 18 | | | | - | | | | 18 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustment | | | - | | | | - | | | | - | | | | - | | | | - | | | | (336 | ) | | | - | | | | (336 | ) | | | - | | | | (336 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (964 | ) | | | (964 | ) | | | (211 | ) | | | (1,175 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balances, June 30, 2018 | | | 83 | | | $ | - | | | | 5,859 | | | $ | 6 | | | $ | 192,891 | | | $ | (529 | ) | | $ | (183,819 | ) | | $ | 8,549 | | | $ | (1,578 | ) | | $ | 6,971 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustment | | | - | | | | - | | | | - | | | | - | | | | - | | | | 13 | | | | - | | | | 13 | | | | - | | | | 13 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (810 | ) | | | (810 | ) | | | (142 | ) | | | (952 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balances, September 30, 2018 | | | 83 | | | $ | - | | | | 5,859 | | | $ | 6 | | | $ | 192,891 | | | $ | (516 | ) | | $ | (184,629 | ) | | $ | 7,752 | | | $ | (1,720 | ) | | $ | 6,032 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Conversion of series B Preferred Stock to Common Stock | | | (1 | ) | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proceeds from sale of Common Stock, net of offering costs | | | - | | | | - | | | | 2,941 | | | | 3 | | | | 4,616 | | | | - | | | | - | | | | 4,619 | | | | - | | | | 4,619 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustment | | | - | | | | - | | | | - | | | | - | | | | - | | | | 60 | | | | - | | | | 60 | | | | - | | | | 60 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (593 | ) | | | (593 | ) | | | (322 | ) | | | (915 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balances, December 31, 2018 | | | 82 | | | $ | - | | | | 8,800 | | | $ | 9 | | | $ | 197,507 | | | $ | (456 | ) | | $ | (185,222 | ) | | $ | 11,838 | | | $ | (2,042 | ) | | $ | 9,796 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustment | | | - | | | | - | | | | - | | | | - | | | | - | | | | (181 | ) | | | - | | | | (181 | ) | | | - | | | | (181 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (573 | ) | | | (573 | ) | | | (111 | ) | | | (684 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balances, March 31, 2019 | | | 82 | | | $ | - | | | | 8,800 | | | $ | 9 | | | $ | 197,507 | | | $ | (637 | ) | | $ | (185,795 | ) | | $ | 11,084 | | | $ | (2,153 | ) | | $ | 8,931 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Conversion of series B Preferred Stock to Common Stock | | | (2 | ) | | | - | | | | 1 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustment | | | - | | | | - | | | | - | | | | - | | | | - | | | | 26 | | | | - | | | | 26 | | | | - | | | | 26 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (1,264 | ) | | | (1,264 | ) | | | (66 | ) | | | (1,330 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balances, June 30, 2019 | | | 80 | | | $ | - | | | | 8,801 | | | $ | 9 | | | $ | 197,507 | | | $ | (611 | ) | | $ | (187,059 | ) | | $ | 9,846 | | | $ | (2,219 | ) | | $ | 7,627 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Conversion of series B Preferred Stock to Common Stock | | | (80 | ) | | | - | | | | 10 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustment | | | - | | | | - | | | | - | | | | - | | | | - | | | | (145 | ) | | | - | | | | (145 | ) | | | - | | | | (145 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (1,086 | ) | | | (1,086 | ) | | | (113 | ) | | | (1,199 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balances, September 30, 2019 | | | - | | | $ | - | | | | 8,811 | | | $ | 9 | | | $ | 197,507 | | | $ | (756 | ) | | $ | (188,145 | ) | | $ | 8,615 | | | $ | (2,332 | ) | | $ | 6,283 | |

NEONODE INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| | | Nine months ended

September 30, | |

| | | 2019 | | | 2018 | |

| Cash flows from operating activities: | | | | | | |

| Net loss (including noncontrolling interests) | | $ | (3,213 | ) | | $ | (3,026 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | |

| Stock-based compensation expense | | | - | | | | 29 | |

| Bad debt expense | | | 20 | | | | - | |

| Depreciation and amortization | | | 650 | | | | 785 | |

| Amortization of operating lease right-of-use assets | | | 298 | | | | - | |

| | | | | | | | | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Accounts receivable and unbilled revenue, net | | | (128 | ) | | | 866 | |

| Projects in process | | | (8 | ) | | | 1 | |

| Inventory | | | (8 | ) | | | (198 | ) |

| Prepaid expenses and other current assets | | | (76 | ) | | | 116 | |

| Accounts payable and accrued expenses | | | (30 | ) | | | (91 | ) |

| Deferred revenues | | | (16 | ) | | | (757 | ) |

| Operating lease obligations | | | (362 | ) | | | - | |

| Net cash used in operating activities | | | (2,873 | ) | | | (2,275 | ) |

| | | | | | | | | |

| Cash flows from investing activities: | | | | | | | | |

| Purchase of property and equipment | | | (89 | ) | | | (184 | ) |

| Net cash used in investing activities | | | (89 | ) | | | (184 | ) |

| | | | | | | | | |

| Cash flows from financing activities: | | | | | | | | |

| Principal payments on finance lease obligations | | | (403 | ) | | | (413 | ) |

| Net cash used in financing activities | | | (403 | ) | | | (413 | ) |

| | | | | | | | | |

| Effect of exchange rate changes on cash | | | (165 | ) | | | (235 | ) |

| | | | | | | | | |

| Net decrease in cash | | | (3,530 | ) | | | (3,107 | ) |

| Cash at beginning of period | | | 6,555 | | | | 5,796 | |

| Cash at end of period | | $ | 3,025 | | | $ | 2,689 | |

| | | | | | | | | |

| Supplemental disclosure of cash flow information: | | | | | | | | |

| Cash paid for income taxes | | $ | 15 | | | $ | 13 | |

| Cash paid for interest | | $ | 27 | | | $ | 39 | |

| Supplemental disclosure of non-cash investing and financing activities: | | | | | | | | |

| Purchase of equipment with capital lease obligations | | $ | - | | | $ | 169 | |

8