Exhibit 99.2

Q2 2 0 22 Earni n gs Call August 11, 2022 2022 - 08 - 11 1 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON)

Today’s Presenters U rb an F o rssell CEO 2022 - 08 - 11 2 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON) Fr edrik Nihlén CFO

Legal Disclaimer 2022 - 08 - 11 3 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON) This presentation contains, and related oral and written statements of Neonode Inc. (the “Company”) and its management may contain, forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward - looking statements include information about current expectations, strategy, plans, potential financial performance or future events. They also may include statements about market opportunity and sales growth, financial results, use of cash, product development and introduction, regulatory matters and sales efforts. Forward - looking statements are based on assumptions, expectations and information available to the Company and its management and involve a number of known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, levels of activity, performance or achievements to be materially different from any expressed or implied by these forward - looking statements. These uncertainties and risks include, but are not limited to, our ability to secure financing when needed on acceptable terms, risks related to new product development, our ability to protect our intellectual property, our ability to compete, general economic conditions including as a result of the ongoing COVID - 19 pandemic or geopolitical conflicts such as the war in Ukraine, as well as other risks outlined in filings of the Company with the U.S. Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934, as amended, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Prospective investors are advised to carefully consider these various risks, uncertainties and other factors. Any forward - looking statements included in this presentation are made as of today’s date. The Company and its management undertake no duty to update or revise forward - looking statements. This presentation has been prepared by the Company based on its own information, as well as information from public sources. Certain of the information contained herein may be derived from information provided by industry sources. The Company believes such information is accurate and that the sources from which it has been obtained are reliable. However, the Company has not independently verified such information and cannot guarantee the accuracy of such information.

A g enda 2022 - 08 - 11 4 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON) 1. Q2 2 0 22 Fin a n c i a l R e s u lts 2. Stra tegy a nd Business Update 3. Conc l uding Re marks 4. Q&A N e onod e I n c . Q2 20 2 2 | A u g u st 1 1 , 20 2 2

$1.3 million Revenue Total Q2, 2022 但 26 % Y oY $0.2 million R e v e n u e Pr o d u ct s Q2, 2022 但 39 % Y oY 1,400 1,200 1,000 800 600 400 200 0 A M E R A P A C EM E A A M E R APAC E M E A A M E R APAC EM E A A M E R APAC EM E A A M E R APAC EM E A A M E R APAC EM E A A M E R APAC EM E A A M E R APAC EM E A A M E R APAC EM E A A M E R APAC EM E A Q 1 - 20 Q 2 - 20 Q 3 - 20 Q 4 - 20 Q 1 - 21 Q 2 - 21 Q 3 - 21 Q 4 - 21 Q 1 - 22 Q 2 - 22 T h o us a nd s Q2/’22 Financial Results – Revenues Revenues by Revenue Stream and Region L i c e n s e fe e s Pr o d u cts N RE 1,800 1,600 1,400 1,200 1,000 800 600 400 200 0 - 200 Q 1 - 2 0 Q 2 - 2 0 Q 3 - 2 0 Q 4 - 2 0 Q 1 - 2 1 Q 2 - 2 1 Q 3 - 2 1 Q 4 - 2 1 Q 1 - 2 2 Q 2 - 2 2 Thousands Revenues by Revenue Stream License fees Products N RE 2022 - 08 - 11 5 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON)

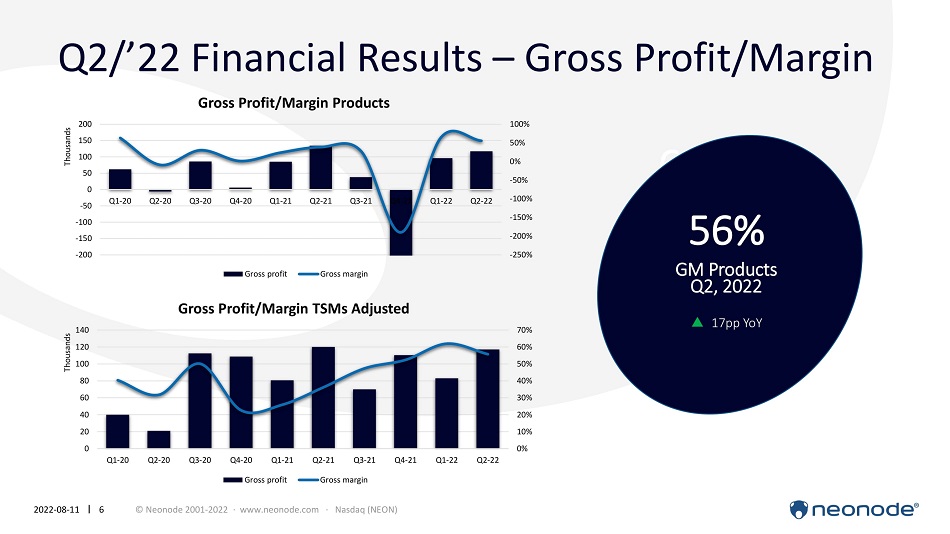

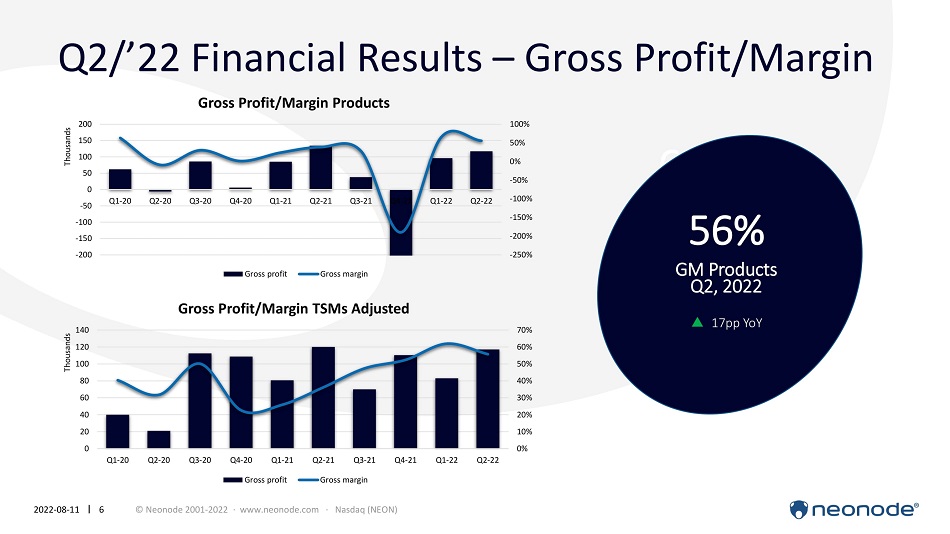

Q2/’22 Financial Results – Gross Profit/Margin 6% GM Products Q2, 2022 似 17pp YoY - 25 0 % - 20 0 % - 10 0 % - 50% 0% 50% 100% - 200 - 100 - 150 - 150% 200 150 100 50 0 - 50 Q 1 - 20 Q 2 - 20 Q 3 - 20 Q 4 - 20 Q 1 - 21 Q 2 - 21 Q 3 - 21 Q 4 - 21 Q 1 - 22 Q 2 - 22 T h o us a nd s Gross Profit/Margin Products Gross profit Gross margin 0% 30% 20% 10% 40% 50% 60% 70% 0 60 40 20 80 100 120 140 Q 1 - 20 Q 2 - 20 Q 3 - 20 Q 4 - 21 Q 1 - 22 Q 2 - 22 T h o us a nd s Gross Profit/Margin TSMs Adjusted Q 4 - 20 Q 1 - 21 Gross profit Q2 - 21 Q3 - 21 Gross margin 2022 - 08 - 11 6 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON) 56% GM Products Q2, 2022 似 17pp YoY

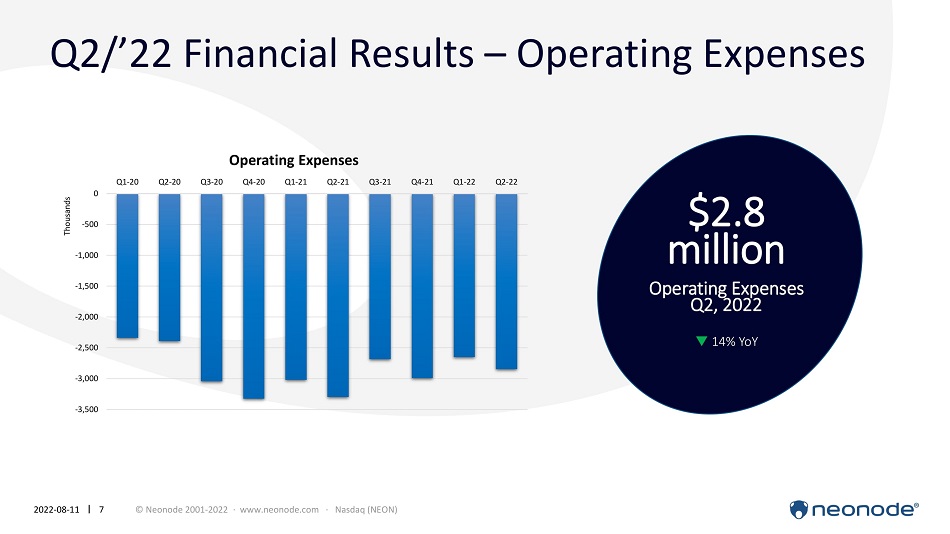

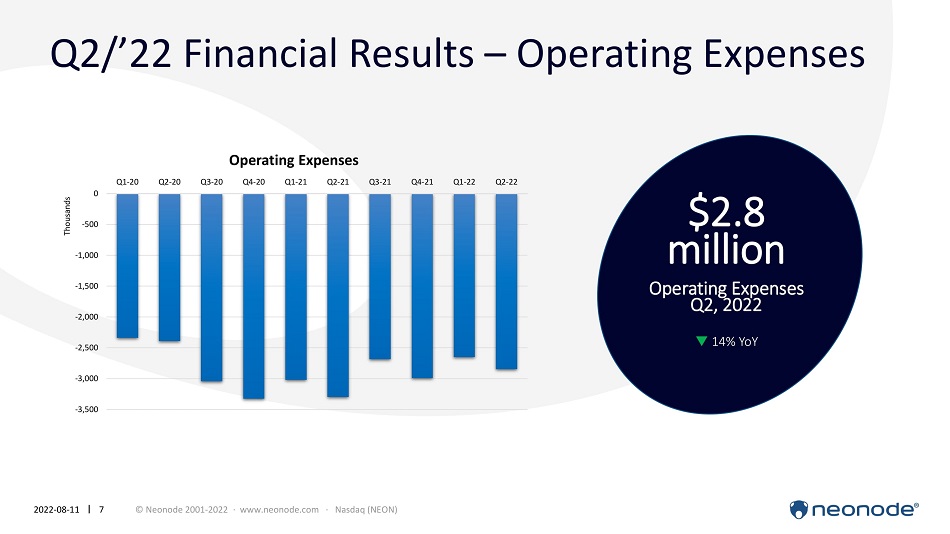

Q2/’22 Financial Results – Operating Expenses $2.8 million O p e r a t i n g E x p e n s e s Q2, 2022 但 14 % Y oY - 3 ,000 - 3 ,500 2022 - 08 - 11 7 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON) - 2 ,500 - 2 ,000 - 1 ,500 - 1 ,000 - 500 0 Q 1 - 20 Q 2 - 20 Q 3 - 20 Q 3 - 21 Q 4 - 21 Q 1 - 22 Q 2 - 22 T h o us a nd s Operating Expenses Q4 - 20 Q1 - 21 Q2 - 21

Q2/’22 Financial Results – Cash $2.9 million Net Cash Burn O p e r a t i n g A ct i v i t i e s Q2, 2022 似 29 % QoQ $13.5 million Cash and Accounts Receivables June 30, 2022 但 5.0 Million Dec. 3 1 ,20 2 1 - 3 ,000 - 3 ,500 2022 - 08 - 11 8 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON) - 2 ,500 - 2 ,000 - 1 ,500 - 1 ,000 - 500 T h o us a nd s Net cash used in operating activities Q1 - 20 Q2 - 20 Q3 - 20 Q4 - 20 Q1 - 21 Q2 - 21 Q3 - 21 Q4 - 21 Q1 - 22 Q2 - 22 0

A g enda 2022 - 08 - 11 9 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON) 1. Q2 2 0 22 Finan c ial R e sults 2. Str ateg y a n d B u siness Up d ate 3. Conc l uding Re marks 4. Q&A N e onod e I n c . Q2 20 2 2 | A u g u st 1 1 , 20 2 2

Business Strategy: Technology Licensing and Product Sales INTERACTIVE KIOSKS ELEVATORS PRI N TER AUTOMOTIVE T A R GET S E GM E N TS B US I N E SS M O D ELS PRODUCT SALES TECHNOLOGY LICENSING C U S T O M ER OFFERI NGS TOUCH SENSOR MODULES (ZFORCE) ZFORCE MULTISENSING 2022 - 08 - 11 10 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON)

3 - step Approach for Growth 3 In v es tments i n to mar ket ing an d sa l e s Expansion of pa r tn e r network Sca l ing b u sines s i n k e y markets Expanding c u st omer off e r in g s an d inc r e as ing ve rtic a l inte g r a t ion O u ts o u r c ing TSM production Expanding b u sines s sco pe to n e w ma r ke t s e g men ts a nd fur t h e r ge o gr a ph ic a l markets Develop i ng ne w HW p r od uct s a nd e xt e nd ing SW off e r in g s Ac c e l e r a ting g r owt h th r o u g h st r a t e g ic pa r tn e r sh ips an d acquisitions 2 1 2022 - 08 - 11 11 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON) 2021 → 2022 → 2023 →

Growth Potential Per Revenue Stream Continue to offer engineering services to facilitate new licensing businesses and to support and drive product sales License R e v en u e s Product R e v en u e s NRE Revenues 2021 → 2022 → 2023 → Existing business with more than a dozen customers, mainly printer manufacturers and automotive Tier 1s Support current customers and work to win new businesses in automotive, military & avionics, and other segments Continue to expand licensing business to further customers and segments, and to SW - only solutions Touch Sensor Module sales, mainly for contactless touch applications in elevators and interactive kiosks Broaden the product portfolio and continue to expand to further market segments Scale business in key markets JP, KR, CN, FR Widen the market scope to include additional market segments and geographical markets N ow License Product N RE 2022 - 08 - 11 12 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON)

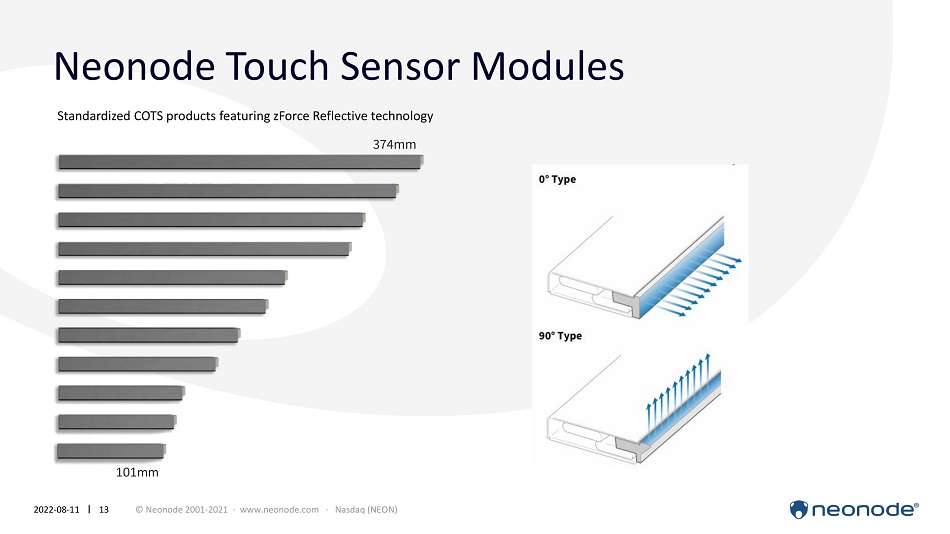

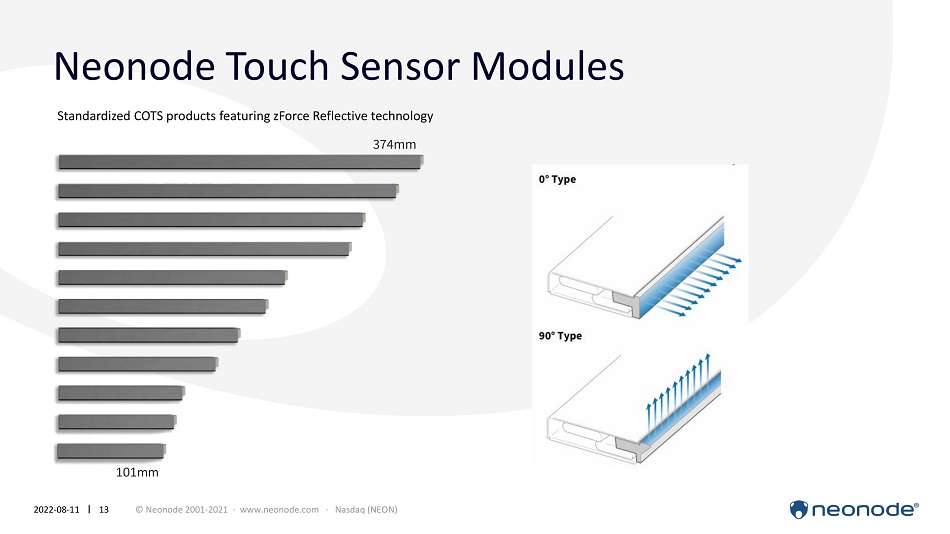

Neonode Touch Sensor Modules Standardized COTS products featuring zForce Reflective technology 374mm 1 0 1 m m 2022 - 08 - 11 13 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON)

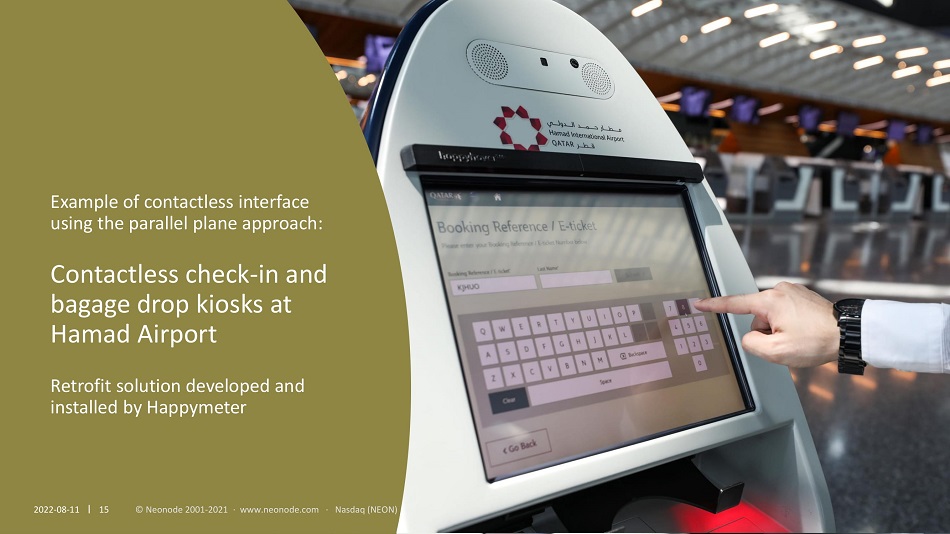

Contactless Touch Solutions Two ways to go with our Touch Sensor Modules! Parallel plane solution Touch interaction area hovering above or in front of a display or surface Holographic solution Touch in t er acti o n o n an i n - air displ ay 2022 - 08 - 11 14 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON)

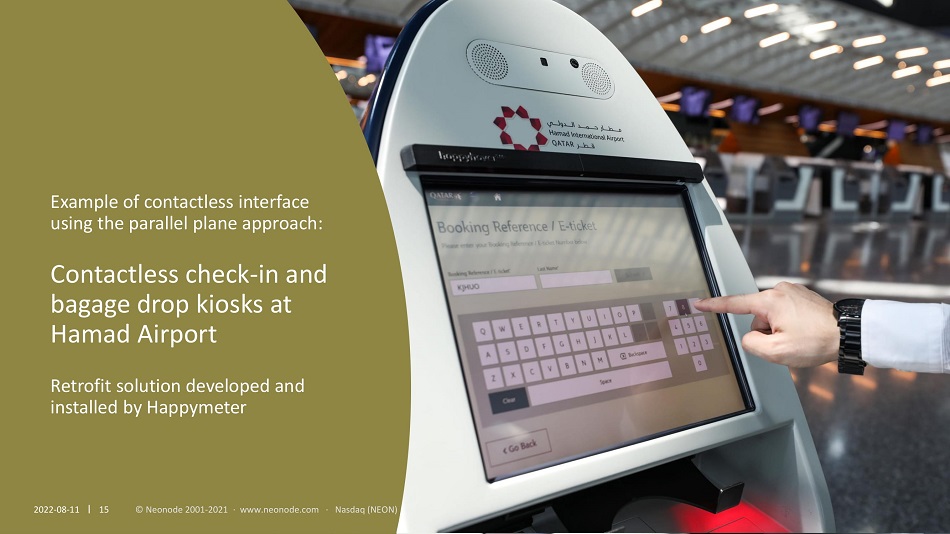

Example of contactless interface using the parallel plane approach: 2022 - 08 - 11 15 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON) Contactless check - in and bagage drop kiosks at Hamad Airport Retrofit solution developed and installed by Happymeter

Example of holographic display interfaces: Contactless medical carts and patient monitors Launched by Holo Industries 2022 - 08 - 11 16 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON)

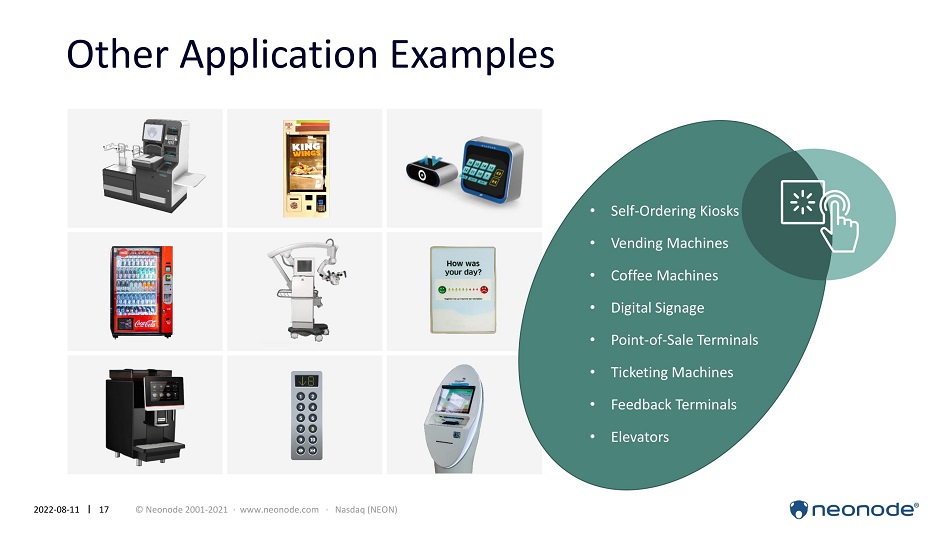

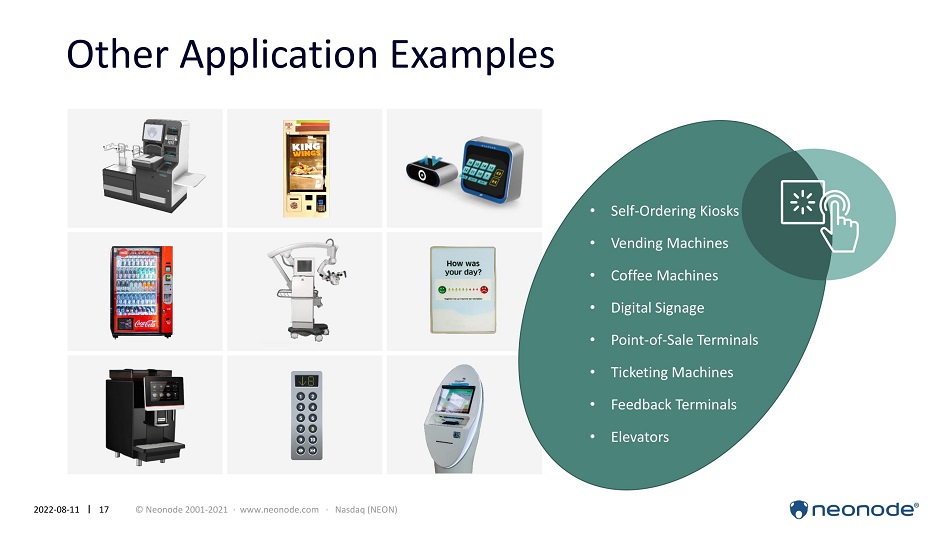

Other Application Examples • Self - Ordering Kiosks • Vending Machines • Coffee Machines • Digital Signage • Point - of - Sale Terminals • Ticketing Machines • Feedback Terminals • Elevators 2022 - 08 - 11 17 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON)

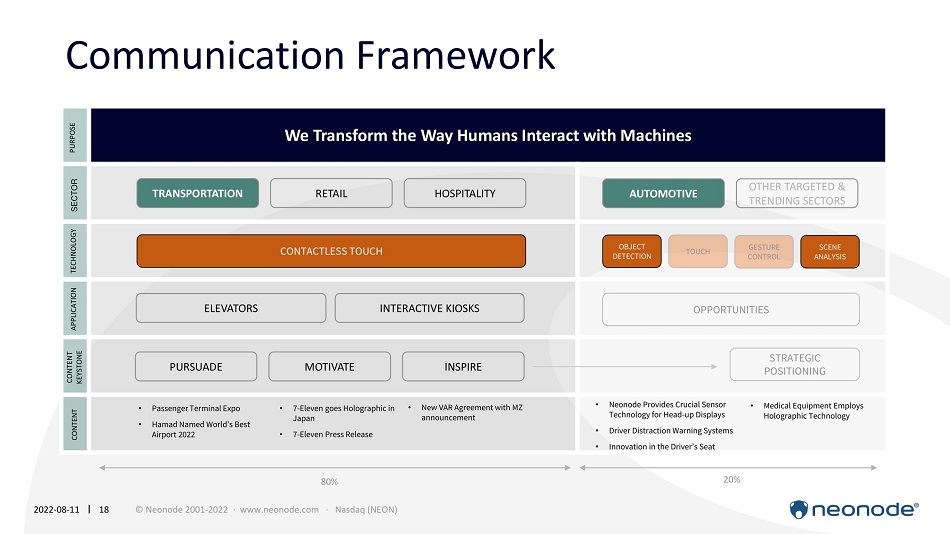

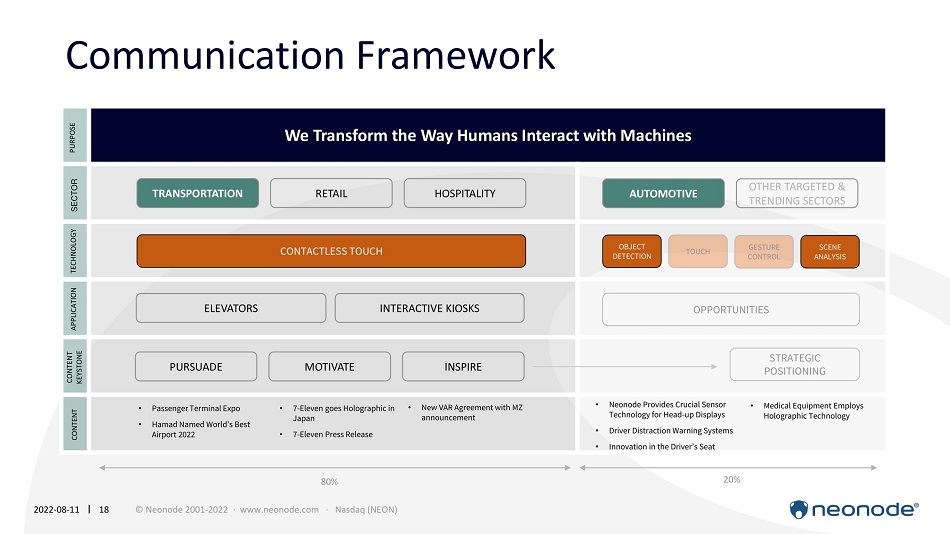

Communication Framework We Transform the Way Humans Interact with Machines • Pas s e ng e r T e r m i na l E x p o • H a ma d Na med W o r ld ’ s Best A i rpor t 202 2 • New V A R Ag r ee ment w i th M Z announcement • 7 - E l e v e n g o e s H o lo g r a p h i c i n Japan • 7 - E l e v e n Press R e l e a se CON T AC T L E SS T O U C H C ON TE N T CONTENT K EY S T ON E APPLICATION TECHNOLOGY SE C TOR OPP O RT U N I T I E S T O U C H SCENE A N A L YS I S GESTURE CONTROL PU R P O SE 80% 20% OBJECT DETECTION • Neonode Provides Crucial Sensor T e c h n o lo g y f o r H e a d - u p D i s p lays • Driver Distraction Warning Systems • I nnovat i on i n th e D r i v e r ’ s S e a t TRANSPORTATION HOSPITALITY RE T AIL OTHER TARGETED & TRENDING SECTORS A U T O M O TI VE PURSUADE INSPIRE MOTIVATE EL E V A T O R S INTERACTIVE KIOSKS • M e d i c a l E q u i pment E m p lo ys H o lo g r a p h i c T e c h n o lo g y STRATEGIC POSITIONING 2022 - 08 - 11 18 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON)

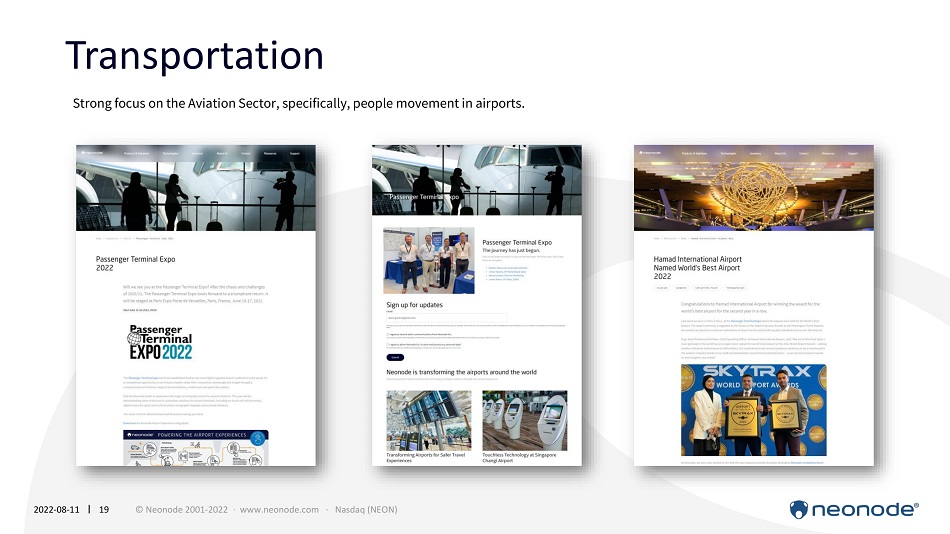

Transportation 2022 - 08 - 11 19 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON) Strong focus on the Aviation Sector, specifically, people movement in airports.

Passenger Terminal Expo 2022 - 08 - 11 20 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON)

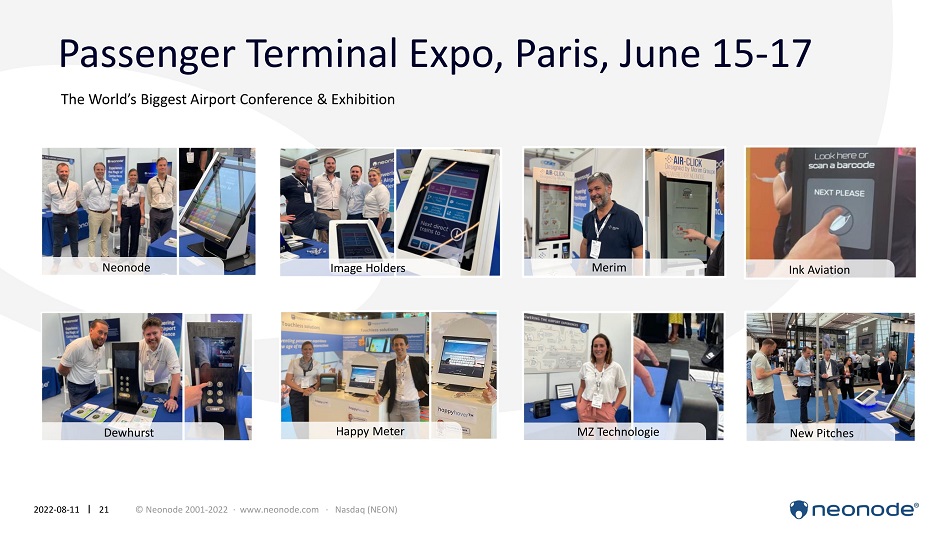

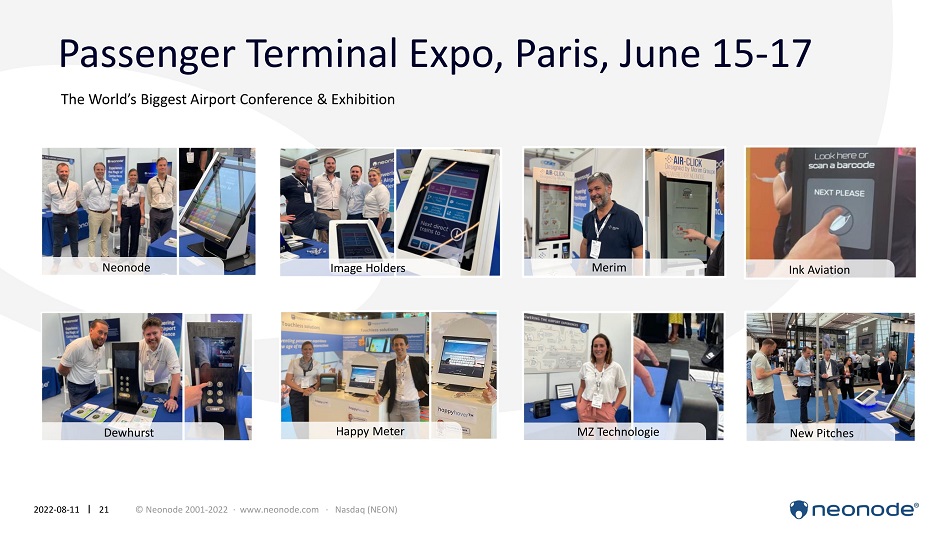

Passenger Terminal Expo, Paris, June 15 - 17 De whu r s t Neonode Merim Happy Meter Image Holders MZ Technologie New Pitches 2022 - 08 - 11 21 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON) Ink Aviation The World’s Biggest Airport Conference & Exhibition

Neonode Extends VAR Agreement with MZ Technologie to Access the Middle East 2022 - 08 - 11 22 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON)

Automotive 2022 - 08 - 11 23 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON) Product releases for the Automotive Industry: Advanced Driver Distraction Warning Systems and Object Detection for Head - up Displays.

A g enda 2022 - 08 - 11 24 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON) 1. Q2 2 0 22 Finan c ial R e sults 2. Stra tegy a nd Business Update 3. C o n c luding Remarks 4. Q&A N e onod e I n c . Q2 20 2 2 | A u g u st 1 1 , 20 2 2

Concluding Remarks 2022 - 08 - 11 25 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON) • Sale s and resu l ts f or Q2 bel o w expect a t i ons o C O V I D - 1 9 re la t ed l o c k - d o wns o Semiconductor shortage affecting our customers o Long sales cycles, long development cycles, protracted new product launches • We continue see a stable and increasing demand for our TSMs, not least for contactless touch solutions using holographic displays • We also see a growing interest in our zForce and MultiSensing technologies from automotive and avionics customers • We remain optimistic about our prospects to grow and improve cash flow during this and the c o ming years

A g enda 2022 - 08 - 11 26 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON) 1. Q2 2 0 22 Finan c ial R e sults 2. Stra tegy a nd Business Update 3. Conc l uding Re marks 4. Q&A N e onod e I n c . Q2 20 2 2 | A u g u st 1 1 , 20 2 2

info@neonode.com neonode.com Subsc r ibe to N e o node n e w s let t e r Thank you. 2022 - 08 - 11 27 © Neonode 2001 - 2021 · www.neonode.com · Nasdaq (NEON) 2022 - 08 - 11 27 © Neonode 2001 - 2022 · www.neonode.com · Nasdaq (NEON)

Appe n dix 2022 - 08 - 11 28 © Neonode 2001 - 2021 · www.neonode.com · Nasdaq (NEON)

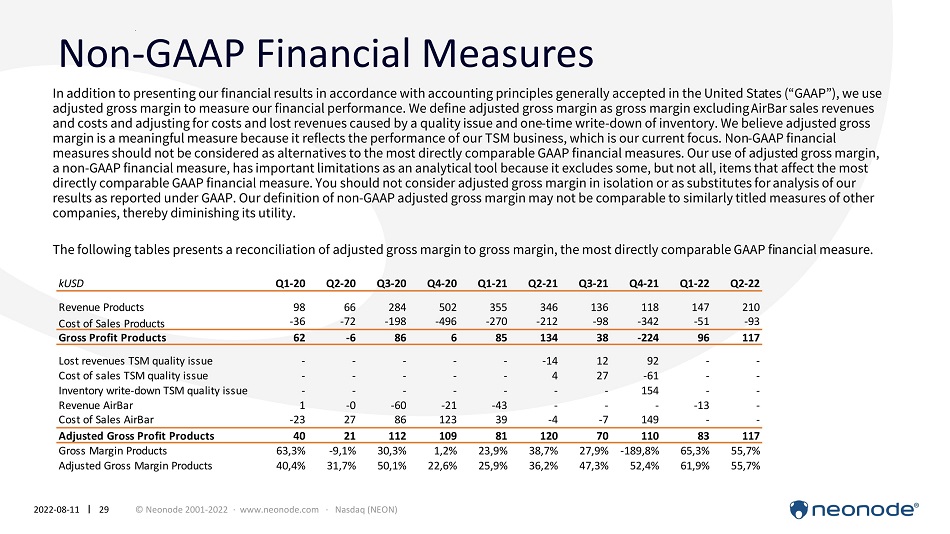

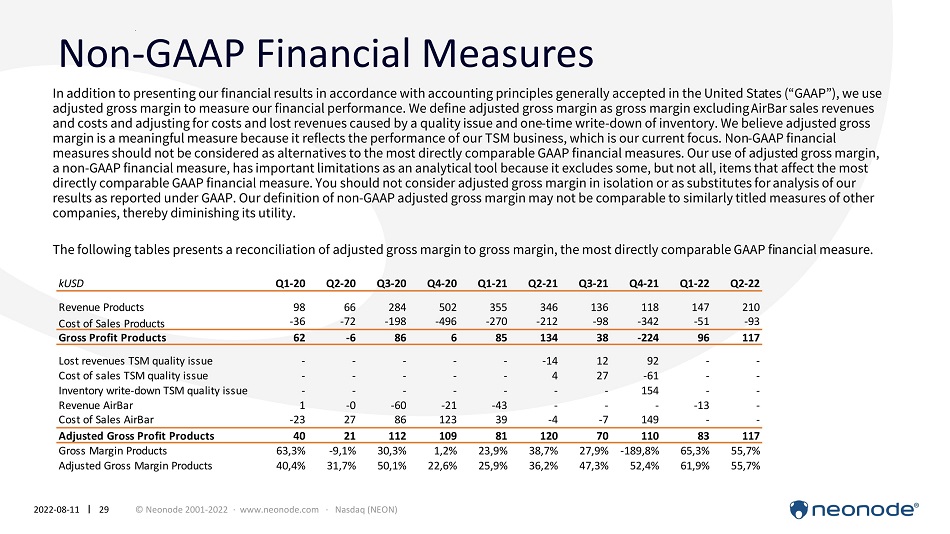

Non - GAAP Financial Measures In addition to presenting our financial results in accordance with accounting principles generally accepted in the United States (“GAAP”), we use adjusted gross margin to measure our financial performance. We define adjusted gross margin as gross margin excluding AirBar sales revenues and costs and adjusting for costs and lost revenues caused by a quality issue and one - time write - down of inventory. We believe adjusted gross margin is a meaningful measure because it reflects the performance of our TSM business, which is our current focus. Non - GAAP financial measures should not be considered as alternatives to the most directly comparable GAAP financial measures. Our use of adjusted gross margin, a non - GAAP financial measure, has important limitations as an analytical tool because it excludes some, but not all, items that affect the most directly comparable GAAP financial measure. You should not consider adjusted gross margin in isolation or as substitutes for analysis of our results as reported under GAAP. Our definition of non - GAAP adjusted gross margin may not be comparable to similarly titled measures of other companies, thereby diminishing its utility. 2022 - 08 - 11 29 © Neonode 2001 - 2021 · www.neonode.com · Nasdaq (NEON) The following tables presents a reconciliation of adjusted gross margin to gross margin, the most directly comparable GAAP financial measure. kUSD Q1 - 20 Q2 - 20 Q3 - 20 Q4 - 20 Q1 - 21 Q2 - 21 Q3 - 21 Q4 - 21 Q1 - 22 Q2 - 22 Revenue Products 98 66 284 502 355 346 136 118 147 210 Cost of Sales Products - 36 - 72 - 198 - 496 - 270 - 212 - 98 - 342 - 51 - 93 Gross Profit Products 62 - 6 86 6 85 134 38 - 224 96 117 Lost revenues TSM quality issue - - - - - - 14 12 92 - - Cost of sales TSM quality issue - - - - - 4 27 - 61 - - Inventory write - down TSM quality issue - - - - - - - 154 - - Revenue AirBar 1 - 0 - 60 - 21 - 43 - - - - 13 - Cost of Sales AirBar - 23 27 86 123 39 - 4 - 7 149 - - Adjusted Gross Profit Products 40 21 112 109 81 120 70 110 83 117 Gross Margin Products 63,3% - 9,1% 30,3% 1,2% 23,9% 38,7% 27,9% - 189,8% 65,3% 55,7% Adjusted Gross Margin Products 40,4% 31,7% 50,1% 22,6% 25,9% 36,2% 47,3% 52,4% 61,9% 55,7%