UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

[X] Filed by Registrant

[ ] Filed by Party other than the Registrant

Check the appropriate box:

[X] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ ] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to §240.14a -11(c) or §240.14a -12

American Natural Energy Corporation

(Name of Registrant as Specified in Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement if other than Registrant)

Payment of Filing Fee (check the appropriate box):

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | | |

| | 2) | Aggregate number of securities to which transaction applies: |

| | | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | 4) | Proposed maximum aggregate value of transaction: |

| | | |

| | 5) | Total Fee Paid: |

| | | |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the Fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | | |

| | 2) | Form, Schedule or Registration Statement Number: |

| | | |

| | 3) | Filing Party: |

| | | |

| | 4) | Date Filed: |

| | | |

American Natural Energy Corporation

6100 South Yale – Suite 2010

Tulsa, Oklahoma 74136 USA

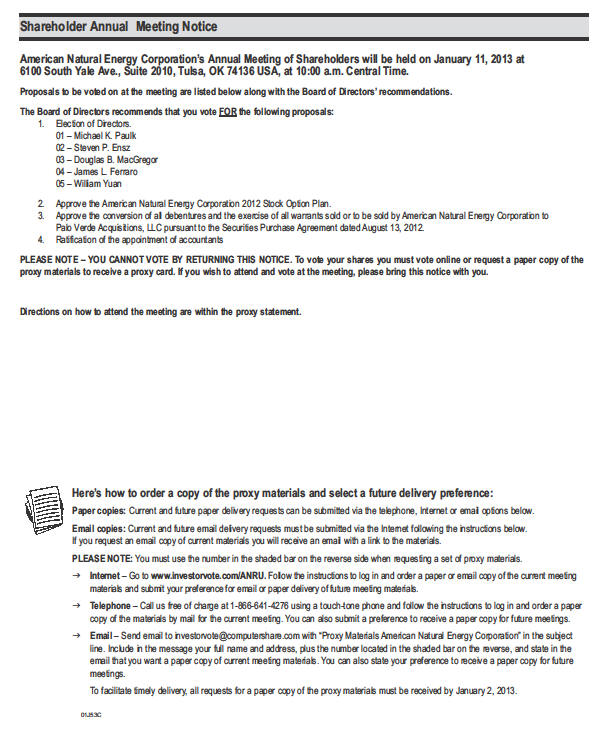

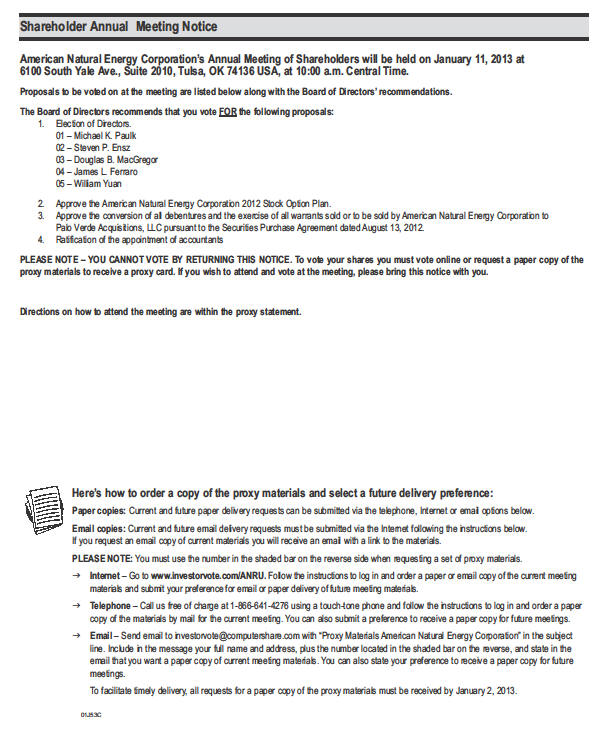

Notice of Annual Meeting of Shareholders

January 11, 2013

Notice is hereby given that the Annual Meeting of Shareholders of American Natural Energy Corporation, an Oklahoma corporation (the "Company"), will be held at the offices of the Company at 6100 South Yale – Suite 2010, Tulsa, Oklahoma, on Friday, January 11, 2013, at 10:00 AM, local time, for the following purposes:

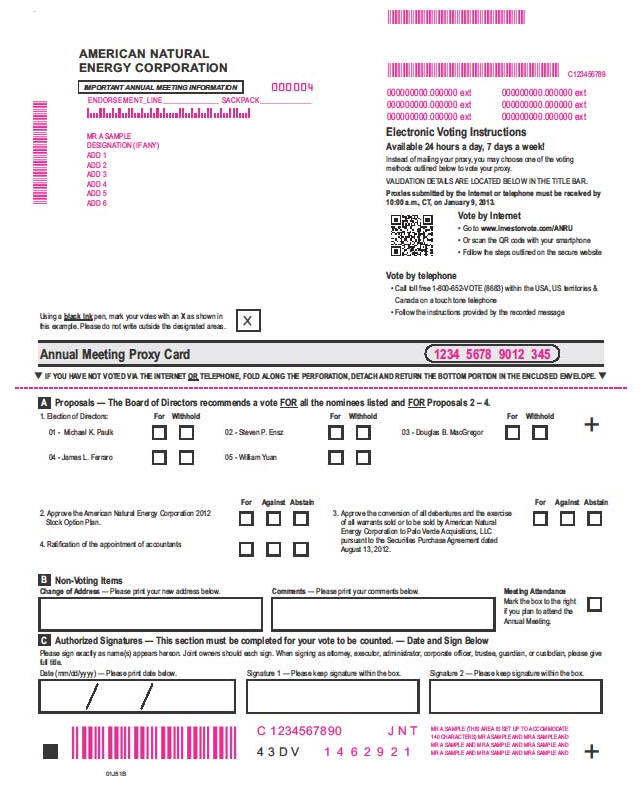

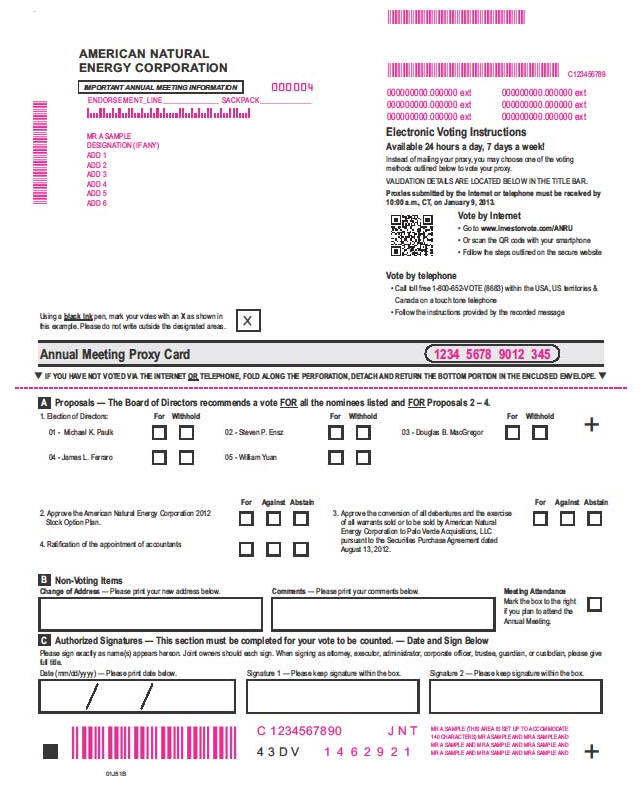

| | 1. | To elect five (5) directors of the Company to hold office until the next Annual Meeting of Shareholders and until their respective successors are elected and qualified; |

| | | |

| | 2. | To consider and act upon a proposal to approve the American Natural Energy Corporation 2012 Stock Option Plan; |

| | | |

| | 3. | To consider and act upon a proposal to approve the conversion of all debentures and the exercise of all warrants sold or to be sold by the Company to Palo Verde Acquisitions, LLC pursuant to the Securities Purchase Agreement dated August 13, 2012, between the Company and Palo Verde Acquisitions, LLC; |

| | | |

| | 4. | To ratify the appointment of MaloneBailey LLP as our independent registered public accountants; and |

| | | |

| | 5. | To transact such other business as may properly come before the meeting, or any adjournments thereof. |

Information with respect to the above is set forth in the Proxy Statement which accompanies this Notice. Only holders of shares of our Common Stock of record at the close of business on November 19, 2012 (the "Record Date") are entitled to notice of and to vote at the meeting. A list of the shareholders entitled to vote at the meeting will be open to the examination of any shareholder, for any purpose germane to the meeting, during ordinary business hours for a period of 10 days prior to the date of the meeting at the offices of the Company and at the time and place of the meeting.

We hope that all of our shareholders who can conveniently do so will attend the meeting. Shareholders who do not expect to be able to attend the meeting are requested to mark, date and sign the enclosed proxy and return the same in the enclosed addressed envelope which is intended for your convenience.

Steven P. Ensz, Secretary

Dated: November 30, 2012

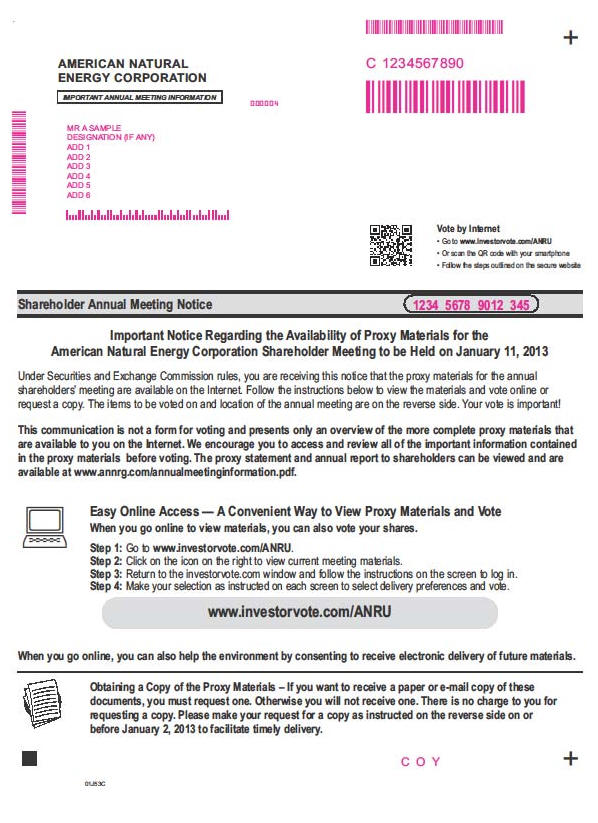

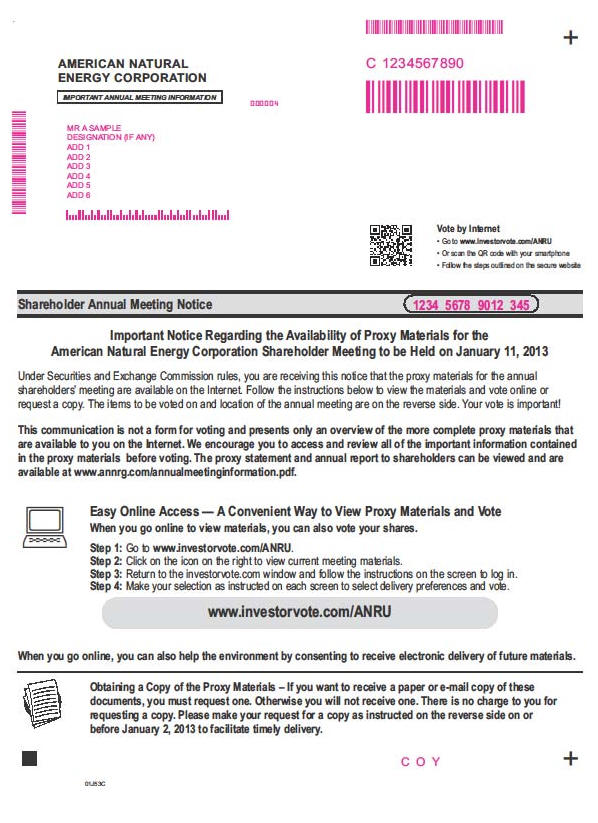

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders

to be held on January 11, 2013 |

| |

The Proxy Statement and our 2011 Annual Report on Form 10-K are available on the internet at:

http://www.annrg.com/annualmeetinginformation.pdf |

Table of Contents

| Caption | Page |

| | |

| The Meeting | 3 |

| | |

| Proxy Voting Options | 5 |

| | |

| Item 1. Election of Directors | 6 |

| | |

| Certain Relationships and Related Transactions | 11 |

| | |

| Item 2. To consider and act upon a proposal to approve the American Natural EnergyCorporation 2012 Stock Option Plan | 15 |

| | |

| Item 3. To consider and act upon a proposal to approve the conversion of all debenturesand the exercise of all warrants sold or to be sold by the Company to Palo VerdeAcquisitions, LLC pursuant to the Securities Purchase Agreement dated August 13, 2012,between the Company and Palo Verde Acquisitions, LLC | 18 |

| | |

| Item 4. Ratify the Appointment of MaloneBailey LLP as Our Independent RegisteredPublic Accountants | 20 |

| | |

| Common Stock Ownership of Certain Beneficial Owners and Management | 22 |

| | |

| General | 23 |

AMERICAN NATURAL ENERGY CORPORATION

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

THE MEETING

The enclosed proxy is solicited by the Board of Directors of American Natural Energy Corporation, an Oklahoma corporation (the "Company"), from the holders of shares of Common Stock, $0.001 par value, of the Company ("Common Stock") to be voted at our Annual Meeting of Shareholders (the "Meeting") to be held at our offices at 6100 South Yale – Suite 2010, Tulsa, Oklahoma, on Friday, January 11, 2013, at 10:00 AM, local time, and at any adjournments thereof. This proxy statement and accompanying proxy were first sent on or about November 30, 2012 to shareholders of record on November 19, 2012.

The only business which the Board of Directors intends to present or knows that others will present at the Meeting is (i) the election of five (5) Directors of the Company to hold office until the next Annual Meeting of Shareholders and until their successors have been elected and qualified, (ii) to consider and act upon a proposal to approve the American Natural Energy Corporation 2012 Stock Option Plan, (iii) to consider and act upon a proposal approve the conversion of all debentures and the exercise of all warrants sold or to be sold by the Company to Palo Verde Acquisitions, LLC pursuant to the Securities Purchase Agreement dated August 13, 2012, between the Company and Palo Verde Acquisitions, LLC, and (iv) to ratify the appointment of MaloneBailey LLP as our independent registered public accountants. Management does not know of any other business to be brought before the Meeting but it is intended that as to any other business, a vote may be cast pursuant to the proxy in accordance with the judgment of the person or persons acting thereunder. If proxies in the enclosed form are properly executed and returned, the Common Stock represented thereby will be voted at the Meeting in accordance with the shareholder's direction. Any shareholder giving a proxy has the power to revoke it at any time before the proxy is voted by revoking it in writing, by executing a later dated proxy or appearing at the Meeting and voting in person. Any writing revoking a proxy should be addressed to Steven P. Ensz, Secretary of the Company, at the address set forth below.

The Directors to be elected at the Meeting will be elected by a plurality of the votes cast by the holders of Common Stock present in person or by proxy and entitled to vote. Votes may be cast for or withheld from each nominee. Votes that are withheld will have no effect on the outcome of the election because Directors will be elected by a plurality of votes cast. The affirmative vote of the holders of shares representing a majority in voting power of the Common Stock present in person or represented by proxy at the Meeting and entitled to vote is necessary for approval of the proposals: (i) to consider and act upon a proposal to approve the American Natural Energy Corporation 2012 Stock Option Plan, (ii) to consider and act upon a proposal approve the conversion of all debentures and the exercise of all warrants sold or to be sold by the Company to Palo Verde Acquisitions, LLC pursuant to the Securities Purchase Agreement dated August 13, 2012, between the Company and Palo Verde Acquisitions, LLC, and (iii) to ratify the appointment of MaloneBailey LLP as our independent registered public accountants. Abstentions, which may be specified on all proposals except the election of directors, will have the effect of a negative vote.

You may vote in person at the Meeting or by proxy. We recommend that you vote by proxy even if you plan to attend the Meeting. You can always change your vote at the Meeting.

If you are a registered shareholder (meaning your name is included on the security holder file maintained by our transfer agent, Computershare Trust Co. N.A.), you can vote in person or by using the internet or telephone as instructed in the section below captioned "Proxy Voting Options" or by completing, signing, dating and returning your proxy card in the enclosed envelope.

3

For purposes of the Meeting, brokers will be prohibited from exercising discretionary authority with respect to all items except the ratification of the appointment of MaloneBailey LLP as our independent registered public accountants. If the organization that holds your shares does not receive instructions from you on how to vote your shares on these matters, the organization that holds your shares will inform us that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a "broker non-vote." Broker non-votes will be considered as represented for purposes of determining a quorum, but will not otherwise affect voting results.

4

PROXY VOTING OPTIONS

YOUR VOTE IS IMPORTANT!

THE FOLLOWING INSTRUCTIONS APPLY ONLY TO PERSONS HOLDING THEIR SHARES IN THEIR NAME.IF YOUR SHARES ARE HELD IN THE NAME OF A BANK, BROKERAGE FIRM OR OTHER NOMINEE, DO NOT USE THE FOLLOWING INSTRUCTIONS. YOU WILL RECEIVE INSTRUCTIONS FROM THE BANK, BROKERAGE FIRM OR OTHER NOMINEETHAT YOU MUST FOLLOW IN ORDER TO HAVE YOUR SHARES VOTED.

INTERNET VOTING – Access "www.investorvote.com/ANRU" and follow the on-screen instructions.Have your proxy card available when you access the web page and use your Identification Number shown on your proxy card.Please view the proxy materials first.

TELEPHONE VOTING – Call toll-free 1-800-652-VOTE (8683) in the United States, United States Territories or Canada at any time on any touch-tone telephone and follow the instructions on the recorded message.Have your proxy card available when you call and use your Identification Number shown on your proxy card.Please view the proxy materials first.

Vote online/phone until 10:00 AM CT on January 9, 2013.

MAIL – Sign, date and mail your proxy card in the envelope provided as soon as possible.

IN PERSON – You may vote your shares in person by attending the Meeting.

TO VIEW THE PROXY MATERIALS – The Notice of Meeting, Proxy Statement and Proxy Card can be viewed athttp://www.annrg.com/annualmeetinginformation.pdf.

TO REQUEST COPIES OF THE PROXY MATERIALS – Email information@annrg.com.

Have your proxy card or voting instruction form in hand and follow the instructions.

Please note that if your shares are held by a bank, brokerage firm or other nominee, and you decide to attend and vote at the Meeting, your vote in person at the Meeting will not be effective unless you present a legal proxy, issued in your name from your bank, brokerage firm, or other holder of record.

Whether or not you expect to personally attend the Meeting, we urge you to vote your shares by phone, via the internet or by signing, dating and returning the enclosed proxy card. Voting early will ensure the presence of a quorum at the Meeting and will save the Company the expense and extra work of possible additional solicitation. An addressed envelope, postage paid if mailed in the United States, is enclosed if you wish to vote your shares by returning your completed proxy card by mail. Submitting your proxy now will not prevent you from voting at the Meeting, as your vote by proxy is revocable at your option as set out below.

Voting by theinternet ortelephone is fast, convenient, and your vote is immediately confirmed and tabulated. Most important, by using the internet or telephone, you help us reduce postage and proxy tabulation costs.

Only holders of record of our Common Stock as of the close of business on November 19, 2012 are entitled to vote at the Meeting or any adjournments thereof. On such date, we had outstanding voting securities consisting of 26,405,085 shares of Common Stock, each of which shares is entitled to one (1) vote on all proposals submitted to a vote of shareholders at the Meeting. Under our By-laws, except as otherwise provided by statute or by our Certificate of Incorporation, a quorum of shareholders at all meetings constitutes no less than one-third of our shares issued and outstanding as of the Record Date, present in person or represented by a proxy.

5

The Company will pay the costs of preparing, assembling and mailing the Proxy Statement, form of proxy and other material used in the solicitation of proxies. In addition, the Company will reimburse brokerage firms and other nominees for their expenses in forwarding proxy materials to beneficial owners of our Common Stock. To the extent necessary to ensure sufficient representation, officers and employees of the Company may solicit proxies in person or by telephone without additional compensation.

Our principal executive office address and the location of the Meeting is 6100 South Yale – Suite 2010, Tulsa, Oklahoma 74136. Our telephone number of our principal executive office is (918) 481-1440.

This Proxy Statement and the enclosed Form of Proxy will be made available on our website or mailed to our shareholders on or about November 30, 2012.

| ITEM 1. | ELECTION OF DIRECTORS |

At the Meeting, it is proposed to elect five (5) Directors to hold office until the next Annual Meeting of Shareholders and until their respective successors are elected and qualified. It is intended that, unless otherwise indicated, the shares of Common Stock represented by proxies solicited by the Board of Directors will be voted for the election as Directors of the five (5) nominees hereinafter named. If, for any reason, any of said nominees shall become unavailable for election, which is not now anticipated, the proxies will be voted for the other nominees and may be voted for a substitute nominee designated by the Board of Directors. Each nominee has indicated that he is willing and able to serve as a Director if elected, and, accordingly, the Board of Directors does not have in mind any substitute.

The Board of Directors recommends that you vote FOR this Item 1.

The nominees as Director and their ages are as follows:

| Name | Age |

| Michael K. Paulk | 63 |

| Steven P. Ensz | 60 |

| Douglas B. MacGregor | 60 |

| James L. Ferraro | 55 |

| William Yuan | 51 |

Michael K. Paulk: Mr. Paulk was elected as a director and appointed the President and Chief Executive Officer of the Company in July 2001. Mr. Paulk previously served as President and a Director of Gothic Energy Corporation, a company then engaged in the acquisition, development, exploration and production of natural gas and oil, from October 1994 to January 2001, when it was acquired by Chesapeake Energy Corporation. Mr. Paulk has been involved in the oil and gas industry for more than 30 years. Our Board of Directors believes that this experience as well as his employment with the Company since 2001 qualifies him for election to our Board of Directors.

Steven P. Ensz: Mr. Ensz has been Vice-President, Finance and Chief Financial Officer and Secretary and a Director of the Company since July 2001. He is a certified public accountant and is responsible for all of the Company's financial disclosure and reporting. From March 1998 to January 2001, he held a similar position with Gothic Energy Corporation, and from July 1991 to February 1998, he was Vice-President, Finance of Anglo-Suisse, Inc., an oil and natural gas exploration and production company. Mr. Ensz has held various positions within the energy industry, including President of Waterford Energy, an independent oil and gas producer, for more than 25 years. Our Board of Directors believes that this experience as well as his employment with the Company since 2001 qualifies him for election to our Board of Directors.

6

Douglas B. MacGregor: Mr. MacGregor has served as a director of the Company since August 13, 2012. For the past five years, Mr. MacGregor has been retired from full time work and has focused on his personal investments and business portfolio. From 2002 until 2006, Mr. MacGregor was a partner in the Eyes of Texas Partners. From 1999 until 2001, he was a Fellow in the Harvard Leadership Initiative, an arm of the Harvard Business School. Prior to his Harvard Fellowship, from 1993 until 1999 he worked as vice president and general manager of five different divisions of Austin-based Dell Computer Corporation. While at Dell Computer Corporation, Mr. MacGregor spent two years as a member of the 15-member Executive Committee that managed operations. From 1992 until 1993, Mr. MacGregor was Vice President of Hardware of Data General Corporation. In 1986, Mr. MacGregor founded Solbourne Computer Incorporated, a Japanese-based company that partnered with Matsushita Electric Industrial Co., and in 1987 Solbourne Computer Incorporated relocated to the United States in Colorado and started the clone market for UNIX workstations in America. Mr. MacGregor received his doctorate in Information Science at Kyoto University in Japan after completing a five-year term as a microprocessor designer at Austin-based Motorola, Inc. He completed his master's degree in computer science at the University Illinois in 1980 after obtaining his Bachelor of Arts in history from the University of Maryland in 1977. Mr. MacGregor has also established The MacGregor Foundation, a non-profit organization committed to support 12-step based drug and alcohol. In 1999, Mr. MacGregor endowed the Muroga-Faiman Professorship at the University of Illinois and has been a member of the United Way Alexis de Tocqueville Society. He is currently a Foundation Board member for Western Colorado State University. Our Board of Directors believes that the various business positions held by Mr. MacGregor over the past several years make him well suited to serve as a member of our Board of Directors.

James L. Ferraro: Mr. Ferraro has served as a director of the Company since August 13, 2012. Mr. Ferraro obtained his Bachelor of Business Administration in 1978 and Master of Science in Accounting in 1979 from the University of Miami. In 1983, he earned his Juris Doctor from the University of Miami School of Law. He became a Certified Public Accountant in 1980. Following his law school graduation, Mr. Ferraro represented athletes and worked for a civil litigation defense firm. In 1985, he launched his own mass tort and wrongful death litigation practice. In 1997, he opened another law firm, Kelley & Ferraro, with partner Michael V. Kelley in Cleveland, Ohio. Mr. Ferraro has focused his law practices in the areas of asbestos litigation, products liability, catastrophic personal injury and wrongful death, environmental disasters, toxic torts, defective drugs, medical malpractice, family law, white-collar criminal defense, False Claims Act qui tam matters and tax whistle-blower claims. Mr. Ferraro's firms now handle nearly 50,000 asbestos cases, and are known for their environmental toxic tort practice. In 1996, Mr. Ferraro successfully went to trial against DuPont in the first case ever prosecuted against a chemical company for causing a birth defect. Because of that case, Mr. Ferraro was named one of the national finalists for Trial Lawyer of the Year in 1997. He is a member of the Ohio, New York, Florida and Massachusetts Bars. Our Board of Directors believes that Mr. Ferraro's experience in advising various clients over the years will assist him in adding insight on numerous issues and makes him well qualified to serve on our Board of Directors.

William Yuan: Mr. Yuan has served as a director of the Company since August 13, 2012. Since 2006, Mr. Yuan has been the Chairman of Fortress Holdings Group, an Asia-based mixed-staged venture capital and investment holding company, and Co-Chairman of Auga Group, as well as its subsidiary, Guangzhou Kingstar Culture Media Investment Co Ltd. Since 2005, he has also been Chairman of the merchant banking business of overseas Virgo Capital Holdings, which specializes in China's cable industry. Mr. Yuan began his finance career at Goldman Sachs as an investment banker in mergers & acquisitions, after attending Cornell University, where he received his B.S. degree in Economics & Marketing in 1983. Mr. Yuan also earned a Baker Scholar of achievement in econometrics as a Mason Fellow from Harvard University's JFK School of Economics and Government in 1983. He then served from 1988 until 1993 as a senior-vice president and co-manager at Morgan Stanley Smith Barney's Portfolio Management Corporation with dual functions as co-head of the Capital Markets Derivative team, and Chairman of the Technology Investment Management and Executive Policy Committee. In 1993, Mr. Yuan then became founder and managing director of the Corporate Institutional Services Group at Merrill Lynch Asset Management. From 1994 until 1997, he was the President and Head of Merrill Lynch Asset Management Asia, and Chairman of Merrill Lynch Global Asset Allocation Committee, which had $488 billion under management. From 1995 until 1996, Mr. Yuan was the Chief Investment Officer and Portfolio Manager of the $1.2 Billion AmerAsia Hedge Fund domiciled in Asia with special emphasis on technology, media and entertainment and telecom. Mr. Yuan also serves on the board of directors of Tech Venture Alliance (a privately-held technology venture investment company) and Terra Nostra Resources Corp. (a privately-held steel and copper manufacturer), and has previously served the boards of Gumtech International which became Matrixx Initiatives (a Nasdaq-listed branded consumer products company specializing in pharmaceutical drug delivery systems), Swedish Match (a public consumer products and research & development company in Sweden, specializing in development of pharmaceutical drugs for oncology industry), IPG Group (a public company based in Toronto specializing in next generation commercial real estate and ecommerce platforms) and Digital Island Technologies (a publicly-traded technology, commercial ISP and data management company). Our Board of Directors believes that the various leadership roles in business held by Mr. Yuan over the years will add a unique and needed perspective to our Board of Directors.

7

In connection with the closing of the Palo Verde Purchase Agreement (as defined in Item 4 below), the Board of Directors of the Company agreed with Palo Verde (as defined in Item 4 below) to fill three of the vacancies on the Board of Directors with individuals selected by Palo Verde. On August 13, 2012, Palo Verde recommended each of Mr. Douglas B. MacGregor, Mr. James L. Ferraro and Mr. William Yuan to fill such vacancies and the Board of Directors of the Company elected each such individual to fill a vacancy on the Board of Directors until the next annual meeting of shareholders of the Company and until such individual's respective successor is duly elected and qualifies, unless such individual sooner dies, retires or resigns.

Executive Officers

The current executive officers of the Company are the following:

| Name | Position |

| Michael K. Paulk | President and Director |

| Steven P. Ensz | Vice President, Finance,

Chief Financial Officer,

Secretary and Director |

The employment background and ages of Messrs. Paulk and Ensz are described above.

Director Compensation

None of our directors received any compensation, including equity awards, during the year ended December 31, 2011.

Our Directors do not receive any cash compensation for serving in that capacity; however, they are reimbursed for their out-of-pocket expenses in attending meetings. Pursuant to the terms of our 2001 Stock Incentive Plan, each non-employee Director who was first elected or appointed after February 1, 2002 automatically received an option grant for 5,000 shares on the date such person joined the Board. In addition, on the date of each annual shareholder meeting, provided such person had served as a non-employee Director for at least six months, each non-employee Board member who was to continue to serve as a non-employee Board member was automatically granted an option to purchase 500 shares. Each such option had a term of ten years, subject to earlier termination following such person's cessation of Board service, and is subject to certain vesting provisions. Our 2001 Stock Incentive Plan expired on December 14, 2011, provided that all outstanding options and unvested stock issuances will continue to have force and effect in accordance with the provisions of the documents evidencing such grants or issuances.

8

Corporate Governance and Board Matters

Board of Directors. Our Board of Directors held one meeting during the year ended December 31, 2011. Each of our Directors participated in the meeting of the Board and of each committee of the board of which he is a member. In addition, the Board of Directors took action one time during fiscal 2011 by unanimous written consent.

In the opinion of our Board of Directors, Messrs. MacGregor, Ferraro and Yuan are "independent" within the meaning of Rule 4200(a)(15) of the NASDAQ listing standards and Messrs. Paulk and Ensz are not "independent" within the meaning of those standards. We have no independent lead Director in view of the stage of development of our revenues, scope of exploration and development activities and financial condition. The Board attempts to exert risk oversight in connection with its review and approval of proposed transactions we seek to enter into which is consistent with the Board's leadership structure. Our Board views good corporate governance and ethical business conduct as an integral component to the success of the Company and to meet responsibilities to shareholders.

None of our Directors are directors of other issuers required to file periodic reports pursuant to Section 13 or 15(d) of the Exchange Act.

By virtue of the small scale of our business activities, we do not provide our new or existing board members with either formal orientation or continuing education. New Board members are provided with information respecting the functioning of our Board and committees, copies of our corporate governance policies, access to our recent, publicly filed documents and internal information, and access to management. Our Board members are encouraged to communicate with management, auditors and technical consultants; to keep themselves current with industry trends and developments and changes in legislation with management's assistance; and to attend related industry seminars and visit our operations.

Committees of the Board

The Board of Directors has a standing Audit Committee and no other standing committees.

Audit Committee. The Audit Committee of our Board of Directors consists of Mr. MacGregor, Ferraro and Yuan. Under our Audit Committee Charter, our Audit Committee's responsibilities include, among other responsibilities, the appointment, compensation and oversight of the work performed by our independent auditor, the adoption and assurance of compliance with a pre-approval policy with respect to services provided by the independent auditor, at least annually, obtain and review a report by our independent auditor as to relationships between the independent auditor and the Company so as to assure the independence of the independent auditor, review the annual audited and quarterly financial statements with our management and the independent auditor, and discuss with the independent auditor their required disclosure relating to the conduct of the audit. The Audit Committee met one time during the year ended December 31, 2011.

On March 30, 2012, our Audit Committee discussed our audited financial statements with management and also discussed with MaloneBailey LLP, our independent registered accountants, the matters required to be discussed by Statement of Auditing Standards No. 61, as amended. The Audit Committee received from MaloneBailey LLP the written disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board regarding MaloneBailey LLP's communications with the Audit Committee concerning independence and discussed with MaloneBailey LLP the independence of their firm. Based on that review and those discussions, our Audit Committee recommended that our audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2011 for filing with the SEC.

| | THE AUDIT COMMITTEE |

| | |

| | Douglas B. MacGregor |

| | James L. Ferraro |

| | William Yuan |

9

Our Audit Committee Charter, as adopted on April 22, 2004, is attached as Annex A to this Proxy Statement.

Our Board of Directors has determined that the Board does not have an Audit Committee Financial Expert serving on its Audit Committee. We do not have an Audit Committee Financial Expert serving on our Audit Committee because at this time the limited magnitude of our revenues and operations does not, in the view of the Board of Directors, justify or require that we obtain the services of a person having the attributes required to be an Audit Committee Financial Expert on our Board of Directors and Audit Committee. Our Board of Directors may in the future determine that a member elected to the Board in the future has the attributes to be determined to be an Audit Committee Financial Expert.

Nominating Committee and Process for Director Nominations.We do not have a standing nominating committee. Under the rules of the TSX Venture Exchange on which our shares of Common Stock are listed, we are not required to have such a committee. Our Board of Directors is of the view that because of the limited magnitude of our revenues and operations at this time, it is appropriate for us not to have a nominating committee. Each Director of the Company has the opportunity to participate in the consideration of nominees for election as Directors and to suggest prospective nominees.

We have not adopted a formal policy with regard to the consideration of candidates for nomination by the Board for election as Directors. Because of the limited magnitude of our revenues and operations at this time, our Board of Directors believes it is appropriate for us not to have such a policy. As such, each of the current directors participates in the consideration of director nominees. In connection with the upcoming Meeting, each nominee for Director named herein nominated the other four Director nominees named herein as a candidate for reelection as director.

Our entire Board considers not less than annually the performance of each of our officers and Directors with a view to determining whether they are performing effectively.

The Board of Directors will consider candidates for director nominees that are recommended by shareholders of the Company in accordance with the procedures set forth below. Any such nominations should be submitted to the Board of Directors in care of the President to American Natural Energy Corporation, 6100 South Yale – Suite 2010, Tulsa, Oklahoma 74136 and accompany it with the following information:

Appropriate biographical information, a statement as to the qualifications of the nominee and any other information relating to such nominee that is required to be disclosed pursuant to Regulation 14A under the Exchange Act, including such person's written consent to being named in the proxy statement as a nominee and to serving as a director if elected; and

The name(s) and address(es) of the shareholder(s) making the nomination and the number of shares of the Company's common stock which are owned beneficially and of record by such shareholder(s).

The written recommendation should be submitted in the time frame described under the caption "General—Submission of Shareholders' Proposals for Next Annual Meeting" below.

In evaluating potential director candidates, the Board will take into consideration such factors that it deems appropriate for the needs of the Board of Directors. Generally, the Board will evaluate new potential director candidates by reviewing their biographical information and qualifications and checking the candidates' references. Those candidates determined to be of interest will be subject to interview by the Board. Using the information obtained and input from the interview, the Board will evaluate whether a prospective candidate is qualified to serve as a director and whether the Board of Directors will nominate the prospective candidate or elect such candidate to fill a vacancy on the Board. Our Board of Directors believes that the backgrounds and qualifications of its directors, considered as a group, should provide a composite mix of experience, knowledge and abilities that will allow it to fulfill its responsibilities. Although the Board may also consider other aspects of diversity, including race, gender and national origin, these factors are not a prerequisite for any prospective nominee. Consequently, while the Board evaluates the mix of experience and skills of the Board of Directors as a group, the Board does not monitor the effectiveness of its policies with respect to diversity of race, gender or national origin.

10

Compensation Committee. Our Board of Directors has not appointed a compensation committee.

Our full Board of Directors acts on matters involving the compensation of our executive officers and employees and the grant of options under our option plan. Executive officers who are Directors whose compensation is being considered do not participate in Board actions regarding their compensation. The Board of Directors seeks to assure that our executive officers are adequately and fairly compensated and that their compensation is competitive with other similar-sized companies in the oil and gas exploration and production industry and, at the same time, reflecting their individual performance and responsibilities within the Company. To date, the Board has generally compensated our executive officers through the payment of a base salary and the grant incentive awards in the form of stock options. We do not have any employment agreements with our executive officers.

Code of Ethics

We have adopted a Code of Ethics that applies to our principal executive officer and principal financial and accounting officer. A copy of our Code of Ethics was filed as an exhibit to our Annual Report on Form 10-K for the year ended December 31, 2003. The Company undertakes to provide any person without charge, upon request, a copy of the Code of Ethics. Requests may be directed to American Natural Energy Corporation, 6100 South Yale – Suite 2010, Tulsa, Oklahoma 74136, or by calling (918) 481-1440.

Communicating With the Board of Directors

Shareholders or other interested parties may communicate with the entire Board of Directors, specified individual Directors, or certain Directors as a group by writing to the secretary of the Company at 6100 South Yale – Suite 2010, Tulsa, OK 74136. All such correspondence will be forwarded to the specified Director or group of Directors.

We urge but do not require Board members to attend annual meetings of shareholders. All of our Directors attended our annual meeting of shareholders held on November 15, 2011 in Tulsa, Oklahoma.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

All transactions between us and our subsidiaries with any of our officers and Directors are subject to approval by a majority of our Directors having no interest in the transaction. The transaction will be reviewed prior to being entered into on the basis of whether the transaction is on terms substantially equivalent to the terms that would exist between us and a non-affiliated person. Transactions with our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, are subject to the standards set forth in our written Code of Ethics.

On February 15, 2011, Michael K. Paulk, a director and the President and Chief Executive Officer of the Company, and Steven P. Ensz, a director and Vice-President, Finance and Chief Financial Officer and Secretary of the Company, made a loan to the Company in the amount of $500,000. In return, the Company executed a $500,000 unsecured short-term note in favor of Mr. Paulk and Mr. Ensz. The note accrued interest at the rate of 10% per annum. Accrued interest on the note was payable monthly and the principal was due in full upon maturity. The note matured on February 15, 2012, and was renewed through February 15, 2013. Proceeds from the loan from Mr. Paulk and Mr. Ensz were used by the Company to pay its outstanding obligation to BOKF, NA dba Bank of Oklahoma and for working capital purposes. The Company paid no principal and $41,805 in interest in connection with the loan during 2011. In total, the Company paid $81,269 of interest in connection with the loan through September 28, 2012.

11

On March 31, 2011, the Company purchased working interests in 3 wells from TPC Energy LLC ("TPC Energy") for $300,000. The transfer of the working interests was effective as of January 1, 2011. Michael K. Paulk, a director and the President and Chief Executive Officer of the Company, and Steven P. Ensz, a director and Vice-President, Finance and Chief Financial Officer and Secretary of the Company, are each minority owners of TPC Energy. The purchase price was financed by TPC Energy, and, accordingly, the Company executed a note in favor of TPC Energy in the amount of the purchase price. The note, dated as of March 31, 2011, accrues interest at the rate of 10% per annum. Principal payments of $12,500 together with accrued interest are due monthly under the note. During the effective date of January 1, 2011 through the closing date of March 31, 2011, revenues of $95,662 were recorded as a net purchase price adjustment in relation to the transaction that lowered the principal balance of the note to $204,338. Furthermore, cash payments totaling $40,155 were also applied to the note during 2011, leaving a remaining principal balance due under the note of $164,183 as of December 31, 2011. No additional principal payments have been made since that date. The Company paid TPC Energy $40,155 in principal and $21,232 in interest under the note during 2011. As of September 1, 2012, $164,162 of principal remained outstanding under the note.

12

Executive Compensation

The following table sets forth the compensation of our principal executive officer and all of our other executive officers for the two fiscal years ended December 31, 2011 who received total compensation exceeding $100,000 for the year ended December 31, 2011 and who served in such capacities at December 31, 2011.

SUMMARY COMPENSATION TABLE

Annual Compensation

Name and

Principal

Position

(a) | Year

(b) | Salary

($)

(c) | Bonus

($)

(d) | Stock

Awards

($)(1)

(e) | Option

Awards

($)(1)

(f) | Non-

Equity

Incentive

Plan

Compensation

($)

(g) | Nonqualified

Deferred

Compensation

Earnings

($)

(h) | All Other

Compensation

($)

(i) | Total

($)

(j) |

| Michael K. Paulk, | 2011 | $150,000 | -0- | -0- | -0- | -0- | -0- | -0- | $150,000 |

| President and CEO(2) | 2010 | $150,000 | -0- | -0- | $196,987 | -0- | -0- | -0- | $346,987 |

| Steven P. Ensz | 2011 | $150,000 | -0- | -0- | -0- | -0- | -0- | -0- | $150,000 |

Executive Vice President

and CFO(2) | 2010 | $150,000 | -0- | -0- | $196,987 | -0- | -0- | -0- | $346,987 |

| | (1) | Represents the dollar amount recognized for financial statement reporting purposes with respect to the fiscal year in accordance with FASB ASC 718. See Note 1 to Notes to Consolidated Financial Statements for the year ended December 31, 2011. |

| | (2) | Messrs. Paulk and Ensz are also Directors of our company; however they receive no additional compensation for serving in those capacities. |

We do not have any employment contracts with any of our executive officers or other significant employees.

13

Outstanding Equity Awards at December 31, 2011

The following table provides information with respect to our named executive officers above regarding outstanding equity awards held at December 31, 2011.

| | Option Awards | Stock Awards |

Name

(a) | Number of

securities

underlying

unexercised

Options

(#)

Exercisable/

Unexercisable

(b-c) | Equity

Incentive

Plan Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options (#)

(d) | Option

Exercise

Price

($)

(e) | Option

Expiration

Date

(f) | Number of

shares or

units of Stock

held that have

not vested

(#)

(g) | Market value

of shares

or units of

Stock held that

have not vested

($)

(h) | Equity

Incentive

Plan Awards:

Number of

Unearned Shares,

Units or Other

Rights That Have

Not Vested

(#)

(i) | Equity Incentive

Plan Awards:

Market or

payout value

of Unearned

Shares, Units

or Other Rights

That Have

Not Vested

($)

(j) |

| Michael K. Paulk | 150,000/0(1) | -0- | 0.90 | 9/8/14 | -0- | -0- | -0- | -0- |

| | 660,000/0(1) | -0- | 0.30 | 11/30/15 | -0- | -0- | -0- | -0- |

| Steven P. Ensz | 150,000/0(1) | -0- | 0.90 | 9/8/14 | -0- | -0- | -0- | -0- |

| | 660,000/0(1) | -0- | 0.30 | 11/30/15 | -0- | -0- | -0- | -0- |

| | (1) | All of these options have vested. |

Compensation Committee Report

We do not have a Compensation Committee. Our full Board of Directors acts on matters involving the compensation of our executive officers and employees and the grant of options under our option plan. The full Board of Directors has reviewed and discussed the compensation discussion and analysis included in this proxy statement with management of the Company, and based on such review and discussions, the full Board of Directors has recommended that the compensation discussion and analysis be included in this proxy statement.

| | THE BOARD OF DIRECTORS |

| | |

| | Michael K. Paulk |

| | Steven P. Ensz |

| | Douglas B. MacGregor |

| | James L. Ferraro |

| | William Yuan |

Compensation Committee Interlocks and Insider Participation

We do not have a Compensation Committee. As mentioned above, our full Board of Directors, which includes Michael K. Paulk, Steven P. Ensz, Douglas B. MacGregor, James L. Ferraro and William Yuan, acts on matters involving the compensation of our executive officers and employees and the grant of options under our option plan. Messrs. Paulk and Ensz are executive officers of the Company. Executive officers who are Directors whose compensation is being considered do not participate in Board actions regarding their compensation. During 2011, none of our executive officers served on the board of directors or on the compensation committee of any other entity who had an executive officer that served on our Board of Directors.

14

| ITEM 2. | TO CONSIDER AND ACT UPON A PROPOSAL TO APPROVE THECOMPANY'S 2012 STOCK OPTION PLAN. |

At the Meeting, it is proposed to seek shareholder approval of a new 10% rolling stock option plan (the "New Plan"). This proposal is being submitted to shareholders for approval because (1) the Company's shares are listed on the TSX Venture Exchange (the "TSXV") and the TSXV requires shareholder approval of stock incentive plans and (2) shareholder approval of the New Plan is required in order to allow "incentive stock options" (within the meaning of Section 422 of the Internal Revenue Code) to be granted under the New Plan. A copy of the New Plan can be found in the accompanying Annex B, and the following summary of the New Plan's material terms is qualified in its entirety by reference to the full text. Shareholders are urged to read the full New Plan as set forth in Annex B to this proxy statement.

The Board of Directors recommends that you vote FOR this Item 2.

Expired Stock Incentive Plan

The Company’s 2001 stock incentive plan (the "Expired Plan") expired pursuant to its terms in December, 2011. The Expired Plan was divided into five separate components: (i) the Discretionary Option Grant Program under which eligible individuals in the Company's employ or service (including officers, directors, consultants and advisors) could be granted options to purchase shares of Common Stock, (ii) the Stock Issuance Program under which such individuals could be issued shares of Common Stock directly, (iii) the Salary Investment Option Grant Program which could be activated for one or more calendar years and, if so activated, allowed executive officers and other highly compensated employees the opportunity to apply a portion of their base salary to the acquisition of stock option grants, (iv) the Automatic Option Grant Program under which option grants could be automatically made at periodic intervals to eligible, non-employee members of the Board of Directors to purchase shares of Common Stock at an exercise price equal to their fair market value on the grant date, and (v) the Director Fee Option Grant Program which could be activated, and, if so activated, would allow non-employee Board members the opportunity to apply a portion of any annual retainer fee otherwise payable to them in cash each year to the acquisition of stock option grants. Under the Expired Plan, 5,000,000 shares of Common Stock were reserved for issuance pursuant to the plan, representing approximately 16.1% of the Company’s outstanding Common Stock. 2,505,000 options are currently outstanding under the Expired Plan.

Description of the New Plan

The Board of Directors of the Company has determined that it is in the best interests of the Company to implement the New Plan. The New Plan was adopted by the Board of Directors of the Company on October 17, 2012, subject to the approval of shareholders. The New Plan provides for the grant of incentive stock options similar to those granted under the Discretionary Option Grant Program in the Expired Plan, but does not contain formal arrangements for the other four components of compensation included in the Expired Plan. The New Plan also includes certain features intended to comply with TSXV requirements.

The purpose of the New Plan is to allow the Company to grant options to directors, officers, employees and consultants, as additional compensation, and as an opportunity to participate in the success of the Company. The granting of such options is intended to align the interests of such persons with that of the shareholders. Options will be exercisable over periods of up to ten years as determined by the Board of Directors of the Company and are required to have an exercise price no less than the closing market price of the Company's shares prevailing on the day that the option is granted, less a discount up to the maximum discount permitted by the policies of the TSXV.

At the time of grant of any option, the aggregate number of shares of Common Stock reserved for issuance under the New Plan which may be made subject to options at any time and from time to time (including those issuable upon the exercise of options outstanding under the Expired Plan) together with those shares of Common Stock reserved for issuance at such time under any other established or proposed share compensation arrangement of the Company shall not exceed 10% of the total number of issued and outstanding shares of Common Stock, on a non-diluted basis, as constituted on the grant date of such option.

15

Any shares of Common Stock subject to an option which has been granted under the New Plan and which has been subsequently cancelled or terminated in accordance with the terms of the New Plan, without having been exercised, will again be available for issuance pursuant to the exercise of options granted under the New Plan.

The number of shares of Common Stock which may be issuable under the New Plan and all of the Company's other previously established or proposed share compensation arrangements, within a one-year period:

| | (a) | to any one optionee, shall not exceed 5% of the total number of issued and outstanding shares of Common Stock on the grant date on a non-diluted basis (unless the Company receives disinterested shareholder approval in accordance with the policies of TSXV); |

| | | |

| | (b) | to “Insiders” (As defined in TSXV rules and policies) as a group shall not exceed 10% of the total number of issued and outstanding shares of Common Stock on the grant date on a non-diluted basis; |

| | | |

| | (c) | to any one consultant shall not exceed 2% of the total number of issued and outstanding shares of Common Stock on the grant date on a non-diluted basis; and |

| | | |

| | (d) | to all eligible persons who undertake investor relations activities shall not exceed 2% in the aggregate of the total number of issued and outstanding shares of Common Stock on the grant date on a non-diluted basis. |

Additional material terms of the New Plan are as follows:

Administration. The Board of Directors administers the New Plan and has authority to make awards under the New Plan, to set the terms of the awards, to interpret the New Plan, to establish any rules or regulations relating to the New Plan that it determines to be appropriate and to make any other determination that it believes necessary or advisable for the proper administration of the New Plan.

Amendment. The Board of Directors of the Company may amend or modify the New Plan at any time, subject to any required awardee approval, TSXV approval or shareholder approval.

Black-Out Period Provisions. In accordance with good corporate governance practices and as recommended by National Policy 51-201Disclosure Standards, the Company imposes black-out periods restricting the trading of its securities by directors, officers, employees and consultants during periods surrounding the release of annual and interim financial statements and at other times when deemed necessary by management and the board of directors. In order to ensure that optionees are not prejudiced by the imposition of such black-out periods, the New Plan includes a provision to the effect that any outstanding stock options with an expiry date that falls during a management imposed black-out period or within five days thereafter will be automatically extended to a date that is ten trading days following the end of the black-out period.

Change of Control. The New Plan provides that if a change of control (as defined therein) occurs, or if the Company is subject to a take-over bid, all shares subject to stock options shall immediately become vested and may thereupon be exercised in whole or in part by the option holder. The Board of Directors of the Company may also accelerate the expiry date of outstanding stock options in connection with a take-over bid.

Adjustments. The New Plan contains adjustment provisions with respect to outstanding options in cases of share reorganizations, special distributions and other corporation reorganizations including an arrangement or other transaction under which the business or assets of the Company become, collectively, the business and assets of two or more companies with the same shareholder group upon the distribution to the Company's shareholders, or the exchange with the Company's shareholders, of securities of the Company or securities of another company.

16

Death, Disability, Retirement and Resignation. The New Plan provides that, on the death or disability of an option holder, all vested options will expire at the earlier of one year after the date of death or disability and the expiry date of such options. Where an optionee is terminated for cause, any outstanding options (whether vested or unvested) are cancelled as of the date of termination. If an optionee retires or voluntarily resigns or is otherwise terminated by the Company other than for cause, then all vested options held by such optionee will expire at the earlier of (i) the expiry date of such options and (ii) the date which is 90 days (30 days if the optionee was engaged in investor relations activities) after the optionee ceases to be an eligible person under the New Plan. Notwithstanding the foregoing, the New Plan permits the Board of Directors of the Company, in its sole discretion if it determines such is in the best interests of the Company, to extend this 90 day termination date to a later date within a reasonable period not exceeding the earlier of the expiry date of the options and one year, provided such extension is in accordance with the policies of the TSXV.

New Company Options. The New Plan contains a provision that, if pursuant to the operation of the plan's adjustment provisions, in respect of options granted under the New Plan (the "Subject Options"), an optionee receives options to purchase securities of another company (the "New Company"), such new options shall expire on the earlier of: (i) the expiry date of the Subject Options; (ii) if the optionee does not become an eligible person in respect of the New Company, the date that the Subject Options expire pursuant to the applicable provisions of the New Plan relating to expiration of options in cases of death, disability or termination of employment discussed in the preceding paragraph above (the "Termination Provisions"); (iii) if the optionee becomes an eligible person in respect of the New Company, the date that such new options expire pursuant to the terms of the New Company's stock option plan that correspond to the Termination Provisions; and (iv) the date that is two years after the optionee ceases to be an eligible person in respect of the New Company or such shorter period as determined by the board.

All existing and outstanding options will count against the number of shares reserved for issuance under the New Plan as long as such options remain outstanding. Upon implementation of the New Plan, all existing options will forthwith be governed by the New Plan, to the extent possible.

If the requisite shareholder approval of the New Plan is not obtained at the Meeting, the New Plan will not be implemented.

Shareholder approval of the New Plan will be required at each annual meeting of the shareholders of the Company held subsequent to this Meeting. If shareholder approval is not received at any such future meeting, the Company’s ability to issue options under the New Plan will be suspended until shareholder approval of the New Plan is again received. The New Plan does not “expire”, but rather is subject to this annual shareholder approval requirement.

Federal Income Tax Consequences

If a holder is granted a nonqualified stock option under the New Plan, the holder should not have taxable income on the grant of the option. Generally, the holder should recognize ordinary income at the time of exercise in an amount equal to the fair market value of a share of our common stock at such time, less the exercise price paid. The holder's basis in the common stock for purposes of determining gain or loss on a subsequent sale or disposition of such shares generally will be the fair market value of our common stock on the date the holder exercises such option. Any subsequent gain or loss generally will be taxable as a capital gain or loss. We generally should be entitled to a federal income tax deduction at the time and for the same amount as the holder recognizes ordinary income.

A holder of an incentive stock option will not recognize taxable income upon grant. Additionally, if the applicable employment-related requirements are met, the holder will not recognize taxable income at the time of exercise. However, the excess of the fair market value of our common stock received over the option price is an item of tax preference income potentially subject to the alternative minimum tax. If any of the requirements for incentive stock options under the Internal Revenue Code are not met, the incentive stock option will be treated as a nonqualified stock option and the tax consequences described above for nonqualified stock options will apply. Once an incentive stock option has been exercised, if the stock acquired upon exercise is held for a minimum of two years from the date of grant and one year from the date of exercise, the gain or loss (in an amount equal to the difference between the fair market value on the date of sale and the exercise price) upon disposition of the stock will be treated as a long-term capital gain or loss, and we will not be entitled to any deduction. If the holding period requirements are not met, the excess of the fair market value on the date of exercise over the exercise price (less any diminution in value of the stock after exercise) will be taxed as ordinary income and we will be entitled to a deduction to the extent of the amount so included in the income of the holder. Appreciation in the stock subsequent to the exercise date will be taxed as long term or short term capital gain, depending on whether the stock was held for more than one year after the exercise date.

17

If, on a change of control of our Company, the exercisability or vesting of an award is accelerated, any excess on the date of the change of control of the fair market value of the shares or cash issued under accelerated awards over the purchase price of such shares, if any, may be characterized as "parachute payments" (within the meaning of Section 280G) if the sum of such amounts and any other such contingent payments received by the employee exceeds an amount equal to three times the "base amount" for such employee. The base amount generally is the average of the annual compensation of such employee for the five years preceding such change in ownership or control. An "excess parachute payment," with respect to any employee, is the excess of the parachute payments to such person, in the aggregate, over and above such person's base amount. If the amounts received by an employee upon a change-in-control are characterized as parachute payments, such employee will be subject to a 20 percent excise tax on the excess parachute payment and we will be denied any deduction with respect to such excess parachute payment.

| ITEM 3. | TO CONSIDER AND ACT UPON A PROPOSAL TO APPROVE THECONVERSION OF ALL DEBENTURES AND THE EXERCISE OF ALLWARRANTS SOLD OR TO BE SOLD BY THE COMPANY TO PALO VERDEACQUISITIONS, LLC PURSUANT TO THE SECURITIES PURCHASEAGREEMENT DATED AUGUST 13, 2012, BETWEEN THE COMPANY ANDPALO VERDE ACQUISITIONS, LLC |

On August 13, 2012, the Company entered into a Securities Purchase Agreement (the "Palo Verde Purchase Agreement") with Palo Verde Acquisitions, LLC ("Palo Verde"), pursuant to which the Company sold to Palo Verde (1) a $2,000,000 12% Convertible Debenture due August 13, 2014 (the "Palo Verde Debenture"), which is convertible into shares of common stock of the Company at a conversion rate of US$0.10 per share of common stock, and (2) warrants to purchase up to 20,000,000 shares of common stock of the Company at an exercise price of US$0.23 per share and expiring on August 13, 2014 (the "Warrants"). Pursuant to the Palo Verde Purchase Agreement, Palo Verde may purchase from the Company an additional $1,000,000 12% convertible debenture (convertible into shares of common stock of the Company at a conversion rate of US$0.10 per share of common stock) and additional warrants to purchase up to 10,000,000 shares of common stock of the Company at an exercise price of US$0.23 per share (such additional debenture and additional warrants, the "Additional Securities") for a total payment of an additional $1,000,000.

The aggregate consideration paid to the Company by Palo Verde for the Palo Verde Debenture and the Warrants was $2,000,000. The obligations of the Company to Palo Verde under the Palo Verde Debenture are unsecured obligations of the Company. Pursuant to the Palo Verde Purchase Agreement, the Company will use the net proceeds from the transaction for expenditures relating directly to the exploration, drilling, and production of its oil and gas properties in the Bayou Couba Field, St. Charles Parish, Louisiana and will not use such proceeds for the satisfaction of the Company’s debt (other than payment of trade payables incurred in the ordinary course of the Company’s business and prior practices in an amount not to exceed $100,000).

18

Interest on the outstanding principal amount of the Palo Verde Debenture will accrue at a rate of 12% per annum, and is payable by the Company on a quarterly basis. At the Company's election, interest may be payable by the Company in shares of common stock of the Company in lieu of cash. The entire principal amount of the Palo Verde Debenture is due on August 13, 2014. The Company may not prepay any portion of the principal amount of the Palo Verde Debenture without the prior written consent of Palo Verde.

At any time prior to the payment of the Palo Verde Debenture in full, Palo Verde may elect, in its sole discretion, to convert all or part of the principal amount of the Palo Verde Debenture into shares of common stock of the Company at a conversion rate of US$0.10 per share of common stock, subject to the Beneficial Ownership Limitation (defined below). The same Beneficial Ownership Limitation applies to the exercise by Palo Verde of any Warrants. The Palo Verde Debenture contains customary adjustment provisions for certain corporate events, such as the payment of stock dividends and stock splits. The Palo Verde Debenture also contains customary events of default.

The Palo Verde Purchase Agreement prevents Palo Verde from converting any principal amount of the Palo Verde Debenture into common shares of the Company, exercising any Warrant or converting or exercising, as applicable, any Additional Securities purchased, if, following such conversion or exercise, Palo Verde and its affiliates would own more than 19.9% of the number of shares of common stock of the Company then outstanding (the "Beneficial Ownership Limitation"). The Beneficial Ownership Limitation was included in the Palo Verde Purchase Agreement as a result of a rule of the TSX Venture Exchange requiring shareholder approval of a transaction that results in the creation of a new "Control Person," which means any person who holds or is one of a combination of persons who hold a sufficient number of any of the securities of an issuer so as to affect materially the control of that issuer, or who holds more than 20% of the outstanding voting shares of an issuer except where there is evidence showing that the holder of those securities does not materially affect the control of the issuer.

As of the date of this proxy statement, Paul Alexander Ross is the beneficial owner of 5,715,371 shares of our Common Stock. Of the amount beneficially owned by the Paul Alexander Ross, 3,400,000 shares represent the shares of our Common Stock held of record by Arkoma Natural Gas Company, Inc. ("Arkoma"), a corporation of which Mr. Ross is the sole shareholder and president, and the maximum 2,315,371 shares that would be issuable to Palo Verde, a limited liability company of which Mr. Ross is the sole member and manager, pursuant to the conversion of the Palo Verde Debenture and/or exercise of the Warrants, taking into account the Beneficial Ownership Limitation.

At the Meeting, it is proposed to seek shareholder approval of the conversion of the Palo Verde Debenture and the exercise of the Warrants (and the conversion and exercise, respectively, of any Additional Securities (as defined below) purchased) without the limitation of the Beneficial Ownership Limitation. Pursuant to the Palo Verde Purchase Agreement, the Company has agreed that the Company and its Board of Directors will use their best efforts to seek the approval of the foregoing.

If this proposal is approved by the shareholders: (1) the Beneficial Ownership Limitation will no longer apply to Mr. Ross and/or Palo Verde, (2) Palo Verde will be allowed to convert any or all of the Palo Verde Debenture, exercise any or all of the Warrants, and if purchased, convert or exercise, as applicable, any or all of the Additional Securities, (3) pursuant to the rules governing the calculation of beneficial ownership of an issuer, Mr. Ross would beneficially own 43,400,000 shares of our Common Stock by virtue of his ownership of Arkoma and Palo Verde (which would represent 65.4% of the outstanding shares of Common Stock, assuming full conversion of the Palo Verde Debenture and full exercise of the Warrants) and (4) pursuant to the rules governing the calculation of beneficial ownership of an issuer, Palo Verde would beneficially own 40,000,000 shares of our Common Stock (which would represent 60.2% of the outstanding shares of Common Stock, assuming full conversion of the Palo Verde Debenture and full exercise of the Warrants). If Palo Verde purchases the Additional Securities, the foregoing beneficial ownership amounts and percentages would be higher.

19

Approval by the shareholders of this Item 4 will not require Palo Verde to convert any or all of the Palo Verde Debenture and/or exercise any or all of the Warrants; any such conversion or exercise shall be made in the sole discretion of Palo Verde.

If Palo Verde converts the Palo Verde Debenture, exercises the Warrants or converts or exercises, as applicable, any Additional Securities purchased, it may materially and adversely affect the price of our Common Stock. In addition, it may dilute the ownership interests of existing shareholders, and any sales in the public market of any of our Common Stock issuable upon such conversion or exercise could adversely affect prevailing market prices of our Common Stock.

References to, and the descriptions of, the Palo Verde Purchase Agreement, the Palo Verde Debenture and the Warrants are qualified in their entirety by reference to the full text of the agreements, which are filed as Exhibits 10.1, 10.2 and 10.3 to the Form 8-K filed by the Company on August 17, 2012. The Company will provide to you, without charge, upon your written or oral request, by first class mail or equally prompt means within one business day of receipt of such request, a copy of the Palo Verde Purchase Agreement, the Palo Verde Debenture and the Warrants. Such request should be directed to American Natural Energy Corporation, 6100 South Yale – Suite 2010, Tulsa, Oklahoma 74136, or by calling (918) 481-1440.

The Board of Directors recommends that you vote FOR this Item 3.

| ITEM 4. | RATIFY THE APPOINTMENT OF MALONEBAILEY LLP AS OURINDEPENDENT REGISTERED PUBLIC ACCOUNTANTS |

Our Audit Committee and Board of Directors have selected MaloneBailey LLP as our independent registered public accounting firm for the year ended December 31, 2011. MaloneBailey LLP audited our financial statements for the year ended December 31, 2011. Our Audit Committee and Board of Directors recommend that you ratify this appointment and the Board intends to introduce a resolution at the Meeting to ratify this appointment.

We do not expect a representative of MaloneBailey LLP to be present at the Meeting to be available to respond to appropriate questions or make a statement.

The Board of Directors recommends that you vote FOR this Item 4.

2011 and 2010 Audit and Related Fees

The following sets forth fees we incurred for services provided by MaloneBailey LLP for the years ended December 31, 2011, and 2010, our independent registered public accountants at those year ends.

| | | Audit Fees | Audit | Tax Fees | All Other |

| | | | Related | | Fees |

| | | | Fees | | |

| | 2011 | $94,000 | -- | - | - |

| | 2010 | $74,000 | -- | - | - |

20

Our Board of Directors believes that the provision of the services during the years ended December 31, 2011 and December 31, 2010 is compatible with maintaining the independence of MaloneBailey, LLP. Our Audit Committee approves before the engagement the rendering of all audit and non-audit services provided to our company by our independent auditor. Engagements to render services are not entered into pursuant to any pre-approval policies and procedures adopted by the Audit Committee. The services provided by MaloneBailey, LLP included under the captionAudit Fees include services rendered for the audit of our annual consolidated financial statements, the review of our quarterly financial reports, the issuance of consents, and assistance with review of documents filed with the SEC.

21

COMMON STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of our common stock as of October 22, 2012, (a) by each person who is known by us to own beneficially more than five percent (5%) of our common shares, (b) by each of our Directors, nominees for Director and executive officers and, and (c) by all Directors and executive officers as a group. As of October 22, 2012, we had 26,405,085 common shares outstanding.

| | | | Percentage of |

| | | Number of Shares | Outstanding |

| | Name and Address(1)(2) | Owned | Shares(3) |

| | | | |

| | Michael K. Paulk | 2,524,888(4) | 9.3% |

| | | | |

| | Steven P. Ensz | 2,874,832(5) | 10.6% |

| | | | |

| | Douglas B. MacGregor, | 1,800,000 | 6.8% |

| | 22 County Road 727 | | |

| | Gunnison, Colorado 81230 | | |

| | | | |

| | James L. Ferraro | 600,000 | 2.3% |

| | 4000 Ponce De Leon Blvd. | | |

| | Suite 700 | | |

| | Coral Gables, Florida 33146 | | |

| | | | |

| | All Directors and officers as a group (4 persons) | 7,799,720(4)(5) | 27.8% |

| | | | |

| | Paul Alexander Ross | 5,715,371(6) | 19.9% |

| | 7711 East 111th Street, Suite 121 | | |

| | Tulsa, Oklahoma 74133 | | |

| | | | |

| | TCA Global Credit Master Fund LP | 1,764,706(7) | 6.7% |

| | P.O. Box 1043, 69 Dr. Roy's Drive, | | |

| | George Town | | |

| | Grand Cayman KY1-1102, Cayman Islands | | |

__________________________________

| (1) | This tabular information is intended to conform with Rule 13d-3 promulgated under the Exchange Act relating to the determination of beneficial ownership of securities. The tabular information gives effect to the exercise of warrants or options exercisable within 60 days of the date of this table owned in each case by the person or group whose percentage ownership is set forth opposite the respective percentage and is based on the assumption that no other person or group exercise their option. |

| (2) | Unless otherwise indicated, the address for each of the above is c/o American Natural Energy Corporation, 6100 South Yale, Suite 2010, Tulsa, Oklahoma 74136. |

| (3) | The percentage of outstanding shares calculation is based upon 26,405,085 shares outstanding as of October 22, 2012. |

| (4) | Includes 150,000 shares issuable at an exercise price of $0.90 on exercise of an option and 660,000 shares issuable at an exercise price of $0.30 on exercise of an option. |

| (5) | Includes 150,000 shares issuable at an exercise price of $0.90 on exercise of an option and 660,000 shares issuable at an exercise price of $0.30 on exercise of an option. |

22

| (6) | Paul Alexander Ross is the beneficial owner of 5,715,371 shares of Common Stock. Of the amount beneficially owned by the Mr. Ross, 3,400,000 shares represent the shares of Common Stock held of record by Arkoma, a corporation of which he is the sole shareholder and president, and the maximum 2,315,371 shares that would be issuable to Palo Verde, a limited liability company of which he is the sole member and manager, within 60 days pursuant to the conversion of debentures and/or exercise of the Warrants, taking into account the Beneficial Ownership Limitation (defined above). As of the date of the foregoing table, Arkoma is the beneficial owner of 3,400,000 shares of Common Stock, which represents 12.9% of our outstanding Common Stock, and Palo Verde is the beneficial owner of 2,315,371 shares of our Common Stock, which represents 8.1% of our outstanding Common Stock. If the proposal in Item 4 herein is approved by the shareholders, Mr. Ross will beneficially own 43,400,000 shares of our Common Stock and 65.4% of the outstanding Common Stock by virtue of his ownership of Arkoma and Palo Verde. |

| (7) | Based on the Schedule 13G dated December 29, 2011 and filed with the SEC on August 9, 2012. Pursuant to that certain Securities Purchase Agreement dated as of December 29, 2011 (the "TCA Purchase Agreement"), between the Company and TCA Global Credit Master Fund, LP ("TCA"), the Company paid to TCA an equity incentive fee of $150,000 worth of shares of our Common Stock (the "Incentive Shares"). The number of Incentive Shares initially issued was 1,764,706 shares. The Incentive Shares carry a nine (9) month ratchet whereby either party is obligated to refund (by TCA) or issue (by the Company) shares to equal the initial value. |

GENERAL

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), requires the Company's directors, executive officers, and persons who beneficially own more than 10 percent of a registered class of the Company's equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company. Officers, directors and greater than ten percent shareholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file. SEC regulations impose specific due dates for such reports, and the Company is required to disclose in this Proxy Statement any failure to file by these dates during and with respect to fiscal 2011.

Based solely on review of the copies of such reports furnished to the Company and any written representations that no other reports were required during the year ended December 31, 2011, to the Company's knowledge, all Section 16(a) filing requirements applicable to its officers, directors and greater than 10% beneficial owners during the year ended December 31, 2011 were complied with on a timely basis.

Submission of Shareholders' Proposals for Next Annual Meeting

Proposals of shareholders intended to be presented at our next Annual Meeting of Stockholders and included in our proxy statement and form of proxy relating to the meeting, pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended, must be received at our principal executive offices, 6100 South Yale – Suite 2010, Tulsa, Oklahoma 74136, on or before August 2, 2013, to be considered for inclusion in our proxy statement and accompanying proxy for that meeting.

If a stockholder, who intends to present a proposal at the Company’s next Annual Meeting of Stockholders and has not sought inclusion of the proposal in the Company’s proxy materials pursuant to Rule 14a-8, fails to provide the Company with notice of such proposal by October 16, 2013, then the persons named in the proxies solicited by the Company’s Board of Directors for its next Annual Meeting of Stockholders may exercise discretionary voting power with respect to such proposal.

23

Householding

The proxy rules of the SEC permit companies and intermediaries, such as brokers and banks, to satisfy delivery requirements for proxy statements with respect to two or more shareholders sharing the same address by delivering a single proxy statement to those shareholders. This method of delivery, often referred to as householding, should reduce the amount of duplicate information that shareholders receive and lower printing and mailing costs for companies. The Company is not householding proxy materials for its shareholders of record in connection with the Meeting. However, the Company is aware that certain intermediaries will household proxy materials. If you hold your shares of common stock through a broker or bank that has determined to household proxy materials:

Only one annual report and proxy statement will be delivered to multiple shareholders sharing an address;

You may request a separate copy of the annual report and proxy statement for the Meeting and for future meetings by calling (918) 481-1440 or by writing to American Natural Energy Corporation, 6100 South Yale – Suite 2010, Tulsa, Oklahoma 74136, or by contacting your bank or broker to make a similar request; and

You may request to discontinue householding by notifying your broker or bank.

Other Matters