UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

NUMEREX CORP.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| | |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

| ¨ | Fee paid previously with preliminary materials. |

| | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | | |

NUMEREX CORP.

3330 Cumberland Blvd SE, Suite 700

Atlanta, Georgia 30339

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

July 26, 2016

9:00 a.m. Eastern Time

Dear Shareholders:

Notice is hereby given that the 2016 annual meeting of shareholders (the “Annual Meeting”) of Numerex Corp, a Pennsylvania corporation (the “Company”), will be held on Tuesday, July 26, 2016 at 9:00 a.m. Eastern Time in the Terrace Level Conference Center at the City View Building, 3330 Cumberland Blvd SE, Atlanta, Georgia 30339 for the following purposes:

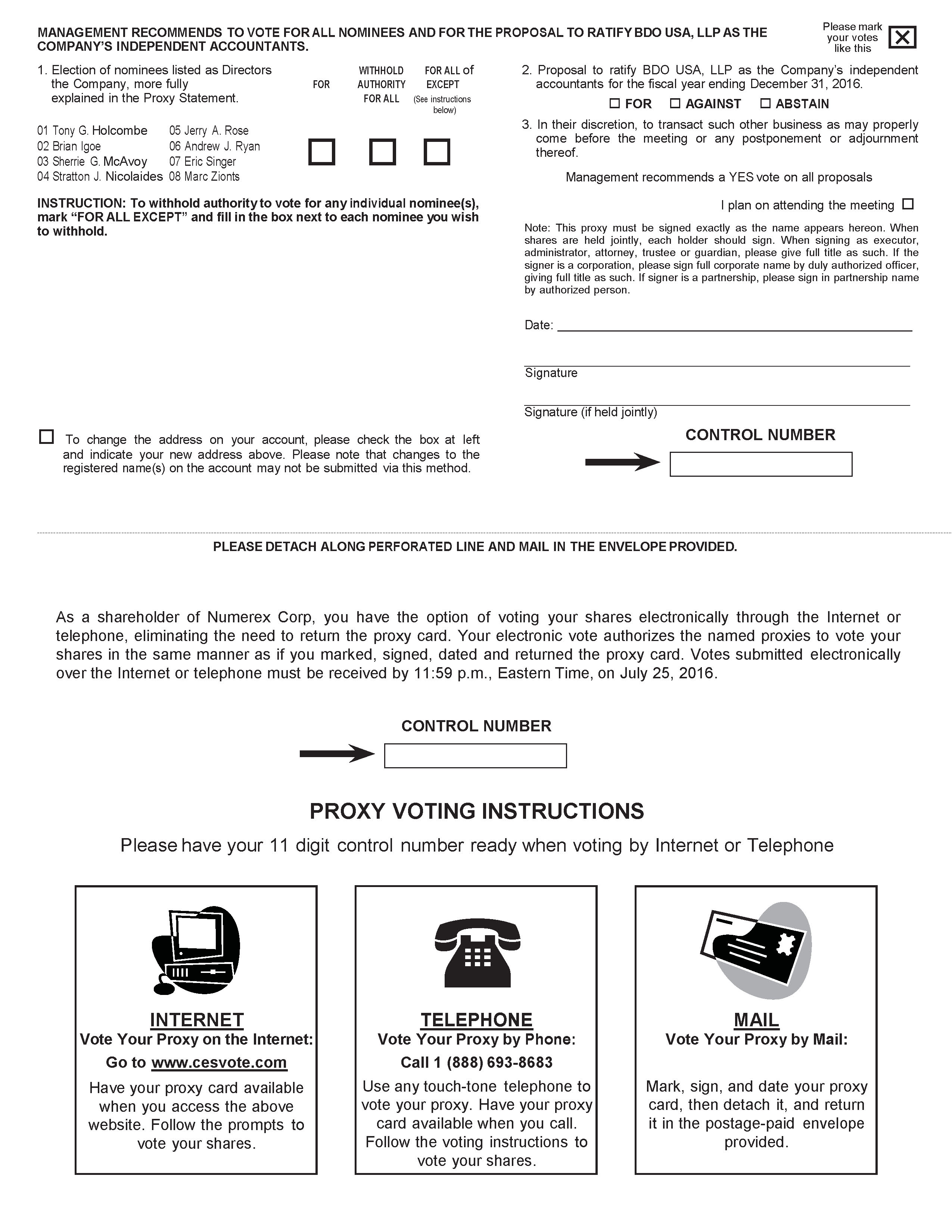

| 1. | To elect eight nominees to serve as directors of the Company; |

| 2. | To ratify the appointment of BDO USA, LLP as the independent registered public accounting firm; and |

| 3. | To transact such other business as may properly come before the Annual Meeting and any postponement(s) or adjournment(s) thereof. |

Only shareholders of record as of the close of business on May 16, 2016 are entitled to receive notice of, to attend, and to vote at the Annual Meeting.

Under rules adopted by the Securities and Exchange Commission (the “SEC”), the Company is pleased to make this Proxy Statement and the Company’s Annual Report to Shareholders available on the internet instead of mailing a printed copy of these materials to each shareholder. Shareholders who receive a Notice of Internet Availability of Proxy Materials (the “Notice”) by mail will not receive a printed copy of these materials other than as described below. Instead, the Notice contains instructions as to how shareholders may access and review all of the important information contained in the materials on the Internet, including how shareholders may submit proxies by telephone or over the Internet.

If you received the Notice by mail and would prefer to receive a printed copy of the Company’s proxy materials, please follow the instructions for requesting printed copies included in the Notice. The Company believes these rules allow it to provide you with the information you need while lowering delivery costs and reducing the environmental impact of the Annual Meeting. This Proxy Statement will be mailed to shareholders on or about June 10, 2016.

You are cordially invited to attend the Annual Meeting in person. However, to ensure your vote is counted at the Annual Meeting, please vote as promptly as possible as provided in the Notice.

| | Sincerely, |

| | |

| | /s/ Stratton J. Nicolaides |

| | Stratton J. Nicolaides |

| | Chairman of the Board of Directors |

| | |

| | |

| | /s/ Andrew J. Ryan |

| | Andrew J. Ryan |

| | General Counsel and Secretary |

NUMEREX CORP.

3330 Cumberland Blvd SE, Suite 700

Atlanta, Georgia 30339

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

GENERAL INFORMATION

Why am I receiving these materials and why did I receive a one-page Notice of Internet Availability of Proxy Materials in the mail regarding the Internet availability of proxy materials this year instead of a full set of proxy materials?

These materials are being made available in connection with the Company's solicitation of proxies for use at the Annual Meeting, to be held on Tuesday, July 26, 2016 at 11:00 a.m. Eastern Time, and any postponement(s) or adjournment(s) thereof. Under SEC rules, the Company is making this Proxy Statement and the Company’s Annual Report to Shareholders available on the Internet instead of mailing a printed copy of these materials to each shareholder. Shareholders who received the Notice of Internet Availability of Proxy Materials (the “Notice”) by mail will not receive a printed copy of these materials other than as described in the Notice, which contains instructions as to how shareholders may access and review all of the important information contained in the materials on the Internet, including how shareholders may submit proxies by telephone or over the Internet.

What is included in the proxy materials?

These proxy materials include:

| · | the Proxy Statement for the Annual Meeting; and |

| · | the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2015, as filed with the SEC on March 15, 2016 (the “Annual Report”). |

If you requested printed versions of these materials by mail as provided in the Notice, these materials also include the printed proxy card for the Annual Meeting.

What matters will be voted on at the Annual Meeting?

Shareholders will vote on two items at the Annual Meeting:

| · | the election to the Board of the eight nominees named in this Proxy Statement (Proposal 1); |

| · | ratification of the appointment of BDO USA, LLP as the independent registered public accounting firm of the Company (Proposal 2); and |

| · | such other business as may properly come before the Annual Meeting and any postponement(s) or adjournment(s) thereof. |

Who may vote at the Annual Meeting?

As of the close of business on May 16, 2016 (the “Record Date”), there were 19,434,218 shares of the Company's common stock issued and outstanding, held by 105 shareholders of record. Only shareholders of record as of the Record Date are entitled to receive notice of the Annual Meeting and vote their shares as provided in the Notice. Each share of the Company's common stock has one vote on each matter.

What are the Board's voting recommendations?

The Board recommends that you vote your shares:

| · | “FOR” each of the nominees to the Board (Proposal 1); and |

| · | “FOR” ratification of the appointment of BDO USA, LLP (Proposal 2). |

What is the difference between a shareholder of record and a beneficial owner of shares held in street name?

Shareholder of Record.If your shares are registered directly in your name with the Company’s transfer agent, Continental Stock Transfer & Trust Company, you are considered the shareholder of record with respect to those shares, and the Notice was sent directly to you by the Company. If you request printed copies of the proxy materials by mail, you will receive a proxy card.

Beneficial Owner of Shares Held in Street Name. If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the beneficial owner of shares held in “street name,” and the Notice was forwarded to you by that organization. The organization holding your account is considered the shareholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct that organization on how to vote the shares held in your account. If you request printed copies of the proxy materials by mail, you will receive a vote instruction form.

If I am a shareholder of record of the Company's shares, how do I vote?

There are four ways to vote:

| · | In person. If you wish to vote in person at the Annual Meeting, the Company will give you a ballot when you arrive. |

| · | Via the Internet. You may vote by proxy via the Internet by following the instructions provided in the Notice. |

| · | By Telephone. If you request printed copies of the proxy materials by mail, you may vote by proxy by calling the toll free number found on the proxy card. |

| · | By Mail. If you request printed copies of the proxy materials by mail, you may vote by proxy by filling out the proxy card and sending it back in the envelope provided. |

If I am a beneficial owner of shares held in street name, how do I vote?

There are four ways to vote:

| · | In person. If you wish to vote in person at the Annual Meeting, you must obtain a legal proxy from the organization that holds your shares. |

| · | Via the Internet. You may vote by proxy via the Internet by visiting the website designated in the Notice and entering the control number found in the Notice. |

| · | By Telephone. If you request printed copies of the proxy materials by mail, you may vote by proxy by calling the toll free number found on the vote instruction form. |

| · | By Mail. If you request printed copies of the proxy materials by mail, you may vote by proxy by filling out the vote instruction form and sending it back in the envelope provided. |

What is the quorum requirement for the Annual Meeting?

The holders of a majority of the shares entitled to vote at the Annual Meeting must be present at Annual Meeting for the transaction of business. This is called a quorum. (If a quorum is not present, the Annual Meeting will be adjourned until a quorum is obtained.) Your shares will be counted for purposes of determining if there is a quorum, whether representing votes for, against, or abstentions, if you:

| · | are present and vote in person at the Annual Meeting; or |

| · | have voted on the Internet, by telephone or by properly submitting a proxy card or vote instruction form by mail. |

How are proxies voted?

All valid proxies received prior to the Annual Meeting will be voted. All shares represented by a proxy will be voted and, where a shareholder specifies by means of the proxy a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the shareholder's instructions.

What happens if I do not give specific voting instructions?

Shareholders of Record. If you are a shareholder of record and you:

| · | vote via the Internet or by telephone by following the instructions on the Notice you received; or |

| · | sign and return a proxy card without giving specific voting instructions, |

then the proxy holders will vote your shares in the manner recommended by the Board on all matters presented in this Proxy Statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting. See the section entitled “Other Matters” below.

Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, under the rules of the SEC and the national securities exchanges, the organization that holds your shares may generally vote on routine matters but cannot vote on non-routine matters.

Who will serve as the inspector of election?

Ken Gayron, CFO of the Company, will serve as the inspector of election.

Who pays for this proxy solicitation?

This proxy is solicited by the Board, and the cost of solicitation will be paid by the Company. Additional solicitation may be made by mail, personal interview, telephone, or facsimile by Company personnel, who will not be additionally compensated for such effort. The cost of any such additional solicitation will be borne by the Company.

Which ballot measures are considered “routine” or “non-routine”?

Brokerage firms have authority under NASDAQ guidelines to vote customers' shares for which they have not received voting instructions on certain "routine" matters, but may not vote for non-routine matters unless they have received voting instructions. Routine matters include the ratification of the Company's principal independent registered public accounting firm. However, the election of directors is not considered a "routine" matter. Therefore, if you do not provide voting instructions, your brokerage firm may not vote your shares on such non-routine matters. We encourage you to provide instructions to your brokerage firm. This ensures your shares will be voted at the meeting. When a brokerage firm votes its customers' shares for which it has not received voting instructions on routine matters, these shares are counted for purposes of establishing a quorum to conduct business at the meeting, but these shares (sometimes referred to as broker non-votes) are considered not entitled to vote on non-routine matters, rather than as a vote against the matter.

How are broker non-votes treated?

Broker non-votes are counted for purposes of determining whether a quorum is present. Broker non-votes will not affect the outcome of voting for the election of directors (Proposal 1) or the ratification of BDO USA, LLP (Proposal 2). We encourage you to provide voting instructions to the organization that holds your shares by carefully following the instructions provided in the Notice.

How are abstentions treated?

Abstentions are counted for purposes of determining whether a quorum is present. Shareholders not present at the Annual Meeting and abstentions have no effect on the election of directors (Proposal l) or the ratification of BDO USA, LLP (Proposal 2).

What is the voting requirement to approve each of the proposals?

For Proposal 1, the eight nominees receiving the highest number of affirmative votes of the outstanding shares of the Company's common stock present or represented by proxy and voting at the Annual Meeting will be elected as directors to serve until the next annual meeting of shareholders and until their successors are duly elected and qualified. Approval of Proposal 2 requires the affirmative vote of a majority of the voting power present or represented by proxy and voting at the Annual Meeting.

Can I change my vote after I have voted?

You may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting. You may vote again on a later date via the Internet or by telephone (only your latest Internet or telephone proxy submitted prior to the Annual Meeting will be counted), by signing and returning a new proxy card or vote on instruct form with a later date, or by attending the Annual Meeting and voting in person. However, your attendance at the Annual Meeting will not automatically revoke your proxy unless you vote again at the Annual Meeting or specifically request that your prior proxy be revoked by delivering to the Company's Secretary at 3330 Cumberland Blvd SE, Suite 700, Atlanta, Georgia 30339 a written notice of revocation prior to the Annual Meeting.

Is my vote confidential?

Proxy instructions, ballots, and voting tabulations that identify individual shareholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties, except:

| · | as necessary to meet applicable legal requirements; |

| · | to allow for the tabulation and certification of votes by Ken Gayron, the Company’s CFO, who is serving as the Inspector of Election; and |

| · | to facilitate a successful proxy solicitation. |

Occasionally, shareholders provide written comments on their proxy cards, which may be forwarded to the Company's management and the Board.

How can I attend the Annual Meeting?

Attendance at the Annual Meeting is limited to shareholders. Admission to the Annual Meeting will be on a first-come, first-served basis. Registration will begin at 11:00 a.m. Eastern Time, and each shareholder may be asked to present valid picture identification such as a driver's license or passport and proof of stock ownership as of the Record Date. The use of cell phones, PDAs, pagers, recording and photographic equipment and/or computers is not permitted in the meeting rooms at the Annual Meeting.

Where can I find the voting results of the Annual Meeting?

The preliminary voting results will be announced at the Annual Meeting. We will include the voting results in a Form 8-K, which will be filed with the Securities and Exchange Commission within four business days following the conclusion of the Annual Meeting.

What is the deadline to propose actions for consideration or to nominate individuals to serve as directors at the 2017 annual meeting of shareholders?

Requirements for Shareholder Proposals to be Considered for Inclusion in the Company's Proxy Materials. Shareholder proposals to be considered for inclusion in the proxy statement and form of proxy relating to the 2017 annual meeting of shareholders must be received no later than February 1, 2017. In addition, all proposals must comply with Rule 14a-8 of the Securities Exchange Act of 1934 (the “Exchange Act”), which lists the requirements for the inclusion of shareholder proposals in company-sponsored proxy materials. Shareholder proposals must be delivered to the Company’s General Counsel and Secretary by mail at The Ryan Law Group, LLP, 14 East 4th Street, Suite 406, New York, NY 10012.

Requirements for Shareholder Proposals to be brought before the 2017 Annual Meeting of Shareholders. Notice of any director nomination or other proposal that you intend to present at the 2017 annual meeting of shareholders, but do not intend to have included in the proxy statement and form of proxy relating to the 2017 annual meeting of shareholders, must be delivered to the Company's General Counsel and Secretary by mail at The Ryan Law Group, LLP, 14 East 4th Street, Suite 406, New York, NY 10012, not later than April 27, 2017. In addition, your notice must set forth the information required by the Company's bylaws with respect to each director nomination or other proposal that you intend to present at the 2017 annual meeting of shareholders. Please read the bylaws carefully to ensure that you comply with all requirements.

Where is the Company’s principal executive office located and what is the Company's main telephone number?

The Company's principal executive offices are located at 3330 Cumberland Blvd SE, Suite 700, Atlanta, Georgia 30339 and the Company's main telephone number is (770) 693-5950.

What are the Company’s Fiscal Years?

As used in this Proxy Statement, “FY 2014” means the Company’s fiscal year ended December 31, 2014. “FY 2015” means the Company’s fiscal year ending December 31, 2015. “FY 2016” means the Company’s fiscal year ending December 31, 2016.

How are the executive-level job titles abbreviated herein?

| • | As used in this Proxy Statement, “CEO” means Chief Executive Officer. “CFO” means Chief Financial Officer. “CRO” means Chief Revenue Officer. “CMO” means Chief Marketing Officer. “CITO” means Chief Innovation and Technology Officer. “CTO” means Chief Technology Officer. “NEO” means the named Executive Officers which consist of the CEO, CFO, CRO, CMO, CITO and CTO. |

PROPOSAL ONE: ELECTION OF DIRECTORS

The Bylaws of the Company provide that the Board, or the “Board,” shall consist of not less than three nor more than ten directors and that the number of directors, subject to the foregoing limits, shall be determined from time to time by the Board. The Board currently has seven directors and has agreed to fix the number of directors at eight. At the Annual Meeting eight directors, who will constitute the Company’s entire Board of Directors, are to be elected to hold office until the next annual meeting and until their respective successors have been duly elected and qualified. The Board has designated the persons listed below to be nominees for election as directors, and each nominee has consented to being named in this Proxy Statement and to serve if elected. The Company has no reason to believe that any of the nominees will be unwilling or unable to serve; however, should any nominee become unavailable for any reason, the Board may designate a substitute nominee. The proxy holders intend (unless authority has been withheld) to vote for the election of the Company’s nominees.

The Board has determined that Tony G. Holcombe, Brian Igoe, Sherrie G. McAvoy, Jerry A. Rose and Eric Singer constituting a majority of the Board members if elected, are “independent directors” as that term is defined in the NASDAQ listing standards and that Stratton J. Nicolaides, Andrew J. Ryan and Marc Zionts are not “independent directors” under the NASDAQ listing standards. The Director nominees for election at the 2016 Annual Meeting were recommended by the Nominating and Corporate Governance Committee and were approved by a majority of the independent members of the Board.

Listed below are the Company’s eight director nominees five of whom are nominated for re-election at the Annual Meeting and three for the first time. All of the directors elected at the Annual Meeting will serve a one-year term expiring at the next annual meeting of shareholders.E. James Constantine, who has served as a director since 2008, will not be standing for re-election.

| Name | Age | Position | Director Since |

| Tony G. Holcombe | 60 | Director | 2011 |

| Brian Igoe | 60 | | Not presently director |

| Sherrie G. McAvoy | 56 | Director | 2013 |

| Stratton J. Nicolaides | 62 | Chairman of the Board | 1999 |

| Jerry A. Rose | 57 | Director | 2013 |

| Andrew J. Ryan | 57 | Director | 1996 |

| Eric Singer | 42 | Director | 2016 |

| Marc Zionts | 54 | Director and Chief Executive Officer | 2015 |

Set forth below is a brief description of the principal occupation and business experience of each of our nominees for director, as well as the summary of our views as to the qualifications of each nominee to serve on the Board and each board committee of which he or she is a member. Our views are formed not only by the current and prior employment and educational background of our directors, but also by the Board’s experience in working with their fellow directors. All but two directors have served on the Board for at least three years, and certain nominees have ten or more years of experience on our Board. Accordingly, the Board has had significant experience with the incumbent directors and has had the opportunity to assess the contributions that the directors have made to the board as well as their industry knowledge, judgment and leadership capabilities.

Tony G. Holcombewas appointed as a director in 2011. Currently, Mr. Holcombe is Vice Chairperson of the Board of Syniverse, where he served as that company’s President and CEO from 2006 to until his retirement in 2011. He has been a member of the Syniverse Board since 2003. He also serves on the Nominating and Governance Committee of Syniverse. During his time as President and CEO of Syniverse, Mr. Holcombe's many accomplishments included diversifying the business through several key acquisitions; defining a strategic vision that transformed Syniverse from a North American roaming and clearing house provider to a leading global provider of technology and business services to the mobile industry; and solidifying The Carlyle Group as the company's single investor in January 2011 for $2.6 billion. Before becoming Syniverse's President and CEO, Mr. Holcombe served as president of Emdeon Corp., formerly WebMD, and as president of Emdeon Business Services. Mr. Holcombe has more than 20 years of executive-level experience in the transaction processing and technology services industry. He was CEO of Valutec Card Solutions and served in various executive positions at Ceridian Corporation, including EVP of Ceridian Corporation, president of Ceridian Employer Employee Services and president of Comdata. Mr. Holcombe

received his bachelor’s degree from Georgia State University, where he currently serves as an Advisor for the Robinson College of Business. Mr. Holcombe’s wide-ranging business experience provides valuable knowledge to our Audit Committee and as the Chairperson of the Compensation Committee.

Brian Igoe has been the Chief Investment Officer of the Rainin Group, Inc., a family office responsible for the investments of the Kenneth Rainin Foundation, since July 2008. Previously, Mr. Igoe was a Managing Director of Pequot Capital Management and served as the Chief Investment Officer for the firm's emerging managers strategy from 2006 to 2008. Prior to this role, Mr. Igoe was one of the founders of Nyes Ledge Capital Management, a hedge fund of funds firm from 2004 to 2005. Before this role, Mr. Igoe was a managing member of Igoe Capital Partners, LLC, where he founded a hybrid public/private equity investment firm with a primary focus on the small and micro-cap sectors. Previously, Mr. Igoe was a Managing Director at Cambridge Associates, Inc. where he served as the Director of the Marketable Securities Manager Research Group. Mr. Igoe currently serves as a member of the Board of Directors of Electro Dunas SA, a Peruvian electric utility distribution company. Mr. Igoe graduated with a B.A. in Economics from Yale University and received his M.B.A. from the Tuck School of Business at Dartmouth. Mr. Igoe has been nominated for election to our board of directors as an independent director in accordance with the terms of the agreement with Viex Capital Advisors and certain of its affiliates described below and because he possesses particular knowledge and experience in finance and capital structure, strategic planning and leadership.

Sherrie G. McAvoy was appointed to the board in 2013. She spent her 31 year career at Deloitte & Touche LLP, a global accounting, auditing and professional services firm. During her last five years with Deloitte, Ms. McAvoy served as the lead audit partner supervising audits of both public and private companies in a diverse group of industries including retail, leisure and technology services. She also held regional and national leadership positions in the retail and governance practices. Ms. McAvoy brings to our Board diversified business experience as well as deep expertise on accounting, auditing, internal controls, risk management, corporate compliance and ethics, and corporate governance. Ms. McAvoy received her Bachelor of Science degree from The Pennsylvania State University in 1980. She is a Certified Public Accountant and a member of The American Institute of Certified Public Accountants. Ms. McAvoy served as an advisor to The Institute for Excellence in Corporate Governance at The University of Texas at Dallas from its inception in 2002 through 2011. We believe that Ms. McAvoy's expertise garnered over 31 years with Deloitte brings a valuable perspective to our Board on accounting, financial and internal control matters. She is Chairperson of the Audit Committee and a member of the Nominating and Governance Committee and the Compensation Committee.

Stratton J. Nicolaides served as CEO of the Company from April 2000 to September 2015, and served as COO from April 1999 until March 2000, and as Chairman of the Board since December 1999. In 2007, Mr. Nicolaides began serving as a director of the Taylor Hooton Foundation, a non-profit organization formed to fight steroid abuse by America's youth. With his years of experience in the wireless communication industry, including more than fifteen years of senior management experience at Numerex , we believe that Mr. Nicolaides' deep industry knowledge and expertise in operations, product development, competitive intelligence and corporate strategy provides the Board with significant insight across a broad range of issues critical to our business.

Jerry A. Rose was appointed to the board in 2013 and brings a successful track record of leading and driving growth in key businesses such as General Electric (GE) and United Technologies Corporation (UTC). He was a Vice President of Product Management of GE Security, Inc. since June 2007 until 2010 and was instrumental in the sale of GE Security to UTC. In 2010, Mr. Rose joined UTC as Vice President of Global Product Management. Mr. Rose held several global leadership positions during his 26 years at GE including Executive Officer roles in GE's Appliances, Lighting and Security businesses. We believe his product development and management knowledge and his leadership in global strategy and integration is a valuable addition to the Board. Mr. Rose currently serves as Chair of the Nominating and Governance Committee and as a member of the Compensation Committee.

Andrew J. Ryan has served as a director of the Company since May 1996. Mr. Ryan currently practices law with The Ryan Law Group (TRLG) a law firm he founded in May 2014. Prior to TRLG, he practiced law with the firm of Salisbury & Ryan since August 1994. Mr. Ryan serves as the Board designee of Gwynedd Resources, Ltd. in accordance with its contractual right to designate a member of the Board. Mr. Ryan's wide-ranging legal practice and breadth of experience gained with his more than 20 years of experience with the Company has been of particular value in assisting the Board with evaluating business and strategic issues. Mr. Ryan provides the Board with significant operational insights regarding strategies and corporate governance issues.

Eric Singer was appointed as Director and a member of the Audit and Nominating and Governance Committee in March of 2016. Mr. Singer serves as the designee of VIEX Capital Advisors, LLC pursuant to the agreement described below. Mr. Singer has served as the managing member of each of VIEX GP, LLC, the general partner of VIEX Opportunities Fund, LP, and various VIEX Opportunities Funds, as well as certain other investment funds since May 2014. Mr. Singer served as co-managing member of Potomac Capital Management III, LLC from March 2012 until September 2014, and General Partner of several of its related entities from May 2009 until September 2014. From July 2007 to April 2009, Mr. Singer was a senior investment analyst at Riley Investment Management. He has served on the board

of directors of TigerLogic Corporation since January 2015, IEC Electronics Corp. since February 2015, and YuMe, Inc. since June 2016. Singer previously served as a director at Meru Networks, Inc. from January 2014 until January 2015, PLX Technology, Inc. from December 2013 until its sale in August 2014, Sigma Designs, Inc. from August 2012 until December 2013, including as its Chairman of the Board from January 2013 until December 2013, and Zilog Corporation from August 2008 until its sale in February 2010. Mr. Singer holds a B.A. from Brandeis University. Mr. Singer brings to the Board experience as a director at other public companies and significant financial and investment experience, including capital allocation and transactional experience.

Marc Zionts was appointed Chief Executive Officer of Numerex Corp. in September of 2015. Mr. Zionts, a telecom executive and entrepreneur over three decades, focuses on developing emerging technologies and services companies in high growth markets. Mr. Zionts has previously led 6 companies since 1987, resulting in 5 trade sales and 1 IPO. Most recently, Mr. Zionts was the President and CEO of Aicent, sold to Syniverse. Prior to starting his first company in 1987, Mr. Zionts worked for GTE (now Verizon). Mr. Zionts earned his Bachelor’s degree and Master’s degree in Management from the Georgia Institute of Technology and remains active at Georgia Tech as an Alumni Mentor. Mr. Zionts is also an Independent Board Director for Pivot 3, based in Austin, TX, TEOCO, a TA Associates portfolio company, based in Fairfax, VA, and Friends of the Earth, a Washington, D.C. based environmental group. Mr. Zionts provides insight to the Board regarding day-to-day operations, customer information, competitive intelligence, general trends in our industry as well as financial results.

Required Vote

If a quorum is present, the nominees receiving the highest number of affirmative votes of the shares present or represented by proxy and entitled to vote on the matter at the Annual Meeting shall be elected as directors. An abstention, withholding of authority to vote, or broker non-vote will have no effect on the vote and will not be counted in determining whether any proposal has received the required shareholder vote.

Recommendation

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF HOLCOMBE, IGOE, MCAVOY, NICOLAIDES, ROSE, RYAN, SINGER AND ZIONTS FOR ELECTION TO THE BOARD OF DIRECTORS.

* * *

PROPOSAL TWO: RATIFICATION OF INDEPENDENT ACCOUNTANTS

The Board, upon the recommendation of the Audit Committee, has selected the firm of BDO USA, LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2016. This nationally known firm has no direct or indirect financial interest in the Company.

Although not required to do so, the Board is submitting the appointment of BDO USA, LLP as the Company’s independent registered public accounting firm for FY 2016 for ratification by the shareholders at the Annual Meeting as a matter of good corporate governance. If a majority of the votes cast in person or by proxy at the Annual Meeting is not voted for ratification, the Board will reconsider its appointment of BDO USA, LLP as the Company’s independent registered public accounting firm for the current fiscal year. Even if the selection is ratified, the Audit Committee, in its discretion, may direct the appointment of different independent registered public accounting firm at any time during the year if they determine that such a change would be in the best interests of the Company and its shareholders.

A representative of BDO USA, LLP will be present at the Annual Meeting and will have the opportunity to make a statement if he or she desires to do so. It is anticipated that such representative will be available to respond to appropriate questions from shareholders.

Change in Accountants

As previously reported, on February 4, 2016 Grant Thornton LLP (“Grant Thornton”) notified the Audit Committee of its decision not to stand for re-appointment following completion of its audit services for 2015.

The audit reports of Grant Thornton on the Company’s financial statements for the years ended December 31, 2014 and December 31, 2015 did not contain an adverse opinion or disclaimer of opinion, nor were such reports qualified or modified as to uncertainty, audit scope or accounting principles.

During the Company’s fiscal years ended December 31, 2015 and December 31, 2015, there were no disagreements with Grant Thornton on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Grant Thornton, would have caused Grant Thornton to make reference to the subject matter of the disagreements in connection with its reports for such periods.

During each of the two fiscal years ended December 31, 2015 and December 31, 2014, and the subsequent interim period through April 5, 2016, there was no “ reportable event,” as that term is described in Item 304(a)(1)(v) of Regulation S-K related to a material weakness in our internal control over financial reporting, except that management's assessment of the Company's internal control over financial reporting identified a material weakness as of December 31, 2015 related to effective monitoring and oversight of controls as it relates to (i) the source data, assumptions and projections utilized pertaining to the evaluation process for impairment of goodwill and other intangible assets and (ii) controls over the completeness, existence, accuracy in its accounting for capitalized internally developed software costs.

During the fiscal years ended December 31, 2015 and 2014, and the subsequent interim period through the date of its appointment, neither the Company nor anyone acting on its behalf has consulted with BDO USA, LLP with respect to (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements, and neither a written report nor oral advice was provided to the Company that BDO USA, LLP concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing, or financial reporting issue or (ii) any matter that was either the subject of a “disagreement” or “reportable event” within the meaning of Item 304(a)(1) of Regulation S-K.

Required Vote

Ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for the FY 2016 requires the affirmative “FOR” vote of a majority of the votes cast on the proposal. Unless marked to the contrary, proxies received will be voted “FOR” ratification of the appointment of BDO USA, LLP.

Recommendation

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF BDO USA, LLP AS INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR FY 2016.

***

MATTERS CONCERNING THE COMPANY’S REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee Charter contains procedures for the pre-approval of audit and non-audit services (the “Pre-Approval Policy”) to ensure that all audit and permitted non-audit services to be provided to the Company by the Company’s independent registered public accounting firm have been pre-approved by the Committee. Specifically, the Committee pre-approved the use of the Company’s independent registered public accounting firm for specific audit and non-audit services, except that pre-approval is not required if the “de minimis” provision of Section 10A(i)(1)(B) of the Exchange Act are satisfied. If a proposed service has not been pre-approved pursuant to the Pre-Approval Policy, then it must be specifically pre-approved by the Committee before it may be provided. For additional information concerning the Committee and its activities with the Company’s independent registered public accounting firm, see “Corporate Governance — Audit Committee” and “Report of the Audit Committee” in this proxy statement.

BDO USA, LLP was first retained by the Company to perform audit services on April 5, 2016. Prior to April 5, 2016, BDO USA, LLP did not perform any audit or non-audit services for the Company.

During FY 2015 and FY 2014, Grant Thornton provided services to the Company in the following categories and amounts:

Audit and Other Fees | | FY 2015 ($) | | | FY 2014 ($) | |

| | | | | | | |

| Audit Fees | | $ | 895,259 | | | $ | 741,190 | |

| Audit-Related Fees | | $ | — | | | $ | — | |

| Tax Fees | | $ | — | | | $ | — | |

| All Other Fees | | $ | — | | | $ | — | |

For FY 2015 and FY 2014, “Audit Fees” consist of fees for professional services associated with the annual consolidated financial statements audit, review of the interim consolidated financial statements included in the Company’s quarterly reports on Form 10-Q, and regulatory filings. Audit fees for both years also include fees for professional services rendered for the audits of management’s assessment of the effectiveness of internal controls over financial reporting and Sarbanes-Oxley compliance. The Audit Committee reviews each non audit service to be provided and assesses the impact of the service on the independent registered public accounting firm’s independence.

REPORT OF THE AUDIT COMMITTEE

The Board has adopted a written charter for the Audit Committee. The Committee’s job is one of oversight as set forth in the Audit Committee Charter. It is not the duty of the Committee to prepare the Company’s financial statements, to plan or conduct audits, or to determine that the Company’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles. The Company’s management is responsible for preparing the Company’s financial statements and for maintaining internal control. The independent registered public accounting firm is responsible for auditing the financial statements and for expressing an opinion as to whether those audited financial statements fairly present the financial position, results of operations, and cash flows to the Company in conformity with generally accepted accounting principles.

The Committee has reviewed and discussed the Company’s audited consolidated financial statements with management and with Grant Thornton LLP, the Company’s independent registered public accounting firm for FY 2015.

The Committee has discussed with Grant Thornton the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA,Professional Standards,Vol. 1, AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T.

The Committee also has received and reviewed the written disclosures and the letter from Grant Thornton required by applicable requirements of the Public Company Accounting Oversight Board regarding Grant Thornton communications with the Audit Committee concerning independence, and has discussed with Grant Thornton its independence.

Based on the review and discussions referred to above, the Committee has recommended to the Board that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10K for FY 2015 for filing with the Securities and Exchange Commission (the “SEC”).

| | | THE AUDIT COMMITTEE |

| | | Sherrie G. McAvoy, Chairperson Tony Holcombe |

| | | E. James Constantine |

In accordance with and to the extent permitted by applicable law or regulation, the information contained in the Report of the Audit Committee and the Audit Committee Charter shall not be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and shall not be deemed to be soliciting material or to be filed with the SEC under the Exchange Act.

CORPORATE GOVERNANCE

Role of the Board

It is the duty of the Board to oversee the Company's CEO and other senior management in the competent and ethical operation of the Company on a day-to-day basis and to assure that the long-term interests of the shareholders are being served. To satisfy this duty, the directors take a proactive, focused approach to their position, and set standards to ensure that the Company is committed to business success through maintenance of high standards of responsibility and ethics. In FY 2015, the full Board held 19 meetings inclusive of the annual meeting of shareholders.

Director Independence

The Board has determined that all Board members, excluding Messrs. Nicolaides, Ryan, and Zionts, are independent under applicable NASDAQ and SEC rules. Furthermore, the Board has determined that each member of each of the committees of the Board is independent within the meaning of NASDAQ’s and the SEC’s director independence standards. In making this determination, the Board solicited information from each of the Company’s directors regarding several factors, including whether such director, or any member of his immediate family, had a direct or indirect material interest in any transactions involving the Company, was involved in a debt relationship with the Company or received personal benefits outside the scope of such person’s normal compensation. The Board considered the responses of the Company’s directors, and independently considered all other material information relevant to each such director in determining such director’s independence under applicable SEC and NASDAQ rules.

Board Leadership Structure

The Board does not have a policy regarding the separation of the roles of CEO and Chairperson of the Board, as the Board believes it is in the best interests of the Company to make that determination based on the position and direction of the Company and the membership of the Board. The Board believes at this time maintaining separate Chairperson and CEO roles and having an independent lead director is in the best interest of shareholders. The Board believes this arrangement provides the appropriate balance between strategy development and independent oversight of management. In addition, much of the work of the Board is conducted through its committees. The Board has three standing committees — Audit, Compensation, and Corporate Governance and Nominating — as further described below. Each of the Board committees is comprised solely of independent directors and has a separate chair. One of the key responsibilities of the Board is to develop the strategic direction for the Company and provide management oversight for the execution of that strategy.

Board Role in Risk Oversight

The responsibility for the day-to-day management of risk lies with senior management while the Board, and each of the Board committees, are responsible for overseeing the risk management process and ensuring that it is properly designed, well-functioning and consistent with the Company’s overall corporate strategy. The role of the Board in the Company’s risk oversight process includes reviewing the Company’s key business risks, understanding how these risks could affect the Company, and receiving regular reports from members of senior management on areas of material risk to the Company, including operational, financial, legal, investment and liquidity, and strategic and reputational risks.

Compensation Risk

Our Compensation Committee has considered the various elements of the Company’s compensation program and does not believe it is reasonably likely to have a material adverse effect on the Company.

We structure our pay to consist of both fixed and variable compensation. The fixed (or salary) portion of compensation is designed to provide a steady income regardless of our stock price performance or short-term business performance so that executives and managers have a threshold level of financial security and are not pressured to produce short-term gains at the expense of long-term business results or through means at odds with our corporate values.

The variable (the short-term performance award or bonuses and equity) portions of compensation are designed to reward both short- and long-term corporate performance in a balanced manner. Our short-term performance awards for all Named Executive Officers and most other executives are based on the balanced achievement of annual adjusted EBITDA, (EBITDA refers to earnings before interest, taxes, depreciation and amortization) and revenue goals. Further, short-term incentive awards are capped at 1.5 times targeted payouts and are only paid in the event of exceptional business results.

Long-term performance is primarily rewarded through a balanced grant of stock options and restricted share units. Stock options only provide value if our stock price increases over time while restricted share units provide some value to recipients throughout any period of

stock price volatility. Historically, the Company has also granted stock appreciation rights and restricted shares which have much the same financial impact to executives as stock options and restricted share units. Equity grants vest over a four year period to further encourage retention and a longer-term perspective.

We feel that that our balanced mix of cash and equity compensation, revenue and profitability, fixed and variable pay and capped bonus payouts provide sufficient incentives to keep executives focused on those activities that produce long-term shareholder growth while not creating incentives for them to take unnecessary or excessive risks.

Stock Ownership and Holding Requirements

In March 2015, we instituted a named executive officer stock ownership policy to more closely align the interests of our NEOs with those of our stockholders. The stock ownership policy requires the CEO to own stock worth at least 3.0 times his base salary and all other NEOs to own stock worth at least 1.0 times their base salary. NEOs have 5 years from the date of adoption of the policy to meet their respective stock ownership guideline.

Compensation Claw Back Policy

In March, 2015, we adopted a compensation “claw back” policy applying to NEOs. In the event of a material restatement of the Company’s financial results, the Board of Directors, after considering the facts and circumstances of the restatement, may take action against the NEO including recoupment of all or part of any compensation paid to the NEO that was based up on the achievement of the financial results that were subsequently restated.

Board Committees

The Board has a standing Audit Committee (the “Audit Committee”), Compensation Committee (the “Compensation Committee”), and Nominating and Corporate Governance Committee (the “Nominating Committee”). The Board has determined that all committee chairs and committee members are independent under the applicable NASDAQ and SEC rules. The members of each of the Company’s committees during FY 2015 are identified in the table below. Mr. Singer was appointed as a member of the Nominating and Audit committees in connection with the Company’s agreement with VIEX on March 30, 2016.

| Name | Audit Committee | Compensation

Committee | Nominating

Committee |

| E. James Constantine | * | | * |

| Tony G. Holcombe | * | Chairperson | |

| Sherrie G. McAvoy | Chairperson | * | * |

| Stratton J. Nicolaides | | | |

| Jerry A. Rose | | * | Chairperson |

| Andrew J. Ryan | | | |

| Eric Singer | * | | * |

Audit Committee

The Board determined that Sherrie McAvoy, Chairperson of the Audit Committee during FY 2015, is an “audit committee financial expert” as defined by the SEC. The principal functions of the Audit Committee are to: (a) assist in the oversight of the integrity of the Company’s financial statements, the Company’s internal controls related to compliance with legal and regulatory requirements, the qualifications and independence, as well as the performance, of the Company’s independent registered public accounting firm; (b) approve the selection, appointment, retention and/or termination of the Company’s independent registered public accounting firm, as well as approving the compensation thereof; and (c) approve all audit and permissible non-audit services provided to the Company and certain other persons by such independent registered public accounting firm. The Audit Committee Charter is available on the Company’s website athttp://www.numerex.com/about/corporate-governance.

Compensation Committee

The Compensation Committee is responsible primarily for reviewing the compensation arrangements for the Company's executive officers, including the CEO, and for formulating the Company's equity compensation plans. The Compensation Committee Charter is available on the Company’s website athttp://investor.numerex.com/corporate-governance.com. All of the members of the Compensation Committee have been determined by the Board to be independent under applicable NASDAQ and SEC rules.

Nominating and Corporate Governance Committee

The Nominating Committee assists the Board in identifying qualified individuals to become directors, determines the composition of the Board and its committees, monitors the process to assess the Board's effectiveness and helps develop and implement the Company's Corporate Governance Guidelines. The Nominating Committee reviews the performance of the Board, its committees and individual members of the Board. The Nominating Committee also considers nominees for election as directors proposed by shareholders. The Nominating Committee Charter specifies that the composition of the Board should reflect experience in the following areas: finance, compensation, sales and marketing, technology and production. The Nominating Committee Charter is available on the Company’s website athttp://investor.numerex.com/corporate-governance.cfm.

Attendance at Meetings

Each director attended at least 80% of the meetings of the Board and its committees of which he/she was a member. Directors are encouraged, but not required, to attend the Company’s annual meetings of shareholders. Although no director is required to do so, three of the Company’s directors attended the annual meeting of shareholders on June 26, 2015. Non-management members of the Board meet in executive sessions, absent the Company’s employee director, following regularly scheduled in-person meetings of the Board.

Executive Sessions

Executive sessions of the independent directors are held at least once each year following regularly scheduled in-person meetings of the Board. These executive sessions include only those directors who meet the independence requirements promulgated by NASDAQ, and Mr. Holcombe, as the Lead Director of the Board, is responsible for chairing these executive sessions. The Board’s independent directors attended four executive sessions in FY 2015.

Code of Ethics

The Company has a Code of Ethics and Business Conduct (the “Code”) that applies to the Company’s directors, officers, and employees, including the Company’s NEOs. The Code is available on the Company’s website athttp://www.numerex.com/about/corporate-governance. We will disclose any future amendments to, or waivers from, provisions of these ethics policies and standards on our website as promptly as practicable, as may be required under applicable SEC and NASDAQ rules.

Right to Designate Director

On March 30, 2016, the Company entered into an agreement with Vertex Opportunities Fund, LP – Series One, Vertex Special Opportunities Fund II, LP, Vertex Special Opportunities Fund III, LP, Vertex GP, LLC, Vertex Special Opportunities GP II, LLC, Vertex Special Opportunities GP III, LLC, Vertex Capital Advisors, LLC, and Eric Singer (collectively, “VIEX”) under which the Company agreed:

| · | to increase the number of members of the Board to eight and for a period until the date that is ten business days prior to the deadline for the submission of shareholder nominations of individuals for election to the Board at the 2017 Annual Meeting (the “Standstill Period”) and not to recommend or take action to increase the size of the Board to more than eight directors; |

| · | to appoint Eric Singer to fill the vacancy created thereby and elect Mr. Singer to the Audit Committee and the Nominating and Corporate Governance Committee; |

| · | to nominate Brian Igoe, Eric Singer, Stratton Nicolaides, Marc Zionts, Tony Holcombe, Sherrie G. McAvoy, Jerry A. Rose, and Andrew Ryan (the “2016 Nominees”) for election to the Board at the 2016 Annual Meeting; and |

| · | if Eric Singer, Brian Igoe, or any replacement director for Eric Singer or Brian Igoe is unable to serve as a director during the Standstill Period then VIEX will be given the right to recommend a substitute person to the Board, provided that VIEX, at the time such individual is unable to serve as a director, beneficially owns in the aggregate at least 5% of the Company’s then outstanding Class A Common Stock (Common Stock), such substitute person is independent pursuant to the SEC and NASDAQ listing standards, and such substitute person is not an Affiliate or Associate of VIEX. |

The Company previously entered into an agreement providing Gwynedd Resources Ltd. (Gwynedd) the right to designate one director to the Board. Additionally, if the Board consists of more than seven directors, Gwynedd, at its option, may designate one additional director. Any designee’s appointment will be subject to the exercise by the Board of its fiduciary duties and the approval of the Company’s shareholders upon the expiration of any appointed term at the next annual meeting of shareholders. Gwynedd waived its right to appoint an additional director during the Standstill Period. Gwynedd’s right to designate a director will cease at such time as Gwynedd’s equity interest in the Company drops below 10% of the outstanding shares of Common Stock. Mr. Ryan currently serves as Gwynedd’s sole designee on the Board. In connection with the Company’s agreement with VIEX, Gwynedd agreed to vote all its shares of Common Stock in favor of the election of the 2016 Nominees.

Communications with the Board of Directors

Any shareholder who wishes to send any communications to the Board or a specific director should deliver such communications to the General Counsel and Secretary of the Company at 3330 Cumberland Blvd SE, Suite 700Atlanta, Georgia 30339 who will forward appropriate communications to the Board. Inappropriate communications include correspondence that is unrelated to the operation of the Company or the Board, is inappropriate for Board consideration, such as advertisements or other commercial communications, or is threatening or otherwise offensive. The Company’s General Counsel and Secretary may consult with other officers of the Company, counsel, and other advisers as appropriate, in making this determination.

Consideration of Director Nominees

The Nominating Committee will consider nominees for director recommended by a shareholder submitted in accordance with the procedure set forth in the Company’s Bylaws. In general, the procedure set forth in the Company’s Bylaws provides that a notice relating to the nomination must be timely given in writing to the: Secretary of the Company, Numerex Corp, 3330 Cumberland Blvd SE, Suite 700 Atlanta, Georgia 30339. To be timely, the notice must have been delivered by the 90th day prior to the anniversary of the prior year’s annual meeting. Such notice must include all information relating to such person that is required to be disclosed in solicitations of proxies for the election of directors, including information relating to the business experience and background of the potential nominee, and certain information with respect to the nominating shareholder and any persons acting in concert with the nominating shareholder. Any such recommendation must also be accompanied by a written consent of the individual to stand for election if nominated by the Board and to serve if elected by the shareholders.

The Committee generally identifies potential nominees through its network of contacts, and may also engage, if it deems appropriate, a professional search firm. The Committee meets to discuss and consider such candidates’ qualifications and then chooses director candidates by majority vote. There are no differences in the manner in which the Committee evaluates potential nominees for director based on whether such potential nominees are recommended by a shareholder or by any other source. The Committee does not have specific, minimum qualifications for nominees and has not established specific qualities or skills that it regards as absolutely necessary for one or more of the Company’s directors to possess (other than any qualities or skills that may be required by applicable law, regulation or listing standard). The Committee’s Charter identifies diversity as a consideration with regard to the identification of director nominees, and the Committee strives to nominate directors with a variety of complementary skills such that, as a group, the Board will possess an appropriate diversity of professional experience, education, knowledge, skills, and abilities to oversee the Company's businesses. Further to the foregoing, in evaluating a person as a potential nominee to serve as a Director of the Company, the Committee considers the following factors, among any others it may deem relevant:

| · | whether or not the person has any relationships that might impair his or her independence, such as any business, financial or family relationships with Company management, Company service providers or their affiliates; |

| · | whether or not the person serves on boards of, or is otherwise affiliated with, competing organizations; |

| · | whether or not the person is willing to serve, and willing and able to commit the time necessary for the performance of the duties of a Director of the Company; |

| · | as specifically provided in the Committee’s Charter, whether the nominee has experience in one or more of the following areas; finance, compensation, technology, sales and marketing, and production; and |

| · | the character and integrity of the person. |

Compensation Committee Interlocks and Insider Participation

Messrs. Holcombe, Rose and Ms. McAvoy served on our Compensation Committee during FY 2015. No members of the Committee during FY 2015 served as an officer, former officer, or employee of the Company or had a relationship requiring disclosure under “Related Person Transactions.”

During FY 2015, none of our executive officers served as:

| · | a member of the Compensation Committee (or other committee performing equivalent functions or, in the absence of any such committee, the entire Board) of another entity, one of whose executive officers served on our Compensation Committee; |

| · | a director of another entity, one of whose executive officers served on our Compensation Committee; or |

| · | a member of the Compensation Committee (or other committee performing equivalent functions or, in the absence of any such committee, the entire Board) of another entity, one of whose executive officers served as a director on our Board. |

DIRECTOR COMPENSATION

Compensation of Directors – FY 2015

The Board uses a combination of cash and stock-based incentives to attract and retain qualified candidates to serve as directors. In determining director compensation, the Board considers the significant amount of time required of our directors in fulfilling their duties, as well as the skill and expertise of our directors. The Compensation Committee periodically reviews director compensation with the assistance of our independent compensation consultant and recommends to the Board the form and amount of compensation to be provided.

The annual retainer fee for directors is $25,000 plus additional fees for participation on committees of the Board as follows: $6,500 for the Lead Director, Compensation Committee Chairperson, and Nominating Committee Chairperson, $10,000 for the Audit Committee Chairperson, and $5,000 for Audit, Compensation, Nominating and Executive Committee members. Fees are paid quarterly. Directors also receive reimbursement of expenses incurred in attending meetings. Non-employee directors may elect to have a portion or all of their annual fees paid in shares of stock having a value equivalent to the cash amount at the end of the fiscal quarter. One director, Ms. McAvoy, has elected to receive stock for a portion of her compensation in lieu of cash. All of the other non-employee directors elected to have all FY 2015 annual fees paid in cash.

In addition to the fees discussed above, each non-employee director receives an award of restricted stock units (“RSUs”) with a targeted value of $125,000 on the date of the grant. On July 29, 2015, non-employee directors were awarded 15,100 RSUs that will vest on the first anniversary of the grant date and will be settled with shares of Common Stock.

The following table provides information concerning compensation paid by the Company to its non-employee directors for FY 2015. Mr. Nicolaides was not additionally compensated for his service as director.

| Name | | Fees Earned or Paid

in Cash ($)(1) | | | Stock Award

($)(2) | | | Options ($) | | | All Other Compensation ($) | | | Total ($) | |

| E. James Constantine | | | 35,000 | | | | 125,028 | | | | — | | | | — | | | | 160,028 | |

| Tony G. Holcombe | | | 43,000 | | | | 125,028 | | | | — | | | | — | | | | 168,028 | |

| Sherrie G. McAvoy | | | 45,000 | | | | 125,028 | | | | — | | | | — | | | | 170,028 | |

| Jerry A. Rose | | | 36,500 | | | | 125,028 | | | | — | | | | — | | | | 161,528 | |

| Andrew J. Ryan | | | 30,000 | | | | 125,028 | | | | — | | | | — | | | | 155,028 | |

| (1) | Includes annual fees and committee fees. Directors may elect to have a portion or all of their annual and committee fees paid in shares of the Common Stock. During FY 2015, Ms. McAvoy elected to have $10,000 of her fees paid in stock. |

| (2) | On July 29, 2015 each director was granted 15,100 RSUs of Common Stock with a grant date fair market value of $8.28 per share.These shares vest after one year. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of the Company’s common stock as of April 25, 2016, by (i) each person known by the Company to be the beneficial owner of more than 5% of the Common Stock, (ii) each director, director nominee, and named executive officer of the Company, and (iii) all current directors and executive officers of the Company as a group. Except as otherwise indicated below, the beneficial owners of the Common Stock listed below have sole investment and voting power with respect to such shares. The shares “beneficially owned” by an individual are determined in accordance with the definition of “beneficial ownership” set forth in the regulations of the SEC. Accordingly, they may include shares owned by or for, among other things, the spouse, minor children or certain other relatives of such individual, as well as other shares as to which the individual has or shares votes or investment power or has the right to acquire within 60 days after April 25, 2016.

| | | Shares Beneficially Owned (1) | |

| Name and Address of Beneficial Owner or Identity of Group | | (#) | | | (%) | |

| More Than 5% Shareholders | | | | | | | | |

Gwynedd Resources, Ltd. (2)

1011 Centre Road, Suite 322

Wilmington, DE 19805 | | | 2,947,280 | | | | 15.2 | % |

VIEX Capital Advisors LLC (3) 825 Third Ave, 33rd Floor

New York, NY 10022 | | | 1,881,394 | | | | 9.7 | % |

Kenneth Lebow (4)

The Lebow Family Revocable Trust

Santa Barbara, CA 93108 | | | 1,356,692 | | | | 7.0 | % |

Yorkmont Capital Partners, LP (5)

2313 Lake Austin Blvd, Suite 202

Austin, TX 78703 | | | 1,343,058 | | | | 6.9 | % |

Paul J. Solit (6)

Potomac Capital Partners, L.P.

825 Third Ave, 33rd Floor

New York, NY 10022 | | | 1,202,270 | | | | 6.2 | % |

| Directors and Executive Officers | | | | | | | | |

| E. James Constantine (7) | | | 83,556 | | | | * | |

| Vincent Costello | | | — | | | | — | |

| Louis Fienberg (8) | | | 192,192 | | | | * | |

| Richard A. Flynt (9) | | | 92,960 | | | | * | |

| Shu Gan | | | 2,000 | | | | * | |

| Kenneth Gayron (10) | | | — | | | | — | |

| Tony G. Holcombe (11) | | | 80,250 | | | | * | |

| Sherrie G. McAvoy (12) | | | 22,982 | | | | * | |

| Stratton J. Nicolaides (13) | | | 268,212 | | | | 1.4 | % |

| Sri Ramachandran | | | — | | | | — | |

| Jerry A. Rose (14) | | | 20,900 | | | | * | |

| Andrew J. Ryan (15) | | | 254,373 | | | | 1.3 | % |

| Eric Singer (3) | | | 1,881,394 | | | | 9.7 | % |

| Jeffrey Smith (16) | | | 327,584 | | | | 1.7 | % |

| Marc J. Zionts (17) | | | 144,097 | | | | * | |

| All Current Directors and Executive Officers as a group | | | 2,754,657 | | | | 14.1 | % |

| (1) | Percentage calculations are based on the 19,437,322 shares of the Company’s Common Stock, no par value, that were outstanding at the close of business on April 25, 2016; includes the subset of shares issuable upon the exercise of outstanding stock options and RSUs exercisable or vesting within 60 days after April 25, 2016. |

| (2) | The shareholders of Gwynedd Resources, Ltd. include various trusts for the benefit of Maria E. Nicolaides and her children for which Elizabeth Baxavanis, Mrs. Nicolaides’ mother-in-law, serves as trustee. The Gwynedd trusts beneficially own, directly or indirectly, 2,947,280 shares representing ownership of approximately 89% of the outstanding stock of Gwynedd. Mrs. Baxavanis disclaims beneficial ownership of all shares of Common Stock owned by Gwynedd. Mrs. Nicolaides disclaims beneficial ownership of 327,143 shares owned by Gwynedd that may be deemed to be beneficially owned by the other shareholders of Gwynedd, including trusts for the benefit of her children. |

| (3) | VIEX Capital Advisors LLC beneficially owns, directly or indirectly, an aggregate of 1,881,394 shares of Common Stock consisting of: (i) 399, 837 shares owned by VIEX Opportunities Fund LP - Series One (Series One), (ii) 1,259,908 shares owned by VIEX Special Opportunities Fund II, LP (VSO II), and (iii) 221,649 shares owned by VIEX Special Opportunities Fund III, LP (VSO III) Mr. Singer, by virtue of his position as managing member of each of the general partners of VIEX, Series One, VSO II, and VSO III may be deemed to beneficially own the shares owned directly by such entities. |

| (4) | According to Schedule 13D/A, filed jointly with the SEC on August 2, 2010, by Kenneth Lebow, et al (Lebow), Lebow beneficially owned 1,356,692 shares. |

| (5) | Based on information provided by Yorkmont Capital Partners, LP, Yorkmont Capital Management, LLC, and Graeme P. Rein in a Schedule 13G/A filed on January 8, 2016. According to the Schedule 13G/A. each of Yorkmont Capital Partners, LP, Yorkmont Capital Management, LLC, and Graeme P. Rein has sole voting and dispositive power over 1,339,158 shares of Common Stock and Graeme P. Rein has sole voting and dispositive power over 3,900 additional shares of Common Stock. |

| (6) | Based on information provided by Potomac Capital Partners, L.P., Paul J. Solit, Potomac Capital Management, LLC, and Potomac Capital Management, Inc. in a Schedule 13G/A filed on February 12, 2016. According to the Schedule 13G/A, each of Potomac Capital Partners, L.P., Potomac Capital Management, LLC, Potomac Capital Management, Inc. and Paul J. Solit has sole voting and dispositive power over 600,210 shares of Common Stock and Paul J. Solit has sole voting and dispositive power over 602,060 additional shares of Common Stock. |

| (7) | The subset of shares held by Mr. Constantine includes: (i) 59,556 shares of Common Stock and (ii) 24,000 shares of Common Stock issuable upon the exercise of stock options exercisable within 60 days of April 25, 2016, but does not include 15,100 nonvested RSUs that vest more than 60 days after April 25, 2016. |

| (8) | The subset of shares held by Mr. Fienberg includes: (i) 78,819 shares of Common Stock and (ii) 113,373 shares of Common Stock issuable upon the exercise of stock options exercisable within 60 days of April 25, 2016. Mr. Fienberg’s employment terminated effective October 31, 2015. |

| (9) | The subset of shares held by Mr. Flynt includes: (i) 5,310 shares of Common Stock, (ii) 4,900 RSUs vesting within 60 days of April 25, 2016, and (iii) 82,750 shares of Common Stock issuable upon the exercise of stock options exercisable within 60 days of April 25, 2016, but does not include 28,366 nonvested RSUs or stock options to acquire 46,050 shares that vest more than 60 days after April 25, 2016. Mr. Flynt’s service as the Company’s Chief Financial Officer ended effective March 7, 2016. |

| (10) | Mr. Gayron was appointed Chief Financial Officer effective March 7, 2016. |

| (11) | The subset of shares held by Mr. Holcombe includes 80,250 shares of Common Stock but does not include 15,100 nonvested RSUs that vest more than 60 days after April 25, 2016. |

| (12) | The subset of shares held by Ms. McAvoy includes 22,974 shares of Common Stock but does not include 15,100 nonvested RSUs that vest more than 60 days after April 25, 2016. |

| (13) | The subset of shares held by Mr. Nicolaides includes: (i) 136,830 shares of Common Stock, (ii) 4,750 RSUs vesting within 60 days of April 25, 2016, and (iii) 126,632 shares of Common Stock issuable upon the exercise of stock options exercisable within 60 days of April 25, 2016, but does not include 32,050 nonvested RSUs or stock options to acquire 56,300 shares of Common Stock that vest more than 60 days after April 25, 2016. Shares beneficially owned by Mr. Nicolaides also do not include the 2,947,280 shares of Common Stock owned by Gwynedd, with respect to which Mr. Nicolaides disclaims beneficial ownership. |

| (14) | The subset of shares held by Mr. Rose includes 20,900 shares of Common Stock but does not include 15,100 nonvested RSUs that vest more than 60 days after April 25, 2016. |

| (15) | The subset of shares held by Mr. Ryan includes: (i) 242,373 shares of Common Stock and (ii) 12,000 shares of Common Stock issuable upon the exercise of stock options exercisable within 60 days of April 25, 2016 but does not include (i) 15,100 nonvested RSUs that vest more than 60 days after April 25, 2016 or (ii) the 2,947,280 shares of Common Stock owned by Gwynedd, with respect to which Mr. Ryan disclaims beneficial ownership. |

| (16) | Dr. Smith’s employment terminated effective November 30, 2015. |

| (17) | The subset of shares held by Mr. Zionts includes: (i) 11,500 shares of Common Stock and (ii) 132,597 shares of voting nonvested restricted stock awards, but does not include 16,655 nonvested RSUs or stock options to acquire 17,813 shares of Common Stock that vest more than 60 days after April 25, 2016. |

*Represents less than 1% of the Company’s total number of shares outstanding on April 25, 2016.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under Section 16(a) of the Exchange Act, the Company’s directors, executive officers and persons who are the beneficial owners of more than 10% of the outstanding Common Stock are required to report their beneficial ownership of Common Stock and any changes in that ownership to the SEC. Based solely on a review of the copies of reports furnished to, or filed by, us and written representations that no other reports were required, we believe that during FY 2015, the Company’s officers and directors complied with all applicable Section 16(a) filing requirements, except as follows:

There was one late Form 4 filing in FY 2015 as follows: July 29, 2015 for Jeffrey Smith for grants of share-based compensation.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Company does not have a formal written policy regarding the review of related party transactions. However, the Board reviews all relationships and transactions in which the Company and its directors and senior executive officers or their immediate family members are participants to determine whether such persons have a direct or indirect material interest. The Company’s senior management is primarily responsible for the development and implementation of processes and controls to obtain information from the directors and senior executive officers with respect to related person transactions and for then determining, based on the facts and circumstances, whether the company or a related person has a direct or indirect material interest in the transaction. As required under SEC rules, transactions, if any, that are determined to be directly or indirectly material to the company or a related person are disclosed in the company’s proxy statement. In addition, the Audit Committee reviews and approves or ratifies any related person transaction that is required to be disclosed. Any member of the Audit Committee who is a related person with respect to a transaction under review may not participate in the deliberations or vote respecting approval or ratification of the transaction, provided, however, that such director may be counted in determining the presence of a quorum at a meeting of the Committee that considers the transaction.

Mr. Ryan, a Director of the Company, is principal partner of The Ryan Law Group. The Ryan Law Group provided legal services to the Company in FY 2015 and will continue to provide such services in FY 2016. For services performed in FY 2015, The Ryan Law Group invoiced the Company legal fees in the amount of approximately $429,000. In addition, a firm affiliated with a family member of Mr. Nicolaides, Chairman of the Board of Directors, provided marketing services to the Company in FY2015. The firm invoiced the Company marketing fees in the amount of approximately $58,000.

REPORT OF THE COMPENSATION COMMITTEE

This report is submitted by the Compensation Committee of the Board. The Compensation Committee has reviewed the Compensation Discussion and Analysis included in this Proxy Statement and discussed it with management. Based on its review of the Compensation Discussion and Analysis and its discussions with management, the Compensation Committee has recommended to the Board that the Compensation Discussion and Analysis be included in this Proxy Statement and incorporated into our Annual Report on Form 10-K for the year ended December 31, 2015.

No portion of this Compensation Committee Report shall be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, as amended, through any general statement incorporating by reference in its entirety the Proxy Statement in which this report appears, except to the extent that the Company specifically incorporates this report or a portion of it by reference. In addition, this report shall not be deemed filed under either the Securities Act or the Exchange Act.

| | THE COMPENSATION COMMITTEE |

| | |

| | Tony G. Holcombe, Chairperson |

| | Sherrie G. McAvoy |

| | Jerry A. Rose |