QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

Cygnus, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

April 29, 2003

Dear Cygnus Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders (the "Annual Meeting") of Cygnus, Inc. ("Cygnus" or the "Company"), which will be held on June 9, 2003, at 9:00 a.m. local time, at the Sofitel Hotel, 223 Twin Dolphin Drive, Redwood City, California 94065.

At this year's Annual Meeting, you will be asked to re-elect five directors for the next year and ratify the re-appointment of Ernst & Young LLP as the Company's independent auditors. Additionally, the Board of Directors is recommending that you approve the amendment to the Company's 1999 Stock Incentive Plan to extend the term of the 1999 Stock Incentive Plan so that the 1999 Stock Incentive Plan will expire on March 18, 2013 instead of January 1, 2004. The accompanying Notice of Annual Meeting and Proxy Statement describe these proposals. We urge you to read this information carefully.

Included in this package is Cygnus' 2002 Annual Report and Form 10-K, which is also available by telephoning us at (650) 369-4300. The Annual Report contains our letter to stockholders. You will find the Company's audited consolidated financial statements included as part of the Form 10-K.

Whether or not you plan to attend the Annual Meeting, please sign, date, and return the enclosed proxy card promptly in the accompanying postage-paid envelope. If you decide to attend the Annual Meeting and wish to change your proxy vote, you may do so by giving notice and voting in person at the Annual Meeting.

I hope to see you at the Annual Meeting. Should you require directions to the Annual Meeting, please contact the Company's headquarters at (650) 369-4300.

| | | Sincerely yours, |

|

|

|

|

|

John C Hodgman

Chairman, President and Chief Executive Officer

Cygnus, Inc.

Redwood City, California |

CYGNUS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 9, 2003

TO THE STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the "Annual Meeting") of Cygnus, Inc., a Delaware corporation ("Cygnus" or the "Company"), will be held on June 9, 2003, at 9:00 a.m. local time, at the Sofitel Hotel, 223 Twin Dolphin Drive, Redwood City, California 94065 to act on the following matters:

- 1.

- To re-elect five directors of the Company to serve until the next annual meeting or the election of their successors.

- 2.

- To approve an amendment to the 1999 Stock Incentive Plan to extend the term of the 1999 Stock Incentive Plan so that the 1999 Stock Incentive Plan will expire on March 18, 2013 instead of January 1, 2004.

- 3.

- To ratify the re-appointment of Ernst & Young LLP to serve as the Company's independent auditors.

- 4.

- To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record at the close of business on April 14, 2003 are entitled to notice of and to vote at the Annual Meeting. The stock transfer books of the Company will remain open between the record date and the date of the Annual Meeting. A list of stockholders entitled to vote at the Annual Meeting will be available for inspection at the corporate offices of the Company.

All stockholders are cordially invited to attend the Annual Meeting in person.Whether or not you plan to attend, please sign, date, and return the enclosed proxy card as promptly as possible in the postage-paid envelope provided. Should you receive more than one proxy because your shares are registered in different names and addresses, each proxy should be signed and returned to ensure that all of your shares will be voted. You may revoke your proxy at any time prior to the Annual Meeting. If you attend the Annual Meeting and vote by ballot, your proxy will be revoked automatically and only your vote at the Annual Meeting will be counted.

| | | By Order of the Board of Directors |

|

|

|

|

|

Barbara G. McClung

Secretary

Cygnus, Inc.

Redwood City, California |

YOUR VOTE IS IMPORTANT.

TO ENSURE YOUR REPRESENTATION AT THE MEETING, PLEASE MARK, SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD AS SOON AS POSSIBLE IN THE ENCLOSED POSTAGE-PAID ENVELOPE. IF YOU ATTEND THE MEETING, YOU MAY VOTE IN PERSON EVEN IF YOU HAVE PREVIOUSLY RETURNED A PROXY.

CYGNUS, INC.

400 PENOBSCOT DRIVE

REDWOOD CITY, CALIFORNIA 94063

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 9, 2003

General

The enclosed proxy is solicited on behalf of the Board of Directors of Cygnus, Inc., a Delaware corporation ("Cygnus" or the "Company") for use at the Annual Meeting of Stockholders to be held on June 9, 2003, at 9:00 a.m. local time, or at any adjournment or postponement thereof, for the purposes set forth herein (the "Annual Meeting"). The Annual Meeting will be held at the Sofitel Hotel, 223 Twin Dolphin Drive, Redwood City, California 94065. These proxy solicitation materials were mailed on or about April 29, 2003 to all stockholders entitled to vote at the Annual Meeting.

Proxies and Solicitation Costs

The enclosed proxy is solicited by the Company's Board of Directors and, when the proxy card is properly completed and returned, it will be voted as directed by the stockholder on the proxy card. Stockholders are urged to specify their choices on the enclosed proxy card. If a proxy card is signed and returned without choices specified, in the absence of contrary instructions, the shares of Common Stock represented by such proxy will be voted "FOR" Proposals 1, 2, and 3 described in the accompanying Notice and this Proxy Statement and will be voted in the proxy holders' discretion as to other matters that may properly come before the Annual Meeting. Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by (i) delivering to the Company, Attention: Chief Financial Officer, at 400 Penobscot Drive, Redwood City, California 94063, a written notice of revocation or duly executed proxy bearing a later date, or (ii) attending the Annual Meeting and voting in person.

The cost of soliciting proxies will be borne by the Company. The Company expects to reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation materials to such beneficial owners. Proxies may be solicited by certain of the Company's directors, officers, regular employees or outside vendors in person or by telephone, facsimile or email. No additional compensation will be paid to directors, officers or other regular employees for such services. The Company has hired Georgeson Shareholder to solicit proxies, and the Company does not anticipate paying more than $20,000 for these services.

Record Date, Share Ownership and Voting

Only holders of Common Stock of record at the close of business on April 14, 2003, the record date and time fixed by the Board of Directors, are entitled to receive notice of and to vote at the Annual Meeting. At the record date, 38,478,671 shares of Common Stock were issued and outstanding and there were 829 stockholders of record. There is no cumulative voting. Each holder of shares of Common Stock is entitled to one vote on each of the proposals presented in this Proxy Statement for each share of Common Stock held on the record date.

A majority of the shares of Common Stock entitled to vote, whether present in person or represented by proxy, will constitute a quorum for the transaction of business at the Annual Meeting. Directors will be elected by plurality vote. The matters submitted for stockholder approval at the Annual Meeting will be decided by the affirmative vote of the holders of a majority of the shares of

Common Stock present in person or represented by proxy and entitled to vote at the Annual Meeting. The five nominees for election as directors at the Annual Meeting who receive the greatest number of votes cast for the election of directors at that meeting by the holders of the Company's Common Stock entitled to vote at that meeting shall become directors at the conclusion of the tabulation of votes. Votes may be cast in favor of or withheld from each nominee; votes that are withheld will be excluded entirely from the vote and will have no effect. Abstentions may be specified on all proposals except the election of directors and will be counted as present or represented for purposes of determining the existence of a quorum regarding the item on which the abstention is noted. However, if shares are not voted by the broker who is the record holder of the shares, or if shares are not voted in other circumstances in which proxy authority is defective or has been withheld with respect to any matter, these non-voted shares are not deemed to be present or represented for purposes of determining whether stockholder approval of that matter has been obtained.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934,as amended, requires the Company's officers and directors, as well as persons who own more than 10% of a registered class of the Company's equity securities, to file reports of ownership and changes in ownership with the Securities and Exchange Commission (the "SEC"). Such officers, directors and 10% stockholders are also required by SEC rules to furnish the Company with copies of all forms that they file pursuant to Section 16(a). Based solely on its review of the copies of such forms received and representations from certain reporting persons that no filings were required for such persons, the Company believes that its officers, directors and 10% stockholders complied with all applicable Section 16(a) filing requirements for the 2002 fiscal year.

Householding

The SEC recently approved a new rule concerning the delivery of annual reports and proxy statements. It permits a single set of these reports to be sent to any household at which two or more stockholders reside if they appear to be members of the same family. Each stockholder continues to receive a separate proxy card. This procedure, referred to as householding, reduces the volume of duplicate information stockholders receive and reduces mailing and printing expenses. A number of brokerage houses have instituted householding. In accordance with a notice sent out earlier this year to certain beneficial stockholders who share a single address, only one annual report and proxy statement will be sent to that address unless any stockholder gives contrary instructions. If any such beneficial stockholder residing at such an address wishes to receive a separate annual report or proxy statement in the future, such stockholder may telephone us at (650) 369-4300 or write to the Company at Cygnus, Inc., Attention: Corporate Communications, 400 Penobscot Drive, Redwood City, California 94063.

2

PROPOSAL ONE—RE-ELECTION OF DIRECTORS

A Board of five directors will be elected at the Annual Meeting. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the five nominees to the Board of Directors named below. If a nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee designated by the proxy holders to fill such vacancy. However, it is not expected that any nominee will be unable or will decline to serve as a director. If a nomination is made to elect an individual to the vacant position on the Board, the proxy holders will propose a nominee to fill such position and vote all proxies received by them to ensure the election of as many of the Company's nominees as possible. The Company's Bylaws fix the Board at five directors. If stockholders nominate persons other than the Company's nominees for election as directors, the proxy holders will vote all proxies received by them to ensure the election of as many of the Company's nominees as possible. The term of office of each person elected as a director will continue until the next annual meeting of stockholders or until the director's successor has been elected.

Name of Nominee

| | Age

| | Principal Occupation

| | Director

Since

|

|---|

| Frank T. Cary(1)(2)(3) | | 82 | | Former Chairman and Chief Executive Officer of International Business Machines Corporation | | 1992 |

| John C Hodgman(4) | | 48 | | Chairman of the Board of Directors, President and Chief Executive Officer of Cygnus | | 1998 |

| André F. Marion(1)(2)(3) | | 67 | | Vice Chairman of the Board of Directors of Cygnus, Former Vice President of the Perkin-Elmer Corporation; Former Chairman and Chief Executive Officer of Applied Biosystems, Inc. | | 1994 |

| Richard G. Rogers(1)(2)(3) | | 74 | | Former President and Chief Operating Officer of Syntex Corporation | | 1989 |

| Walter B. Wriston(1)(2)(3) | | 83 | | Former Chairman and Chief Executive Officer of Citicorp/Citibank, N.A. | | 1992 |

- (1)

- Member of the Audit Committee

- (2)

- Member of the Compensation Committee

- (3)

- Member of the Nominating Committee

- (4)

- Member of the Employee Stock Option Committee

Business Experience of Nominees for Re-Election as Directors

Mr. Cary has served as a director since July 1992. He was Chairman of the Board and Chief Executive Officer of International Business Machines Corporation (IBM) from 1973 until his retirement in 1981. Mr. Cary is also a director of Celgene Corporation, ICOS Corporation, Lexmark International, Inc., VION Pharmaceuticals, Inc. and Lincare Holdings, Inc.

Mr. Hodgman was appointed Chairman of the Board in 1999 and has served as a director, President and Chief Executive Officer of Cygnus since August 1998. He was President, Cygnus Diagnostics from May 1995 to August 1998, during which time he was responsible for all commercialization efforts for the GlucoWatch® Biographer and was also Chief Financial Officer. Mr. Hodgman joined Cygnus in August 1994 as Vice President, Finance and Chief Financial Officer. Prior to joining Cygnus, Mr. Hodgman served as Vice President of Operations and Finance, Chief Financial Officer and a Board of Directors member for Central Point Software, a personal computer and networking software company. Prior to that, he was the Vice President of Finance and

3

Administration and Chief Financial Officer of Ateq Corporation. Mr. Hodgman holds a B.S. degree from Brigham Young University and an M.B.A. from the University of Utah. Mr. Hodgman is also a director of Immersion Corporation.

Mr. Marion was appointed Vice Chairman of the Board in August 1998. He has served as a director of Cygnus since August 1994. Mr. Marion was a founder of Applied Biosystems, Inc., a supplier of instruments for biotechnology research, and served as its Chairman of the Board and Chief Executive Officer from 1981 until February 1993, when it merged with the Perkin-Elmer Corporation, a manufacturer of analytical instruments. Mr. Marion served as Vice President of the Perkin-Elmer Corporation and President of its Applied Biosystems Division until his retirement in February 1995. Mr. Marion is also a director of Molecular Devices Corp., Applied Imaging Corporation, Aclara BioSciences, Inc. and several privately held companies.

Mr. Rogers has served as a director since October 1989. He was President and Chief Operating Officer of Syntex Corporation, a pharmaceutical company, from 1982 until his retirement in 1985.

Mr. Wriston has served as a director of Cygnus since July 1992. He was Chairman of the Board of Citicorp/Citibank, N.A. from 1970 through 1984 and its Chief Executive Officer from 1967 until his retirement in 1984. Mr. Wriston is also a director of ICOS Corporation, VION Pharmaceuticals, Inc. and other privately held companies.

Board Meetings and Committees

The Board of Directors of the Company held five regularly scheduled meetings during the 2002 fiscal year. Each of the nominees attended or participated in 75% or more of the aggregate number of meetings of the Board of Directors and the committees of the Board on which the director served. The Board of Directors has an Audit Committee, a Compensation Committee, a Nominating Committee and an Employee Stock Option Committee.

The Audit Committee, which consisted of independent non-employee directors Wriston (chair), Cary, Marion and Rogers, in fiscal 2002 held two regularly scheduled meetings and two special meetings. The principal functions and responsibilities of the Audit Committee are to oversee the Company's financial reporting processes on behalf of the Board of Directors and to report the results of its activities to the Board. The members of the Audit Committee are independent, as defined under Rule 4200(a)(4) of the Nasdaq Stock Market Rules. The Audit Committee has determined that the non-audit services provided by the Company's independent auditors are compatible with maintaining the auditors' independence. In 2000, the Board of Directors adopted a written Charter for the Audit Committee.

The Compensation Committee, which also consisted of independent non-employee directors Cary (chair), Marion, Rogers and Wriston, in fiscal 2002 held one regularly scheduled meeting. The Compensation Committee establishes the Company's executive compensation policy, approves the bonus plans and incentive option plans, and grants stock options and stock bonuses to officers.

The Nominating Committee, which also consisted of independent non-employee directors Marion (chair), Cary, Rogers and Wriston, in fiscal 2002 held one regularly scheduled meeting. The Nominating Committee nominates qualified candidates to fill vacancies on the Board of Directors, proposes qualifications requisite for continuing service as a member of the Board of Directors, and considers whether nominees for the Board of Directors duly proposed by stockholders meet the requisite qualifications for serving as a member of the Board of Directors.

The Employee Stock Option Committee, which consisted of director Hodgman, took action by written consent on nineteen separate occasions in fiscal year 2002. The Employee Stock Option Committee was established by the Board of Directors to grant stock options to the Company's employees (other than officers of the Company) and consultants under the Company's stock plan, and

4

such Committee is currently responsible for making grants under the Company's 1999 Stock Incentive Plan.

Compensation of Directors

All non-employee directors of the Company receive $3,750 per fiscal quarter, a $1,000 fee for attending each Board meeting and a $500 fee for attending each committee meeting. Non-employee directors are also eligible to receive periodic stock option grants under the Automatic Option Grant Program in effect for them under the Company's 1999 Stock Incentive Plan. Automatic option grants are made under the 1999 Stock Incentive Plan as follows: (i) on the first trading day in June of the year the non-employee Board member is first elected or appointed as such, he or she will automatically receive an option grant for 6,000 shares of Common Stock, and (ii) on the first trading day in June of each subsequent year that such person continues to serve as a non-employee Board member, he or she will automatically receive an additional option for that number of shares which is equal to 110% of the shares that were subject to the previous year's grant. In addition, any person who becomes a non-employee Board member after the first trading day in June but before December 31 of any year will receive his or her initial automatic grant on the date of his or her initial election or appointment to cover the option that person would have received on the first trading day in June of that year had such Board member then been eligible. Each automatic option grant under the 1999 Stock Incentive Plan has a price equal to 100% of the fair market value of the Common Stock on the option grant date and becomes exercisable for the option shares on the first anniversary of such grant date.

On June 3, 2002, directors Cary, Rogers and Wriston each received an automatic option grant under the 1999 Stock Incentive Plan for 15,563 shares, and director Marion received an automatic grant for 14,148 shares. Each such grant has an exercise price per share equal to $2.02, the fair market value of the Common Stock on the grant date, and has a term of ten (10) years measured from such grant date. The options become exercisable for all the option shares on the first anniversary of the grant date, subject to termination in the event of the optionee's cessation of Board service prior to such time. In addition, the options will immediately accelerate in full upon an acquisition of the Company, unless the options are assumed by the successor corporation.

Compensation Committee Interlocks and Insider Participation

None of the Company's executive officers serves, or in the past has served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on the Company's Board of Directors or Compensation Committee.

Indemnification of Directors and Officers

The Company's Restated Certificate of Incorporation and Bylaws provide for indemnification of all directors and officers. Each director and officer of the Company has entered into a separate indemnification agreement with the Company.

Stockholder Approval

The affirmative vote of the holders of a majority of the Company's voting stock present in person or represented by proxy and entitled to vote at the Annual Meeting is required for approval of Proposal One.

5

PROPOSAL TWO—APPROVAL OF AN AMENDMENT TO

THE COMPANY'S 1999 STOCK INCENTIVE PLAN

General

At the Annual Meeting, stockholders will be asked to approve an amendment to the Company's 1999 Stock Incentive Plan (the "1999 Plan") that will extend the term of the 1999 Plan so that the 1999 Plan will expire on March 18, 2013 instead of January 1, 2004. This amendment requires stockholder approval.

The following is a summary of the principal features of the 1999 Plan. Any stockholder of the Company who wishes to obtain a copy of the actual 1999 Plan document may do so upon written request to the Corporate Secretary at the Company's corporate offices in Redwood City, California.

Share Reserve

The aggregate number of shares that has been reserved for issuance under the 1999 Plan is 11,416,385 shares of Common Stock. The amendment to the 1999 Plan does not add any additional shares of Common Stock. As of April 14, 2003, a total of 475,164 shares of Common Stock remained available for issuance pursuant to option grants and stock awards under the 1999 Plan.

In no event may any one participant in the 1999 Plan be granted restricted stock, stock units or stock appreciation rights awards for more than 1,200,000 shares in the aggregate under the 1999 Plan. In addition, no participant in the 1999 Plan may receive stock options in a calendar year that exceed 25% of the shares authorized for award under the 1999 Plan.

In the event any change is made to the outstanding shares of Common Stock by reason of any recapitalization, stock dividend, stock split, combination of shares, exchange of shares or other change in corporate structure effected without the Company's receipt of consideration, appropriate adjustments will be made to the class and number of securities issuable (on both an aggregate and per-participant basis) under the 1999 Plan and under each outstanding option and equity-based award. Appropriate adjustments will also be made to the exercise price (if any) payable per share under the outstanding options and equity-based awards.

Administration

The Employee Stock Option Committee is responsible for administering the 1999 Plan with respect to restricted stock, stock units, stock options, stock appreciation rights and other awards to be made to employees who are not executive officers of the Company and to consultants in the Company's service. The Compensation Committee of the Board administers the 1999 Plan with respect to stock options, restricted stock, stock units and stock appreciation rights and other awards to be made to executive officers of the Company, who are subject to the short-swing profit restrictions of Section 16(b) of the Securities Exchange Act of 1934, as amended. Each such committee, acting in its administrative capacity, will be referred to as the "1999 Plan Administrator." The 1999 Plan Administrator has complete discretion, subject to the provisions of the 1999 Plan, to authorize stock options, restricted stock, stock units and stock appreciation rights awards under the 1999 Plan. However, all stock option grants made under the Automatic Option Grant Program will be made in compliance with the provisions of that program, and no administrative discretion will be exercised by the 1999 Plan Administrator with respect to the grants made under such program.

Equity Incentive Program Eligibility

The 1999 Plan consists of (i) discretionary stock option grants, (ii) equity-based awards under which the 1999 Plan Administrator may award restricted stock, stock units and stock appreciation rights (collectively, "equity-based awards"), and (iii) an Automatic Option Grant Program. Employees

6

(including officers and directors) of the Company and its subsidiaries will be eligible to participate in the discretionary option grant and equity-based award programs. Only the non-employee Board members will be eligible to participate in the Automatic Option Grant Program.

As of April 14, 2003, approximately 67 employees (including officers and an employee director), 1 independent contractor and/or consultant, and 4 non-employee members of the Board were eligible to participate in the 1999 Plan.

Discretionary Option Grants

The 1999 Plan Administrator may grant nonstatutory stock options, incentive stock options (which are entitled to favorable tax treatment), or a combination thereof under the 1999 Plan. The number of shares of the Company's Common Stock covered by each stock option granted to a participant will be determined by the 1999 Plan Administrator, but no participant may be granted stock options in a calendar year that exceed 25% of the shares authorized for award under the 1999 Plan.

Stock options become exercisable at the times and on the terms established by the 1999 Plan Administrator. The stock option exercise price is equal to the fair market value of Company shares on the date the options vest. Stock options expire at the times established by the 1999 Plan Administrator, but not later than ten (10) years after the date of grant. The 1999 Plan Administrator may extend the maximum term of any stock option granted under the 1999 Plan, subject to such ten-year limit.

Equity-Based Awards

The 1999 Plan Administrator may award shares of Common Stock that are generally not paid for, but which are not transferable unless certain conditions are met. Such an award is called restricted stock. When the restricted stock award conditions are satisfied, then the participant is vested in the shares and has complete ownership of the shares. At any particular time, a participant may be partially vested, fully vested or not vested at all in the restricted stock that was awarded.

The 1999 Plan Administrator may also award stock units. A stock unit is a bookkeeping entry that represents the equivalent of a Company share of Common Stock. A stock unit is similar to restricted stock in that the 1999 Plan Administrator will establish performance goals and/or other conditions that must be satisfied before the participant can receive any benefit from the stock unit. When the participant satisfies the conditions of the stock unit award, the Company will pay the participant for the vested stock units with either cash or Company shares. The amount received will depend upon the degree of achievement of the performance goals, although the 1999 Plan Administrator has discretion to reduce or waive any performance objectives. No stock units have ever been awarded under the 1999 Plan.

Additionally, the 1999 Plan Administrator may grant stock appreciation rights, and such grants may be made in conjunction with stock options. The number of shares covered by each stock appreciation right will be determined by the 1999 Plan Administrator. Upon exercise of a stock appreciation right, the participant will receive payment from the Company in an amount determined by multiplying (a) the difference between (i) the fair market value of a share of the Company's Common Stock on the date of exercise and (ii) the grant price (fair market value of a share on the grant date) times (b) the number of shares with respect to which the stock appreciation right is exercised. Stock appreciation rights may be paid in cash or shares of the Company's Common Stock, as determined by the 1999 Plan Administrator. Stock appreciation rights are exercisable at the times and on the terms established by the 1999 Plan Administrator. No stock appreciation rights have ever been awarded under the 1999 Plan.

7

Automatic Option Grant Program

Non-employee Board members will receive nonstatutory option grants under this program as follows: Each non-employee Board member will automatically receive a nonstatutory option grant for 6,000 shares on the first trading day in June following his or her initial election or appointment. However, any non-employee Board member who is first elected or appointed as such between June 1 and December 31 of any year (and who is not already serving on the Board at that time) will receive an automatic option grant on the date of such initial election or appointment for the number of shares he or she would have received on the first trading day in June of that year had he or she then been eligible. In addition, on the anniversary of each Board member's initial automatic option grant on the first trading day in June, each such continuing non-employee Board member will automatically receive an additional nonstatutory stock option for that number of shares equal to 110% of the number of shares he or she received under the previous year's automatic option grant.

Each automatic option grant to the non-employee Board members will have an exercise price per share equal to 100% of the fair market value per share of Common Stock on the option grant date. The options will have a maximum term of ten (10) years measured from the grant date, subject to earlier termination at the end of the three-month period measured from the date of the optionee's cessation of Board service for any reason other than his or her disability or death, and the end of the twelve-month period measured from such date in the event the optionee's service terminates by reason of his or her disability or death. Each automatic option grant will become fully exercisable for vested shares on the first anniversary of the option grant date and will remain exercisable until the earlier to occur of (i) the expiration of the option term or (ii) the termination of the option in connection with the optionee's termination of service or an acquisition of the Company.

Amendment and Termination

The Board may amend or modify the 1999 Plan in any or all respects whatsoever, subject to any required stockholder approval. The Board may terminate the 1999 Plan at any time and the 1999 Plan will terminate on January 1, 2004 unless the stockholders approve this Proposal Two to extend the 1999 Plan's term until March 18, 2013.

New Plan Benefits

Other than the annual automatic option grants to non-employee directors, all other awards are made at the discretion of the applicable 1999 Plan Administrator. Therefore, the benefits and amounts that will be received by the Chief Executive Officer and the other executive officers, the executive officers as a group and all other employees are not determinable. Details on stock options granted during the last three years to the Chief Executive Officer and the other executive officers are presented in the table entitled "Summary Compensation Table."

Federal Income Tax Consequences

A recipient of a stock option or stock appreciation right will not have taxable income upon the grant of the option. For nonstatutory stock options and stock appreciation rights, the participant will recognize ordinary income upon exercise in an amount equal to the difference between the fair market value of the shares and the exercise price on the date of exercise. Any gain or loss recognized upon any later disposition of the shares generally will be capital gain or loss.

A participant is not deemed to receive any taxable income at the time an award of stock units is granted, nor is the Company entitled to a tax deduction at that time. When vested stock units and any dividend equivalents are settled and distributed, the participant is deemed to receive an amount of ordinary income equal to the amount of cash and/or the fair market value of shares received. This

8

income is subject to withholding taxes for employees or former employees. The Company is allowed a tax deduction in an amount equal to the ordinary income that the participant is deemed to receive.

The acquisition of shares upon exercise of an incentive stock option will not result in any taxable income to the participant, except for purposes of the alternative minimum tax. Gain or loss recognized by the participant on a later sale or other disposition of such shares will either be long-term capital gain or loss or ordinary income, depending upon whether the participant holds the shares transferred upon the exercise for the legally required period. For restricted stock awards, unless the participant elects to be taxed at the time of receipt of the restricted stock, the participant will not have taxable income upon the receipt of the award, but upon vesting will recognize ordinary income equal to the fair market value of the shares or cash received at the time of vesting.

At the discretion of the 1999 Plan Administrator, the 1999 Plan allows a participant to satisfy tax withholding requirements under federal and state tax laws in connection with the exercise or receipt of an award by electing to have shares of Common Stock withheld, and/or by delivering to the Company already-owned shares.

Stockholder Approval

The affirmative vote of the holders of a majority of the Company's voting stock present in person or represented by proxy and entitled to vote at the Annual Meeting is required for approval of the amendment extending the 1999 Plan's term until March 18, 2013. If such stockholder approval is not obtained, then the 1999 Plan will expire on January 1, 2004.

The Board of Directors recommends that stockholders vote FOR the approval of the term extension for the Company's 1999 Stock Incentive Plan.

9

PROPOSAL THREE—RATIFICATION OF THE COMPANY'S INDEPENDENT AUDITORS

During 2002, the Board of Directors has re-appointed the firm of Ernst & Young LLP, as the Company's independent auditors to serve in the same capacity for the fiscal year ending December 31, 2003 and is asking the stockholders to ratify this re-appointment. In the event the stockholders fail to ratify the re-appointment, the Board of Directors will reconsider its selection. Even if the re-appointment is ratified, the Board of Directors in its discretion may direct the appointment of a different independent auditing firm at any time during the year if the Board of Directors believes that such a change would be in the best interests of the Company and its stockholders. In addition, the Board of Directors in its discretion may determine not to seek stockholder ratification of any such different independent auditing firm or any independent auditing firm appointed with respect to future fiscal years.

Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting and will have the opportunity to make a statement, if they desire to do so, and they will be available to respond to appropriate questions.

The audit services provided by Ernst & Young LLP during fiscal 2002 included an audit of the Company's annual financial statements; a review of the financial statements included in the Company's quarterly reports on Form 10-Q; audit-related services, such as review of SEC registrations and benefit plans; preparation of comfort letters; consultation on accounting standards and transactions; and non-audit-related services, such as those related to taxes.

Audit and Related Fees

Audit Fees. The aggregate fees billed to the Company by Ernst & Young LLP during the Company's 2002 fiscal year for the audit of the Company's annual financial statements and for the review of the financial statements included in the Company's quarterly reports on Form 10-Q totaled $270,900.

Financial Information Systems Design and Implementation Fees. The Company did not engage Ernst & Young LLP to provide advice to the Company regarding financial information systems design and implementation during the 2002 fiscal year.

All Other Fees. The aggregate fees billed to the Company by Ernst & Young LLP for services rendered to the Company during the 2002 fiscal year, other than the services described above under Audit Fees, totaled $413,782. Of this amount, $300,000 was for audit-related services, which included fees for review of SEC registration statements, audits of the Company's benefit plans, preparation of comfort letters, and consultation on accounting standards and transactions; and $113,782 was for non-audit-related services, which were primarily tax-related.

Stockholder Approval

The affirmative vote of the holders of a majority of the Company's voting stock present in person or represented by proxy and entitled to vote at the Annual Meeting is required to ratify the re-appointment of Ernst & Young LLP as the Company's independent auditors.

The Board of Directors recommends that stockholders vote FOR the ratification of the re-appointment of Ernst & Young LLP to serve as the Company's independent auditors for the fiscal year ending December 31, 2003.

10

AUDIT COMMITTEE REPORT

Notwithstanding anything to the contrary set forth in any of the Company's previous or future filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate this Proxy Statement or future filings with the SEC, in whole or in part, the following report shall not be deemed to be soliciting material or deemed to be incorporated by reference into any such filing.

The Audit Committee oversees the Company's financial reporting process on behalf of the Board of Directors. The Committee recommends the selection of the Company's independent auditors to the Board of Directors. In fulfilling its responsibilities, the Committee has reviewed and discussed the audited financial statements contained in the 2002 Annual Report on Form 10-K with the Company's management and the Company's independent auditors. The Chairman, as the representative of the Committee, reviewed the interim financial information contained in each quarterly earnings announcement with management and the Company's independent auditors prior to public release. Management is responsible for the financial statements and the reporting process, including the system of internal controls. The Company's independent auditors are responsible for expressing an opinion on the conformity of those audited financial statements with accounting principles generally accepted in the United States.

The Committee discussed with the Company's independent auditors the matters required to be discussed by American Institute of Certified Public Accountants Statement on Auditing Standards No. 61, "Communication with Audit Committees," as amended. In addition, the Committee has held discussions with the Company's independent auditors regarding the auditors' independence from the Company and its management. Also, the Company's independent auditors provided to the Audit Committee the letter and written disclosures confirming their independence, as required by Independence Standards Board Standard No. 1, "Independence Discussions with Audit Committees."

The Committee has reviewed the services provided by, and the fees paid to, the Company's independent auditors and also whether the provision of these services is compatible with maintaining the independence of the Company's auditors.

In reliance on the reviews and discussions referred to above, the Committee recommended to the Board of Directors (and the Board has approved) that the audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2002, filed with the SEC.

| | | AUDIT COMMITTEE |

|

|

Walter B. Wriston (Chairman)

Frank T. Cary

André F. Marion

Richard G. Rogers |

11

SECURITY OWNERSHIP OF PRINCIPAL STOCKHOLDERS

The following table lists all persons known by Cygnus to own beneficially, as of April 14, 2003, 5% or more of the outstanding shares of its Common Stock. On December 31, 2002, there were 38,478,671 shares of Cygnus Common Stock outstanding.

Name and Address of Beneficial Owner

| | Number of

Shares

Beneficially

Owned

| | Approximate

Percentage Owned

|

|---|

The Palladin Group L.P.

195 Maplewood Avenue

Maplewood, NJ 07040 | | 4,227,956 | (1) | 9.99%(1) |

FMR Corp

82 Devonshire Street

Boston, MA 02109 |

|

1,960,350 |

(2) |

5.095% |

- (1)

- Based on a Schedule 13G/A, dated February 14, 2003, The Palladin Group L.P. acts as an investment adviser for certain investors and has shared voting and dispositive power with respect to the shares owned by each investor. None of the investors individually owns 5% or more of the outstanding shares.

- (2)

- Based on a Schedule 13G/A, dated February 14, 2003, FMR acts as an investment advisor for certain investors and has sole dispositive authority over shares and no voting power with respect to such shares.

12

SECURITY OWNERSHIP OF DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth certain information regarding the beneficial ownership of the Company's Common Stock as of April 14, 2003 by (i) each director, (ii) the Chief Executive Officer and each of the other executive officers for the year ended December 31, 2002, and (iii) all directors and executive officers as a group.

Name of Beneficial Owner

| | Number of

Shares

Beneficially

Owned(1)

| | Approximate

Percent Owned(2)

| |

|---|

| Neil R. Ackerman | | 581,512 | | 1.43 | % |

| Craig W. Carlson | | 417,983 | | 1.02 | % |

| Frank T. Cary | | 128,191 | | * | |

| John C Hodgman | | 782,760 | | 1.92 | % |

| André F. Marion | | 110,628 | | * | |

| Barbara G. McClung | | 243,704 | | * | |

| Richard G. Rogers | | 89,752 | | * | |

| Walter B. Wriston | | 103,791 | | * | |

| All executive officers and directors as a group (eight persons) | | 2,458,321 | | 6.03 | % |

- *

- Less than 1% of the shares outstanding.

- (1)

- This disclosure is made pursuant to certain rules and regulations promulgated by the SEC and, in certain instances, the number of shares shown as being beneficially owned may not be deemed to be beneficially owned for other purposes. This amount includes options to purchase shares exercisable within 60 days of April 14, 2003 in the following amounts: Mr. Ackerman, 555,465 shares; Mr. Carlson, 406,307 shares; Mr. Cary, 83,345 shares; Mr. Hodgman, 728,404 shares; Mr. Marion, 109,628 shares; Ms. McClung, 243,704 shares; Mr. Rogers, 80,701 shares; Mr. Wriston, 98,591 shares.

- (2)

- Percentage of outstanding Common Stock and of Common Stock that may be acquired upon exercise of outstanding options on or before June 13, 2003 by the persons named above and by all directors and executive officers as a group.

13

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Summary of Cash and Certain Other Compensation

The following table provides certain summary information concerning compensation paid or accrued by the Company to the Company's Chief Executive Officer and each of the other executive officers of the Company (determined as of December 31, 2002) (hereinafter referred to as the "Named Executive Officers") for the fiscal years ended December 31, 2002, 2001 and 2000:

SUMMARY COMPENSATION TABLE

| |

| | Annual Compensation

| | Long-Term

Compensation Awards

| |

|

|---|

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus

($)(1)

| | Other Annual

Compensation

($)

| | Restricted

Stock Awards

($)(2)

| | Securities

Underlying

Options (#)

| | All Other

Compensation

($)(2)

|

|---|

John C Hodgman

Chairman, President and Chief Executive Officer | | 2002

2001

2000 | | $

| 297,115

295,962

300,000 | | $

| 300,000

300,000

— | | —

—

— | |

$

| —

300,000

— | | 100,000

100,000

100,000 | | $

| 150,000

—

— |

Neil R. Ackerman

Chief Technical Officer and Senior Vice President, Research & Development and Scientific Affairs |

|

2002

2001

2000 |

|

$

|

242,644

241,702

241,308 |

|

$

|

200,000

200,000

— |

|

—

—

— |

|

$

|

—

200,000

— |

|

75,000

75,000

75,000 |

|

$

|

100,000

—

— |

Craig W. Carlson

Chief Operating Officer, Chief Financial Officer and Senior Vice President |

|

2002

2001

2000 |

|

$

|

227,788

226,904

217,692 |

|

$

|

200,000

200,000

— |

|

—

—

— |

|

$

|

—

175,000

— |

|

75,000

75,000

60,000 |

|

$

|

87,500

—

— |

Barbara G. McClung

Senior Vice President, General Counsel and Secretary |

|

2002

2001

2000 |

|

$

|

220,928

217,644

213,673 |

|

$

|

150,000

150,000

— |

|

—

—

— |

|

$

|

—

150,000

— |

|

60,000

60,000

60,000 |

|

$

|

75,000

—

— |

- (1)

- Represents amounts that were accrued in the indicated year under the Company's employee bonus plan in which all employees of the Company participate.

- (2)

- A retention restricted stock grant was made on March 2, 2001 to employees, including the Named Executive Officers. Pursuant to the March 2, 2001 grant, restrictions were to be lifted on the performance of certain milestones or on the passage of time. A restriction on one-half (1/2) of the shares was lifted on July 9, 2001, wherein Mr. Ackerman received 20,000 shares, Mr. Carlson received 17,500 shares, Mr. Hodgman received 30,000 shares, and Ms. McClung received 15,000 shares. With respect to the remaining one-half (1/2) of the restricted shares that were scheduled to vest in 2002, the Board paid the officers cash for the value of the remaining one-half (1/2) of the restricted stock in exchange for forfeiture of these shares by the officers to the Company, and the amount of cash paid to each Named Executive Officer is reflected in the All Other Compensation column.

14

Stock Options

The following table sets forth information concerning the grant of stock options in fiscal year 2002 under the Company's 1999 Stock Incentive Plan to each of the Named Executive Officers. No stock appreciation rights were granted to the Named Executive Officers during such fiscal year:

OPTION GRANTS IN LAST FISCAL YEAR

| | Individual Grants

| |

| |

| |

| |

|

|---|

| |

| |

| | Potential Realizable Value ($) at Assumed Annual Rates of Stock Price Appreciation for Option Term(3)

|

|---|

| |

| | Percentage of Total Options Granted to Employees in Fiscal Year

| |

| |

|

|---|

| | Number of Securities Underlying Options Granted(#)(1)

| |

| |

|

|---|

Name

| | Exercise or Base Price ($/Sh)(2)

| | Expiration Date

|

|---|

| | 5%

| | 10%

|

|---|

| John C Hodgman | | 100,000 | | 10.25 | % | $ | 4.17 | | 02/27/12 | | $ | 262,249 | | $ | 664,591 |

| Neil R. Ackerman | | 75,000 | | 7.69 | % | $ | 4.17 | | 02/27/12 | | $ | 196,687 | | $ | 498,443 |

| Craig W. Carlson | | 75,000 | | 7.69 | % | $ | 4.17 | | 02/27/12 | | $ | 196,687 | | $ | 498,443 |

| Barbara G. McClung | | 60,000 | | 6.15 | % | $ | 4.17 | | 02/27/12 | | $ | 157,349 | | $ | 398,754 |

- (1)

- Generally, stock option grants become vested (i) for 25% of the underlying shares on the first anniversary of the grant date and (ii) for the balance of the shares in a series of thirty-six (36) successive equal monthly installments over the optionee's thirty-six-month period of service thereafter. These options have a term of ten (10) years measured from the grant date.

- (2)

- The exercise price may be paid in (i) cash, (ii) shares of Common Stock held for the requisite period to avoid a charge to the Company's earnings for financial reporting purposes, or (iii) through a same-day sale program.

- (3)

- Potential realizable value is based on an assumption that the stock price of the Common Stock appreciates at the annual rate shown (compounded annually) from the date of grant until the end of the ten-year option term. These numbers are calculated based on the requirements promulgated by the SEC and do not reflect the Company's estimate of future stock price growth.

The following table sets forth information with respect to the Named Executive Officers concerning exercise of options during the 2002 fiscal year and unexercised options held as of the end of that fiscal year. No stock appreciation rights were exercised by such Named Executive Officers during such fiscal year and no stock appreciation rights were held by them at the end of such fiscal year.

AGGREGATE OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL-YEAR END OPTION VALUES

| |

| |

| | Number of Securities Underlying Unexercised Options at FY End(#)

| | Value of Unexercised

In-the-Money

Options at FY End($)(1)

|

|---|

Name

| | Shares Acquired on Exercise (#)

| | Value Realized ($)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| John C Hodgman | | 0 | | N/A | | 555,904 | | 189,170 | | $ | 0 | | $ | 0 |

| Neil R. Ackerman | | 0 | | N/A | | 439,945 | | 141,565 | | $ | 0 | | $ | 0 |

| Craig W. Carlson | | 0 | | N/A | | 292,037 | | 137,813 | | $ | 0 | | $ | 0 |

| Barbara G. McClung | | 0 | | N/A | | 159,537 | | 116,251 | | $ | 0 | | $ | 0 |

- (1)

- Market value of shares covered by in-the-money options on December 31, 2002 ($0.66), less the option exercise price. Options are in-the-money if the market value of the shares covered thereby is greater than the option exercise price.

15

Equity Compensation Plan Information (as of December 31, 2002)

Equity Compensation Plan category

| | (a) Number of securities to be issued upon exercise of outstanding options, warrants and rights

| | (b) Weighted-average exercise price of outstanding options, warrants and rights

| | (c) Number of securities remaining available for future issuance under Equity Compensation Plans, (excluding securities reflected in column (a))(1)

|

|---|

| Equity Compensation Plans approved by security holders | | 4,015,341 | | $ | 8.71 | | 3,875,818 |

Equity Compensation Plans not approved by security holders |

|

N/A |

|

|

N/A |

|

N/A |

| | |

| |

| |

|

| Total | | 4,015,341 | | $ | 8.71 | | 3,875,818 |

| | |

| |

| |

|

- (1)

- As of December 31, 2002, the amounts shown include 3,006,863 stock options or shares of restricted stock or stock units or stock appreciation rights available for future issuance under the Company's 1999 Stock Incentive Plan (which has a limit of 1,200,000 shares that can be issued as restricted stock, stock units or stock appreciation rights) and 868,955 shares available for issuance under the Company's Amended Employee Stock Purchase Plan (the "ESPP"). As a result of the Company's stock being delisted from the Nasdaq Stock Market and being quoted on the OTC Bulletin Board effective on January 8, 2003, the ESPP was suspended by the Board of Directors and no shares will be issued under the ESPP until such suspension is lifted.

Employment Agreements

Effective December 2000, the Company entered into employment agreements with each of the Named Executive Officers. The employment agreements replaced the prior employment and change-in-control agreements for each of the Named Executive Officers. The agreements generally provide that if a Named Executive Officer's employment is constructively terminated or terminated by the Company without cause, then such Named Executive Officer shall receive, with no duty to mitigate, the following: (i) a cash lump sum payment equal to one times the officer's highest amount of base salary and annual bonus, (ii) up to twelve months of health and life insurance benefits, (iii) full vesting of all unvested stock options and restricted stock, and (iv) up to six months of outplacement services. Each Named Executive Officer's unvested stock options shall vest in full upon a change of control in the Company and each Named Executive Officer shall receive an excise tax restoration payment, if necessary. Under the employment agreements, the stated base salaries as of April 14, 2003 for Mr. Hodgman, Mr. Ackerman, Mr. Carlson and Ms. McClung are $300,000, $245,000, $250,000 and $235,000, respectively.

16

COMPENSATION COMMITTEE REPORT

General

Notwithstanding anything to the contrary set forth in any of the Company's previous or future filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate this Proxy Statement or future filings with the SEC, in whole or in part, the following report and the Performance Graph that follows shall not be deemed to be incorporated by reference into any such filing.

The Compensation Committee of the Board of Directors (the "Committee") exercises broad oversight responsibilities regarding executive compensation and determines the total compensation of executive officers. The Committee is composed exclusively of independent, non-employee directors. The Committee sets the base salary of the Company's executive officers and administers the Company's 1999 Stock Incentive Plan, under which stock option and restricted stock grants may be made to executive officers and other employees. In addition, the Committee administers the Company's Incentive Bonus Plan, under which the Company's executive officers and other employees may receive a bonus based upon the accomplishment of corporate goals, as well as individual performance, and considers and approves management succession for all of the Company's officers.

The fundamental policy of the Committee is to attract and retain individuals of high caliber to serve as executive officers of the Company, to motivate their performance in the achievement of aggressive business plans, to achieve the Company's strategic objectives and to align the interests of executive officers with the long-term interest of stockholders by optimizing stockholder value in a rapidly changing health care market environment. Because the Company's underlying philosophy is "pay for performance," each executive's total compensation is based on the overall performance of the Company and the executive as an individual. Accordingly, each executive officer's compensation package comprises three components: (i) base salary, which reflects individual performance and is designed primarily to be competitive with the base salary levels of other companies within the industry of comparable size to the Company, (ii) annual variable bonus awards, which are tied to the achievement of the Company's performance goals and/or retention objectives established and approved by the Board of Directors (as described more fully in the section entitled "Annual Incentive Compensation" herein), and (iii) stock options and restricted stock grants, which align and strengthen the mutuality of interests between the executive officers and stockholders.

In designing and administering its executive compensation program, the Company attempts to strike an appropriate balance among these various elements, each of which is discussed in greater detail below.

Factors

The process involved and the factors considered in the executive compensation determination for fiscal year 2002 are summarized below. It is expected that this process will remain the same in fiscal year 2003. However, the Committee may, at its discretion, apply a different set of factors in setting executive compensation in the future in order to further enhance the basic concept of "pay for performance."

Salary Levels

The Company's salary program is designed to reward individual performance within the context of the Company's overall performance. Using survey data as a starting point, the Committee takes into account the performance of each officer based on the achievement of specific performance objectives. Other factors considered in the review include the executive's experience and adherence to the Company's values.

17

Annual Incentive Compensation

The Incentive Bonus Plan is designed to reward executive officers for their contributions to corporate objectives and to serve strategic retention objectives. The corporate objectives are established at the beginning of the year by executive management and approved by the Committee and the Board of Directors. Information regarding Company performance (or summaries thereof) is considered by the Committee in a subjective evaluation of overall performance of the Company and the executive officers for purposes of determining actual bonus levels. Based upon 2002 Company performance and retention objectives, the Compensation Committee awarded cash bonuses to the executive officers.

Long-Term Incentive Compensation

The Company's primary incentive for long-term performance is the utilization of stock options as a component of a competitive, performance-based compensation program. The Committee continues to believe that stock options that are granted at the current market price are an excellent incentive for employees to pursue a long-term strategy that will result in increased stockholder value. The performance stock option grant program is designed to align the interests of the executive officers with those of the Company's stockholders and provide each individual with an incentive to manage the Company from the perspective of stockholders. Stock option grants to executive officers are considered annually and are intended to reflect, as well as reward, the individual's contribution to the achievement of aggressive business goals. Each option grant allows the executive officer to acquire shares of the Company's Common Stock at the fair market price on the grant date. Accordingly, the options will provide a return to the executive only if the market price of the underlying shares appreciates over the terms of the options and the executive remains employed by the Company.

The guidelines for stock option grants are reviewed and set periodically, based on a comparison to survey data from other pharmaceutical, biotechnology and high technology companies. In 2002, the Committee considered and approved long-term incentive stock option grants for the plan participants that reflected an assessment of each individual's performance and the individual's impact on overall Company performance.

In January 2003, the Company's stock was delisted from the Nasdaq Stock Market and is now being quoted on the OTC Bulletin Board. As a result of the delisting, the Company suspended the operation of its Employee Stock Purchase Plan ("ESPP"). In addition, none of the Company's outstanding employee stock options were in-the-money. In February 2003, to restore the equity incentives derived from the out-of-the-money stock options and the suspended ESPP, the Committee granted larger-than-usual annual grants of stock options at fair market value to all employees that vest monthly on a pro-rata basis over a twenty-four month period with a ten-year option term.

Chief Executive Officer Compensation

Mr. Hodgman's annual salary for 2002 was $300,000 and is unchanged as of the date of the mailing of this proxy. In determining any adjustment in Mr. Hodgman's salary, the Compensation Committee seeks competitiveness with other companies of comparable size within the industry. In addition, Mr. Hodgman is eligible to receive an incentive bonus dependent on overall Company performance, as well as his individual performance. Based upon the Committee's judgment of the overall performance of the Company in 2002 and Mr. Hodgman's importance to the Company's future success, Mr. Hodgman was awarded a bonus in the amount of $300,000. In 2002, Mr. Hodgman was granted options to purchase 100,000 shares of the Company's Common Stock under the terms and conditions of the Company's stock option plan. As part of the Company's desire to restore some of the value of its equity incentive program, Mr. Hodgman received a grant of 675,000 nonstatutory stock options in February 2003. The exercise prices for the 2002 and 2003 option grants were equal to 100% of the fair market value of the Common Stock on the option grant date. Mr. Hodgman also received a

18

cash payment of $150,000 in exchange for his forfeiture of 30,000 shares of restricted stock that were otherwise scheduled to vest in 2002.

Compliance with Internal Revenue Code Section 162(m)

Section 162(m) of the Internal Revenue Code generally disallows a tax deduction to publicly held companies for compensation exceeding $1 million paid to certain of the corporation's Named Executive Officers. The limitation applies only to compensation that is not considered to be performance-based. The non-performance- based compensation that was paid or vested for fiscal year 2002 did not exceed the $1 million limit per officer, and it is expected that the non-performance-based compensation that will be paid or vested for fiscal year 2003 will not exceed that limit. The Company's 1999 Stock Incentive Plan is structured so that any compensation deemed paid to an executive officer in connection with the exercise of option grants issued under that plan will qualify as performance-based compensation, which will not be subject to the $1 million limitation. The Committee believes that payment of compensation that is subject to the deduction limits of Section 162(m) is sometimes in the best interest of the Company and has approved, and may approve, such arrangements in certain circumstances.

| | | COMPENSATION COMMITTEE |

|

|

Frank T. Cary (Chairman)

André F. Marion

Richard G. Rogers

Walter B. Wriston |

19

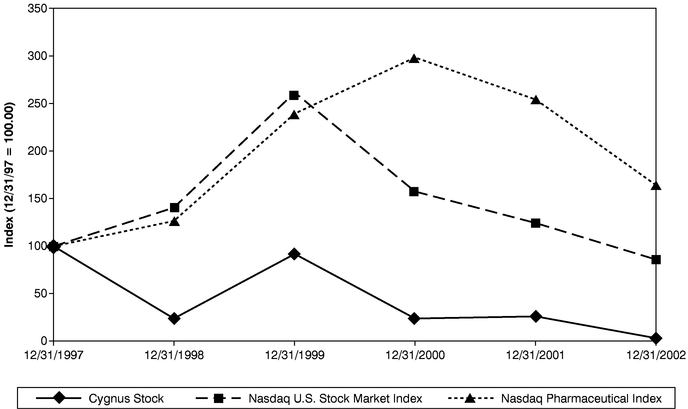

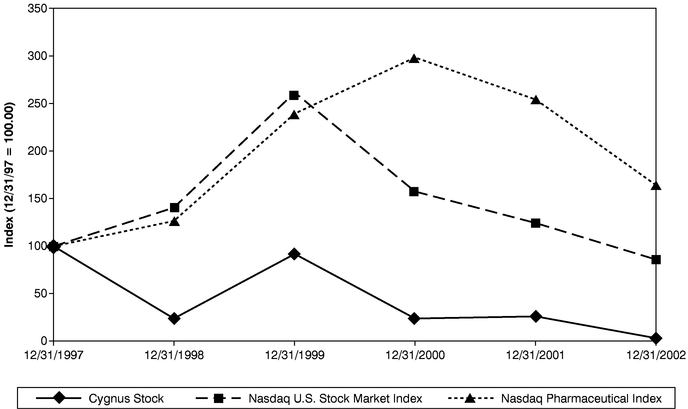

STOCK PERFORMANCE GRAPH

The following graph shows a five-year comparison of cumulative total stockholder returns for the Company, the Nasdaq U.S. Stock Market Index and the Nasdaq Pharmaceutical Index, based on an assumed $100 invested on December 31, 1997, with immediate reinvestment of dividends.

The Company does not believe it can reasonably identify a peer group of companies on an index or line-of-business basis for the purpose of developing a comparative performance index. The Nasdaq Pharmaceutical Index includes companies that develop, manufacture and market pharmaceutical products, including biopharmaceutical products, as well as diagnostic device companies, and, in the opinion of the Company, provides a meaningful index of comparative performance.

The comparisons in the graph below are based on historical data and are not indicative of, or intended to forecast, the possible future performance of the Company's Common Stock.

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL RETURN ON CYGNUS STOCK

AND NASDAQ U.S. STOCK MARKET AND PHARMACEUTICAL INDICES

Total stockholder returns assumes $100 invested on December 31, 1997 with immediate reinvestment of dividends.

STOCKHOLDER PROPOSALS FOR THE 2004 ANNUAL MEETING

Proposals of stockholders of the Company that are intended to be presented by such stockholders at the Company's 2004 Annual Meeting and that stockholders desire to have included in the Company's proxy materials relating to such meeting must be received by the Company no later than December 31, 2003, which is 120 calendar days prior to the anniversary of this year's mail date, and must be in compliance with applicable laws and regulations in order to be considered for possible inclusion in the proxy statement and form of proxy for that meeting.

20

SEC rules also establish a different deadline for submission of stockholder proposals that are not intended to be included in the Company's proxy statement with respect to discretionary voting (the "Discretionary Vote Deadline"). The Discretionary Vote Deadline for the year 2004 Annual Meeting is March 15, 2004, which is 45 calendar days prior to the anniversary of this year's mail date. If a stockholder gives notice of such proposal before the Discretionary Vote Deadline, the Company's proxy holders will be allowed to use their discretionary voting authority to vote against the stockholder proposal when and if the proposal is raised at the Company's 2004 Annual Meeting. Such proposals may be included in next year's Proxy Statement if they comply with certain rules and regulations promulgated by the SEC.

ANNUAL REPORT

A copy of the Company's Annual Report for the fiscal year ended December 31, 2002 has been mailed concurrently with this Proxy Statement to all stockholders entitled to receive notice of and to vote at the Annual Meeting. The Annual Report is not incorporated into this Proxy Statement and is not proxy soliciting material.

FORM 10-K

THE COMPANY WILL MAIL WITHOUT CHARGE TO ANY STOCKHOLDER UPON WRITTEN REQUEST A COPY OF THE COMPANY'S ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2002, INCLUDING THE FINANCIAL STATEMENTS, SCHEDULES AND A LIST OF EXHIBITS. REQUESTS SHOULD BE SENT TO THE COMPANY AT CYGNUS, INC., ATTENTION: CORPORATE COMMUNICATIONS, 400 PENOBSCOT DRIVE, REDWOOD CITY, CALIFORNIA 94063.

OTHER MATTERS

The Company knows of no other matters to be submitted to the meeting. If any other matters properly come before the meeting, the persons named in the accompanying form of proxy will vote the shares represented by proxy as the Board of Directors may recommend or as the proxy holders, acting in their sole discretion, may determine.

| | | By Order of the Board of Directors |

|

|

|

|

|

John C Hodgman

Chairman, President and Chief Executive Officer |

Dated: April 29, 2003

21

CYGNUS, INC.

1999 STOCK INCENTIVE PLAN

(As Amended and Restated March 18, 2003)

TABLE OF CONTENTS

| |

| | Page

|

|---|

| SECTION 1. INTRODUCTION | | A-1 |

SECTION 2. DEFINITIONS |

|

A-1 |

SECTION 3. ADMINISTRATION |

|

A-3 |

|

|

(a) Committee Composition |

|

A-3 |

|

|

(b) Authority of the Committee |

|

A-4 |

SECTION 4. ELIGIBILITY |

|

A-4 |

|

|

(a) General Rules |

|

A-4 |

|

|

(b) Incentive Stock Options |

|

A-4 |

SECTION 5. SHARES SUBJECT TO PLAN |

|

A-4 |

|

|

(a) Basic Limitations |

|

A-4 |

|

|

(b) Additional Shares |

|

A-4 |

|

|

(c) Dividend Equivalents |

|

A-4 |

SECTION 6. TERMS AND CONDITIONS FOR AWARDS OF RESTRICTED STOCK AND STOCK UNITS |

|

A-4 |

|

|

(a) Time, Amount and Form of Awards |

|

A-4 |

|

|

(b) Payment for Awards |

|

A-5 |

|

|

(c) Vesting Conditions |

|

A-5 |

|

|

(d) Form and Time of Settlement of Stock Units |

|

A-5 |

|

|

(e) Death of Recipient |

|

A-5 |

|

|

(f) Creditors' Rights |

|

A-5 |

|

|

(g) Effect of a Change in Control |

|

A-5 |

SECTION 7. TERMS AND CONDITIONS OF OPTIONS |

|

A-5 |

|

|

(a) Stock Option Agreement |

|

A-5 |

|

|

(b) Number of Shares |

|

A-6 |

|

|

(c) Exercise Price |

|

A-6 |

|

|

(d) Exercisability and Term |

|

A-6 |

|

|

(e) Effect of a Change in Control |

|

A-6 |

|

|

(f) Modifications or Assumption of Options |

|

A-6 |

|

|

(g) Transferability of Options |

|

A-6 |

|

|

(h) No Rights as a Stockholder |

|

A-6 |

|

|

(i) Restrictions on Transfer |

|

A-7 |

|

|

(j) Automatic Option Grants to Non-Employee Directors |

|

A-7 |

|

|

|

|

|

i

SECTION 8. PAYMENT FOR OPTION SHARES |

|

A-7 |

|

|

(a) General Rule |

|

A-7 |

|

|

(b) Surrender of Stock |

|

A-8 |

|

|

(c) Promissory Note |

|

A-8 |

|

|

(d) Cashless Exercise |

|

A-8 |

|

|

(e) Other Forms of Payment |

|

A-8 |

SECTION 9. STOCK APPRECIATION RIGHTS |

|

A-8 |

|

|

(a) SAR Agreement |

|

A-8 |

|

|

(b) Number of Shares |

|

A-8 |

|

|

(c) Exercise Price |

|

A-8 |

|

|

(d) Exercisability and Term |

|

A-8 |

|

|

(e) Effect of Change in Control |

|

A-8 |

|

|

(f) Exercise of SARs |

|

A-9 |

|

|

(g) Modification or Assumption of SARs |

|

A-9 |

SECTION 10. PROTECTION AGAINST DILUTION |

|

A-9 |

|

|

(a) Adjustments |

|

A-9 |

|

|

(b) Reorganizations |

|

A-9 |

SECTION 11. VOTING AND DIVIDEND RIGHTS |

|

A-9 |

|

|

(a) Restricted Stock |

|

A-9 |

|

|

(b) Stock Units |

|

A-10 |

SECTION 12. AWARDS UNDER OTHER PLANS |

|

A-10 |

SECTION 13. LIMITATIONS ON RIGHTS |

|

A-10 |

|

|

(a) Retention Rights |

|

A-10 |

|

|

(b) Stockholders' Rights |

|

A-10 |

|

|

(c) Regulatory Requirements |

|

A-10 |

SECTION 14. WITHHOLDING TAXES |

|

A-10 |

|

|

(a) General |

|

A-10 |

|

|

(b) Share Withholding |

|

A-10 |

SECTION 15. ASSIGNMENT OR TRANSFER OF AWARDS |

|

A-11 |

|

|

(a) General |

|

A-11 |

|

|

(b) Trusts |

|

A-11 |

|

|

|

|

|

ii

SECTION 16. DURATION AND AMENDMENTS |

|

A-11 |

|

|

(a) Term of the Plan |

|

A-11 |

|

|

(b) Right to Amend or Terminate the Plan |

|

A-11 |

SECTION 17. EXECUTION |

|

A-11 |

iii

CYGNUS, INC.

1999 STOCK INCENTIVE PLAN

As Amended and Restated March 18, 2003

SECTION 1. INTRODUCTION.

The purpose of the Plan is to promote the long-term success of the Company and the creation of stockholder value by offering Key Employees an opportunity to acquire a proprietary interest in the success of the Company, or to increase such interest, and to encourage such selected persons to continue to provide services to the Company or its Subsidiaries and to attract new individuals with outstanding qualifications.

The Plan seeks to achieve this purpose by providing for Awards in the form of Restricted Stock, Stock Units, Options (which may constitute Incentive Stock Options or Nonstatutory Stock Options) or Stock Appreciation Rights.

The Plan shall be governed by, and construed in accordance with, the laws of the State of California (except its choice-of-law provisions). Capitalized terms shall have the meaning provided in Section 2 unless otherwise provided in this Plan, or in the applicable Stock Award Agreement, SAR Agreement or Stock Option Agreement.

SECTION 2. DEFINITIONS.

(a) "Award" means any award of an Option, SAR, Restricted Stock or Stock Unit under the Plan.

(b) "Board" means the Board of Directors of the Company, as constituted from time to time.

(c) "Change in Control" means a change in control of a nature that would be required to be reported (assuming such event has not been "previously reported") in response to Item 1(a) of the Current Report on Form 8-K, as in effect on the date hereof, pursuant to Section 13 or 15(d) of the Exchange Act; provided that, without limitation, such a change in control shall be deemed to have occurred at such time as (a) any person is or becomes the "beneficial owner" (as defined in Rule 13d-3 under the Exchange Act), directly or indirectly, of 50% or more of the combined voting power of the Company's voting securities; or (b) individuals who constitute the Board on the date hereof (the "Incumbent Board") cease for any reason to constitute at least a majority thereof, provided that any person becoming a director subsequent to the date hereof whose election, or nomination for election by the Company's stockholders, was approved by a vote of at least three quarters of the directors comprising the Incumbent Board (either by a specific vote or by approval of the proxy statement of the Company in which such person is named as a nominee for director, without objection to such nomination) shall be, for purposes of this clause (b), considered as though such person were a member of the Incumbent Board.

A transaction shall not constitute a Change in Control if its sole purpose is to change the state of the Company's incorporation or to create a holding company that will be owned in substantially the same proportions by the persons who held the Company's securities immediately before such transaction.

(d) "Code" means the Internal Revenue Code of 1986, as amended.

(e) "Committee" means a committee consisting of one or more members of the Board that is appointed by the Board (as described in Section 3) to administer the Plan.

(f) "Common Stock" means the Company's common stock.

(g) "Company" means Cygnus, Inc. a Delaware corporation.

(h) "Consultant" means an individual who performs bona fide services to the Company or a Subsidiary other than as an Employee or Director or Non-Employee Director.

(i) "Director" means a member of the Board who is also a common-law employee of the Company or Subsidiary.

(j) "Disability" means that the Key Employee is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment.

(k) "Employee" means any individual who is a common-law employee of the Company or Subsidiary.

(l) "Exchange Act" means the Securities Exchange Act of 1934, as amended.