Exhibit (d)(6)

Syndicated multi currency senior facilities agreement

Project Frankfort

Each party listed in part 1 of schedule 1

(as Borrowers)

Each party listed in part 2 of schedule 1

(as Initial Guarantors)

Each party listed in schedule 2

(as Financiers)

National Australia Bank Limited

ABN 12 004 044 937

(as Senior Agent)

Westpac Banking Corporation

ABN 33 007 457 141

(as Security Trustee)

Westpac Banking Corporation

ABN 33 007 457 141

(as Australian WC Facility Provider)

and

National Australia Bank Limited

ABN 12 004 044 937

(as US LC Facility Provider)

MLC Centre Martin Place Sydney New South Wales 2000 Australia

Telephone +61 2 9225 5000 Facsimile +61 2 9322 4000

www.freehills.com DX 361 Sydney

SYDNEY MELBOURNE PERTH BRISBANE SINGAPORE

Correspondent Offices HANOI HO CHI MINH CITY JAKARTA KUALA LUMPUR

Reference JRS:EDC:36G

This syndicated multi currency senior facilities agreement

is made on 2005 between the following parties:

1 Each party listed in part 1 of schedule 1

(each a Borrower)

2 Each party listed in part 2 of schedule 1

(each an Initial Guarantor)

3 Each party listed in schedule 2

(each a Financier)

4 National Australia Bank Limited

ABN 12 004 044 937

of Level 25, 225 George Street, Sydney NSW 2000

(Senior Agent)

5 Westpac Banking Corporation

ABN 33 007 457 141

of Level 1, 255 Elizabeth Street, Sydney NSW 2000

(Security Trustee)

6 Westpac Banking Corporation

ABN 33 007 457 141

of Level 14, 260 Queen Street Brisbane

(Australian WC Facility Provider)

7 �� National Australia Bank Limited

ABN 12 004 044 937

of Level 25, 225 George Street, Sydney NSW 2000

(US LC Facility Provider)

Recital

The Financiers have agreed, subject to this agreement, to provide the Facilities to the Borrowers through their respective Facility Offices on the terms of this agreement.

The parties agree

in consideration of, among other things, the mutual promises contained in this agreement:

1.1 Definitions

In this agreement:

Account Bank Deed means an agreement or other instrument executed by a Transactional Bank or other bank or financial institution with which a Transaction Party operates deposit accounts in favour of the Security Trustee and which contains certain acknowledgements and undertakings with respect to the Senior Finance Parties’ Security over the relevant deposit accounts with that

1

Transactional Bank or other bank or financial institution and includes, in relation to a US Transaction Party, a “Deposit Account Control Agreement” under and as defined in the US Security Agreement in relation to those deposit accounts;

Accounting Standards means accounting principles and practices applying by law, or otherwise generally accepted accounting principles, in Australia;

Acquisition Agreement Claim means any claim for breach of contract or warranty by, misrepresentation by, indemnity or other similar claim against, any person (including any employee, officer or adviser of a Transaction Party or any of its Subsidiaries) in relation to the Merger Agreement or the CFG Share Sale Agreement (but does not include any claim under the CFG Share Sale Agreement which is satisfied by a transfer of shares in AusHoldco, USHoldco or AsiaHoldco from, or on behalf of CFG Management, to the Sponsor or Entities exclusively managed and advised by the Sponsor);

Acquisition Costs means:

(a) amounts payable to:

(1) holders of certificates representing WRC Common Stock issued and outstanding immediately prior to the Effective Time; and

(2) holders of WRC Options at the Effective Time,

pursuant to the Merger Agreement and any other amounts payable by the Australian Borrower or a Target Company under or in connection with the Merger Agreement (but not including any payments between Transaction Parties or a payment from the Australian Borrower to a Target Company under the Merger Agreement);

(b) amounts payable to CFG Management for the acquisition of shares and other equity interests in CFG under the CFG Share Sale Agreement;

(c) any dividends or other distributions of WRC, CFG or any Target Group Member which have been declared, but remain unpaid immediately prior to Financial Close;

(d) any special one time bonuses, retention bonuses and other amounts payable to executives and employees of Target Companies which are payable in connection with the Merger or are otherwise accrued but remain unpaid immediately prior to Financial Close;

(e) liabilities of WRC under or in connection with the Existing Pat & Oscars Lease Guarantees;

(f) amounts required to repay any Financial Indebtedness of the Target Companies outstanding immediately prior to Financial Close in accordance with clause 2.1(v);

(g) amounts required to be paid by a Transaction Party at or about Financial Close under any Merger Agreement Hedging;

(h) costs and expenses (including Taxes) incurred in connection with the cancellation of the Corporate-Owned Life Insurance Policies issued on 1 June 1985 by Manufacturers Life Insurance Company as contemplated in section 7.3(j) of the Merger Agreement;

(i) the YUM Transfer Fee,

2

and all other costs and transaction expenses (including costs of the advisors of the Borrowers, the Sponsor, WRC, the Senior Finance Parties and the Mezzanine Finance Parties) and other amounts incurred or to be incurred by a Consolidated Group Member in connection with the Merger, a Shareholders’ Agreement, the Corporate Restructure and the Establishment of Groups contemplated in the Funds Flow Statement;

Additional Guarantor means a person who has executed a Guarantee Assumption Agreement;

Anti-Terrorism Law means any requirement of law relating to terrorism or money laundering;

AsiaHoldco means SingCo Trading Pte. Ltd., a Singaporean Company;

Asian Business means the businesses to be operated by the Asian Group after Financial Close, including:

(a) the ownership, operation, development and franchising (as franchisor, franchisee or licensee) of the “Sizzler” concept outside Australia, North America, South America and the Caribbean;

(b) the ownership (whether under licence or otherwise) of all “Sizzler” related trademarks and service marks and other Intellectual Property Rights related to the “Sizzler” business other than to the extent they relate to Australia, North America, South America or the Caribbean; and

(c) the ownership of the Existing Joint Venture Interests;

Asian Group means AsiaHoldco and its Subsidiaries and, prior to the completion of Corporate Restructure Step Number 6, SIM and each of its Subsidiaries (other than a Subsidiary of SIM which is to be transferred to the US Borrower or another US Group Member pursuant to the Corporate Restructure (being Restaurant Concepts of Australia Pty Ltd, Furnace Concepts International, Inc. and Furnace Concepts Australia Corp));

Asian Group Member means an Entity which forms part of the Asian Group;

Asian Group Subordinated Intercompany Loan Agreement means the agreement entitled “Asian Group Subordinated Intercompany Loan Agreement” dated on or before Financial Close between the Australian Borrower (as borrower) and AsiaHoldco (as lender);

Asian Sale means a sale of all or substantially all of the assets and undertaking of the Asian Group or a sale of all the Marketable Securities in SIM or AsiaHoldco;

ASIC means the Australian Securities and Investments Commission;

Associate means an associate as defined in section 318 of the Income Tax Assessment Act 1936 (Cth);

Attorney means an attorney appointed under a Senior Finance Document;

AUD Facility means a Facility denominated in Australian Dollars, being Facility A, Facility B, the Australian WC Facility or Facility E;

AusHoldco means Collins Foods Holding Pty Limited ACN 113 801 648;

Australian Borrower means Aus Bidco Pty Limited ACN 113 833 391;

3

Australian Business means the businesses to be operated by the Australian Group after Financial Close, including:

(a) the operation under franchise of “KFC” restaurants in Australia;

(b) the ownership, operation, development and franchising (as franchisor, franchisee or licensee) of the “Sizzler” concept in Australia;

(c) the ownership (whether under licence or otherwise) of all “Sizzler” related trademarks and service marks and other Intellectual Property Rights related to the “Sizzler” business in Australia; and

(d) prior to the Permitted Asian Sale Completion Date, the Asian Business;

Australian Dollar Equivalent means in relation to an amount expressed in US Dollars at any time, such amount translated into Australian Dollars at the rate of exchange, determined by the Senior Agent, as the spot rate of exchange at which the Senior Agent could, on that date, purchase from another person, in the normal course of dealings with currencies, that amount of currency with Australian Dollars;

Australian Dollars, AUD and A$ means the lawful currency of the Commonwealth of Australia;

Australian Facility Office means, in respect of a Financier:

(a) the office of the Financier set out opposite its name in schedule 2; or

(b) subject to clause 1.9, the office of the Financier or its Related Body Corporate notified by the Financier under this agreement;

Australian Funding Portion means a Funding Portion provided or to be provided to the Australian Borrower;

Australian Group means:

(a) AusHoldco;

(b) the Australian Borrower;

(c) CFG and each of its Subsidiaries; and

(d) prior to the completion of any Permitted Asian Sale, each Asian Group Member;

Australian Group Member means any Entity which forms part of the Australian Group;

Australian Group Tax Sharing Agreement means a tax sharing agreement or tax contribution agreement in relation to any Consolidated Group Member which is part of a consolidated group for Australian tax purposes;

Australian Target Company means each Entity listed in part 1 of schedule 11;

Australian Target Security means a Security required to be executed by an Australian Target Company on the Whitewash Completion Date being:

(a) a Property Mortgage referred to in paragraph (a) to (e) of the definition of “Property Mortgage”; or

(b) a Deed of Charge referred to in paragraph (e) of the definition of “Deed of Charge”;

4

Australian Transaction Party means a Transaction Party incorporated or registered under the laws of Australia;

Australian WC Facility means the Australian Dollar revolving credit facility with an aggregate facility limit of A$15,000,000 made available by the Australian WC Facility Provider to the Australian Borrower under the Australian WC Facility Documents;

Australian WC Facility Documents means the agreement dated on or about the date of this agreement between the Australian Borrower and the Australian WC Facility Provider (as amended or replaced from time to time as permitted under clause 11.27);

Australian WC Facility Letter of Credit means a guarantee, performance bond, banker’s undertaking, letter of credit or similar instrument issued under an Australian WC Facility Document;

Australian WC Facility Provider means:

(a) Westpac Banking Corporation; or

(b) any bank or financial institution substituted by the then current Australian WC Facility Provider under and in accordance with clause 19 for the whole of that Australian WC Facility Provider’s Commitment for the Australian WC Facility;

Australian Withholding Tax means any Australian Tax required to be withheld or deducted from any interest or other payment under Division 11A of Part III of the Income Tax Assessment Act 1936 (Cth) or any equivalent Tax imposed under any other legislation from time to time;

Authorisation means:

(a) any consent, registration, filing, agreement, notice of non-objection, notarisation, certificate, licence, approval, permit, authority or exemption; or

(b) in relation to anything which a Government Agency may prohibit or restrict within a specific period, the expiry of that period without intervention or action or notice of intended intervention or action;

Authorised Officer means:

(a) in relation to a Transaction Party, a director or a secretary, or a person notified to the Senior Agent to be an authorised officer, of the Transaction Party for the purposes of a Senior Finance Document and whose specimen signature is provided with such notification to the Senior Agent and in respect of which the Senior Agent has not received written notification of the revocation of that appointment; and

(b) in relation to a Senior Finance Party, any person whose title includes the word “Director”, “Managing Director”, “Manager” or “Vice President”, and, provided notification of authorisation is given to the Borrowers on request by any Borrower, any other person appointed by the Senior Finance Party to act as its authorised officer for the purposes of this agreement;

5

Available Currency means:

(a) in relation to an AUD Facility (other than Facility E), Australian Dollars;

(b) in relation to a USD Facility, US Dollars; and

(c) in relation to Facility E:

(1) for Funding Portions to be provided or provided to the Australian Borrower, Australian Dollars; and

(2) for Funding Portions to be provided or provided to the US Borrower, US Dollars;

Availability Period means, in relation to a Facility, the period commencing on the date of this agreement and ending on the earlier of:

(a) in the case of:

(1) Facilities A, B and C, Financial Close; and

(2) in the case of Facilities D and E, the date which is 30 days before the Termination Date; and

(b) the date on which the Total Commitments for that Facility are cancelled in full under this agreement;

Base Rate means:

(a) in relation to a Funding Portion or other amount denominated in Australian Dollars, BBR;

(b) in relation to a Funding Portion or other amount denominated in US Dollars, LIBOR;

BBR means, in respect of an Interest Period for a Funding Portion denominated in Australian Dollars:

(a) the average bid rate displayed at or about 10.30am (Sydney time) on the Rate Set Date on the Reuters screen BBSY page for a term equivalent to, or if not equivalent to, most closely approximating, the Interest Period, provided, in the case where the term is not equivalent to that Interest Period, the term is not more than 3 days longer or shorter than the Interest Period; or

(b) if:

(1) for any reason that rate is not displayed (or is not displayed for the relevant period); or

(2) the basis on which that rate is displayed is changed and in the opinion of the Senior Agent it ceases to reflect the Financiers’ cost of funding to the same extent as at the date of this agreement,

then the BBR will be the rate determined by the Senior Agent to be the average of the buying rates quoted to the Senior Agent by 3 Reference Banks at or about 10.30am (Sydney time) on the Rate Set Date; the buying rates must be for bills of exchange accepted by a leading Australian bank and which have a term equivalent to, or, if not equivalent to, most closely approximating, the Interest Period provided, in the case where the term is not equivalent to that Interest Period, the term is not more than 3 days longer or shorter than the Interest Period; if there are less than 3 Reference Banks quoting buying rates for that period, then the BBR for each

6

Financier will be the rate notified by that Financier to the Senior Agent to be that Financier’s cost of funding its Pro Rata Share of the Funding Portion for the Interest Period.

All calculations of rates for the purposes of this definition will be expressed as a yield percent per annum to maturity;

Bill means a bill of exchange as defined in the Bills of Exchange Act 1909 (Cth);

Blocked Account means an Australian Prepayment Suspense Account referred to in clause 8.6(b) or, prior to the US Repayment Date, a US Prepayment Suspense Account referred to in clause 8.7(b);

Borrower means:

(a) the Australian Borrower; or

(b) at any time prior to the US Repayment Date, the US Borrower,

and, where used in relation to a Funding Portion, means the Borrower which requested that Funding Portion or to whom that Funding Portion is provided;

Break Benefits means, for any repayment or prepayment, the amount (if any) by which:

(a) the interest (excluding any Margin) on the amount repaid or prepaid which a Financier should have received under this agreement (had the repayment or prepayment not occurred),

is less than:

(b) the return which that Financier certifies that it would otherwise be able to obtain in respect of the amount repaid or prepaid,

in each case for the period from the date of repayment or prepayment until the last day of the then current Interest Period applicable to the repaid or prepaid amount;

Break Costs means, for any repayment or prepayment, the amount (if any) by which:

(a) the interest (excluding any Margin) on the amount repaid or prepaid which a Financier should have received under this agreement (had the repayment or prepayment not occurred),

exceeds:

(b) the return which that Financier would be able to obtain by placing the amount repaid or prepaid to it on deposit with a Reference Bank,

in each case for the period from the date of repayment or prepayment until the last day of the then current Interest Period applicable to the repaid or prepaid amount;

Business Day means:

(a) for the purposes of clause 21.3, a day on which banks are open for business in the city where the notice or other communication is received excluding a Saturday, Sunday or public holiday;

(b) in relation to the delivery of a Funding Notice or Selection Notice under a USD Facility or in respect of a Funding Portion provided or to be provided to the US Borrower under Facility E or any payment or advance of a currency by or to the US Borrower, a day on which banks are open for

7

business in New York City, Sydney and Melbourne (excluding a Saturday, Sunday or public holiday);

(c) in relation to the determination of the Base Rate for a Funding Portion:

(1) denominated in Australian Dollars, a day on which banks are open for business in Sydney (excluding a Saturday, Sunday or public holiday); and

(2) denominated in US Dollars, a day on which banks are open for business in London and New York City (excluding a Saturday, Sunday or public holiday); and

(d) for all other purposes, a day on which banks are open for business in Sydney and Melbourne (excluding a Saturday, Sunday or public holiday);

Business Plan means the Consolidated Group’s proposed budget and updated financial model projections, including a detailed capital expenditure budget for the period prior to the Termination Date (such plan to be in the form approved by the Senior Agent in writing prior to Financial Close or in such other form as may be agreed by the Senior Agent);

Calculation Date means the last day of the third, sixth or ninth Trading Cycle in any Financial Year or the last day of any Financial Year, in each case, occurring on or after 1 January 2006 and on or before the Termination Date. Details of each Calculation Date are highlighted in schedule 13;

Calculation Period means, in relation to a Calculation Date, a period of 13 Trading Cycles ending on the Calculation Date;

Capital Expenditure means expenditure on equipment, machinery, fixed assets, real property improvements or any other capital assets which under Accounting Standards is regarded as capital expenditure;

Cash Equivalent means:

(a) bank deposits expressly permitted under this agreement; or

(b) debt instruments which mature within 6 months or are readily tradeable in a liquid market,

in each case which are deposits with, or debts obligations of or which are unconditionally guaranteed by, an entity which has a short term credit rating of at least A1 from Standard & Poor’s or P1 from Moody’s Investors Service or, in the case of bank deposits only, deposits with a Financier;

CFG means Collins Foods Group Pty Limited ABN 52 009 937 900;

CFG Management means each shareholder of CFG immediately prior to Financial Close, other than WRC;

CFG Share Sale Agreement means the agreement entitled “Share Sale and Subscription Agreement” dated on or before Financial Close between, among others, CFG Management (as vendors) and the Australian Borrower (as purchaser) under which CFG Management agree to sell and the Australian Borrower agrees to purchase the shares owned by CFG Management in CFG;

CFI means Collins Foods International Pty Limited, a Nevada corporation;

8

Change of Control means, in relation to an Entity, where funds exclusively managed and advised by the Sponsor do not, or cease to, Control that Entity;

Change in Law means any present or future law, regulation, treaty, order or official directive or official request (which, if not having the force of law, would be complied with by a responsible financial institution) which:

(a) commences, is introduced, or changes, after the date of this agreement; and

(b) does not relate to a change in the effective rate at which Tax is imposed on the overall net income of a Senior Finance Party;

Code means the United States Internal Revenue Code of 1986;

Collateral Security means any present or future Encumbrance, Guarantee or other document or agreement created or entered into by a Transaction Party or any other person as security for, or to credit enhance, the payment of any of the Secured Moneys;

Commitment means:

(a) in respect of a Financier and a Facility other than the Australian WC Facility, the amount specified opposite its name in schedule 2 in respect of that Facility, as adjusted under this agreement;

(b) in respect of the Australian WC Facility Provider and the Australian WC Facility, its commitment under the Australian WC Facility Documents (up to a maximum total commitment of A$15,000,000); or

(c) in respect of a Financier without reference to a particular Facility, the aggregate of the amounts specified opposite its name in schedule 2 for all Facilities, as adjusted under this agreement plus, in the case of a Financier which is also the Australian WC Facility Provider, its commitment under the Australian WC Facility Documents at that time (up to a maximum total commitment of A$15,000,000 in respect of the Australian WC Facility at any time);

Compliance Certificate means a certificate in the form of schedule 8;

Consolidated Group means at any time:

(a) each Australian Group Member at that time; and

(b) if that time is prior to the US Repayment Date, each US Group Member at that time;

Consolidated Group Member means any Entity which forms part of the Consolidated Group;

Contested Tax means a Tax payable by a Transaction Party that is being contested in good faith on reasonable grounds;

Continuing Intercompany Loan Agreement means:

(a) the Asian Group Subordinated Intercompany Loan Agreement;

(b) the SIM Long Term Loan Agreement; or

(c) the Subordinated Intercompany Loan Agreement;

9

Continuing SERP Guarantee means the guarantees given or assumed by CFI or CRQ in respect of the obligations of WRC to 11 former employees in connection with the SERP;

Control means, in respect of an Entity:

(a) power or control over the management of the Entity, and the identity of the persons responsible for managing the Entity, whether through ownership of voting securities or interests, contract or otherwise including control of the board of directors and the appointment of the majority of directors. It does not matter whether the power or control is direct or (in the reasonable opinion of the Senior Agent) indirect or is, or can be exercised as a result of, by means of or by the revocation or breach of a trust, an agreement, a practice, or a combination of them, whether or not they are enforceable. It does not matter whether the power or control is expressed or implied, formal or informal, exercisable alone or jointly with someone else; and

(b) the practical ability to determine the outcome of decisions about the Entity’s financial and operating policies;

Controller means a controller as defined in section 9 of the Corporations Act;

Core Australian Group means the Australian Group other than the Asian Group and Core Australian Group Member means each Australian Group Member other than an Asian Group Member;

Core Australian Business means the Australian Business, but excludes the Asian Business;

Corporate Restructure means the corporate restructure contemplated in clause 2.7;

Corporate Restructure Loan means:

(a) the advance to be made by the US Borrower to the Australian Borrower on Financial Close of approximately A$62,000,000 (or its equivalent in US Dollars), the proceeds of which are to be used by the Australian Borrower to pay Acquisition Costs;

(b) the promissory note for approximately A$12 million dated the date of completion of Corporate Restructure Step Number 4 made by CFG in favour of SIM, which is to be distributed by way of dividend to WRC on or simultaneously with its issue, as referred to in Corporate Restructure Step Number 4;

(c) the agreement between the Australian Borrower and WRC to defer payment by the Australian Borrower of the purchase price for the acquisition by the Australian Borrower of all of the issued share capital in CFG held by WRC (that purchase price being approximately A$182,000,000), as referred to in Corporate Restructure Step Number 5;

(d) the agreement between the Australian Borrower and WRC to defer payment by the Australian Borrower of the purchase price for the acquisition by the Australian Borrower of the rights of WRC under the SIM Long Term Loan Agreement from WRC as referred to in Corporate Restructure Step Number 6;

10

(e) on and from completion of Corporate Restructure Step Number 2, the loan existing from WRC to the Australian Borrower as a consequence of the assignment or novation by P&O Holding Corp of it rights under the Pat & Oscars Loan Agreement to WRC at the time of completion of Corporate Restructure Step Number 2;

Corporate Restructure Loan Borrower means the borrower of a Corporate Restructure Loan or, in the case of a promissory note that has been indorsed in favour of another person (as payee), the person to whom that promissory note has been indorsed;

Corporate Restructure Loan Lender means the provider of a Corporate Restructure Loan (and includes the issuer of any promissory note);

Corporate Restructure Step means a step to be undertaken as part of the Corporate Restructure and a reference to the Number of a Corporate Restructure Step is the step corresponding to that number in the table set out in schedule 12;

Corporations Act means the Corporations Act 2001 (Cth);

CRM means Collins Restaurants Management Pty Limited ACN 093 912 979;

Cross Guarantee means the guarantee and indemnity in clause 14;

CRQ means Collins Restaurants Queensland Pty Limited ABN 97 009 988 381;

Current Australian Dollar Amount means, at any time, in respect of a Funding Portion or proposed Funding Portion denominated in:

(a) Australian Dollars, the principal amount outstanding of the Funding Portion in Australian Dollars at that time; and

(b) US Dollars, the Australian Dollar Equivalent at that time of the principal amount outstanding of the Funding Portion;

Current LC means any Letter of Credit which has not been discharged in full or in respect of which the obligations of the US Borrower remain unsatisfied;

Debt Interest means an interest (whether present or future) of a Financier under any of the AUD Facilities (other than the Australian WC Facility or a Funding Portion provided or to be provided to the US Borrower under Facility E), including any participation in a Funding Portion provided under an AUD Facility (other than the Australian WC Facility or a Funding Portion provided or to be provided to the US Borrower under Facility E);

Debt Service Cover Ratio means, as at any Calculation Date, the ratio of A to B, where:

(a) “A” is EBITDA of the Consolidated Group for the Calculation Period ending on that Calculation Date,

less:

(1) the amount of corporate Tax and other Tax on income and gains (other than Taxes incurred prior to Financial Close and Taxes incurred in connection with the Merger or Corporate Restructure) paid in cash by the Consolidated Group on a consolidated basis during the Calculation Period ending on that Calculation Date (net of cash Tax amounts, including refunds of Tax, received by

11

Consolidated Group Members during the Calculation Period ending on that Calculation Date); and

(2) Net Capital Expenditure incurred by the Consolidated Group on a consolidated basis during the Calculation Period ending on that Calculation Date; and

(b) “B” is the repayments of Facility A required be made under clause 8.2 plus Net Interest Expense for the Consolidated Group in each case during the Calculation Period ending on that Calculation Date;

Deed of Charge means:

(a) the deed of charge and share mortgage dated on or about the date of this agreement between the Australian Borrower, AusHoldco and the Security Trustee;

(b) the share pledge dated on or about the date of this agreement between the Australian Borrower and the Security Trustee;

(c) the share pledge dated on or about the date of completion of Corporate Restructure Step Number 6 between AsiaHoldco and the Security Trustee;

(d) the US Security Agreement;

(e) any deed of charge, deed of charge and share mortgage, security agreement or other Encumbrance entered into by an Australian Target Company and the Security Trustee;

(f) any security agreement, deed of charge, deed of charge and mortgage, share mortgage or other Encumbrance between any one or more US Target Companies or WRC and the Security Trustee (including any joinder agreement to the US Security Agreement);

(g) the deed of fixed and floating charge dated on or about the date of this agreement between AsiaHoldco and the Security Trustee; or

(h) the share mortgage dated on or about Financial Close between WRC and the Security Trustee;

Default means:

(a) an Event of Default; or

(b) a Potential Event of Default;

Deferred Equity Contribution means equity contributions to be made by CFG Management (or Entities Controlled by CFG Management) contemplated in the Funds Flow Statement which are not actually made on or before Financial Close as contemplated in clause 2.1(q);

DGCL means the General Corporation Law of the State of Delaware;

Disposal means, in respect of any thing, a sale, assignment, transfer or other disposal of that thing or parting with possession of or creating an interest in that thing (or agreeing to do any of those things) and Dispose has a corresponding meaning (with necessary modifications);

Dissenting Share has the meaning given to that term in the Merger Agreement;

Dissenting Shareholder Payment means any payment to be made by WRC in respect of a Dissenting Share either:

12

(a) required to be paid under section 262 of the DGCL; or

(b) agreed to be paid by WRC with respect to any demand for payment provided that the Senior Agent has been given prior written notice of, and has been consulted in relation to, that payment in accordance with clause 11.34;

Distribution means:

(a) any dividend, distribution or other amount declared or paid by a Transaction Party on any Marketable Securities issued by it, including any payment in respect of a redeemable or preference share; or

(b) any payment of interest, principal or other amounts in respect of any Financial Indebtedness of a Transaction Party to an Associate or Related Body Corporate;

Dormant Subsidiary means:

(a) each of the following companies, but only for so long as that company does not carry on any business, undertake any activity or own any assets (including rights under contracts or Intellectual Property Rights) with aggregate book or market values (whichever is higher) in excess of A$50,000 (or equivalent amount in any other currency):

(1) Collins Foods International Pty Ltd, a company incorporated in Nevada, USA;

(2) Collins International, Inc., a company incorporated in Delaware, USA;

(3) Restaurant Concepts International, Inc., a company incorporated in Nevada, USA;

(4) Furnace Concepts International, Inc., a company incorporated in Nevada, USA;

(5) Restaurant Concepts of Australia Pty. Ltd., a company incorporated in Nevada, USA;

(6) Furnace Concepts Australia Corp., a company incorporated in Nevada, USA;

(7) Sizzler Holdings of Canada, Inc., a company incorporated in Canada;

(8) Sizzler of NY., Inc., a company incorporated in New York, USA;

(9) Josephina’s, Inc., a company incorporated in California, USA;

(10) Sizzler Australia Pty Limited, a company incorporated in Australia

(11) Curly’s of Springfield P.A., Inc., a company incorporated in Pennsylvania, USA;

(12) Collins Foods Superannuation Pty Ltd ACN 067 252 635, a company incorporated in Australia;

(13) Collins Properties, Inc., a company incorporated in New York, USA;

(14) Scott & Sizzler’s Ltd, a company incorporated in Canada;

13

(15) CFI Insurers, Ltd., a Bermudan corporation;

(b) any other Subsidiary of a Transaction Party which the Senior Agent (acting on the instructions of the Majority Financiers) agrees in writing to be a “Dormant Subsidiary” for the purposes of this agreement but only for so long as that company does not carry on any business, undertake any activity or own any assets (including rights under contracts or Intellectual Property Rights) with aggregate book or market values (whichever is higher) in excess of A$50,000 (or equivalent amount in any other currency);

EBITDA means in respect of any period the consolidated profit of the Consolidated Group (or a Consolidated Group Member, or a Group, depending on the context) for that period after adjustment to exclude (to the extent included):

(a) any deduction or contribution in respect of corporate Tax or other Taxes on income or gains during that period;

(b) any deduction in respect of Interest Expense during that period;

(c) any contribution in respect of Interest Income during that period;

(d) any contribution in respect of individually significant or abnormal items during that period;

(e) any deduction in respect of individually significant or abnormal items during that period;

(f) any deduction in respect of any loss against book value incurred on the disposal of any asset (not being disposals made in the ordinary course of trading) during that period and any loss on any revaluation or impairment of any asset (including intangibles) during that period;

(g) any contribution in respect of any profit against book value incurred on the disposal of any asset (not being disposals made in the ordinary course of trading) during that period and any profit on any revaluation or impairment of any asset (including intangibles) during that period;

(h) net profits or losses of any entity which have been consolidated within consolidated profit during that period but are attributable to outside equity interests (not being a Consolidated Group Member, member of the US Group or Australian Group (as applicable));

(i) amortisation of any goodwill and any intangible assets during that period;

(j) any deduction for Acquisition Costs or Restructuring Costs (whether amortised or not) (provided that the maximum amount of Acquisition Costs or Restructuring Costs that can be excluded from EBITDA for all Consolidated Group Members or the Consolidated Group under this paragraph (j) during any period is the aggregate amount of all Acquisition Costs and Restructuring Costs contemplated in the Funds Flow Statement less than any deduction made under this paragraph (j) in any previous period (as such maximum amount may be adjusted in accordance with clause 11.12(b)(10) and clause 11.12(c)(6), as applicable));

(k) any depreciation on fixed assets during that period;

(l) any unrealised gains or losses during that period;

14

(m) any deduction in respect of any management fees paid or payable to PEP Advisory pursuant to the Management Agreement permitted to be paid under clause 11.21(a)(6)(A) or clause 11.21(a)(6)(B) during that period; and

(n) any other non cash items that are required to be expensed in the profit and loss statement under Accounting Standards;

Effective Time has the meaning given to that term in the Merger Agreement;

Embargoed Person means any person subject to sanctions or trade restrictions under United States law;

Encumbrance means an interest or power, lien or security interest:

(a) reserved in or over an interest in any asset, including any retention of title; or

(b) created or otherwise arising in or over any interest in any asset under a bill of sale, mortgage, charge, lien, pledge, trust or power,

by way of, or having similar commercial effect to, security for the payment of a debt, any other monetary obligation or the performance of any other obligation, and includes any agreement to grant or create any of the above;

Entity means a person, corporation, partnership, trust or any other entity or organisation;

Environmental Law means any law or provision of a law (whether statute or common law) concerning environmental matters, health or planning, including law regulating Pollutants in connection with the protection of the environment, any law or provision of a law concerning land use, development pollution, waste disposal, toxic or hazardous substances, conservation of natural or cultural resources and resource allocation or health and safety;

Equity Document means:

(a) the constitution of AusHoldco;

(b) the Certificate of Incorporation and By-laws of USHoldco;

(c) a Shareholders’ Agreement;

(d) the Umbrella Deed;

(e) prior to the Permitted Asian Sale Completion Date only, the Articles of Association of AsiaHoldco;

ERISA means the Employee Retirement Income Security Act of 1974, as amended;

ERISA Entity means any member of an ERISA Group;

ERISA Event means:

(a) any “reportable event,” as defined in Section 4043 of ERISA or the regulations issued thereunder with respect to a US Pension Plan (other than an event for which the 30-day notice period is waived by regulation);

(b) the existence with respect to any US Pension Plan of an “accumulated funding deficiency” (as defined in Section 412 of the Code or Section 302 of ERISA), whether or not waived;

15

(c) the failure to make by its due date a required instalment under Section 412(m) of the Code with respect to any US Pension Plan or the failure to make any required contribution to a US Multiemployer Plan;

(d) the filing pursuant to Section 412(d) of the Code or Section 303(d) of ERISA of an application for a waiver of the minimum funding standard with respect to any US Pension Plan;

(e) the incurrence by any ERISA Entity of any liability under Title IV of ERISA with respect to the termination of any US Pension Plan;

(f) the receipt by any ERISA Entity from the US Pension Benefit Guaranty Corporation or a plan administrator of any notice relating to an intention to terminate any US Pension Plan or to appoint a trustee to administer any US Pension Plan, or the occurrence of any event or condition which could reasonably be expected to constitute grounds under ERISA for the termination of or the appointment of a trustee to administer any US Pension Plan;

(g) the incurrence by any ERISA Entity of any liability with respect to the withdrawal or partial withdrawal from any US Pension Plan or US Multiemployer Plan;

(h) the receipt by an ERISA Entity of any notice concerning the imposition of Withdrawal Liability or a determination that a US Multiemployer Plan is, or is expected to be, insolvent or in reorganization, within the meaning of Title IV of ERISA;

(i) the making of any amendment to any US Pension Plan which could result in the imposition of a lien or the posting of a bond or other security;

(j) the occurrence of a nonexempt prohibited transaction (within the meaning of Section 4975 of the Code or Section 406 of ERISA) which could result in liability to any Transaction Party or any of the Subsidiaries; or

(k) the “substantial cessation of operations” within the meaning of Section 4062(e) of the ERISA with respect to any US Multiemployer Plan;

ERISA Group means any Transaction Party, any Subsidiary of a Transaction Party, any member of a controlled group of corporations and any trade or business (whether or not incorporated) that, together with any Transaction Party or any such Subsidiary, is treated as a single employer under Section 414 of the Code;

Establishment of Groups means the establishment of the US Group, Australian Group and Asian Group as contemplated in clause 2.1(p);

Event of Default means any event specified in clause 12.1;

Exceptions to the Establishment of Groups means:

(a) at any time:

(1) obligations and liabilities of the Transaction Parties under the Senior Finance Documents and the Mezzanine Finance Documents;

(2) obligations and liabilities of a member of any Group (the Payor) to reimburse, on an arm’s length basis, a member of another Group (that other Group being the Payee Group) for a reasonable and commensurate share of all salaries, bonuses and associated salary

16

costs paid to or in respect of executives and employees of the Payee Group to the extent those executives or employees provide services to the Group of which the Payor is a member (whether in common with the Payee Group or any other Group or otherwise);

(3) obligations and liabilities of a member of the US Group or the Asian Group to reimburse, on an arm’s length basis, the Australian Borrower for a reasonable and commensurate share of the fees payable by Australian Borrower to the Security Trustee and the Senior Agent under the Fee Letters;

(4) obligations and liabilities of a member of the Asian Group to reimburse, on an arm’s length basis, the Australian Borrower for a reasonable and commensurate share of the fees payable by Australian Borrower to the Mezzanine Agent under any “Fee Letters” as defined in the Mezzanine Facility Agreement;

(b) at any time prior to the US Repayment Date:

(1) obligations and liabilities of WRC under or in connection with the Existing Pat & Oscars Lease Guarantees;

(2) obligations and liabilities of CFI or CRQ under the Continuing SERP Guarantees;

(3) obligations and liabilities of the parties under the Subordinated Intercompany Loan Agreement;

(4) obligations and liabilities of WRC to pay any premiums in respect of any insurance policy taken out by WRC on behalf of and at the request of a Core Australian Group Member or, prior to the Permitted Asian Sale Completion Date, an Asian Group Member and obligations liabilities of any Core Australian Group Member or, prior to the Permitted Asian Completion Date, any Asian Group Member to reimburse WRC for any payment of premiums for any such insurance policy taken out on its behalf and its request;

(5) obligations and liabilities of WRC to pay any premiums in respect of any umbrella insurance coverage taken out by WRC for which a Core Australian Group Member or, prior to the Permitted Asian Sale Completion Date, an Asian Group Member is named as an insured at the request of that Australian Group Member and obligations and liabilities of any Core Australian Group Member or, prior to the Permitted Asian Completion Date, any Asian Group Member to reimburse WRC for a reasonable and commensurate share of the premium paid in respect of any such umbrella insurance coverage (calculated by reference to the proportionate share of that Australian Group Member in that insurance cover;

(c) at any time prior to the Permitted Asian Sale Completion Date:

(1) obligations and liabilities of the parties under the Asian Group Subordinated Loan Agreement and the SIM Long Term Loan Agreement; and

17

(2) investments of Core Australian Group Members in Asian Group Members where the investment is expressly permitted under the terms of clause 11.13(e);

Excess Cashflow, for any period for the Australian Group or US Group, means EBITDA of the Australian Group or US Group (as applicable) for that period minus (without double counting the same amount twice):

(a) any amounts paid in cash in respect of scheduled principal repayment of Principal Outstanding made during that period by Australian Group Members or US Group Members, as applicable;

(b) any amounts paid in cash by Australian Group Members or US Group Members, as applicable, in respect of unscheduled principal repayment or prepayment of Principal Outstanding made during that period under any Facility (and, in the case of Facility D or the Australian Working Capital Facility, only to the extent such repayment or prepayment permanently reduces the Total Commitments for that Facility) provided that in the case of unscheduled principal prepayments under clause 8.6 (in the case of Excess Cashflow of the Australian Group) or clause 8.7 (in the case of Excess Cashflow of the US Group), only to the extent the proceeds from which that prepayment was sourced were included in EBITDA;

(c) the amount of any proceeds of insurance claims, Disposals (other than Disposals referred to in paragraph (a) of the definition of Permitted Disposal) or Acquisition Agreement Claims of the Australian Group or US Group, as applicable, which are not required to be applied to make mandatory prepayments under clause 8.6 (in the case of Excess Cashflow of the Australian Group) or clause 8.7 (in the case of Excess Cashflow of the US Group), but only to the extent those proceeds were included in EBITDA;

(d) Interest Expense paid in cash during that period by Australian Group Members or US Group Members, as applicable;

(e) Net Capital Expenditure for that period by the Australian Group Members or US Group Members, as applicable;

(f) any corporate Tax or other Taxes on income or gain:

(1) paid by an Australian Group Member or US Group Member, as applicable, in cash during that period (net of cash Tax amounts, including refunds of Tax, received by Australian Group Members or US Group Members, as applicable, during that period); and

(2) estimated to be payable by an Australian Group Member or US Group Member, as applicable, in cash during the 6 month period immediately following that period (net of cash Tax amounts, including refunds of Tax, estimated to be receivable by the Australian Group Members or US Group Members, as applicable, during that 6 month period); and

(g) any realised losses or individually significant costs incurred in cash (ie not including unrealised costs) by Australian Group Members, or US Group Members, as applicable, to the extent not already deducted from EBITDA;

18

plus:

(h) any realised gains or individually significant earnings received in cash (ie not including unrealised earnings) during that period by Australian Group Members, or US Group Members, as applicable, to the extent not already included in earnings in EBITDA, except for any realised gains or individually significant earnings which form part of any proceeds of insurance claims, Disposals (other than Disposals referred to in paragraph (a) of the definition of Permitted Disposal) or Acquisition Agreement Claims;

(i) any amounts deducted from Excess Cashflow by Australian Group Members, or US Group Members, as applicable, pursuant to paragraph (f)(2) of this definition during a previous period for which Excess Cashflow was calculated but not paid during that period;

(j) the amount of dividends or other profit distributions received in cash by any Australian Group Member or US Group Member, as applicable, during that period from companies that are not members of the Australian Group or US Group (as applicable) (and excluding, for the avoidance of doubt, any equity contribution from a company that is not a member of the Australian Group or US Group (as applicable) to the extent that dividend or profit distribution is already included in EBITDA); and

(k) Interest Income received in cash during that period by Australian Group Members or US Group Members, as applicable;

Exchange Agent has the meaning given to that term in the Merger Agreement;

Exchange Fund has the meaning given to that term in the Merger Agreement;

Excluded Interest means Interest Expense in respect of the Mezzanine Debt (as defined in the Intercreditor Deed) which:

(a) is capitalised or deferred; or

(b) is interest (which is itself capitalised or deferred) on such capitalised or deferred interest; or

(c) is any other capitalised or deferred interest in respect of the Mezzanine Debt (as defined in the Intercreditor Deed) if and to the extent that it is payable based on a margin of greater than 5.50% per annum,

in each case in accordance with the Mezzanine Finance Documents. For the avoidance of doubt, if and to the extent that any Interest Expense referred to above ceases to be deferred or capitalised, it will no longer be Excluded Interest;

Excluded Tax means a Tax imposed by a jurisdiction on the net income of a Senior Finance Party but not a Tax:

(a) calculated on or by reference to the gross amount of any payment (without allowance for any deduction) derived by a Senior Finance Party under a Senior Finance Document; or

(b) imposed as a result of a Senior Finance Party being considered a resident of or organised or doing business in that jurisdiction solely as a result of it being a party to a Senior Finance Document or any transaction contemplated by a Senior Finance Document;

Executive Order means United States Executive Order No. 13224 on Terrorist Financing, effective September 24, 2001;

19

Existing Australian Tax Consolidation means the consolidation for Australian tax purposes existing between CFG and its Subsidiaries (other than Subsidiaries incorporated or organised under the laws of, or any state (including the District of Columbia) of, the USA) immediately prior to Financial Close, including the tax sharing agreement dated 30 September 2004 between CFG and each of the parties listed in schedule 1 to that agreement as a “TSA Contribution Member”;

Existing Bank Guarantee means each bank guarantee referred to in part 2 of schedule 10;

Existing Finance Leases means each finance lease referred to in part 1 of schedule 10;

Existing Joint Venture Interest means:

(a) the interest of Sizzler Asia Holdings, Inc. in Sizzler China Pte Ltd, a joint venture established with International Franchise Holding (LaBaun) Ltd to provide support and services for “Sizzler” franchises in China; or

(b) the interest of Sizzler Asia Holdings, Inc., in Sizzler Steak Seafood Salad(s) Pte Ltd, a joint venture established with Kwang Sai Food Pte Ltd to develop “Sizzler” restaurants in Singapore;

Existing Other Material Contract means:

(a) the distribution agreement dated 31 July 1995 between CFI (as transferred to CFG) and P&O Logistics;

(b) the exclusive supply contract between PepsiCo and CRM in place as at Financial Close;

(c) the exclusive supply contract between Coca-Cola and CFG in place as at Financial Close; or

(d) the Fountain Beverage Sales Agreement dated 21 March 2005 between Pepsi-Cola and WRC,

or any replacement of any of those contracts;

Existing Pat & Oscars Lease Guarantees means each of the following guarantees:

(a) Guaranty dated January 18 1996, of the January 25 1996 Carmel Mountain Ranch Lease Agreement between Sudberry-Pardee/CMR #31, Ltd. and S&C Company by Oscar and Martha Sarkisian and George and Tamara Celmo in respect of which WRC has granted an indemnity;

(b) Guaranty dated August 22 2000 of the June 18 1993 Encinitas Lease Agreement between Karl H. Keller and S&C Co., Inc. by WRC (then known as Sizzler International, Inc.) and FFPE Holding Company, Inc.;

(c) Guaranty dated before the date of this agreement of the June 18, 1993 Encinitas Lease Agreement between Karl H. Keller and S&C Co., Inc. by Oscar and Martha Sarkisian and George and Tamara Celmo in respect of which WRC has granted an indemnity;

(d) Guaranty dated September 19 1996, of the September 10 1996 Phoenix Lease Agreement between Vestar Arizona XIII, L.L.C. and Oscar’s of Arizona, L.L.C. by Oscar, Martha, Bernadette and John Sarkisian, George

20

and Tamara Celmo and Tom and Shauna Mattix in respect of which WRC has granted an indemnity;

(e) Guaranty dated November 13 1997 of the November 13, 1997 Parkway Plaza Lease Agreement between H and H-EL Cajon and S&C Company, Inc. by Oscar and Martha Sarkisian and George and Tamara Celmo in respect of which WRC has granted an indemnity;

(f) Guaranty dated April 25 2001, of the April 25, 2001 Carmel Valley Lease Agreement between CDM Retail, L.P. and FFPE, LLC by WRC (then known as Sizzler International, Inc.);

(g) Guaranty dated October 19 2001 of the October 19 2001 Ontario Lease Agreement between Pacific Oscar’s Ontario and FFPE, LLC by WRC;

(h) Guaranty dated November 20 2000, of the insurance deductibles related to the November 21 2002 Glendale Lease Agreement between Asset Acquisition, LLC and FFPE, LLC by WRC;

(i) Guaranty dated November 12 2002, of the November 12 2002 Torrance Lease Agreement between The Torrance Company and FFPE, LLC by WRC;

(j) Guaranty dated December 23 2002, of the December 23 2002 Buena Park Lease Agreement between Sunrise Buena Park, L.P. and FFPE, LLC by WRC;

(k) Guaranty dated December 2004 of the December 2004 Moreno Valley Lease Agreement between Gateway Company, L.C. and FFPE, LLC by WRC; and

(l) Guaranty dated before the date of this agreement of the Mission Valley Lease Agreement between Rio Vista Station and S&C Co., Inc. by Oscar and Martha Sarkisian and George and Tamara Celmo which expires on 30 September 2005 in respect of which WRC has granted an indemnity;

Existing Sizzler Franchisee Debt means amounts owing by US Group Members to Sizzler franchisees (or to any person who was, as at the date the Financial Indebtedness was incurred, a Sizzler franchisee) as at Financial Close, provided that the aggregate principal amount of all such Financial Indebtedness as at Financial Close does not exceed US$1,000,000;

Existing US Tax Consolidation the consolidation for US tax purposes existing between certain Consolidated Group Members and Pat & Oscars Group Members which are incorporated or organised under the laws of, or any state (including the District of Columbia) of, the USA in place immediately prior to Financial Close;

Existing Westpac Charge means the deed entitled “Fixed and Floating Charge” dated 21 August 2000 between CRM and Westpac Banking Corporation;

Existing Westpac Lease Consent means each agreement entered into on or before Financial Close under which the lessor of a Leasehold Interest has, among other things, consented to the existence of a mortgage over the relevant lessee’s interest in that Leasehold Interest to Westpac Banking Corporation;

Existing Westpac Lease Mortgage means each leasehold mortgage entered into on or before Financial Close under which a lessee of a Leasehold Interest has mortgaged its interest in that Leasehold Interest to Westpac Banking Corporation;

21

Expiry Date means the date of expiry stated on any Letter of Credit;

Face Value Amount means, in respect of a Letter of Credit or an Australian WC Facility Letter of Credit at any time, the amount shown on the Letter of Credit or Australian WC Facility Letter of Credit (as applicable) as the maximum amount payable under it or if one or more drawings have been made under that Letter of Credit or Australian WC Facility Letter of Credit, the maximum amount capable of being drawn under that Letter of Credit or Australian WC Facility Letter of Credit at that time following such drawing or drawings;

Facility means Facility A, Facility B, Facility C, Facility D, Facility E or the Australian WC Facility;

Facility A means the Australian Dollar amortising term cash advance facility made available under this agreement, as described in clause 3.1(a)(1)(A);

Facility A Repayment Date means each date specified as such in column 1 of the table in schedule 9;

Facility A Repayment Amount means, in relation to a Facility A Repayment Date, the amount next to that date in column 2 of the table in schedule 9 (as adjusted in accordance with clause 8.2(e));

Facility B means the Australian Dollar term cash advance facility made available under this agreement, as described in clause 3.1(a)(1)(B);

Facility C means the US Dollar term cash advance facility made available under this agreement, as described in clause 3.1(a)(2);

Facility D means the letter of credit and bank guarantee facility made available under this agreement, as described in clause 3.1(c);

Facility E means the term cash advance facility made available under this agreement, as described in clause 3.1(a)(3);

Facility Office means, in relation to a Financier, the Australian Facility Office or US Facility Office of the Financier;

Fee Letter means:

(a) the “Project Frankfort – Senior Facilities Arrangement and Underwriting Fee Letter” dated 18 April 2005 between the Joint Lead Arrangers and the Sponsor;

(b) the fee letter dated on or before Financial Close between the Borrowers and the Senior Agent; or

(c) the letter dated on or before Financial Close between the Australian Borrower and the Security Trustee;

Financial Close means the time at which all the conditions precedent set out in clause 2.1 have been satisfied or waived in writing by the Senior Agent and the first Funding Portion is provided;

Financial Indebtedness means any debt or other monetary liability (including contingent liabilities) in respect of moneys borrowed or raised or any financial accommodation including under or in respect of any:

(a) Bill, bond, debenture, note or similar instrument;

(b) acceptance, endorsement or discounting arrangement;

22

(c) Guarantee in respect of moneys borrowed or raised or any financial accommodation;

(d) finance or capital Lease (the amount of such Financial Indebtedness being determined in accordance with Accounting Standards);

(e) agreement for the deferral of a purchase price or other payment in relation to the acquisition of any asset or service for more than 120 days;

(f) obligation to deliver goods or provide services paid for in advance by any person where the deferral exceeds 120 days;

(g) agreement for the payment of capital or premium on the redemption of any preference or redeemable shares other than where the shares are redeemable solely at the option of the issuer; or

(h) a swap, option, hedge, forward, futures or similar transaction (the amount of such Financial Indebtedness being the mark to market value of the relevant transaction);

and irrespective of whether the debt or liability:

(i) is present or future;

(j) is actual, prospective, contingent or otherwise;

(k) is at any time ascertained or unascertained;

(l) is owed or incurred alone or severally or jointly or both with any other person; or

(m) comprises any combination of the above;

Financial Market Contract means an interest rate, foreign exchange transaction, equity or equity index option, bond option, commodity swap, commodity option, cap transaction, currency swap transaction, cross-currency swap rate transaction or any other hedge or derivative agreement, including any master agreement and any transaction or confirmation under it;

Financial Report means, in relation to an entity or a group, the following financial statements and information in relation to the entity or group (as applicable), prepared for each of its Trading Cycles or a Financial Year:

(a) a statement of financial performance;

(b) a statement of financial position; and

(c) a statement of cash flows,

and, in relation to the Consolidated Group, means an Australian Dollar special purpose combination of the Financial Reports of the Core Australian Group, the Asian Group (if the Permitted Asian Sale Completion Date has not occurred at that time) and the US Group (if the US Repayment Date has not occurred at that time) for a corresponding period;

Financial Undertakings means the undertakings set out in clause 11.36;

Financial Year means any of the following periods:

(a) 2 May 2005 to 30 April 2006 inclusive;

(b) 1 May 2006 to 29 April 2007 inclusive;

23

(c) 30 April 2007 to 27 April 2008 inclusive;

(d) 28 April 2008 to 3 May 2009 inclusive;

(e) 4 May 2009 to 2 May 2010 inclusive;

(f) 3 May 2010 to 1 May 2011 inclusive;

Financier means:

(a) a party listed in schedule 2;

(b) any person who is a Substitute Financier;

(c) any Related Body Corporate of a Financier who acts in accordance with clause 1.9;

(d) the Australian WC Facility Provider; or

(e) the US LC Facility Provider;

Franchise Expense means all amounts payable by a Consolidated Group Member as a franchisee under any franchise arrangement including any payments under any franchise agreement with KFC, any Related Body Corporate of KFC or other person in connection with the franchise of any KFC outlet (including the franchise agreements referred to in paragraphs (a), (b) and (c) of the definition of “KFC Agreement” in this clause 1.1), but not including any payments required to be made as an “Advertising Contribution” or similar payments; the YUM Transfer Fee or any payments under franchise agreements between Australian Group Members or between US Group Members;

Franchisee Shareholder Deed means the deed entitled “Franchisee Shareholder Deed (KFC Outlets)” dated on or about Financial Close between, among others, KFC, CFG, the Australian Borrower and AusHoldco;

Funding Date means the date on which a Funding Portion is provided or issued, or is to be provided or issued, to or for the account or request of a Borrower under this agreement;

Funding Notice means a notice given under clause 4.1;

Funding Period means, in respect of a Letter of Credit, the period from the Funding Date to the Expiry Date of that Letter of Credit;

Funding Portion means each portion of the Total Commitments provided under this agreement or the Australian WC Facility Documents, whether by way of issue of a Letter of Credit under Facility D or provision of a cash advance or otherwise;

Funding Rate means, in respect of an Interest Period, the aggregate of:

(a) the applicable Base Rate on the Rate Set Date for that Interest Period; and

(b) the applicable Margin on the Rate Set Date for that Interest Period;

Funds Flow Statement means the funds flow statement provided under clause 2.1(t);

Gearing Ratio means, as at a Calculation Date, the ratio of A:B, where:

(a) “A” is all outstanding Financial Indebtedness of the Consolidated Group as at that Calculation Date (without double counting Financial Indebtedness of a Consolidated Group Member which is also Guaranteed by another Consolidated Group Member) other than:

24

(1) Financial Indebtedness under a Hedge Agreement entered into to hedge against interest rates in relation to one or more of the Facilities or Mezzanine Debt with a Financier which complies with clause 11.25;

(2) Financial Indebtedness constituting contingent exposures under or in respect of any Letter of Credit issued under Facility D to a Transactional Bank in respect of a Transactional Secured Financing;

(3) Permitted Financial Indebtedness between Consolidated Group Members;

(4) Financial Indebtedness of a Joint Venture Subsidiary provided that there is no recourse to or liability of any other member of the Consolidated Group in connection with that Financial Indebtedness; and

(5) Financial Indebtedness constituting contingent exposures of WRC or a US Group Member in respect of the UBOC Letter of Credit;

less the aggregate balance of each Blocked Account as at that Calculation Date and plus the Face Value Amount of each Australian WC Letter of Credit (to the extent it does not otherwise constitute Financial Indebtedness of the Consolidated Group).

For the avoidance of doubt, Financial Indebtedness under a Transactional Secured Financing and amounts drawn under Letters of Credit or the UBOC Letter of Credit and not repaid will be included in “A”; and

(b) “B” is EBITDA of the Consolidated Group for the Calculation Period ending on that Calculation Date;

Government Agency means any government or any governmental, semi-governmental, administrative, fiscal or judicial body, department, commission, authority, tribunal, agency or entity;

Group means:

(a) the Core Australian Group;

(b) the US Group; or

(c) the Asian Group;

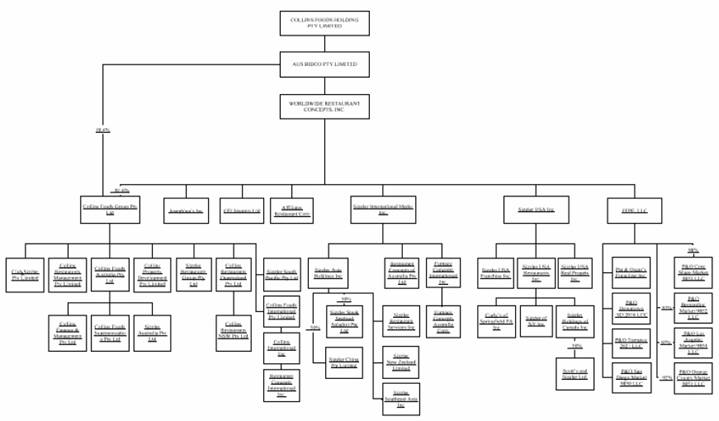

Group Structure Diagram means the group structure diagram in schedule 7, as amended or updated by the delivery of a new diagram to the Senior Agent under clause 11.1(f);

GST means the goods and services tax levied under the GST Act;

GST Act means A New Tax System (Goods and Services Tax) Act 1999;

Guarantee means any guarantee, indemnity, suretyship, letter of credit, letter of comfort or any other obligation:

(a) to provide funds (whether by the advance or payment of money, the purchase of or subscription for shares or other securities, the purchase of assets or services, or otherwise) for the payment or discharge of;

25

(b) to indemnify any person against the consequences of default in the payment of; or

(c) to be responsible for,

any debt or monetary liability of another person or the assumption of any responsibility or obligation in respect of the insolvency or the financial condition of any other person;

Guarantee Assumption Agreement means a deed poll in the form of annexure A;

Guarantor means:

(a) an Initial Guarantor; or

(b) a person who has executed a Guarantee Assumption Agreement,

unless it has ceased to be a Guarantor in accordance with clause 1.10, 1.11 or 14.19 or has otherwise been released in writing by the Senior Agent (acting on the instructions of all Financiers (other than a Retired Financier)) in full from its obligations as a “Guarantor” under this agreement;

Hedge Agreement means a swap or other agreement to hedge against interest rate exposure entered into by a Borrower in relation to one or more of the Facilities or the Mezzanine Debt with a Financier which complies with clause 11.25;

Hedge Counterparty means each Financier that has entered into a Hedge Agreement with a Borrower;

IFRS means international financial reporting standards;

Indirect Tax means any goods and services tax, consumption tax, value added tax or any tax of a similar nature;

Insurance Policy means, in respect of a Transaction Party or a Subsidiary of a Transaction Party, an insurance policy required to be held by it under clause 11.24;

Intellectual Property Rights includes any patent, design, trade mark, copyright, trade secret, confidential information and any right to use, or to grant the use of, or to be registered owner or user of, any of them;

Intercompany Loan means:

(a) a Corporate Restructure Loan;

(b) the loan made pursuant to the Pat & Oscars Loan Agreement;

(c) any loan made pursuant to the Asian Group Subordinated Intercompany Loan Agreement;

(d) amounts outstanding under the SIM Long Term Loan Agreement; or

(e) any loan made pursuant to the Subordinated Intercompany Loan Agreement;

Intercreditor Deed means the deed entitled “Intercreditor Deed – Project Frankfort” dated on or about the date of this agreement between each Borrower each Initial Guarantor, the Senior Agent, the Security Trustee and the Mezzanine Agent;

26

Interest Expense for a period means all interest and amounts in the nature of interest or of similar effect to interest payable in cash in that period by any Consolidated Group Member including:

(a) any dividend or distribution payable on any Marketable Security included as Financial Indebtedness;

(b) any interest expense portion of rentals in respect of capitalised finance lease obligations;

(c) the face amount of bills of exchange or other financial instruments (but not reliquification bills drawn under this agreement) drawn, issued, endorsed or accepted by a Consolidated Group Member less their net proceeds after discount or issue and payment of any acceptance, endorsement, underwriting or similar fee;

(d) all line, facility, letter of credit, guarantee, unused line or commitment fees and similar fees of a recurring nature payable in relation to Financial Indebtedness (but not agency, establishment, arrangement or similar fees payable in relation to Financial Indebtedness);

(but not including Interest Expense incurred on transactions between Transaction Parties or Excluded Interest), and adjusted for the net amount of any difference payments by or to a Consolidated Group Member under any interest rate Hedge Agreement, net payments by a Consolidated Group Member under an interest rate Hedge Agreement being added to Interest Expense and net payments to a Consolidated Group Member under an interest rate Hedge Agreement being subtracted from Interest Expense;

Interest Income, for a period, means all interest and amounts in the nature of interest or of similar effect to interest received in cash in that period by any Consolidated Group Member (but not including Interest Income earned on transactions between Consolidated Group Members and not including any adjustment for difference payments by or to a Consolidated Group Member under an interest rate Hedge Agreement);

Interest Payment Date means, in respect of a Funding Portion, the last day of each Interest Period applying to that Funding Portion and, if such an Interest Period is longer than 3 months, each date during that Interest Period falling at 3 monthly intervals after the first day of that Interest Period;

Interest Period means, in respect of a Funding Portion, a period selected or determined under clause 4.6 in relation to that Funding Portion;

Joint Lead Arrangers means UBS AG, Australia Branch and National Australia Bank Limited;

Joint Venture Subsidiary means a Subsidiary of a Transaction Party:

(a) which is not a Material Subsidiary;

(b) where Transaction Parties own less than 50.1% of the Marketable Securities (by value and voting rights) in that Subsidiary;

(c) where one or more third parties (not being a Related Body Corporate or Associate of a Consolidated Group Member or the Sponsor) (the Joint Venturer) own in aggregate not less than 49.9% of the Marketable Securities (by value and voting rights) in that Subsidiary; and

27

(d) the Subsidiary was established for the purpose of undertaking a joint venture with the Joint Venturer;

Key Manager means:

(a) Kevin Perkins;

(b) Simon Perkins,

or any replacement Key Manager notified in accordance with clause 11.1(j);

KFC means Kentucky Fried Chicken Pty Limited ABN 79 000 587 780;

KFC Agreement means:

(a) the Master Franchise Agreement;

(b) a franchise agreement entered into pursuant to the Master Franchise Agreement;

(c) a franchise agreement between CRQ or Collins Restaurants NSW Pty Ltd and KFC in relation to KFC restaurants at the following locations:

(1) Atherton;

(2) Gatton;

(3) Royal Harbour (Cairns);

(4) Tannum Sands;

(5) Garden City Foodcourt;

(6) Airlie Beach;

(7) Strathpine Foodcourt;

(8) Carindale Foodcourt;

(9) Albany Creek;

(10) Chermside Foodcourt;

(11) Carindale;

(12) Loganholme;

(13) Grand Plaza Foodcourt;

(14) Tweed Heads;

(15) Annandale;

(16) BP Caboolture North;

(17) Cairns Central;

(18) BP Caboolture South;

(19) Kawana;

(20) Sunshine Plaza;

(21) Inala;

(22) Everton Park;

(23) Miami;

(24) Biloela;

28

(25) Hervey Bay; or

(26) Southport;

(d) the agreement entitled “Development Agreement” dated 1 October 1996 between CFI and KFC as assigned from CFI to CRQ on 21 August 2000;

(e) the deed entitled “KFC Facility Actions Deed” dated 31 March 2005 between CRQ, CFG and KFC;

(f) the Franchisee Shareholder Deed;

(g) the deed entitled “Marketing Fund Participation Deed” dated 4 August 1998 between KFC, KFC Adco Limited and CFI, as assigned by CFI to CRQ on 21 August 2000, as extended by agreement between the parties;

(h) any other undertaking or agreement between KFC, or any Related Body Corporate of KFC, and a Consolidated Group Member (whether or not any other Entity is also a party to that undertaking or agreement) (including any other franchise agreement); or

(i) any undertaking or agreement entered into or given under any of the above,

but does not include any such undertaking or agreement determined by performance or terminated in accordance with this agreement or in circumstances which would not otherwise give rise to a Default;

Land means any estate or interest in land owned or occupied by or under the control of a Transaction Party;

LC Beneficiary means the beneficiary of a Letter of Credit;

LC Contract means any written contract or arrangement between a Borrower or any other person and an LC Beneficiary in connection with which the Borrower has requested a Senior Agent to issue a Letter of Credit to the LC Beneficiary;

LC Fee Payment Date means, in respect of a Letter of Credit, each date on which the Letter of Credit fee is payable in respect of that Letter of Credit in accordance with clause 6.10(b);

LC Rate has the meaning given to that term in the Pricing Letter;

Lease means a lease, charter, hire purchase, hiring agreement or any other agreement under which any property is or may be used or operated by a person other than the owner;

Lease Adjusted Interest Cover Ratio means, as at a Calculation Date, the ratio of A:B, where:

(a) “A” is EBITDA of the Consolidated Group for the Calculation Period ending on that Calculation Date plus all Franchise Expense and Rental Expense for that Calculation Period:

(b) “B” is the aggregate of:

(1) Net Interest Expense for that Calculation Period; and

(2) Franchise Expense for that Calculation Period; and

(3) Rental Expense during that Calculation Period;

29

Leasehold Interest means any Lease of any real property or Land to a Consolidated Group Member;

Letter of Credit means any letter of credit or bank guarantee issued under Facility D and includes a letter of credit or bank guarantee issued under clause 19.3(d);

LIBOR means, in respect of an Interest Period for a Funding Portion denominated in US Dollars:

(a) the arithmetic mean of the rates quoted on the page entitled “LIBOR01” or “LIBOR02” (as applicable) on the Reuters Monitor System at or about 11.00 am (London time) on the Rate Set Date for that Funding Portion for eurodeposits in US Dollars having a tenor or a term (as the case may be) equal to, or if not equal to, most closely approximating, that Interest Period provided in the case where the term is not equivalent to that Interest Period, the term is not more than 3 days longer or shorter than the Interest Period (the Screen Rate); or

(b) (if no Screen Rate is available) the arithmetic mean of the rates (rounded upwards to four decimal places) as supplied to the Senior Agent at its request quoted by the relevant Reference Banks to leading banks in the London interbank market, of at or about 11.00 am (London time) on the Rate Set Date for the offering of deposits in US dollars and for a term comparable to the Interest Period for that Funding Portion provided in the case where the term is not equivalent to that Interest Period, the term is not more than 3 days longer or shorter than the Interest Period; or

(c) otherwise, as determined in accordance with clause 7;

All calculations of rates for the purpose of this definition will be expressed as a yield percent per annum to maturity;

Liquidation includes official management, appointment of an administrator, compromise, arrangement, merger, amalgamation, reconstruction, reorganisation, winding up, dissolution, deregistration, assignment for the benefit of creditors, scheme, composition or arrangement with creditors, insolvency, bankruptcy, or a similar procedure or, where applicable, changes in the constitution of any partnership or person, or death;

Liquidity Bill means a Bill drawn under clause 5.5;

Loss means any claim, action, damage, loss, liability, cost, charge, expense, outgoing or payment;

Majority Financiers means Financiers whose Commitments for all Facilities aggregate at least 66.67% of the Total Commitments for all Facilities or, if the Commitments are cancelled, Financiers to whom at least 66.67% of the Principal Outstanding is owing (as calculated in accordance with clause 3.7);

Management Agreement means the agreement entitled “Investment Services Agreement” dated on or about Financial Close between AusHoldco, the Australian Borrower and PEP Advisory;

Margin has the meaning given to that term in the Pricing Letter;

30

Marketable Securities means marketable securities as defined in section 9 of the Corporations Act and includes and share capital or other equity or quasi equity interest;