ValueVision Media, Inc.

May 21, 2014 Conference Call Script to Discuss

First Quarter Fiscal 2014 Financial Results1

Conference Call Operator

Good afternoon, and welcome to ValueVision Media’s fiscal 2014 first quarter conference call. Following today's presentation, there will be a formal question and answer session. Today's call is being recorded for instant replay. I would now like to turn the call over to Teresa Dery, Senior Vice President and General Counsel at ValueVision. You may begin.

Teresa Dery, Senior Vice President, General Counsel and Corporate Secretary

Thank you, operator, and good afternoon. I'm joined today by Keith Stewart, CEO; Bill McGrath, EVP and CFO; Bob Ayd, President; Carol Steinberg, COO, and other members of the senior management team.

Comments on today's conference call may contain certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements may be identified by words such as anticipate, believe, estimate, expect, intend, predict, hope, should, plan or similar expressions. Listeners are cautioned that these forward-looking statements may involve risks and uncertainties that could significantly affect actual results from those expressed in any such statements. More detailed information about these risks and uncertainties and related cautionary statements is contained in ValueVision's SEC filings.

Comments on today's call may refer to adjusted EBITDA and adjusted net income (or loss), which are both non-GAAP financial measures. For reconciliations of each of these measures to our GAAP results, and for a description of why we use them, please refer to our Q1 2014 news release available on the Investor Relations section of our website.

As you may have seen, on May 9th, we filed our Definitive Proxy Statement and a white proxy card for our annual meeting of shareholders to be held on June 18th at our corporate headquarters. We urge investors to read carefully our proxy statement and any other relevant documents filed by us with the SEC when they become available because they will contain important information about our annual meeting, including information regarding the participants in our Board’s solicitation.

A Definitive Proxy Statement has also been filed by an activist shareholder. We are not responsible for the accuracy of any information contained in the proxy statement or any other proxy solicitation materials used by the activist shareholder or any other statements that they may make.

With that said, we are here today to talk about the business and ValueVision’s Q1 results. We do not intend to take any questions regarding the proxy statement or proposals of the activist shareholder. We thank you for your cooperation in that regard.

All information in this conference call is as of today and the Company undertakes no obligation to update these statements.

I will now turn the call over to Keith.

1 Excluding unscripted Q&A portion of conference call.

Keith Stewart, Chief Executive Officer

Thanks Teresa, and thank you for joining today’s call.

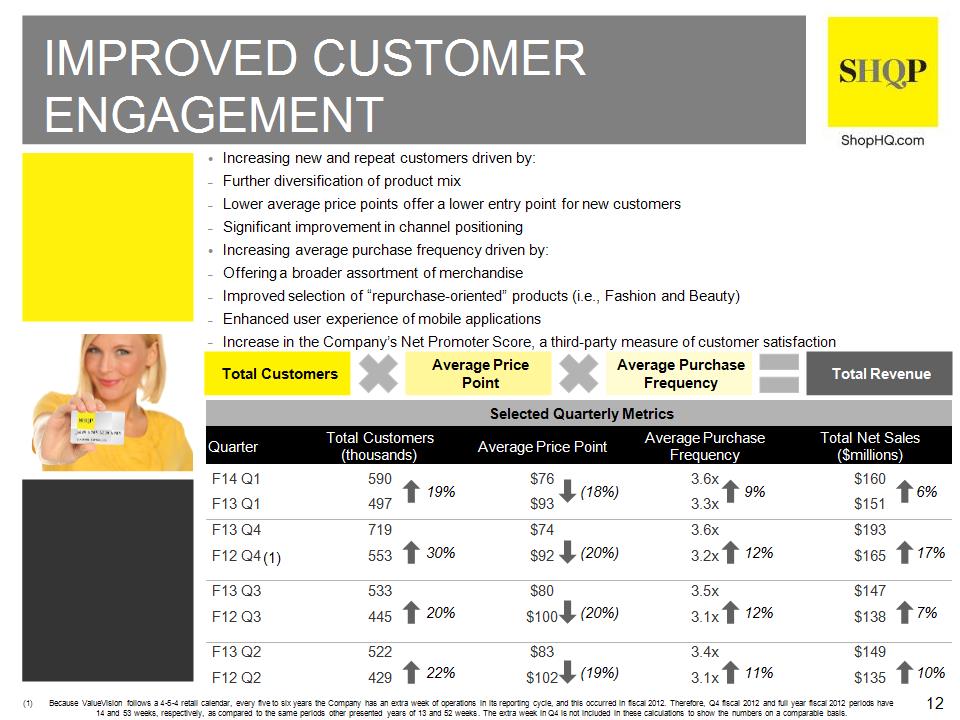

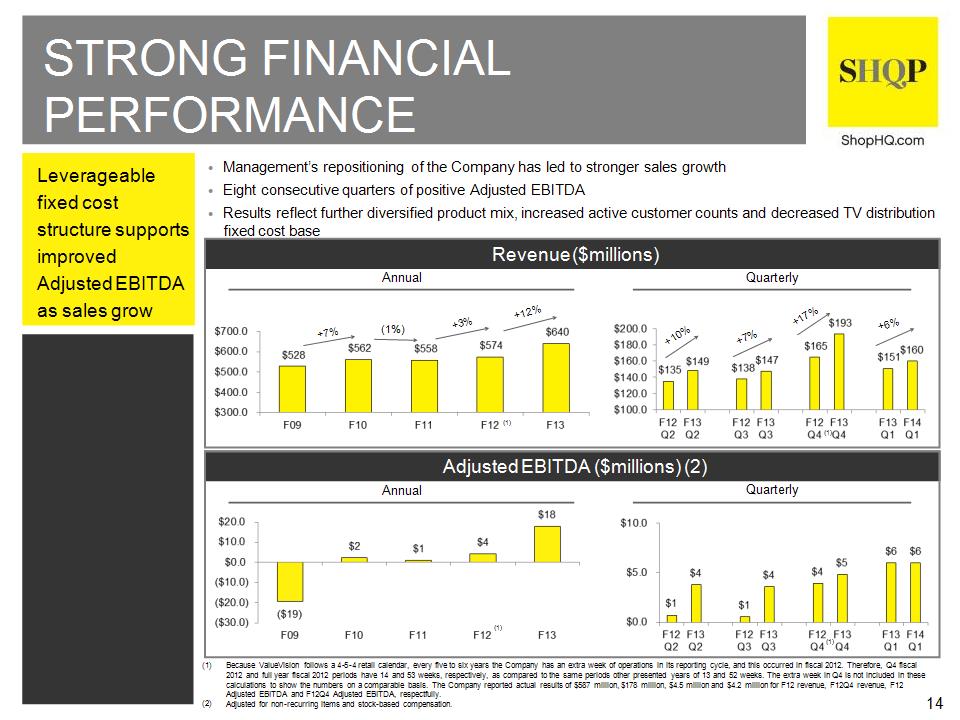

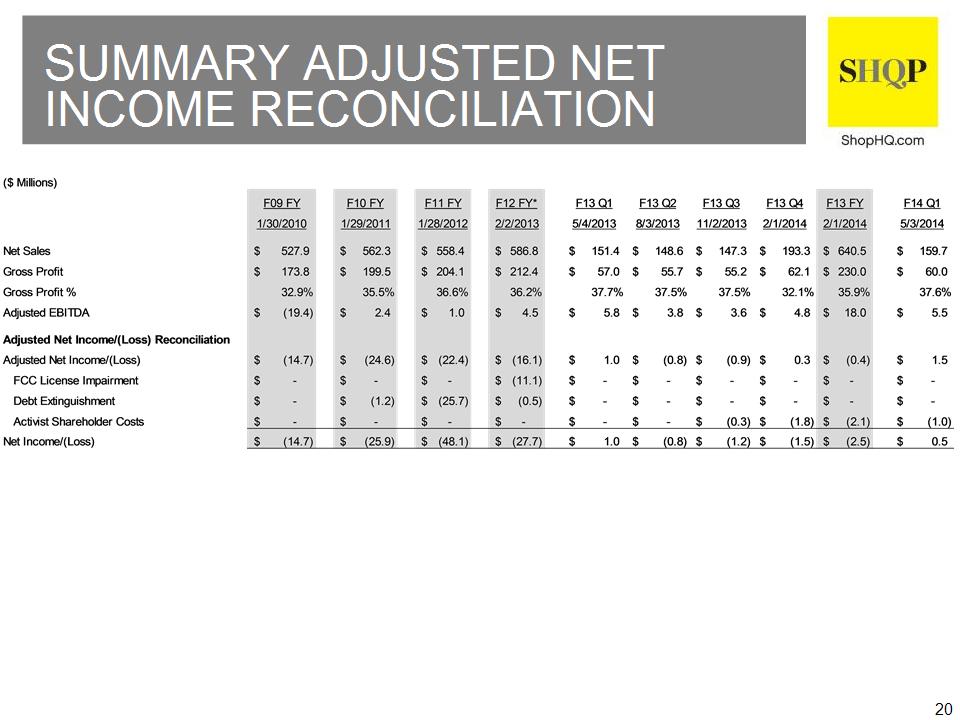

Our team delivered strong operating results in Q1. Net sales were $160 million, an increase of 6% over Q1 last year, and Adjusted EBITDA was $6 million. Compared to last year, net shipped units increased 28% to 1.9 million and our average price point, as expected, decreased 18%. Bill will provide more detail on our financial performance later on.

I must say that it’s an energizing time to be at ShopHQ. Q1 marks our 8th consecutive quarter of sales growth and positive adjusted EBTIDA. At the end of Q1, we have over a quarter million more customers than we had at this time last year. Our customers and stakeholders have embraced our new consumer brand ShopHQ. Our customer base is growing at a greater rate than any time in our Company’s recent history. And our team members are focused and aligned on our vision of building and inspiring communities through shopping.

As to the progress we are making on our 4-point strategy to drive growth, we feel confident about our positive momentum and it’s coming through in our operating results.

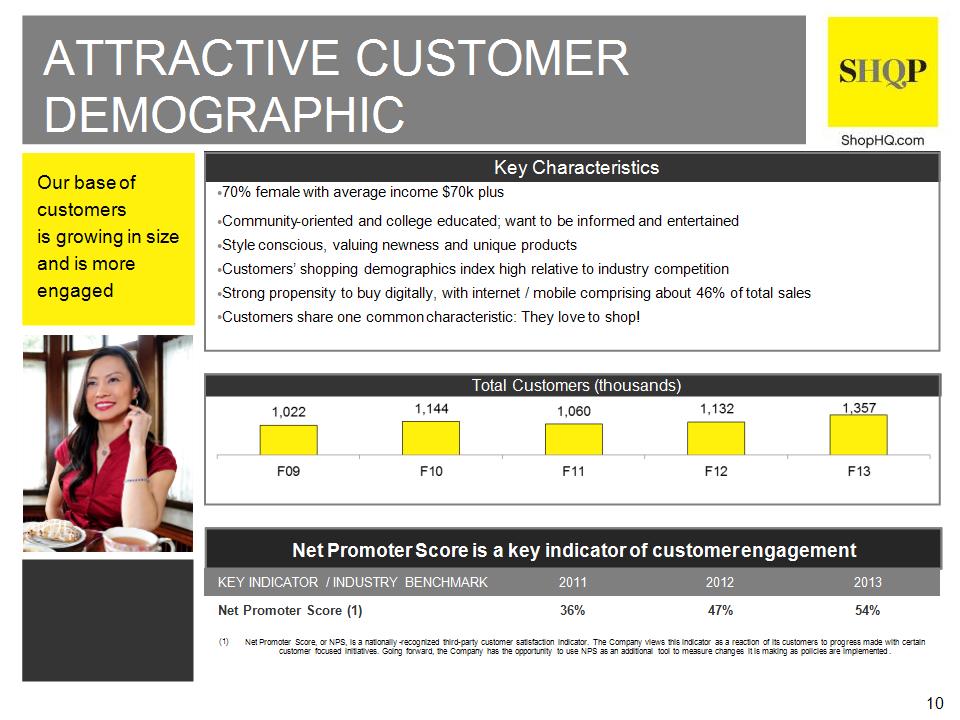

With respect to our 1st key strategy, our efforts to broaden, expand and diversify our product mix continued to attract and retain customers in Q1. Customers liked our expanded product offerings as they bought more merchandise in the quarter compared to last year. Specifically, purchase frequency increased 9% in Q1. New customers increased 19%, and our total customer file increased 19% in Q1, both over the same quarter last year. Investments made to further develop our growing customer base should continue to benefit future quarterly results.

By broadening our product offerings, we continued to strategically lower our average price point to $76 in Q1 as compared to $93 in last year’s Q1. These more accessible price points on a wider assortment of products are broadening ShopHQ’s appeal to a much larger audience. Lower price points also tend to draw greater numbers of new customers. When they return to shop again, our customers have a variety of trusted brands from which to choose across our broader online extended assortment like Apple, Cannon, Samsung, Gucci, Versace and Ferragamo.

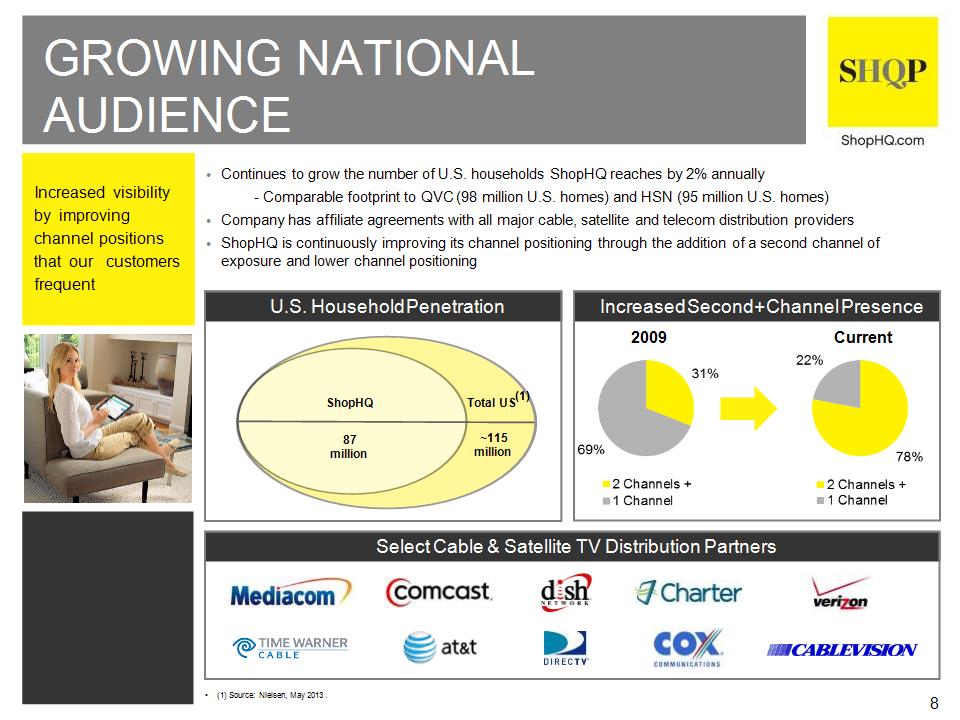

Optimizing our TV distribution footprint to attract more shoppers is our 2nd critical strategy. Over the last six years, we have worked diligently to right size our cost per home, reducing the annualized rate from $1.72 in 2008 to $1.12 to Q1 2014. At the same time, we have made significant improvements in the quality of our distribution platform through improved channel positioning. We are pleased with the positive sales results being achieved so far in the systems where we invested.

Our 3rd key strategy is: Be where the customer wants us to be. This is our Shop & Watch Anytime, Anywhere experience. Consumer shopping behavior continues to rapidly evolve. We are creating more content on more platforms than ever before. Our digital strategy enables our customers to conveniently watch our broadcast, browse and buy product, as well as interact, provide feedback on our products, presentations and service. We believe this customer experience further helps us realize our vision to build and inspire communities through shopping.

Our 4th key strategy centers on increasing customer growth metrics. We are growing our customer base at an unprecedented rate and have amassed a record 1.4 million customer file. We expect to continue to grow our customer base, entice them to buy more of our high-quality products, and in turn earn their loyalty. Everything we do starts and ends with the customer. We are serving them better than ever before, and we are well-positioned for consistent, scalable, long-term growth.

With the positive momentum we achieved in Q1, we feel confident about the direction of our business. Over the next two quarters, the average price point is expected to decrease at a lesser rate than the 18% reduction in Q1. In Q2 last year, our average price point was $83, and in Q3 it was $80. This is closer to our current run rate.

Looking ahead over the next 18-24 months, we plan to make investments to support the growing needs of our business. We are significantly upgrading our distribution center in Bowling Green, Kentucky, which will roughly double its current size.

We strategically decided to utilize one larger facility as opposed to multiple, smaller distribution centers. This approach helps position us to provide unique customer service levels in a competitive multichannel retailing climate. Today when a consumer purchases more than one product online at a retailer, they often receive multiple packages at different times, sometimes even days apart.

Our new distribution center will give us the option to package more than one item in one box from a variety of product categories. At ShopHQ, whenever practical, it will be our goal for the customer to receive one package on time and to delight their expectations.

The new complex will also be outfitted with the latest warehouse management system. In addition, we plan to expand our call center capacity and equip it with a leading edge CRM system. Carol will provide more detail about these investments shortly.

In closing, as these initiatives are fully implemented, we expected them to reduce operating expenses and improve the operating leverage of our multichannel retailing model.

I’ll now turn the call over to Bill.

Bill McGrath, Executive Vice President and Chief Financial Officer

Thanks Keith.

First quarter sales of $160 million were up 6% over prior-year. Sales growth was driven by performance in the Fashion and Accessories, Jewelry and Watches, and Beauty, Health, and Fitness categories.

Gross Profit dollars increased 5% to $60 million in Q1 from $57 million last year. Gross Margin remained strong at 37.6% compared to 37.7% in Q1 of last year.

First quarter Operating Expenses increased 7% to $59 million from $55 million in Q1, including $1 million of Activist Shareholder Response costs. Excluding the Activist Shareholder Response costs, operating expenses as a percentage of sales were 36% versus 37% in Q1 last year.

Operating expenses were affected by increased variable costs as a percentage of sales to 8.4% this quarter from 7.5% last year, reflecting the impact of a 28% increase in net shipped units over the prior-year quarter. We anticipate that variable expense as a percentage of sales over the remainder of 2014 will be at a similar range as we experienced in Q1.

Cable and satellite expenses increased $1.6 million in the quarter vs. prior year, reflecting a 2% increase in home counts as well as investments associated with improved channel positions that began in the second half of 2013. Our annualized cost per home in the first quarter was $1.12 compared to $1.06 in prior year Q1. We will continue to look for opportunities to improve the quality of our distribution footprint. Investments related to these potential improvements could increase our annualized cost per home to around $1.15 by the end of fiscal 2014.

Depreciation and Amortization decreased $1 million vs. last year, due to the discontinuation of the NBC license fee. The total of all other operating expenses was in line with prior year.

Adjusted EBITDA in the first quarter was $6 million, roughly flat to Q1 last year, with sales growth offset by the increased costs associated with the 28% increase in higher shipping volume as well as investments in improved channel positions.

During the first quarter, the Company incurred $1 million in advisory fees and other costs related to the ongoing activist shareholder matter. Since the inception of the activist shareholder matter in third quarter of 2013 the company has incurred aggregate costs of around $3 million. We expect to incur additional costs associated with this issue in subsequent quarters. The Company is working to manage these expenses prudently while ensuring that all shareholder interests are represented.

Adjusted Net Income for Q1’14 was $2 million or $0.03 per share, vs. $1 million and $0.02 per share last year.

Our balance sheet remains strong. Cash, including restricted cash, totaled $27 million, compared to $31 million at the end of Q4’13. The net use of cash includes $5 million in working capital investment, $3 million in capital expenditures and $1 million in costs associated with the ongoing activist shareholder issue, partially offset by positive adjusted EBITDA in the period.

In regards to capital expenditures, the estimated project cost of the Bowling Green expansion is $25 million, the majority of which will be incurred during 2014. This spending will be funded through the expanded PNC credit facility. All other capital expenditures during this fiscal year will be around $10 million, primarily related to the system initiatives Keith discussed.

I will now turn the call over to Bob.

Bob Ayd, President

Thank you, Bill. Q1 was a solid quarter for ShopHQ. We achieved positive results in every category except for some softness in Consumer Electronics.

Overall, our broader product offerings, lower average price point and improved channel positioning combined to attract more new customers in Q1 while increasing the purchase frequency of existing customers in the quarter.

In the first quarter, we continued to allocate assets and expand our product assortment in the emerging categories of Fashion, Beauty and Home in order to drive customer acquisition. At the same time, our team added a number of new luxury, proprietary and national brands in Q1 to further elevate customer engagement.

Notable brand introductions in Q1 included timepieces from Gucci and Versus by Versace. In Jewelry, we also added Wolf Jewelry boxes and premiered a new turquoise jewelry line called Dine Spirit, which is created by Native American artisans. In Fashion, we launched Labrado leather handbags from Paraguay, and we continued to expand our proprietary brands, offering our customers relevant and exciting fashion accessories.

Beauty enjoyed success on multiple fronts in Q1. We launched an innovative color line from the UK called New CID, and we introduced Juara Bath & Body from Indonesia. Moreover in the Beauty category, we continued to expand our high-end, anti-aging skincare line called Rodial as well as expanded the international skincare and color brand, Borghese.

In Home, we debuted our first gardening show featuring Spring Hill Gardens, and we expanded our food business with Penn Street Bakery. In total, we added over 7,000 new styles and approximately 80 new suppliers in the first quarter.

Regarding our online-only product assortment, I’m pleased with the progress we made in expanding our web exclusive merchandise in the quarter. Sales of our online-only merchandise rose approximately 70% vs. last year’s same period.

Expanding and diversifying our multichannel product mix is central to our ongoing success, and remains our 1st key strategy, as Keith mentioned. To this point, we plan to continue steadily reducing our concentration in Jewelry & Watches and allocate our resources in the emerging product categories of Fashion, Beauty and Home, which tend to attract, retain and increase the purchase frequency of new and active customers.

Looking ahead, a few new concepts that we are excited about launching include iconic footwear from Hush Puppies; high-quality, upscale textiles from Croscill; and a health and fitness line from Chris Freytag, a national trainer and fitness expert.

We also look forward to launching a fashion line from New York designer Mark Bower, and hair care products from renowned European stylist Philip Kingsly. And finally, we are working with Mark Cuban from Shark Tank on a new programming concept and are planning to have him appear on ShopHQ this summer.

This concludes my remarks. Carol?

Carol Steinberg, Chief Operating Officer

Thanks Bob. Our solid first quarter performance was driven by a number of key initiatives that improved operating metrics, increased customer counts and enhanced our digital store front.

Continued progress was the result of our focus on providing the customer an inspired and convenient shop anytime, anywhere experience, which is part of our 3rd key strategy that Keith addressed earlier.

Operationally, we successfully managed the 28% increase in shipped units at our distribution center and temporary off-site storage while keeping transaction costs flat at $2.51 per unit in Q1 compared to the year-ago quarter. We improved the customer experience by continuing to provide faster order delivery times to the customer, and through improved internal processes, we reduced inbound customer service inquires.

We are excited to announce we broke ground last week on the expansion of our Bowling Green, Kentucky fulfillment and customer service facility. This expansion is needed to meet the demands of our growing customer base and higher shipped unit volume. We expect Phase I of our 337,000 foot expansion will be completed by late fall of this year, which will enable us to use the shell of the new facility for storage, thus minimizing our expense and reliance on off-site storage during the 2014 holiday season. The balance of the expansion is scheduled to be completed in Q1 2015.

In addition to expanding our capacity in Bowling Green, this year we will start the planning and implementation of a new material handling systems, and a new warehouse management system, Manhattan, one of the most sophisticated warehouse management systems available today. These enhancements should further optimize our operations and allow us to minimize transaction costs while maximizing speed from order to ship time.

Other noteworthy operational initiatives we initiated in Q1 include the launch of the implementation of our Salesforce CRM system. Concurrent with this implementation is the initiative to enhance our automated phone ordering system and call center systems with the industry leading Genesys Echopass Software. Both initiatives are expected to increase customer satisfaction, yield increased purchase frequency, and streamline operations.

Turning to ShopHQ’s online platform, in Q1 we experienced solid growth in sales transacted on mobile devices and smart phones as a percentage of total Internet revenue. Overall, we continued to deliver strong Internet sales penetration of 45% in Q1. Our mobile sales penetration increased to 32% of Internet orders in Q1, an 870 basis point increase over last year’s quarter, while Q1 mobile revenue yielded a 41% sales increase over the same quarter last year to $23 million.

Enhancements made in previous quarters to our iPad shopping app along with our Android and iPad apps are proving successful. With a strong track record, we continue to optimize other elements of our online platform, making ShopHQ accessible on any device, anytime, anywhere.

Lastly, on the mobile front, which is certainly a major focus for us, continued enhancements are planned in subsequent quarters for our tablet apps as well as for our mobile site and iOS and Android apps, which are all designed to drive increased customer engagement and purchase frequency.

Overall, we are pleased with the positive results of our first quarter operating and digital performance, especially with our customer growth and mobile results being at record levels. We remain focused on a digital strategy that enables our customers to conveniently watch the broadcast, browse, purchase and share products. We believe this experience inspires shopping, builds community and drives increased customer engagement.

Operator, please open the line for questions.

###

Important Information

This script may be deemed to be solicitation material in respect of the solicitation of proxies from shareholders in connection with one or more meetings of the Company's shareholders, including the Company's 2014 Annual Meeting of Shareholders. On May 9, 2014, the Company filed with the Securities and Exchange Commission (“SEC”) a proxy statement and a WHITE proxy card in connection with the Company's 2014 Annual Meeting of Shareholders. The Company, its directors and certain of its executive officers and employees may be deemed to be participants in the solicitation of proxies from shareholders in connection with the Company's 2014 Annual Meeting of Shareholders. Information concerning the interests of these directors and executive officers in connection with the matters to be voted on at the Company's 2014 Annual Meeting of Shareholders is included in the proxy statement filed by the Company with the SEC in connection with such meeting. In addition, the Company files annual, quarterly and special reports, proxy and information statements, and other information with the SEC. The proxy statement for the 2014 Annual Meeting of Shareholders is available, and any other relevant documents and any other material filed with the SEC concerning the Company will be, when filed, available, free of charge at the SEC website at http://www.sec.gov. SHAREHOLDERS ARE URGED TO READ CAREFULLY THE PROXY STATEMENT FILED BY THE COMPANY AND ANY OTHER RELEVANT DOCUMENTS FILED WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION WITH RESPECT TO PARTICIPANTS.

3-5