Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. 2)

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

x | Preliminary Proxy Statement | |

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

¨ | Definitive Proxy Statement | |

¨ | Definitive Additional Materials | |

¨ | Soliciting Material Pursuant to §240.14a-12 | |

ValueVision Media, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x | No fee required. | |||

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

(1) | Title of each class of securities to which transaction applies:

| |||

(2) | Aggregate number of securities to which transaction applies:

| |||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

(4) | Proposed maximum aggregate value of transaction:

| |||

(5) | Total fee paid:

| |||

¨ | Fee paid previously with preliminary materials. | |||

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid:

| |||

(2) | Form, Schedule or Registration Statement No.:

| |||

(3) | Filing Party:

| |||

(4) | Date Filed:

| |||

Table of Contents

PRELIMINARY COPY

VALUEVISION MEDIA, INC.

Dear Shareholders:

You are cordially invited to attend the Annual Meeting of Shareholders (the “Annual Meeting”) of ValueVision Media, Inc., a Minnesota corporation (the “Company”), to be held at our offices located at 6690 Shady Oak Road (Human Resources Entrance), Eden Prairie, Minnesota, on June 18, 2014 at 9:00 a.m. CT. The items to be considered and voted on at the Annual Meeting are described in the enclosed notice of the Annual Meeting and are more fully addressed in our proxy materials accompanying this letter. We encourage you to read all of these materials carefully and then vote the enclosedWHITE proxy card.

We hope that you will be able to attend the meeting in person and we look forward to seeing you. Whether or not you plan to attend the Annual Meeting, please take the time to vote. Please vote on yourWHITE proxy card and send your proxy through the Internet, telephone or mail as soon as possible so that your proxy is received prior to the Annual Meeting. This will assure that your shares will be represented at the meeting and voted in accordance with your wishes. Please vote as quickly as possible, even if you plan to attend the Annual Meeting.

Your participation at this meeting is extremely important. Clinton Relational Opportunity Master Fund, L.P. (together with certain related persons and entities, the “Clinton Group”) has filed a preliminary proxy statement with the SEC indicating that it intends to nominate its own slate of director nominees for election as directors, as well as submit certain By-law amendments for approval, at the Annual Meeting. Our Board of Directors (the “Board”) has carefully reviewed the Clinton Group’s nominees and proposed By-law amendments and does not endorse either the election of any of such nominees as directors or any of the proposed By-law amendments. If the Clinton Group, a minority group of shareholders beneficially owning approximately 4% of the Company’s shares as of the record date for the Annual Meeting, were to succeed in this proxy contest, then the Clinton Group’s nominees would occupy 75% of the seats on your Board. You may receive solicitation material from the Clinton Group, including proxy statements and proxy cards. The Company is not responsible for the accuracy of any information contained in any such proxy solicitation materials used by the Clinton Group or any other statements that they may otherwise make.

THE FUTURE OF VALUEVISION IS IN YOUR HANDS. THE BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL OF OUR DIRECTOR NOMINEES NAMED ON THE ENCLOSED WHITE PROXY CARD AND URGES YOU NOT TO SIGN OR RETURN ANY PROXY CARD SENT TO YOU BY OR ON BEHALF OF THE CLINTON GROUP. OUR BOARD ALSO RECOMMENDS A VOTE “FOR” PROPOSALS NO. 2 AND NO. 3 AND A VOTE “AGAINST” THE CLINTON GROUP’S PROPOSALS NO. 4 AND NO. 5.

Your vote is extremely important regardless of the number of shares you own. Please promptly follow the directions on the enclosedWHITE proxy card to vote by telephone, by Internet, or by signing, dating and returning theWHITE proxy card in the postage-paid envelope provided. A “Withhold” vote against the Clinton Group’s nominees on any gold proxy card that is circulated by the Clinton Group is not the same as voting for our director nominees, because submitting a gold proxy card that is circulated by the Clinton Group will revoke any proxy previously submitted by you on theWHITE proxy card. Only your latest dated proxy will count, and any proxy may be revoked at any time prior to its exercise at the Annual Meeting as described in the accompanying proxy statement.

If you have any questions or need assistance in voting your shares, please contact our proxy solicitor, Innisfree M&A Incorporated, toll-free at (888) 750-5834; banks and brokers may call collect at (212) 750-5833.

The Board is deeply committed to the Company, its shareholders and enhancing shareholder value, and I can assure you that the Company’s Board of Directors and management will continue to act in the best interests of the Company’s shareholders. We appreciate your continued support.

Sincerely,

[ ]

Keith R. Stewart

Chief Executive Officer

and Member of the Board of Directors

Table of Contents

PRELIMINARY COPY

VALUEVISION MEDIA, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 18, 2014

To the Shareholders of ValueVision Media, Inc.:

The Annual Meeting of Shareholders (the “Annual Meeting”) of ValueVision Media, Inc., a Minnesota corporation (the “Company”), will be held at our offices located at 6690 Shady Oak Road (Human Resources Entrance), Eden Prairie, Minnesota on June 18, 2014 at 9:00 a.m. CT, or at any adjournments or postponements thereof. The Annual Meeting is being held for the purpose of considering and taking action with respect to the following:

1. | to elect eight persons to serve as directors on our Board of Directors until the next Annual Meeting of Shareholders or until their successors have been duly elected and qualified; |

2. | to ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending January 31, 2015; |

3. | to approve, on an advisory basis, the 2013 compensation of the Company’s named executive officers as disclosed in the accompanying proxy statement; |

4. | to consider a shareholder proposal to amend our by-laws (the “By-laws”) to provide for the repeal of any provision of the By-laws that was not included in the By-laws publicly filed with the Securities and Exchange Commission (the “SEC”) on September 27, 2010, and that is inconsistent with or disadvantageous to the election of the nominees or other proposals presented by Clinton Relational Opportunity Fund, L.P. at the Annual Meeting (if the proposal is properly brought before the Annual Meeting); |

5. | to consider a shareholder proposal to amend the By-laws to delete in its entirety Section 4.12 of Article 4 of the By-laws (if the proposal is properly brought before the Annual Meeting); and |

6. | to transact such other business as may properly come before the Annual Meeting, or any adjournments or postponements thereof. |

Only Company shareholders of record as of the close of business on May 2, 2014 will be entitled to receive notice of and to vote at the Annual Meeting or any adjournments or postponements thereof. The mailing of the accompanying proxy statement and the Board’s form of proxy to shareholders whose shares are registered directly in their names with our transfer agent will commence on or about May [ ], 2014.

Clinton Relational Opportunity Master Fund, L.P. (together with certain related persons and entities, the “Clinton Group”) has filed a preliminary proxy statement with the SEC indicating that it intends to nominate its own slate of director nominees for election as directors, as well as submit certain By-law amendments for approval, at the Annual Meeting. Our Board of Directors (the “Board”) has carefully reviewed the Clinton Group’s nominees and proposed By-law amendments and does not endorse either the election of any of such nominees as directors or any of the proposed By-law amendments. If the Clinton Group, a minority group of shareholders beneficially owning approximately 4% of the Company’s shares as of the record date for the Annual Meeting, were to succeed in this proxy contest, then the Clinton Group’s nominees would occupy 75% of the seats on your Board. You may receive solicitation material from the Clinton Group, including proxy statements and proxy cards. The Company is not responsible for the accuracy of any information contained in any such proxy solicitation materials used by the Clinton Group or any other statements that they may otherwise make.

The Board does not believe the Clinton Group’s nominees or proposals are in the best interests of all of our shareholders and does not endorse any of them.

THE BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL OF OUR DIRECTOR NOMINEES NAMED ON THE ENCLOSED WHITE PROXY CARD AND URGES YOU NOT TO SIGN OR RETURN ANY PROXY CARD SENT TO YOU BY OR ON BEHALF OF THE CLINTON GROUP. OUR BOARD ALSO RECOMMENDS A VOTE “FOR” PROPOSALS NO. 2 AND NO. 3 AND A VOTE “AGAINST” THE CLINTON GROUP’S PROPOSALS NO. 4 AND NO. 5.

Table of Contents

Your vote is extremely important. You may attend the Annual Meeting and vote in person, or you may vote by following the directions on theWHITEproxy card for the Annual Meeting. If you choose to attend or to submit a proxy card, we request that you submit a proxy votingFOR each of our director nominees named on the enclosedWHITE proxy card,FOR Proposals No. 2 and No. 3 andAGAINST the Clinton Group’s Proposals No. 4 and No. 5. You may vote on theWHITEproxy by telephone, by Internet, or by signing, dating and returning the enclosedWHITE proxy card in the postage-paid envelope provided. Shareholders or their proxies attending the Annual Meeting should be prepared to provide proper identification.

We urge youNOT to sign or return any gold proxy card that may be sent to you by the Clinton Group.The Board does not endorse any of the Clinton Group nominees or proposed amendments. A “Withhold” vote against the Clinton Group’s nominees on any gold proxy card that is circulated by the Clinton Group is not the same as voting for our director nominees, because submitting a gold proxy card that is circulated by the Clinton Group will revoke any previous proxy submitted by you on theWHITE proxy card.

If you attend the Annual Meeting and wish to change your proxy, you may do so automatically by voting in person at the Annual Meeting. You may also revoke any previously returned proxy by sending another later-dated proxy for the Annual Meeting. If you have previously returned a gold proxy card sent to you by the Clinton Group, we urge you to sign, date and return the enclosed WHITE proxy card markedFOR each of our director nominees named on the enclosed WHITE proxy card,FOR Proposals No. 2 and No. 3 andAGAINST the Clinton Group’s Proposals No. 4 and No. 5, or to so vote by following the instructions for telephone or Internet voting included on the WHITE proxy card.Only your latest-dated proxy counts.

By Order of the Board of Directors

[ ]

Teresa Dery

SVP General Counsel

Corporate Secretary

May [ ], 2014

If you have any questions about these proxy materials or require assistance in voting your shares on the

WHITE proxy card, or need additional copies of ValueVision’s proxy materials, please contact:

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, NY 10022

Shareholders May Call Toll Free: (888) 750-5834

Banks and Brokers May Call Collect: (212) 750-5833

Table of Contents

Table of Contents

PRELIMINARY COPY

VALUEVISION MEDIA, INC.

PROXY STATEMENT FOR THE

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 18, 2014

These proxy materials are being furnished to holders of shares of common stock of ValueVision Media, Inc., a Minnesota corporation (the “Company” or “ValueVision”), in connection with the solicitation of proxies by our Board of Directors (the “Board”) for the Annual Meeting of Shareholders (the “Annual Meeting”) to be held on June 18, 2014, at 9:00 a.m. CT, and at any adjournments or postponements thereof, for the purposes set forth herein. The Annual Meeting will be held at our offices located at 6690 Shady Oak Road (Human Resources Entrance), Eden Prairie, Minnesota.

This proxy statement and the accompanyingWHITE proxy card are first being sent or given to ValueVision shareholders on or about May [ ], 2014.

This proxy statement contains important information to consider when deciding how to vote on the matters set forth in the Notice of Annual Meeting of Shareholders. In this proxy statement, the terms “ValueVision,” the “Company,” “we,” “our,” “ours,” and “us” refer to ValueVision Media, Inc. Our principal executive offices are located at 6740 Shady Oak Road, Eden Prairie, Minnesota 55344-3433 and our main telephone number is (952) 943-6000.

ABOUT THE ANNUAL MEETING

The following questions and answers are intended to address briefly some commonly asked questions regarding the matters to be considered at the Annual Meeting, or at any adjournments or postponements thereof. We urge you to read the remainder of this proxy statement carefully because the information in this section does not provide all information that might be important to you. Please refer to the more detailed information contained elsewhere in this proxy statement, the appendix to this proxy statement and the documents referred to in this proxy statement, which you should read carefully.

Q: What is the purpose of the Annual Meeting?

A: The Annual Meeting is being held for the purpose of considering and taking action with respect to the following:

1. | to elect eight persons to serve as directors on our Board of Directors until the next Annual Meeting of Shareholders or until their successors have been duly elected and qualified; |

2. | to ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending January 31, 2015; |

3. | to approve, on an advisory basis, the 2013 compensation of the Company’s named executive officers as disclosed in this proxy statement; |

4. | to consider a shareholder proposal to amend our by-laws (the “By-laws”) to provide for the repeal of any provision of the By-laws that was not included in the By-laws publicly filed with the Securities and Exchange Commission (the “SEC”) on September 27, 2010, and that is inconsistent with or disadvantageous to the election of the nominees or other proposals presented by Clinton Relational Opportunity Fund, L.P. at the Annual Meeting (if the proposal is properly brought before the Annual Meeting); |

1

Table of Contents

5. | to consider a shareholder proposal to amend the By-laws to delete in its entirety Section 4.12 of Article 4 of the By-laws (if the proposal is properly brought before the Annual Meeting); and |

6. | to transact such other business as may properly come before the Annual Meeting, or any adjournments or postponements thereof. |

Q: Who is making this solicitation?

A: The Board of Directors of ValueVision Media, Inc.

Q: Has the Company been notified that a shareholder intends to propose its own director nominees at the Annual Meeting in opposition to the Board of Director’s nominees?

A: Yes. Clinton Relational Opportunity Master Fund, L.P. (together with certain related persons and entities, the “Clinton Group”) has filed a preliminary proxy statement with the SEC indicating that it intends to nominate its own slate of director nominees for election as directors, as well as submit certain By-law amendments for approval, at the Annual Meeting. Our Board of Directors has carefully reviewed the Clinton Group’s nominees and proposed By-law amendments and does not endorse either the election of any of such nominees as directors or any of the proposed By-law amendments. If the Clinton Group, a minority group of shareholders beneficially owning approximately 4% of the Company’s shares as of the record date for the Annual Meeting, were to succeed in this proxy contest, then the Clinton Group’s nominees would occupy 75% of the seats on your Board.

You may receive solicitation material from the Clinton Group, including proxy statements and proxy cards. The Company is not responsible for the accuracy of any information contained in any such proxy solicitation materials used by the Clinton Group or any other statements that they may otherwise make.

Q: How does the Board of Directors recommend that I vote?

A:The Board is soliciting proxiesFOR the election of the Board’s nominees for election to the Board of Directors pursuant to Proposal No. 1;FOR the approval of Proposals No. 2 and No. 3; andAGAINST the approval of the Clinton Group’s Proposals No. 4 and No. 5. The Board unanimously recommends that you voteFOR the election of the Board’s nominees pursuant to Proposal No. 1;FOR Proposals No. 2 and No. 3; andAGAINST the Clinton Group’s Proposals No. 4 and No. 5.

Q: What vote is required to approve each proposal?

A: With respect to Proposal No. 1, the affirmative vote of a plurality of the shares of common stock present in person or by proxy at the Annual Meeting and entitled to vote is required for election to the Board. Shareholders do not have the right to cumulate their votes in the election of directors or with respect to any other proposal or matter. Assuming a quorum is present, the eight validly nominated individuals receiving the highest number of votes cast at the Annual Meeting will be elected directors.

Proposals No. 2, No. 4 and No. 5 require the affirmative vote of the holders of a majority of the number of shares of common stock present in person or by proxy at the Annual Meeting and entitled to vote (provided that the number of shares voted in favor of such proposals constitutes more than 25% of the outstanding shares of our common stock).

Proposal No. 3 will be considered approved by the Company’s shareholders if the number of votes cast “For” Proposal No. 3 exceeds the number of votes cast “Against” Proposal No. 3.

Q: Who is entitled to vote at the Annual Meeting?

A: Only Company shareholders of record as of the close of business on May 2, 2014 will be entitled to notice of, and to vote at, the Annual Meeting. Our common stock is our only authorized and issued voting security. Every

2

Table of Contents

share is entitled to one vote on each matter that comes before the Annual Meeting. At the close of business on the record date, we had 49,836,253 shares of our common stock outstanding and entitled to vote.

Q: Who is entitled to attend the Annual Meeting?

A: All ValueVision shareholders of record as of the record date, or their duly appointed proxies, may attend the Annual Meeting in person. Cameras, recording devices and other electronic devices will not be permitted at the Annual Meeting.

Please also note that if you hold your shares in “street name” (that is, through a broker or other nominee), and you wish to vote your shares at the Annual Meeting, instead of by proxy, you will need to bring a legal proxy issued to you by your broker or other nominee entitling you to vote in person.

Q: What constitutes a quorum for the Annual Meeting?

A: The presence at the Annual Meeting, in person or represented by proxy, of a majority of the outstanding shares of our common stock as of the record date will constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and “broker non-votes” are counted in determining whether a quorum is present for the transaction of business at the Annual Meeting.

Q: How can I vote at the Annual Meeting?

A: You may vote shares by proxy or in person using one of the following methods:

• | Voting by Internet. You can vote over the Internet using the directions on yourWHITE proxy card by accessing the website address printed on the card. If you received a proxy card and vote over the Internet, you need not return your proxy card. |

• | Voting by Telephone. You can vote by telephone using the directions on yourWHITE proxy card by calling the toll-free number printed on the card. If you received a proxy card and vote by telephone, you need not return your proxy card. |

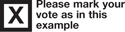

• | Voting by Proxy Card. You can vote by completing and returning your signedWHITE proxy card. To vote using yourWHITE proxy card, please mark, date and sign the card and return it by mail in the accompanying postage-paid envelope. You should mail your signed proxy card sufficiently in advance for it to be received by June 17, 2014. |

• | Voting in Person. You can vote in person at the Annual Meeting if you are the record owner of the shares to be voted. If you hold your shares in “street name” (that is, through a broker or other nominee) and you wish to vote your shares at the Annual Meeting, instead of by proxy, you will need to bring a legal proxy issued to you by your broker or other nominee entitling you to vote in person. |

Q: What do I need to do if I plan to attend the Annual Meeting in person?

A: If you plan to attend the Annual Meeting in person, you must provide proof of your ownership of ValueVision shares (such as a brokerage account statement or the voting instruction form provided by your broker) and a form of government-issued personal identification (such as a driver’s license or passport) for admission to the meeting. If you wish to vote at the Annual Meeting you will have to provide evidence that you owned ValueVision shares as of May 2, 2014, the record date for the Annual Meeting. If you own your shares in the name of a bank or broker, and you wish to be able to vote at the Annual Meeting, you must obtain a proxy, executed in your favor, from the bank or broker, indicating that you owned ValueVision shares as of the record date.

Failure to provide adequate proof that you were a shareholder on the record date may prevent you from being admitted to the Annual Meeting.

Q: Can I vote my shares without attending the Annual Meeting?

A: Yes. Whether you hold shares directly as a shareholder of record or beneficially in street name, you may vote without attending the Annual Meeting. If you are a shareholder of record, you may vote without attending the

3

Table of Contents

Annual Meeting only by submitting a proxy by telephone, by Internet or by signing and returning a proxy card. If you hold your shares in street name you may vote by submitting voting instructions to your broker or other nominee, following the directions provided by such broker or other nominee.

Shares will be voted in accordance with the specific voting instructions on theWHITE proxy. AnyWHITE proxies received by the Company which are signed by shareholders but which lack specific instructions will be votedFOR the election of the Board’s nominees for election to the Board of Directors pursuant to Proposal No. 1;FOR Proposals No. 2 and No. 3; andAGAINST Proposals No. 4 and No. 5.

Q: Can I change my vote after I return my proxy?

A: Yes. You may revoke any proxy and change your vote at any time before the vote at the Annual Meeting. You may do this by:

• | signing and delivering a new proxy prior to the Annual Meeting; |

• | delivering written notice to ValueVision prior to the time of voting, c/o Innisfree M&A Incorporated, 501 Madison Avenue, 20th Floor, New York, NY 10022, stating that your proxy is being revoked; or |

• | attending the Annual Meeting and voting in person. |

Attending the Annual Meeting alone will not revoke your proxy unless you specifically request it.

Q: How will abstentions and “broker non-votes” be treated at the Annual Meeting?

A: Shares of our common stock represented at the Annual Meeting for which proxies have been received but with respect to which shareholders have abstained will be treated as present at the Annual Meeting for purposes of determining whether a quorum exists.

Abstentions will have no effect on the election of directors pursuant to Proposal No. 1 or the approval of Proposal No. 3, but will have the effect of a vote AGAINST Proposals No. 2, No. 4 and No. 5.

Under the rules that govern brokers who have record ownership of shares that they hold in “street name” for their clients who are the beneficial owners of the shares, brokers have the discretion to vote such shares on discretionary, or routine, matters but not on non-discretionary, or non-routine, matters. Broker non-votes generally occur when shares held by a broker nominee for a beneficial owner are not voted with respect to a proposal because the broker nominee has not received voting instructions from the beneficial owner and lacks discretionary authority to vote the shares. Brokers normally have discretion to vote on routine matters, such as ratification of independent registered public accounting firms, but not on non-routine matters, such as contested elections or shareholder proposals. For brokerage accounts that are sent proxy materials in opposition to the Board’s solicitation, all items on the proxy card will be considered non-routine matters, and your broker will not be able to vote your shares unless you provide instructions as to how your shares are to be voted. Accordingly, we urge you to direct your broker or nominee to vote your shares by following the instructions provided on the voting instruction card that you receive from your broker.

Consistent with the Company’s historical practice, if a broker submits a proxy which indicates that the broker does not have discretionary authority as to certain shares to vote on proposals at the Annual Meeting, such “broker non-votes” will be counted for purposes of determining the presence of a quorum at the Annual Meeting, but will not be considered as present in person or by proxy and entitled to vote for purposes of determining the approval or disapproval of any proposal that requires the affirmative vote of the holders of a majority of the number of shares of common stock present in person or by proxy at the Annual Meeting and entitled to vote. Therefore, broker non-votes will have no effect on the election of directors pursuant to Proposal No. 1 and, except to the extent such broker non-votes could cause the affirmative vote total to be 25% or less of the number

4

Table of Contents

of our outstanding shares with respect to Proposals No. 2, No. 4 or No. 5, will have no effect on the outcome of Proposals No. 2, No. 3, No. 4 or No. 5.

Q: What should I do if I receive more than one set of voting and proxy materials?

A: If your shares are registered differently and are held in more than one account, then you will receive more than one proxy statement and proxy card. Please be sure to vote all of your accounts so that all of your shares are represented at the Annual Meeting.

Since the Clinton Group has notified us that they intend to nominate alternative director candidates, resulting in a contested proxy solicitation, we will likely conduct multiple mailings prior to the Annual Meeting date to ensure shareholders have our latest proxy information and materials to vote. We will send you a newWHITE proxy card with each mailing, regardless of whether you have previously voted. The latest dated proxy you submit will be counted, and, IF YOU WISH TO VOTE AS RECOMMENDED BY THE BOARD OF DIRECTORS then you should only submitWHITE proxy cards.

Q: What should I do with any gold proxy card I may receive from the Clinton Group?

A: The Board recommends that you discard any gold proxy card sent to you by the Clinton Group and instead use theWHITE proxy card to vote by telephone, by Internet or by signing, dating and returning theWHITE proxy card in the envelope providedTODAY. If you have already returned a gold proxy card, you can effectively revoke it by voting the enclosedWHITE proxy card. Only your latest-dated proxy will be counted at the Annual Meeting.

A “Withhold” vote against the Clinton Group’s nominees on any gold proxy card that is circulated by the Clinton Group is not the same as voting for the Board’s director nominees, because submitting a gold proxy card that is circulated by the Clinton Group will revoke any previous proxy submitted by you on theWHITE proxy card. In addition, because directors are elected by the affirmative vote of a plurality of the shares of common stock present in person or by proxy at the Annual Meeting and entitled to vote, a “Withhold” vote against the Clinton Group’s nominees is not the same as voting for the Board’s director nominees on theWHITE proxy card.

Q: May the Annual Meeting be adjourned?

A: The persons named as proxies on theWHITE proxy card may propose one or more adjournments of the Annual Meeting. Any adjournment would require the affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting. If you have submitted aWHITE proxy card, the persons named as proxies will vote your shares according to their discretion with respect to any proposed adjournment.

Q: Who will count the votes at the Annual Meeting and how can I find out about the results of the voting at the Annual Meeting?

A: The Company will retain an independent inspector of elections in connection with the Annual Meeting. The independent inspector of elections will have the authority to receive, inspect, electronically tally and determine the validity of the proxies received. The Company intends to notify shareholders of the voting results by issuing a press release, which it will also file with the SEC as an exhibit to a Current Report on Form 8-K.

Q: What happens if other matters come up at the Annual Meeting?

A: The matters described in this proxy statement are the only matters we know of that will be voted on at the Annual Meeting. If other matters are properly presented at the Annual Meeting and you are a shareholder of record and have submitted a completed proxy card or voting instruction form, the persons named as proxies in such proxy card or voting instruction form will vote your shares in accordance with their discretion.

If you need additional proxy materials or have any questions, please call Innisfree M&A Incorporated. Shareholders may call toll-free at (888) 750-5834. Banks and brokers may call collect at (212) 750-5833.

5

Table of Contents

ELECTION OF DIRECTORS

Proposal No. 1 is a proposal to elect eight persons to serve as directors on our Board of Directors. Each director will hold office until the next Annual Meeting of Shareholders and until his or her successor is elected and qualified, or his or her earlier resignation or removal. All of the Board’s director nominees have consented to be named in this proxy statement and to serve as a director, if elected.

At a meeting held on April 25, 2014, our corporate governance and nominating committee reviewed the makeup of the Board and recommended, by unanimous vote, that each person named below be nominated for election as directors. All of the nominees named below (other than Messrs. Hobbs and Robinson) were elected to serve as directors at our 2013 Annual Meeting of Shareholders. Messrs. Hobbs and Robinson were appointed to the Board in March 2014. Based upon the recommendation of our corporate governance and nominating committee, the full Board unanimously nominated the individuals recommended by the corporate governance and nominating committee for election as directors.

Unless the authority to vote for one or more of the Board’s director nominees has been withheld in a shareholder’s proxy or specific instructions to vote otherwise have been given, the persons named on theWHITE proxy card as proxy holders intend to vote at the Annual Meeting “FOR” the election of each nominee presented below.

If prior to the Annual Meeting the Board should learn that any of its nominees will be unable to serve for any reason, the proxies that otherwise would have been voted for such nominee will be voted for a substitute nominee as selected by the Board. Alternatively, the proxies, at the Board’s discretion, may be voted for that fewer number of nominees as results from the inability of any nominee to serve. The Board has no reason to believe that any of its nominees will be unable to serve. There are no family relationships between any director, executive officer, or person nominated to become a director.

The affirmative vote of a plurality of the shares of common stock present in person or by proxy at the Annual Meeting and entitled to vote is required for the election to the Board. Shareholders do not have the right to cumulate their votes in the election of directors or with respect to any other proposal or matter. Assuming a quorum is present, the eight validly nominated individuals receiving the highest number of votes cast at the Annual Meeting will be elected directors.

Summarized below is certain information concerning the persons who are nominated by the Board for election to the Board.OUR BOARD RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” EACH OF THE DIRECTOR NOMINEES NAMED BELOW AND LISTED ON THE ACCOMPANYING WHITE PROXY CARD:

Jill R. Botway has served as Executive Vice President and Director of Sales and Marketing for Specific Media/MySpace, a multi-platform, digital media company in New York since 2012. In addition, from 2009 to 2010, Ms. Botway was Chief Executive Officer of WMI, Inc., a multi-platform media services company, and since 2010, she has been a Managing Member at private equity firm Cavu Holdings LLC. From 2005-2009, Ms. Botway was President of Omnicom Media Group’s U.S. Strategic Business Units. Before joining Omnicom, Ms. Botway held various executive positions with media companies and as an attorney has prior law firm experience.

Ms. Botway brings broad expertise in media and consumer marketing, as well as brand development, which gives the Board insight into customer focusing initiatives, marketing methods and brand positioning. As an attorney, Ms. Botway also brings a sound understanding of legal issues and concerns that may face the Company.

John D. Buck currently serves as non-executive chairman of the board of Medica (Minnesota’s second largest health insurer) and previously served as chief executive officer of Medica from July 2001 until his

6

Table of Contents

retirement in January 2003. From October 2007 to March 2008, and again from August 2008 through January 2009, Mr. Buck served as our interim Chief Executive Officer. Previously, Mr. Buck worked for Fingerhut Companies where he held several senior executive positions, including president and chief operating officer. He left Fingerhut in October 2000. Mr. Buck also previously held executive positions at Graco Inc., Honeywell Inc., and Alliant Techsystems Inc. Mr. Buck currently serves on the Board of Directors of Patterson Companies, Inc.

Mr. Buck provides the Board with his experience in the consumer retail industry, including his past service as an interim Chief Executive Officer of our Company and his senior leadership positions at Fingerhut Companies. He additionally brings to us the knowledge and judgment he gains from serving on other public and private company boards, which allows us to benefit from his insight into board governance matters and appropriate board processes.

William F. Evans most recently served as the executive vice president and chief financial officer of Witness Systems, Inc., a public, global provider of workforce optimization software and services based in Roswell, Georgia from May 2002 until he retired when the company was sold in June 2007. Previously, Mr. Evans had served in a number of operational and financial management roles for a variety of companies, including Superior Essex, ProSource, Inc., H&R Block, Inc., Management Sciences of America and Electromagnetic Sciences, Inc. He began his professional career at Peat Marwick, Mitchell, and Co. (now KPMG), where he was elected a partner in 1980 and was named partner-in-charge of the Atlanta audit practice in 1985. Mr. Evans has served on the Board of Directors of several other private and public companies, including SFN Group, Inc. and Wolverine Tube, Inc. Mr. Evans also currently serves on the board of directors of SAIA, Inc., where he serves on the audit committee.

Mr. Evans offers senior financial management and accounting expertise gained through his long career both in public accounting as well as in senior management and board positions with corporate governance duties at a number of companies. We believe his broad experience and service in senior management and boards of directors provides our Board with valuable expertise, particularly with respect to financial reporting.

Landel C. Hobbs has been Chief Executive Officer of LCH Enterprises LLC, a consulting firm that operates in the broader telecommunications and media space, since 2010. Mr. Hobbs previously served as Chief Operating Officer of Time Warner Cable (“TWC”) from 2005 until the end of 2010 and was Chief Financial Officer of TWC from 2001 until 2005. He served as Vice President of Financial Analysis and Operations Support for all divisions of AOL Time Warner from September 2000 until October 2001. Mr. Hobbs also served in various positions, including Senior Vice President, Controller and Chief Accounting Officer, of Turner Broadcasting System, Inc. from 1993 until 2000. Before joining Turner in 1993, he served as Senior Vice President and Audit Director of Banc One Illinois Corporation and Senior Manager with KPMG Peat Marwick. He is Lead Director of Allconnect and a current Trustee of the National 4H Council and The Dyslexia Resource Trust. He was previously Chair and a Director of CSPAN and a Trustee of Women in Cable Television (WICT) and is a Broadcasting and Cable Hall of Fame Member.

We believe Mr. Hobbs’ experience in the media and telecommunications sectors, including financial, strategic and operational leadership roles, provide the Board with important experience and viewpoints in the strategically important areas of media, telecommunications and finance.

Sean F. Orr is currently the Chief Financial Officer and Treasurer of Accretive Health, Inc., a position he has served in since August 2013. Before that, Mr. Orr served as Senior Vice President and Chief Financial Officer for Maxum Petroleum, Inc. a national marketer and logistics company for petroleum products, from July 2012 until December 2012, following the company’s sale to a third party. From March 2009 through June 2012, Mr. Orr provided consulting services to a range of clients in his own consulting business as well as serving active roles on two not-for-profit boards. Prior to that he served as president and chief financial officer of Dale and Thomas Popcorn, LLC, a snack food business, from February 2007 until March 2009. Prior to that, he was a partner in Tatum Partners, LLC, an executive services firm, in 2006, and the executive vice president and chief financial officer of The Interpublic Group of Companies, a parent of global advertising and public relations firms, from 1999 to 2003. He also worked at Pepsico Inc. from 1994 to 1999 in the roles of Senior Vice President and Controller at Pepsico Corporate Headquarters and Executive Vice President and Chief Financial Officer of its Frito-Lay division; Reader’s Digest as Vice President and Controller from 1990 to 1994; and Peat Marwick, Mitchell, and Co. (now

7

Table of Contents

KPMG), from 1976 to 1990 (serving as a partner from 1986 to 1990). Mr. Orr also was a member of the Board of Directors and Chairman of the Board’s Finance Committee for The Interpublic Group of Companies from 1999-2003. Between his departure from Maxum Petroleum, Inc. in December 2012 (following the company’s sale to a third party) and his being appointed as the Chief Financial Officer and Treasurer of Accretive Health, Inc. in August 2013, Mr. Orr provided consulting services to a range of clients in his own consulting business.

Mr. Orr is a certified public accountant and offers senior financial management and accounting expertise gained through his long career both in public accounting and in private industry. We believe his broad experience and service in senior management provides our Board with valuable expertise, particularly with respect to financial reporting and capital markets.

Lowell W. Robinson served as the Chief Financial Officer and Chief Operating Officer of MIVA, Inc., an online advertising network, from 2007 through 2009. He joined MIVA in 2006 as Chief Financial Officer and Chief Administrative Officer. He had previously served as the President of LWR Advisors from 2002 to 2006 and as the Chief Financial Officer and Chief Administrative Officer at HotJobs.com from 2000 to 2002. He previously held senior financial positions at Advo, Inc., Citigroup Inc. and Kraft Foods, Inc. Mr. Robinson also served on the Board of Directors of The Jones Group from 2005 to 2014, the Board of Directors of Local.com Corporation from 2011 to 2012, the Board of Advisors for the University of Wisconsin School of Business from 2006 to 2010, the Board of Directors of International Wire Group, Inc. from 2003 to 2009, and the Board of Directors of Independent Wireless One, Diversified Investment Advisors and Edison Schools Inc. He is a member of the Smithsonian Libraries Advisory Board and the Board of the Metropolitan Opera Guild. Since 2009, Mr. Robinson’s principal occupation and employment has consisted of his service on the Board of Directors of the Jones Group, the Board of Directors of Local.com Corporation and the Board of Advisors for the University of Wisconsin School of Business.

We believe that Mr. Robinson’s extensive public company experience and deep understanding of the Internet, media, consumer and retail industries provide our Board with critical experience and perspectives on issues of importance to public companies operating in the e-commerce area.

Randy S. Ronning currently serves as Chairman of our Board. Mr. Ronning served as executive vice president and chief merchandising officer of QVC, a major electronic retailer, where he oversaw all merchandising, brand management, and merchandise analysis efforts of QVC and QVC.com, from June 2005 until his retirement in January 2007. He also was responsible for QVC.com operations during this period. Previously, Mr. Ronning was executive vice president with responsibility over affiliate sales and marketing, information services, marketing, research and sales analysis, direct marketing, corporate marketing, public relations, and charitable giving at QVC, from 2001 to May 2005. Prior to joining QVC, Mr. Ronning spent 30 years with J.C. Penney Co., where he held executive positions including president of its catalog and internet divisions. Mr. Ronning has also served on the boards of several non-profit and organizations, including the Electronic Retailing Association, the Dallas Symphony Association, the University of Dallas, the Fashion Institute of Technology, the Mail Order Association, Chairman of the Board, Forrester Research, Knot, Philadelphia Orchestra, The Franklin Institute, and another private company, Commerce Hub, where he was Chairman of the Board.

Mr. Ronning’s extensive senior executive level experience at two major retailing companies provides the Board and the Company with invaluable expertise and industry knowledge as we continue to execute our strategy for growth and profitability. In particular, Mr. Ronning’s record of success in leading the development and success of the e-commerce operations at his prior companies is of substantial importance to the Board and the Company in addressing similar growth opportunities in our Company’s business. Mr. Ronning’s depth of experience in managing, leading and motivating employees provides the Board with great insights in his role as chairman of the human resources and compensation committee.

Keith R. Stewart is our Chief Executive Officer. He was named our President and Chief Executive Officer in January 2009 after having joined the Company as President and Chief Operating Officer in August 2008. Mr. Stewart

8

Table of Contents

voluntarily relinquished the title of President in February 2010 in conjunction with the appointment of a new President of our Company. Mr. Stewart retired from QVC in July 2007 where he had served a significant part of his retail career, most recently as vice president — global sourcing of QVC (USA) and vice president — merchandising of QVC (USA) from April 2004 to June 2007. Previously he was general manager of QVC’s German business unit and was overseas from 1998 to March 2004. Mr. Stewart first joined QVC as a consumer electronics buyer in 1992 and was promoted through a series of progressively responsible positions in key operational areas of tv home shopping.

Mr. Stewart brings to our Board and our Company extensive executive retail, operations, product sourcing and e-commerce experience both domestically and internationally with more than 23 years of leadership experience in the electronic retailing industry. His strong understanding of multichannel retailing strategy and operations and his track record of delivering growth and profitability in our industry gives the Board essential perspectives and insights in their oversight of Company strategy and development.

As described elsewhere in this proxy statement, Clinton Relational Opportunity Master Fund, L.P. (together with certain related persons and entities, the “Clinton Group”) has filed a preliminary proxy statement with the SEC indicating that it intends to nominate its own slate of director nominees for election as directors, as well as submit certain By-law amendments for approval, at the Annual Meeting. Our Board has carefully reviewed the Clinton Group’s nominees and proposed By-law amendments and does not endorse either the election of any of such nominees as directors or any of the proposed By-law amendments.

The election of the Clinton Group’s nominees would effect a change in control of the Company’s Board of Directors by replacing a majority of the current members of the Board with Clinton Group nominees. There are several compelling reasons to reject the Clinton Group’s nominees and proposals, including:

• | Our Board has carefully reviewed the qualifications of the nominees proposed by the Clinton Group and has determined that they do not represent the most qualified and best suited candidates for our Board. If the Clinton Group, a minority group of shareholders beneficially owning approximately 4% of the Company’s shares as of the record date for the Annual Meeting, were to succeed in this proxy contest, then the Clinton Group’s nominees would occupy 75% of the seats on your Board. We believe that the introduction of a substantially reconstituted Board would disrupt the Company’s continued successful execution of its plan to bring value to all shareholders, which success is evidenced by the accomplishments described in the bullet point below (among others). |

• | Since the January 26, 2009 appointment by the Board of Mr. Stewart to the position of Chief Executive Officer, the Company’s common stock has experienced a total return of 817.3%, as of May 8, 2014. Moreover, the Company has either decreased the amount of its quarterly net loss per share on a year-over-year basis or achieved a quarterly net profit per share rather than a quarterly net loss per share on a year-over-year basis in 16 of the 20 fiscal quarters under Mr. Stewart’s tenure as Chief Executive Officer. In addition, the Company has had a 20% growth in the average number of households from fiscal year 2008 to fiscal year 2013 and has reduced average price point by 54% from fiscal year 2008 to fiscal year 2013. |

• | In its discussions with the Company and members of the Board, the Clinton Group has not put forward any concrete strategic recommendations or provided any specific insight into what value their nominees would bring to the Board or how they would alter or improve the Company’s business plan or strategy if given the opportunity. The Board believes that the Company’s shareholders will be better served by the current Board and management continuing to pursue the Company’s business plan, which has been thoughtfully developed and refined with the primary objective of enhancing shareholder value. |

• | We believe our Board and management team have taken meaningful steps to drive performance and position the Company to deliver shareholder value. We are continuing to pursue the following actions to improve the operational and financial performance of our Company: (i) expand and diversify our product mix to appeal to more customers and to increase the purchase frequency of active customers, |

9

Table of Contents

(ii) attract, retain and increase new and active customers and improve household penetration, (iii) increase our gross margin dollars by maintaining merchandise margins in key product categories while prudently managing inventory levels, (iv) enhance our customer experience through a variety of investments in technology, promotional activity and improved and competitive service, (v) manage our fixed operating costs and variable transaction expenses, (vi) grow our internet and mobile business with expanded product assortments and internet-only merchandise offerings, (vii) expand our internet, mobile and social media channels to attract and retain more customers, and (viii) maintain cable and satellite carriage contracts at appropriate durations and cost while improving distribution productivity through better channel positions and dual illumination or multiple channels. |

• | We believe that the current Board and management team have been effective stewards of the Company and our business, as demonstrated by their ability to streamline operations, improve the quality and cost effectiveness of the Company’s TV distribution footprint, and significantly enhance the stability and flexibility of the Company’s balance sheet, resulting in stronger financial performance. We believe we have already begun to see results, as evidenced by our strong financial and operating performance in fiscal 2013. |

• | We believe we have strengthened the Board over the past three years to add independent directors that ensure we have the best team to oversee the execution of our strategy. The average tenure of our board is approximately 3.5 years, with five of our directors having been appointed in the last three years. The members of the Board were carefully selected by our Nominating and Corporate Governance Committee following a thorough review of their qualifications and (other than Messrs. Hobbs and Robinson, who were appointed to the Board in March 2014) were overwhelmingly re-elected at the June 2013 Annual Meeting of Shareholders with strong support from our shareholders. |

• | The election of the Clinton Group’s nominees to a majority of the Board seats would constitute a “change of control” under the Company’s revolving credit and security agreement with PNC Bank, N.A., potentially requiring the Company, among other things, to offer to repay amounts owed under its revolving line of credit, which are approximately $38 million as of May 8, 2014 and which could be materially harmful to the Company. |

• | The election of the Clinton Group’s nominees to a majority of the Board seats would also constitute an “Event” or a “Change in Control,” as applicable and as described in more detail below, under Keith Stewart’s Second Amended and Restated Employment Agreement (the “Amended Agreement”), our Executives’ Severance Benefit Plan (the “Plan”) and our equity award plans. |

• | As described in detail below under the heading “Executive Compensation – Keith Stewart Second Amended and Restated Employment Agreement” beginning on page 42, if (i) an “Event” occurs during the term of the Amended Agreement and (ii) within one year after the occurrence of such “Event,” Mr. Stewart’s employment is terminated involuntarily by the Company without “Cause” or voluntarily by Mr. Stewart for “Good Reason,” then Mr. Stewart would be entitled to receive a lump sum amount equal to twenty four months of base salary, twenty four months of his target bonus opportunity and continued group medical and dental insurance for twenty four months. In addition, the Amended Agreement provides that, upon the occurrence of an “Event,” (x) the restrictions on Mr. Stewart’s restricted stock awards will lapse, (y) all outstanding unvested stock options, stock appreciation rights and other equity based awards granted to Mr. Stewart under the Company’s 2011 Omnibus Incentive Plan that are subject to vesting requirements will immediately become exerciseable in full, and (z) all performance units and other performance-based incentives will be deemed earned at 100% of the target level thereof. The Company notes that the Clinton Group has publicly stated that it would likely replace Mr. Stewart with a different Chief Executive Officer should its nominees succeed in obtaining a majority of the seats on our Board. |

10

Table of Contents

• | As described in detail below under the heading “Executive Compensation – ValueVision Media, Inc. Executives’ Severance Benefit Plan” beginning on page 44, if, within a two-year period commencing on the date of a “Change in Control,” (i) the Company terminates the employment of an officer of the Company (other than Mr. Stewart) for any reason other than “Cause,” death or the officer’s becoming disabled or (ii) the officer terminates his or her employment for “Good Reason,” the officer would be entitled to receive a lump sum amount equal to (a) one and one-half (1 1/2) times the officer’s highest annual rate of base salary during the preceding 12 month period plus (b) one and one-half (1 1/2) times the target annual incentive bonus determined from such base salary. In addition, for eighteen months following any such termination, the officer would be entitled to reimbursement for a portion of the premium amount for COBRA coverage equal to the amount paid by other similarly situated participants in the Plan. Our directors do not participate in the Plan. |

• | The Company’s equity award plans provide that stock options and restricted stock will immediately vest and options will immediately become exercisable upon an “Event” or a “Change in Control” (depending on the terminology used in the applicable plan), subject to certain triggers and exceptions. Accelerated vesting of equity awards is mandatory upon the occurrence of an “Event” (including a change of control of the Board that is not approved by the current Board) under the terms of our 2004 Omnibus Stock Plan, while accelerated vesting would generally be at the discretion of our Compensation Committee upon the occurrence of a “Change in Control” (including a change of control of the Board that is not approved by the current Board) under the terms of our 2011 Omnibus Stock Plan. There are no unvested equity awards outstanding under our 2001 Omnibus Stock Plan. |

• | Each of these arrangements is described in further detail below under the heading “Executive Compensation – Severance Agreements and Severance Guidelines (change of control)” beginning on page 51, where additional information regarding hypothetical potential payments under such compensation and severance arrangements can be found. The actual amounts of compensation, if any, that would become payable to our directors and executive officers based on the occurrence of an “Event” or a “Change in Control” under these arrangements would depend upon (among other things) the actual date on which the applicable “Event” or “Change in Control” occurred, whether or not (and under what circumstances) an executive officer was terminated or resigned, and whether or not (and on what date) a director or officer elected to exercise any stock options or shares of restricted stock that vested or became exercisable as a result of such “Event” or “Change of Control.” |

Background on the Solicitation

In August 2013, Greg Taxin, President of the Clinton Group, Inc., contacted representatives of the Company and notified them that the Clinton Group was a shareholder of the Company and requested to meet with members of our senior management team.

On September 4, 2013, at the request of the Clinton Group, Keith Stewart, our Chief Executive Officer, and Bill McGrath, our Chief Financial Officer, had a telephonic meeting with Mr. Taxin and other members of the Clinton Group in order to provide the Clinton Group an opportunity to discuss the Company’s business and performance, as well as its views of the Company and anything else it wanted to bring to the Company’s attention. At the meeting, Mr. Taxin said that the Clinton Group had acquired at least 4% of the Company’s outstanding shares.

On September 19, 2013, at the request of the Clinton Group, Messrs. Stewart and McGrath had a telephonic meeting with Messrs. Taxin and Hall of the Clinton Group in order to provide the Clinton Group an opportunity to further discuss the Company’s business and performance. At this meeting, Mr. Taxin advised Messrs. Stewart and McGrath that, among other things, he did not believe that Mr. Stewart was the right CEO for the Company’s

11

Table of Contents

business going forward and that “fresh thinking” was needed on the Board. In this conversation Mr. Taxin also advised that he expected that the Clinton Group would hold 5% of the Company’s outstanding shares by September 24, 2013.

On September 24, 2013, Mr. McGrath and a member of our senior management team attended a consumer conference, at which Mr. Taxin approached them and again expressed the Clinton Group’s views of the Company.

On September 25, 2013, the finance committee of the Board (the “Finance Committee”) met. Among other things, the Finance Committee discussed recent communications from the Clinton Group and considered further comments and criticism made by Mr. Taxin.

On September 27, 2013, at the request of representatives of the Clinton Group and at the direction of the Finance Committee, our general counsel and our outside counsel spoke with representatives of the Clinton Group, who requested the opportunity to meet with members of our Board. In this conversation representatives of the Clinton Group advised that the Clinton Group owned 4.9% of the Company’s outstanding shares.

On October 2, 2013, the Board discussed the Clinton Group’s stated views about the Company’s performance, management team and Board members and resolved to give a special committee (the “Special Committee”) comprised of independent Board members Randy Ronning (Chairman of the Board) and Sean Orr the authority to consider and respond to shareholder inquiries and requests including, but not limited to, the authority to negotiate with such shareholders, to consider and evaluate strategic decisions in response to shareholder inquiries and requests, and to take such other actions in connection therewith as the Special Committee may deem necessary or appropriate, including to recommend to the Board the approval or rejection of particular actions or transactions.

On October 21, 2013, at the request of the Clinton Group, the members of the Special Committee and representatives of management hosted representatives of the Clinton Group, including Mr. Taxin, at a meeting in Minneapolis. Representatives of the Clinton Group made a number of comments about the Company, its performance, its strategy and its management and said that both Mr. Stewart and the Board must be replaced, but did not provide any concrete suggestions or recommendations to improve the Company’s business and strategy. Mr. Taxin also said that the Clinton Group had acquired over 5% of the Company’s outstanding shares and would be filing a Schedule 13D with the SEC within 10 days.

On October 28, 2013, Mr. Orr and ValueVision’s general counsel spoke with Mr. Taxin and other members of the Clinton Group to follow-up on the meeting of October 21, 2013.

On October 30, 2013, the Clinton Group sent a letter to Mr. Ronning calling for the removal of Mr. Stewart and stating that it would be interested in making an investment of “at least $25 million at a substantial premium to the stock price” if the Company replaced Mr. Stewart and “updated the Board significantly.” This proposal was conditioned on the completion of due diligence; however, the Clinton Group had refused to enter into a confidentiality agreement with the Company that could permit a diligence process to be conducted. On the same day, the Clinton Group filed a Schedule 13D with the SEC disclosing that it beneficially owned 2,887,847 shares of our common stock, which represented approximately 5.8% of our outstanding shares.

On the same day, the Company responded to the Schedule 13D filing with a press release noting that the Company had engaged in numerous discussions with the Clinton Group since early September, when Clinton first met with senior representatives of management but that the Clinton Group had failed to provide any concrete suggestions or recommendations to improve the Company’s business and strategy.

On November 4, 2013, an amended Schedule 13D was filed stating that the Clinton Group and Cannell Capital LLC (together with certain of its affiliates, “Cannell”) had formed a group (together, the “Shareholder Group”). The amended Schedule 13D stated that the Shareholder Group beneficially owned

12

Table of Contents

5,445,679 shares, or approximately 11.0%, of the Company’s outstanding common stock, including 3,194,346 shares, representing 6.5% of the Company’s outstanding common stock, held by the Clinton Group.

On the same day, the Clinton Group delivered letters to the Company on behalf of the Shareholder Group requesting that ValueVision call a special meeting of shareholders to be held on December 19, 2013, and communicating the Shareholder Group’s intention to present the following shareholder proposals: (i) to repeal any provision of the By-laws that was not included in the By-laws publicly filed by the Company with the SEC on September 27, 2010, to the extent inconsistent with or disadvantageous to the election of the nominees or other proposals proposed to be presented by the Shareholder Group (summarized in (ii)-(vi) below); (ii) to delete in its entirety Section 4.12 of the By-laws to eliminate the Board’s authority under the By-laws to remove directors; (iii) to amend and restate Section 4.13 of the By-laws to allow shareholders to fill vacancies on the Board; (iv) to remove each of Jill R. Botway, John D. Buck, William F. Evans, Randy S. Ronning and Keith R. Stewart from the Board; (v) to fix the size of the Board at nine directors; and (vi) to elect up to seven individuals named by the Shareholder Group to fill any vacancies resulting from the removal of incumbent directors or from any increase in the size of the Board.

The letters were reviewed by the Board’s and the Company’s legal advisors, discussed with the Board and found to be deficient because (among other things) the Shareholder Group (i) did not hold of record, or have valid voting power with respect to, a sufficient number of shares of Company common stock to demand a special meeting of shareholders under Minnesota law or ValueVision’s By-laws and (ii) had not included in its demand letters all information required by ValueVision’s By-laws from shareholders seeking to demand and present proposals for consideration at a special meeting of shareholders. For example, the Shareholder Group’s letters did not include (among other things) all required information regarding the Shareholder Group’s options and derivatives trading activity and all required information regarding the Shareholder Group’s “affiliates” and “associates” and any compensatory or other material monetary arrangements between or among them. Notwithstanding this finding, the Board determined that the Company should continue to engage in discussions with the Shareholder Group.

On November 5, 2013, Mr. Ronning sent a letter to the Clinton Group stating that the Board was receptive to listening to and considering the views of our shareholders, including the suggestion of adding qualified independent directors to our Board with appropriate expertise in areas that would complement the strengths of our current Board members. The letter also requested that the Shareholder Group withdraw its request for a special meeting until after the end of the holiday season so that our management could devote its full energy to running the Company and executing its strategy over that critical period.

On November 6, 2013, the Clinton Group sent a letter to Mr. Ronning again demanding that a special meeting be held in late January 2014. The Shareholder Group also filed an amendment to its Schedule 13D on November 6, 2013, which included as exhibits the Shareholder Group’s letters seeking to demand a special meeting of shareholders.

On November 14, 2013, although we and our Minnesota counsel had determined that the Shareholder Group’s letters requesting that a special meeting be held continued to be deficient under our By-laws and Minnesota law (for the reasons summarized above), our Board determined that it would be in the best interests of all shareholders to provide shareholders with an opportunity to vote and express their views on the Clinton Group’s proposals, in part to avoid the distraction and expenses associated with a prolonged public dispute with the Shareholder Group regarding the calling and scheduling of a special meeting. Accordingly, the Company announced in a press release on November 15, 2013 that a special meeting (the “Special Meeting”) had been scheduled to be held on March 14, 2014. Also on November 15, 2013, the Company sent a letter to outside counsel to the Shareholder Group, advising the Shareholder Group of the deficiencies of their demand letters and rejecting the Shareholder Group’s demand for a special meeting of ValueVision shareholders.

On November 18, 2013, the Clinton Group sent a letter to the Company criticizing the Company for calling the Special Meeting for March 14, 2014 and threatening to bring legal action to force the Company to convene a special shareholder meeting at the end of January 2014.

13

Table of Contents

On November 21, 2013, the Company received a new letter from the Clinton Group seeking to demand a special meeting of the shareholders to vote on the Shareholder Group’s proposals, even though the Company had already publicly announced that it had scheduled the Special Meeting for March 14, 2014.

On December 6, 2013, a member of the Special Committee spoke with Mr. Taxin to discuss the Shareholder Group’s proposals. The member of the Special Committee noted that the Company would be willing to consider expanding our Board of Directors to include one nominee of the Shareholder Group that would qualify as an independent director as well as one additional mutually acceptable independent candidate. The Clinton Group rejected this offer.

On December 20, 2013, the Company sent a letter to the Shareholder Group notifying them that their second demand letter, dated November 21, 2013, was deficient under our By-laws and Minnesota law because (among other things) the letter did not include all of the information required by our By-laws from shareholders seeking to demand and present proposals for consideration at a special meeting of shareholders, including required information about the Shareholder Group’s “affiliates” and “associates.”

On December 24, 2013, the Clinton Group filed an amendment to its Schedule 13D, indicating that it had sold 545,685 Company shares since October 30, 2013 and that the Shareholder Group owned 4,899,994 shares, or approximately 9.8%, of our outstanding shares (fewer than the 10% required to demand a special meeting), including 2,698,661 shares, representing 5.4% of the Company’s outstanding common stock, held by the Clinton Group.

On January 10, 2014, a representative of the Company’s outside counsel called a representative of outside counsel to the Shareholder Group, to discuss the Special Meeting and suggested that, in order to save the costs and expenses of calling the Special Meeting (among other reasons), the Shareholder Group consider a settlement in which two mutually acceptable individuals would be added to the Board. Later that day, the Clinton Group responded that it was not interested in discussing this proposal either.

On January 16, 2014, a representative of outside counsel to the Shareholder Group called a representative of the Company’s outside counsel to suggest that the Company agree to explore strategic alternatives, as well as add an unspecified number of directors to the Board. On January 17, 2014, the Company publicly announced that it had set February 13, 2014 as the record date for the Special Meeting to be held on March 14, 2014. On January 24, 2014, a representative of the Company’s outside counsel formally advised a representative of the Shareholder Group’s outside counsel that the Company was not interested in discussing the Clinton Group proposal with them. Later that day, the Company filed preliminary proxy materials for the Special Meeting with the SEC.

On January 27, 2014, the Company received two letters from the Shareholder Group, in which the Shareholder Group sought to modify its proposals submitted to the Company on November 4 and 21, 2013, which the Company had publicly announced on November 15, 2013 would be presented for consideration at the Special Meeting scheduled for March 14, 2014, notwithstanding that the Shareholder Group’s letters did not satisfy the requirements for demanding and proposing business to be conducted at a special meeting of shareholders under Minnesota law and our By-laws. Specifically, the Shareholder Group sought: (i) modifications to one of its By-law amendment proposals to ask shareholders to approve an amendment to the By-laws that would lower the required vote for the removal of directors to a majority vote of the number of shares entitled to vote and represented at any meeting at which there is a quorum (as compared with the current standard of a majority of the number of all voting shares outstanding); (ii) modifications to its director removal proposal to ask shareholders to vote on the removal of only William F. Evans, Randy S. Ronning and Keith R. Stewart, and to no longer ask shareholder to vote on the removal of Jill Botway or John D. Buck; (iii) modifications to its proposal to increase the size of the Board to ask shareholders to set the size of the Board at the greater of (x) nine directors or (y) such number of directors as the Board shall consist of as of the commencement of the Special Meeting (or any adjournment or postponement thereof)plusthree directors; and (iv) modifications to its director nominations proposal to remove Melissa B. Fisher from the Shareholder Group’s slate of director nominees.

14

Table of Contents

On January 28, 2014, the Company sent a letter to the Shareholder Group, in which the Company advised the Shareholder Group that the business proposed to be conducted at the Special Meeting by the Shareholder Group in its January 27, 2014 letter had not been timely received by the Company. Under Section 3.3(b) of the By-laws, notice of business to be conducted at a special meeting must be received by the Company prior to the later of (i) the 90th calendar day prior to the date of such special meeting (in the case of the Special Meeting, December 14, 2013) or (ii) the 10th calendar day following the day on which public disclosure of the date of such special meeting was first made (in the case of the Special Meeting, such 10th calendar day was November 25, 2013). The By-laws define “public disclosure” to mean “disclosure in a press release reported by a national news service or in a document publicly filed by the [Company] with the Securities and Exchange Commission pursuant to Sections 13, 14 or 15(d) of the Exchange Act,” which the Company had made on November 15, 2014. Because the Shareholder Group’s letters were not received prior to the later of these dates (December 14, 2013), the Company informed the Shareholder Group that the proposals had not been timely received and would not be presented for consideration or included in the business to be conducted at the Special Meeting.

On February 3, 2014, the Clinton Group sent the Company a letter and made a public announcement in which the Clinton Group stated, among other things, that it would not participate in the Special Meeting, but would instead pursue its proposals at the Company’s 2014 Annual Meeting of Shareholders.

On February 4, 2014, the Company announced that it had determined that it would be in the best interest of the Company and its shareholders to cancel the Special Meeting in response to the Clinton Group’s announcement that it no longer intended to participate in the Special Meeting.

On February 6, 2014, the Clinton Group and Cannell filed an amended Schedule 13D with the SEC, in which the Clinton Group and Cannell disclosed that they had terminated their status as a “group” for purposes of Section 13(d)(3) of the Securities Exchange Act of 1934 and Rule 13d-5(b)(1) promulgated thereunder. In addition, the Clinton Group disclosed that it beneficially owned 4.9% of the Company’s outstanding common stock, and Cannell disclosed that it beneficially owned 4.6% of the Company’s outstanding common stock. Each of the Clinton Group and Cannell also disclosed that because their respective beneficial ownership of Company common stock had fallen below the 5% Schedule 13D reporting threshold, that the February 6, 2014 Schedule 13D/A filing constituted an “exit filing” for each of the Clinton Group, Cannell and the other reporting persons identified therein.

On February 24, 2014, the Clinton Group delivered a letter to the Company, which communicated the Clinton’s Group intention to nominate six individuals for election to the Board at the 2014 Annual Meeting and to submit to a vote of the Company’s shareholders the By-law amendments described in Proposals No. 4 and No. 5 herein at the 2014 Annual Meeting.

On March 13, 2014, the Board appointed each of Landel C. Hobbs and Lowell W. Robinson as directors of the Company, in each case effective immediately, and fixed the size of the Board at eight directors in connection therewith.

On April 14, 2014, at the request of the Clinton Group, Mr. Orr and counsel for the Company spoke with the Clinton Group to discuss possible approaches to reaching a settlement. The parties agreed to keep the discussions confidential.

On April 21, 2014, Mr. Orr and the Clinton Group spoke again regarding a possible settlement, but no agreement was reached. The parties agreed to keep the discussions confidential.

* * * * * *

FOR THE REASONS STATED ABOVE, AMONG OTHERS DESCRIBED IN THE ACCOMPANYING PROXY MATERIALS, THE BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL OF THE BOARD’S DIRECTOR NOMINEES NAMED ON THE ENCLOSED

15

Table of Contents

WHITE PROXY CARD AND URGES YOU NOT TO SIGN OR RETURN ANY PROXY CARD SENT TO YOU BY OR ON BEHALF OF THE CLINTON GROUP.

DO NOT DELAY. IN ORDER TO HELP ENSURE THAT THE CURRENT BOARD IS ABLE TO ACT IN YOUR BEST INTERESTS, PLEASE USE THE ENCLOSEDWHITE PROXY TO VOTE BY TELEPHONE, BY INTERNET, OR BY SIGNING, DATING AND RETURNING THEWHITE PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED AS PROMPTLY AS POSSIBLE WHETHER OR NOT YOU HAVE RETURNED THE GOLD PROXY CARD FROM THE CLINTON GROUP.

16

Table of Contents

RATIFICATION OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Proposal No. 2 is a proposal to ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending January 31, 2015.

Proposal No. 2 requires the affirmative vote of the holders of a majority of the number of shares of common stock present in person or by proxy at the Annual Meeting and entitled to vote (provided that the number of shares voted in favor of such proposal constitutes more than 25% of the outstanding shares of our common stock). Shareholders may vote “FOR” or “AGAINST,” or may “ABSTAIN” with respect to, Proposal No. 2.

Deloitte & Touche LLP has been our independent registered public accounting firm since fiscal 2002. Upon recommendation from our audit committee, the Board selected Deloitte & Touche LLP to serve as our independent registered public accounting firm for our fiscal year ending January 31, 2015, subject to ratification by our shareholders. While it is not required to do so, the Board is submitting the selection of this firm for ratification in order to ascertain the view of our shareholders. If the selection is not ratified, our audit committee will reconsider its selection. Proxies solicited by the Board will, unless otherwise directed, be voted to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending January 31, 2015.

Deloitte & Touche LLP Attendance at the Annual Meeting

A representative of Deloitte & Touche LLP will be present at the Annual Meeting and will be afforded an opportunity to make a statement if the representative so desires and will be available to respond to appropriate questions during the meeting.