FILED BY MANPOWER INC.

PURSUANT TO RULE 425 UNDER THE SECURITIES ACT OF 1933, AS AMENDED

SUBJECT COMPANY: COMSYS IT PARTNERS, INC.

COMMISSION FILE NO. 000-27792

Manpower Inc. (NYSE: MAN)

February 2010

2

This presentation includes forward-looking statements which are subject to risks

and uncertainties. Actual results might differ materially from those projected in

the forward-looking statements. Additional information concerning factors that

could cause actual results to materially differ from those in the forward-looking

statements is contained in the Company’s Annual Report on Form 10-K dated

December 31, 2009, which information is incorporated herein by reference, and

such other factors as may be described from time to time in the Company’s SEC

filings.

This presentation does not constitute an offer of any securities for sale. The

exchange offer related to the acquisition of COMSYS IT Partners, Inc. has not

commenced. Manpower intends to commence an exchange offer and file a

Schedule TO and a registration statement on Form S-4, and COMSYS intends

to file a Solicitation/Recommendation Statement on Schedule 14D-9 with the

Securities and Exchange Commission in connection with the transaction.

Manpower and COMSYS expect to mail a Preliminary Prospectus, the Schedule

14D-9 and related exchange offer materials to stockholders of COMSYS.

These documents, however, are not currently available. INVESTORS AND

SECURITY HOLDERS ARE URGED TO READ THESE DOCUMENTS

CAREFULLY WHEN THEY ARE AVAILABLE BECAUSE THEY CONTAIN

IMPORTANT INFORMATION ABOUT MANPOWER, COMSYS AND THE

TRANSACTION. Documents filed with the SEC by Manpower and COMSYS

may be obtained without charge at the SEC's website at www.sec.gov, and at

Manpower's website at www.manpower.com or COMSYS' website at

www.comsys.com.

Forward-Looking Statement

Manpower Inc. (NYSE: MAN)

February 2010

At Manpower, our job is helping the world work,

and today it’s more important than ever before.

Despite the challenging business

environment, we remain true to our long-

term strategy. This is no easy task: It

requires careful planning, expertise and

agility. With confidence and focus

Manpower will emerge stronger and

smarter than ever.

OUR VISION is to lead in the

creation and delivery of services

that enable our clients to win in

the changing world of work.

3

Manpower Inc. (NYSE: MAN)

February 2010

Manpower Facts

2009 Segment Revenues in millions ($)

2009 Segment Operating Unit Profit* in millions ($)

400,000 clients

28,000 employees

82 countries/territories

$16 billion in revenues in 2009

3 million placements

4,000 offices

9 million trained

4

Americas 2,561.0 (16%)

France 4,675.5 (29%)

EMEA 6,322.5 (39%)

Asia Pacific 1,728.0 (11%)

Right Management 559.4 (4%)

Jefferson Wells 192.3 (1%)

*Excludes non-recurring items as detailed in our earnings release and further explained on our website.

Americas (4.0)

France 26.4

EMEA 73.0

Asia Pacific 29.1

Right Management 113.4

Jefferson Wells (15.4)

Manpower Inc. (NYSE: MAN)

February 2010

We Offer Solutions for Employers of all Sizes

End-to-End Services for the

Employment Lifecycle

Our comprehensive range of services

allows us to help employers raise their

productivity through improved quality,

efficiency and cost-reduction strategies

at every stage of their business evolution.

And because we focus on their talent

needs, they can concentrate on their

core business activities.

The Manpower Group of Companies:

5

Manpower Inc. (NYSE: MAN)

February 2010

A Recognized Leader

Recent accolades

In 2009, Institutional Investor magazine named Manpower

the Most Shareholder-Friendly Company in the Business

& Professional Services category for the fourth year in a

row, based on interviews with directors of research, chief

investment officers, portfolio managers and analysts.

In 2009, Manpower was named as one of Fortune’s

most admired companies in the staffing industry for the

seventh year in a row by a group of 10,000 executives,

directors and security analysts.

Forbes magazine named Manpower to its 2008 list of the

best-managed companies for the sixth time, citing

Manpower’s integrity in the areas of accounting and

governance, financial condition and earnings quality.

Manpower ranked 119th on the 2009 Fortune 500 list

of the largest companies in America.

Manpower ranked 432nd on the 2009 Fortune Global

500 list of the largest companies in the world.

Named a Global High Performer in 2007, Manpower

ranked 1,306th on the 2009 Forbes Global 2000

ranking of the largest public companies in the world.

In 2009, Manpower was named one of America’s greenest

“big” companies by Newsweek Magazine. The U.S. Green

Building Council awarded Manpower Gold Status under

LEED certification system for its “green” headquarters.

Since 2008, Manpower has been listed on the

FTSE4Good Index Series, which measures the

performance of companies that meet globally recognized

corporate responsibility standards, and facilitates

investment in those companies.

America’s Most Shareholder-Friendly

America’s Most Admired Companies

America’s Best Managed Companies

Fortune America 500

Fortune Global 500

Forbes Global 2000

Greenest Big Companies in America

FTSE4Good Index

6

Manpower Inc. (NYSE: MAN)

February 2010

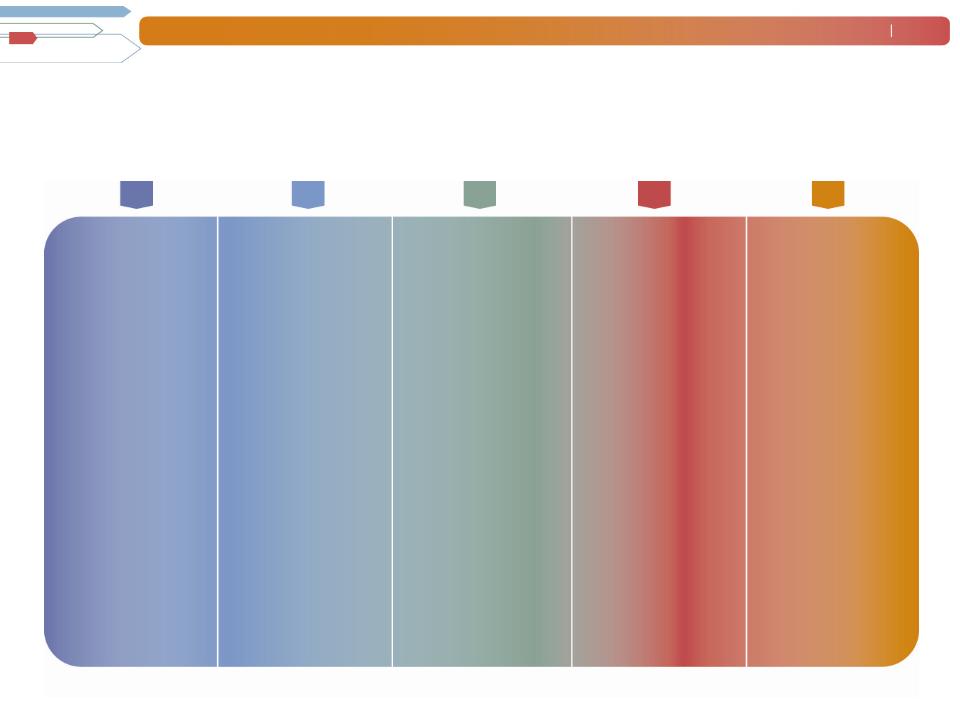

Organization

and Culture

Evolving our

organization

and culture

requires attracting

and

retaining high

quality people for

the long term.

It also requires

creating an

environment that

promotes

entrepreneurship,

rewards high

performance, and

motivates us to

reach our full

potential.

Improving our

efficiency

means achieving

speed, quality and

effective use of

resources

throughout all our

operations.

Efficiency

Demonstrating our

commitment to

innovation

requires us to

continuously

capture creativity in

local markets, and

replicate this

around the world.

Our role is to

develop and

expand our

capabilities, while

creating services

targeted to what’s

new and what’s

next in the world of

work.

Innovation

Thought

Leadership

Maintaining our

thought

leadership

means

continuously

anticipating future

dynamics of the

market and

contributing to the

design of social

and employment

systems on a

global basis.

Generating more

revenue

requires us to

develop strategic

insights about

our clients’

needs and

goals, elevating

and broadening

our mutually-

beneficial

relationships and

measuring our

contribution to

our clients’

businesses.

Revenue

Key Strategies

7

Manpower Inc. (NYSE: MAN)

February 2010

2010 Global Strategic Priorities

To achieve our vision, better service our clients and candidates, and differentiate

ourselves from our competition, the Manpower group of companies will focus on:

Manpower Experience

• Candidate Experience

• Client Experience

Digital Strategy

• MyPath

• Direct Talent

• Direct Office / Direct Time

Manpower Professional

• ICT, Engineering, Finance and

Accounting

• Go-to-Market Strategy

• Enhanced Business Model

New Services & Sectors

• Manpower Business Solutions

-RPO (Recruitment Process Outsourcing)

-MSP (Managed Service Programs)

-TBO (Task Based Outsourcing)

• Workforce Strategy

• Government Sector

8

Manpower Inc. (NYSE: MAN)

February 2010

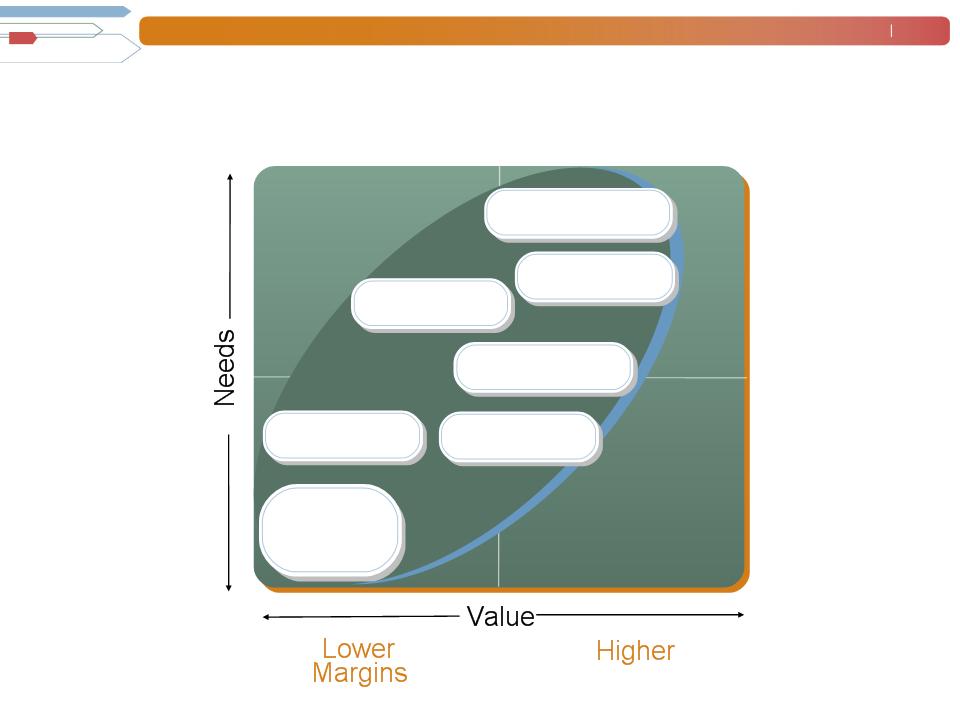

Specialty

Core

Margins

Staffing

HR Consulting

Where We’re Going

Permanent

Professional

Outplacement

F&A

MBS

9

Manpower Inc. (NYSE: MAN)

February 2010

COMSYS Acquisition Summary

10

February 2010

Announced

$17.65 per share; $431 million enterprise value

Purchase Price

50% stock / 50% cash, with option to pay all cash

Consideration

April 2010

Expected Closing

$20 million by 2011 (3% of revenue)

Synergies

Accretive in 2010, excluding intangible amortization costs

EPS Accretive

Manpower Inc. (NYSE: MAN)

February 2010

COMSYS Business Overview

11

• Third largest IT staffing and

managed solutions company in the

U.S. with $650 million in revenue.

- Project Management

- Business Analysis

- Network Infrastructure

- Business Intelligence

- Applications Programming and

Development

- Quality Assurance and Testing

- Workforce Solutions (RPO and

MSP)

• National footprint with 52 branches

• Diversified client base across several

high-growth industry sectors

Manpower Inc. (NYSE: MAN)

February 2010

Combined Professional Staffing Business

12

Combined revenue of Manpower Professional and COMSYS will be over $2.5 billion

Combined number of contractors on assignment daily will be over 25,000

Combined footprint will be 400 offices

Combined MSP offering will be total flow through dollars of $3.5 billion

* Includes Manpower Professional, Elan and Comsys

Manpower Inc. (NYSE: MAN)

February 2010

$975M

$185M

2009 Pro forma

1999

11%

13

Diversifying Via Specialty Services

Evolution of Specialty Gross Margin

Manpower Professional

Elan

COMSYS

Jefferson Wells

Right Management

Gross margin from specialty

services now exceeds one-third of

our total gross margin.

% of Total GP

* 2009 Pro forma includes the results of COMSYS IT Partners

*

33%

Manpower Inc. (NYSE: MAN)

February 2010

Exciting Growth Opportunities

SOURCE: Manpower estimates

Italy | 0.9% | +++ | 16% |

Nordics | 1.0% | +++ | 30% |

Germany | 1.4% | +++ | 5% |

Japan | 1.8% | ++ | 3% |

US | 1.5% | + | 3% |

France | 2.1% | + | 21% |

UK | 3.5% | + | 4% |

Staffing Market

Penetration

Growth

Opportunity

Manpower

Market Share

14

Manpower Inc. (NYSE: MAN)

February 2010

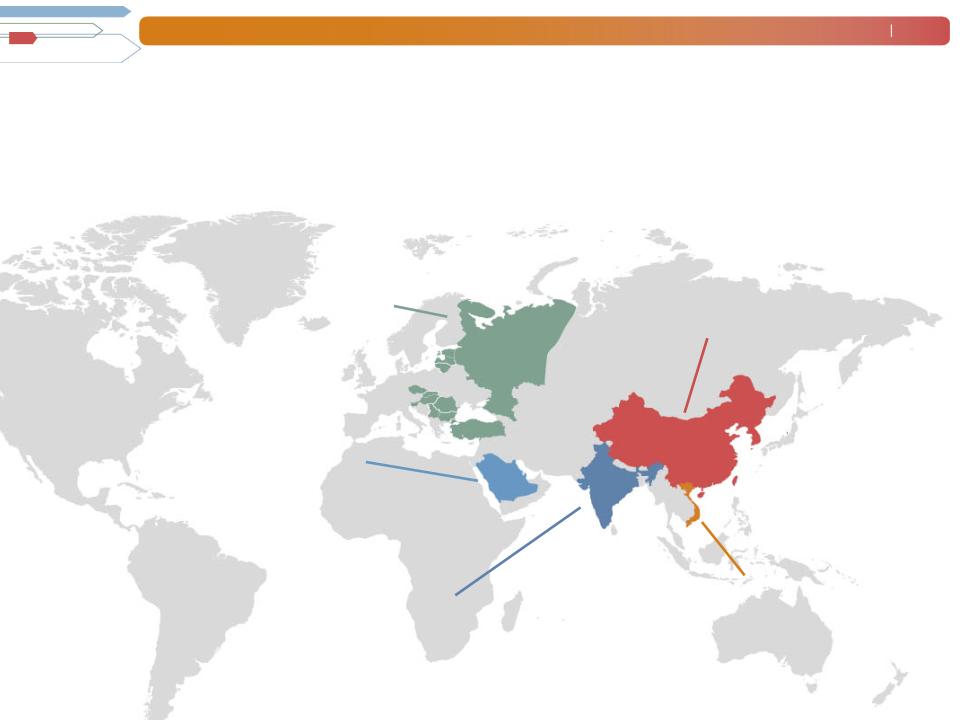

• First foreign company to

receive a license to provide

temporary staffing services

in China; largest network with

19 offices in 19 cities

Capitalizing on Emerging Markets

Manpower continues to shape labor policy in emerging economies,

resulting in new sources of revenue.

• Extensive network in Eastern Europe

with 136 offices in 12 countries

• Established operations in

the Middle East with the

2007 acquisition of one of the

leading professional staffing

and recruitment companies

in the region

• First to provide

employment services

in Vietnam

• India’s largest ITeS

staffing firm with 22

offices in 13 cities

15

Manpower Inc. (NYSE: MAN)

February 2010

Financial Highlights

• Quarter Financial Summary

• Full Year Cash Flow Summary

• Balance Sheet

• Trend Analysis: Revenue

and Operating Profit

• Operating Cash Flows

• Return on Invested Capital

• Financial Targets

• Record of Long-Term Growth

16

Manpower Inc. (NYSE: MAN)

February 2010

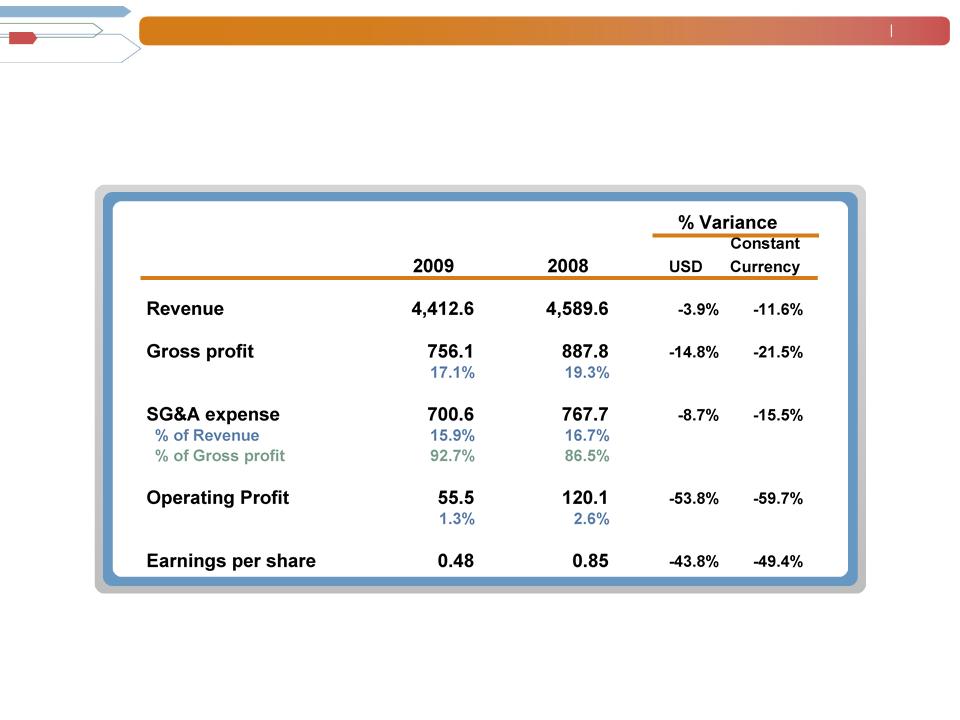

17

Financial Summary - Fourth Quarter

($ in millions, except EPS)

(1) Constant currency is further explained in our quarterly filings with the SEC.

(2) 2009 excludes reorganization charges of $12.7M.

(3) 2008 excludes the impact of the French business tax refund, French payroll tax change, and $37.2M of reorganization charges.

(1)

(2)

(3)

Manpower Inc. (NYSE: MAN)

February 2010

18

Cash Flow Summary - Full Year

Manpower Inc. (NYSE: MAN)

February 2010

19

Balance Sheet

December 31, 2009 ($ in millions)

Assets

$6,214

3,071

2,128

1,015

Cash

Accounts Receivable

Other Assets

Liabilities

& Equity

$6,214

2,537

2,920

Other Liabilities

Total Debt

Equity

757

Manpower Inc. (NYSE: MAN)

February 2010

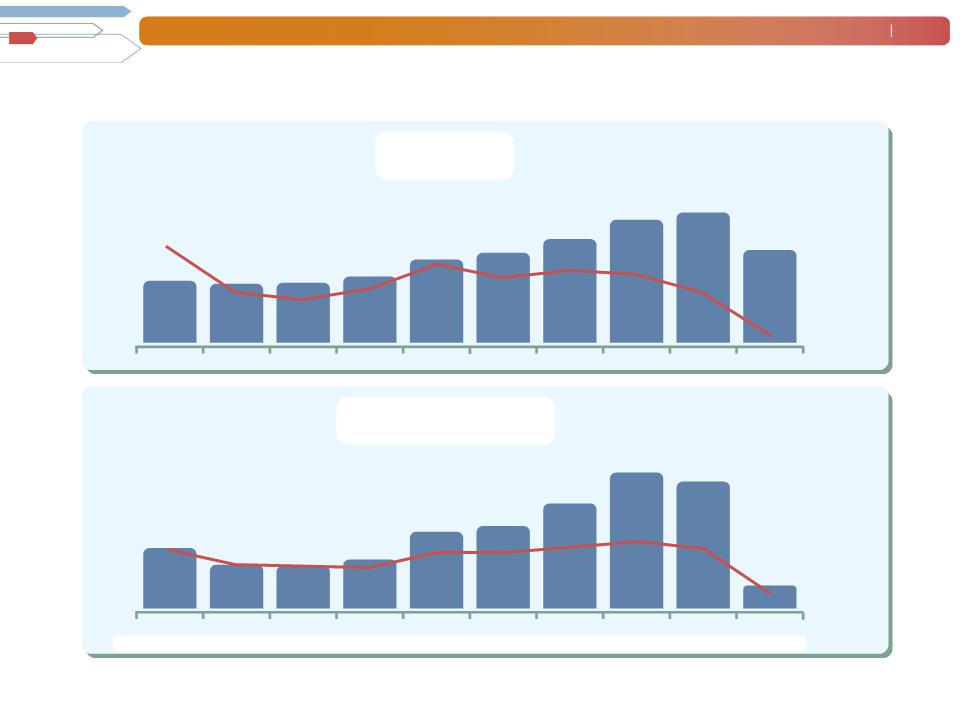

Trend Analysis

(1) Excludes non-recurring items as detailed in our earnings release and further explained on our website. As reported, operating

profit was $41.7M in 2009, $493.5M in 2008 and $811.2M in 2007 and OP% was 0.3%, 2.3% and 4.0%, respectively.

25

20

15

10

5

0

50.0%

35.0%

20.0%

5.0%

-10.0%

-25.0%

+9.0%

+10.0%

+7.9%

+2.1%

-2.6%

+0.4%

+20.8%

10.8

15.8

17.6

20.5

21.5

2000

2001

2002

2003

2004

2005

2006

2007

2008

Dollars in Billions

% = Variance in constant currency

Revenue

750

600

450

300

150

0

7.5%

7.0%

4.5%

3.0%

1.5%

0.0%

+17.6%

+21.9%

+8.4%

+43.1%

+1.5%

-7.9%

+47.5%

311.0

233.1

259.1

428.8

532.1

680.6

631.4

2000

2001

2002

2003

2004

2005

2006

2007

2008

Dollars in Millions

% = Variance in constant currency

Operating Profit

OP% 2.9% 2.3% 2.2% 2.1% 2.7% 2.7% 3.0% 3.3% 2.9% 0.8%

+0.5%

-12.9%

(1)

(1)

20

16.0

-20.9%

2009

2009

12.1

+13.1%

136.3

-78.1%

237.6

-21.6%

Y-O-Y Growth

in CC%

OP Margin

(1)

397.8

10.5

10.5

14.7

Manpower Inc. (NYSE: MAN)

February 2010

Operating Cash Flows

($ in millions)

* Free Cash Flow is equal to cash provided by operating activities

less capital expenditures, and is further explained on our website.

Free Cash Flow *

Capital Expenditures

130.3

82.6

212.9

281.0

227.9

223.4

187.4

268.8

359.1

432.2

87.3

58.5

55.5

67.9

77.6

80.0

91.6

279.1

119.5

167.9

169.4

193.7

698.9

93.1

792.0

340.6

191.2

Share Repurchases

2000

$20.0

2001

$3.3

2002

$30.7

2003

-

2004

-

2005

$217.6

2006

$235.9

2007

$419.2

2008

$125.4

21

379.2

35.1

2009

-

414.3

Manpower Inc. (NYSE: MAN)

February 2010

Return on Invested Capital* (ROIC)

* Return on Invested Capital is defined as operating profit after tax divided by the average monthly total of net

debt (total debt less cash and cash equivalents) and equity for the year, and is further explained on our website.

2009, 2008 and 2007 exclude non-recurring items as detailed in our earnings releases.

2007

2006

2005

2004

2003

11.4%

13.3%

10.9%

9.8%

15.6%

2008

13.0%

22

2009

5.7%

Manpower Inc. (NYSE: MAN)

February 2010

Financial Targets

Revenue

Growth

>

Market

Operating

Profit

Margin

>

4%

EPS

Growth

>

15%

Constant

Currency

ROIC

>

15%

SG&A

Expense

<

80% of

Gross

Profit

23

Manpower Inc. (NYSE: MAN)

February 2010

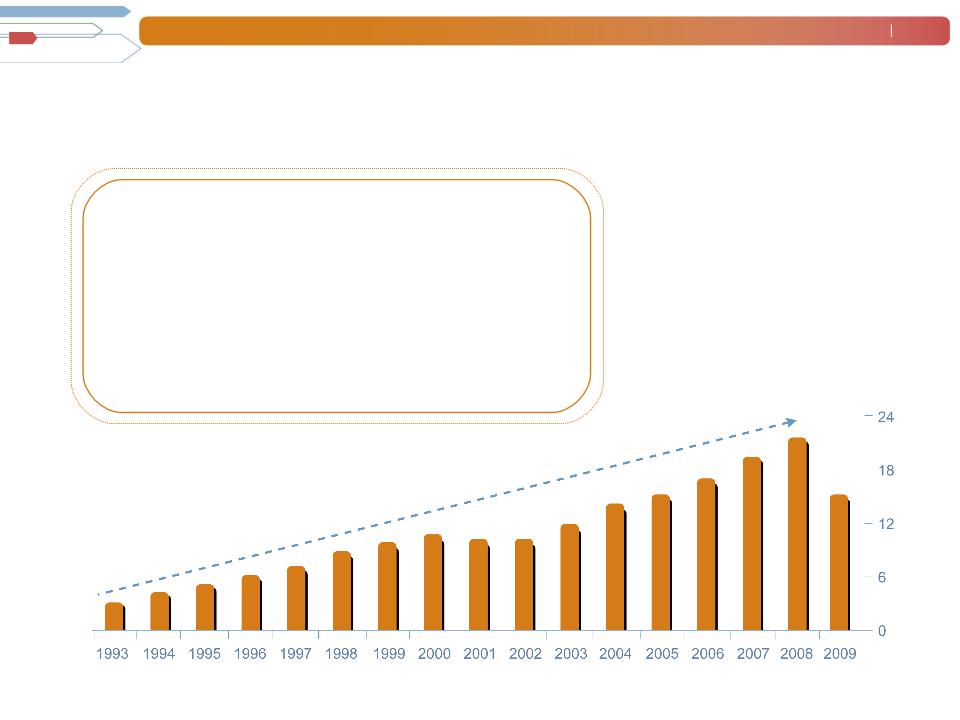

Strong Record of Long-Term Growth

• Balanced service portfolio

• Geographic diversification

• Well positioned for emerging market growth

• Clear, effective strategy

• Seasoned management team

• Industry leader with superior brand recognition

24

Additional Information

This presentation is being filed by Manpower Inc. pursuant to Rule 425 under the Securities Act of 1933. This presentation does not constitute an offer of any securities for sale. The exchange offer described above has not commenced. Manpower intends to commence an exchange offer and file a Schedule TO and a registration statement on Form S-4, and COMSYS intends to file a Solicitation/Recommendation Statement on Schedule 14D-9, with the Securities and Exchange Commission in connection with the transaction. Manpower and COMSYS expect to mail a Preliminary Prospectus, the Schedule 14D-9 and related exchange offer materials to stockholders of COMSYS. These documents, however, are not currently available. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY ARE AVAILABLE BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT MANPOWER, COMSYS AND THE TRANSACTION. Documents filed by Manpower with the SEC may be obtained without charge at the SEC’s website at www.sec.gov and at Manpower’s website at www.manpower.com. Documents filed by COMSYS with the SEC may be obtained without charge at the SEC's website and at COMSYS’ website at www.comsys.com.

Forward-Looking Statements

This presentation contains statements, including statements regarding timing, completion and results of the proposed transaction, that are forward-looking in nature and, accordingly, are subject to risks and uncertainties. Actual results may differ materially from those described or contemplated in the forward-looking statements. Factors that may cause actual results to differ materially from those contained in the forward-looking statements include, among others, the risk that the exchange offer and the merger will not close; the risk that Manpower’s business and/or COMSYS’ business will be adversely impacted during the pendency of the exchange offer and the merger; the risk that the operations of the two companies will not be integrated successfully; the risk that Manpower’s expected cost savings and other synergies from the transaction may not be fully realized, realized at all or take longer to realize than anticipated; the risk that demand for and acceptance of Manpower’s or COMSYS’ products or services may be reduced; the impact of economic conditions; the impact of competition and pricing; and other factors found in the Manpower’s and COMSYS’ reports filed with the SEC, including the information under the heading ‘Risk Factors’ in Manpower’s Annual Report on Form 10-K for the year ended December 31, 2009 and COMSYS’ Annual Report on Form 10-K for the fiscal year ended December 28, 2008, which information is incorporated herein by reference.