ManpowerGroup 2011 3rd Quarter Results October 2011

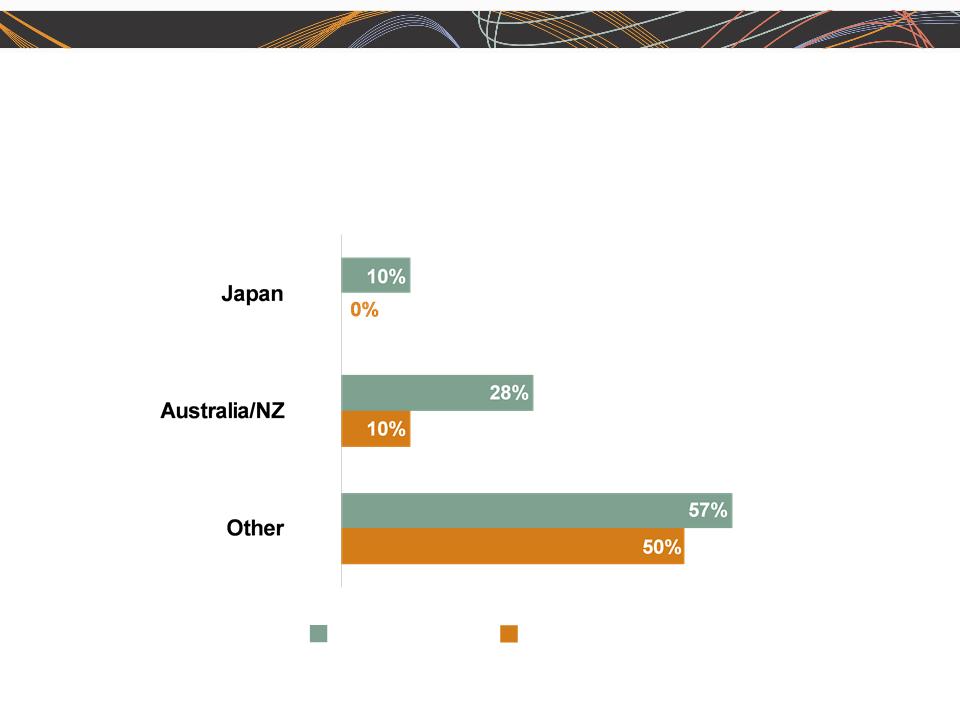

Credit Facilities

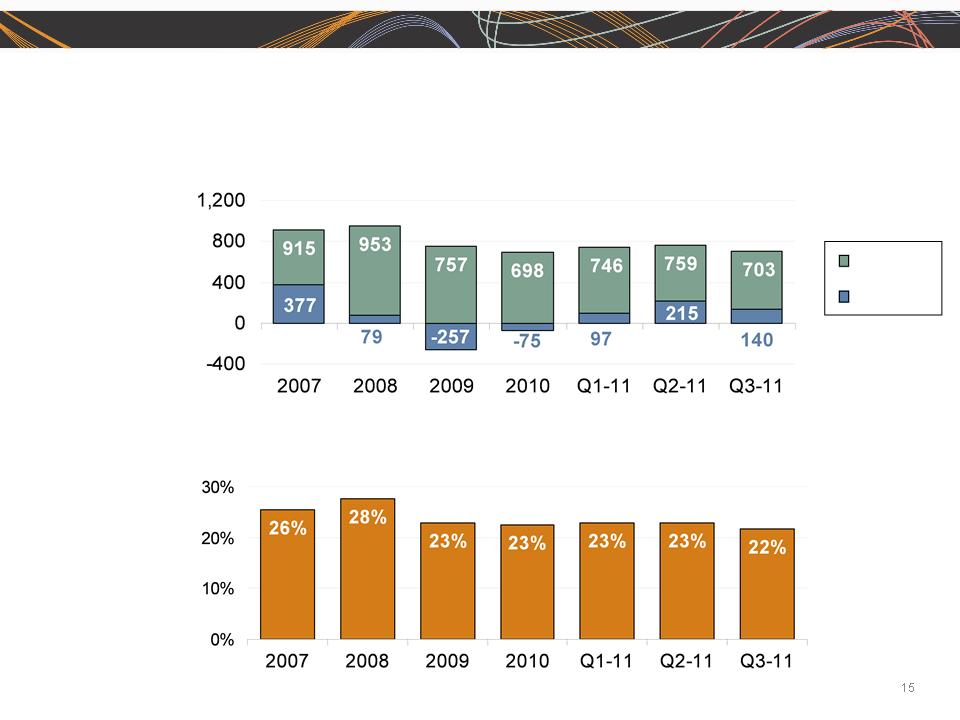

($ in millions)

| Interest Rate | Maturity Date | Total Outstanding

at 9/30/11 | | Remaining Available at 9/30/11 | | Remaining Available Adjusted

for New

Agreement |

Euro Notes: | | | | | | | |

- Euro 200M | 4.86% | Jun 2013 | 267 | | - | | - |

- Euro 300M | 4.58% | Jun 2012 | 401 | | - | | - |

Revolving Credit Agreement | 2.79% | Nov 2012 | - | | 398 | | n/a |

Revolving Credit Agreement -

New | 1.51% | Oct 2016 | n/a | | n/a | | 800 |

Uncommitted lines and Other | Various | Various | 35 | | 354 | | 354 |

Total Debt | | | 703 | | 752 | 1,154 |

(3)

(1)

This $400M agreement required, as of September 30, that we comply with a Debt-to-EBITDA ratio of less than 3.25 to 1 and a fixed charge coverage

ratio of greater than 1.50 to 1. As defined in the agreement, we had a Debt-to-EBITDA ratio of 1.17 and a fixed charge coverage ratio of 2.96 as of

September 30, 2011. As of September 30, there were $2.2M of standby letters of credit issued under the agreement. This agreement was terminated on

October 5, 2011 in connection with our entry into our new $800M agreement.

Represents subsidiary uncommitted lines of credit & overdraft facilities, which total $386.9M. Total subsidiary borrowing are limited to $300M due to

restrictions in our Revolving Credit Facility, with the exception of Q3 when subsidiary borrowings are limited to $600M.

(1)

(2)

(3)

(2)

We completed a new $800M five year revolving credit agreement on October 5, 2011 with a syndicate of commercial banks .This new agreement

replaces the previous $400M agreement. This agreement, which expires in October 2016, allows for borrowings in various currencies and up to $150M

may be used for the issuance of stand-by letters of credit. Under this agreement, a debt ratings-based pricing grid determines the credit spread that we

add to the applicable interbank borrowing rate on all borrowings as well as the facility and issuance fees. At our current credit ratings, our facility fee is

0.225% and our credit spread for borrowings is 1.275%. This agreement requires that we comply with a Leverage Ratio (Debt-to-EBITDA) of not greater

than 3.5 to 1 and a Fixed Charge Coverage Ratio of not less than 1.5 to 1, in addition to other customary restrictive covenants.

16