Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Related financial report

MAN similar filings

- 21 Jul 14 ManpowerGroup Reports 2nd Quarter and First Half 2014 Results

- 2 May 14 Departure of Directors or Certain Officers

- 30 Apr 14 Departure of Directors or Certain Officers

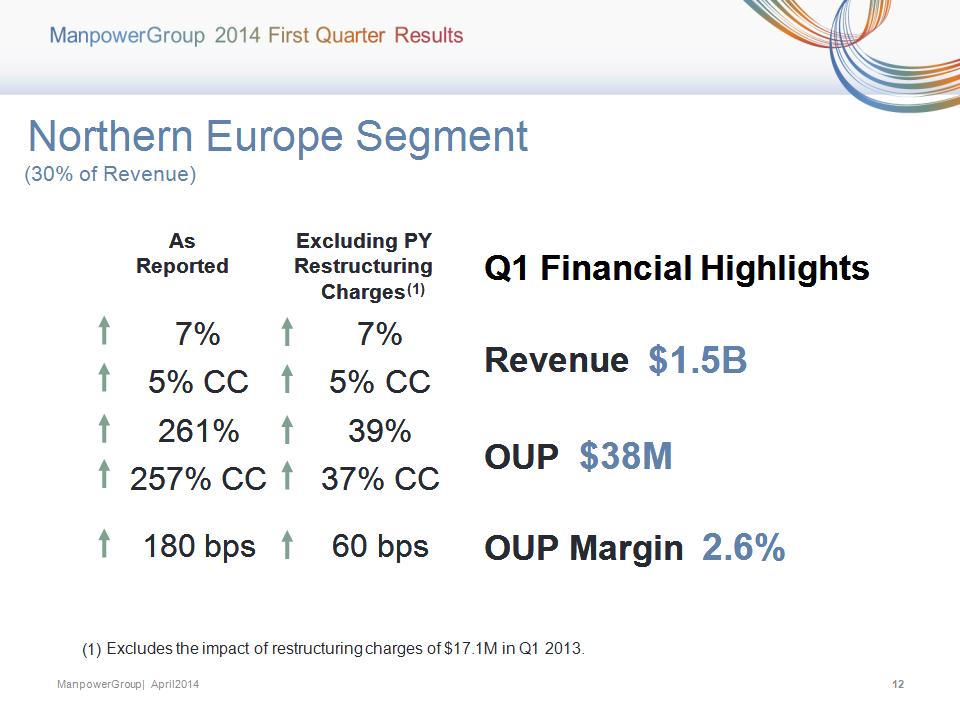

- 23 Apr 14 ManpowerGroup Reports 1st Quarter 2014 Results

- 13 Feb 14 Departure of Directors or Certain Officers

- 11 Feb 14 Departure of Directors or Certain Officers

- 30 Jan 14 Results of Operations and Financial Condition

Filing view

External links