ManpowerGroup Fourth Quarter Results | February 2, 2018 Exhibit 99.2

ManpowerGroup February 2018 2 FORWARD-LOOKING STATEMENT This presentation contains statements, including financial projections, that are forward- looking in nature. These statements are based on managements’ current expectations or beliefs, and are subject to known and unknown risks and uncertainties regarding expected future results. Actual results might differ materially from those projected in the forward-looking statements. Additional information concerning factors that could cause actual results to materially differ from those in the forward-looking statements is contained in the ManpowerGroup Inc. Annual Report on Form 10-K dated December 31, 2016, which information is incorporated herein by reference, and such other factors as may be described from time to time in the Company’s SEC filings. Any forward-looking statements in this presentation speak only as of the date hereof. The Company assumes no obligation to update or revise any forward-looking statements.

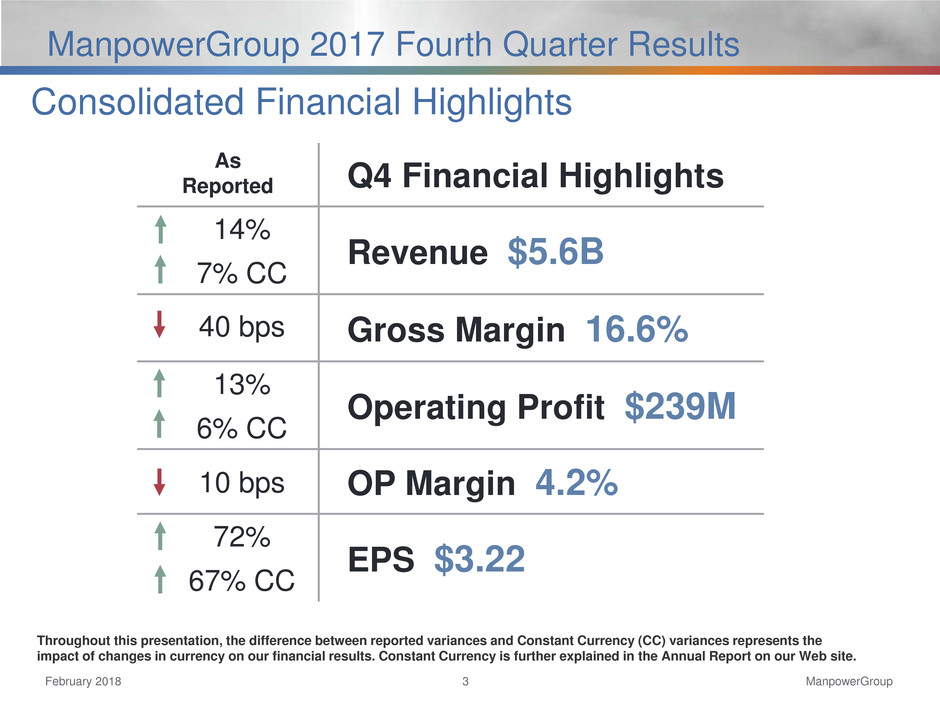

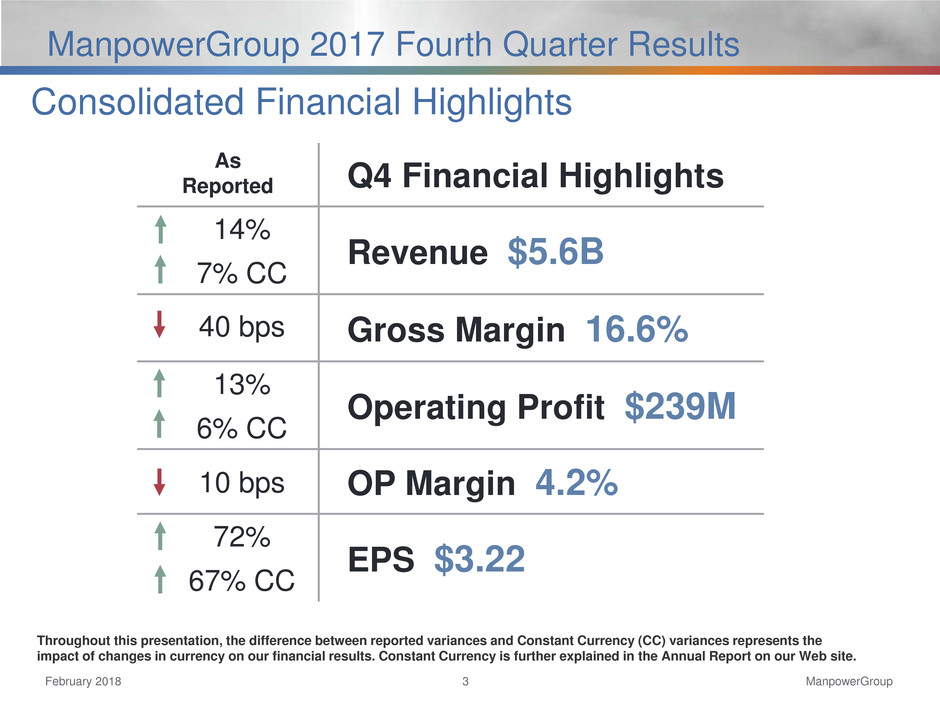

ManpowerGroup February 2018 3 ManpowerGroup 2017 Fourth Quarter Results Throughout this presentation, the difference between reported variances and Constant Currency (CC) variances represents the impact of changes in currency on our financial results. Constant Currency is further explained in the Annual Report on our Web site. Consolidated Financial Highlights As Reported Q4 Financial Highlights 14% Revenue $5.6B 7% CC 40 bps Gross Margin 16.6% 13% Operating Profit $239M 6% CC 10 bps OP Margin 4.2% 72% EPS $3.22 67% CC

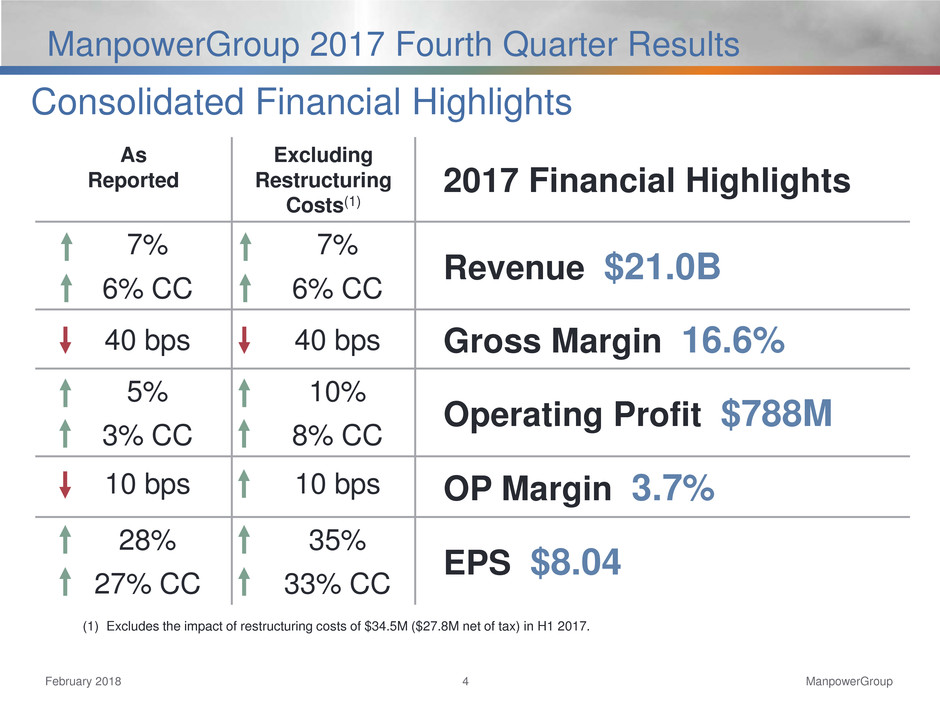

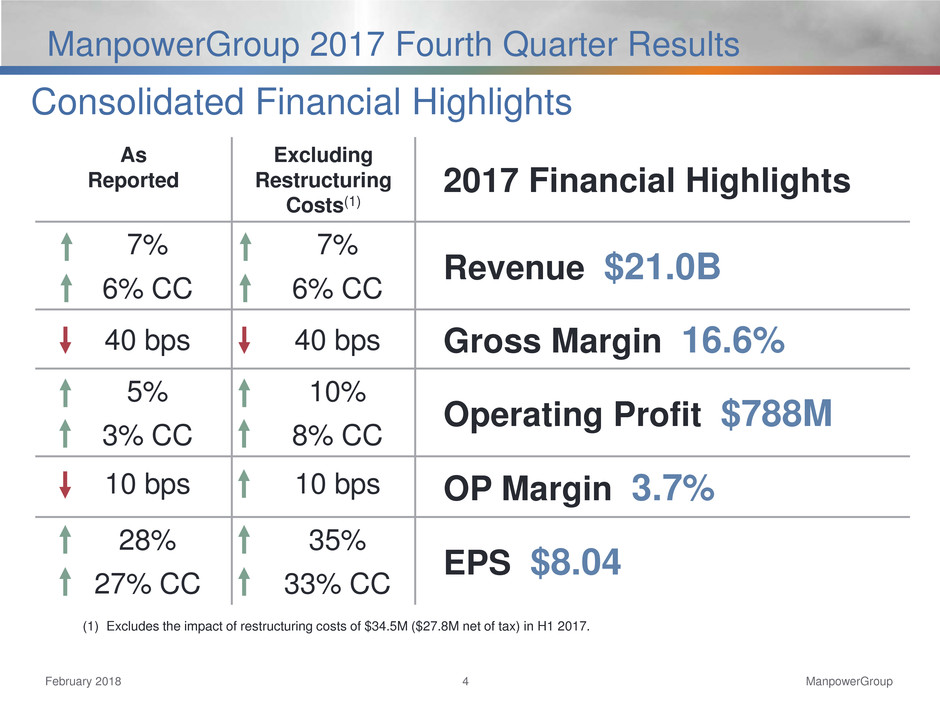

ManpowerGroup February 2018 4 ManpowerGroup 2017 Fourth Quarter Results As Reported Excluding Restructuring Costs(1) 2017 Financial Highlights 7% 7% Revenue $21.0B 6% CC 6% CC 40 bps 40 bps Gross Margin 16.6% 5% 10% Operating Profit $788M 3% CC 8% CC 10 bps 10 bps OP Margin 3.7% 28% 35% EPS $8.04 27% CC 33% CC Consolidated Financial Highlights (1) Excludes the impact of restructuring costs of $34.5M ($27.8M net of tax) in H1 2017.

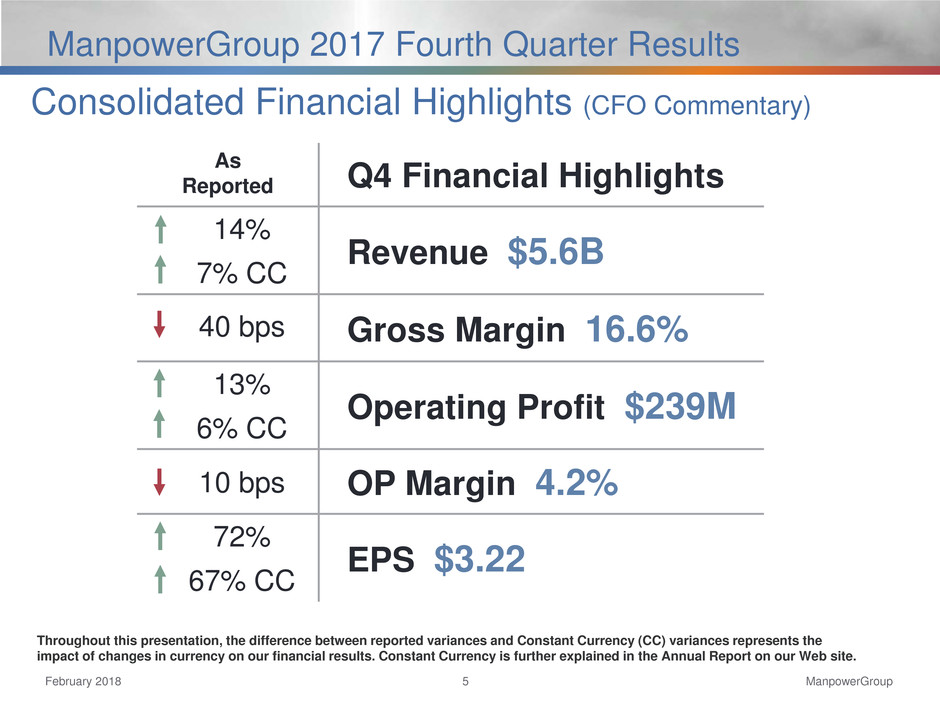

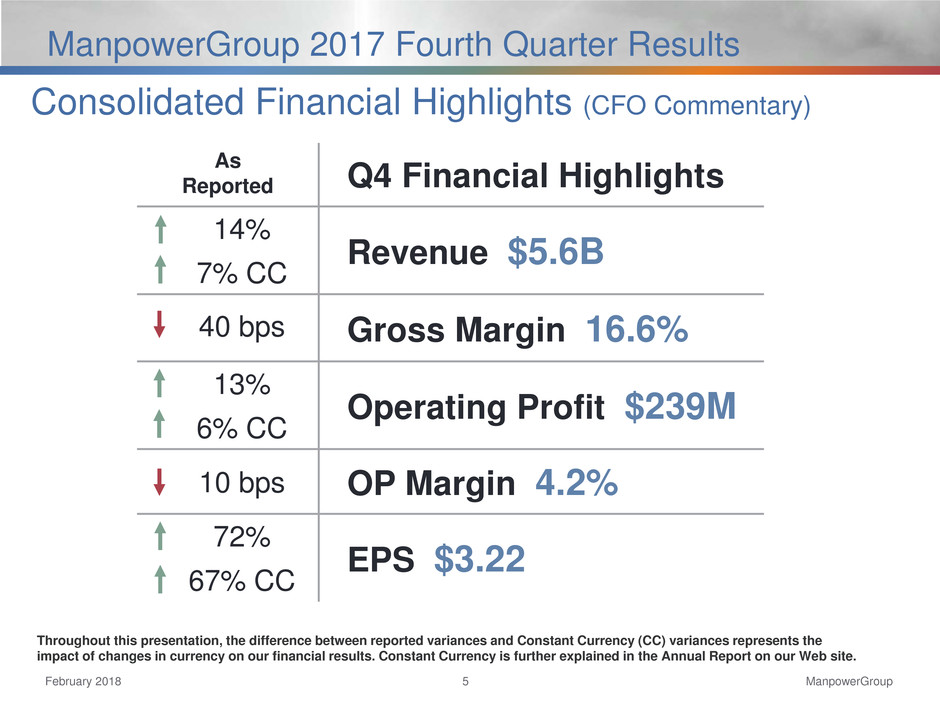

ManpowerGroup February 2018 5 ManpowerGroup 2017 Fourth Quarter Results Throughout this presentation, the difference between reported variances and Constant Currency (CC) variances represents the impact of changes in currency on our financial results. Constant Currency is further explained in the Annual Report on our Web site. Consolidated Financial Highlights (CFO Commentary) As Reported Q4 Financial Highlights 14% Revenue $5.6B 7% CC 40 bps Gross Margin 16.6% 13% Operating Profit $239M 6% CC 10 bps OP Margin 4.2% 72% EPS $3.22 67% CC

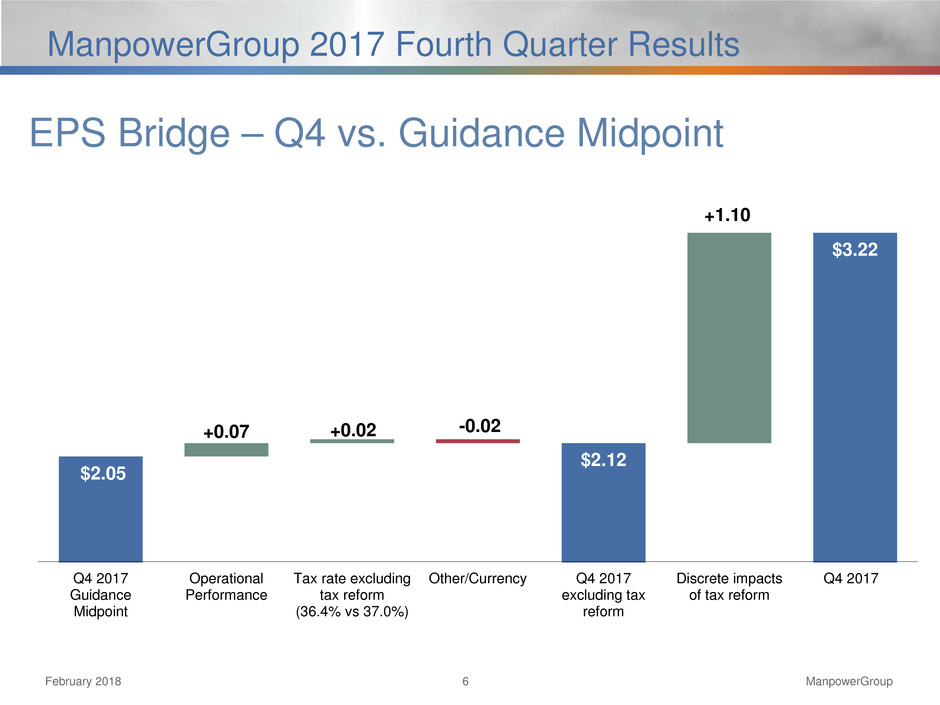

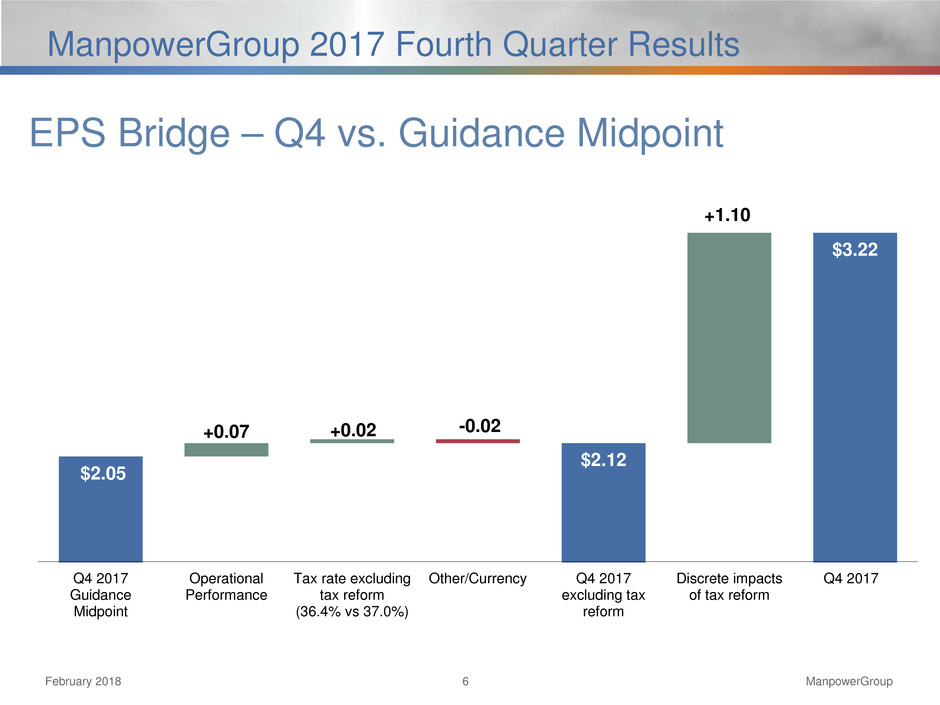

ManpowerGroup February 2018 6 ManpowerGroup 2017 Fourth Quarter Results EPS Bridge – Q4 vs. Guidance Midpoint $2.12 $2.05 $2.12 $3.22 +0.07 +0.02 -0.02 Q4 2017 Guidance Midpoint Operational Performance Tax rate excluding tax reform (36.4% vs 37.0%) Other/Currency Q4 2017 excluding tax reform Discrete impacts of tax reform Q4 2017 +1.10

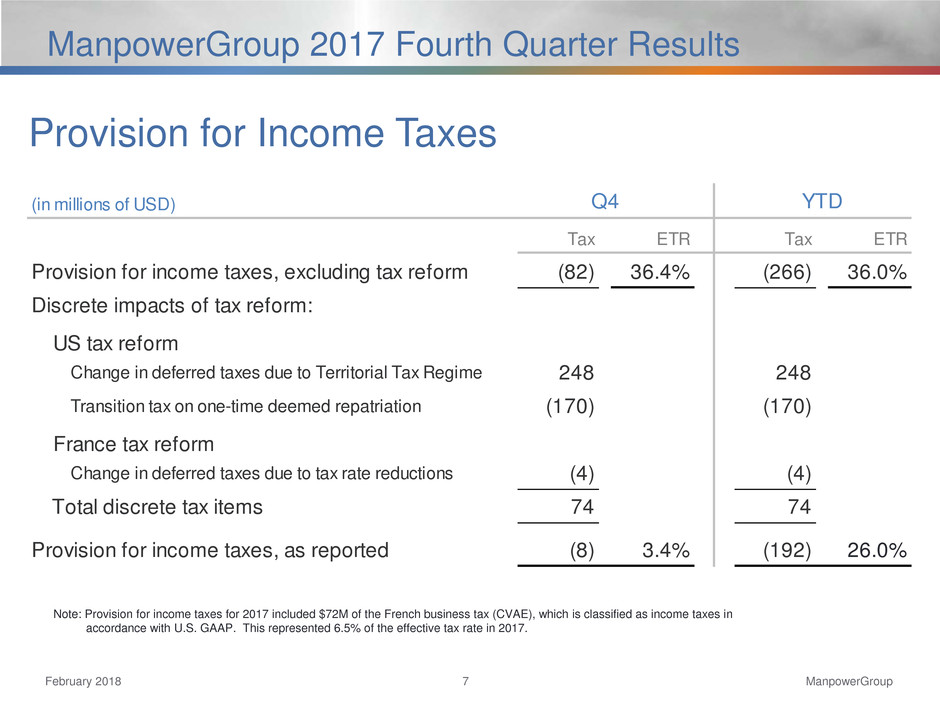

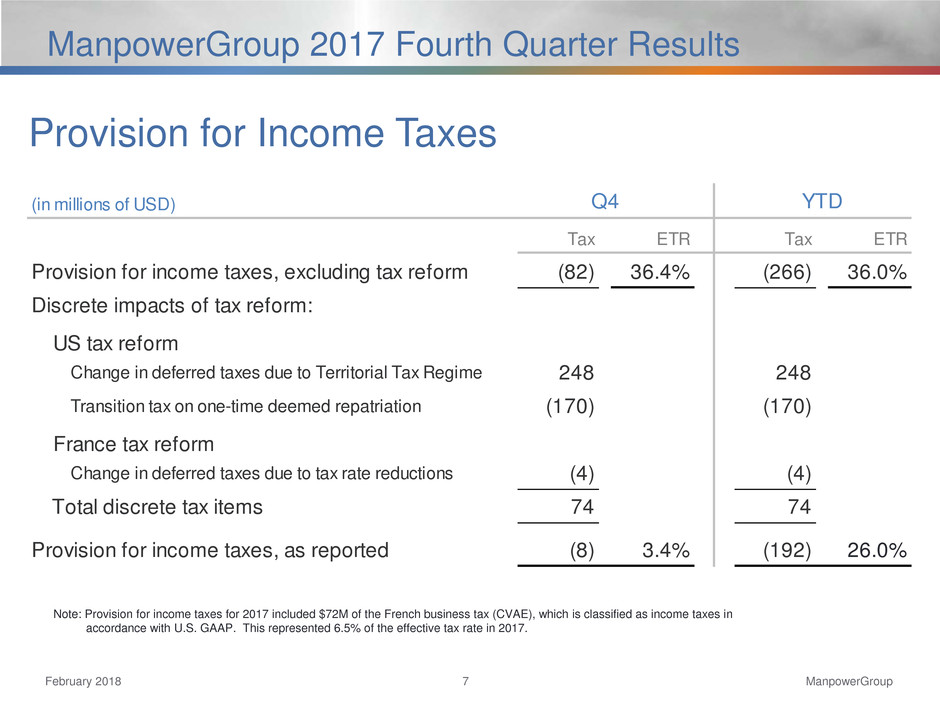

ManpowerGroup February 2018 7 ManpowerGroup 2017 Fourth Quarter Results Note: Provision for income taxes for 2017 included $72M of the French business tax (CVAE), which is classified as income taxes in accordance with U.S. GAAP. This represented 6.5% of the effective tax rate in 2017. Provision for Income Taxes (in millions of USD) Tax ETR Tax ETR Provision for income taxes, excluding tax reform (82) 36.4% (266) 36.0% Discrete impacts of tax reform: US tax reform Change in deferred taxes due to Territorial Tax Regime 248 248 Transition tax on one-time deemed repatriation (170) (170) France tax reform Change in deferred taxes due to tax rate reductions (4) (4) Total discrete tax items 74 74 Provision for income taxes, as reported (8) 3.4% (192) 26.0% Q4 YTD

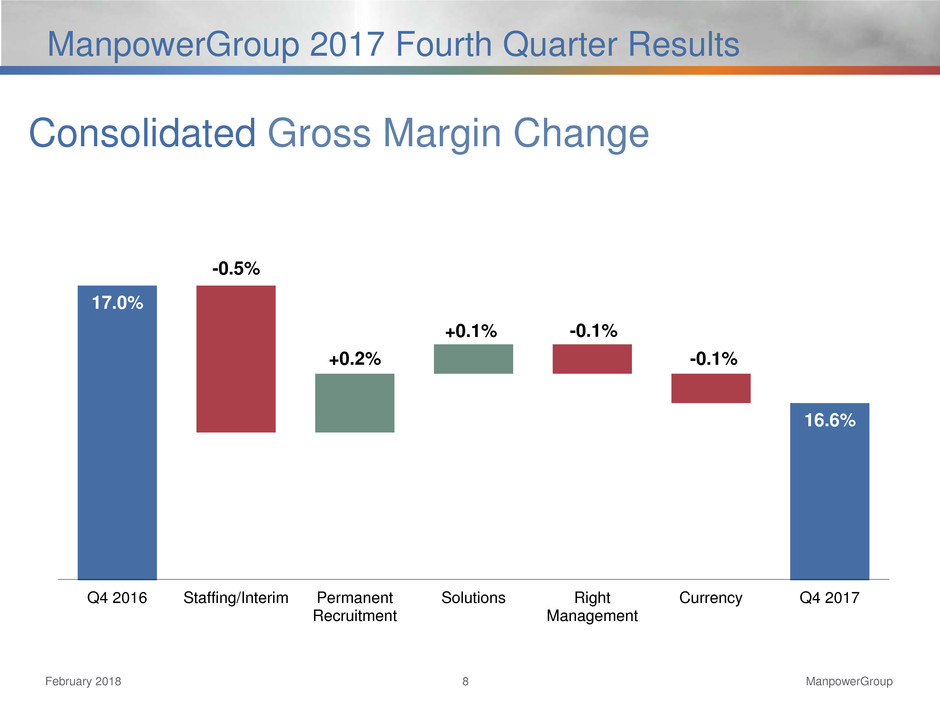

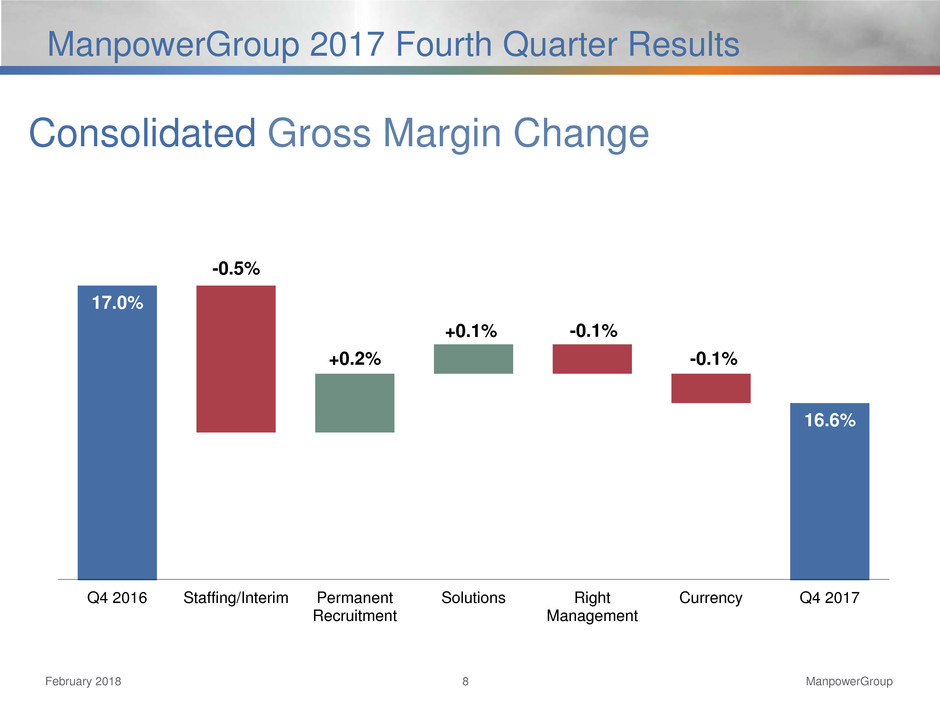

ManpowerGroup February 2018 8 ManpowerGroup 2017 Fourth Quarter Results 17.0% 16.6% Q4 2016 Staffing/Interim Permanent Recruitment Solutions Right Management Currency Q4 2017 -0.5% -0.1% +0.1% -0.1% +0.2% Consolidated Gross Margin Change

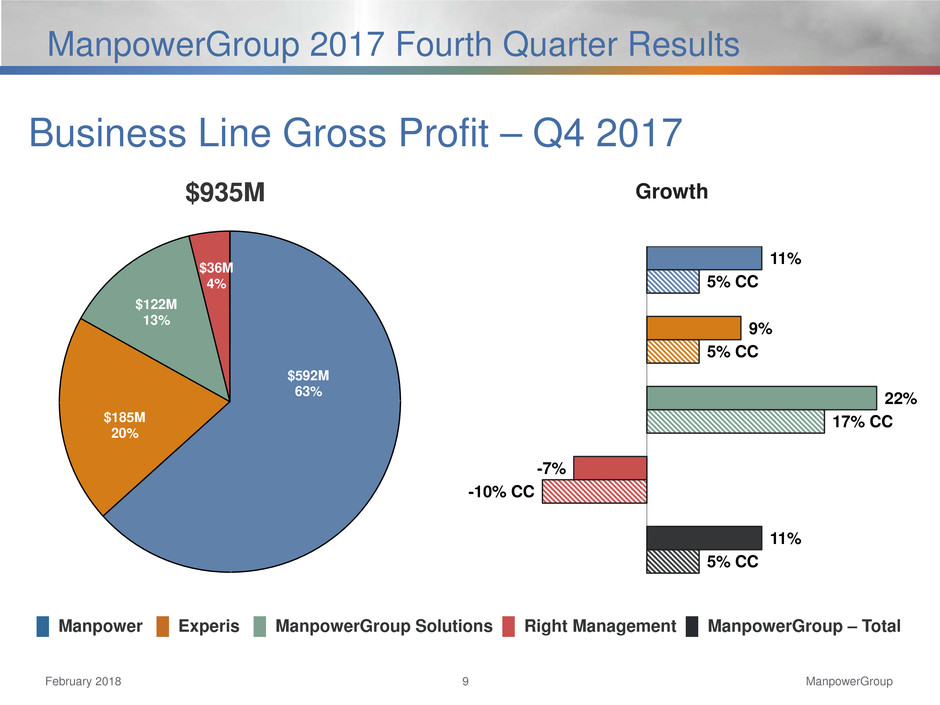

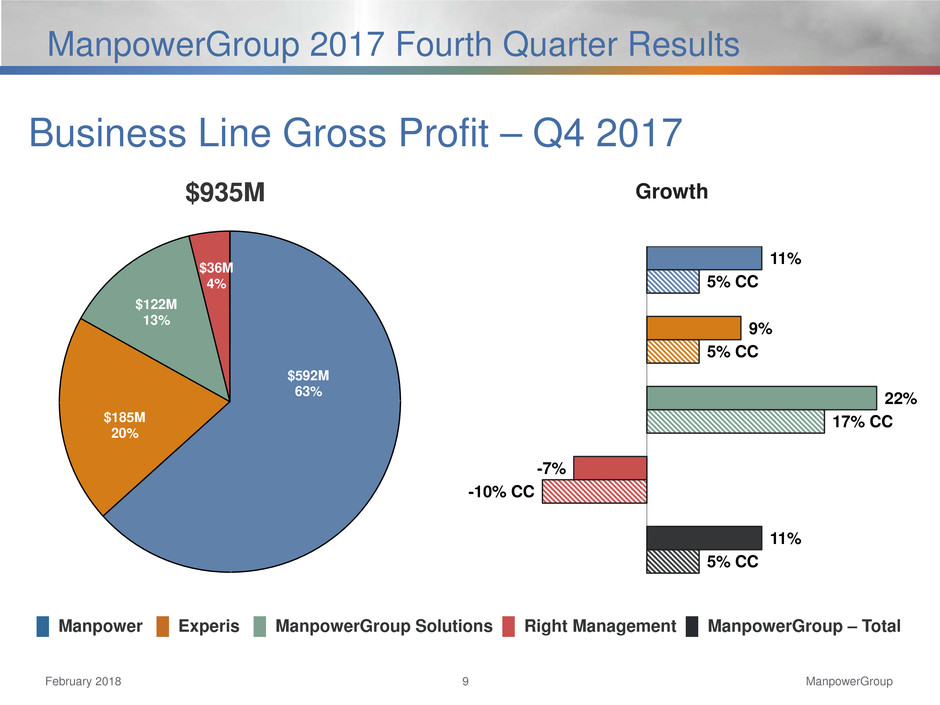

ManpowerGroup February 2018 9 ManpowerGroup 2017 Fourth Quarter Results Growth █ Manpower █ Experis █ ManpowerGroup Solutions █ Right Management █ ManpowerGroup – Total Business Line Gross Profit – Q4 2017 $592M 63% $185M 20% $122M 13% $36M 4% $935M 11% 5% CC 9% 5% CC 22% 17% CC -7% -10% CC 11% 5% CC

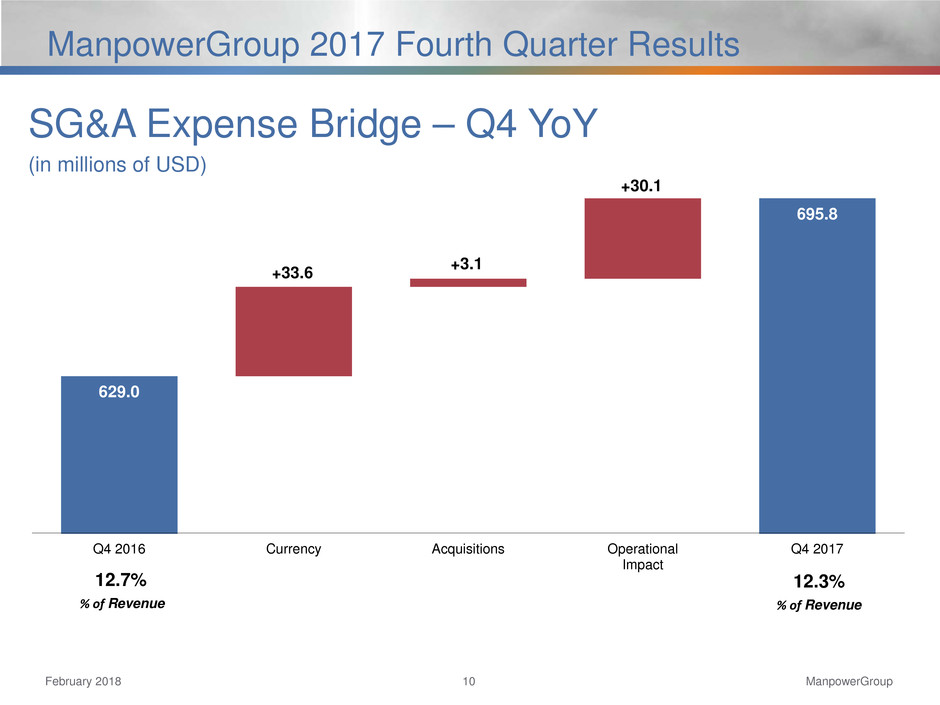

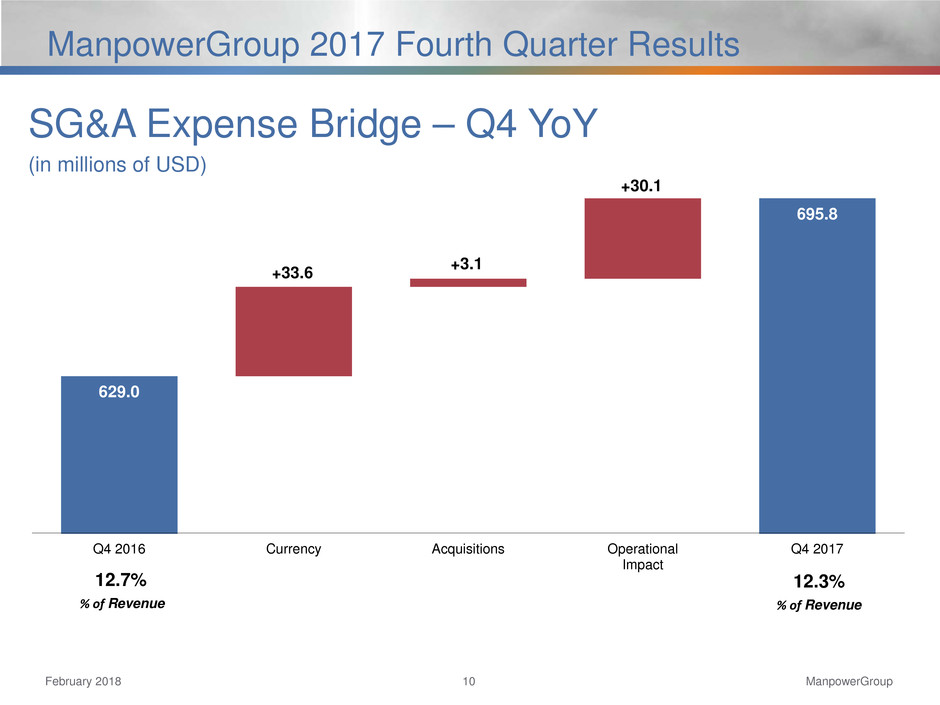

ManpowerGroup February 2018 10 ManpowerGroup 2017 Fourth Quarter Results 629.0 695.8 Q4 2016 Currency Acquisitions Operational Impact Q4 2017 +33.6 +30.1 12.7% % of Revenue % of Revenue 12.3% +3.1 SG&A Expense Bridge – Q4 YoY (in millions of USD)

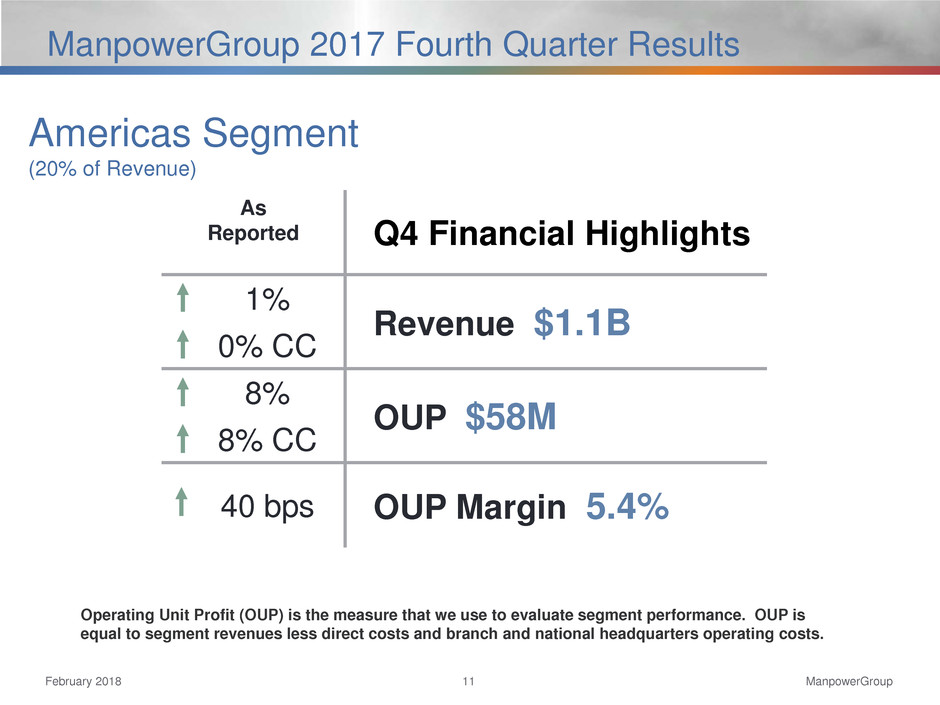

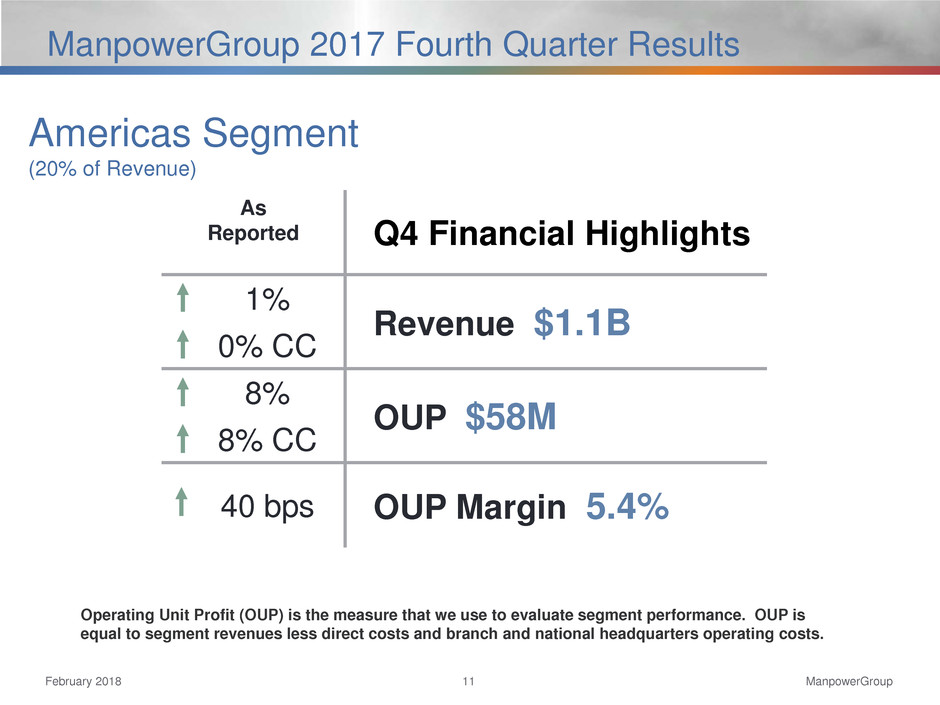

ManpowerGroup February 2018 11 ManpowerGroup 2017 Fourth Quarter Results Operating Unit Profit (OUP) is the measure that we use to evaluate segment performance. OUP is equal to segment revenues less direct costs and branch and national headquarters operating costs. Americas Segment (20% of Revenue) As Reported Q4 Financial Highlights 1% Revenue $1.1B 0% CC 8% OUP $58M 8% CC 40 bps OUP Margin 5.4%

ManpowerGroup February 2018 12 ManpowerGroup 2017 Fourth Quarter Results Revenue Growth - CC Revenue Growth % of Segment Revenue Americas – Q4 Revenue Growth YoY Average Daily Revenue Growth - CC -3% 15% -2% 5% -3% 10% 12% 3% US Mexico Argentina Other 63% 13% 5% 19% -3% 12% 12%

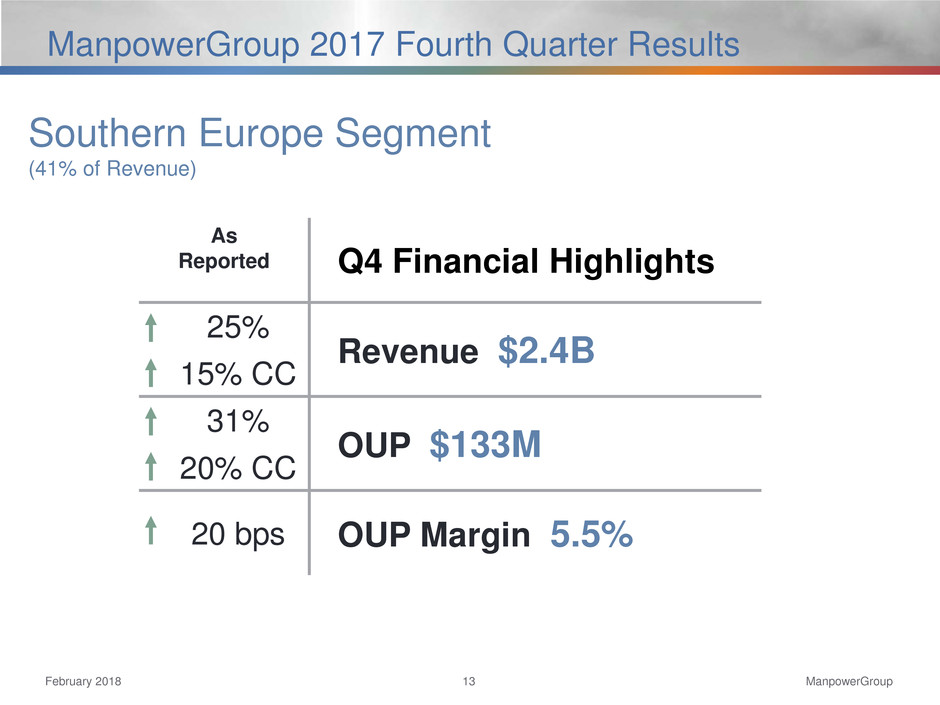

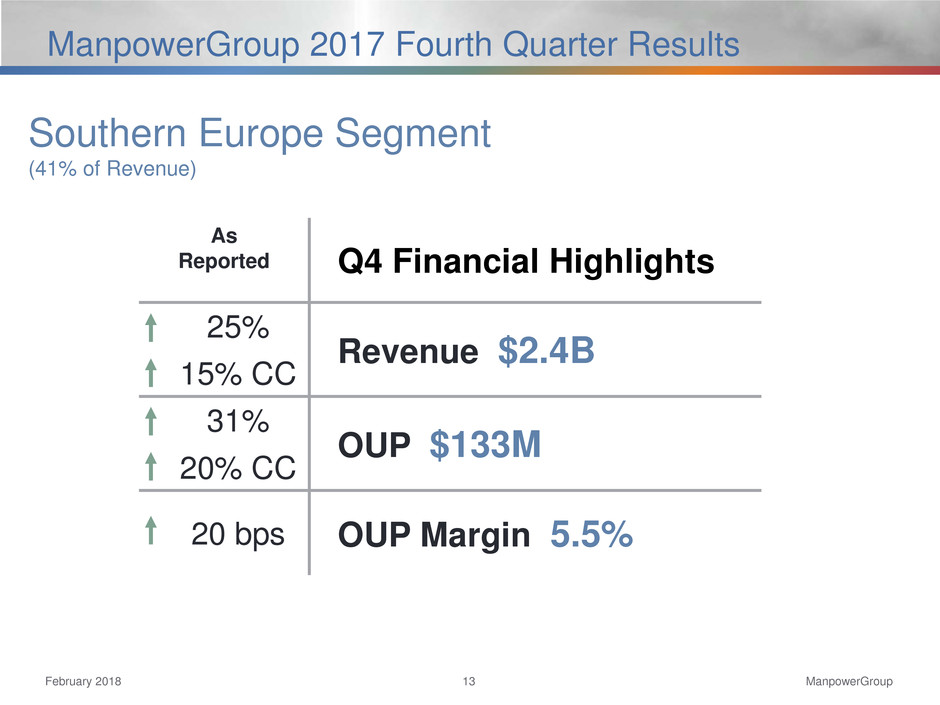

ManpowerGroup February 2018 13 ManpowerGroup 2017 Fourth Quarter Results As Reported Q4 Financial Highlights 25% Revenue $2.4B 15% CC 31% OUP $133M 20% CC 20 bps OUP Margin 5.5% Southern Europe Segment (41% of Revenue)

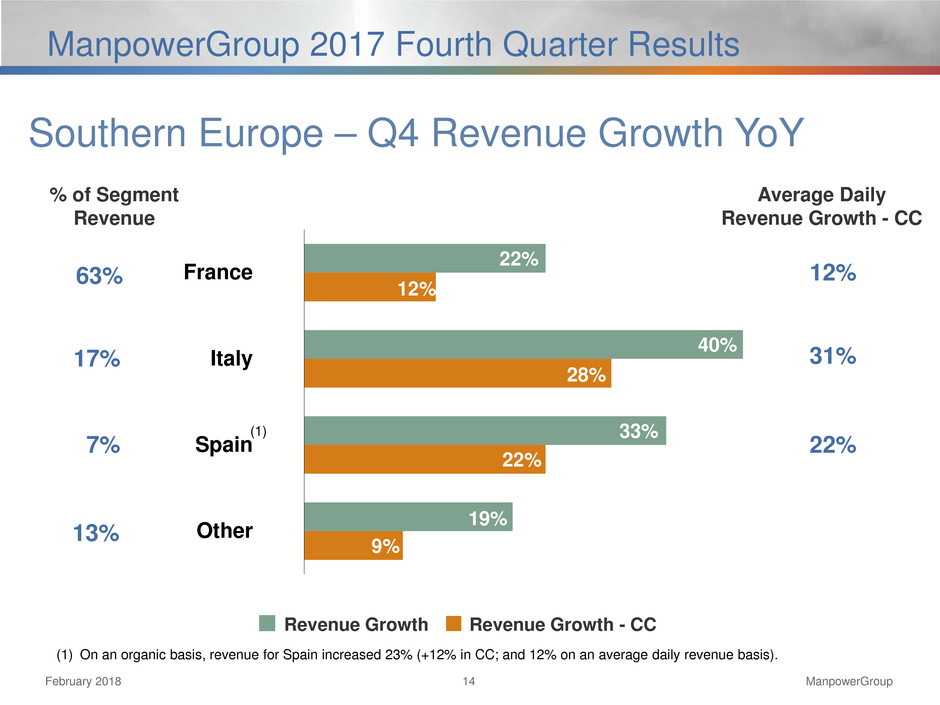

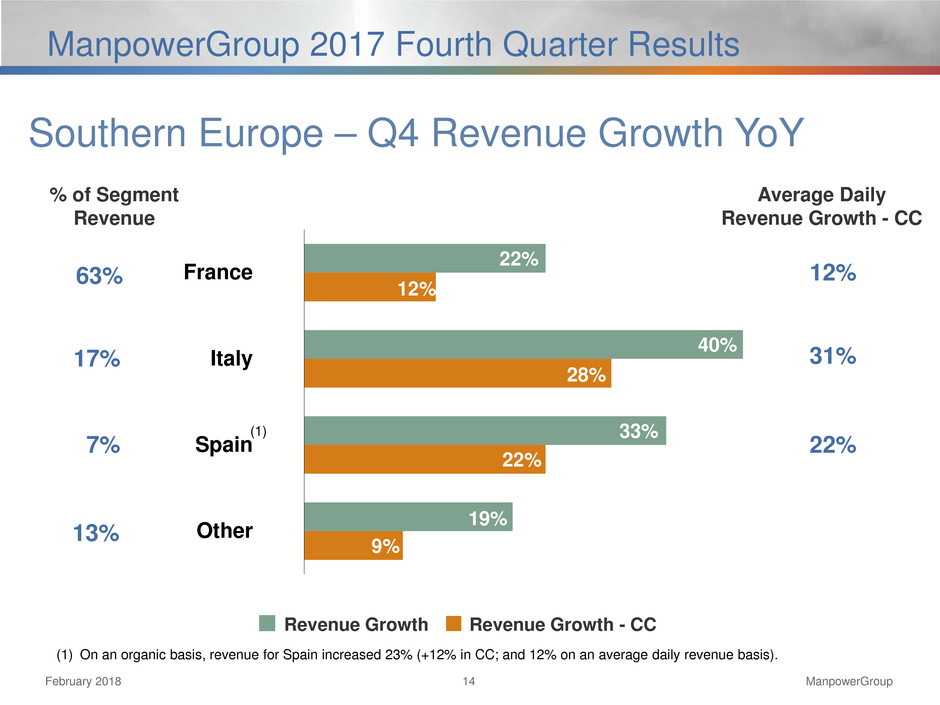

ManpowerGroup February 2018 14 ManpowerGroup 2017 Fourth Quarter Results (1) Southern Europe – Q4 Revenue Growth YoY Revenue Growth - CC Revenue Growth % of Segment Revenue (1) On an organic basis, revenue for Spain increased 23% (+12% in CC; and 12% on an average daily revenue basis). Average Daily Revenue Growth - CC 22% 40% 33% 19% 12% 28% 22% 9% France Italy Spain Other 63% 17% 7% 13% 12% 31% 22%

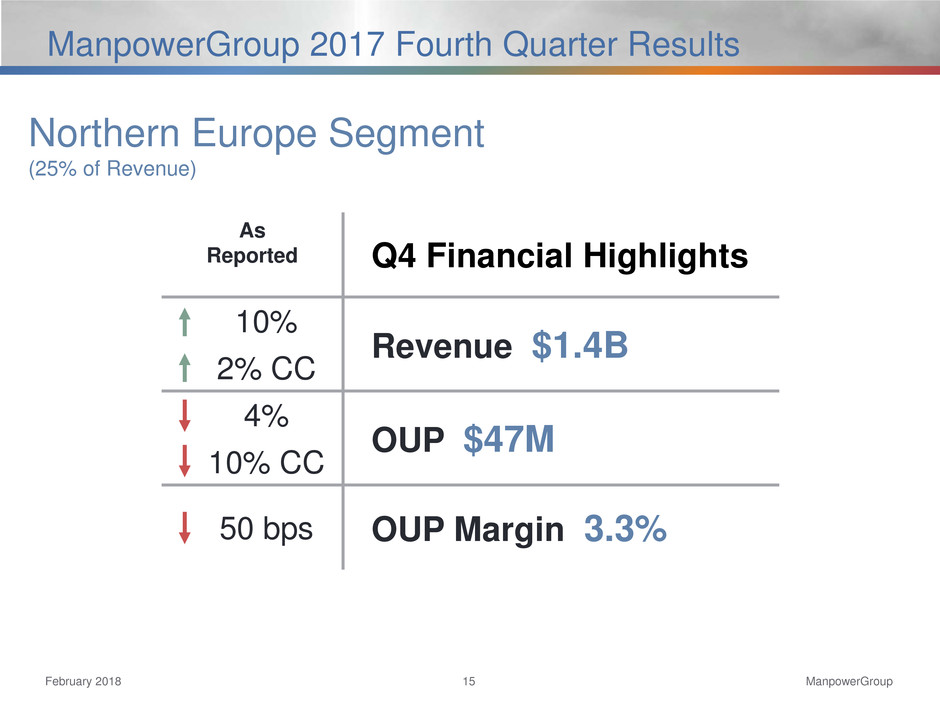

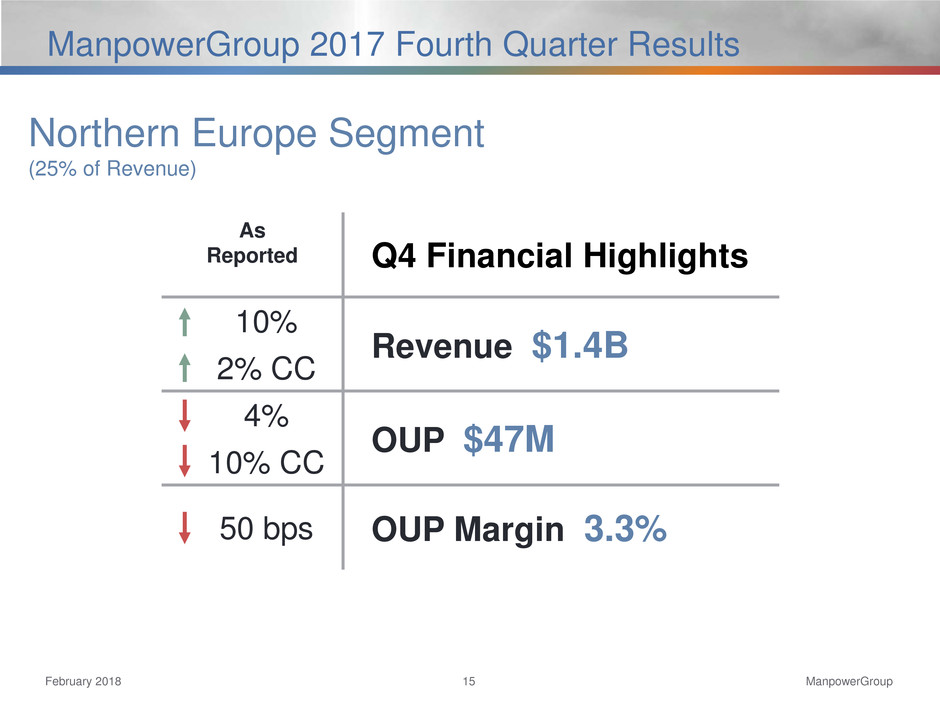

ManpowerGroup February 2018 15 ManpowerGroup 2017 Fourth Quarter Results Northern Europe Segment (25% of Revenue) As Reported Q4 Financial Highlights 10% Revenue $1.4B 2% CC 4% OUP $47M 10% CC 50 bps OUP Margin 3.3%

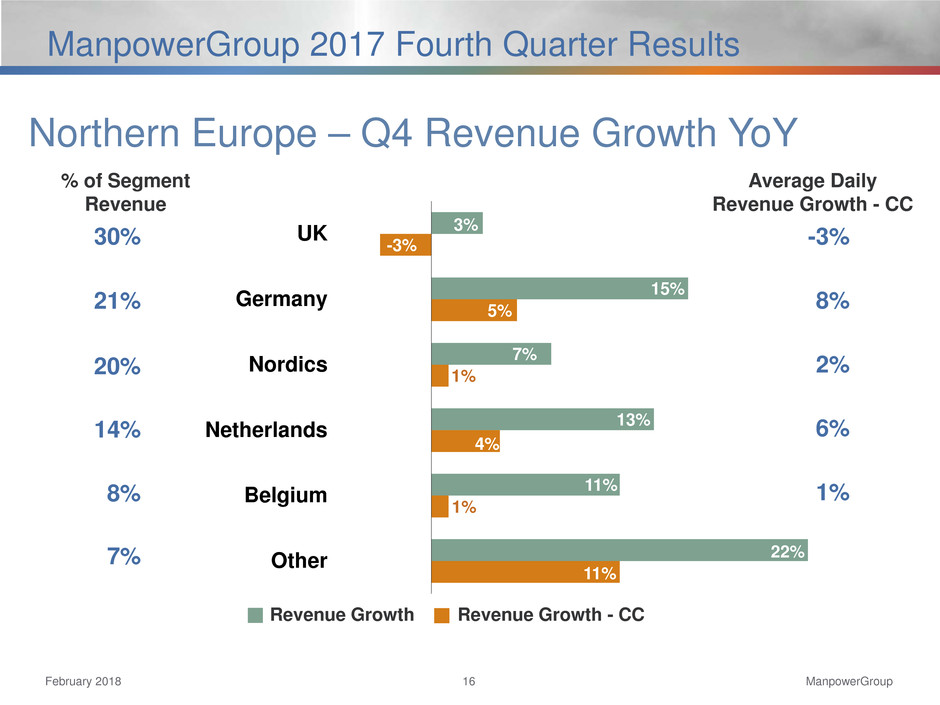

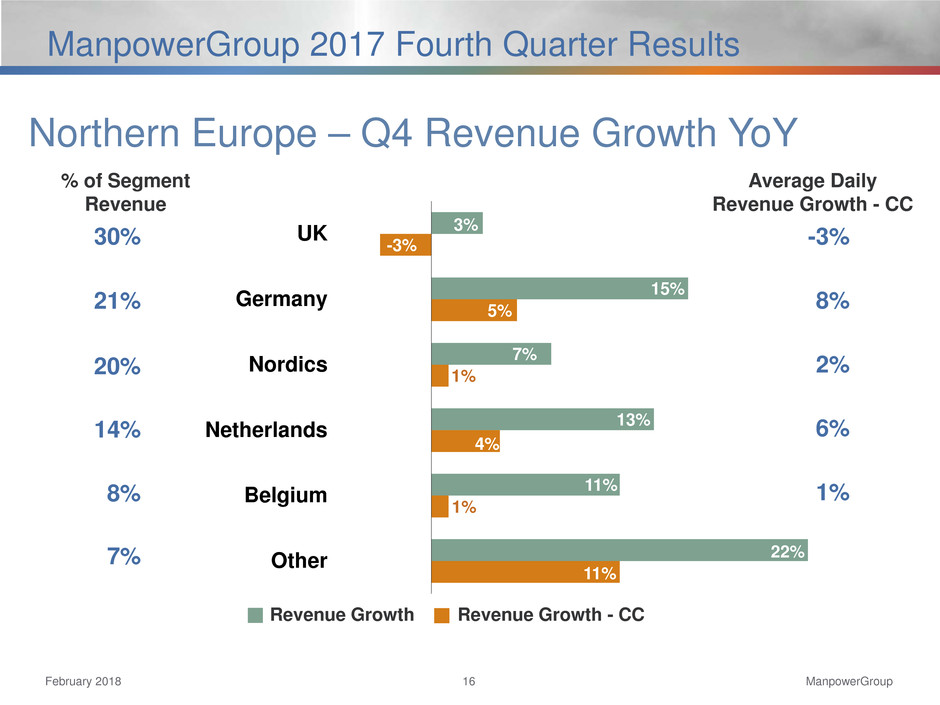

ManpowerGroup February 2018 16 ManpowerGroup 2017 Fourth Quarter Results 3% 15% 7% 13% 11% 22% -3% 5% 1% 4% 1% 11% UK Germany Nordics Netherlands Belgium Other 30% 21% 20% 14% 8% 7% -3% 8% 2% 6% 1% Northern Europe – Q4 Revenue Growth YoY Revenue Growth - CC Revenue Growth % of Segment Revenue Average Daily Revenue Growth - CC

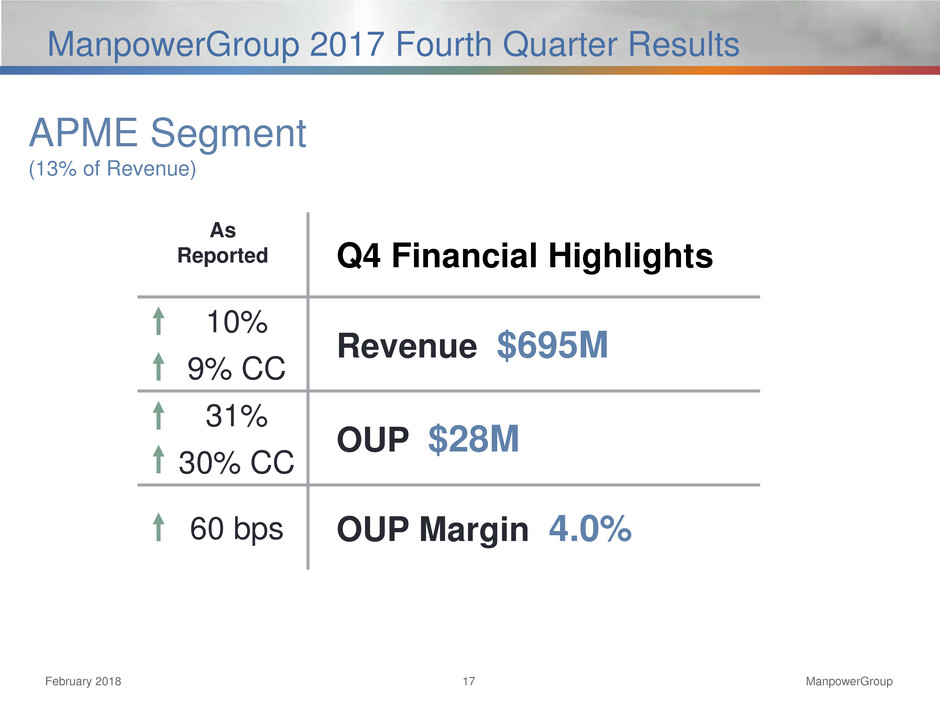

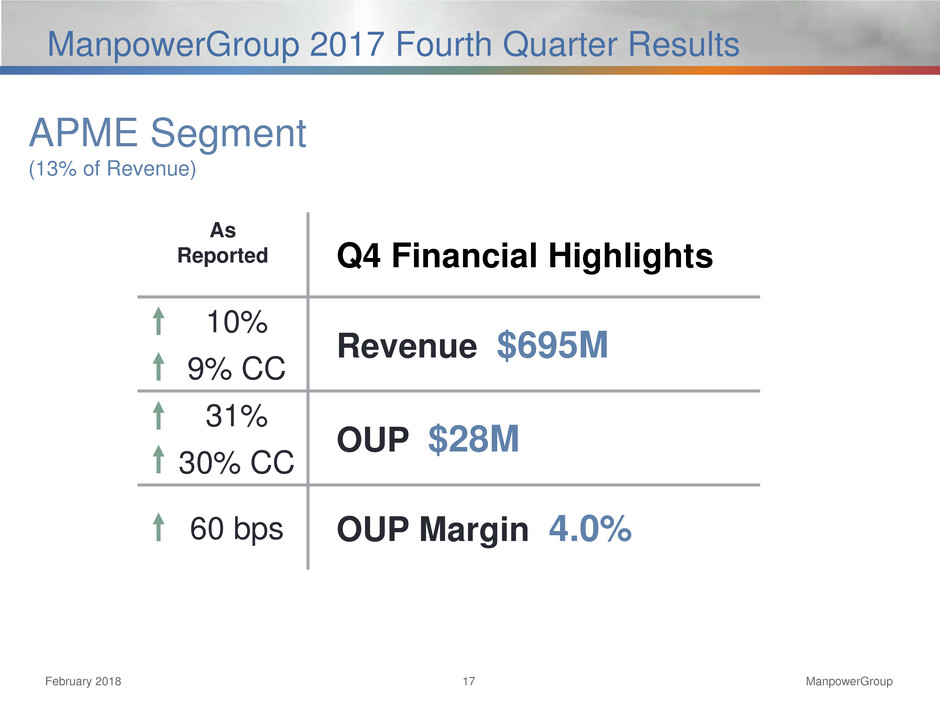

ManpowerGroup February 2018 17 ManpowerGroup 2017 Fourth Quarter Results As Reported Q4 Financial Highlights 10% Revenue $695M 9% CC 31% OUP $28M 30% CC 60 bps OUP Margin 4.0% APME Segment (13% of Revenue)

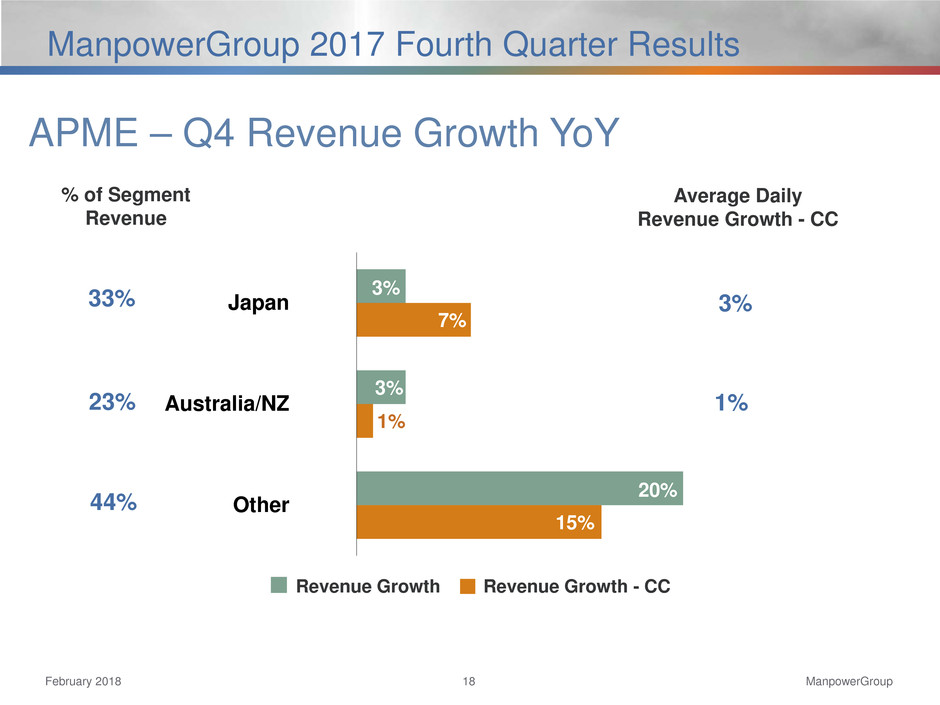

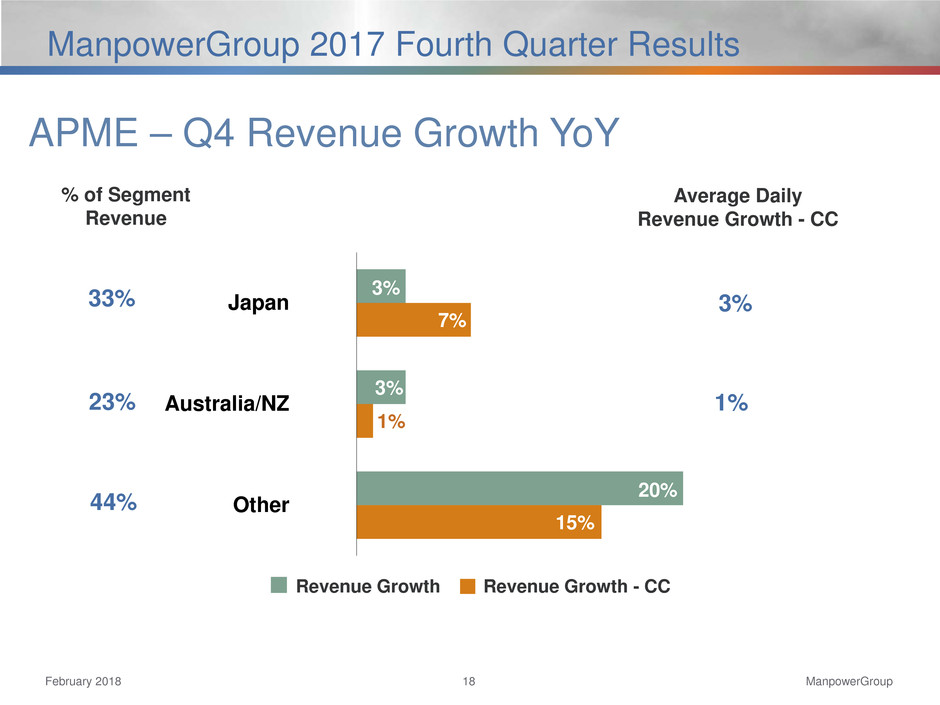

ManpowerGroup February 2018 18 ManpowerGroup 2017 Fourth Quarter Results APME – Q4 Revenue Growth YoY Revenue Growth - CC Revenue Growth % of Segment Revenue Average Daily Revenue Growth - CC 3% 3% 20% 7% 1% 15% Japan Australia/NZ Other 33% 23% 44% 3% 1%

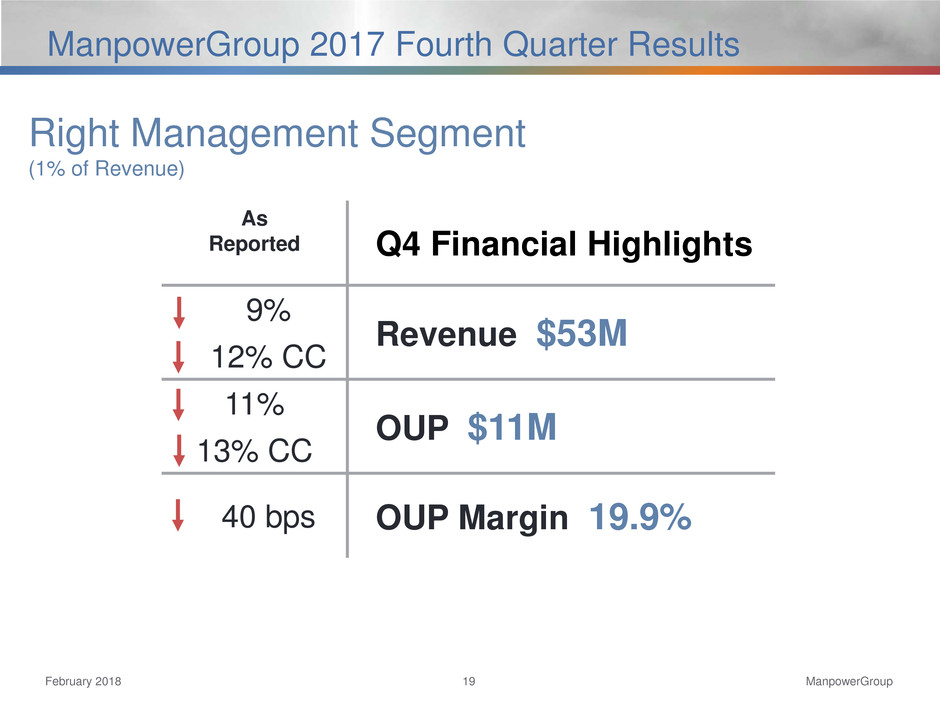

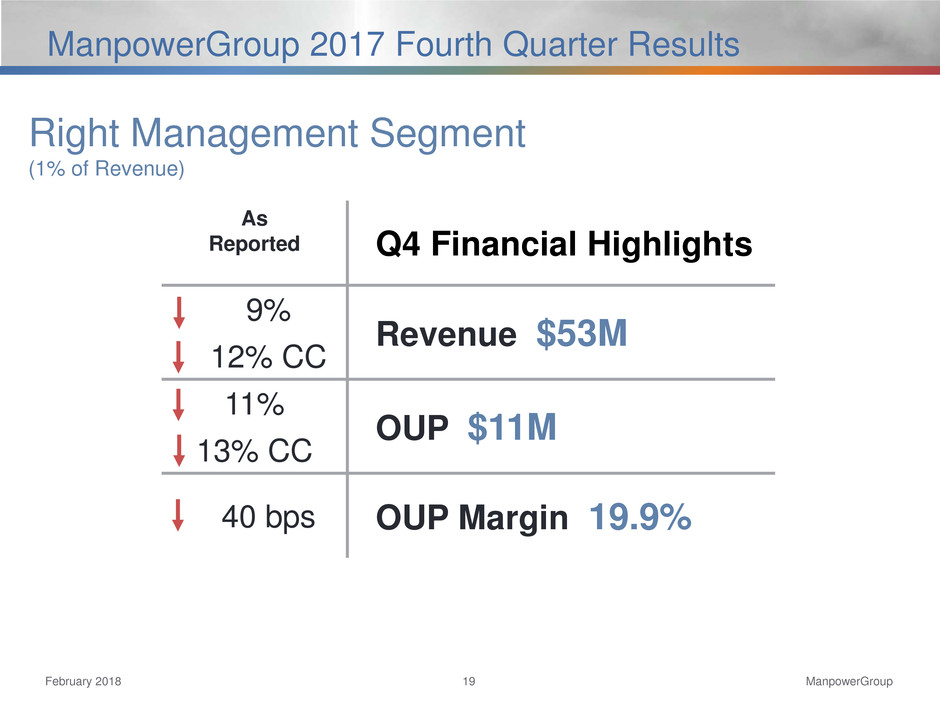

ManpowerGroup February 2018 19 ManpowerGroup 2017 Fourth Quarter Results As Reported Q4 Financial Highlights 9% Revenue $53M 12% CC 11% OUP $11M 13% CC 40 bps OUP Margin 19.9% Right Management Segment (1% of Revenue)

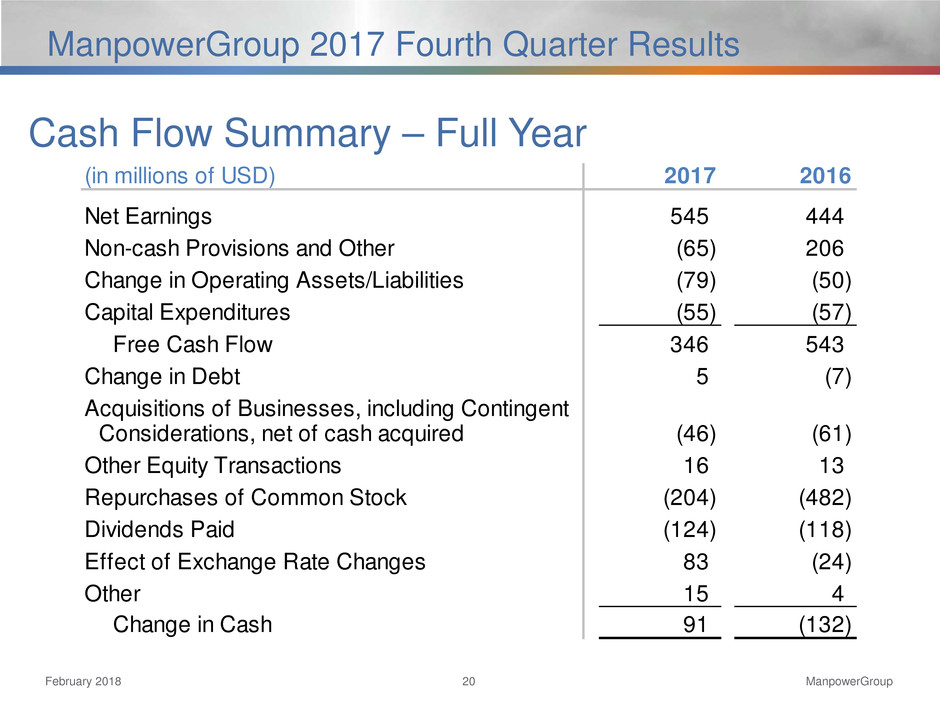

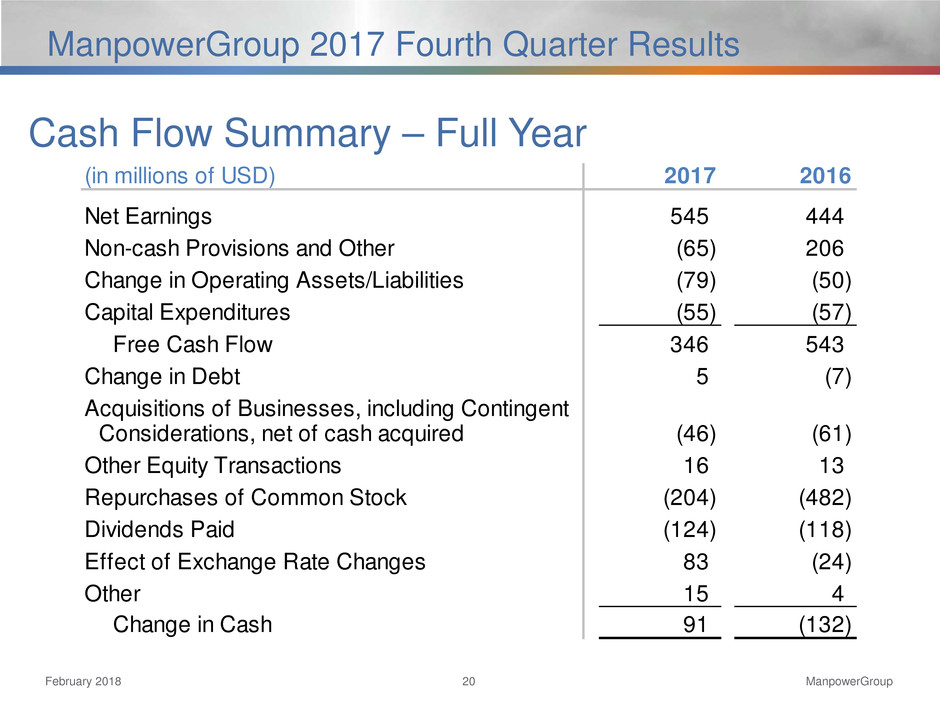

ManpowerGroup February 2018 20 ManpowerGroup 2017 Fourth Quarter Results Cash Flow Summary – Full Year (in millions of USD) 2017 2016 Net Earnings 545 444 Non-cash Provisions and Other (65) 206 Change in Operating Assets/Liabilities (79) (50) Capital Expenditures (55) (57) Free Cash Flow 346 543 Change in Debt 5 (7) Acquisitions of Businesses, including Contingent Considerations, net of cash acquired (46) (61) Other Equity Transactions 16 13 Repurchases of Common Stock (204) (482) Dividends Paid (124) (118) Effect of Exchange Rate Changes 83 (24) Other 15 4 Change in Cash 91 (132)

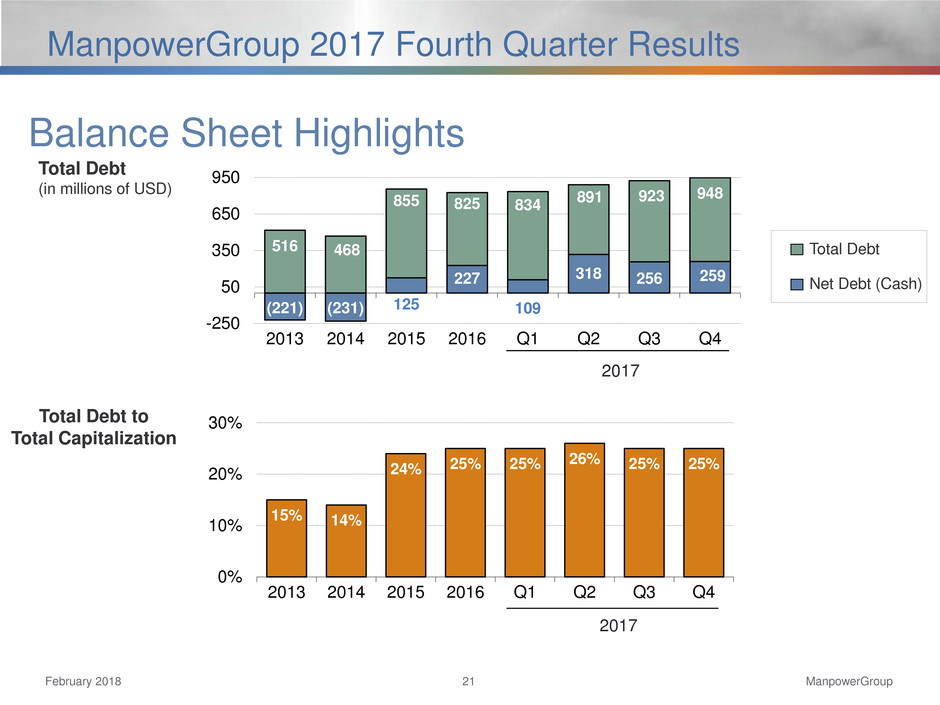

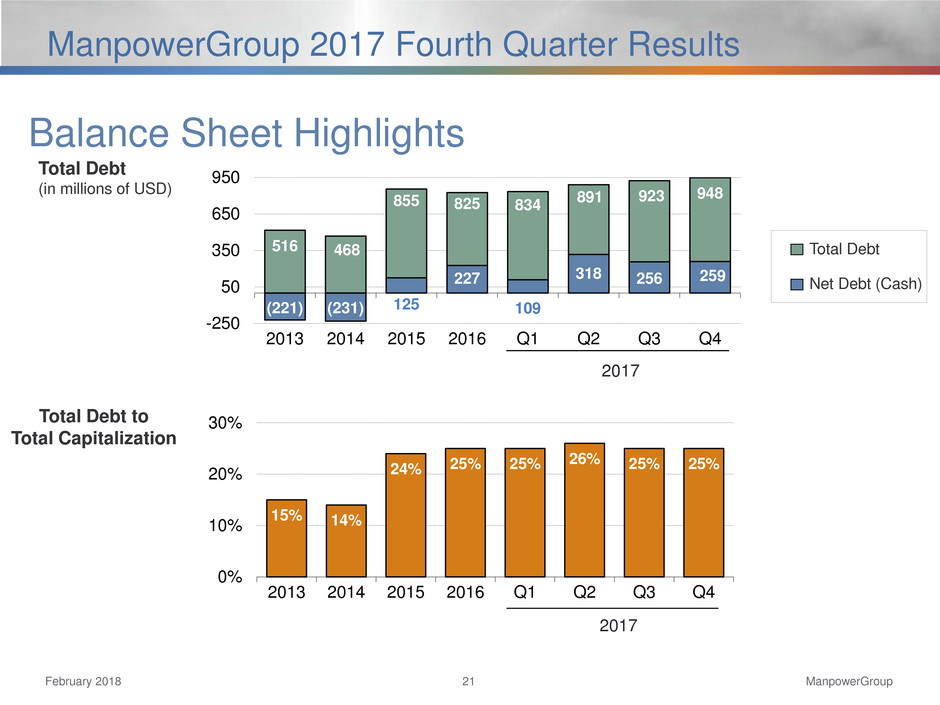

ManpowerGroup February 2018 21 ManpowerGroup 2017 Fourth Quarter Results Balance Sheet Highlights Total Debt (in millions of USD) Total Debt to Total Capitalization Total Debt Net Debt (Cash) (221) (231) 125 227 109 318 256 259 923 948 516 468 855 825 834 891 -250 50 350 650 950 2013 2014 2015 2016 Q1 Q2 Q3 Q4 2017 15% 14% 24% 25% 25% 26% 25% 25% 0% 10% 20% 30% 2013 2014 2015 2016 Q1 Q2 Q3 Q4 2017

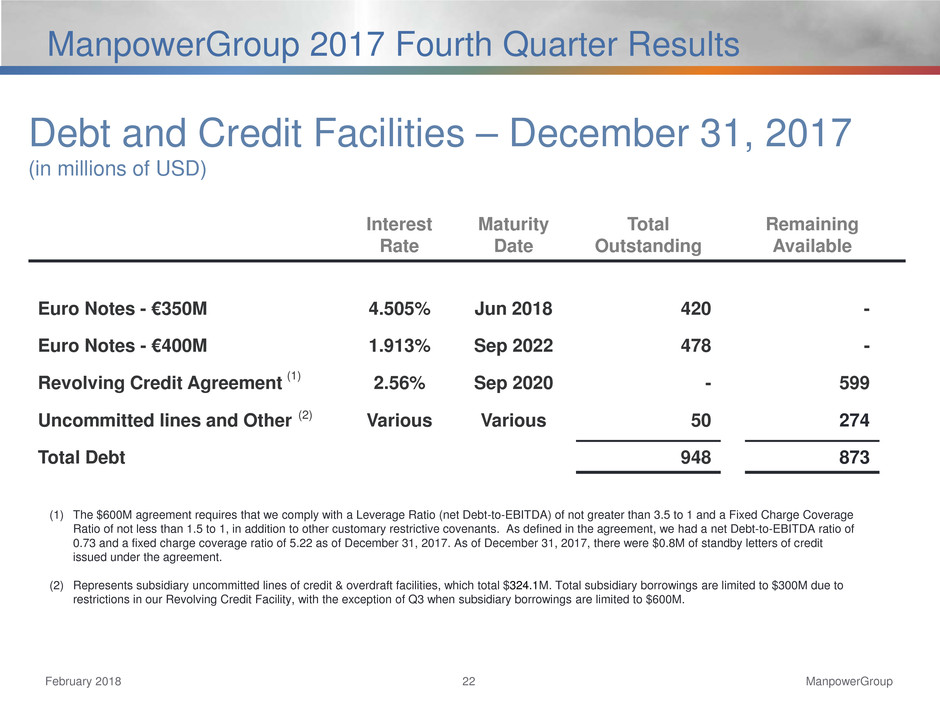

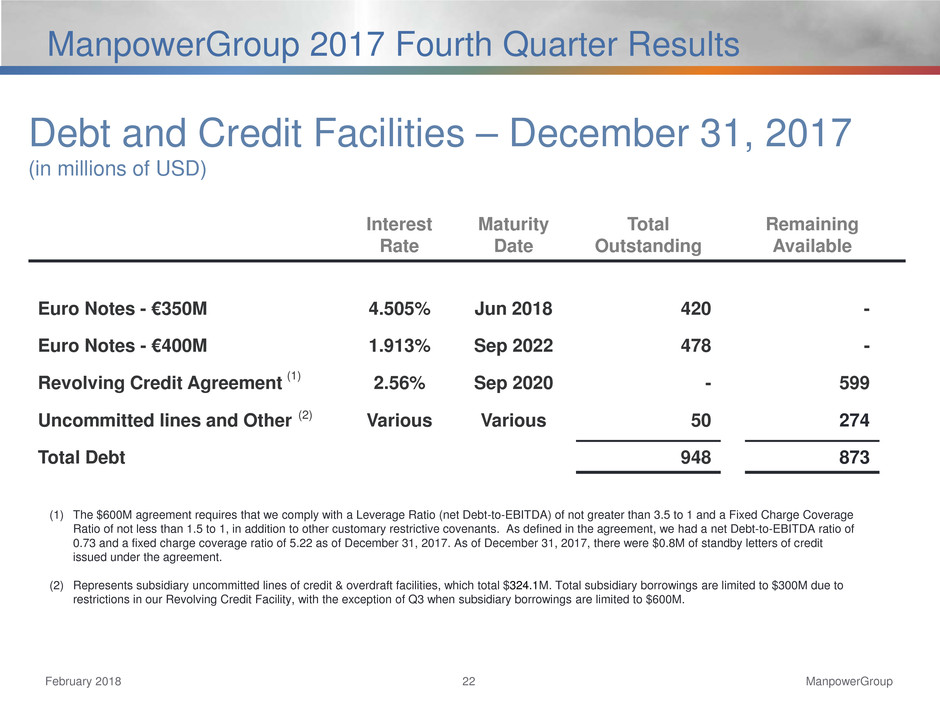

ManpowerGroup February 2018 22 ManpowerGroup 2017 Fourth Quarter Results (1) The $600M agreement requires that we comply with a Leverage Ratio (net Debt-to-EBITDA) of not greater than 3.5 to 1 and a Fixed Charge Coverage Ratio of not less than 1.5 to 1, in addition to other customary restrictive covenants. As defined in the agreement, we had a net Debt-to-EBITDA ratio of 0.73 and a fixed charge coverage ratio of 5.22 as of December 31, 2017. As of December 31, 2017, there were $0.8M of standby letters of credit issued under the agreement. (2) Represents subsidiary uncommitted lines of credit & overdraft facilities, which total $324.1M. Total subsidiary borrowings are limited to $300M due to restrictions in our Revolving Credit Facility, with the exception of Q3 when subsidiary borrowings are limited to $600M. Interest Rate Maturity Date Total Outstanding Remaining Available Euro Notes - €350M 4.505% Jun 2018 420 - Euro Notes - €400M 1.913% Sep 2022 478 - Revolving Credit Agreement 2.56% Sep 2020 - 599 Uncommitted lines and Other Various Various 50 274 Total Debt 948 873 Debt and Credit Facilities – December 31, 2017 (in millions of USD) (2) (1)

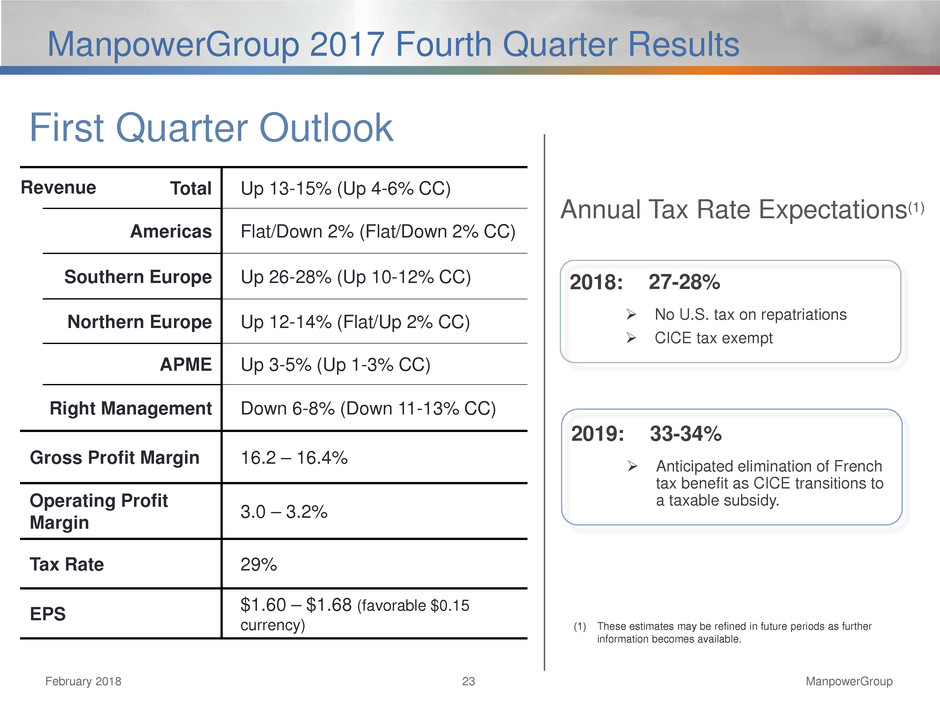

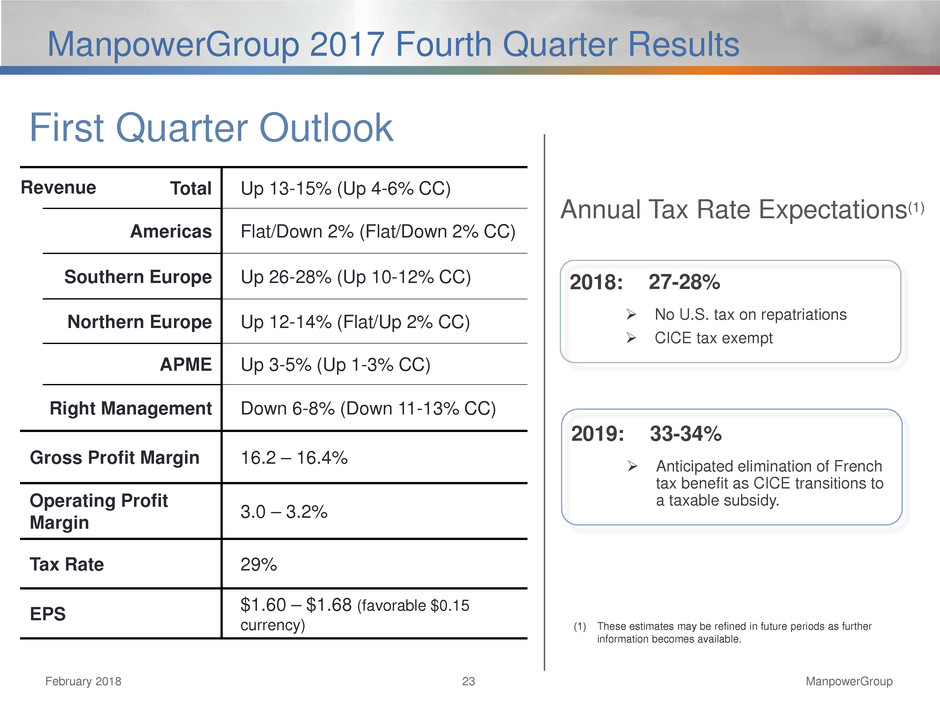

ManpowerGroup February 2018 23 ManpowerGroup 2017 Fourth Quarter Results First Quarter Outlook Total Up 13-15% (Up 4-6% CC) Americas Flat/Down 2% (Flat/Down 2% CC) Southern Europe Up 26-28% (Up 10-12% CC) Northern Europe Up 12-14% (Flat/Up 2% CC) APME Up 3-5% (Up 1-3% CC) Right Management Down 6-8% (Down 11-13% CC) Gross Profit Margin 16.2 – 16.4% Operating Profit Margin 3.0 – 3.2% Tax Rate 29% EPS $1.60 – $1.68 (favorable $0.15 currency) Revenue 33-34% Anticipated elimination of French tax benefit as CICE transitions to a taxable subsidy. Annual Tax Rate Expectations(1) 27-28% No U.S. tax on repatriations CICE tax exempt 2018: 2019: (1) These estimates may be refined in future periods as further information becomes available.

February 2018 24 ManpowerGroup Our Strategies and Key Priorities provide the platform to achieve our new Financial Targets

ManpowerGroup February 2018 25 ManpowerGroup 2017 Fourth Quarter Results Strong Market Growth Fundamentals Companies demanding flexibility in cost structure given more volatile global economic cycles. Companies looking to the “experts” for workforce management solutions. Massive opportunity in emerging markets in Asia, Eastern Europe and Latin America. Job seekers looking for current positions as well as career advice and assistance. Companies reducing the number of vendors, partnering with those that best meet their talent needs.

ManpowerGroup February 2018 26 ManpowerGroup 2017 Fourth Quarter Results Strong and Connected Brands 63% of GP Leverage our trusted brand, while driving relentless efficiency / productivity • Targeted sales • Permanent recruitment growth • Multi-channel delivery • Centers of recruiting excellence • Core growth in Experis IT • Innovative talent resourcing • Permanent recruitment growth • Delivery excellence • Career Transition / Talent Management & Assessment • Tailored solutions to improve the effectiveness of organizations and individuals • RPO, MSP, Proservia, TBO • Expert workforce solutions that deliver performance 37% of GP Drive higher growth and gross margin while investing more in changing our business mix Sustainability, Mission and Values We are a world leader in innovative workforce solutions and services, helping clients win through our family of brands and offerings. Digitally-Fueled Transformation

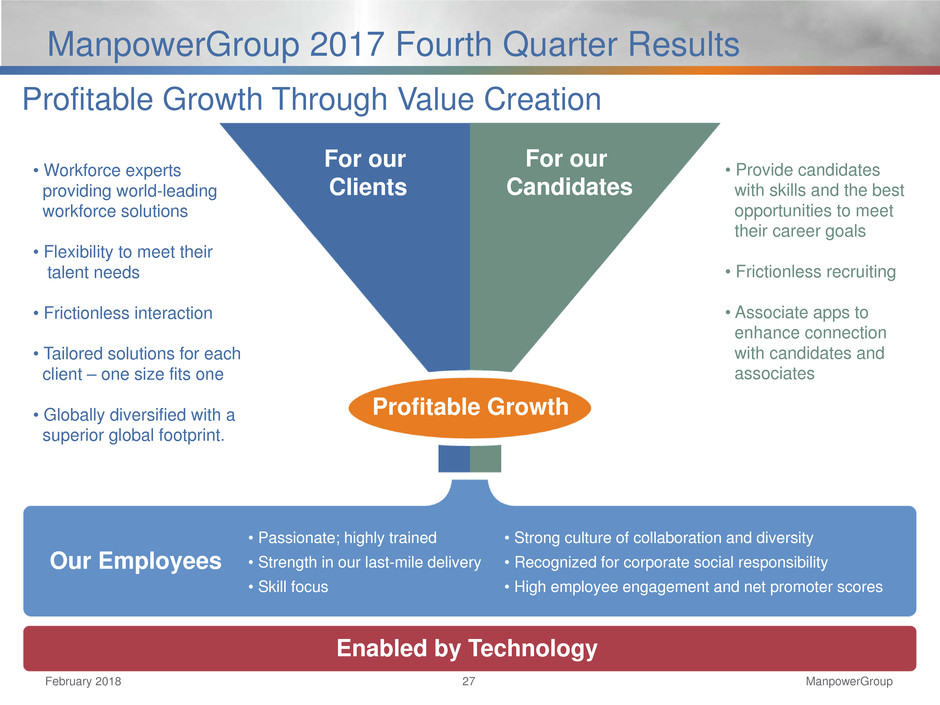

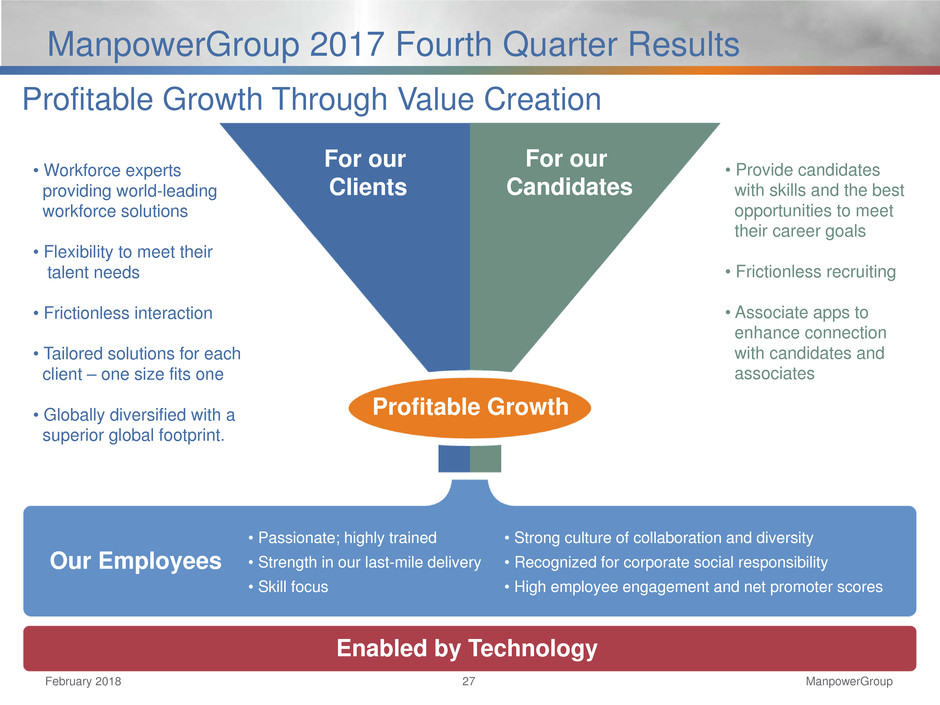

ManpowerGroup February 2018 27 ManpowerGroup 2017 Fourth Quarter Results Profitable Growth Through Value Creation For our Clients For our Candidates Profitable Growth • Workforce experts providing world-leading workforce solutions • Flexibility to meet their talent needs • Frictionless interaction • Tailored solutions for each client – one size fits one • Globally diversified with a superior global footprint. • Provide candidates with skills and the best opportunities to meet their career goals • Frictionless recruiting • Associate apps to enhance connection with candidates and associates Our Employees Enabled by Technology • Passionate; highly trained • Strength in our last-mile delivery • Skill focus • Strong culture of collaboration and diversity • Recognized for corporate social responsibility • High employee engagement and net promoter scores

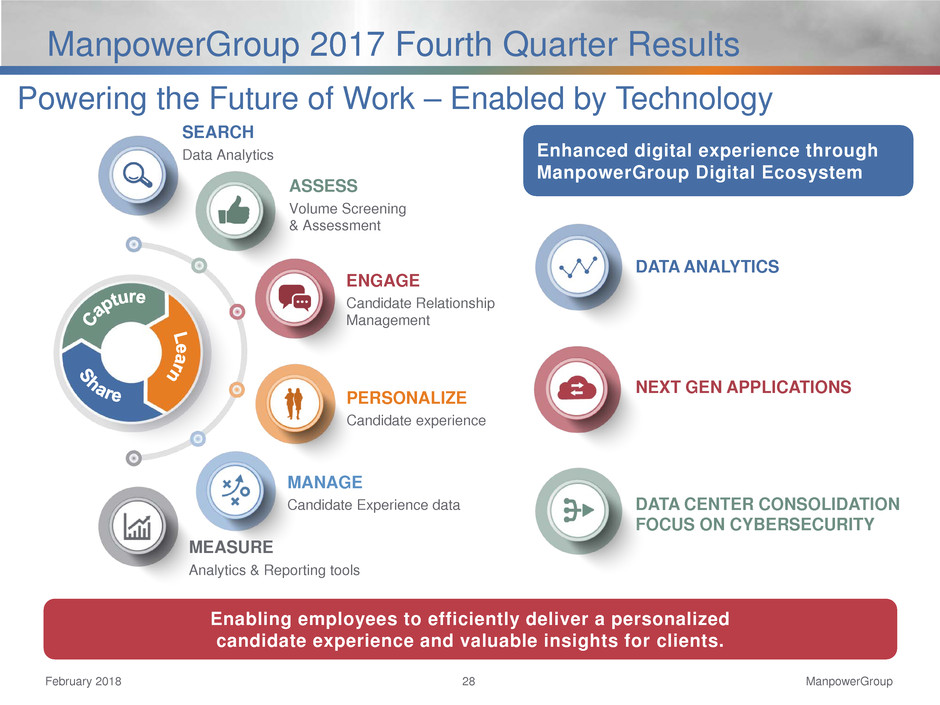

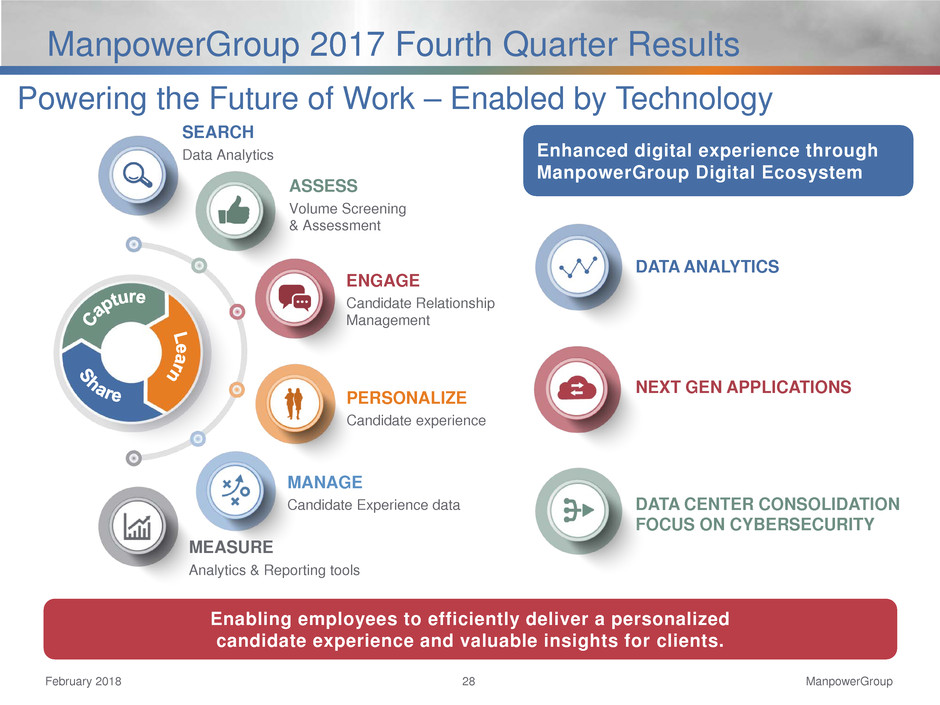

ManpowerGroup February 2018 28 ManpowerGroup 2017 Fourth Quarter Results SEARCH Data Analytics ASSESS Volume Screening & Assessment MEASURE Analytics & Reporting tools PERSONALIZE Candidate experience ENGAGE Candidate Relationship Management MANAGE Candidate Experience data Powering the Future of Work – Enabled by Technology Enabling employees to efficiently deliver a personalized candidate experience and valuable insights for clients. DATA ANALYTICS NEXT GEN APPLICATIONS DATA CENTER CONSOLIDATION FOCUS ON CYBERSECURITY Enhanced digital experience through ManpowerGroup Digital Ecosystem. Enhanced digital experience through ManpowerGroup Digital Ecosystem

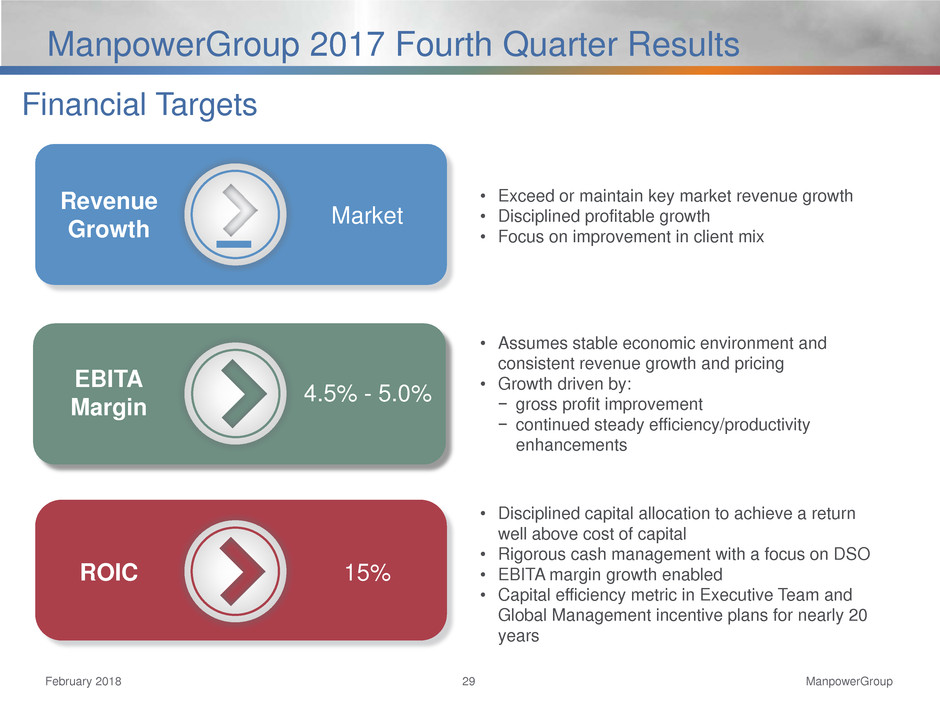

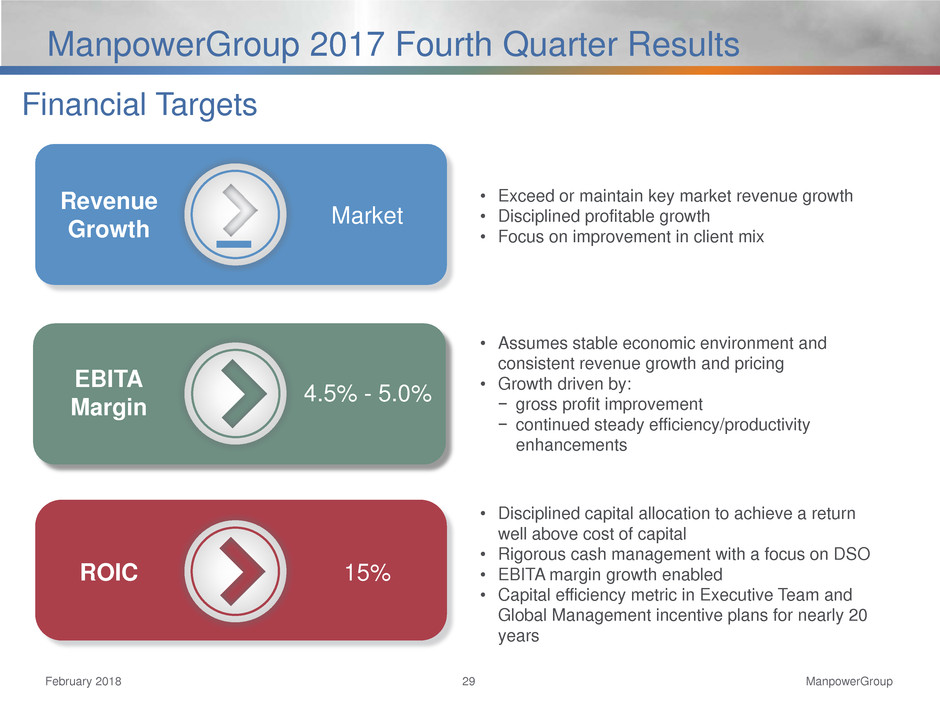

ManpowerGroup February 2018 29 ManpowerGroup 2017 Fourth Quarter Results Financial Targets • Exceed or maintain key market revenue growth • Disciplined profitable growth • Focus on improvement in client mix • Assumes stable economic environment and consistent revenue growth and pricing • Growth driven by: − gross profit improvement − continued steady efficiency/productivity enhancements • Disciplined capital allocation to achieve a return well above cost of capital • Rigorous cash management with a focus on DSO • EBITA margin growth enabled • Capital efficiency metric in Executive Team and Global Management incentive plans for nearly 20 years EBITA Margin 4.5% - 5.0% Market Revenue Growth 15% ROIC

ManpowerGroup February 2018 30 ManpowerGroup 2017 Fourth Quarter Results Q & A