ManpowerGroup Third Quarter Results October 19, 2023 Exhibit 99.2

FORWARD-LOOKING STATEMENT This presentation contains statements, including statements regarding economic and geopolitical uncertainty, financial outlook, including future restructuring charges resulting from the wind-down of the Proservia business in Germany, labor demand, the outlook for our business in key countries, the Company’s strategic initiatives and technology investments, business alliances and partnerships and the positioning of future growth for our brands that are forward-looking in nature and, accordingly, are subject to risks and uncertainties regarding the Company’s expected future results. The Company’s actual results may differ materially from those described or contemplated in the forward-looking statements due to numerous factors. These factors include those found in the Company’s reports filed with the SEC, including the information under the heading “Risk Factors” in its Annual Report on Form 10-K for the year ended December 31, 2022, which information is incorporated herein by reference. The Company assumes no obligation to update or revise any forward-looking statements. We reference certain non-GAAP financial measures, which we believe provide useful information for investors. We include a reconciliation of these measures, where appropriate, to GAAP on the Investor Relations section of our website at manpowergroup.com.

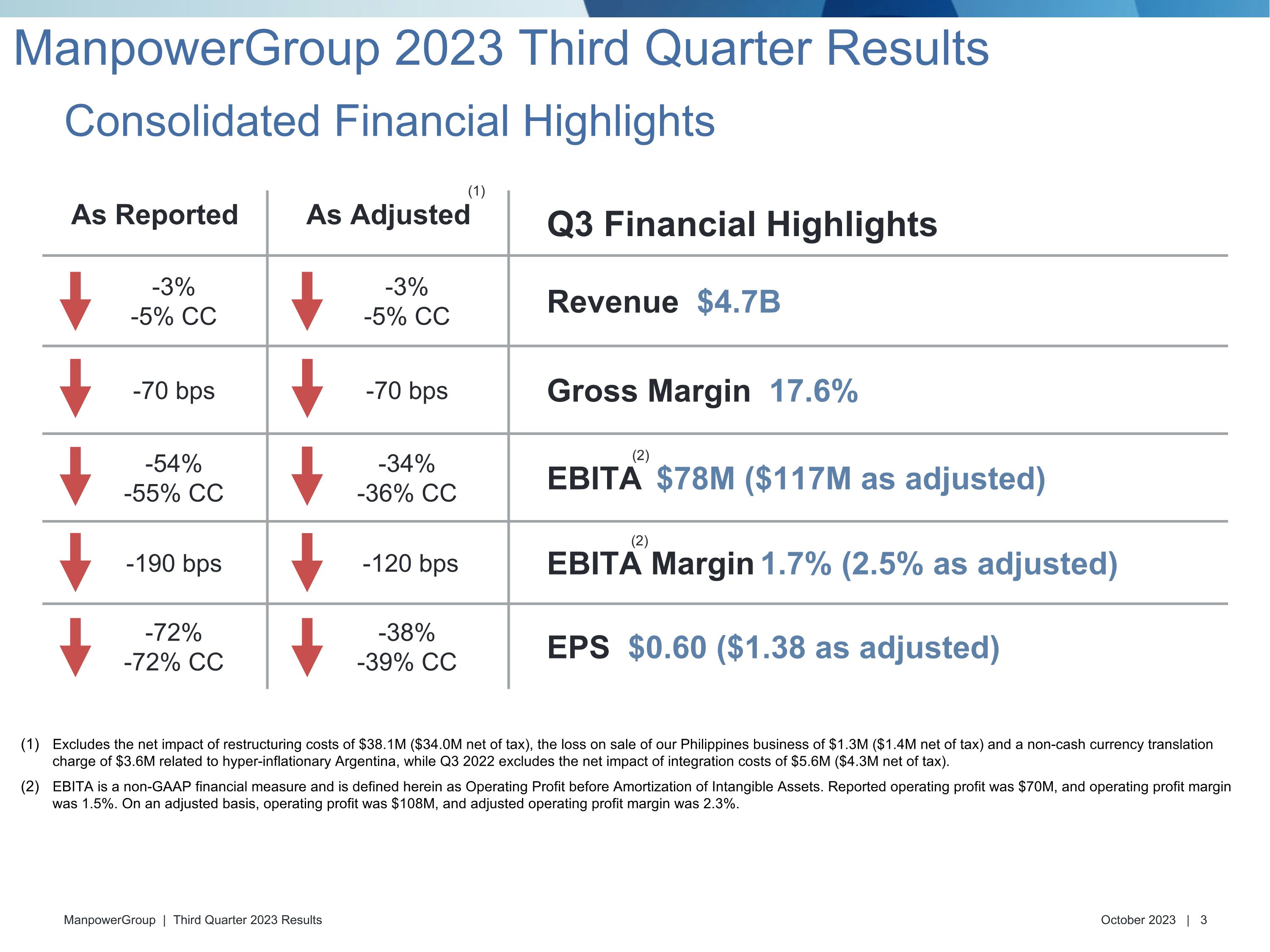

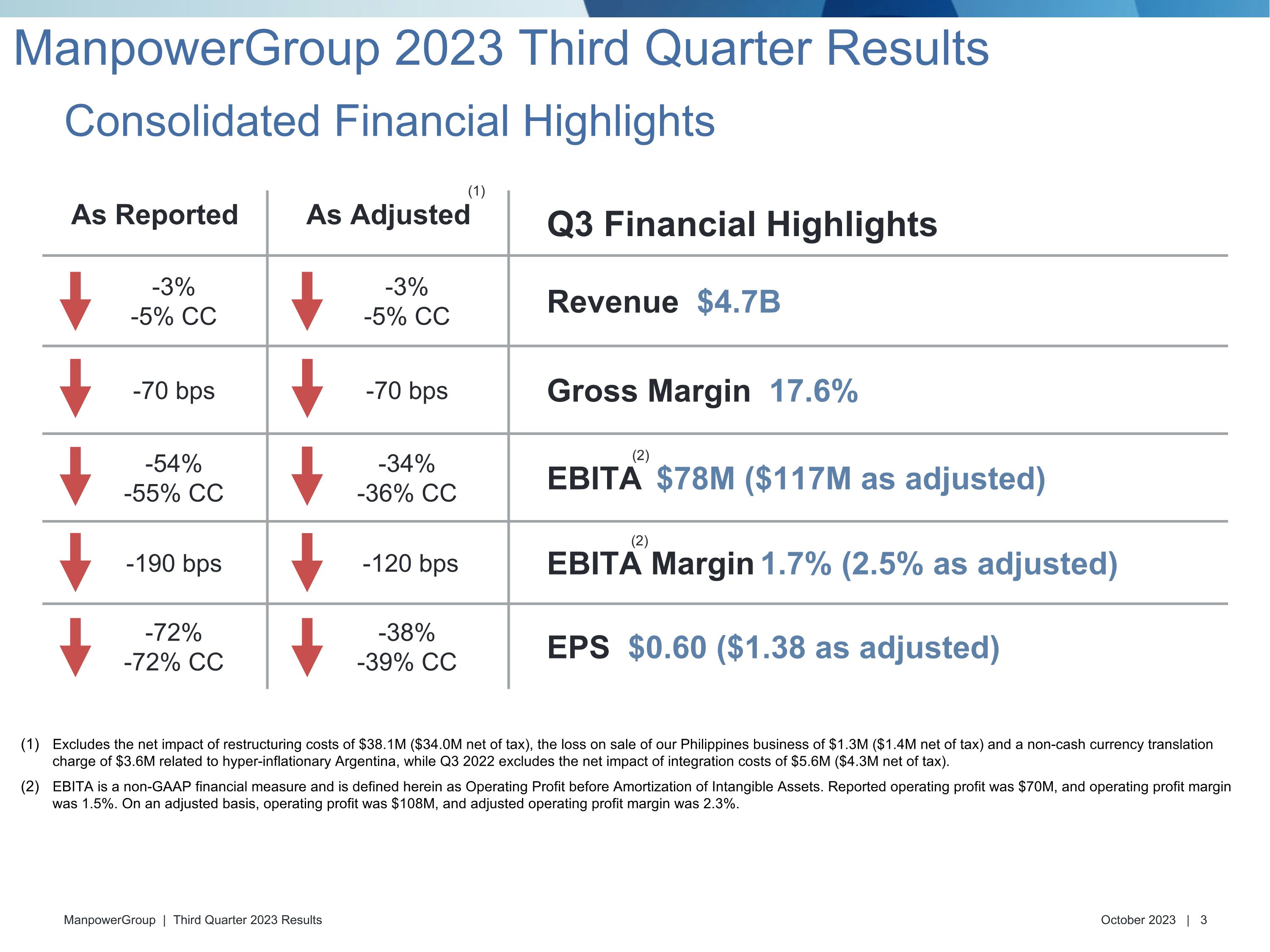

Excludes the net impact of restructuring costs of $38.1M ($34.0M net of tax), the loss on sale of our Philippines business of $1.3M ($1.4M net of tax) and a non-cash currency translation charge of $3.6M related to hyper-inflationary Argentina, while Q3 2022 excludes the net impact of integration costs of $5.6M ($4.3M net of tax). EBITA is a non-GAAP financial measure and is defined herein as Operating Profit before Amortization of Intangible Assets. Reported operating profit was $70M, and operating profit margin was 1.5%. On an adjusted basis, operating profit was $108M, and adjusted operating profit margin was 2.3%. As Reported As Adjusted Q3 Financial Highlights -3% -5% CC -3% -5% CC Revenue $4.7B -70 bps -70 bps Gross Margin 17.6% -54% -55% CC -34% -36% CC EBITA $78M ($117M as adjusted) -190 bps -120 bps EBITA Margin 1.7% (2.5% as adjusted) -72% -72% CC -38% -39% CC EPS $0.60 ($1.38 as adjusted) (2) (2) (1) Consolidated Financial Highlights ManpowerGroup 2023 Third Quarter Results

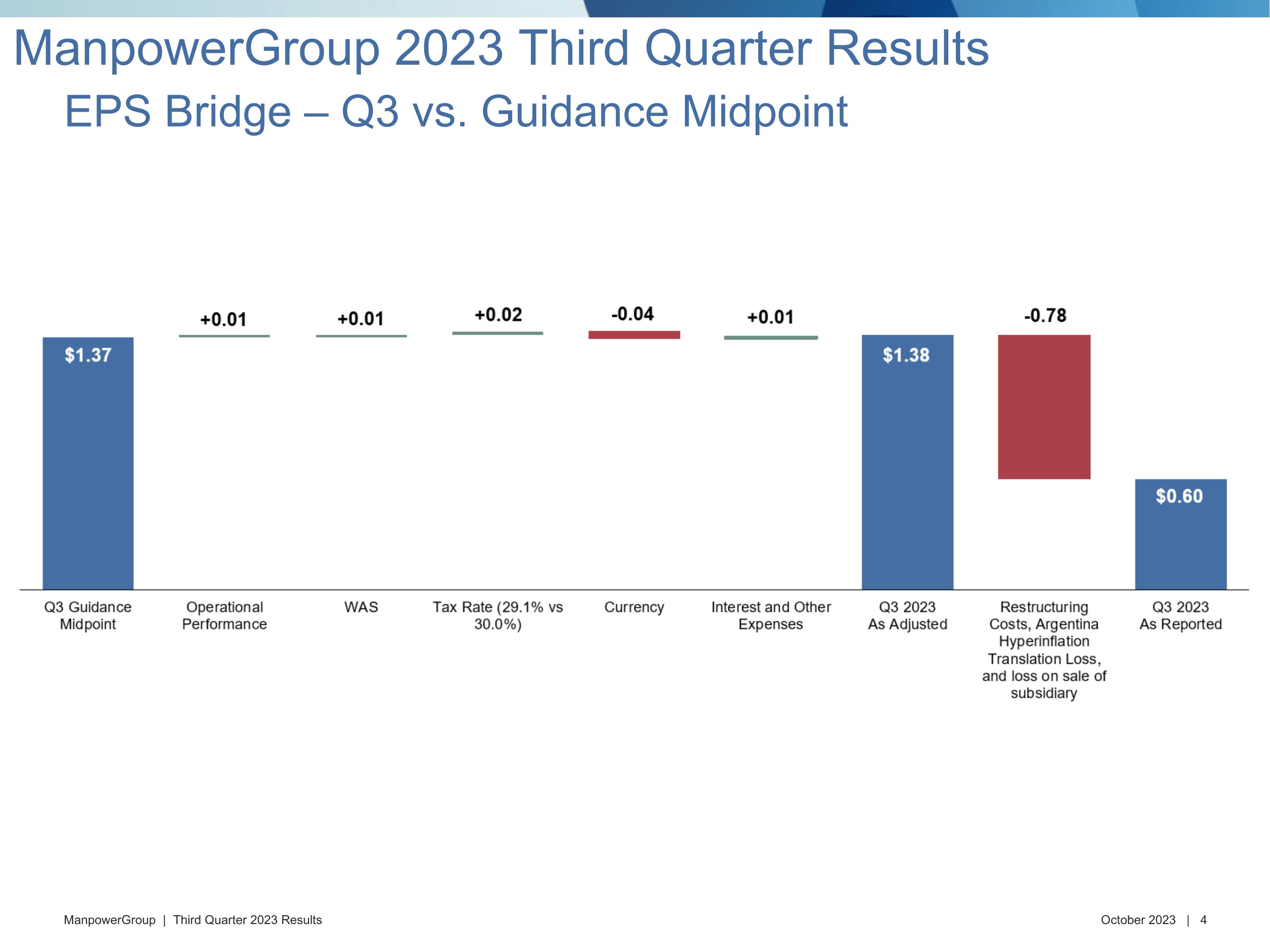

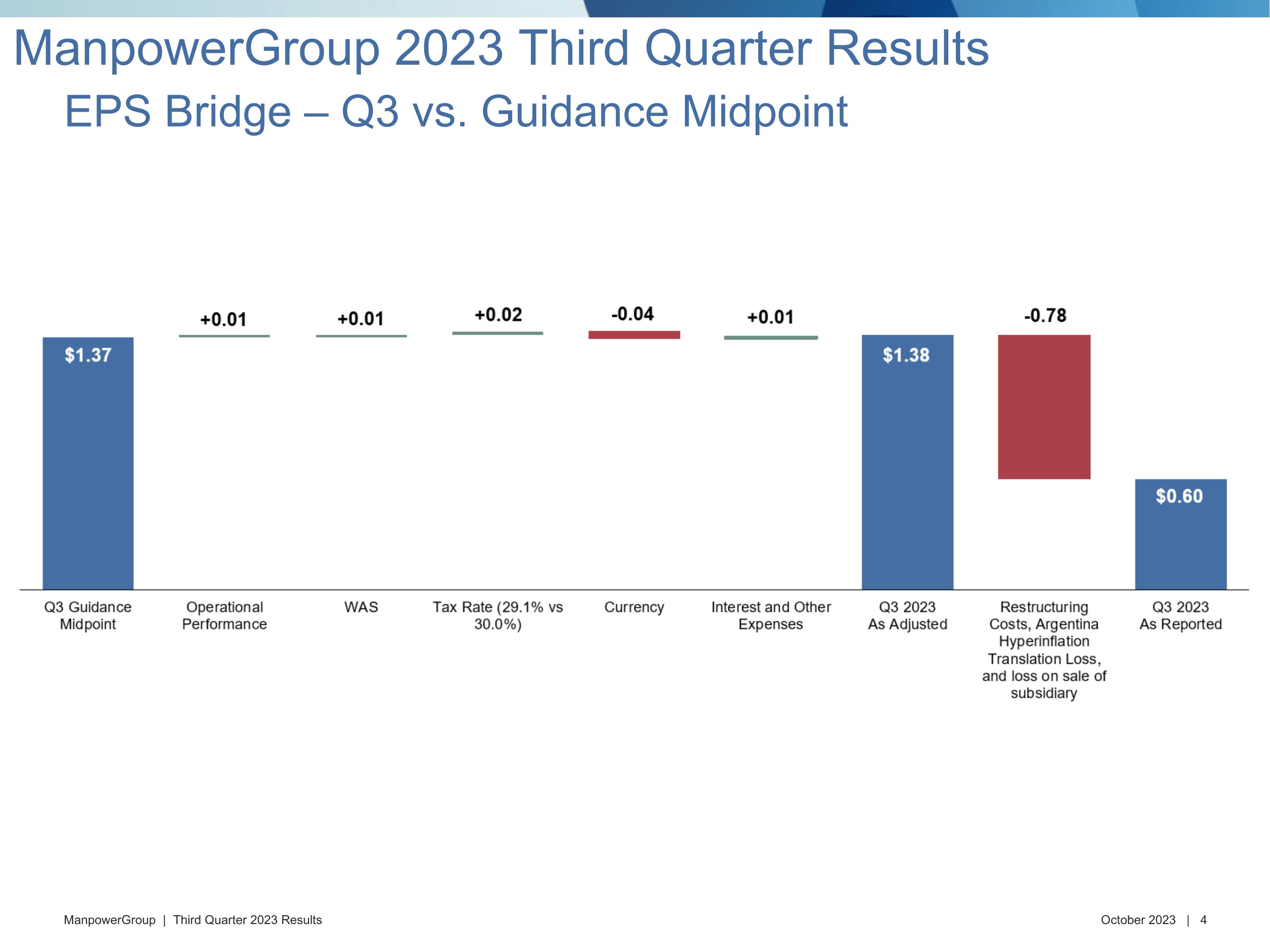

EPS Bridge – Q3 vs. Guidance Midpoint ManpowerGroup 2023 Third Quarter Results

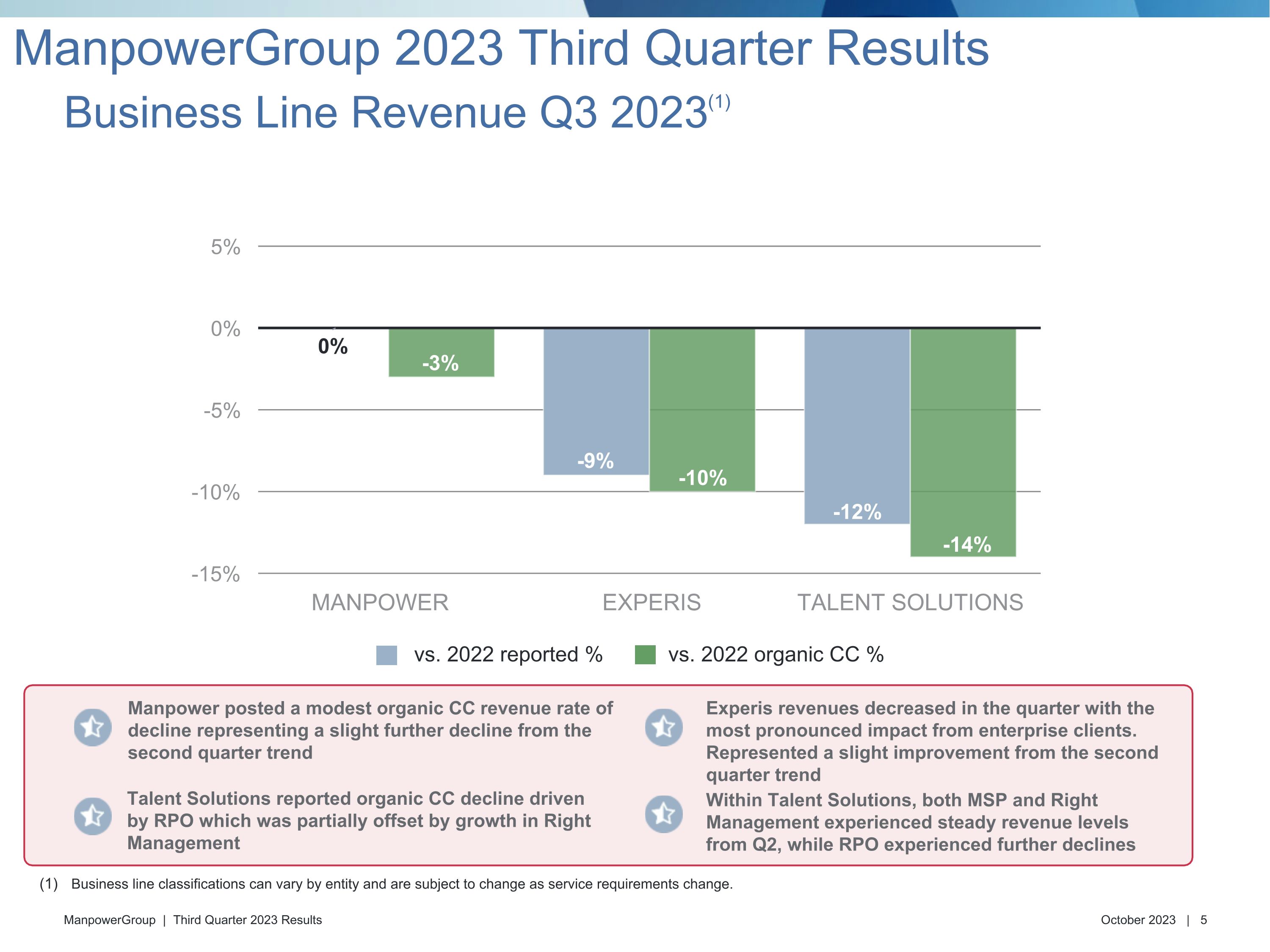

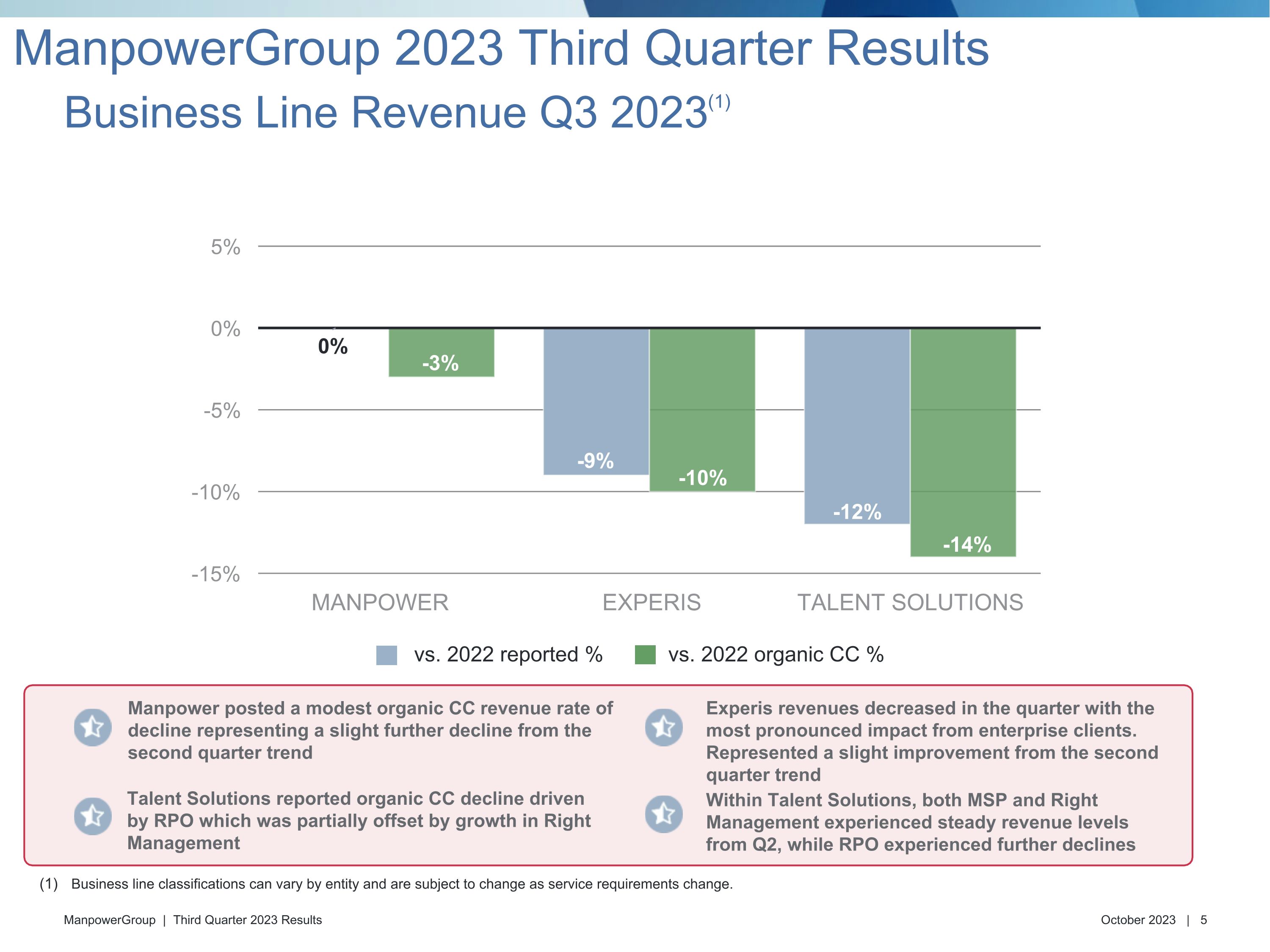

Experis revenues decreased in the quarter with the most pronounced impact from enterprise clients. Represented a slight improvement from the second quarter trend Within Talent Solutions, both MSP and Right Management experienced steady revenue levels from Q2, while RPO experienced further declines Manpower posted a modest organic CC revenue rate of decline representing a slight further decline from the second quarter trend Business line classifications can vary by entity and are subject to change as service requirements change. Talent Solutions reported organic CC decline driven by RPO which was partially offset by growth in Right Management MANPOWER EXPERIS TALENT SOLUTIONS Business Line Revenue Q3 2023(1) vs. 2022 reported % vs. 2022 organic CC % ManpowerGroup 2023 Third Quarter Results

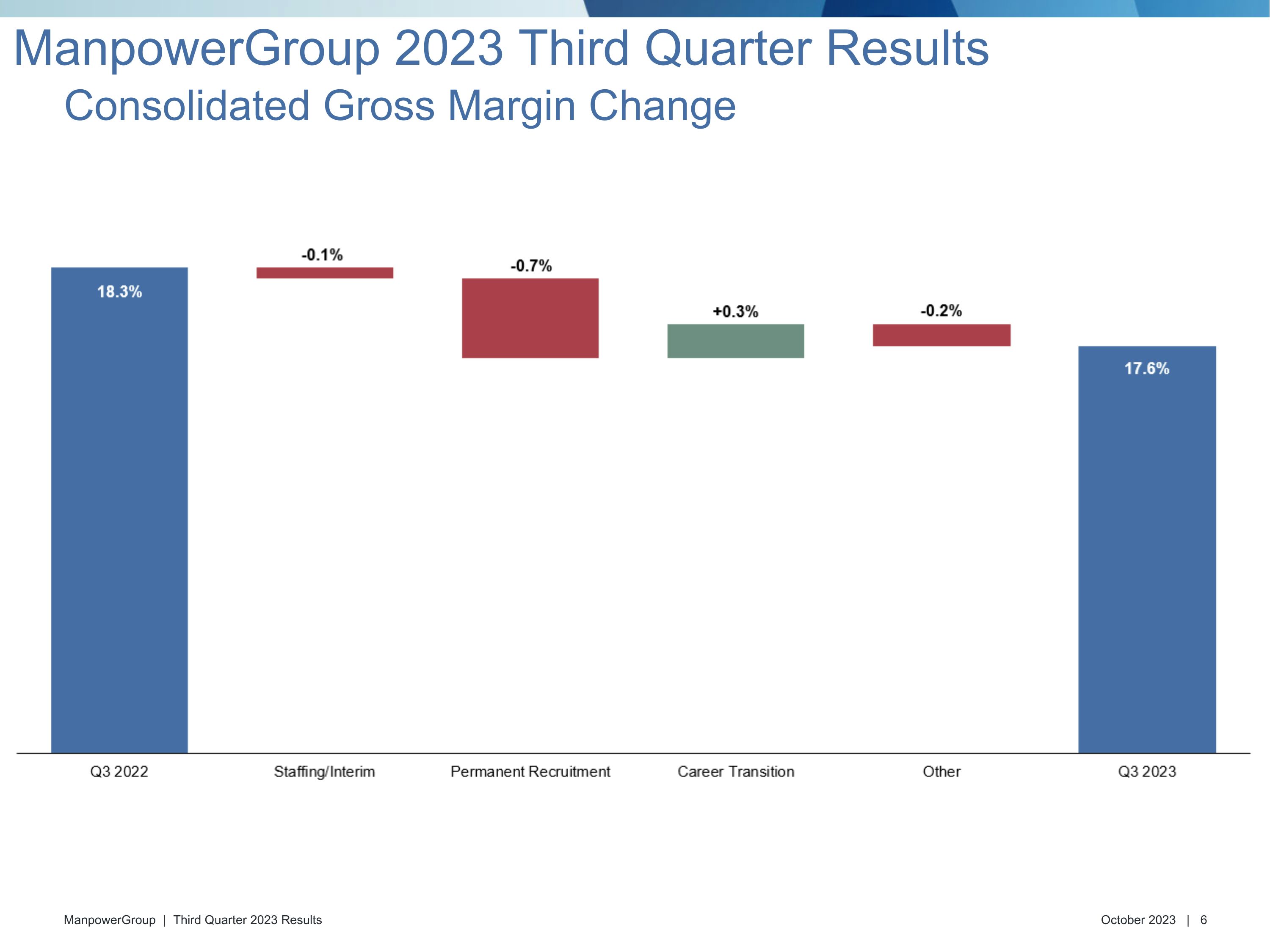

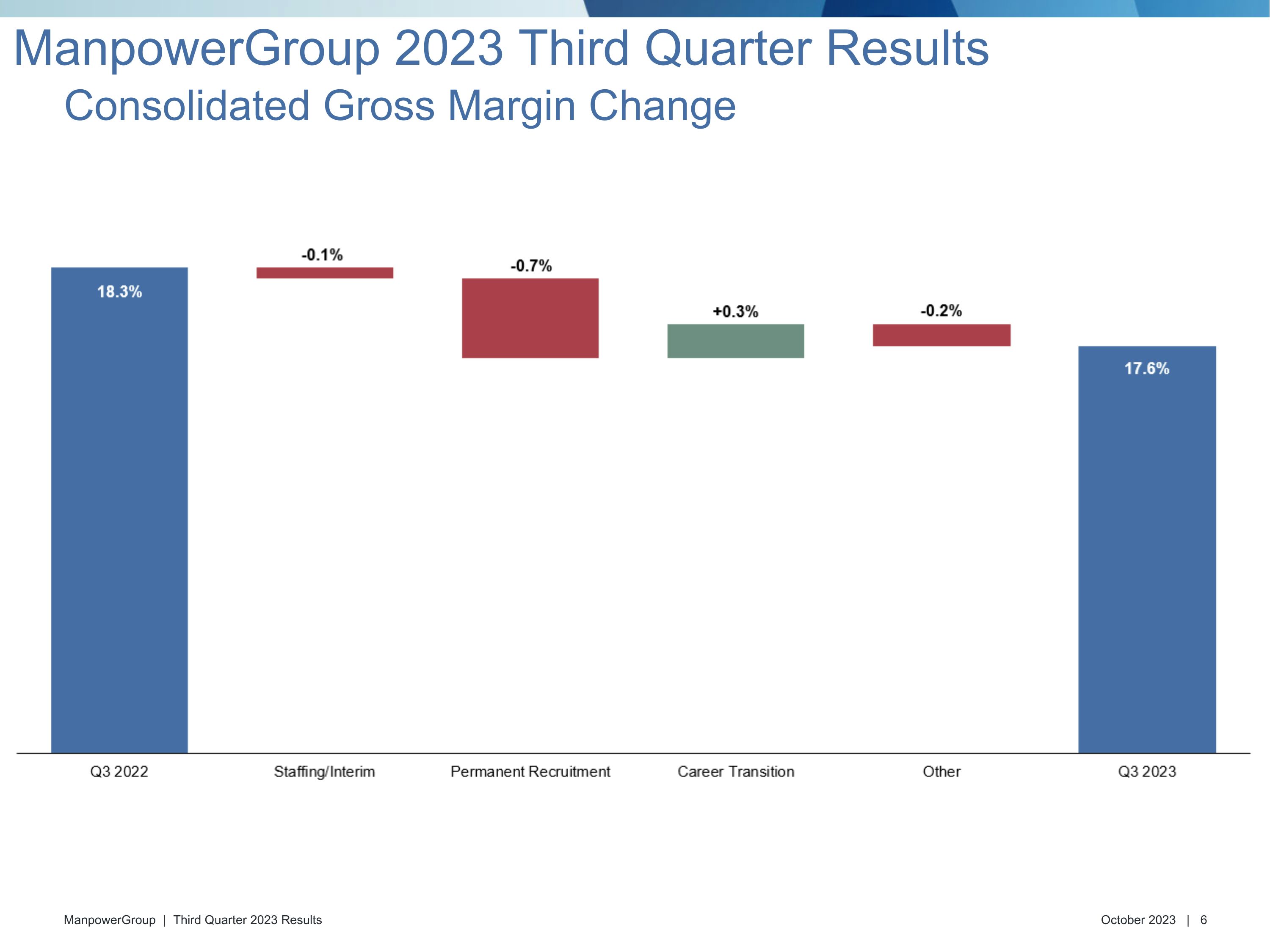

Consolidated Gross Margin Change ManpowerGroup 2023 Third Quarter Results

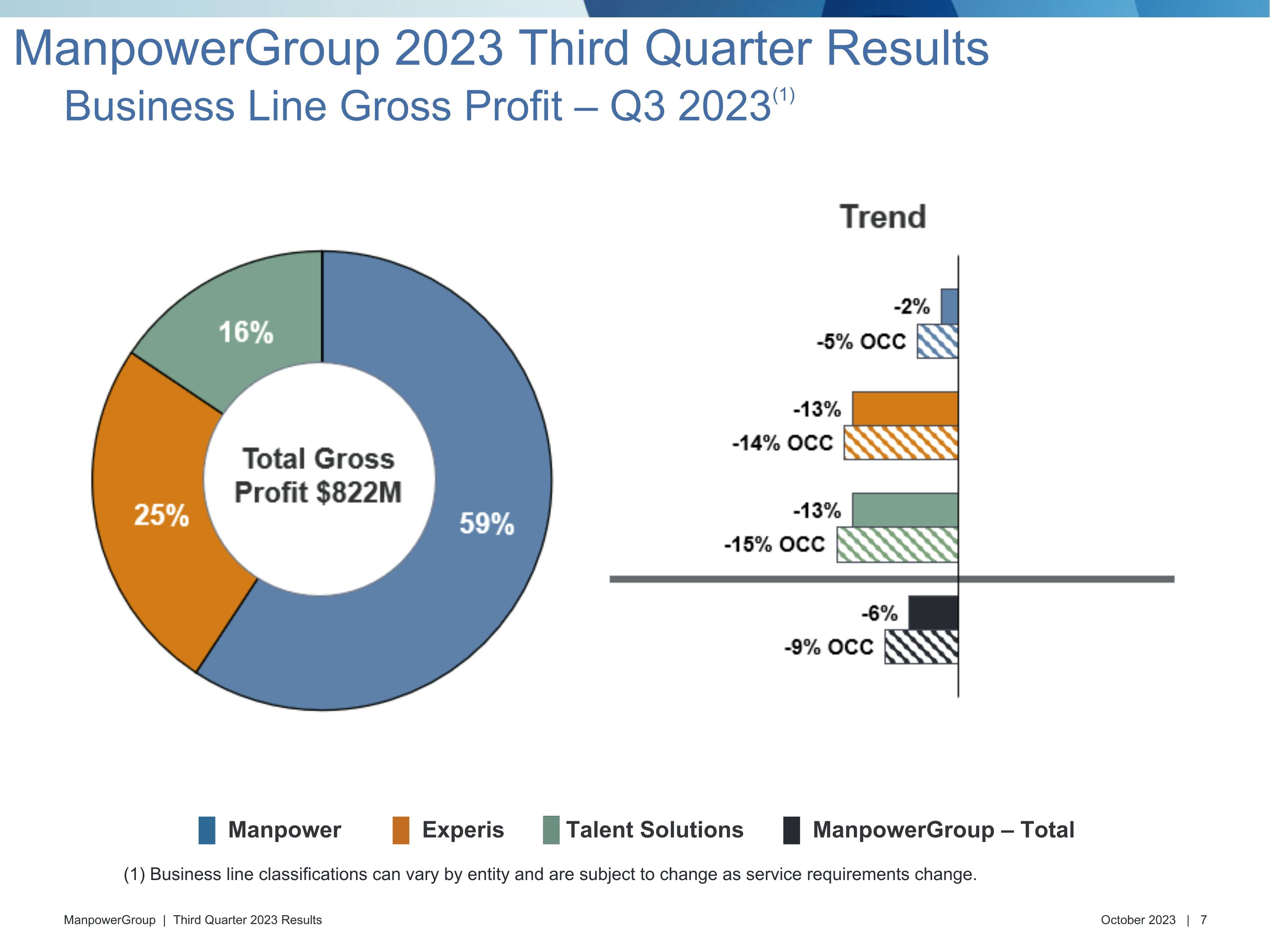

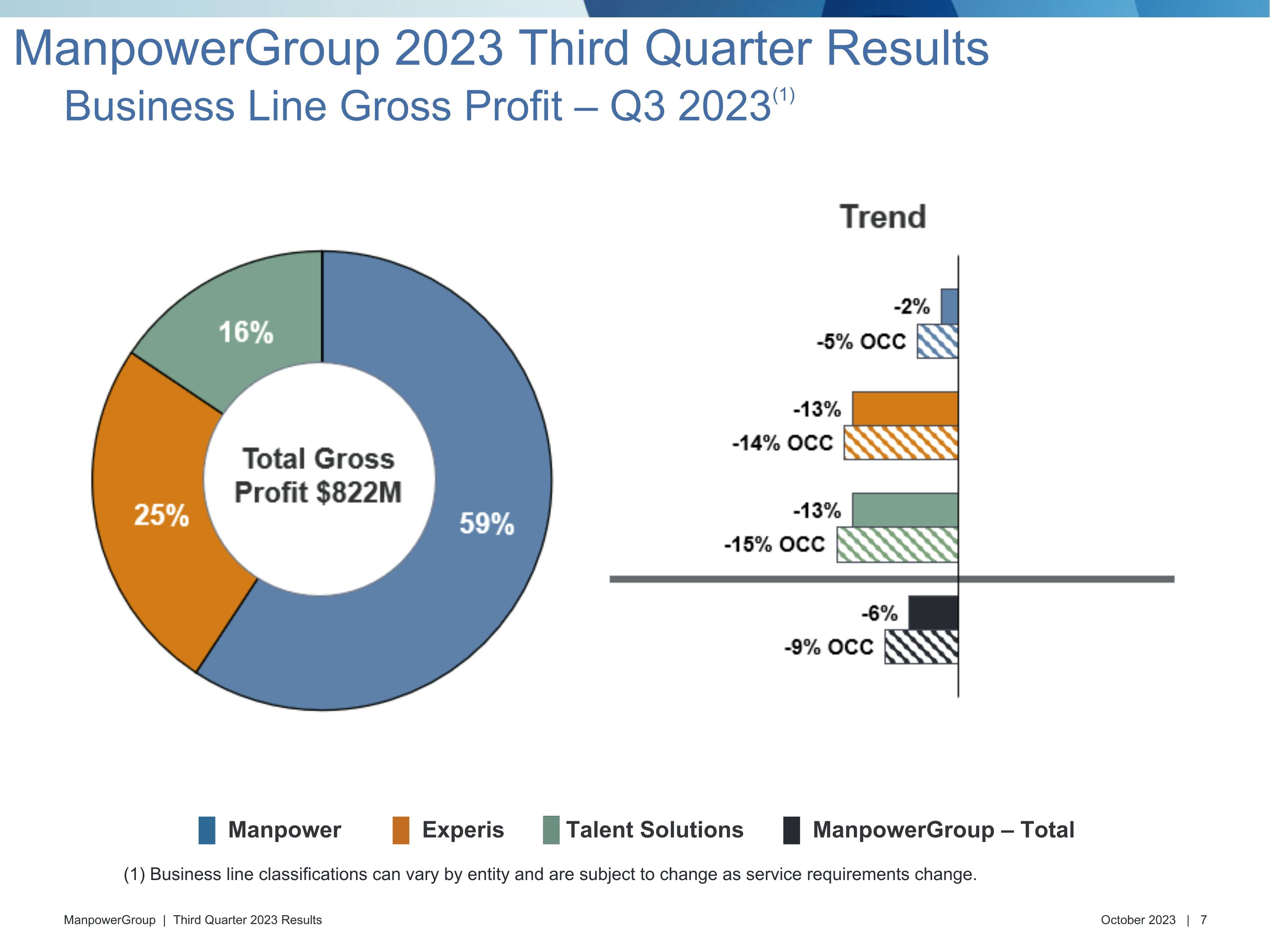

(1) Business line classifications can vary by entity and are subject to change as service requirements change. █ Manpower █ Experis █ Talent Solutions █ ManpowerGroup – Total Business Line Gross Profit – Q3 2023(1) ManpowerGroup 2023 Third Quarter Results

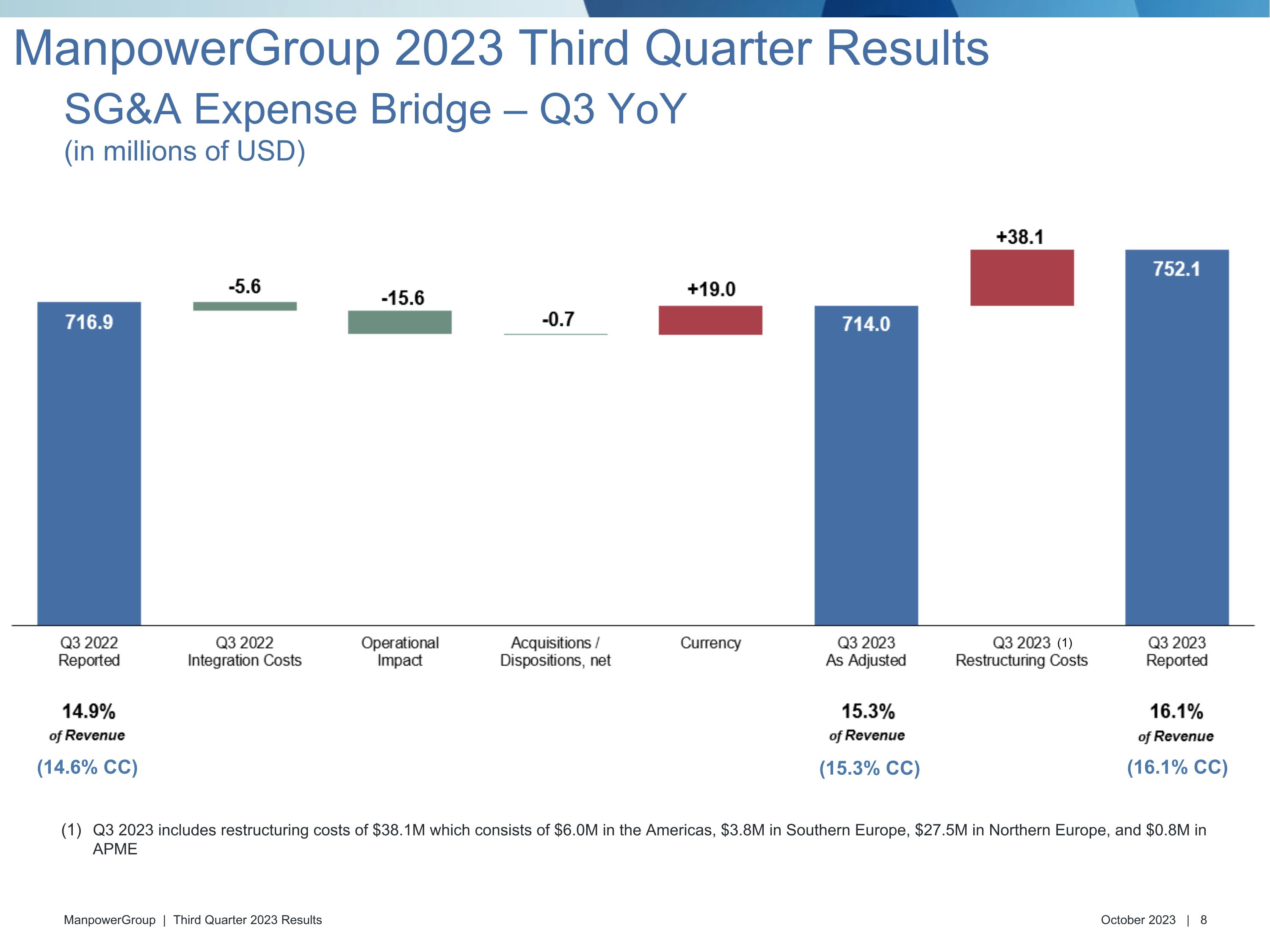

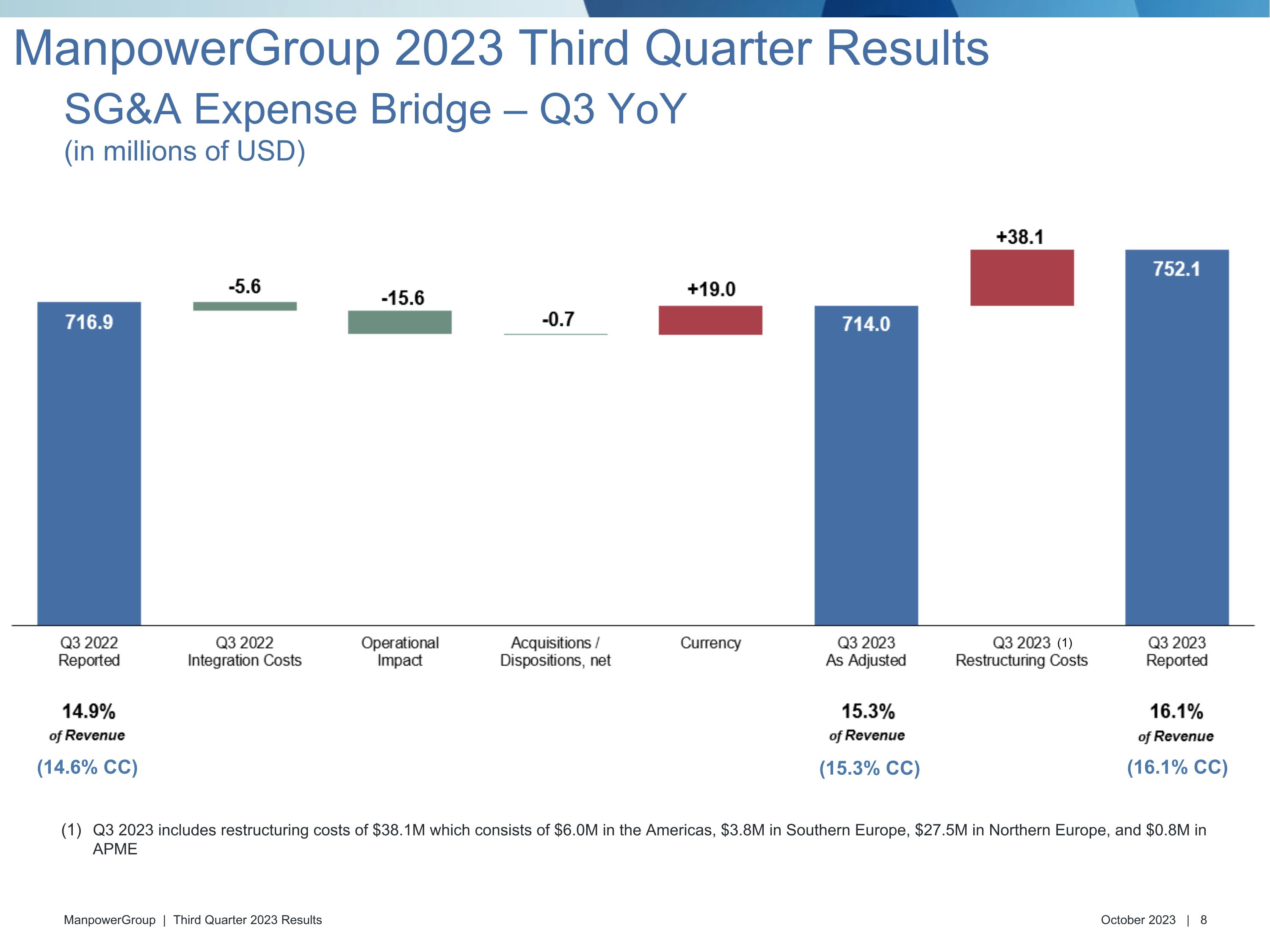

Q3 2023 includes restructuring costs of $38.1M which consists of $6.0M in the Americas, $3.8M in Southern Europe, $27.5M in Northern Europe, and $0.8M in APME (1) (15.3% CC) (16.1% CC) (14.6% CC) SG&A Expense Bridge – Q3 YoY�(in millions of USD) ManpowerGroup 2023 Third Quarter Results

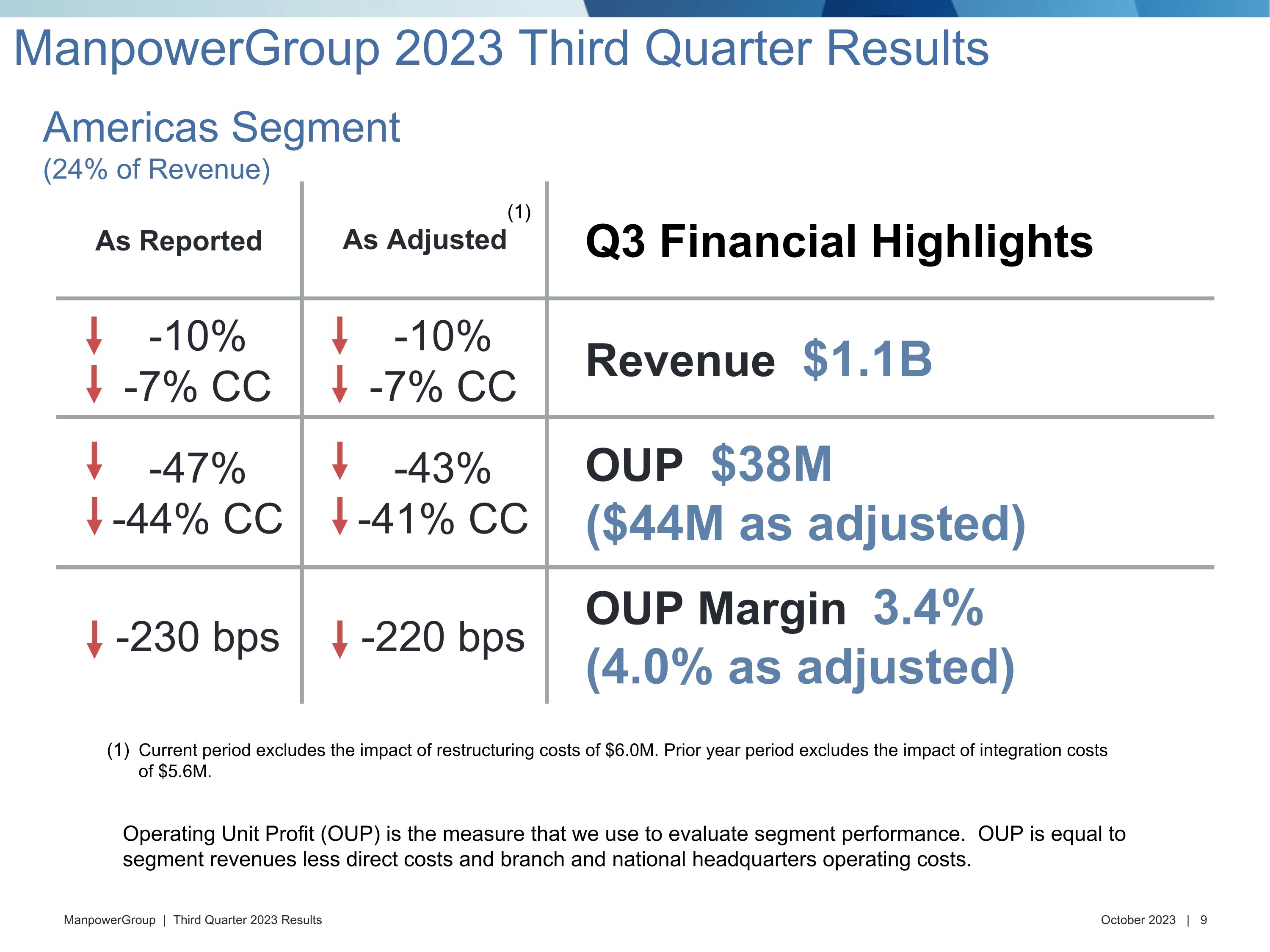

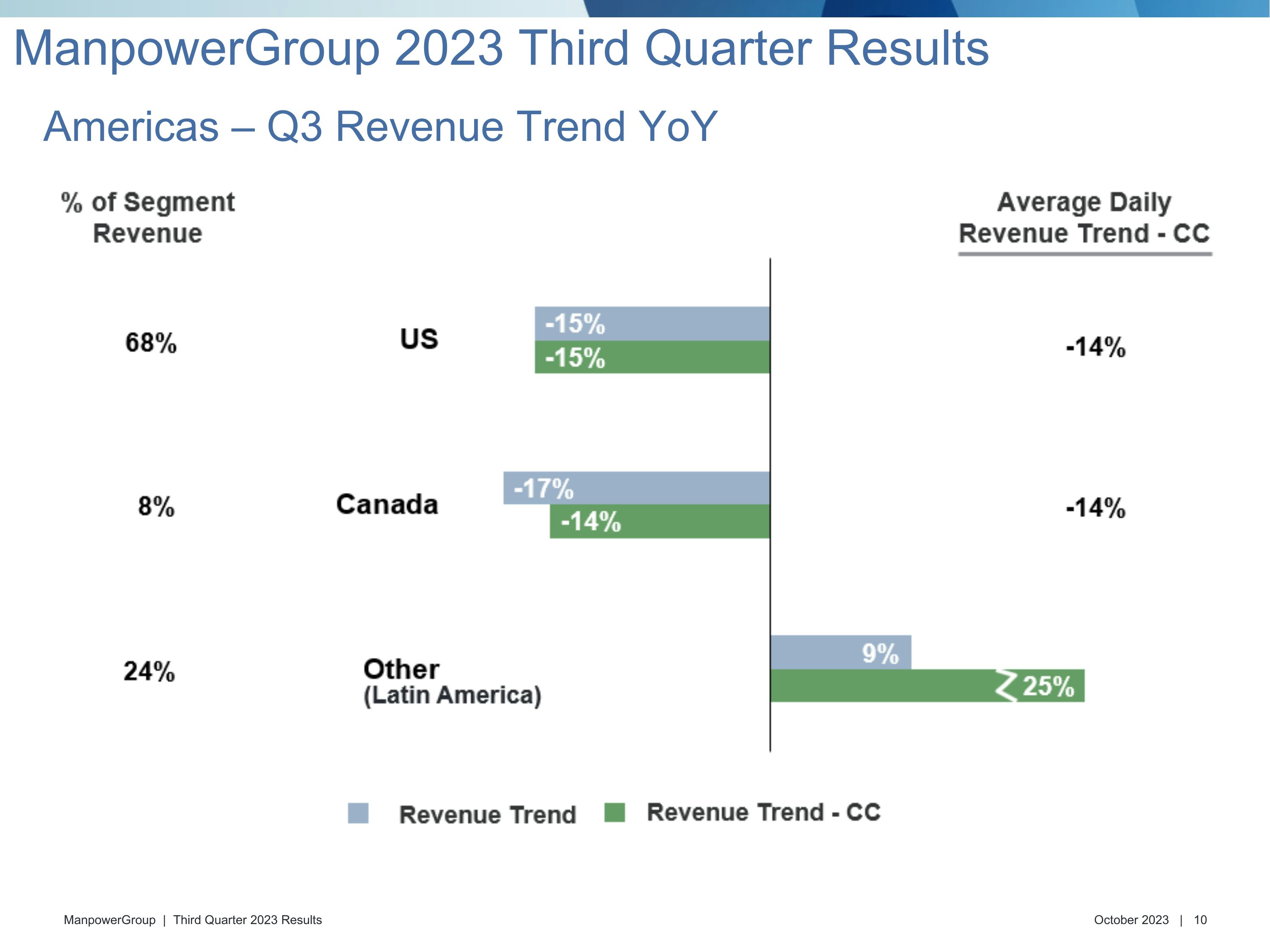

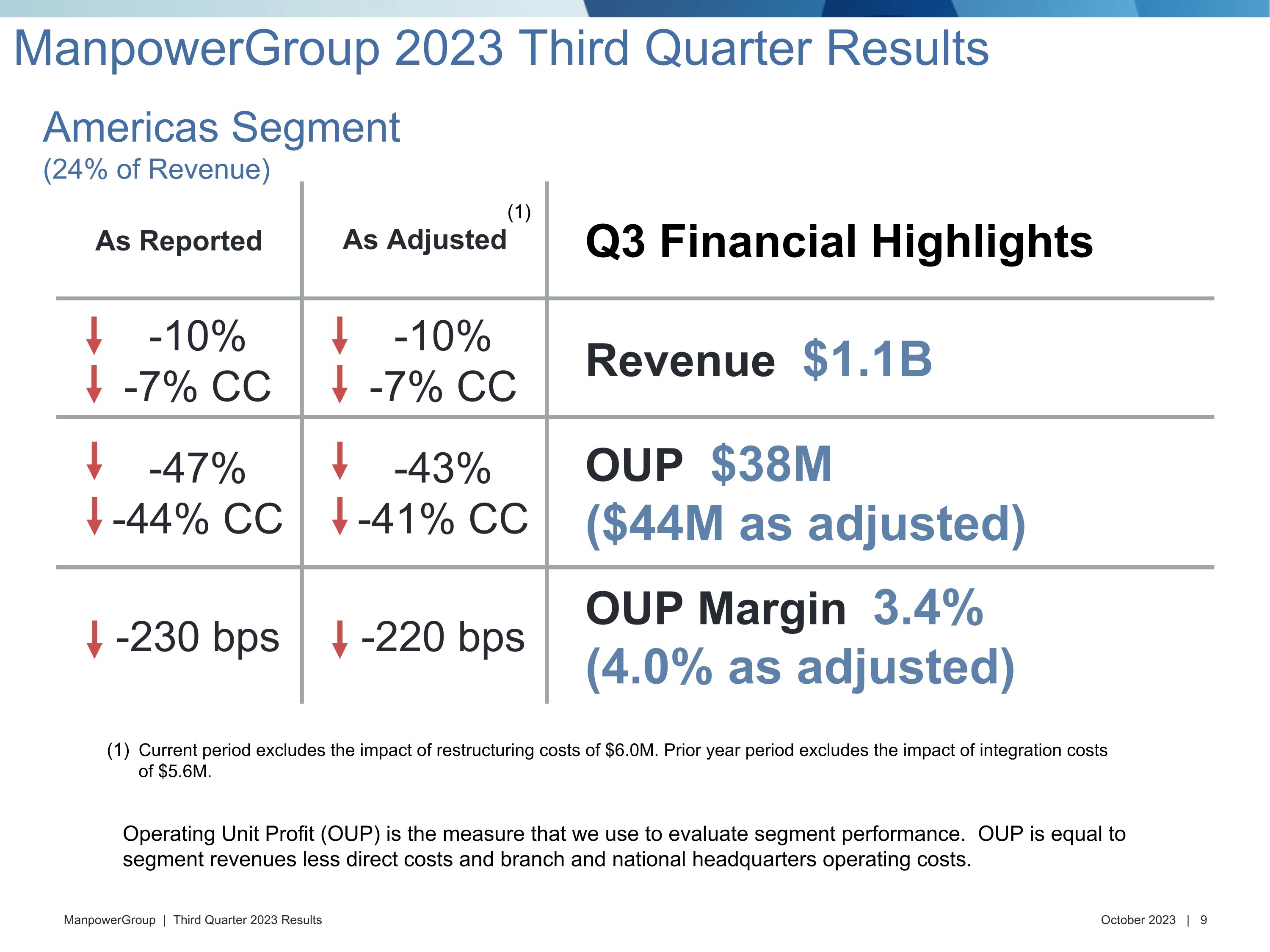

As Reported As Adjusted Q3 Financial Highlights -10% -7% CC -10% -7% CC Revenue $1.1B -47% -44% CC -43% -41% CC OUP $38M ($44M as adjusted) -230 bps -220 bps OUP Margin 3.4% (4.0% as adjusted) Operating Unit Profit (OUP) is the measure that we use to evaluate segment performance. OUP is equal to segment revenues less direct costs and branch and national headquarters operating costs. Current period excludes the impact of restructuring costs of $6.0M. Prior year period excludes the impact of integration costs of $5.6M. (1) Americas Segment�(24% of Revenue) ManpowerGroup 2023 Third Quarter Results

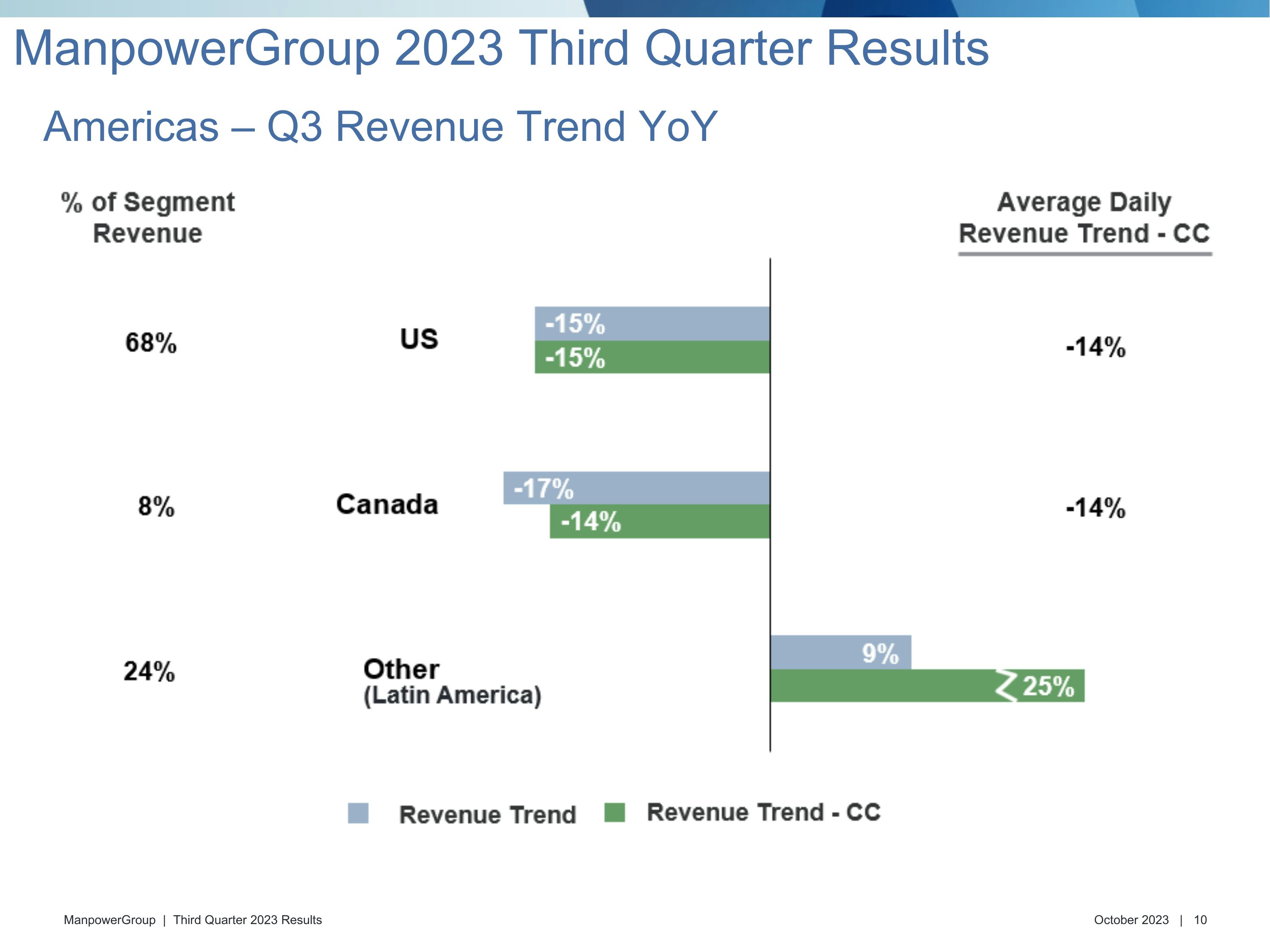

Americas – Q3 Revenue Trend YoY ManpowerGroup 2023 Third Quarter Results

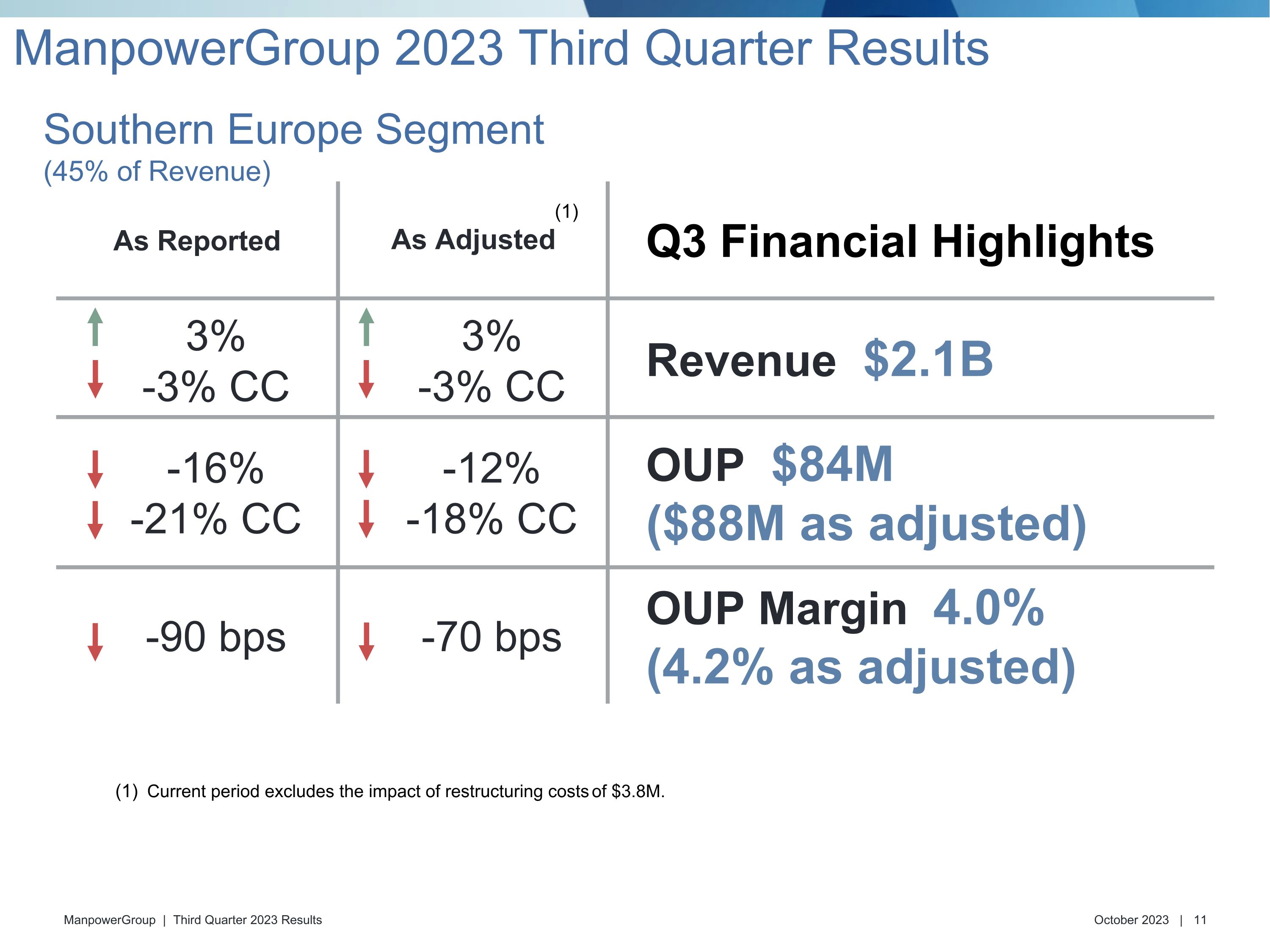

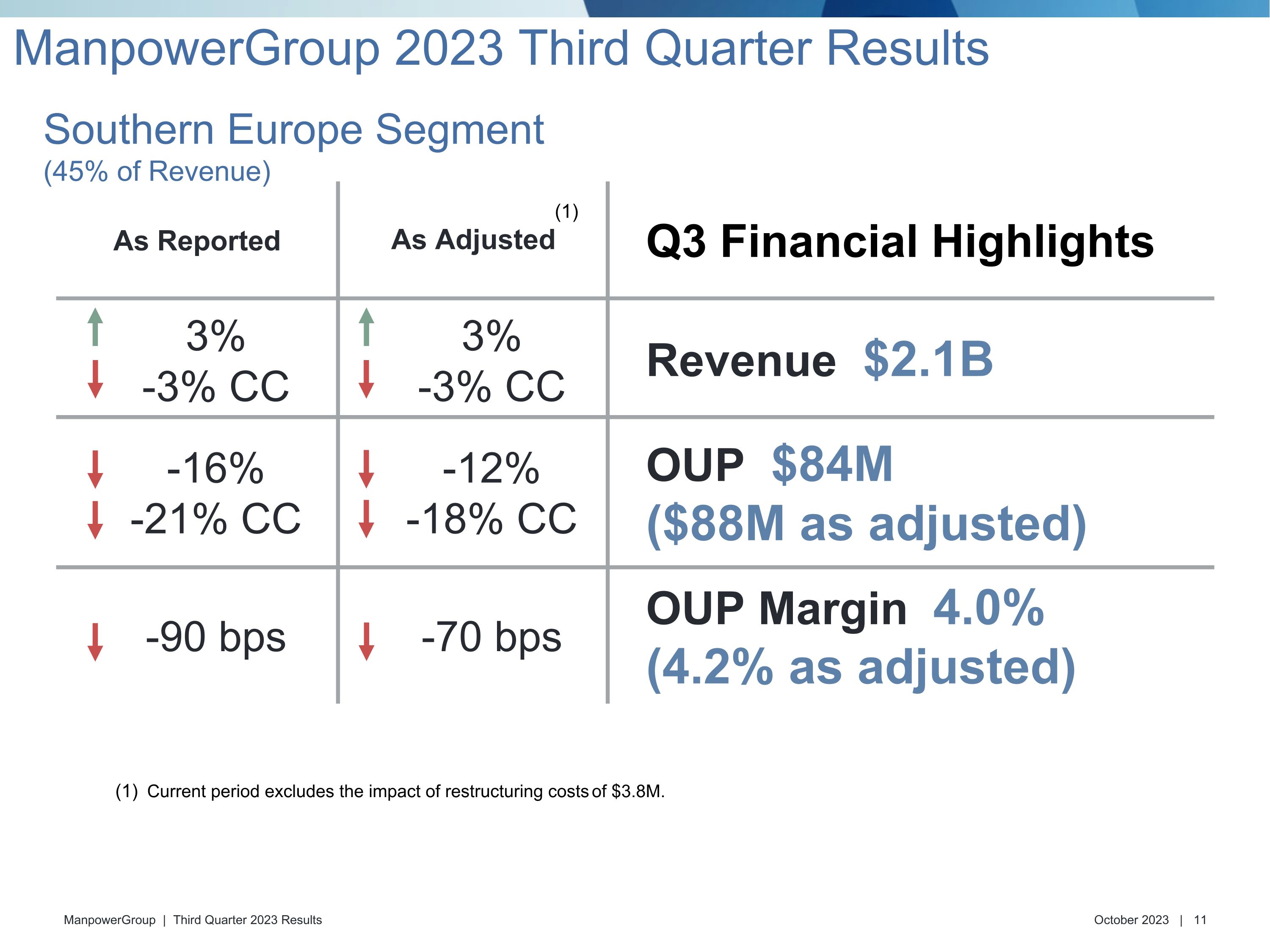

As Reported As Adjusted Q3 Financial Highlights 3% -3% CC 3% -3% CC Revenue $2.1B -16% -21% CC -12% -18% CC OUP $84M ($88M as adjusted) -90 bps -70 bps OUP Margin 4.0% (4.2% as adjusted) Southern Europe Segment�(45% of Revenue) Current period excludes the impact of restructuring costs of $3.8M. (1) ManpowerGroup 2023 Third Quarter Results

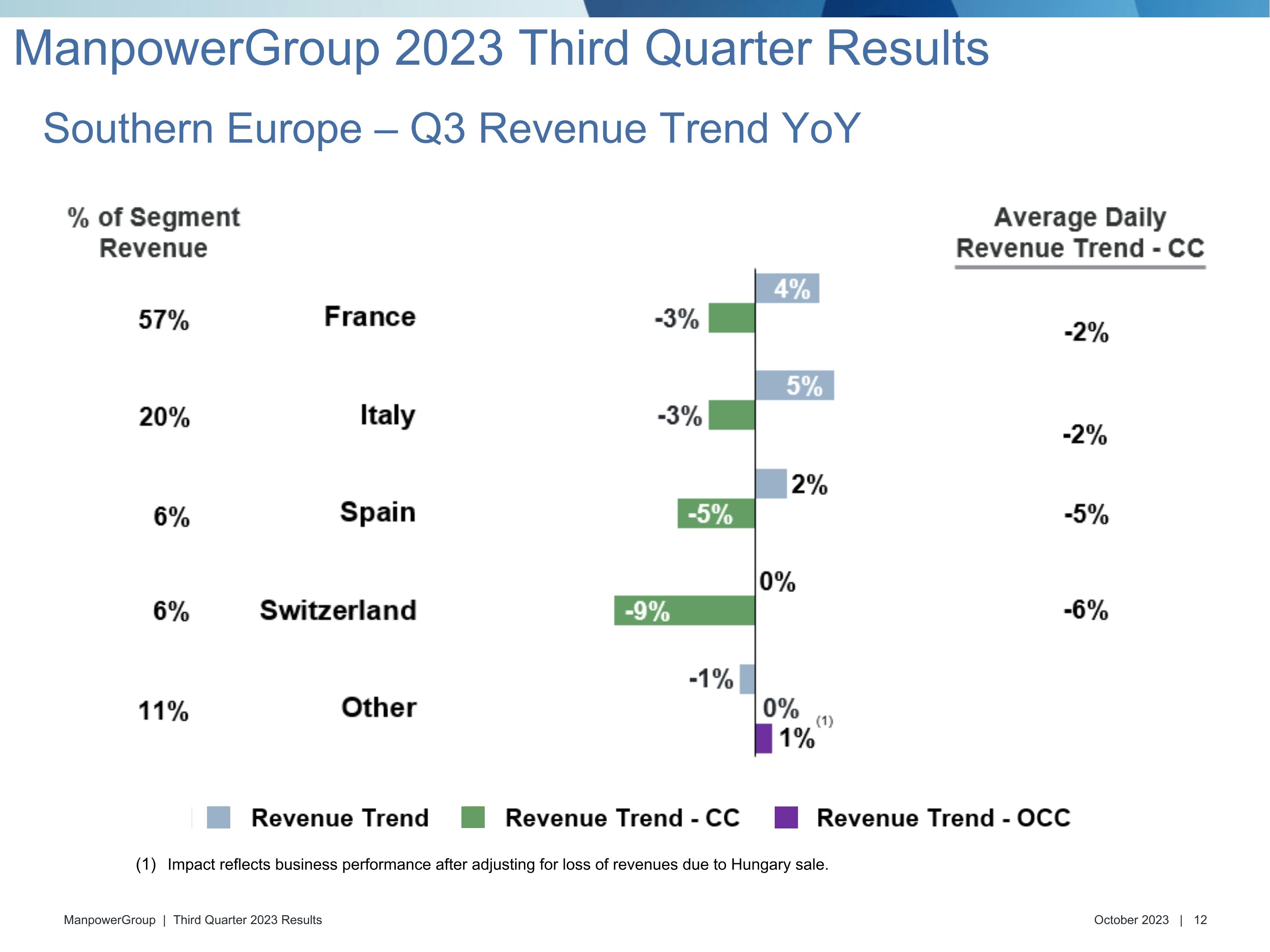

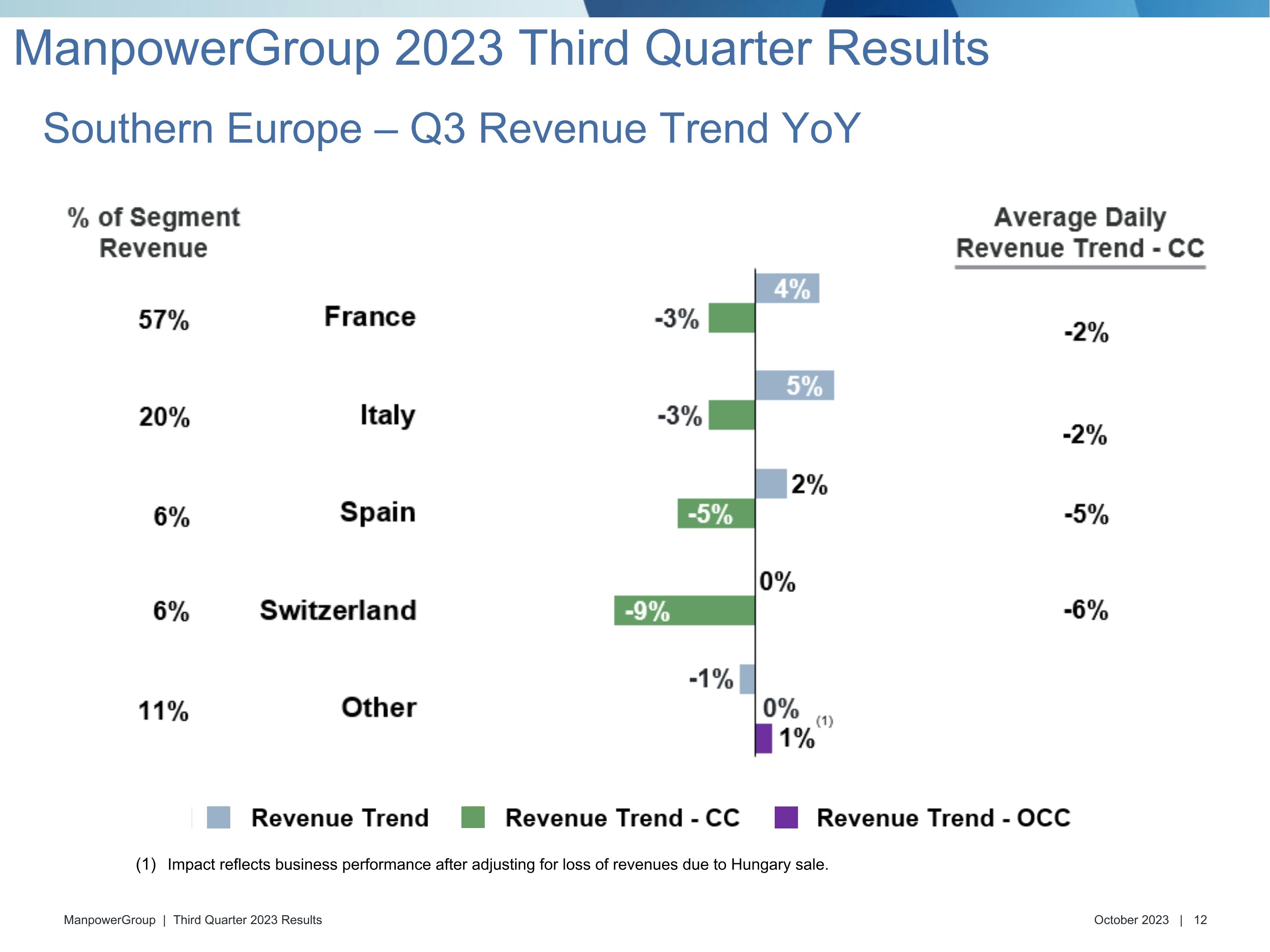

Impact reflects business performance after adjusting for loss of revenues due to Hungary sale. Southern Europe – Q3 Revenue Trend YoY ManpowerGroup 2023 Third Quarter Results

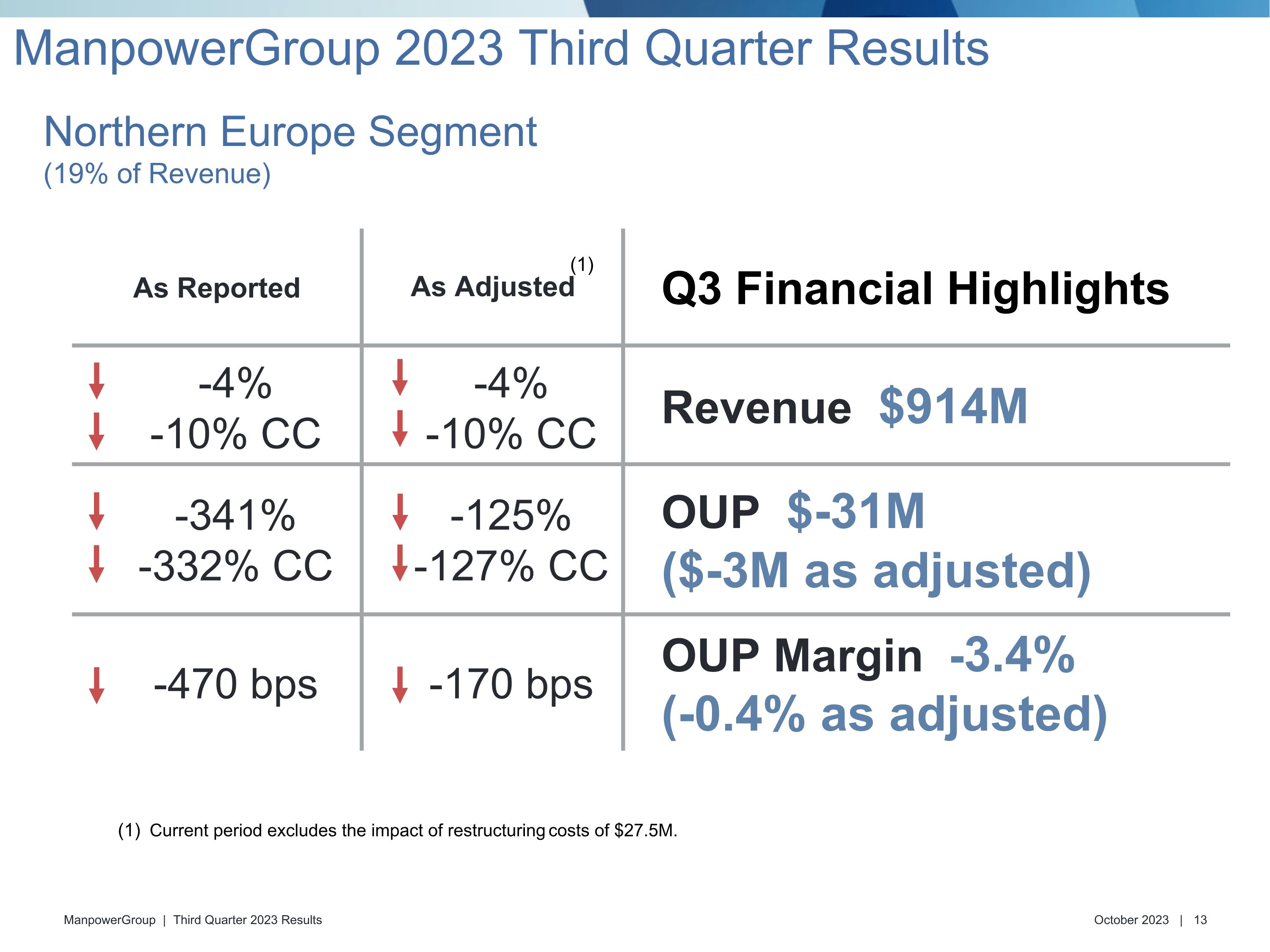

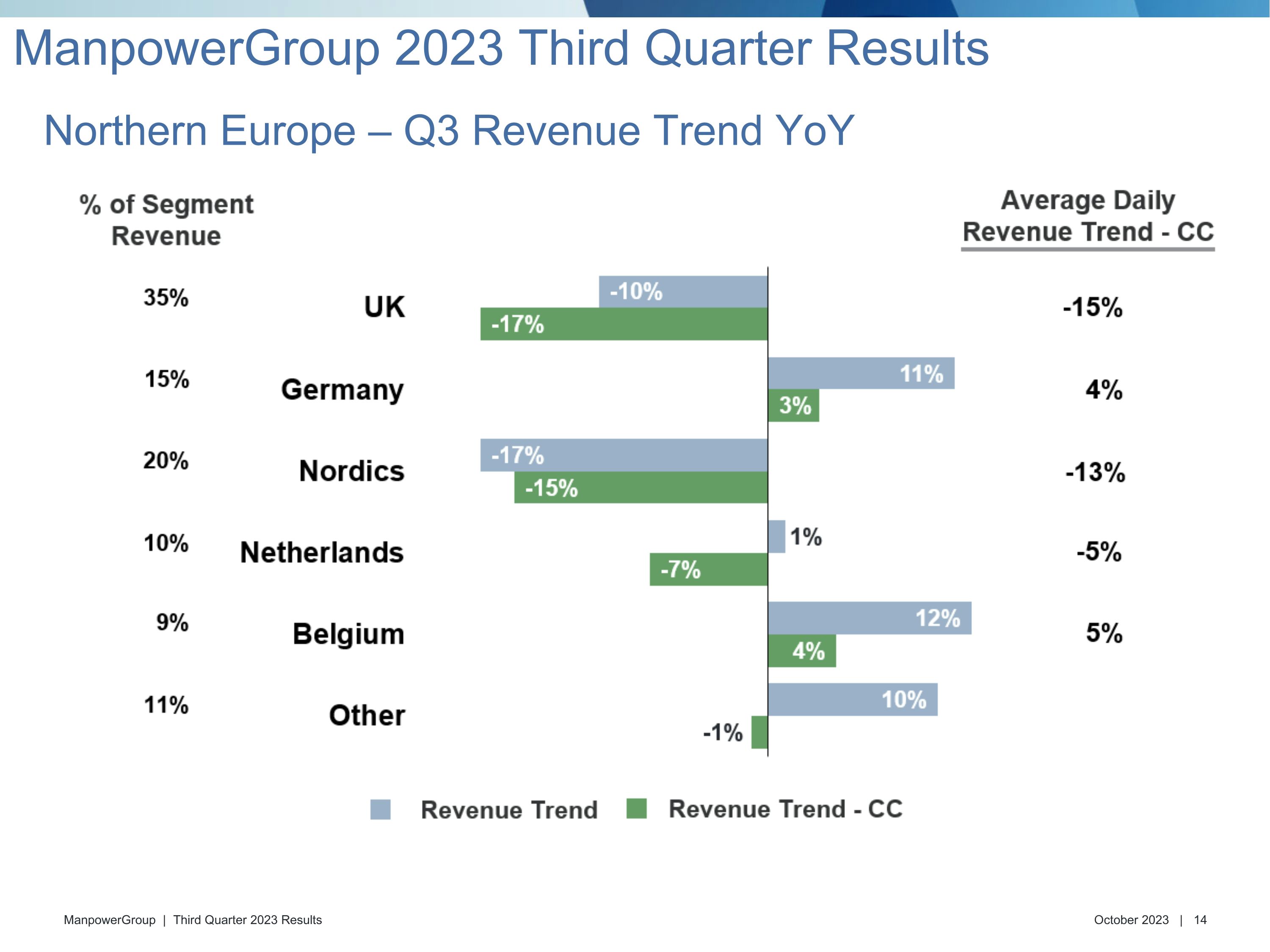

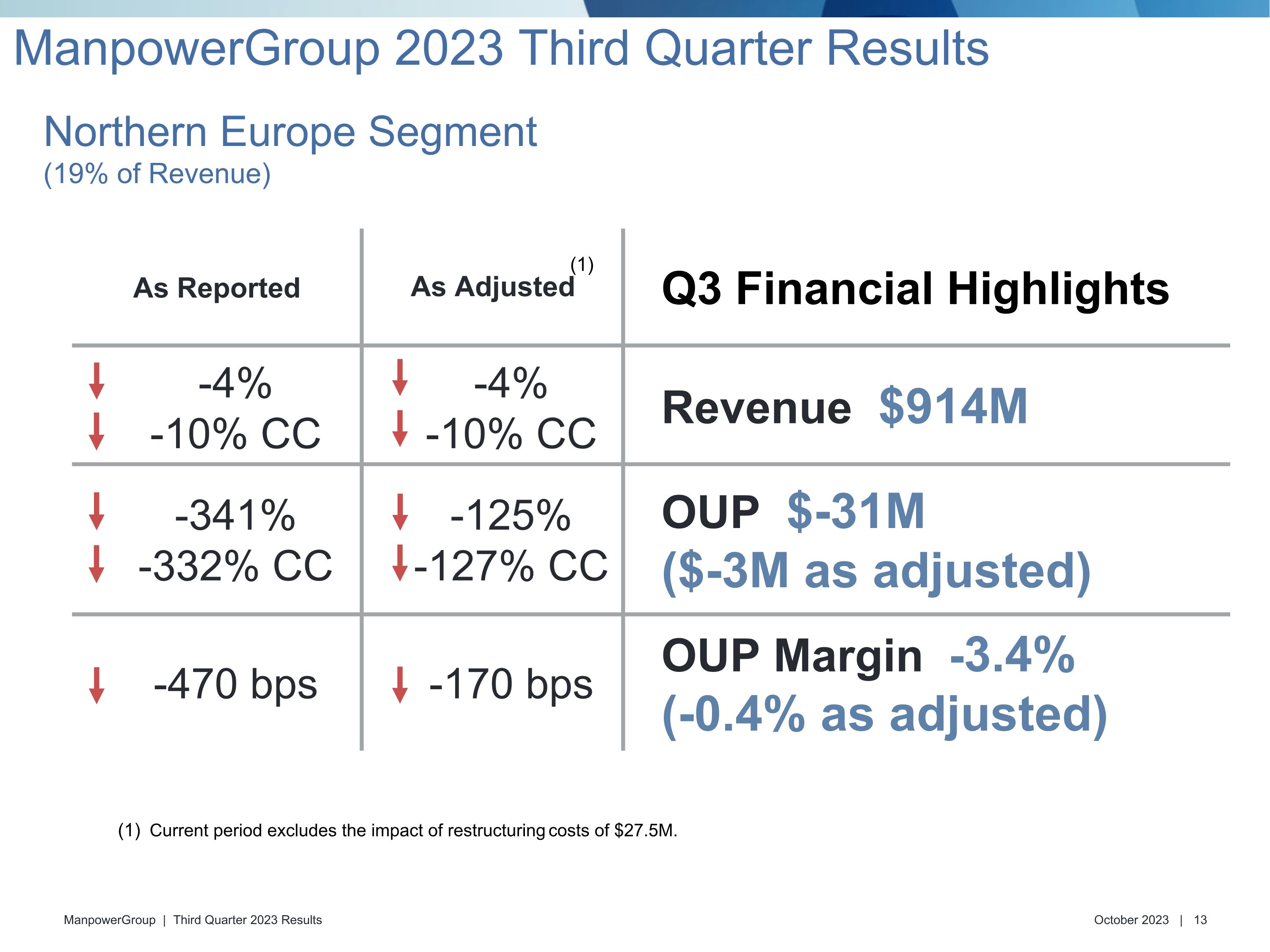

As Reported As Adjusted Q3 Financial Highlights -4% -10% CC -4% -10% CC Revenue $914M -341% -332% CC -125% -127% CC OUP $-31M ($-3M as adjusted) -470 bps -170 bps OUP Margin -3.4% (-0.4% as adjusted) Northern Europe Segment�(19% of Revenue) Current period excludes the impact of restructuring costs of $27.5M. ManpowerGroup 2023 Third Quarter Results (1)

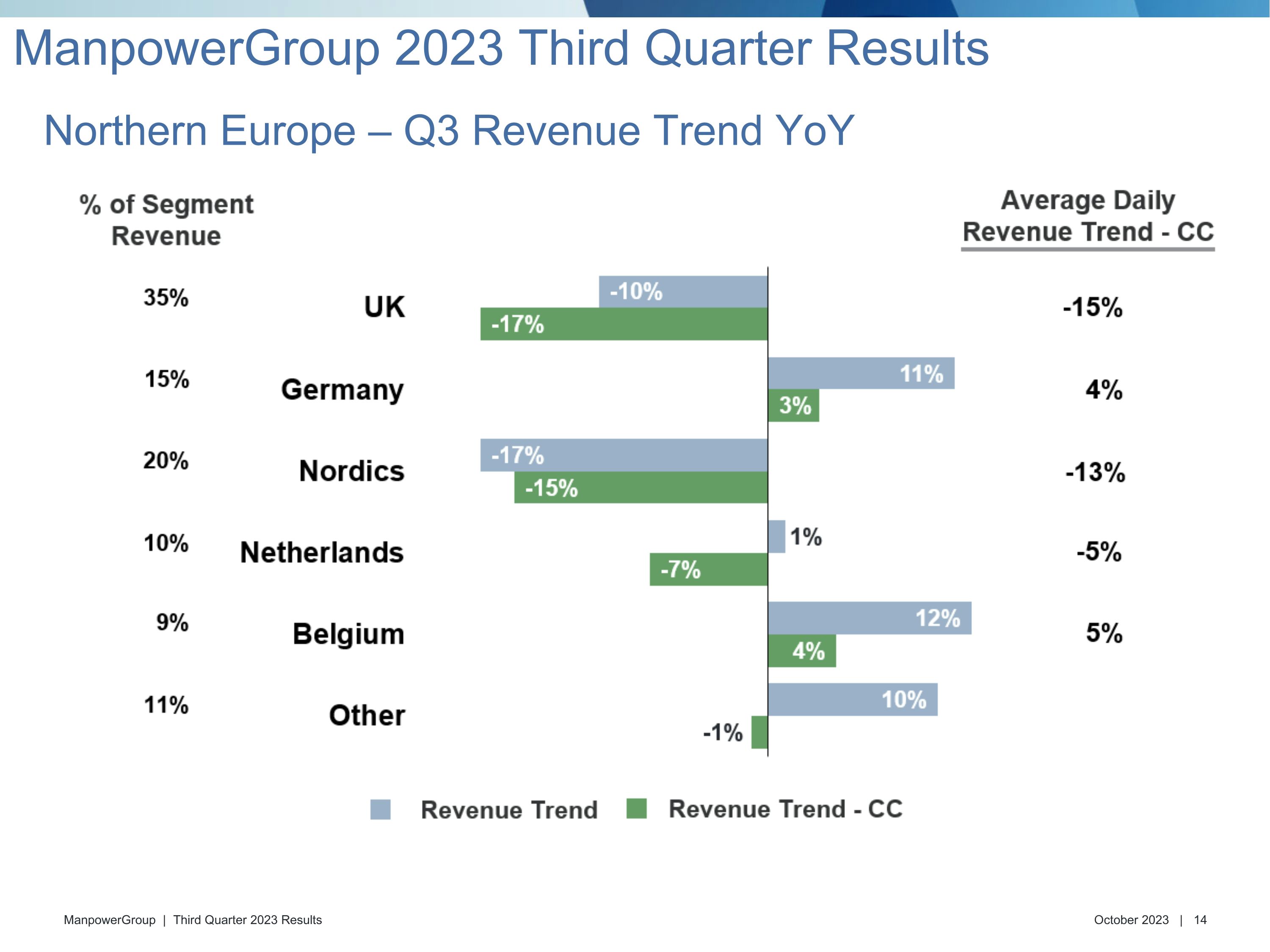

Northern Europe – Q3 Revenue Trend YoY ManpowerGroup 2023 Third Quarter Results

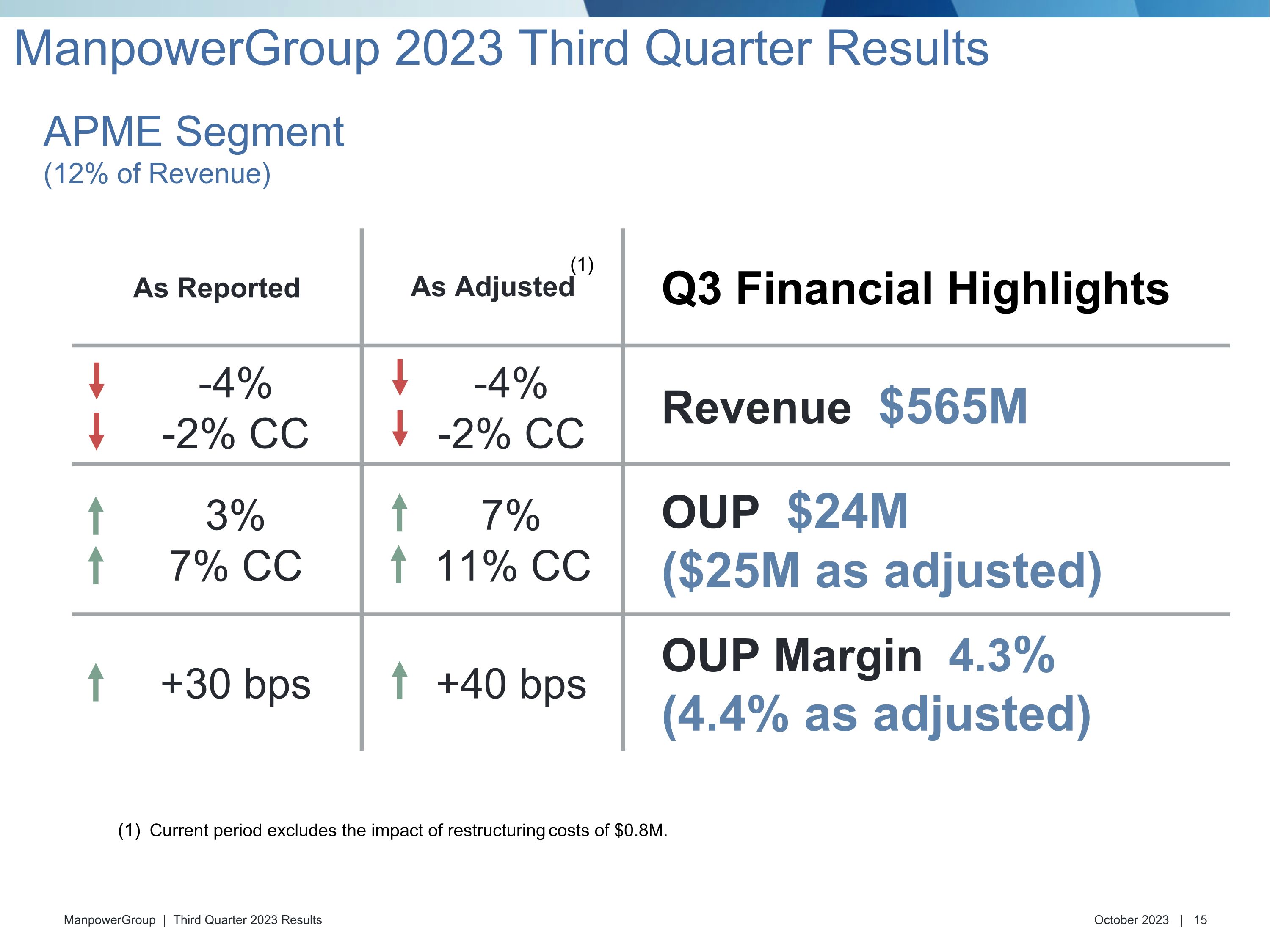

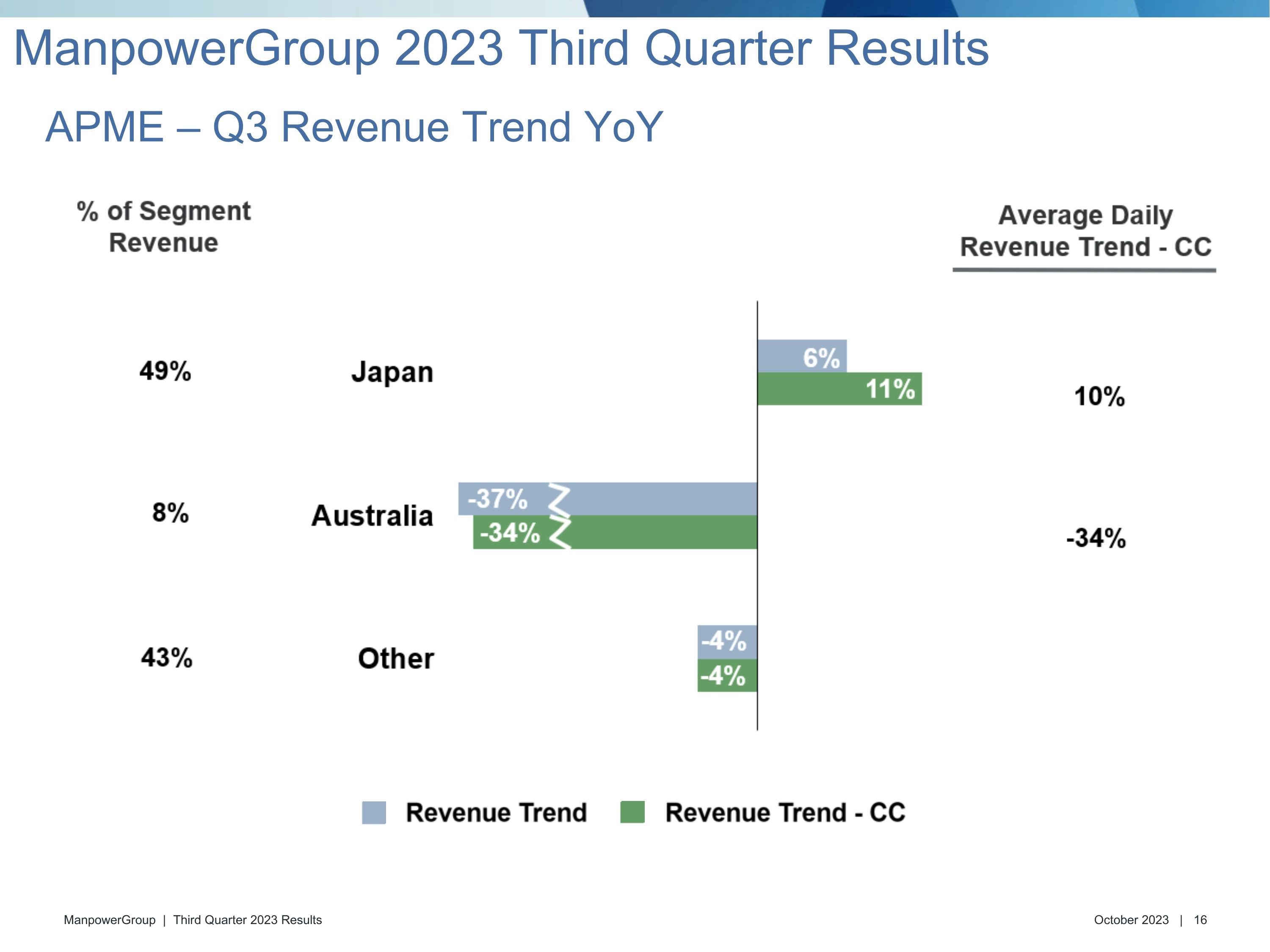

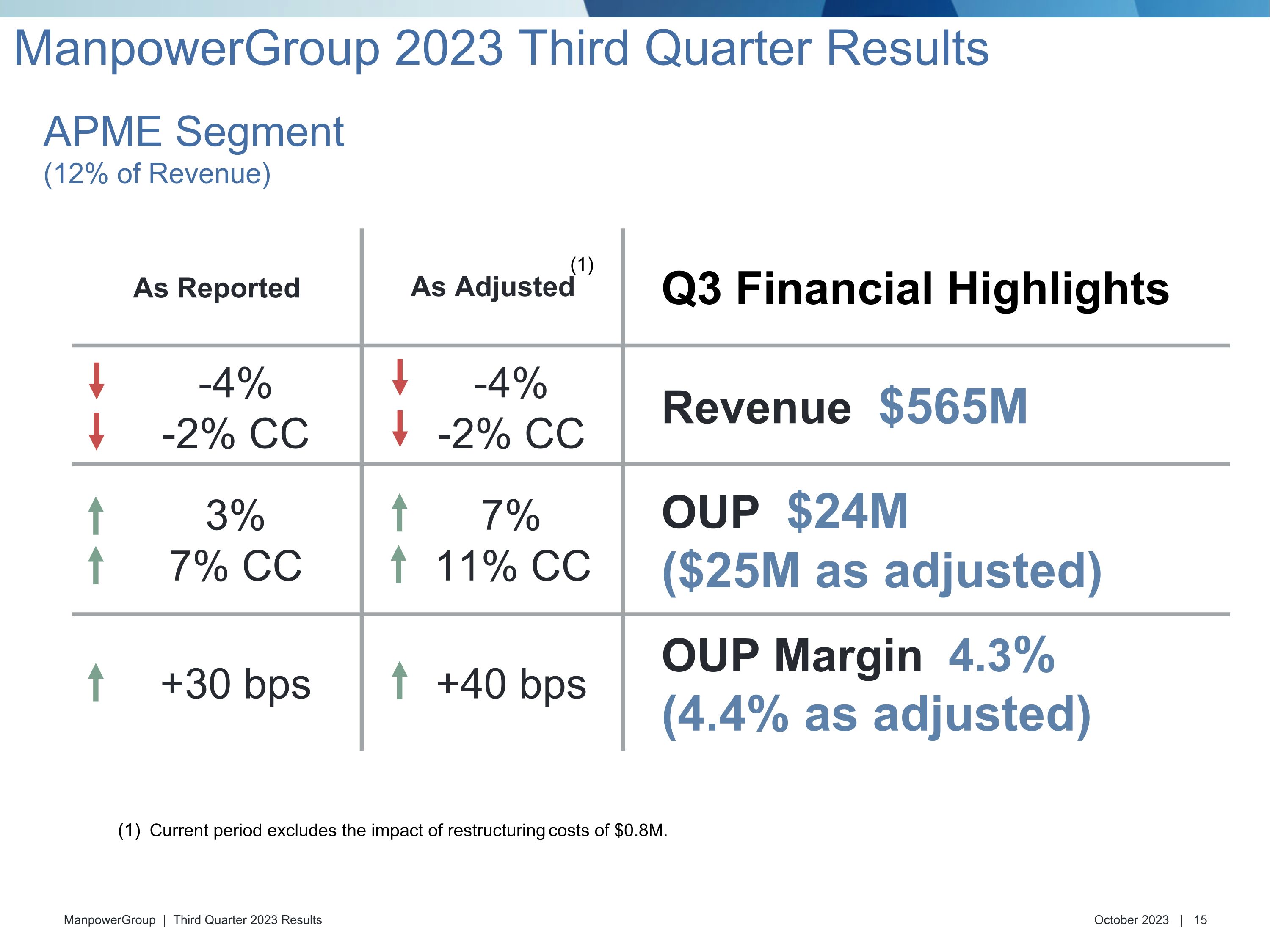

As Reported As Adjusted Q3 Financial Highlights -4% -2% CC -4% -2% CC Revenue $565M 3% 7% CC 7% 11% CC OUP $24M ($25M as adjusted) +30 bps +40 bps OUP Margin 4.3% (4.4% as adjusted) APME Segment�(12% of Revenue) Current period excludes the impact of restructuring costs of $0.8M. ManpowerGroup 2023 Third Quarter Results (1)

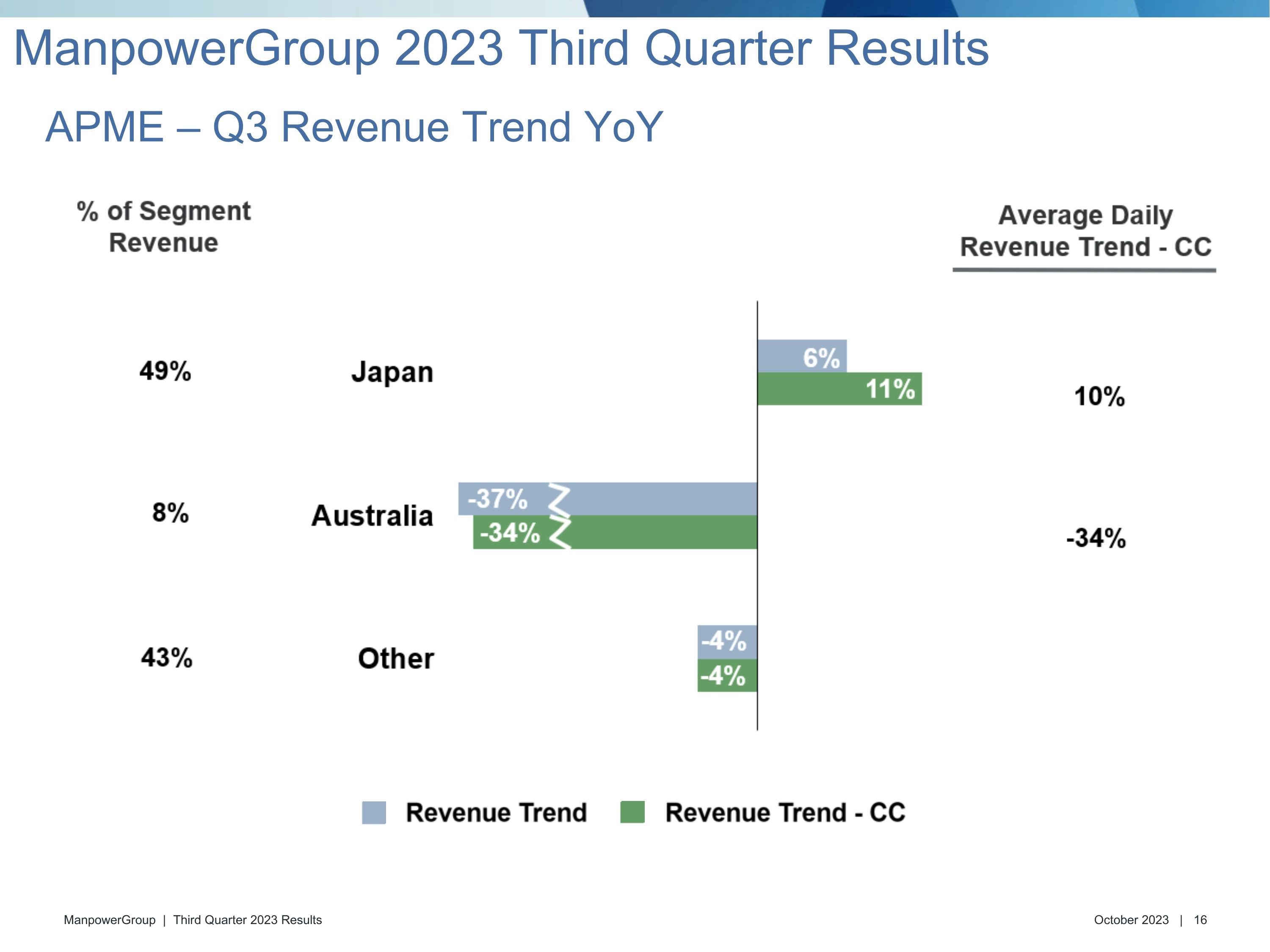

APME – Q3 Revenue Trend YoY ManpowerGroup 2023 Third Quarter Results

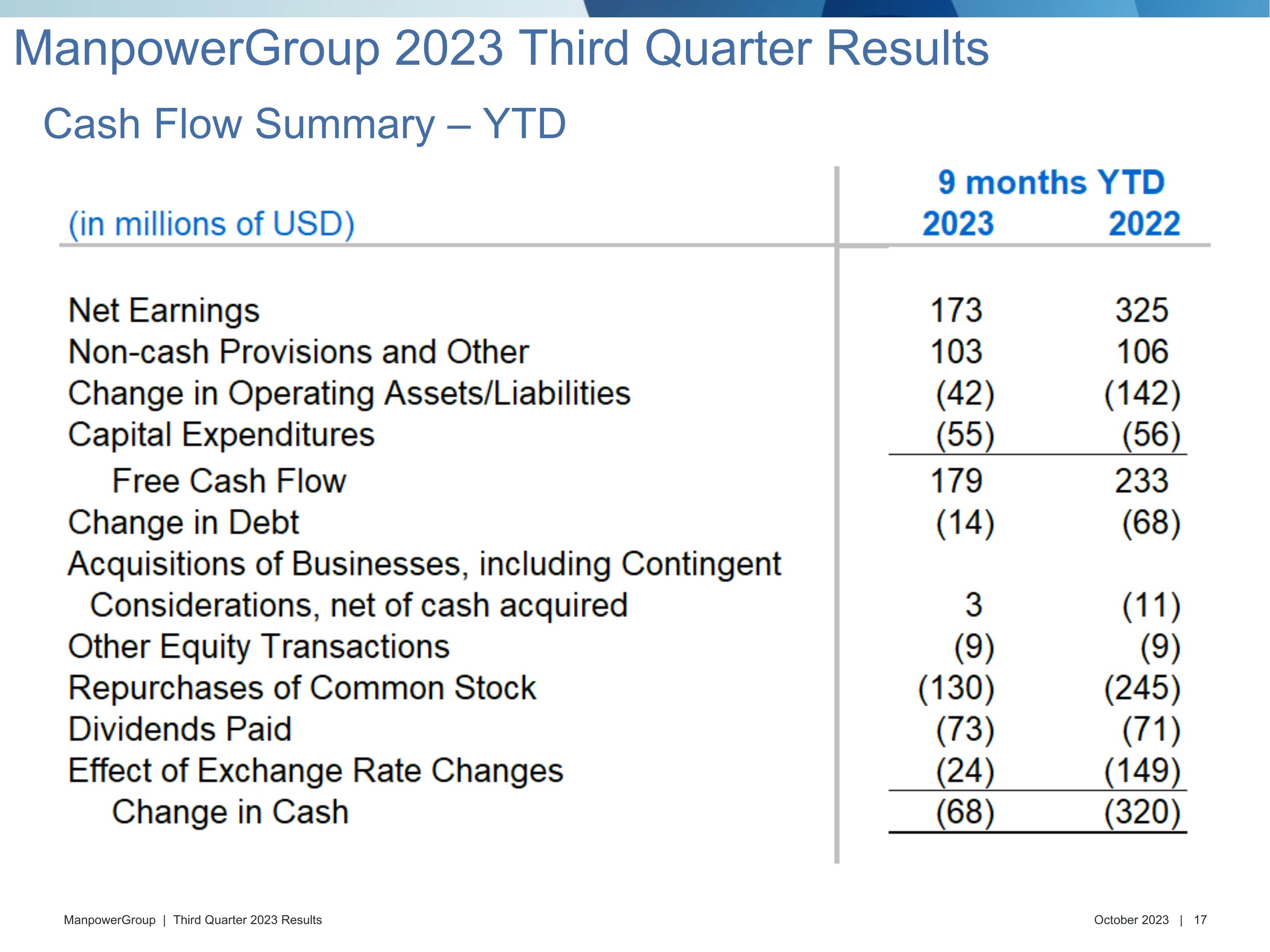

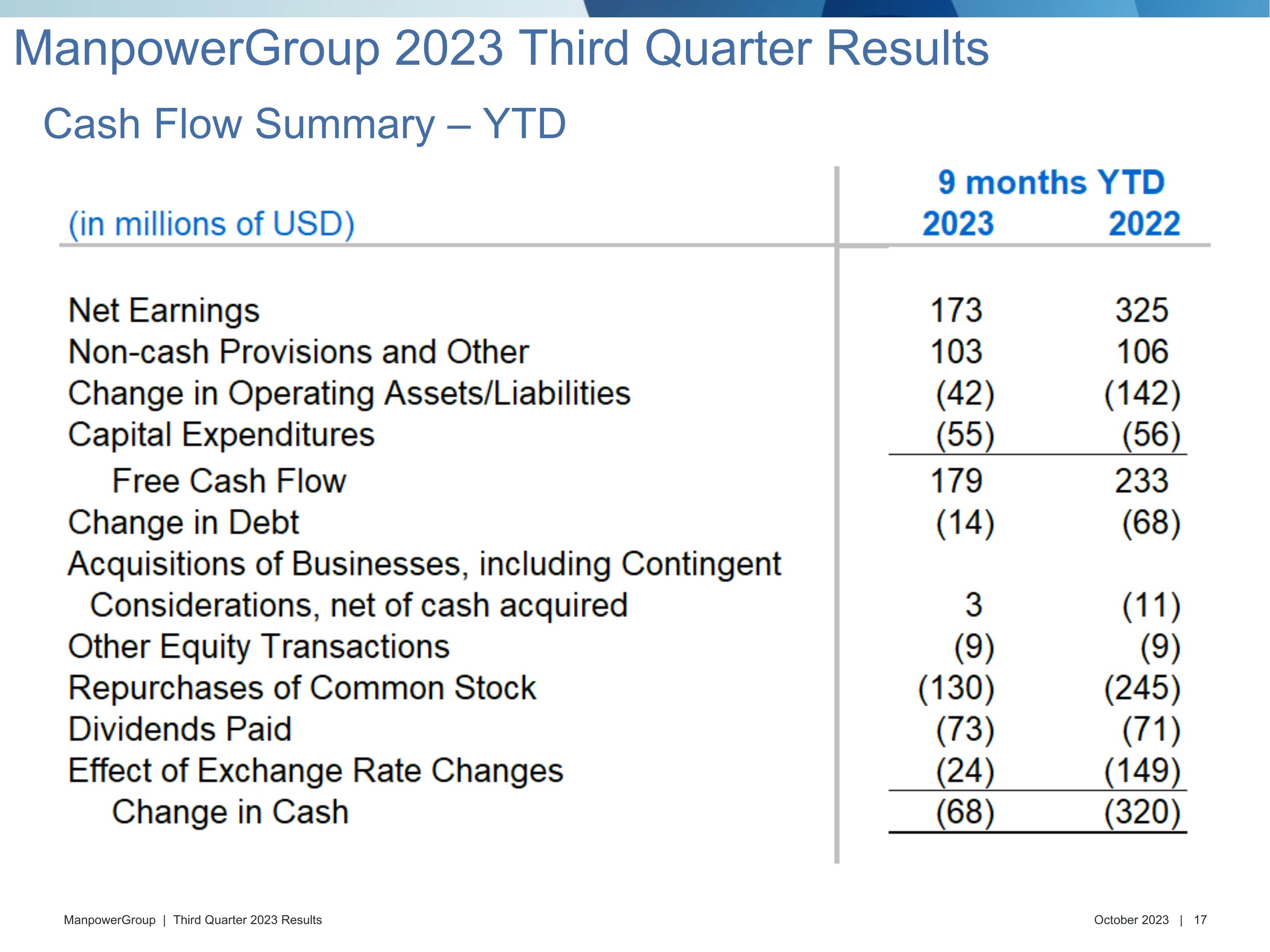

Cash Flow Summary – YTD ManpowerGroup 2023 Third Quarter Results

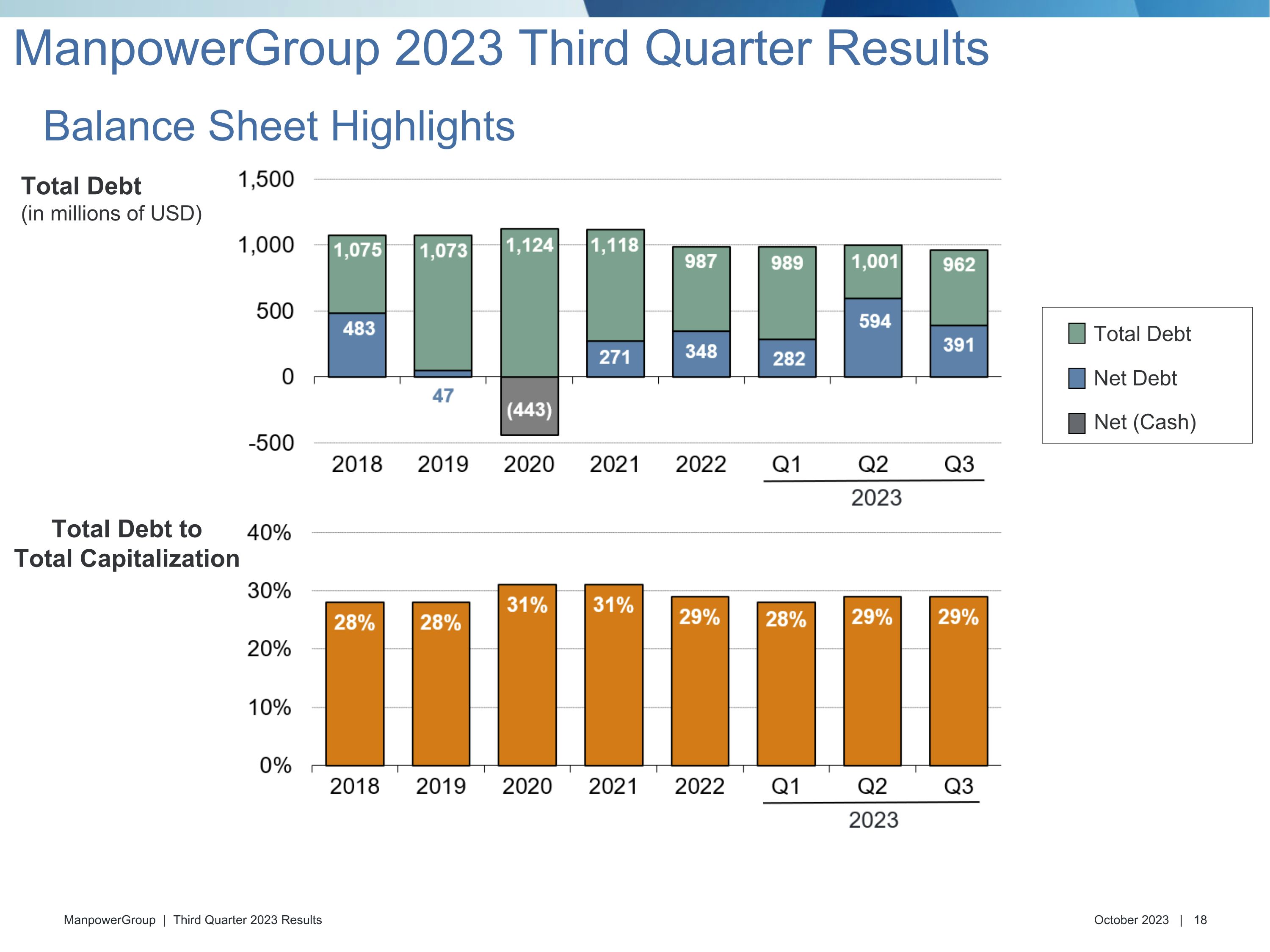

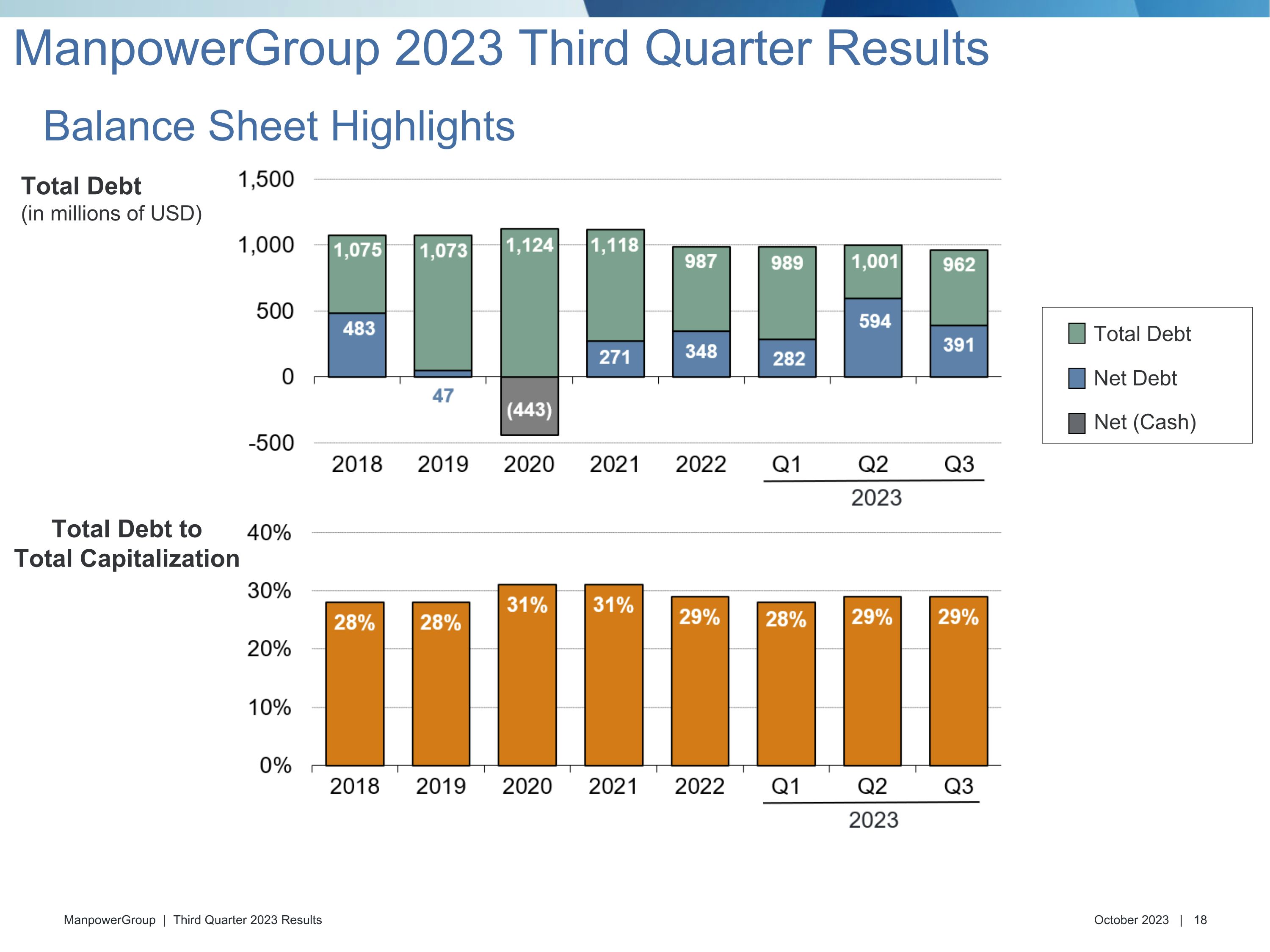

Total Debt (in millions of USD) Total Debt to Total Capitalization Total Debt Net Debt Net (Cash) Balance Sheet Highlights ManpowerGroup 2023 Third Quarter Results

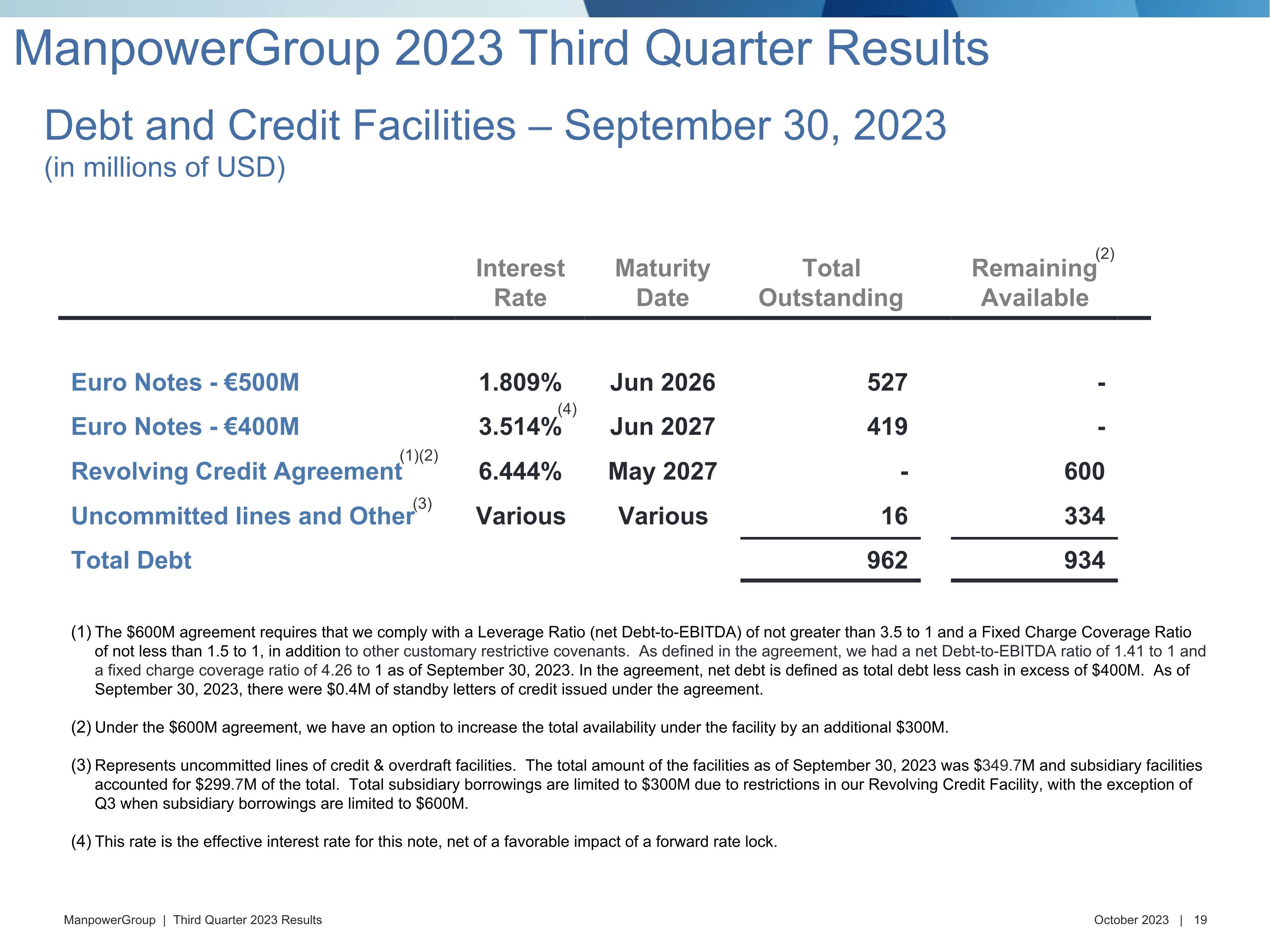

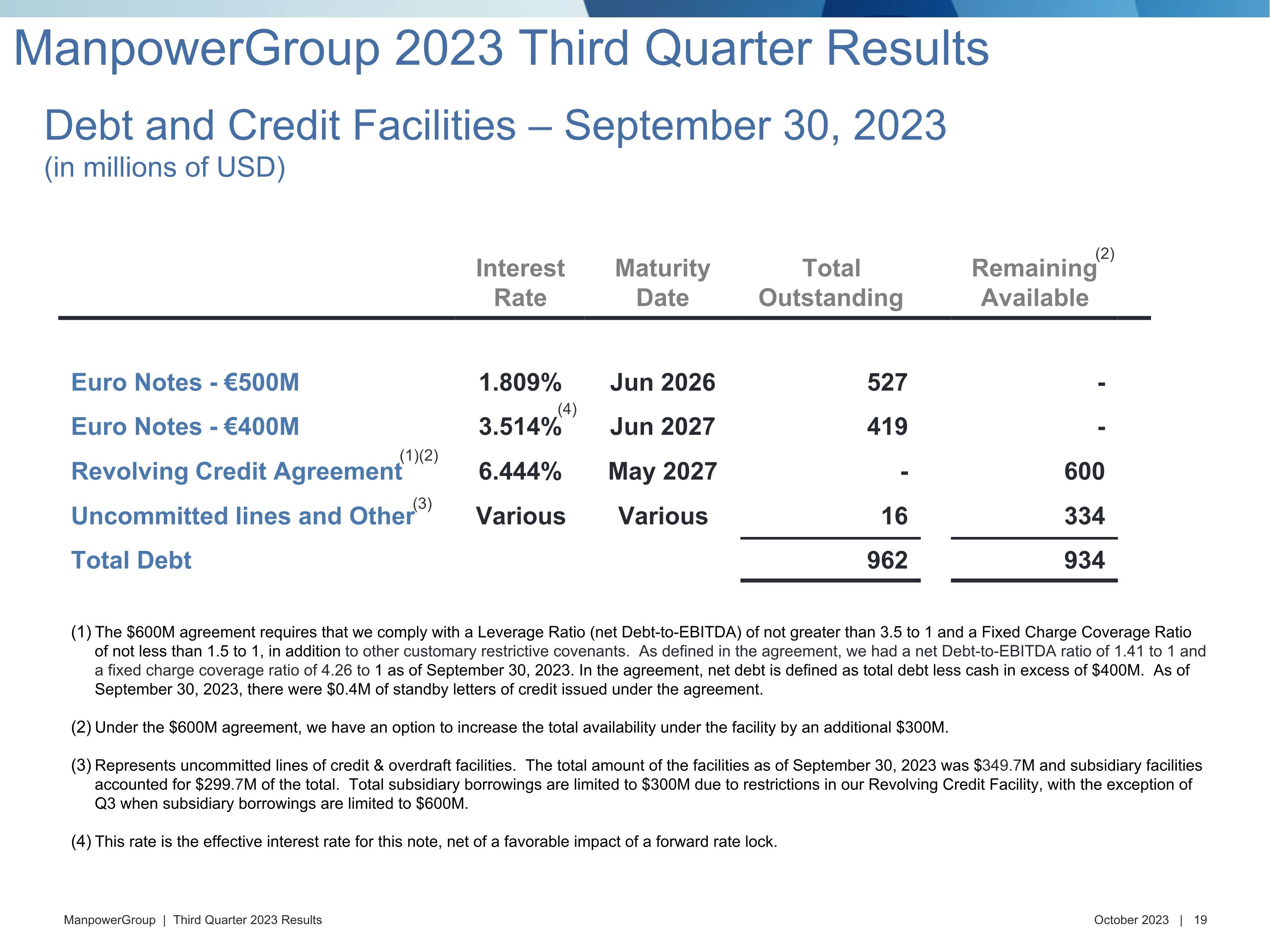

Interest Rate Maturity Date Total Outstanding Remaining Available Euro Notes - €500M 1.809% Jun 2026 527 - Euro Notes - €400M 3.514% Jun 2027 419 - Revolving Credit Agreement 6.444% May 2027 - 600 Uncommitted lines and Other Various Various 16 334 Total Debt 962 934 (3) (1)(2) (4) (2) Debt and Credit Facilities – September 30, 2023�(in millions of USD) The $600M agreement requires that we comply with a Leverage Ratio (net Debt-to-EBITDA) of not greater than 3.5 to 1 and a Fixed Charge Coverage Ratio of not less than 1.5 to 1, in addition to other customary restrictive covenants. As defined in the agreement, we had a net Debt-to-EBITDA ratio of 1.41 to 1 and a fixed charge coverage ratio of 4.26 to 1 as of September 30, 2023. In the agreement, net debt is defined as total debt less cash in excess of $400M. As of September 30, 2023, there were $0.4M of standby letters of credit issued under the agreement. Under the $600M agreement, we have an option to increase the total availability under the facility by an additional $300M. Represents uncommitted lines of credit & overdraft facilities. The total amount of the facilities as of September 30, 2023 was $349.7M and subsidiary facilities accounted for $299.7M of the total. Total subsidiary borrowings are limited to $300M due to restrictions in our Revolving Credit Facility, with the exception of Q3 when subsidiary borrowings are limited to $600M. This rate is the effective interest rate for this note, net of a favorable impact of a forward rate lock. ManpowerGroup 2023 Third Quarter Results

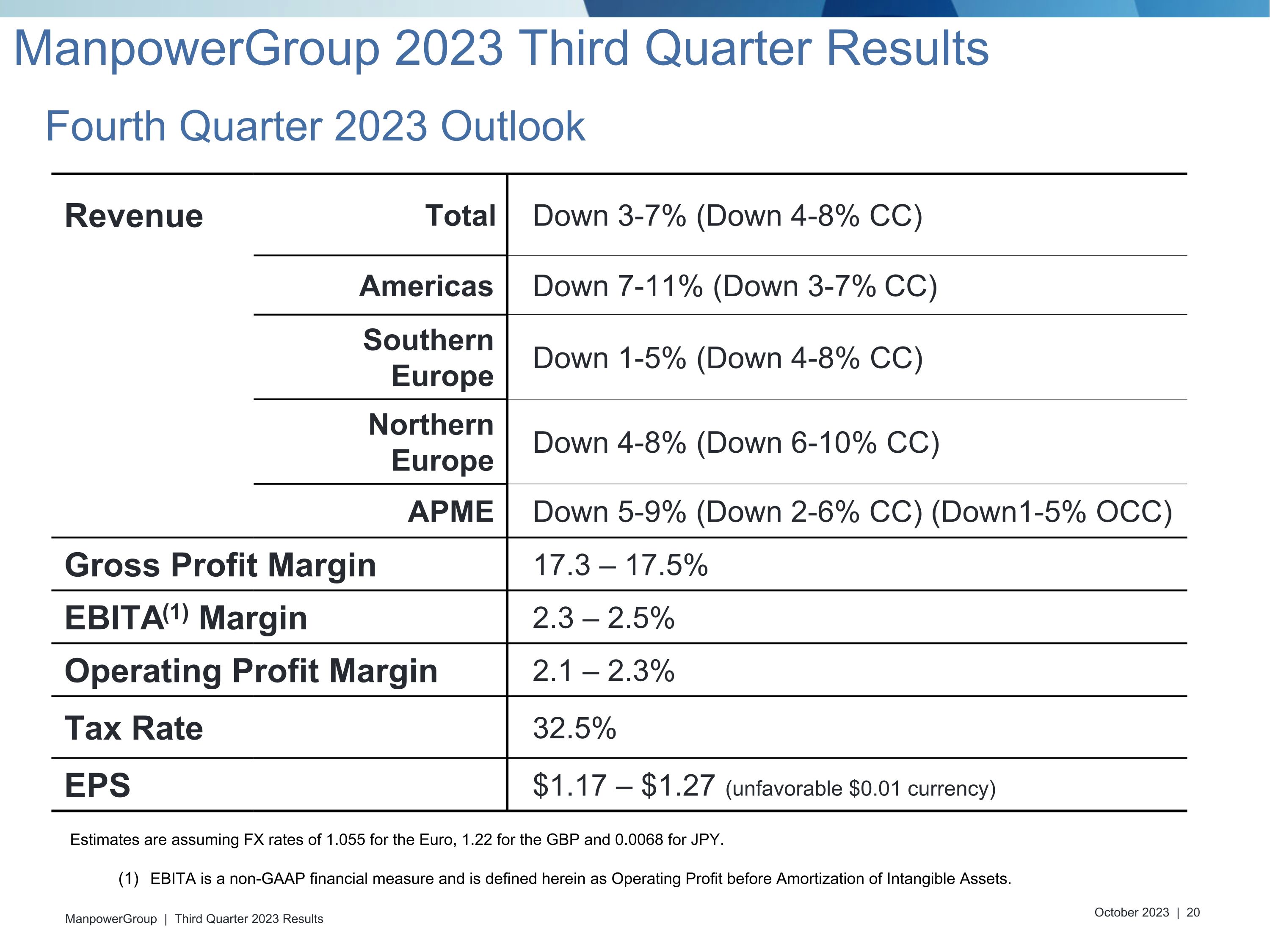

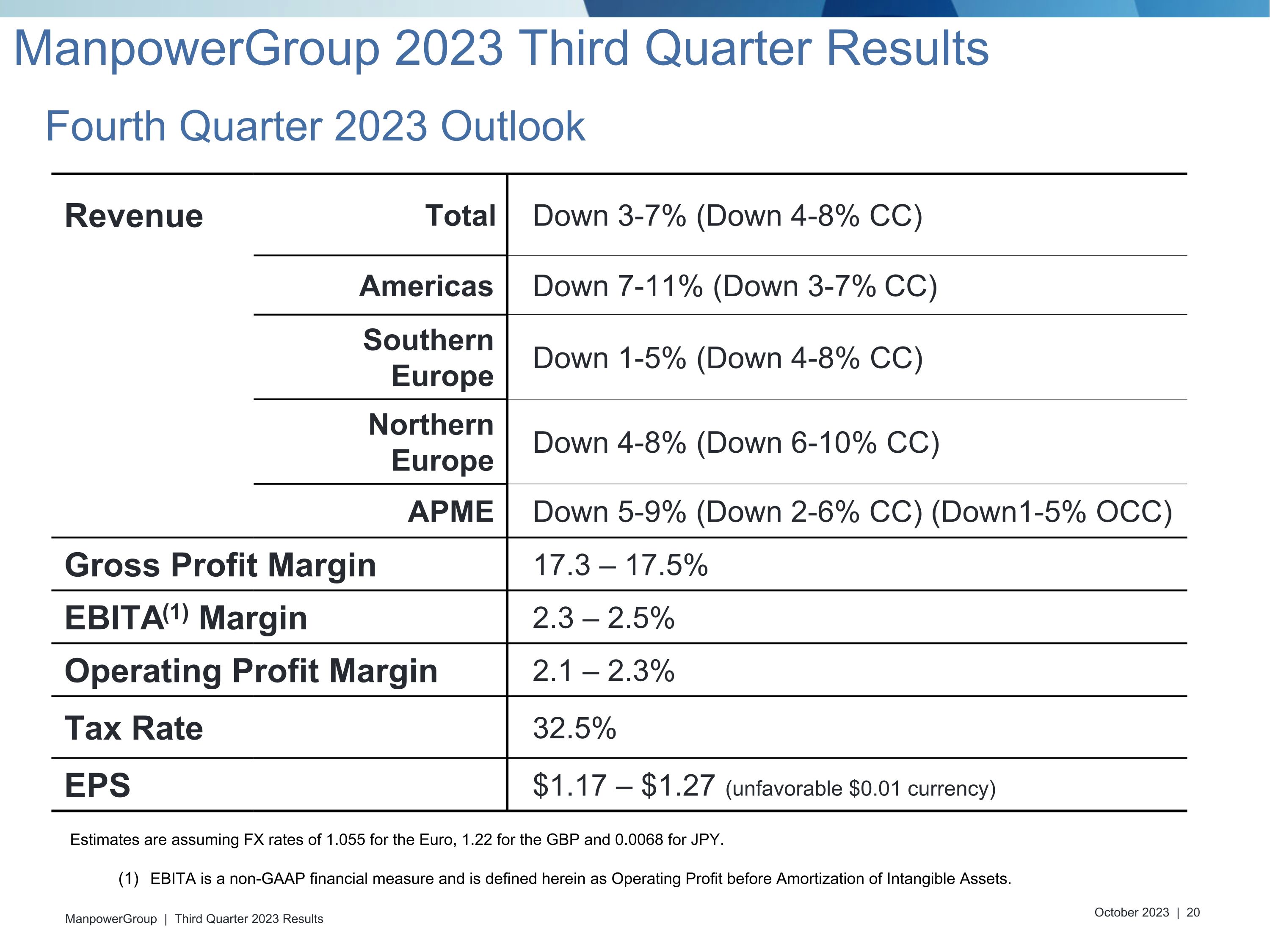

EBITA is a non-GAAP financial measure and is defined herein as Operating Profit before Amortization of Intangible Assets. Estimates are assuming FX rates of 1.055 for the Euro, 1.22 for the GBP and 0.0068 for JPY. Revenue Total Down 3-7% (Down 4-8% CC) Americas Down 7-11% (Down 3-7% CC) Southern Europe Down 1-5% (Down 4-8% CC) Northern Europe Down 4-8% (Down 6-10% CC) APME Down 5-9% (Down 2-6% CC) (Down1-5% OCC) Gross Profit Margin 17.3 – 17.5% EBITA(1) Margin 2.3 – 2.5% Operating Profit Margin 2.1 – 2.3% Tax Rate 32.5% EPS $1.17 – $1.27 (unfavorable $0.01 currency) Fourth Quarter 2023 Outlook ManpowerGroup 2023 Third Quarter Results

A challenging operating environment in North America and Europe contributed to revenue declines across brands during the quarter. This was partially offset by strength in APME and Latin America. Gross profit margin of 17.6% reflects strong staffing margin trends. We have taken decisive actions to simplify our operations and deliver on our strategy serving to preserve profitability in the current environment while progressing longer term margin objectives. Everest Group has named our Experis U.S. business as a Leader and Star Performer in 2023. Key Take Aways ManpowerGroup 2023 Third Quarter Results

Building Candidate Loyalty with huManpower

Appendix

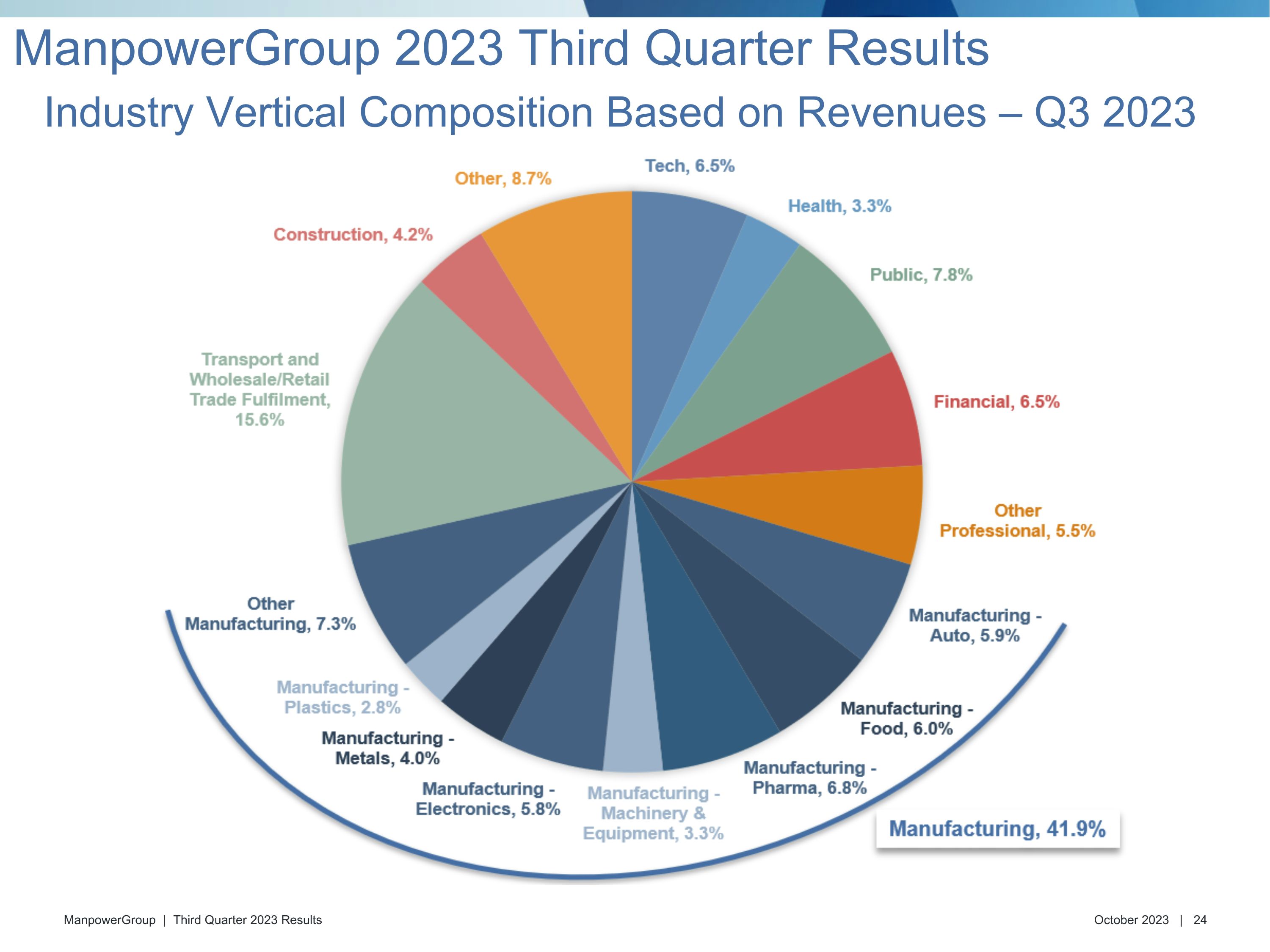

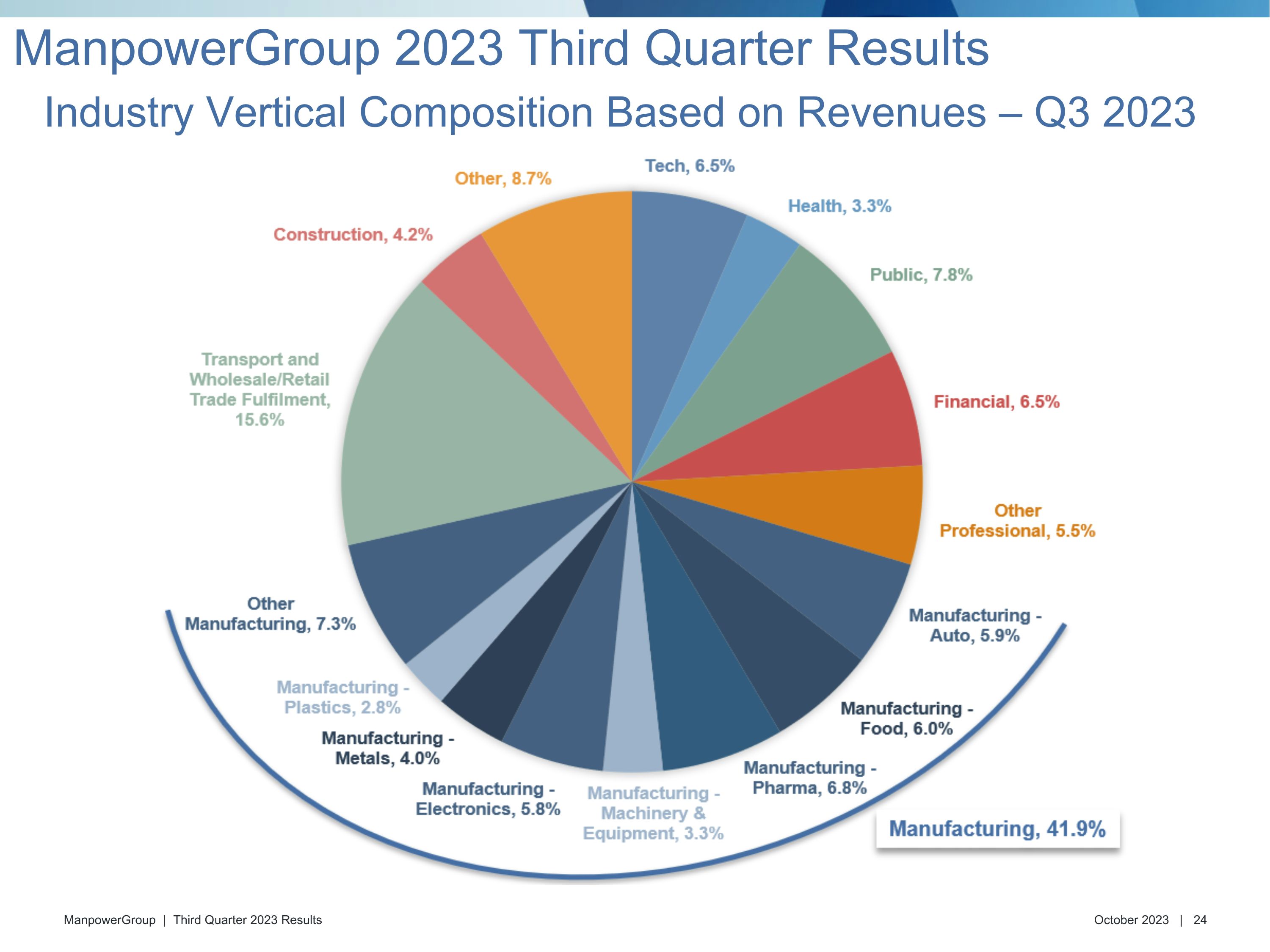

Industry Vertical Composition Based on Revenues – Q3 2023 ManpowerGroup 2023 Third Quarter Results