Exhibit 99.2

Manpower Inc.

2005 1st Quarter Results

April 19, 2005

Forward Looking Statement:

This presentation includes forward-looking statements which are subject to risks and uncertainties. Actual results might differ materially from those projected in the forward-looking statements. Forward-looking statements can be identified by words such as “expect,” “plan,” “may,” “will,” and similar expressions. Additional information concerning factors that could cause actual results to materially differ from those in the forward-looking statements is contained in the Company’s Annual Report on Form 10-K dated December 31, 2004, which information is incorporated herein by reference, and such other factors as may be described from time to time in the Company’s SEC filings.

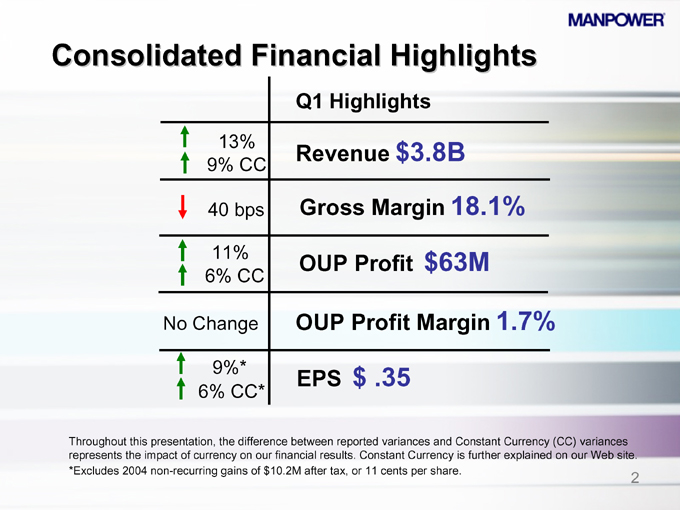

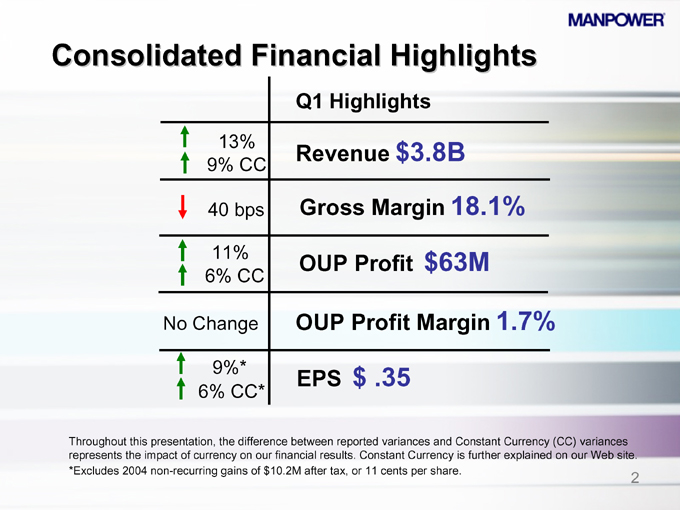

Consolidated Financial Highlights

Q1 Highlights

13% 9% CC Revenue $3.8B

40 bps Gross Margin 18.1%

11% 6% CC OUP Profit $63M

No Change OUP Profit Margin 1.7%

9%* 6% CC* EPS $ .35

Throughout this presentation, the difference between reported variances and Constant Currency (CC) variances represents the impact of currency on our financial results. Constant Currency is further explained on our Web site. *Excludes 2004 non-recurring gains of $10.2M after tax, or 11 cents per share.

2

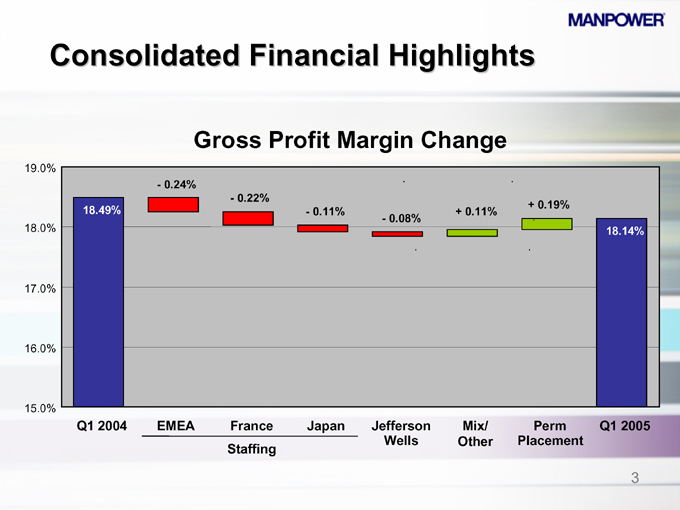

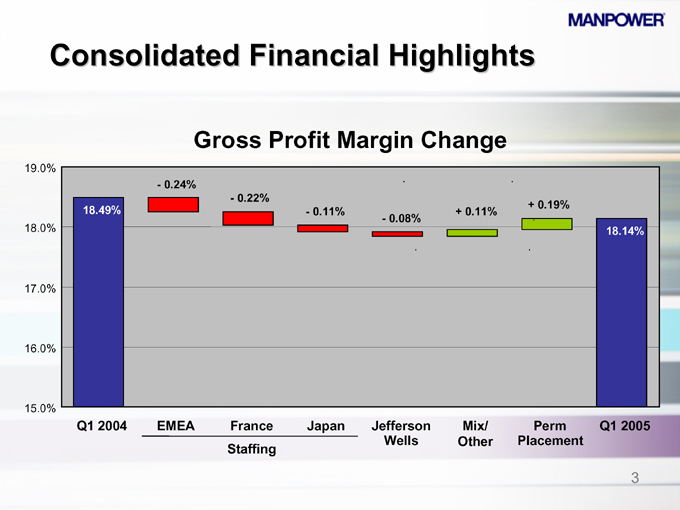

Consolidated Financial Highlights

Gross Profit Margin Change

19.0% 18.0% 17.0% 16.0% 15.0%

18.49%

- 0.24%

- 0.22%

- 0.11%

- 0.08%

+ 0.11%

+ 0.19%

18.14%

Q1 2004 EMEA France Japan Jefferson Mix/ Perm Q1 2005 Wells Other Placement Staffing

3

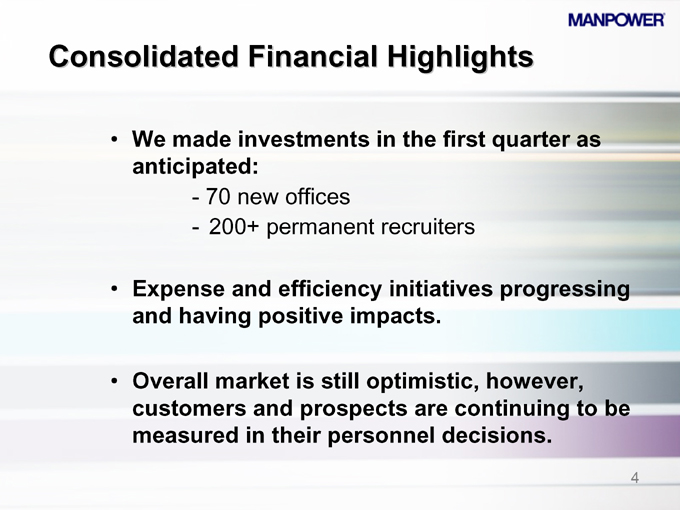

Consolidated Financial Highlights

We made investments in the first quarter as anticipated:

- 70 new offices

- 200+ permanent recruiters

Expense and efficiency initiatives progressing and having positive impacts.

Overall market is still optimistic, however, customers and prospects are continuing to be measured in their personnel decisions.

4

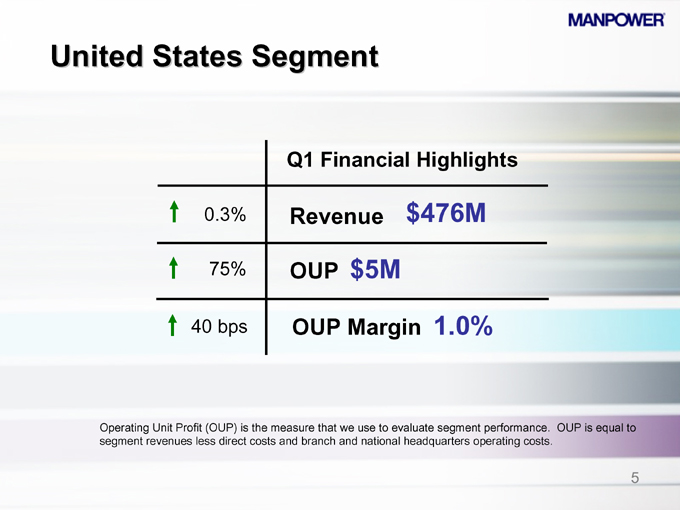

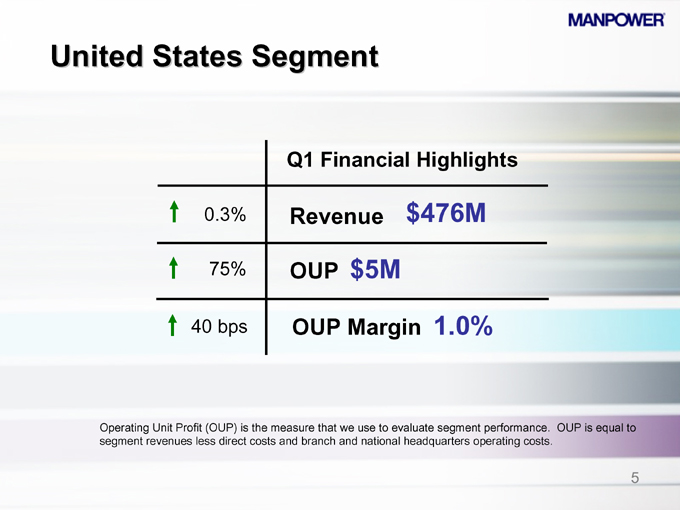

United States Segment

Q1 Financial Highlights

0.3% Revenue $476M

75% OUP $5M

40 bps OUP Margin 1.0%

Operating Unit Profit (OUP) is the measure that we use to evaluate segment performance. OUP is equal to segment revenues less direct costs and branch and national headquarters operating costs.

5

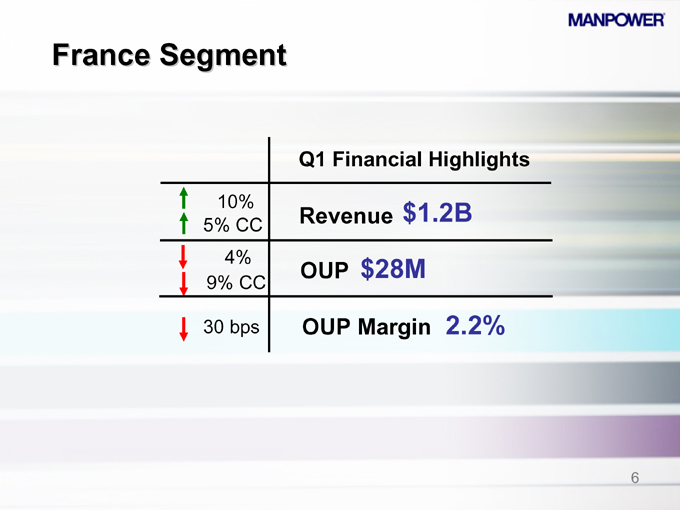

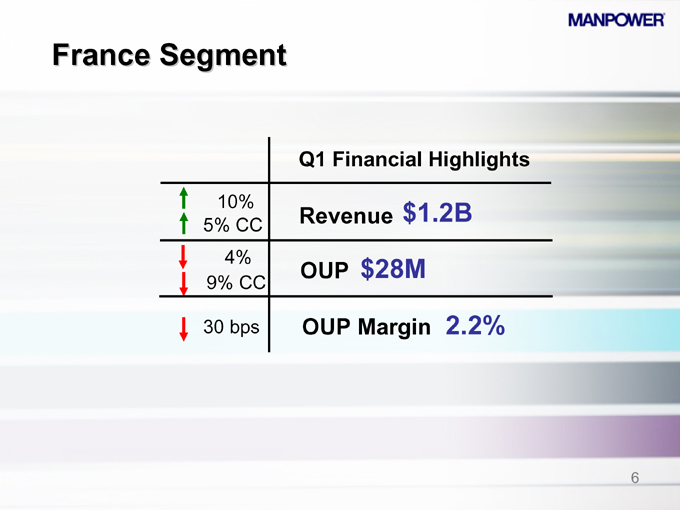

France Segment

Q1 Financial Highlights

10% $1.2B

5% CC Revenue

4% 9% CC OUP $28M

30 bps OUP Margin 2.2%

6

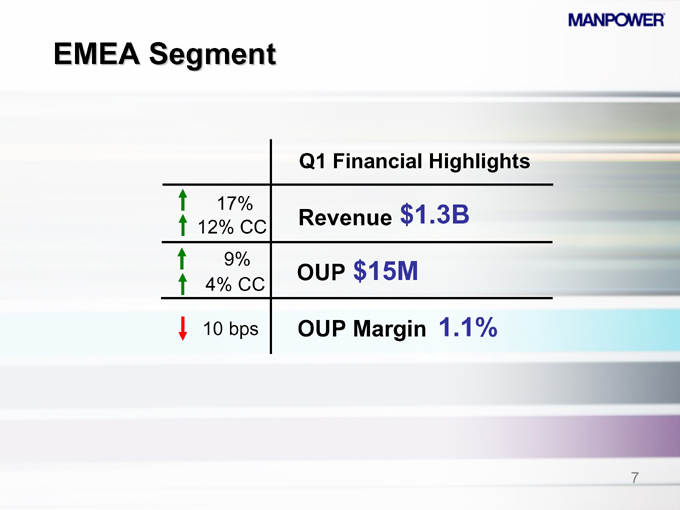

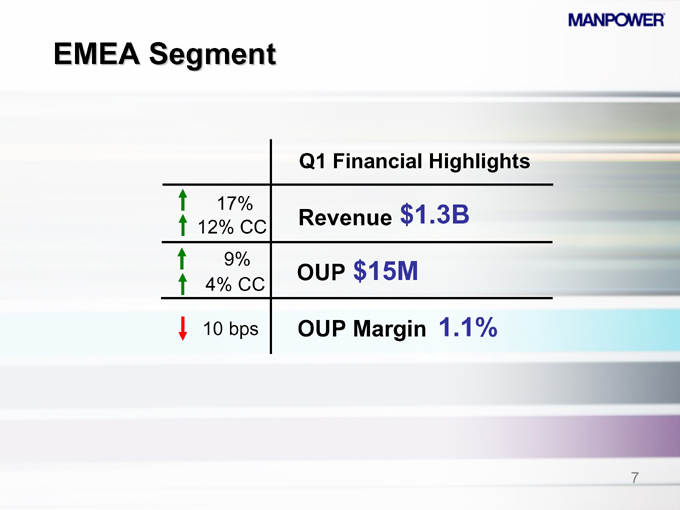

EMEA Segment

Q1 Financial Highlights

17% 12% CC Revenue $1.3B

9% 4% CC OUP $15M

10 bps OUP Margin 1.1%

7

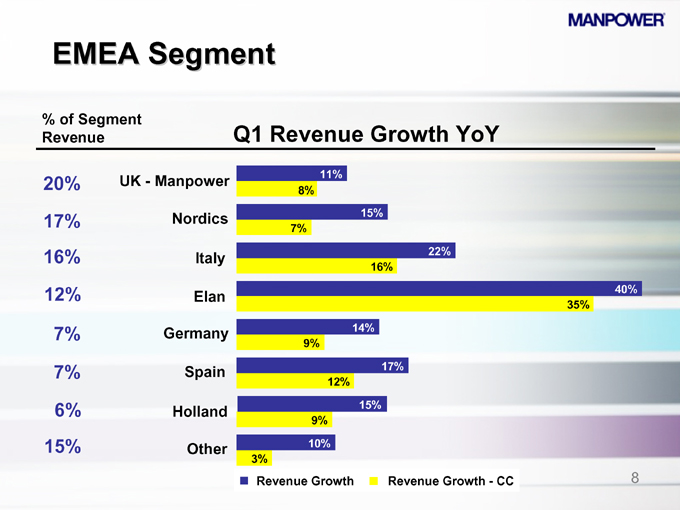

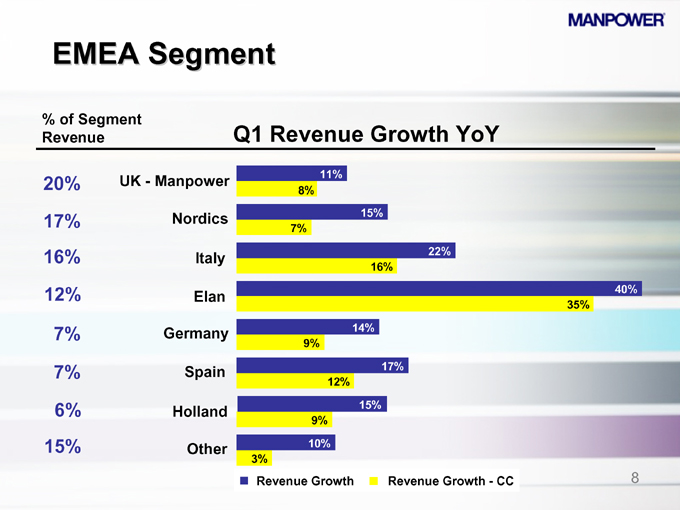

EMEA Segment

% of Segment Revenue Q1 Revenue Growth YoY

20% UK - Manpower 11%

8%

17% Nordics 15%

7%

16% Italy 22%

16%

12% Elan 40%

35%

7% Germany 14%

9%

7% Spain 17%

12%

6% Holland 15%

9%

15% Other 10%

3%

Revenue Growth Revenue Growth - CC

8

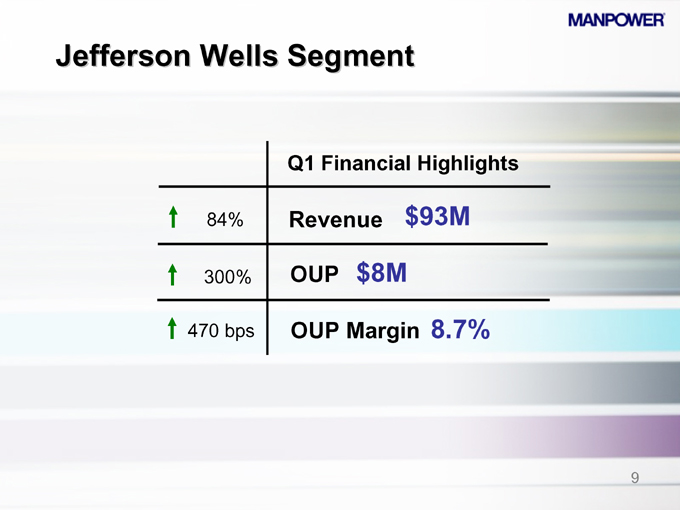

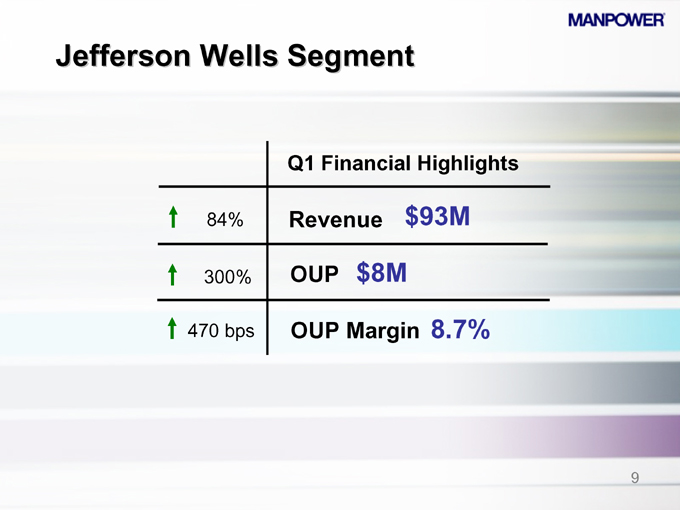

Jefferson Wells Segment

Q1 Financial Highlights

84% Revenue $93M

300% OUP $8M

470 bps OUP Margin 8.7%

9

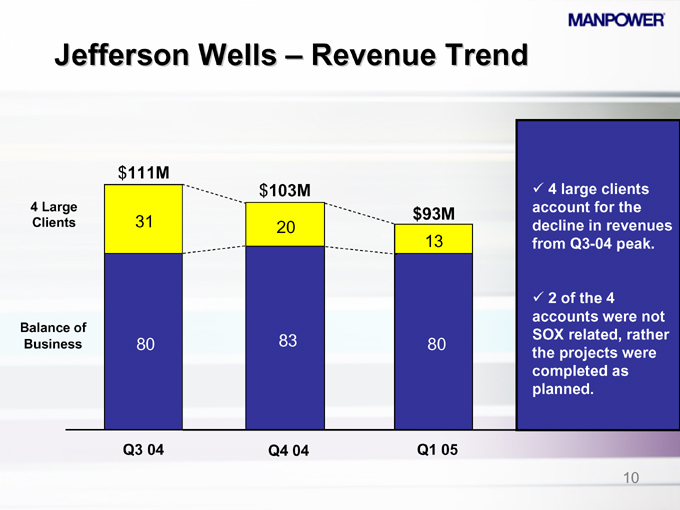

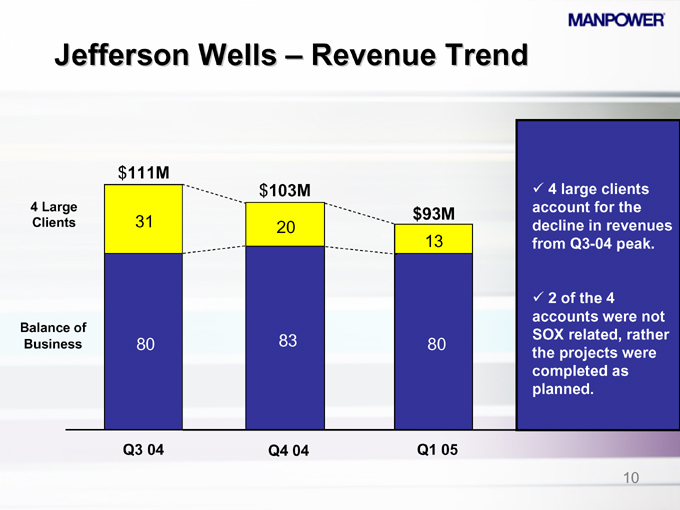

Jefferson Wells – Revenue Trend

4 Large Clients

Balance of Business $111M

31

80 $103M

20

83 $93M

13

80

Q3 04 Q4 04 Q1 05

4 large clients account for the decline in revenues from Q3-04 peak.

2 of the 4 accounts were not SOX related, rather the projects were completed as planned.

10

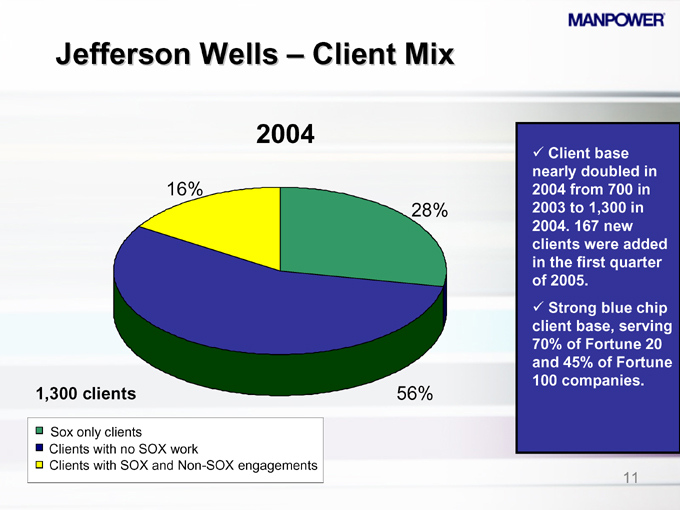

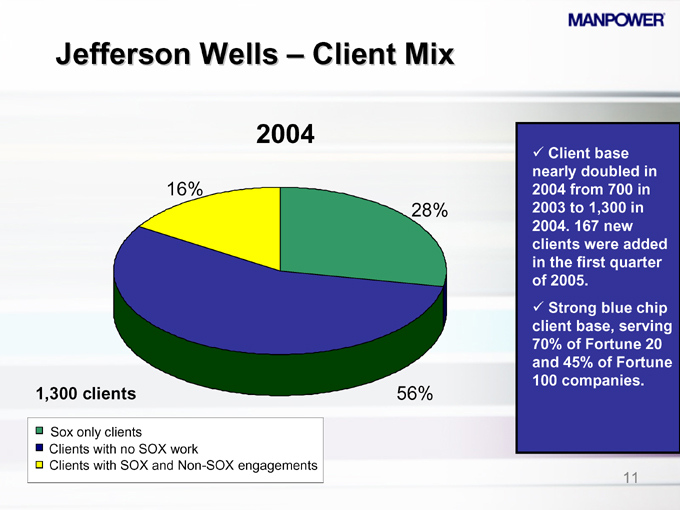

Jefferson Wells – Client Mix

2004

16%

28%

56%

1,300 clients

Sox only clients

Clients with no SOX work

Clients with SOX and Non-SOX engagements

Client base nearly doubled in 2004 from 700 in 2003 to 1,300 in 2004. 167 new clients were added in the first quarter of 2005.

Strong blue chip client base, serving 70% of Fortune 20 and 45% of Fortune 100 companies.

11

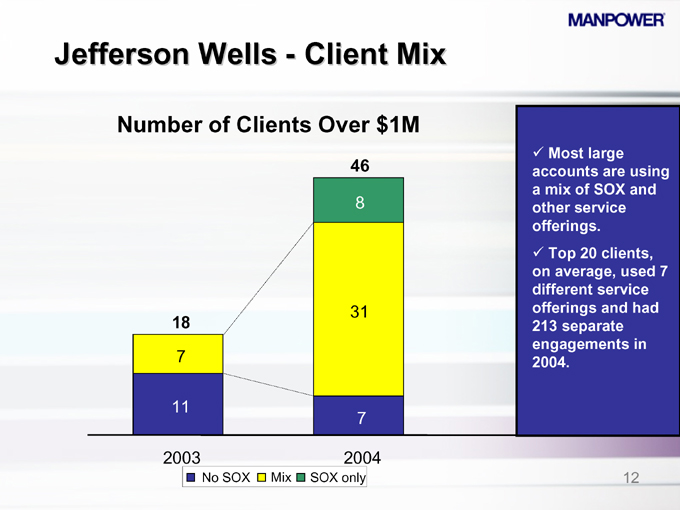

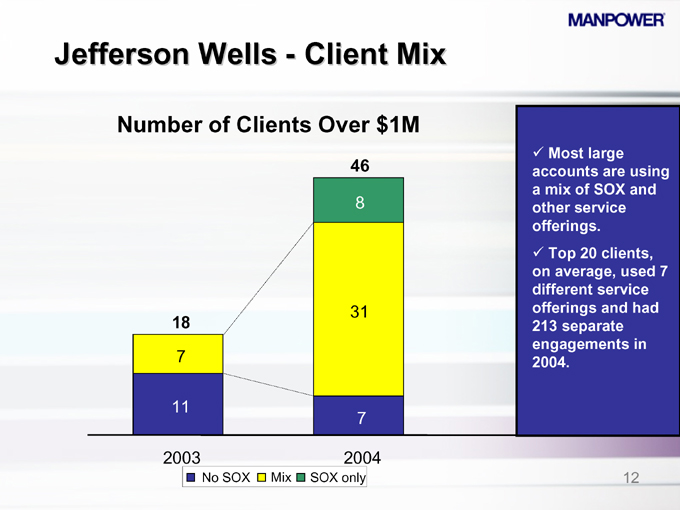

Jefferson Wells—Client Mix

Number of Clients Over $1M

46

8 31 7

18

7

11

2003 2004

No SOX Mix SOX only

Most large accounts are using a mix of SOX and other service offerings.

Top 20 clients, on average, used 7 different service offerings and had 213 separate engagements in 2004.

12

Jefferson Wells – Future Outlook

Jefferson Wells’ market position is strong and future growth prospects are solid.

Pipeline of sales opportunities are currently at record levels.

Transitioning contractors to full-time staff to support future growth.

Retention program implemented to retain highly skilled salaried professionals.

13

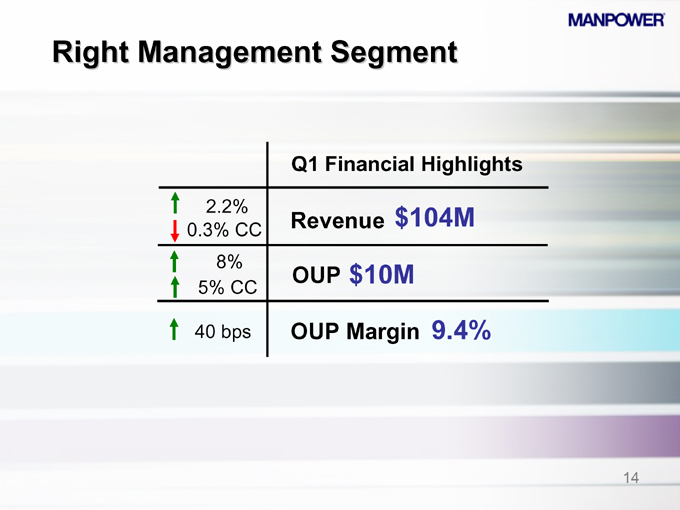

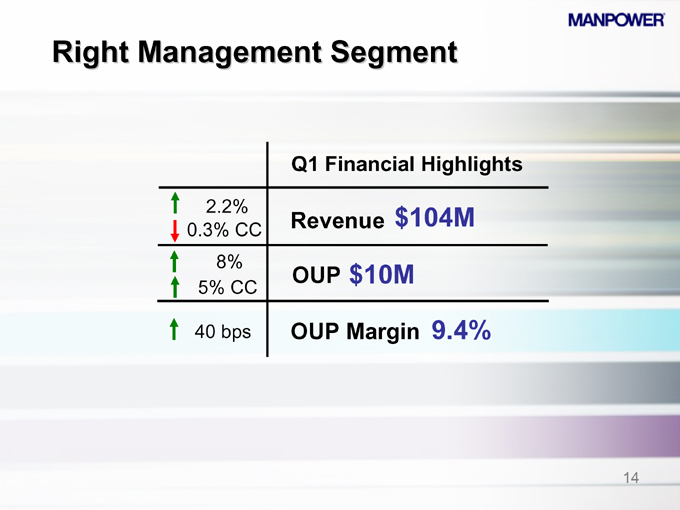

Right Management Segment

Q1 Financial Highlights

2.2% $104M

0.3% CC Revenue

8%

OUP $10M

5% CC

40 bps OUP Margin 9.4%

14

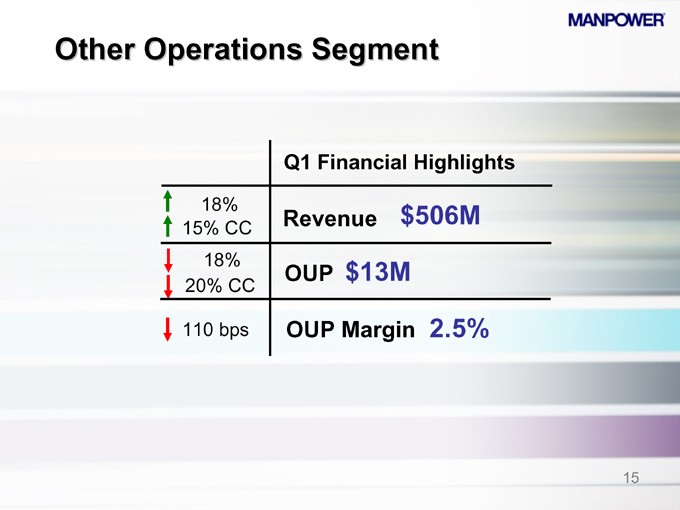

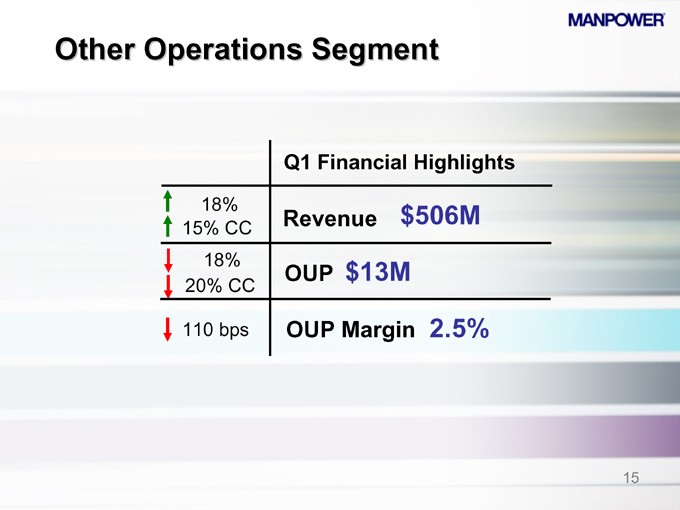

Other Operations Segment

Q1 Financial Highlights

18% $506M

15% CC Revenue

18% $13M

OUP

20% CC

110 bps OUP Margin 2.5%

15

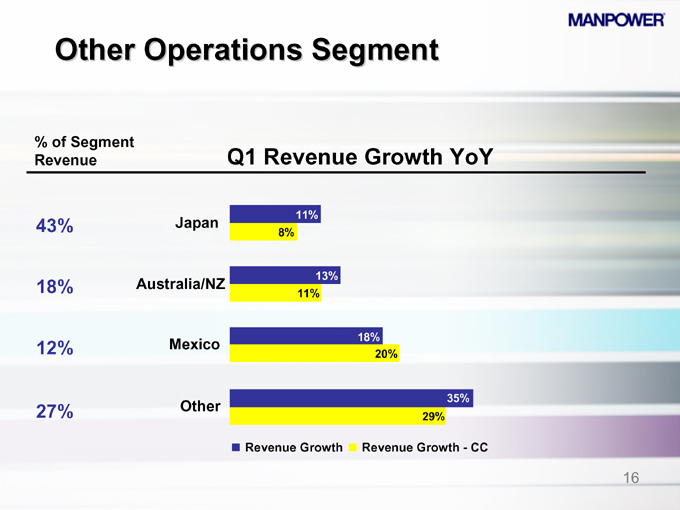

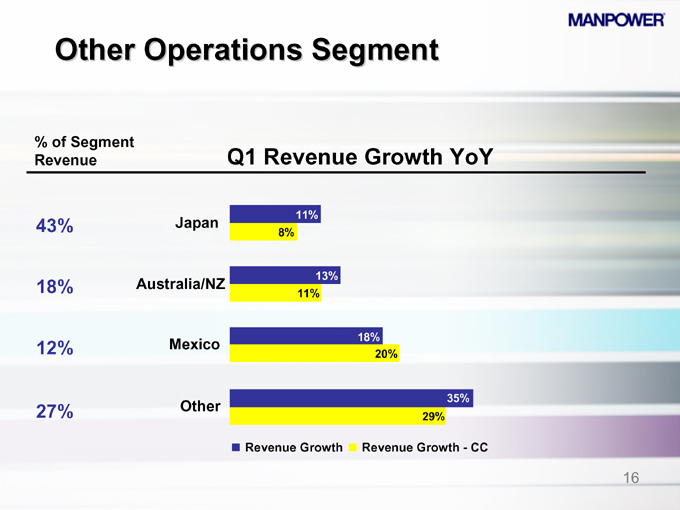

Other Operations Segment

% of Segment Revenue Q1 Revenue Growth YoY

11%

43% Japan

8%

13%

18% Australia/NZ

11%

Mexico 18%

12% 20%

35%

27% Other

29%

Revenue Growth Revenue Growth - CC

16

Financial Highlights

17

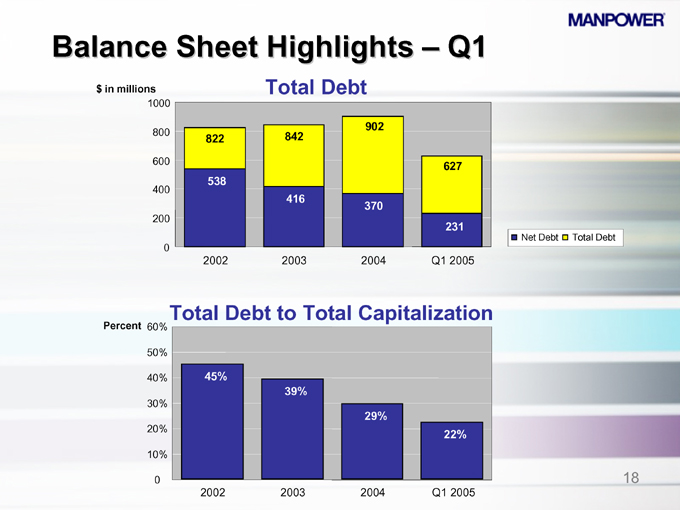

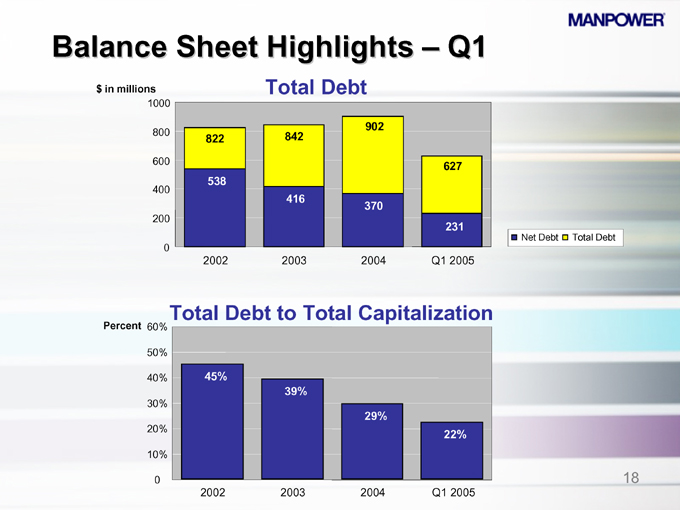

Balance Sheet Highlights – Q1

Total Debt $ in millions

1000 800 600 400 200 0

2002 2003 2004 Q1 2005

822

538

842

416

902

370

627

231

Total Debt to Total Capitalization

Percent 60% 50% 40% 30% 20% 10% 0

2002 2003 2004 Q1 2005

45%

39%

29%

22%

Net Debt Total Debt

18

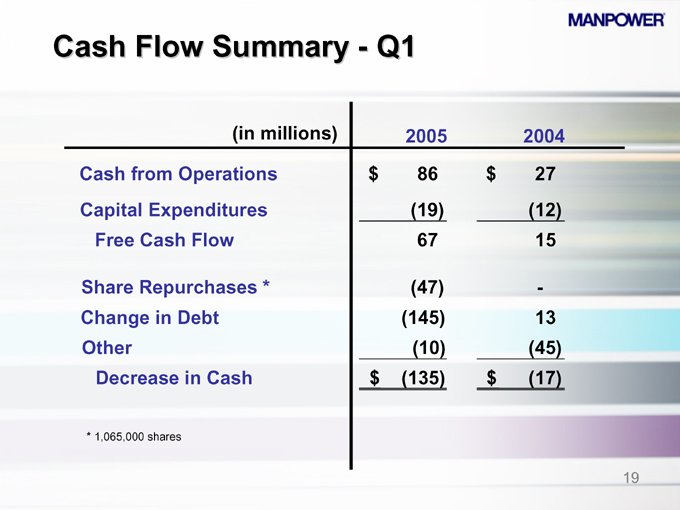

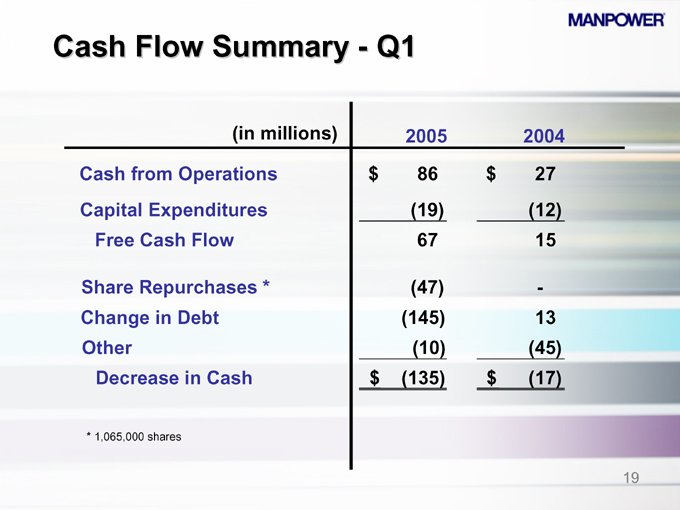

Cash Flow Summary - Q1

(in millions) 2005 2004

Cash from Operations $86 $27

Capital Expenditures (19) (12)

Free Cash Flow 67 15

Share Repurchases * (47) -

Change in Debt (145) 13

Other (10) (45)

Decrease in Cash $(135) $(17)

* 1,065,000 shares

19

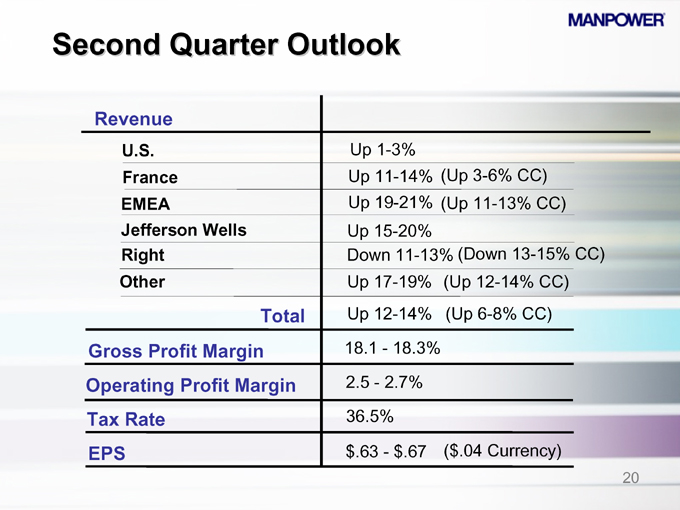

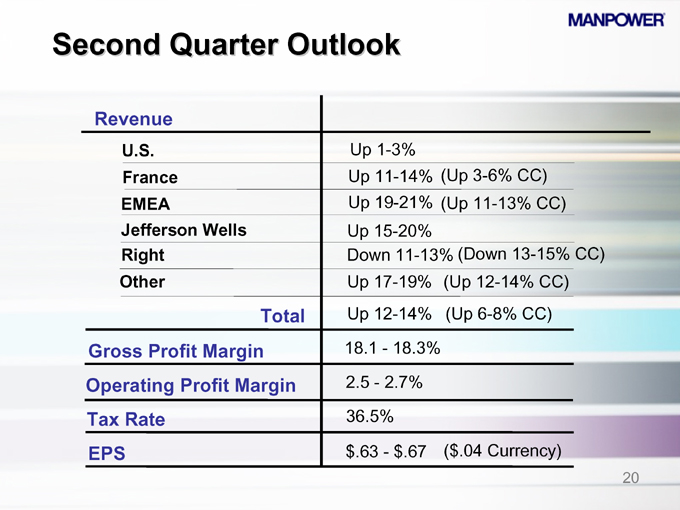

Second Quarter Outlook

Revenue

U.S. Up 1-3%

France Up 11-14% (Up 3-6% CC)

EMEA Up 19-21% (Up 11-13% CC)

Jefferson Wells Up 15-20%

Right Down 11-13% (Down 13-15% CC)

Other Up 17-19% (Up 12-14% CC)

Total Up 12-14% (Up 6-8% CC)

Gross Profit Margin 18.1 - 18.3%

Operating Profit Margin 2.5 - 2.7%

Tax Rate 36.5%

EPS $.63 - $.67 ($.04 Currency)

20

Manpower Inc.

2005 1st Quarter Results

April 19, 2005

Questions