Exhibit 99.2

Exhibit 99.2

Manpower Inc. 2005 2nd Quarter Results July 19, 2005

Forward Looking Statement:

This presentation includes forward-looking statements which are subject to risks and uncertainties. Actual results might differ materially from those projected in the forward-looking statements. Forward-looking statements can be identified by words such as “expect,” “plan,” “may,” “will,” and similar expressions. Additional information concerning factors that could cause actual results to materially differ from those in the forward-looking statements is contained in the Company’s Annual Report on Form 10-K dated December 31, 2004, which information is incorporated herein by reference, and such other factors as may be described from time to time in the Company’s SEC filings.

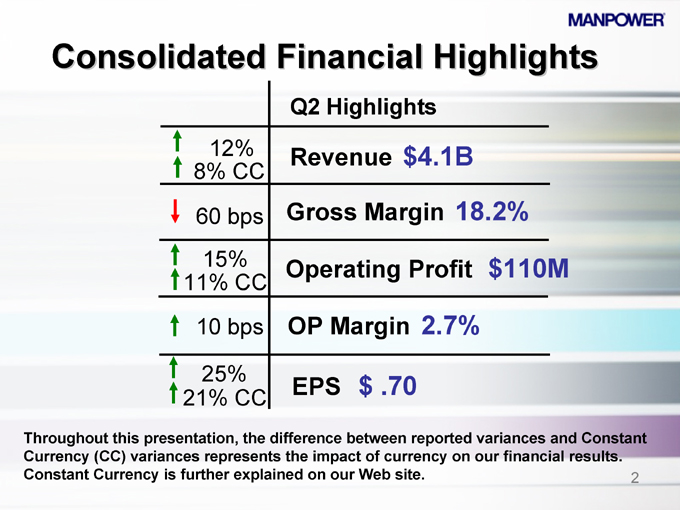

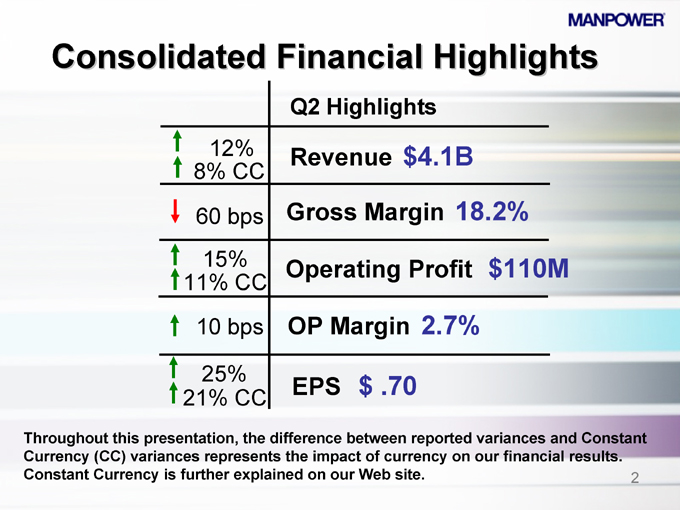

Consolidated Financial Highlights

Q2 Highlights

12% 8% CC Revenue $4.1B

60 bps Gross Margin 18.2%

15% 11% CC Operating Profit $110M

10 bps OP Margin 2.7%

25% 21% CC EPS $.70

Throughout this presentation, the difference between reported variances and Constant Currency (CC) variances represents the impact of currency on our financial results.

Constant Currency is further explained on our Web site.

2

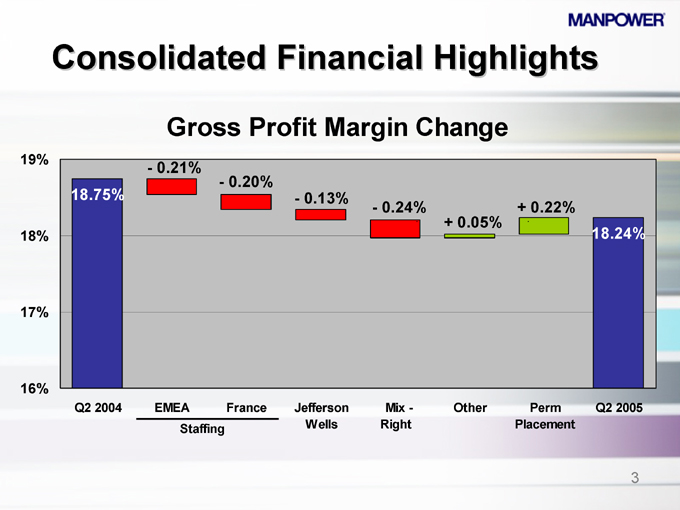

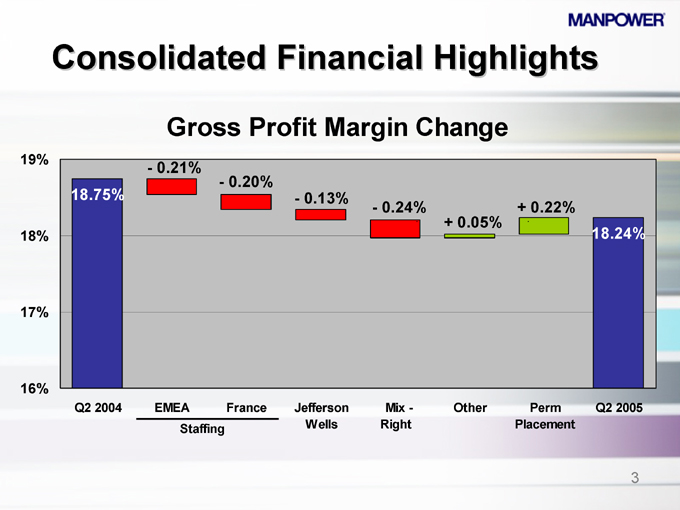

Consolidated Financial Highlights

Gross Profit Margin Change

19%

18%

17%

16%

18.75%

- 0.21%

- 0.20%

- 0.13%

- 0.24%

+ 0.05%

+ 0.22%

18.24%

Q2 2004

EMEA

France

Staffing

Jefferson Wells

Mix -Right

Other

Perm Placement

Q2 2005

3

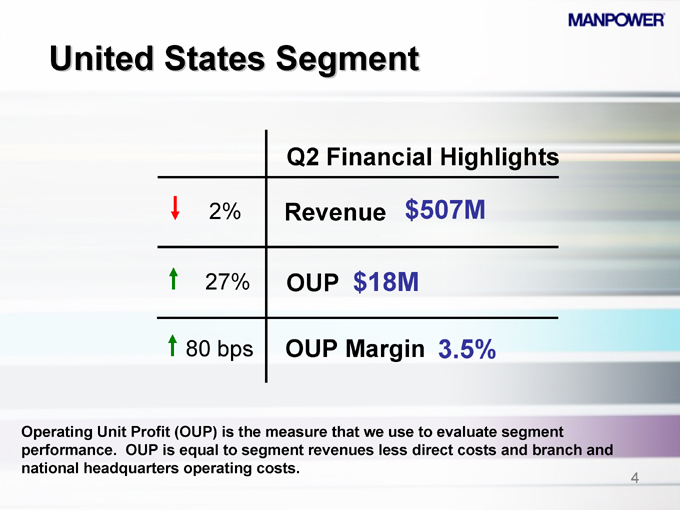

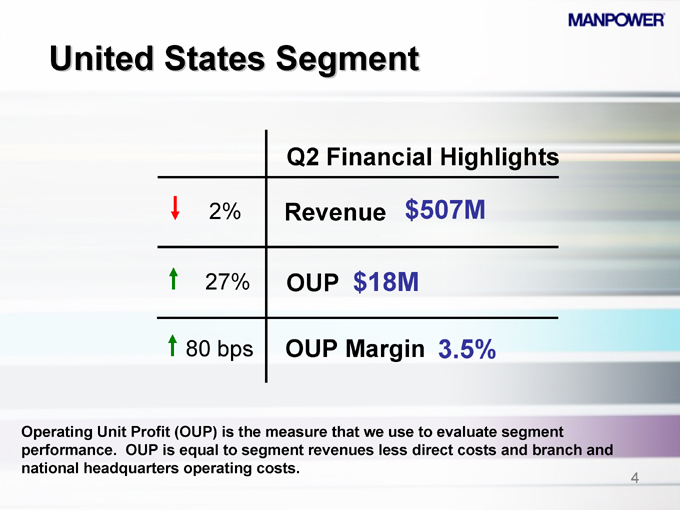

United States Segment

Q2 Financial Highlights

2% Revenue $507M

27% OUP $18M

80 bps OUP Margin 3.5%

Operating Unit Profit (OUP) is the measure that we use to evaluate segment performance. OUP is equal to segment revenues less direct costs and branch and national headquarters operating costs.

4

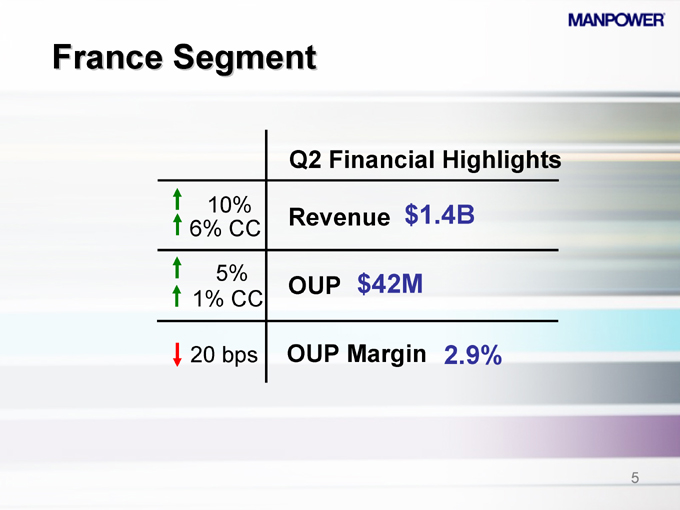

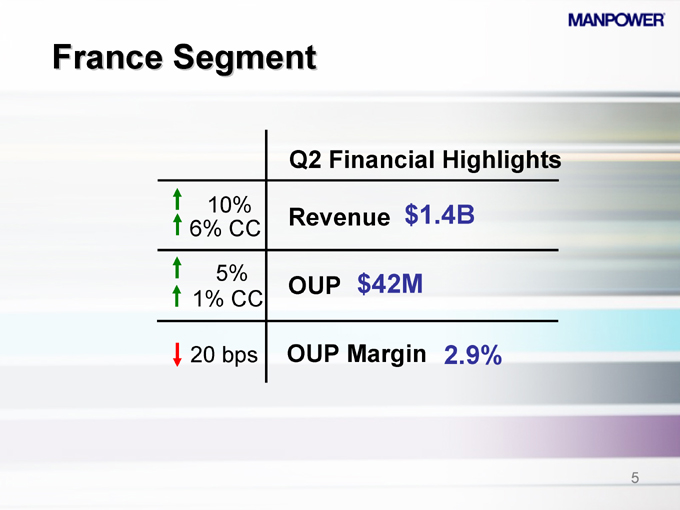

France Segment

Q2 Financial Highlights

10% 6% CC $1.4B Revenue

5% 1% CC $42M OUP

20 bps OUP Margin 2.9%

5

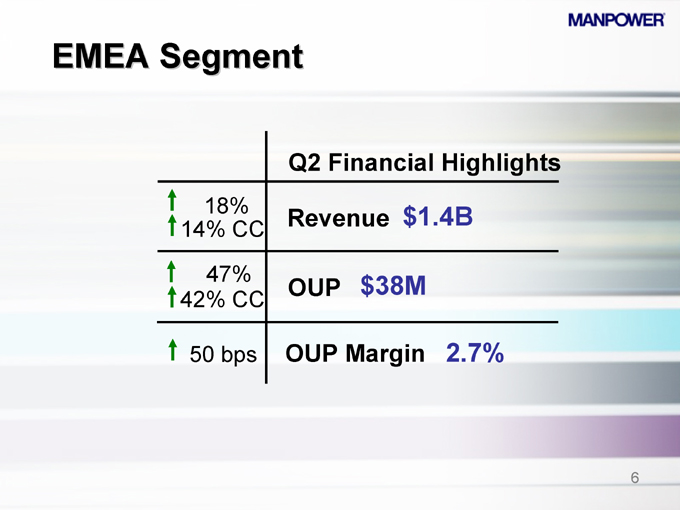

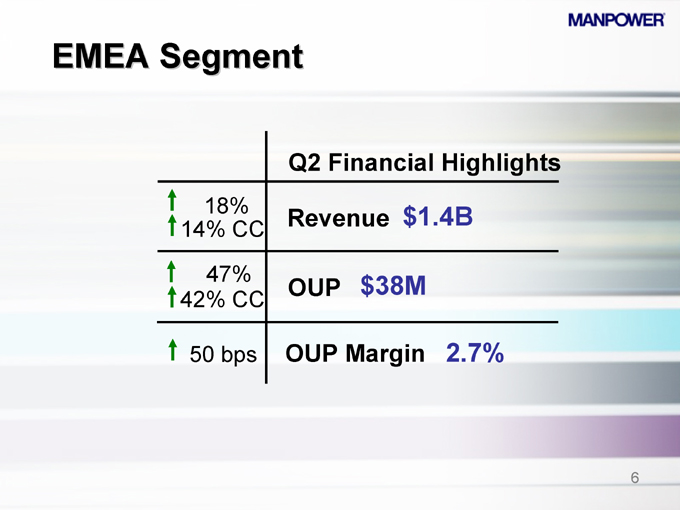

EMEA Segment

Q2 Financial Highlights

18% 14% CC $1.4B Revenue

47% 42% CC $38M OUP

50 bps OUP Margin 2.7%

6

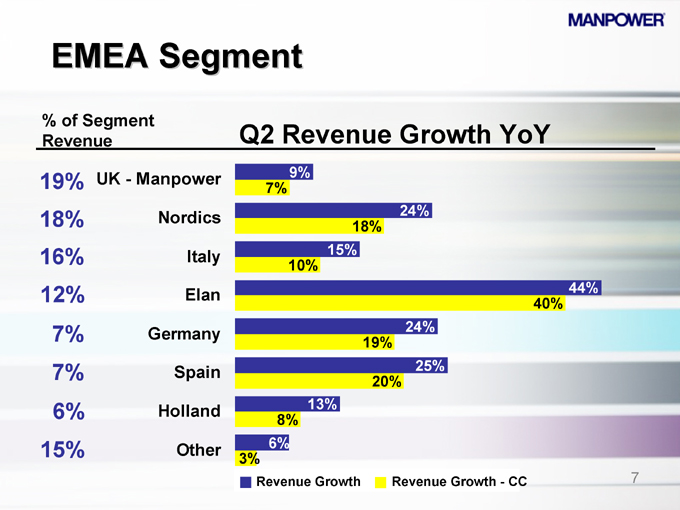

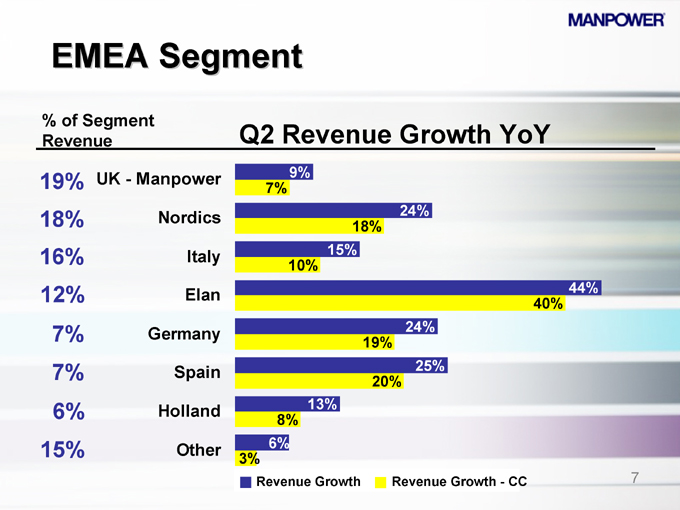

EMEA Segment

% of Segment

Revenue Q2 Revenue Growth YoY

19% UK—Manpower 9%

7%

18% Nordics 24%

18%

16% Italy 15%

10%

12% Elan 44%

40%

7% Germany 24%

19%

7% Spain 25%

20%

6% Holland 13%

8%

15% Other 6%

3%

Revenue Growth

Revenue Growth—CC

7

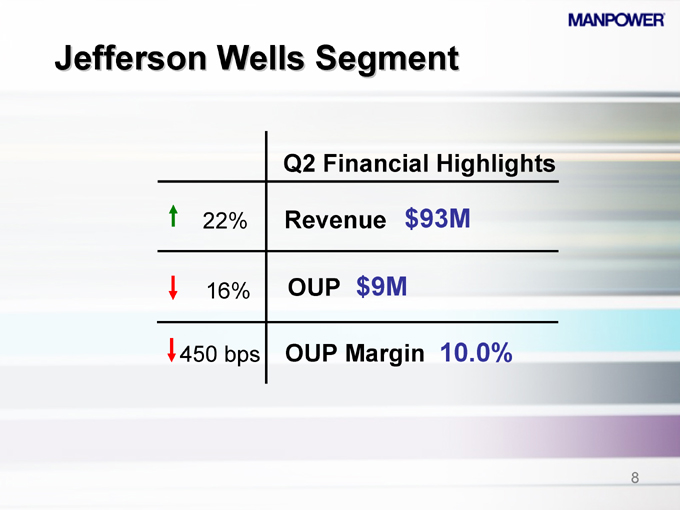

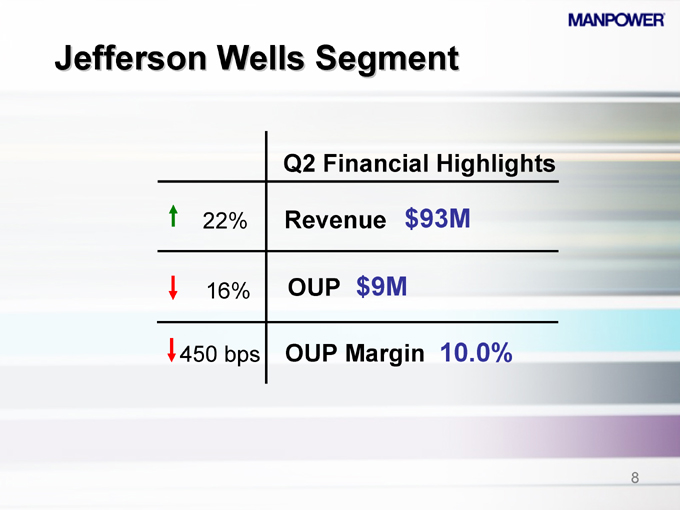

Jefferson Wells Segment

Q2 Financial Highlights

22% Revenue $93M

16% OUP $9M

450 bps OUP Margin 10.0%

8

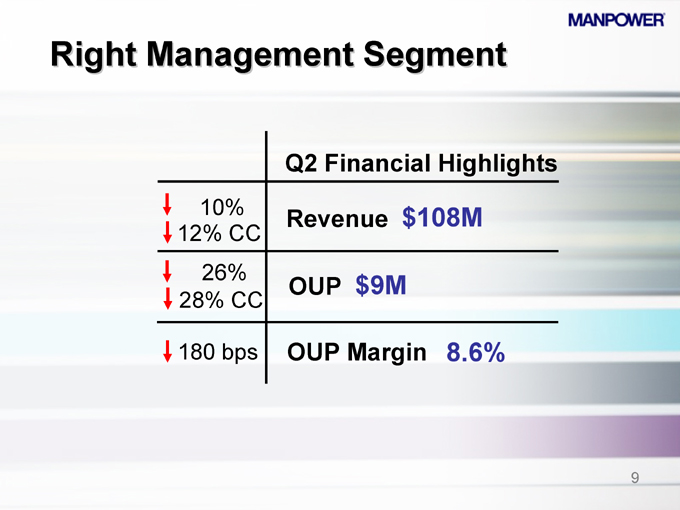

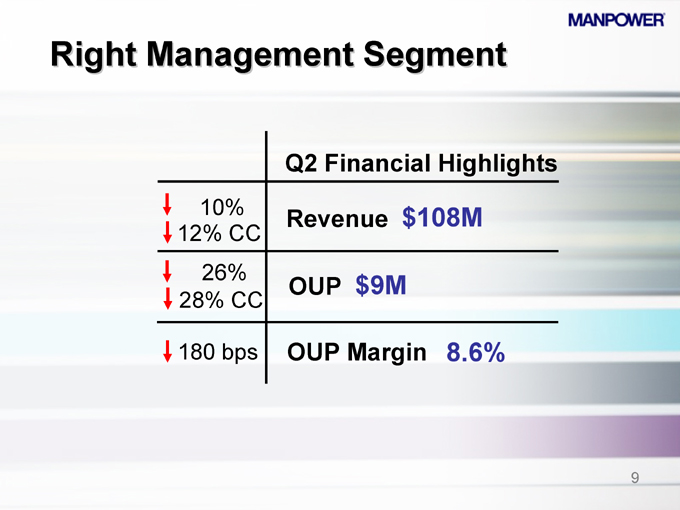

Right Management Segment

Q2 Financial Highlights

10% 12% CC Revenue $108M

26% 28% CC OUP $9M

180 bps OUP Margin 8.6%

9

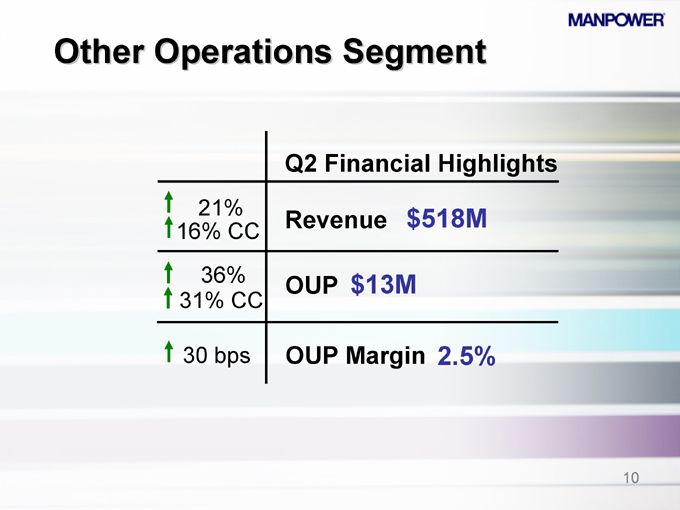

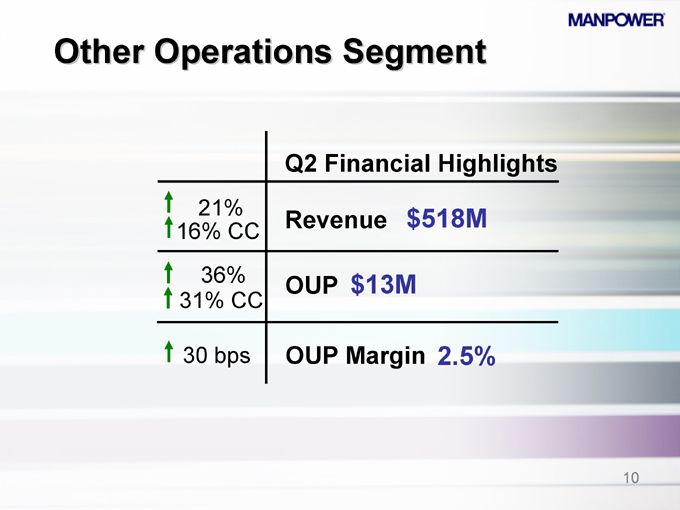

Other Operations Segment

Q2 Financial Highlights

21% 16% CC $518M Revenue

36% 31% CC OUP $13M

30 bps OUP Margin 2.5%

10

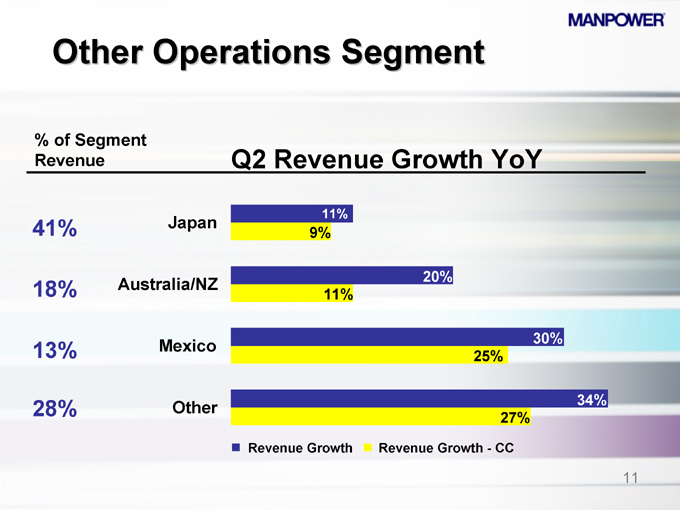

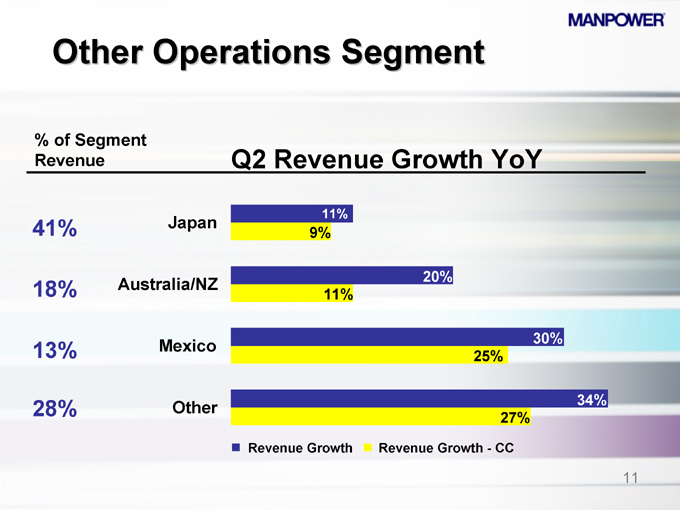

Other Operations Segment

% of Segment

Revenue Q2 Revenue Growth YoY

11%

41% Japan

9%

Australia/NZ 20%

18% 11%

Mexico 30%

13% 25%

28% Other 34%

27%

Revenue Growth

Revenue Growth—CC

11

Financial Highlights

12

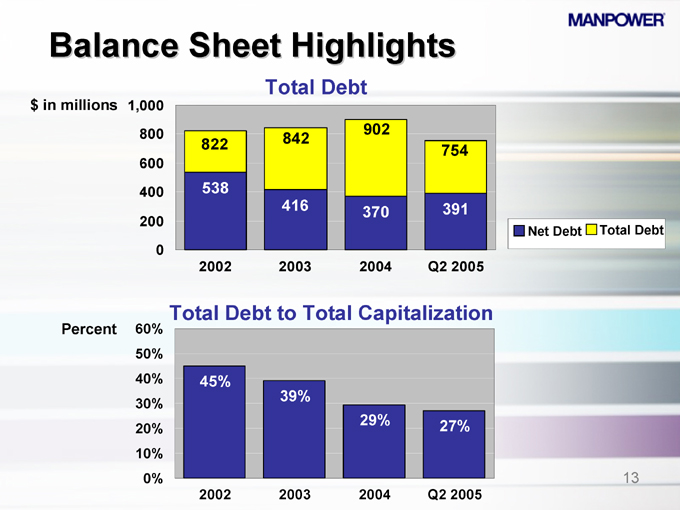

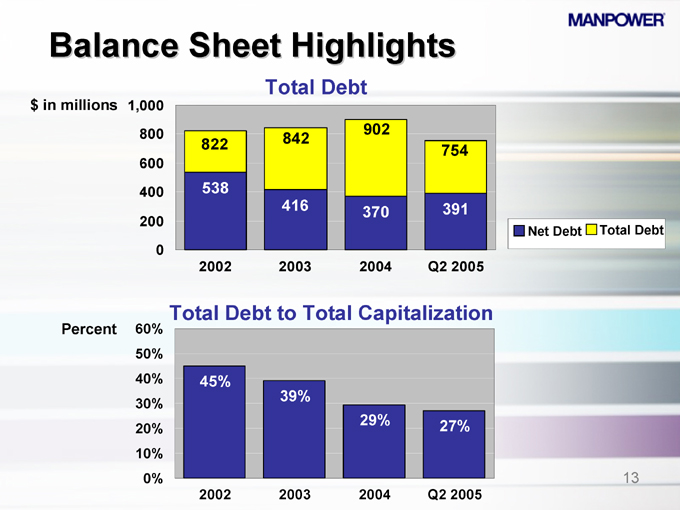

Balance Sheet Highlights

Total Debt $ in millions

1,000 800

600 400

200 0

822

538

842

416

902

370

754

391

2002 2003 2004 Q2 2005

Net Debt

Total Debt

Total Debt to Total Capitalization

Percent

60% 50% 40% 30% 20% 10% 0%

45%

39%

29%

27%

2002 2003 2004 Q2 2005

13

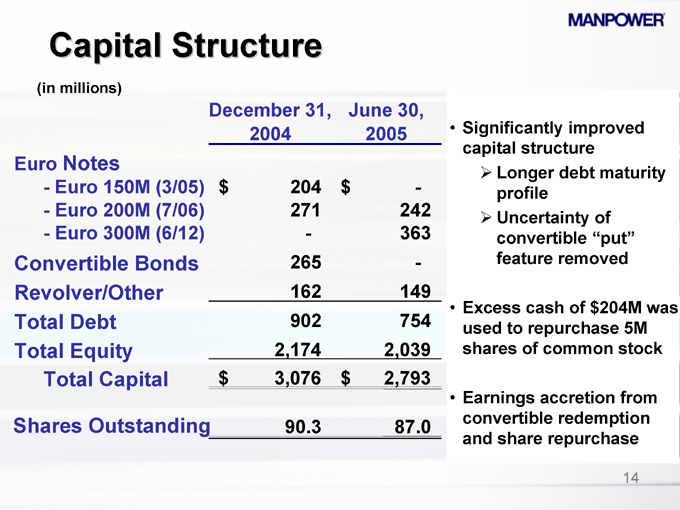

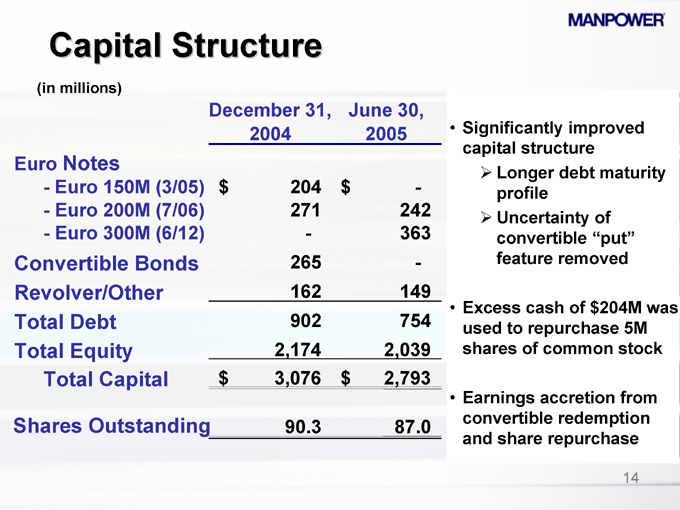

Capital Structure

(in millions)

December 31, 2004 June 30, 2005

Euro Notes

- Euro 150M (3/05) $204 $-

- Euro 200M (7/06) 271 242

- Euro 300M (6/12) - 363

Convertible Bonds 265 -

Revolver/Other 162 149

Total Debt 902 754

Total Equity 2,174 2,039

Total Capital $3,076 $2,793

Shares Outstanding 90.3 87.0

Significantly improved capital structure

Longer debt maturity profile

Uncertainty of convertible “put” feature removed

Excess cash of $204M was used to repurchase 5M shares of common stock

Earnings accretion from convertible redemption and share repurchase

14

Cash Flow Summary – First Half

(in millions) 2005 2004

Cash from Operations $98 $68

Capital Expenditures (36) (27)

Free Cash Flow 62 41

Share Repurchases * (204) -

Change in Debt (32) 9

Other 5 (36)

Change in Cash $(169) $14

* 5,000,000 shares

15

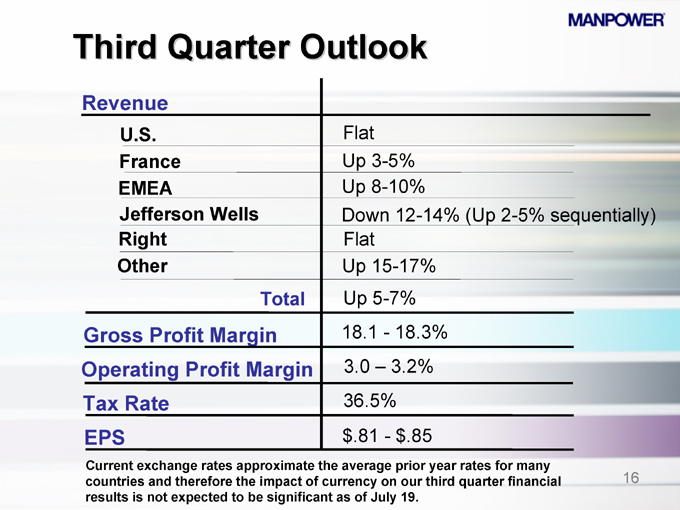

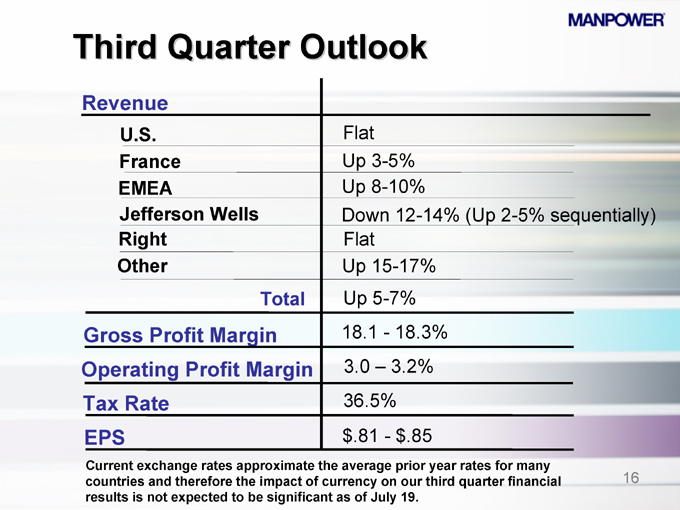

Third Quarter Outlook

Revenue

U.S. Flat

France Up 3-5%

EMEA Up 8-10%

Jefferson Wells Down 12-14% (Up 2-5% sequentially)

Right Flat

Other Up 15-17%

Total Up 5-7%

Gross Profit Margin 18.1—18.3%

Operating Profit Margin 3.0 – 3.2%

Tax Rate 36.5%

EPS $.81—$.85

Current exchange rates approximate the average prior year rates for many countries and therefore the impact of currency on our third quarter financial results is not expected to be significant as of July 19.

16

Manpower Inc. 2005 2nd Quarter Results July 19, 2005

Questions