UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-06275

T. Rowe Price Balanced Fund, Inc.

(Exact name of registrant as specified in charter)

100 East Pratt Street, Baltimore, MD 21202

(Address of principal executive offices)

David Oestreicher

100 East Pratt Street, Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1

Annual Shareholder Report

December 31, 2024

This annual shareholder report contains important information about Balanced Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Balanced Fund - Investor Class | $58 | 0.55% |

|---|

What drove fund performance during the past 12 months?

Equity markets were broadly positive in 2024, while fixed income markets were mixed. U.S. stocks produced strong gains, and various equity indexes reached new all-time highs during the year. The equity market was buoyed by generally favorable corporate earnings and by continuing interest in companies expected to benefit from artificial intelligence developments. Developed non-U.S. equity markets were mostly positive in 2024, helped by looser monetary policies from various central banks around the world. However, many markets surrendered some of their gains in the fourth quarter amid rising geopolitical tensions. U.S. taxable investment-grade bonds produced positive returns in 2024. U.S. Treasury bill yields declined, as the Federal Reserve reduced the fed funds target rate by 50 basis points in mid-September and by an additional 50 basis points in the fourth quarter.

Versus the Morningstar Moderate Target Risk Index, security selection within U.S. large-cap growth stocks contributed to relative results. The fund’s greater exposure to U.S large-caps compared to small- and mid-caps was also additive during a period of stronger performance for large-caps.

Conversely, an overweight allocation to real assets equities was detrimental to relative results, as this sector lagged broader global equities over the trailing 12 months. Unfavorable security selection within high yield bonds also detracted.

The fund seeks to provide capital growth, current income, and preservation of capital through a portfolio of stocks and fixed income securities. It normally invests approximately 65% of total assets in U.S. and foreign common stocks and 35% in fixed income securities.

How has the fund performed?

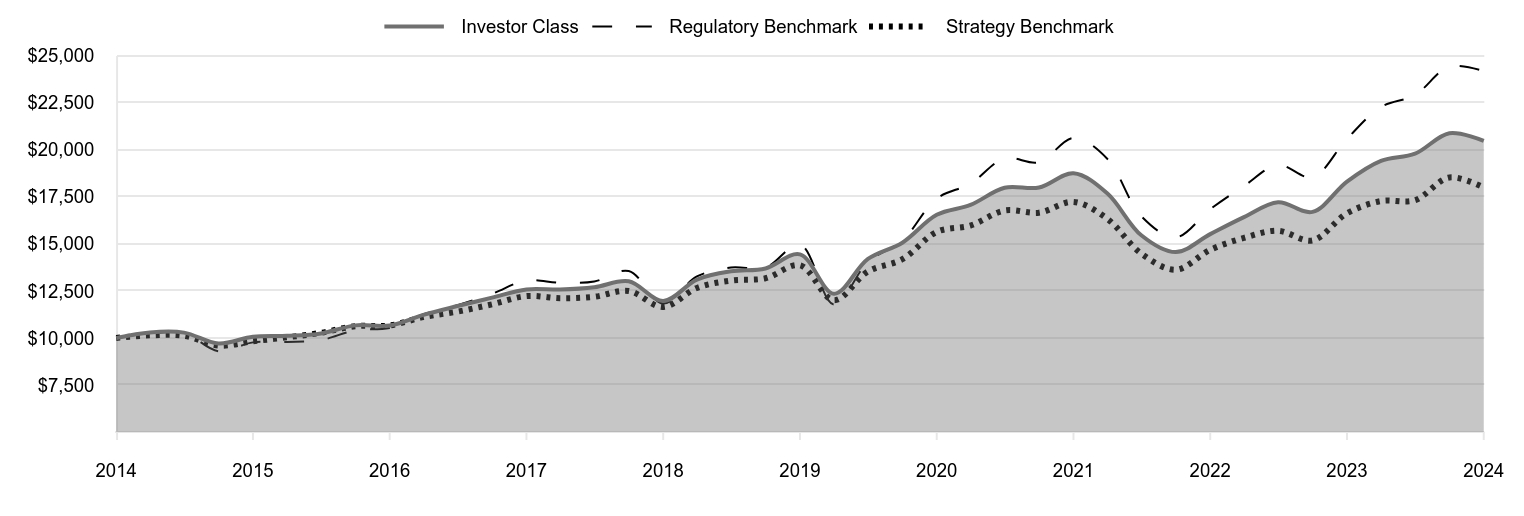

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| Investor Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 2014 | 10,000 | 10,000 | 10,000 |

|---|

| 2015 | 10,293 | 10,231 | 10,137 |

|---|

| 2015 | 10,283 | 10,266 | 10,115 |

|---|

| 2015 | 9,705 | 9,296 | 9,596 |

|---|

| 2015 | 10,065 | 9,764 | 9,821 |

|---|

| 2016 | 10,112 | 9,787 | 10,032 |

|---|

| 2016 | 10,240 | 9,884 | 10,273 |

|---|

| 2016 | 10,667 | 10,408 | 10,622 |

|---|

| 2016 | 10,661 | 10,531 | 10,663 |

|---|

| 2017 | 11,228 | 11,259 | 11,109 |

|---|

| 2017 | 11,695 | 11,740 | 11,398 |

|---|

| 2017 | 12,141 | 12,348 | 11,785 |

|---|

| 2017 | 12,580 | 13,056 | 12,225 |

|---|

| 2018 | 12,575 | 12,931 | 12,115 |

|---|

| 2018 | 12,695 | 13,000 | 12,187 |

|---|

| 2018 | 13,009 | 13,555 | 12,495 |

|---|

| 2018 | 11,961 | 11,827 | 11,644 |

|---|

| 2019 | 13,102 | 13,267 | 12,655 |

|---|

| 2019 | 13,541 | 13,746 | 13,050 |

|---|

| 2019 | 13,694 | 13,742 | 13,170 |

|---|

| 2019 | 14,442 | 14,973 | 13,859 |

|---|

| 2020 | 12,346 | 11,774 | 12,005 |

|---|

| 2020 | 14,197 | 14,036 | 13,534 |

|---|

| 2020 | 15,063 | 15,178 | 14,184 |

|---|

| 2020 | 16,545 | 17,406 | 15,636 |

|---|

| 2021 | 17,068 | 18,202 | 15,975 |

|---|

| 2021 | 17,981 | 19,548 | 16,771 |

|---|

| 2021 | 17,993 | 19,342 | 16,658 |

|---|

| 2021 | 18,755 | 20,633 | 17,230 |

|---|

| 2022 | 17,690 | 19,527 | 16,336 |

|---|

| 2022 | 15,456 | 16,469 | 14,484 |

|---|

| 2022 | 14,562 | 15,346 | 13,626 |

|---|

| 2022 | 15,518 | 16,844 | 14,684 |

|---|

| 2023 | 16,419 | 18,075 | 15,319 |

|---|

| 2023 | 17,209 | 19,191 | 15,699 |

|---|

| 2023 | 16,700 | 18,538 | 15,183 |

|---|

| 2023 | 18,309 | 20,584 | 16,626 |

|---|

| 2024 | 19,411 | 22,271 | 17,276 |

|---|

| 2024 | 19,792 | 22,910 | 17,322 |

|---|

| 2024 | 20,880 | 24,425 | 18,530 |

|---|

| 2024 | 20,477 | 24,183 | 18,000 |

|---|

202501-4140694, 202502-4108138

Average Annual Total Returns

| | 1 Year | 5 Years | 10 Years |

|---|

| Balanced Fund (Investor Class) | 11.84% | 7.23% | 7.43% |

|---|

| MSCI All Country World Index Net (Regulatory Benchmark) | 17.49 | 10.06 | 9.23 |

|---|

| Morningstar Moderate Target Risk Index (Strategy Benchmark) | 8.27 | 5.37 | 6.05 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$4,599,799

- Number of Portfolio Holdings1,589

- Investment Advisory Fees Paid (000s)$17,720

- Portfolio Turnover Rate39.2%

What did the fund invest in?

Security Allocation (as a % of Net Assets)

| Common Stocks | 61.3% |

| Corporate Bonds | 8.3 |

| U.S. Government & Agency Mortgage-Backed Securities | 8.1 |

| U.S. Government Agency Obligations (Excluding Mortgage-Backed) | 7.9 |

| Bond Mutual Funds | 5.2 |

| Equity Mutual Funds | 4.2 |

| Asset-Backed Securities | 1.5 |

| Non-U.S. Government Mortgage-Backed Securities | 1.3 |

| Short-Term and Other | 2.2 |

Top Ten Holdings (as a % of Net Assets)

| U.S. Treasury Notes | 5.4% |

| T. Rowe Price Institutional High Yield Fund - Institutional Class | 4.7 |

| T. Rowe Price Real Assets Fund - I Class | 4.2 |

| Federal National Mortgage Assn. | 4.0 |

| NVIDIA | 2.8 |

| Microsoft | 2.6 |

| Apple | 2.6 |

| U.S. Treasury Bonds | 2.5 |

| Amazon.com | 1.9 |

| Government National Mortgage Assn. | 1.8 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

MSCI and Morningstar do not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Balanced Fund

Investor Class (RPBAX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

December 31, 2024

This annual shareholder report contains important information about Balanced Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Balanced Fund - I Class | $45 | 0.42% |

|---|

What drove fund performance during the past 12 months?

Equity markets were broadly positive in 2024, while fixed income markets were mixed. U.S. stocks produced strong gains, and various equity indexes reached new all-time highs during the year. The equity market was buoyed by generally favorable corporate earnings and by continuing interest in companies expected to benefit from artificial intelligence developments. Developed non-U.S. equity markets were mostly positive in 2024, helped by looser monetary policies from various central banks around the world. However, many markets surrendered some of their gains in the fourth quarter amid rising geopolitical tensions. U.S. taxable investment-grade bonds produced positive returns in 2024. U.S. Treasury bill yields declined, as the Federal Reserve reduced the fed funds target rate by 50 basis points in mid-September and by an additional 50 basis points in the fourth quarter.

Versus the Morningstar Moderate Target Risk Index, security selection within U.S. large-cap growth stocks contributed to relative results. The fund’s greater exposure to U.S large-caps compared to small- and mid-caps was also additive during a period of stronger performance for large-caps.

Conversely, an overweight allocation to real assets equities was detrimental to relative results, as this sector lagged broader global equities over the trailing 12 months. Unfavorable security selection within high yield bonds also detracted.

The fund seeks to provide capital growth, current income, and preservation of capital through a portfolio of stocks and fixed income securities. It normally invests approximately 65% of total assets in U.S. and foreign common stocks and 35% in fixed income securities.

How has the fund performed?

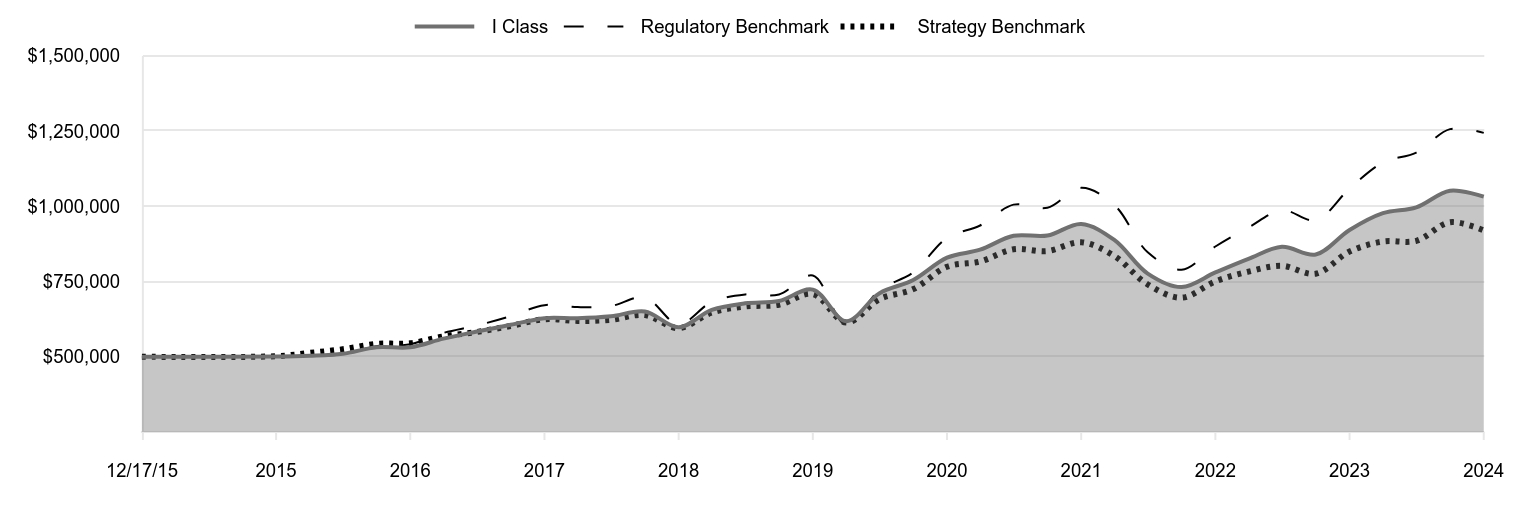

Cumulative Returns of a Hypothetical $500,000 Investment as of December 31, 2024

| I Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 12/17/15 | 500,000 | 500,000 | 500,000 |

|---|

| 12/31/15 | 500,934 | 502,118 | 501,822 |

|---|

| 3/31/16 | 503,506 | 503,314 | 512,595 |

|---|

| 6/30/16 | 510,144 | 508,291 | 524,917 |

|---|

| 9/30/16 | 531,633 | 535,240 | 542,779 |

|---|

| 12/31/16 | 531,541 | 541,606 | 544,831 |

|---|

| 3/31/17 | 560,074 | 579,021 | 567,638 |

|---|

| 6/30/17 | 583,597 | 603,764 | 582,415 |

|---|

| 9/30/17 | 606,095 | 635,052 | 602,199 |

|---|

| 12/31/17 | 628,276 | 671,440 | 624,692 |

|---|

| 3/31/18 | 628,040 | 664,984 | 619,034 |

|---|

| 6/30/18 | 634,285 | 668,532 | 622,734 |

|---|

| 9/30/18 | 650,210 | 697,125 | 638,441 |

|---|

| 12/31/18 | 597,824 | 608,228 | 594,977 |

|---|

| 3/31/19 | 655,417 | 682,281 | 646,617 |

|---|

| 6/30/19 | 677,380 | 706,924 | 666,848 |

|---|

| 9/30/19 | 685,302 | 706,741 | 672,978 |

|---|

| 12/31/19 | 723,032 | 770,001 | 708,178 |

|---|

| 3/31/20 | 618,123 | 605,489 | 613,430 |

|---|

| 6/30/20 | 711,142 | 721,857 | 691,536 |

|---|

| 9/30/20 | 754,785 | 780,546 | 724,757 |

|---|

| 12/31/20 | 829,097 | 895,164 | 798,978 |

|---|

| 3/31/21 | 855,589 | 936,085 | 816,308 |

|---|

| 6/30/21 | 901,693 | 1,005,293 | 856,964 |

|---|

| 9/30/21 | 902,597 | 994,694 | 851,188 |

|---|

| 12/31/21 | 941,147 | 1,061,104 | 880,395 |

|---|

| 3/31/22 | 888,043 | 1,004,220 | 834,721 |

|---|

| 6/30/22 | 776,175 | 846,954 | 740,083 |

|---|

| 9/30/22 | 731,340 | 789,194 | 696,273 |

|---|

| 12/31/22 | 779,995 | 866,243 | 750,318 |

|---|

| 3/31/23 | 825,202 | 929,529 | 782,772 |

|---|

| 6/30/23 | 865,213 | 986,948 | 802,186 |

|---|

| 9/30/23 | 839,905 | 953,367 | 775,831 |

|---|

| 12/31/23 | 921,191 | 1,058,565 | 849,539 |

|---|

| 3/31/24 | 976,982 | 1,145,328 | 882,770 |

|---|

| 6/30/24 | 996,476 | 1,178,191 | 885,108 |

|---|

| 9/30/24 | 1,051,691 | 1,256,115 | 946,834 |

|---|

| 12/31/24 | 1,031,743 | 1,243,694 | 919,770 |

|---|

202501-4140694, 202502-4108138

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 12/17/15 |

|---|

| Balanced Fund (I Class) | 12.00% | 7.37% | 8.34% |

|---|

| MSCI All Country World Index Net (Regulatory Benchmark) | 17.49 | 10.06 | 10.61 |

|---|

| Morningstar Moderate Target Risk Index (Strategy Benchmark) | 8.27 | 5.37 | 6.98 |

|---|

The preceding line graph shows the value of a hypothetical $500,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$4,599,799

- Number of Portfolio Holdings1,589

- Investment Advisory Fees Paid (000s)$17,720

- Portfolio Turnover Rate39.2%

What did the fund invest in?

Security Allocation (as a % of Net Assets)

| Common Stocks | 61.3% |

| Corporate Bonds | 8.3 |

| U.S. Government & Agency Mortgage-Backed Securities | 8.1 |

| U.S. Government Agency Obligations (Excluding Mortgage-Backed) | 7.9 |

| Bond Mutual Funds | 5.2 |

| Equity Mutual Funds | 4.2 |

| Asset-Backed Securities | 1.5 |

| Non-U.S. Government Mortgage-Backed Securities | 1.3 |

| Short-Term and Other | 2.2 |

Top Ten Holdings (as a % of Net Assets)

| U.S. Treasury Notes | 5.4% |

| T. Rowe Price Institutional High Yield Fund - Institutional Class | 4.7 |

| T. Rowe Price Real Assets Fund - I Class | 4.2 |

| Federal National Mortgage Assn. | 4.0 |

| NVIDIA | 2.8 |

| Microsoft | 2.6 |

| Apple | 2.6 |

| U.S. Treasury Bonds | 2.5 |

| Amazon.com | 1.9 |

| Government National Mortgage Assn. | 1.8 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

MSCI and Morningstar do not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Balanced Fund

I Class (RBAIX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Item 1. (b) Notice pursuant to Rule 30e-3.

Not applicable.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors has determined that Mr. Paul F. McBride qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. McBride is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

| | | | | | | | | | |

| | | 2024 | | | 2023 | | | |

Audit Fees | | $ | 33,841 | | | $ | 34,808 | |

Audit-Related Fees | | | - | | | | - | |

Tax Fees | | | - | | | | - | |

All Other Fees | | | - | | | | - | |

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,262,000 and $1,524,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a – b) Report pursuant to Regulation S-X.

Financial

Highlights

Portfolio

of

Investments

Financial

Statements

and

Notes

Additional

Fund

Information

Financial

Statements

and

Other

Information

For

more

insights

from

T.

Rowe

Price

investment

professionals,

go

to

troweprice.com

.

T.

ROWE

PRICE

RPBAX

Balanced

Fund

RBAIX

Balanced

Fund–

.

I Class

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Investor

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

25.22

$

22.22

$

28.20

$

27.24

$

24.94

Investment

activities

Net

investment

income

(1)(2)

0.55

0.51

0.43

0.37

0.40

Net

realized

and

unrealized

gain/loss

2.42

3.45

(5.29)

3.22

3.15

Total

from

investment

activities

2.97

3.96

(4.86)

3.59

3.55

Distributions

Net

investment

income

(0.58)

(0.52)

(0.44)

(0.38)

(0.41)

Net

realized

gain

(1.33)

(0.44)

(0.68)

(2.25)

(0.84)

Total

distributions

(1.91)

(0.96)

(1.12)

(2.63)

(1.25)

NET

ASSET

VALUE

End

of

period

$

26.28

$

25.22

$

22.22

$

28.20

$

27.24

Ratios/Supplemental

Data

Total

return

(2)(3)

11.84%

17.99%

(17.26)%

13.36%

14.57%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

0.60%

0.60%

0.61%

0.57%

0.58%

Net

expenses

after

waivers/

payments

by

Price

Associates

0.55%

0.55%

0.57%

0.53%

0.55%

Net

investment

income

2.06%

2.15%

1.74%

1.27%

1.63%

Portfolio

turnover

rate

39.2%

40.9%

97.7%

91.9%

75.7%

Net

assets,

end

of

period

(in

millions)

$2,484

$2,490

$2,318

$4,224

$4,087

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

I

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

25.20

$

22.21

$

28.20

$

27.23

$

24.94

Investment

activities

Net

investment

income

(1)(2)

0.59

0.54

0.49

0.41

0.43

Net

realized

and

unrealized

gain/loss

2.42

3.44

(5.31)

3.22

3.14

Total

from

investment

activities

3.01

3.98

(4.82)

3.63

3.57

Distributions

Net

investment

income

(0.62)

(0.55)

(0.49)

(0.41)

(0.44)

Net

realized

gain

(1.33)

(0.44)

(0.68)

(2.25)

(0.84)

Total

distributions

(1.95)

(0.99)

(1.17)

(2.66)

(1.28)

NET

ASSET

VALUE

End

of

period

$

26.26

$

25.20

$

22.21

$

28.20

$

27.23

Ratios/Supplemental

Data

Total

return

(2)(3)

12.00%

18.10%

(17.12)%

13.51%

14.67%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

0.47%

0.47%

0.47%

0.45%

0.46%

Net

expenses

after

waivers/payments

by

Price

Associates

0.42%

0.42%

0.43%

0.41%

0.43%

Net

investment

income

2.20%

2.28%

2.02%

1.39%

1.74%

Portfolio

turnover

rate

39.2%

40.9%

97.7%

91.9%

75.7%

Net

assets,

end

of

period

(in

millions)

$2,116

$1,889

$1,669

$1,173

$871

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Balanced

Fund

December

31,

2024

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

ASSET-BACKED

SECURITIES

1.5%

AmeriCredit

Automobile

Receivables

Trust

Series 2021-2,

Class

D

1.29%,

6/18/27

2,100,000

2,026

Bayview

Opportunity

Master

Fund

VII

Series 2024-CAR1,

Class

A,

FRN

SOFR30A

+

1.10%,

5.669%,

12/26/31 (1)

178,056

178

BRE

Grand

Islander

Timeshare

Issuer

Series 2019-A,

Class

A

3.28%,

9/26/33 (1)

149,999

147

CarMax

Auto

Owner

Trust

Series 2021-1,

Class

D

1.28%,

7/15/27

1,205,000

1,195

CarMax

Auto

Owner

Trust

Series 2023-3,

Class

A3

5.28%,

5/15/28

735,000

741

CarMax

Auto

Owner

Trust

Series 2023-3,

Class

B

5.47%,

2/15/29

580,000

587

CarMax

Auto

Owner

Trust

Series 2024-1,

Class

B

5.17%,

8/15/29

105,000

106

CarMax

Auto

Owner

Trust

Series 2024-3,

Class

A3

4.89%,

7/16/29

400,000

402

Carvana

Auto

Receivables

Trust

Series 2021-P4,

Class

C

2.33%,

2/10/28

1,715,000

1,599

Carvana

Auto

Receivables

Trust

Series 2024-N1,

Class

A3

5.60%,

3/10/28 (1)

195,000

197

Carvana

Auto

Receivables

Trust

Series 2024-N1,

Class

B

5.63%,

5/10/30 (1)

235,000

237

Carvana

Auto

Receivables

Trust

Series 2024-N3,

Class

B

4.67%,

12/10/30 (1)

3,420,000

3,388

CCG

Receivables

Trust

Series 2024-1,

Class

A2

4.99%,

3/15/32 (1)

2,715,000

2,729

CIFC

Funding

Series 2018-1A,

Class

A1R,

CLO,

FRN

3M

TSFR

+

1.32%,

5.794%,

1/18/38 (1)

520,000

519

CyrusOne

Data

Centers

Issuer

I

Series 2024-2A,

Class

A2

4.50%,

5/20/49 (1)

2,330,000

2,221

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Drive

Auto

Receivables

Trust

Series 2024-2,

Class

B

4.52%,

7/16/29

1,800,000

1,787

Driven

Brands

Funding

Series 2020-1A,

Class

A2

3.786%,

7/20/50 (1)

630,715

605

Driven

Brands

Funding

Series 2020-2A,

Class

A2

3.237%,

1/20/51 (1)

1,164,698

1,091

Driven

Brands

Funding

Series 2021-1A,

Class

A2

2.791%,

10/20/51 (1)

1,457,752

1,318

Elara

HGV

Timeshare

Issuer

Series 2023-A,

Class

A

6.16%,

2/25/38 (1)

395,183

403

Elara

HGV

Timeshare

Issuer

Series 2023-A,

Class

B

6.53%,

2/25/38 (1)

317,735

322

Elmwood

Series 2022-7A,

Class

AR,

CLO,

FRN

3M

TSFR

+

1.50%,

6.147%,

1/17/37 (1)

1,385,000

1,394

Enterprise

Fleet

Financing

Series 2024-3,

Class

A3

4.98%,

8/21/28 (1)

155,000

156

Enterprise

Fleet

Financing

Series 2024-3,

Class

A4

5.06%,

3/20/31 (1)

110,000

110

Enterprise

Fleet

Financing

Series 2024-4,

Class

A2

4.69%,

7/20/27 (1)

455,000

456

Enterprise

Fleet

Financing

Series 2024-4,

Class

A4

4.70%,

6/20/31 (1)

670,000

666

Ford

Credit

Auto

Owner

Trust

Series 2020-2,

Class

C

1.74%,

4/15/33 (1)

1,665,000

1,619

Ford

Credit

Auto

Owner

Trust

Series 2023-1,

Class

A

4.85%,

8/15/35 (1)

2,565,000

2,575

Ford

Credit

Floorplan

Master

Owner

Trust

Series 2020-2,

Class

B

1.32%,

9/15/27

1,275,000

1,244

Golub

Capital

Partners

Series 2019-43A,

Class

A1R,

CLO,

FRN

3M

TSFR

+

1.34%,

5.889%,

10/20/37 (1)

2,175,000

2,175

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Hardee's

Funding

Series 2024-1A,

Class

A2

7.253%,

3/20/54 (1)

1,672,363

1,708

Highbridge

Loan

Management

Series 5A-2015,

Class

A1R3,

CLO,

FRN

3M

TSFR

+

1.06%,

6.068%,

10/15/30 (1)

630,000

631

Huntington

Bank

Auto

Credit-Linked

Notes

Series 2024-1,

Class

B1

6.153%,

5/20/32 (1)

191,602

194

Invesco

U.S.

Series 2023-1A,

Class

AR,

CLO,

FRN

3M

TSFR

+

1.57%,

6.202%,

4/22/37 (1)

720,000

723

Jamestown

XV

Series 2020-15A,

Class

A1R,

CLO,

FRN

3M

TSFR

+

1.37%,

6.026%,

7/15/35 (1)

1,160,000

1,164

Jersey

Mike's

Funding

Series 2019-1A,

Class

A2

4.433%,

2/15/50 (1)

279,885

276

Jersey

Mike's

Funding

Series 2021-1A,

Class

A2I

2.891%,

2/15/52 (1)

49,750

48

KKR

Series 2022-43A,

Class

A1R,

CLO,

FRN

3M

TSFR

+

1.75%,

6.406%,

1/15/36 (1)

1,075,000

1,081

Madison

Park

Funding

XXXIII

Series 2019-33A,

Class

AR,

CLO,

FRN

3M

TSFR

+

1.29%,

5.946%,

10/15/32 (1)

1,205,000

1,206

MVW

Series 2019-2A,

Class

A

2.22%,

10/20/38 (1)

422,654

412

Navient

Private

Education

Refi

Loan

Trust

Series 2019-CA,

Class

A2

3.13%,

2/15/68 (1)

377,945

369

Navient

Private

Education

Refi

Loan

Trust

Series 2020-GA,

Class

A

1.17%,

9/16/69 (1)

249,218

229

Navistar

Financial

Dealer

Note

Master

Owner

Trust

Series 2024-1,

Class

A

5.59%,

4/25/29 (1)

165,000

167

Neuberger

Berman

XXI

Series 2016-21A,

Class

A1R3,

CLO,

FRN

3M

TSFR

+

1.32%,

5.792%,

1/20/39 (1)

415,000

415

OCP

Series 2017-13A,

Class

AR2,

CLO,

FRN

3M

TSFR

+

1.34%,

5.90%,

11/26/37 (1)

1,910,000

1,912

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Octane

Receivables

Trust

Series 2024-RVM1,

Class

A

5.01%,

1/22/46 (1)

870,000

869

Palmer

Square

Series 2020-3A,

Class

A1R2,

CLO,

FRN

3M

TSFR

+

1.65%,

6.173%,

11/15/36 (1)

1,405,000

1,411

Porsche

Innovative

Lease

Owner

Trust

Series 2024-2A,

Class

A4

4.26%,

9/20/30 (1)

790,000

784

Post

Road

Equipment

Finance

Series 2024-1A,

Class

A2

5.59%,

11/15/29 (1)

129,874

131

Progress

Residential

Trust

Series 2024-SFR4,

Class

A

3.10%,

7/17/41 (1)

2,505,000

2,297

Progress

Residential

Trust

Series 2024-SFR5,

Class

A

3.00%,

8/9/29 (1)

345,000

314

Santander

Bank

Auto

Credit-Linked

Notes

Series 2022-C,

Class

B

6.451%,

12/15/32 (1)

416,006

418

Santander

Drive

Auto

Receivables

Trust

Series 2021-1,

Class

E

2.51%,

12/15/28

4,100,000

4,025

Santander

Drive

Auto

Receivables

Trust

Series 2021-3,

Class

E

2.70%,

10/16/28 (1)

4,300,000

4,220

Santander

Drive

Auto

Receivables

Trust

Series 2024-5,

Class

A3

4.62%,

11/15/28

800,000

799

Santander

Drive

Auto

Receivables

Trust

Series 2024-5,

Class

B

4.63%,

8/15/29

900,000

896

SBNA

Auto

Lease

Trust

Series 2024-A,

Class

A3

5.39%,

11/20/26 (1)

180,000

181

SBNA

Auto

Lease

Trust

Series 2024-A,

Class

A4

5.24%,

1/22/29 (1)

175,000

176

SCF

Equipment

Leasing

Series 2024-1A,

Class

C

5.82%,

9/20/32 (1)

390,000

395

SEB

Funding

Series 2024-1A,

Class

A2

7.386%,

4/30/54 (1)

400,000

409

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

ServiceMaster

Funding

Series 2021-1,

Class

A2I

2.865%,

7/30/51 (1)

1,555,686

1,397

Signal

Peak

Series 2018-5A,

Class

A1R,

CLO,

FRN

3M

TSFR

+

1.55%,

6.176%,

4/25/37 (1)

2,220,000

2,235

SMB

Private

Education

Loan

Trust

Series 2018-B,

Class

A2A

3.60%,

1/15/37 (1)

246,209

242

SMB

Private

Education

Loan

Trust

Series 2020-B,

Class

A1A

1.29%,

7/15/53 (1)

673,837

625

SMB

Private

Education

Loan

Trust

Series 2021-A,

Class

APT1

1.07%,

1/15/53 (1)

1,403,809

1,245

Synchrony

Card

Funding

Series 2023-A1,

Class

A

5.54%,

7/15/29

585,000

593

TPIC

SPV

I

Series 2024-1A,

Class

A

7.131%,

11/30/44,

Acquisition

Date:

12/10/24,

Cost $1,685 (2)

1,685,000

1,685

U.S.

Bank

Series 2023-1,

Class

B

6.789%,

8/25/32 (1)

133,853

136

Verdant

Receivables

Series 2023-1A,

Class

A2

6.24%,

1/13/31 (1)

317,110

322

Verdant

Receivables

Series 2024-1A,

Class

A2

5.68%,

12/12/31 (1)

170,000

172

Total

Asset-Backed

Securities

(Cost

$69,412)

68,705

BOND

MUTUAL

FUNDS

5.2%

T.

Rowe

Price

Inflation

Protected

Bond

Fund

-

I

Class,

3.22% (3)(4)

2,211,631

22,426

T.

Rowe

Price

Institutional

High

Yield

Fund

-

Institutional

Class,

6.73% (3)(4)

27,701,490

216,903

T.

Rowe

Price

Limited

Duration

Inflation

Focused

Bond

Fund

-

I

Class,

2.91% (3)(4)

102,720

474

Total

Bond

Mutual

Funds

(Cost

$256,228)

239,803

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

COMMON

STOCKS

61.3%

COMMUNICATION

SERVICES

4.9%

Diversified

Telecommunication

Services

0.4%

AT&T

19,531

445

BT

Group

(GBP) (5)

2,927,022

5,276

KT

(KRW)

131,837

3,923

Nippon

Telegraph

&

Telephone

(JPY)

8,780,100

8,770

18,414

Entertainment

0.5%

Netflix (6)

22,694

20,228

Sea,

ADR (6)

20,691

2,195

Spotify

Technology (6)

1,400

627

Walt

Disney

12,800

1,425

24,475

Interactive

Media

&

Services

3.2%

Alphabet,

Class

A

106,572

20,174

Alphabet,

Class

C

304,061

57,906

LY

(JPY)

754,600

1,995

Meta

Platforms,

Class

A

101,705

59,549

NAVER

(KRW)

24,952

3,330

Pinterest,

Class

A (6)

19,700

571

Tencent

Holdings

(HKD)

38,200

2,039

145,564

Media

0.4%

Charter

Communications,

Class

A (6)

4,700

1,611

Comcast,

Class

A

212,511

7,975

CyberAgent

(JPY)

379,100

2,609

WPP

(GBP)

598,871

6,173

18,368

Wireless

Telecommunication

Services

0.4%

T-Mobile

U.S.

81,764

18,048

18,048

Total

Communication

Services

224,869

CONSUMER

DISCRETIONARY

7.0%

Automobile

Components

0.4%

Autoliv,

SDR

(SEK)

48,151

4,484

Denso

(JPY)

365,000

5,032

Dowlais

Group

(GBP)

1,184,819

996

Magna

International (5)

92,604

3,870

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Stanley

Electric

(JPY)

103,800

1,702

16,084

Automobiles

1.2%

Subaru

(JPY)

106,500

1,892

Suzuki

Motor

(JPY)

357,700

4,008

Tesla (6)

91,685

37,026

Toyota

Motor

(JPY)

546,800

10,677

53,603

Broadline

Retail

2.1%

Alibaba

Group

Holding,

ADR

17,123

1,452

Amazon.com (6)

394,517

86,553

Isetan

Mitsukoshi

Holdings

(JPY)

243,600

4,183

Next

(GBP)

52,285

6,202

98,390

Hotels,

Restaurants

&

Leisure

1.3%

Airbnb,

Class

A (6)

1,577

207

Amadeus

IT

Group

(EUR)

71,314

5,034

Booking

Holdings

2,988

14,845

Chipotle

Mexican

Grill (6)

127,509

7,689

Compass

Group

(GBP)

313,461

10,430

Domino's

Pizza

858

360

DoorDash,

Class

A (6)

14,759

2,476

Hilton

Worldwide

Holdings

4,756

1,175

Las

Vegas

Sands

18,590

955

Marriott

International,

Class

A

4,588

1,280

McDonald's

41,536

12,041

Norwegian

Cruise

Line

Holdings (6)

12,482

321

Royal

Caribbean

Cruises

5,579

1,287

Starbucks

5,161

471

Wingstop

1,151

327

Wynn

Resorts

3,504

302

59,200

Household

Durables

0.4%

NVR (6)

190

1,554

Panasonic

Holdings

(JPY)

475,100

4,856

Persimmon

(GBP)

161,305

2,409

Sony

Group

(JPY)

461,200

9,720

18,539

Specialty

Retail

1.2%

AutoZone (6)

2,624

8,402

Bath

&

Body

Works

4,441

172

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Burlington

Stores (6)

2,476

706

Carvana (6)

55,004

11,186

Home

Depot

28,770

11,191

Kingfisher

(GBP)

1,633,519

5,078

Lowe's

7,282

1,797

O'Reilly

Automotive (6)

1,057

1,253

Ross

Stores

60,003

9,077

TJX

35,258

4,259

Tractor

Supply

62,505

3,316

Ulta

Beauty (6)

714

311

56,748

Textiles,

Apparel

&

Luxury

Goods

0.4%

Cie

Financiere

Richemont,

Class

A

(CHF)

29,412

4,449

Deckers

Outdoor (6)

2,600

528

Kering

(EUR)

9,910

2,448

Lululemon

Athletica (6)

7,082

2,708

Moncler

(EUR)

75,821

4,003

NIKE,

Class

B

5,127

388

Samsonite

International

(HKD)

768,000

2,118

Tapestry

13,673

893

17,535

Total

Consumer

Discretionary

320,099

CONSUMER

STAPLES

3.8%

Beverages

0.8%

Coca-Cola

189,184

11,779

Constellation

Brands,

Class

A

2,285

505

Diageo

(GBP)

165,882

5,271

Heineken

(EUR)

71,609

5,103

Keurig

Dr

Pepper

309,453

9,940

Kirin

Holdings

(JPY) (5)

123,200

1,600

Monster

Beverage (6)

6,444

339

PepsiCo

17,870

2,717

37,254

Consumer

Staples

Distribution

&

Retail

0.7%

Costco

Wholesale

6,014

5,510

Dollar

General

11,472

870

Dollar

Tree (6)

30,092

2,255

Seven

&

i

Holdings

(JPY)

502,700

7,881

Sysco

2,379

182

Target

6,535

883

Walmart

162,070

14,643

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Welcia

Holdings

(JPY)

66,900

872

33,096

Food

Products

0.6%

Barry

Callebaut

(CHF) (5)

1,094

1,457

Lamb

Weston

Holdings

1,800

120

Mondelez

International,

Class

A

81,437

4,864

Nestle

(CHF)

202,812

16,639

Wilmar

International

(SGD)

1,739,800

3,949

27,029

Household

Products

0.6%

Clorox

3,000

487

Colgate-Palmolive

123,163

11,197

Kimberly-Clark

4,825

632

Procter

&

Gamble

91,902

15,408

27,724

Personal

Care

Products

1.0%

Kenvue

919,488

19,631

L'Oreal

(EUR)

16,934

5,995

Puig

Brands,

Class

B

(EUR) (6)

88,485

1,631

Unilever

(GBP)

292,801

16,637

43,894

Tobacco

0.1%

Altria

Group

13,058

683

Philip

Morris

International

32,775

3,944

4,627

Total

Consumer

Staples

173,624

ENERGY

2.5%

Energy

Equipment

&

Services

0.3%

Schlumberger

265,040

10,162

TechnipFMC

59,500

1,722

11,884

Oil,

Gas

&

Consumable

Fuels

2.2%

Chevron

73,847

10,696

ConocoPhillips

126,531

12,548

Diamondback

Energy

35,827

5,870

EOG

Resources

10,658

1,306

EQT

134,382

6,196

Equinor

(NOK)

374,381

8,880

Expand

Energy

26,485

2,637

Exxon

Mobil

153,687

16,532

Hess

1,916

255

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Marathon

Petroleum

7,207

1,005

Phillips

66

35,689

4,066

Range

Resources

235,437

8,471

Shell,

ADR

129,936

8,141

Suncor

Energy

7,569

270

Targa

Resources

6,160

1,100

Texas

Pacific

Land

300

332

TotalEnergies

(EUR)

198,061

11,035

Valero

Energy

7,401

907

Williams

54,362

2,942

103,189

Total

Energy

115,073

FINANCIALS

10.8%

Banks

3.4%

ANZ

Group

Holdings

(AUD)

202,633

3,570

Bank

of

America

468,071

20,572

Citigroup

103,147

7,261

DBS

Group

Holdings

(SGD)

173,600

5,563

DNB

Bank

(NOK)

486,717

9,717

Fifth

Third

Bancorp

19,797

837

HDFC

Bank

(INR)

249,614

5,162

Huntington

Bancshares

176,114

2,865

ING

Groep

(EUR)

565,148

8,857

Intesa

Sanpaolo

(EUR)

1,086,239

4,357

JPMorgan

Chase

135,870

32,569

KeyCorp

241,581

4,141

Mitsubishi

UFJ

Financial

Group

(JPY)

712,000

8,312

National

Bank

of

Canada

(CAD)

83,285

7,592

Popular

3,400

320

Skandinaviska

Enskilda

Banken,

Class

A

(SEK)

243,657

3,339

Societe

Generale

(EUR)

106,990

3,003

Standard

Chartered

(GBP)

548,508

6,753

Sumitomo

Mitsui

Trust

Group

(JPY)

117,308

2,740

Truist

Financial

5,386

234

UniCredit

(EUR)

134,609

5,391

United

Overseas

Bank

(SGD)

287,900

7,646

Wells

Fargo

41,489

2,914

Western

Alliance

Bancorp

4,063

339

154,054

Capital

Markets

1.6%

Ares

Management,

Class

A

4,625

819

Bank

of

New

York

Mellon

14,793

1,137

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Blackrock

1,834

1,880

Blackstone

3,461

597

Bridgepoint

Group

(GBP)

706,060

3,158

Brookfield

(CAD)

106,467

6,119

Cboe

Global

Markets

2,463

481

Charles

Schwab

225,611

16,698

CME

Group

29,480

6,846

CVC

Capital

Partners

(EUR) (6)

178,368

3,944

Goldman

Sachs

Group

15,555

8,907

Julius

Baer

Group

(CHF)

88,765

5,758

KKR

11,683

1,728

Macquarie

Group

(AUD)

33,008

4,514

Moody's

800

379

Morgan

Stanley

38,742

4,871

MSCI

212

127

S&P

Global

9,703

4,832

State

Street

9,000

883

TPG

6,500

408

Tradeweb

Markets,

Class

A

5,022

658

74,744

Consumer

Finance

0.3%

American

Express

41,162

12,216

Capital

One

Financial

4,000

713

Synchrony

Financial

14,100

917

13,846

Financial

Services

2.8%

Adyen

(EUR) (6)

2,245

3,336

Apollo

Global

Management

7,697

1,271

Berkshire

Hathaway,

Class

B (6)

68,719

31,149

Block (6)

4,800

408

Challenger

(AUD)

332,393

1,234

Corebridge

Financial

213,516

6,391

Corpay (6)

19,660

6,653

Edenred

(EUR)

61,311

2,016

Equitable

Holdings

20,449

965

Fiserv (6)

94,797

19,473

Global

Payments

9,628

1,079

Mastercard,

Class

A

41,358

21,778

Mitsubishi

HC

Capital

(JPY)

307,800

2,028

Visa,

Class

A

102,050

32,252

Voya

Financial

12,434

856

130,889

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Insurance

2.6%

AIA

Group

(HKD)

726,000

5,215

Allstate

42,806

8,253

American

International

Group

22,036

1,604

AXA

(EUR)

377,350

13,430

Axis

Capital

Holdings

4,644

411

Chubb

46,441

12,832

Definity

Financial

(CAD)

75,609

3,074

Great-West

Lifeco

(CAD)

90,015

2,985

Hartford

Financial

Services

Group

12,224

1,337

Mandatum

(EUR)

412,976

1,921

Marsh

&

McLennan

20,632

4,382

MetLife

55,340

4,531

Muenchener

Rueckversicherungs-Gesellschaft

(EUR)

30,442

15,389

Progressive

11,401

2,732

RenaissanceRe

Holdings

3,913

974

Sampo,

Class

A

(EUR)

158,103

6,458

Storebrand

(NOK)

520,374

5,549

Sun

Life

Financial

(CAD)

83,950

4,985

Tokio

Marine

Holdings

(JPY)

300,700

10,792

Travelers

28,878

6,956

Zurich

Insurance

Group

(CHF)

10,626

6,320

120,130

Mortgage

Real

Estate

Investment

Trusts

0.1%

Annaly

Capital

Management,

REIT

215,316

3,940

3,940

Total

Financials

497,603

HEALTH

CARE

7.1%

Biotechnology

0.5%

AbbVie

20,821

3,700

Amgen

6,499

1,694

Argenx,

ADR (6)

7,973

4,903

BeiGene,

ADR (6)

2,800

517

Biogen (6)

4,642

710

Genmab

(DKK) (6)

11,381

2,377

Gilead

Sciences

13,062

1,206

Regeneron

Pharmaceuticals (6)

9,083

6,470

Vertex

Pharmaceuticals (6)

2,428

978

22,555

Health

Care

Equipment

&

Supplies

1.3%

Abbott

Laboratories

10,022

1,134

Alcon

(CHF)

45,233

3,835

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Becton

Dickinson

&

Company

28,044

6,362

Boston

Scientific (6)

16,657

1,488

Cooper (6)

7,800

717

Edwards

Lifesciences (6)

10,200

755

Elekta,

Class

B

(SEK)

364,500

2,013

EssilorLuxottica

(EUR)

22,178

5,410

GE

HealthCare

Technologies

28,249

2,209

Intuitive

Surgical (6)

26,234

13,693

Koninklijke

Philips

(EUR) (6)

271,255

6,871

Medtronic

9,339

746

Siemens

Healthineers

(EUR)

135,296

7,145

Stryker

15,976

5,752

Zimmer

Biomet

Holdings

12,291

1,298

59,428

Health

Care

Providers

&

Services

1.6%

Cencora

47,508

10,674

Cigna

Group

18,153

5,013

CVS

Health

12,600

566

Elevance

Health

40,510

14,944

HCA

Healthcare

5,259

1,579

Humana

6,441

1,634

McKesson

2,050

1,168

Molina

Healthcare (6)

9,110

2,651

Quest

Diagnostics

4,800

724

Tenet

Healthcare (6)

50,745

6,406

UnitedHealth

Group

57,922

29,300

74,659

Life

Sciences

Tools

&

Services

0.8%

Danaher

48,683

11,175

ICON (6)

1,695

356

Mettler-Toledo

International (6)

877

1,073

Repligen (6)

5,116

736

Revvity

64,956

7,250

Thermo

Fisher

Scientific

30,291

15,758

36,348

Pharmaceuticals

2.9%

Astellas

Pharma

(JPY)

387,600

3,764

AstraZeneca,

ADR

367,225

24,061

Bayer

(EUR)

98,640

1,970

Bristol-Myers

Squibb

6,894

390

Chugai

Pharmaceutical

(JPY)

97,500

4,298

Eli

Lilly

42,221

32,595

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Johnson

&

Johnson

72,164

10,436

Merck

26,806

2,667

Novartis

(CHF)

119,946

11,678

Novo

Nordisk,

Class

B

(DKK)

127,066

10,963

Pfizer

40,770

1,082

Roche

Holding

(CHF)

40,669

11,371

Sanofi

(EUR)

128,661

12,507

Sanofi,

ADR

11,900

574

Shionogi

(JPY)

113,600

1,593

Viatris

74,282

925

Zoetis

1,769

288

131,162

Total

Health

Care

324,152

INDUSTRIALS

&

BUSINESS

SERVICES

6.4%

Aerospace

&

Defense

1.2%

Boeing (6)

47,748

8,451

General

Dynamics

16,971

4,472

General

Electric

71,646

11,950

Howmet

Aerospace

8,965

981

L3Harris

Technologies

29,572

6,218

Lockheed

Martin

689

335

Melrose

Industries

(GBP)

978,383

6,761

Northrop

Grumman

11,388

5,344

RTX

8,089

936

Safran

(EUR)

36,321

7,958

TransDigm

Group

2,030

2,573

55,979

Air

Freight

&

Logistics

0.0%

FedEx

2,564

721

721

Building

Products

0.1%

Carrier

Global

14,174

968

Johnson

Controls

International

7,505

592

Owens

Corning

12,600

2,146

Trane

Technologies

2,990

1,104

Trex (6)

1,000

69

4,879

Commercial

Services

&

Supplies

0.4%

Cintas

13,152

2,403

Copart (6)

13,492

774

Element

Fleet

Management

(CAD)

421,764

8,527

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Republic

Services

29,567

5,948

Veralto

4,598

469

Waste

Connections

3,317

569

Waste

Management

3,738

754

19,444

Construction

&

Engineering

0.1%

Worley

(AUD)

416,461

3,521

3,521

Electrical

Equipment

1.2%

ABB

(CHF)

203,568

10,992

AMETEK

55,454

9,996

Emerson

Electric

5,292

656

GE

Vernova

11,146

3,666

Hubbell

2,430

1,018

Legrand

(EUR)

66,898

6,507

Mitsubishi

Electric

(JPY)

403,400

6,812

Prysmian

(EUR)

140,449

8,988

Rockwell

Automation

29,167

8,336

Vertiv

Holdings,

Class

A

3,802

432

57,403

Ground

Transportation

0.8%

Central

Japan

Railway

(JPY)

140,900

2,644

CSX

145,491

4,695

Norfolk

Southern

41,781

9,806

Old

Dominion

Freight

Line

47,340

8,351

Saia (6)

1,964

895

Uber

Technologies (6)

27,310

1,647

Union

Pacific

30,884

7,043

35,081

Industrial

Conglomerates

0.7%

DCC

(GBP)

55,962

3,586

Honeywell

International

9,478

2,141

Roper

Technologies

8,982

4,669

Siemens

(EUR)

116,956

22,806

33,202

Machinery

1.1%

Caterpillar

2,413

875

Cummins

19,762

6,889

Deere

27,405

11,611

Dover

5,400

1,013

Esab

4,189

502

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Fortive

16,500

1,238

IDEX

3,564

746

Ingersoll

Rand

7,932

718

KION

Group

(EUR)

66,820

2,206

Parker-Hannifin

7,400

4,707

Sandvik

(SEK)

250,744

4,496

SMC

(JPY)

5,000

1,942

Stanley

Black

&

Decker

20,773

1,668

THK

(JPY)

101,700

2,346

Westinghouse

Air

Brake

Technologies

56,005

10,618

Xylem

1,000

116

51,691

Passenger

Airlines

0.0%

Delta

Air

Lines

4,645

281

United

Airlines

Holdings (6)

5,910

574

855

Professional

Services

0.3%

Booz

Allen

Hamilton

Holding

1,900

245

Equifax

2,810

716

Paylocity

Holding (6)

2,700

539

Recruit

Holdings

(JPY)

110,800

7,701

TechnoPro

Holdings

(JPY)

168,900

3,158

Teleperformance

(EUR)

19,787

1,697

Verisk

Analytics

2,705

745

14,801

Trading

Companies

&

Distributors

0.5%

Ashtead

Group

(GBP)

26,552

1,643

Bunzl

(GBP)

119,326

4,913

Fastenal

9,893

711

Ferguson

Enterprises

23,342

4,051

Mitsubishi

(JPY)

199,400

3,263

SiteOne

Landscape

Supply (6)

3,901

514

Sumitomo

(JPY)

273,100

5,910

WW

Grainger

400

422

21,427

Total

Industrials

&

Business

Services

299,004

INFORMATION

TECHNOLOGY

14.2%

Communications

Equipment

0.2%

Arista

Networks (6)

8,896

983

Cisco

Systems

38,682

2,290

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

LM

Ericsson,

Class

B

(SEK)

711,130

5,759

9,032

Electronic

Equipment,

Instruments

&

Components

0.8%

Amphenol,

Class

A

62,027

4,308

Hamamatsu

Photonics

(JPY)

159,000

1,768

Keysight

Technologies (6)

85,106

13,671

Largan

Precision

(TWD)

19,000

1,547

Murata

Manufacturing

(JPY)

152,100

2,413

Omron

(JPY)

58,500

1,970

TE

Connectivity

63,386

9,062

Teledyne

Technologies (6)

2,696

1,251

Zebra

Technologies,

Class

A (6)

2,836

1,095

37,085

IT

Services

0.3%

Accenture,

Class

A

11,964

4,209

Gartner (6)

600

291

International

Business

Machines

6,564

1,443

MongoDB (6)

2,443

569

Nomura

Research

Institute

(JPY)

132,100

3,878

Shopify,

Class

A (6)

47,315

5,031

Snowflake,

Class

A (6)

686

106

15,527

Semiconductors

&

Semiconductor

Equipment

6.0%

Advanced

Micro

Devices (6)

42,137

5,090

Analog

Devices

29,667

6,303

ASML

Holding

(EUR)

20,439

14,316

ASML

Holding

7,303

5,061

BE

Semiconductor

Industries

(EUR)

19,105

2,619

Broadcom

211,655

49,070

First

Solar (6)

2,200

388

KLA

3,433

2,163

Lam

Research

2,579

186

Marvell

Technology

22,814

2,520

Micron

Technology

41,300

3,476

Monolithic

Power

Systems

4,245

2,512

NVIDIA

956,630

128,466

NXP

Semiconductors

29,962

6,228

QUALCOMM

22,230

3,415

Renesas

Electronics

(JPY)

208,400

2,637

Taiwan

Semiconductor

Manufacturing

(TWD)

681,969

22,164

Taiwan

Semiconductor

Manufacturing,

ADR

15,218

3,005

Texas

Instruments

55,068

10,326

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Tokyo

Electron

(JPY)

27,900

4,194

274,139

Software

4.2%

Adobe (6)

5,897

2,622

Atlassian,

Class

A (6)

1,555

378

Autodesk (6)

4,144

1,225

BILL

Holdings (6)

12,595

1,067

Cadence

Design

Systems (6)

7,337

2,204

Canva,

Acquisition

Date:

8/16/21

-

12/17/21,

Cost $668 (2)(6)

(7)

392

519

Confluent,

Class

A (6)

19,455

544

Crowdstrike

Holdings,

Class

A (6)

7,514

2,571

Datadog,

Class

A (6)

7,686

1,098

Descartes

Systems

Group (6)

1,587

180

Dynatrace (6)

9,366

509

Fair

Isaac (6)

461

918

Fortinet (6)

29,623

2,799

Gen

Digital

43,262

1,185

Gusto,

Acquisition

Date:

10/4/21,

Cost $216 (2)(6)(7)

7,517

140

HubSpot (6)

614

428

Intuit

10,506

6,603

Microsoft

287,214

121,061

Oracle

21,972

3,661

Palo

Alto

Networks (6)

3,920

713

Salesforce

18,798

6,285

SAP

(EUR)

58,146

14,302

ServiceNow (6)

16,420

17,407

Synopsys (6)

13,080

6,349

Zscaler (6)

1,800

325

195,093

Technology

Hardware,

Storage

&

Peripherals

2.7%

Apple

471,641

118,108

Pure

Storage,

Class

A (6)

6,600

406

Samsung

Electronics

(KRW)

145,185

5,181

Western

Digital (6)

12,465

743

124,438

Total

Information

Technology

655,314

MATERIALS

2.2%

Chemicals

1.2%

Air

Liquide

(EUR)

43,243

7,030

Akzo

Nobel

(EUR)

58,233

3,495

Asahi

Kasei

(JPY)

317,800

2,190

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

BASF

(EUR)

75,673

3,318

CF

Industries

Holdings

9,023

770

Covestro

(EUR) (6)

62,745

3,770

Johnson

Matthey

(GBP)

142,464

2,390

Linde

30,934

12,951

Mosaic

125,966

3,096

PPG

Industries

25,522

3,049

RPM

International

1,312

161

Sherwin-Williams

34,634

11,773

Umicore

(EUR) (5)

115,352

1,191

55,184

Construction

Materials

0.1%

Martin

Marietta

Materials

5,801

2,996

Vulcan

Materials

3,238

833

3,829

Containers

&

Packaging

0.2%

Ball

11,942

659

International

Paper

167,546

9,017

Packaging

Corp.

of

America

3,562

802

10,478

Metals

&

Mining

0.6%

Antofagasta

(GBP)

246,877

4,891

BHP

Group

(AUD)

115,963

2,829

BHP

Group

(GBP) (5)

175,793

4,285

Franco-Nevada

38,986

4,584

Freeport-McMoRan

83,548

3,182

South32

(AUD)

824,353

1,729

Southern

Copper

16,855

1,536

Steel

Dynamics

6,833

780

Wheaton

Precious

Metals

28,119

1,581

25,397

Paper

&

Forest

Products

0.1%

Stora

Enso,

Class

R

(EUR)

252,930

2,546

West

Fraser

Timber (5)

8,299

718

3,264

Total

Materials

98,152

REAL

ESTATE

0.8%

Health

Care

Real

Estate

Investment

Trusts

0.0%

Welltower,

REIT

10,117

1,275

1,275

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Industrial

Real

Estate

Investment

Trusts

0.1%

Prologis,

REIT

14,515

1,534

Rexford

Industrial

Realty,

REIT

25,370

981

Segro

(GBP)

168,060

1,474

3,989

Office

Real

Estate

Investment

Trusts

0.0%

Great

Portland

Estates

(GBP)

253,703

915

915

Real

Estate

Management

&

Development

0.2%

CBRE

Group,

Class

A (6)

4,434

582

CoStar

Group (6)

3,959

284

Mitsui

Fudosan

(JPY)

773,000

6,182

7,048

Residential

Real

Estate

Investment

Trusts

0.1%

American

Homes

4

Rent,

Class

A,

REIT

8,019

300

AvalonBay

Communities,

REIT

2,008

442

Camden

Property

Trust,

REIT

1,158

134

Equity

LifeStyle

Properties,

REIT

23,853

1,589

Essex

Property

Trust,

REIT

2,193

626

Sun

Communities,

REIT

5,260

647

3,738

Retail

Real

Estate

Investment

Trusts

0.1%

Kimco

Realty,

REIT

17,421

408

Regency

Centers,

REIT

4,961

367

Scentre

Group

(AUD)

2,236,111

4,733

Simon

Property

Group,

REIT

2,738

472

5,980

Specialized

Real

Estate

Investment

Trusts

0.3%

American

Tower,

REIT

8,051

1,477

CubeSmart,

REIT

6,407

274

Equinix,

REIT

5,265

4,964

Public

Storage,

REIT

24,879

7,450

14,165

Total

Real

Estate

37,110

UTILITIES

1.6%

Electric

Utilities

0.9%

Constellation

Energy

29,372

6,571

Duke

Energy

1,012

109

Entergy

10,698

811

Evergy

6,900

425

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Exelon

239,315

9,008

FirstEnergy

7,819

311

NextEra

Energy

73,274

5,253

PG&E

110,370

2,227

Redeia

(EUR)

144,289

2,464

Southern

11,198

922

Xcel

Energy

170,962

11,543

39,644

Gas

Utilities

0.1%

Atmos

Energy

38,287

5,332

5,332

Independent

Power

&

Renewable

Electricity

Producers

0.1%

Electric

Power

Development

(JPY)

198,200

3,235

Vistra

4,287

591

3,826

Multi-Utilities

0.5%

Ameren

101,216

9,022

CMS

Energy

7,900

526

Engie

(EUR)

457,627

7,258

National

Grid

(GBP)

628,238

7,464

Sempra

900

79

24,349

Total

Utilities

73,151

Total

Common

Stocks

(Cost

$1,341,946)

2,818,151

CONVERTIBLE

PREFERRED

STOCKS

0.0%

INFORMATION

TECHNOLOGY

0.0%

Software

0.0%

Canva,

Series

A,

Acquisition

Date:

11/4/21

-

12/17/21,

Cost $43 (2)(6)(7)