UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |||

Nuveen Premier Municipal Income Fund, Inc. (NPF) Nuveen Premium Income Municipal Fund 4, Inc. (NPT) Nuveen Quality Municipal Fund, Inc. (NQI) Nuveen Select Quality Municipal Fund, Inc. (NQS) Nuveen Municipal Market Opportunity Fund, Inc. (NMO) Nuveen Premium Income Municipal Fund, Inc. (NPI) Nuveen Quality Income Municipal Fund, Inc. (NQU) Nuveen Performance Plus Municipal Fund, Inc. (NPP) Nuveen Premium Income Municipal Fund 2, Inc. (NPM) Nuveen Municipal Opportunity Fund, Inc. (NIO) | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| ||||

| (5) | Total fee paid: | |||

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| ||||

| (3) | Filing Party:

| |||

| ||||

| (4) | Date Filed:

| |||

| ||||

Important Notice to Fund Shareholders

June 13, 2014

Although we recommend that you read the complete Proxy Statement, for your convenience, we have provided a brief overview of the issues to be voted on.

| Q. | Why am I receiving this Proxy Statement? |

| A. | You are being asked to vote on several important matters affecting your Fund: |

| (1) | Approval of a New Investment Management Agreement. Nuveen Fund Advisors, LLC (“Nuveen Fund Advisors” or the “Adviser”) serves as your Fund’s investment adviser. Nuveen Investments, Inc. (“Nuveen”), the parent company of Nuveen Fund Advisors, recently announced its intention to be acquired by TIAA-CREF (the “Transaction”). In the event the Transaction takes place, securities laws require your Fund’s shareholders to approve a new investment management agreement between Nuveen Fund Advisors and the Fund to permit Nuveen Fund Advisors to continue to serve as investment adviser to your Fund. |

| (2) | Approval of a New Investment Sub-Advisory Agreement. Nuveen Fund Advisors has retained Nuveen Asset Management, LLC (“NAM”), a subsidiary of Nuveen, as sub-adviser to manage the assets of your Fund. In the event the Transaction takes place, shareholders of your Fund must approve a new sub-advisory agreement between Nuveen Fund Advisors and NAM to permit NAM to continue to manage your Fund. |

| (3) | Approval of Fund Board Nominees. Each year, shareholders of your Fund must approve the election of Board Members to serve on your Fund’s Board. This is a requirement for all funds that list their common shares on a stock exchange. The list of specific nominees for your Fund is contained in the enclosed proxy statement. |

Your Fund’s Board, including the independent Board Members, unanimously recommends that you voteFOReach proposal applicable to your Fund.

Your vote is very important. We encourage you as a shareholder to participate in your Fund’s governance by returning your vote as soon as possible. If enough shareholders do not cast their votes, your Fund may not be able to hold its meeting or the vote on each issue, and additional solicitation costs may need to be incurred in order to obtain sufficient shareholder participation.

| Q. | How will I as a Fund shareholder be affected by the Transaction? |

| A. | Your Fund investment will not change as a result of Nuveen’s change of ownership. You will still own the same Fund shares before and after the Transaction. Nuveen Fund Advisors and NAM will continue to manage your Fund according to the same objectives and policies as before, and do not anticipate any significant changes to your Fund’s operations. |

TIAA-CREF is a national financial services organization with approximately $569 billion in assets under management, as of March 31, 2014, and is the leading provider of retirement services in the academic, research, medical and cultural fields. Nuveen will operate as a separate subsidiary within TIAA-CREF’s asset management business. Nuveen’s current leadership and key investment teams are expected to stay in place.

| Q. | Will there be any important differences between my Fund’s new investment management agreement and sub-advisory agreement and the current agreements? |

| A. | No. The terms of the new and current agreements are substantially identical. There will be no change in the contractual management fees you pay. |

| Q. | What will happen if shareholders of my Fund do not approve the new investment management agreement or sub-advisory agreement before consummation of the Transaction? |

| A. | Nuveen Fund Advisors and NAM will continue to manage your Fund under an interim investment management agreement and an interim sub-advisory agreement, but must place their compensation for their services during this interim period in escrow, pending shareholder approval. Your Fund’s Board urges you to vote without delay in order to avoid potential disruption to the Fund’s operations. |

| Q. | Who do I call if I have questions? |

| A. | If you need any assistance, or have any questions regarding the proposals or how to vote your shares, please call Computershare Fund Services, your Fund’s proxy solicitor, at (866) 209-5784 with your proxy material. |

| Q. | How do I vote my shares? |

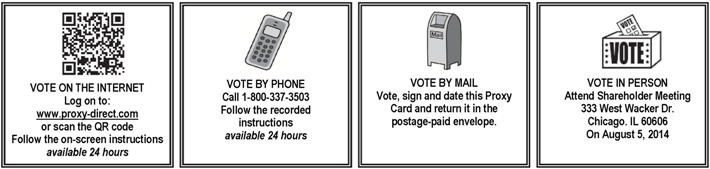

| A. | You can vote your shares by completing and signing the enclosed proxy card, and mailing it in the enclosed postage-paid envelope. Alternatively, you may vote by telephone by calling the toll-free number on the proxy card or by computer by going to the Internet address provided on the proxy card and following the instructions, using your proxy card as a guide. |

| Q. | Will anyone contact me? |

| A. | You may receive a call from Computershare Fund Services, the proxy solicitor hired by the Funds, to verify that you received your proxy materials, to answer any questions you may have about the proposals and to encourage you to vote your proxy. |

Notice of Annual Meeting to be held on August 5, 2014 | 333 West Wacker Drive Chicago, Illinois 60606 (800) 257-8787 |

Nuveen Municipal Advantage Fund, Inc. (NMA)

Nuveen Premier Municipal Income Fund, Inc. (NPF)

Nuveen Premium Income Municipal Fund 4, Inc. (NPT)

Nuveen Quality Municipal Fund, Inc. (NQI)

Nuveen Select Quality Municipal Fund, Inc. (NQS)

Nuveen Municipal Market Opportunity Fund, Inc. (NMO)

Nuveen Premium Income Municipal Fund, Inc. (NPI)

Nuveen Quality Income Municipal Fund, Inc. (NQU)

Nuveen Performance Plus Municipal Fund, Inc. (NPP)

Nuveen Premium Income Municipal Fund 2, Inc. (NPM)

Nuveen Municipal Opportunity Fund, Inc. (NIO)

June 13, 2014

To the Shareholders of the Above Funds:

Notice is hereby given that the Annual Meeting of Shareholders (the “Meeting”) of each of Nuveen Municipal Advantage Fund, Inc. (“NMA”), Nuveen Premier Municipal Income Fund, Inc. (“NPF”), Nuveen Premium Income Municipal Fund 4, Inc. (“NPT”), Nuveen Quality Municipal Fund, Inc. (“NQI”), Nuveen Select Quality Municipal Fund, Inc. (“NQS”), Nuveen Municipal Market Opportunity Fund, Inc. (“NMO”), Nuveen Premium Income Municipal Fund, Inc. (“NPI”), Nuveen Quality Income Municipal Fund, Inc. (“NQU”), Nuveen Performance Plus Municipal Fund, Inc. (“NPP”), Nuveen Premium Income Municipal Fund 2, Inc. (“NPM”) and Nuveen Municipal Opportunity Fund, Inc. (“NIO”), each a Minnesota corporation (each, a “Fund” and collectively, the “Funds”), will be held (along with meetings of shareholders of several other Nuveen funds) in the offices of Nuveen Investments, 333 West Wacker Drive, Chicago, Illinois 60606, on Tuesday, August 5, 2014, at 10:00 a.m., Central time, for the following purposes and to transact such other business, if any, as may properly come before the Meeting:

Matters to Be Voted on by Shareholders:

| 1. | To approve a new investment management agreement between each Fund and Nuveen Fund Advisors, LLC (“Nuveen Fund Advisors” or the “Adviser”), each Fund’s investment adviser. |

| 2. | To approve a new sub-advisory agreement between Nuveen Fund Advisors and Nuveen Asset Management, LLC, with respect to each Fund. |

| 3. | To elect twelve (12) Board Members in the following manner: |

| a. | ten (10) Board Members to be elected by the holders of common shares and Preferred Shares, voting together as a single class; and |

| b. | two (2) Board Members to be elected by the holders of Preferred Shares only, voting separately as a single class. |

Please see the table contained on page 2 of the enclosed joint proxy statement, which indicates which proposals shareholders of each Fund are being asked to approve.

Shareholders of record at the close of business on June 6, 2014 are entitled to notice of and to vote at the Meeting.

All shareholders are cordially invited to attend the Meeting. In order to avoid delay and additional expense and to assure that your shares are represented, please vote as promptly as possible, regardless of whether or not you plan to attend the Meeting. You may vote by mail, telephone or over the Internet. To vote by mail, please mark, sign, date and mail the enclosed proxy card. No postage is required if mailed in the United States. To vote by telephone, please call the toll-free number located on your proxy card and follow the recorded instructions, using your proxy card as a guide. To vote over the Internet, go to the Internet address provided on your proxy card and follow the instructions, using your proxy card as a guide.

If you intend to attend the Meeting in person and you are a record holder of a Fund’s shares, in order to gain admission you must show photographic identification, such as your driver’s license. If you intend to attend the Meeting in person and you hold your shares through a bank, broker or other custodian, in order to gain admission you must show photographic identification, such as your driver’s license, and satisfactory proof of ownership of shares of a Fund, such as your voting instruction form (or a copy thereof) or broker’s statement indicating ownership as of a recent date. If you hold your shares in a brokerage account or through a bank or other nominee, you will not be able to vote in person at the Meeting unless you have previously requested and obtained a “legal proxy” from your broker, bank or other nominee and present it at the Meeting.

Kevin J. McCarthy

Vice President and Secretary

| Joint Proxy Statement | 333 West Wacker Drive Chicago, Illinois 60606 (800) 257-8787 |

June 13, 2014

This Joint Proxy Statement is first being mailed to shareholders on or about June 18, 2014.

Nuveen Municipal Advantage Fund, Inc. (NMA)

Nuveen Premier Municipal Income Fund, Inc. (NPF)

Nuveen Premium Income Municipal Fund 4, Inc. (NPT)

Nuveen Quality Municipal Fund, Inc. (NQI)

Nuveen Select Quality Municipal Fund, Inc. (NQS)

Nuveen Municipal Market Opportunity Fund, Inc. (NMO)

Nuveen Premium Income Municipal Fund, Inc. (NPI)

Nuveen Quality Income Municipal Fund, Inc. (NQU)

Nuveen Performance Plus Municipal Fund, Inc. (NPP)

Nuveen Premium Income Municipal Fund 2, Inc. (NPM)

Nuveen Municipal Opportunity Fund, Inc. (NIO)

This Joint Proxy Statement is furnished in connection with the solicitation by the board of directors (each a “Board” and collectively, the “Boards,” and each director a “Board Member” and collectively, the “Board Members”) of each of Nuveen Municipal Advantage Fund, Inc. (“NMA”), Nuveen Premier Municipal Income Fund, Inc. (“NPF”), Nuveen Premium Income Municipal Fund 4, Inc. (“NPT”), Nuveen Quality Municipal Fund, Inc. (“NQI”), Nuveen Select Quality Municipal Fund, Inc. (“NQS”), Nuveen Municipal Market Opportunity Fund, Inc. (“NMO”), Nuveen Premium Income Municipal Fund, Inc. (“NPI”), Nuveen Quality Income Municipal Fund, Inc. (“NQU”), Nuveen Performance Plus Municipal Fund, Inc. (“NPP”), Nuveen Premium Income Municipal Fund 2, Inc. (“NPM”) and Nuveen Municipal Opportunity Fund, Inc. (“NIO”), each a Minnesota corporation (each, a “Fund” and collectively, the “Funds”), of proxies to be voted at the Annual Meeting of Shareholders to be held (along with the meeting of shareholders of several other Nuveen funds) in the offices of Nuveen Investments, 333 West Wacker Drive, Chicago, Illinois 60606, on Tuesday, August 5, 2014, at 10:00 a.m., Central time (for each Fund, a “Meeting” and collectively, the “Meetings”), and at any and all adjournments, postponements or delays thereof.

This Joint Proxy Statement solicits the holders of common shares of each Fund and holders of Variable Rate Demand Preferred Shares (“VRDP”) of NMA, NPF, NPT, NQS, NMO, NQU, NPM and NIO and Variable Rate MuniFund Term Preferred Shares (“VMTP”) of NQI, NPI, NPP. VRDP Shares and VMTP Shares are collectively referred to herein as “Preferred Shares.” The common shares of each Fund are listed on the New York Stock Exchange.

1

Proposals

The following table indicates which shareholders are solicited with respect to each proposal:

| Fund | Common Shares | Preferred Shares | ||||

1. | Approval of new investment management agreement. | X | X | |||

2. | Approval of new sub-advisory agreement between Nuveen Fund Advisors and Nuveen Asset Management, LLC (“NAM”) | X | X | |||

3. | Election of board members in the following manner: |

|

X |

Voting Information

On the proposals coming before each Meeting as to which a choice has been specified by shareholders on the proxy, the shares will be voted accordingly. If a properly executed proxy is returned and no choice is specified, the shares will be voted:

| • | FOR the approval of the new investment management agreement, |

| • | FORthe approval of the new sub-advisory agreement, and |

| • | FOR the election of the Board Member nominees listed in this Joint Proxy Statement. |

Shareholders who execute proxies may revoke them at any time before they are voted by filing a written notice of revocation, by delivering a duly executed proxy bearing a later date, or by attending the Meeting and voting in person. A prior proxy can also be revoked by voting again through the toll-free number or the Internet address listed in the proxy card. Merely attending the Meeting, however, will not revoke any previously submitted proxy.

A quorum of shareholders is required to take action at each Meeting. A majority of the shares entitled to vote at each Meeting, represented in person or by proxy, will constitute a quorum of shareholders at that Meeting, except that for the election of the two Board Member nominees to be elected by holders of Preferred Shares of each Fund, 33 1/3% of the Preferred Shares entitled to vote and represented in person or by proxy will constitute a quorum. Votes cast by proxy or in person at each Meeting will be tabulated by the inspectors of election appointed for that Meeting. The inspectors of election will determine whether or not a quorum is present at the Meeting. The inspectors of election will treat abstentions and “broker non-votes” (i.e., shares held by brokers or nominees, typically in “street name,” as to which (i) instructions have not been received from the beneficial owners or persons entitled to vote and (ii) the broker or nominee does not have discretionary voting power on a particular matter) as present for purposes of determining a quorum.

Broker-dealer firms holding shares of a Fund in “street name” for the benefit of their customers and clients will request the instructions of such customers and clients on how to vote their shares before the Meeting. The Funds understand that, under the rules of the New York Stock

2

Exchange, such broker-dealer firms may for certain “routine” matters, without instructions from their customers and clients, grant discretionary authority to the proxies designated by the Board to vote if no instructions have been received prior to the date specified in the broker-dealer firm’s request for voting instructions. Proposal 3 is a “routine” matter and beneficial owners who do not provide proxy instructions or who do not return a proxy card may have their shares voted by broker-dealer firms in favor of proposal 3.

VRDP Shares held in “street name” as to which voting instructions have not been received from the beneficial owners or persons entitled to vote as of one business day before the Meeting, or, if adjourned, one business day before the day to which the Meeting is adjourned, and that would otherwise be treated as “broker non-votes” may, pursuant to Rule 452 of the New York Stock Exchange, be voted by the broker on the proposal in the same proportion as the votes cast by all holders of VRDP Shares as a class who have voted on the proposal, or in the same proportion as the votes cast by all holders of Preferred Shares of the Fund who have voted on that item. Rule 452 permits proportionate voting of VRDP Shares with respect to a particular item if, among other things, (i) a minimum of 30% of the VRDP Shares or shares of a series of VRDP Shares outstanding has been voted by the holders of such shares with respect to such item, (ii) less than 10% of the VRDP Shares or shares of a series of VRDP Shares outstanding has been voted by the holders of such shares against such item and (iii) for any proposal as to which holders of common shares and Preferred Shares vote as a single class, holders of common shares approve the proposal. For the purpose of meeting the 30% test, abstentions will be treated as shares “voted” and, for the purpose of meeting the 10% test, abstentions will not be treated as shares “voted” against the item.

Broker-dealers who are not members of the New York Stock Exchange may be subject to other rules, which may or may not permit them to vote your shares without instruction. We urge you to provide instructions to your broker or nominee so that your votes may be counted.

The details of the proposals to be voted on by the shareholders of each Fund and the vote required for approval of the proposals are set forth under the description of the proposals below.

The Boards have determined that the use of this Joint Proxy Statement for each Meeting is in the best interest of each Fund in light of the similar proposals being considered and voted on by the shareholders. Certain other Nuveen funds, not listed in this Joint Proxy Statement, will also hold meetings of shareholders with similar proposals. If you were also a shareholder of record of one or more of those other funds on the record date established for the meetings of shareholders of such other funds, you will receive a separate proxy statement and proxy card(s) relating to those funds. Shareholders of each Fund will vote separately on the respective proposals relating to their Fund. In any event, an unfavorable vote on any proposal by the shareholders of one Fund will not affect the implementation of such proposal by another Fund if the proposal is approved by the shareholders of that Fund. However, proposals 1 and 2 will only take effect upon the closing of the Transaction (as defined herein), which is conditioned upon obtaining the consent of a specified percentage of Nuveen clients (including through shareholder approval of proposal 1).

3

Shares Outstanding

Those persons who were shareholders of record at the close of business on June 6, 2014 (the “Record Date”), will be entitled to one vote for each share held and a proportionate fractional vote for each fractional share held. As of the Record Date, the shares of the Funds were issued and outstanding as follows:

| Fund | Common Shares | Preferred Shares | ||

| NMA | 43,697,408 | VRDP, Series 1: 2,968 | ||

| NPF | 19,888,518 | VRDP, Series 1: 1,277 | ||

| NPT | 43,338,451 | VRDP, Series 1: 2,622 | ||

| NQI | 38,461,871 | VMTP, Series 2015: 2,404 | ||

| NQS | 35,222,129 | VRDP, Series 1: 2,675 | ||

| NMO | 45,874,035 | VRDP, Series 1: 3,509 | ||

| NPI | 64,060,043 | VMTP, Series 2015: 4,070 | ||

| NQU | 54,379,091 | VRDP, Series 1: 4,284 | ||

| NPP | 60,025,455 | VMTP, Series 2015: 5,350 | ||

| NPM | 70,692,851 | VRDP, Series 1: 4,895 | ||

| NIO | 95,610,971 | VRDP, Series 1: 6,672 |

4

PROPOSAL 1: APPROVAL OF NEW INVESTMENT MANAGEMENT AGREEMENTS

Background

Under an investment management agreement between Nuveen Fund Advisors and each Fund (each, an “Original Investment Management Agreement” and collectively, the “Original Investment Management Agreements”), Nuveen Fund Advisors serves as each Fund’s investment adviser and is responsible for each Fund’s overall investment strategy and its implementation. The date of each Fund’s Original Investment Management Agreement and the date on which it was last approved by shareholders and approved for continuance by the Board are provided inAppendix A.

Nuveen Fund Advisors is a wholly-owned subsidiary of Nuveen Investments, Inc. (“Nuveen”). Nuveen is a wholly-owned subsidiary of Windy City Investments, Inc. (“Windy City”), a corporation formed by an investor group led by Madison Dearborn Partners, LLC (“MDP”), a private equity investment firm based in Chicago, Illinois. Windy City is controlled by MDP on behalf of the Madison Dearborn Capital Partner V funds.

On April 14, 2014, TIAA-CREF entered into a Purchase and Sale Agreement (the “Transaction Agreement”) to acquire Nuveen from the investor group led by MDP. TIAA-CREF is a national financial services organization with approximately $569 billion in assets under management, as of March 31, 2014, and is the leading provider of retirement services in the academic, research, medical and cultural fields. If the Transaction is completed, Nuveen will become a wholly-owned subsidiary of TIAA-CREF. Nuveen will operate as a separate subsidiary within TIAA-CREF’s asset management business. Nuveen’s current leadership and key investment teams are expected to stay in place.

Each Original Investment Management Agreement, as required by Section 15 of the Investment Company Act of 1940 (the “1940 Act”), provides for its automatic termination in the event of its “assignment” (as defined in the 1940 Act). Any change in control of the Adviser is deemed to be an assignment. The consummation of the Transaction will result in a change in control of the Adviser and therefore cause the automatic termination of each Original Investment Management Agreement, as required by the 1940 Act.

Completion of the Transaction is subject to a number of conditions, including obtaining consent to the Transaction by a certain percentage of Nuveen’s clients representing at least 80% of annualized investment advisory, investment management and sub-advisory fees (which includes fund shareholder approval of new investment management agreements with Nuveen Fund Advisors). Nuveen and TIAA-CREF currently expect to complete the Transaction byyear-end 2014.

The Transaction has been structured in reliance upon Section 15(f) of the 1940 Act. Section 15(f) provides in substance that when a sale of a controlling interest in an investment adviser occurs, the investment adviser or any of its affiliated persons may receive any amount or benefit in connection with the sale so long as two conditions are satisfied. The first condition of Section 15(f) is that, during the three-year period following the consummation of a transaction, at least 75% of the investment company’s board of directors must not be “interested persons” (as defined in the 1940 Act) of the investment adviser or predecessor adviser. Each of the Funds currently meets this test. Second, an “unfair burden” (as defined in

5

the 1940 Act, including any interpretations or no-action letters of the Securities and Exchange Commission (the “SEC”) or the staff of the SEC) must not be imposed on the investment company as a result of the transaction relating to the sale of such interest, or any express or implied terms, conditions or understandings applicable thereto. The term “unfair burden” (as defined in the 1940 Act) includes any arrangement, during the two-year period after the transaction, whereby the investment adviser (or predecessor or successor adviser), or any “interested person” (as defined in the 1940 Act) of such an adviser, receives or is entitled to receive any compensation directly or indirectly, from the investment company or its security holders (other than fees for bona fide investment advisory or other services) or from any person in connection with the purchase or sale of securities or other property to, from or on behalf of the investment company (other than bona fide ordinary compensation as principal underwriter for the investment company). Under the Transaction Agreement, TIAA-CREF acknowledges the sellers’ reliance on Section 15(f) of the 1940 Act and has agreed that it will, and will cause its affiliates to, use commercially reasonable efforts to enable the provisions of Section 15(f) to be true in relation to the Funds.

To prevent the occurrence of an “unfair burden” under Section 15(f), Nuveen has committed, for a period of two years from the date of the closing of the Transaction, not to increase contractual management fee rates for any Fund. This commitment shall not limit or otherwise affect mergers or liquidations of any Funds in the ordinary course.

In anticipation of the Transaction, each Fund’s Board met at a series of joint meetings, including meetings of the full Board and meetings of the Independent Board Members (as defined herein) separately, commencing in February 2014 and concluding at the Board’s April 30, 2014 in person meeting, for purposes of, among other things, considering whether it would be in the best interests of each Fund to approve a new investment management agreement between the Fund and Nuveen Fund Advisors in substantially the same form as the Original Investment Management Agreement to take effect immediately after the Transaction or shareholder approval, whichever is later (each a “New Investment Management Agreement” and collectively, the “New Investment Management Agreements”). The form of the New Investment Management Agreement is attached hereto asAppendix L.

The 1940 Act requires that each New Investment Management Agreement be approved by the Fund’s shareholders in order for it to become effective. At the April 30, 2014 Board meeting, and for the reasons discussed below (see “Board Considerations” after proposal 2), each Board, including the Board Members who are not parties to the Original Investment Management Agreements, New Investment Management Agreements or the sub-advisory agreement entered into by the Adviser with respect to any Fund or who are not “interested persons” (as defined in the 1940 Act) of the Fund, the Adviser or the sub-adviser (the “Independent Board Members”), unanimously approved the continuation of the Original Investment Management Agreement and approved the New Investment Management Agreement on behalf of each Fund and unanimously recommended approval of the New Investment Management Agreement by shareholders.

In the event shareholders of a Fund do not approve the New Investment Management Agreement at the Meeting or any adjournment, postponement or delay thereof prior to the closing of the Transaction, an interim investment management agreement between the Adviser and each such Fund (each, an “Interim Investment Management Agreement” and collectively, the “Interim Investment Management Agreements”) will take effect upon the closing of the Transaction. At the April 30, 2014 meeting, each Board, including the Independent Board Members, also unanimously approved Interim Investment Management Agreements for

6

each Fund in order to assure continuity of investment advisory services to the Funds after the Transaction. The terms of each Interim Investment Management Agreement are substantially identical to those of the Original Investment Management Agreements and New Investment Management Agreements, except for the term and escrow provisions described below. The Interim Investment Management Agreement will continue in effect for a term ending on the earlier of 150 days from the closing of the Transaction (the “150-day period”) or when shareholders of a Fund approve the New Investment Management Agreement. Pursuant to Rule 15a-4 under the 1940 Act, compensation earned by the Adviser under an Interim Investment Management Agreement will be held in an interest-bearing escrow account. If shareholders of a Fund approve the New Investment Management Agreement prior to the end of the 150-day period, the amount held in the escrow account under the Interim Investment Management Agreement will be paid to the Adviser. If shareholders of a Fund do not approve the New Investment Management Agreement prior to the end of the 150-day period, the Board will take such action as it deems to be in the best interests of the Fund, and the Adviser will be paid the lesser of its costs incurred in performing its services under the Interim Investment Management Agreement or the total amount in the escrow account, plus interest earned.

Comparison of Original Investment Management Agreement and New Investment Management Agreement

The terms of each New Investment Management Agreement, including fees payable to the Adviser by the Fund thereunder, are substantially identical to those of the Original Investment Management Agreement, except for the date of effectiveness. There is no change in the fee rate payable by each Fund to the Adviser. If approved by shareholders of a Fund, the New Investment Management Agreement for each Fund will expire on August 1, 2015, unless continued. Each New Investment Management Agreement will continue in effect from year to year thereafter if such continuance is approved for the Fund at least annually in the manner required by the 1940 Act and the rules and regulations thereunder. Below is a comparison of certain terms of the Original Investment Management Agreement to the terms of the New Investment Management Agreement.

Investment Management Services. The investment management services to be provided by the Adviser to each Fund under the New Investment Management Agreements will be identical to those services currently provided by the Adviser to each Fund under the Original Investment Management Agreements. Both the Original Investment Management Agreements and New Investment Management Agreements provide that the Adviser shall manage the investment and reinvestment of the Fund’s assets in accordance with the Fund’s investment objective and policies and limitations and administer the Fund’s affairs to the extent requested by and subject to the oversight of the Fund’s Board. In addition, the investment management services are expected to be provided by the same Adviser personnel under the New Investment Management Agreements as under the Original Investment Management Agreements. The Adviser does not anticipate that the Transaction will have any adverse effect on the performance of its obligations under the New Investment Management Agreements.

Fees. Under each Original Investment Management Agreement and New Investment Management Agreement, the Fund pays to the Adviser an investment management fee that consists of two components: a fund-level fee, based only on the amount of assets within a Fund, and a complex-level fee, based on the aggregate amount of all eligible fund assets

7

managed by Nuveen Fund Advisors. This pricing structure enables Fund shareholders to benefit from growth in the assets within the Fund as well as from growth in the amount of complex-wide assets managed by the Adviser. Each Fund’s fee schedule under the New Investment Management Agreement for such Fund is identical to the fee schedule under the Original Investment Management Agreement.

Each Fund’s annual fund-level fee, payable monthly, is based upon the average daily managed assets (which includes assets attributable to all types of leverage used in leveraged Funds) of each Fund pursuant to the fee schedule set forth inAppendix B. The fund-level fee schedule is identical under each Fund’s Original Investment Management Agreement and New Investment Management Agreement.

The overall complex-level fee begins at a maximum rate of 0.2000% of each Fund’s average daily managed assets, based upon complex-level assets of $55 billion, with breakpoints for eligible assets above that level pursuant to the complex-level fee schedule set forth onAppendix B. The complex-level fee schedule is identical under each Fund’s Original Investment Management Agreement and New Investment Management Agreement.

Each Fund’s managed assets as of December 31, 2013 and fees paid to the Adviser during the Fund’s last fiscal year are also set forth inAppendix B.

Other Services. Under each Original Investment Management Agreement and each New Investment Management Agreement, the Adviser shall furnish office facilities and equipment and clerical, bookkeeping and administrative services (other than such services, if any, provided by the Fund’s transfer agent) for the Fund.

Limitation on Liability. The Original Investment Management Agreements and New Investment Management Agreements provide that the Adviser will not be liable for any loss sustained by reason of the purchase, sale or retention of any security, whether or not such purchase, sale or retention shall have been based upon the investigation and research made by any other individual, firm or corporation, if such recommendation shall have been selected with due care and in good faith, except loss resulting from willful misfeasance, bad faith or gross negligence on the part of the Adviser in the performance of its obligations and duties, or by reason of its reckless disregard of its obligations and duties under the agreement.

Continuance. The Original Investment Management Agreement of each Fund originally was in effect for an initial term and could be continued thereafter for successive one-year periods if such continuance was specifically approved at least annually in the manner required by the 1940 Act. If the shareholders of a Fund approve the New Investment Management Agreement for that Fund, the New Investment Management Agreement will expire on August 1, 2015, unless continued. The New Investment Management Agreement may be continued for successive one-year periods if approved at least annually in the manner required by the 1940 Act.

Termination. The Original Investment Management Agreement and New Investment Management Agreement for each Fund provide that the agreement may be terminated at any time without the payment of any penalty by the Fund or Adviser on sixty (60) days’ written notice to the other party, and may be terminated, at any time, without the payment of any penalty, by the Fund, in the event that it shall have been established by a court of competent jurisdiction that the Adviser, or any officer or director of the Adviser, has taken any action which results in a breach of the covenants of the Adviser set forth therein. A Fund may effect termination by action of the Board or by vote of a majority of the outstanding voting securities of the Fund, accompanied by appropriate notice.

8

Information about the Adviser

Nuveen Fund Advisors, a registered investment adviser, is organized as a Delaware limited liability company and is a wholly-owned subsidiary of Nuveen. Founded in 1898, Nuveen and its affiliates had approximately $224.6 billion in assets under management as of March 31, 2014. Nuveen Fund Advisors offers advisory and investment management services to a broad range of mutual fund and closed-end fund clients. Nuveen Fund Advisors is responsible for each Fund’s overall investment strategy and its implementation. Nuveen Fund Advisors also is responsible for managing each Fund’s business affairs and providing certain clerical, bookkeeping and other administrative services. The business address of Nuveen Fund Advisors and Nuveen is 333 West Wacker Drive, Chicago, Illinois 60606.

Certain information regarding the executive officer and directors of Nuveen Fund Advisors is set forth inAppendix F.

Nuveen Securities, LLC (the “Distributor”), 333 West Wacker Drive, Chicago, Illinois 60606, an affiliate of the Adviser, has entered into a Distribution Agreement with certain Funds with respect to at-the-market offerings of common shares of each such Fund. During each Fund’s last fiscal year, fees paid to the Distributor by such Funds were: NQS - $35,768. A portion of such fees are paid by the Distributor to sub-placement agents who have entered into selected dealer agreements with the Distributor.

Shareholder Approval

To become effective with respect to a particular Fund, the New Investment Management Agreement must be approved by a vote of a majority of the outstanding voting securities of the Fund, with the holders of common shares and Preferred Shares voting together as a single class. The “vote of a majority of the outstanding voting securities” is defined in the 1940 Act as the lesser of the vote of (i) 67% or more of the shares of the Fund entitled to vote thereon present at the meeting if the holders of more than 50% of such outstanding shares are present in person or represented by proxy; or (ii) more than 50% of such outstanding shares of the Fund entitled to vote thereon. For purposes of determining the approval of the New Investment Management Agreement, abstentions and broker non-votes will have the same effect as shares voted against the proposal.

Each New Investment Management Agreement was approved by the Board of the respective Fund after consideration of all factors which it determined to be relevant to its deliberations, including those discussed after proposal 2 below. The Board of each Fund also determined to submit the Fund’s New Investment Management Agreement for consideration by the shareholders of such Fund.

The Board of each Fund unanimously recommends that shareholders of the Fund vote FOR approval of the New Investment Management Agreement.

9

PROPOSAL 2: APPROVAL OF NEW SUB-ADVISORY AGREEMENTS

Background

Nuveen Fund Advisors has entered into investment sub-advisory agreements (each, an “Original Sub-Advisory Agreement” and collectively, the “Original Sub-Advisory Agreements”) with respect to each Fund with Nuveen Asset Management, LLC (“NAM” or the“Sub-Adviser”).

The date of each Original Sub-Advisory Agreement and the date it was last approved by shareholders and approved for continuance by the Board are provided inAppendix C.

As with the Original Investment Management Agreements, each Original Sub-Advisory Agreement, as required by Section 15 of the 1940 Act, provides for its automatic termination in the event of its assignment. The completion of the Transaction will result in a change in control of NAM, which is a subsidiary of Nuveen, and therefore will be deemed an assignment of each Original Sub-Advisory Agreement with NAM. In addition, each Original Sub-Advisory Agreement provides that it will terminate upon the termination of the Original Investment Management Agreement with respect to such Fund. As a result, the completion of the Transaction will result in the termination of each Original Sub-Advisory Agreement.

In anticipation of the Transaction, each Fund’s Board met at a series of joint meetings, including meetings of the full Board and meetings of the Independent Board Members separately, commencing in February 2014 and concluding at the Board’s April 30, 2014 in person meeting, for purposes of, among other things, considering whether it would be in the best interests of each Fund to approve a new sub-advisory agreement between Nuveen Fund Advisors and the Sub-Adviser (each a “New Sub-Advisory Agreement” and collectively, the “New Sub-Advisory Agreements”). The form of the New Sub-Advisory Agreement is attached hereto asAppendix M.

The 1940 Act requires that each New Sub-Advisory Agreement be approved by the Fund’s shareholders in order for it to become effective. At the April 30, 2014 Board meeting, and for the reasons discussed below (see “Board Considerations” after proposal 2), each Board, including the Independent Board Members, unanimously approved the continuation of the Original Sub-Advisory Agreement and approved the New Sub-Advisory Agreement and unanimously recommended approval of the New Sub-Advisory Agreement by shareholders.

Because each New Sub-Advisory Agreement, like each Original Sub-Advisory Agreement, is between the Adviser and the Sub-Adviser, a Fund’s New Sub-Advisory Agreement will not take effect until the New Investment Management Agreement for such Fund has been approved by shareholders.

In the event shareholders of a Fund do not approve the New Investment Management Agreement and New Sub-Advisory Agreement at the Meeting or any adjournment, postponement or delay thereof prior to the closing of the Transaction, an interim sub-advisory agreement between the Adviser and NAM (each an “Interim Sub-Advisory Agreement” and collectively, the “Interim Sub-Advisory Agreements”) will take effect upon the closing of the Transaction. At the April 30, 2014 meeting, each Board, including the Independent Board Members, also unanimously approved Interim Sub-Advisory Agreements in order to assure continuity of advisory services to the Funds after the Transaction. The terms of each Interim Sub-Advisory Agreement are substantially identical to those of the Original Sub-Advisory Agreements and New Sub-Advisory Agreements, except for the term and escrow provisions

10

described below. The Interim Sub-Advisory Agreement will continue in effect for a term ending on the earlier of 150 days from the closing of the Transaction (the “150-day period”) or when shareholders of a Fund approve the New Investment Management Agreement and New Sub-Advisory Agreement. Pursuant to Rule 15a-4 under the 1940 Act, compensation earned by a Sub-Adviser under an Interim Sub-Advisory Agreement will be held in an interest-bearing escrow account. If shareholders of a Fund approve the New Investment Management Agreement and New Sub-Advisory Agreement prior to the end of the 150-day period, the amount held in the escrow account under the Interim Sub-Advisory Agreement will be paid to the Sub-Adviser. If shareholders of a Fund do not approve the New Investment Management Agreement and New Sub-Advisory Agreement prior to the end of the 150-day period, the Board will take such action as it deems to be in the best interests of the Fund, and the Sub-Adviser will be paid the lesser of its costs incurred in performing its services under the InterimSub-Advisory Agreement or the total amount in the escrow account, plus interest earned.

Comparison of Original Sub-Advisory Agreement and NewSub-Advisory Agreement

The terms of each New Sub-Advisory Agreement, including fees payable to the Sub-Adviser by Nuveen Fund Advisors thereunder, are substantially identical to those of the Original Sub-Advisory Agreement, except for the date of effectiveness. There is no change in the fee rate payable by Nuveen Fund Advisors to the Sub-Adviser. If approved by shareholders of a Fund, the New Sub-Advisory Agreement for the Fund will expire onAugust 1, 2015, unless continued. Each New Sub-Advisory Agreement will continue in effect from year to year thereafter if such continuance is approved for the Fund at least annually in the manner required by the 1940 Act and the rules and regulations thereunder. Below is a comparison of certain terms of the Original Sub-Advisory Agreements to the terms of the New Sub-Advisory Agreements.

Advisory Services. The advisory services to be provided by the Sub-Adviser to each Fund under the New Sub-Advisory Agreements will be identical to those advisory services currently provided by the Sub-Adviser to each Fund under the Original Sub-Advisory Agreements. Both the Original Sub-Advisory Agreements and New Sub-Advisory Agreements provide that the Sub-Adviser will furnish an investment program in respect of, make investment decisions for and place all orders for the purchase and sale of securities for the portion of the Fund’s investment portfolio allocated by the Adviser to the Sub-Adviser, all on behalf of the Fund and subject to oversight of the Fund’s Board and the Adviser. In performing its duties under both the Original Sub-Advisory Agreements and the New Sub-Advisory Agreements, the Sub-Adviser will monitor the Fund’s investments and will comply with the provisions of the Fund’s organizational documents and the stated investment objectives, policies and restrictions of the Fund. It is not anticipated that the Transaction will have any adverse effect on the performance of aSub-Adviser’s obligations under the New Sub-Advisory Agreements.

Brokerage. Both the Original Sub-Advisory Agreements and New Sub-Advisory Agreements authorize the Sub-Adviser to select the brokers or dealers that will execute the purchases and sales of portfolio securities for the Funds, subject to its obligation to obtain best execution under the circumstances, which may take account of the overall quality of brokerage and research services provided to the Sub-Adviser.

11

Fees. Under both the Original Sub-Advisory Agreements and New Sub-Advisory Agreements, the Adviser pays the Sub-Adviser a portfolio management fee out of the investment management fee it receives from the Fund. The rate of the portfolio management fees payable by the Adviser to the Sub-Adviser under the New Sub-Advisory Agreements is identical to the rate of the fees paid under the Original Sub-Advisory Agreements. The annual rate of portfolio management fees payable to the Sub-Adviser under the Original Sub-Advisory Agreements and the New Sub-Advisory Agreements and the fees paid by the Adviser to the Sub-Adviser with respect to each Fund during each Fund’s last fiscal year is set forth inAppendix D.

Payment of Expenses. Under each Original Sub-Advisory Agreement and New Sub-Advisory Agreement, the Sub-Adviser will bear all of its expenses in connection with its performance of services under the agreement.

Limitation on Liability. The Original Sub-Advisory Agreements and New Sub-Advisory Agreements provide that the Sub-Adviser will not be liable for any error of judgment or mistake of law or for any loss suffered by the Fund or the Adviser in connection with the matters to which the agreement relates, except for a loss resulting from willful misfeasance, bad faith or gross negligence on the part of the Sub-Adviser in the performance of duties under the agreement, or by reason of its reckless disregard of its obligations and duties under the agreement.

Continuance. The Original Sub-Advisory Agreement of each Fund originally was in effect for an initial term and could be continued thereafter for successive one-year periods if such continuance was specifically approved at least annually in the manner required by the 1940 Act. If the shareholders of a Fund approve the New Sub-Advisory Agreement for that Fund, the New Sub-Advisory Agreement will expire on August 1, 2015, unless continued. Thereafter, the New Sub-Advisory Agreement may be continued for successive one-year periods if approved at least annually in the manner required by the 1940 Act.

Termination. The Original Sub-Advisory Agreement and New Sub-Advisory Agreement for each Fund provide that the agreement may be terminated at any time without the payment of any penalty by either party on sixty (60) days’ written notice. The Original Sub-Advisory Agreement and New Sub-Advisory Agreement may also be terminated by action of the Fund’s Board or by a vote of a majority of the outstanding voting securities of that Fund, accompanied by 60 days’ written notice.

Information About the Sub-Adviser

NAM. NAM is an affiliate of Nuveen Fund Advisors and serves as investment sub-adviser to each Fund. NAM is organized as a Delaware limited liability company, and its sole managing member is Nuveen Fund Advisors. The business address of NAM is 333 West Wacker Drive, Chicago, Illinois 60606.

Additional Information.Appendix E includes the advisory fee rates and net assets of registered investment companies, other than funds in the Nuveen fund complex, advised by the Sub-Adviser with similar investment objectives to the Funds.

Certain information regarding the executive officer and directors of the Sub-Adviser is set forth inAppendix F.

12

Affiliated Brokerage and Other Fees

No Fund paid brokerage commissions within the last fiscal year to (i) any broker that is an affiliated person of such Fund or an affiliated person of such person, or (ii) any broker an affiliated person of which is an affiliated person of such Fund, the Adviser or the Sub-Adviser.

During each Fund’s last fiscal year, no Fund made any material payments to the Adviser or the Sub-Adviser or any affiliated person of the Adviser or the Sub-Adviser for services provided to the Fund (other than pursuant to the Original Investment Management Agreement or Original Sub-Advisory Agreement or to the Distributor as described herein).

Shareholder Approval

To become effective with respect to a particular Fund, the New Sub-Advisory Agreement must be approved by a vote of a majority of the outstanding voting securities of the Fund, with the holders of common shares and Preferred Shares voting together as a single class. The “vote of a majority of the outstanding voting securities” is defined in the 1940 Act as the lesser of the vote of (i) 67% or more of the shares of the Fund entitled to vote thereon present at the meeting if the holders of more than 50% of such outstanding shares are present in person or represented by proxy; or (ii) more than 50% of such outstanding shares of the Fund entitled to vote thereon. For purposes of determining the approval of the New Sub-Advisory Agreement, abstentions and broker non-votes will have the same effect as shares voted against the proposal.

Each New Sub-Advisory Agreement was approved by the Board after consideration of all factors which it determined to be relevant to its deliberations, including those discussed below. The Board of each Fund also determined to submit the Fund’s New Sub-Advisory Agreement for consideration by the shareholders of the Fund.

The Board of each Fund unanimously recommends that shareholders of the Fund vote FOR approval of the Fund’s New Sub-Advisory Agreement.

13

BOARD CONSIDERATIONS

| I. | The Approval Process |

The Board of each Fund, including the Independent Board Members, is responsible for overseeing the performance of the Adviser and Sub-Adviser to the respective Fund and determining whether to approve or continue such Fund’s Original Investment Management Agreement and Original Sub-Advisory Agreement (collectively, the “Original Advisory Agreements”). Pursuant to the 1940 Act, each Board is required to consider the continuation of the Original Advisory Agreements on an annual basis. In addition, prior to its annual review, the Board Members were advised of the potential acquisition of Nuveen by TIAA-CREF. For purposes of this section, references to “Nuveen” herein include all affiliates of Nuveen providing advisory, sub-advisory, distribution or other services to the Funds and references to the “Board” refer to the Board of each Fund. In accordance with the 1940 Act and the terms of the Original Advisory Agreements, the completion of the Transaction would terminate each of the Original Investment Management Agreements and Original Sub-Advisory Agreements. Accordingly, at anin-person meeting held on April 30, 2014 (the “April Meeting”), the Board, including all of the Independent Board Members, performed its annual review of the Original Advisory Agreements and approved the continuation of the Original Advisory Agreements for the Funds. Furthermore, in anticipation of the termination of the Original Advisory Agreements that would occur upon the consummation of the Transaction, the Board also approved the New Investment Management Agreements and the New Sub-Advisory Agreements (collectively, the “New Advisory Agreements”) on behalf of the Funds to be effective following the completion of the Transaction and the receipt of the requisite shareholder approval.

Leading up to the April Meeting, the Independent Board Members had several meetings and deliberations, with and without management from Nuveen present and with the advice of legal counsel, regarding the Original Advisory Agreements, the Transaction and its impact and the New Advisory Agreements. At its meeting held on February 25-27, 2014 (the “February Meeting”), the Board Members met with a senior executive representative of TIAA-CREF to discuss the proposed Transaction. At the February Meeting, the Independent Board Members also established an ad hoc committee comprised solely of the Independent Board Members to monitor and evaluate the Transaction and to keep the Independent Board Members updated with developments regarding the Transaction. On March 20, 2014, the ad hoc committee met telephonically to discuss with management of Nuveen, and separately with independent legal counsel, the terms of the proposed Transaction and its impact on, among other things: the governance structure of Nuveen; the strategic plans for Nuveen; the operations of the Funds; the quality or level of services provided to the Funds; key personnel that service the Funds and/or the Board and the compensation or incentive arrangements to retain such personnel; Nuveen’s capital structure; the regulatory requirements applicable to Nuveen or Fund operations; and the Funds’ fees and expenses, including the Funds’ complex-wide fee arrangement. Following the meeting of the ad hoc committee, the Board met in person (two Independent Board Members participating telephonically) in executive session on March 26, 2014 to further discuss the proposed Transaction. At the executive session, the Board met privately with independent legal counsel to review its duties with respect to reviewing advisory agreements, particularly in the context of a change of control, and to evaluate further the Transaction and its impact on the Funds, the Adviser and Sub-Adviser (collectively, the “Fund Advisers” and each a “Fund Adviser”) and the services provided. Representatives of Nuveen also met with the Board to update the Board Members on developments regarding the Transaction, respond to questions and to discuss, among other things: the governance of the Fund Advisers following the Transaction; the

14

background, culture (including with respect to regulatory and compliance matters) and resources of TIAA-CREF; the general plans and intentions of TIAA-CREF for Nuveen; the terms and conditions of the Transaction (including financing terms); any benefits or detriments the Transaction may impose on the Funds, TIAA-CREF or the Fund Advisers; the reaction from Fund Advisers’ employees knowledgeable of the Transaction; the incentive and retention plans for key personnel of Fund Advisers; the potential access to additional distribution platforms and economies of scale; and the impact of any additional regulatory schemes that may be applicable to the Funds given the banking and insurance businesses operated in the TIAA-CREF enterprise. As part of its review, the Board also held a separate meeting on April 15-16, 2014 to review the Funds’ investment performance and consider an analysis provided by the Adviser of the Sub-Adviser, the Transaction and its implications to the Funds. During their review of the materials and discussions, the Independent Board Members presented the Adviser with questions and the Adviser responded. Further, the Independent Board Members met in executive session with independent legal counsel on April 29, 2014 and April 30, 2014.

In connection with their review of the Original Advisory Agreements and the New Advisory Agreements, the Independent Board Members received extensive information regarding the Funds and Fund Advisers including, among other things: the nature, extent and quality of services provided by a Fund Adviser; the organization and operations of any Fund Adviser; the expertise and background of relevant personnel of the Fund Adviser; a review of the applicable Fund’s performance (including performance comparisons against the performance of peer groups and appropriate benchmarks); a comparison of Fund fees and expenses relative to peers; a description and assessment of shareholder service levels for the Funds; a summary of the performance of certain service providers; a review of fund initiatives and shareholder communications; and an analysis of the Adviser’s profitability with comparisons to peers in the managed fund business. In light of the proposed Transaction, the Independent Board Members, through their independent legal counsel, also requested in writing and received additional information regarding the proposed Transaction and its impact on the provision of services by the Fund Advisers.

The Independent Board Members received, well in advance of the April Meeting, materials which responded to the request for information regarding the Transaction and its impact on Nuveen and the Funds including, among other things: the structure and terms of the Transaction; the impact of the Transaction on Nuveen, its operations and the nature, quality and level of services provided to the Funds, including, in particular, any changes to those services that the Funds may experience following the Transaction; the strategic plan for Nuveen, including any financing arrangements following the Transaction and any cost-cutting efforts that may impact services; the organizational structure of TIAA-CREF, including the governance structure of Nuveen following the Transaction; any anticipated effect on each Fund’s expense ratios (including changes to advisory and sub-advisory fees) and economies of scale that may be expected; any benefits or conflicts of interest that TIAA-CREF, Nuveen or their affiliates can expect from the Transaction; any benefits or undue burdens or other negative implications that may be imposed on the Funds as a result of the Transaction; the impact on Nuveen or the Funds as a result of being subject to additional regulatory schemes that TIAA-CREF must comply with in operating its various businesses; and the costs associated with obtaining necessary shareholder approvals and the bearer of such costs. The Independent Board Members also received a memorandum describing the applicable laws, regulations and duties in approving advisory contracts, including in conjunction with a change of control, from their independent legal counsel.

15

The materials and information prepared in connection with the review of the Original Advisory Agreements and New Advisory Agreements supplemented the information and analysis provided to the Board during the year. In this regard, throughout the year, the Board, acting directly or through its committees, regularly reviewed the performance and various services provided by the Adviser andSub-Adviser. The Board met at least quarterly as well as at other times as the need arose. At its quarterly meetings, the Board reviewed reports by the Adviser regarding, among other things, Fund performance, Fund expenses, premium and discount levels of closed-end funds, the performance of the investment teams and compliance, regulatory and risk management matters. In addition to regular reports, the Adviser provided special reports to the Board or a committee thereof from time to time to enhance the Board’s understanding of various topics that impact some or all the Nuveen funds (such as distribution channels, oversight of omnibus accounts and leverage management topics), to update the Board on regulatory developments impacting the investment company industry or to update the Board on the business plans or other matters impacting the Adviser. The Board also met with key investment personnel managing certain Nuveen fund portfolios during the year.

In addition, the Board has created several standing committees (the Executive Committee; the Dividend Committee; the Audit Committee; the Compliance, Risk Management and Regulatory Oversight Committee; the Nominating and Governance Committee; theOpen-End Funds Committee; and the Closed-End Funds Committee). The Open-End Funds Committee and Closed-End Funds Committee are intended to assist the full Board in monitoring and gaining a deeper insight into the distinctive business practices of closed-end and open-end funds. These two Committees have met prior to each quarterly Board meeting, and the Adviser provided presentations to these Committees permitting them to delve further into specific matters or initiatives impacting the respective product line.

Further, the Board continued its program of seeking to have the Board Members or a subset thereof visit eachsub-adviser to the Nuveen funds and meet key investment and business personnel at least once over a multiple year rotation. In this regard, the Independent Board Members made site visits to certain NAM equity and fixed income teams in September 2013 and met with the NAM municipal team at the August and November 2013 quarterly meetings.

The Board considered the information provided and knowledge gained at these meetings and visits during the year when performing its annual review of the Original Advisory Agreements and its review of the New Advisory Agreements. The Independent Board Members also were assisted throughout the process by independent legal counsel. During the course of the year and during their deliberations regarding the review of advisory contracts, the Independent Board Members met with independent legal counsel in executive sessions without management present. In addition, it is important to recognize that the management arrangements for the Funds are the result of many years of review and discussion between the Independent Board Members and Fund management and that the Board Members’ conclusions may be based, in part, on their consideration of fee arrangements and other factors developed in previous years.

The Board considered all factors it believed relevant with respect to each Fund, including, among other things: (a) the nature, extent and quality of the services provided by the Fund Advisers, (b) the investment performance of the Funds and Fund Advisers, (c) the advisory fees and costs of the services to be provided to the Funds and the profitability of the Fund Advisers, (d) the extent of any economies of scale, (e) any benefits derived by the Fund Advisers from the relationship with the Funds and (f) other factors. With respect to the New Advisory

16

Agreements, the Board also considered the Transaction and its impact on the foregoing factors. Each Board Member may have accorded different weight to the various factors in reaching his or her conclusions with respect to a Fund’s Original Advisory Agreements and New Advisory Agreements. The Independent Board Members did not identify any single factor as all-important or controlling. The Independent Board Members’ considerations were instead based on a comprehensive consideration of all the information presented. The principal factors considered by the Board and its conclusions are described below.

| A. | Nature, Extent and Quality of Services |

1. The Original Advisory Agreements

In considering renewal of the Original Advisory Agreements, the Independent Board Members considered the nature, extent and quality of the respective Fund Adviser’s services, including portfolio management services (and the resulting Fund performance) and administrative services. The Independent Board Members further considered the overall reputation and capabilities of the Adviser and its affiliates, the commitment of the Adviser to provide high quality service to the Funds, their overall confidence in the capability and integrity of the Adviser and its staff and the Adviser’s responsiveness to questions and concerns raised by them. The Independent Board Members reviewed materials outlining, among other things: the Fund Adviser’s organization and business; the types of services that the Fund Adviser or its affiliates provide to the Funds; the performance record of the applicable Fund (as described in further detail below); and any initiatives Nuveen had taken for the applicable open-end or closed-end fund product line.

In considering the services provided by the Fund Advisers, the Board recognized that the Adviser provides a myriad of investment management, administrative, compliance, oversight and other services for the Funds, and the Sub-Adviser generally provides the portfolio advisory services to the Funds under the oversight of the Adviser. The Board considered the wide range of services provided by the Adviser to the Nuveen funds beginning with developing the fund, monitoring and analyzing its performance, to providing or overseeing the services necessary to support a fund’s daily operations. The Board recognized the Adviser, among other things, provides: (a) product management (such as analyzing ways to better position a fund in the marketplace, maintaining relationships to gain access to distribution platforms, and setting dividends); (b) fund administration (such as preparing a fund’s tax returns, regulatory filings and shareholder communications; managing fund budgets and expenses; overseeing the fund’s various service providers and supporting and analyzing new and existing funds); (c) Board administration (such as supporting the Board and its committees, in relevant part, by organizing and administering the Board and committee meetings and preparing the necessary reports to assist the Board in its duties); (d) compliance (such as monitoring adherence to the fund’s investment policies and procedures and applicable law; reviewing the compliance program periodically and developing new policies or updating existing compliance policies and procedures as considered necessary or appropriate; responding to regulatory requests; and overseeing compliance testing of sub-advisers); (e) legal support (such as preparing or reviewing fund registration statements, proxy statements and other necessary materials; interpreting regulatory requirements and compliance thereof; and maintaining applicable registrations); and (f) investment services (such as overseeing and reviewing sub-advisers and their investment teams; analyzing performance of the funds; overseeing investment and risk management; overseeing the daily

17

valuation process for portfolio securities and developing and recommending valuation policies and methodologies and changes thereto; and participating in fund development, leverage management, and the development of investment policies and parameters). With respect to closed-end funds, the Adviser also monitors asset coverage levels on leveraged Funds, manages leverage, negotiates the terms of leverage, evaluates alternative forms and types of leverage, promotes an orderly secondary market for common shares and maintains an asset maintenance system for compliance with certain rating agency criteria.

In its review, the Board also considered the new services, initiatives or other changes adopted since the last advisory contract review that were designed to enhance the services and support the Adviser provides to the Nuveen funds. The Board recognized that some initiatives are a multi-year process. In reviewing the activities of 2013, the Board recognized that the year reflected the Adviser’s continued focus on fund rationalization for both closed-end andopen-end funds, consolidating certain funds through mergers that were designed to improve efficiencies and economies of scale for shareholders, repositioning various funds through updates in their investment policies and guidelines with the expectation of bringing greater value to shareholders, and liquidating certain funds. As in the past, the Board recognized the Adviser’s significant investment in its technology initiatives, including the continued progress toward a central repository for fund and other Nuveen product data and implementing a data system to support the risk oversight group enabling it to provide more detailed risk analysis for the Funds. The Board noted the new data system has permitted more in-depth analysis of the investment risks of the funds and across the complex providing additional feedback and insights to the investment teams and more comprehensive risk reporting to the Board. The Adviser also conducted several workshops for the Board regarding the new data system, including explaining the risk measures being applied and their purpose. The Board also recognized the enhancements in the valuation group within the Adviser, including centralizing the fund pricing process within the valuation group, trending to more automated and expedient reviews, and continuing to expand its valuation team. The Board further considered the expansion of personnel in the compliance department enhancing the collective expertise of the group, investments in additional compliance systems and the updates of various compliance policies.

In addition to the foregoing actions, the Board also considered other initiatives related to the closed-end funds, including the continued investment of considerable resources and personnel dedicated to managing and overseeing the various forms of leverage utilized by certain funds. The Board recognized the results of these efforts included the development of less expensive forms of leverage, expansion of leverage providers, the negotiation of more favorable terms for existing leverage, the enhanced ability to respond to market and regulatory developments and the enhancements to technology systems to manage and track the various forms of leverage. The Board also noted Nuveen’s continued capital management services, including executing share repurchase programs, its implementation of data systems that permit more targeted solicitation strategies for fund mergers and more targeted marketing and promotional efforts and its continued focus and efforts to address the discounts of various Funds. The Board further noted Nuveen’s continued commitment to supporting the secondary market for the common shares of its closed-end funds through a comprehensive communication program designed to further educate the investor and analyst about closed-end funds. Nuveen’s support services included, among other things, maintaining and enhancing a closed-end fund website, creating marketing campaigns and educational materials, communicating with financial advisers, sponsoring and participating in conferences, providing educational seminars and programs and evaluating the results of these marketing efforts.

18

As noted, the Adviser also oversees theSub-Adviser who provides the portfolio advisory services to the Funds. In reviewing the portfolio advisory services provided to each Fund, the Nuveen Investment Services Oversight Team of the Adviser analyzes the performance of the Sub-Adviser and may recommend changes to the investment team or investment strategies as appropriate. In assisting the Board’s review of the Sub-Adviser, the Adviser provides a report analyzing, among other things, theSub-Adviser’s investment team and changes thereto, organization and history, assets under management, the investment team’s philosophy and strategies in managing the Fund, developments affecting theSub-Adviser or Fund and their performance. In their review of the Sub-Adviser, the Independent Board Members considered, among other things, the experience and qualifications of the relevant investment personnel, their investment philosophy and strategies, the Sub-Adviser’s organization and stability, its capabilities and any initiatives taken or planned to enhance its current capabilities or support potential growth of business and, as outlined in further detail below, the performance of the Funds. The Independent Board Members also reviewed portfolio manager compensation arrangements to evaluate each Fund Adviser’s ability to attract and retain high quality investment personnel, preserve stability, and reward performance while not providing an inappropriate incentive to take undue risks.

Given the importance of compliance, the Independent Board Members also considered Nuveen’s compliance program, including the report of the chief compliance officer regarding the Nuveen funds’ compliance policies and procedures; the resources dedicated to compliance; the record of compliance with the policies and procedures; and its supervision of the Funds’ service providers. The Board recognized Nuveen’s commitment to compliance and strong commitment to a culture of compliance. Given the Adviser’s emphasis on monitoring investment risk, the Board has also appointed two Independent Board Members as point persons to review and keep the Board apprised of developments in this area and work with applicable Fund Adviser personnel.

Based on their review, the Independent Board Members found that, overall, the nature, extent and quality of services provided to the respective Funds under each applicable Original Advisory Agreement were satisfactory.

2. The New Advisory Agreements

In evaluating the nature, quality and extent of the services expected to be provided by the Fund Advisers under the applicable New Investment Management Agreement or NewSub-Advisory Agreement, the Board Members concluded that no diminution in the nature, quality and extent of services provided to the Funds and their shareholders by the respective Fund Advisers is expected as a result of the Transaction. In making their determination, the Independent Board Members considered, among other things: the expected impact, if any, of the Transaction on the operations, facilities, organization and personnel of the respective Fund Adviser; the ability of the Fund Adviser to perform its duties after the Transaction, including any changes to the level or quality of services provided to the Funds; the potential implications of any additional regulatory requirements imposed on the Fund Adviser or Funds following the Transaction; and any anticipated changes to the investment and other practices of the Funds.

The Board noted that the terms of each New Investment Management Agreement, including the fees payable thereunder, are substantially identical to those of the Original Investment Management Agreement relating to the same Fund. Similarly, the terms of each New

19

Sub-Advisory Agreement, including fees payable thereunder, are substantially identical to those of the OriginalSub-Advisory Agreement relating to the same Fund. The Board considered that the services to be provided and the standard of care under the New Investment Management Agreements and the NewSub-Advisory Agreements are the same as the corresponding original agreements. The Board Members noted the Transaction also does not alter the allocation of responsibilities between the Adviser andSub-Adviser. TheSub-Adviser will continue to furnish an investment program, make investment decisions and place all orders for the purchase and sale of securities, all on behalf of the applicable Fund and subject to oversight of the Board and the Adviser. The Board noted that TIAA-CREF did not anticipate any material changes to the advisory, sub-advisory or other services provided to the Funds as a result of the Transaction. The Independent Board Members recognized that there were not any planned “cost cutting” measures that could be expected to reduce the nature, extent or quality of services. The Independent Board Members further noted that there were currently no plans for material changes to senior personnel at Nuveen or key personnel who provide services to the Funds and the Board following the Transaction. The key personnel who have responsibility for the Funds in each area, including portfolio management, investment oversight, fund management, fund operations, product management, legal/compliance and board support functions, are expected to be the same following the Transaction, although such personnel may have additional reporting requirements to TIAA-CREF. The Board also considered the anticipated incentive plans designed to retain such key personnel. Notwithstanding the foregoing, the Board Members recognized that personnel changes may occur in the future as a result of normal business developments or personal career decisions.

The Board Members also considered Nuveen’s proposed governance structure following the Transaction and noted that Nuveen was expected to remain a stand-alone business within the TIAA-CREF enterprise and operate relatively autonomously from the other TIAA-CREF businesses, but would receive the general support and oversight from certain TIAA-CREF functional groups (such as legal, finance, internal audit, compliance, and risk management groups). The Board recognized, however, that Nuveen may be subject to additional reporting requirements as it keeps TIAA-CREF abreast of developments affecting the Nuveen business, may be required to modify certain of its reports, policies and procedures as necessary to conform to the practices followed in the TIAA-CREF enterprise, and may need to collaborate with TIAA-CREF with respect to strategic planning for its business.