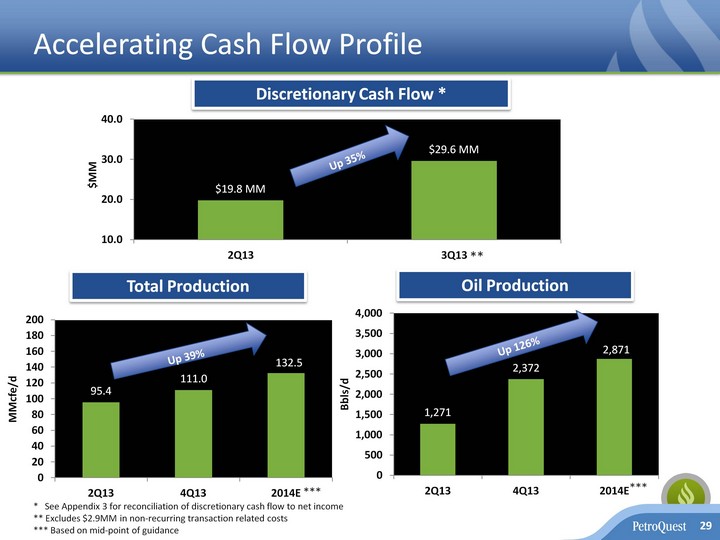

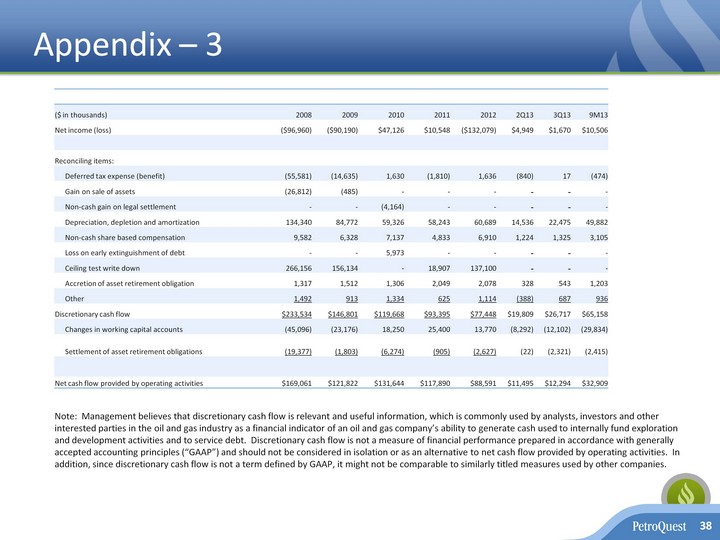

| Appendix - 3 ($ in thousands) 2008 2009 2010 2011 2012 2Q13 3Q13 9M13 Net income (loss) ($96,960) ($90,190) $47,126 $10,548 ($132,079) $4,949 $1,670 $10,506 Reconciling items: Deferred tax expense (benefit) (55,581) (14,635) 1,630 (1,810) 1,636 (840) 17 (474) Gain on sale of assets (26,812) (485) - - - - - - Non-cash gain on legal settlement - - (4,164) - - - - - Depreciation, depletion and amortization 134,340 84,772 59,326 58,243 60,689 14,536 22,475 49,882 Non-cash share based compensation 9,582 6,328 7,137 4,833 6,910 1,224 1,325 3,105 Loss on early extinguishment of debt - - 5,973 - - - - - Ceiling test write down 266,156 156,134 - 18,907 137,100 - - - Accretion of asset retirement obligation 1,317 1,512 1,306 2,049 2,078 328 543 1,203 Other 1,492 913 1,334 625 1,114 (388) 687 936 Discretionary cash flow $233,534 $146,801 $119,668 $93,395 $77,448 $19,809 $26,717 $65,158 Changes in working capital accounts (45,096) (23,176) 18,250 25,400 13,770 (8,292) (12,102) (29,834) Settlement of asset retirement obligations (19,377) (1,803) (6,274) (905) (2,627) (22) (2,321) (2,415) Net cash flow provided by operating activities $169,061 $121,822 $131,644 $117,890 $88,591 $11,495 $12,294 $32,909 Note: Management believes that discretionary cash flow is relevant and useful information, which is commonly used by analysts, investors and other interested parties in the oil and gas industry as a financial indicator of an oil and gas company's ability to generate cash used to internally fund exploration and development activities and to service debt. Discretionary cash flow is not a measure of financial performance prepared in accordance with generally accepted accounting principles ("GAAP") and should not be considered in isolation or as an alternative to net cash flow provided by operating activities. In addition, since discretionary cash flow is not a term defined by GAAP, it might not be comparable to similarly titled measures used by other companies. 38 |