UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06243

Franklin Strategic Series

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Alison Baur, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: 650 312-2000

Date of fiscal year end: 4/30

Date of reporting period: 10/31/24

Item 1. Reports to Stockholders.

| a.) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1). |

| | |

| b.) | Include a copy of each notice transmitted to stockholders in reliance on Rule 30e-3 under the Act (17 CFR 270.30e-3) that contains disclosures specified by paragraph (c)(3) of that rule. |

Not Applicable.

| | |

Franklin Growth Opportunities Fund | |

| Class A [FGRAX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Growth Opportunities Fund for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class A | $48 | 0.89% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $4,588,362,911 |

Total Number of Portfolio Holdings* | 88 |

Portfolio Turnover Rate | 8.96% |

| * | Does not include derivatives, except purchased options, if any. |

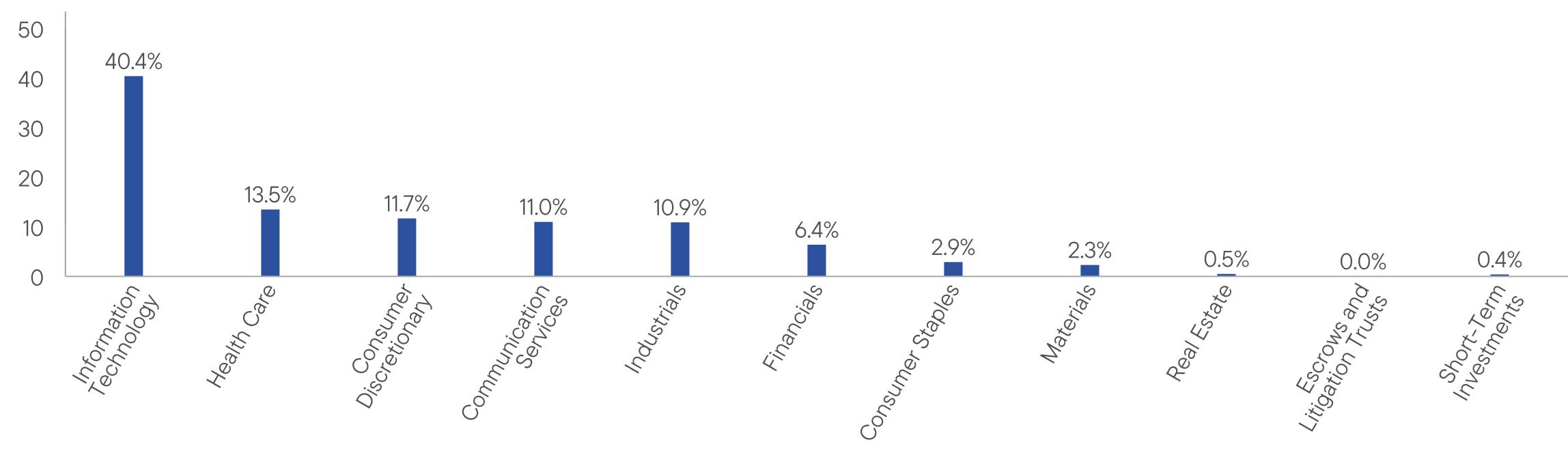

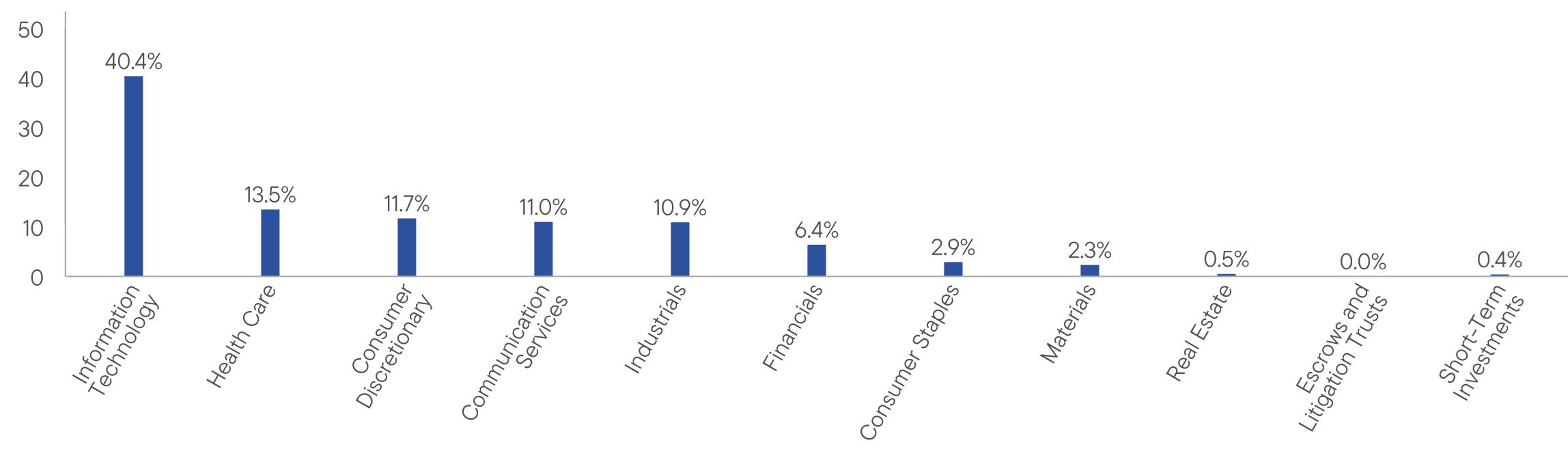

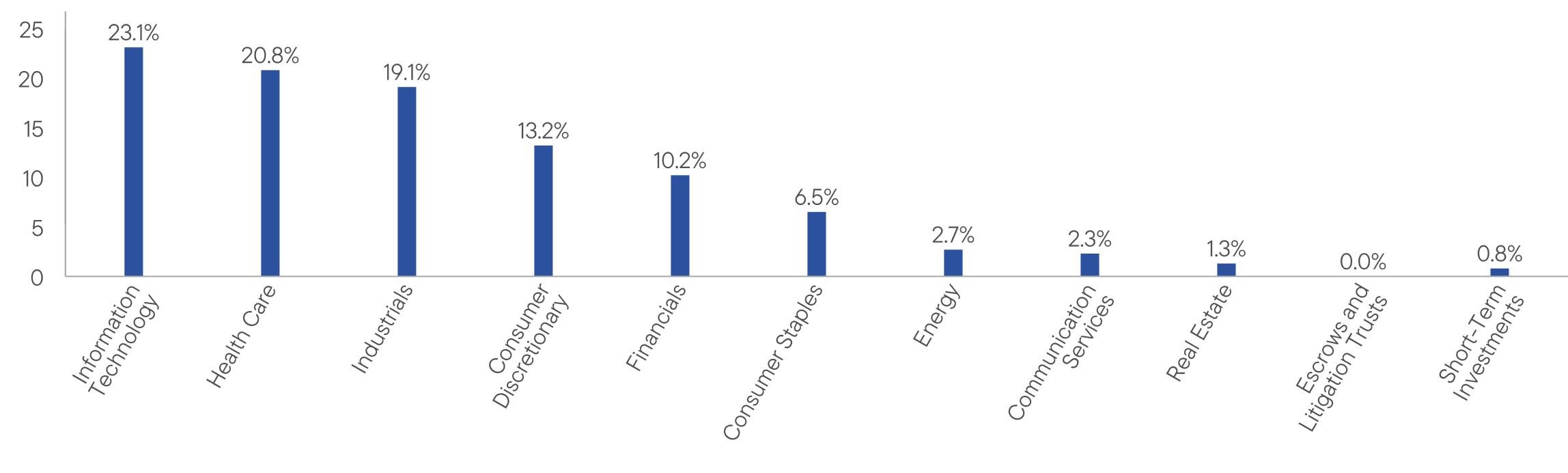

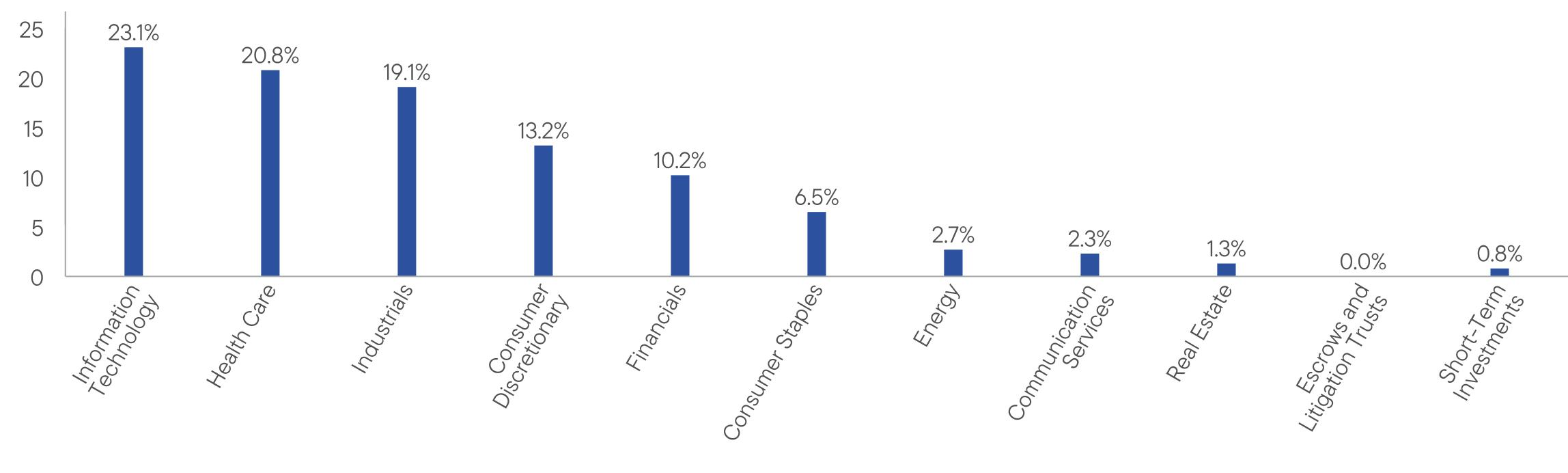

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Growth Opportunities Fund | PAGE 1 | 462-STSR-1224 |

40.413.511.711.010.96.42.92.30.50.00.4

| | |

Franklin Growth Opportunities Fund | |

| Class C [FKACX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Growth Opportunities Fund for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class C | $88 | 1.64% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $4,588,362,911 |

Total Number of Portfolio Holdings* | 88 |

Portfolio Turnover Rate | 8.96% |

| * | Does not include derivatives, except purchased options, if any. |

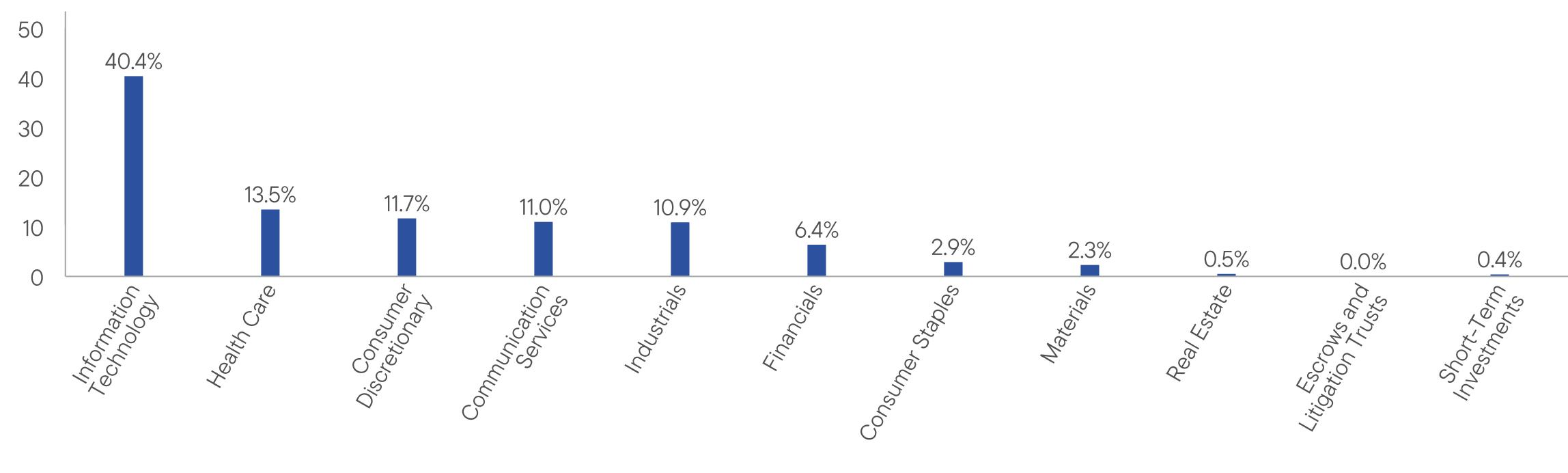

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Growth Opportunities Fund | PAGE 1 | 562-STSR-1224 |

40.413.511.711.010.96.42.92.30.50.00.4

| | |

Franklin Growth Opportunities Fund | |

| Class R [FKARX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Growth Opportunities Fund for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class R | $61 | 1.14% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $4,588,362,911 |

Total Number of Portfolio Holdings* | 88 |

Portfolio Turnover Rate | 8.96% |

| * | Does not include derivatives, except purchased options, if any. |

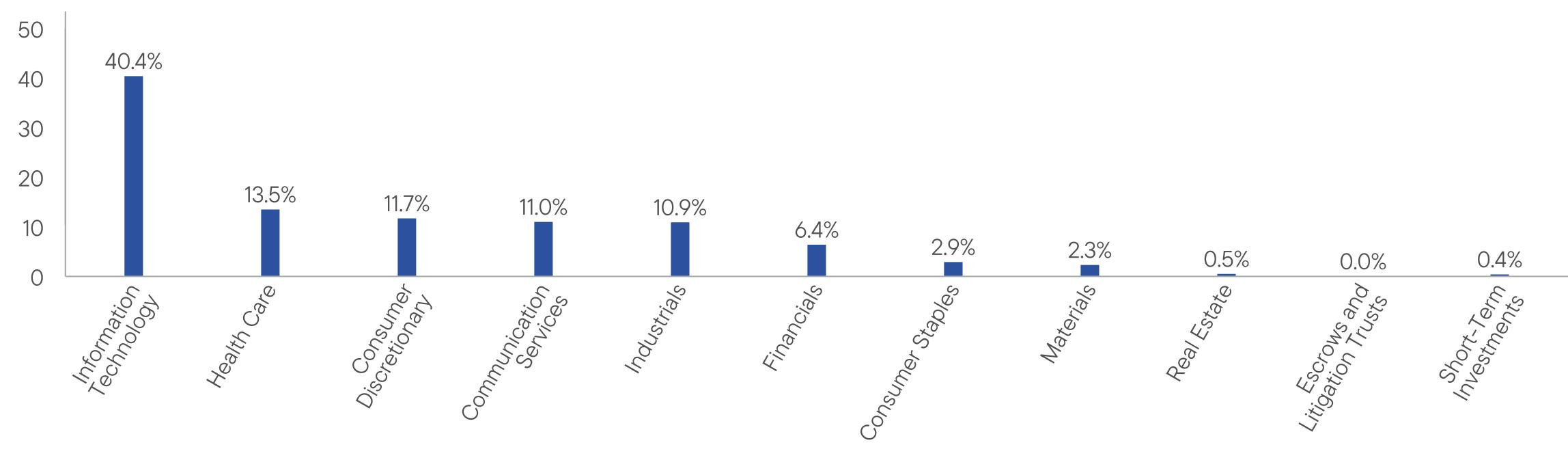

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Growth Opportunities Fund | PAGE 1 | 862-STSR-1224 |

40.413.511.711.010.96.42.92.30.50.00.4

| | |

Franklin Growth Opportunities Fund | |

| Class R6 [FOPPX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Growth Opportunities Fund for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class R6 | $31 | 0.57% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $4,588,362,911 |

Total Number of Portfolio Holdings* | 88 |

Portfolio Turnover Rate | 8.96% |

| * | Does not include derivatives, except purchased options, if any. |

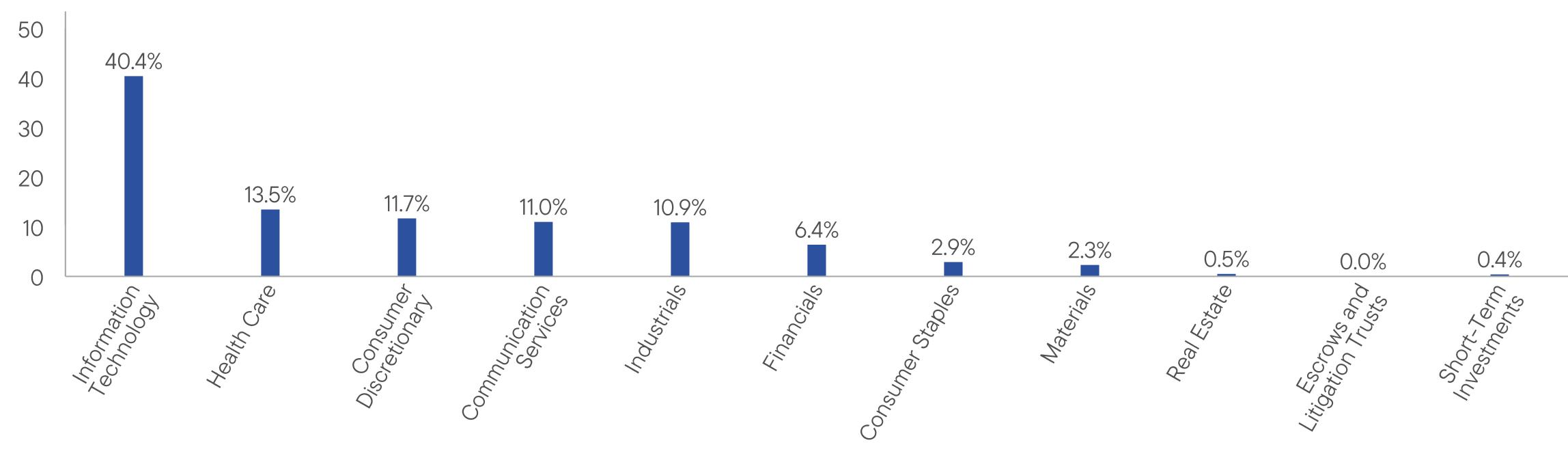

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Growth Opportunities Fund | PAGE 1 | 352-STSR-1224 |

40.413.511.711.010.96.42.92.30.50.00.4

| | |

Franklin Growth Opportunities Fund | |

| Advisor Class [FRAAX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Growth Opportunities Fund for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Advisor Class | $34 | 0.64% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $4,588,362,911 |

Total Number of Portfolio Holdings* | 88 |

Portfolio Turnover Rate | 8.96% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Growth Opportunities Fund | PAGE 1 | 662-STSR-1224 |

40.413.511.711.010.96.42.92.30.50.00.4

| | |

Franklin Small Cap Growth Fund | |

| Class A [FSGRX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Small Cap Growth Fund for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class A | $54 | 1.04% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $2,758,042,092 |

Total Number of Portfolio Holdings* | 125 |

Portfolio Turnover Rate | 9.15% |

| * | Does not include derivatives, except purchased options, if any. |

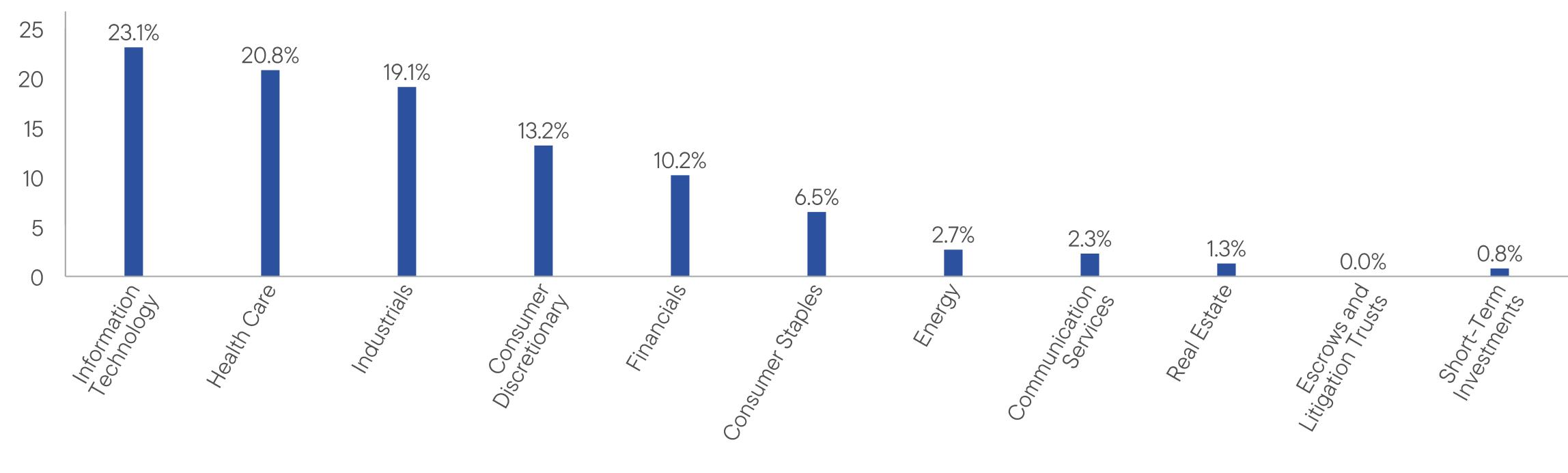

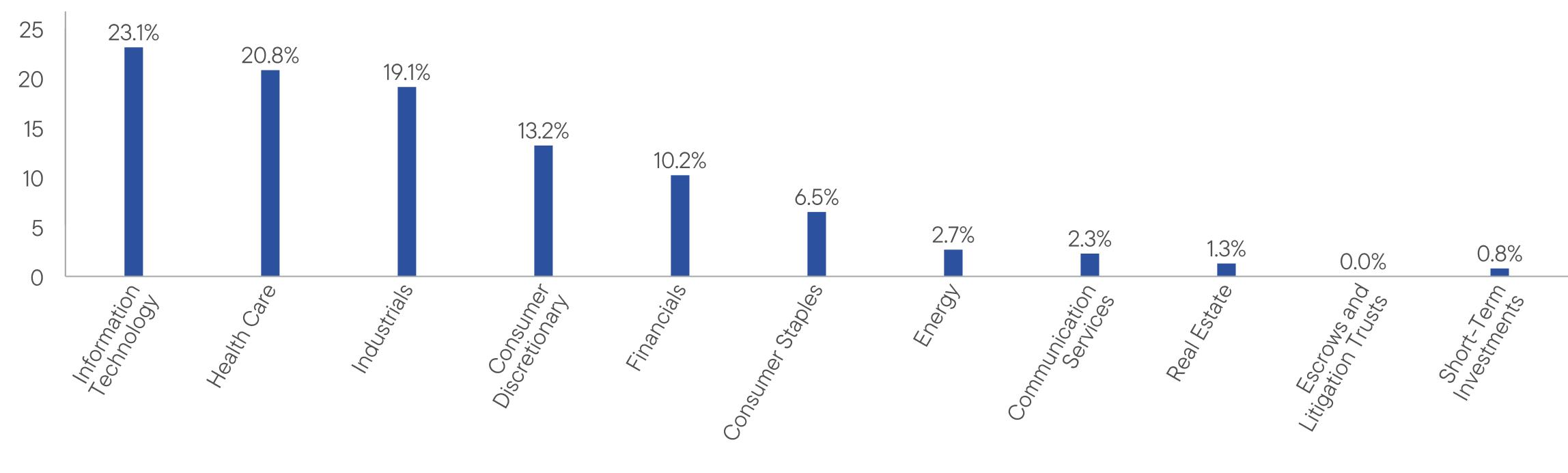

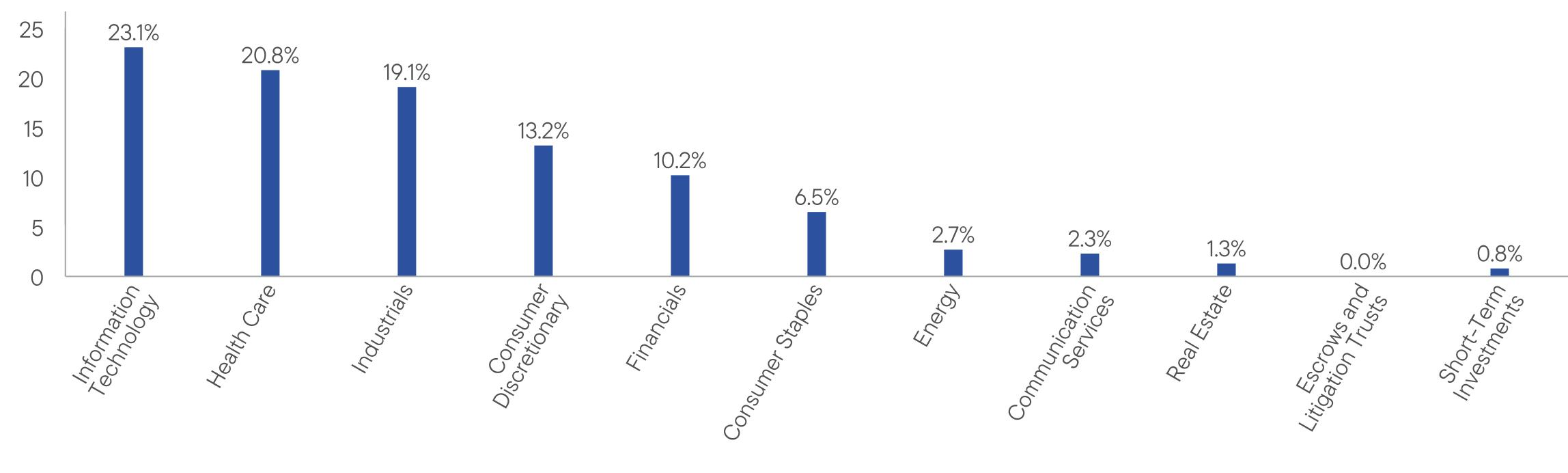

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Small Cap Growth Fund | PAGE 1 | 465-STSR-1224 |

23.120.819.113.210.26.52.72.31.30.00.8

| | |

Franklin Small Cap Growth Fund | |

| Class C [FCSGX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Small Cap Growth Fund for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class C | $93 | 1.79% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $2,758,042,092 |

Total Number of Portfolio Holdings* | 125 |

Portfolio Turnover Rate | 9.15% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Small Cap Growth Fund | PAGE 1 | 565-STSR-1224 |

23.120.819.113.210.26.52.72.31.30.00.8

| | |

Franklin Small Cap Growth Fund | |

| Class R [FSSRX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Small Cap Growth Fund for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class R | $67 | 1.29% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $2,758,042,092 |

Total Number of Portfolio Holdings* | 125 |

Portfolio Turnover Rate | 9.15% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Small Cap Growth Fund | PAGE 1 | 865-STSR-1224 |

23.120.819.113.210.26.52.72.31.30.00.8

| | |

Franklin Small Cap Growth Fund | |

| Class R6 [FSMLX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Small Cap Growth Fund for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class R6 | $34 | 0.65% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $2,758,042,092 |

Total Number of Portfolio Holdings* | 125 |

Portfolio Turnover Rate | 9.15% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Small Cap Growth Fund | PAGE 1 | 335-STSR-1224 |

23.120.819.113.210.26.52.72.31.30.00.8

| | |

Franklin Small Cap Growth Fund | |

| Advisor Class [FSSAX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Small Cap Growth Fund for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Advisor Class | $41 | 0.79% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $2,758,042,092 |

Total Number of Portfolio Holdings* | 125 |

Portfolio Turnover Rate | 9.15% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Small Cap Growth Fund | PAGE 1 | 665-STSR-1224 |

23.120.819.113.210.26.52.72.31.30.00.8

| | |

Franklin Small-Mid Cap Growth Fund | |

| Class A [FRSGX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Small-Mid Cap Growth Fund for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class A | $45 | 0.85% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $3,961,125,238 |

Total Number of Portfolio Holdings* | 105 |

Portfolio Turnover Rate | 21.22% |

| * | Does not include derivatives, except purchased options, if any. |

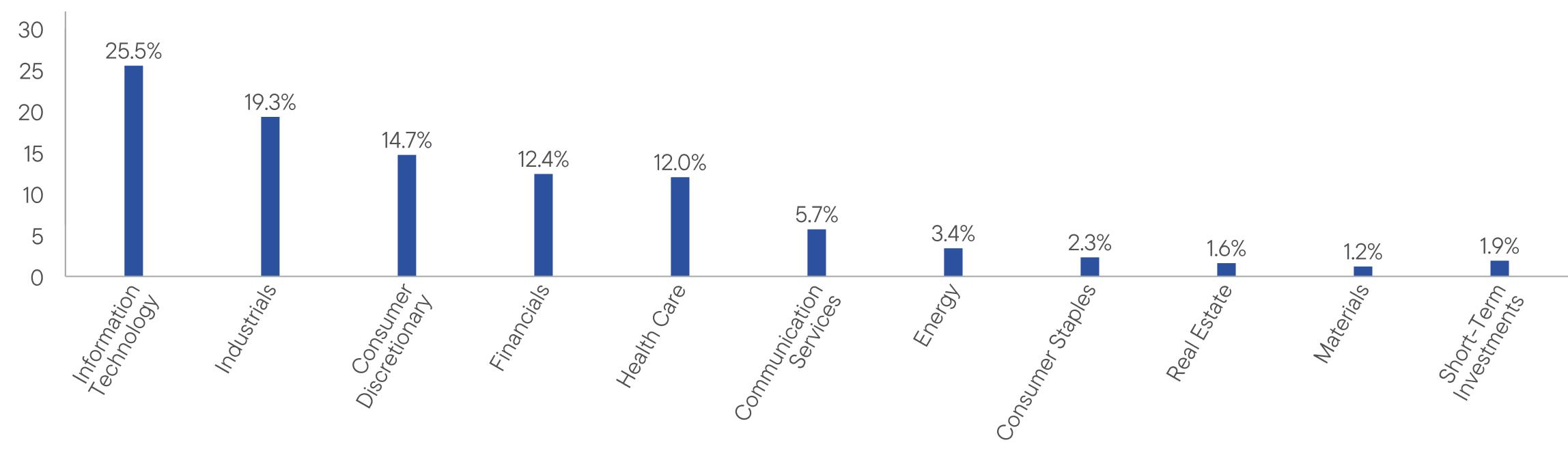

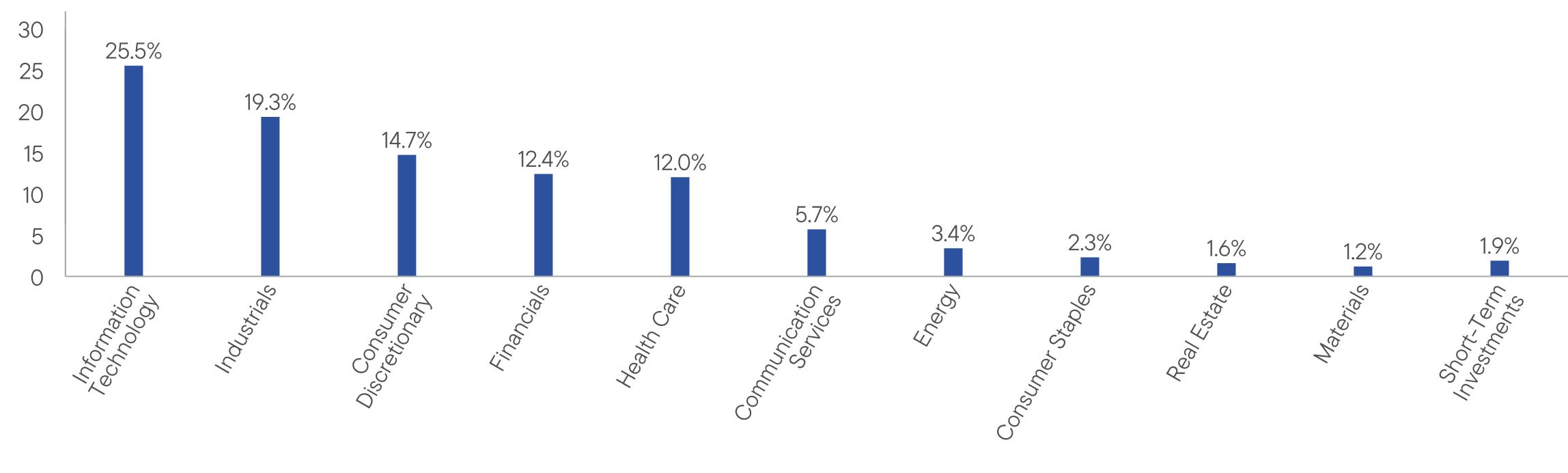

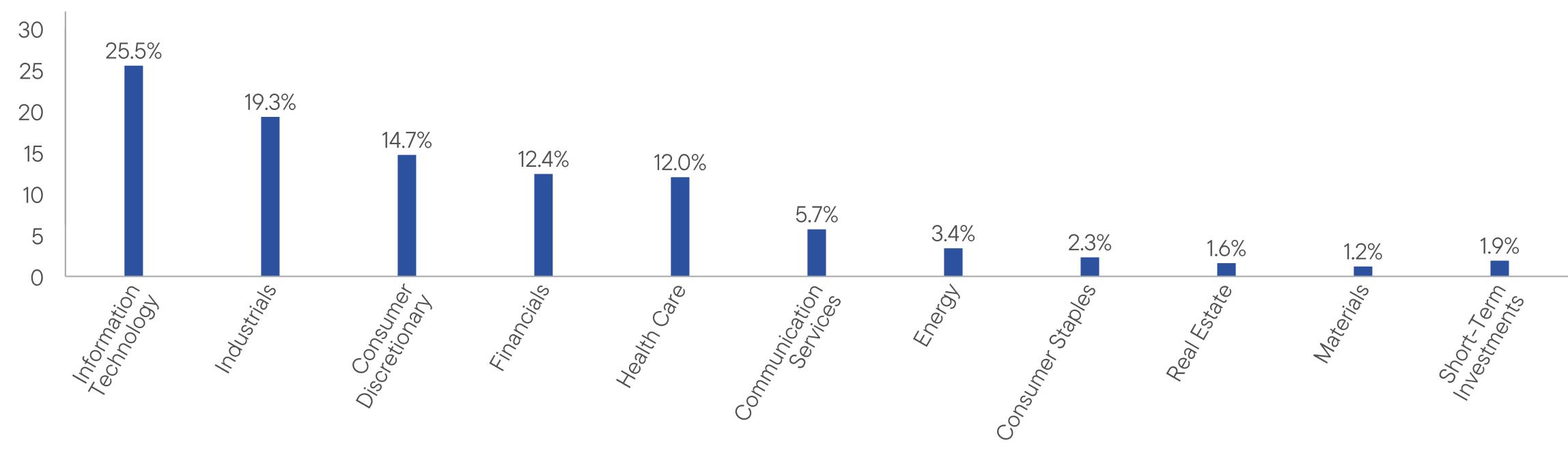

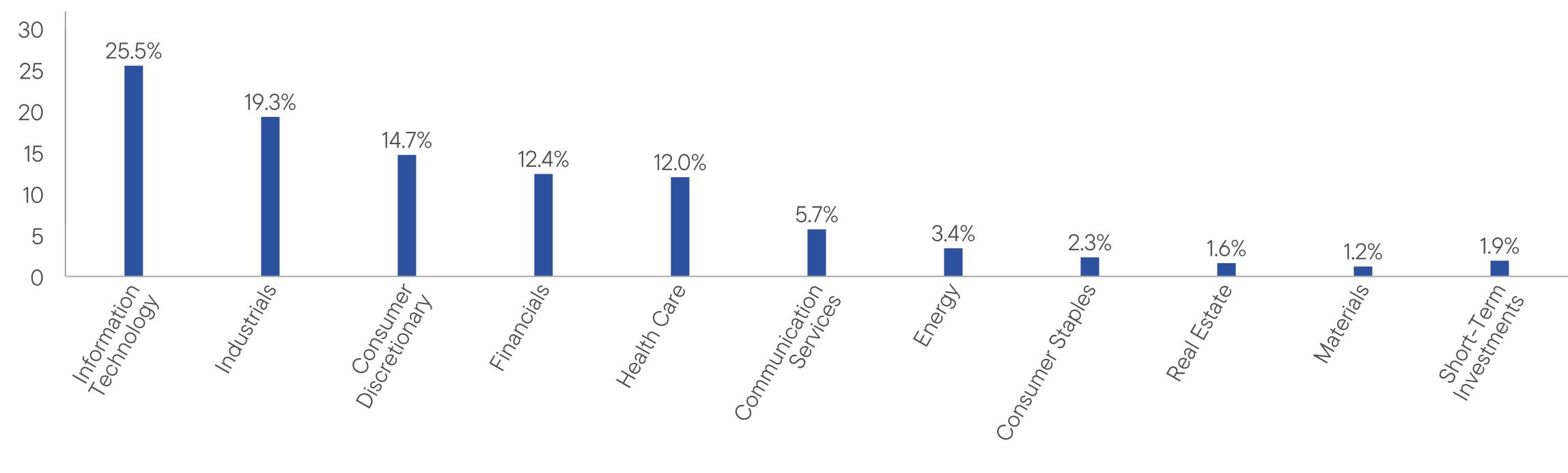

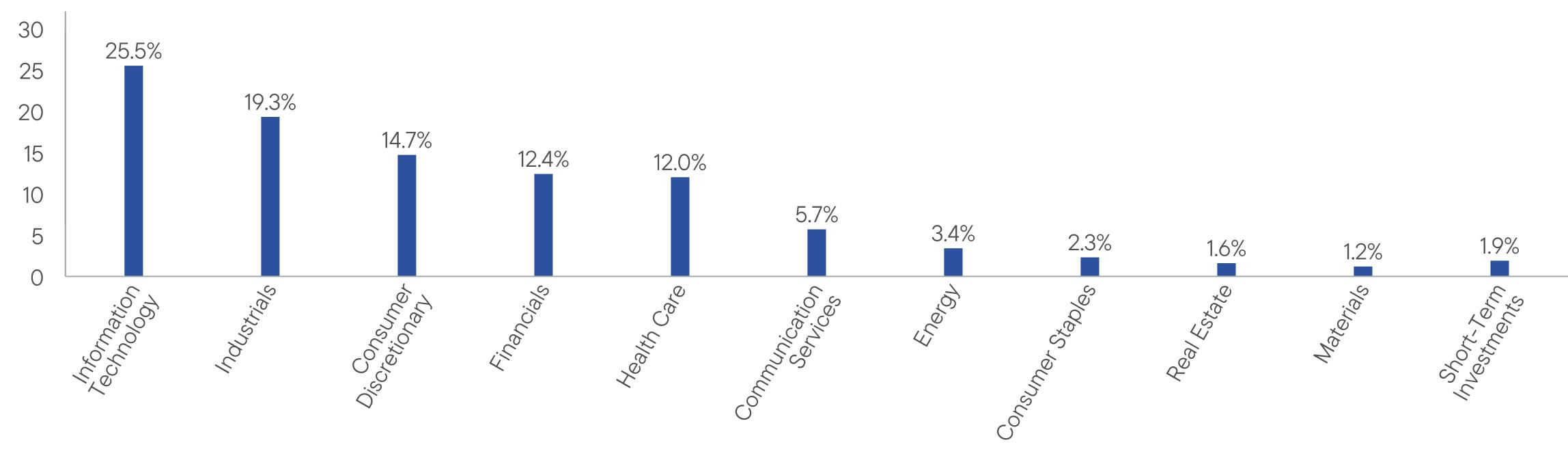

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Small-Mid Cap Growth Fund | PAGE 1 | 198-STSR-1224 |

25.519.314.712.412.05.73.42.31.61.21.9

| | |

Franklin Small-Mid Cap Growth Fund | |

| Class C [FRSIX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Small-Mid Cap Growth Fund for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class C | $83 | 1.59% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $3,961,125,238 |

Total Number of Portfolio Holdings* | 105 |

Portfolio Turnover Rate | 21.22% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Small-Mid Cap Growth Fund | PAGE 1 | 298-STSR-1224 |

25.519.314.712.412.05.73.42.31.61.21.9

| | |

Franklin Small-Mid Cap Growth Fund | |

| Class R [FSMRX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Small-Mid Cap Growth Fund for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class R | $57 | 1.09% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $3,961,125,238 |

Total Number of Portfolio Holdings* | 105 |

Portfolio Turnover Rate | 21.22% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Small-Mid Cap Growth Fund | PAGE 1 | 898-STSR-1224 |

25.519.314.712.412.05.73.42.31.61.21.9

| | |

Franklin Small-Mid Cap Growth Fund | |

| Class R6 [FMGGX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Small-Mid Cap Growth Fund for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class R6 | $26 | 0.50% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $3,961,125,238 |

Total Number of Portfolio Holdings* | 105 |

Portfolio Turnover Rate | 21.22% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Small-Mid Cap Growth Fund | PAGE 1 | 318-STSR-1224 |

25.519.314.712.412.05.73.42.31.61.21.9

| | |

Franklin Small-Mid Cap Growth Fund | |

| Advisor Class [FSGAX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Small-Mid Cap Growth Fund for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Advisor Class | $31 | 0.60% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $3,961,125,238 |

Total Number of Portfolio Holdings* | 105 |

Portfolio Turnover Rate | 21.22% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Small-Mid Cap Growth Fund | PAGE 1 | 698-STSR-1224 |

25.519.314.712.412.05.73.42.31.61.21.9

| | |

Franklin Biotechnology Discovery Fund | |

| Class A [FBDIX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Biotechnology Discovery Fund for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class A | $53 | 1.01% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $896,599,561 |

Total Number of Portfolio Holdings* | 98 |

Portfolio Turnover Rate | 11.92% |

| * | Does not include derivatives, except purchased options, if any. |

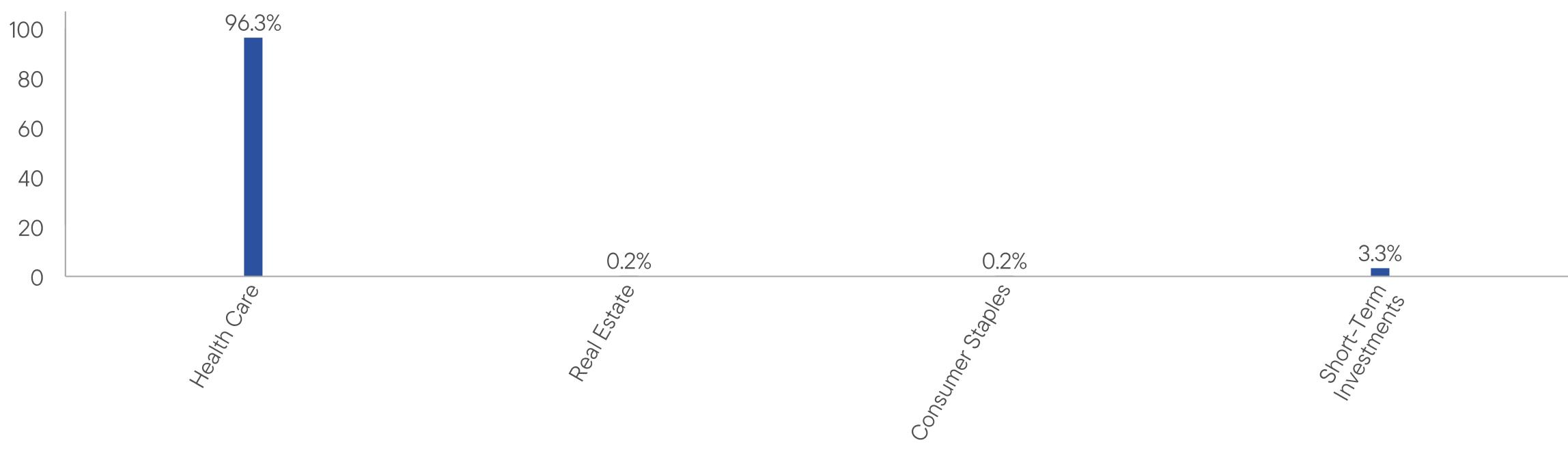

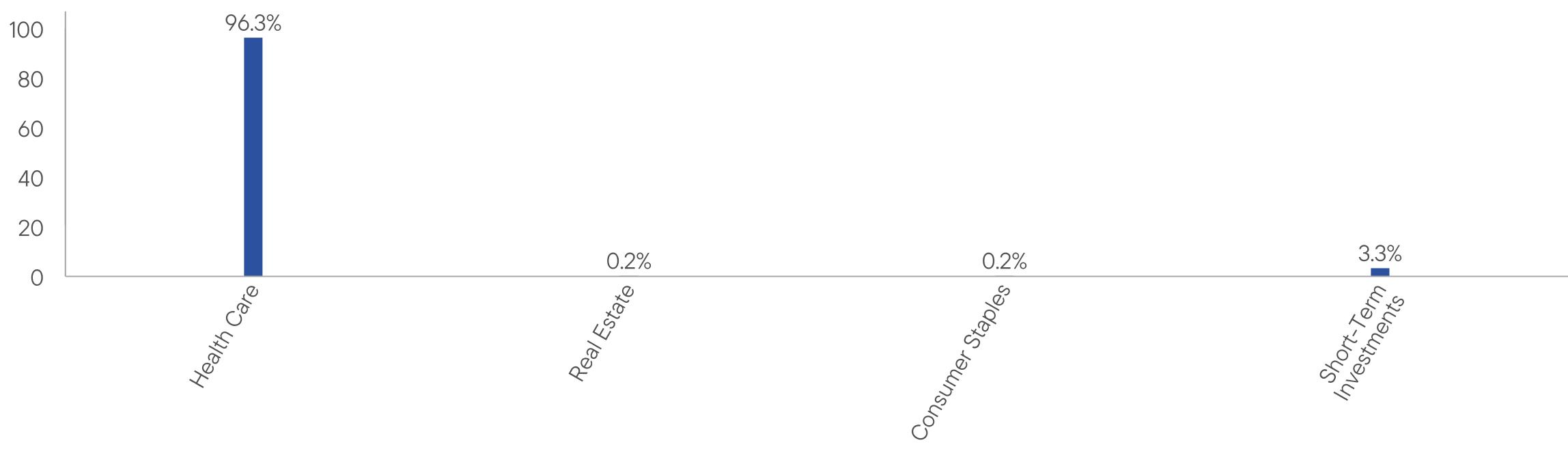

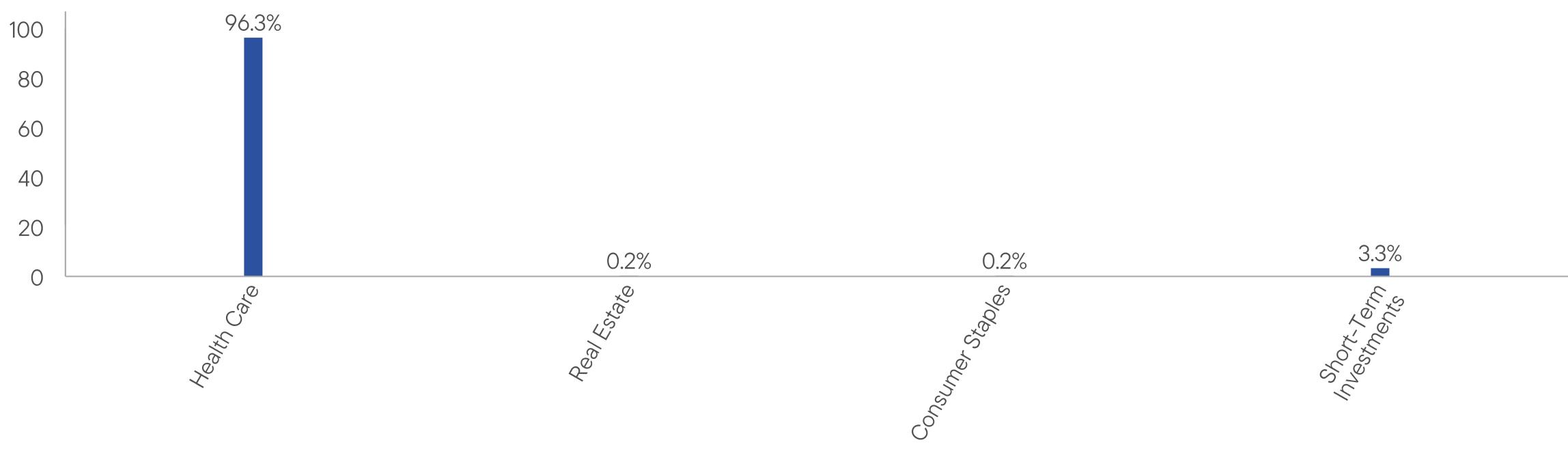

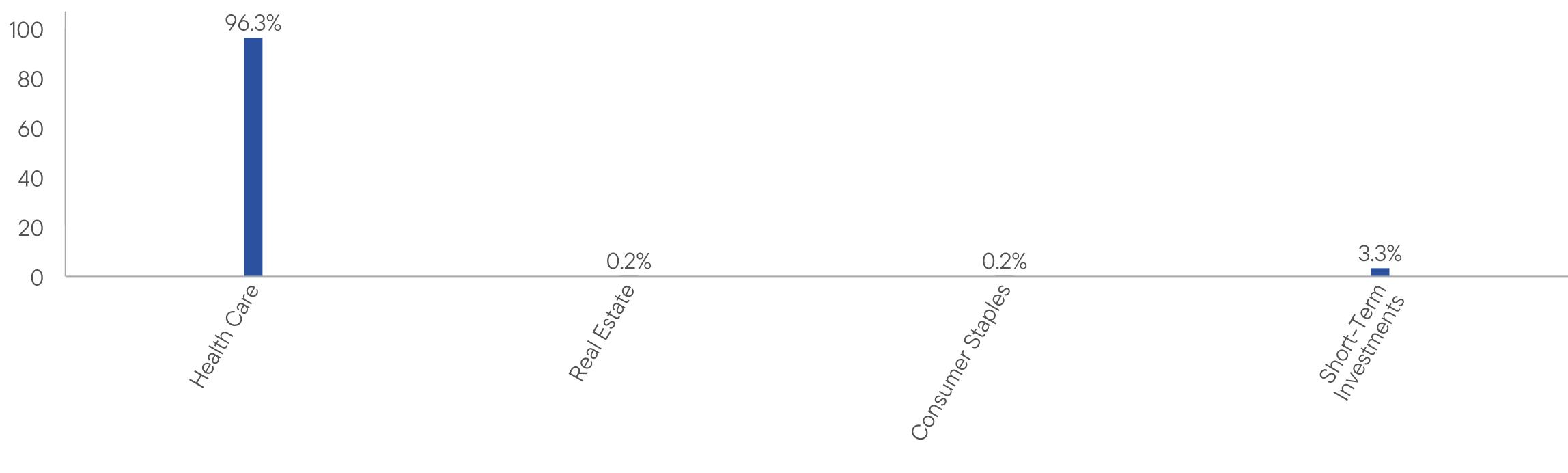

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Biotechnology Discovery Fund | PAGE 1 | 402-STSR-1224 |

96.30.20.23.3

| | |

Franklin Biotechnology Discovery Fund | |

| Class C [FBTDX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Biotechnology Discovery Fund for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class C | $93 | 1.76% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $896,599,561 |

Total Number of Portfolio Holdings* | 98 |

Portfolio Turnover Rate | 11.92% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Biotechnology Discovery Fund | PAGE 1 | 242-STSR-1224 |

96.30.20.23.3

| | |

Franklin Biotechnology Discovery Fund | |

| Class R6 [FRBRX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Biotechnology Discovery Fund for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class R6 | $35 | 0.66% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $896,599,561 |

Total Number of Portfolio Holdings* | 98 |

Portfolio Turnover Rate | 11.92% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Biotechnology Discovery Fund | PAGE 1 | 342-STSR-1224 |

96.30.20.23.3

| | |

Franklin Biotechnology Discovery Fund | |

| Advisor Class [FTDZX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Biotechnology Discovery Fund for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Advisor Class | $40 | 0.76% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $896,599,561 |

Total Number of Portfolio Holdings* | 98 |

Portfolio Turnover Rate | 11.92% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Biotechnology Discovery Fund | PAGE 1 | 42-STSR-1224 |

96.30.20.23.3

| | |

Franklin Natural Resources Fund | |

| Class A [FRNRX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Natural Resources Fund for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class A | $49 | 0.99% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $337,872,240 |

Total Number of Portfolio Holdings* | 93 |

Portfolio Turnover Rate | 5.20% |

| * | Does not include derivatives, except purchased options, if any. |

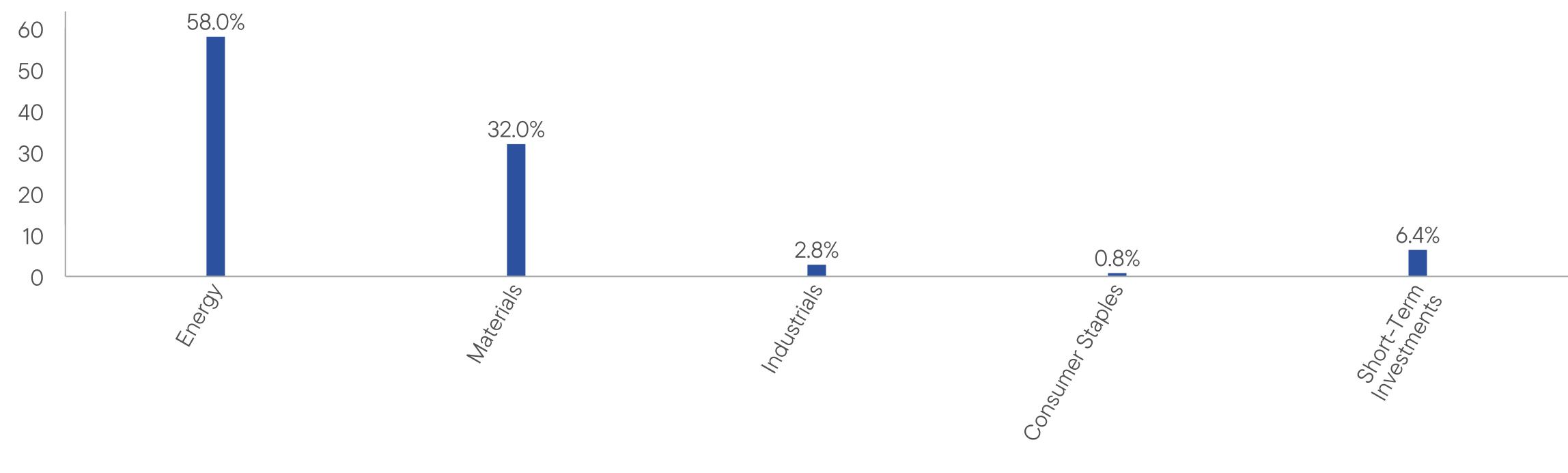

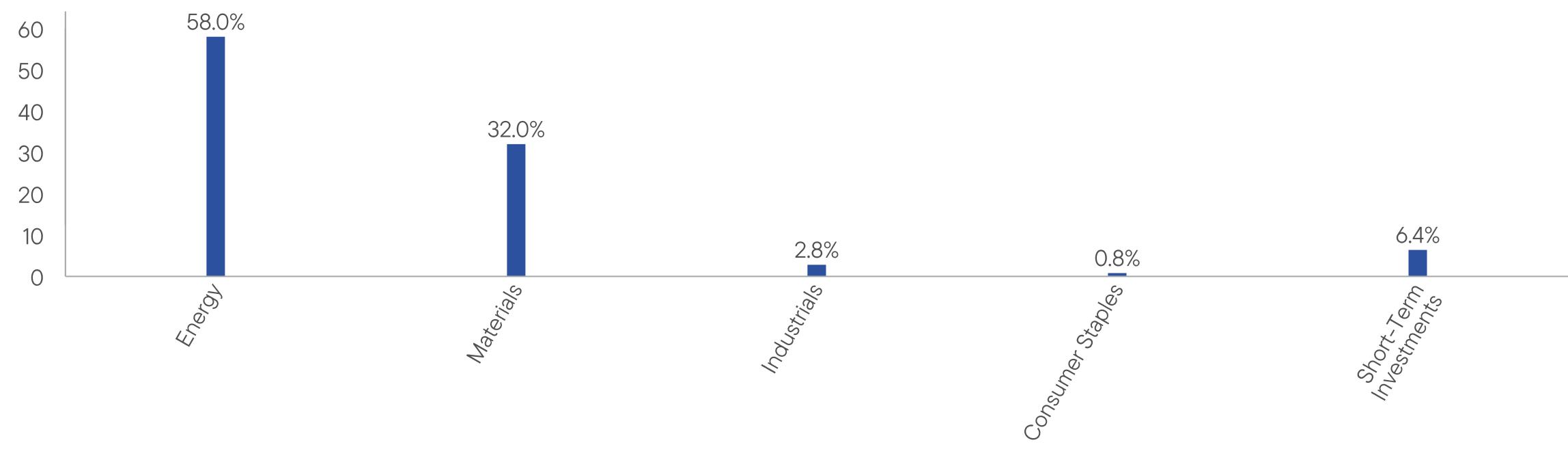

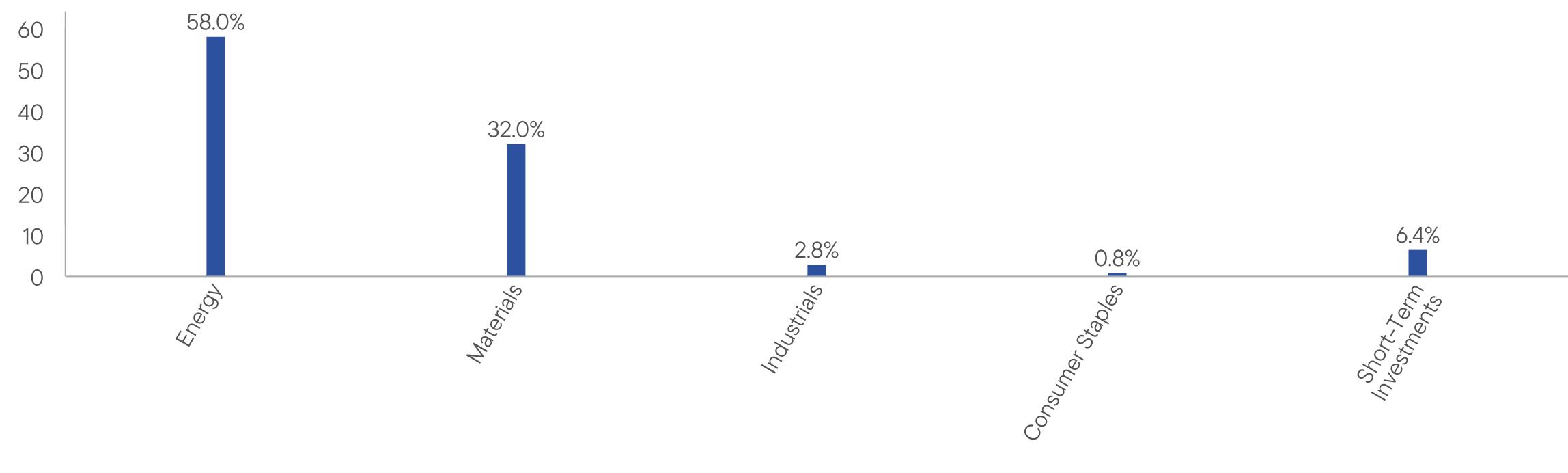

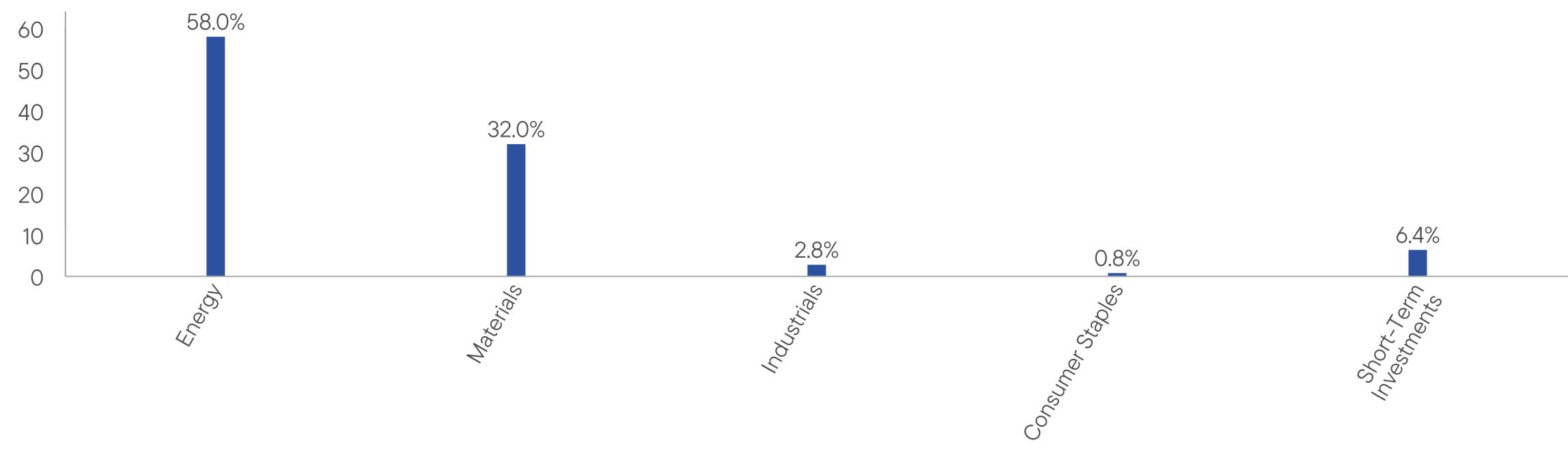

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Natural Resources Fund | PAGE 1 | 403-STSR-1224 |

58.032.02.80.86.4

| | |

Franklin Natural Resources Fund | |

| Class C [FNCRX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Natural Resources Fund for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class C | $87 | 1.74% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $337,872,240 |

Total Number of Portfolio Holdings* | 93 |

Portfolio Turnover Rate | 5.20% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Natural Resources Fund | PAGE 1 | 503-STSR-1224 |

58.032.02.80.86.4

| | |

Franklin Natural Resources Fund | |

| Class R6 [FNCSX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Natural Resources Fund for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class R6 | $30 | 0.61% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $337,872,240 |

Total Number of Portfolio Holdings* | 93 |

Portfolio Turnover Rate | 5.20% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Natural Resources Fund | PAGE 1 | 803-STSR-1224 |

58.032.02.80.86.4

| | |

Franklin Natural Resources Fund | |

| Advisor Class [FNRAX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Natural Resources Fund for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Advisor Class | $37 | 0.74% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $337,872,240 |

Total Number of Portfolio Holdings* | 93 |

Portfolio Turnover Rate | 5.20% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Natural Resources Fund | PAGE 1 | 613-STSR-1224 |

58.032.02.80.86.4

| | |

Franklin Core Plus Bond Fund | |

| Class A [FRSTX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Core Plus Bond Fund (previously known as Franklin Strategic Income Fund) for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class A | $48 | 0.93% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $2,569,415,815 |

Total Number of Portfolio Holdings* | 701 |

Portfolio Turnover Rate | 53.06% |

| * | Does not include derivatives, except purchased options, if any. |

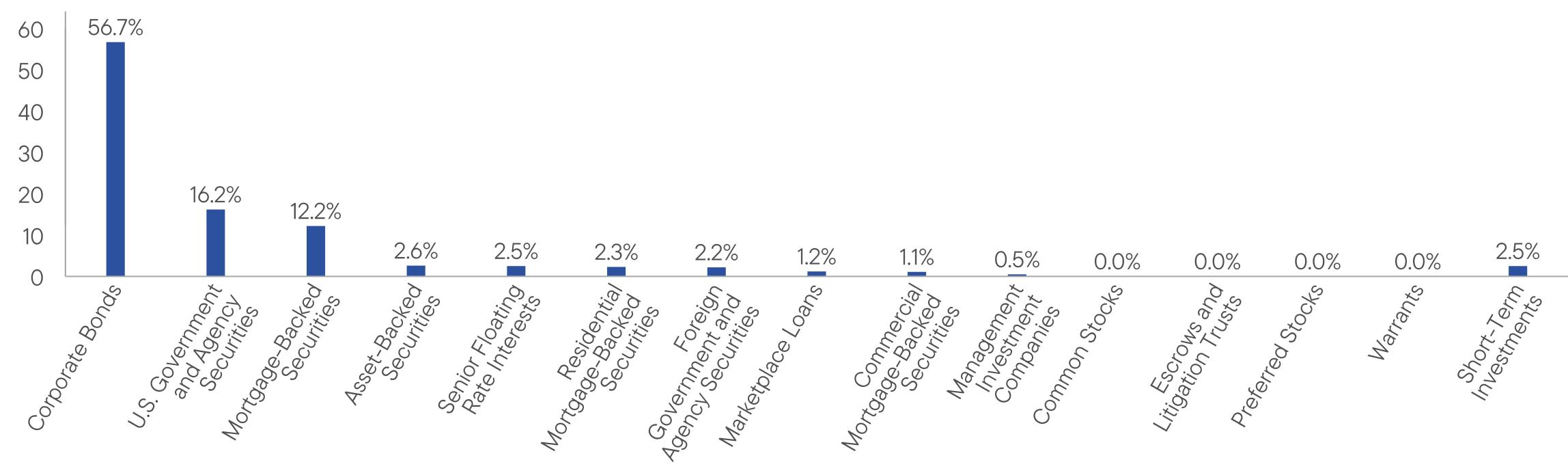

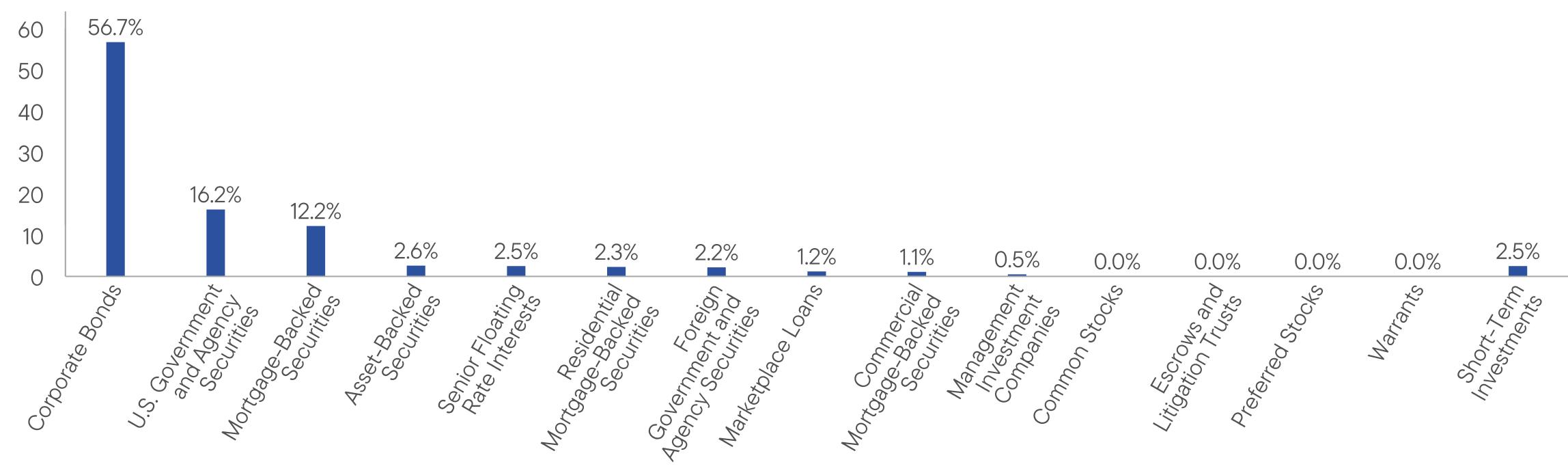

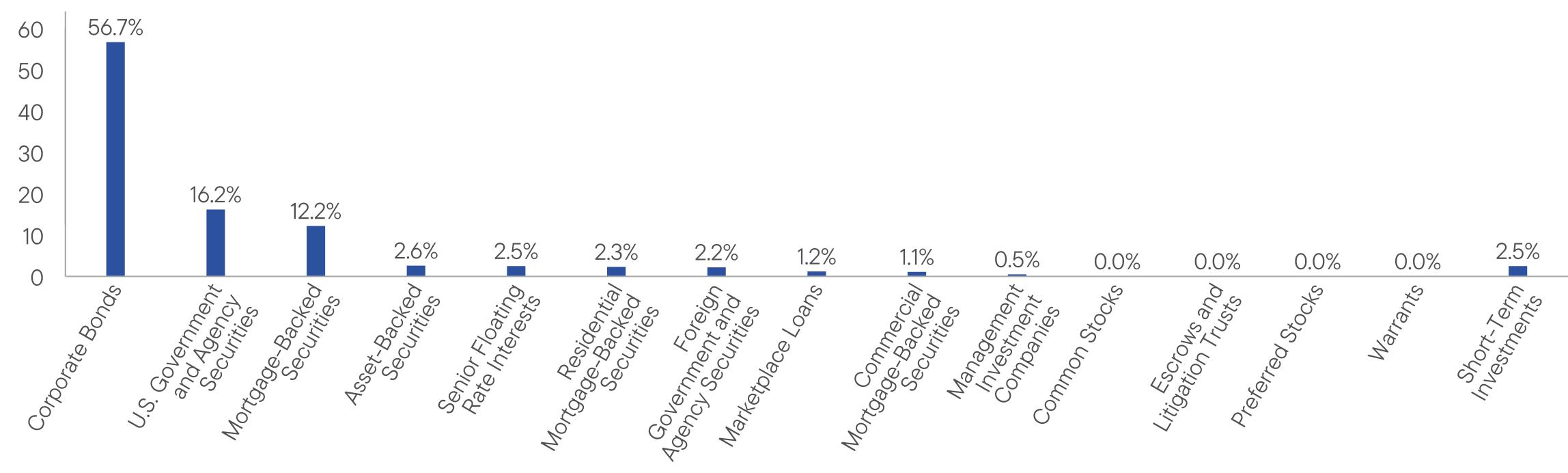

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Core Plus Bond Fund | PAGE 1 | 194-STSR-1224 |

56.716.212.22.62.52.32.21.21.10.50.00.00.00.02.5

| | |

Franklin Core Plus Bond Fund | |

| Class C [FSGCX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Core Plus Bond Fund (previously known as Franklin Strategic Income Fund) for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class C | $69 | 1.33% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $2,569,415,815 |

Total Number of Portfolio Holdings* | 701 |

Portfolio Turnover Rate | 53.06% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Core Plus Bond Fund | PAGE 1 | 294-STSR-1224 |

56.716.212.22.62.52.32.21.21.10.50.00.00.00.02.5

| | |

Franklin Core Plus Bond Fund | |

| Class R [FKSRX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Core Plus Bond Fund (previously known as Franklin Strategic Income Fund) for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class R | $61 | 1.18% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $2,569,415,815 |

Total Number of Portfolio Holdings* | 701 |

Portfolio Turnover Rate | 53.06% |

| * | Does not include derivatives, except purchased options, if any. |

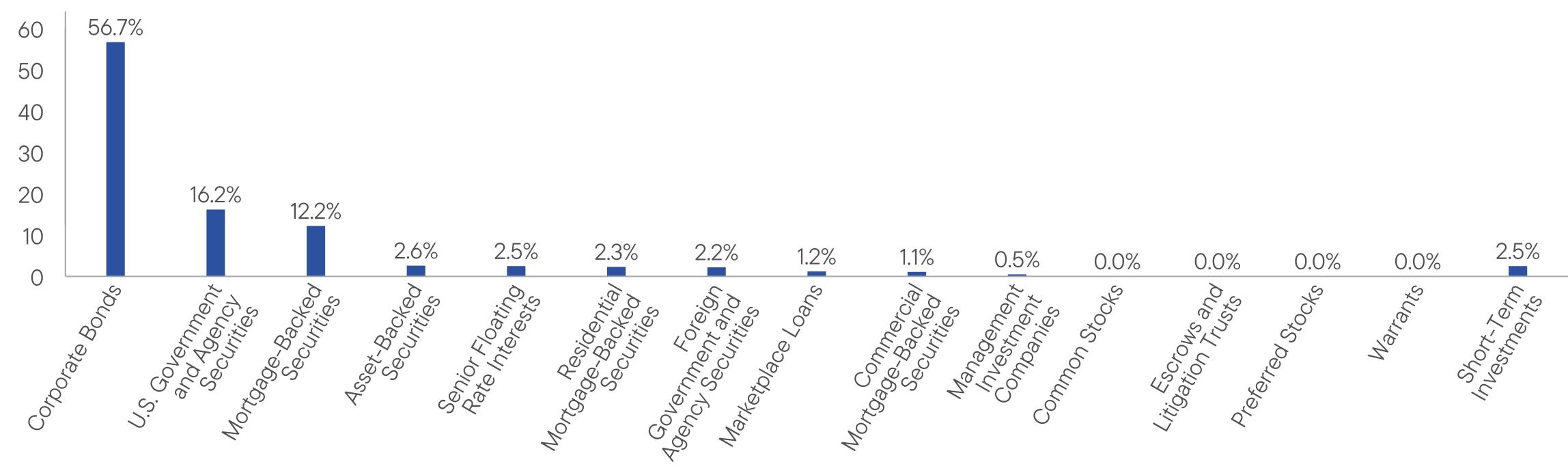

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Core Plus Bond Fund | PAGE 1 | 894-STSR-1224 |

56.716.212.22.62.52.32.21.21.10.50.00.00.00.02.5

| | |

Franklin Core Plus Bond Fund | |

| Class R6 [FGKNX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Core Plus Bond Fund (previously known as Franklin Strategic Income Fund) for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class R6 | $29 | 0.56% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $2,569,415,815 |

Total Number of Portfolio Holdings* | 701 |

Portfolio Turnover Rate | 53.06% |

| * | Does not include derivatives, except purchased options, if any. |

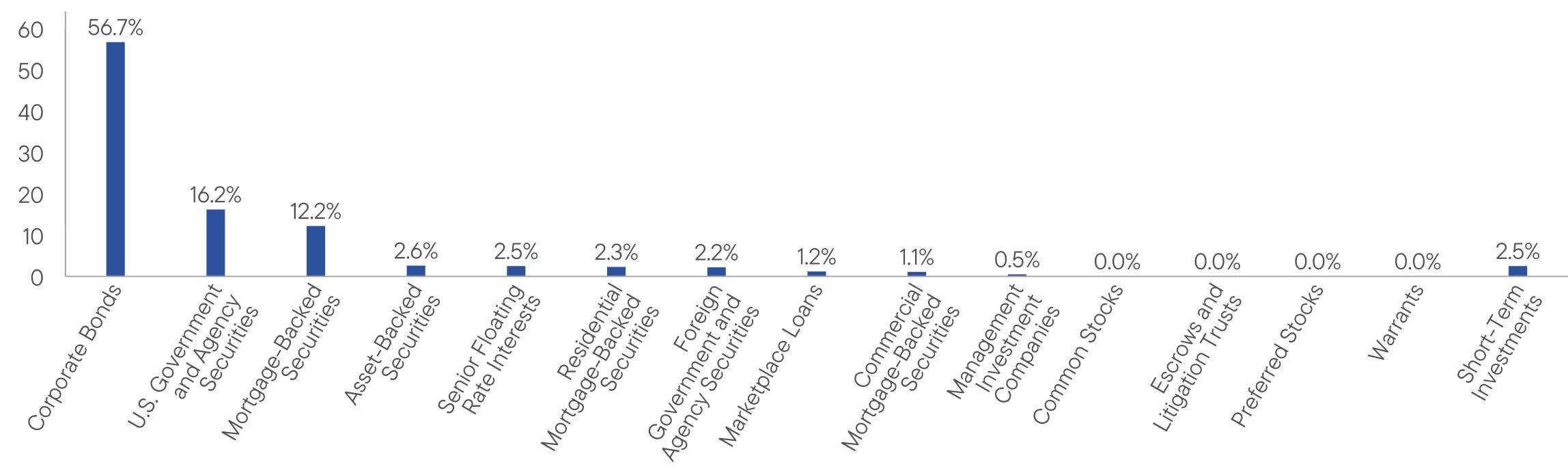

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Core Plus Bond Fund | PAGE 1 | 314-STSR-1224 |

56.716.212.22.62.52.32.21.21.10.50.00.00.00.02.5

| | |

Franklin Core Plus Bond Fund | |

| Advisor Class [FKSAX] |

| Semi-Annual Shareholder Report | October 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Core Plus Bond Fund (previously known as Franklin Strategic Income Fund) for the period May 1, 2024, to October 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Advisor Class | $35 | 0.68% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Total Net Assets | $2,569,415,815 |

Total Number of Portfolio Holdings* | 701 |

Portfolio Turnover Rate | 53.06% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Core Plus Bond Fund | PAGE 1 | 694-STSR-1224 |

56.716.212.22.62.52.32.21.21.10.50.00.00.00.02.5

Item 2. Code of Ethics. N/A

Item 3. Audit Committee Financial Expert. N/A

Item 4. Principal Accountant Fees and Services. N/A

Item 5. Audit Committee of Listed Registrants. N/A

Item 6. Schedule of Investments.

(a) Please see schedule of investments contained in the Financial Statements and Financial Highlights included under Item 7 of this Form N-CSR.

(b) N/A

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Franklin

Strategic

Series

Financial

Statements

and

Other

Important

Information

Semi-Annual

|

October

31,

2024

Franklin

Growth

Opportunities

Fund

Franklin

Small

Cap

Growth

Fund

Franklin

Small-Mid

Cap

Growth

Fund

Financial

Statements

and

Other

Important

Information—Semiannual

Financial

Highlights

and

Schedules

of

Investments

2

Financial

Statements

31

Notes

to

Financial

Statements

36

Changes

In

and

Disagreements

with

Accountants

58

Results

of

Meeting(s)

of

Shareholders

58

Remuneration

Paid

to

Directors,

Officers

and

Others

58

Board

Approval

of

Management

and

Subadvisory

Agreements

58

Financial

Highlights

Franklin

Growth

Opportunities

Fund

Semiannual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

Six

Months

Ended

October

31,

2024

(unaudited)

Year

Ended

April

30,

2024

2023

2022

2021

2020

Class

A

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

period)

Net

asset

value,

beginning

of

period

.....

$45.99

$39.15

$43.14

$56.25

$39.60

$39.57

Income

from

investment

operations

a

:

Net

investment

(loss)

b

..............

(0.05)

(0.20)

(0.12)

(0.28)

(0.26)

(0.14)

Net

realized

and

unrealized

gains

(losses)

6.16

12.81

(2.19)

(7.76)

20.03

3.59

Total

from

investment

operations

........

6.11

12.61

(2.31)

(8.04)

19.77

3.45

Less

distributions

from:

Net

realized

gains

.................

—

(5.77)

(1.68)

(5.07)

(3.12)

(3.42)

Net

asset

value,

end

of

period

..........

$52.10

$45.99

$39.15

$43.14

$56.25

$39.60

Total

return

c

.......................

13.29%

33.49%

(4.98)%

(16.57)%

50.64%

8.90%

Ratios

to

average

net

assets

d

Expenses

before

waiver

and

payments

by

affiliates

.........................

0.89%

0.91%

0.95%

0.90%

0.91%

0.95%

Expenses

net

of

waiver

and

payments

by

affiliates

.........................

0.89%

e

0.91%

e,f

0.94%

f

0.89%

f

0.91%

e,f

0.95%

e,f

Net

investment

(loss)

................

(0.18)%

(0.45)%

(0.30)%

(0.49)%

(0.51)%

(0.35)%

Supplemental

data

Net

assets

,

end

of

period

(000’s)

........

$3,727,092

$3,453,647

$2,765,017

$3,215,834

$4,203,693

$2,883,392

Portfolio

turnover

rate

................

8.96%

27.49%

16.52%

g

17.20%

17.54%

19.47%

a

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchas-

es

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

b

Based

on

average

daily

shares

outstanding.

c

Total

return

does

not

reflect

sales

commissions

or

contingent

deferred

sales

charges,

if

applicable,

and

is

not

annualized

for

periods

less

than

one

year.

d

Ratios

are

annualized

for

periods

less

than

one

year.

e

Benefit

of

waiver

and

payments

by

affiliates

rounds

to

less

than

0.01%.

f

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

g

Excludes

the

value

of

portfolio

activity

as

a

result

of

in-kind

transactions.

Franklin

Strategic

Series

Financial

Highlights

Franklin

Growth

Opportunities

Fund

(continued)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Semiannual

Report

a

Six

Months

Ended

October

31,

2024

(unaudited)

Year

Ended

April

30,

2024

2023

2022

2021

2020

Class

C

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

period)

Net

asset

value,

beginning

of

period

.....

$31.99

$28.86

$32.55

$43.87

$31.61

$32.47

Income

from

investment

operations

a

:

Net

investment

(loss)

b

..............

(0.17)

(0.38)

(0.30)

(0.54)

(0.50)

(0.35)

Net

realized

and

unrealized

gains

(losses)

4.28

9.28

(1.71)

(5.71)

15.88

2.91

Total

from

investment

operations

........

4.11

8.90

(2.01)

(6.25)

15.38

2.56

Less

distributions

from:

Net

realized

gains

.................

—

(5.77)

(1.68)

(5.07)

(3.12)

(3.42)

Net

asset

value,

end

of

period

..........

$36.10

$31.99

$28.86

$32.55

$43.87

$31.61

Total

return

c

.......................

12.85%

32.52%

(5.69)%

(17.20)%

49.47%

8.10%

Ratios

to

average

net

assets

d

Expenses

before

waiver

and

payments

by

affiliates

.........................

1.64%

1.66%

1.70%

1.65%

1.66%

1.70%

Expenses

net

of

waiver

and

payments

by

affiliates

.........................

1.64%

e

1.66%

e,f

1.69%

f

1.64%

f

1.66%

e,f

1.70%

e,f

Net

investment

(loss)

................

(0.93)%

(1.18)%

(1.05)%

(1.23)%

(1.26)%

(1.10)%

Supplemental

data

Net

assets

,

end

of

period

(000’s)

........

$90,627

$87,686

$119,070

$158,895

$278,804

$216,757

Portfolio

turnover

rate

................

8.96%

27.49%

16.52%

g

17.20%

17.54%

19.47%

a

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchas-

es

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

b

Based

on

average

daily

shares

outstanding.

c

Total

return

does

not

reflect

sales

commissions

or

contingent

deferred

sales

charges,

if

applicable,

and

is

not

annualized

for

periods

less

than

one

year.

d

Ratios

are

annualized

for

periods

less

than

one

year.

e

Benefit

of

waiver

and

payments

by

affiliates

rounds

to

less

than

0.01%.

f

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

g

Excludes

the

value

of

portfolio

activity

as

a

result

of

in-kind

transactions.

Franklin

Strategic

Series

Financial

Highlights

Franklin

Growth

Opportunities

Fund

(continued)

Semiannual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

Six

Months

Ended

October

31,

2024

(unaudited)

Year

Ended

April

30,

2024

2023

2022

2021

2020

Class

R

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

period)

Net

asset

value,

beginning

of

period

.....

$41.85

$36.13

$40.06

$52.69

$37.32

$37.57

Income

from

investment

operations

a

:

Net

investment

(loss)

b

..............

(0.10)

(0.29)

(0.20)

(0.39)

(0.36)

(0.22)

Net

realized

and

unrealized

gains

(losses)

5.59

11.78

(2.05)

(7.17)

18.85

3.39

Total

from

investment

operations

........

5.49

11.49

(2.25)

(7.56)

18.49

3.17

Less

distributions

from:

Net

realized

gains

.................

—

(5.77)

(1.68)

(5.07)

(3.12)

(3.42)

Net

asset

value,

end

of

period

..........

$47.34

$41.85

$36.13

$40.06

$52.69

$37.32

Total

return

c

.......................

13.12%

33.18%

(5.21)%

(16.79)%

50.26%

8.64%

Ratios

to

average

net

assets

d

Expenses

before

waiver

and

payments

by

affiliates

.........................

1.14%

1.16%

1.20%

1.15%

1.15%

1.20%

Expenses

net

of

waiver

and

payments

by

affiliates

.........................

1.14%

e

1.16%

e,f

1.19%

f

1.14%

f

1.15%

e,f

1.20%

e,f

Net

investment

(loss)

................

(0.43)%

(0.70)%

(0.55)%

(0.73)%

(0.75)%

(0.60)%

Supplemental

data

Net

assets

,

end

of

period

(000’s)

........

$31,719

$28,933

$22,664

$27,009

$40,396

$31,060

Portfolio

turnover

rate

................

8.96%

27.49%

16.52%

g

17.20%

17.54%

19.47%

a

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchas-

es

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

b

Based

on

average

daily

shares

outstanding.

c

Total

return

is

not

annualized

for

periods

less

than

one

year.

d

Ratios

are

annualized

for

periods

less

than

one

year.

e

Benefit

of

waiver

and

payments

by

affiliates

rounds

to

less

than

0.01%.

f

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

g

Excludes

the

value

of

portfolio

activity

as

a

result

of

in-kind

transactions.

Franklin

Strategic

Series

Financial

Highlights

Franklin

Growth

Opportunities

Fund

(continued)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Semiannual

Report

a

Six

Months

Ended

October

31,

2024

(unaudited)

Year

Ended

April

30,

2024

2023

2022

2021

2020

Class

R6

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

period)

Net

asset

value,

beginning

of

period

.....

$53.82

$44.87

$48.98

$63.06

$43.97

$43.42

Income

from

investment

operations

a

:

Net

investment

income

(loss)

b

........

0.04

(0.05)

0.02

(0.10)

(0.10)

0.01

Net

realized

and

unrealized

gains

(losses)

7.20

14.77

(2.45)

(8.91)

22.31

3.96

Total

from

investment

operations

........

7.24

14.72

(2.43)

(9.01)

22.21

3.97

Less

distributions

from:

Net

realized

gains

.................

—

(5.77)

(1.68)

(5.07)

(3.12)

(3.42)

Net

asset

value,

end

of

period

..........

$61.06

$53.82

$44.87

$48.98

$63.06

$43.97

Total

return

c

.......................

13.46%

33.94%

(4.62)%

(16.32)%

51.13%

9.34%

Ratios

to

average

net

assets

d

Expenses

before

waiver

and

payments

by

affiliates

.........................

0.57%

0.58%

0.59%

0.57%

0.57%

0.59%

Expenses

net

of

waiver

and

payments

by

affiliates

.........................

0.57%

e

0.58%

e,f

0.58%

f

0.57%

e,f

0.57%

e,f

0.59%

e,f

Net

investment

income

(loss)

..........

0.14%

(0.11)%

0.05%

(0.16)%

(0.17)%

0.01%

Supplemental

data

Net

assets

,

end

of

period

(000’s)

........

$410,720

$375,777

$449,119

$461,475

$563,918

$383,208

Portfolio

turnover

rate

................

8.96%

27.49%

16.52%

g

17.20%

17.54%

19.47%

a

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchas-

es

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

b

Based

on

average

daily

shares

outstanding.

c

Total

return

is

not

annualized

for

periods

less

than

one

year.

d

Ratios

are

annualized

for

periods

less

than

one

year.

e

Benefit

of

waiver

and

payments

by

affiliates

rounds

to

less

than

0.01%.

f

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

g

Excludes

the

value

of

portfolio

activity

as

a

result

of

in-kind

transactions.

Franklin

Strategic

Series

Financial

Highlights

Franklin

Growth

Opportunities

Fund

(continued)

Semiannual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

Six

Months

Ended

October

31,

2024

(unaudited)

Year

Ended

April

30,

2024

2023

2022

2021

2020

Advisor

Class

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

period)

Net

asset

value,

beginning

of

period

.....

$52.54

$43.96

$48.07

$62.01

$43.31

$42.87

Income

from

investment

operations

a

:

Net

investment

income

(loss)

b

........

0.02

(0.10)

(0.02)

(0.15)

(0.14)

(0.04)

Net

realized

and

unrealized

gains

(losses)

7.03

14.45

(2.41)

(8.72)

21.96

3.90

Total

from

investment

operations

........

7.05

14.35

(2.43)

(8.87)

21.82

3.86

Less

distributions

from:

Net

realized

gains

.................

—

(5.77)

(1.68)

(5.07)

(3.12)

(3.42)

Net

asset

value,

end

of

period

..........

$59.59

$52.54

$43.96

$48.07

$62.01

$43.31

Total

return

c

.......................

13.42%

33.80%

(4.71)%

(16.37)%

51.01%

9.20%

Ratios

to

average

net

assets

d

Expenses

before

waiver

and

payments

by

affiliates

.........................

0.64%

0.66%

0.69%

0.65%

0.66%

0.70%

Expenses

net

of

waiver

and

payments

by

affiliates

.........................

0.64%

e

0.66%

e,f

0.68%

f

0.64%

f

0.66%

e,f

0.70%

e,f

Net

investment

income

(loss)

..........

0.06%

(0.19)%

(0.05)%

(0.24)%

(0.26)%

(0.10)%

Supplemental

data

Net

assets

,

end

of

period

(000’s)

........

$328,205

$291,914

$325,234

$636,524

$643,449

$467,727

Portfolio

turnover

rate

................

8.96%

27.49%

16.52%

g

17.20%

17.54%

19.47%

a

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchas-

es

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

b

Based

on

average

daily

shares

outstanding.

c

Total

return

is

not

annualized

for

periods

less

than

one

year.

d

Ratios

are

annualized

for

periods

less

than

one

year.

e

Benefit

of

waiver

and

payments

by

affiliates

rounds

to

less

than

0.01%.

f

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

g

Excludes

the

value

of

portfolio

activity

as

a

result

of

in-kind

transactions.

Schedule

of

Investments

(unaudited),

October

31,

2024

Franklin

Growth

Opportunities

Fund

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Semiannual

Report

a

a

Country

Shares

a

Value

a

a

a

a

a

a

Common

Stocks

98.7%

Aerospace

&

Defense

2.7%

a

Axon

Enterprise,

Inc.

.................................

United

States

218,188

$

92,402,618

a,b,c

Space

Exploration

Technologies

Corp.

,

A

..................

United

States

142,857

15,999,984

a

Standardaero,

Inc.

..................................

United

States

500,100

14,427,885

122,830,487

Beverages

0.5%

a

Monster

Beverage

Corp.

..............................

United

States

409,808

21,588,685

Biotechnology

1.1%

a

Vaxcyte,

Inc.

.......................................

United

States

480,843

51,137,653

Broadline

Retail

6.3%

a

Amazon.com,

Inc.

...................................

United

States

1,547,369

288,429,582

Building

Products

1.4%

Trane

Technologies

plc

...............................

United

States

169,034

62,569,625

Capital

Markets

3.6%

Ares

Management

Corp.

,

A

............................

United

States

505,173

84,707,409

MSCI,

Inc.

,

A

.......................................

United

States

55,681

31,804,987

S&P

Global,

Inc.

....................................

United

States

100,764

48,402,995

164,915,391

Chemicals

1.6%

Linde

plc

..........................................

United

States

156,596

71,431,265

Commercial

Services

&

Supplies

1.4%

a,b,c

Celonis

SE

........................................

Germany

4,619

1,271,159

a,b,c

Celonis

SE

,

D

......................................

Germany

25,571

7,037,195

Republic

Services,

Inc.

,

A

.............................

United

States

288,276

57,078,648

65,387,002

Construction

Materials

0.7%

Martin

Marietta

Materials,

Inc.

..........................

United

States

57,275

33,926,274

Electrical

Equipment

0.8%

Eaton

Corp.

plc

.....................................

United

States

112,746

37,384,319

Entertainment

2.3%

a

Netflix,

Inc.

........................................

United

States

83,501

63,129,261

a

ROBLOX

Corp.

,

A

...................................

United

States

805,883

41,680,269

104,809,530

Financial

Services

2.9%

Mastercard,

Inc.

,

A

..................................

United

States