UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-06247 |

| | |

| | |

| | |

| AMERICAN CENTURY WORLD MUTUAL FUNDS, INC. |

| (Exact name of registrant as specified in charter) |

| | |

| | |

| | |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| | |

| | |

| | |

CHARLES A. ETHERINGTON 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

| | |

| | |

| Registrant’s telephone number, including area code: | 816-531-5575 |

| | |

| | |

| Date of fiscal year end: | 11-30 |

| | |

| | |

| Date of reporting period: | 05-31-09 |

ITEM 1. REPORTS TO STOCKHOLDERS.

|

| Semiannual Report |

| May 31, 2009 |

|

| American Century Investments |

International Growth Fund

Global Growth Fund

Emerging Markets Fund

International Value Fund

Prospectus Supplement Enclosed

Dear Investor:

Thank you for investing with us during the financial reporting period ended May 31, 2009. We appreciate your trust in American Century Investments® during these challenging times.

The U.S. economy continued to struggle at the close of the reporting period, part of the lingering fallout from the subprime-initiated credit and financial crises and global recession that shook the capital markets during the past two years. The recession has affected everyone—from first-time individual investors to hundred-year-old financial institutions.

However, as we mark the second anniversary of the start of the subprime mortgage meltdown, the worst of the economic and financial market obstacles appear to be behind us. The rate of U.S. economic decline has slowed, as have the drop-offs in housing prices and jobs. Risk appetites returned to the markets in recent months, evidenced by the strong stock rebound since early March.

Risk was a predominant theme during the reporting period, as the investment pendulum swung from risk avoidance to risk acceptance. We believe, however, that caution and risk management are still advisable. We don’t think we’re out of the economic woods yet, not with mortgage and corporate default rates on the rise, housing prices still declining, and job losses still mounting.

Effective risk management requires a commitment to disciplined investment approaches that balance risk and reward, with the goal of setting and maintaining risk levels that are appropriate for portfolio objectives. At American Century Investments, we’ve stayed true to the principles that have guided us for over 50 years, including our commitment to delivering superior investment performance and helping investors reach their financial goals. Risk management is part of that commitment—we offer portfolios that can help diversify and stabilize investment returns.

The coming months will likely present additional challenges, but I’m certain that we have the investment professionals and processes in place to provide competitive and compelling long-term results for you. Thank you for your continued confidence in us.

Sincerely,

Jonathan S. Thomas

President and Chief Executive Officer

American Century Investments

|

| Independent Chairman’s Letter |

I am Don Pratt, an independent director and chairman of the mutual fund board responsible for the U.S. Growth Equity, U.S. Value Equity, Global and Non-U.S. Equity and Asset Allocation funds managed by American Century Investments. The board consists of seven independent directors and two directors who are affiliated with the investment advisor.

As one of your independent shareholder representatives on the fund board, I plan to write you from time to time with updates on board activities and news about your funds. My co-independent directors and I are committed to putting your interests first. We work closely with American Century Investments on maintaining strong fund performance, providing quality service to shareholders at competitive fees and ensuring ethical business practices and compliance with all applicable fund regulations.

Last year, the board welcomed its newest independent director, John R. Whitten. He is a great addition to an experienced board where, collectively, the independent directors have served the funds for more than 76 years. This continuity served shareholders well as the investment advisor initiated a successful management transition, creating a strong senior leadership team consisting of well-tenured company executives and experienced industry veterans. Under the leadership of President and Chief Executive Officer Jonathan Thomas and Chief Investment Officer Enrique Chang, the firm has made the achievement of superior investment performance its primary focus and the key driver of its success going forward. This focus helped the company generate strong relative performance against the backdrop of 2008’s unprecedented market volatility.

As investors in the American Century funds, my fellow directors and I share your investing experience. We know firsthand how decisions made at the board level affect all shareholders. To further guide our efforts on your behalf, I invite you to send me your comments, questions or suggestions by email to dhpratt@fundboardchair.com. Thank you for allowing me to serve as your advocate on our board.

| |

| Market Perspective | 2 |

| International Equity Total Returns | 2 |

| |

| International Growth | |

| Performance | 3 |

| Portfolio Commentary | 5 |

| Top Ten Holdings, Types of Investments in Portfolio | |

| and Investments by Country | 7 |

| |

| Global Growth | |

| Performance | 8 |

| Portfolio Commentary | 10 |

| Top Ten Holdings, Types of Investments in Portfolio | |

| and Investments by Country | 12 |

| |

| Emerging Markets | |

| Performance | 13 |

| Portfolio Commentary | 15 |

| Top Ten Holdings, Types of Investments in Portfolio | |

| and Investments by Country | 17 |

| |

| International Value | |

| Performance | 18 |

| Portfolio Commentary | 20 |

| Top Ten Holdings, Types of Investments in Portfolio | |

| and Investments by Country | 22 |

| |

| Shareholder Fee Examples | 23 |

| |

| Financial Statements | |

| Schedule of Investments | 26 |

| Statement of Assets and Liabilities | 37 |

| Statement of Operations | 39 |

| Statement of Changes in Net Assets | 40 |

| Notes to Financial Statements | 42 |

| Financial Highlights | 54 |

| |

| Other Information | |

| Additional Information | 78 |

| Index Definitions | 79 |

The opinions expressed in the Market Perspective and each of the Portfolio Commentaries reflect those of the portfolio management team as of the date of the report, and do not necessarily represent the opinions of American Century Investments or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

By Mark Kopinski, Chief Investment Officer, Global and Non-U.S. Equity

Stock Performance Made a U-Turn

The global economic slowdown and ongoing credit crisis weighed heavily on the world’s equity markets for the first half of the period, as import and export volumes plummeted, industrial output shrank, and unemployment soared. As a result, stocks remained on the downward track triggered by last fall’s near-collapse of the global financial system.

Midway through the period, however, investor confidence and stock market performance showed an abrupt and surprising rebound. After hitting multi-year lows on March 9, global stocks rallied sharply to finish the six-month period with strong gains. The rebound was triggered by a belief that the global financial system was no longer in imminent danger of collapse.

Prominent central banks, including those in the United States, United Kingdom, and Japan, helped steady investor confidence by launching debt-purchase programs aimed at taming interest rates. Additionally, easy monetary and fiscal policies, including $2.1 trillion in stimulus programs targeting infrastructure development and consumer demand, contributed to improved investor sentiment. Nevertheless, GDP growth remained negative. Shrinking exports weighed on Germany’s economy, where manufacturing output sagged and the unemployment rate climbed. Likewise, reduced output and a deteriorating jobs environment darkened economic prospects for France and the United Kingdom, suggesting an uneven recovery at best.

Emerging Markets Gained as “Riskier” Assets Returned to Favor

With renewed confidence in equities, investors shifted funds toward assets considered “riskier.” Additionally, an uptick in commodity prices coupled with monetary and fiscal stimulus provided support to domestic growth in these economies. As a result, emerging equities performed exceptionally well, reversing some of last year’s significant declines. In China, optimism about the country’s large domestic-oriented stimulus plan helped propel the Shanghai Composite higher, even as declining global export levels remained a concern.

Economic growth seems likely to improve in the second half of the year. However, the economic recovery may not be as robust as the financial markets have discounted. A tug of war between bulls and bears may best characterize the second half of the year.

| | | | |

| International Equity Total Returns | | | | |

| For the six months ended May 31, 2009 (in U.S. dollars)* | |

| MSCI EM Index (Net) | 48.62% | | MSCI EAFE Index | 15.10% |

| MSCI EM Growth Index | 48.09% | | MSCI World Free Index | 10.26% |

| MSCI EAFE Growth Index | 13.26% | | MSCI EAFE Value Index | 16.96% |

| MSCI Europe Index | 14.90% | | MSCI Japan Index | 9.01% |

| *Total returns for periods less than one year are not annualized. | | | |

2

| | | | | | |

| Performance | | | | | | |

| International Growth | | | | | |

| |

| Total Returns as of May 31, 2009 | | | | | |

| | | | Average Annual Returns | |

| | | | | | Since | Inception |

| | 6 months(1) | 1 year | 5 years | 10 years | Inception | Date |

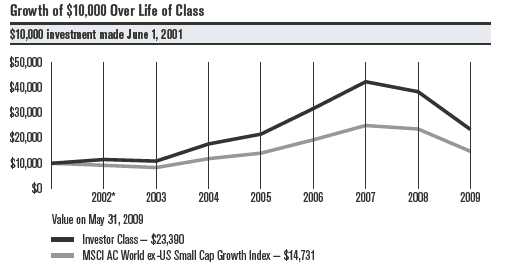

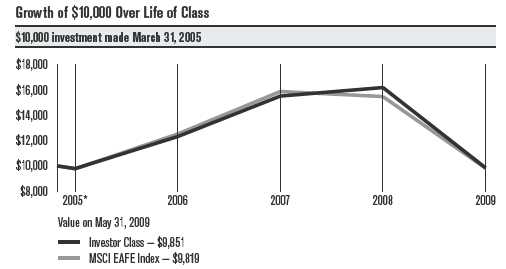

| Investor Class | 15.05% | -39.24% | 2.50% | 1.57% | 7.00% | 5/9/91 |

| MSCI EAFE Index | 15.10% | -36.61% | 2.87% | 1.62% | 4.45%(2) | — |

| MSCI EAFE Growth Index | 13.26% | -38.12% | 2.47% | -0.20% | 2.65%(2) | — |

| Institutional Class | 15.09% | -39.15% | 2.71% | 1.78% | 3.51% | 11/20/97 |

| A Class(3) | | | | | | 10/2/96 |

| No sales charge* | 14.82% | -39.45% | 2.24% | 1.30% | 4.45% | |

| With sales charge* | 8.29% | -42.91% | 1.03% | 0.71% | 3.96% | |

| B Class | | | | | | 1/31/03 |

| No sales charge* | 14.47% | -39.82% | 1.48% | — | 5.59% | |

| With sales charge* | 9.47% | -43.82% | 1.29% | — | 5.59% | |

| C Class | | | | | | 6/4/01 |

| No sales charge* | 14.41% | -39.88% | 1.46% | — | -0.85% | |

| With sales charge* | 13.41% | -39.88% | 1.46% | — | -0.85% | |

| R Class | 14.83% | -39.53% | 2.02% | — | 4.25% | 8/29/03 |

| |

| * Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% |

| maximum initial sales charge for equity funds and may be subject to a maximum CDSC of 1.00%. B Class shares redeemed within six |

| years of purchase are subject to a CDSC that declines from 5.00% during the first year after purchase to 0.00% the sixth year after |

| purchase. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that |

| mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied. |

| |

| (1) | Total returns for periods less than one year are not annualized. |

| (2) | Since 4/30/91, the date nearest the Investor Class’s inception for which data are available. |

| (3) | Prior to December 3, 2007, the A Class was referred to as the Advisor Class. Performance, with sales charge, prior to that date has been adjusted |

| | to reflect the A Class’s current sales charge. |

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the indices do not.

3

| | | | | | | | | | |

| One-Year Returns Over 10 Years | | | | | | | |

| Periods ended May 31 | | | | | | | | | |

| | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 |

| Investor Class | 48.27% | -22.48% | -13.34% | -15.25% | 22.36% | 10.36% | 26.80% | 26.71% | 5.05% | -39.24% |

| MSCI EAFE Index | 17.14% | -17.23% | -9.60% | -12.30% | 32.66% | 14.62% | 28.24% | 26.84% | -2.53% | -36.61% |

| MSCI EAFE | | | | | | | | | | |

| Growth Index | 20.82% | -27.39% | -11.58% | -11.92% | 27.01% | 11.88% | 26.83% | 25.13% | 2.83% | -38.12% |

| | | | | | | | | | | |

| Total Annual Fund Operating Expenses | | | | | | |

| | Institutional | | | | | | | | |

| Investor Class | Class | A Class | B Class | C Class | R Class |

| 1.41% | 1.21% | 1.66% | 2.41% | 2.41% | 1.91% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the indices do not.

4

International Growth

Portfolio Managers: Alex Tedder and Raj Gandhi

Performance Summary

The International Growth portfolio advanced 15.05%* for the six months ended May 31, 2009, compared with its benchmark, the MSCI EAFE Index, which gained 15.10%.

The reporting period began with international stocks suffering the effects of a severe global recession and financial-sector crisis. In early March, stocks plunged to new current-cycle lows, as rising unemployment, shrinking industrial output, and negative economic growth rates sent investor confidence tumbling. Market sentiment and performance reversed course quickly, though, as the numerous and unprecedented actions from global central banks and governments sparked optimism among investors. As a result, stocks rebounded sharply in the second half of the reporting period, to finish the six months with solid gains.

On an absolute basis, all sectors and nearly every country represented in the portfolio and benchmark posted positive returns for the six-month period. Sector allocations accounted for the portfolio’s slight underperformance relative to the benchmark.

Germany Led Detractors; Italy Topped Contributors

From a regional perspective, the portfolio’s holdings in Germany detracted the most from relative results, followed by positions in France and Sweden. Stock selection was the culprit in Germany and France, while an underweight hurt relative performance in Sweden.

At the opposite end of the performance spectrum, Italy, followed by portfolio-only positions in Canada and South Korea, made the greatest contributions to relative performance. Canada’s Research In Motion (RIM), the developer of the BlackBerry wireless device, was the portfolio’s top performer for the period. Sales of the company’s touch-screen BlackBerry Storm device, RIM’s answer to Apple’s iPhone, gained traction after RIM resolved several software issues. Within our allocation to South Korea, automaker Hyundai Motor Co. drove results.

Materials Sector Lagged

The materials sector represented the portfolio’s largest performance detractor. Our underweight combined with negative stock selection in the metals and mining industry accounted for the bulk of the sector’s under-performance. Although our overweight to the consumer discretionary sector yielded positive performance, our stock selection—particularly in the textiles, apparel, and luxury goods segment—led to overall lagging results on a relative basis.

*All fund returns referenced in this commentary are for Investor Class shares. Total returns for periods less than one year are not annualized.

5

International Growth

The portfolio’s health care sector also detracted from performance, primarily due to an overweight in the biotechnology industry and in the health care providers and services segment. In particular, our overweight positions in Switzerland-based Actelion Ltd., a biopharmaceutical company, and Germany’s Fresenius Medical Care, a provider of dialysis products and services, hurt results.

Technology, Energy Outperform

The top contributors to the portfolio’s relative performance included the information technology and energy sectors. The outperformance primarily was due to stock selection, but our allocations (overweight technology, underweight energy) also helped. In addition to the strong results from RIM, the portfolio benefited from good stock selection in the internet software and services and computer and peripherals areas.

After falling in the first half of the reporting period, oil prices skyrocketed later in the six-month period, and this helped push select energy stocks higher. Our energy stocks showed strong results, led by our overweighted position in Italy’s Saipem, an oil and gas services company.

Another leading portfolio performer was Belgium-based brewer Anheuser-Busch InBev. The company shored up its balance sheet by selling most of its stake in Tsingtao Brewery, one of China’s largest brewers; soliciting bids for its Oriental Brewing of South Korea; and cutting $1 billion from its capital expenditure budget.

Outlook

International Growth primarily invests in companies located in developed countries around the world (excluding the United States). Although we expect further volatility throughout the international stock markets, we will continue to focus on finding companies with sustainable growth characteristics and promising long-term outlooks.

6

| | |

| International Growth | | |

| |

| Top Ten Holdings as of May 31, 2009 | | |

| | % of net assets | % of net assets |

| | as of 5/31/09 | as of 11/30/08 |

| ENI SpA | 1.9% | 2.2% |

| Nestle SA | 1.8% | 2.1% |

| Banco Santander SA | 1.8% | 1.2% |

| BG Group plc | 1.8% | 2.4% |

| BHP Billiton Ltd. | 1.7% | 1.1% |

| Muenchener Rueckversicherungs-Gesellschaft AG | 1.6% | 1.6% |

| Saipem SpA | 1.6% | 1.2% |

| iShares MSCI Japan Index Fund | 1.5% | 1.7% |

| Vale SA Preference Shares | 1.5% | 0.8% |

| Koninklijke Ahold NV | 1.4% | 1.7% |

| |

| Types of Investments in Portfolio | | |

| | % of net assets | % of net assets |

| | as of 5/31/09 | as of 11/30/08 |

| Foreign Common Stocks & Rights | 99.5% | 99.4% |

| Temporary Cash Investments | 0.5% | 0.3% |

| Other Assets and Liabilities | —(1) | 0.3% |

| (1) Category is less than 0.05% of total net assets. | | |

| |

| Investments by Country as of May 31, 2009 | | |

| | % of net assets | % of net assets |

| | as of 5/31/09 | as of 11/30/08 |

| United Kingdom | 17.6% | 23.1% |

| Japan | 14.2% | 14.4% |

| Switzerland | 9.9% | 9.8% |

| Germany | 6.9% | 7.2% |

| France | 6.1% | 7.2% |

| Italy | 5.1% | 4.0% |

| Australia | 4.8% | 4.3% |

| Spain | 3.4% | 4.1% |

| People’s Republic of China | 3.3% | 1.1% |

| South Korea | 2.9% | 0.4% |

| Canada | 2.8% | 3.8% |

| Brazil | 2.7% | 2.2% |

| Other Countries | 19.8% | 17.8% |

| Cash and Equivalents(2) | 0.5% | 0.6% |

| (2) Includes temporary cash investments and other assets and liabilities. | | |

7

| | | | | | | |

| Global Growth | | | | | | |

| |

| Total Returns as of May 31, 2009 | | | | | |

| | | | | Average Annual Returns | |

| | | | | | | Since | Inception |

| | | 6 months(1) | 1 year | 5 years | 10 years | Inception | Date |

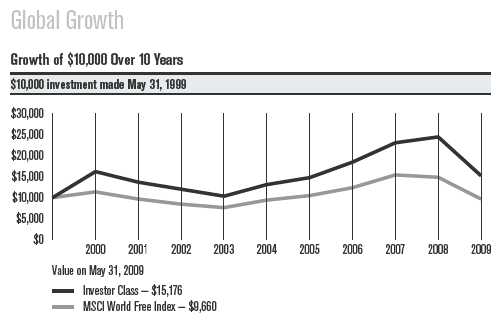

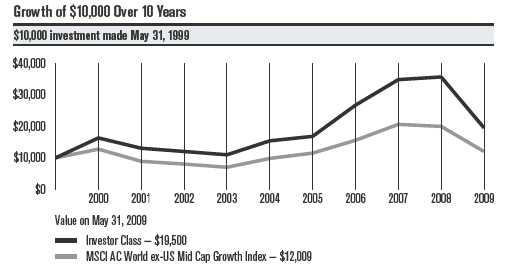

| Investor Class | 9.18% | -37.82% | 3.00% | 4.26% | 5.75% | 12/1/98 |

| MSCI World Free Index | 10.26% | -34.83% | 0.53% | -0.35% | 0.46%(2) | — |

| Institutional Class | 9.28% | -37.69% | 3.22% | — | -1.09% | 8/1/00 |

| A Class(3) | | | | | | 2/5/99 |

| No sales charge* | 9.12% | -37.90% | 2.74% | 4.00% | 4.48% | |

| With sales charge* | 2.92% | -41.46% | 1.53% | 3.38% | 3.89% | |

| B Class | | | | | | 12/1/05 |

| No sales charge* | 8.73% | -38.44% | — | — | -4.29% | |

| With sales charge* | 3.73% | -42.44% | — | — | -5.26% | |

| C Class | | | | | | 3/1/02 |

| No sales charge* | 8.84% | -38.41% | 2.00% | — | 2.77% | |

| With sales charge* | 7.84% | -38.41% | 2.00% | — | 2.77% | |

| R Class | 9.11% | -38.17% | — | — | -1.63% | 7/29/05 |

| * Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% |

| maximum initial sales charge for equity funds and may be subject to a maximum CDSC of 1.00%. B Class shares redeemed within six |

| years of purchase are subject to a CDSC that declines from 5.00% during the first year after purchase to 0.00% the sixth year after |

| purchase. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that |

| mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied. |

| |

| (1) | Total returns for periods less than one year are not annualized. | | | | |

| (2) | Since 11/30/98, the date nearest the Investor Class’s inception for which data are available. | | | |

| (3) | Prior to September 4, 2007, the A Class was referred to as the Advisor Class. Performance, with sales charge, prior to that date has been |

| | adjusted to reflect the A Class’s current sales charge. | | | | | |

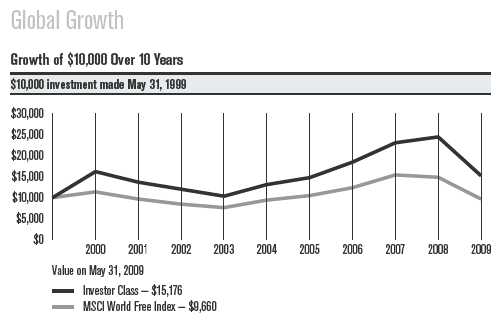

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

8

| | | | | | | | | | |

| One-Year Returns Over 10 Years | | | | | | | |

| Periods ended May 31 | | | | | | | | | |

| | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 |

| Investor Class | 61.77% | -15.57% | -12.17% | -13.86% | 26.69% | 12.61% | 24.97% | 24.97% | 6.00% | -37.82% |

| MSCI World | | | | | | | | | | |

| Free Index | 13.56% | -14.95% | -12.56% | -9.86% | 23.60% | 11.35% | 17.98% | 24.51% | -3.68% | -34.83% |

| | | | | | | | | | | |

| Total Annual Fund Operating Expenses | | | | | | |

| | Institutional | | | | | | | | |

| Investor Class | Class | A Class | B Class | C Class | R Class |

| 1.26% | 1.06% | 1.51% | 2.26% | 2.26% | 1.76% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

9

Global Growth

Portfolio Managers: Keith Creveling and Brent Puff

Performance Summary

The Global Growth portfolio advanced 9.18%* for the six months ended May 31, 2009, underperforming its benchmark, the MSCI World Free Index, which gained 10.26%.

The reporting period began with stocks around the world suffering the effects of a severe global recession and financial-sector crisis. In early March, stocks plunged to new current-cycle lows, as rising unemployment, shrinking industrial output, and negative economic growth rates sent investor confidence tumbling. Market sentiment and performance reversed course quickly, though, as the numerous and unprecedented actions from global central banks and governments sparked optimism among investors. As a result, global stocks rebounded sharply in the second half of the reporting period, to finish the six months with solid gains.

Other than the utilities sector, every sector in the portfolio and benchmark showed positive absolute returns for the period.

Canada Led Detractors; U.S. Was Top Contributor

From a country perspective, the portfolio’s holdings in Canada, Spain, and Japan detracted the most from relative performance, primarily due to stock selection. In addition, we underweighted each country, which also detracted from relative results. Spain was home to the portfolio’s leading detractor, toll road operator Cintra Concesiones de Infraestructuras de Transporte. The company reported traffic declines on its roads in the U.S. and Spain and experienced funding complications and minority shareholder challenges when it explored a potential merger with its parent, Grupo Ferrovial of Spain.

The United States led all country contributors in the portfolio, followed by China and the United Kingdom. Performance in the United States was driven by overweight positions in Goldman Sachs Group and Apple Inc. Shares in Goldman Sachs advanced, as the investment company’s competitive environment improved and a boost in trading revenues bolstered the company’s bottom line. At computer and electronic device maker Apple, better-than-expected revenues and strong market enthusiasm for the iPhone’s extensive software update helped push the stock price higher.

Materials Stocks Lagged

Stock selection showed the greatest drag on relative results in the portfolio’s materials, consumer discretionary, and information technology sectors. In the materials sector, our stock selections combined with an underweight in the metals and mining industry hurt performance.

*All fund returns referenced in this commentary are for Investor Class shares. Total returns for periods less than one year are not annualized.

10

Global Growth

In the consumer discretionary sector, U.S.-based Apollo Group, an educational services company, tumbled on concerns about potential regulatory and legal changes from the U.S. Department of Education. An overweight to the information technology sector (the portfolio’s largest sector weighting) contributed positively to the portfolio’s performance, but stock selection, primarily in the software and IT services industries, detracted from results.

Energy Led All Sectors

A sharp upswing in oil prices during the second half of the reporting period helped generate strong returns in the energy sector. Our overweight positions in Saipem, an Italian oil and gas services company, and Southwestern Energy and Occidental Petroleum, U.S.-based oil and natural gas exploration companies, drove the portfolio’s energy-sector outperformance.

The portfolio’s utilities and telecommunication services sectors also contributed positively to relative performance. Specifically, an underweight in utilities, which was the smallest sector allocation in the portfolio, and favorable stock selection among wireless telecommunication providers helped drive results.

Outlook

Global Growth primarily invests in companies located in developed countries throughout the world, including the United States. We remain focused on identifying companies with the ability to grow sustainably over time. In the current environment, we are focused on identifying companies with sustainable growth characteristics, a management team focused on protecting profit margins, and a strong competitive position in the marketplace. Although we expect continued market volatility in the short term, we remain committed to identifying and exploiting attractive opportunities and helping our shareholders build value over time.

11

| | |

| Global Growth | | |

| |

| Top Ten Holdings as of May 31, 2009 | | |

| | % of net assets | % of net assets |

| | as of 5/31/09 | as of 11/30/08 |

| Compass Group plc | 2.1% | 1.7% |

| Apple, Inc. | 2.0% | 1.5% |

| BG Group plc | 1.8% | 1.4% |

| Colgate-Palmolive Co. | 1.8% | 1.6% |

| American Tower Corp., Class A | 1.8% | 1.4% |

| Occidental Petroleum Corp. | 1.8% | 1.6% |

| Hewlett-Packard Co. | 1.8% | 2.1% |

| BHP Billiton Ltd. | 1.8% | 1.4% |

| Southwestern Energy Co. | 1.8% | 1.3% |

| Goldman Sachs Group, Inc. (The) | 1.8% | — |

| |

| Types of Investments in Portfolio | | |

| | % of net assets | % of net assets |

| | as of 5/31/09 | as of 11/30/08 |

| Domestic Common Stocks | 50.4% | 51.6% |

| Foreign Common Stocks | 48.5% | 47.0% |

| Total Equity Exposure | 98.9% | 98.6% |

| Temporary Cash Investments | 0.5% | 1.4% |

| Other Assets and Liabilities | 0.6% | —(1) |

| (1) Category is less than 0.05% of total net assets. | | |

| |

| Investments by Country as of May 31, 2009 | | |

| | % of net assets | % of net assets |

| | as of 5/31/09 | as of 11/30/08 |

| United States | 50.4% | 51.6% |

| United Kingdom | 9.7% | 10.5% |

| Japan | 6.3% | 4.3% |

| Switzerland | 4.5% | 6.0% |

| Germany | 4.4% | 5.7% |

| Australia | 3.3% | 3.8% |

| Netherlands | 3.2% | 2.4% |

| Ireland | 2.2% | 0.6% |

| People’s Republic of China | 2.0% | — |

| Other Countries | 12.9% | 13.7% |

| Cash and Equivalents(2) | 1.1% | 1.4% |

| (2) Includes temporary cash investments and other assets and liabilities. | | |

12

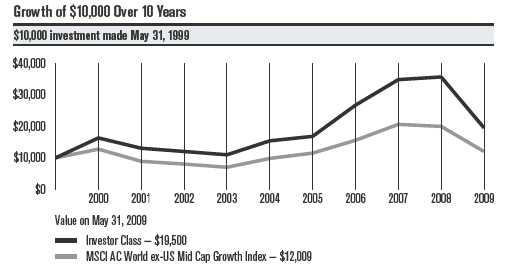

| | | | | | | |

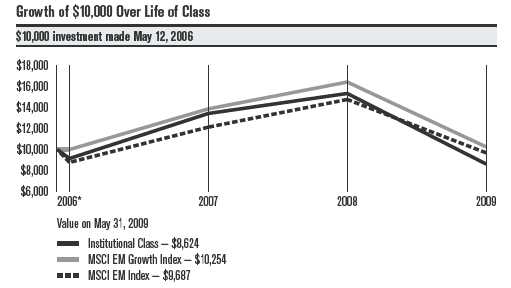

| Emerging Markets | | | | | | |

| |

| Total Returns as of May 31, 2009 | | | | | |

| | | | | Average Annual Returns | |

| | | | | | | Since | Inception |

| | | 6 months(1) | 1 year | 5 years | 10 years | Inception | Date |

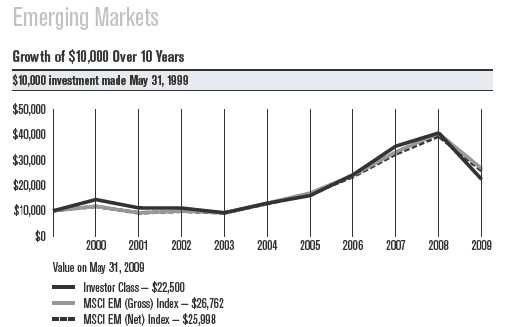

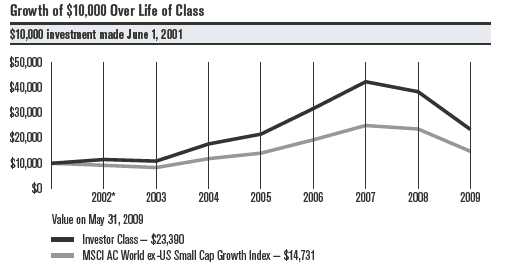

| Investor Class | 38.50% | -44.86% | 11.59% | 8.44% | 5.88% | 9/30/97 |

| MSCI EM Growth Index(2)(3) | 48.09% | -37.52% | 12.60% | — | — | — |

| MSCI EM (Net) Index(2)(3) | 48.62% | -34.36% | 15.12% | 10.03% | — | — |

| MSCI EM (Gross) Index(3) | 48.86% | -34.13% | 15.50% | 10.34% | 6.44% | — |

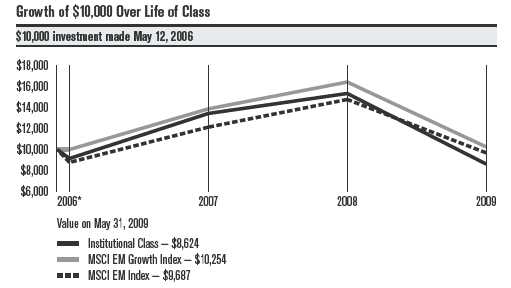

| Institutional Class | 38.74% | -44.76% | 11.78% | 8.65% | 10.95% | 1/28/99 |

| A Class(4) | | | | | | 5/12/99 |

| No sales charge* | 38.71% | -44.87% | 11.36% | 8.19% | 7.88% | |

| With sales charge* | 30.69% | -48.01% | 10.03% | 7.56% | 7.24% | |

| B Class | | | | | | 9/28/07 |

| No sales charge* | 38.13% | -45.40% | — | — | -31.44% | |

| With sales charge* | 33.13% | -49.40% | — | — | -34.57% | |

| C Class | | | | | | 12/18/01 |

| No sales charge* | 38.13% | -45.35% | 10.47% | — | 10.22% | |

| With sales charge* | 37.13% | -45.35% | 10.47% | — | 10.22% | |

| R Class | 38.42% | -45.13% | — | — | -31.13% | 9/28/07 |

| * Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% |

| maximum initial sales charge for equity funds and may be subject to a maximum CDSC of 1.00%. B Class shares redeemed within six |

| years of purchase are subject to a CDSC that declines from 5.00% during the first year after purchase to 0.00% the sixth year after |

| purchase. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that |

| mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied. |

| |

| (1) | Total returns for periods less than one year are not annualized. | | | | |

| (2) | MSCI EM Growth Index data first available 2/1/01. MSCI EM (Net) Index data first available 12/31/98. | | |

| (3) | From September of 1997 through December 2008, the fund’s benchmark was the MSCI EM (Gross) Index. From January 2009 through |

| | March 2009, the fund’s benchmark was the MSCI EM (Net) Index. In April of 2009, the fund’s benchmark changed from the MSCI EM (Net) |

| | Index to the MSCI EM Growth Index. The fund’s investment advisor believes this index better represents the fund’s portfolio composition. |

| (4) | Prior to September 4, 2007, the A Class was referred to as the Advisor Class. Performance, with sales charge, prior to that date has been |

| | adjusted to reflect the A Class’s current sales charge. | | | | | |

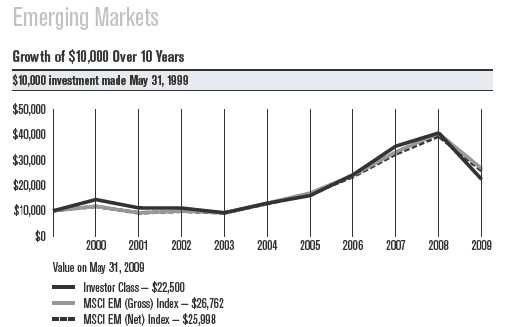

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

13

| | | | | | | | | | | |

| One-Year Returns Over 10 Years | | | | | | | |

| Periods ended May 31 | | | | | | | | | |

| | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 |

| Investor Class | 44.57% | -22.82% | -0.43% | -17.03% | 41.04% | 23.34% | 51.35% | 46.65% | 14.66% | -44.86% |

| MSCI EM | | | | | | | | | | |

| Growth Index(1) | — | -15.45%(2) | 4.13% | -8.63% | 37.78% | 26.82% | 39.20% | 38.64% | 18.37% | -37.52% |

| MSCI EM | | | | | | | | | | |

| (Net) Index | 17.64% | -21.93% | 7.03% | -6.65% | 40.10% | 30.52% | 40.41% | 38.16% | 21.67% | -34.36% |

| MSCI EM | | | | | | | | | | |

| (Gross) Index | 17.75% | -21.60% | 7.28% | -6.40% | 40.48% | 30.99% | 40.90% | 38.59% | 22.00% | -34.13% |

| (1) | Since benchmark data is only available from 2/1/01, it is not included in the line chart. One year data is listed for all periods available. |

| (2) | Benchmark return from 2/1/01 to 5/31/01. Not annualized. | | | | | | |

| |

| Total Annual Fund Operating Expenses | | | | | | |

| Institutional | | | | | | | | |

| Investor Class | Class | A Class | B Class | C Class | R Class |

| 1.82% | 1.62% | 2.07% | 2.82% | 2.82% | 2.32% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includesn acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

14

|

| Portfolio Commentary |

| Emerging Markets |

Portfolio Manager: Patricia Ribeiro

Performance Summary

The Emerging Markets portfolio advanced 38.50%* for the six months ended May 31, 2009, underperforming its benchmark, the MSCI Emerging Markets Growth Index, which gained 48.09%.

The global economic recession and worldwide financial crisis led to plummeting returns for emerging market stocks during the first three months of the reporting period. Then, in mid-March, optimism surrounding global governments’ efforts to battle the recession and restore credit flow and economic growth helped generate a strong worldwide stock market rally.

Emerging market stocks significantly outperformed the developed markets, which, as measured by the MSCI EAFE Index, returned 15.10% for the six-month period. In particular, rising commodity prices in the second half of the reporting period helped boost performance among the natural resources-rich developing markets.

Former Laggards Led Rally

Within the MSCI Emerging Markets Growth Index, every sector and nearly every country showed double-digit gains for the period. The strong rally that propelled stocks in the second half of the reporting period was primarily driven by former market laggards. In general, these companies outperformed even the higher-quality companies that had been reporting strong earnings growth—the type of companies we tend to favor in our portfolio. This factor accounted for the bulk of the portfolio’s performance shortfall relative to the benchmark.

Korea Led Detractors; Mexico Led Contributors

From a regional perspective, the portfolio’s largest detractors to performance included South Korea (which was among the portfolio’s four largest-weighted countries), India, and Israel. In each country, stock selection primarily accounted for the portfolio’s poor relative performance.

On the positive side, Mexico, Malaysia, and an out-of-benchmark position in Singapore represented the portfolio’s leading country contributors. Stock selection drove the portfolio’s positive relative results in Mexico, while an underweight accounted for the portfolio’s better relative performance in Malaysia.

All Sectors Showed Positive Returns

On an absolute basis, all of the portfolio’s 10 sectors posted gains for the six-month period—and other than in the health care sector, all were strong double-digit gains. Relative to the benchmark, the portfolio’s information technology, materials, and energy sectors detracted from results, while its telecommunication services and utilities sectors contributed positively to relative performance.

|

| *All fund returns referenced in this commentary are for Investor Class shares. Total returns for periods less than one year are not annualized. |

15

Emerging Markets

Our poor relative performance in the information technology sector was primarily due to portfolio-only holding Rolta India. Stock in the India-based geospatial mapping systems company plummeted in the wake of a scandal involving Indian technology outsourcing company Satyam, which falsified its financial statements. Subsequent rumors implicated Rolta, which responded with a firm denial of any wrongdoing.

In the materials sector, our stock selection and an underweight in the metals and mining industry accounted for the bulk of the lagging results. In particular, our underweight position in Brazilian iron ore miner Companhia Vale do Rio Doce detracted from performance. The company, a leading supplier to the global steel industry, said it anticipates stable demand levels from China, a large steel producer.

The portfolio’s outperformance in the telecommunication services sector was largely due to our portfolio-only position in Vivo Participacoes, a Brazil-based wireless telecommunication provider. The company reported sharp increases in its net income, revenues, and subscriber base. Stock selection in the electric utilities industry drove the strong overall performance in the portfolio’s utilities sector. In particular, the portfolio benefited from our overweight position in India’s state-owned Power Grid Corp.

Outlook

Emerging Markets primarily invests in companies located in emerging market countries. We anticipate continued volatility throughout the global financial markets is likely. As we navigate this turbulence, we will continue to focus on finding companies we believe possess sustainable growth characteristics, including the ability to grow earnings and revenues, and promising long-term outlooks.

16

| | |

| Emerging Markets | | |

| |

| Top Ten Holdings as of May 31, 2009 | | |

| | % of net assets | % of net assets |

| | as of 5/31/09 | as of 11/30/08 |

| Petroleo Brasileiro SA ADR | 4.9% | 3.4% |

| Vale SA Preference Shares | 4.3% | — |

| Samsung Electronics Co. Ltd. | 3.5% | 2.2% |

| China Mobile Ltd. ADR | 2.6% | 3.1% |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 2.4% | 2.1% |

| America Movil SAB de CV ADR, Series L | 2.3% | 1.2% |

| OAO Gazprom ADR | 2.1% | 2.1% |

| Reliance Industries Ltd. | 2.1% | — |

| Itau Unibanco Banco Holding SA Preference Shares | 2.0% | — |

| Hon Hai Precision Industry Co. Ltd. | 1.9% | 0.6% |

| |

| Types of Investments in Portfolio | | |

| | % of net assets | % of net assets |

| | as of 5/31/09 | as of 11/30/08 |

| Foreign Common Stocks | 98.1% | 97.7% |

| Temporary Cash Investments | 0.8% | 1.2% |

| Other Assets and Liabilities | 1.1% | 1.1% |

| |

| Investments by Country as of May 31, 2009 | | |

| | % of net assets | % of net assets |

| | as of 5/31/09 | as of 11/30/08 |

| Brazil | 16.8% | 12.9% |

| Taiwan (Republic of China) | 13.9% | 7.1% |

| People’s Republic of China | 13.7% | 15.7% |

| South Korea | 11.6% | 10.6% |

| India | 8.5% | 6.5% |

| Russian Federation | 6.7% | 4.4% |

| South Africa | 6.7% | 7.5% |

| Hong Kong | 5.2% | 5.1% |

| Mexico | 2.9% | 3.1% |

| Other Countries | 12.1% | 24.8% |

| Cash and Equivalents* | 1.9% | 2.3% |

| * Includes temporary cash investments and other assets and liabilities. | | |

17

| | | | | | |

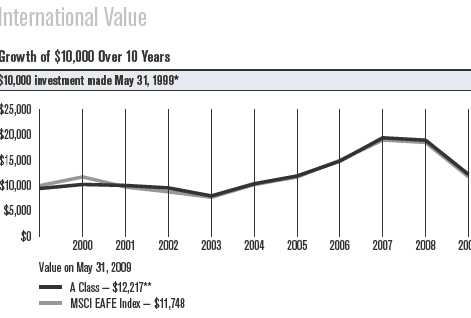

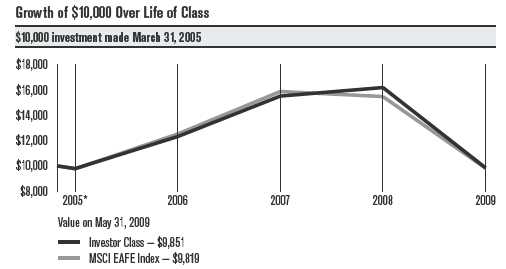

| International Value | | | | | |

| |

| Total Returns as of May 31, 2009 | | | | | |

| | | | Average Annual Returns | |

| | | | | | Since | Inception |

| | 6 months(1) | 1 year | 5 years | 10 years | Inception | Date |

| A Class | | | | | | 3/31/97 |

| No sales charge* | 14.07% | -35.62% | 3.36%(2) | 2.63%(2) | 2.35%(2) | |

| With sales charge* | 7.59% | -39.31% | 2.13%(2) | 2.02%(2) | 1.85%(2) | |

| MSCI EAFE Index | 15.10% | -36.61% | 2.87% | 1.62% | 3.15% | — |

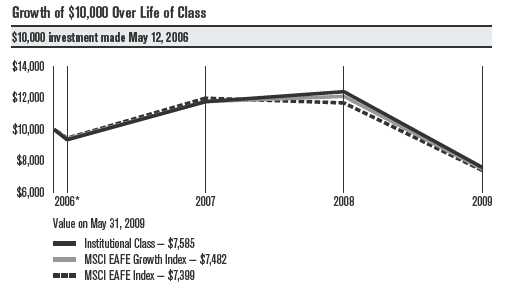

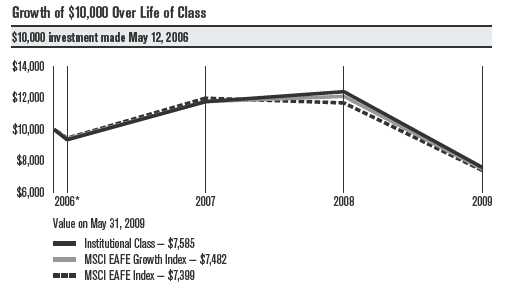

| Investor Class | 14.37% | -35.44% | — | — | -5.72% | 4/3/06 |

| Institutional Class | 14.38% | -35.31% | — | — | -5.56% | 4/3/06 |

| B Class | | | | | | 3/31/97 |

| No sales charge* | 13.46% | -36.12% | 2.60%(2) | 1.92%(2) | 1.65%(2) | |

| With sales charge* | 8.46% | -40.12% | 2.42%(2) | 1.92%(2) | 1.65%(2) | |

| C Class | | | | | | 4/3/06 |

| No sales charge* | 13.59% | -36.14% | — | — | -6.70% | |

| With sales charge* | 12.59% | -36.14% | — | — | -6.70% | |

| R Class | 13.87% | -35.75% | — | — | -6.21% | 4/3/06 |

| * Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% |

| maximum initial sales charge for equity funds and may be subject to a maximum CDSC of 1.00%. B Class shares redeemed within six |

| years of purchase are subject to a CDSC that declines from 5.00% during the first year after purchase to 0.00% the sixth year after |

| purchase. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that |

| mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied. |

International Value acquired all the net assets of the Mason Street International Equity Fund on March 31, 2006, pursuant to a plan of reorganization approved by the acquired fund’s shareholders on March 15, 2006. Performance information prior to April 1, 2006, is that of the Mason Street International Equity Fund.

| |

| (1) | Total returns for periods less than one year are not annualized. |

| (2) | Class returns would have been lower if fees had not been waived. |

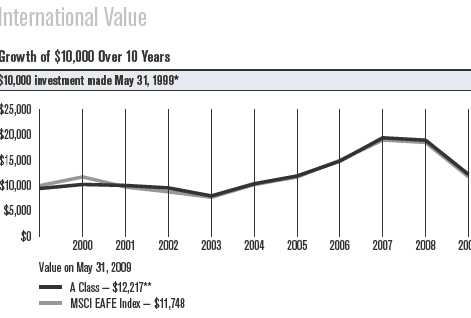

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks.

Unless otherwise indicated, performance reflects A Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

18

| | | | | | | | | | |

| One-Year Returns Over 10 Years | | | | | | | |

| Periods ended May 31 | | | | | | | | | |

| | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 |

| A Class | | | | | | | | | | |

| (no sales charge)** | 8.40% | -1.91% | -4.88% | -16.59% | 30.27% | 14.87% | 24.74% | 31.07% | -2.43% | -35.62% |

| MSCI EAFE Index | 17.14% | -17.23% | -9.60% | -12.30% | 32.66% | 14.62% | 28.24% | 26.84% | -2.53% | -36.61% |

| * International Value A Class’s initial investment is $9,425 to reflect the maximum 5.75% initial sales charge. | | | |

| **Class returns would have been lower if fees had not been waived. | | | | | | |

| | | | | | | | | | | |

| Total Annual Fund Operating Expenses | | | | | | |

| | Institutional | | | | | | | | |

| Investor Class | Class | A Class | B Class | C Class | R Class |

| 1.31% | 1.11% | 1.56% | 2.31% | 2.31% | 1.81% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks.

Unless otherwise indicated, performance reflects A Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

19

|

| Portfolio Commentary |

| International Value |

Portfolio Managers: Gary Motyl and Guang Yang

Performance Summary

International Value returned 14.07%* for the six months ended May 31, 2009. By comparison, its benchmark, the MSCI EAFE Index, returned 15.10%.

The portfolio’s performance was indicative of a volatile period in which global financial markets generally declined through about early March, then rallied sharply to end the six months with sizable gains. In that environment, consumer discretionary shares contributed most to the portfolio’s absolute results. The fund’s utilities allocation was the only segment to detract from absolute performance in dollar terms. In terms of returns compared with the benchmark, stock selection and an underweight position meant materials shares detracted most from relative results, while holdings in the industrials sector contributed most to relative performance.

Materials Led Detractors

In the materials sector, the main source of weakness was positioning among metals and mining and paper and forest products companies. Four of the portfolio’s top-10 detractors for the six months come from these industry segments. In particular, it hurt to be underrepresented in mining conglomerates BHP Billiton and Rio Tinto, which benefited from optimism on improving global growth and a rebound from a sharp sell-off through early 2009. The two other notable detractors were overweight positions in Finnish paper-products companies UPM-Kymmene and Stora Enso Oyj. These stocks continued to struggle with issues of overcapacity, high input costs, and poor demand that have plagued the industry for some time. We like the cost and capacity cuts these firms have enacted and believe they can perform well when demand stabilizes.

Financials, Health Care Also Hurt

It also hurt relative results to be underweight financial shares, which rallied sharply since early March, and overweight health care, which lagged in the market recovery. The leading detractors were property and casualty insurer Ace Limited and Takeda Pharmaceutical, which is Japan’s largest drug maker. We consider both to be high-quality, fairly defensive-oriented shares—they held up better than the market during the sharp sell-off in 2008 and early 2009, but underperformed in the recent market rebound.

Industrials Contributed Most

The leading contribution to portfolio performance at the sector level came from stock picks in the industrials sector. The key sources of strength in the sector were overweight stakes in Shanghai Electric, Vestas Wind Systems, and Atlas Copco. Shanghai Electric is among China’s largest mechanical and electrical equipment manufacturers, and benefited from optimism on a recovery in global growth. Norwegian firm Vestas is a leading wind

|

| * All fund returns referenced in this commentary are for A Class shares and are not reduced by sales charges. A Class shares are subject to a |

| maximum sales charge of 5.75%. Had the sales charge been applied, returns would have been lower than those shown. Total returns for periods |

| less than one year are not annualized. |

20

International Value

turbine provider well positioned to benefit from the increasing demand for alternative energy sources. Swedish manufacturer Atlas, which announced cost and capacity cuts in recent months, rallied sharply with the market beginning in March.

Other Contributors

Stock picks in the consumer discretionary and information technology sectors also helped. The top contributors in these sectors were Korean car maker Hyundai Motor Co. and Chinese battery and auto manufacturer BYD, respectively. Both are seen as benefiting from the turmoil in the U.S. auto market and demand for lower-cost, more fuel-efficient vehicles.

Outlook

“Despite the volatile market and economic conditions, we remain focused on adding what we believe to be high-quality companies trading at very attractive valuations,” said portfolio manager Guang Yang. “We believe that owning such companies will generate attractive, risk-adjusted results over time compared with our benchmark and peer group.”

“Because we build the International Value portfolio stock by stock from the bottom up, the portfolio’s sector and industry selection as well as capitalization range allocations reflect where we are finding individual securities about which we have the highest conviction at a given time,” noted Yang. “As of May 31, 2009, we found opportunity in the telecommunication services and information technology sectors, the portfolio’s largest overweight positions,” he added. “We also continued to maintain our most sizable underweight positions in the financials and consumer staples sectors.”

21

| | |

| International Value | | |

| |

| Top Ten Holdings as of May 31, 2009 | | |

| | % of net assets | % of net assets |

| | as of 5/31/09 | as of 11/30/08 |

| Nintendo Co. Ltd. | 1.9% | 2.4% |

| Sanofi-Aventis | 1.9% | 1.8% |

| Samsung Electronics Co. Ltd. | 1.8% | 1.5% |

| Telefonica SA ADR | 1.8% | 1.9% |

| Novartis AG | 1.8% | 2.3% |

| France Telecom SA | 1.7% | 2.0% |

| Royal Dutch Shell plc, Class B | 1.6% | 1.7% |

| GlaxoSmithKline plc | 1.6% | 1.8% |

| DBS Group Holdings Ltd. | 1.6% | 0.9% |

| HSBC Holdings plc | 1.6% | 2.1% |

| |

| Types of Investments in Portfolio | | |

| | % of net assets | % of net assets |

| | as of 5/31/09 | as of 11/30/08 |

| Foreign Common Stocks & Rights | 92.9% | 91.1% |

| Temporary Cash Investments | 6.4% | 8.4% |

| Other Assets and Liabilities | 0.7% | 0.5% |

| |

| Investments by Country as of May 31, 2009 | | |

| | % of net assets | % of net assets |

| | as of 5/31/09 | as of 11/30/08 |

| United Kingdom | 16.5% | 19.1% |

| France | 9.0% | 9.0% |

| Germany | 8.2% | 8.5% |

| Switzerland | 7.9% | 8.2% |

| Japan | 6.8% | 9.2% |

| Netherlands | 5.4% | 5.3% |

| South Korea | 4.6% | 4.2% |

| Hong Kong | 4.5% | 2.9% |

| Spain | 4.5% | 4.4% |

| People’s Republic of China | 3.9% | 2.3% |

| Brazil | 3.2% | 1.7% |

| Taiwan (Republic of China) | 2.6% | 2.3% |

| Other Countries | 15.8% | 14.0% |

| Cash and Equivalents* | 7.1% | 8.9% |

| * Includes temporary cash investments and other assets and liabilities. | | |

22

|

| Shareholder Fee Examples (Unaudited) |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/ exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from December 1, 2008 to May 31, 2009.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or Institutional Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. We will not charge the fee as long as you choose to manage your accounts exclusively online. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

23

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | |

| | Beginning | Ending | Expenses Paid | |

| | Account Value | Account Value | During Period* | Annualized |

| | 12/1/08 | 5/31/09 | 12/1/08 – 5/31/09 | Expense Ratio* |

| International Growth | | | | |

| Actual | | | | |

| Investor Class | $1,000 | $1,150.50 | $7.56 | 1.41% |

| Institutional Class | $1,000 | $1,150.90 | $6.49 | 1.21% |

| A Class | $1,000 | $1,148.20 | $8.89 | 1.66% |

| B Class | $1,000 | $1,144.70 | $12.89 | 2.41% |

| C Class | $1,000 | $1,144.10 | $12.88 | 2.41% |

| R Class | $1,000 | $1,148.30 | $10.23 | 1.91% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,017.90 | $7.09 | 1.41% |

| Institutional Class | $1,000 | $1,018.90 | $6.09 | 1.21% |

| A Class | $1,000 | $1,016.65 | $8.35 | 1.66% |

| B Class | $1,000 | $1,012.91 | $12.09 | 2.41% |

| C Class | $1,000 | $1,012.91 | $12.09 | 2.41% |

| R Class | $1,000 | $1,015.41 | $9.60 | 1.91% |

| Global Growth | | | | |

| Actual | | | | |

| Investor Class | $1,000 | $1,091.80 | $6.57 | 1.26% |

| Institutional Class | $1,000 | $1,092.80 | $5.53 | 1.06% |

| A Class | $1,000 | $1,091.20 | $7.87 | 1.51% |

| B Class | $1,000 | $1,087.30 | $11.76 | 2.26% |

| C Class | $1,000 | $1,088.40 | $11.77 | 2.26% |

| R Class | $1,000 | $1,091.10 | $9.18 | 1.76% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,018.65 | $6.34 | 1.26% |

| Institutional Class | $1,000 | $1,019.65 | $5.34 | 1.06% |

| A Class | $1,000 | $1,017.40 | $7.59 | 1.51% |

| B Class | $1,000 | $1,013.66 | $11.35 | 2.26% |

| C Class | $1,000 | $1,013.66 | $11.35 | 2.26% |

| R Class | $1,000 | $1,016.16 | $8.85 | 1.76% |

| * Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period |

| multiplied by 182, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. |

24

| | | | |

| | Beginning | Ending | Expenses Paid | |

| | Account Value | Account Value | During Period* | Annualized |

| | 12/1/08 | 5/31/09 | 12/1/08 – 5/31/09 | Expense Ratio* |

| Emerging Markets | | | | |

| Actual | | | | |

| Investor Class | $1,000 | $1,385.00 | $10.76 | 1.81% |

| Institutional Class | $1,000 | $1,387.40 | $9.58 | 1.61% |

| A Class | $1,000 | $1,387.10 | $12.26 | 2.06% |

| B Class | $1,000 | $1,381.30 | $16.68 | 2.81% |

| C Class | $1,000 | $1,381.30 | $16.68 | 2.81% |

| R Class | $1,000 | $1,384.20 | $13.73 | 2.31% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,015.91 | $9.10 | 1.81% |

| Institutional Class | $1,000 | $1,016.90 | $8.10 | 1.61% |

| A Class | $1,000 | $1,014.66 | $10.35 | 2.06% |

| B Class | $1,000 | $1,010.92 | $14.09 | 2.81% |

| C Class | $1,000 | $1,010.92 | $14.09 | 2.81% |

| R Class | $1,000 | $1,013.41 | $11.60 | 2.31% |

| International Value | | | | |

| Actual | | | | |

| Investor Class | $1,000 | $1,143.70 | $6.95 | 1.30% |

| Institutional Class | $1,000 | $1,143.80 | $5.88 | 1.10% |

| A Class | $1,000 | $1,140.70 | $8.27 | 1.55% |

| B Class | $1,000 | $1,134.60 | $12.24 | 2.30% |

| C Class | $1,000 | $1,135.90 | $12.25 | 2.30% |

| R Class | $1,000 | $1,138.70 | $9.60 | 1.80% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,018.45 | $6.54 | 1.30% |

| Institutional Class | $1,000 | $1,019.45 | $5.54 | 1.10% |

| A Class | $1,000 | $1,017.20 | $7.80 | 1.55% |

| B Class | $1,000 | $1,013.46 | $11.55 | 2.30% |

| C Class | $1,000 | $1,013.46 | $11.55 | 2.30% |

| R Class | $1,000 | $1,015.96 | $9.05 | 1.80% |

| * Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period |

| multiplied by 182, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. |

25

|

| Schedule of Investments |

| International Growth |

| MAY 31, 2009 (UNAUDITED) | | | | | | |

| |

| | Shares | Value | | | Shares | Value |

| Common Stocks — 99.5% | | | LVMH Moet Hennessy | | |

| | | | | Louis Vuitton SA | 39,820 | $ 3,310,475 |

| AUSTRALIA — 4.8% | | | | Publicis Groupe | 104,580 | 3,395,598 |

| BHP Billiton Ltd. | 793,564 | $ 22,294,517 | | Total SA | 329,256 | 19,058,499 |

| Commonwealth | | | | | | 80,986,316 |

| Bank of Australia | 279,210 | 7,935,846 | | | | |

| CSL Ltd. | 571,362 | 13,379,710 | | GERMANY — 6.9% | | |

| Origin Energy Ltd. | 498,010 | 5,911,307 | | Allianz SE | 87,320 | 8,608,052 |

| Rio Tinto Ltd. | 115,034 | 6,006,809 | | BASF SE | 283,290 | 11,963,280 |

| Wesfarmers Ltd. | 474,640 | 8,150,958 | | Bayer AG | 98,950 | 5,634,379 |

| | | 63,679,147 | | Daimler AG | 152,700 | 5,600,363 |

| BELGIUM — 1.2% | | | | Deutsche Boerse AG | 149,760 | 13,075,602 |

| | | | | Fresenius Medical | | |

| Anheuser-Busch InBev NV | 457,077 | 16,155,379 | | Care AG & Co. KGaA | 315,663 | 13,230,438 |

| BERMUDA — 0.3% | | | | Muenchener | | |

| Seadrill Ltd. | 269,140 | 3,955,440 | | Rueckversicherungs- | | |

| BRAZIL — 2.7% | | | | Gesellschaft AG | 150,080 | 21,057,594 |

| Vale SA Preference Shares | 1,204,000 | 19,868,815 | | SAP AG | 178,220 | 7,672,440 |

| Petroleo Brasileiro SA ADR | 179,930 | 7,922,318 | | Wacker Chemie AG | 42,310 | 5,296,193 |

| Redecard SA | 565,700 | 8,165,216 | | | | 92,138,341 |

| | | 35,956,349 | | GREECE — 1.3% | | |

| CANADA — 2.8% | | | | National Bank | | |

| Canadian National | | | | of Greece SA(1) | 626,201 | 17,331,515 |

| Railway Co. | 229,150 | 9,862,843 | | HONG KONG — 1.2% | | |

| EnCana Corp. | 154,514 | 8,564,711 | | Hang Seng Bank Ltd. | 205,300 | 2,950,140 |

| Precision Drilling Trust | 240,480 | 1,407,527 | | Li & Fung Ltd. | 2,098,000 | 5,645,001 |

| Research In Motion Ltd.(1) | 222,640 | 17,508,409 | | Link Real Estate | | |

| | | 37,343,490 | | Investment Trust (The) | 3,909,000 | 7,688,865 |

| CZECH REPUBLIC — 0.2% | | | | | | 16,284,006 |

| CEZ AS | 72,340 | 3,268,198 | | INDIA — 1.3% | | |

| DENMARK — 1.7% | | | | Housing Development | | |

| | | | | Finance Corp. Ltd. | 90,848 | 4,208,544 |

| Novo Nordisk A/S B Shares | 231,099 | 12,034,037 | | ICICI Bank Ltd. ADR | 185,880 | 5,788,303 |

| Vestas Wind Systems A/S(1) | 145,980 | 10,682,286 | | | | |

| | | 22,716,323 | | Larsen & Toubro Ltd. | 230,300 | 6,862,543 |

| | | | | | | 16,859,390 |

| FINLAND — 0.6% | | | | INDONESIA — 0.1% | | |

| Nokia Oyj | 480,620 | 7,361,285 | | PT Bank Rakyat Indonesia | 3,307,000 | 2,019,144 |

| FRANCE — 6.1% | | | | IRELAND — 2.4% | | |

| Air Liquide SA | 95,170 | 8,852,845 | | CRH plc | 380,722 | 9,017,270 |

| ALSTOM SA | 75,410 | 4,790,220 | | Experian plc | 1,945,850 | 14,409,077 |

| BNP Paribas | 237,230 | 16,493,082 | | Ryanair Holdings plc ADR(1) | 274,314 | 7,988,024 |

| Cie Generale des | | | | | | 31,414,371 |

| Etablissements Michelin, | | | | | | |

| Class B | 178,920 | 10,881,871 | | ISRAEL — 0.9% | | |

| Cie Generale d’Optique | | | | Teva Pharmaceutical | | |

| Essilor International SA | 71,550 | 3,296,155 | | Industries Ltd. ADR | 257,620 | 11,943,263 |

| Danone SA | 90,608 | 4,514,736 | | ITALY — 5.1% | | |

| Legrand SA(1) | 301,830 | 6,392,835 | | ENI SpA | 1,038,969 | 25,151,105 |

| | | | | Intesa Sanpaolo SpA(1) | 3,387,160 | 12,253,007 |

26

| | | | | | |

| International Growth | | | | | |

| |

| | Shares | Value | | | Shares | Value |

| Luxottica Group SpA(1) | 118,630 | $ 2,470,293 | | NETHERLANDS — 2.0% | | |

| Saipem SpA | 809,344 | 20,668,433 | | ASML Holding NV | 201,410 | $ 4,155,209 |

| Snam Rete Gas SpA | 1,831,824 | 7,933,539 | | Koninklijke Ahold NV | 1,581,870 | 19,183,147 |

| | | 68,476,377 | | Koninklijke KPN NV | 249,540 | 3,282,910 |

| JAPAN — 14.2% | | | | | | 26,621,266 |

| Benesse Corp. | 246,100 | 10,345,302 | | PEOPLE’S REPUBLIC OF CHINA — 3.3% | |

| Central Japan Railway Co. | 1,181 | 7,568,690 | | Baidu, Inc. ADR(1) | 15,140 | 3,996,203 |

| Daikin Industries Ltd. | 83,600 | 2,584,304 | | China Merchants Bank Co. | | |

| FAST RETAILING CO. LTD. | 54,700 | 6,498,885 | | Ltd. H Shares | 4,526,600 | 9,277,384 |

| Honda Motor Co. Ltd. | 562,100 | 16,316,719 | | Ctrip.com International | | |

| HOYA Corp. | 345,900 | 7,246,487 | | Ltd. ADR | 140,570 | 5,756,342 |

| | | | | iShares FTSE/Xinhua China | | |

| iShares MSCI Japan | | | | 25 Index Fund | 140,930 | 5,262,326 |

| Index Fund | 2,146,420 | 20,111,955 | | | | |

| Japan Steel | | | | NetEase.com, Inc. ADR(1) | 174,330 | 6,028,331 |

| Works Ltd. (The) | 902,000 | 11,783,563 | | Shanda Interactive | | |

| | | | | Entertainment Ltd. ADR(1) | 49,820 | 2,870,629 |

| Kurita Water Industries Ltd. | 181,300 | 5,024,800 | | | | |

| Mitsubishi Corp. | 721,000 | 13,682,985 | | Tencent Holdings Ltd. | 940,600 | 10,535,681 |

| Mitsubishi Estate Co. Ltd. | 432,000 | 7,123,704 | | | | 43,726,896 |

| Mitsubishi UFJ | | | | SINGAPORE — 0.6% | | |

| Financial Group, Inc. | 1,798,800 | 11,350,990 | | United Overseas Bank Ltd. | 779,000 | 7,706,989 |

| Murata Manufacturing | | | | SOUTH KOREA — 2.9% | | |

| Co. Ltd. | 142,400 | 6,091,285 | | Hyundai Motor Co. | 225,450 | 12,550,857 |

| Nidec Corp. | 114,200 | 6,567,029 | | KB Financial Group, Inc.(1) | 88,790 | 2,879,654 |

| Nintendo Co. Ltd. | 9,400 | 2,553,730 | | POSCO | 22,840 | 7,656,370 |

| Nitori Co. Ltd. | 178,750 | 10,845,882 | | Samsung | | |

| Rakuten, Inc. | 26,040 | 14,320,492 | | Electronics Co. Ltd. | 35,810 | 16,056,383 |

| SMC Corp. | 55,600 | 5,943,505 | | | | 39,143,264 |

| SOFTBANK CORP. | 438,200 | 8,007,740 | | SPAIN — 3.4% | | |

| Sony Financial Holdings, Inc. | 2,270 | 6,634,240 | | Banco Santander SA | 2,234,292 | 24,088,724 |

| Terumo Corp. | 82,100 | 3,449,866 | | Indra Sistemas SA | 261,340 | 5,955,544 |

| Unicharm Corp. | 84,900 | 5,931,313 | | Telefonica SA | 686,930 | 14,838,751 |

| | | 189,983,466 | | | | 44,883,019 |

| LUXEMBOURG — 1.5% | | | | SWEDEN — 0.6% | | |

| Millicom International | | | | Electrolux AB, Series B(1) | 249,050 | 3,184,280 |

| Cellular SA(1) | 166,967 | 10,134,897 | | H & M Hennes & Mauritz AB | | |

| SES SA Fiduciary | | | | B Shares | 100,620 | 4,805,878 |

| Depositary Receipt | 469,509 | 9,394,896 | | | | 7,990,158 |

| | | 19,529,793 | | SWITZERLAND — 9.9% | | |

| MEXICO — 0.3% | | | | ABB Ltd.(1) | 402,565 | 6,634,798 |

| America Movil, SAB de CV | | | | Actelion Ltd.(1) | 94,850 | 4,906,871 |

| ADR, Series L | 119,140 | 4,566,636 | | | | |

| | | | | Adecco SA | 233,510 | 10,189,247 |

| MULTI-NATIONAL — 1.4% | | | | | | |

| | | | | Credit Suisse Group AG | 346,930 | 15,525,542 |

| iShares MSCI EAFE | | | | | | |

| Growth Index Fund | 70,568 | 3,333,633 | | Julius Baer Holding AG | 313,820 | 13,371,346 |

| iShares MSCI EAFE | | | | Lonza Group AG | 47,070 | 4,866,798 |

| Index Fund | 70,460 | 3,339,804 | | Nestle SA | 671,990 | 24,419,105 |

| iShares MSCI Emerging | | | | Novartis AG | 405,010 | 16,192,804 |

| Markets Index Fund | 343,820 | 11,435,453 | | Roche Holding AG | 118,369 | 16,152,809 |

| | | 18,108,890 | | | | |

27

| | | | | | | |

| International Growth | | | | | | |

| |

| | Shares | Value | | | | Shares | Value |

| SGS SA | 3,710 | $ 4,643,787 | | Temporary Cash Investments — 0.5% |

| Syngenta AG | 61,742 | 15,030,779 | | JPMorgan U.S. Treasury | | |

| | | 131,933,886 | | Plus Money Market Fund | | |

| TAIWAN (REPUBLIC OF CHINA) — 1.5% | | | Agency Shares | 94,422 | $ 94,422 |

| AU Optronics Corp. ADR | 776,257 | 8,065,310 | | Repurchase Agreement, Goldman Sachs | |

| Taiwan Semiconductor | | | | Group, Inc., (collateralized by various U.S. | |

| Manufacturing Co. Ltd. ADR | 764,520 | 8,363,849 | | Treasury obligations, 4.75%, 2/15/37, valued | |

| | | | | at $7,364,173), in a joint trading account | |

| Wistron Corp. | 2,326,000 | 3,696,328 | | at 0.10%, dated 5/29/09, due 6/1/09 | |

| | | 20,125,487 | | (Delivery value $7,200,060) | | 7,200,000 |

| TURKEY — 0.7% | | | | TOTAL TEMPORARY | | |

| Turkiye Garanti | | | | CASH INVESTMENTS | | |

| Bankasi AS(1) | 3,590,220 | 9,089,743 | | (Cost $7,294,422) | | 7,294,422 |

| UNITED KINGDOM — 17.6% | | | | TOTAL INVESTMENT | | |

| Admiral Group plc | 686,017 | 9,577,880 | | SECURITIES — 100.0% | | |

| | | | | (Cost $1,149,137,698) | | 1,333,427,444 |

| AMEC plc | 375,180 | 4,103,349 | | | | | |

| | | | | OTHER ASSETS AND LIABILITIES(2) | (95,687) |

| AstraZeneca plc | 255,880 | 10,666,539 | | | | | |

| | | | | TOTAL NET ASSETS — 100.0% | | $1,333,331,757 |

| Autonomy Corp. plc(1) | 268,483 | 6,726,202 | | | | | |

| Barclays plc | 1,137,780 | 5,485,040 | | Market Sector Diversification | |

| BG Group plc | 1,279,079 | 23,440,652 | | | | | |

| British American | | | | (as a % of net assets) | | |

| Tobacco plc | 296,028 | 8,086,468 | | Financials | | 20.6% |

| British Sky | | | | Consumer Discretionary | | 13.4% |

| Broadcasting Group plc | 1,621,060 | 11,695,173 | | Industrials | | 10.9% |

| Cadbury plc | 148,980 | 1,302,178 | | Information Technology | | 9.9% |

| Capita Group plc (The) | 1,099,100 | 12,750,281 | | Health Care | | 9.4% |

| Carnival plc | 359,900 | 9,374,359 | | Energy | | 9.0% |

| Cobham plc | 1,308,106 | 3,786,170 | | Consumer Staples | | 9.0% |

| Compass Group plc | 2,063,140 | 11,939,545 | | Materials | | 8.0% |

| GlaxoSmithKline plc | 541,592 | 9,128,907 | | Telecommunication Services | | 3.9% |