| | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

|

| FORM N-CSR |

|

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| |

| Investment Company Act file number | 811-06247 |

| |

| AMERICAN CENTURY WORLD MUTUAL FUNDS, INC. |

| (Exact name of registrant as specified in charter) |

| |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| |

| CHARLES A. ETHERINGTON |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

| |

| Registrant’s telephone number, including area code: | 816-531-5575 |

| |

| Date of fiscal year end: | 11-30 |

| |

| Date of reporting period: | 05-28-2010 |

| |

| |

| |

| |

| | |

| |

| ITEM 1. REPORTS TO STOCKHOLDERS. |

|

| Semiannual Report | |

| May 28, 2010 | |

|

| American Century Investments® |

International Stock Fund

| |

| President’s Letter | 2 |

| Independent Chairman’s Letter | 3 |

| Market Perspective | 4 |

| International Equity Total Returns | 4 |

| |

| International Stock | |

| |

| Performance | 5 |

| Portfolio Commentary | 6 |

| Top Ten Holdings | 8 |

| Types of Investments | 8 |

| Investments by Country | 8 |

| |

| Shareholder Fee Example | 9 |

| |

| Financial Statements | |

| |

| Schedule of Investments | 11 |

| Statement of Assets and Liabilities | 14 |

| Statement of Operations | 15 |

| Statement of Changes in Net Assets | 16 |

| Notes to Financial Statements | 17 |

| Financial Highlights | 22 |

| |

| Other Information | |

| |

| Board Approval of Management and Subadvisory Agreements | 23 |

| Additional Information | 29 |

| Index Definitions | 30 |

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

Dear Investor:

To learn more about the capital markets, your investment, and the portfolio management strategies American Century Investments provides, we encourage you to review this shareholder report for the financial reporting period ended May 28, 2010.

On the following pages, you will find investment performance and portfolio information, presented with the expert perspective and commentary of our portfolio management team. This report remains one of our most important vehicles for conveying the information you need about your investment performance, and about the market factors and strategies that affect fund returns. For additional information on the markets, we encourage you to visit the “Insights & News” tab at our Web site, americancentury.com, for updates and further expert commentary.

The top of our Web site’s home page also provides a link to “Our Story,” which, first and foremost, outlines our commitment—since 1958—to helping clients reach their financial goals. We believe strongly that we will only be successful when our clients are successful. That’s who we are.

Another important, unique facet of our story and who we are is “Profits with a Purpose,” which describes our bond with the Stowers Institute for Medical Research (SIMR). SIMR is a world-class biomedical organization—founded by our company founder James E. Stowers, Jr. and his wife Virginia—that is dedicated to researching the causes, treatment, and prevention of gene-based diseases, including cancer. Through American Century Investments’ private ownership structure, more than 40% of our profits support SIMR.

Mr. Stowers’ example of achieving financial success and using that platform to help humanity motivates our entire American Century Investments team. His story inspires us to help each of our clients achieve success. Thank you for sharing your financial journey with us.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

2

|

| Independent Chairman’s Letter |

Fellow Shareholders,

The principal event at a recent board meeting was the retirement of Jim Stowers, Jr. from the American Century Mutual Funds Kansas City board. This was one of those times when you felt like you were living a historical moment. Jim—who celebrated his 86th birthday in January—founded what was known as Twentieth Century Mutual Funds over 50 years ago. Through the years, his number one priority has been to “Put Investors First!” The board presented Jim with a resolution acknowledging that, by building a successful investment company, he has impacted the lives of many by helping them on the path to financial success.

We respect Jim’s decision to focus his energy on the Stowers Institute for Medical Research and American Century Companies, Inc. (ACC), the parent company of the funds’ investment advisor. The pioneering medical research that Jim and his wife Virginia have made possible through the Institute should enrich the lives of millions in the future.

Shortly after his retirement from the board, we received word that ACC’s co-chairman Richard W. Brown had succeeded Jim as trustee of a trust that holds a significant interest in ACC stock as a part of Jim’s long-standing estate and business succession plan. While holding less than a majority interest, the trust is presumed to control the funds’ investment advisors under the Investment Company Act of 1940. This change triggered the need for a shareholder proxy to approve new management and subadvisory agreements for the funds. I am happy to report that all of the proposals contained in the proxy received the necessary votes and were approved.

On behalf of the board, I want to once again thank Jim for his mutual fund board service. More than three years ago, Jim and Richard Brown installed a strong and effective leadership team at American Century Investments and I look forward to continuing to work with them on behalf of fund shareholders. And while Jim no longer sits on the fund board, the inherent optimism captured by his favorite catch phrase—“The best is yet to be”—still resonates with all of us who have the privilege of serving you. I invite you to send your comments, questions or concerns to me at dhpratt@fundboardchair.com.

3

By Mark Kopinski, Chief Investment Officer, Global and Non-U.S. Equity

Events in May Sent Stocks Tumbling

Global stock returns generally remained robust for the first several months of the period, as the rally unleashed in March 2009 continued into 2010. Optimism regarding the global economic recovery and business sector gains helped keep stocks in positive territory.

Nevertheless, as spring set in, the global stock market rally ended abruptly, starting with the May 6 “Flash Crash” in the U.S. stock market, when the major indices plunged nearly 7% within 15 minutes. Furthermore, problems that had been percolating in Europe and in the global geopolitical arena boiled over in May, triggering a sharp stock market selloff. In particular, the expanding European government debt crisis beyond Greece, the downgrade of Spain’s credit rating, the worsening oil disaster in the Gulf of Mexico, and escalating tensions in the Middle East rattled investors’ nerves.

Overall, developed international equity markets significantly under-performed the U.S. market and the emerging markets. European stocks suffered the largest losses for the six-month period, as the mounting debt crisis worried investors. Exploding debt in Greece, Italy, Spain, Ireland, and Portugal all came under scrutiny.

Debt Remained the Roadblock to Growth

The sovereign debt problem did not just happen as a result of the recent financial crisis or recession; it is a longer-term issue. Recent events only exacerbated the problem and accelerated its becoming a crisis.

In fact, sovereign solvency has emerged as one of the most significant roadblocks to growth. Currently, the market is focused on Europe, where severe austerity measures are required to get fiscal balances back in order. This is likely to trim 0.5% from European growth during the next year. The weaker euro should help offset some of the decline in growth, but the more export-oriented northern countries will be the main beneficiaries. Commodity-based countries, such as Australia and Norway, have been the most resilient and have seen more impressive economic recoveries. The debt crisis likely will mean European interest rates will remain accommodative for the remainder of 2010.

| | | | |

| International Equity Total Returns | | | | |

| For the six months ended May 28, 2010* (in U.S. dollars) | |

| MSCI EAFE Index | -10.90% | | MSCI Europe Index | -14.77% |

| MSCI EAFE Growth Index | -8.85% | | MSCI World Free Index | -4.92% |

| MSCI EAFE Value Index | -12.95% | | MSCI Japan Index | 0.10% |

| MSCI EM Index | -2.75% | | *Total returns for periods less than one year are not annualized and are |

| | | | based on the period beginning December 1, 2009. | |

4

| | | | | | | |

| International Stock | | | | | | |

| |

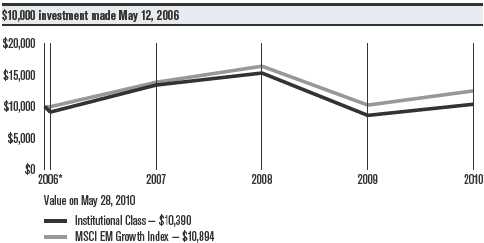

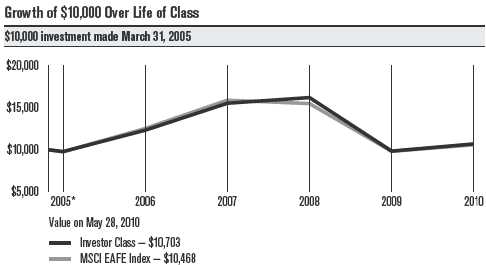

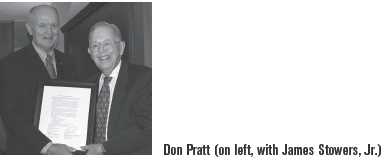

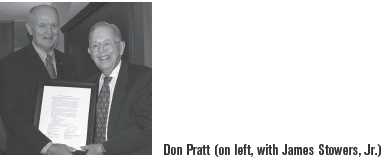

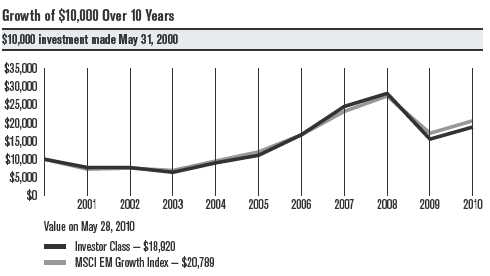

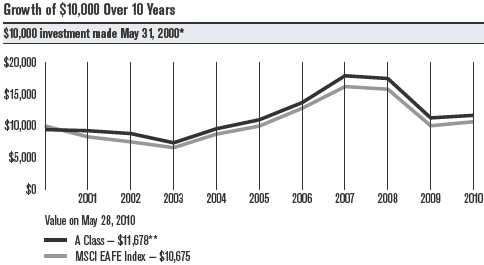

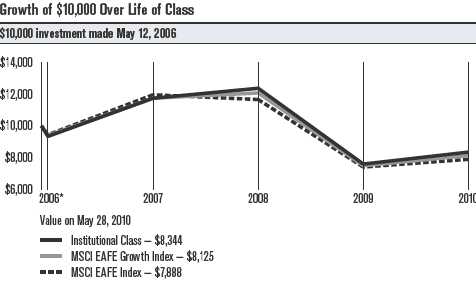

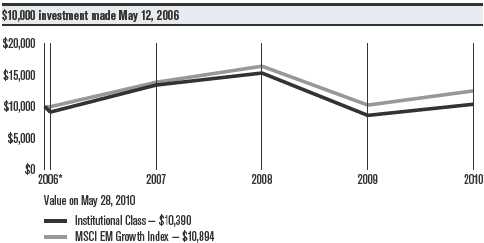

| Total Returns as of May 28, 2010 | | | | | |

| | | | | | Average Annual Returns | |

| | | Ticker | | | | Since | Inception |

| | | Symbol | 6 months(1) | 1 year(2) | 5 years(2) | Inception | Date |

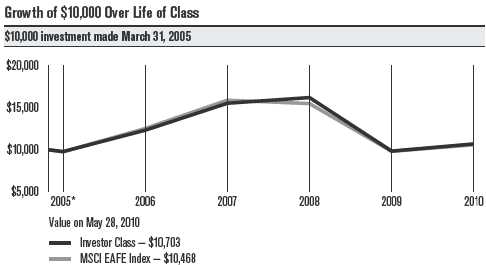

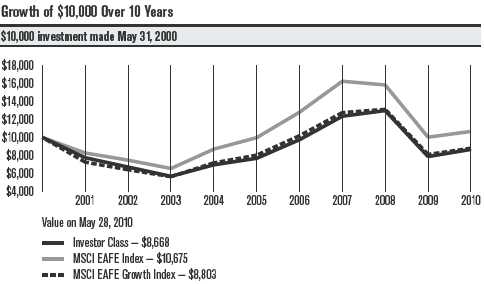

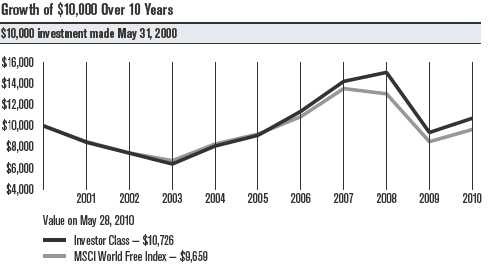

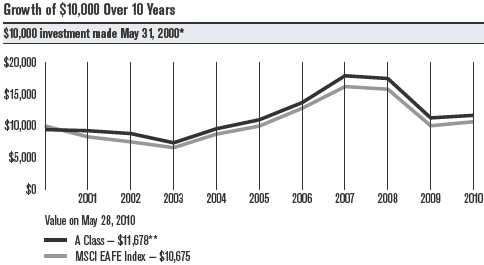

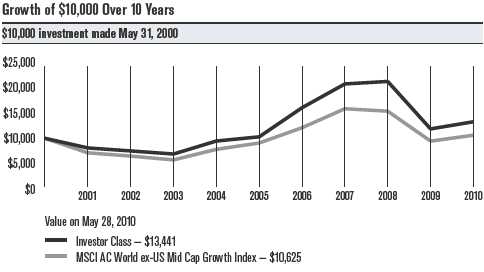

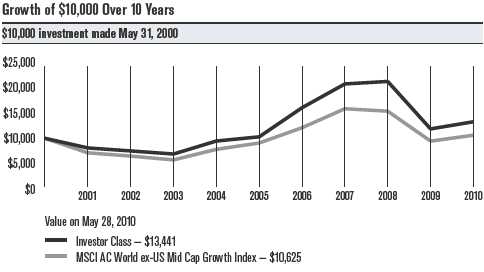

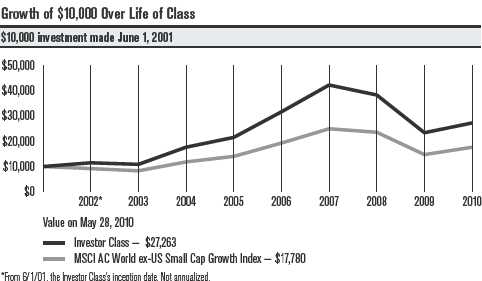

| Investor Class | ASKIX | -9.16% | 8.65% | 1.80% | 1.32% | 3/31/05 |

| MSCI EAFE Index | — | -10.90% | 6.61% | 1.39% | 0.89% | — |

| (1) | Total returns for periods less than one year are not annualized and are based on the period beginning December 1, 2009. | |

| (2) | Total returns are based on the periods beginning June 1, 2009 for the 1 year returns and June 1, 2005 for the 5 year returns. | |

| |

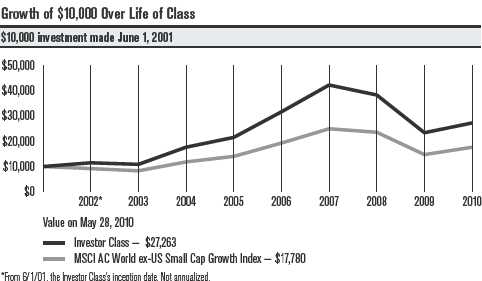

| *From 3/31/05, the Investor Class’s inception date. Not annualized. |

| Total Annual Fund Operating Expenses |

| Investor Class | 1.52% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

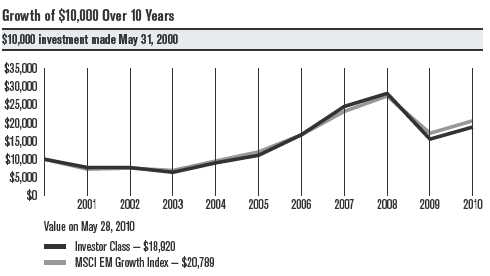

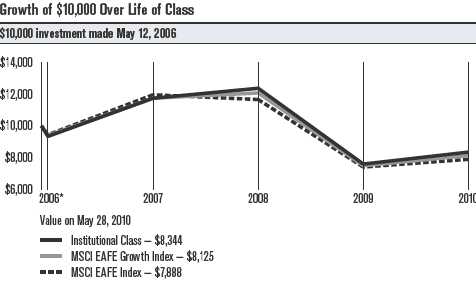

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks.

Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

5

International Stock

Portfolio Managers: Alex Tedder and Raj Gandhi

Performance Summary

The International Stock portfolio returned -9.16%* for the six months ended May 28, 2010, compared with its benchmark, the MSCI EAFE Index, which returned -10.90%.

Investor confidence generally remained upbeat for the first four months of the period, as the global economic recovery appeared to gain momentum and stock prices continued to climb. But, late in the period, mounting concerns about the massive levels of sovereign debt in Greece, Spain, and other European nations put an end to the yearlong global stock market rally. Stock prices plunged, wiping out the gains achieved earlier in the period. International growth stocks fared slightly better than their value counterparts, while small-cap stocks outperformed large-cap stocks. Meanwhile, the euro tumbled sharply relative to the U.S. dollar, which added to the woes of foreign-based corporations.

Stock selection, primarily in the financials and consumer discretionary sectors, accounted for the portfolio’s outperformance relative to the benchmark. Our sector allocations also had an overall positive influence on the portfolio’s relative performance.

U.K., Italy Were Top Countries

From a regional perspective, the portfolio’s holdings in the United Kingdom and Italy contributed the most to relative performance, due to favorable stock selection. In particular, an overweight position in British technology company ARM Holdings, a designer of microchips used in mobile devices, digital TVs and other products, contributed positively. The company benefited primarily from strong growth in the smartphone and tablet computer markets, and it posted record royalty revenues, profits, and net cash generation.

At the opposite end of the spectrum, Japan and Norway represented the largest detractors to relative performance, primarily due to stock selection. Norway’s TGS-NOPEC Geophysical Co., which provides seismic data for the oil and gas industries, was among the portfolio’s largest performance detractors. The company’s stock price faltered in the wake of the oil spill in the Gulf of Mexico, which is within the company’s survey boundaries.

Financials, Consumer Discretionary Led Sector Results

Financials and consumer discretionary were the portfolio’s top-performing sectors for the six-month period. Stock selection was strong in the financials sector, with our holdings in the commercial banking industry driving results. In the consumer discretionary sector, stock selection and an overweight accounted for the portfolio’s relative outperformance. Our stock selection was particularly effective in the auto industry, where our

*Total returns for periods less than one year are not annualized and are based on the period beginning December 1, 2009.

6

International Stock

out-of-benchmark position in South Korea’s Hyundai Motor Co. was the portfolio’s top-contributing stock. In the challenging economic environment, consumers “traded down” for value, and Hyundai’s line of affordable cars benefited. Backed by a savvy, yet frugal, marketing strategy, the company continued to gain market share in a difficult climate for automakers.

Materials, Consumer Staples Sectors Lagged

The materials sector represented the portfolio’s largest performance detractor. Stock selection dragged down results, particularly in the metals and mining segment. Additionally, in the sector’s construction materials segment, German cement producer HeidelbergCement represented the portfolio’s largest performance detractor. The company said its 2009 operating income slid 38.6% from 2008 levels, as revenues plunged 21.6%. The company also said it expects Asia and Africa to drive global growth in 2010 but anticipates slack demand in the U.S. and Europe until the second half of the year.

The portfolio’s consumer staples sector also detracted from performance. While stock selection and an underweight position were slightly negative influences, currency returns accounted for the bulk of the lagging results.

Outlook

Global economic activity is improving, but significant headwinds remain—namely, the explosion of sovereign debt in developed nations. So far, government responses to the crisis have varied, and this lack of coordination may lead to divergent economic performance in the year ahead. We expect further volatility throughout the international stock markets, yet we will continue to focus on finding companies located in developed countries around the world (excluding the United States) with sustainable growth characteristics and promising long-term outlooks.

7

| |

| International Stock | |

| |

| Top Ten Holdings | |

| | % of net assets |

| | as of 5/28/10 |

| BHP Billiton Ltd. | 2.2% |

| Barclays plc | 1.8% |

| Novartis AG | 1.8% |

| BG Group plc | 1.7% |

| Saipem SpA | 1.6% |

| Credit Suisse Group AG | 1.5% |

| Vale SA Preference Shares | 1.5% |

| Nestle SA | 1.4% |

| Tesco plc | 1.4% |

| Unilever NV CVA | 1.4% |

| |

| Types of Investments in Portfolio | |

| | % of net assets |

| | as of 5/28/10 |

| Foreign Common Stocks | 99.2% |

| Other Assets and Liabilities | 0.8% |

| |

| Investments by Country | |

| | % of net assets |

| | as of 5/28/10 |

| United Kingdom | 21.3% |

| Japan | 14.6% |

| Switzerland | 10.0% |

| Germany | 7.3% |

| France | 6.8% |

| Sweden | 4.8% |

| Netherlands | 3.5% |

| Australia | 3.2% |

| People’s Republic of China | 2.8% |

| Brazil | 2.5% |

| South Korea | 2.3% |

| India | 2.0% |

| Taiwan (Republic of China) | 2.0% |

| Other Countries | 16.1% |

| Other Assets and Liabilities | 0.8% |

8

|

| Shareholder Fee Example (Unaudited) |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/ exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from December 1, 2009 to May 28, 2010.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or Institutional Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. We will not charge the fee as long as you choose to manage your accounts exclusively online. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information

9

to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | |

| | Beginning | Ending | Expenses Paid | |

| | Account Value | Account Value | During Period* | Annualized |

| | 12/1/09 | 5/28/10 | 12/1/09 - 5/28/10 | Expense Ratio* |

| Actual | $1,000 | $908.40 | $7.07 | 1.51% |

| Hypothetical | $1,000 | $1,017.12 | $7.47 | 1.51% |

| *Expenses are equal to the fund’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, |

| multiplied by 179, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. | |

10

| | | | | | |

| International Stock | | | | | |

| |

| MAY 28, 2010 (UNAUDITED) | | | | | | |

| | Shares | Value | | | Shares | Value |

| Common Stocks — 99.2% | | | GERMANY — 7.3% | | |

| | | | | Allianz SE | 5,906 | $ 589,695 |

| AUSTRALIA — 3.2% | | | | | | |

| | | | | BASF SE | 12,266 | 643,029 |

| BHP Billiton Ltd. | 45,014 | $ 1,462,180 | | | | |

| | | | | Bayerische Motoren | | |

| Commonwealth Bank | | | | Werke AG | 11,411 | 525,680 |

| of Australia | 9,277 | 406,501 | | | | |

| | | | | Daimler AG(1) | 17,808 | 877,815 |

| Wesfarmers Ltd. | 9,833 | 239,337 | | | | |

| | | | | Fresenius Medical Care AG | | |

| | | 2,108,018 | | & Co. KGaA | 13,777 | 686,443 |

| AUSTRIA — 0.5% | | | | Metro AG | 9,438 | 493,930 |

| Erste Group Bank AG | 8,526 | 304,263 | | SAP AG(1) | 8,673 | 368,188 |

| BELGIUM — 0.7% | | | | Siemens AG | 6,809 | 611,917 |

| Anheuser-Busch InBev NV | 9,901 | 473,620 | | | | 4,796,697 |

| BERMUDA — 0.2% | | | | HONG KONG — 1.7% | | |

| Seadrill Ltd. | 7,235 | 148,152 | | CNOOC Ltd. | 378,000 | 591,705 |

| BRAZIL — 2.5% | | | | Li & Fung Ltd. | 122,000 | 541,563 |

| Banco Santander Brasil | | | | | | |

| SA ADR | 35,471 | 369,608 | | | | 1,133,268 |

| Itau Unibanco Holding SA | | | | INDIA — 2.0% | | |

| Preference Shares | 17,380 | 321,399 | | Housing Development | | |

| Vale SA Preference Shares | 41,300 | 952,228 | | Finance Corp. Ltd. | 7,276 | 436,413 |

| | | 1,643,235 | | Infosys Technologies Ltd. | 11,234 | 645,464 |

| CANADA — 1.0% | | | | Larsen & Toubro Ltd. | 6,806 | 238,220 |

| Canadian National | | | | | | 1,320,097 |

| Railway Co. | 10,970 | 629,597 | | INDONESIA — 1.1% | | |

| CZECH REPUBLIC — 1.0% | | | | PT Bank Mandiri | | |

| CEZ AS(1) | 14,940 | 623,919 | | (Persero) Tbk | 562,000 | 309,787 |

| DENMARK — 1.8% | | | | PT Bank Rakyat Indonesia | 280,500 | 253,594 |

| Carlsberg A/S B Shares | 4,370 | 330,052 | | PT United Tractors Tbk | 88,000 | 168,396 |

| Novo Nordisk A/S B Shares | 10,643 | 818,250 | | | | 731,777 |

| | | 1,148,302 | | IRELAND — 0.5% | | |

| | | | | Ryanair Holdings plc ADR(1) | 14,586 | 343,354 |

| FINLAND — 0.1% | | | | | | |

| Fortum Oyj | 3,007 | 67,808 | | ISRAEL — 0.6% | | |

| FRANCE — 6.8% | | | | Teva Pharmaceutical | | |

| | | | | Industries Ltd. ADR | 7,432 | 407,422 |

| Air Liquide SA | 6,674 | 648,448 | | ITALY — 1.6% | | |

| BNP Paribas | 11,624 | 659,003 | | Saipem SpA | 33,869 | 1,050,414 |

| Cie Generale d’Optique | | | | | | |

| Essilor International SA | 5,585 | 317,706 | | JAPAN — 14.6% | | |

| Danone SA | 7,568 | 386,709 | | Asahi Glass Co. Ltd. | 53,000 | 555,612 |

| LVMH Moet Hennessy Louis | | | | Canon, Inc. | 20,100 | 823,378 |

| Vuitton SA | 6,610 | 694,004 | | Fanuc Ltd. | 7,000 | 734,551 |

| Pernod-Ricard SA | 7,974 | 597,981 | | HOYA Corp. | 18,400 | 437,211 |

| Societe Television | | | | Komatsu Ltd. | 34,200 | 642,554 |

| Francaise 1 | 12,170 | 172,492 | | Mitsubishi Corp. | 36,500 | 824,015 |

| Total SA | 10,944 | 510,458 | | Mitsubishi UFJ Financial | | |

| Vallourec SA | 2,468 | 456,491 | | Group, Inc. | 111,400 | 541,145 |

| | | 4,443,292 | | Mitsui O.S.K. Lines Ltd. | 48,000 | 340,354 |

| | | | | Nidec Corp. | 6,800 | 618,328 |

11

| | | | | | |

| International Stock | | | | | |

| |

| | Shares | Value | | | Shares | Value |

| Nomura ETF - Nikkei 225 | 7,360 | $ 799,265 | | SPAIN — 1.9% | | |

| Omron Corp. | 22,500 | 466,115 | | Banco Bilbao Vizcaya | | |

| ORIX Corp. | 8,290 | 633,321 | | Argentaria SA | 75,758 | $ 785,071 |

| Rakuten, Inc. | 772 | 540,328 | | Banco Santander SA | 45,355 | 460,330 |

| Shin-Etsu Chemical Co. Ltd. | 3,100 | 156,304 | | | | 1,245,401 |

| SOFTBANK CORP. | 17,200 | 413,872 | | SWEDEN — 4.8% | | |

| Unicharm Corp. | 6,500 | 641,080 | | Alfa Laval AB | 31,153 | 393,236 |

| Yahoo! Japan Corp. | 1,187 | 413,852 | | Atlas Copco AB A Shares | 59,033 | 835,011 |

| | | 9,581,285 | | Getinge AB B Shares | 10,506 | 207,171 |

| LUXEMBOURG — 0.9% | | | | H & M Hennes & Mauritz AB | | |

| Millicom International | | | | B Shares | 8,579 | 480,095 |

| Cellular SA | 7,182 | 574,057 | | Telefonaktiebolaget LM | | |

| MACAU — 0.3% | | | | Ericsson B Shares | 40,026 | 403,053 |

| | | | | Volvo AB B Shares(1) | 78,094 | 808,727 |

| Wynn Macau Ltd.(1) | 132,665 | 213,015 | | | | |

| NETHERLANDS — 3.5% | | | | | | 3,127,293 |

| Akzo Nobel NV | 6,794 | 345,299 | | SWITZERLAND — 10.0% | | |

| ASML Holding NV | 10,780 | 304,489 | | Adecco SA | 6,360 | 307,215 |

| Royal Dutch Shell plc | | | | Credit Suisse Group AG | 24,808 | 961,723 |

| B Shares | 30,643 | 773,383 | | Holcim Ltd. | 6,364 | 401,086 |

| Unilever NV CVA | 32,579 | 888,932 | | Kuehne + Nagel | | |

| | | 2,312,103 | | International AG | 7,233 | 677,742 |

| NORWAY — 1.0% | | | | Nestle SA | 20,186 | 911,298 |

| Telenor ASA | 31,500 | 387,890 | | Novartis AG | 25,559 | 1,157,204 |

| TGS Nopec Geophysical | | | | Roche Holding AG | 4,911 | 673,382 |

| Co. ASA(1) | 18,738 | 253,839 | | Sonova Holding AG | 4,819 | 518,595 |

| | | 641,729 | | Swatch Group AG (The) | 2,696 | 701,103 |

| PEOPLE’S REPUBLIC OF CHINA — 2.8% | | | Syngenta AG | 1,219 | 269,332 |

| Baidu, Inc. ADR(1) | 5,140 | 376,300 | | | | 6,578,680 |

| Ctrip.com International | | | | TAIWAN (REPUBLIC OF CHINA) — 2.0% | |

| Ltd. ADR(1) | 4,457 | 175,561 | | Hon Hai Precision | | |

| Industrial & Commercial | | | | Industry Co. Ltd. | 154,000 | 607,253 |

| Bank of China Ltd. H Shares | 914,000 | 672,351 | | HTC Corp. | 37,000 | 499,992 |

| Mindray Medical | | | | Taiwan Semiconductor | | |

| International Ltd. ADR | 8,046 | 239,288 | | Manufacturing Co. Ltd. ADR | 18,112 | 176,592 |

| Tencent Holdings Ltd. | 17,300 | 329,311 | | | | 1,283,837 |

| ZTE Corp. H Shares | 16,300 | 53,356 | | TURKEY — 0.3% | | |

| | | 1,846,167 | | Turkiye Garanti Bankasi AS | 47,386 | 204,393 |

| SINGAPORE — 0.9% | | | | UNITED KINGDOM — 21.3% | | |

| United Overseas Bank Ltd. | 48,098 | 621,748 | | Admiral Group plc | 30,332 | 563,846 |

| SOUTH KOREA — 2.3% | | | | Antofagasta plc | 27,655 | 352,100 |

| Hyundai Motor Co. | 6,255 | 713,848 | | ARM Holdings plc | 151,338 | 540,347 |

| POSCO | 613 | 239,053 | | Autonomy Corp. plc(1) | 7,044 | 177,926 |

| Samsung Electronics | | | | Barclays plc | 268,599 | 1,171,881 |

| Co. Ltd. | 870 | 562,347 | | BG Group plc | 71,695 | 1,097,402 |

| | | 1,515,248 | | British Airways plc(1) | 62,775 | 181,861 |

| | | | | British American | | |

| | | | | Tobacco plc | 13,689 | 403,763 |

12

| | | | | |

| International Stock | | | | |

| |

| | Shares | Value | | Market Sector Diversification | |

| British Sky Broadcasting | | | | (as a % of net assets) | |

| Group plc | 265 | $ 2,203 | | Financials | 18.2% |

| Carnival plc | 17,033 | 646,715 | | Industrials | 16.0% |

| Compass Group plc | 103,356 | 798,217 | | Consumer Discretionary | 13.7% |

| HSBC Holdings plc | | | | Information Technology | 10.9% |

| (Hong Kong) | 90,061 | 825,476 | | Consumer Staples | 10.6% |

| Intercontinental Hotels | | | | | |

| Group plc | 32,750 | 516,468 | | Materials | 9.4% |

| ITV plc(1) | 818,905 | 660,071 | | Health Care | 7.7% |

| Kingfisher plc | 179,034 | 577,609 | | Energy | 7.4% |

| Lonmin plc(1) | 29,033 | 703,194 | | Telecommunication Services | 3.0% |

| | | | | Diversified | 1.2% |

| Next plc | 5,601 | 167,854 | | | |

| | | | | Utilities | 1.1% |

| Petrofac Ltd. | 10,352 | 168,004 | | | |

| | | | | Other Assets and Liabilities | 0.8% |

| Reckitt Benckiser Group plc | 14,720 | 689,416 | | | |

| Rolls-Royce Group plc(1) | 60,061 | 510,419 | | Notes to Schedule of Investments | |

| Rolls-Royce Group plc | | | | ADR = American Depositary Receipt | |

| C Shares(1) | 5,405,490 | 7,817 | | | |

| Schroders plc | 16,204 | 310,240 | | CVA = Certificaten Van Aandelen | |

| Smiths Group plc | 26,482 | 395,324 | | ETF = Exchange Traded Fund | |

| Standard Chartered plc | 22,848 | 539,565 | | (1) Non-income producing. | |

| Tesco plc | 153,116 | 910,049 | | | |

| Tullow Oil plc | 16,993 | 273,759 | | | |

| Vodafone Group plc | 295,391 | 591,502 | | See Notes to Financial Statements. | |

| Wolseley plc(1) | 8,389 | 199,273 | | | |

| | | 13,982,301 | | | |

| TOTAL INVESTMENT | | | | | |

| SECURITIES — 99.2% | | | | | |

| (Cost $60,010,726) | | 65,100,492 | | | |

| OTHER ASSETS | | | | | |

| AND LIABILITIES — 0.8% | | 516,461 | | | |

| TOTAL NET ASSETS — 100.0% | | $65,616,953 | | | |

13

|

| Statement of Assets and Liabilities |

| |

| MAY 28, 2010 (UNAUDITED) | |

| Assets | |

| Investment securities, at value (cost of $60,010,726) | $65,100,492 |

| Foreign currency holdings, at value (cost of $111,814) | 112,008 |

| Receivable for investments sold | 1,253,896 |

| Receivable for capital shares sold | 42,070 |

| Dividends and interest receivable | 353,660 |

| Other assets | 416 |

| | 66,862,542 |

| | |

| Liabilities | |

| Disbursements in excess of demand deposit cash | 113,458 |

| Payable for investments purchased | 1,001,068 |

| Payable for capital shares redeemed | 51,893 |

| Accrued management fees | 79,170 |

| | 1,245,589 |

| Net Assets | $65,616,953 |

| | |

| Investor Class Capital Shares, $0.01 Par Value | |

| Authorized | 50,000,000 |

| Outstanding | 6,684,526 |

| | |

| Net Asset Value Per Share | $9.82 |

| | |

| Net Assets Consist of: | |

| Capital (par value and paid-in surplus) | $88,039,523 |

| Undistributed net investment income | 357,917 |

| Accumulated net realized loss on investment and foreign currency transactions | (27,865,229) |

| Net unrealized appreciation on investments and translation of assets and liabilities | |

| in foreign currencies | 5,084,742 |

| | $65,616,953 |

| |

| |

| See Notes to Financial Statements. | |

14

| |

| FOR THE SIX MONTHS ENDED MAY 28, 2010 (UNAUDITED) | |

| Investment Income (Loss) | |

| Income: | |

| Dividends (net of foreign taxes withheld of $105,021) | $ 1,005,606 |

| Interest | 97 |

| | 1,005,703 |

| Expenses: | |

| Management fees | 554,767 |

| Directors’ fees and expenses | 1,070 |

| Other expenses | 1,894 |

| | 557,731 |

| Net investment income (loss) | 447,972 |

| | |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss) on: | |

| Investment transactions | 2,383,629 |

| Foreign currency transactions (net of foreign tax expenses paid (refunded) of $2,645) | (6,838) |

| | 2,376,791 |

| | |

| Change in net unrealized appreciation (depreciation) on: | |

| Investments | (2,939,385) |

| Translation of assets and liabilities in foreign currencies | (6,667,865) |

| | (9,607,250) |

| | |

| Net realized and unrealized gain (loss) | (7,230,459) |

| | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | $(6,782,487) |

| |

| |

| See Notes to Financial Statements. | |

15

|

| Statement of Changes in Net Assets |

| | |

| SIX MONTHS ENDED MAY 28, 2010 (UNAUDITED) AND YEAR ENDED NOVEMBER 30, 2009 | |

| Increase (Decrease) in Net Assets | 2010 | 2009 |

| Operations | | |

| Net investment income (loss) | $ 447,972 | $ 676,711 |

| Net realized gain (loss) | 2,376,791 | (11,198,804) |

| Change in net unrealized appreciation (depreciation) | (9,607,250) | 31,104,600 |

| Net increase (decrease) in net assets resulting from operations | (6,782,487) | 20,582,507 |

| | | |

| Distributions to Shareholders | | |

| From net investment income | (782,319) | (936,365) |

| | | |

| Capital Share Transactions | | |

| Proceeds from shares sold | 4,553,474 | 8,529,669 |

| Proceeds from reinvestment of distributions | 765,232 | 914,349 |

| Payments for shares redeemed | (8,842,267) | (12,302,762) |

| Net increase (decrease) in net assets from capital share transactions | (3,523,561) | (2,858,744) |

| | | |

| Redemption Fees | | |

| Increase in net assets from redemption fees | 3,364 | 2,513 |

| | | |

| Net increase (decrease) in net assets | (11,085,003) | 16,789,911 |

| | | |

| Net Assets | | |

| Beginning of period | 76,701,956 | 59,912,045 |

| End of period | $65,616,953 | $76,701,956 |

| | | |

| Undistributed net investment income | $357,917 | $692,264 |

| | | |

| Transactions in Shares of the Fund | | |

| Sold | 415,086 | 937,931 |

| Issued in reinvestment of distributions | 69,752 | 105,583 |

| Redeemed | (821,257) | (1,423,706) |

| Net increase (decrease) in shares of the fund | (336,419) | (380,192) |

| |

| |

| See Notes to Financial Statements. | | |

16

|

| Notes to Financial Statements |

MAY 28, 2010 (UNAUDITED)

1. Organization and Summary of Significant Accounting Policies

Organization — American Century World Mutual Funds, Inc. (the corporation) is registered under the Investment Company Act of 1940 (the 1940 Act) as an open-end management investment company. International Stock Fund (the fund) is one fund in a series issued by the corporation. The fund is diversified under the 1940 Act. The fund’s investment objective is to seek capital growth. The fund pursues its objective by investing primarily in equity securities of issuers in developed foreign countries that are large-sized companies, although it may invest in companies of any size. The following is a summary of the fund’s significant accounting policies.

Security Valuations — Securities traded primarily on a principal securities exchange are valued at the last reported sales price, or at the mean of the latest bid and asked prices where no last sales price is available. Depending on local convention or regulation, securities traded over-the-counter are valued at the mean of the latest bid and asked prices, the last sales price, or the official close price. Investments in open-end management investment companies are valued at the reported net asset value. Discount notes may be valued through a commercial pricing service or at amortized cost, which approximates fair value. Securities traded on foreign securities exchanges and over-the-counter markets are normally completed before the close of business on days that the New York Stock Exchange (the Exchange) is open and may also take place on days when the Exchange is not open. If an event occurs after the value of a security was established but before the net asset value per share was determined that was likely to materially change the net asset value, that security would be valued as determined in accordance with procedures adopted by the Board of Directors. If the fund determines that the market price of a portfolio security is not readily available, or that the valuation methods mentioned above do not reflect the security’s fair value, such security is valued as determined by the Board of Directors or its designee, in accordance with procedures adopted by the Board of Directors, if such determination would materially impact a fund’s net asset value. Certain other circumstances may cause the fund to use alternative procedures to value a security such as: a security has been declared in default; trading in a security has been halted during the trading day; or there is a foreign market holiday and no trading will commence .

Security Transactions — For financial reporting purposes, security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes. Certain countries impose taxes on realized gains on the sale of securities registered in their country. The fund records the foreign tax expense, if any, on an accrual basis. The foreign tax expense on realized gains and unrealized appreciation reduces the net realized gain (loss) on investment transactions and net unrealized appreciation (depreciation) on investments, respectively.

Investment Income — Dividend income less foreign taxes withheld, if any, is recorded as of the ex-dividend date. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums.

Foreign Currency Translations — All assets and liabilities initially expressed in foreign currencies are translated into U.S. dollars at prevailing exchange rates at period end. The fund may enter into spot foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of investment securities, dividend and interest income, spot foreign currency exchange contracts, and certain expenses are translated at the rates of exchange prevailing on the respective dates of such transactions. Realized and unrealized gains and losses from foreign currency translations arise from changes in currency exchange rates.

Net realized and unrealized foreign currency exchange gains or losses occurring during the holding period of investment securities are a component of net realized gain (loss) on foreign currency transactions and net unrealized appreciation (depreciation) on translation of assets and liabilities in foreign currencies, respectively. Certain countries may impose taxes on the contract amount of purchases and sales of foreign currency contracts in their currency. The fund records the foreign tax expense, if any, as a reduction to the net realized gain (loss) on foreign currency transactions.

17

Exchange Traded Funds — The fund may invest in exchange traded funds (ETFs). ETFs are a type of index fund bought and sold on a securities exchange. An ETF trades like common stock and represents a fixed portfolio of securities designed to track the performance and dividend yield of a particular domestic or foreign market index. A fund may purchase an ETF to temporarily gain exposure to a portion of the U.S. or a foreign market while awaiting purchase of underlying securities. The risks of owning an ETF generally reflect the risks of owning the underlying securities they are designed to track, although the lack of liquidity on an ETF could result in it being more volatile. Additionally, ETFs have fees and expenses that reduce their value.

Repurchase Agreements — The fund may enter into repurchase agreements with institutions that American Century Investment Management, Inc. (ACIM) has determined are creditworthy pursuant to criteria adopted by the Board of Directors. Each repurchase agreement is recorded at cost. The fund requires that the collateral, represented by securities, received in a repurchase transaction be transferred to the custodian in a manner sufficient to enable the fund to obtain those securities in the event of a default under the repurchase agreement. ACIM monitors, on a daily basis, the securities transferred to ensure the value, including accrued interest, of the securities under each repurchase agreement is equal to or greater than amounts owed to the fund under each repurchase agreement.

Joint Trading Account — Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with certain other funds in the American Century Investments family of funds, may transfer uninvested cash balances into a joint trading account. These balances are invested in one or more repurchase agreements that are collateralized by U.S. Treasury or Agency obligations.

Income Tax Status — It is the fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. The fund is no longer subject to examination by tax authorities for years prior to 2006. Additionally, non-U.S. tax returns filed by the fund due to investments in certain foreign securities remain subject to examination by the relevant taxing authority for 7 years from the date of filing. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. Accordingly, no provision has been made for federal or state income taxes.

Distributions to Shareholders — Distributions to shareholders are recorded on the ex-dividend date. Distributions from net investment income, if any, are generally declared and paid annually. Distributions from net realized gains, if any, are generally declared and paid twice per year. The fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code, in all events in a manner consistent with provisions of the 1940 Act.

Redemption — The fund may impose a 2.00% redemption fee on shares held less than 60 days. The redemption fee is retained by the fund and helps cover transaction costs that long-term investors may bear when the fund sells securities to meet investor redemptions.

Indemnifications — Under the corporation’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the fund enters into contracts that provide general indemnifications. The maximum exposure under these arrangements is unknown as this would involve future claims that may be made against a fund. The risk of material loss from such claims is considered by management to be remote.

Use of Estimates — The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America, which may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates.

18

2. Fees and Transactions with Related Parties

Management Fees — The corporation has entered into a Management Agreement with American Century Global Investment Management, Inc. (ACGIM) (the investment advisor) (See Note 8), under which ACGIM provides the fund with investment advisory and management services in exchange for a single, unified management fee (the fee). The Agreement provides that all expenses of managing and operating the fund, except brokerage expenses, taxes, interest, fees and expenses of the independent directors (including legal counsel fees), and extraordinary expenses, will be paid by ACGIM. The fee is computed and accrued daily based on the daily net assets of the fund and paid monthly in arrears. For funds with a stepped fee schedule, the rate of the fee is determined by applying a fee rate calculation formula. This formula takes into account the f und’s assets as well as certain assets, if any, of other clients of the investment advisor outside the American Century Investments family of funds (such as subadvised funds and separate accounts) that have very similar investment teams and investment strategies (strategy assets). The annual management fee schedule ranges from 1.10% to 1.50%. The effective annual management fee for the six months ended May 28, 2010 was 1.50%.

ACGIM has entered into a Subadvisory Agreement with ACIM (the subadvisor) on behalf of the fund. The subadvisor makes investment decisions for he cash portion of the fund in accordance with the fund’s investment objectives, policies and restrictions under the supervision of ACGIM and the Board of Directors. ACGIM pays all costs associated with retaining ACIM as the subadvisor of the fund.

Acquired Fund Fees and Expenses — The fund may invest in mutual funds, exchange traded funds, and business development companies (the acquired funds). The fund will indirectly realize its pro rata share of the fees and expenses of the acquired funds in which it invests. These indirect fees and expenses are not paid out of the fund’s assets but are reflected in the return realized by the fund on its investment in the acquired funds.

Related Parties — Certain officers and directors of the corporation are also officers and/ or directors of American Century Companies, Inc. (ACC), the parent of the corporation’s investment advisor, ACGIM, the corporation’s subadvisor, ACIM, the distributor of the corporation, American Century Investment Services, Inc., and the corporation’s transfer agent, American Century Services, LLC.

The fund is eligible to invest in a money market fund for temporary purposes, which is managed by J.P. Morgan Investment Management, Inc. (JPMIM). The fund has a Mutual Funds Services Agreement with J.P. Morgan Investor Services Co. (JPMIS) and a securities lending agreement with JPMorgan Chase Bank (JPMCB). JPMCB is a custodian of the fund. JPMIM, JPMIS and JPMCB are wholly owned subsidiaries of JPMorgan Chase & Co. (JPM). JPM is an equity investor in ACC.

3. Investment Transactions

Purchases and sales of investment securities, excluding short-term investments, for the six months ended May 28, 2010, were $46,801,696 and $50,719,846, respectively.

4. Fair Value Measurements

The fund’s securities valuation process is based on several considerations and may use multiple inputs to determine the fair value of the positions held by the fund. In conformity with accounting principles generally accepted in the United States of America, the inputs used to determine a valuation are classified into three broad levels as follows:

• Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical securities;

• Level 2 valuation inputs consist of significant direct or indirect observable market data (including quoted prices for similar securities, evaluations of subsequent market events, interest rates, prepayment speeds, credit risk, etc.); or

19

• Level 3 valuation inputs consist of significant unobservable inputs (including a fund’s own assumptions).

The level classification is based on the lowest level input that is significant to the fair valuation measurement. The valuation inputs are not an indication of the risks associated with investing in these securities or other financial instruments.

The following is a summary of the valuation inputs used to determine the fair value of the fund’s securities as of May 28, 2010. The Schedule of Investments provides additional details on the fund’s portfolio holdings.

| | | |

| | Level 1 | Level 2 | Level 3 |

| Investment Securities | | | |

| Foreign Common Stocks | $2,662,182 | $62,438,310 | — |

5. Risk Factors

There are certain risks involved in investing in foreign securities. These risks include those resulting from future adverse political, social, and economic developments, fluctuations in currency exchange rates, the possible imposition of exchange controls, and other foreign laws or restrictions. Investing in emerging markets may accentuate these risks.

6. Interfund Lending

The fund, along with certain other funds in the American Century Investments family of funds, may participate in an interfund lending program, pursuant to an Exemptive Order issued by the Securities and Exchange Commission (SEC). This program provides an alternative credit facility allowing the fund to borrow from or lend to other funds in the American Century Investments family of funds that permit such transactions. Interfund lending transactions are subject to each fund’s investment policies and borrowing and lending limits. The interfund loan rate earned/paid on interfund lending transactions is determined daily based on the average of certain current market rates. Interfund lending transactions normally extend only overnight, but can have a maximum duration of seven days. The program is subject to annual approval by the Board of Directors. During the six months ended May 28, 2010, the fund did not utiliz e the program.

7. Federal Tax Information

The book-basis character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements.

As of May 28, 2010, the components of investments for federal income tax purposes were as follows:

| | |

| Federal tax cost of investments | $60,801,437 |

| Gross tax appreciation of investments | $7,609,842 |

| Gross tax depreciation of investments | (3,310,787) |

| Net tax appreciation (depreciation) of investments | $4,299,055 |

The difference between book-basis and tax-basis cost and unrealized appreciation (depreciation) is attributable primarily to the tax deferral of losses on wash sales.

20

As of November 30, 2009, the fund had accumulated capital losses of $(28,974,208), which represent net capital loss carryovers that may be used to offset future realized capital gains for federal income tax purposes. Future capital loss carryover utilization in any given year may be subject to Internal Revenue Code limitations. Capital loss carryovers of $(13,731,461) and $(15,242,747) expire in 2016 and 2017, respectively.

8. Corporate Event

As part of a long-standing estate and business succession plan established by ACC Co-Chairman James E. Stowers, Jr., the founder of American Century Investments, ACC Co-Chairman Richard W. Brown succeeded Mr. Stowers as trustee of a trust that holds a greater-than-25% voting interest in ACC, the parent corporation of the fund’s advisors. Under the 1940 Act, this is presumed to represent control of ACC even though it is less than a majority interest. The change of trustee may technically be considered a “change of control” of ACC and therefore also a change of control of the fund’s advisors even though there has been no change to their management and none is anticipated. The “change of control” resulted in the assignment of the fund’s investment advisory and subadvisory agreements. Under the 1940 Act, an assignment automatically terminated such agreements, making the approval of a new agreement necessary.

On February 16, 2010, the Board of Directors approved interim investment advisory and subadvisory agreements under which the fund will be managed until a new agreement is approved by fund shareholders. The interim agreements are substantially identical to the terminated agreements (with the exception of different effective and termination dates) and will not result in changes in the management of American Century Investments, the fund, its investment objectives, fees or services provided. On March 29, 2010, the Board of Directors approved a new investment advisory agreement. The new agreement is also substantially identical to the terminated agreement (except for the date, the substitution of ACIM for ACGIM and certain other non-material changes). In order to streamline American Century’s corporate organization, ACGIM was merged into ACIM on July 16, 2010. The new agreement for the fund was approved by shar eholders at a Special Meeting of Shareholders on June 16, 2010. The new agreement went into effect on July 16, 2010.

9. Subsequent Events

On June 10, 2010, the Board of Directors approved a plan of reorganization (the reorganization) pursuant to which International Growth Fund (International Growth), a fund in a series issued by the corporation, would acquire all of the assets of the fund in exchange for shares of equal value of International Growth and assumption by International Growth of certain liabilities of the fund. Holders of shares of the fund would receive shares of equal value of International Growth. The financial statements and performance history of International Growth would survive after the reorganization. The reorganization is expected to be effective at the close of business on October 29, 2010; however, such timing is subject to change.

In preparing the financial statements, management evaluated the impact of events or transactions occurring through the date the financial statements were issued that would merit recognition or disclosure.

21

| | | | | | | |

| International Stock | | | | | |

| |

| Investor Class | | | | | | |

| For a Share Outstanding Throughout the Years Ended November 30 (except as noted) | | |

| | | 2010(1) | 2009 | 2008 | 2007 | 2006 | 2005(2) |

| Per-Share Data | | | | | | |

| Net Asset Value, | | | | | | |

| Beginning of Period | $10.92 | $8.09 | $16.53 | $13.57 | $10.84 | $10.00 |

| Income From | | | | | | |

| Investment Operations | | | | | | |

| Net Investment | | | | | | |

| Income (Loss) | 0.06(3) | 0.09(3) | 0.15(3) | 0.13 | 0.06 | 0.06(3) |

| Net Realized and | | | | | | |

| Unrealized Gain (Loss) | (1.05) | 2.87 | (7.81) | 2.88 | 2.74 | 0.78 |

| Total From | | | | | | |

| Investment Operations | (0.99) | 2.96 | (7.66) | 3.01 | 2.80 | 0.84 |

| Distributions | | | | | | |

| From Net | | | | | | |

| Investment Income | (0.11) | (0.13) | (0.12) | (0.05) | (0.08) | — |

| From Net Realized Gains | — | — | (0.66) | — | — | — |

| Total Distributions | (0.11) | (0.13) | (0.78) | (0.05) | (0.08) | — |

| Redemption Fees(3) | —(4) | —(4) | —(4) | —(4) | 0.01 | — |

| Net Asset Value, | | | | | | |

| End of Period | $9.82 | $10.92 | $8.09 | $16.53 | $13.57 | $10.84 |

| |

| Total Return(5) | (9.16)% | 36.96% | (48.50)% | 22.22% | 26.07% | 8.40% |

| | | | | | | |

| Ratios/Supplemental Data | | | | | | |

| Ratio of Operating | | | | | | |

| Expenses to Average | | | | | | |

| Net Assets | 1.51%(6) | 1.50% | 1.51% | 1.50% | 1.50% | 1.50%(6) |

| Ratio of Net Investment | | | | | | |

| Income (Loss) to Average | | | | | | |

| Net Assets | 1.21%(6) | 1.05% | 1.12% | 0.83% | 0.40% | 0.91%(6) |

| Portfolio Turnover Rate | 63% | 117% | 107% | 103% | 109% | 109% |

| Net Assets, End of Period | | | | | | |

| (in thousands) | $65,617 | $76,702 | $59,912 | $144,812 | $90,181 | $20,342 |

| (1) | Six months ended May 28, 2010 (unaudited). | | | | | |

| (2) | March 31, 2005 (fund inception) through November 30, 2005. | | | | |

| (3) | Computed using average shares outstanding throughout the period. | | | | |

| (4) | Per-share amount was less than $0.005. | | | | | |

| (5) | Total return assumes reinvestment of net investment income and capital gains distributions, if any. Total returns for periods less than one year |

| | are not annualized. Total returns are calculated based on the net asset value of the last business day. | | |

| (6) | Annualized. | | | | | | |

See Notes to Financial Statements.

22

|

| Board Approval of Management and Subadvisory Agreements |

American Century Global Investment Management, Inc. (“ACGIM” or the “Advisor”) currently serves as investment advisor to the Fund under an interim management agreement (the “Interim Management Agreement”) between the Advisor and the Fund approved by the Fund’s Board of Directors (the “Board”). American Century Investment Management, Inc. (“ACIM” or the “Subadvisor”) currently serves as subadvisor to the Fund under an interim investment subadvisory agreement (the “Interim Subad-visory Agreement” and, together with the Interim Management Agreement, the “Interim Agreements”). The Advisor and the Subadvisor (together, the “Advisors”) previously served as investment advisors to the Fund pursuant to agreements (the “Prior Agreements”) that terminated in accordance with their terms on February 16, 2010, as a result of a change of control of the Advisor’s and the Subadvisor’s parent company, American Century Companies, Inc. (“ACC”). The change in control occurred as the result of a change in the trustee of a trust created by James E. Stowers, Jr., the founder of American Century Investments, which holds shares representing a significant interest in ACC stock. Mr. Stowers previously served as the trustee of the trust. On February 16, 2010, Mr. Richard W. Brown, Co-Chairman of ACC with Mr. Stowers, became the trustee in accordance with the terms of the trust and Mr. Stowers’ long-standing estate and succession plan.

On February 18, 2010, the Board approved the Interim Agreements in accordance with Rule 15a-4 under the Investment Company Act to ensure continued management of the Funds by the Advisor and the Subad-visor after the termination of the Prior Agreements and until shareholder approval of a new management agreement (the “Proposed Agreement”) as required under the Act. The Board approved the Proposed Agreement and recommended its approval to shareholders. Fund shareholders approved the Proposed Agreement at a meeting on June 16, 2010.

Because American Century had indicated its intention to merge ACGIM into ACIM prior to the expiration of the Interim Agreements, the Proposed Agreement is with ACIM as sole investment advisor to the Fund. The Board took into consideration that the combination is being undertaken for reasons of organizational simplification and will eliminate the need for multiple investment management agreements without changing the nature, quality, or extent of services provided to the Fund. The Board noted that the merger was not related to the change of control that necessitated the Interim Agreements and would not result in any change to the personnel managing the Fund.

The Interim Agreements and the Proposed Agreement are substantially identical to the Prior Agreements except for their effective dates, the termination provisions of the Interim Agreements, and the elimination of a subadvisor in the Proposed Agreement. Under the Proposed Agreement, ACIM will provide the same services as provided by ACGIM and ACIM, be subject to the same duties, and receive the same compensation rate as under the Prior Agreements.

23

Basis for Board Approval of Interim Agreements

In considering the approval of the Interim Agreements, Rule 15a-4 requires the Board to approve the contracts within ten business days of the termination of the prior agreements and to determine that the compensation to be received under each interim agreement is no greater than would have been received under the corresponding prior agreement. In connection with the approval, the Board noted that it oversees on a continuous basis and evaluates at its quarterly meetings, directly and through the committees of the Board, the nature and quality of significant services provided by the Advisor and the Subadvisor, the investment performance of the Fund, shareholder services, audit and compliance functions and a variety of other matters relating to the Fund’s operations.

In evaluating the Interim Agreements, the Board, assisted by the advice of its independent legal counsel, considered a number of factors in addition to those required by the rule with no one factor being determinative to its analysis. Among the factors considered by the Board were the circumstances and effect of the change of control, the fact that the Advisor and the Subad-visor will provide the same services and receive the same compensation rate as under the Prior Agreements, and that the change of control did not result in a change of the personnel managing the Fund. Upon completion of its analysis, the Board approved the Interim Agreements, determining that the continued management of the Fund by the Advisor and the Subadvisor was in the best interests of the Fund and Fund shareholders.

Basis for Board Approval of Proposed Agreement

At a meeting held on March 29, 2010, after considering all information presented, the Board approved, and determined to recommend that shareholders approve, the Proposed Agreement. In connection with that approval, the Board requested and reviewed extensive data and information compiled by the Advisor, the Subadvisor, and certain independent providers of evaluation data concerning the Fund and services provided to the Fund. The Board oversees on a continuous basis and evaluates at its quarterly meetings, directly and through the committees of the Board, the nature and quality of significant services provided to the Fund, the investment performance of the Fund, shareholder services, audit and compliance functions and a variety of other matters relating to the Fund’s operations. The information considered and the discussions held at the meetings included, but were not limited to:

• the nature, extent and quality of investment management, shareholder services and other services provided to the Fund;

• the wide range of programs and services provided to the Fund and their shareholders on a routine and non-routine basis;

• the compliance policies, procedures, and regulatory experience of the Advisors;

• data comparing the cost of owning the Fund to the cost of owning similar funds;

24

• the fact that there will be no changes to the fees, services, or personnel who provide such services as compared to the Prior Agreements;

• data comparing the Fund’s performance to appropriate benchmarks and/ or a peer group of other mutual funds with similar investment objectives and strategies;

• financial data showing the profitability of the Fund to the Advisors and the overall profitability of the Advisors;

• data comparing services provided and charges to the Fund with those for other non-fund investment management clients of the Advisors; and

• consideration of collateral or “fall-out” benefits derived by the Advisors from the management of the Fund and potential sharing of economies of scale in connection with the management of the Fund.

The Board also considered whether there was any reason for not continuing the existing arrangement with the Advisor. In particular, the Board recognized that shareholders may have invested in the Fund on the strength of the Advisor’s industry standing and reputation and in the expectation that the Advisor will have a continuing role in providing services to the Fund.

The Board considered all of the information provided by the Advisor, the Subadvisor, the independent data providers, and the Board’s independent counsel, and evaluated such information for the Fund. The Board did not identify any single factor as being all-important or controlling, and each Board member may have attributed different levels of importance to different factors. In deciding to approve the Proposed Agreement under the terms ultimately determined by the Board to be appropriate, the Board based its decision on a number of factors, including the following:

Nature, Extent and Quality of Services – Generally. Under the Proposed Agreement, ACIM is responsible for providing or arranging for all services necessary for the operation of the Fund. The Board noted that under the Proposed Agreement, ACIM provides or arranges at its own expense a wide variety of services including:

• constructing and designing the Fund

• portfolio research and security selection

• initial capitalization/funding

• securities trading

• Fund administration

• custody of Fund assets

• daily valuation of the Fund’s portfolio

25

• shareholder servicing and transfer agency, including shareholder confir-

mations, recordkeeping and communications

• legal services

• regulatory and portfolio compliance

• financial reporting

• marketing and distribution

The Board noted that many of these services have expanded over time both in terms of quantity and complexity in response to shareholder demands, competition in the industry, changing distribution channels and the changing regulatory environment.

Investment Management Services. The investment management services provided to the Fund are complex and provide Fund shareholders access to professional money management, instant diversification of their investments within an asset class, the opportunity to easily diversify among asset classes, and liquidity. As a part of its general oversight and in evaluating investment performance, the Board expects ACIM to manage the Fund in accordance with its investment objectives and approved strategies. In providing these services, ACIM utilizes teams of investment professionals who require extensive information technology, research, training, compliance and other systems to conduct their business. The Board, directly and through its Fund Performance Review Committee, regularly reviews investment performance information for the Fund, toget her with comparative information for appropriate benchmarks and/or peer groups of similarly-managed funds, over different time horizons. If performance concerns are identified, the Fund receives special reviews until performance improves, during which time the Board discusses with ACIM the reasons for such underperformance and any efforts being undertaken to improve performance.

Shareholder and Other Services. Under the Proposed Agreement, ACIM will also provide the Fund with a comprehensive package of transfer agency, shareholder, and other services. The Board, directly and through the various committees of the Board, regularly reviews reports and evaluations of such services. These reports include, but are not limited to, information regarding the operational efficiency and accuracy of the shareholder and transfer agency services provided, staffing levels, shareholder satisfaction (as measured by external as well as internal sources), technology support, new products and services offered to Fund shareholders, securities trading activities, portfolio valuation services, auditing services, and legal and operational compliance activities. Certain aspects of shareholder and transfer agency service level eff iciency and the quality of securities trading activities are measured by independent third party providers and are presented in comparison to other fund groups not managed by ACIM.

26

Costs of Services Provided and Profitability. The Advisor provided detailed information concerning its cost of providing various services to the Fund, its profitability in managing the Fund, its overall profitability, and its financial condition. The Board reviewed with the Advisor the methodology used to prepare this financial information. The Board has also reviewed with the Advisor its methodology for compensating the investment professionals that provide services to the Fund as well as compensation to the five highest paid personnel of the Advisor. This financial information regarding the Advisor is considered in order to evaluate the Advisor’s financial condition, its ability to continue to provide services under the Proposed Agreement, and the reasonableness of the proposed management fees. The Board concluded that the Advisor’s profits were reasonable in light of the services provided to the Fund.

Ethics. The Board generally considers ACIM’s commitment to providing quality services to shareholders and to conducting its business ethically. It noted that ACIM’s practices generally meet or exceed industry best practices.

Economies of Scale. The Board also reviewed information provided by ACIM regarding the possible existence of economies of scale in connection with the management of the Fund. The Board concluded that economies of scale are difficult to measure and predict with precision, especially on a fund-by-fund basis. The analysis of economies of scale is further complicated by the additional services and content provided by ACIM and its reinvestment in its ability to provide and expand those services. Accordingly, the Board seeks to evaluate economies of scale by reviewing information, such as year-over-year profitability of its advisor generally, the profitability of its management of the Fund specifically, and the expenses incurred by the advisor in providing various functions to the Fund. The Board believes ACIM will appropriately sha re economies of scale through its competitive fee structure, offering competitive fees from fund inception, fee breakpoints as the Fund increases in size, and through reinvestment in its business to provide shareholders additional services and enhancements to existing services.

Comparison to Fees of Funds not Managed by the Advisor. Both the Prior and Proposed Agreements provide that the Fund pays ACGIM or ACIM a single, all-inclusive (or unified) management fee for providing all services necessary for the management and operation of the Fund, other than brokerage expenses, taxes, interest, extraordinary expenses, and the fees and expenses of the Fund’s Independent Directors (including their independent legal counsel) and expenses incurred in connection with the provision of shareholder services and distribution services under a plan adopted pursuant to Rule 12b-1 under the 1940 Act. Under the unified fee structure, ACIM is responsible for providing all investment advisory, custody, audit, administrative, compliance, recordkeeping, marketing and shareholder services, or arranging and supervising third parties that provide such services. By contrast, most other funds are charged a variety of fees, including an investment advisory fee, a transfer agency fee, an administrative fee, distribution charges and other expenses. Other than their investment advisory fees and any applicable Rule 12b-1 distribution fees, the components of the total fees charged by these other funds may be

27

increased without shareholder approval. The Board believes the unified fee structure is a benefit to Fund shareholders because it clearly discloses to shareholders the cost of owning Fund shares, and, since the unified fee cannot be increased without a vote of Fund shareholders, it shifts to ACIM the risk of increased costs of operating the Fund and provides a direct incentive to minimize administrative inefficiencies. Part of the Board’s analysis of fee levels involves reviewing certain evaluative data compiled by an independent provider comparing the Fund’s unified fee to the total expense ratios of similar funds not managed by ACIM. The Board concluded that the management fee to be paid by the Fund to ACIM under the Proposed Agreement is reasonable in light of the services to be provided to the Fund.

Comparison to Fees and Services Provided to Other Clients of the Advisor. The Board also requested and received information from ACIM concerning the nature and extent of the services, fees, and profitability of its advisory services to advisory clients other than the Fund. They observed that these varying types of client accounts require different services and involve different regulatory and entrepreneurial risks than the management of the Fund. The Board analyzed this information and concluded that the fees charged and services provided to the Fund were reasonable by comparison.

Collateral or “Fall-Out” Benefits Derived by the Advisor. The Board considered the existence of collateral benefits ACIM may receive as a result of its relationship with the Fund. The Board concluded that ACIM’s primary business is managing mutual funds and it generally does not use Fund or shareholder information to generate profits in other lines of business, and therefore does not derive any significant collateral benefits from them. The Board noted that ACIM receives proprietary research from broker-dealers that execute Fund portfolio transactions and concluded that this research is likely to benefit Fund shareholders. The Board also determined that ACIM is able to provide investment management services to certain clients other than the Fund, at least in part, due to its existing infrastructure built to serv e the fund complex. The Board concluded, however, that the assets of those other clients are not material to the analysis and, in any event, are included with the assets of fund clients to determine breakpoints in each fund’s fee schedule, provided they are managed using the same investment team and strategy.

Conclusion of the Board. As a result of this process, the Board, in the absence of particular circumstances and assisted by the advice of its independent legal counsel, taking into account all of the factors discussed above and the information provided by ACIM and others, concluded that the Proposed Agreement be approved and recommended its approval to Fund shareholders.

28

Retirement Account Information

As required by law, distributions you receive from certain IRAs, or 403(b), 457 and qualified plans are subject to federal income tax withholding, unless you elect not to have withholding apply. Tax will be withheld on the total amount withdrawn even though you may be receiving amounts that are not subject to withholding, such as nondeductible contributions. In such case, excess amounts of withholding could occur. You may adjust your withholding election so that a greater or lesser amount will be withheld.

If you don’t want us to withhold on this amount, you must notify us to not withhold the federal income tax. You may notify us in writing or in certain situations by telephone or through other electronic means. You have the right to revoke your withholding election at any time and any election you make may remain in effect until revoked by filing a new election.

Remember, even if you elect not to have income tax withheld, you are liable for paying income tax on the taxable portion of your withdrawal. If you elect not to have income tax withheld or you don’t have enough income tax withheld, you may be responsible for payment of estimated tax. You may incur penalties under the estimated tax rules if your withholding and estimated tax payments are not sufficient. You can reduce or defer the income tax on a distribution by directly or indirectly rolling such distribution over to another IRA or eligible plan. You should consult your tax advisor for additional information.

State tax will be withheld if, at the time of your distribution, your address is within one of the mandatory withholding states and you have federal income tax withheld. State taxes will be withheld from your distribution in accordance with the respective state rules.

Proxy Voting Guidelines

American Century Investment Management, Inc., the fund’s investment advisor, is responsible for exercising the voting rights associated with the securities purchased and/or held by the fund. A description of the policies and procedures the advisor uses in fulfilling this responsibility is available without charge, upon request, by calling 1-800-345-2021. It is also available on American Century Investments’ website at americancentury.com and on the Securities and Exchange Commission’s website at sec.gov. Information regarding how the investment advisor voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available on the “About Us” page at americancentury.com. It is also available at sec.gov.

Quarterly Portfolio Disclosure