Exhibit 99

RELEASE DATE: | CONTACT: |

| |

| April 21, 2009 | CHARLES P. EVANOSKI |

| | GROUP SENIOR VICE PRESIDENT |

| | CHIEF FINANCIAL OFFICER |

| | (724) 758-5584 |

| | |

| | |

| | |

| FOR IMMEDIATE RELEASE |

| |

| ESB FINANCIAL CORPORATION ANNOUNCES |

| AN INCREASE TO FIRST QUARTER EARNINGS |

| |

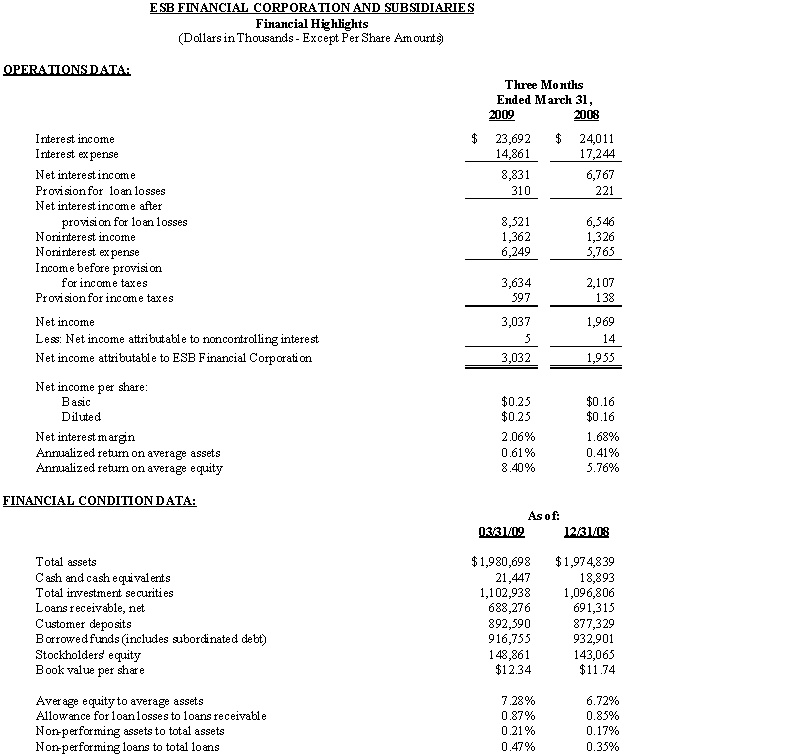

Ellwood City, Pennsylvania, April 21, 2009 – ESB Financial Corporation (Nasdaq: ESBF), the parent company of ESB Bank, today announced earnings of $0.25 per diluted share on net income of $3.0 million for the quarter ended March 31, 2009, which represents a 56.3% increase in net income per diluted share as compared to earnings of $0.16 per diluted share on net income of $2.0 million for the quarter ended March 31, 2008. The Company’s annualized return on average assets and average equity were 0.61% and 8.40%, respectively, for the quarter ended March 31, 2009.

Charlotte A. Zuschlag, President and Chief Executive Officer of the Company, stated, “The Board of Directors, senior management and I are pleased with the improvement in earnings for the quarter ended March 31, 2009, especially considering the challenging time for the banking industry. Our philosophy has been to manage the interest rate margin without compromising asset quality or future earnings potential while continuing to offer quality products to our customers. The results of these efforts are an improvement to our net interest margin of approximately 38 basis points and a significant improvement in earnings over the quarter ended March 31, 2008. Assisting the enhancement to the net interest margin was an increase in core deposits of $23.4 million, or 8.1%, since March 31, 2008. Ms. Zuschlag concluded by stating, “Management will continue to strive to pursue growth opportunities that will provide a sound investment return to our shareholders.”

Net income for the first quarter of 2009, as compared to the first quarter of 2008, increased by $1.1 million due to increases in net interest income after provision for loan losses and non-interest income of $2.0 million and $36,000, respectively, partially offset by increases in non-interest expense and provision for income taxes of $484,000 and $459,000, respectively.

Press Release

Page 2 of 3

April 21, 2009

The Company’s total assets increased by $5.9 million, or 0.3%, during the quarter to $1.98 billion at March 31, 2009. This increase resulted primarily from an increase to cash and cash equivalents of $2.6 million, or 13.5%, to $21.4 million and securities available for sale of $6.1 million, or 0.6%, to $1.10 billion, partially offset by a decrease in loans receivable of $3.0 million, or 0.4%, to $688.3 million. Total non-performing assets increased to $4.2 million at March 31, 2009 compared to $3.3 million at December 31, 2008 and non-performing assets to total assets were 0.21% at March 31, 2009 compared to 0.17% at December 31, 2008. The Company’s total liabilities increased a nominal $63,000 to $1.83 billion at March 31, 2009. Total stockholders’ equity increased $5.8 million, or 4.1%, to $148.9 million at March 31, 2009, from $143.1 million at December 31, 2008. The increase to stockholders’ equity was primarily the result of increases in accumulated other comprehensive income and retained earnings of $4.4 million and $1.8 million, respectively, and a decrease in unearned employee stock ownership plan shares of $218,000, partially offset by a net increase in treasury stock of $610,000. Average stockholders’ equity to average assets was 7.28%, and book value per share was $12.34 at March 31, 2009 compared to 6.72% and $11.74, respectively, at December 31, 2008.

ESB Financial Corporation is the parent holding company of ESB Bank and offers a wide variety of financial products and services through 23 offices in the contiguous counties of Allegheny, Lawrence, Beaver and Butler in Pennsylvania. The common stock of the Company is traded on The Nasdaq Stock Market under the symbol “ESBF”. We make available on our web site, which is located at http://www.esbbank.com, our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, on the date which we electronically file these reports with the Securities and Exchange Commission. Investors are encouraged to access these reports and the other information about our business and operations on our web site.

This news release contains certain forward-looking statements with respect to the financial condition, results of operations and business of the Company. Forward-looking statements are subject to various factors which could cause actual results to differ materially from these estimates. These factors include, but are not limited to, changes in general economic conditions, interest rates, deposit flows, loan demand, competition, legislation or regulation and accounting principles, policies or guidelines, as well as other economic, competitive, governmental, regulatory and accounting and technological factors affecting the Company’s operations.

Press Release

Page 3 of 3

April 21, 2009