VALUES WE SHARE

| | | | |

| | |

Our Purpose: | | C | | USTOMER SATISFACTION |

| | | — Strive to exceed customer expectations |

| | | | — Listen, understand and respond to customer needs — Serve in a friendly, professional, caring way, adding that personal touch — Earn confidence and loyalty of customers through exceptional service |

| | |

Our Foundation: | | I | | NTEGRITY |

| | | — Uncompromising, adhere to highest professional and personal ethics |

| | | | — Accept responsibility, fulfill commitments and maintain credibility — Actions founded on honesty, fairness and trust — Do what’s right |

| | |

Our Goal: | | E | | XCELLENCE |

| | | — Approach responsibilities with passion and commitment |

| | | | — Consistently endeavor to do the best job possible — Committed to the concept of rising expectations and continual improvement — Set challenging goals, learn from mistakes, demonstrate innovation and creativity and attention to detail |

| | |

Our Style: | | T | | EAMWORK |

| | | — Value diversity and the contributions of others |

| | | | — Share information and expertise — Build trust and relationships through open candid communication — Enthusiastically work together to achieve common goals |

| | |

Our Responsibility: | | C | | OMMUNITY INVOLVEMENT |

| | | — Give time, skills and resources to improve our communities |

| | | | — Be a positive role model; strive to make a difference |

| | |

Our Strength: | | L | | EADERSHIP |

| | | — Lead by example in both words and actions |

| | | | — Stimulate and relish opportunities for positive change — Recognize performance, effectively plan and communicate, demand quality — Respect others and encourage a balanced life approach |

| | | | |

| |

| | Company Profile |

| |

| | ESB Financial Corporation (NASDAQ: ESBF), a publicly traded financial services company, provides a wide range of retail and commercial financial products and services to customers in Western Pennsylvania through its wholly owned subsidiary, ESB Bank. |

| |

| | ESB Bank is a Pennsylvania chartered, FDIC insured stock savings bank which, as of December 31, 2011, conducted business through 25 offices in Allegheny, Beaver, Butler and Lawrence counties, Pennsylvania. To compliment retail and commercial operations conducted through its bank offices, the Company invests in U.S. Government, municipal and mortgage-backed securities through ESB Bank. |

| |

| | Mission Statement |

| |

| | The mission of ESB Financial Corporation and its subsidiaries is to effectively provide for the financial service needs of our customers and community while creating value for our shareholders. Our mission will be accomplished by growing in a profitable and controlled manner; by identifying and meeting the financial needs of our customers; by offering quality products and services that are competitively priced and serviced by a knowledgeable, attentive and friendly staff; and by creating a positive work environment that maximizes the alignment of customer and employee objectives. |

Consolidated Financial Highlights

(Dollar amounts in thousands, except share data)

| | | | | | | | | | | | |

| | | As of or for the

year ended December 31, | |

| | 2011 | | | 2010 | | | Change | |

| | | |

Total assets | | | $1,964,791 | | | | $1,913,867 | | | | 3% | |

| | | |

Securities available for sale | | | 1,130,116 | | | | 1,077,672 | | | | 5% | |

| | | |

Loans receivable, net | | | 648,921 | | | | 640,887 | | | | 1% | |

| | | |

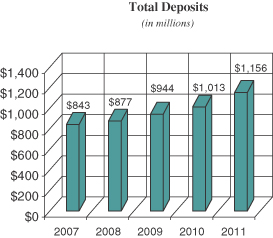

Total deposits | | | 1,156,410 | | | | 1,012,645 | | | | 14% | |

| | | |

Borrowed funds, including junior subordinated notes | | | 606,960 | | | | 715,456 | | | | (15%) | |

| | | |

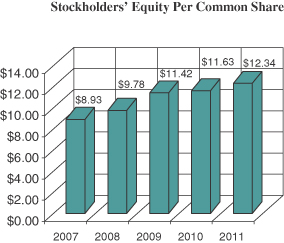

Stockholders’ equity | | | 179,075 | | | | 167,353 | | | | 7% | |

| | | |

Net interest income | | | 44,087 | | | | 42,967 | | | | 3% | |

| | | |

Net income | | | 14,910 | | | | 14,231 | | | | 5% | |

| | | |

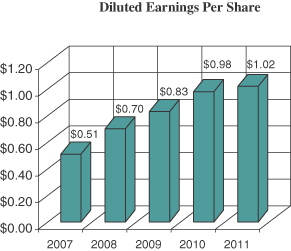

Net income per share (diluted) (1) | | | $1.02 | | | | $0.98 | | | | 4% | |

| | | |

Cash dividends declared per share (1) | | | $0.38 | | | | $0.33 | | | | 0.14 | |

| | | |

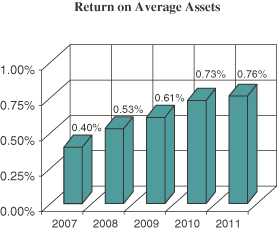

Return on average assets | | | 0.76% | | | | 0.73% | | | | 4% | |

| | | |

Return on average stockholders’ equity (1) | | | 8.40% | | | | 8.26% | | | | 2% | |

| (1) | Per share data has been adjusted for the year 2010 to reflect the six-for-five stock split paid on May 16, 2011. |

| | | | |

| ESB Financial Corporation | | 2 | | 2011 Annual Report |

Consolidated Financial Highlights(continued)

| | | | |

| ESB Financial Corporation | | 3 | | 2011 Annual Report |

Letter to Shareholders

Dear Fellow Shareholders:

ESB Financial Corporation delivered remarkable results in 2011 and for a third year in a row reported record earnings. The Company posted earnings of $1.02 per diluted share on net income of $14.9 million for the year ended December 31, 2011, which represents a 4.1% increase in net income per diluted share as compared to earnings of $0.98 per diluted share on net income of $14.2 million for the year ended December 31, 2010.

The past several years have presented a challenging time for the banking industry. Our philosophy has been to manage the interest rate margin without compromising asset quality or future earnings potential while continuing to offer quality products to our customers. We accomplish this philosophy by challenging our employees to actively pursue new customers through commercial, public and personal checking account relationships. The results continue to be outstanding. The overall deposit growth for the year ended December 31, 2011 was $143.8 million or 14.2% when compared to December 31, 2010. Included in the $143.8 million increase is growth of approximately $111.0 million in low cost core deposits.

These results as well as the prior year growth of approximately $51.2 million in core deposits has fueled the improvement to our cost of funds which decreased 39 basis points to 2.00% when compared to 2.39% for the year ended December 31, 2010 and has contributed towards our ability to maintain our net interest margin which increased slightly in 2011 to 2.67% when compared to 2.62% at December 31, 2010. This steadfast policy in managing and growing our interest rate margin has minimized the effect of impairment related charges on securities and joint ventures on our income in 2011. Management will continue to strive to pursue investment and growth opportunities that will provide a sound investment return to our shareholders, such as the recent construction of our 25th office in Cranberry Township, Butler County, which opened in the fourth quarter of 2011.

I am pleased to report that during 2011, the Board of Directors declared its tenth six-for-five stock split of the ESBF common stock. This stock split, combined with our maintaining the current payout of $0.10 per share quarterly cash dividend, effectively increased the cash payout to our stockholders by 20%. I am also pleased to state that with current quarterly cash dividends remaining at $0.10 per share in 2011 our record of paying cash dividends was extended to 86 consecutive quarters. As in previous years, the Board of Directors approved a common stock repurchase program, and for the year, the Company repurchased approximately 356,000 shares with a market value of $4.8 million.

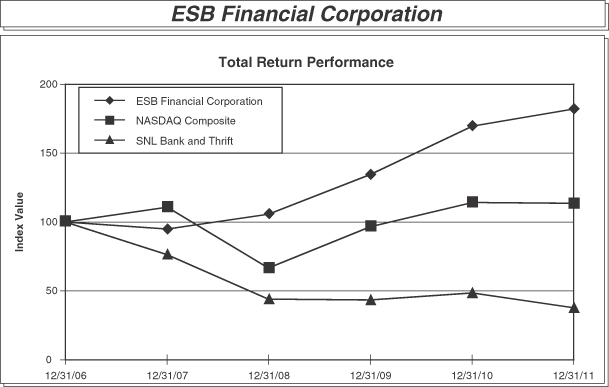

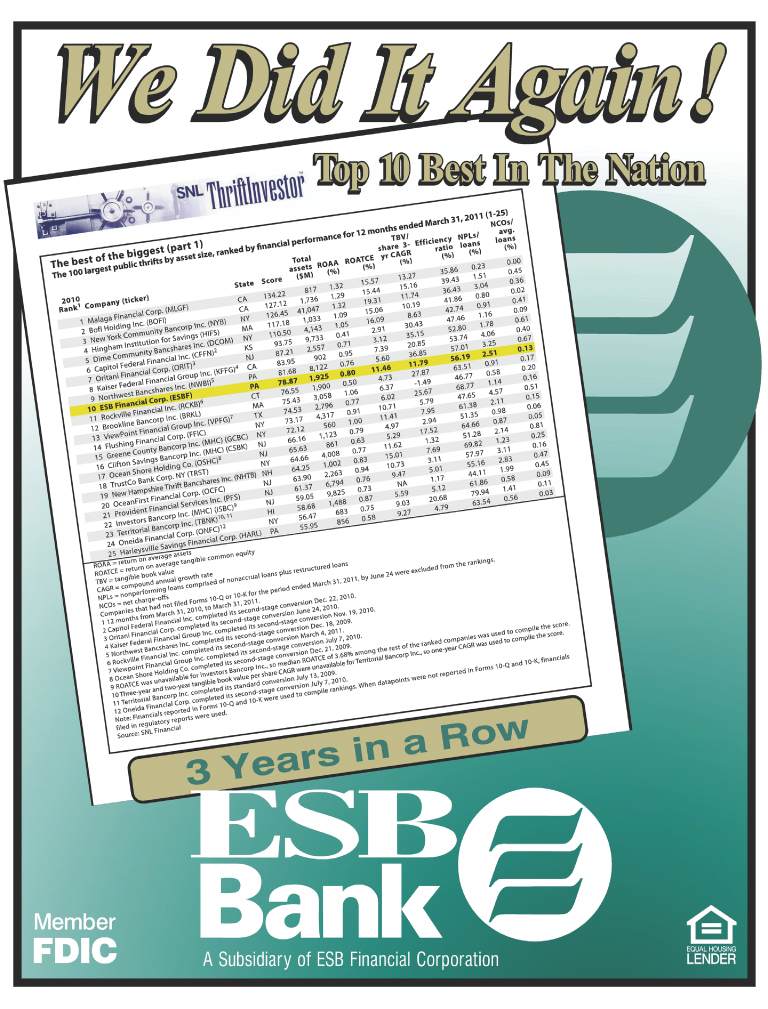

Recognition

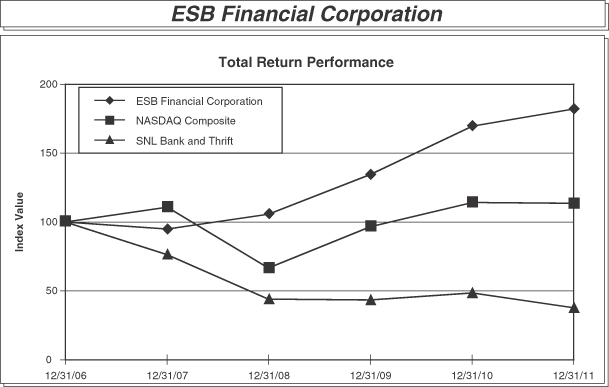

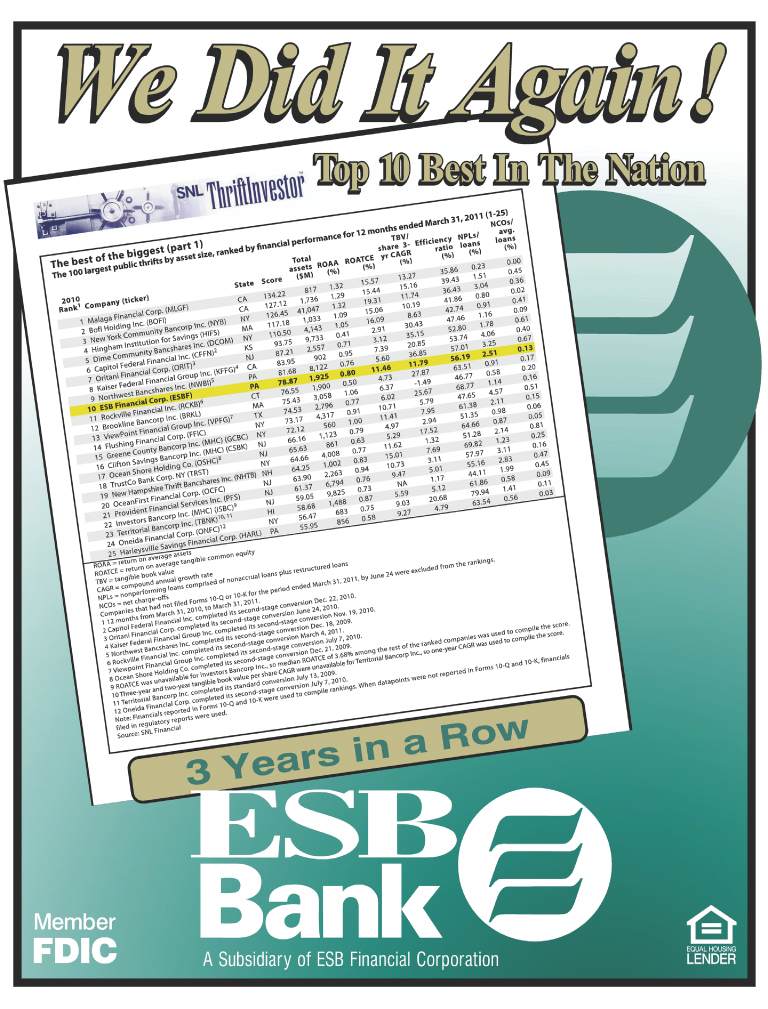

In addition to record earnings, 2011 proved to be a very successful year for ESB Financial Corporation in a number of ways. The Company received recognition at both the national and local level, SNL Financial, a nationally recognized financial information firm, ranked ESB Financial Corp. in the top 10 of the 100 largest public thrifts by asset size for the third year in a row and Bauer Financial, which is another organization that evaluates the strength of banking institutions, once again rated ESB Bank 5-stars (out of 5-stars) for superior financial stability. Additional recognition at the national level came by way of KBW Inc. which named ESB Financial Corporation to its “Bank Honor Roll” of superior performers. Only 40 U.S. Banking Institutions received this recognition for successfully navigating the financial crisis and generating a superior ten-year track record.

Not only did the Company receive national recognition, but once again received praise at the local level. The Pittsburgh Business Times again honored ESB Bank as one of the Best Places to Work in Western PA. Customers in Beaver County, Ellwood City and the New Castle areas voted ESB Bank “Best of the Best in Banking” for 2011. Both of these honors have become an almost annual tradition.

| | | | |

| ESB Financial Corporation | | 4 | | 2011 Annual Report |

Letter to Shareholders (continued)

Community

At ESB, we believe that we are all responsible for the health and success of our communities. Our involvement extends beyond the bricks and mortar of our buildings into the community, through individual volunteerism and company-wide support for those in need of help. We’re proud of our commitment and service – we just don’t talk the talk of community involvement, we walk the walk.

The Company strongly encourages employees to participate in charitable, community and personal service activities. So much, that a Community Service Program is in place to encourage and recognize those employees actively involved in community organizations and activities. During 2011, 131 ESB Bank employees reported a total of 5,223 community service hours donated to organizations ranging from schools, churches, volunteer fire departments to youth organizations and participation in charitable fundraisers. This equates to approximately 652 eight hour days or 130 forty hour work weeks.

Many of these employees spent paid time volunteering during the regular workday. Each year the top “Shining Stars” are recognized during a Community Service Recognition Luncheon. This luncheon is proudly supported and attended by executive and senior management. You will often see ESB as a sponsor for local athletic sports as well as other artistic, cultural and/or musical events. These include events at our local school districts as well as those put on by or through other community groups. The Company also once again participated in the Educational Improvement Tax Credit Program (EITC). This program provides tax credits to eligible businesses contributing to a Scholarship Organization or an Educational Improvement Organization. In 2011, ESB was able to distribute $70,000 to thirty organizations throughout Western Pennsylvania.

Looking Ahead

2011 can be summarized by: record earnings, growth, awards, recognition and community. The combined hard work of our employees and the strong leadership of our board of directors made this past year the best year at our Company. I want to thank all of those who contributed to our past success and those that will continue to contribute to our future success. I also want to thank you, our shareholders and customers for your continued trust, loyalty and support.

Needless to say, there will be many challenges in 2012 and in future years. Look at the Federal Reserve’s recent announcement, interest rates will remain at current and historical low levels through the end of 2014. Despite this challenge and others that will inevitably turn up, “I am confident and optimistic that we can build on our past success and look ahead to future success”. Much of what we accomplished and the momentum we have will carry over into 2012 and beyond.

Again, I would like to thank all of you, our customers, our shareholders, our employees and our Board of Directors for your dedication to the success of ESB. We invite our shareholders to join us at our annual shareholders’ meeting on Wednesday, April 18, 2012 at 4:00 p.m. at the Connoquenessing Country Club in Ellwood City, Pennsylvania.

Sincerely,

Charlotte A. Zuschlag

President and Chief Executive Officer

| | | | |

| ESB Financial Corporation | | 5 | | 2011 Annual Report |

Selected Consolidated Financial Data

(Dollar amounts in thousands, except share data)

| | | | | | | | | | | | | | | | | | | | |

| | | As of December 31, | |

Financial Condition Data | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| | | | | |

Total assets | | $ | 1,964,791 | | | $ | 1,913,867 | | | $ | 1,960,677 | | | $ | 1,974,839 | | | $ | 1,880,235 | |

Securities | | | 1,130,116 | | | | 1,077,672 | | | | 1,106,910 | | | | 1,096,806 | | | | 1,059,972 | |

Loans receivable, net | | | 648,921 | | | | 640,887 | | | | 671,387 | | | | 691,315 | | | | 624,251 | |

Deposits | | | 1,156,410 | | | | 1,012,645 | | | | 944,347 | | | | 877,329 | | | | 842,854 | |

Borrowed funds, including subordinated debt | | | 606,960 | | | | 715,456 | | | | 829,641 | | | | 932,901 | | | | 876,727 | |

Stockholders’ equity | | | 179,075 | | | | 167,353 | | | | 164,752 | | | | 143,065 | | | | 133,657 | |

Stockholders’ equity per common share (1) | | | $12.34 | | | | $11.63 | | | | $11.42 | | | | $9.78 | | | | $8.93 | |

| |

| | | For the year ended December 31, | |

Operations Data | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

Net interest income | | $ | 44,087 | | | $ | 42,967 | | | $ | 38,148 | | | $ | 31,143 | | | $ | 24,983 | |

Provision for loan losses | | | 1,130 | | | | 1,404 | | | | 912 | | | | 1,406 | | | | 865 | |

| | | | | | | | | | | | | | | | | | | | |

Net interest income after provision for loan losses | | | 42,957 | | | | 41,563 | | | | 37,236 | | | | 29,737 | | | | 24,118 | |

Noninterest income | | | 4,306 | | | | 4,467 | | | | 3,595 | | | | 5,277 | | | | 7,216 | |

Noninterest expense | | | 28,062 | | | | 27,813 | | | | 26,784 | | | | 23,042 | | | | 22,667 | |

| | | | | | | | | | | | | | | | | | | | |

Income before income taxes | | | 19,201 | | | | 18,217 | | | | 14,047 | | | | 11,972 | | | | 8,667 | |

Provision for income taxes | | | 3,380 | | | | 3,553 | | | | 2,382 | | | | 1,548 | | | | 400 | |

| | | | | | | | | | | | | | | | | | | | |

Net income | | | 15,821 | | | | 14,664 | | | | 11,665 | | | | 10,424 | | | | 8,267 | |

Less: net income (loss) attributable to the noncontrolling interest | | | 911 | | | | 433 | | | | (347) | | | | 209 | | | | 606 | |

| | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 14,910 | | | $ | 14,231 | | | $ | 12,012 | | | $ | 10,215 | | | $ | 7,661 | |

| | | | | | | | | | | | | | | | | | | | |

Net income per common share: | | | | | | | | | | | | | | | | | | | | |

Basic (1) | | | $1.03 | | | | $0.99 | | | | $0.84 | | | | $0.71 | | | | $0.52 | |

Diluted (1) | | | $1.02 | | | | $0.98 | | | | $0.83 | | | | $0.70 | | | | $0.51 | |

| | | As of or for the year ended December 31, | |

Other Data | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

Performance Ratios (for the year ended) | | | | | | | | | | | | | | | | | | | | |

Return on average assets | | | 0.76% | | | | 0.73% | | | | 0.61% | | | | 0.53% | | | | 0.40% | |

Return on average equity | | | 8.40% | | | | 8.26% | | | | 7.66% | | | | 7.88% | | | | 5.98% | |

Average equity to average assets | | | 9.08% | | | | 8.87% | | | | 7.95% | | | | 6.72% | | | | 6.74% | |

Interest rate spread (2) | | | 2.52% | | | | 2.48% | | | | 2.14% | | | | 1.73% | | | | 1.38% | |

Net interest margin (2) | | | 2.67% | | | | 2.62% | | | | 2.29% | | | | 1.90% | | | | 1.57% | |

Efficiency ratio | | | 51.21% | | | | 51.58% | | | | 57.84% | | | | 55.21% | | | | 63.88% | |

Noninterest expense to average assets | | | 1.43% | | | | 1.43% | | | | 1.36% | | | | 1.20% | | | | 1.22% | |

Dividend payout ratio (3) | | | 37.58% | | | | 33.90% | | | | 40.00% | | | | 47.62% | | | | 65.57% | |

Asset Quality Ratios (as of year end) | | | | | | | | | | | | | | | | | | | | |

Non-performing loans to total loans | | | 2.00% | | | | 2.00% | | | | 0.59% | | | | 0.35% | | | | 0.36% | |

Non-performing assets to total assets | | | 0.88% | | | | 0.75% | | | | 0.25% | | | | 0.17% | | | | 0.23% | |

Allowance for loan losses to total loans | | | 0.98% | | | | 1.00% | | | | 0.88% | | | | 0.85% | | | | 0.85% | |

Allowance for loan losses to non-performing loans | | | 48.86% | | | | 49.78% | | | | 147.58% | | | | 239.95% | | | | 236.21% | |

Capital Ratios (as of year end) | | | | | | | | | | | | | | | | | | | | |

Stockholders’ equity to assets | | | 9.11% | | | | 8.74% | | | | 8.40% | | | | 7.24% | | | | 7.07% | |

Tangible stockholders’ equity to tangible assets | | | 5.89% | | | | 5.76% | | | | 5.19% | | | | 4.77% | | | | 4.78% | |

| (1) | Outstanding shares and per share data have been adjusted for the years 2010, 2009, 2008 and 2007 to reflect the six-for-five stock split paid on May 16, 2011. |

| (2) | Interest income utilized in calculation is on a fully tax equivalent basis, which is deemed to be the most prevalent industry standard for measuring interest rate spread and net interest margin. |

| (3) | Dividend payout ratio calculation utilizes diluted net income per share for all periods. |

| | | | |

| ESB Financial Corporation | | 6 | | 2011 Annual Report |

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

Overview

ESB Financial Corporation (the Company) is a Pennsylvania corporation and thrift holding company that provides a wide range of retail and commercial financial products and services to customers in Western Pennsylvania through its wholly-owned subsidiary, ESB Bank (ESB or the Bank). The Company is also the parent company of ESB Capital Trust II (Trust II), ESB Statutory Trust III (Trust III) and ESB Capital Trust IV (Trust IV), Delaware statutory business trusts established to facilitate the issuance of trust preferred securities to the public, and THF, Inc., a Pennsylvania corporation established as a title agency to provide residential and commercial loan closing services and title closing services.

ESB is a Pennsylvania chartered Federal Deposit Insurance Corporation (FDIC) insured stock savings bank. At December 31, 2011, the Bank conducted business through 25 offices in Allegheny, Beaver, Butler and Lawrence Counties, Pennsylvania. ESB operates two wholly-owned subsidiaries: (i) AMSCO, Inc., which engages in the management of certain real estate development partnerships on behalf of the Company and (ii) ESB Financial Services, Inc., a Delaware corporation which holds loans and other investments.

ESB is a financial intermediary whose principal business consists of attracting deposits from the general public and investing such deposits in real estate loans secured by liens on residential and commercial properties, consumer loans, commercial business loans, securities and interest-earning deposits.

The Company is subject to examination and regulation by the Board of Governors of the Federal Reserve System (Federal Reserve) as a savings and loan holding company. The Bank is subject to examination and comprehensive regulation by the FDIC and the Pennsylvania Department of Banking. ESB is a member of the Federal Home Loan Bank (FHLB) of Pittsburgh, which is one of the twelve regional banks comprising the FHLB System. ESB is further subject to regulations of the Federal Reserve which governs the reserves required to be maintained against deposits and certain other matters.

During the year ended December 31, 2011, the Company reported net income of $14.9 million, an increase of $679,000, or 4.8%, compared to the year ended December 31, 2010. The income for the year reflects the Company’s sustained effort to manage the net interest margin during this challenging time for the banking industry without compromising asset quality or future earnings potential. The result of this effort is reflected in our earnings, which increased over the prior year, the strong growth to our deposit base and our net interest margin, which increased slightly over 2010. The increase in the net interest margin was driven by a decrease to interest expense of $6.8 million, or 16.1%, partially offset by a decrease in interest income of $5.6 million, or 6.6%. The Company has an ongoing campaign to increase commercial, public and personal checking accounts. The results of which were an increase in low cost core deposits. The Company was able to replace higher priced borrowings with these lower rate deposits therefore contributing to the decline in the cost of funds for the year by 39 basis points to 2.00% at December 31, 2011 from 2.39% at December 31, 2010, which led to a decrease in overall interest expense.

The Company is continuing efforts to improve the net interest margin by employing strategies to further decrease the cost of funds, while attempting to increase the yield from the investment portfolio. The Company employs a strategy of purchasing cash-flowing fixed and variable rate mortgage-backed securities funded by wholesale borrowings, which are comprised of FHLB advances and repurchase agreements.

The Company has utilized a wholesale strategy since its initial public offering in 1990. The Company manages this strategy through its interest rate risk management on a macro level. The wholesale strategy operates with a lower cost of operations, although with lower interest rate spreads and, therefore, at a lower margin than the retail operations of the Company. This strategy historically produces wider margins during periods of lower short-term interest rates, reflected in a steep yield curve and can be susceptible to net interest margin strain in rapidly rising

| | | | |

| ESB Financial Corporation | | 7 | | 2011 Annual Report |

Management’s Discussion and Analysis of

Financial Condition and Results of Operations(continued)

rates and rapidly declining rates as well as a sustained inverted yield curve. During 2011, this wholesale leverage strategy accounted for $4.8 million, of the Company’s tax equivalent net interest income of $47.9 million.

Management continues to pursue methods of insulating this wholesale strategy from significant fluctuations in interest rates by: (1) incorporating a laddered maturity schedule of up to five years on the wholesale borrowings; (2) purchasing interest rate caps; (3) providing structure in the investment portfolio in the form of corporate bonds and municipal securities; (4) utilizing cash flows from fixed and adjustable rate mortgage-backed securities; and (5) including the Company’s securities in the available for sale portfolio thereby creating the flexibility to change the composition of the portfolio through restructuring as management deems it necessary due to interest rate fluctuations. Management believes that this insulation affords them the ability to react to measured changes in interest rates and restructure the Company’s balance sheet accordingly. This strategy is continually evaluated by management on an ongoing basis.

This Management Discussion and Analysis section of the Annual Report contains certain forward-looking statements (as defined in the Private Securities Litigation Reform Act of 1995). In the normal course of business, we, in an effort to help keep our shareholders and the public informed about our operations, may from time to time issue or make certain statements, either in writing or orally, that are or contain forward-looking statements, as that term is defined in the U.S. federal securities laws. Generally, these statements relate to business plans or strategies, projected or anticipated benefits from acquisitions made by or to be made by us, projections involving anticipated revenues, earnings, profitability or other aspects of operating results or other future developments in our affairs or the industry in which we conduct business. Forward-looking statements may be identified by reference to a future period or periods or by the use of forward-looking terminology such as “anticipate,” “believe,” “expect,” “intend,” “plan,” “estimate” or similar expressions.

Although we believe that the anticipated results or other expectations reflected in our forward-looking statements are based on reasonable assumptions, we can give no assurance that those results or expectations will be attained. Forward-looking statements involve risks, uncertainties and assumptions (some of which are beyond our control) and as a result actual results may differ materially from those expressed in forward-looking statements. Factors that could cause actual results to differ from forward-looking statements include, but are not limited to, the following, as well as those discussed elsewhere herein:

| | • | | our investments in our businesses and in related technology could require additional incremental spending might not produce expected deposit and loan growth and anticipated contributions to our earnings; |

| | • | | general economic or industry conditions could be less favorable than expected, resulting in a deterioration in credit quality, a change in the allowance for loan and lease losses or a reduced demand for credit or fee-based products and services; |

| | • | | changes in the interest rate environment could reduce net interest income and could increase credit losses; |

| | • | | the conditions of the securities markets could change, which could adversely affect, among other things, the value or credit quality of our assets, the availability and terms of funding necessary to meet our liquidity needs and our ability to originate loans and leases; |

| | • | | changes in the extensive laws, regulations and policies governing financial holding companies and their subsidiaries could alter our business environment or affect our operations; |

| | • | | the potential need to adapt to industry changes in information technology systems, on which we are highly dependent, could present operational issues or require significant capital spending; |

| | | | |

| ESB Financial Corporation | | 8 | | 2011 Annual Report |

Management’s Discussion and Analysis of

Financial Condition and Results of Operations(continued)

| | • | | competitive pressures could intensify and affect our profitability, including as a result of continued industry consolidation, the increased availability of financial services from non-banks, technological developments such as the internet or bank regulatory reform; |

| | • | | acquisitions may result in one-time charges to income, may not produce revenue enhancements or cost savings at levels or within time frames originally anticipated and may result in unforeseen integration difficulties; and |

| | • | | acts or threats of terrorism and actions taken by the United States or other governments as a result of such acts or threats, including possible military action, could further adversely affect business and economic conditions in the United States generally and in our principal markets, which could have an adverse effect on our financial performance and that of our borrowers and on the financial markets and the price of our common stock. |

You should not put undue reliance on any forward-looking statements. Forward-looking statements speak only as of the date they are made and we undertake no obligation to update them in light of new information or future events except to the extent required by federal securities laws.

Critical Accounting Policies and Estimates

The Company’s consolidated financial statements are prepared in accordance with U.S. generally accepted accounting principles (GAAP) and follow general practices within the industry in which it operates. Application of these principles requires management to make estimates, assumptions and judgments that affect the amounts reported in the financial statements and accompanying notes. These estimates, assumptions and judgments are based on information available as of the date of the financial statements; accordingly, as this information changes, the financial statements could reflect different estimates, assumptions and judgments. Certain policies inherently have a greater reliance on the use of estimates, assumptions and judgments and as such have a greater possibility of producing results that could be materially different than originally reported. Estimates, assumptions and judgments are necessary when assets and liabilities are required to be recorded at fair value, when a decline in the value of an asset not carried on the financial statements at fair value warrants an impairment write-down or valuation reserve to be established, or when an asset or liability needs to be recorded contingent upon a future event. Carrying assets and liabilities at fair value inherently results in more financial statement volatility. The fair values and the information used to record valuation adjustments for certain assets and liabilities are based either on quoted market prices or are provided by other third-party sources, when available. When third-party information is not available, valuation adjustments are estimated in good faith by management primarily through the use of internal cash flow modeling techniques.

The Company’s most significant accounting policies are presented in Note 1 to the consolidated financial statements and are discussed below. These policies along with the disclosures presented in the other financial statement notes and in this financial review, provide information on how significant assets and liabilities are valued in the financial statements and how those values are determined. Based on the valuation techniques used and the sensitivity of financial statement amounts to the methods, assumptions and estimates underlying those amounts, management has identified the determination of the fair value of securities, the allowance for loan losses and the valuation of goodwill, income taxes and intangible assets to be the accounting areas that require the most subjective or complex judgments.

| | | | |

| ESB Financial Corporation | | 9 | | 2011 Annual Report |

Management’s Discussion and Analysis of

Financial Condition and Results of Operations(continued)

Securities

Securities are reported at fair value adjusted for premiums and discounts which are recognized in interest income using the interest method over the period to maturity. Declines in the fair value of individual securities below their amortized cost and that are deemed to be other than temporary, will be written down to current market value and included in earnings as realized losses. For a discussion on the determination of an other than temporary decline, please refer to Note 1 of the consolidated financial statements. Management systematically evaluates securities for other than temporary declines in fair value on a quarterly basis. The Company had impairment charges of approximately $78,000 on a $2.5 million collateralized debt obligation that is comprised of sixteen financial institutions. This charge was in addition to impairment charges of $1.9 million taken on the same security in the prior three years. At December 31, 2011, the Company utilized an independent third party to analyze this bond. Management determined that no additional impairment on the bond existed at December 31, 2011. During this analysis, the value of this security was derived using a discounted cash flow method which is a level three pricing method. Additionally, the Company had impairment charges of approximately $317,000 on five of its equity investments in various banks that had experienced a decline in their market value for the last several quarters and impairment charges of approximately $52,000 on a private label mortgage backed security.

Allowance for loan losses

The allowance for loan losses is increased by charges to income and decreased by charge-offs (net of recoveries). The Company’s periodic evaluation of the adequacy of the allowance for loan losses is determined by management through evaluation of the loss exposure on individual non-performing, delinquent and high-dollar loans; review of economic conditions and business trends; historical loss experience and growth and composition of the loan portfolio, as well as other relevant factors.

A quantitative analysis is utilized to support the adequacy of the allowance for loan losses. This analysis includes review of historical charge-off rates for loan categories, fluctuations and trends in the amount of classified loans and economic factors. Significant to this analysis are any changes in observable trends that may be occurring relative to loans to assess potential weaknesses within the credit. Current economic factors and trends in risk ratings are considered in the determination and allocation of the allowance for loan losses.

The allowance for loan losses was $6.5 million allocated as follows at December 31, 2011: residential loans $2.1 million, or 31.7%; commercial real estate $2.5 million, or 38.0%; commercial business loans $384,000, or 5.9%, consumer loans $1.0 million, or 16.0% and an unallocated portion of $551,000, or 8.4%. The allowance for loan losses was $6.5 million at December 31, 2010.

Goodwill and other intangible assets

The guidance in GAAP regarding goodwill and other intangible assets establishes standards for the amortization of acquired intangible assets and the non-amortization and impairment assessment of goodwill. At December 31, 2011, the Company had $554,000 of core deposit intangible assets subject to amortization and $41.6 million in goodwill, which was not subject to periodic amortization.

Goodwill arising from business combinations represents the value attributable to unidentifiable intangible elements in the business acquired. The Company’s goodwill relates to value inherent in the banking business and the value is dependent upon the Company’s ability to provide quality, cost effective services in a competitive market place. As such, goodwill value is supported ultimately by revenue that is driven by the volume of business transacted. A decline in earnings as a result of a lack of growth or the inability to deliver cost effective services over sustained periods can lead to impairment of goodwill that could adversely impact earnings in future periods.

| | | | |

| ESB Financial Corporation | | 10 | | 2011 Annual Report |

Management’s Discussion and Analysis of

Financial Condition and Results of Operations(continued)

In September 2011, the FASB issued ASU No. 2011-08,Testing Goodwill for Impairment which permits an entity to make a qualitative assessment of whether it is more likely than not that a reporting unit’s fair value is less than its carrying amount before applying the two-step goodwill impairment test. The Company evaluated goodwill by assessing various qualitative factors to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount. The Company concluded that the recorded value of goodwill was not impaired as a result of the evaluation.

Income taxes

The Company files a consolidated federal income tax return. Deferred tax assets and liabilities are computed based on the difference between the financial statement and the income tax basis of assets and liabilities using the enacted marginal tax rates. Deferred income taxes or benefits are based on changes in the deferred tax asset or liability from period to period. Deferred tax assets and liabilities are reflected at currently enacted income tax rates applicable to the period in which such items are expected to be realized or settled. As changes in tax rates are enacted, deferred tax assets and liabilities are adjusted through the provision for income taxes. The Company evaluates its deferred tax assets to ensure they are able to be recognized through future taxable income. Should a deficiency exist, the Company would establish valuation allowance for the asset.

Changes in Financial Condition

General. The Company’s total assets increased $50.9 million, or 2.7%, to $1.96 billion at December 31, 2011 from $1.91 billion at December 31, 2010. This increase was primarily composed of net increases in cash and cash equivalents, securities available for sale, loans receivable, premises and equipment, real estate acquired through foreclosure, and bank owned life insurance of $3.1 million, $52.4 million, $8.0 million, $1.2 million, $2.8 million and $704,000, respectively, partially offset by decreases to loans held for sale, accrued interest receivable, Federal Home Loan Bank (FHLB) stock, real estate held for investment, intangible assets, securities receivable and prepaid expenses and other assets of $80,000, $380,000, $4.8 million, $7.0 million, $341,000, $1.0 million and $3.7 million, respectively.

The increase in the Company’s total assets reflects a corresponding increase in total liabilities of $39.2 million, or 2.2%, to $1.79 billion at December 31, 2011 compared to $1.75 billion at December 31, 2010 and an increase in total stockholders’ equity of $11.7 million, or 7.0%, to $179.1 million at December 31, 2011 from $167.4 million at December 31, 2010. The increase in total liabilities was primarily due to increases in deposits, advance payments by borrowers for taxes and insurance and accrued expenses and other liabilities of $143.8 million, $78,000 and $4.6 million, partially offset by decreases in FHLB advances, repurchase agreements, other borrowings and accounts payable for land development of $83.1 million, $20.0 million, $5.4 million and $775,000 respectively. The net increase in total stockholders’ equity can be attributed primarily to increases in common stock, additional paid in capital, retained earnings and accumulated other comprehensive income (AOCI) of $25,000, $438,000, $9.6 million and $5.6 million as well as a decrease in treasury stock of $875,000. These items were partially offset by an increase in unearned employee stock ownership plan of $4.2 million.

Cash on hand, Interest-earning deposits and Federal funds sold. Cash on hand, interest-earning deposits and federal funds sold represent cash equivalents which increased a combined $3.1 million, or 8.8%, to $38.8 million at December 31, 2011 from $35.7 million at December 31, 2010. Deposits from customers into savings and checking accounts, loan and security repayments and proceeds from borrowed funds typically increase these accounts. Decreases result from customer withdrawals, new loan originations, security purchases and repayments of borrowed funds.

Securities. The Company’s securities and loan portfolios represent its two largest balance sheet asset classifications, respectively. The Company’s securities portfolio increased by $52.4 million, or 4.9%, to $1.1 billion at December 31, 2011. During 2011, the Company recorded purchases of available for sale securities of

| | | | |

| ESB Financial Corporation | | 11 | | 2011 Annual Report |

Management’s Discussion and Analysis of

Financial Condition and Results of Operations(continued)

$302.5 million, consisting of purchases of fixed-rate mortgage backed securities of $191.6 million, adjustable-rate securities of $14.0 million, $12.1 million of municipal bonds, $84.1 million of corporate bonds and $711,000 of equity securities. In addition, the portfolio increased by $11.7 million due to increases in market value. These fair value adjustments represent temporary fluctuations resulting from changes in market rates in relation to average yields in the available for sale portfolio. Offsetting these increases were sales of $25.4 million, consisting of sales of fixed-rate mortgage backed securities of $24.6 million, adjustable-rate mortgage back securities of $648,000 and common stock of $204,000, resulting in an aggregate net gain of $937,000. In addition, there were repayments and maturities of securities of $234.8 million, premium amortizations of $2.0 million and OTTI losses of $447,000. These fair value adjustments represent temporary fluctuations resulting from changes in market rates in relation to average yields in the available for sale portfolio. If securities are held to their respective maturity dates, no fair value gain or loss is realized.

Loans receivable. The loans receivable category consists primarily of single family mortgage loans used to purchase or refinance personal residences located within the Company’s market area and commercial real estate loans used to finance properties that are used in the borrowers’ businesses or to finance investor-owned rental properties and to a lesser extent commercial and consumer loans. Net loans receivable increased $8.0 million, or 1.3%, to $648.9 million at December 31, 2011 from $640.9 million at December 31, 2010. Included in this increase were increases in mortgage loans and other loans of $6.3 million, or 1.3% and $6.3 million, or 3.7%, respectively, partially offset by increases in the allowance for loan losses, deferred fees and loans in process of approximately $4.6 million, or 27.4%, combined. The increase in net loans receivable is due to several factors, including a decrease of approximately $44.3 million in repayments to $172.4 million in 2011 as compared to $216.8 million in 2010, partially offset by a slight decrease in originations of approximately $3.2 million, to $181.8 million for 2011 as compared to $185.1 million for 2010. The yield on the loan portfolio decreased to 5.47% at December 31, 2011 from 5.64% at December 31, 2010.

Loans held for sale. Loans held for sale decreased to $0 at December 31, 2011 from $80,000 at December 31, 2010. During the period the Company originated loans held for sale of approximately $325,000 and sold approximately $411,000, with a resulting gain of approximately $6,000.

Non-performing assets. Non-performing assets include non-accrual loans, repossessed vehicles, real estate acquired through foreclosure (REO) and loans modified in troubled debt restructuring (TDR). Non-performing assets increased to $17.3 million, or 0.88%, of total assets at December 31, 2011 from $14.4 million, or 0.75%, of total assets at December 31, 2010. Non-performing assets consisted of non-performing loans, REO, repossessed vehicles and TDR of $5.6 million, $3.9 million, $69,000 and $7.8 million respectively, at December 31, 2011 and $5.7 million, $1.1 million, $193,000 and $7.5 million, respectively, at December 31, 2010. The increase in non-performing assets was primarily due to an increase in REO as well as an increase in TDR’s.

Accrued interest receivable. Accrued interest receivable decreased by $380,000, or 4.0%, to $9.2 million at December 31, 2011 as compared to $9.6 million at December 31, 2010. This decrease was primarily a result of decreases in the yields on both the loan and securities portfolios.

FHLB stock. FHLB stock decreased $4.8 million to $21.3 million at December 31, 2011 compared to $26.1 million at December 31, 2010. The Bank is required to maintain an investment in capital stock of the FHLB of Pittsburgh in an amount not less than 5.0% of its outstanding notes payable to the FHLB of Pittsburgh. In 2008 the FHLB suspended both the payment of dividends and the repurchase of excess capital stock. During the fourth quarter of 2010 the FHLB partially lifted the suspension with a limited repurchase of excess stock. The dividend suspension remains in effect and no dividends were paid in 2011. Recently the FHLB declared a dividend equal to an annual yield of 0.10% on the Company’s average balances during the fourth quarter of 2011. This repurchase restriction could result in the Bank’s investment in FHLB stock being greater than 5.0% of its outstanding notes payable to the FHLB.

| | | | |

| ESB Financial Corporation | | 12 | | 2011 Annual Report |

Management’s Discussion and Analysis of

Financial Condition and Results of Operations(continued)

Premises and equipment. Premises and equipment increased $1.2 million, or 8.6%, to $15.1 million at December 31, 2011 from $13.9 million at December 31, 2010. This increase was primarily due to construction of the Company’s 25th branch office in Cranberry Twp, PA which was opened in the fourth quarter of 2011.

Real estate held for investment. The Company’s real estate held for investment decreased $7.0 million, or 31.5%, to $15.3 million at December 31, 2011 from $22.3 million at December 31, 2010. This decrease is the result of sales activity in the joint ventures in which the Company has a 51% ownership as well as write-downs of land acquisition and development costs and unit construction costs of approximately $1.3 million at four of the Company’s joint ventures. For a complete description of the Company’s existing projects see “Item 1. Business –Subsidiaries” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2011.

Intangible assets. Intangible assets decreased $341,000, or 38.1%, to $554,000 at December 31, 2011 from $895,000 at December 31, 2010. The decrease primarily resulted from amortization of the core deposit intangible of approximately $332,000. Additionally, the mortgage servicing asset resulting from the loan sale and securitization in 2002 experienced amortization of approximately $15,000 in 2011, partially offset by a $6,000 recovery of the valuation against the servicing asset.

Prepaid expenses and other assets. Prepaid expenses and other assets decreased by $3.7 million, or 31.3%, to $8.1 million at December 31, 2011 from $11.8 million at December 31, 2010. This decrease is primarily the result of decreases in the prepaid FDIC premium, the fair value of the interest rate cap contracts and the deferred tax asset of $1.2 million, $200,000 and $2.6 million, respectively.

Bank owned life insurance. Bank owned life insurance (BOLI) is universal life insurance, purchased by the Bank, on the lives of the Bank’s employees. The beneficial aspects of these universal life insurance policies are tax-free earnings and a tax-free death benefit, which are realized by ESB as the owner of the policies. The cash surrender value of the BOLI as of December 31, 2011 was $30.8 million.

Deposits. The Company considers various sources when evaluating funding needs, including but not limited to deposits, which are a significant source of funds totaling $1.2 billion, or 65.6%, of the Company’s total funding sources at December 31, 2011. Total deposits increased $143.8 million, or 14.2%, to $1.2 billion at December 31, 2011 from $1.0 billion at December 31, 2010. For the year, the Company’s interest-bearing demand and savings deposits increased $99.6 million, or 33.5%, time deposits increased $32.8 million, or 5.2% and noninterest-bearing deposits increased $11.4 million, or 13.6%. The increase to core deposits of approximately $111.0 million is primarily due to the Company’s ongoing campaign to increase these types of accounts. The Company continues to be diligent in monitoring the rates being offered by regional banks in the Company’s market area and offering special time deposit rates to remain competitive.

Advance payments by borrowers for taxes and insurance. Advance payments by borrowers for taxes and insurance increased $78,000, or 3.2%, to $2.5 million at December 31, 2011 from $2.4 million at December 31, 2010 due to the increase in the net loans receivable.

Borrowed funds. The Company utilizes short and long-term borrowings as another source of funding for asset growth and liquidity needs. These borrowings primarily include FHLB advances and repurchase agreement borrowings. Borrowed funds decreased $108.5 million, or 15.2%, to $607.0 million at December 31, 2011 from $715.5 million at December 31, 2010. FHLB advances decreased $83.1 million, or 28.6%, repurchase agreements decreased $20.0 million, or 5.5%, other borrowings decreased $5.4 million, or 34.6%, while junior subordinated notes remained the same at $46.4 million.

Accounts payable for land development. Accounts payable for land development decreased by $775,000 to $2.6 million at December 31, 2011 from $3.4 million at December 31, 2010. This account represents the unpaid portion of the development costs for the Company’s joint ventures. The decrease is primarily due to ongoing

| | | | |

| ESB Financial Corporation | | 13 | | 2011 Annual Report |

Management’s Discussion and Analysis of

Financial Condition and Results of Operations(continued)

construction activity at the Company’s existing joint venture projects and that the Company did not begin any new projects in 2011.

Accrued expenses and other liabilities. Accrued expenses and other liabilities increased $4.6 million, or 36.9%, to $17.2 million at December 31, 2011 from $12.6 million at December 31, 2010. The increase was primarily due to an increase in the deferred tax liability of $2.7 million as well as an increase in the valuation allowance on the interest rate swap contracts, partially offset by decreases in accrued interest and escrow accounts and various liability accounts.

Stockholders’ equity. Stockholders’ equity increased by $11.7 million, or 7.0%, to $179.1 million at December 31, 2011 from $167.4 million at December 31, 2010. The increase in total stockholders’ equity can be attributed primarily to increases in common stock, additional paid in capital, retained earnings and AOCI of $25,000, $438,000, $9.6 million and $5.6 million, respectively, as well as a decrease in treasury stock of $875,000. These items were partially offset by an increase in unearned employee stock ownership plan of $4.2 million. The increase in AOCI represents temporary fluctuations resulting from changes in market rates in relation to average yields in the available for sale portfolio.

Results of Operations

General. The Company reported net income of $14.9 million, $14.2 million and $12.0 million in 2011, 2010 and 2009, respectively.

Average Balance Sheet and Yield/Rate Analysis. The following table sets forth, for the periods indicated, information concerning the total dollar amounts of interest income from interest-earning assets and the resultant average yields, the total dollar amounts of interest expense on interest-bearing liabilities and the resultant average costs, net interest income, interest rate spread and the net interest margin earned on average interest-earning assets. For purposes of this table, average balances are calculated using monthly averages and the average loan balances include non-accrual loans and exclude the allowance for loan losses and interest income includes accretion of net deferred loan fees. Yields on tax-exempt securities and loans (tax-exempt for federal income tax purposes) are shown on a fully tax equivalent basis utilizing a federal tax rate of 34%.

| | | | |

| ESB Financial Corporation | | 14 | | 2011 Annual Report |

Management’s Discussion and Analysis of

Financial Condition and Results of Operations(continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollar amounts in thousands) | | Year ended December 31, | |

| | | 2011 | | | | | 2010 | | | | | 2009 | |

| | | Average | | | | | | Yield / | | | | | Average | | | | | | Yield / | | | | | Average | | | | | | Yield / | |

| | | Balance | | | Interest | | | Rate | | | | | Balance | | | Interest | | | Rate | | | | | Balance | | | Interest | | | Rate | |

Interest-earning assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Taxable securities available for sale | | $ | 776,765 | | | $ | 31,751 | | | | 4.09% | | | | | $ | 770,176 | | | $ | 35,134 | | | | 4.56% | | | | | $ | 847,578 | | | $ | 43,095 | | | | 5.08% | |

Taxable corporate bonds AFS | | | 163,690 | | | | 6,203 | | | | 3.79% | | | | | | 147,453 | | | | 6,314 | | | | 4.28% | | | | | | 109,089 | | | | 4,709 | | | | 4.32% | |

Tax-exempt securities available for sale | | | 142,729 | | | | 6,415 | | | | 6.81% | | | | | | 132,164 | | | | 5,933 | | | | 6.80% | | | | | | 121,078 | | | | 5,400 | | | | 6.76% | |

| | | | | | | | | | | | | | | | |

| | | 1,083,184 | | | | 44,369 | | | | 4.40% | | | | | | 1,049,793 | | | | 47,381 | | | | 4.80% | | | | | | 1,077,745 | | | | 53,204 | | | | 5.19% | |

| | | | | | | | | | | | | | | | |

Mortgage loans | | | 469,358 | | | | 25,612 | | | | 5.46% | | | | | | 491,014 | | | | 27,596 | | | | 5.62% | | | | | | 489,817 | | | | 28,438 | | | | 5.81% | |

Other loans | | | 150,608 | | | | 8,170 | | | | 5.42% | | | | | | 161,185 | | | | 9,071 | | | | 5.63% | | | | | | 173,324 | | | | 10,027 | | | | 5.79% | |

Tax-exempt loans | | | 26,487 | | | | 1,023 | | | | 5.85% | | | | | | 19,241 | | | | 800 | | | | 6.30% | | | | | | 19,124 | | | | 806 | | | | 6.38% | |

| | | | | | | | | | | | | | | | |

| | | 646,453 | | | | 34,805 | | | | 5.47% | | | | | | 671,440 | | | | 37,467 | | | | 5.64% | | | | | | 682,265 | | | | 39,271 | | | | 5.82% | |

| | | | | | | | | | | | | | | | |

Cash equivalents | | | 40,102 | | | | 53 | | | | 0.13% | | | | | | 21,348 | | | | 16 | | | | 0.07% | | | | | | 21,529 | | | | 20 | | | | 0.09% | |

FHLB stock | | | 23,304 | | | | - | | | | - | | | | | | 27,184 | | | | - | | | | - | | | | | | 27,470 | | | | - | | | | - | |

| | | | | | | | | | | | | | | | |

| | | 63,406 | | | | 53 | | | | 0.08% | | | | | | 48,532 | | | | 16 | | | | 0.03% | | | | | | 48,999 | | | | 20 | | | | 0.04% | |

| | | | | | | | | | | | | | | | |

Total interest-earning assets | | | 1,793,043 | | | | 79,227 | | | | 4.63% | | | | | | 1,769,765 | | | | 84,864 | | | | 4.99% | | | | | | 1,809,009 | | | | 92,495 | | | | 5.29% | |

Other noninterest-earning assets | | | 163,332 | | | | - | | | | - | | | | | | 174,345 | | | | - | | | | - | | | | | | 162,422 | | | | - | | | | - | |

| | | | | | | | | | | | | | | | |

Total assets | | $ | 1,956,375 | | | $ | 79,227 | | | | 4.25% | | | | | $ | 1,944,110 | | | $ | 84,864 | | | | 4.54% | | | | | $ | 1,971,431 | | | $ | 92,495 | | | | 4.85% | |

| | | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing demand deposits | | $ | 363,403 | | | $ | 1,032 | | | | 0.28% | | | | | $ | 291,292 | | | $ | 981 | | | | 0.34% | | | | | $ | 255,929 | | | $ | 761 | | | | 0.30% | |

Time deposits | | | 646,186 | | | | 10,922 | | | | 1.69% | | | | | | 620,155 | | | | 13,289 | | | | 2.14% | | | | | | 588,496 | | | | 17,035 | | | | 2.89% | |

| | | | | | | | | | | | | | | | |

| | | 1,009,589 | | | | 11,954 | | | | 1.18% | | | | | | 911,447 | | | | 14,270 | | | | 1.57% | | | | | | 844,425 | | | | 17,796 | | | | 2.11% | |

| | | | | | | | | | | | | | | | |

FHLB advances | | | 238,779 | | | | 7,536 | | | | 3.16% | | | | | | 335,551 | | | | 11,818 | | | | 3.52% | | | | | | 459,727 | | | | 20,372 | | | | 4.43% | |

Repurchase agreements | | | 357,583 | | | | 12,481 | | | | 3.49% | | | | | | 358,833 | | | | 12,555 | | | | 3.50% | | | | | | 344,146 | | | | 12,704 | | | | 3.69% | |

Other borrowings | | | 15,770 | | | | 736 | | | | 4.67% | | | | | | 19,564 | | | | 795 | | | | 4.06% | | | | | | 29,425 | | | | 955 | | | | 3.25% | |

| | | | | | | | | | | | | | | | |

| | | 612,132 | | | | 20,753 | | | | 3.39% | | | | | | 713,948 | | | | 25,168 | | | | 3.53% | | | | | | 833,298 | | | | 34,031 | | | | 4.08% | |

| | | | | | | | | | | | | | | | |

Preferred securities - fixed | | | 36,083 | | | | 2,088 | | | | 5.79% | | | | | | 36,083 | | | | 2,111 | | | | 5.85% | | | | | | 36,083 | | | | 2,111 | | | | 5.85% | |

Preferred securities - adjustable | | | 10,310 | | | | 345 | | | | 3.35% | | | | | | 10,310 | | | | 348 | | | | 3.38% | | | | | | 10,310 | | | | 409 | | | | 3.97% | |

| | | | | | | | | | | | | | | | |

| | | 46,393 | | | | 2,433 | | | | 5.24% | | | | | | 46,393 | | | | 2,459 | | | | 5.30% | | | | | | 46,393 | | | | 2,520 | | | | 5.43% | |

| | | | | | | | | | | | | | | | |

Total interest-bearing liabilities | | | 1,668,114 | | | | 35,140 | | | | 2.11% | | | | | | 1,671,788 | | | | 41,897 | | | | 2.51% | | | | | | 1,724,116 | | | | 54,347 | | | | 3.15% | |

Noninterest-bearing demand deposits | | | 90,585 | | | | - | | | | - | | | | | | 78,902 | | | | - | | | | - | | | | | | 70,134 | | | | - | | | | - | |

Other noninterest-bearing liabilities | | | 20,130 | | | | - | | | | - | | | | | | 21,049 | | | | - | | | | - | | | | | | 20,438 | | | | - | | | | - | |

| | | | | | | | | | | | | | | | |

Total liabilities | | | 1,778,829 | | | | 35,140 | | | | 1.98% | | | | | | 1,771,739 | | | | 41,897 | | | | 2.36% | | | | | | 1,814,688 | | | | 54,347 | | | | 2.99% | |

Stockholders’ equity | | | 177,546 | | | | - | | | | - | | | | | | 172,371 | | | | - | | | | - | | | | | | 156,743 | | | | - | | | | - | |

| | | | | | | | | | | | | | | | |

Total liabilities and equity | | $ | 1,956,375 | | | $ | 35,140 | | | | 1.80% | | | | | $ | 1,944,110 | | | $ | 41,897 | | | | 2.16% | | | | | $ | 1,971,431 | | | $ | 54,347 | | | | 2.76% | |

| | | | | | | | | | | | | | | | |

Net interest income | | | | | | $ | 44,087 | | | | | | | | | | | | | $ | 42,967 | | | | | | | | | | | | | $ | 38,148 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest rate spread(difference between weighted average rate on interest-earning assets and interest-bearing liabilities) | | | | | | | | | | | 2.52% | | | | | | | | | | | | | | 2.48% | | | | | | | | | | | | | | 2.14% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest margin(net interest income as a percentage of average interest-earning assets) | | | | | | | | | | | 2.67% | | | | | | | | | | | | | | 2.62% | | | | | | | | | | | | | | 2.29% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| ESB Financial Corporation | | 15 | | 2011 Annual Report |

Management’s Discussion and Analysis of

Financial Condition and Results of Operations(continued)

Analysis of Changes in Net Interest Income. The following table analyzes the changes in interest income and interest expense in terms of: (i) changes in volume of interest-earning assets and interest-bearing liabilities and (ii) changes in yield and rates. The table reflects the extent to which changes in the Company’s interest income and interest expense are attributable to changes in rate (change in rate multiplied by prior year volume), changes in volume (changes in volume multiplied by prior year rate) and changes attributable to the combined impact of volume/rate (change in rate multiplied by change in volume). The changes attributable to the combined impact of volume/rate are allocated on a consistent basis between the volume and rate variances.

| | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollar amounts in thousands) | | 2011 vs. 2010 | | | 2010 vs. 2009 | |

| | | Increase (decrease) due to | | | Increase (decrease) due to | |

| | | Volume | | | Rate | | | Total | | | Volume | | | Rate | | | Total | |

Interest income: | | | | | | | | | | | | | | | | | | | | | | | | |

Securities | | $ | 1,471 | | | $ | (4,483) | | | $ | (3,012) | | | $ | (1,352) | | | $ | (4,471) | | | $ | (5,823) | |

Loans | | | (1,369) | | | | (1,293) | | | | (2,662) | | | | (617) | | | | (1,187) | | | | (1,804) | |

Cash equivalents | | | 20 | | | | 17 | | | | 37 | | | | - | | | | (4) | | | | (4) | |

FHLB stock | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total interest-earning assets | | | 122 | | | | (5,759) | | | | (5,637) | | | | (1,969) | | | | (5,662) | | | | (7,631) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Interest expense: | | | | | | | | | | | | | | | | | | | | | | | | |

Deposits | | | 1,422 | | | | (3,738) | | | | (2,316) | | | | 1,327 | | | | (4,853) | | | | (3,526) | |

FHLB advances | | | (3,148) | | | | (1,134) | | | | (4,282) | | | | (4,861) | | | | (3,693) | | | | (8,554) | |

Repurchase agreements | | | (44) | | | | (30) | | | | (74) | | | | 529 | | | | (678) | | | | (149) | |

Other borrowings | | | (167) | | | | 108 | | | | (59) | | | | (366) | | | | 206 | | | | (160) | |

Subordinated debt | | | - | | | | (26) | | | | (26) | | | | - | | | | (61) | | | | (61) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total interest-bearing liabilities | | | (1,937) | | | | (4,820) | | | | (6,757) | | | | (3,371) | | | | (9,079) | | | | (12,450) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net interest income | | $ | 2,059 | | | $ | (939 | ) | | $ | 1,120 | | | $ | 1,402 | | | $ | 3,417 | | | $ | 4,819 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

2011 Results Compared to 2010 Results

General. The Company reported net income of $14.9 million and $14.2 million for 2011 and 2010, respectively. The $679,000, or 4.8%, increase in net income between 2011 and 2010 can primarily be attributed to decreases in interest expense, provision for loan losses and provision for income taxes of $6.8 million, $274,000 and $173,000, respectively, partially offset by decreases in interest income and noninterest income of $5.6 million and $161,000, respectively and increases in noninterest expense and noncontrolling interest of $249,000 and $478,000, respectively.

Net interest income. Net interest income, the primary source of revenue for the Company, is determined by the Company’s interest rate spread, which is defined as the difference between income on earning assets and the cost of funds supporting those assets and the relative amounts of interest earning assets and interest bearing liabilities. Management periodically adjusts the mix of assets and liabilities, as well as the rates earned or paid on those assets and liabilities in order to manage and improve net interest income. The level of interest rates and changes in the amount and composition of interest earning assets and liabilities affect the Company’s net interest income. Historically from an interest rate risk perspective, it has been management’s perception that differing interest rate environments can cause sensitivity to the Company’s net interest income, these being extended low long-term interest rates or rapidly rising short-term interest rates as well as a sustained inverted yield curve. Net interest income increased by $1.1 million, or 2.6%, to $44.1 million for 2011, compared to $43.0 million for 2010. This increase in net interest income can be attributed to a decrease in interest expense of $6.8 million, or 16.1%, which was only partially offset by a decrease in interest income of $5.6 million, or 6.6%. The decrease to interest expense reflects a 40 basis point decrease in the cost of interest bearing liabilities to 2.11% for 2011 from 2.51% for 2010.

| | | | |

| ESB Financial Corporation | | 16 | | 2011 Annual Report |

Management’s Discussion and Analysis of

Financial Condition and Results of Operations(continued)

Interest income. Interest income decreased $5.6 million, or 6.6%, to $79.2 million for 2011, compared to $84.9 million for 2010. This decrease in interest income can be attributed to decreases in interest earned on loans receivable and securities available for sale of $2.7 million and $3.0 million, respectively.

Interest earned on loans receivable decreased $2.7 million, or 7.1%, to $34.8 million for 2011, compared to $37.5 million for 2010. This decrease was attributable to a decrease in the average balance of loan outstanding of $25.0 million, or 3.7%, to $646.5 million for the year ended December 31, 2011, as compared to $671.4 million for the year ended December 31, 2010, as well as a decrease in the yield on the portfolio to 5.47% at December 31, 2011 as compared to 5.64% at December 31, 2010.

Interest earned on securities decreased $3.0 million, or 6.4%, to $44.4 million for 2011 compared to $47.4 million for 2010. This decrease was primarily attributable to a decline in the tax equivalent yield on the portfolio of 40 basis points to 4.40% for 2011, compared to 4.80% for 2010, partially offset by an increase in the average balance of securities of $33.4 million, or 3.2% to $1.08 billion for the year ended December 31, 2011, as compared to $1.05 billion for the year ended December 31, 2010.

Interest expense. Interest expense decreased $6.8 million, or 16.1%, to $35.1 million for 2011, compared to $41.9 million for 2010. This decrease in interest expense can be attributed to decreases in interest incurred on deposits, borrowed funds and junior subordinated notes of $2.3 million, $4.4 million and $26,000, respectively.

Interest incurred on deposits decreased $2.3 million, or 16.2%, to $12.0 million for 2011, compared to $14.3 million for 2010. This decrease was primarily attributable to a decrease in the cost of interest earning deposits to 1.18% in 2011 from 1.57% in 2010, partially offset by an increase of $98.1 million, or 10.8%, in the average balance of interest-bearing deposits to $1.0 billion for 2011 as compared to $911.4 million for 2010. The Company manages its cost of interest-bearing deposits by diligently monitoring the interest rates on its products as well as the rates being offered by its competition through weekly interest rate committee meetings and utilizing rate surveys and hence subsequently adjusting rates accordingly.

Interest incurred on borrowings, which includes FHLB advances and repurchase agreements decreased $4.4 million, or 17.5%, to $20.8 million for 2011, compared to $25.2 million for 2010. This decrease was primarily attributable to a decrease in the average balance of borrowed funds of $101.8 million, or 14.3%, to $612.1 million for 2011, compared to $713.9 million for 2010, as well as a decrease in the cost of these funds to 3.39% for 2011 compared to 3.53% for 2010. The Company, as part of its wholesale strategy, continues to manage its cost of funds through its policy of laddering the maturities of borrowings up to a five year period. This strategy allows the Company the flexibility to alter its borrowing structure quarterly. During 2011, the Company had approximately $111.9 million of maturing wholesale borrowings at a weighted average rate of 2.82% and an original call/maturity of 2.4 years. The borrowings that matured were replaced with the deposit growth of approximately $143.8 million during the period. The restructuring of these borrowings contributed to the overall decline in interest expense for 2010. For purposes of determining the average life of the borrowings, the Company utilizes the call date if applicable.

Interest expense on junior subordinated notes decreased $26,000, or 1.1%, to $2.4 million at December 31, 2011 as compared to $2.5 million for 2010. This decrease was due to a decline in the cost of these funds to 5.24% for 2011, compared to 5.30% for 2010.

Provision for loan losses. The Company records provisions for loan losses to bring the total allowance for loan losses to a level deemed adequate to cover probable losses in the loan portfolio. In determining the appropriate level of allowance for loan losses, management considers historical loss experience, the financial condition of borrowers, economic conditions (particularly as they relate to markets where the Company originates loans), the status of non-performing assets, the estimated underlying value of the collateral and other factors related to the

| | | | |

| ESB Financial Corporation | | 17 | | 2011 Annual Report |

Management’s Discussion and Analysis of

Financial Condition and Results of Operations(continued)

collectibility of the loan portfolio. The provision for loan losses decreased $274,000 to $1.1 million for the year ended December 31, 2011 compared to $1.4 million for the prior year. These provisions were part of the normal operations of the Company for 2011. As a result of the provisions for loan losses during 2011 and 2010, the Company’s allowance for loan losses amounted to $6.5 million, or 0.98%, of the Company’s total loan portfolio at December 31, 2011 compared to $6.5 million, or 1.0%, at December 31, 2010. The Company’s allowance for loan losses as a percentage of non-performing loans at December 31, 2011 and December 31, 2010 was 48.86% and 49.78%, respectively.

Noninterest income. Noninterest income decreased $161,000, or 3.6%, to $4.3 million for 2011, compared to $4.5 million for 2010. This decrease can be attributed to an increase in the net realized loss on derivatives of $1.3 million as well as decreases in fees and service charges, net gain on sale of loans, cash surrender value of the bank owned life insurance and income from real estate joint ventures of $370,000, $34,000, $13,000 and $241,000, respectively. Partially offsetting these decreases was a decrease in the impairment losses on securities of $792,000 as well as increases in net realized gain on securities available for sale and other income of $937,000 and $62,000, respectively.

Fees and service charges decreased $370,000, or 9.5%, to $3.5 million for 2011, compared to $3.9 million for 2010. The decrease is primarily due to a decrease in fees on NOW Accounts of $368,000.

Net realized gain on investments increased $937,000 as there were no security sales in 2010. Net impairment losses on securities decreased $792,000 to reflect a loss of $447,000 for 2011 compared to a loss of $1.2 million for 2010. During 2011 the Company incurred pre-tax impairment charges of approximately $447,000, including approximately $78,000 on a $2.5 million collateralized debt obligation that is comprised of sixteen financial institutions, $52,000 on a private-label mortgage-backed security having a book value of approximately $1.5 million and approximately $317,000 on five of its equity investments in various banks that had experienced a decline in their market value for the last several quarters. There was non-credit related other than temporary impairment (OTTI) on these debt securities recognized in AOCI during 2011 of approximately $548,000.

Additionally, the Company had a loss on derivatives in 2011 of $2.0 million compared to a loss in 2010 of $711,000 because of market value adjustments to the Company’s interest rate caps.

Income from the cash surrender value of BOLI decreased $13,000, or 1.8%, to $704,000 for 2011, compared to $717,000 for 2010. The BOLI consists of separate account policies backed by separate account assets. These assets re-priced in 2011 during a declining rate environment, which resulted in lower overall yields.

Income from real estate joint ventures decreased $241,000, or 21.5%, to $881,000 for 2011 compared to $1.1 million for 2010. Partially offsetting the income recognized for the year was a pre-tax write-down of land acquisition and development costs as well as unit construction costs of approximately $1.3 million at the Company’s joint ventures.

Net gain on sale of loans held for sale decreased $34,000, or 85.0% to $6,000 for the period ended December 31, 2011 from $40,000 at December 31, 2010. During the period, the Company originated loans held for sale of approximately $325,000 and sold approximately $411,000 of loans held for sale. In comparison, in 2010 the Company originated approximately $3.3 million and sold approximately $3.4 million of loans held for sale.

Noninterest expense. Noninterest expenses increased $249,000, or 0.9%, to $28.1 million for 2011, compared to $27.8 million for 2010. This increase can be primarily attributed to increases in compensation and employee benefits, data processing and advertising and other expenses of $786,000, $161,000, $4,000 and $47,000, respectively, partially offset by decreases to premises and equipment, federal deposit insurance premiums and amortization of intangible assets of $49,000, $619,000 and $81,000, respectively.

| | | | |

| ESB Financial Corporation | | 18 | | 2011 Annual Report |

Management’s Discussion and Analysis of

Financial Condition and Results of Operations(continued)

Compensation and employee benefits increased $786,000, or 5.1%, to $16.3 million for 2011, compared to $15.5 million in 2010. This increase was related to normal salary adjustments and bonuses between the years of approximately $322,000 as well as increases to stock compensation expense, retirement plan expense, employee life and health insurance expenses and various taxes and insurance of $120,000, $98,000, $215,000 and $31,000, respectively.

Premises and equipment expense decreased $49,000, or 1.8%, to $2.7 million for 2011. The Company incurred decreases to expenses that were part of the normal course of business, in repairs and maintenance, taxes and depreciation to the Company’s properties.

Federal deposit insurance premiums expense decreased $619,000, or 32.6%, to $1.3 million for 2011 compared to $1.9 million for 2010. This decrease is primarily due to a decrease in the quarterly assessment rate the Bank is paying to the FDIC.

Data processing expense increased $161,000, or 7.5%, to $2.3 million for 2011 compared to $2.2 million for 2010. This increase is primarily due to increases in data service contracts and data processing service fees of $82,000 and $66,000, respectively as well as an increase in depreciation expense of $18,000.

Amortization of intangible assets decreased $81,000, or 19.6%, to $332,000 for 2011, compared to $413,000 for 2010. The decrease was to the normal amortization of the core deposit intangible of prior acquisitions. Amortization is expected to total $251,000, $170,000, $110,000 and $8,000 for the years 2012, 2013, 2014 and 2015, respectively.

Provision for income taxes. The provision for income taxes decreased $173,000, or 4.9%, to $3.4 million for 2011 as compared to $3.6 million in 2010. The effective tax rate for 2011 was 18.5% compared to 19.9% for 2010. This was primarily due to an increase in the percentage of the Company’s tax free income to total income, partially offset by the $506,000, or 2.8%, increase in pre-tax income.

Net Income Attributable to the noncontrolling interest. Minority interest increased $478,000, or 110.4%, to $911,000 for 2011 as compared to $433,000 for 2010. This represents the portion of the Company’s profits on the consolidated joint ventures earned by its partners.

2010 Results Compared to 2009 Results

General. The Company reported net income of $14.2 million and $12.0 million for 2010 and 2009, respectively. The $2.2 million, or 18.5%, increase in net income between 2010 and 2009 can primarily be attributed to a decrease in interest expense of $12.5 million as well as an increase in noninterest income of $872,000, partially offset by a decrease in interest income of $7.6 million and increases in provision for loan losses, noninterest expense, provision for income taxes and noncontrolling interest of $492,000, $1.0 million, $1.2 million and $780,000, respectively.

Net interest income. Net interest income, the primary source of revenue for the Company, is determined by the Company’s interest rate spread, which is defined as the difference between income on earning assets and the cost of funds supporting those assets and the relative amounts of interest earning assets and interest bearing liabilities. Management periodically adjusts the mix of assets and liabilities, as well as the rates earned or paid on those assets and liabilities in order to manage and improve net interest income. The level of interest rates and changes in the amount and composition of interest earning assets and liabilities affect the Company’s net interest income. Historically from an interest rate risk perspective, it has been management’s perception that differing interest rate environments can cause sensitivity to the Company’s net interest income, these being extended low long-term interest rates or rapidly rising short-term interest rates as well as a sustained inverted yield curve. Net interest income increased by $4.8 million, or 12.6%, to $43.0 million for 2010, compared to $38.1 million for 2009.

| | | | |

| ESB Financial Corporation | | 19 | | 2011 Annual Report |

Management’s Discussion and Analysis of

Financial Condition and Results of Operations(continued)

This increase in net interest income can be attributed to a decrease in interest expense of $12.5 million, or 22.9%, which was only partially offset by a decrease in interest income of $7.6 million, or 8.3%. The decrease to interest expense reflects a 64 basis point decrease in the cost of interest bearing liabilities to 2.51% for 2010 from 3.15% for 2009.

Interest income. Interest income decreased $7.6 million, or 8.3%, to $84.9 million for 2010, compared to $92.5 million for 2009. This decrease in interest income can be attributed to decreases in interest earned on loans receivable and securities available for sale of $1.8 million and $5.8 million, respectively.

Interest earned on loans receivable decreased $1.8 million, or 4.6%, to $37.5 million for 2010, compared to $39.3 million for 2009. This decrease was attributable to a decrease in the yield on the portfolio to 5.64% at December 31, 2010 as compared to 5.82% at December 31, 2009, as well as a decrease in the average balance of loans outstanding of $10.8 million, or 1.6%, to $671.4 million for the year ended December 31, 2010, as compared to $682.3 million for the year ended December 31, 2009.

Interest earned on securities decreased $5.8 million, or 10.9%, to $47.4 million for 2010 compared to $53.2 million for 2009. This decrease was primarily attributable to a decline in the tax equivalent yield on the portfolio of 39 basis points to 4.80% for 2010, compared to 5.19% for 2009, as well as a decrease in the average balance of securities of $28.0 million, or 2.6% to $1.0 billion for the year ended December 31, 2010, as compared to $1.1 billion for the year ended December 31, 2009.

Interest expense. Interest expense decreased $12.5 million, or 22.9%, to $41.9 million for 2010, compared to $54.3 million for 2009. This decrease in interest expense can be attributed to decreases in interest incurred on deposits, borrowed funds and junior subordinated notes of $3.5 million, $8.9 million and $61,000, respectively.