IRMT10.22.16 4Q 2016 Earnings Overview February 2017

2 Safe Harbor Statement All statements in this presentation that are not based on historical fact are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 and the provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. While management has based any forward-looking statements contained herein on its current expectations, the information on which such expectations were based may change. These forward-looking statements rely on a number of assumptions concerning future events and are subject to a number of risks, uncertainties, and other factors, many of which are outside of our control, that could cause actual results to materially differ from such statements. Such risks, uncertainties, and other factors include, but are not necessarily limited to, those set forth under "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2015. We operate in a highly competitive and rapidly changing environment, thus new or unforeseen risks may arise. Accordingly, investors should not place any reliance on forward-looking statements as a prediction of actual results. We disclaim any intention to, and undertake no obligation to, update or revise any forward-looking statements. Anyone reviewing this presentation is also urged to carefully review and consider the other various disclosures in the Company's Annual Report on Form 10-K, quarterly reports on Form 10-Q and Current Reports on Form 8-K. Non-GAAP Measures This presentation contains certain non-GAAP measures that are labeled as “non-GAAP”. A reconciliation of these measures to the most comparable GAAP measures is available in the Company’s earnings release and the Appendix to this presentation.

3 Full Year Financial Highlights: 2016 vs. 2015 2015 2016 % Change Revenue $184.6M $212.4M Up 15.1% YoY Software-Systems revenue $55.0M $56.8M Up 3.2% YoY Hardware Solutions revenue $129.6M $155.6M Up 20.1% YoY Gross Profit* $60.3M $64.1M Up 6.4% YoY Operating Income* $7.8M $9.8M Up 25.5% YoY EPS* $0.21 $0.25 Up 19.0% YoY * Figures reported on a non-GAAP basis. Refer to the GAAP to non-GAAP reconciliation tables included herein

4 FY 2016 Highlights ▪ Revenue growth of 15% • Strategic revenue growth of 122% ▪ Non-GAAP EPS of $0.25, 19% increase from 2015 ▪ Launched DCEngine and secured orders with Verizon • 2016 DCEngine and FlowEngine revenue of ~$70 million ▪ Expanded proof-of-concepts and trials with Tier 1 service providers ▪ Hired key executives and direct sales personnel with Tier 1 account experience

5 Strategic Products Update (4Q 2016) ▪ DCEngine • Second Tier 1 U.S. service provider with three systems in labs; potential for initial commercial revenue in second half of 2017 • New trial ongoing with existing customer to transition onto DCEngine ▪ FlowEngine • Booked initial orders with existing customer for new use case as well as with a new Tier 1 European service provider • New product scheduled for release mid-2017 ▪ MediaEngine • Record quarterly revenue in 4Q tied to continued build-out of Tier 1 Asian service provider LTE network ▪ Professional Services • Expanded ongoing projects with largest Tier 1 customer • Secured orders from two Tier 1 European service providers for CORD hardware and integration services

6 Quarterly Financial Highlights: 4Q 2016 vs. 4Q 2015 4Q 2015 4Q 2016 % Change Revenue $44.1M $40.6M Down 8.0% YoY Software-Systems revenue $15.7M $17.7M Up 12.8% YoY Hardware Solutions revenue $28.4M $22.9M Down 19.5% YoY Gross Profit* $15.9M $15.6M Down 2.0% YoY Operating Income* $2.8M $1.2M Down 56.1% YoY EPS* $0.08 $0.04 Down 50.0% YoY * Figures reported on a non-GAAP basis. Refer to the GAAP to non-GAAP reconciliation tables included herein

7 Year-end Balance Sheet Other Highlights • $55M line of credit closed September 2016 • Amended January 2017 to further expand borrowing availability • Asset-backed line against receivables • Expires Sept 2019 • 4Q16 cash generation from operations of $7.2M $ millions Q415 Q316 Q416 Cash 20.8 27.5 33.1 A/R 60.9 56.6 38.4 Inventory 30.9 19.1 20.0 Other current assets 14.1 6.4 7.1 Total current assets 126.7 109.6 98.6 Long term assets 40.4 31.7 29.6 Total Assets 167.1 141.3 128.2 A/P 43.4 32.4 20.8 Deferred revenue 23.1 6.1 5.7 Current debt 15.0 25.0 25.0 Other current 16.7 11.9 14.2 Total current liabilities 98.2 75.4 65.7 Long term liabilities 3.0 5.6 6.0 Shareholders' equity 65.9 60.3 56.5 Total liabilities + equity 167.1 141.3 128.2 Net Cash 5.8 2.5 8.1

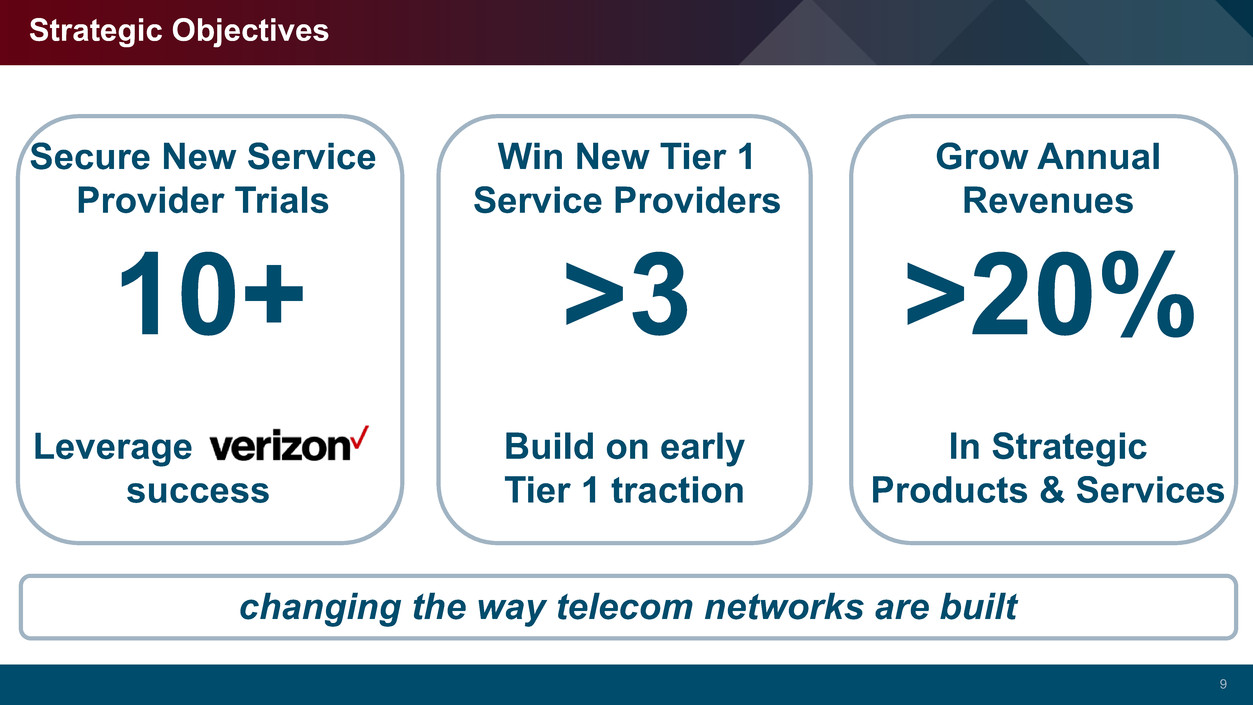

8 Disruptive Market & Opportunity Market Environment: ▪ Telecom industry in the early stages of fundamentally changing the way networks are built ▪ Service providers are looking to significantly reduce CapEx and OpEx ▪ Software defined networking, network function virtualization, and open source software and hardware, along with disruptive new business models, are the key enablers of this change Radisys Opportunity: ▪ Telecom experts with an enabling technology portfolio of open standard products and services ▪ Successful track record with multiple Tier 1 service providers ▪ Growing funnel of proof-of-concepts and trials with targeted accounts

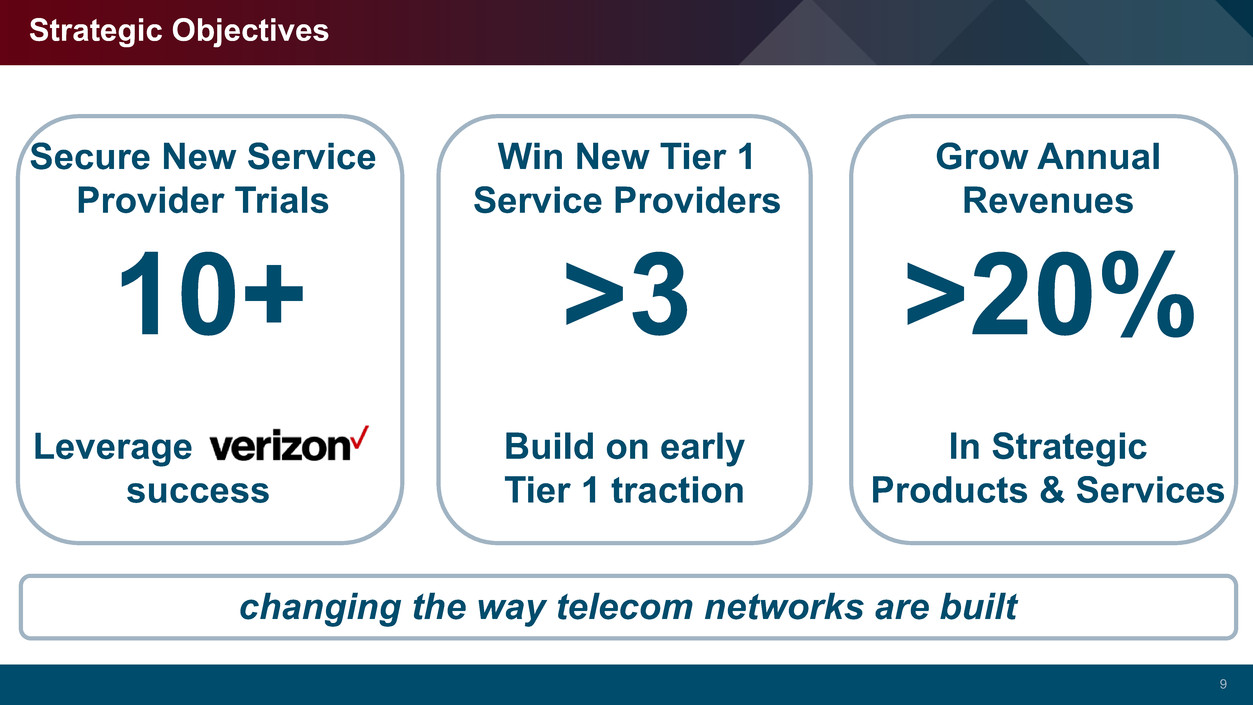

9 Strategic Objectives 10+ Secure New Service Provider Trials >20% Grow Annual Revenues In Strategic Products & Services >3 Win New Tier 1 Service Providers Build on early Tier 1 traction changing the way telecom networks are built Leverage success

10 2017 Outlook ▪ 20% growth in Strategic products & services revenue to $150M ▪ Embedded products revenue of $55M ▪ Continued investment in sales, marketing and infrastructure for Strategic products & services ▪ Maintain full year Non-GAAP profitability and positive cash flow ▪ 1Q17 Guidance: • Revenue $37 to 41M • GAAP Gross Margin 21%, EPS ($0.29) to ($0.23) • Non-GAAP Gross Margin 24 to 28%, EPS ($0.16) to ($0.10) ▪ 2017 Guidance: • Revenue $190 to 220M • GAAP Gross Margin 28%, EPS ($0.36) to ($0.24) • Non-GAAP Gross Margin 32%, EPS $0.07 to $0.17

11 APPENDIX RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

12 Reconciliation of GAAP to Non-GAAP Financial Measures Actual Results

13 Reconciliation of GAAP to Non-GAAP Financial Measures Guidance RECONCILIATION OF GAAP TO NON-GAAP GUIDANCE GROSS MARGIN (unaudited) Estimates at the midpoint of the guidance range Three Months Ended For the Year Ended March 31, 2017 December 31, 2017 GAAP 20.8% 28.0% (a) Amortization of acquired intangible assets 4.9 3.8 (b) Stock-based compensation 0.3 0.2 Non-GAAP 26.0% 32.0% RECONCILIATION OF GAAP TO NON-GAAP GUIDANCE RESEARCH AND DEVELOPMENT EXPENSE AND SELLING, GENERAL AND ADMINISTRATIVE EXPENSE (In millions, unaudited) Estimates at the midpoint of the guidance range Three Months Ended For the Year Ended March 31, 2017 December 31, 2017 GAAP $ 15.5 $ 63.0 (b) Stock-based compensation 1.0 4.0 Non-GAAP $ 14.5 $ 59.0 RECONCILIATION OF GAAP TO NON-GAAP GUIDANCE NET INCOME (LOSS) PER SHARE (In millions, except per share amounts, unaudited) Three Months Ended For the Year Ended March 31, 2017 December 31, 2017 Low End High End Low End High End GAAP net loss $ (11.3) $ (8.8) $ (14.4) $ (9.6) (a) Amortization of acquired intangible assets 3.2 3.2 10.7 10.7 (b) Stock-based compensation 1.1 1.1 4.4 4.4 (c) Restructuring and acquisition-related charges, net 0.5 0.3 1.0 0.5 (d) Income taxes 0.2 0.2 1.2 0.9 Total adjustments 5.0 4.8 17.3 16.5 Non-GAAP net income (loss) $ (6.3) $ (4.0) $ 2.9 $ 6.9 GAAP weighted average shares 39,000 39,000 39,500 39,500 Non-GAAP adjustments 1,000 1,000 1,000 1,000 Non-GAAP weighted average shares (diluted) 40,000 40,000 40,500 40,500 GAAP net loss per share (0.29) (0.23) (0.36) (0.24) Non-GAAP adjustments detailed above 0.13 0.13 0.43 0.41 Non-GAAP net income per share (diluted) $ (0.16) $ (0.10) $ 0.07 $ 0.17

14 Description of Non-GAAP Financial Measures Following is a description of the Company’s Non-GAAP measures included in the reconciliation GAAP to non-GAAP guidance included in this presentation: (a) Amortization of acquired intangible assets: Amortization of acquisition-related intangible assets primarily relate to core and existing technologies, trade name and customer relationships that were acquired with the acquisitions of Continuous Computing and Pactolus. The Company excludes the amortization of acquisition-related intangible assets because it does not reflect the Company's ongoing business and it does not have a direct correlation to the operation of the Company's business. In addition, in accordance with GAAP, the Company generally recognizes expenses for internally-developed intangible assets as they are incurred, notwithstanding the potential future benefit such assets may provide. Unlike internally-developed intangible assets, however, and also in accordance with GAAP, the Company generally capitalizes the cost of acquired intangible assets and recognizes that cost as an expense over the useful lives of the assets acquired. As a result of their GAAP treatment, there is an inherent lack of comparability between the financial performance of internally-developed intangible assets and acquired intangible assets. Accordingly, the Company believes it is useful to provide, as a supplement to its GAAP operating results, non- GAAP financial measures that exclude the amortization of acquired intangibles in order to enhance the period-over-period comparison of its operating results, as there is significant variability and unpredictability across companies with respect to this expense. (b) Stock-based compensation: Stock-based compensation consists of expenses recorded under GAAP, in connection with stock awards such as stock options, restricted stock awards and restricted stock units granted under the Company's equity incentive plans and shares issued pursuant to the Company's employee stock purchase plan. The Company excludes stock-based compensation from non-GAAP financial measures because it is a non-cash measurement that does not reflect the Company's ongoing business and because the Company believes that investors want to understand the impact on the Company of the adoption of the applicable GAAP surrounding share based payments; the Company believes that the provision of non-GAAP information that excludes stock-based compensation improves the ability of investors to compare its period-over-period operating results, as there is significant variability and unpredictability across companies with respect to this expense. (c) Restructuring and other charges, net: Restructuring and other charges, net relates to costs associated with non-recurring events. These include costs incurred for employee severance, acquisition or divestiture activities, excess facility costs, certain legal costs, asset related charges and other expenses associated with business restructuring activities. Restructuring and other charges are excluded from non-GAAP financial measures because they are not considered core operating activities. Although the Company has engaged in various restructuring activities over the past several years, each has been a discrete event based on a unique set of business objectives. The Company does not engage in restructuring activities in the ordinary course of business. As such, the Company believes it is appropriate to exclude restructuring charges from its non-GAAP financial measures because it enhances the ability of investors to compare the Company's period-over-period operating results. (d) Income taxes: Non-GAAP income tax expense is equal to the Company's projected cash tax expense. Adjustments to GAAP income tax expense are required to eliminate the recognition of tax expense from profitable entities where we utilize deferred tax assets to offset current period tax liabilities. We believe that providing this non-GAAP figure is useful to our investors as it more closely represents the true economic impact of our tax positions. (e) Gain on the liquidation of foreign subsidiaries: On a non-recurring basis we have recorded a gain or loss to reflect the realization of accumulated foreign currency translation adjustments upon the liquidation of certain international subsidiaries. This gain or loss represents the net unrealized foreign currency translation gains or losses accumulated from changes in exchange rates and the related effects from the translation of assets and liabilities of these entities. The liquidation of foreign subsidiaries occurs on an infrequent basis and management does not view the impact of this non-cash charge as indicative of the ongoing performance of the Company. As such, the Company believes it is appropriate to exclude this gain from its non-GAAP financial measures because it enhances the ability of investors to compare the Company's period-over-period operating results.

Thank You 15