Exhibit 99.1

Ladies and gentlemen good morning—it’s a pleasure to be back in New Orleans and I’d like to thank Jeff Parker and Bill Sanchez for their invitation. I’m going to use my time to give you our view of the industry today and present some of the obstacles and opportunities that we believe are essential for future growth in oil and gas production. I will also describe why I remain confident that Schlumberger is ideally positioned to benefit from the urgent need to increase production and reserves.

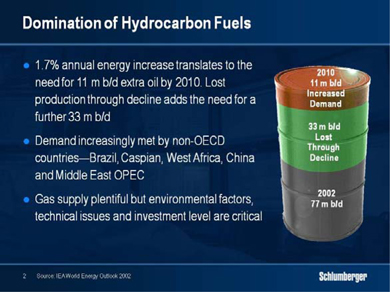

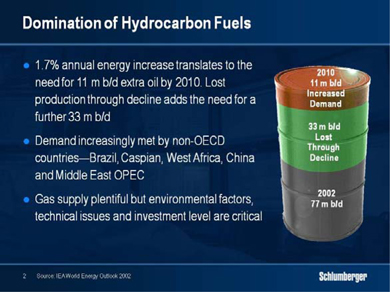

Five years ago, I used this slide to summarise oil supply and demand. As you can see, that demand was expected to grow by 11 mb/d to 88 mb/d by 2010 with three times as much production being needed to offset the decline in mature field output—assuming of course a moderate rate of decline.

Since then, non-OECD demand has grown much faster than OECD demand, while the global 88 mb/d forecast is likely to be exceeded somewhat earlier than previously forecast in spite of a quadrupling of the oil price. This unexpected strength in non-OECD demand is well illustrated by the fact that 2007 non-OECD demand has already surpassed the 2002 forecast for 2010 by 800 kb/d, while the continuing complexity in estimating global demand trends in a rapidly rising price environment is evidenced by a series of data revisions.

As an example of these revisions, in July 2006 the IEA forecast that OECD demand would reach 50 mb/d in 2007, yet in its most recent figures the agency reported that OECD demand had in fact fallen to 49.1 mb/d. This year, the IEA expects OECD demand to increase only marginally, while non-OECD demand could rise by some 1.6 mb/d—a figure far greater than the total world demand growth in 2007. These are the trends that lead me to believe that only a major global recession can have an effect on the exploration and production industry as far as the demand for oil is concerned.

The slide also emphasizes the importance of decline rate assumptions when determining the necessary level of investment in exploration and production. One way to moderate this decline is by increasing drilling intensity which has the added benefit of improving recovery. I will illustrate this later with some examples.

If we look now at where supply will come from in the future, there are several factors that affect the industry’s speed and ability to respond that are creating today’s positive outlook.

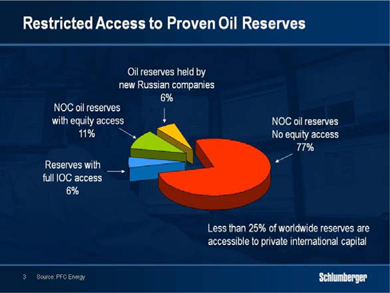

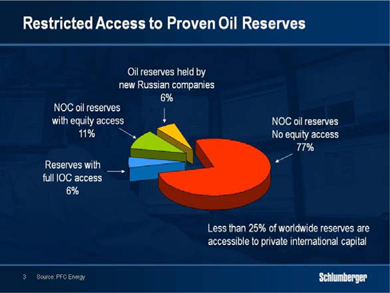

First, heightened resource nationalism around the world has limited investment opportunities for private international capital particularly in areas where quick incremental gains in production would be possible. This does not mean that gains will not occur, but it does mean that they will take longer than if access had been more open. In addition, geopolitical and security issues have either hampered efforts to maintain production in some areas, or have prevented development of new production in others.

This shift in resource control is having a fundamental effect on the oilfield service industry as more and more exploration and development work is being undertaken

directly by the national oil companies. With the majority of the identified hydrocarbon reserves lying in the Middle East, Central Asia and Russia, the industry will need to work in new geological and geographical environments. In addition, governments are increasing their tax take and any changes in upstream fiscal regimes inevitably impact our customers’ investment decisions. We have seen governments in both the developing and developed world assume that high oil prices mean they can tax with impunity. The result is lower or slower investment.

Second, the difficulty of bringing new non-OPEC production on line and on time has increased. The 2010 non-OPEC production forecast published in the IEA medium-term oil market report in 2006 was just over 53.5 mb/d, excluding Angola and Ecuador. One year later, that forecast had slipped to under 52 million led by declines in mature areas such as the North Sea and Mexico.

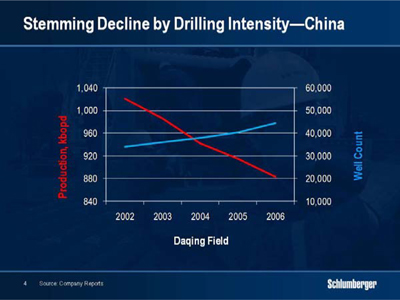

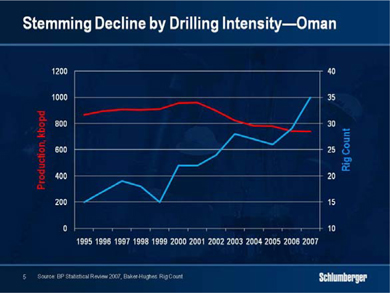

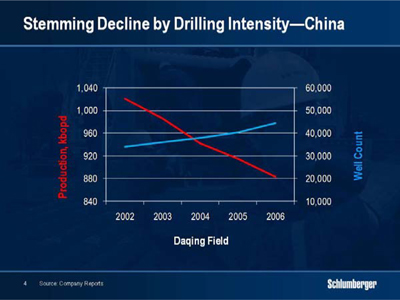

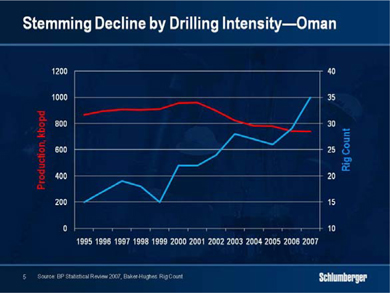

One of the main reasons for this continuing disappointment is the difficulty in stemming decline in mature fields. While new wells on land have often alleviated the problem, the logistics of offshore operations make a rapid increase in drilling intensity more difficult yet increases become necessary as offshore fields such as the North Sea mature.

The Daqing Field in China for example is one of the world’s largest producing land fields with production around 1 million bpd. In spite of 10,000 new wells being drilled over the past few years, production has fallen by more than 10%.

Oman provides another example where a doubling of rig count has not yet been sufficient to do more than slow the decline. Meanwhile, new technologies are being enthusiastically embraced to assist with stemming the decline.

While natural factors affect decline rates, these are also heavily affected by the amount of resources and degree of investment applied. In a market where operators have been devoting scarce human, technical and equipment resources to new projects, I contend that sufficient efforts have yet to be applied to stemming decline.

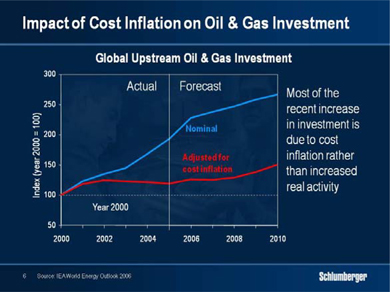

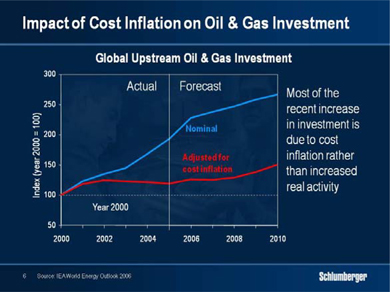

Third, the efforts of the industry to increase investment have not only led to shortages but also to high cost inflation. IEA data show that although investment has dramatically increased, much of that increase is due to cost inflation and not to activity. For example, the price of high-carbon stainless steel has more than doubled over the past three years, while the cost of cementing and stimulation raw materials has grown by half. At the same time personnel costs have increased by as much as a third in some areas.

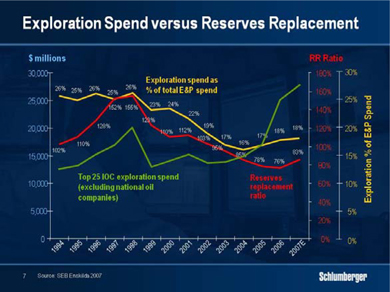

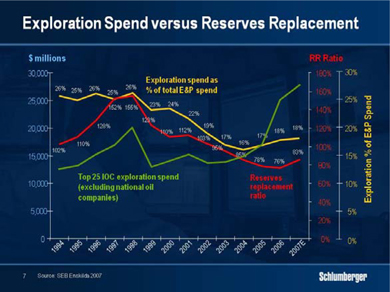

Fourth, lower exploration spending, partly as a result of the restricted domain available, has not helped the reserve replacement ratio of our customers. The estimate shown

here—based on the twenty-five top private international oil companies—clearly shows the declining trend in exploration spending over the past 10 to 12 years although recent data show some reversal of this trend that is reflected in growing activity within the service industry. While the national oil companies are excluded from this study, a recent report by Energy Intelligence shows a stagnation in overall reserves within the principal producing countries although their national companies are being increasingly active in exploration as the Tupi discovery offshore Brazil attests.

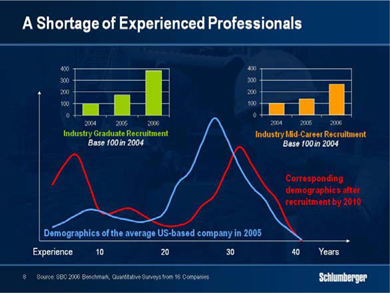

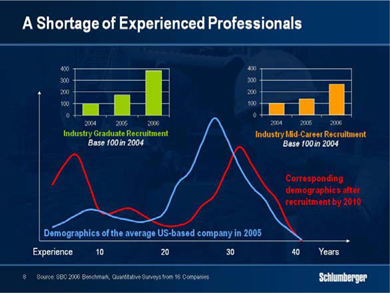

Finally, the most significant shortage is the lack of experienced professionals in almost every part of the business. Years of underinvestment in new talent have led to a limited and ageing pool of skilled workers. Their replacement cannot be done overnight, and while the industry has begun to hire again in considerable quantity, it takes time to train the large numbers of new recruits. There is little doubt that the shortage of engineering talent is the single largest factor that stops our customers from investing more.

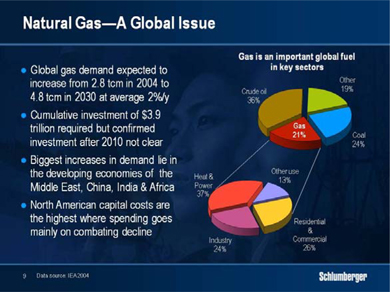

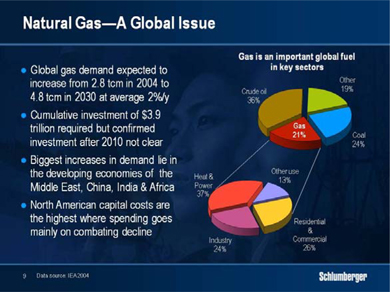

As for natural gas, IEA data show demand rising at an average annual rate of 2.5% over the 10-year period from 2004 to 2015 and then slowing somewhat thereafter. Cumulative investment of $3.9 trillion will be required to grow global supply to the levels needed to meet this demand through 2030, and demand growth will be fastest in the developing economies. But it is in North America that capital costs are highest and where spending goes mainly on combating rapid decline rates to maintain production.

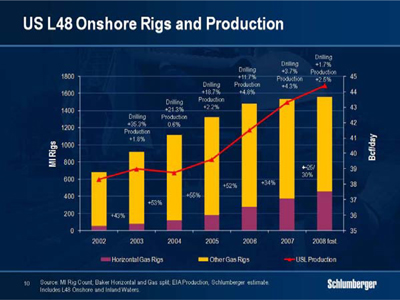

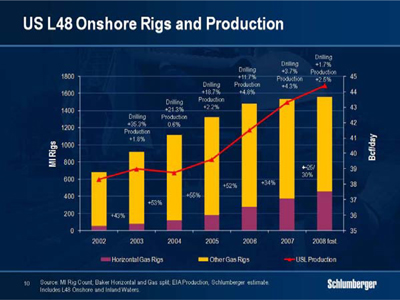

In the short term, the outlook for North American natural gas activity has improved considerably as lower storage levels, declining Canadian production and the absence of LNG cargoes on the scale of 2007 have all helped to firm prices. We anticipate a more active drilling season in Canada after the spring break up and some uptick in activity in the lower 48—a change confirmed by recent customer announcements. Many of these reservoirs display high decline rates and this has important consequences in service intensity and technology needs. In particular, the shift to horizontal wells is becoming more marked as a means to improve reservoir contact and therefore initial production rates. We believe that the high decline rates of existing fields and poorer quality reservoirs will continue to underpin activity in the medium to longer term and that excess service capacity will be gradually absorbed.

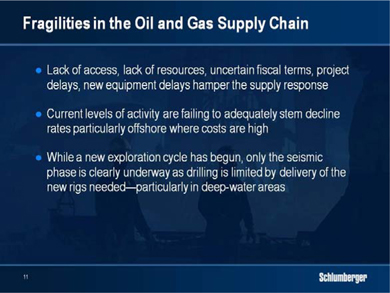

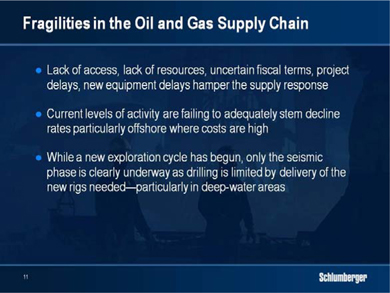

These inherent fragilities in the oil and gas supply chain mean that the response to build adequate new supplies is going to take much longer than originally anticipated. The cycle has reached a stage where a number of constraints are slowing expansion. Lack of access, lack of resources, uncertain fiscal terms, project delays and new equipment delays are all hampering the supply response. Current levels of activity are failing to adequately stem decline rates, particularly offshore where intervention and new drilling is more difficult and costly. In mature land operations, drilling will need to increase to maintain

production in areas such as Russia and Mexico. And while a new exploration cycle has begun, only the seismic phase is clearly under way as drilling is limited by the delivery of the new rigs needed—particularly in deepwater areas.

Within this context, the challenges currently facing the service industry provide opportunities for Schlumberger to grow.

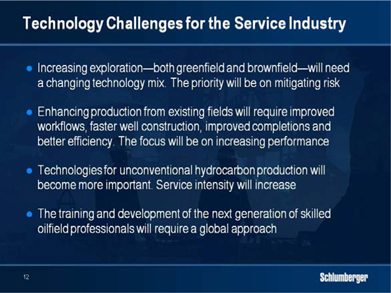

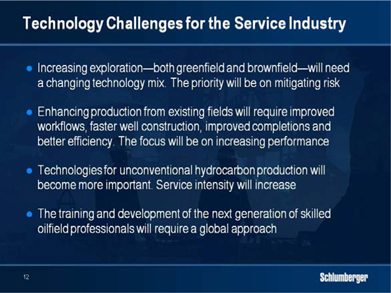

The first of these is the trend towards exploration which we believe will continue to accelerate. The economics of sustained higher oil prices are making exploration projects that would have seemed impossible only three years ago very attractive. This will affect the types of technology required as well as the overall uptake of technology. Exploration activities are more service intense than those used for development. Among these, advanced seismic and electromagnetic imaging technologies help reduce uncertainty and mitigate technical risk in complex areas where better imaging of the subsurface below salt and below basalt is essential. New methods for sampling and analyzing complex fluids in-situ enable faster and better reservoir understanding. And better reservoir testing technologies can reinsure economic viability.

Second, technology is required to improve the performance of the existing production base where 70% of fields have been producing for more than 35 years. Combating decline is crucial to this and technology intensity will only accelerate. Here we see the need for accelerated drilling and well construction where integration of completion and stimulation can bring significant operating efficiency.

Third, there will be a growing shift to more and more unconventional hydrocarbon resources. The greater service intensity required to produce unconventional natural gas in North America is just one example of this challenge. The move to heavier oil production in Canada and Venezuela is another. In addition, extreme conditions of temperature and pressure together with increasing toxicity of crudes and gases all make new exploitation more difficult.

Lastly the industry will continue to struggle with the lack of trained professionals. As a result, systems for more effective use of the core of specialists that exists will become more and more prevalent. While this will begin with their recruiting and initial training, it will need to continue in such a way that the new workforce is brought rapidly to levels of competence that permit autonomous decision-making earlier than before.

I do not intend to discuss all of these points in detail. But I would like to spend some time on how the exploration and production market is developing and why I think it offers significant potential for growth beyond the end of this decade.

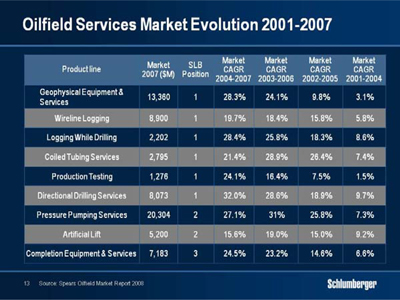

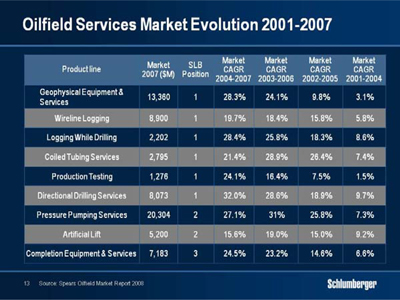

The compound annual figures shown here are taken from the annual Spears Oilfield Market report and track growth in overlapping three-year periods from 2001 to 2007. They confirm that product line growth has been heavily biased towards products and services such as pressure pumping and artificial lift. But they also show that growth has recently accelerated in the 2004-2007 timeframe for products and services linked to new exploration and development. Geophysical services, directional drilling, logging-while-drilling, wireline logging together with production testing are all likely to experience above average growth rates as new exploration activities develop.

Schlumberger has an enviable position in these markets. In the last three years we have made major technology introductions in geophysical services with Q* marine and land seismic systems, in directional drilling and logging-while-drilling with the PowerDrive* and Scope* families of services, and in Wireline with Scanner* technologies. We are also introducing significant new products and services in pressure pumping and completions with the Contact* family of stimulation technologies. Another technology that has seen significant new developments is that of petrotechnical software with the Petrel* integrated model-based seismic-to-simulation suite.

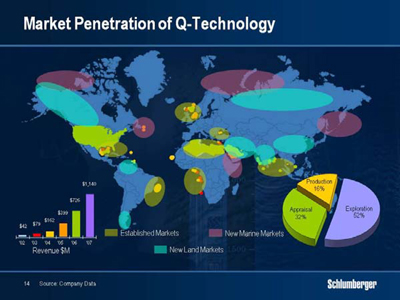

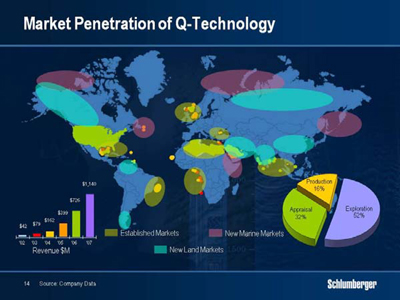

Indeed the growth of Schlumberger Q seismic is a good example of how a technology has been driven by the upsurge in exploration activity through the value it brings to the characterization of the more difficult exploration prospects of today. Q has penetrated most of the hydrocarbon basins in the world and new markets are opening in frontier environments in the Arctic, the Gulf of Suez and East Africa as well as in Alaska, Siberia, Venezuela, Argentina, India and China.

But as we have gained more experience with Q, we have also been developing more advanced applications that benefit from the quality of the data. These include the rich and wide azimuth surveys that increase illumination of potential reservoirs below salt and basalt—two minerals systematically prevalent in many of the world’s exploration areas.

Such surveys are highly complex and expensive—requiring more boats and more time while generating as much as six times more data than standard work. Q technology is succeeding here not only because of its greater fidelity, but also because its steerable streamer capability permits greater efficiency. The introduction of dynamic control steering technology adds a further level of accuracy by steering the vessel, the streamers and the source automatically and is unmatched in the industry for its capacity to acquire azimuthal data efficiently.

In response, we acquired Eastern Echo last November with two convictions in mind—first, that exploration will be a major driver of the cycle going forward, and second, that we will continue to significantly differentiate ourselves in all aspects of geophysics. The six new high-performance, high-capacity vessels will all be equipped with Q generation technology and their increased efficiency will impact the speed and complexity of future operations. These fleet additions will give WesternGeco considerable flexibility in matching capacity to demand as vessel-intensive operations grow.

At the same time we also expect integration of seismic with other data to accelerate. Our acquisitions of TerraTek, Odegaard and Geosystem coupled with our own research and development efforts are adding capability in the complete seismic-to-simulation chain. Of particular interest is the emerging technology of deep electromagnetic imaging based on magneto-telluric and controlled source measurements.

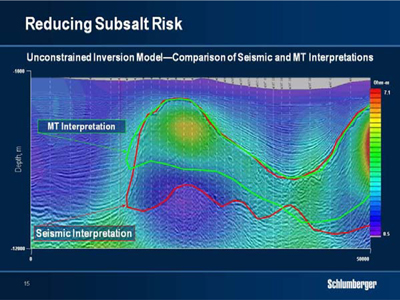

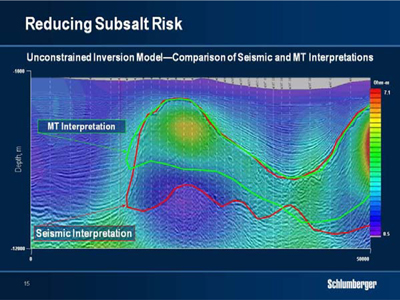

As an example of what integration can bring, this plot displays an overlay of magneto-telluric data over the seismic survey. The seismic data alone lead to the salt body shape shown in red while the electromagnetic data gives the much shallower yellow base.

Drilling decisions based only on the seismic data would lack this detailed knowledge. While it is still early days for this type of work, with much development remaining, we are confident that integrated results will bring significant value to complex reservoir characterization and will meaningfully impact subsalt drilling costs through better identification of potential hydrocarbon zones.

These new technologies are also having an effect on multiclient survey acquisition and usage. For example, rich-azimuth, wide-azimuth and magneto-telluric data sets have been added to the WesternGeco library while older sets of standard data have been reprocessed with new techniques to improve resolution.

The new azimuthal data sets are considerably more expensive than traditional narrow azimuth multi-client data, and as a result customers are reluctant to commit to major purchases until they know what success they have had in any lease sales. This will result in a shift in multi-client revenues away from traditional patterns of increases before lease sales to increases in the quarters following the sales. This is an important fact to remember in 2008 when the major Gulf-of-Mexico lease sale only occurred at the end of the first quarter.

In support of our technology objectives to meet customer requirements, we are continuing to focus on research and engineering. We increased our R&E expenditure by 18% in 2007 and we will increase again in 2008. With the move of Schlumberger-Doll Research to Boston, Massachusetts, the opening of our Carbonate Research Center in Dhahran, Saudi Arabia and the expansion of Schlumberger Moscow Research to Novosibirsk, we have now located research facilities in key academic centers worldwide. We have also opened a network of Regional Technology Centers putting scientists and engineers in proximity to major customers and their operations with centers already open in Kuala Lumpur, Abu Dhabi, Stavanger, Dallas, Mexico City, Edmonton and Puerto La Cruz in Venezuela.

If I insist on the regional aspect of our technology infrastructure, it is because serving our customers today implies a worldwide footprint with the ability to grow infrastructure wherever it is needed. While Schlumberger has always had a strong technology presence in the Eastern Hemisphere, growth over the last three years has meant we have expanded our network at a much more rapid rate. And in addition to the locations I just mentioned, we have also built new or extended manufacturing facilities in Russia, in China, Singapore, the UK and the USA.

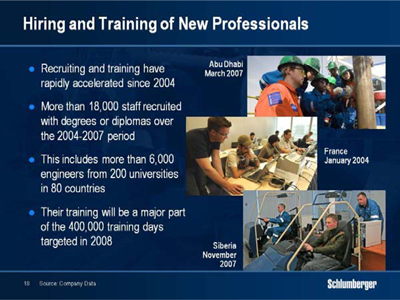

We have also been systematically extending our operating locations in the field. In the last 3 years we have renewed or added facilities in Libya, Algeria, Nigeria, Angola, Mexico, Ecuador, Malaysia, Qatar, Saudi Arabia and Russia. Many are catering to the growing activity in exploration as well as the ongoing development of deep-water reservoirs. However the greatest challenge has been in the hiring and training of new professionals.

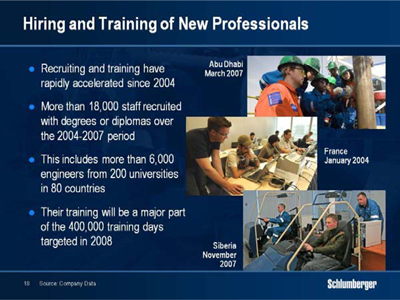

For almost 40 years we have had a policy of hiring professionals from the areas in which we work. This history has allowed us to respond vigorously to the need to expand the workforce. From 2004 to 2007 we recruited more than 13,000 technical staff with university and college degrees or diplomas out of an overall headcount increase of approximately 18,000. In the last two years, in answer to the extraordinary explosion of activity we recruited more than 6,000 engineers from over 200 universities in 80 countries.

To cope with this load, engineer and specialist training days have more than doubled since 2004, and we have opened new training centers in France and Abu Dhabi. In addition, just two weeks ago I opened the new training center in Tyumen, Western Siberia, which will meet all our needs in Russia and the Russian speaking republics. It

has a total capacity of 160 students covering Artificial Lift, Drilling & Measurements, IPM, Schlumberger Information Solutions and Well Services activities.

The last area where we have made considerable investment over the last few years is in Integrated Project Management—an activity that we began more than 10 years ago.

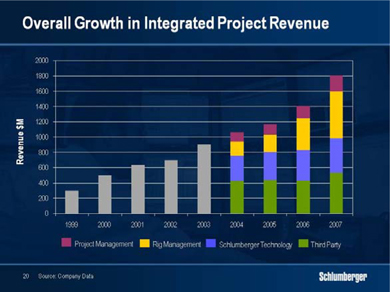

IPM is particularly relevant in today’s market as the industry responds to an increasing need to drill against a background of limited human resources. Today, IPM operates 55 well construction and field management projects, runs more than 100 rigs, employs over 6,000 people, and manages production similar to that of a moderately sized independent.

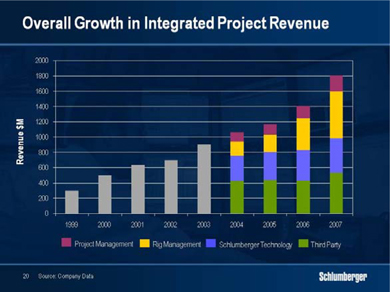

Revenue has increased fivefold since 1999 and the rate of growth is currently accelerating. We generate revenue in four ways. The first is through project management where Schlumberger brings workflow processes, risk management and field operations capability. The second is rig management, where we operate either our own rigs, such as those in Russia or operated through our joint venture in the Middle East, or those owned or leased directly by our customers. The third revenue stream comes from deployment of Schlumberger technologies that offer the prospect of risk and reward pricing. The fourth category, which is often the most misunderstood, includes third-party revenues for the services that we do not provide directly. It is important to understand that the IPM revenues vary in their composition over the life of the project as new phases begin, and additional rigs and equipment are mobilized.

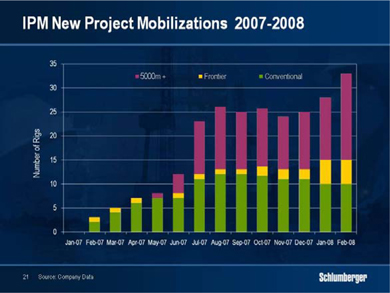

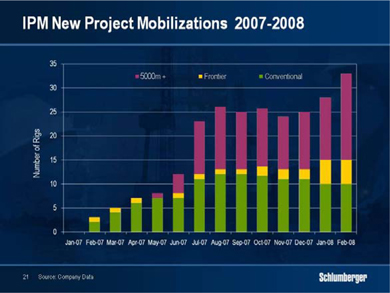

IPM is a GeoMarket-based service where customer needs and Schlumberger capabilities converge. IPM operations are increasing in GeoMarkets in both Latin America and Europe/CIS/Africa where Russia became the fastest growing region for IPM in 2007. In the last 12 months, IPM has mobilized 33 drilling rigs on 8 new projects while projects are moving to areas where depths are greater, temperatures hotter or operations more remote. The bars in this chart show this trend and it should be remembered that third party costs are higher and drilling efficiencies lower during the mobilization phases of such projects. We anticipate that at least another 16 rigs will be mobilized on various projects between now and the end of 2008.

But as the IPM business grows, so does the capability of the organization. Success lies in capturing and leveraging best operational practices from project to project and region to region. In Mexico for example, operating time per well fell by 70% as experience increased and logistical capacity grew over the various phases of the Burgos project. We expect to see similar gains in our new operations in more difficult environments.

By the end of the first quarter of this year, IPM global backlog through 2010 had grown to $5.3 billion. The industry’s need to stem decline through increased drilling intensity plays to the strengths of IPM through managing efficient well construction campaigns

while applying technology to enhance recovery from both new and existing wells. I am fully convinced that we now have a well-managed project management business that will be a major growth engine for Schlumberger.

Ladies and Gentlemen, rather than repeating the growth targets that we iterated over the last two years, I would now like to summarize what I have said today. It is our contention, in which we have already heavily invested, that the current cycle will be “stronger for longer”.

I have of course to repeat the caveat that a severe global recession leading to a major drop in demand would materially affect this scenario. Our conviction stems from the belief that current investment levels are insufficient to both stem decline and to explore and develop new reserves. Part of the investment delay is due to political and fiscal uncertainties, part is due to a continuing lack of resources both in terms of people and equipment. I have outlined in some detail the obstacles—now let me outline the positives for the cycle going forward.

First, there is an interest in new exploration in all parts of the industry on a scale not seen for 30 years. I illustrated this through the success of WesternGeco seismic technology and our commitment to its future through expansion of our marine fleet with the acquisition of Eastern Echo. I could have also discussed the impact of the unprecedented expansion of the offshore rig fleet where 70 of the 168 rigs currently under construction have deepwater capability. The importance is that increased complex exploration drilling places a premium on Schlumberger

technologies that improve performance while reducing risk. Over the last two years, we have developed and deployed many new Drilling & Measurements, Wireline and Testing technologies that will significantly impact our customers’ ability to drill, evaluate and test deepwater reservoirs.

Second, the industry will have to drill more. The fragile balance of natural gas supply in the lower 48 is perhaps the best example of this. Following the dramatic decline in shelf-gas supply, the industry has had to increase drilling for lower-quality natural gas resources to levels never seen before to compensate for GoM production losses.

Increasingly we will need to compensate for production decline in mature areas worldwide through increased drilling activity. This is already the case in Mexico and Western Siberia, and while I showed examples from China and Oman, I could have presented many others. This need to drill confirms the size of the opportunity for IPM, and we have seen and are seeing, an unprecedented demand for this service as well as for other technologies that impact recovery rates.

Finally, all this will not be possible without efficient and cost effective global infrastructure, a highly trained and motivated workforce, and the technology to increase recovery factors and keep costs in check. All this plays to Schlumberger’s core strengths and explains my belief that the cycle will remain stronger for longer.

While this is fundamental to the future of the company, I am sure investors are equally concerned by the outlook for 2008. I am of the opinion that growth will strengthen as the year progresses. The current strength in North American gas prices and the acceleration in production declines in several countries around the world will be the two key drivers but the quarterly progression will be more uneven than in the past three years. I have already mentioned the changing pattern of multi-client seismic sales and the costs related to the start up of new IPM projects. I could also have mentioned the storm days in the North Sea in the first quarter or the delays in various customer projects around the world.

None of this however detracts from the long-term opportunity. It only remains for us to execute to be able to continue to produce exceptional financial results.

Thank you very much.