Exhibit 99.1

Ocwen Acquisition Update

June 01, 2010

©2010 Ocwen Financial Corporation. All rights reserved.

Forward-Looking Statements

Our presentation may contain certain forward-looking statements that are made pursuant to the Safe Harbor provisions of the federal securities laws. These forward-looking statements may be identified by a reference to a future period or by the use of forward-looking terminology. They may involve risks and uncertainties that could cause the company’s actual results to differ materially from the results discussed in the forward-looking statements.

Presenters

William C. Erbey

Chairman & Chief Executive Officer

Ronald M. Faris

President

David J. Gunter

Chief Financial Officer

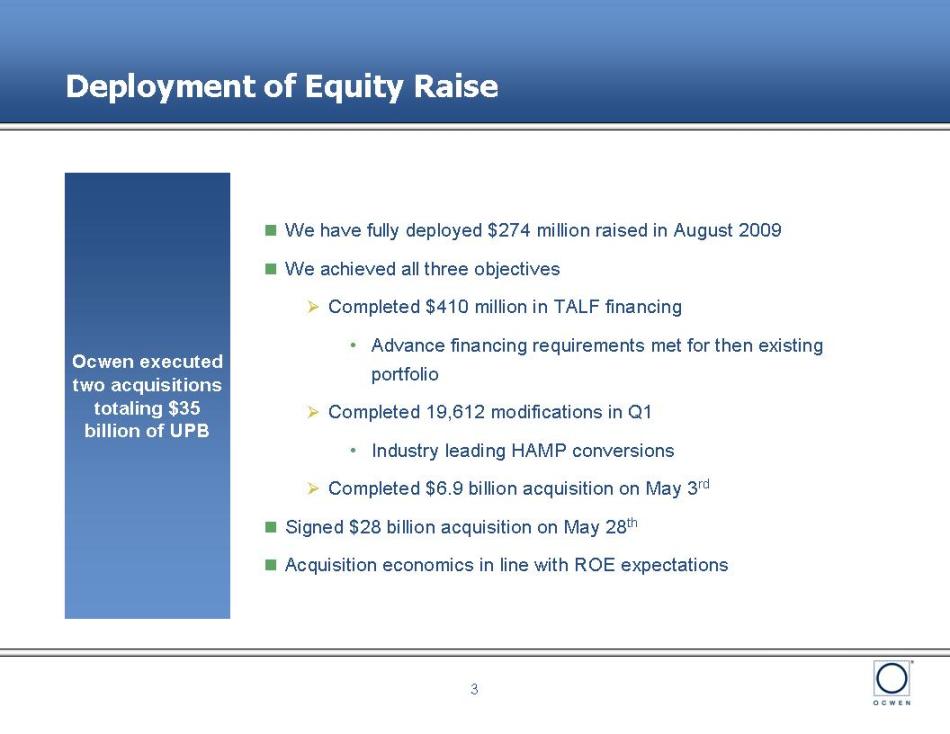

Deployment of Equity Raise

Ocwen executed

two acquisitions

totaling $35

billion of UPB

| n | We have fully deployed $274 million raised in August 2009 |

| n | We achieved all three objectives |

| Ø | Completed $410 million in TALF financing |

| • | Advance financing requirements met for then existing portfolio |

| Ø | Completed 19,612 modifications in Q1 |

| • | Industry leading HAMP conversions |

| Ø | Completed $6.9 billion acquisition on May 3rd |

| n | Signed $28 billion acquisition on May 28th |

| n | Acquisition economics in line with ROE expectations |

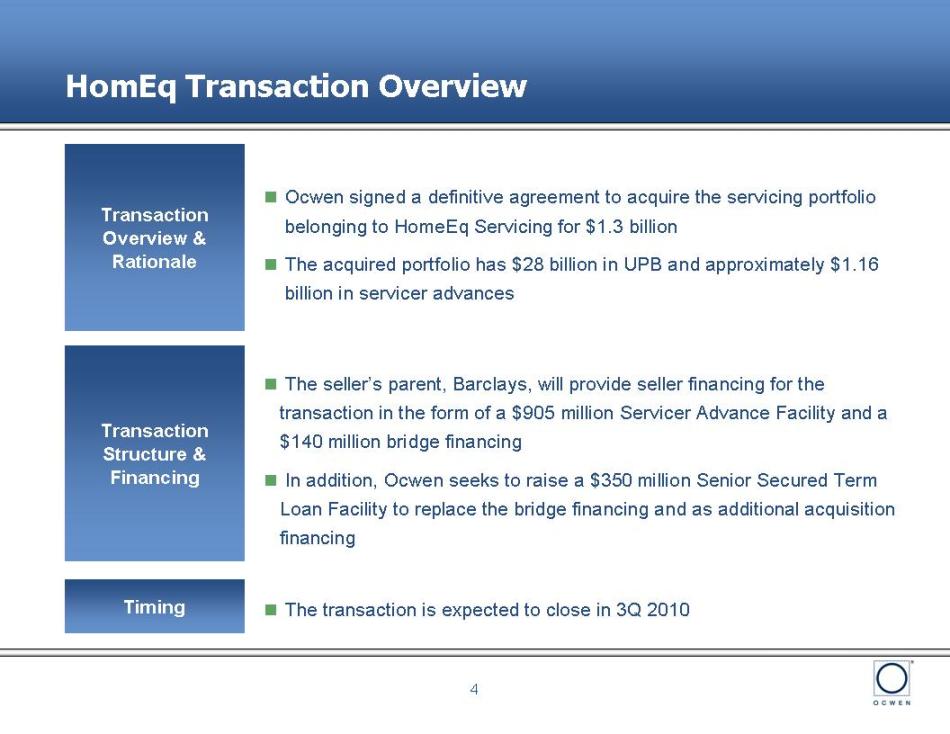

HomEq Transaction Overview

Transaction

Overview &

Rationale

| n | Ocwen signed a definitive agreement to acquire the servicing portfolio belonging to HomeEq Servicing for $1.3 billion |

| n | The acquired portfolio has $28 billion in UPB and approximately $1.16 billion in servicer advances |

Transaction

Structure &

Financing

| n | The seller’s parent, Barclays, will provide seller financing for the transaction in the form of a $905 million Servicer Advance Facility and a $140 million bridge financing |

| n | In addition, Ocwen seeks to raise a $350 million Senior Secured Term Loan Facility to replace the bridge financing and as additional acquisition financing |

Timing

| n | The transaction is expected to close in 3Q 2010 |

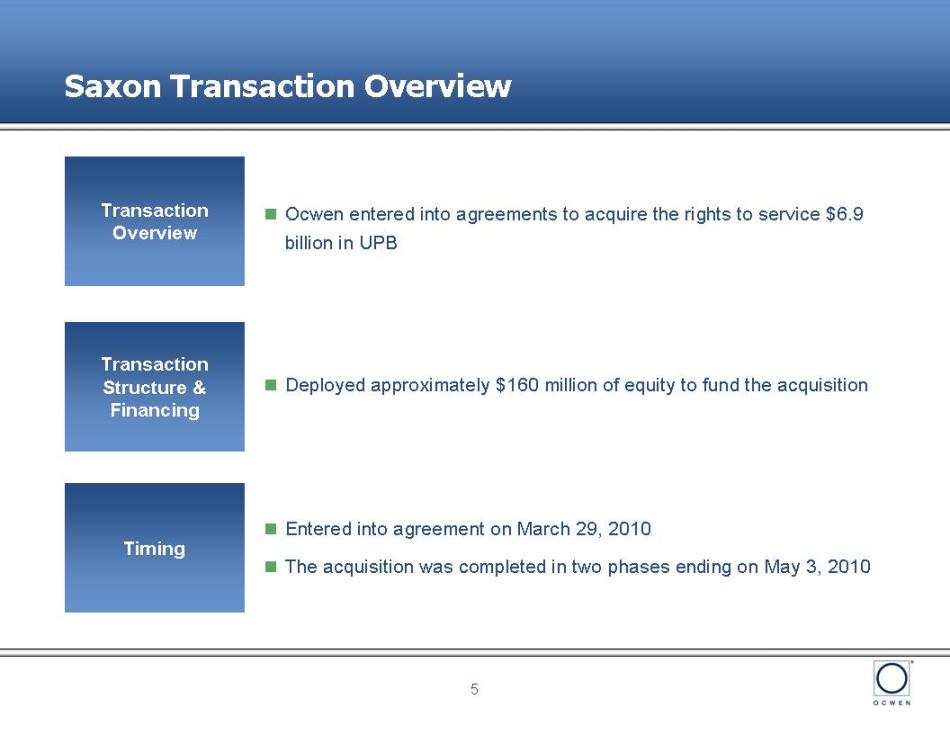

Saxon Transaction Overview

Transaction

Overview

| n | Ocwen entered into agreements to acquire the rights to service $6.9 billion in UPB |

Transaction

Structure &

Financing

| n | Deployed approximately $160 million of equity to fund the acquisition |

Timing

| n | Entered into agreement on March 29, 2010 |

| n | The acquisition was completed in two phases ending on May 3, 2010 |

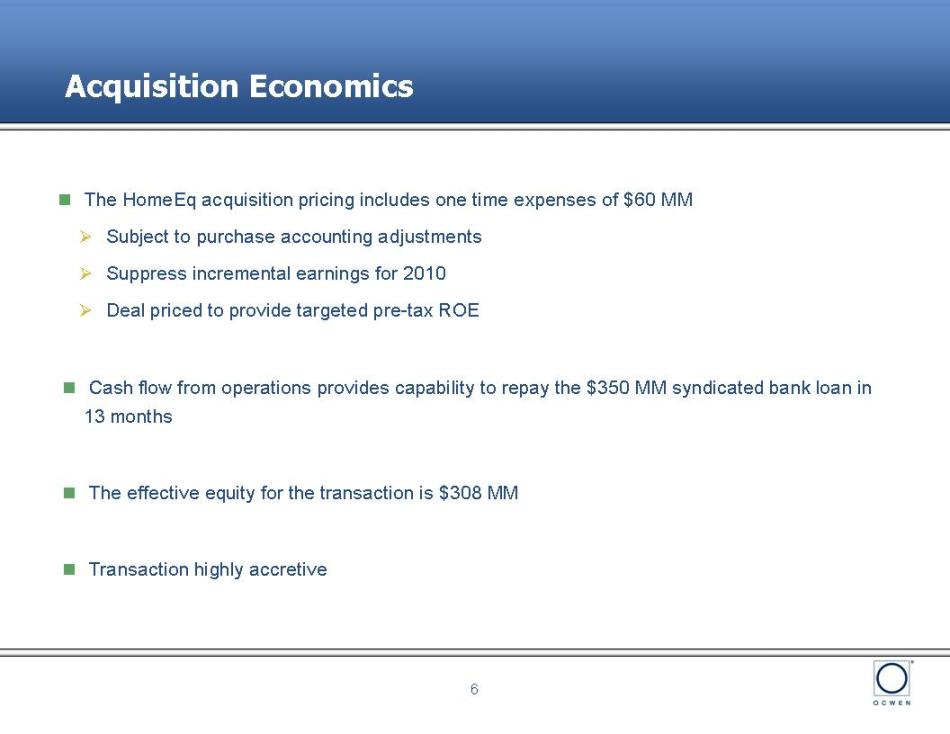

Acquisition Economics

| n | The HomeEq acquisition pricing includes one time expenses of $60 MM |

| Ø | Subject to purchase accounting adjustments |

| Ø | Suppress incremental earnings for 2010 |

| Ø | Deal priced to provide targeted pre-tax ROE |

| n | Cash flow from operations provides capability to repay the $350 MM syndicated bank loan in 13 months |

| n | The effective equity for the transaction is $308 MM |

| n | Transaction highly accretive |

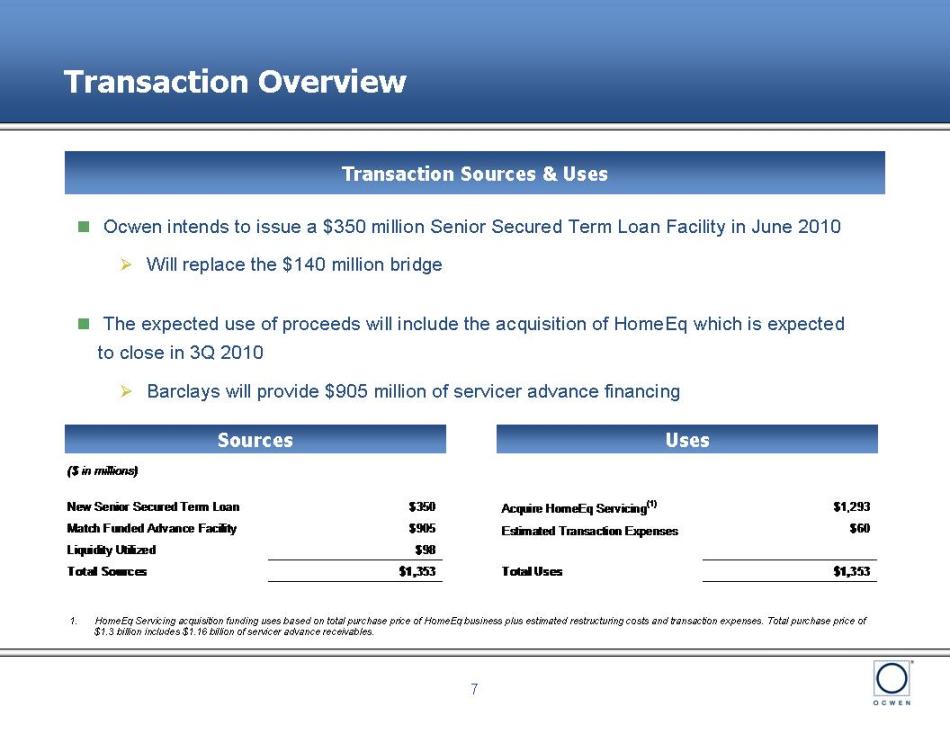

Transaction Overview

Transaction Sources & Uses

| n | Ocwen intends to issue a $350 million Senior Secured Term Loan Facility in June 2010 |

| Ø | Will replace the $140 million bridge |

| n | The expected use of proceeds will include the acquisition of HomeEq which is expected to close in 3Q 2010 |

| Ø | Barclays will provide $905 million of servicer advance financing |

Sources

Uses

| 1. | HomeEq Servicing acquisition funding uses based on total purchase price of HomeEq business plus estimated restructuring costs and transaction expenses. Total purchase price of $1.3 billion includes $1.16 billion of servicer advance receivables. |

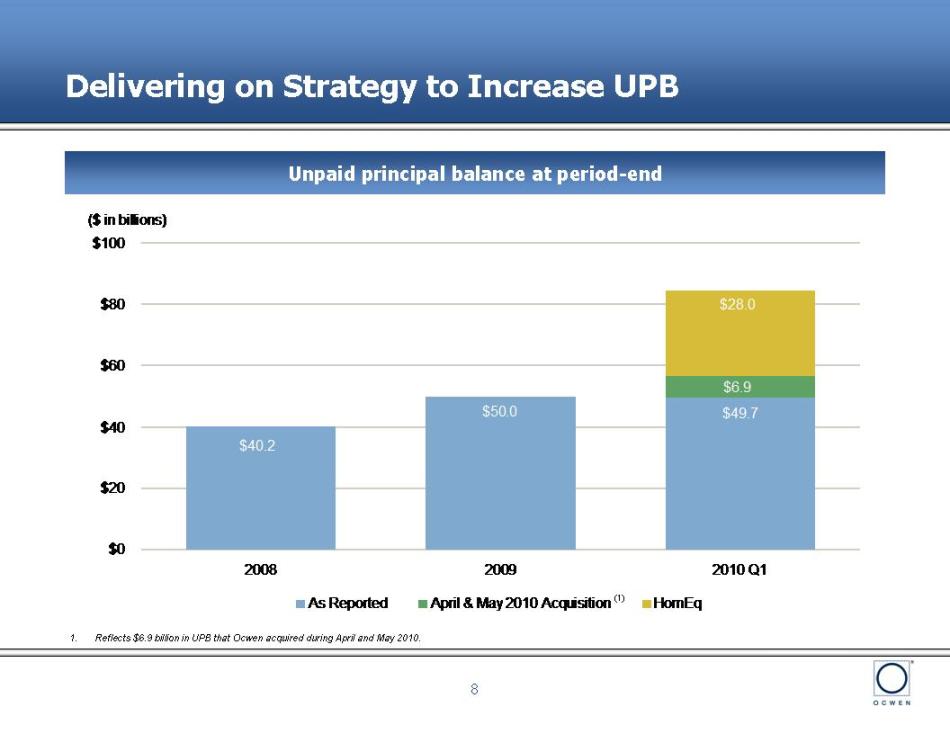

Delivering on Strategy to Increase UPB

Unpaid principal balance at period-end

| 1. | Reflects $6.9 billion in UPB that Ocwen acquired during April and May 2010. |