Exhibit 99.1

Investor Presentation November 2012 © 2012 Ocwen Financial Corporation. All rights reserved.

2 Who we are and what we do Leading provider of residential and commercial mortgage loan servicing and special servicing » Publicly - traded (NYSE: OCN) pure play mortgage servicer with more than $5.0 billion in market capitalization » 20+ years of innovation in loss mitigation » #1 in servicing quality in third party studies of servicers » Low cost, scalable servicing platform and technology $127 billion servicing portfolio at the end of Q3 2012 Employer of over 4,900 professionals and staff worldwide Management and the Board have a 18% ownership in Ocwen and strong alignment of interests Applies psychological principles to overcome borrower fear and objections » Delivered via artificial intelligence and dialogue engine ensuring reliability and consistency Utilizes advanced models to reduce variability and losses by evaluating loan resolution alternatives Ocwen maximizes value for mortgage owners by keeping borrowers in their homes… …through the intelligent use of scalable technology Home Retention Relationship Managers are hired based on intellect and personality profile – not necessarily experience Ocwen can create a best - in - class collector in three months Technology and global resources enable Ocwen to dedicate more staff to keep people in their homes and lower delinquency rates

3 Ocwen Has Produced Substantial Shareholder Value While the S&P 500 index increased by only 12% between 12/31/2010 and 10/26/2012, Ocwen’s share price increased by 307% during the same period .

Acquisition Updates Litton Acquisition meeting or exceeding pro forma expectations Boarded about 240,000 loans that were 1/3 over 60 - days delinquent while quickly improving performance – proving the scalability of Ocwen’s servicing platform Saxon MSR Portfolio of approximately $22.2 billion in UPB of securitized and non - securitized agency and non - agency residential mortgag e loans acquired on April 2, 2012. Acquisition already showing good results in delinquency and advance reduction JPM Chase Acquired MSRs for approximately $8.0 billion UPB of non - prime loans on April 2, 2012 Simultaneous close of 104,000 Saxon and Chase loans on same day also shows flexibility and scalability of Ocwen’s platform Aurora Commercial Portfolio Acquired servicing of 3,316 commercial mortgage loans with $1.8 billion UPB on May 31, 2012 GSE Portfolios Acquired Freddie portfolio from Bank of America of $10.7 billion on May 22, 2012 -- Boarding completed Acquired $2.2 billion Fannie that closed in September and boarded on October 1 4

Acquisition Updates ResCap Acquisition will add almost $127 billion in MSR and $31 billion in subservicing based on the UPB at the end of August 2012 Boarding is expected to be in the first quarter of 2013 Adds substantial capabilities in prime loan servicing, including GNMA Homeward Acquisition will add almost $74 billion in MSR and $7 billion in subservicing based on the UPB at the end of June 2012 Closing is expected to be in December 2012 Adds strong servicing team and originations capability Liberty Reverse Largest originator of reverse mortgages with strong capabilities in correspondent, wholesale and retail channels Expected to close in first quarter of 2013 Bank Subservicing Continue to acquire approximately 8,000 loans per month since end of June from a large bank Expect to bring on another bank by end of this year 5

Low risk balance sheet Summary of investment highlights 6 Ocwen has built - in growth and is well - positioned for more Substantial competitive advantages with lowest costs and scalable platform Operating model that drives strong returns to shareholders Superior servicing and loss mitigation practices effective at driving down delinquencies and advances Proven ability to close transactions and effectively board loans 1 2 3 4 5 7 Substantial upside from improving economy 8 Substantial cash flow generation that leads earnings 6

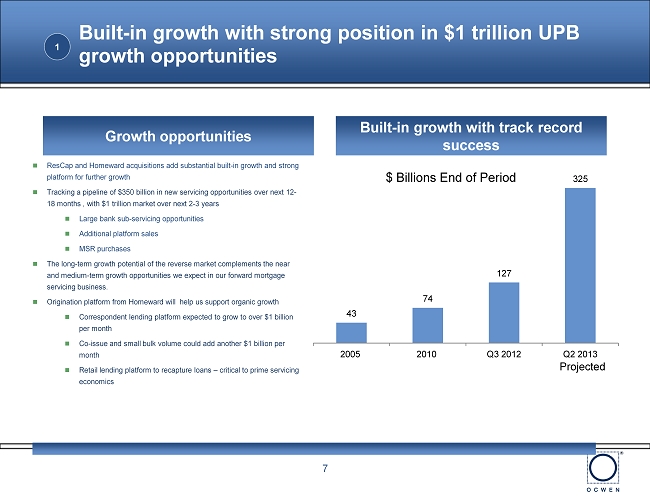

7 Built - in growth with strong position in $1 trillion UPB growth opportunities Built - in growth with track record success Growth opportunities ResCap and Homeward acquisitions add substantial built - in growth and strong platform for further growth Tracking a pipeline of $350 billion in new servicing opportunities over next 12 - 18 months , with $1 trillion market over next 2 - 3 years Large bank sub - servicing opportunities Additional platform sales MSR purchases The long - term growth potential of the reverse market complements the near and medium - term growth opportunities we expect in our forward mortgage servicing business. Origination platform from Homeward will help us support organic growth Correspondent lending platform expected to grow to over $1 billion per month Co - issue and small bulk volume could add another $1 billion per month Retail lending platform to recapture loans – critical to prime servicing economics 1 43 74 127 325 2005 2010 Q3 2012 Q2 2013 $ Billions End of Period Projected

8 Ocwen’s key differentiators are directly proportional to delinquency of target portfolios Ocwen has » A 70% cost advantage in servicing non - performing loans » A proven ability to reduce delinquencies and advances » Best in class 90+ day to current roll rates of 14% for subprime adjustable rate loans and 15% for subprime fixed rate loans » Reduced advances of the HomEq portfolio more than 38% within the first 13 months after on - boarding » Unmatched ability to finance advances across cycles » Ability to integrate portfolios without meaningful disruption to platform or efficiency » Ocwen has grown UPB from $21.9 billion in 2001 to $127.1 billion at the end of Q3 2012. » Access to efficient funding mechanisms » HLSS » Advance funding lines and asset - backed - securities » Maintained strong cash and debt capacity and a demonstrated ability to close large, complex transactions Ocwen has substantial competitive advantages, especially in non - performing portfolios 1

Highly scalable platform with lowest operating cost in the industry 9 9 Can quickly scale its servicing platform to efficiently board acquired portfolios with only modest additions to infrastructure Lowest operating cost in the subprime mortgage servicing industry Achieves its competitive position through the use of a technology - enabled servicing platform and a global workforce » Global locations where per employee cost is one - eighth of a US - based employee » A decade of experience operating in India Cost per non - performing loan (1) Ocwen has a sustainable cost advantage due to superior processes and a global infrastructure which enable it to efficiently board new portfolios and realize significant cost savings 2 $260 $835 Ocwen Cost Industry Average Cost 70% cost benefit Note: Analysis of costs as of second quarter 2012 MIAC cost per non - performing loan compared to Ocwen's marginal cost study for the sa me period.

Litton Saxon HomEq Proven ability to close transactions and effectively board loans 3 Portfolio acquired in September 2011 with $38.6 billion in UPB Over 240,000 loans with 1/3 delinquent Since then, 90 day + delinquency has dropped from 35% to 29% of UPB Portfolio acquired in September of 2010 with $22.4 billion in UPB Since then, 90 day + delinquency has dropped from 28% to 20% of UPB Boarded 135,000 loans Acquired portfolio with $6.9 billion in UPB, funded with $160 million of equity Since then, 90 day + delinquency has dropped from 42% to 25% of UPB 10 Saxon 2 Portfolio acquired in early April of 2012 with $24.9 billion in UPB, of which Ocwen subservices $9.9 billion Delinquency rates started falling immediately after transfer Chase Portfolio acquired in late May of 2012 with approximately $10.1 billion in UPB Boarding complete BOA Portfolio acquired in early April of 2012 with approximately $8.0 billion in UPB Delinquency rates started falling immediately after transfer

11 Superior servicing and loss mitigation practices… 1. Source: Bank of America/Merrill Lynch report dated July 2009, based on 2006 vintage loans on data from December 2008 to M ay 2009. 2. Source: Corelogic LoanPerformance, Barclays Capital, March 2011 Roll rate from 90+ days delinquent to current subprime adjustable rate (1) Roll rate from 90+ days delinquent to current subprime fixed rate (1) 4 Subprime Servicer Processing Speeds (2) FCL/ REO processing speeds classification 60+ processing speeds classification Fast processors/liquidators Middle of the pack Slow processors/liquidators Ocwen JPM (EMC, WAMU) Countrywide Option One Carrington (REO liquidations) Saxon Ameriquest Wells HLS Fast processors/liquidators Middle of the pack Slow processors/liquidators Ocwen Option One Countrywide / BofA Saxon Natcity Carrington Wells JPM / EMC HomEq (now Ocwen) Ameriquest

Modifications Outstanding as % of Portfolio and % of Modifications 60+ days late for Subprime Private Securities Source: BlackBox Logic Ocwen Mods Outstanding 52.8% Ocwen Mods 60+ 27.3% N on - Ocwen Mods Outstanding 46.6% Non - Ocwen Mods 60+ 38.3% 20% 25% 30% 35% 40% 45% 50% 55% Jan - 10 Feb - 10 Mar - 10 Apr - 10 May - 10 Jun - 10 Jul - 10 Aug - 10 Sep - 10 Oct - 10 Nov - 10 Dec - 10 Jan - 11 Feb - 11 Mar - 11 Apr - 11 May - 11 Jun - 11 Jul - 11 Aug - 11 Sep - 11 Oct - 11 Nov - 11 Dec - 11 Jan - 12 Feb - 12 Mar - 12 Apr - 12 May - 12 Jun - 12 Jul - 12 Aug - 12 Sep - 12 Superior servicing and loss mitigation practices… 4 Ocwen modifies more loans and has lower re - default rate 12

Ocwen outperforms other sub - prime servicers in generating cash - flow from borrowers Source: BlackBox Logic as of September 2012 Percentage of loans in subprime PLS that have made 10 or more payments in the past 12 months Making all 12 payments 60.0% 54.1% 4

14 … with differing levels of advances as a % of UPB (1) Delinquency Percentage (90+ Days) by Portfolio …Effective at driving down delinquencies and advances 4 1) Includes advances not on Ocwen’s books due to transfer to HLSS

15 Revenue in bps – Ramp up on acquired business 4 15 Revenue exceeds contractual rate soon after boarding due to recapture of deferred servicing fees and due to ancillary income Notes: - Saxon servicing portfolio was boarded in May - 2010, HomEq portfolio in Sep - 2010, & Litton portfolio in Sep - 2011. - Total Revenue = Contractual Servicing Fee plus Ancillary Revenue - Average contractual servicing fees on Litton portfolio averages 46 bps vs. 50 bps for HomEq & Saxon 40.0 72.2 73.5 72.9 77.5 54.2 69.3 67.6 68.5 63.5 45.7 72.1 73.9 50.6 84.8 50.1 69.4 30 40 50 60 70 80 90 Q2 2010 Q3 2010 Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Annualized Revenue (bps) Revenue in bps – large portfolios acquired since 2010 Total Revenue (Saxon) Total Revenue (HomEq) Total Revenue (Litton) Contractual servicing fee Total Revenue (Saxon 2012) Total Revenue (Chase)

1. Illustrative numbers representing average across several most recent large deal pro formas Indexed Capital / UPB (1) As performance improves, capital requirements fall and return on capital increases Pre - tax return on capital (1) Margins expand as Revenue per UPB grows without a concomitant increase in expense Portfolio becomes less capital intensive as delinquencies and advances decline Return on capital increases 5 16 100% = Initial Capital/UPB 40% 50% 60% 70% 80% 90% 100% 110% 0 Year 1 Year 2 Year 3 Year 4 0% 5% 10% 15% 20% 25% 30% 35% Year 1 Year 2 Year 3 Year 4 Year 5

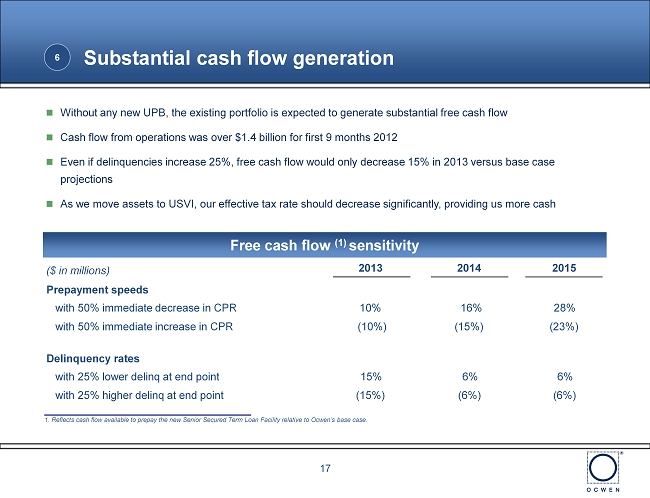

Substantial cash flow generation 17 17 Without any new UPB, the existing portfolio is expected to generate substantial free cash flow Cash flow from operations was over $1.4 billion for first 9 months 2012 Even if delinquencies increase 25%, free cash flow would only decrease 15% in 2013 versus base case projections As we move assets to USVI, our effective tax rate should decrease significantly, providing us more cash 6 1. Reflects cash flow available to prepay the new Senior Secured Term Loan Facility relative to Ocwen’s base case. Free cash flow (1) sensitivity ($ in millions) 2013 2014 2015 Prepayment speeds with 50% immediate decrease in CPR 10% 16% 28% with 50% immediate increase in CPR (10%) (15%) (23%) Delinquency rates with 25% lower delinq at end point 15% 6% 6% with 25% higher delinq at end point (15%) (6%) (6%)

Operating Cash Flow Substantially Exceeds Net Income * Adjusted cash flow from operations starts with Net cash provided by operating activities on Statement of Cash Flows and subtracts advance reductions used to pay down match - funded liabilities Substantial cash flow generation 6 18

Profitability is persistent, even if no growth in new business 6 Note: Normalized Pre - tax profit excludes transition - related expenses that typically occur in year 1 19 Normalized Pre - Tax Profit Year 1 indexed to 100 100 153 139 99 71 0 20 40 60 80 100 120 140 160 180 Year 1 Year 2 Year 3 Year 4 Year 5

Conservative balance sheet… 20 Highly rated assets (as reported 9/30/12) $ 1,523 million of equity supported by high quality assets with limited recourse debt 7 The balance sheet consists of high quality / low risk assets consisting primarily of advance receivables » Advances are over - collateralized and have priority of repayment » 82.6% of assets are investment grade quality assets Even if other assets such as MSRs, DTAs, Net Receivables and Other Assets all fell to zero, there would still be sufficient equity to cover all debt and other liabilities Ocwen’s second largest operating asset category, MSRs, has never experienced a net impairment of greater than 2% Duration matched liabilities and hedged against LIBOR increases Source: Company filings. 1. Excludes $53.4 million of Loans, Net - Restricted for Securitization Investors arising from FAS 167 accounting rule change. 2. Includes $70.2 million of goodwill.

21 Improving economy would offer substantial potential upside to Ocwen’s results Reduced delinquencies and Re - defaults Lower involuntary CPR with little incentive to prepay Lower Costs and Higher Revenue 8

Proven ability to close transactions and effectively board loans Summary of investment highlights 22 Ocwen has built - in growth and is well - positioned for more Substantial cash flow generation that leads earnings Superior servicing and loss mitigation practices effective at driving down delinquencies and advances Low risk balance sheet 1 3 4 6 7 Substantial upside from improving economy 8 Substantial competitive advantages with lowest costs and scalable platform 2 Operating model that drives strong returns to shareholders 5

23 On September 12, 2012, HLSS completed a successful follow - on equity offering raising $236 million at a share price of $15.25, up from the $14 price of the initial offering – the offering was substantially over - subscribed. We expect that HLSS should be able to continue raising funds to purchase assets from Ocwen On September 13, HLSS used most of the proceeds to purchase rights to approximately $21.2 billion in MSRs and related advances. On September 28, HLSS purchased an additional $6.7 billion in MSRs and related advances The effective cost of these funds is well below our capital return expectations for Ocwen, especially as it accelerates deferred tax assets, leading to improved returns to Ocwen shareholders Net income will fall as a result of these deals Required equity is expected to fall by more, increasing potential returns available to shareholders Apart from the required pay - down in our Senior Secured Term Loan, these proceeds will bolster our cash position to make further acquisitions. Further significant HLSS purchases are expected in near term, which will bolster our cash position for the acquisitions HLSS has been able to effectively tap both equity and debt markets in the recent past. We expect the benefit to be passed to us resulting in lower expense levels HLSS Transaction Update

24 Mortgage servicing overview Residential mortgage loan servicing primarily involves: » Collection and transfer of mortgage payments from borrowers » Cash management and escrow account responsibilities » Mitigation of losses through loan modifications, short sales and other options » Administration of foreclosure and real estate owned Servicers receive contractual fees based on the unpaid principal balance (“UPB”) of the loans serviced In most cases, if there is a shortfall in monthly collections from a delinquent borrower, the servicer is required to “advance” the missed payments and other costs » The right to be repaid for these servicer advances is senior to the AAA securities issued by the MBS trusts, or “top - of - the - waterfall” The primary costs are operating expenses and the cost of funding servicer advances Borrowers Servicer Loan Owners Servicer Borrower Borrower Borrower Borrower Borrower Borrower Borrower Monthly Principal & Interest Communication & Billing Monthly Principal & Interest Servicing Fee GSEs RMBS Trusts Whole Loan Owners

25 Mortgage servicing overview – Advance Quality Advances are very high - quality assets Advances self - liquidate at par Advances have the right to be repaid at “top - of - the - waterfall,” i.e. they are paid before any other payments to the trust Advances are substantially over - collateralized, as home prices would need to fall nearly 98% for there to be insufficient funds to pay - back advances at our current average advance rate OCN advance collateral coverage 9/30/12 $132.6 Billion (Property Value) The “Properties” ~97.8% Equity Cushion $129.7 Billion Downside Protection / Cushion for Servicer Advances ~2.2% Advance Rate $2.9 Billion Servicer Advances