Exhibit 99.1

Upcoming Transactions Financing Update December 2012 ©2012 Ocwen Financial Corporation. All rights reserved.

1 Forward -looking statements and GAAP reconciliation Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by which, such performance or results will be achieved or whether such performance or results will ever be achieved. Forward-looking information is based on information available at the time and management’s good faith belief with respect to future events and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. Forward-looking statements speak only as of the date the statements are made. Ocwen Financial Corporation (“the Company”) assumes no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information except to the extent required by applicable securities laws. If the Company does update one or more forward-looking statements, no inference should be drawn that the Company will make additional updates with respect thereto or with respect to other forward-looking statements. SEC rules regulate the use of “non-GAAP financial measures”in public disclosures that are derived on the basis of methodologies other than in accordance with generally accepted accounting principles, or “GAAP.”These rules govern the manner in which non-GAAP financial measures may be publicly presented and prohibit in all filings with the SEC, among otherthings: Exclusion of charges or liabilities that require, or will requir e, cash settlement or would have required cash settlement, absent an ability to settle in another manner, from a non-GAAP financial measure; and Adjustment of a non-GAAP financial measure to eliminate or smooth items identified as non-recurring, infrequent or unusual, when the nature of the charge or gain is such that it has occurred in the past two years or is reasonably likely to recur within the next two years We have included non-GAAP financial measures in this presentation, that may not comply with the SEC rules governing the presentation of non-GAAP financial measures.

2 Transaction Sources and Uses Sources Uses Source: Ocwen. Note: As part of Ocwen’s acquisition of Homeward, Ocwen will assume the liabilities of Homeward. 1. Includes the impact of other "normal course" business activitiesincluding, but not limited to the financing of mortgage servicer advances. 2. Includes Homeward excess cash, other unsecured loan and ResCap bid deposit. ($ in millions) Cash on Balance Sheet (1) $480 Homeward Equity Purchase $750 Proceeds from HLSS Transactions 387 Repay Homeward Term Loan 300 New Senior Secured Term Loan 1,200 ResCap Servicing Assets 651 Convertible Preferred Equity (Homeward) 162 ResCap Net Advances 1,665 ResCap Advance Facility 1,325 Repay Existing Senior Secured Term Loan 360 Other Sources (2) 205 Transaction Fees and Expenses 33 Total Sources $3,759 Total Uses $3,759

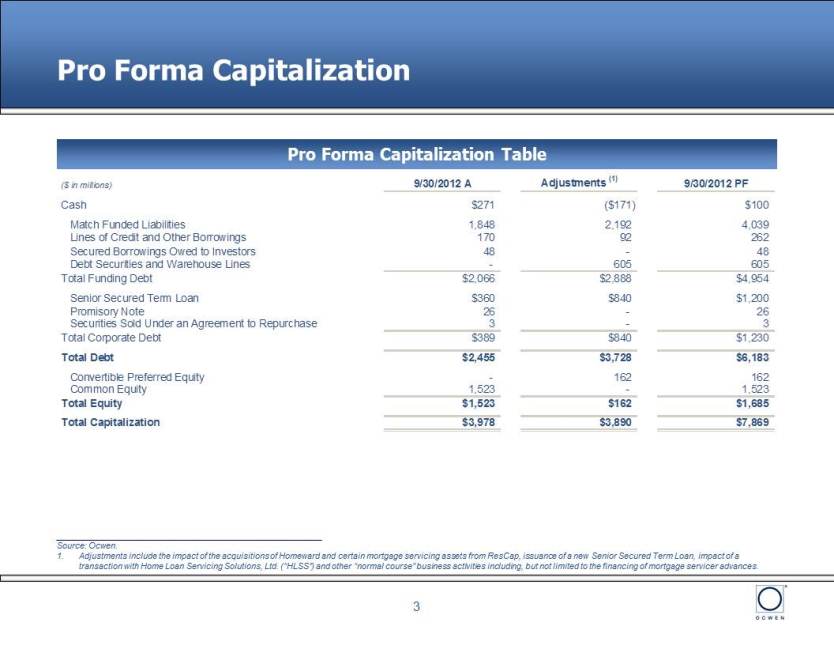

3 Pro Forma Capitalization Source: Ocwen. 1. Adjustments include the impact of the acquisitions of Homeward and certain mortgage servicing assets from ResCap, issuance of a new Senior Secured Term Loan, impact of a transaction with Home Loan Servicing Solutions, Ltd. (“HLSS”) and other “normal course”business activities including, but not limited to the financingof mortgage servicer advances. Pro Forma Capitalization Table ($ in millions) 9/30/2012 A Adjustments (1) 9/30/2012 PF Cash $271 ($171) $100 Match Funded Liabilities 1,848 2,192 4,039 Lines of Credit and Other Borrowings 170 92 262 Secured Borrowings Owed to Investors 48 - 48 Debt Securities and Warehouse Lines - 605 605 Total Funding Debt $2,066 $2,888 $4,954 Senior Secured Term Loan $360 $840 $1,200 Promisory Note 26 - 26 Securities Sold Under an Agreement to Repurchase 3 - 3 Total Corporate Debt $389 $840 $1,230 Total Debt $2,455 $3,728 $6,183 Convertible Preferred Equity - 162 162 Common Equity 1,523 - 1,523 Total Equity $1,523 $162 $1,685 Total Capitalization $3,978 $3,890 $7,869