UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to ss. 240.14a-12

The Jones Group Inc.

|

| (Name of Registrant as Specified in its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies: ____________________________________________________________________

(2) Aggregate number of securities to which transaction applies: ____________________________________________________________________

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): ____________________________________________________________________

(4) Proposed maximum aggregate value of transaction: ____________________________________________________________________

(5) Total fee paid:

____________________________________________________________________

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

____________________________________________________________________

(2) Form, Schedule or Registration Statement No.:

____________________________________________________________________

(3) Filing Party:

____________________________________________________________________

(4) Date Filed:

____________________________________________________________________

1411 BROADWAY

NEW YORK, NEW YORK 10018

_________________

April 15, 2011

Dear Fellow Stockholder:

Our 2011 Annual Meeting of Stockholders will be held on May 19, 2011 at 9:30 a.m. at the offices of Cravath, Swaine & Moore at 825 Eighth Avenue, The Paul D. Cravath Room - 48th Floor, New York, New York, and we look forward to your attending, either in person or by proxy.

The enclosed notice of meeting and proxy statement explains the agenda for the meeting and voting information and procedures. It also includes information about the business we will conduct at the meeting and provides information about the Company. I encourage you to read the proxy statement carefully. Also included with the proxy statement is a copy of our Annual Report.

Whether or not you plan to attend the annual meeting, your vote is very important to us. Information about voting procedures can be found in the proxy statement. Please return a signed proxy card or give your voting instructions using the means described on page 1 of the proxy statement, so that you can be sure that your shares will be voted as you direct, even if you can't attend the meeting. If you would like to attend the meeting, please see the instructions on page 54.

| Sincerely,

Wesley R. Card Chief Executive Officer |

THE JONES GROUP, INC.

1411 BROADWAY

NEW YORK, NEW YORK 10018

_________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 19, 2011

NOTICE IS HEREBY GIVEN that our annual meeting of stockholders will be held on May 19, 2011 at 9:30 a.m. at the offices of Cravath, Swaine & Moore at 825 Eighth Avenue, The Paul D. Cravath Room - 48th Floor, New York, New York. The purpose of the meeting is to vote on the following matters:

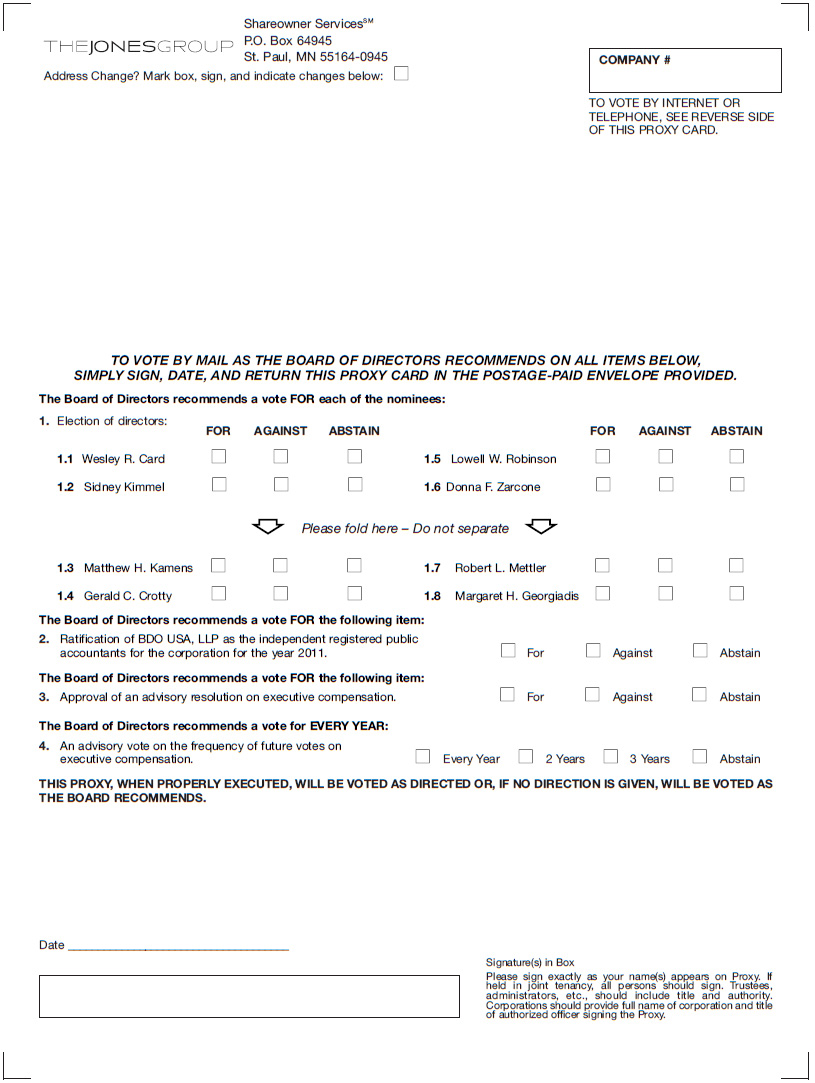

Election of the eight nominees for director named in our proxy statement;

Ratification of the selection of BDO USA, LLP as our independent registered public accountants for 2011;

An advisory vote on executive compensation; and

An advisory vote on the frequency of future votes on executive compensation.

The close of business on March 23, 2011 has been fixed as the record date. Only stockholders of record at the close of business on that date can vote at the annual meeting.

Please refer to page 1 of the proxy statement for information about voting procedures. If you would like to attend the meeting, please see the instructions on page 54 of the proxy statement.

| By Order of the Board of Directors Wesley R. Card

Chief Executive Officer |

Dated: April 15, 2011

Important Notice Regarding the Availability of

Proxy Materials for the Shareholder Meeting

to be Held on May 19, 2011

Copies of this proxy statement, form of proxy card and our annual report to shareholders are available at the home page of our website, www.jonesgroupinc.com. For information about attending the shareholder meeting and voting in person, please see "How to Attend the Annual Meeting." The Board of Directors' recommendations regarding the matters intended to be acted on at the meeting listed in 1, 2 , 3 and 4 above can be found with the description of those matters in this proxy statement. In summary, the Board recommends a vote FOR each of the eight nominees for director, FOR ratification of the selection of BDO USA, LLP as our independent registered public accountants for 2011, FOR the advisory resolution to approve the compensation of our named executive officers and FOR annual frequency of future stockholder advisory votes on the compensation of our named executive officers.

TABLE OF CONTENTS

_________________

DEFINITIONS

As used in this proxy statement, unless the context requires otherwise, "the Company," "Jones," "our" and "we" means The Jones Group Inc. and consolidated subsidiaries, "NYSE" means New York Stock Exchange, "SEC" means the United States Securities and Exchange Commission, "FASB" means the Financial Accounting Standards Board" and "ASC" means the "FASB Accounting Standards CodificationTM."

PROXY STATEMENT

THE JONES GROUP INC.

1411 Broadway

New York, New York 10018

ANNUAL MEETING OF STOCKHOLDERS

The Board of Directors is soliciting proxies to be used at our annual meeting of stockholders to be held on May 19, 2011 at 9:30 a.m. at the offices of Cravath, Swaine & Moore at 825 Eighth Avenue, The Paul D. Cravath Room - 48th Floor, New York, New York. This proxy statement and the proxies solicited by this proxy statement will be sent to stockholders on or about April 15, 2011. The Annual Report to our stockholders for the year ended December 31, 2010 accompanies this proxy statement.

Who Can Vote

At the close of business on March 23, 2011, 87,474,271 shares of our common stock were outstanding and eligible for voting at the annual meeting. Each stockholder of record has one vote for each share of common stock held on all matters to come before the meeting. Only stockholders of record at the close of business on March 23, 2011 are entitled to notice of and to vote at the annual meeting.

How You Can Vote

If your shares are registered directly in your name with our transfer agent, Wells Fargo Bank, National Association, you are the holder of record of those shares, and we are sending these proxy materials directly to you. If you return your properly signed proxy before the annual meeting, we will vote your shares as you direct.

If you are a Jones employee holding restricted shares granted to you under the Company's 1999 Stock Incentive Plan or 2009 Long Term Incentive Plan and have a Company-issued e-mail account, an e-mail has been sent to you with instructions for voting those shares online.

If your shares are held in a stock brokerage account or by a bank, brokerage firm or other holder of record, you are considered the "beneficial owner" of shares held in street name. In that event, the proxy materials have been forwarded to you by your bank, broker or other holder of record. As the beneficial owner, you have the right to direct your bank, broker or other holder of record as to how to vote your shares by following the instructions provided to you with the proxy materials.

If you hold shares in more than one account, you must vote each proxy and/or voting instruction card you receive (either in hard copy form or online) to ensure that all shares you own are voted.

You can specify on your proxy and/or voting instruction card whether your shares should be voted for or against each of the nominees for director or whether you abstain from voting on any nominee. You can also specify whether you approve or disapprove of or abstain from voting on (i) the ratification of BDO USA, LLP to be our independent registered public accountants for 2011 and (ii) the advisory vote on the compensation of our named executive officers. You can also specify "every year," "every 2 years" or "every 3 years" or you can abstain from voting on the advisory vote on the frequency of future votes on executive compensation. If you do not specify on your proxy card how you want to vote your shares, we will vote them "FOR" the election of all nominees for director as set forth under "Election of Nominees for Directors" below, "FOR" the ratification of BDO USA, LLP to be our independent registered public accountants for 2011, "FOR" the approval, on an advisory basis, of the compensation of our named

- 1 -

executive officers as described in this proxy statement and "FOR" the approval, on an advisory basis, of conducting an advisory vote on the compensation of our named executive officers every year.

If you are a beneficial owner of shares and your bank or brokerage firm does not receive instructions from you about how your shares are to be voted, one of two things can happen, depending on the type of proposal. Under New York Stock Exchange ("NYSE") rules, brokers have discretionary power to vote your shares with respect to "routine" matters, but they do not have discretionary power to vote your shares on "non-routine" matters. Uninstructed brokers have discretionary voting power as to ratification of BDO USA, LLP as our independent registered public accountants (Item 2), which is considered a routine matter. Uninstructed brokers do not have discretionary voting power as to election of the eight nominees for director (Item 1), the advisory vote on executive compensation (Item 3) or the advisory vote on the frequency of future votes on executive compensation (Item 4), all of which are considered non-routine matters. A bank or brokerage firm may not vote your shares with respect to the non-routine matters if you have not provided instructions. This is called a "broker non-vote." We strongly encourage you to complete and submit your proxy or voting instruction card and exercise your right to vote as a stockholder.

If you are the stockholder of record, you may revoke your proxy at any time prior to its use, by voting in person by ballot at the annual meeting, by executing a later-dated proxy or, if you voted electronically, by your subsequent vote online, or by submitting a written notice of revocation to the Secretary of Jones at our office at the above address or at the annual meeting. If you are a beneficial owner of the shares, you may submit new voting instructions by contacting your bank, broker or other holder of record. If you wish to vote your shares at the annual meeting, you must obtain a valid proxy from your broker, bank or other holder of record and present it to the inspector of election with your ballot at the meeting.

Required Votes

Pennsylvania law and our by-laws require the presence of a "quorum" for the annual meeting. A quorum is defined as the presence, either in person or represented by proxy, of the holders of a majority of the votes which could be cast in the election or on a proposal. Abstentions and broker non-votes will be counted in determining whether a quorum has been reached for the transaction of business at the annual meeting.

Assuming a quorum has been reached, a determination must be made as to the results of the vote on each matter submitted for stockholder approval. Each of Items 1, 2 and 3 must be approved by a majority of votes cast on the item by all stockholders entitled to vote on the proposal. With respect to the election of directors, this means that a nominee will be elected to the Board of Directors if he or she receives more "FOR" votes than "AGAINST" votes. A plurality of the votes cast at the meeting by all stockholders entitled to vote on Item 4 will determine whether future stockholder advisory votes on executive compensation will occur every year, every two years or every three years. Abstentions will have no effect on the vote for directors or Items 2, 3 and 4.

Security Ownership of Certain Beneficial Owners

The information contained herein has been obtained from our records or from information furnished directly by the individual or entity to us.

The table below shows, as of March 23, 2011, how much of our common stock was owned by each of our directors, nominees, executive officers named in the 2010 Summary Compensation Table in this proxy statement (the "named executive officers"), each person known to us to own 5% or more of our

- 2 -

common stock (as determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934) and all of our current directors and executive officers, as a group.

Name

| | Number

of Shares

Owned (1)

| | Rights to

Acquire (2)

| | Restricted

Stock (3)

| | Percent of

Outstanding

Shares

|

| Wesley R. Card | | 261,836 | (4) | | 100,000 | | 959,588 | | 1.5% |

| Sidney Kimmel | | 1,027,529 | (5) | | 400,000 | | 6,390 | | 1.6% |

| Matthew H. Kamens | | 35,512 | | | - | | 16,708 | | * |

| J. Robert Kerrey | | 11,123 | | | - | | 16,708 | | * |

| Ann N. Reese | | 38,512 | | | - | | 16,708 | | * |

| Gerald C. Crotty | | 50,512 | | | - | | 16,708 | | * |

| Lowell W. Robinson | | 29,512 | | | - | | 16,708 | | * |

| Donna F. Zarcone | | 23,512 | | | - | | 16,708 | | * |

| Robert L. Mettler | | 31,980 | | | - | | 25,440 | | * |

| Margaret H. Georgiadis | | 31,980 | | | - | | 25,440 | | * |

| John T. McClain | | 75,389 | | | - | | 197,493 | | * |

| Richard Dickson | | 20,580 | | | - | | 436,311 | | * |

| Ira M. Dansky | | 39,636 | | | 100,000 | | 173,302 | | * |

| Andrew Cohen | | - | (6) | | - | | - | | - |

Hotchkis and Wiley Capital Management, LLC

725 S. Figueroa Street, 39th Floor

Los Angeles, CA 90017 | | 7,658,761 | (7) | | - | | - | | 8.8% |

Janus Capital Management LLC

151 Detroit Street

Denver, CO 80206 | | 5,919,435 | (8) | | - | | - | | 6.8% |

BlackRock, Inc.

40 East 52nd Street

New York, NY 10022 | | 5,338,003 | (9) | | - | | - | | 6.1% |

LSV Asset Management

155 N. Wacker Drive, Suite 4600

Chicago, IL 60606 | | 4,548,892 | (10) | | - | | - | | 5.2% |

| All directors and current executive officers as a group (14 persons) | | 1,691,613 | | | 600,000 | | 1,958,839 | | 4.8% |

| ___________________ |

| * | Less than one percent. |

| (1) | Includes shares for which the named person has either sole or shared voting and investment power. Excludes shares of restricted stock and shares that can be acquired through the exercise of options. Also excludes "share units" (i.e., phantom stock) under our Deferred Compensation Plan for Outside Directors. Under that plan, non-management directors can elect to have the value of deferred amounts of all or a portion of their annual retainer and meeting attendance fees paid out based on an assumed investment in our Common Stock. The participants making that election do not have any right to vote or to receive Common Stock in connection with the assumed investments of the deferred amounts, and they are ultimately paid out in cash, but the assumed investments do represent an economic interest in our Common Stock. Such accounts are credited with additional share units for cash dividends paid on our Common Stock. The following share units have been credited to the following directors under the plan as of March 23, 2011: Mr. Kerrey, 63,812.107 share units and Mr. Crotty, 18,777.466 share units. See footnote 2 to the 2010 Director Compensation table in this proxy statement. |

- 3 -

| (2) | Shares that can be acquired through stock options exercisable through May 22, 2011. |

| (3) | Shares subject to a vesting schedule and other restrictions as to which the named individual has voting power. |

| (4) | 261,836 shares are pledged under a margin account. |

| (5) | Shares are held in the Sidney Kimmel Revocable Indenture of Trust. |

| (6) | Based solely on information provided to us as of January 24, 2011. Mr. Cohen's employment with us ended on October 11, 2010. |

| (7) | Based solely upon information reported in Amendment No. 8 to Schedule 13G, filed with the SEC on February 14, 2011, reporting beneficial ownership as of December 31, 2010. According to the filing, Hotchkis and Wiley Capital Management, LLC ("HWCM") has sole power to vote or to direct the vote of 4,855,800 shares, and sole power to dispose or to direct the disposition of 7,658,761 shares. Such shares are owned of record by clients of HWCM, for whom HWCM serves as investment adviser and as to which shares HWCM disclaims ownership. No such client is known to have voting or dispositive power with respect to more than 5% of Jones common stock. |

| (8) | Based solely upon information reported in Schedule 13G, filed with the SEC on February 14, 2011. According to the filing, Janus Capital Management LLC has a direct ownership stake in INTECH Investment Management ("Intech") and in Perkins Investment Management LLC ("Perkins"), and as such, holdings for Janus, INTECH and Perkins were aggregated for purposes of the filing. All three entities serve as registered investment advisers to various investment companies and to individual and institutional clients. Although Perkins may be deemed to share voting and dispositive power as to such shares as a result of its role as investment adviser or sub-adviser, Perkins does not have the right to receive dividends from or proceeds from the sale of such shares and disclaims ownership. |

| (9) | Based solely upon information reported in Amendment No. 1 to Schedule 13G, filed with the SEC on February 9, 2011, reporting beneficial ownership as of December 31, 2010. |

| (10) | Based solely upon information reported in Schedule 13G, filed with the SEC on February 9, 2011, reporting beneficial ownership as of December 31, 2010. |

Item 1. Election of Nominees for Director

Our Board of Directors currently has ten members. J. Robert Kerrey, a director of Jones since 2002, and Ann N. Reese, a director of Jones since 2003, are not standing for re-election as directors and will cease their service on the Board of Directors as of the date of the annual meeting. Each other current Board member is standing for re-election. On March 24, 2011, in accordance with our by-laws, our Board of Directors reduced the number of directors from ten to eight, effective May 19, 2011. Our Board of Directors has nominated eight persons to be elected at the annual meeting to serve as our directors until the next annual meeting of stockholders and until their respective successors are elected. All of the nominees currently serve as our directors.

We will vote your shares as you specify on the enclosed proxy card or by means of your voting instructions via the Internet. If you sign, date and return the proxy card or vote electronically but don't specify how you want your shares voted, we will vote them "FOR" all of the nominees listed below. If unforeseen circumstances (such as death or disability) make it necessary for the Board of Directors to substitute another person for any of the nominees, we will vote your shares for that other person.

The following information is supplied with respect to each person nominated and recommended to be elected by our Board of Directors and is based upon our records and information furnished to us by the nominees. It includes the experience, qualification, attributes or skills that caused the Nominating/Corporate Governance Committee and the Board to determine that the person should serve as one of our directors. See "Security Ownership of Certain Beneficial Owners" for information pertaining to stock ownership by the nominees.

- 4 -

Name

| Age

| Other Positions with Jones

and Principal Occupation

| Has served as

director since

|

| Wesley R. Card | 63 | Chief Executive Officer | 2007 |

| Sidney Kimmel | 83 | Chairman of the Board* | 1975 |

| Matthew H. Kamens | 59 | Attorney | 2001 |

| Gerald C. Crotty | 59 | President of Weichert Enterprise, LLC | 2005 |

| Lowell W. Robinson | 62 | Former Chief Financial Officer and Chief Operating Officer of MIVA, Inc. | 2005 |

| Donna F. Zarcone | 53 | President and Chief Executive Officer, D. F. Zarcone & Associates LLC | 2007 |

| Robert L. Mettler | 70 | Retired President of Special Projects of Macy's, Inc. | 2009 |

| Margaret H. Georgiadis | 47 | Vice President, Global Sales Operations of Google Inc. | 2009 |

*Non-executive position

Mr. Card has served as our Chief Executive Officer since July 2007. He also served as our President from July 2007 to February 8, 2010. Mr. Card was our Chief Operating Officer from March 2002 to July 2007 and also our Chief Financial Officer from March 2007 to July 2007. He had previously served as our Chief Financial Officer from 1990 to March 2006. Mr. Card was the President and Chief Financial Officer of Carolyne Roehm, Inc. from 1988 to 1990. Prior to that, he held various positions at Warnaco, Inc., Bank of Boston and PriceWaterhouse & Co.

We believe Mr. Card's qualifications to sit on our Board include his over 30 years experience in the apparel industry, his business acumen and financial knowledge, and his deep understanding of the Company and its operations derived from 16 years as our Chief Financial Officer, five years as our Chief Operating Officer and almost four years as our Chief Executive Officer.

Mr. Kimmel founded the Jones Apparel Division of W.R. Grace & Co. in 1970. Mr. Kimmel served as our executive Chairman from 1975 to December 31, 2010 and as Chief Executive Officer from 1975 to May 2002. Effective January 1, 2011, Mr. Kimmel ceased to be our executive Chairman and became our non-executive Chairman of the Board. Prior to founding Jones, Mr. Kimmel was employed by W.R. Grace & Co. and was President of Villager, Inc., a sportswear company.

We believe Mr. Kimmel's qualifications to sit on our Board include his over 50 years experience in the fashion industry and broad knowledge of our business, including as our founder, as our executive Chairman for 36 years, and as our Chief Executive Officer for 27 years.

Mr. Kamens has been employed by Mr. Kimmel as a lawyer and personal advisor since 2001. Since April 2009, he has also been Of Counsel to the law firm of Cozen O'Connor. Previously, he practiced law with the law firm of Wolf Block, LLP, where he served as its Chairman from 1995 to 2001 and was Of Counsel from 2001 to April 2009. He has practiced law for more than 30 years.

We believe Mr. Kamens' qualifications to sit on our Board include his background and analytical skills as a lawyer and the experience he has gained as a trustee with significant responsibilities for businesses with large real estate holdings, including regional shopping centers, as well as the understanding of our business acquired over almost a decade of service on our Board.

- 5 -

Mr. Crotty has served as President of Weichert Enterprise, LLC, a private equity investment firm, since 2001. He previously served as Chairman of Excelsior Ventures Management LLC from 1999 to 2001. From 1991 to 1998, he held various executive positions with ITT Corporation and its affiliates, including President and Chief Operating Officer of ITT Consumer Financial Corporation and Chairman, President and Chief Executive Officer of ITT Communications and Information Services. Prior to that time, he served as both Counsel, and then later as Secretary, to the Governor of New York State. Mr. Crotty serves on the Board of Trustees of AXA Premier VIP Trust, where he serves on the Compliance, Nominating and Compensation and Audit Committees, and on the Board of Directors of Cinedigm Digital Cinema Corp., where he serves on the Compensation Committee. He also serves on the boards of several portfolio companies of Weichert Enterprise.

We believe Mr. Crotty's qualifications to sit on our Board include extensive experience in strategic planning and operational and corporate governance expertise, as well as the knowledge and perspective derived from his experience on other boards and compensation committees.

Mr. Robinson served as the Chief Financial Officer and Chief Operating Officer of MIVA, Inc., an online advertising network, from August 2007 through March 2009. He joined MIVA in 2006 as Chief Financial Officer and Chief Administrative Officer. He had previously served as the President of LWR Advisors from 2002 to 2006, served as the Chief Financial Officer and Chief Administrative Officer at HotJobs.com from 2000 to 2002, at PRT Group from 1997 to 1999, and at Advo Inc. from 1994 to 1997. He previously held senior financial positions at Citigroup Inc. and Kraft Foods, Inc. Mr. Robinson served on the Board of Advisors for the University of Wisconsin School of Business from 2006 to 2010. He previously served on the Board of Directors of International Wire Group, Inc., where he served as chairman of the Audit Committee from 2003 to 2009, and on the Board of Directors of Independent Wireless One, Diversified Investment Advisors and Edison Schools Inc. He also serves as Chairman of the Board for two private publishing and digital media companies.

We believe Mr. Robinson's qualifications to sit on our Board include extensive executive experience in corporate finance, financial reporting, strategic planning and Internet expertise, as well as his corporate governance expertise. Our Board of Directors has determined that Mr. Robinson is an audit committee financial expert.

Ms. Zarcone is the President and Chief Executive Officer of D. F. Zarcone & Associates LLC, a strategic advisory consulting firm founded in January 2007. From 1994 until 2006, she held various executive positions with Harley-Davidson Financial Services, Inc., including President and Chief Operating Officer and Chief Financial Officer. Prior to that time, she served as Executive Vice President, Chief Financial Officer and Treasurer of Chrysler Systems Leasing, Inc. and as Supervising Senior and Computer Audit Specialist at KPMG/Peat Marwick. Ms. Zarcone also serves on the Board of Directors of CIGNA Corporation, where she is chairperson of the Audit Committee.

We believe Ms. Zarcone's qualifications to sit on our Board include extensive executive experience in finance, financial reporting and strategic planning and her corporate governance expertise. Our Board of Directors has determined that Ms. Zarcone is an audit committee financial expert.

Mr. Mettler was President of Special Projects of Macy's, Inc. from February 2008 until his retirement in January 2009. He previously served as Chairman and Chief Executive Officer of Macy's West, a division of Macy's, Inc., from 2002 to 2008 and as President and Chief Operating Officer of Macy's West from 2000 to 2002. Prior to joining Macy's, Mr. Mettler held various executive positions in the retail industry, including President of Merchandising - Full Line Stores of Sears, Roebuck and Co. from 1996 to 2000, President of Apparel and Home Fashions of Sears from 1993 to 1996, and President and Chief Executive Officer of Robinson's May Company from 1987 to 1993. Mr. Mettler also serves on the Board of

- 6 -

Directors of Stein Mart, Inc. and on the Board of Directors of Quiksilver, Inc., where he serves on the Compensation Committee.

We believe Mr. Mettler's qualifications to sit on our Board include his over 46 years of experience in the retail industry, including more than 20 years in leadership positions with major department stores, his merchandising and marketing expertise, and his insights into Macy's, Inc., which has been our largest customer for many years.

Ms. Georgiadis has served as the Vice President, Global Sales Operations of Google Inc. since October 2009. From January 2009 until October 2009, she served as a Principal of Synetro Capital LLC, a private investment firm. From 2004 to 2008, she served as the Executive Vice President of Card Products and Chief Marketing Officer of Discover Financial Services. Prior to joining Discover, she was a Partner at McKinsey & Company, a global management consulting firm, from 1990 to 2004, where she co-led the Marketing and Retail Practices and founded the Customer Acquisition and Management and Retail Marketing Practices.

We believe Ms. Georgiadis' qualifications to sit on our Board include her extensive range of knowledge and experience derived from providing strategic planning, risk management, operational, organizational and merger and acquisition advisory services to retail and marketing businesses, as well as her management and corporate finance skills.

Corporate Governance

We have adopted Corporate Governance Guidelines, which, in conjunction with the articles of incorporation, by-laws and Board Committee charters, form the basis for governance of Jones. We have also adopted a Code of Business Conduct and Ethics for directors, officers and employees and a Code of Ethics for Senior Executive and Financial Officers. The Corporate Governance Guidelines and Codes are available on our website, www.jonesgroupinc.com (under the "Our Company - Corporate Governance" caption).

Independence of Directors

Our Corporate Governance Guidelines provide that a majority of the Board shall consist of independent directors. For a director to be independent, the Board must affirmatively determine that the director is independent under the Company's Director Independence Standards.

The Board has determined that five of our current directors who are nominees for re-election at this meeting - Gerald C. Crotty, Lowell W. Robinson, Donna F. Zarcone, Robert L. Mettler and Margaret H. Georgiadis - are independent. The Board has also determined that Ann N. Reese, who is currently a director but is not standing for re-election, is independent.

The Board has determined that three of our current directors, each of whom is a nominee for re-election at this meeting - Wesley R. Card, our Chief Executive Officer, Sidney Kimmel, currently our non-executive Chairman of the Board and until January 1, 2011, our executive Chairman, and Matthew H. Kamens, who since 2002 has had a personal services contract with Mr. Kimmel - are not independent.

J. Robert Kerrey has served as an independent member of the Board from his election in 2002 through 2010. At the beginning of 2011, Mr. Kerrey advised the Board that he expected that his future activities would include serving as an executive with a private company controlled by Mr. Kimmel. Mr. Kerrey and the Board agreed at that time that it would be prudent for Mr. Kerrey to not participate in Board committee meetings or in meetings of the independent directors, to avoid the possibility or appearance of any conflict of interest. Mr. Kerrey subsequently advised the Board in March 2011 that he

- 7 -

would serve out his term on the Board but would not stand for re-election, and that he believed it prudent that he resign as a member of the board committees on which he had served.

The Director Independence Standards adopted by the Board of Directors are attached to this proxy statement as Annex A and are available on our website, www.jonesgroupinc.com (under the "Our Company - Corporate Governance" caption).

Board Leadership

Since May 2002, the Company has separated the positions of the Chief Executive Officer and Chairman. During 2010, both the Chief Executive Officer and the Chairman were executive officers. Effective on January 1, 2011, the executive officer position of Chairman of the Company was eliminated, and Mr. Kimmel ceased to be our executive Chairman and became our non-executive Chairman of the Board. Both Mr. Card, our Chief Executive Officer, and Mr. Kimmel, our Chairman of the Board, are not independent within the meaning of our Director Independence Standards.

Since 2003, the independent directors have selected an independent director as Presiding Director. Robert L. Mettler is currently our Presiding Director. Among other responsibilities, the Presiding Director presides over executive sessions of the non-management and independent directors and establishes agendas for the meetings of the non-management and independent directors.

Through this structure, the non-management and independent directors have exercised an active role in setting out agendas and establishing priorities and procedures for the work of the Board. Based upon this experience over eight years, the Board of Directors has determined that having an independent director serve as Presiding Director is the most appropriate leadership structure for the Board when neither the Chairman nor Chief Executive Officer is independent within the meaning of our Director Independence Standards.

Executive Sessions

Executive sessions of the non-management directors were held six times in 2010. In addition, one session was held for independent directors. Any non-management director may request that an additional executive session be scheduled.

Board Oversight of Risk

The Board exercises its oversight of the Company's risks through regular reports to the Board from Mr. Card, in his role as Chief Executive Officer, and other members of senior management on areas of material risk, actions and strategies to mitigate those risks and the effectiveness of those actions and strategies. The Board also administers its risk oversight function through its Audit and Compensation Committees.

The Audit Committee discusses with management the Company's policies with respect to risk assessment and risk management, including the Company's major financial risk exposures and the steps management has taken to monitor and control those risks. Members of senior management with responsibility for oversight of particular risks report to the Audit Committee periodically throughout the year. The Company's senior vice president of internal audit and compliance, with assistance from the Company's outside internal audit firm, prepares annually a comprehensive risk assessment report which identifies the material business risks (including strategic, operational, financial reporting and compliance risks) for the Company as a whole, as well as for each business unit, and identifies the controls that address and mitigate those risks. The Company's senior vice president of internal audit and compliance and the outside internal audit firm review that report with the Audit Committee each year. The Audit

- 8 -

Committee reports to the full Board annually, or more frequently as required, on its review of the Company's risk management.

Management has assessed how our compensation policies and practices for our employees impact risk and reported on its assessment to the Compensation Committee. Representatives of the Company's Internal Audit and Human Resources Departments, in consultation with the Compensation Committee's independent compensation consultant, performed a risk analysis of our compensation programs for all employees. Management first identified all employee compensation programs and the basic components of each program. Management then identified key risks and, for those risks, identified both structural mitigating factors and mitigating controls in the Company's internal control processes. Based on this risk analysis, management determined those policies and practices are not reasonably likely to have a material adverse effect on the Company. The Compensation Committee reviewed management's assessment and discussed it with management.

Board Structure and Committee Composition

The Board of Directors maintains three standing committees: Audit, Compensation and Nominating/Corporate Governance. All three committees are composed entirely of independent directors. The current members of each committee are identified in the table below.

Director

| Audit

Committee

| Compensation Committee

| Nominating/ Corporate Governance Committee

|

| Wesley R. Card | | | |

| Sidney Kimmel | | | |

| Matthew H. Kamens | | | |

| J. Robert Kerrey | | | |

| Ann N. Reese | ** | | * |

| Gerald C. Crotty | | ** | |

| Lowell W. Robinson | * | * | |

| Donna F. Zarcone | * | | * |

| Robert L. Mettler | | * | * |

| Margaret H. Georgiadis | * | | |

* Member ** Chair | | | |

Assignments to, and chairs of, the committees are recommended by the Nominating/Corporate Governance Committee and selected by the Board. All committees report on their activities to the Board. The function of each of the committees is described below. Each of the committees operates under a written charter adopted by the Board. All of the committee charters are available on our website, www.jonesgroupinc.com (under the "Our Company - Corporate Governance" caption).

During 2010, the Board held seven meetings and acted eight times by written consent. Each director attended at least 75% of all Board and applicable Committee meetings held during the period for which he or she served as a director. In addition, in any month when there is not a regularly scheduled Board meeting, the Board holds a conference call with senior management to review financial performance issues and other items of significance that may arise between Board meetings. As set forth in our Corporate Governance Guidelines, directors are expected to attend our annual meetings of stockholders. Nine of the ten incumbent directors at the time of the last annual meeting of stockholders in May 2010 attended that meeting.

- 9 -

Audit Committee

The Audit Committee has been established in accordance with Section 3(a)(58)A of the Securities Exchange Act of 1934, as amended. The Audit Committee assists the Board in oversight of (1) the integrity of our financial statements, (2) our independent registered public accountants' qualifications and independence, (3) the performance of our internal audit function and the independent registered public accountants and (4) our compliance with legal and regulatory requirements. In addition, the Committee renders its report for inclusion in our annual proxy statement.

The Audit Committee is also responsible for retaining (subject to stockholder approval), evaluating and, if it deems appropriate, terminating our independent registered public accountants.

The Audit Committee has the authority to obtain advice and assistance from, and receive appropriate funding from us for, outside legal, accounting or other advisors as the Audit Committee deems necessary to carry out its duties. Each of the current members of the Audit Committee meets the enhanced standards for the independence of audit committee members under SEC rules and New York Stock Exchange listing standards, and is financially literate, as required of audit committee members by the New York Stock Exchange. The Board has determined that Ann N. Reese, Lowell W. Robinson and Donna F. Zarcone are audit committee financial experts.

The Audit Committee held five meetings in 2010.

The report of the Audit Committee is included in this proxy statement on page 16.

Compensation Committee

The Compensation Committee assists the Board in discharging its responsibilities relating to compensation of our Chief Executive Officer and other executives in light of such factors as our compensation philosophy, competitive practices and such other factors as the Committee deems appropriate. The Compensation Committee recommends to the Board the compensation of directors.

The Compensation Committee held four meetings in 2010 and acted by written consent two times.

The Committee has retained Compensation Advisory Partners LLP ("CAP"), an outside compensation consultant. The consultant reports directly to the Compensation Committee. For a description of the scope and nature of CAP's engagement with respect to our executive compensation program, see "Executive Compensation - Compensation Discussion and Analysis - Oversight of Our Executive Compensation Program" in this proxy statement. CAP provides advice on the structure of our director compensation program and assists the Compensation Committee and the Nominating/Corporate Governance Committee in the periodic review of our director compensation in comparison to that of peer companies.

The Compensation Committee's process includes executive sessions where the Committee meets alone, or with its consultant, tax counsel or other legal advisors, without the presence of management. The Compensation Committee Chair also regularly consults with other Committee members, management, the Committee's consultant and the Committee's other advisors. The Committee has exclusive authority to determine the compensation of our named executive officers, as well as to make equity grants to other executives who are subject to Section 16 of the Securities Exchange Act of 1934, pursuant to Rule 16a-2. The Committee also exercises authority to determine the compensation for other individuals who report directly to our Chief Executive Officer and our President.

- 10 -

The Compensation Committee has the authority to designate a "CEO Committee," composed of the director serving as our Chief Executive Officer, and to delegate to the CEO Committee the authority to:

- direct the grant of awards to persons who are eligible to receive awards under our 2009 Long Term Incentive Plan in connection with either the hiring or promotion of such persons and

- determine the number of shares covered by such awards, the types and terms of any such options to be granted and the exercise prices of such options, and the terms and conditions of vesting and the purchase price, if any, of any such grants of restricted stock or restricted stock units.

However, the CEO Committee does not have authority to:

- grant awards to any chief executive officer of the Company or to any other eligible individual who at the time of the award is, or is reasonably expected to become, subject to the provisions of Section 16 of the Securities Exchange Act of 1934, pursuant to Rule 16a-2,

- during any calendar year, grant options to purchase more than 200,000 shares in the aggregate, grant more the 75,000 shares of restricted stock in the aggregate, or grant more than 75,000 restricted stock units in the aggregate or

- grant to any person eligible to receive an award under our 2009 Long Term Incentive Plan awards of options to purchase more than 25,000 shares in the aggregate and/or awards of more than 10,000 shares of restricted stock in the aggregate and/or awards of more than 10,000 restricted stock units in the aggregate.

The report of the Compensation Committee is included in this proxy statement on page 30.

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee during 2010 were Mr. Crotty, Mr. Kerrey, Mr. Robinson and Mr. Mettler. No current member of the Compensation Committee has, and no former member had during his service on the Compensation Committee, a relationship that would constitute an interlocking relationship with our executive officers or our other directors.

Nominating/Corporate Governance Committee

The Nominating/Corporate Governance Committee assists the Board in fulfilling its responsibilities by (1) identifying individuals qualified to become directors and selecting, or recommending that the Board of Directors select, the candidates for all directorships to be filled by the Board of Directors or by the stockholders, (2) advising the Board and the committees of the Board regarding their membership and procedures and (3) developing and recommending to the Board of Directors a set of corporate governance principles applicable to us and otherwise taking a leadership role in shaping our corporate governance.

The Nominating/Corporate Governance Committee held five meetings in 2010.

Director Nomination Process

Pursuant to our Corporate Governance Guidelines in connection with the director selection and nomination process, the Nominating/Corporate Governance Committee reviews the composition of the Board as a whole and considers the desired experience, mix of skills and other qualities necessary to assure appropriate Board composition, taking into account the current Board members and specific needs

- 11 -

of the Company and the Board. The Nominating/Corporate Governance Committee considers the requirement set forth in the Corporate Governance Guidelines that at least a majority of the Board members be independent as required by applicable laws and regulations and also considers any specific expertise necessary for members of Board committees.

Our Corporate Governance Guidelines contain general criteria for the nomination of director candidates, which include the following:

- the candidate's unquestioned character and integrity,

- mature judgment,

- diversity of background and experience,

- demonstrated skills in his/her area of present or past professional, business, academic or non-profit responsibility,

- an ability to work effectively with others,

- sufficient time to devote to the affairs of the Company and

- freedom from conflicts of interest.

The Nominating/Corporate Governance Committee and the Board believe that candidates who satisfy those criteria will (i) advance the Board's ability to oversee and direct the officers and business of the Company and (ii) enhance the decision making ability of the Board as a whole in the best interests of the Company's stockholders.

The information as to each director set forth above on pages 5 to 7 includes a description of the experience, qualification, attributes or skills that were considered by the Nominating/Corporate Governance Committee and Board to determine that the individual nominee should serve as a director of the Company. The Nominating/Corporate Governance Committee and the Board believe the nominees, taken together, create a Board that is strong in its collective knowledge and experience, derived from the skills and experience of its individual members in a wide variety of areas that are important to the Company, including corporate governance and board service, executive management, finance, accounting, marketing and retailing.

In its consideration of the criteria providing for diversity of background and experience, the Nominating/Corporate Governance Committee looks at the entirety of the Board and the full range of diversity, including professional experience, skills, background and age, as well as personal characteristics.

The Nominating/Corporate Governance Committee and the Board implement the consideration of diversity of background and experience through discussions at meetings of the Nominating/Corporate Governance Committee. In the Nominating/Corporate Governance Committee's annual self evaluation, one of the factors the Committee considers is how the Committee performed in assuring appropriate Board composition and diversity of background and experience.

Stockholder Nominees

Our Nominating/Corporate Governance Committee is open to selecting as candidates for the Board of Directors individuals of merit regardless of background, whom the Committee believes have the potential to be superior directors of a public company, consistent with applicable law, the listing standards of the New York Stock Exchange and our Corporate Governance Guidelines.

As provided in our Corporate Governance Guidelines, the Nominating/Corporate Governance Committee will consider director candidates recommended by stockholders. The policy of the

- 12 -

Nominating/Corporate Governance Committee is to consider properly submitted stockholder recommendations for candidates for membership on the Board as described below under "Identifying and Evaluating Nominees for Director." Any candidate proposals by stockholders for consideration by the Nominating/Corporate Governance Committee should include the candidate's name and qualifications for Board membership and should be addressed to:

Chair

Nominating/Corporate Governance Committee

c/o Secretary

The Jones Group Inc.

1411 Broadway, 36th Floor

New York, New York 10018

In addition, our by-laws permit stockholders to nominate directors for consideration at a stockholders' meeting. For a description of the process for nominating directors in accordance with our by-laws, see "Submission of Stockholder Proposals and Nominations" on page 53.

Identifying and Evaluating Nominees for Director

When the Board identifies an opportunity or needs to add a new Board member with specific qualifications or to fill a vacancy on the Board, the Nominating/Corporate Governance Committee initiates a search and seeks input from Board members, senior management and others. From time to time, including in February 2011, the Board has hired an executive search firm to assist it in identifying or evaluating potential candidates for submission to the Nominating/Corporate Governance Committee for its consideration.

When initial candidates who satisfy specific criteria and otherwise qualify for membership on the Board are identified and presented to the Nominating/Corporate Governance Committee, members of the Nominating/Corporate Governance Committee interview them. The Committee keeps the full Board informally informed of its progress, including giving the full Board an opportunity to interview the candidates. The Nominating/Corporate Governance Committee considers and approves the final candidate, and then seeks full Board endorsement of the selected candidate. Candidates recommended by stockholders and candidates recommended by other persons or entities are evaluated by the Nominating/Corporate Governance Committee in the same manner, including whether they meet the minimum criteria set forth in our Corporate Governance Guidelines.

All nominees for election at this annual meeting were previously elected by stockholders.

Communications with the Board or the Presiding Director

Interested parties may contact our Board of Directors, our non-management directors as a group, our Presiding Director or any other director by writing to the Board, our non-management directors as a group, or such director c/o Secretary, The Jones Group Inc., 1411 Broadway, 36th Floor, New York, New York 10018. The Secretary will promptly forward any communication unaltered to the Board, non-management directors as a group or such director.

Policy with Respect to Related Person Transactions

It is our policy, set forth in writing, not to permit any transaction in which the Company is a party and in which executive officers or directors, their immediate family members, or 5% shareholders have or will have a direct or indirect interest unless approved in advance by the Audit Committee of the Board of Directors, other than

- 13 -

- transactions available to all employees,

- transactions involving purchases of our products at discounts made generally available to all employees or an identified group of employees,

- transactions involving compensation approved by the Compensation Committee of the Board of Directors, or

- charitable contributions involving less than $10,000 per annum to a charitable entity of which an executive officer or director of the Company, their immediate family members, or a 5% shareholder of the Company is an executive officer.

Any issues as to the application of this policy shall be resolved by the Audit Committee of the Board of Directors. A copy of our Statement of Policy with Respect to Related Person Transactions is available on our website, www.jonesgroupinc.com (under the "Our Company - Corporate Governance" caption).

Director Compensation and Stock Ownership Guidelines

The following table provides information on compensation for the year ended December 31, 2010 paid to each non-management director. Directors who are employees receive no additional compensation for serving on the Board of Directors.

2010 Director Compensation

Name

| Fees Earned

or Paid in Cash

($)(1)(2)

| Stock Awards

($)(3)

| Option Awards

($)(3)

| Non-Equity Incentive Plan Compen-

sation ($)

| Change in Pension Value and Nonqualified Deferred Compensation Earnings ($)

| All Other

Compen-

sation

($)

| Total

($)

|

| Matthew H. Kamens | 76,000 | 100,000 | - | - | - | - | 176,000 |

| J. Robert Kerrey | 127,000 | 100,000 | - | - | - | - | 227,000 |

| Ann N. Reese | 109,333 | 100,000 | - | - | - | - | 209,333 |

| Gerald C. Crotty | 94,000 | 100,000 | - | - | - | - | 194,000 |

| Lowell W. Robinson | 114,000 | 100,000 | - | - | - | - | 214,000 |

| Donna F. Zarcone | 96,000 | 100,000 | - | - | - | - | 196,000 |

| Robert L. Mettler | 102,583 | 100,000 | - | - | - | - | 202,583 |

| Margaret H. Georgiadis | 86,000 | 100,000 | - | - | - | - | 186,000 |

| (1) | Non-management directors receive a $50,000 annual retainer, $2,000 for attending a Board meeting and $2,000 for attending a committee meeting or a meeting of the non-management or independent directors. In addition, the Presiding Director receives an annual retainer of $25,000, and the chair of the Audit Committee receives an annual retainer of $20,000. Until January 1, 2011, the chairs of other committees received an annual retainer of $10,000. Effective January 1, 2011, the amount of the annual retainer for the chair of the Compensation Committee and the Nominating/Corporate Governance Committee was increased to $15,000. Non-management directors are not compensated for participation in the conference calls with senior management that are held during months in which there is no regularly-scheduled Board meeting. |

| (2) | Each non-management director may elect to defer all or a portion of his or her annual retainer and meeting attendance fees under The Jones Group Inc. Deferred Compensation Plan for Outside Directors until the earlier of his or her termination of service on the Board or a date selected by the director under the Plan. The Plan does not provide for above-market or preferential earnings. Each |

- 14 -

| | director can choose to invest the funds in either of the following two types of hypothetical investments: Share Units. This type of investment allows the director to invest his or her compensation in hypothetical shares of Jones common stock based on the market price of the common stock at the time the compensation would have been paid. Hypothetical dividends are "reinvested" in additional share units based on the market price of the common stock at the time dividends are paid on the common stock. All share units are paid out in cash. Cash Units. Funds in this type of account are credited with interest monthly based on U.S. Treasury bill rates using the Treasury constant maturities daily "1-year" rate. Mr. Kerrey elected to have his 2010 fees deferred in the form of share units. For certain years prior to 2010, Mr. Crotty had elected to have his fees deferred in the form of share units. |

| (3) | Each non-management director receives an annual grant of restricted common stock equal in value to $100,000, with new non-management directors receiving an initial grant equal in value to $150,000. The restricted stock awards vest in equal installments over three years. The awards are made from shares available under our 2009 Long Term Incentive Plan. (Awards prior to May 20, 2009 were granted under predecessor equity incentive plans.) The restricted stock awards have a value equal to the aggregate grant date fair value calculated in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, "Compensation - Stock Compensation" ("ASC Topic 718"). Assumptions used in the valuation of equity-based awards are discussed in "Summary of Accounting Policies - Restricted Stock" and "Stock Options and Restricted Stock" in Notes to Consolidated Financial Statements in our Annual Report on Form 10-K for the fiscal year ended December 31, 2010. |

The following table shows the aggregate number of outstanding restricted stock awards held by our non-management directors as of December 31, 2010.

Name

| Shares of Restricted Stock

|

| Matthew H. Kamens | 18,941 |

| J. Robert Kerrey | 18,941 |

| Ann N. Reese | 18,941 |

| Gerald C. Crotty | 18,941 |

| Lowell W. Robinson | 18,941 |

| Donna F. Zarcone | 20,941 |

| Robert L. Mettler | 36,060 |

| Margaret H. Georgiadis | 36,060 |

Non-management directors are expected to own shares of our common stock equal in value to at least five times the then-current amount of the annual retainer. The guidelines are in place to further enhance alignment between the interests of Board members and stockholders, through meaningful stockholdings on the part of the directors. That ownership stake should be achieved within five years of their election or appointment to the Board of Directors (or, in the case of those directors serving as such at the time the requirement was adopted on October 28, 2002, by October 28, 2007). Each director may count toward that requirement the value of shares owned (including shares of restricted stock) and the value of share units credited to the director's account under The Jones Group Inc. Deferred Compensation Plan for Outside Directors. All non-management directors meet the share ownership level under the guidelines as of the date of this proxy statement.

- 15 -

Audit Committee Report

The Audit Committee assists the Board of Directors in its general oversight of the integrity of Jones' financial statements, the independent registered public accountants' qualifications and independence, the performance of Jones' internal audit function and the independent registered public accountants' and Jones' compliance with legal and regulatory requirements. The independent registered public accountants report directly to the Audit Committee.

Jones' management has primary responsibility for preparing Jones' financial statements and Jones' financial reporting process. Jones' independent registered public accountants, BDO USA, LLP, are responsible for expressing an opinion on the conformity of Jones' audited financial statements with accounting principles generally accepted in the United States.

Jones' management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting. BDO USA, LLP's responsibility is to express an opinion on the effectiveness of Jones' internal control over financial reporting based on their audit.

In this context, the Audit Committee hereby reports as follows:

- The Audit Committee has reviewed and discussed the audited financial statements with Jones' management.

- The Audit Committee has discussed with the independent registered public accountants the matters required to be discussed by Statements on Auditing Standards No. 61, as amended (AICPA Professional Standards, Vol. 1, AU Section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T.

- The Audit Committee has received the written disclosures and the letter from the independent registered public accountants required by the applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountants' communications with the Audit Committee concerning independence, and has discussed with the independent registered public accountants the independent registered public accountants' independence.

- Based on the review and discussion referred to in paragraphs 1 through 3 above, the Audit Committee recommended to the Board, and the Board has approved, that the audited financial statements be included in Jones' Annual Report on Form 10-K for the fiscal year ended December 31, 2010, for filing with the Securities and Exchange Commission.

| Audit Committee: | Ann N. Reese (Chairperson)

Lowell W. Robinson

Donna F. Zarcone

Margaret H. Georgiadis |

The foregoing Report of the Audit Committee shall not be deemed to be soliciting material, to be filed with the SEC or to be incorporated by reference into any of our previous or future filings with the SEC, except as otherwise explicitly specified by us in any such filing.

- 16 -

Executive Compensation

Compensation Discussion and Analysis

The Compensation Committee of the Board of Directors (the "Committee"), which is responsible for establishing the compensation of our named executive officers, has overseen the development of a compensation program designed to attract, retain and motivate executives who enable us to achieve our strategic and financial goals. The compensation program is designed to deliver a substantial portion of the total compensation of our named executive officers in the form of performance-contingent cash and equity awards to achieve our objectives of holding executives accountable and offering rewards for successful business results and producing value for our stockholders over the long term.

Executive Summary

During 2010, we did not change the overall structure of our compensation program. Instead, we worked within our structure to recalibrate the financial performance targets embedded in our incentive programs to reflect the economy's transition from recession to recovery. Within our incentive programs, we raised the bar to encourage improved performance, achieving higher growth and profitability in 2010. We also made important organizational changes.

2010 Financial Results

Our Company's financial results in 2010 were strong. Our revenues grew 9.5%, reflecting both organic growth and the impact of several acquisitions that strengthened our portfolio of brands. We also generated substantial positive earnings and operating cash flow in 2010.

A comparison of key 2010 financial results to 2009 appears below:

| Measure | | 2010 | | 2009 |

| Revenues (in millions) | | $3,642.7 | | $3,327.4 |

| Earnings (Loss) Per Share | | $0.62 | | ($1.02) |

| Operating Cash Flow (in millions) | | $141.3 | | $349.0 |

Our financial results are discussed in greater detail in "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our Annual Report on Form 10-K for the year ended December 31, 2010, which accompanies this proxy statement.

Organizational Changes

- Richard Dickson was hired and became our President and Chief Executive Officer - Branded Businesses on February 8, 2010.

- Andrew Cohen's employment as Chief Executive Officer - Footwear, Accessories and Retail terminated on October 11, 2010.

- Effective January 1, 2011, Sidney Kimmel, our founder, ceased to serve as our executive Chairman. He continues to serve on our board as our non-executive Chairman.

Major Compensation Actions in 2010

- The 2010 annual cash incentive plan was built on a premise that substantial earnings growth compared to 2009 would be required to fund target awards. Achievement of 108 - 112% of

- 17 -

budget, depending on the performance metric, was required for payment of 100% of target awards.

- We made no changes to the performance metrics, weightings or target award opportunities of named executive officers under the 2010 annual cash incentive plan.

- Wesley Card, our Chief Executive Officer, voluntarily reduced the annual cash incentive of $2,400,000 he earned for 2010 performance to $2,000,000. Mr. Card believed that the $400,000 reduction in his bonus was appropriate to reflect operational issues that occurred during the second half of 2010.

- Since our stock price rebounded compared to 2009, we reintroduced our normal award guidelines for the value of performance-contingent restricted shares granted to our named executive officers (other than Mr. Kimmel, who did not receive a grant). Vesting of these awards continues to depend on achieving three-year targets for total shareholder return performance and cumulative operating cash flow.

- We negotiated amendments to employment agreements with Mr. Card and Ira Dansky, our Executive Vice President, General Counsel & Secretary, so that we could continue to deduct performance-based incentive awards for tax purposes. We granted 75,000 time-vested restricted shares that vest approximately two years after grant to Mr. Card and 25,000 shares to Mr. Dansky, in consideration for their agreeing to the amendments.

- We established compensation guidelines for Mr. Dickson that fit within our structure, including a salary at an annual rate of $1,000,000, a target annual cash incentive of 90% of salary and a guideline long-term incentive opportunity of 180% of salary. Vesting of the long-term incentive awards will depend on achieving three-year targets for total shareholder return performance and cumulative operating cash flow.

- We paid Mr. Dickson a sign-on bonus of $455,000 and awarded 100,000 shares of restricted stock with time-based vesting to replace cash and stock compensation forfeited upon his resignation from his former employer and to allow him to establish an ownership position in our stock.

We believe that the actions taken in 2010 have strengthened our organization and continue to position our Company to continue to be a strong competitor in our markets as the economy rebounds.

Compensation Program Objectives

The objectives of our executive compensation program are to:

- Allow us to successfully attract, retain, and motivate executives who enable us to achieve high standards of consumer satisfaction and operational excellence; and

- Hold our executives accountable and offer rewards for successful business results and produce value for our shareholders over the long term.

Our policy for the named executive officers is to pay competitively, taking into account our objectives for annual and long-term performance. The Committee believes this helps to achieve the objective of attracting, retaining and motivating executives in the highly competitive retail and apparel / footwear / accessories industries. Because a large portion of total executive compensation is provided in the form of incentives that are contingent on performance, actual compensation of these executives will vary above

- 18 -

and below the amount payable at target performance levels, depending on our financial results and their individual performance. In periods of strong performance, actual compensation will exceed the amount payable at target. If a downturn in performance occurs, actual compensation will fall below the target amount.

Compensation Program for Mr. Kimmel

Effective January 1, 2011, Mr. Kimmel, our founder, ceased to serve as our executive Chairman. He continues to serve as our non-executive Chairman of our Board. The transition agreement that we entered into with Mr. Kimmel in connection with the change in his role is described in more detail under "Potential Payments and Benefits Upon Termination of Employment" in this proxy statement.

In 2010, the executive compensation program in place for Mr. Kimmel was composed of base salary, participation in our employee benefit plans and certain perquisites. Since Mr. Kimmel relinquished the role of Chief Executive Officer in 2002 and became our executive Chairman until January 1, 2011 when he ceased to serve as executive Chairman, the Committee's approach to Mr. Kimmel's compensation was to continue his base salary of $1,200,000, pursuant to the terms of his employment agreement with us. His base salary was not adjusted from 2001 through 2010. Mr. Kimmel last received an annual cash incentive in 2005 for performance in 2004. He did not receive any equity grants from 2001 through 2010.

Elements of Compensation Program for Other Named Executive Officers

The compensation program for our named executive officers (other than Mr. Kimmel) includes:

| Elements | Description |

| Base salary | - Compensates our executives for their position and level of responsibility.

- Employment agreements define a minimum annual salary for each named executive officer.

- Committee reviews annually and may adjust salaries above the minimum, depending on individual performance, impact on the business, tenure and experience, changes in job responsibilities and market practice.

|

| Annual cash incentive | - Pays cash awards if financial and individual performance objectives are achieved.

- Target awards were established so that total target annual cash compensation levels would be in line with the peer group described below under "Market Data Used to Assess Compensation" when current base salaries are taken into account.

|

| Performance-contingent restricted stock | - Granted to align the interests of our executives with the interests of our stockholders.

- Value of awards depends on our stock price performance and achievement of three-year total shareholder return and operating cash flow objectives.

- Retains our executives through three-year cliff vesting requirements.

|

- 19 -

| Elements | Description |

| Restricted stock with time-based vesting | - Used selectively.

- Primary purposes are for recruiting, retention and special recognition.

- Vest over two to four-year periods.

|

| Employee benefits | - Named executive officers participate in the same benefit plans available to all full-time, salaried employees.

- Supplemental retirement benefits are provided to Messrs. Card and Dansky.

|

| Perquisites | - Includes one-time charitable donations totaling $8 million by the Company in honor of Mr. Kimmel to recognize his special contributions to us over time upon his transition to non-executive Chairman of the Board.

- Includes a car and driver for Mr. Kimmel and car allowances for other named executive officers.

- Includes a housing allowance and related tax gross-up for Mr. Card.

- Includes relocation benefits and related tax gross-up for Mr. Dickson.

|

We implemented the annual and long-term incentive programs in 2007. As discussed below, these programs remained in place in 2010 and will continue in 2011.

Compensation Mix

For 2010, we did not have policies that define specific percentage allocations for performance-based and non-performance-based compensation, or cash and non-cash compensation. We did, however, intend to deliver a substantial portion of total compensation in the form of performance-based cash and equity incentives to achieve our objective of holding executives accountable and offering rewards for successful business results and producing value for our stockholders over the long term. As a result, recognizing that individual variations and year-to-year variations will occur, between 52% and 71% of the total compensation of the named executive officers (other than Mr. Kimmel) was composed of performance-based compensation, as shown in the table below. Performance-based compensation includes annual cash incentives actually paid and awards of performance-contingent restricted shares.

| Non-Performance-Based

Compensation | Performance-Based

Compensation |

Named Executive Officer | Base

Salary | Discretionary

Bonus | Time-Based

Equity | Annual Cash

Incentive | Performance-

Based Equity |

Wesley R. Card

Richard Dickson

John T. McClain

Ira M. Dansky

Andrew Cohen | 18%

15%

29%

31%

33% | 0%

8%

0%

0%

0% | 14%

24%

0%

18%

0% | 23%

23%

28%

21%

27% | 45%

30%

43%

31%

40% |

- 20 -

Base Salary

In 2010, the following salaries were in effect for the named executive officers, other than Mr. Kimmel. Mr. McClain received a salary increase in 2010 to reflect our assessment of his performance, his contribution to the Company's success and the scope of his job responsibilities as well as to respond to market data prepared by the Committee's consultant and the difficulty of replacement.

Named Executive Officer | 2010 Salary | 2009 Salary | Increase |

Wesley R. Card

Richard Dickson

John T. McClain

Ira M. Dansky

Andrew Cohen | $1,600,000

$1,000,000

$650,000

$700,000

$1,000,000 | $1,600,000

--

$550,000

$700,000

$1,000,000 | $0

--

$100,000

$0

$0 |

In 2011, Mr. Dickson's salary was increased to $1,100,000 to recognize his rapid and highly effective assumption of the management of the Company's brands, marketing and merchandising activities, as well as his contribution to the Company's success. None of the other named executive officers received salary increases in 2011.

Annual Cash Incentive

The 2007 Executive Annual Cash Incentive Plan (the "Incentive Plan") was adopted and approved by our stockholders in 2007. During the first quarter of each year, the Committee assigns a target annual cash incentive award to each participant and approves the financial performance and individual performance objectives to be met during the year. The threshold awards represent the incentive awards payable if our minimum financial goals are achieved and, if applicable, our named executive officers achieve their individual performance objectives. The maximum award is the largest amount payable if financial goals are exceeded and, if applicable, our named executive officers fully achieve their individual performance objectives.

| | Annual Cash Incentive

Award for 2010 Performance Year |

Named Executive Officer | Threshold %

of Salary | Target %

of Salary | Maximum %

of Salary |

Wesley R. Card

Richard Dickson

John T. McClain

Ira M. Dansky

Andrew Cohen | 50%

45%

38%

25%

40% | 100%

90%

75%

50%

80% | 150%

135%

103%

69%

110% |

Annual Cash Incentive Structure for 2010 Performance Year. In the first quarter of 2010, the Committee established financial performance goals for 2010 annual cash incentive awards. These goals were based on three metrics: corporate operating income, corporate operating cash flow, and business unit contribution margin. The percentage of target awards that could be paid as to each of these metrics remained unchanged from 2009 and is shown in the following table:

- 21 -

Weighting of Annual Incentive Performance Factors

|

| | Total Company | Business Unit Contribution Margin | Individual

Performance

Goals |

Named Executive Officer | Operating Income | Operating

Cash Flow |

Wesley R. Card

Richard Dickson

John T. McClain

Ira M. Dansky

Andrew Cohen | 33%

33%

25%

25%

10% | 67%

67%

50%

50%

15% | 0%

0%

0%

0%

50% | 0%

0%

25%

25%

25% |

Annual cash incentives for Messrs. Card and Dickson depended solely on total company performance. For Messrs. Cohen, McClain and Dansky, annual cash incentives of up to 25% of the target award could be paid to recognize individual performance against qualitative goals, after an assessment of compliance with Company policies. The individual performance component was payable, so long as we achieved the minimum amount specified on the performance scales approved for either corporate operating income, corporate operating cash flow or business unit contribution margin. This allowed us some flexibility to pay out incentive compensation in recognition of excellent individual contributions, if financial results warranted.

Performance scales were established for 2010 that align corporate and business unit achievement against budget with the percentage of the target annual cash incentive award payable. The 2010 bonus plan was built on a premise that substantial earnings growth compared to 2009 would be required to fund target awards. In 2009, performance goal targets were designed to pay out 100% of target awards for performance at 90% of budget to recognize the declining economic environment, the increased volatility of the Company's businesses (particularly in the Company-owned retail stores), and the greater emphasis the Company was placing on cash generation and preservation. The Committee determined that this accommodation was no longer necessary in 2010 and established the following performance scales for corporate and most business units. As indicated below, achievement of 108 - 112% of budget, depending on the performance metric, was required for payment of 100% of target awards.

| | % Budget Achievement for Corporate Operating Income | % Budget Achievement for Corporate Operating Cash Flow | % Budget Achievement for Business Unit Contribution Margin |

Goal for Maximum Bonus

Goal for Target Bonus

Budgeted Goal

Goal for Threshold Bonus | 120%

112%

100%

56% | 113%

108%

100%

72% | 116%

109%

100%

70% |