February 27, 2014

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549

| Attention: | Brigitte Lippmann |

Revised Preliminary Proxy Statement on Schedule 14A

Filed February 27, 2014

File No. 001-10746

Dear Ms. Lippmann:

We refer to the letter dated February 26, 2014 (the “Comment Letter”) from the U.S. Securities and Exchange Commission (the “SEC” or the “Commission”) to The Jones Group Inc., a Pennsylvania corporation (the “Company” or “we”), setting forth the comments of the staff of the SEC (the “Staff”) with respect to Amendment No. 2 (“Amendment No. 2”) to the Company’s Preliminary Proxy Statement on Schedule 14A (the “Preliminary Proxy Statement”), File No. 001-10746, filed on February 25, 2014.

Concurrently with this response letter, the Company is electronically transmitting Amendment No. 3 (“Amendment No. 3”) to the Preliminary Proxy Statement. Amendment No. 3 includes revisions made in response to the comments of the Staff in the Comment Letter. We have enclosed for your convenience five clean copies of Amendment No. 3 and five copies of Amendment No. 3 that have been marked to show changes made to Amendment No. 2.

The numbered paragraphs and headings below correspond to the paragraphs and headings set forth in the Comment Letter. Each of the Staff’s comments is set forth in bold, followed by the Company’s response to each comment. The page numbers in the responses refer to pages in the clean copy of Amendment No. 3.

1

Citigroup Global Markets Inc. Financial Analyses and Opinion, page 59

Selected Public Companies Analysis, page 61

| | 1. | We note your response to comment 4 in our letter dated February 21, 2014. Please include your response in this section of the filing. |

Response: In response to the Staff’s comment, the Company has supplemented the disclosure under “The Merger—Citigroup Global Markets Inc. Financial Analyses and Opinion—Selected Public Companies Analysis” on pages 61-62 of Amendment No. 3.

AlixPartners, LLP Analyses, page 72

| | 2. | We note your response to comment 2 in our letter dated February 21, 2014. Please disclose the instructions the consultant received from the company in connection with its analyses and describe any limitation imposed by the company on the scope of evaluating potential alternative courses of action. See Item 1015(b)(6) of Regulation M-A. |

Response: In response to the Staff’s comment, the Company has supplemented the disclosure under “The Merger—AlixPartners, LLP Analyses” on page 72 of Amendment No. 3.

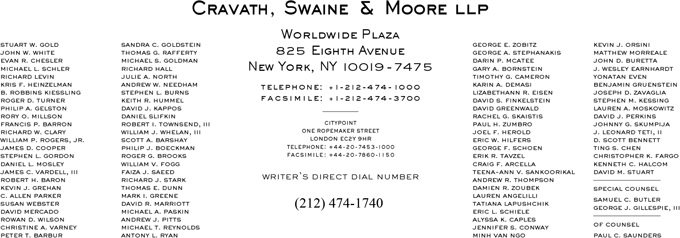

We hope that these responses adequately address the Staff’s comments. If the Staff has any questions concerning this response letter or requires further information, please do not hesitate to contact me at (212) 474-1740.

|

| Very truly yours, |

|

| /s/ George F. Schoen |

| George F. Schoen |

2